At a glance, small business bookkeeping for beginners may feel like trying to decrypt a complex code. But it’s one of the skills necessary to make a small business thrive.

In fact, if you don’t do it well, you might face cash flow issues, which could lead to business failure. And given that running out of cash is the number one reason 38% of small businesses fail, you need to be serious about it.

Proper bookkeeping is a key measure that can significantly improve survival rates for small businesses.

And how does it help?

Accurate bookkeeping helps entrepreneurs identify early signs of financial problems, allowing them to take corrective action promptly.

But how can you do it the right way?

This guide on small business bookkeeping for beginners will help you understand the essentials of maintaining your business’s financial health. From choosing the right accounting software to managing your financial records effectively, this A-Z guide covers it all.

So, let’s dive in.

What is Small Business Bookkeeping for Beginners?

Small business bookkeeping for beginners involves understanding the fundamental concepts and processes required to maintain accurate financial records and make informed business decisions.

In simpler terms, it is the systematic process of recording, organizing, and managing the financial transactions and records of a small business in an accounting system.

Here are a few things that go into the bookkeeping process for small businesses:

- Recording transactions: Bookkeepers record transactions using journal entries. Every transaction has two parts: money coming in (debit) and money going out (credit).

- Double-entry bookkeeping system: A debit and credit entry is required for every transaction recorded. The number of debits recorded must equal the number of credits. Double-entry is a better method than single-entry bookkeeping because it’s easier to detect bookkeeping errors if accounts don’t match up.

- Categorizing transactions: Bookkeepers categorize transactions into specific buckets for reporting and analysis. These accounts are:

- Assets

- Liabilities

- Revenue

- Expenses

- Equity

- Basic financial reports: These are financial statements that make sense of the transactions recorded. They show the financial health of the business.

- Tax compliance: This involves calculating the taxes the small business owes and creating the needed documentation for tax filings

- Payroll processing: It’s also a component of efficient bookkeeping and involves processing employees’ pay and the applicable taxes.

Small business bookkeeping may seem overwhelming for beginners, but as we’ll see later, accounting software solutions automate most of these tasks.

You May Also Like:

Bookkeeping vs. Accounting: What is the Difference?

Most beginners wrongly use the words bookkeeping and accounting interchangeably.

Although bookkeeping and accounting are critical processes for managing the financial activities of a small business, they focus on different areas.

Bookkeeping focuses on recording and organizing business transactions

It centers on gathering and organizing financial data and addressing any discrepancies and errors.

Accounting, on the other hand, involves analyzing and interpreting financial data to help business owners make informed decisions about their business’s finances.

Accountants rely on accurate bookkeeping to draw insights into the business’s performance and growth potential.

They use records from bookkeeping to make forecasts and provide financial recommendations during decision-making.

Importance of Bookkeeping for Small Businesses

As a small business owner, you often wear many hats. But one of the most crucial roles you play is managing your business’s finances.

Proper bookkeeping is essential for small businesses to maintain accurate records of their business transactions, manage their business accounts, and make informed financial decisions.

That said, here are a few reasons why bookkeeping is important for small businesses:

1. Better Financial Planning

As you might have gathered from the definition, bookkeeping organizes your financial data, which helps with financial planning.

It simplifies cash flow management and detects when the business is at risk of not meeting its short-term financial obligations.

You’re able to determine the most appropriate time to invest in growth opportunities or look for additional funding with it too.

2. Keeps you Compliant

Proper bookkeeping helps small businesses stay compliant with tax regulations and avoid potential penalties. For instance, the IRS expects small businesses to provide accurate information on their expenses, sales, payroll, etc. in compliance with tax regulations. Failure to comply can result in hefty interests and penalties, which can cripple the growth of your small business.

By maintaining accurate records of all the money flowing in and out of the business, a business owner can easily prepare and file their tax returns

3. Supports Investor and Lender Relations

Most investors and lenders check the financial health of a business before providing funding. They do it to check its growth potential.

This is where bookkeeping comes in handy by helping you track your growth and profits over a time period.

You can use these records to show investors that your business is stable and capable of generating profits. It also shows lenders your business has enough cash flow to meet its financial liabilities and makes getting loans easier.

4. Keeps Personal and Business Expenses Separate

If you’ve set up your small business as a Corporation or an LLC, you will benefit from their limited liability protection, which safeguards your personal assets.

However, mixing personal and business finances can make you lose this protection and put your personal assets at stake for any business liabilities.

But how does bookkeeping help beginners here?

Proper bookkeeping provides proof that you’re keeping personal finances separate from business finances and helps keep the liability protection intact.

