For a small business owner, managing business finances is the top priority.

An important aspect of your financial management is to keep your personal and business finances separate using a business checking account.

However, choosing the best small business checking account is not easy given the plethora of options.

But don’t worry, we’ve got you covered.

Go through this list to pick the best small business checking account that meets your needs.

But first, let’s understand what a business checking account is and why small businesses need it.

You May Also Like:

Small Business Checking Account: What is it and Why Do You Need One?

A business checking account is an account that a business can use to deposit its earnings and make payments.

You can open such accounts at banks or credit unions.

A business checking account differs from a personal checking account in terms of:

- Features

- Minimum balance and deposit requirements

- The process of opening an account

- Maintenance fees

For instance, you can open a personal checking account with just $1, while you may need to deposit $500 to $1,000 (or more) to open a business checking account.

The balance you need to maintain in your business checking account is also higher than what is required for a personal checking account.

While the fees and deposits are higher for a business checking account, this type of account offers multiple benefits for small businesses like:

- Bookkeeping integrations

- Debit cards for your employees

- Payroll processing services

- Financial planning services

- Credit card processing

That’s not all. With a business checking account you can:

- Organize your finances

- Simplify your tax payments

- Track your income and expenses easily

- Accept credit card payments

- Get protection against financial fraud

To derive these benefits, you’ll need to choose the best small business checking account.

However, that’s easier said than done. Even the best business checking accounts are not created equal. Some offer unlimited daily transactions while others offer a higher interest rate.

The best small business checking account is also the one that offers the features you need for your small business.

Take a look at the different options we have listed here to zero in on the best business checking account. But first, let’s understand the difference between personal and business accounts in more detail.

What’re the Differences Between Personal and Business Accounts?

While there are some similarities between personal bank accounts and business bank accounts or checking accounts, they are different in many ways.

The main difference is that business bank accounts are used for business-related transactions, while personal bank accounts are used for personal transactions.

Here are the differences between the two types of bank accounts.

Documents Required to Open an Account

Before you can open a business checking account, there are some documents that you will need to provide.

The documents required to open a business checking account vary from bank to bank. However, the following documents are usually needed:

- A letter from the company’s president or sole proprietor authorizing the opening of the account.

- A list of authorized signatories and their signatures.

- Articles of organization or certificate of formation from the state that shows your company’s name, address, and type of business.

- A copy of your driver’s license or passport and a copy of your social security card.

On the other hand, a personal bank account can be opened by anyone over the age of 18 who has either a US Social Security number or taxpayer ID number.

Minimum Opening Deposit and Balance

The minimum deposit required for a personal bank account varies depending on the bank and the type of account.

To open a personal savings bank account, most financial institutions require between $25 and $100 as an initial deposit. Some banks may also require that you have a direct deposit set up with your employer to qualify for this type of account.

The minimum account balance you need to maintain ranges from $300 to $500 for personal savings accounts.

However, many banks offer free checking accounts with a passbook, which means you don’t have to worry about fees or minimum balances.

Similarly, for business checking accounts, you can find banks that require no minimum deposit. Some banks require $25 while some others require $250 as an initial deposit. Having a higher balance can also mean a higher APY in some cases.

You’ll read about this in the section on the best small business checking account.

Interest Rate

Typically, personal savings accounts offer higher interest rates than business checking accounts because savings accounts are designed to help you save.

Checking accounts are designed to make it easy for businesses to manage regular transactions including bill payments, payroll, and purchases.

Most banks offer an interest rate of 0.01% on personal bank accounts, while the national average is 0.17%. Some personal bank accounts, however, do offer a higher APY at 3%.

Many business checking accounts earn zero interest rates and most APYs vary from 0.10% to 0.20%.

Businesses typically need to maintain a large balance in order to generate enough revenue from the interest.

Transaction Limits

Regulation D is the law that governs the availability of funds in US savings accounts. It requires savings deposits to be limited to a total of six transfers per month.

When it comes to business checking accounts, most banks impose a monthly limit of 100 to 200 transactions. Any transaction above this limit will incur a charge.

Now that you know why you need a business checking account, it’s time to talk about how to find the best small business checking account.

Let’s get started.

You May Also Like:

32 Best Small Business Checking Accounts

There are many contenders for the title of the best small business checking account. Each comes with its own features and benefits that can help your business succeed.

Here are our top picks to get you started with your search for the best small business checking account.

1. Chase

Image via Chase

Let’s start your search for the best small business checking account with Chase. The well-known bank offers three different types of business checking accounts.

Of these, the Complete Banking account is the best small business checking account in terms of the monthly service fee.

The best part is you can waive the service fee of $15 if you ensure a daily balance of $2000.

The other reason to call it the best small business checking account is that it offers a chance to earn interest on your balance.

Read on to know if it is the best small business checking account for your business.

Key Features

- A monthly service fee of $15

- Unlimited Chase ATM transactions and debit card purchases

- Multiple ways to receive funds including wire transfers

- Up to $5,000 no-fee cash deposits per statement cycle

- Employee Deposit Cards

- Online banking and mobile banking

Pros

- QuickAccept℠ makes it easy to accept payments

- You can make cash deposits up to $5,000 per cycle without a fee

- With QuickDeposit℠ you can deposit checks through your mobile

- No minimum deposit requirement

Cons

- Not the best small business checking account if you need to deposit a lot of checks or make withdrawals.

