If you’re confused about whether to choose DBA or LLC for your new business, this post is for you.

Both these business structures are wildly popular in the United States. In fact, there were over 3 million Limited Liability Companies (LLCs) in the country as of 2020. As for DBAs, the number could be even bigger as every organization or person could get them.

Now both DBAs and LLCs enable you to run your business under a name that’s different from the legal business name, it’s important to understand how they differ. Only then should you choose which one to form and engage an agency like Incfile or Inc Authority.

So, how are they different?

To help you understand the differences between the two, we’ve put together this guide.

Let’s get started.

What is a DBA?

DBA is short for Doing Business As. It’s also called a Fictitious Business Name or assumed name, which allows a business to operate under a name that’s different from its legal name.

It’s typically used by businesses that want to create an offshoot company with a different brand name or rebrand themselves.

Creating a new business from scratch wouldn’t make sense in this case, making a DBA favorable. Many Sole Proprietorship firms also use DBAs to assume a different brand name as they otherwise have to operate under the owner’s name.

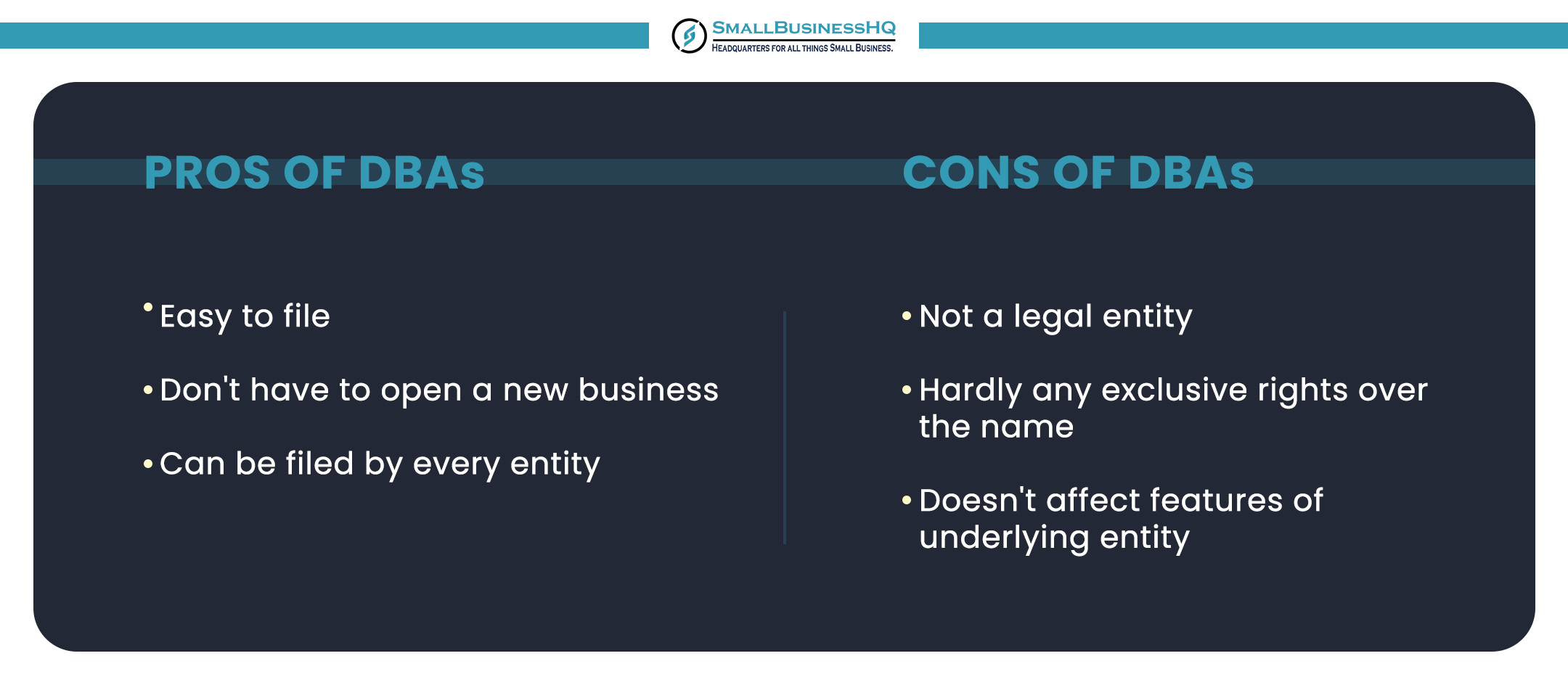

Pros of DBAs

- Easy to file and relatively inexpensive.

- Don’t need to open a new business to file a DBA.

- Can be filed by almost every type of business entity, including LLCs and Corporations.

Cons of DBAs

- DBA isn’t a business structure or a legal entity. It’s just a new name that your business assumes—not a legal business name. You can’t conduct business solely with a DBA.

- You don’t necessarily get exclusive rights to the DBA name.

- The limited liability protection, business compliance requirements, and other factors aren’t influenced by the DBA.

What is an LLC?

LLC is short for Limited Liability Company, and it’s a legal business entity that is registered with the state. It’s a separate legal entity from its owners, so everything that it owns or owes is attributed to the business and not its owners, who are called members.

This clear distinction between the members and the LLC is the reason why an LLC offers liability protection to its members. They can’t be held liable for the debts the LLC incurs as their personal and business affairs are separate. You can start an LLC by using the services of a company like Incfile.

