A new small business may find building a financial plan daunting. Having to come up with projections for sales, revenue, and profits and conduct analyses likely sounds intimidating to the newly-initiated.

So how do you develop a financial plan for a small business? Is it as technical as it sounds?

The truth is that you can develop a financial plan for your small business all by yourself, without the necessity of expert help. This article is your ultimate guide to developing a financial plan for your small business.

Is developing a plan even necessary?

Yes. Every business, big or small, needs a financial plan. A financial plan provides proof of the sustainability and financial feasibility of a small business. It also provides direction as to where your small business is headed long-term.

And of course, investors and long-term debtors need to see your finances before investing in your small business.

A financial plan is precisely how you assure investors of consistent returns and debtors of your credit-worthiness.

So what is a financial plan, and why is it important for a small business? Keep reading to find out.

What Is a Financial Plan?

A financial plan is a document that shows the current monetary situation of a business and its future financial projections.

This financial plan also serves as proof of a business’s financial sustainability in the long term. It uses an analysis of cash flow statements, income statements, and balance sheets to do that.

A financial plan also helps forecast a business’ future projections by providing outlines, goals, and estimates.

And analyses of cost, volume, and profits determine a business’s future profitability using historical data.

A financial plan also details every step that the business will take to achieve the projected goals.

So why does every small business need a financial plan?

Find out in the next section.

The Importance of a Financial Plan for a Small Business

In this section, we will discuss some of the reasons why it is important for every small business to have a financial plan.

Here are the specifics:

1. Helps You Commit to Your Business Goals

Having a financial plan helps remind you of what your financial goals are and how much your small business should grow during a particular period.

It acts as a constant reminder about the specific numbers you’re working towards.

It can be easy to lose sight of your business goals, especially the long-term ones, when you’re busy with day-to-day challenges. But with a financial plan, any negative deviation from the projected revenue, business income, and profits will only inspire more effort.

2. Helps Manage Your Business Finances

Having a solid financial plan is one of the best ways you can manage your finances as a small business.

A financial plan can help you manage your business’s income and money reserves. Through your financial plan, you can budget for the future and create contingency reserves for economically uncertain times.

Additionally, a financial plan helps small businesses manage their cash flows and taxes.

For small businesses, resource conservation is essential. With a financial plan, you can tell which expenses to prioritize in order to maximize the use of those resources.

3. Inspires Confidence In Your Business

Any small business owner can be confident in their business’s sustainability if they know where it’s headed financially. This is what a financial plan does for you.

And with that kind of confidence, pitching your startup idea to investors will be easy. A good financial plan, after all, helps you identify your business’ funding needs.

With concrete financial projections, you can estimate your future revenue and how much financing you’d need to take it to the next level.

Having that confidence in yourself inspires confidence in the outside investors funding your small business, as well.

4. Helps In Future Decision-Making Processes

A good financial plan will spot deficiencies in your financial decisions. For instance, it allows you to identify an investment that was made that didn’t yield good returns versus one that did.

It also helps in identifying high-performing and low-performing areas so that you can direct resources to the former.

A simple break-even analysis will help measure your cost versus benefit for different areas of your business, helping with your future production decisions.

How?

A break-even analysis lets you know exactly how many more units you need to sell to start making profits. These are details included in a financial plan for a small business.

With a financial plan, you’ll know both where your business is and where it’s headed. You can tell how much more is needed to propel it forward, both financially and in terms of time and resources.

Wondering how to develop a financial plan for a small business?

Find out in the next section.

How to Develop a Financial Plan for a Small Business

When developing a financial plan for a small business, the key element is to be realistic. A plan should be a true plan, not a distant dream or fantasy.

You may want your business to grow at a certain rate within a given period. Every startup, after all, dreams of exponential growth in the shortest time possible.

Investors want to be a part of those types of companies just as much.

But how realistic is this trend when making financial predictions?

The answer to that question is one thing every small business needs to consider.

But first, let’s understand what makes a good financial plan.

Characteristics of a Good Financial Plan

Here are the key characteristics of a good financial plan:

- It should be exhaustive. A good financial plan should cover every monetary aspect of the business, present, and future.

- A good financial plan should be fully customized to the business. It should consider the business’s needs, risks, environment, goals, and projections.

- It should reflect the current status of the business’s financial situation. The progress from its current monetary state to your future trajectory should be reasonable and plausible.

You can develop a financial plan for your small business yourself, or you can hire a financial planner to do it for you.

But before we get into the steps of how to make a financial plan for a small business, let’s discuss what goes into a financial plan.

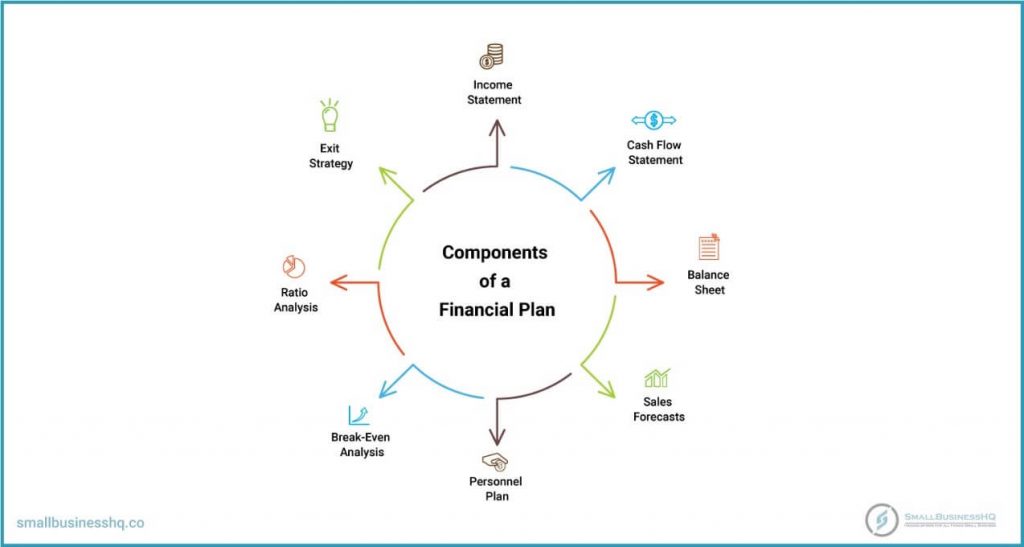

Components of a Financial Plan for a Small Business

When developing a financial plan, there are a few must-haves that you’ll need to include. This goes for both small and large businesses.

Let’s discuss each one of them in detail.

Income Statement

An income statement, otherwise known as a profit and loss statement, determines a business’s profitability. Profit and loss statements are a crucial part of the financial plan for your small business.

An income statement explains your business performance over time, whether you’re making profits or losses.