2. Novo

Image via Novo

If you own an ecommerce business, Novo is the best small business checking account for you. Technically, Novo is not a bank but partners with Middlesex Federal Savings to offer these services.

You can transfer and receive funds online with ease while managing the other banking tasks with a few swipes.

It has all the features that you would expect from the best small business checking account including unlimited free transactions, zero incoming wire fees, ATM reimbursements, etc.

Integration with Xero, QuickBooks, and Shopify is the other highlight of Novo.

Here are all the features that make it the best small business checking account.

Key Features

- Novo Virtual Card offers instant access to funds

- Option to create and send professional invoices

- Stripe integration for seamless payment processing

- Ability deposit your checks through the mobile app

- Integrations with Xero, QuickBooks, Zapier, eBay, and Shopify

Pros

- No monthly service fee

- Free ACH transfers

- No minimum deposit or balance requirements

- The best small business checking account for getting refunds on transactions at all ATMs

Cons

- Novo is not the best small business checking account for those who need to deposit cash frequently.

3. Lili

Image via Lili

While we’ve listed Lili in this post on the best small business checking account, it isn’t a bank, but a fin-tech (financial technology) company. The banking services are through Choice Financial Group.

Lili is ideal for you if you are comfortable with digital-only banking and don’t need checkbooks.

There are also other useful business tools such as a tax tracker, automated savings, and an expense tracker. What’s more, with its built-in invoicing, you don’t need to invest in separate invoicing software.

And, there are the perks of zero opening deposits and account fees.

But is it the best small business checking account for you?

Find out.

Key Features

- No minimum balance or account fees

- No minimum deposit required to open an account

- Mobile banking app to track expenses

- No monthly fees

- No requirement of minimum balance to earn 1.5% APY

Pros

- Invoicing software to manage invoicing and payments

- You can automate tax savings

- Cashback rewards on debit card purchases

- No ATM fees across 38,000 locations

- Expense reports

Cons

- Cash deposits are charged at $4.95 per deposit.

- Does not support wire transfers

- No checkbooks

- High outgoing wire transfer charges

4. Bluevine

Image via Bluevine

Bluevine business checking account is the best small business checking account in terms of its digital-only banking services.

It is also the best small business checking account on the basis of zero monthly service fee, lack of minimum deposit requirement, and an option to earn a high interest rate on deposits.

Bluevine offers many features to help your business thrive. One of these is the ability to create multiple sub-accounts to categorize your business income and expenses.

Key Features

- No minimum balance requirement

- No monthly service fees

- 1.5% interest on an account balance of up to $100,000. You can earn this if you spend $500 with the Bluevine Debit Mastercard® per month or receive $2,500 in customer payments per month into your checking account

- The best small business checking account for those who want sub-accounts to organize their finances

- Supports multiple payment options

Pros

- Opportunity to earn an APY that is 50% higher than the national average

- No minimum deposit requirement

- No limits on transactions

- You can sync your Bluevine account with Xero, PayPal, QuickBooks, and other business apps

- Access to more than 38,000 ATMs

Cons

- No refunds for out-of-network ATM transactions

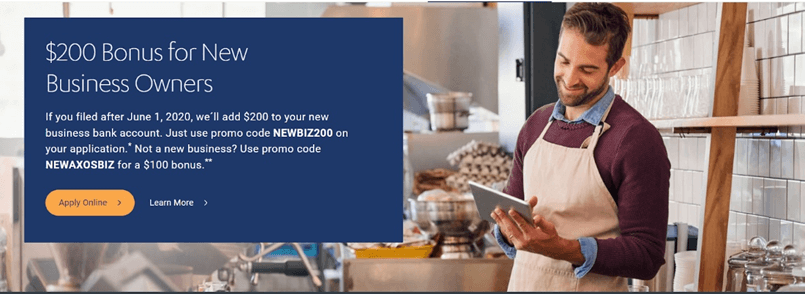

5. Axos

Image via Axos

Axos Bank has been around since 2000. It offers two types of business checking accounts, a Business Interest Checking account and a Basic Business Checking account.

Like its competitors, Axos offers all the features that make it one of the best small business checking accounts.

Check out its features to learn more.

Key Features

- No opening deposit requirement

- No minimum monthly balance

- First 50 checks are free

- Reimbursements for two domestic wire transactions per month

- Unlimited fee reimbursements for domestic ATM transactions

- Visa benefits

Pros

- Per the latest promo on the Axos website, the bank will credit $200 to your bank account if your business was incorporated after June 1, 2020.

- Dedicated relationship manager

- No limits on domestic ATM transactions

- Supports cash deposits

- The best small business checking account if you use QuickBooks

Cons

- No physical branches

6. Relay

Image via Relay

Relay easily meets the criteria for the best small business checking account thanks to the freebies it offers.

Apart from zero minimum balance requirements, Relay offers unlimited transactions.

The best part is that it allows you to consolidate your payments and income in one place to get a quick overview of your finances.

Read on to know what else makes it the best small business checking account.

Key Features

- Zero minimum balance, account fees, and overdraft charges

- Option to issue 50 debit cards for your employees

- Integrates with accounting software like Xero and QuickBooks

- Option to open 20 business checking accounts

Pros

- Allows you to consolidate your income and payments with useful integrations

- You can specify withdrawal and transaction limits on your employees’ debit cards

- Free incoming domestic wire transfers

- No minimum deposit or monthly balance requirements

Cons

- No physical branch locations

- No option to deposit cash

- Limited phone support

7. NorthOne Business Banking

Image via NorthOne Business Banking

Next option in your search for the best small business checking account is NorthOne. Like most of its competitors, the bank offers the benefit of free ATM access within the network, free transactions, and digital banking tools.