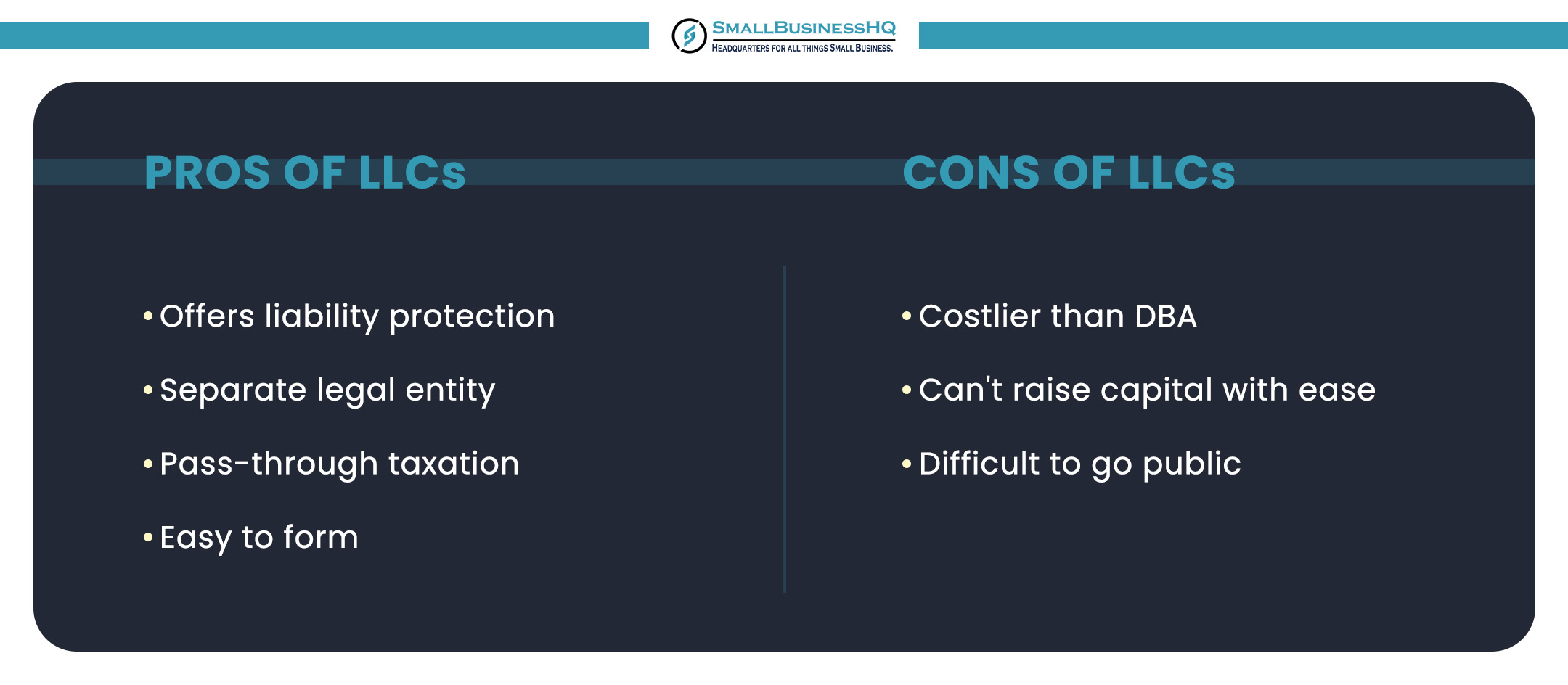

Pros of LLCs

- Offers liability protection to the owners.

- It’s a separate legal entity, even if it’s a single or multi-member LLC.

- Provides pass-through taxation feature that saves you from double taxation—something that Corporations have to deal with.

- They are easy to form.

Cons of LLCs

- They are costlier to run compared to DBAs as they are legal entities.

- You can’t raise capital with ease, unlike Corporations that can easily issue shares.

- It’s difficult to go public with an LLC.

You May Also Like:

Differences Between DBA and LLC

Now that you know what an LLC and DBA are and their pros and cons, let’s get down to the real deal—how these two stack up. Here’s how both are different based on various factors.

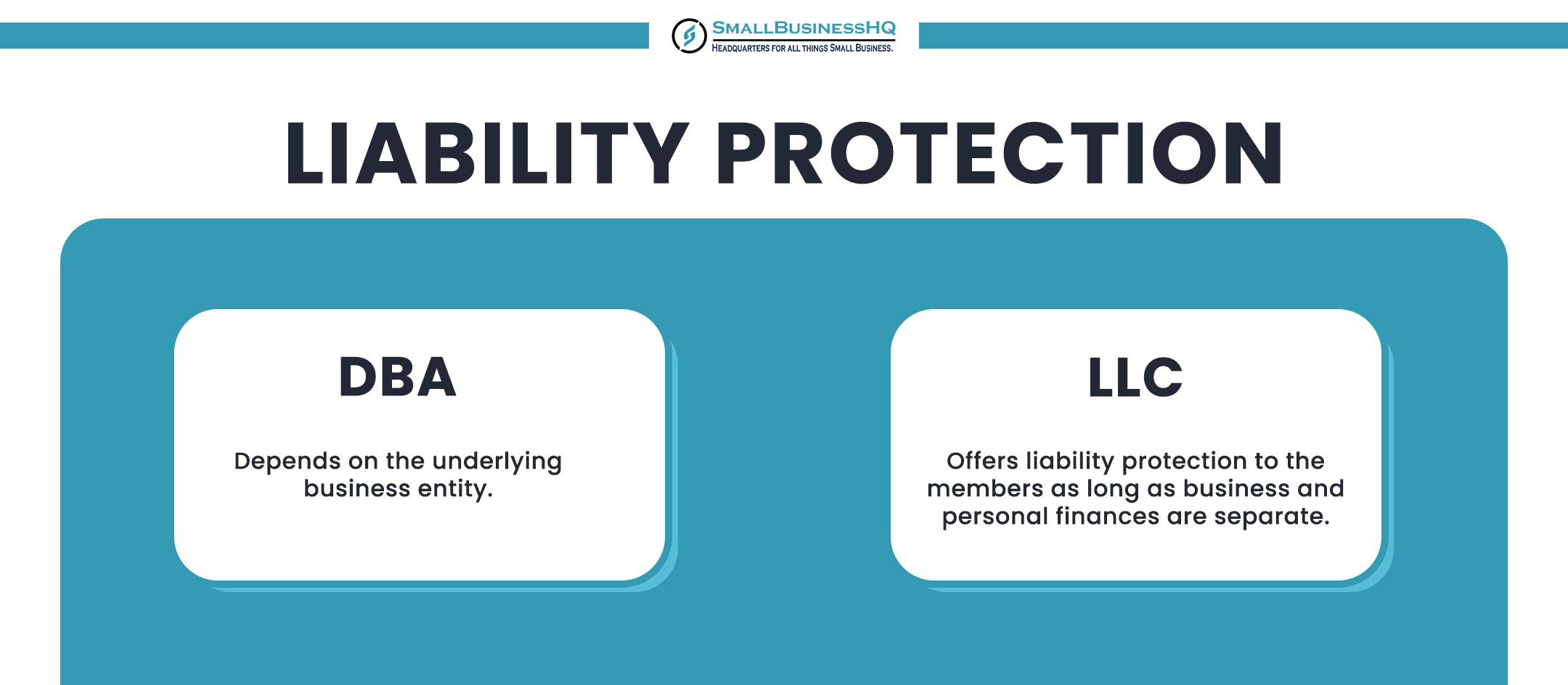

Liability Protection

When you launch a business, you’d want to shield yourself from any potential legal and financial ramifications. That’s where liability protection comes into play.