5. Helps Identify and Correct Mistakes Early

One of the tasks beginners must undertake in bookkeeping is regular reconciliations of financial accounts. It involves comparing the records in the books to the supporting documentation.

Reconciliation eliminates errors and inconsistencies that could lead to financial issues and problems with the IRS.

You May Also Like:

7 Steps to Do Small Business Bookkeeping Well as a Beginner

As a business owner, you have the option to do your own bookkeeping or hire a professional. But if you choose to handle your own books, you must have a reliable and efficient bookkeeping system.

Here are 7 steps to make sure your bookkeeping game is running optimally.

1. Choose an Accounting Software

Whether you choose to hire an in-house bookkeeper or do your own bookkeeping as a beginner, it’s essential to use the best accounting software you can find.

Here are some reasons why your accounting software matters for both beginners and experienced professionals:

- Automates basic bookkeeping tasks like transaction categorization and calculations. This reduces errors, especially for beginners

- Provides real-time access to financial data, allowing small business owners to stay updated with the current financial status of the business.

- Has built-in security features that keep sensitive financial information accessible to only authorized people.

So how can beginners choose the right accounting software for their small business bookkeeping needs? Let’s find out.

Check if it is Cloud-Based or Desktop Software

A cloud-based accounting software solution is entirely accessible online from a range of devices. But desktop software needs to be downloaded and installed on your computer or smartphone.

The convenience of accessing your data from anywhere makes investing in an online accounting software better for beginners than desktop software.

Also, in case your IT infrastructure crashes, your financial records remain accessible with online accounting solutions.

In contrast, desktop accounting software is limited to the computers it’s installed on. You have to make manual updates and the responsibility of creating a safe backup for your financial records is on you.

Features of Accounting Software

Most accounting software have a variety of pricing plans. Usually, higher-priced plans offer more features than lower-priced plans and can overwhelm beginners.

Check the features offered under each plan and choose the one with the functions you need for your small business bookkeeping needs. As a beginner, take it easy when starting out.

Additionally, review the number of users allowed in each plan and choose accordingly.

Ease of Integration

As a beginner, you might not check the integration capabilities of an accounting platform.

But that’s not ideal.

If you plan to use other software for your small business, such as customer relationship management (CRM), choose a bookkeeping software that can integrate with these tools.

It’ll facilitate the smooth flow of data between the accounting software solution and these tools, enabling a better workflow.

Ease of Use

The last thing you’d want as a beginner would be to use a bookkeeping platform that’s complicated and packed with jargon. Instead, you should concentrate on getting small business accounting software that’s easy to use. You’ll find it easier to get accustomed to it.

You must also verify if the platform offers a reliable customer support team that can handle your queries on time. They can help you overcome any roadblocks you may encounter as a beginner.

Security

Security is a top priority when choosing an accounting software. Choose software with powerful security features to protect your financial data.

Some features you should look for include two-factor authentication, regular backup, and data encryption.

Inquire with the vendor about the security measures they have implemented to safeguard users’ information.

It’s also a good idea to check if the accounting software vendor has a history of cyber-attacks and data breaches.

Finally, compare the shortlisted software solutions well to ensure you select a platform that safeguards your data.

2. Select an Accounting Method

When setting up your bookkeeping system, it’s essential to choose the right accounting method for your business.

Defining the accounting method you’ll use in your small business bookkeeping facilitates consistent and accurate records.

That said, small business owners have two primary accounting method options: cash-based accounting and accrual accounting.

Cash-based Accounting Method

It’s where you record transactions when money is exchanged. Revenue is recognized only when cash is received, and expenses are noted when cash is paid.

It’s the simplest approach to bookkeeping for a beginner.

This method is most suitable for small businesses with straightforward financial transactions and short sales cycles. An example is service providers receiving immediate payments.

Accrual-based Accounting Method

Accrual-based accounting is the recommended method under the generally accepted accounting principles (GAAP).

It recognizes revenue and expenses when they occur, regardless of whether payment has been received or made.

This method provides a more accurate portrayal of the company’s financial status and allows for better matching of revenue and expenses.

Accrual-based accounting requires more complex record-keeping and is more suitable for businesses with significant accounts receivable and payable, and long sales cycles. An example is real estate agencies. You might find it difficult as a beginner.

Your choice between methods should align with your business’s nature.

Consulting with a tax expert or accounting professional can shed light on the best method based on your unique financial objectives and the regulatory requirements in your industry.