Easy integration with a wide range of point-of-sales, ecommerce, and accounting software is an added bonus.

And, if you need to open multiple sub-accounts, this is the best small business checking account.

However, there is a minimum opening deposit as well as a monthly service fee that cannot be waived.

Key Features

- Unlimited free transactions

- No fee if you use MoneyPass or Mastercard Cirrus ATM

- Expense management, unlimited sub-accounts, and bill payments

- You can use the mobile app to deposit checks

- The best small business checking account that integrates with point-of-sales, ecommerce, and accounting software

Pros

- Banking services are available across states

- Multiple customer support channels

- No ATM charges

Cons

- Minimum opening deposit is $50

- A monthly fee of $10 that is not waivable

- Does not support international wires

8. nbkc Bank

Image via nbkc

If your business is located in Kansas or Missouri, the best small business checking account may be the one offered by nbkc Bank.

With four physical branches in these two states, the bank’s checking account comes with a range of benefits.

Let’s see what they are.

Key Features

- No opening deposit

- Zero minimum balance

- No charges for online banking or for nbkc debit card transactions

- Zero overdraft charges

Pros

- Complimentary debit card

- Physical bank branches

- Refunds of up to $12 for out-of-network ATM transactions

- Offers savings deposit accounts and business credit cards

Cons

- Charges apply for outgoing domestic and both incoming and outgoing international wire transfers

- Not the best small business checking account if you want physical branches outside of Kansas and Missouri

9. U.S. Bank

Image via U.S. Bank

U.S. Bank’s small business checking account offers a variety of features to help your business grow.

It offers both a free Silver Business Checking account and a Gold Business Checking account that yields interest.

It is the best small business checking account if you want a bank with a strong physical presence in addition to online and mobile banking features.

Let’s see what else it has to offer.

Key Features

- Payment processing solutions that includes point-of-sale solutions, such as card reader, touch-screen terminal, and mobile app

- Access to 2,000+ branches across 27 states

- No monthly maintenance charges

- Free cash deposits up to $2,500

- Remote check deposit

Pros

- Free ATM transactions across 37,000 MoneyPass and 4,700 U.S. Bank ATMs

- Option to open a business checking account online, via a phone call, or online

- The best small business checking account if you are looking for a sign-up bonus. U.S. Bank offers a sign up bonus of $300

Cons

- The minimum opening deposit amount is $100

- Limited free transactions per month

- No interest

10. Capital One

Image via Capital One

Next contender in your search to find the best small business checking account is Capital One. This bank is known for its “Spark for Business” suite, which consists of a range of online tools that help small business owners to manage their finances.

The suite offers various benefits to make it easier for SMBs to manage their finances.

The Business Basic Checking account and Business Unlimited Checking are part of this suite.

One of the features that makes Capital One qualify for the title of the best small business checking account is the access it offers to 330 branch locations.

Let’s check out its other important features.

Key Features

- Unlimited free monthly transactions

- No extra charges for depositing up to $5,000 in cash each month

- A service fee of $15 that can be avoided by maintaining an average balance of $2,000

- Free debit card and online banking

Pros

- Easy access to ATM and physical branches

- Integrates with Xero and other accounting software

- The best small business checking account for overdraft protection

Cons

- Both domestic or international wire transfers are charged at $15

- Minimum deposit of $250 is required to open an account

- Not the best small business checking account if you want your account to gather interest

11. Mercury

Image via Mercury

Next up in this post on the best small business checking account is Mercury. Zero balance and deposit requirements in addition to customizable features make Mercury an ideal option for ecommerce start-ups and small business owners.

One of the stand-out features that VC-funded businesses can leverage is the ability to apply for VC funding via the platform.

If you want a digital-only business checking account that offers free transactions, Mercury is the best small business checking account for you.

Key Features

- No minimum account balance required

- Zero minimum deposit

- No overdraft or monthly fee

- The best small business checking account for domestic, ACH, and wire transfers

- VC-funded businesses can apply for venture debt funding

- Mercury Treasury offers the option to earn 2.054% APY through managed high liquid funds

Pros

- Seamless integration with Stripe, Shopify, and QuickBooks

- Ability to automate recurring transfers, payments, and other transactions

- Option to set custom employee permissions

- Free transactions on Allpoint ATMs

Cons

- No support for cash deposits

- Does not cater to sole proprietors

12. Navy Federal Credit Union

Image via Navy Federal Credit Union

The Navy Federal credit union is a financial institution that is dedicated to serving the members of the United States military and their families.

The company offers a variety of products and services including business checking accounts, money market accounts, savings accounts, certificates of deposits, mortgages, home equity loans, and auto loans.

Navy Federal Credit Union has three types of business checking accounts on offer. These include Business Checking, Business Premium, and Business Plus Checking.

Find out what else makes it the best small business checking account.

Key Features

- Unlimited free electronic transactions

- Premium checking accounts can earn up to 0.45% APY on balances above $25,000

- No monthly fee for the basic business checking account

- Up to 30 non-electronic transactions are free per month

Pros

- 24/7 responsive customer service

- All checking accounts gather interest

- The best small business checking account in terms of comprehensive banking services

- Free debit card

Cons

- High minimum deposit requirement of $250

- Eligibility restricted to members of the defense

- Outgoing wire transfers are charged

13. Wells Fargo

Image via Wells Fargo

Apart from being one of the most recognized banks in the U.S., Wells Fargo also offers one of the best small business checking accounts.