If you opt for a business structure that offers business liability protection, your personal assets can’t be used to pay off business debts. This means you can do business without worrying about how it could impact your personal finances.

DBA

A DBA registration, by itself, doesn’t offer any liability protection for your business. That’s because it’s not a legal entity at all. It’s just a fictitious name for your business.

Instead, what matters here is your business entity. If you’ve opted for a Sole Proprietorship, you’ll not have any liability protection. However, if you’ve opted for a DBA after starting an LLC or Corporation, you’ll get the advantage of business liability protection.

LLC

As the name suggests, limited liability forms a part of the LLC name. When you start an LLC in any state in the United States, you won’t be liable to pay off your business liability using personal assets. This is the case with both single and multi-member LLCs.

That said, there’s a chance your liability protection could be withdrawn if you don’t keep your business and personal finances separate.

That’s why it’s crucial to open a business bank account and conduct your business transactions solely through that.

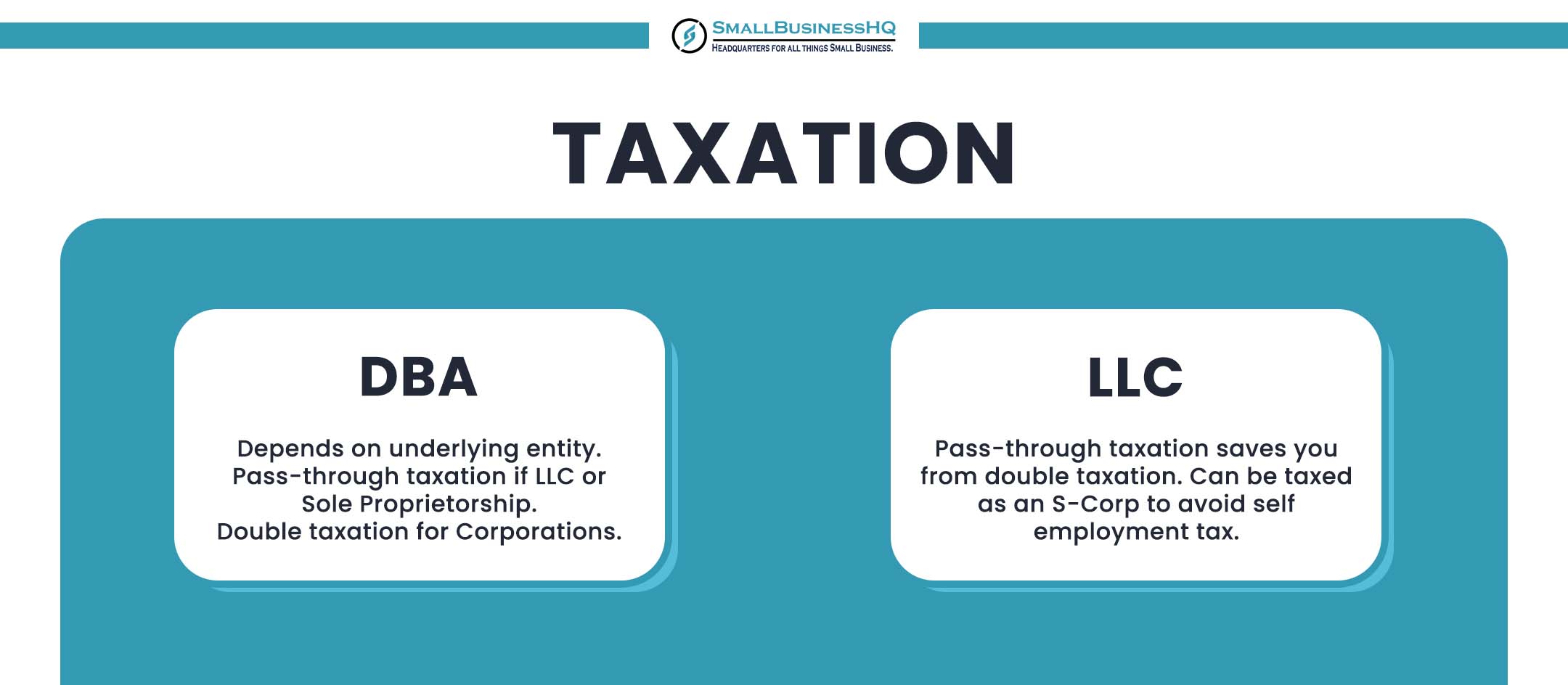

Taxation

When you start a business, you’ll have to pay tax on its profits. But how your business is taxed completely depends on your business structure. That’s why it’s important to take tax considerations into account before choosing an entity for your business.

DBA

When you file for a DBA, your taxation doesn’t change in any way. That’s because the way your business is taxed depends on the business entity, and DBA isn’t one.

So, if you’ve chosen a Sole Proprietorship, your income will pass through to your personal income tax returns. The same would also be true for LLCs. However, if you’ve started a Corporation, your income will be taxed twice—first at the corporate level (corporate tax) and then at the personal level (dividends).

LLC

As an LLC owner, your business will be subject to pass-through taxation. This means the LLCs profits or losses will pass through to the members, and they have to file those in their personal income tax returns.

LLCs aren’t subject to double taxation like Corporations, so the LLC’s income only gets taxed at the personal level in the hands of the owners.

That said, you’ll incur self-employment taxes as an LLC owner. To avoid this tax, you can choose to get your business taxed as an S-Corporation by filing the S-Corp Election Form.