You May Also Like:

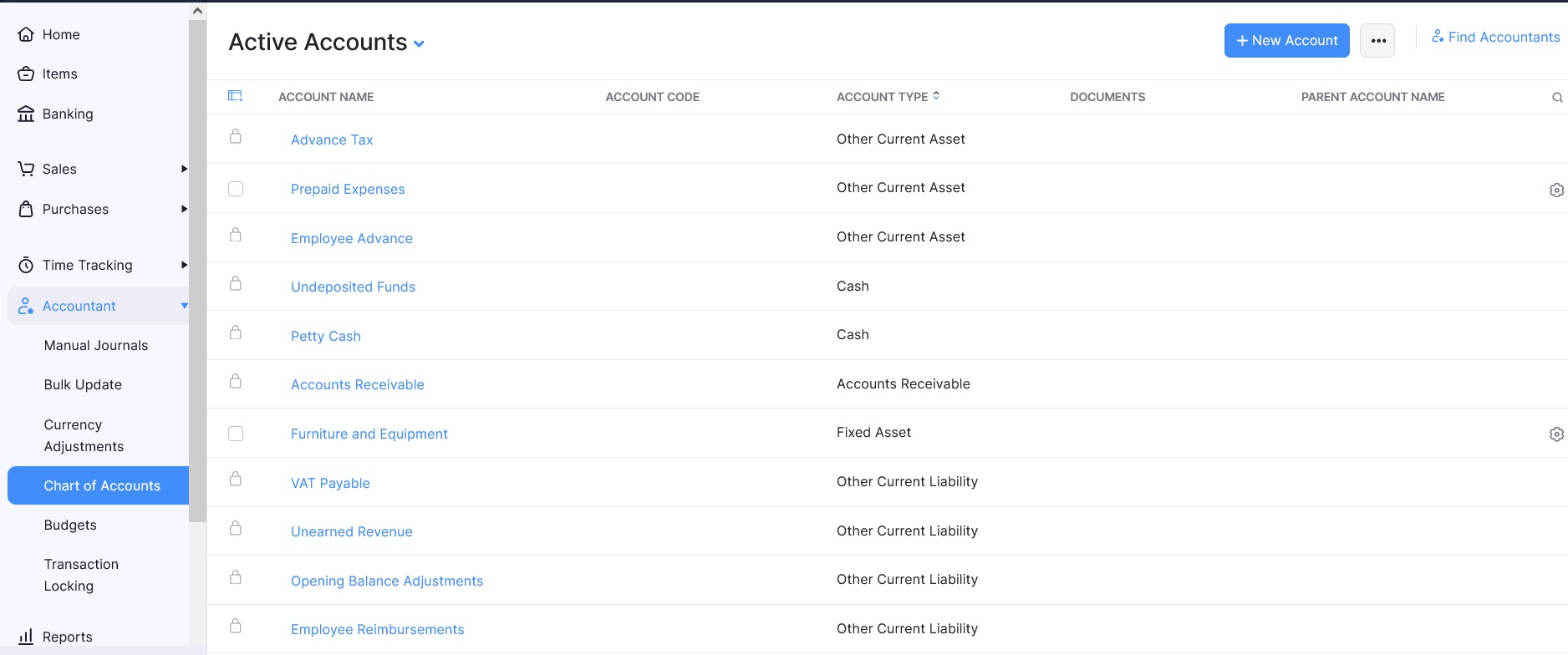

3. Set Up Your Chart of Accounts

A chart of accounts is the foundational tool for bookkeeping and financial management.

It’s a structured listing of all the accounts in an accounting system and creates a standardized method for categorizing financial activities in businesses. The accounts, in this case, are assets, revenues, expenses, liabilities, and equity.

The chart of accounts makes it easy to get a quick overview of the business’s financial data.

Most accounting software comes with a standard chart of accounts. This means beginners don’t have to build one from scratch.

Here’s what you get with Zoho Books, for instance.

Image via Zoho

You can modify what is provided to fit the needs of your small business.

Many accounting solutions also let you import your own chart of accounts. As your business expands, you can add and remove accounts as required.