In fact, there are three key business checking accounts on offer including Initiate Business Checking Optimize, Business Checking, and Navigate Business Checking.

In addition to its business loan products, Wells Fargo business checking accounts are also preferred for easy access to both digital banking and brick-and-mortar banks.

Check out its features, pros, and cons to see if it is indeed the best small business checking account.

Key Features

- Monthly fee of $10 that can be avoided by maintaining a monthly balance of $500

- Minimum opening deposit of $25

- Up to 100 transactions are free per month

- Contactless debit card

- Free cash deposit limit of up to $5,000 per month

- Free debit card, mobile, and online banking

Pros

- More branch locations compared to other banks

- Responsive customer support

- The best small business checking account if you want to open your account entirely online

- Convenient payment options

Cons

- Opening deposit and monthly service charges

- Out of network ATM transactions are charged

- The account does not earn interest

14. Regions Bank

Image via Regions Bank

Regions Bank offers most of the features you would expect from the best small business checking account.

You can pick from different business checking accounts based on your banking needs.

For instance, those with limited transactions can opt for the Business Simple Checking account. The Advantage Business Checking account is ideal for small businesses with a moderate number of transactions.

These accounts come with expected benefits such as overdraft protection and ways to avoid a monthly service fee.

To compare it with others in the best small business checking accounts list, go through its features, pros, and cons.

Key Features

- Minimum opening deposit is $100

- Monthly service fee of $7 which can be waived by making purchases worth $500 through Regions business debit or credit card.

- You can deposit up to $2,500 each month for free

- The best small business checking account if you are located in Midwest and southern states

- Option of Business Interest Checking account to earn interest on balance

Pros

- 30% discount on safe deposit box

- You can specify withdrawal and transaction limits on your employees’ debit cards

- Multiple customer service modes including phone, online, in-branch, and social media

- Sole proprietors can also open a business checking account

- No monthly fee for non-profit organizations

Cons

- High monthly balance requirements for businesses with moderate transactions

- Interest depends on the balance you maintain

- Not the best small business checking account if you want to avoid transaction limits

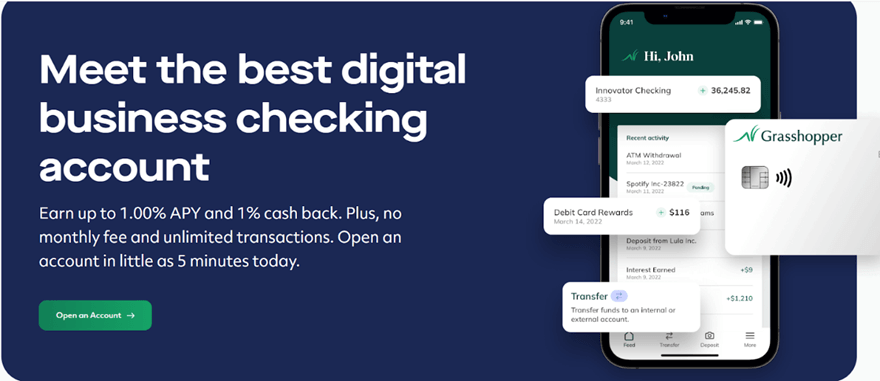

15. Grasshopper

Image via Grasshopper

If you are looking for an interest-earning, online fee-free checking account, Grasshopper offers the best small business checking account.

You also get a cashback offer for designated purchases in addition to a free debit card.

Other notable features include free payment transfers and unlimited transactions. Let’s see what else makes it the best small business checking account.

Key Features

- Your account can earn 1% APY

- No overdraft charges

- No monthly fee

- Integrated bookkeeping software

- Instant check deposits through the mobile app

Pros

- 1% cashback on certain debit card purchases.

- You can specify withdrawal and transaction limits on your employees’ debit cards

- Supports unlimited transactions

- Easy online account opening

Cons

- Opening deposit is $100

- No physical locations

16. Security Service Federal Credit Union

Image via Security Service Federal Credit Union

Looking for the best small business checking account that provides access to attorneys for your business?

The right choice is Security Service Federal Credit Union (SSFCU).

You can choose from Not-For-Profit Checking, Premium Checking, and Classic Business Checking accounts, each of which come with certain perks.

In addition to different business checking accounts, SSFCU offers unique advantages that include legal services, data breach protection, and telehealth services with the Premium Checking account.

Like others in this list of the best small business checking accounts, SSFCU offers some freebies along with a good APY.

Here are the features of SSFCU’s business checking account.

Key Features

- No minimum balance needed

- Free transactions for up to 50 items

- Free debit card and online Bill Pay

- A monthly maintenance fee of $10

- An APY of 0.05% on balance above $1500 (for Premium Business Checking account only)

Pros

- Data security, legal, and telehealth services available with the Premium Business Checking account

- The ability to earn interest on your balance

- Mobile phone coverage including protection against theft and accidental damage

- Access to 30,000 free ATMs and 5,000 shared branches across the country

Cons

- Only accessible to business owners in Utah, Texas, or Colorado, Texas, and members of the military/Department of Defense in some areas

- No integrations with accounting software

- Not the best small business checking account if you are looking to minimize wire transfer fees

17. Bethpage Federal Credit Union

Image via Bethpage Federal Credit Union

Founded in 1941, Bethpage Federal Credit Union is known for its low minimum balance and competitive interest rates.