When you become an S-Corp, you’ll be treated as an employee of the business and only pay tax on your salary. And unlike a C-Corporation, an S-Corp isn’t subject to double taxation too.

Filing Process

The process of starting your business also depends on the legal business structure you choose. While starting a Sole Proprietorship is the easiest, Corporations are the toughest to form. LLCs, on the other hand, lie somewhere between.

So, how do DBA vs. LLC stack up when it comes to the ease of business filing? Let’s take a look.

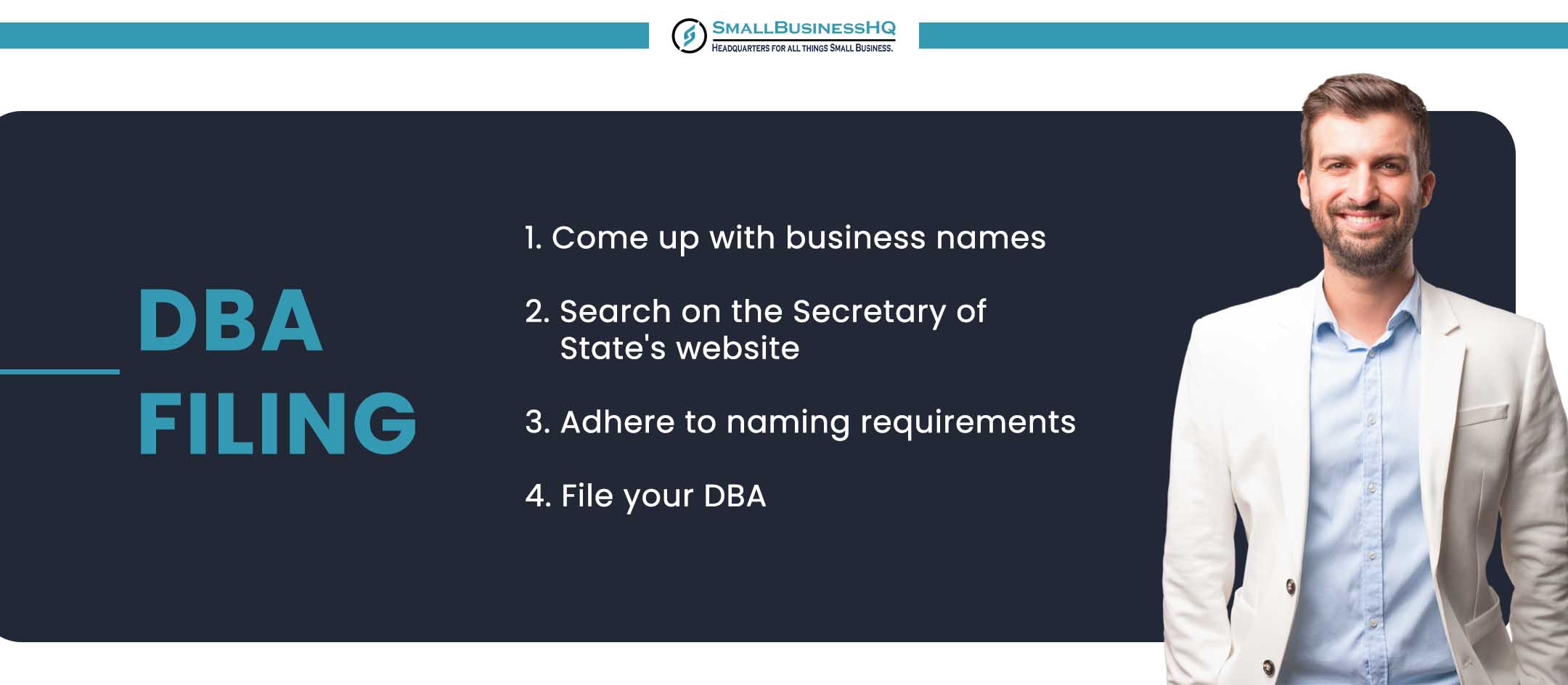

DBA

It’s easy to file for a Doing Business As compared to an LLC, solely due to the fact that it’s not a legal business entity. DBA is a fictitious name for your business so the process to get it is fairly straightforward.

Here’s the process for registering your DBA.

- Come up with a list of potential DBA names for your business.

- Search your name on the Secretary of State’s website or with a service like ZenBusiness to ensure it’s not already in use.

- Review the naming requirements of your state and make sure your DBA name adheres to them.

- File your DBA with the county or Secretary of State and pay the filing fee.

You could also engage the services of a business formation agency like Incfile or Inc Authority to file for your DBA with ease.