An income statement is comprised of:

- Sales/revenue

- Cost of goods sold (for businesses selling goods)

- Gross margin

- Expenses

- Earnings

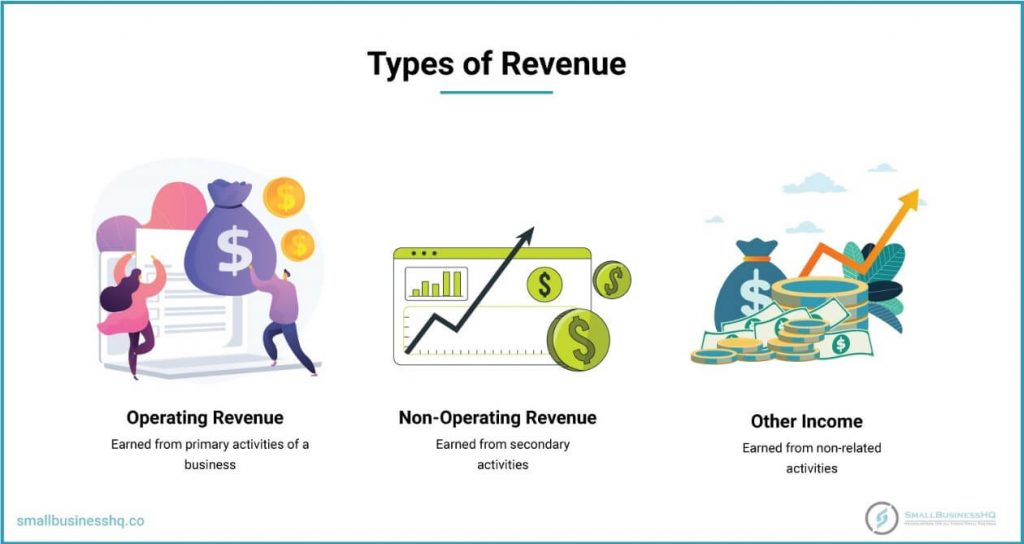

Revenue refers to money received from sales or other operations. It can be categorized into:

- Operating revenue: This is revenue that is generated from a business’s core activities. It can be from the sale of goods and services that the company primarily offers.

- Non-operating revenue: This is revenue from your business’s secondary activities. It can include revenue from royalties and interest.

- Other income: This refers to revenue from activities unrelated to your business’s core operations. Asset disposal is one example of this.

Revenue is counted for the period it was earned. If a sale is made, whether payment is received or not, it’s registered as revenue for the period in which the sale occurred.

Expenses are the costs a business incurs to keep its operations running. They can be categorized into:

- Primary expenses: These are expenses incurred on a day-to-day basis by a business. They include items such as the cost of goods sold, administrative expenses, salaries, utility bills, and depreciation.

- Secondary expenses: These relate to activities that do not directly involve its core operations. For example, interest paid on debt is a secondary expense.

Primary revenue and expenses show how well a business is handling its core operations. Secondary expenses and revenue, on the other hand, illustrate how well a business can deal with unexpected obligations.

Depending on the size of your business and the nature of its operations, income statements can be categorized into two categories:

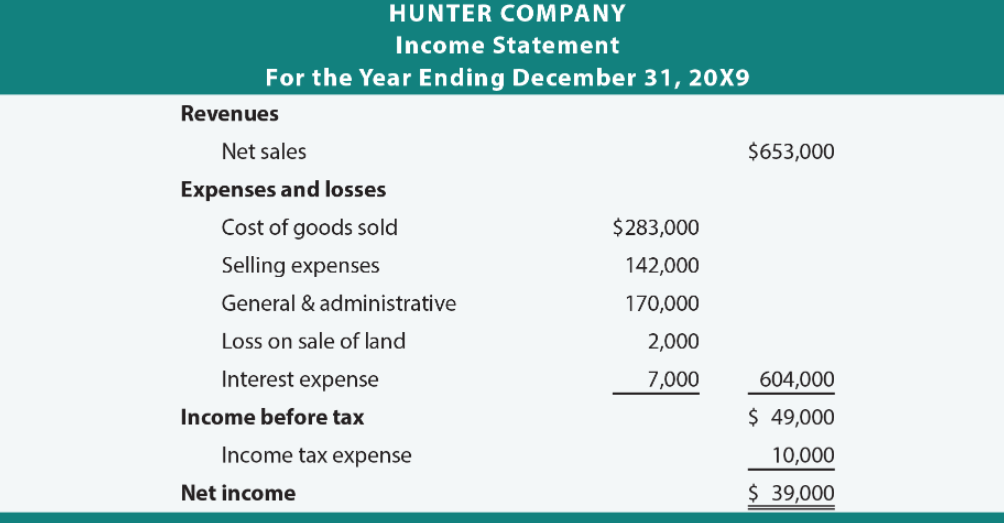

Single-Step Income Statement

These are simple income statements suitable for small businesses with few entries and simple, straightforward structures.

This kind of income statement takes your business’s total revenue and gains and deducts them from your total expenses and losses. Here’s an example:

Image via Principles of Accounting

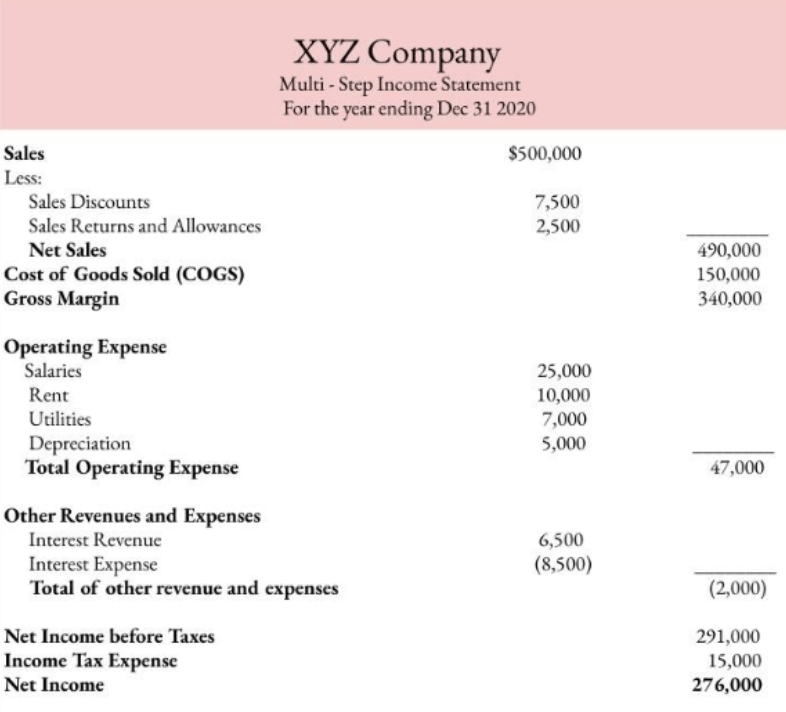

Multi-Step Income Statement

These are suitable for larger businesses or companies. They are more detailed and contain more entries than a single-step income statement.

These entries are separated by categories. For instance, expenses can be separated as operating and non-operating expenses.

Profits are also measured in more detail in a multi-step income statement. These include gross profit, earnings before interest, tax (EBIT), and profit after tax.