That’s not all. At an APY of 0.20%, Bethpage offers one of the highest interest rates among credit unions.

Unlike most credit unions, Bethpage doesn’t restrict membership. While it is based in New York, anyone can open a savings account at Bethpage.

It supports digital banking in addition to offering investment advisory services.

These are some of the features that make Bethpage the best small business checking account.

Take a look at the other features to make an informed decision.

Key Features

- The best small business checking account with a competitive APY at 0.20%

- No minimum balance

- No limits on transactions

- Free debit card

- Free telephone and online banking

Pros

- No minimum deposit

- Your account can earn interest with just 1 cent

- No monthly fee

- A range of banking services

- No ATM fees at Bethpage and associated Co-op networks

Cons

- All branches are located in New York City or Long Island

- Not the best small business checking account if you are not in the bank’s online jurisdiction

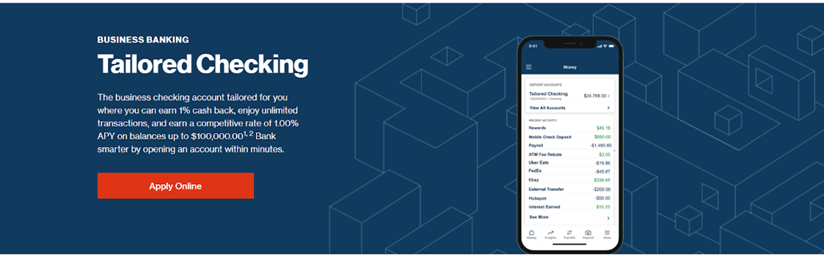

18. LendingClub

Image via LendingClub

The best small business checking account for businesses with a huge volume of transactions is LendingClub.

Unlike most others in this list of the best small business checking accounts, LendingClub offers cashbacks and a good interest rate.

What’s more, the FDIC insurance offered by LendingClub is the same as what traditional banks offer.

Key features

- No monthly fee if the deposit is $500 or more

- No fee when you use other banks’ ATMs

- 1.00% APY if your balance is less than $100,000 and 0.10% APY for any amount greater than 100,000

- 1% cashback when you use a Tailored Checking debit card to make qualified purchases

Pros

- You can sync your account with other finance software including Mint®, Quicken, and QuickBooks.

- Autobook integration supports digital invoices and payments

- The best small business checking account if you are looking for mobile check deposit feature

Cons

- No physical branches

- You need to maintain a balance of $500 to avoid a monthly fee

- No interest on amounts below $5000

19. Comerica

Image via Comerica

Comerica’s 170-year-plus wealth of experience makes it one of the best options for you to open a small business checking account.

Comerica offers 3 types of bank accounts suitable for small businesses: Basic Business Checking, Small Business Checking, and Small Business Interest Checking.

For this post, we’ll place the spotlight on their Small Business Checking and Small Business Interest Checking accounts. Here’re some stand-out features, pros, and cons for you to consider.

Key features

- Conduct up to 300 transactions per month at no charge

- Deposit up to $5,000 in cash per month with no Cash Deposited Fee

- No monthly maintenance fee with an average balance of $7500 (for Small Business Checking) and $15,000 for Small Business Interest Checking

Pros

- Easy to earn interest with competitive rates with the Small Business Interest Checking account

- No minimum balance requirement

- Easy business accounting with QuickBooks partnership

- Several account options according to the stage you’re business is at

- Online and mobile banking

- Range of banking features

Cons

- Interest rates vary according to market conditions

- Comerica primarily operates in the Midwest and Texas regions, so businesses located outside these areas may have limited access to their services

20. Truist

Image via Truist

Truist was formed through the merger of BB&T Corporation and SunTrust Banks, Inc. in 2019. It’s now one of the largest financial institutions in the United States.

Right now, Truist’s Simple Business Checking is one of the best small business checking accounts available for business owners.

If you complete fewer than 50 business transactions a month and have under $2000 per month in cash deposits, then Truist is the best bank for you.

Key features

- Personalized business debit card with your logo or custom art

- Helps you curb fraud with Fraud Inspector™

- Earn loyalty cash bonus on your credit card

Pros

- $25 discount on your first order of checks

- Option to add deals and earn cashback

- No minimum balance requirement

Cons

- 50 monthly transactions is small even for a small business. Above this number, you have to pay transaction fees

- Truist simple business checking is a relatively new account

21. PNC

Image via PNC

Headquartered in Pittsburgh, Pennsylvania, PNC operates in 21 states and the District of Columbia, serving millions of customers.

The bank traces its roots back to the Pittsburgh Trust and Savings Company, which was founded in 1852.

Over the years, it went through several mergers and acquisitions and eventually became PNC Bank in 1983. The name “PNC” stands for Pittsburgh National Corporation.

PNC offers a comprehensive range of banking products and services for individuals, businesses, and corporate clients including a basic Business Checking Account.

Key features

- Anytime online banking, including bill payments and remote deposit

- Earn cash rewards on everyday purchases with PNC Purchase Payback®

- You can avoid the monthly maintenance fee by fulfilling certain requirements

- Free PNC Bank Visa® Business Debit Card

Pros

- No charge for 150 or fewer transactions per month

- No charge for online statements

- No ATM transaction fee at PNC Bank ATMs

- $5,000 over-the-counter cash deposits per month

- No set-up fee for Overdraft Protection

- A wide range of banking features

Cons

- $100 minimum requirement to open an account

- $12 monthly account maintenance fee

- Not available in all states

- Pay for out-of-network ATMs

22. First Citizens Bank

Image via First Citizens Bank

First Citizens Bank is one of the largest family-controlled banks in the country and operates in multiple states, primarily in the South-East. It serves customers in over 19 states, including North Carolina, South Carolina, Virginia, Maryland, West Virginia, Tennessee, Georgia, Florida, and others.