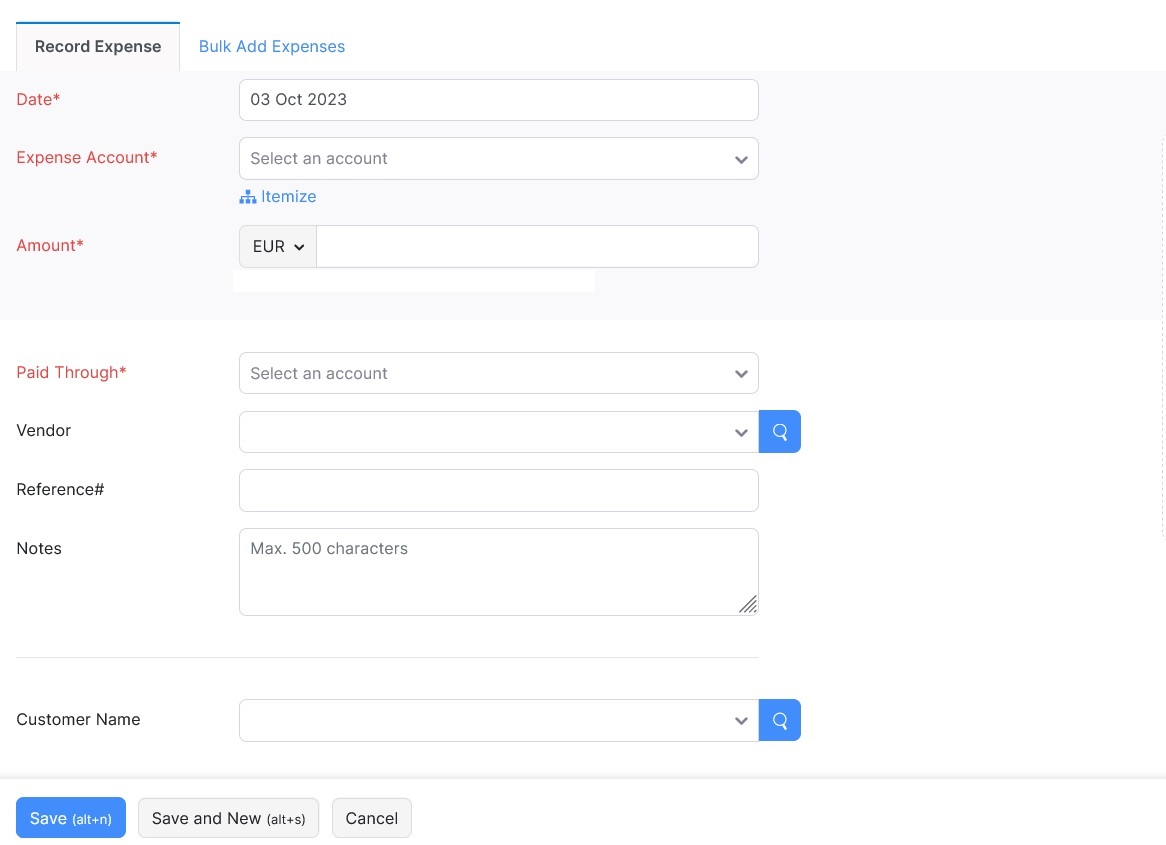

4. Record Every Transaction

Record all transactions in your bookkeeping software. This includes every sale, invoice paid, miscellaneous expense incurred, bills paid, your sales, purchases, expenses, etc.

Capture details like the amount, expense account, and source of funds. You can also add a description of the expense.

Here’s an example of what you’d need to fill in an expense entry with Zoho Books accounting software.

Image via Zoho

One of the benefits of using accounting software for small businesses is the automation of the double-entry process.

As a beginner, getting the hang of the double-entry process can be challenging.

But with this automation, all you have to do is provide the details requested and the software will debit and credit the right amounts.