At each level of profitability, the changes in amounts can be interpreted differently. For example, when profits before tax are a lot higher than profits after tax, it indicates more tax expenses incurred by your business.

Here’s an example of a multi-step income statement:

Image via Deskera

Every financial plan needs to have a business’s current and projected income statement to:

- Show a company’s profitability levels

- Show a snapshot of a business’s internal activities across its departments

- Help in decision-making

These decisions may include deciding whether to expand a business’s operations or whether to shut some of them down.

Cash Flow Statements

A cash flow statement explains the cash that goes through a business: both inflows and outflows.

A cash inflow refers to money that the business receives from its transactions. These can come from:

- Revenue from cash sales

- Income from investments

- Interest received

- Royalties

Cash outflows are financial payments made by the business. These may include:

- General expenses

- Interest paid on a bank loan

In essence, a cash flow statement is a statement of direct cash spent, versus cash on hand or in the bank.

Cash flow statements differ from income statements in that they only focus on cash transactions, as the name suggests.

When assessing transactions on income statements, income is included as earned and expenses as incurred. Neither are necessarily based on receipts.

Cash flow statements do not make deductions or additions on intangible gains and losses.

For instance, depreciation amounts are added back as these are not cash losses. Similarly, gains such as those from revaluation are deducted, as these are not cash gains.

Why are cash flow statements an integral part of your business’s financial plan? Why does your business need a cash flow analysis besides its income statement?

Here’s the reason:

A cash flow statement helps you assess your company’s liquidity position. This means that you can easily determine if your business can take care of its day-to-day operations sufficiently.

You can also determine your business’s ability to fund unforeseen future expenses through a cash flow statement.

Can your business remain operational in uncertain times? A positive cash flow will provide confidence that yes, it can.

With this kind of outline, you can easily show investors what your business is capable of when it comes to its primary activities.

Furthermore, you can determine if there’s a gap in financing, exactly what the gap is from, and what’s needed to fill it. You can also use these for future cash flow projections.

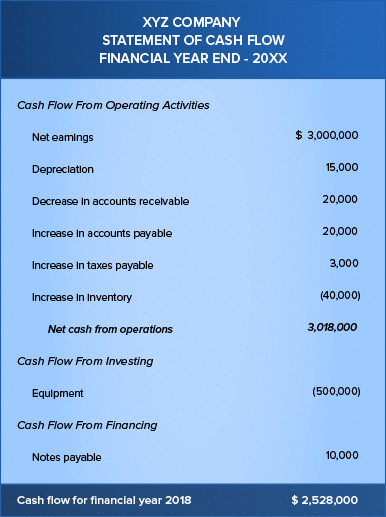

Here’s an example of what a simple cash flow statement looks like.

Image via Zoho Books

There are several different types of cash flows.

This refers to cash flow from a business’s basic operations. For instance, Walmart’s basic operations would be the sale of goods.

If your business offers a service, then its operating cash flow would include transactions around this service.

It also includes other activities that directly support this basic operation, such as salaries, utility bills, and transportation.

With operating cash flows, you deduct operating expenses from cash sales.

An operating cash flow helps determine if a business needs funding or if it needs to expand its operations.

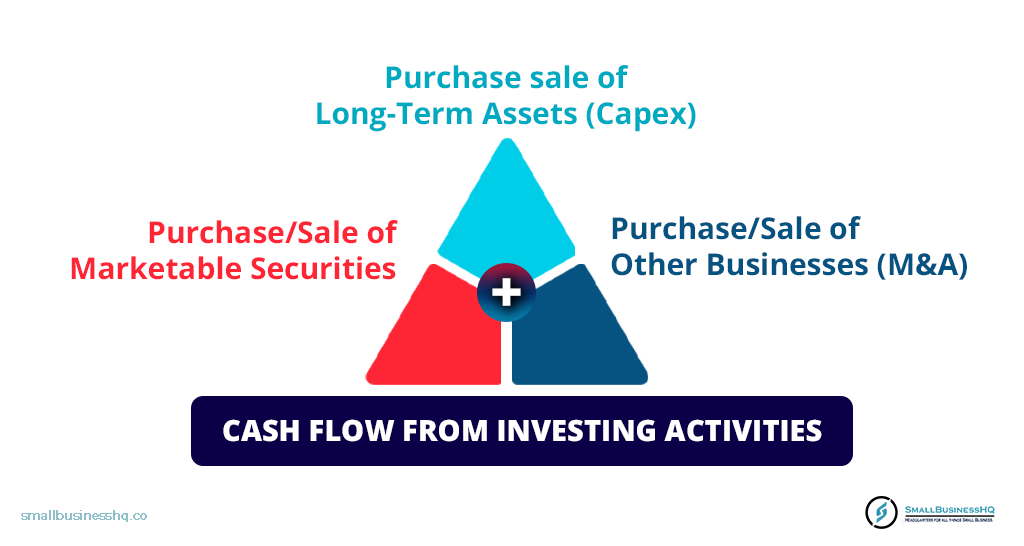

2. Investing Cash Flow

Investing cash flow refers to money spent on or received from an investment. This could include:

- Purchase or sale of fixed assets

- Purchase or sale of securities

Negative investing cash flow may indicate poor investments. This information, then, will help a small business make better future investment decisions.

3. Financing Cash Flow

This refers to cash flow from financing activities such as debt and equity. It shows how money flows from investors and creditors into the business and back out.

This, therefore, involves transactions such as:

- Dividend payments

- Payment of debt or interest on debt

- Selling and issuing stocks

- Issuing bonds

With financing cash flow, your investors will see how you’re funding your business and what your gearing ratios (ratios comparing equity to debt) are. This way, they can determine if your business is a good fit for them.

Cash Flow Versus Income Statement

An income statement determines a firm’s profitability. However, a firm may be profitable yet still struggle with short-term liquidity.

This is because a firm’s profitability is measured only by its revenue and expenses. An income statement, however, does not distinguish between cash and non-cash revenue and also accounts for money not received.

For this reason, cash flow statements offer more precision than income statements for short-term predictions.

Income statements and cash flows, then, can and should be analyzed alongside each other.

Some factors indicate that the flow of cash in your business may need fixing, and these factors can be traced back to your income statement.

For instance, too much cash can be stuck in your business’s accounts receivables or in excess inventory. This shows you that you need to better manage your cash flow.

Statement of Financial Position

Commonly known as a balance sheet, a statement of financial position contains information about a business’s assets, liabilities, and equity.

This is the statement that indicates how much a business owns, how much it owes, and how much has been invested in it.

Balance sheet statements from different years are commonly used in comparison to each other for ratio analysis. This analysis provides trends that help in making financial predictions.

We’ll discuss these business financial ratios and their significance to your business later.

For now, let’s discuss exactly what a statement of financial position contains and what it looks like.