The bank has a long history that dates back to 1898 when it was founded as The Bank of Smithfield in Smithfield, North Carolina. Over the years, the bank expanded its presence through mergers and acquisitions, eventually becoming First Citizens Bank in 1986.

It offers 4 types of business checking accounts for small businesses. They include Business Banking, Business Banking I, Business II, and Business III.

Key features

- Maintenance fee ranges from $0 to $75 a month

- Treasury management feature

- Payroll services and online invoicing

Pros

- No statement fee when enrolled in paperless statements

- With Business Banking III, you get up to 750 free transactions per month

- Up to $20,000 cash processing each month at no charge

- Ability to combat fraud with ACH Positive Pay

Cons

- To avoid the monthly maintenance fee for Business Banking I, you must either maintain an average daily ledger balance of $25,000 or have an active First Citizens merchant account

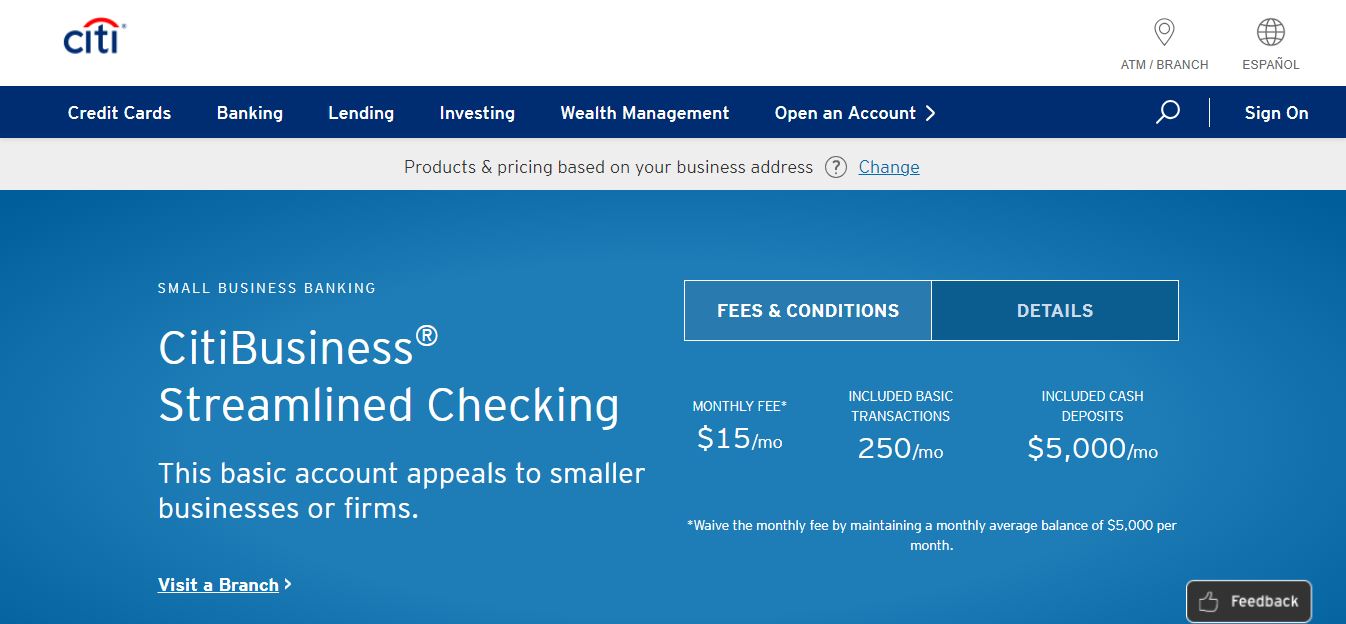

23. Citibank

Image Citibank

Citibank is a global financial institution and one of the largest banks in the United States.

It operates as a subsidiary of Citigroup, offering a wide range of banking and financial services to individuals, businesses, and institutional clients.

The global bank offers CitiBusiness® Streamlined Checking, one of the best small business checking accounts you can get.

Key features

- Monthly maintenance fee of $15 a month. This can be avoided by maintaining a monthly average balance of $5,000

- Overdraft protection

Pros

- 250 basic transactions a month for free

- Up to $250,000 insurance by the FDIC

- Access to over 60,000 ATMs with no surcharge fee

- Fraud protection

Cons

- Products and pricing vary based on location

24. Citizens Bank

Image via Citizens Bank

Citizens Bank is a prominent financial institution operating primarily in the United States.

With a history dating back over 190 years, Citizens Bank offers a wide range of banking and financial services.

These services include one of the best business checking accounts—the Business Advisor Checking account.

This small business checking account comes with a range of benefits. Let’s see what they are.

Key features

- $25 monthly maintenance fee. Get a fee waiver when you reach a $10,000 average daily balance or with $35,000 monthly combined balance

- The minimum balance to open an account is set as “any amount”

- Overdraft protection

Pros

- First 500 check transactions are free

- $100 discount on your initial order of checks

- 10% off when utilizing their payroll services

- Business credit card with no annual fee

Cons

- Mobile Bill Pay is temporarily unavailable for Small Business customers

25. WaFD Bank

Image via WaFD Bank

Previously known as Washington Federal, WaFD Bank is a full-service commercial bank that provides a range of banking services to individuals, businesses, and commercial clients.