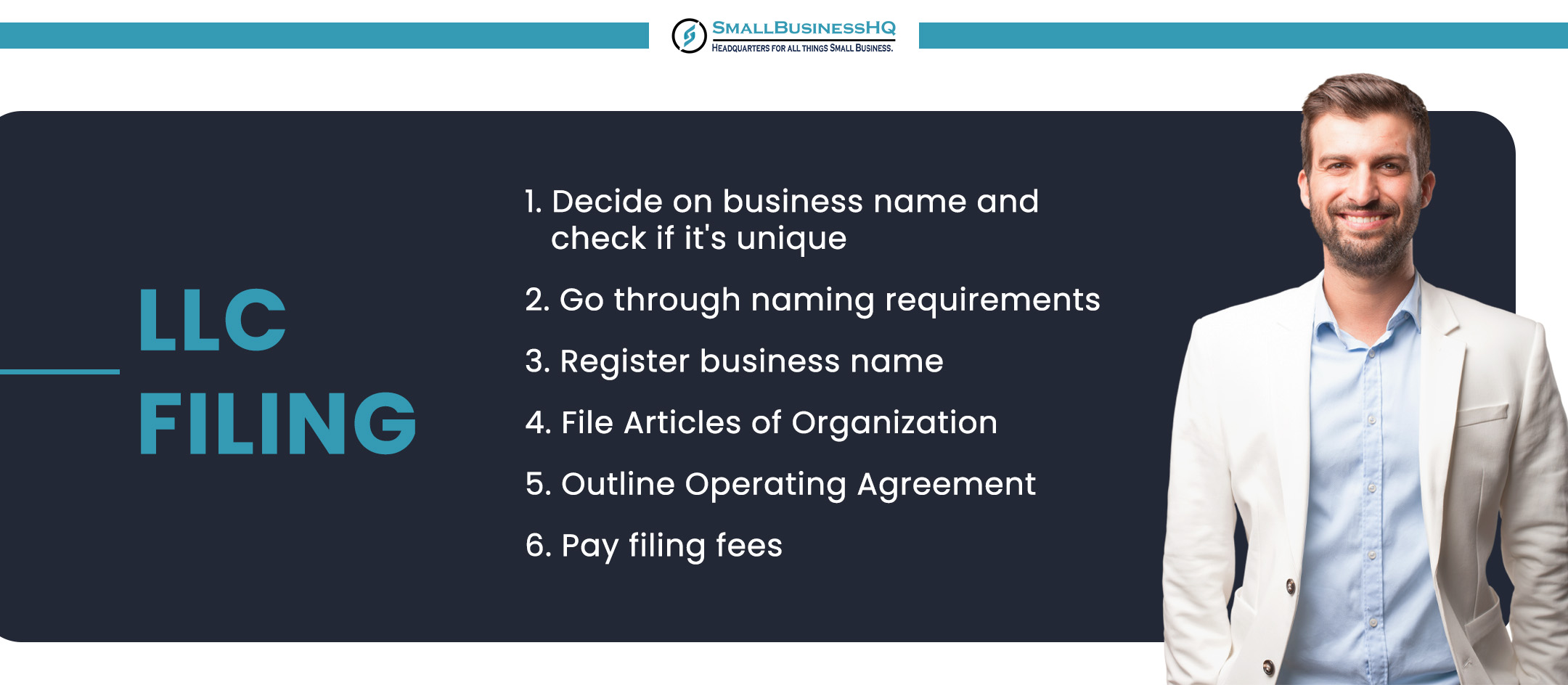

LLC

While filing for an LLC is easy, the process is longer than the one you need to go through to file for a DBA. One of the main reasons for this is the fact that an LLC is a legal entity, and DBA isn’t.

Here’s the process to get your LLC up and running.

- Decide on a business name and check your Secretary of State’s database or with a service like Inc Authority or LegalZoom to check if it’s already in use.

- Go through the naming requirements and abide by them.

- Register your business name.

- Fill out your LLC Articles of Organization and file them with the Secretary of State.

- Outline an LLC Operating Agreement that lists the roles and responsibilities of the members.

- Pay the filing fees.

To simplify this process, you could opt to engage the services of a business formation company like Inc Authority or Incfile.

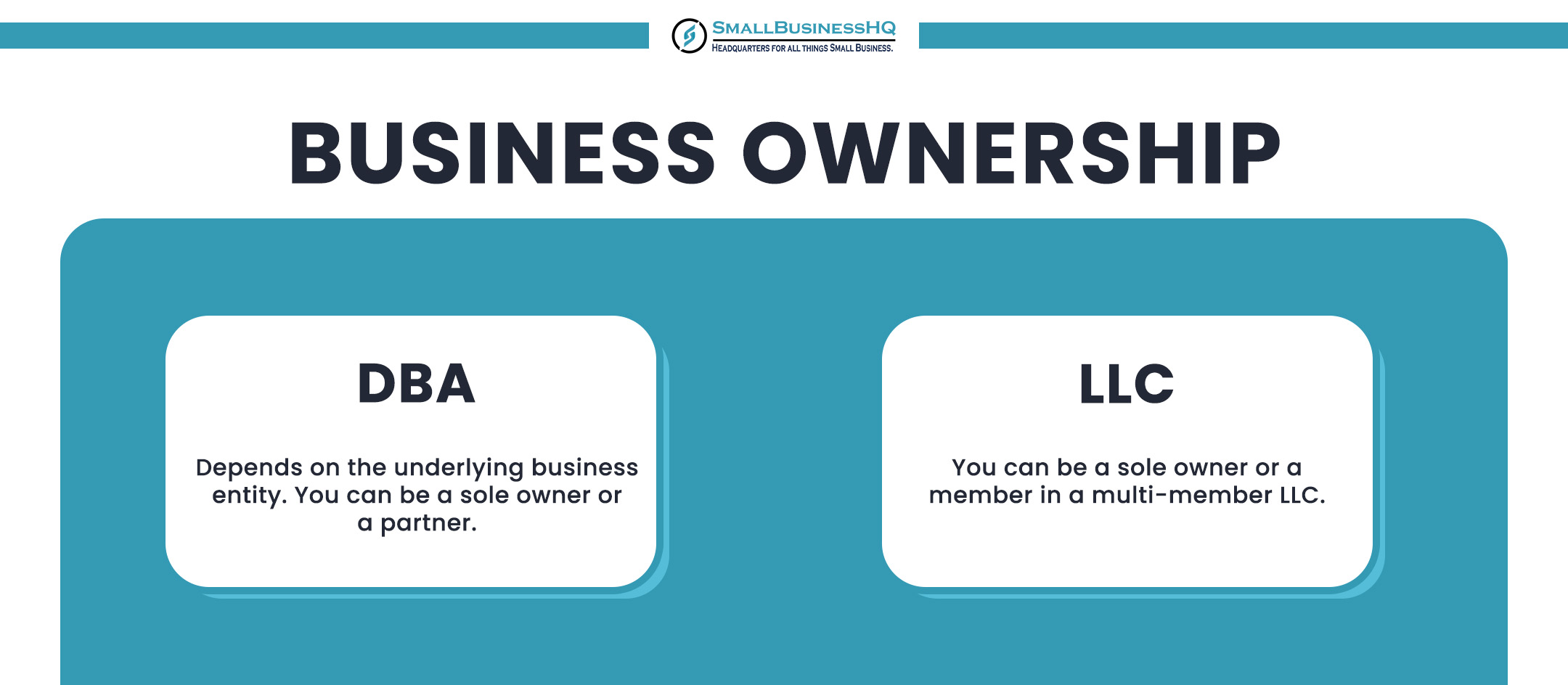

Business Ownership

Another major factor that differentiates an LLC and a DBA is the business ownership structure. Let’s see how these two stack up when it comes to the ownership of the business.