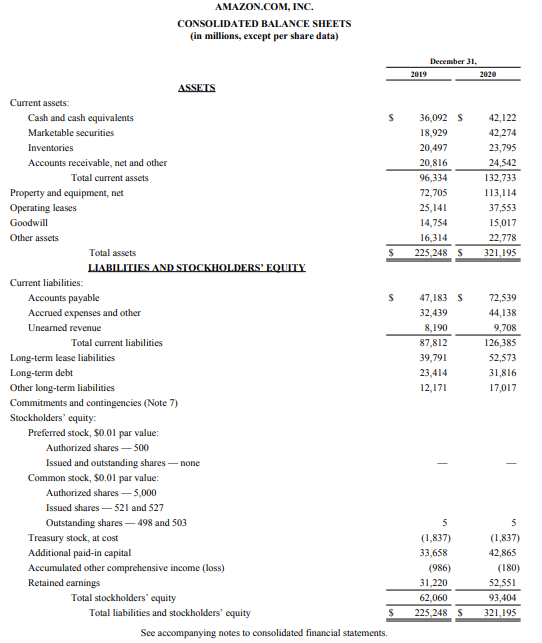

Here’s an example of what a balance sheet should look like:

Image via Amazon

First, it’s called a balance sheet for a reason: the assets a business owns should equal its liabilities and equity.

The components of a balance sheet may vary by business, and different items may have different interpretations. Here are some common items each balance sheet should contain:

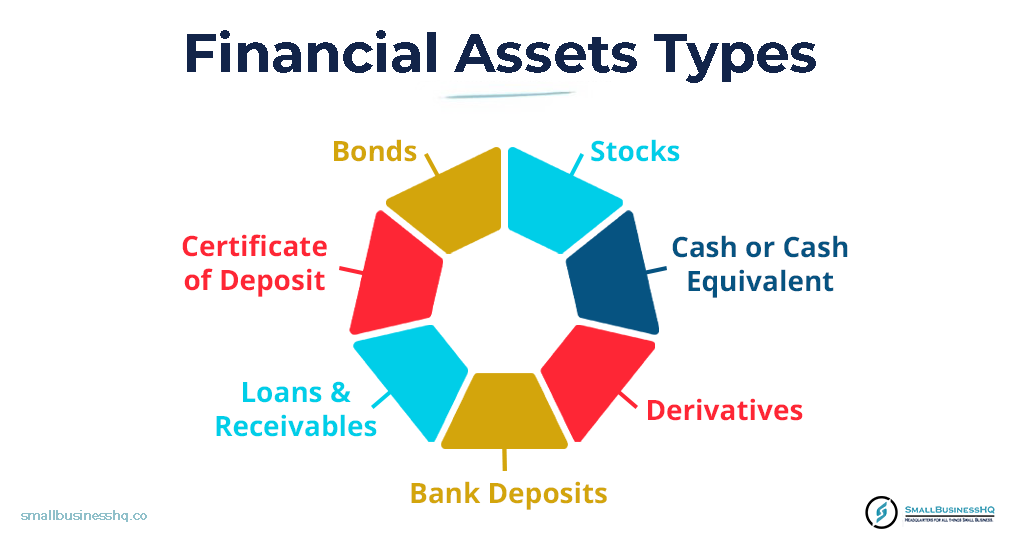

Assets

The assets on a balance sheet will appear in ascending order of their liquidity.

This means assets that cannot be easily converted to cash are listed first. More current assets should follow.

Fixed assets of a company may include:

- Intangible assets such as patents and goodwill

- Long term securities

- Land and buildings

- Equipment

- Machinery

- Furniture and fixtures

Current assets may include:

- Inventory

- Cash and cash equivalents

- Accounts receivable

- Short-term securities

Liabilities

These constitute a company’s financial obligations and these also appear in the order of liquidity.

Long-term liabilities include:

- Long-term debt

- Deferred tax

Here are examples of current liabilities:

- Bank overdraft

- Accounts payable

- Interests payable

- Wages payable

- Dividends payable

Shareholder’s Equity

This section contains equity investments made in the company as well as the company’s retained earnings.

Retained earnings are either invested back into the company or distributed among shareholders.

Besides retained earnings, this section contains:

- Ordinary shares

- Preference shares

Unlike ordinary shares, preference shares have par values that are not affected by market changes.

A company’s statement of financial position is used alongside its income statement, and a cash flow statement is used to assess its performance.

Here’s more on why it’s important to have a balance sheet in your financial plan. It determines:

- Your company’s net worth

- Its liquidity ratio

- Whether your company can handle its financial obligations

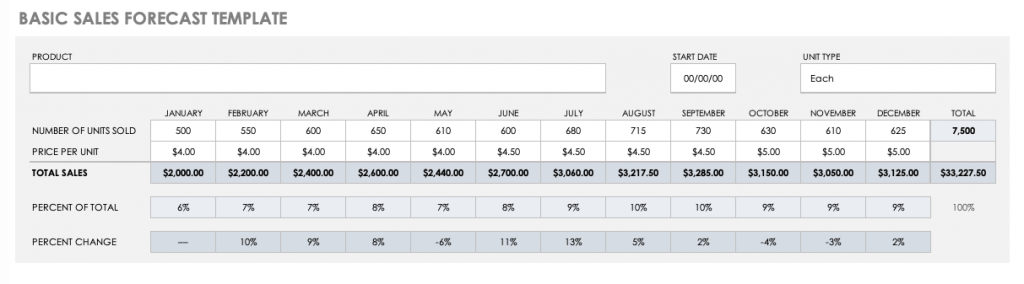

Sales Forecasts

This refers to the projected sales revenue your business expects to make in the future.

Sales forecasts are important for any business. Here’s why:

Businesses develop budgets based on their sales forecasts. Marketers also create their sales demand plans based on this data, including the amount of inventory to purchase.

Sales forecasts, therefore, need to be incredibly accurate.

Accurate sales forecasts ensure you avoid major issues like understocking or overstocking.

They also give your business confidence in its performance, and increase your business’s credibility to your stakeholders.

Here’s an example of a basic sales forecast template:

Image via Smartsheet

So how do you come up with accurate sales forecasts?

Keep reading to find out.

Guide for Creating Accurate Sales Forecasts

Here is a step-by-step guide to creating accurate sales forecasts.

- First, you need to assess your business’s past trends. These set the basis for your projections.

- After coming up with projections, optimize them based on:

- Price: Ask yourself if there are going to be any price changes for your products in the future. If yes, incorporate these changes into the projections.

- Marketing strategies: Are there any new marketing strategies you plan on implementing to promote your products? How do you suppose these strategies will change your sales forecasts? Have you used them in the past? How did they perform? Use these insights to adjust your projections.

- Projected customers: This refers to how many new customers you anticipate winning in the future. Are you planning to hire new salespeople to win more clients? If so, how will this change your business’s current state?

- Projected growth: Adjust your projections to match anticipated growth within your business. Does your business have geographical expansion plans? Are you planning to open new branches? Do you want to reach a different demographic? Are there any new products being introduced?

- Then, try to anticipate how market changes could affect your business. This involves identifying any legislative changes that may affect your product.