It has branches in eight western states of the US including Washington, Oregon, Idaho, Utah, Nevada, Arizona, Texas, and New Mexico.

WaFD Bank offers tailored banking solutions to small businesses including three specialized Business Checking accounts.

These include Business Checking, Business Interest Checking, and Business Analyzed Checking.

Key features

- $100 initial deposit for all checking accounts

- Online banking with Bill Pay

- Fraud protection

- eWire transfer service

Pros

- 50 free checks and 40 deposits per month for the Simple Business Checking account

- 150 free checks and 90 deposits per month for Business Interest Checking account

- Automatic sweep accounts

- Estatements

- Electronic ACH payments

- Remote deposit capture

Cons

- $5 monthly charge if balance falls below $500 for Simple Business Checking

- $15 per month if balance falls below $2,000 for Business Interest Checking

26. TD Bank

Image via TD Bank

TD Bank, also known as TD Bank, N.A., is a prominent financial institution operating in the United States. It’s a subsidiary of the Canadian multinational Toronto-Dominion Bank.

TD Bank prides itself as America’s most convenient bank. No doubt, as its business convenience checking plus account is one of the best business checking accounts for small businesses.

Let’s look at the bank’s key features, pros, and cons.

Key features

- Send money with ACH, Bill Pay, and Wire Transfers

- Extensive Branch Network

- Mobile banking

- Treasury management services

- Business loans

Pros

- No minimum balance required

- Friendly and helpful customer service representatives

- Fraud monitoring

- Free online statements

- Instant-issue debit card

- Overdraft relief

- Free mobile deposits

Cons

- $25 monthly maintenance fee. To waive the monthly fee for this account, maintain a minimum daily balance of $1,500 across both this account and a TD personal checking account

- Not available in all states

27. Bank OZK

Image via Bank OZK

Bank OZK was founded in 1903 and initially operated as a community bank in Jasper, Arkansas. Over the years, it expanded through acquisitions and organic growth to become one of the largest banks in the state.

OZK offers two business bank accounts that are suitable for small-scale entrepreneurs. OZK business checking and OZK Interest+ business checking.

Compare its key features, pros and cons below.

Key features

- $100 minimum opening balance

- $10 monthly maintenance fee. Can be avoided by maintaining a $500 average collected daily balance per month

- eStatements

- Mobile banking

- Online banking

Pros

- Free online bill payments

- Treasury management services

- Up to 250 free checks per month (with OZK business checking)

- Overdraft protection

- Mobile wallets

- FDIC insurance

Cons

- OZK business checking account does not bear interest

- Limited market presence

28. Popular Bank

Image via Popular Bank

Popular Bank was established in 1893 as Banco Popular de Puerto Rico. It initially focused on serving the local community in Puerto Rico.

Over time, it expanded its operations and established a presence in various regions, including the mainland United States.

Popular Bank offers essential business solutions for small and growing enterprises including Popular Primary Business Checking, Popular Preferred Business Checking, and Popular Platinum Business Checking.

Key features

- Online and mobile banking tools with Bill Pay

- Network of branches and ATMs across Puerto Rico, the mainland United States, and the US Virgin Islands

Pros

- Up to $5,000 monthly cash deposits for free with Primary. $10,000 for Preferred, and $25,000 for Platinum

- All accounts business checking accounts support domestic and international wire transfers

- 250 free monthly transactions for Preferred account holders

- Up to 400 free monthly transactions for Platinum account holders

Cons

- $5 per month hidden fee if you do not log into online banking

29. Webster Bank

Image via Webster Bank

If your small business conducts fewer than 300 transactions a month, then Webster Bank’s Basic Business Checking might just be the right account for you.

Webster Bank is a regional bank based in Waterbury, Connecticut, United States. The bank was established in 1935 and initially operated as the First Federal Savings and Loan Association of Waterbury.

Over the years, it grew through acquisitions and expansions to become one of the largest banks in Connecticut.

While Webster Bank is headquartered in Connecticut, it has expanded its operations into neighboring states. It has a presence in Connecticut, Massachusetts, New York, Rhode Island, and Pennsylvania, serving customers through a network of branches and ATMs.

Here are its key features, pros and cons.

Key features

- Online and mobile banking

- Bill Pay

- $100 opening balance

- FDIC insurance

Pros

- Free chip-enabled debit MasterCard®

- No monthly maintenance fee when you accrue a monthly average collected checking balance of $2K or combined deposit balance of $4K

- Up to 300 free debits and credits per statement cycle, including ACH

- 24/7 live chat support

Cons

- $37 overdraft fee

- Relatively small ATM and branch network

- No interest potential

30. KeyBank

Image via KeyBank

KeyBank traces its roots back to 1825 with the establishment of the Commercial Bank of Albany in New York. Over time, through mergers and acquisitions, it evolved into KeyBank and became one of the largest banks in the United States.

The bank operates across a significant area of the United States. It caters to the commercial banking needs of 15 states, primarily in the Midwest, Northeast, and Northwest regions.

KeyBank offers 3 of the best business checking accounts suitable for early-stage entrepreneurs. They include KeyBank Basic Business Checking, KeyBank Business Interest Checking, and Key Business Reward Checking.