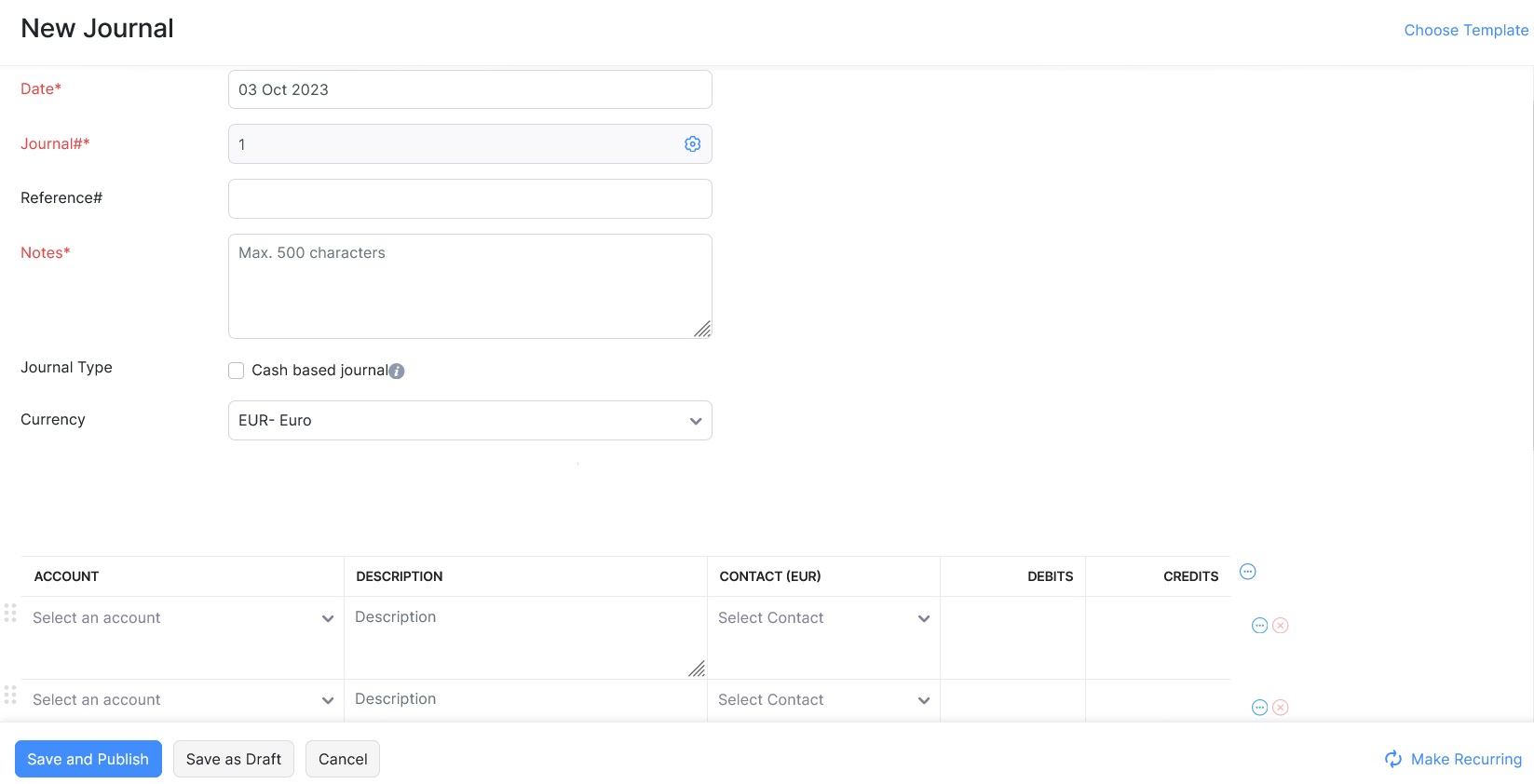

Some accounting software also permit manual entries for unique transactions.

In this case, you’ll need to take care of the double-entry accounting. So, enter the amount in the debit and credit section and specify the respective account that is credited and debited.

And if your accounting software supports it, you can choose to turn it into a recurring entry.

Here’s an example.

Image via Zoho

5. Perform Regular Reconciliations

Regularly reconciling your bank statements with your accounting records is crucial for maintaining the accuracy of your financial reporting.

This process helps identify any discrepancies, errors, or omissions in your bookkeeping process and ensures that your financial statements accurately reflect your business’s financial standing.

Now, one of the major advantages of using accounting software for small business bookkeeping is that you don’t need to wait for your bank statements at the end of the month to make bank reconciliations.

Simply connect your business’s checking account and credit cards to your accounting software directly. This will enable you to monitor both cleared and outstanding checks.

You can easily capture any fees charged on your checking account and business credit card that you haven’t added to your accounting ledger.

As a beginner, making daily or weekly bank reconciliations is recommended to ensure that the cash balance is accurate.

Reconcile other accounts as well. Compare the amounts on the accounting system to the source records to ensure your records reflect the accurate data.

Replace estimates with confirmed amounts promptly. This practice enhances transparency in your small business bookkeeping.

6. Stay in Charge of Accounts Receivable and Accounts Payable

Managing accounts receivable and accounts payable is an essential part of small business bookkeeping.

That’s because sending invoices and estimates promptly and keeping track of the due dates of accounts receivable guarantees a steady cash flow—something important for healthy business finances.

Managing account payables properly, on the other hand, protects the credibility of your small business and prevents late fee charges.

If your small business is using accounting software, you can automate payment reminders, which can help you drive cash flow.

Some of the top accounting software for small businesses provide the option to set automatic payments for recurring bills too. They also provide an auto-charge option to collect payments for recurring invoices, taking hard work out of the equation.

You May Also Like:

7. Run Monthly Basic Financial Statements

Running monthly financial statements is particularly important for a small business. It simplifies keeping track of the business’s financial health and enables quick decision-making in challenging situations.

Preparation of financial statements is an area where accounting software greatly improves the efficiency of small business bookkeeping. It also eases work for beginners.

When using manual accounting methods, business owners must manually close each account and categorize them correctly, which could be difficult as a beginner.

But with accounting software, the platform automatically generates accurate financial statements, making the process much more efficient.