It may also involve predicting economic situations that could affect your business, such as recessions.

- Monitor your competitors. Are they introducing new products that may take a share of the revenue from your products? Which markets are they expanding into?

- Once you have made all these analyses and comparisons, you can modify your forecast to make it more accurate.

Now that you understand how to create accurate sales forecasts, let’s discuss why they’re helpful.

Benefits of Sales Forecasting

Having a sales forecast helps your business in the following ways:

- You can make better decisions for the future of your business

- Your sales and revenue align more closely if your sales forecasts are accurate

- If your sales forecasts correctly reflect your sales, they can be used for future trend analysis

- They help reduce wastage from overstocking

Types of Sales Forecasts

Here are the various types of forecasts:

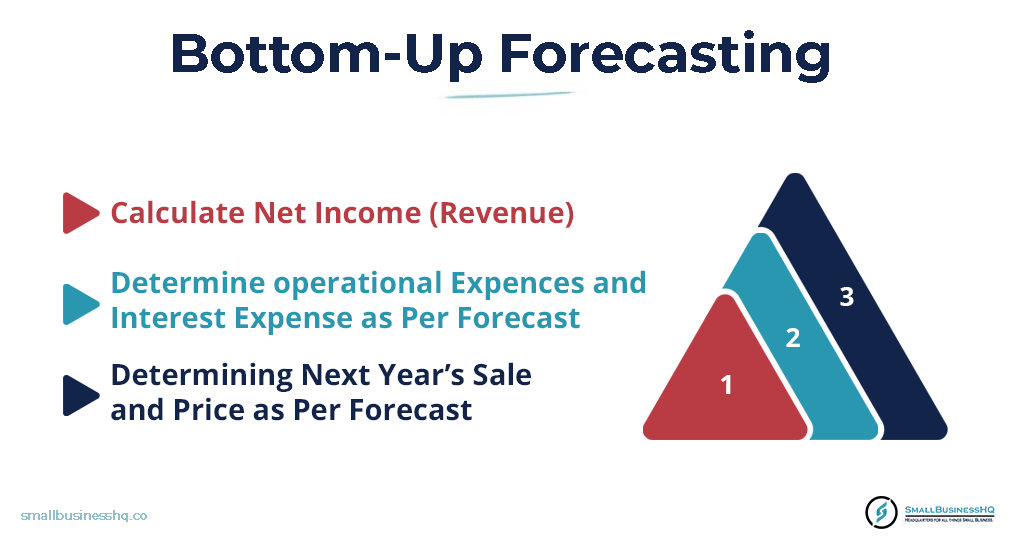

Bottom-Up Forecast: This method of sales forecasting starts with the smaller items that add up to form the major items.

For instance, you could begin by projecting the number of units of sale you want your business to achieve. From here, you can proceed to estimate a price and multiply that by that number of units.

It’s a simple method to use, as you can easily modify variable items such as unit prices in case of any changes.

Top-Down Forecast: This method estimates the total market share that your product competes for. This is done in terms of the amount of revenue the market can produce.

From there, you can then determine, as a percentage, the share your business will have in this market.

Say the total market size is $20M and your market share is 15%. This means that your projected revenue will be $3M.

The best way to go about sales forecasting is by using both methods. This way, you can compare the results of both and try to streamline them over time for higher accuracy.

The efficiency of your sales forecast depends on its accuracy. Accuracy is determined by:

- The reliability of your data

- Your business’s past analytics and trends

- The collaboration among your company’s departments

- Whether you’re using automated forecasting features of a sales software solution

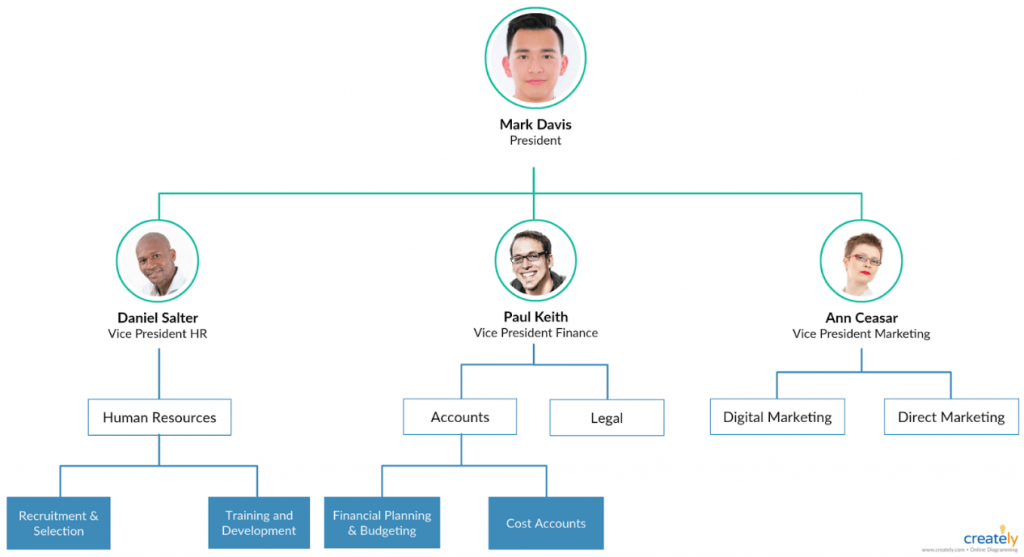

Personnel Plan

A personnel plan refers to an overview of employees or contractors your business hires, and their expenses.

It could also contain a projection of employees that your organization intends on hiring in the future.

A personnel plan is a crucial part of every financial plan. This is because human resources usually account for the most costly expense for most organizations.

However, human resources are as important as they are costly, and businesses simply can’t do without them.

Investors need to know the nature of your team and why each member is important for your business. A personnel plan outlines every team member as well as their significance and why the business needs them.

Potential investors will also need to know if any financial gaps need to be filled regarding personnel. For instance, if there are any positions that you need to fill but have financial constraints, that’s pertinent information.

With a personnel plan, you’ll easily identify these gaps and know when to hire new people.

In addition to this, deciding your employee remuneration rates will be easier.

Here’s a guide on how to create a personnel plan:

When creating a personnel plan, you need to first describe the team you’re currently working with. This includes naming your team members and mentioning their qualifications.

It doesn’t stop at that. You will also need to convince investors why these people are best-suited for their respective roles.

Include information on their backgrounds, what they’ve worked on before, and their academic qualifications. This way, you can easily match their skills to their roles.

Next, describe the hierarchical structure of your team and who takes care of what.

This could be represented visually using a chart, as shown below:

Image Source: Creately

You can also include employees that haven’t joined yet or estimates for an increase in the number of employees.

Note: If your team still has gaps, which is often the case for startups and small businesses, that’s perfectly okay.

However, if you’re using your financial plan to approach investors, you may need to explain those gaps. This would mean explaining why you haven’t hired someone for a role yet and what your plans are to do so.