Key features

- Monthly, waivable, maintenance fees between $5 and $25

- 40,000+ Keypoin and Allpoint ATMs

Pros

- Discounts on Wire Transfers for account holders

- Up to 200 combined transactions per month included in KeyBank Basic Business Checking,100 for KeyBank Business Interest Checking, and 500 for Key Business Reward Checking

- FDIC insurance

Cons

- Not available in certain states

31. Fifth Third Bank

Image via Fifth Third Bank

Fifth Third Bank was established in 1858 as the Bank of the Ohio Valley. It went through several mergers and acquisitions to become the Fifth Third Bank in 1968. The name “Fifth Third” originated from the merger of the Third National Bank and the Fifth National Bank in 1908.

Fifth Third Bank operates in ten states primarily in the Midwest and Southeast regions of the United States. Its primary markets include Ohio, Florida, Illinois, Indiana, Kentucky, Michigan, North Carolina, Georgia, Tennessee, and West Virginia.

Fifth Third has some of the best small business checking accounts including. These include Fifth Third Business Checking Account and Fifth Third Business Premium Checking Account.

Key features

- Online banking

- Bill payment

- Mobile payment

- Text alerts

Pros

- Free business debit MasterCard

- Overdraft protection

- Over 40,000 free-to-use ATMs

- Discounted pricing on payroll solutions

- Up to 100 free transactions with the Business Checking Account

- Up to $5,000 free cash deposits per month with the Business Checking Account

- No minimum balance requirements

- No monthly maintenance fees

Cons

- Low interest rates

- Relatively few branches (1,100 precisely)

32. United Bank

Image via United Bank

United Bank has a history that spans over 150 years. It was established in 1858 as the United Bank of West Springfield in Massachusetts.

Since 1858, United Bank has expanded to serve several states in America, including Connecticut, Massachusetts, Rhode Island, and Vermont.

United Bank offers an impressive zero-cost business bank account appropriately named: Free Business Checking Account. This account is perfect for small business owners that need to cut costs.

Key Features

- Free online business checking account

- Online bill pay

- Free NSF Check Recovery service (in partnership Profituity®)

- United Business Visa® Debit Card (with no annual fee)

- Remote deposit capture

- Overdraft protection

Pros

- 500 free monthly transactions (Including deposited items, checks paid and deposits.)

- Transactions above 500 per month are only $0.25 each

- No monthly maintenance fees

- No minimum balance requirements

- Only $100 required to open

- Email and phone support

- Free check safekeeping

Cons

- Limited ATM network

What to Consider When Choosing the Best Small Business Checking Account

Choosing a business checking account is not an easy task. There are many things to consider and the following list should help you find the best option.

Start by asking yourself these questions to zero in on the best small business checking account:

- Do you need a bank with a physical branch close to your business?

- Do you frequently deposit cash or checks?

- Do you need unlimited transactions?

- Do you need overdraft protection?Do you need banking services such as loans, retirement plans, and venture funds?

- Are you looking for a checking account without minimum balance or deposit requirements?

To make it easy for you to pick the best small business checking account, here’s a table that lists the best accounts for each criterion.

| Criteria | The best small business checking account |

| Zero deposit, monthly fee, and balance requirements |

|

| High APY |

|

| VC funding |

|

| Digital only/ Online business checking account |

|

| Convenient ways of opening an account (online, phone, in-person) |

|

| Integration with accounting software |

|

| Access to physical branches |

|

| Cash and check deposits |

|

| Safe deposit box |

|

| Invoice and payment processing |

|

| Frequent wire transfers |

|

Of course, you may have more than one criteria. In this case, list all the features that are important to you, and go through the list to see which one meets your requirements.

You May Also Like:

FAQs

1. Which bank is best suited for small businesses?

The best small business checking account is one that is tailored to the needs of your business. This includes how much money is needed in the account, the interest your account earns, and other charges you incur.

Some of the most popular providers are Chase, Wells Fargo, Capital One, Bluevine, and Bank of America. These banks offer a variety of accounts and services that can help you grow your business.

2. What bank doesn’t charge monthly fees for a business account?

Many banks don’t charge a monthly fee. Some examples are:

- DCU

- Lili

- Bethpage

- Grasshopper

- Relay

- Mercury

- Nbkc

- Novo

- Bluevine

3. Do any banks pay interest on business checking accounts?

Yes. The most competitive rates of interest are offered by these banks:

- Bethpage at 0.20%

- Navy Federal Credit Union at 0.45%

- Bluevine at 1.5% (on a balance of $100,000 or more)

- LendingClub at 1.0% (on a balance of $100,000 or more)

4. Which account is best for business?

The best small business checking account for your business will depend on the features and benefits it offers. For example, if you are a startup, you may want to look for an account with zero monthly fees and deposits.

If you are looking for full-service banking, choose an account that offers loans, funding, retirement plans, and so on.

5. Is Chase Business Account good?

Chase is a good option if you’re looking for free ATM transactions, cash deposits, and easy ways to transfer money.

Final Thoughts

We hope this blog post made it easy for you to find the best small business checking account for your business.

The best way to go about it if you are a startup is to choose an account with zero monthly charges, deposit, and balance requirements.

As your business grows, you can consider switching to an account that offers comprehensive banking services.

Compare the checking accounts we have listed here to select the one that is as closely aligned with your needs as possible.

Do you have your own thoughts on what features the best small business checking account should have?

Share your thoughts by commenting below.