DBA

A DBA isn’t a legal entity, so it doesn’t affect the underlying business structure in any way. The business ownership solely depends on the business structure you’ve chosen to start your business.

If you’ve opted to become a Sole Proprietor, you’ll be the sole business owner of the DBA. The same would also apply to a single-member LLC.

On the contrary, if you’ve started a multi-member LLC or a Corporation, you’ll have multiple business owners with equal or varying stakes in the business based on the understanding while starting the business or share distribution.

In a nutshell, when you get a DBA, the business ownership structure remains intact.

LLC

An LLC is a legal business entity, so your business ownership completely depends on it. If it’s a single-member LLC, you’ll be the whole and sole for the business, much like a Sole Proprietorship firm.

However, if you’ve got other members who’ll run the business with you, the business ownership will depend on the stake of the members in the business. Alternatively, you can define the business ownership in the Articles of Organization.

Similarly, the LLC Operating Agreement outlines who will run the business. Will it be a member-managed LLC or a manager-run LLC? The Operating Agreement determines that.

You May Also Like:

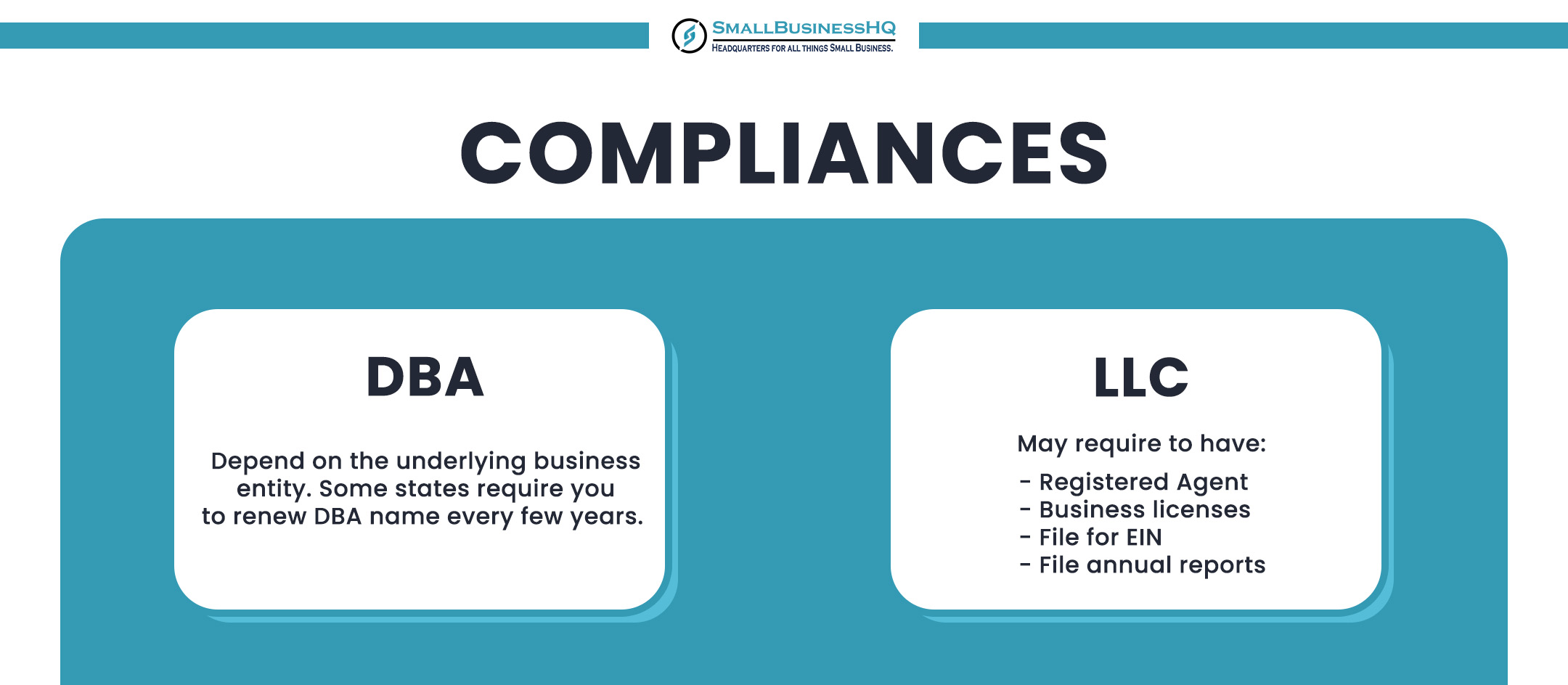

Compliances

While the business structure you choose gives you various advantages in the form of tax benefits, liability protection, and more, it also determines the compliances that you’ll have to follow.

Let’s see how a DBA and LLC compare with each other in terms of compliance needs.

DBA

By itself, running a DBA doesn’t bring in any compliances apart from renewals. Some states require you to renew your DBA regularly—between one to ten years—depending on the state. This is the only compliance requirement for your DBA.

However, there may be other compliances that you’d have to fulfill based on the business entity you’ve chosen the DBA for. While a Sole Proprietorship has minimal compliance requirements, they are pretty stringent if you’ve decided to form a Corporation. From annual reports to annual general meetings, there’s a lot that you need to do to remain compliant with state and federal regulations.

A service like Incfile or Inc Authority could help you remain compliant and in the good books of the state by providing routine reminders.

LLC

As an LLC owner, you have more compliance requirements as compared to a DBA. After completing your business filings, you may be required to pay an annual fee to your state to keep your LLC running. This fee varies from state to state.

Some of the other compliance requirements that you may have as an LLC include:

- You might have to get a Registered Agent who will receive all the legal business communication on your behalf. You can be your own Registered Agent or hire an agency to do it. This requirement depends on the state.

- Obtaining related business licenses and permits based on the type of business.

- Filing annual reports if the state requires you to do so.

- Applying for an EIN (Employer Identification Number) to be able to hire employees, open a business bank account, and more.