With small businesses and startups, it’s also important to note that some employees could take on many roles. Given the size of the business, there may be undefined structures and fewer roles per department.

A financial plan also includes forecasts of what the employees will be paid.

Payment to personnel can be categorized into two categories:

Direct labor costs: These are payments directly made to employees or contractors for their work. They include salaries, wages, bonuses, and overtime.

Indirect expenses: These are other expenses that are related to employees but are not directly associated with their work. These include:

- Paid leave

- Health and insurance covers

- Payroll costs such as software and taxes

- Employee benefits

Numbers for indirect costs may not be exact. In such cases, you can always add estimates to your financial plan for these expenses.

When listing employee costs, you can put them together as a group per department, and then list your top employees only.

For instance, you can list customer service representatives under the customer care department. Then, prepare individual lists for department heads and so on.

You can then include these personnel cost projections in the expenses section of your income statement estimates.

Break-Even Analysis

This is an analysis of your costs, sales, and profitability. A break-even analysis seeks to determine your business’ safety margin.

This involves examining how many units of sales your business requires to cover its fixed and variable costs.

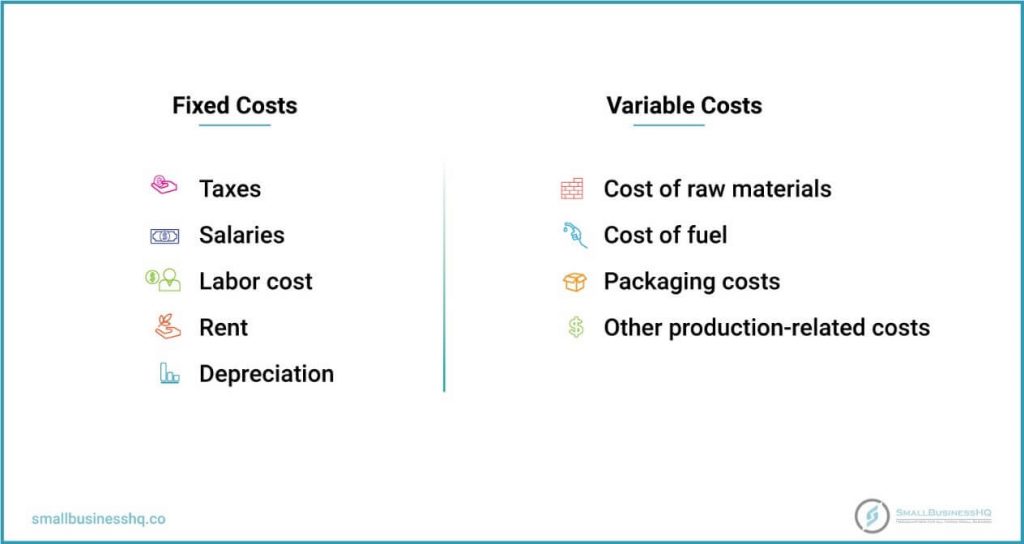

Fixed costs, also known as overhead costs, are expenses that remain constant regardless of the number of sales. Examples of fixed cost include:

- Taxes

- Salaries

- Labor cost

- Rent

- Depreciation

Variable costs, on the other hand, vary and can either increase or decrease depending on the production volume. These include:

- Cost of raw materials

- Cost of fuel

- Packaging costs

- Other production-related costs

Fixed assets are the main determinant of your company’s break-even point.

Here’s why:

When calculating your break-even point, you take your total fixed costs and divide that by sale price per unit. You then subtract your variable costs from this result.

Therefore, lower fixed costs will equal lower break-even points.

Why is it important to conduct a break-even analysis?

Here’s why your financial plan needs it:

- Managing production: With a break-even analysis, you can tell how many units you need to produce to cover your company’s costs.

- Decision-making: With knowledge of the sale volume needed to make a profit, management can come up with reports on the safety margins. These reports help in future production decisions.

- Tracking costs: With this analysis, you’ll see the amount of fixed and variable costs and how they’re affecting your profitability.

- Pricing: Break-even analysis uses product unit price to determine profitability. So, you can set your pricing optimally to reach break-even faster. For instance, to break even, increasing a product’s price would mean a reduction of sales volume. Likewise, reducing the price of your products would mean increasing the production volume. You need to find the perfect balance between the two to set your price right.

- Budgeting and sales forecasting: Knowing your business’s break-even point makes it easier to set sales targets. It also makes it easier to budget production costs.

Investors may need break-even analysis data to determine at what point their investments start giving them returns.

Break-even analyses act as guides for startups on how to price products before launching them. The same goes for businesses planning to launch a new product.

Ratio Analysis

Financial ratios are tools that gauge your business’s efficiency, liquidity, profitability, and stability.

They are calculated using data obtained from your income statements, cash flow statements, and balance sheets.

This is done by comparing data in these statements from various years to identify trends.

There are different types of financial ratios that businesses use, and each has its own distinct formula. Let’s look at these business ratios in more detail:

- Liquidity ratios: They measure how well a business can take care of its current debts without extra help. Examples include:

- Quick Ratio

- Current Ratio

- Cash Ratio

- Working Capital

- Profitability ratios: These ratios measure how well your business can make profits given its revenue and expenses. These include

- Return on Investment (ROI)

- Gross Profit Ratio

- Net Profit Ratio

- Operating Ratio

- Operating Profit Ratio

- Solvency ratios: These measure the business’s ability to fulfill its long-term debt obligations, and are mostly used by lenders. Examples of solvency ratios are:

- Total Debt-to-Equity Ratio

- Long-Term Debt-to-Equity Ratio

- Debt Ratio

- Proprietary Ratio

- Financial Leverage

- Efficiency ratios: These measure how well a company uses its assets to generate income. They also measure how a business manages its liabilities.

- Asset Turnover

- Inventory Turnover

- Accounts Receivable Turnover

- Accounts Payable Turnover

- Valuation ratios: These are metrics used to measure the value of companies across industries. For example:

- Price-Earnings (P/E) Ratio

- Price to Book Ratio

- Price to Cash Flow (P/CF) Ratio

You don’t need to include all of these complex ratios in your financial plan. However, there are a few essential ones that will tell you and your investors what you need to know.

Here’s a quick overview of the top financial ratios every business needs:

- Acid test: This is also called the quick ratio, and it shows how sufficiently your current liabilities can be offset by your near-cash assets. You get this by subtracting inventory from your current assets and dividing that by current liabilities.

- Working capital: This determines how your business can pay current liabilities using current assets. It’s the difference between your current assets and current liabilities.

- Debt-equity ratio: This is a company’s gearing ratio; a comparison between your debt funding versus equity financing. You get this by dividing your debt by the book value of your shareholder’s equity.

- Earnings per share: This measures the returns an investor gets on every share they buy from your company. You get it by dividing net income by the number of ordinary shares owned.

- Price-earnings ratio: This ratio shows the value of a company’s future earnings. It’s calculated as the share price divided by earnings per share.