Here are the core financial reports necessary for small business bookkeeping.

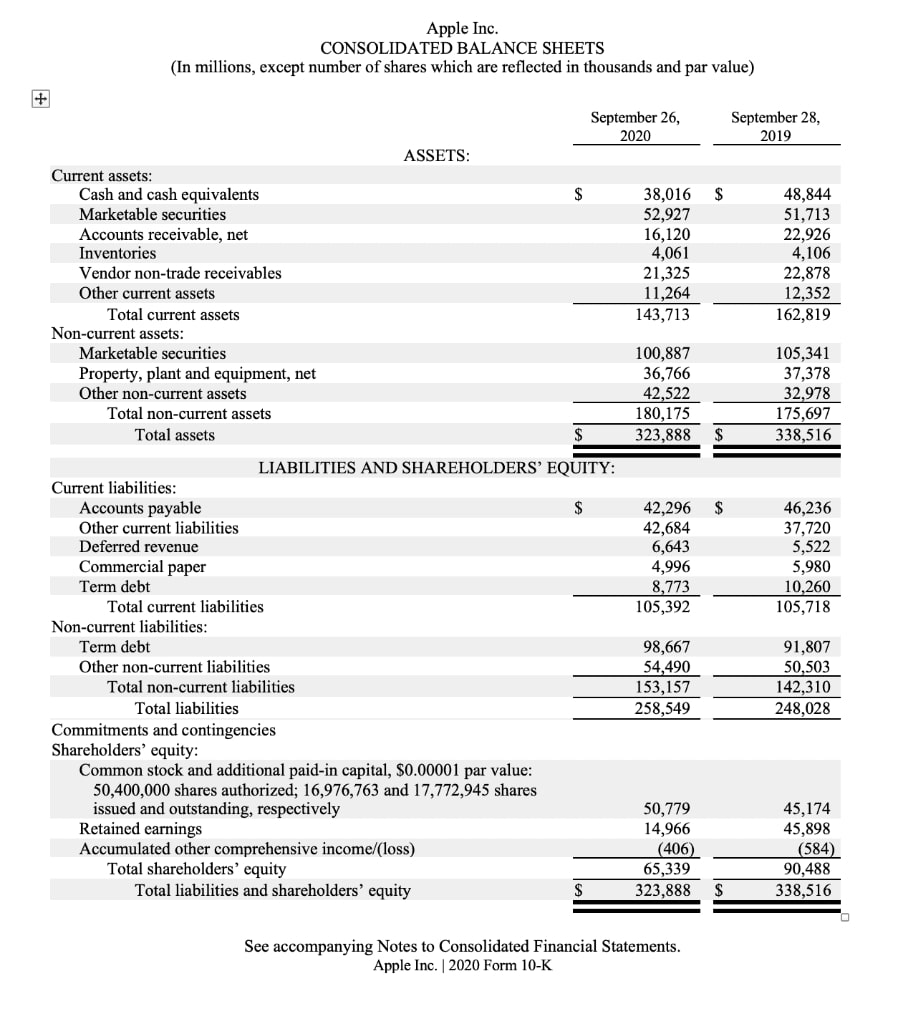

Balance Sheet

Image via Investopedia

A balance sheet shows the financial health of a small business by comparing what the business owns (assets) versus what it owes (liabilities) and the amount invested by shareholders.

A balance sheet operates using this accounting equation:

Assets = Liabilities + Equity

The assets (cash, accounts receivable, inventory, etc.) must always be equal to the sum of liabilities (accounts payable, loans, deferred tax liabilities, etc.) and equity (retained earnings, stock, etc.).

A balance sheet can tell if your business is taking on too much debt.

By comparing the balance sheets of two or more periods, you can also tell how much your small business has grown too.

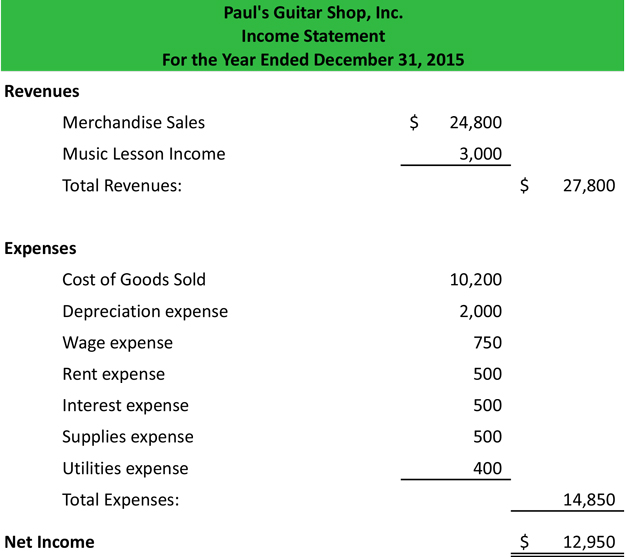

Income Statement

Image via My Accounting Course

An income statement summarizes the income and expenditures of a small business.