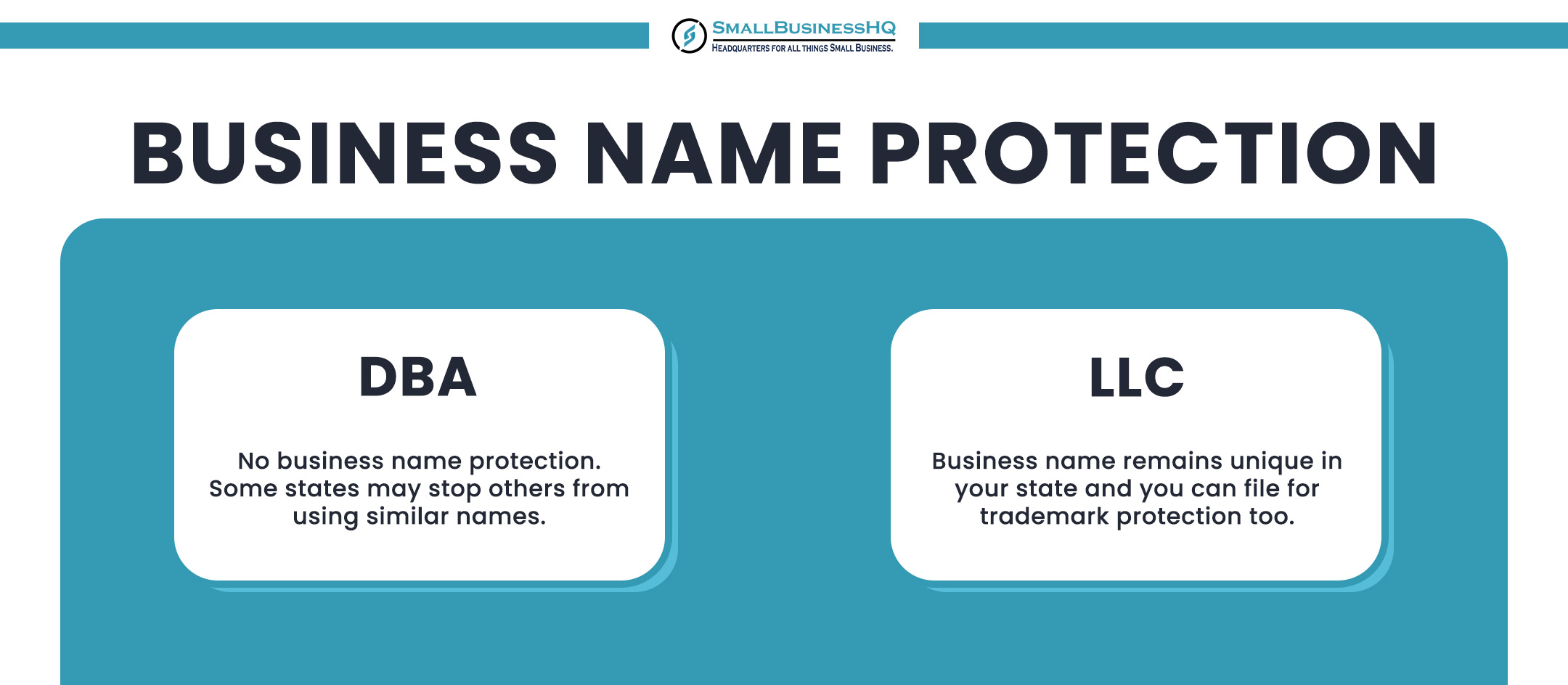

Business Name Protection

Once you’ve got a business name, you’d ideally want to keep it as unique as possible to ensure that nobody confuses your business with others. A unique business name also ensures that you can create it into a brand.

That’s why it’s crucial to consider business name protection features that come with the business structures. Here’s how LLCs and DBAs are different in terms of business names.

DBA

Getting a DBA for your business doesn’t guarantee business name exclusivity. Depending on the state in which you start your business, you may or may not get any business name protection. Some states do prevent other businesses from adopting names that are similar to an existing DBA.

That said, the situation may be different for the legal name of the business based on the underlying business structure. For instance, if you’ve started a Corporation, the Corporation’s legal name will remain protected.

LLC

LLCs offer greater protection for your business name. When you register your LLC business name, the state usually won’t allow any other business to adopt a similar name. It may not even permit other businesses to file a DBA that’s similar to your business name.

That said, the protection isn’t complete. If there’s another business that wants to use the same or similar name, it can do so. However, the industry in which the business operates should be drastically different from your industry. This helps the state (and customers) establish a clear distinction between the two businesses.