- Return on equity (ROE): This ratio measures the profitability of a company against shareholder’s equity. It helps show investors how profitable their investment in the business has been. It’s calculated by taking the net profit after taxes less dividends then dividing the result by the ordinary share value.

Why does your business need financial ratios? Here are a few reasons.

- Provides a regulated method of comparison: Financial ratios are calculated using uniform formulae. This way, analysts and investors can compare the performance of different companies across industries using the same standards.

It also offers a more detailed view of a company’s liquidity and profitability. For instance, a smaller company with seemingly fewer returns can have more earnings per share than a larger business.

- Provides analysis and benchmarks: Using these ratios, you can identify trends not only for your business but also for the industry you operate in.

This way, you can make comparisons and benchmark your performance against the high performers in your industry. You can also measure your company’s performance against the industry using these ratios.

- Determines company worth: With financial ratios, you can determine a company’s worth for investing purposes. Stock valuation ratios show how sustainable your investors’ earnings will be if they buy stocks in your business.

- Helps with planning: Financial ratios guide small businesses through planning presentations for investors. They also help them set goals based on industry performance.

Trends provided by financial ratio analysis help you make strategic changes in your organization.

Exit Strategy

Every business needs an exit strategy in its financial plan. Exit strategies outline the owner’s plan to sell their business to investors in an event that it becomes either unsuccessful or unprofitable.

The purpose of an exit strategy is to minimize any losses the business might incur in the process.

There are a few exit strategy options a business can make depending on its size and type. These include:

- Going public by issuing an IPO (initial public offering)

- Management buyouts

- Strategic mergers and acquisitions

- Liquidation

- Filing for bankruptcy

Picking an exit strategy may be influenced by several factors including but not limited to:

- The type of business you’re running. Selling a business may be convenient for a sole proprietor. This is because their goal would be to make as much money as they can on their way out. That is different from public companies with stakeholders whose interests have to be considered as well, for example. In a case like that, selling may not be the best option.

- The market situation. Initial public offerings are considered an appealing way to raise extra capital by most privately-owned companies. However, it can be a disadvantageous strategy to adopt during periods of recession. This is because share prices tend to drop during that time. The company would lose money trying to gain capital this way, as they’d have to issue shares at prices below par value.

- How much control one is willing to let go of. With exit strategies like acquisition, you will have to relinquish all control of your business. Strategies like initial public offerings let you retain some control of your business, giving up only a fraction of it.

- The way you want the business to be run. With mergers, you can retain part of your business structures and even staff.

- How much liquidity the exit strategy offers. For instance, an acquisition offers the highest liquidity within the shortest time frame. It will determine whether or not you can let go of your business as long as a certain amount of money is paid.

- Reputation. Some exit strategies such as filing for bankruptcy are considered undesirable.

There is no single best exit strategy, as they all depend on the different factors listed above. Remember, you should make sure that the exit strategies you choose are as favorable for your business as possible.

4-Step Process for How to Develop a Financial Plan for a Small Business

Now that you have an in-depth understanding of financial plans, it’s time to take action and learn how to develop a financial plan for a small business.

Here’s a step-by-step guide on how to do it:

1. Evaluate Your Company’s Strategic Plan

Before you develop a financial plan for your small business, you need to first review what your business’ overall strategy is.

The reason for this is that it is from your overall business strategy that you will develop a financial plan, as these two need to be in sync.

You will need to look at what your business has in store in the near future. To find this out, you may need to ask questions such as:

- Does your business plan on expanding to new locations?

- Are you planning on making any heavy purchases on fixed assets, e.g. equipment, machinery?

- Are you planning on making any new hires in any department?

- Are there any additional resources the business wants to introduce?

- How much extra funding does the business need for these business plans, if any?

By answering these questions, you’ll know where to start when making your financial projections.

2. Create Financial Estimates

The next step is to start creating your financial projections. You can do this either on a monthly or weekly basis depending on the bulk of your transactions and cash flow.

These projections include income and expenses. Based on the strategic plans you already have in mind, you can come up with estimates for your expenses.

Keeping track of these expenses is crucial. To do so, you can use accounting software, as they are more organized and automated.

You will also need to prepare income estimates, which will be based on your sales forecasts. With an accurate forecast of how many sales you will make, you can come up with near-accurate income projections.

Just remember, it’s important to play it safe when making income projections. You should include both conservative and optimistic estimates that take different possible scenarios into account.

That way, you can mitigate losses for periods with reduced sales and still keep your business afloat. If you run into difficulties making these projections, then you can always seek help from professionals.

However, if you’re going to pitch these statements to investors for funding, you need extensive knowledge of your company’s financial standing.

Financial estimates help you determine your business’s financial gaps. Once you have identified these gaps, you can then approach your partners and discuss funding.

At that point, you’ll decide if debt capital or equity is the way to go. If you’re going for a mix of both, then you can come up with the right ratios based on your forecasts.

3. Anticipate Uncertainties

This means preparing for those inevitable rainy days. Some periods are better than others, and there are many factors that can affect business performance.

The truth is that businesses always experience some form of unforeseen financial constraints at some point. These could be in the form of emergencies or simply an unexpected decrease in sales.

Your financial plan needs to have a strategy for such times.

How can you put that in place?

By setting aside contingency funds. This is a must-have for any business in these kinds of situations.

Reserves come in handy for uncertain situations and can help your business survive tough times.

What’s next in this guide on how to develop a financial plan for a small business?

Keep reading to find out.

4. Monitor and Adjust Goals

Once you have set your financial goals, you can monitor them over time against your actual performance. Compare the results against your projections and take note of any disparities.

Once you identify how much deviation there is between the two, you will know what steps to take next.

Negative disparities show that there are adjustments you need to make in your way of doing business. Luckily with these projections, you can easily spot the problem.

You’ll also be able to find solutions to the problems causing those disparities. For instance, a costly marketing strategy might not be yielding enough sales. If you discover that this is the case, then you can switch to a different marketing strategy.

This marks the end of the section on how to develop a financial plan for a small business.

In the next section, we’ll discuss how you can develop a financial plan for a small business quickly by using certain resources and tools.

Resources to Help You Develop a Financial Plan Faster

Creating your financial plan from scratch can be tedious. The good news is, you don’t have to! Some tools can help you develop a financial plan for a small business much faster and with less effort.

These tools include templates, apps, and financial plan outlines. Let’s discuss them further.