It shows the profitability of the business by showing the net income or loss for the period, helping you analyze its financial health.

An income statement also helps small business owners conduct more effective financial planning.

You’re able to make more efficient decisions that directly affect the profitability of your small business, such as:

- Implementing new sales strategies to increase revenue

- Expanding to new markets to boost revenue

- Increasing production capacity to grow revenue

- Cutting unnecessary costs to reduce expenses

- Shutting down a product line that’s not bringing in revenue

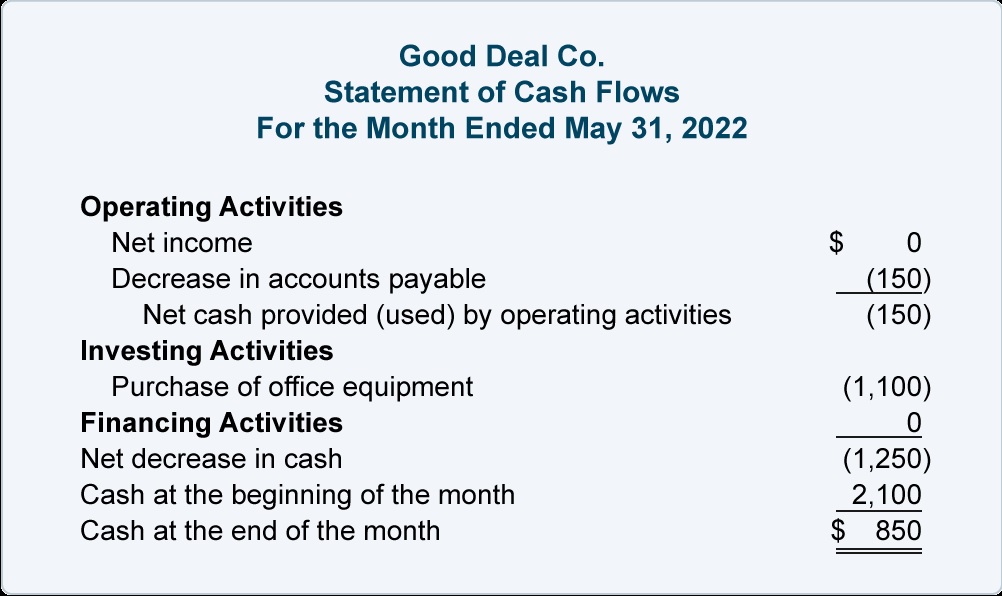

Cash Flow Statement

Image via Accounting Coach

A cash flow statement shows the cash inflow and outflow of your small business from the following activities:

- Operating activities: Sources and uses of cash related to the core operations of your small business, such as the sale of company products and payments to suppliers.

- Investing activities: Any inflow and outflow of cash related to the investments of your small business, such as the purchase of assets and returns on investments.

- Financing activities: Flow of cash related to the financing of the small business, such as loan repayments and cash from issuing of shares.

It shows where your business is earning its cash from and where it’s spending it.

Cash flow is also one of the critical tools for effective financial planning.

It sheds light on the business activities you need to regulate to improve the cash position of your small business.

Additionally, it indicates when borrowing money might be necessary to sustain your business operations.

5 Tips for Small Business Bookkeeping for Beginners

Here are some tips you can use to make your small business bookkeeping more efficient as a beginner.

1. Open a Separate Business Account

One of the most important bookkeeping basics for a business owner is to keep personal and business finances separate. Combining your personal and business finances in the same checking account raises the risk of errors in small business bookkeeping.

Besides, if you are using a bookkeeping software solution that connects to your business bank accounts, it can lead to confusion during reconciliations.

To prevent this confusion, consider setting up dedicated business bank accounts or using a separate business credit card for all business transactions. Ensure no personal transactions occur in the business bank account to maintain clear financial records.

Pro tip: Instead of using your business bank account to pay for personal expenses, pay yourself a salary. You’ll get to cover personal expenses without bringing confusion into your small business bookkeeping.

You May Also Like:

2. Schedule Your Small Business Bookkeeping Tasks

As much as entrepreneurs know the importance of small business bookkeeping, the burden of running the business could mean small transactions might slip unrecorded.

To prevent oversight, establish a regular recording schedule.