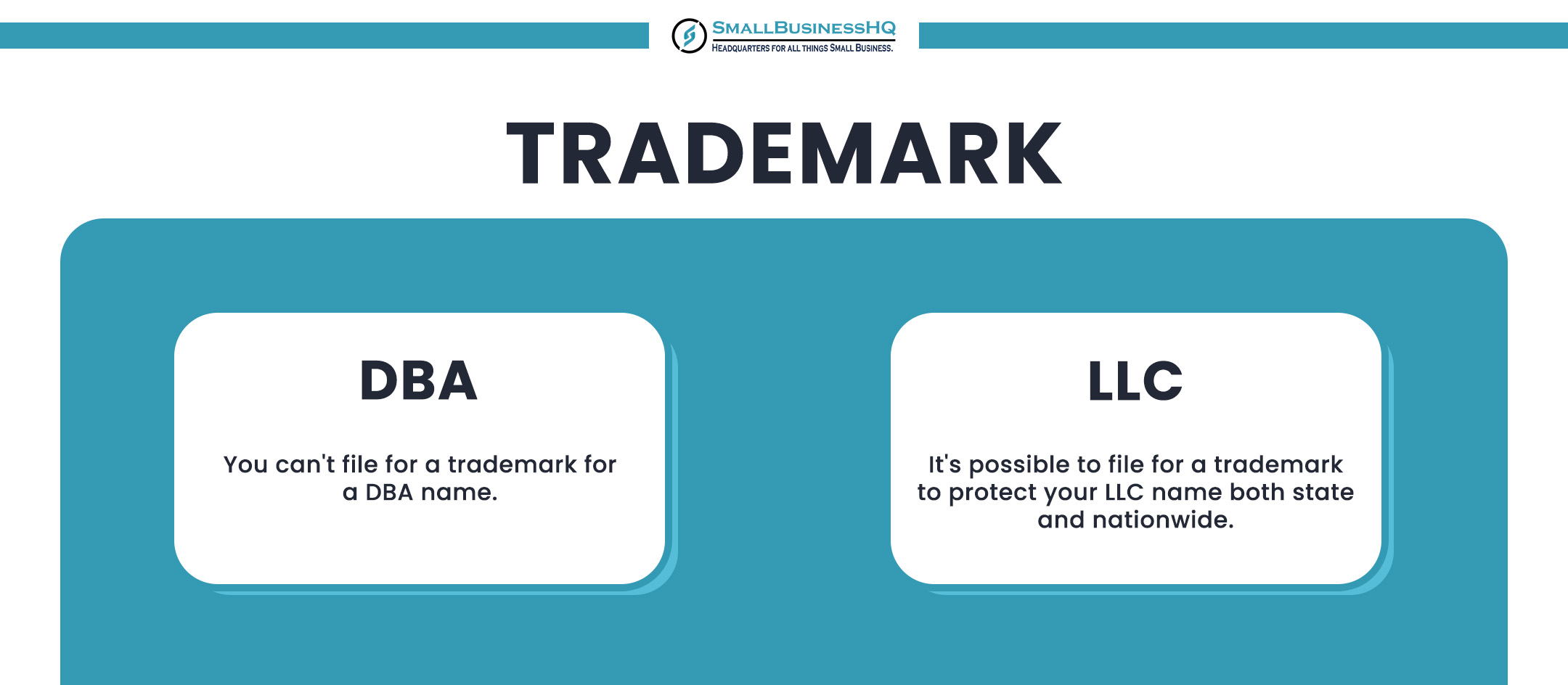

Trademark

A trademark registration gives you the sole right to your business name. It’s a great way to protect your brand and ensure that no one else can infringe upon it. You could apply for a trademark at both the state and federal levels to give your business name state or nationwide protection.

DBA

One of the greatest drawbacks of a DBA is that it doesn’t offer any trademark protection. So, anyone can choose to use the same name as yours if the state permits them to start using it.

In essence, a fictitious name isn’t the best option if you want to secure the business name. Instead, it’s a good way to get a new name for your business without spending a lot of money.

LLC

When you start an LLC, you do have the advantage of opting for trademark protection for your business’s legal name. You could file for a state or national trademark to prevent other businesses from using your name or names similar to yours.

Registered Agent

As mentioned above, a Registered Agent is a person or organization that chooses to receive legal communication on your company’s behalf. You could also be your own Registered Agent, but you’d have to be present at the Registered Address on all working days during working hours.

That said, not all business entities require a Registered Agent. Additionally, the rules regarding Registered Agents differ from state to state too.

Let’s see how they apply to DBAs and LLCs.

DBA

When you file for a DBA in the United States, you don’t necessarily need to get a Registered Agent. Instead, the requirement is completely based on the business structure you’ve chosen in the first place.

If it’s a Sole Proprietorship, you don’t need to have a Registered Agent for it. However, if you’ve chosen an LLC or a Corporation for your DBA, you’ll likely have to get a Registered Agent.

In such a case, you can choose to have a Registered Agent service like ZenBusiness or LegalZoom do it all for you.

LLC

If you’ve started an LLC, you’ll likely need a Registered Agent for it. Many states have made it mandatory for LLCs to have a Registered Agent when they start their operations in the state.

So, even if your LLC is based out of one state, it may need to get a Registered Agent in another state if you expand it there. In a nutshell, you would need a Registered Agent in each state where you operate if the state requires you to have one.

While you can be your own agent, it wouldn’t be feasible for you to be in every state all the time. That’s where a Registered Agent service like Incfile or ZenBusiness can help you. They have offices all over the country and can act as your Registered Agent and receive communication on your behalf. This helps ensure continued compliance for your business and keeps your business in the good books of the state.

FAQ

1. Is it better to be a DBA or LLC?

There’s no right answer to this. LLC is a legal entity, while a DBA is just an alternate name for your business. If you solely want a new business name under which you can run your operations, a DBA is the right and inexpensive way to do it. But if you’re looking to start a business from scratch and want benefits like liability protection, an LLC is the way to go.

2. What are the disadvantages of a DBA?

Some of the main disadvantages of a DBA include:

DBA isn’t a business structure or a legal entity. It’s just a new name that your business assumes.

You don’t get exclusive rights to the DBA name.

No liability protection.

You can’t apply for a trademark on the DBA name.

3. What are the pros and cons of DBA vs LLC?

Here are some of the advantages and disadvantages of DBA vs. LLC:

DBA is inexpensive to form, but an LLC can cost more.

Liability protection is only offered by an LLC.

DBA can’t be used to start a business.

DBA has minimal compliance requirements compared to LLCs.

Your business name is more secure in an LLC as compared to DBAs.

4. How does a DBA affect taxes?

A DBA doesn’t affect your business taxation in any way. It’s just an assumed name for your business. The taxation will depend on your business entity—whether it’s a Sole Proprietorship, LLC, or a Corporation. You’ll have pass-through taxation for the first two cases but double taxation if you have a Corporation.

5. Is a DBA the same as a subsidiary?

No, a subsidiary is a separate company that operates under an umbrella organization. It’s either partially or fully owned by the parent company. However, a DBA is only a separate name for the same company, it’s not a different company.

DBA vs. LLC: What Should You Choose?

Ultimately, the choice of a DBA vs. LLC boils down to what you need. If you’re in need of a separate name for your business and don’t want to establish a subsidiary or another business, a DBA is a great way to go about it. You can easily get an assumed name for your business without spending much.

But if you’re looking to start a business from scratch and want to reap benefits like liability protection and pass-through taxation, LLC is the right choice for you. It’s always possible to get a DBA for your LLC at a later stage if you want another name for it.

So, determine your requirements and make your decision wisely. All the best!

Disclaimer: This content contains affiliate links, which means we’ll earn a commission when you click on them (at no additional cost to you).

![Inc Authority vs Incfile [2024]: Which is a Better Choice? Inc Authority vs Incfile [2024]: Which is a Better Choice?](https://smallbusinesshq.co/wp-content/uploads/small-business-marketing-62432218f1319-sej-300x158.png)