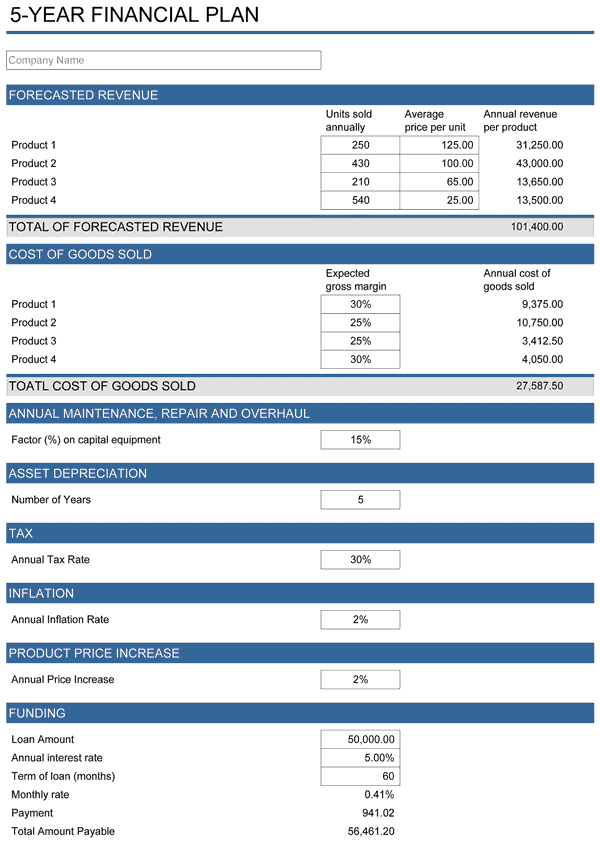

1. Financial Plan Templates

There are plenty of templates that can help you with your financial planning. Some of them come as downloadable documents that you can fill in with your business-specific details.

Some are customizable, allowing you to make them into whatever fits your business structure. These templates are especially useful for smaller businesses.

More complex templates can act as models that will guide you through how to include items in your financial plan.

They contain provisions for past entries and future projections. This will eliminate the distress that comes with deciding which way to structure your financial plan.

This makes it easier to come up with your customized template as well. There are many such free templates online that you can draw inspiration from.

Here’s an example:

Image via SpreadSheet 123

2. Financial Planning Software

Financial planning software has built-in instructions and prompts that guide you through the process of how to develop a financial plan for a small business.

Depending on the tool, it might also provide tutorial videos to take you through developing your plan.

They’re also easier to use than spreadsheets since you’ll likely have automated functions, such as calculations.

These kinds of software applications will also help you easily produce analytics and provide visuals such as graphs and charts.

Additionally, these applications allow you the flexibility to develop a financial plan according to your requirements. Wherever you’re located, they allow you to access your financial plan from any of your devices.

3. Financial Plan Samples

In addition to templates, there are financial plan samples that you can easily access and use to develop a financial plan of your own.

Samples are based on examples from real businesses, and consist of examples of finished financial plans showing transactions from companies you may know.

You can study the details of these existing businesses, especially those with a structure similar to that of your business. This way, you’ll get a more detailed look at what your own projections would look like.

Then, you can personalize these plans based on the distinct challenges your business faces. Different businesses, even those with similar structures, have varying challenges.

Remember: don’t use any of these samples as-is; use them only as guides to help you develop a financial plan for your small business.

4. Financial Plan Outline

These outlines give a basic structure of what a financial plan generally looks like. They guide you on how to develop a financial plan easily and what all to include in it.

Different types of businesses may have different components in their financial plans and have different outlines.

Therefore, be sure to consider the nature of your business when choosing a financial plan outline.

5. Financial Planning Services

If the whole process just seems too overwhelming to you, you can always hire professional financial planners to develop a financial plan for your small business.

However, since you’re the one with the most knowledge about your business, you’ll still need to be involved in the process to develop a financial plan.

It will be your duty to provide the information needed. It’s also crucial to be part of the process to make changes to it over time, as needed.

This brings us to the end of this post on how to develop a financial plan for a small business. We hope it’s been helpful to you!

FAQs

1. How can you develop a financial plan for a business?

Developing a financial plan for a business involves knowing what its purpose is. You also need to know the components of a financial plan.

Once you have this figured out, everything else will fall into place. You can then easily analyze your business’ financial strategies, create estimates, anticipate uncertainties, and adjust your financial goals.

2. What is included in a financial plan for a small business?

A financial plan for a small business needs to have the following components:

- Cash flow statement

- Income statement or a profit and loss statement

- Statement of financial position/balance sheet

- Sales forecast

- Personnel plan

- Break-even analysis

- Financial ratio analysis

- Exit strategy

3. What are the four steps in the financial planning process?

The four steps in the financial planning process include:

- Evaluating your company’s long-term strategy

- Creating financial estimates

- Anticipating uncertainties

- Monitoring and adjusting goals

Be sure to follow those steps to develop a financial plan for your small business.

4. What financial statements are needed for a business plan?

All three financial statements are needed for a business plan, i.e., an income statement, a balance sheet, and a cash flow statement.

They’ll all be analyzed together to determine a business’s performance, profitability, liquidity, and net worth.

5. How do you write a financial assumption?

When making financial assumptions for your forecasts, you need to:

- Research various aspects of the small business you intend to project.

- Refer to your financial statements and those of other industry players.

- Be ready for any outcome. Make pessimistic, moderate, and optimistic assumptions.

- Record all your assumptions for future reference.

- Explain the basis for your financial assumptions.

6. How do you create a sales forecast for a business plan?

You create a forecast by estimating what your company’s future sales will be based on historical financial data. Making a sales forecast for a business plan requires accuracy for the forecast to be useful.

When making sales forecasts, therefore, there are several different factors you consider. These include past trends, future pricing, market changes, promotional activities, and competitor behavior.

7. What is a break-even point for a small business?

A break-even point for a small business refers to the sales it needs to make to cover its fixed and variable costs.

At the break-even point, a company’s profitability is zero. This analysis helps determine a company’s safety margin. It shows the exact point where a company covers its costs and starts making profits.

8. How do you calculate the break-even point of a small business?

You calculate the break-even point of a small business by taking its fixed costs and dividing this by cost per unit sale. You then take the amount you get and subtract your variable costs.

The result is the number of units a company needs to sell to break even, i.e. cover all costs without making a profit.

9. What should an exit strategy include?

An exit strategy should include a company’s options in case its operations turn out to be unsuccessful. These options need to ensure the company cuts its losses and exits in the best possible manner.

10. What are the four exit strategies?

A company can choose any of the following common exit strategies:

- Initial public offering

- Strategic mergers and acquisitions

- Liquidation or filing for bankruptcy

- Management buyout

It’s important to consider the best exit strategy and include it in your financial plan. After all, it’s always good policy to hope for the best but prepare for the worst.

Ready to Develop a Financial Plan for Your Small Business?

Every business needs a financial plan. Small businesses need a financial plan more to get a sense of structure and direction that they need to grow.

This post has all you need to know about how to develop a financial plan for a small business. Use it as a reference to develop a financial plan for your business.

Also, note that developing a financial plan is an ongoing process that doesn’t just stop at creating a plan once. You’ll need to make constant reviews and changes to keep optimizing your financial plan.

What are you waiting for?

Use this guide on how to develop a financial plan for a small business and set your business up for success.

![Inc Authority vs Incfile [2024]: Which is a Better Choice? Inc Authority vs Incfile [2024]: Which is a Better Choice?](https://smallbusinesshq.co/wp-content/uploads/small-business-marketing-62432218f1319-sej-300x158.png)