Allocate specific times for recording all of your business’s financial transactions. For beginners, we recommend making this a daily task.

Also, make it a priority to close your books every month. It’ll help you stay constantly aware of where your finances stand.

Pro tip: Schedule a time when your mind is still fresh, perhaps in the morning hours. Tackling bookkeeping when your mind is tired could result in data entry and accounting errors.

3. Plan Your Tax Returns

Effective small business bookkeeping gives you the advantage of foresight. This means you can plan your finances for upcoming tax obligations and avoid errors resulting from the last-minute rush.

By referring to your bookkeeping records, you can budget for your tax obligations throughout the year. You could accordingly save up the amount that needs to be paid as tax at the end of the year.

When it’s time to make the payment, you can use these savings instead of taking out a large chunk of money out of your cash flow.

Pro tip: Consult with a tax specialist on how you can remain compliant in your small business bookkeeping if you’re a beginner. They can also provide beginner-friendly tips on how you can make tax savings and the small business tax deductions you can take advantage of.

4. Always Leave an Audit Trail

An audit trail is a chronological record of events crucial for tracking the foundation of financial records.

It’s an accounting best practice that ensures the accuracy, integrity, and transparency of financial records

Maintaining an audit trail is necessary, especially for beginners in small business bookkeeping. In case you experience an error, you can retrace the source of the recorded financial activities and verify their accuracy.

If you’re doing your small business bookkeeping manually, then it’s up to you to leave an audit trail.

However, a major benefit of using modern accounting software is that an audit trail comes as one of the standard features offered so you don’t have to worry about it as a beginner.

5. Embrace Technology

Leveraging technology can improve the efficiency, accuracy, and effectiveness of your small business bookkeeping.

And we’re not only talking about accounting software solutions. You can use numerous other platforms like CRMs, ERPs, and inventory management software to scale your business operations and boost your growth.

Beginners can also make small business bookkeeping easier by investing in expense management software, billing tools, invoicing solutions, and more.

You May Also Like:

FAQs

Q1. How do I start bookkeeping for beginners?

Beginners in small business bookkeeping should:

- Learn basic bookkeeping principles first, such as double-entry accounting

- Automate basic bookkeeping tasks using effective accounting software

- Select an accounting method and set up a chart of accounts

- Record all transactions in the accounting software

- Conduct regular reconciliations

- Keep track of the business’s obligations and follow up on invoices

- Create monthly financial statements to keep track of the company’s financial health

Q2. Can I teach myself bookkeeping?

Yes, beginners can teach themselves small business bookkeeping. All you have to do is invest in a reliable accounting software and start keeping track of your revenues and expenses. The accounting software will do the heavy lifting for you.

Q3. What is the best way to learn basic bookkeeping?

As a beginner, you can learn basic bookkeeping for small businesses by taking a course on sites like Coursera.

Q4. What is the best bookkeeping method for small businesses?

The best small business bookkeeping method is double-entry. It makes it easy for beginners to detect errors in the financial records.

Q5. Are bookkeeping and accounting different?

Yes, small business bookkeeping involves recording and organizing financial transactions while accounting involves interpreting and analyzing these records to draw insights that can help in decision-making.

Q6. How often should I reconcile my accounts?

Aim to reconcile your accounts at least once a month. This helps you catch errors early, ensures your records are accurate, and gives you a clear picture of your business’s financial standing.

Q7. What’s the difference between single-entry and double-entry bookkeeping?

A. Single-entry bookkeeping records each transaction once, while double-entry bookkeeping records transactions twice—as a debit and a credit. Double-entry is more accurate and helps prevent errors.

Q8. Can I use a spreadsheet for my bookkeeping?

A. While spreadsheets can work for very small businesses, they’re prone to errors and can become ineffective as your business grows. As such, dedicated bookkeeping software is recommended for better long-term accuracy and efficiency.

Q9. What financial reports should I create regularly?

A. Key financial reports you should create regularly include a balance sheet, income statement, and cash flow statement. These give you crucial insights into your business’s financial performance and help you make informed decisions.

Small Business Bookkeeping for Beginners: Wrapping Up

Now that you’ve gone through the guide, it’s time to put these things into action.

By mastering the essentials of small business bookkeeping for beginners, business owners can take control of their business’s financial health and make more informed decisions.

Start by investing in the best accounting software for your small business, opening a business bank account, and creating a daily schedule for recording your business transactions. Then get to work and see your bookkeeping improve.

Ensure that you:

- Maintain accurate financial records

- Choose the right bookkeeping method

- Review your financial statements regularly

- Conduct regular reconciliations

- Stay on top of your business’s finances

By following this regimen, you can ensure your small business finances always remain balanced and aid your business growth.