Proforma and commercial invoices are essential in business transactions. However, they serve different purposes. Using the wrong one can lead to delays, miscommunication, or legal complications.

So, what distinguishes a proforma invoice from a commercial invoice, and why should they matter to you and your business?

In this article, we’ll discuss proforma invoice vs commercial invoice and their key differences. We’ll also explore invoice best practices and when to use them.

By the end of this article, you’ll learn common mistakes to avoid with both invoices and how using online invoicing software can improve business efficiency.

Let’s get started!

Proforma Invoice vs Commercial Invoice: Overview

In business transactions, especially in international trade, understanding the differences between a proforma invoice and a commercial invoice is essential. While both documents relate to the sale of goods, they serve different functions.

Proforma invoices are an estimate or preview of the transaction, whereas commercial invoices are the formal request for payment for shipped goods.

In this section, we’ll break down proforma invoice vs commercial invoice, provide examples, and explain when to use each.

What is a Proforma Invoice?

A proforma invoice is a preliminary document that provides a buyer with a detailed cost estimate before finalizing the sale. It’s not a payment request but rather an outline of the transaction’s potential terms.

Sellers issue a proforma invoice to give the buyer an overview of the charges, including item descriptions, quantities, prices, and the total cost.

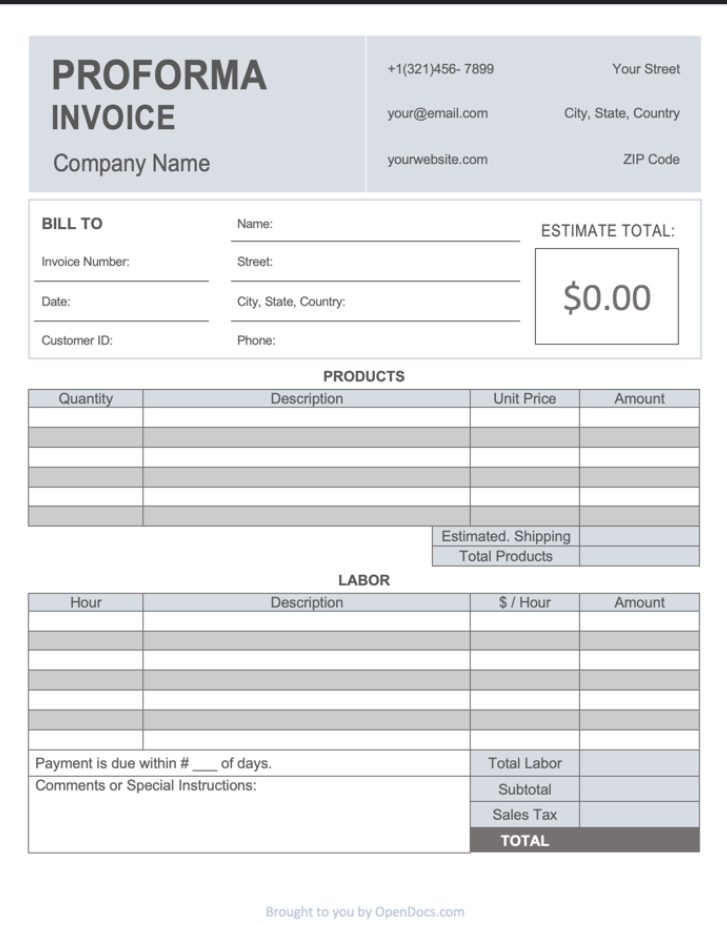

Here is a sample of a proforma invoice:

Image via OpenDocs

In most cases, a proforma invoice serves the following purposes:

- Provide the buyer with an estimate before making a purchase

- Assist with obtaining funds for the purchase

- Help businesses with customs procedures for international shipments

- Offer clarity on the terms of the actual sale before an official agreement

The proforma invoice can also serve as an official record for the buyer to track the expected cost; however, it remains non-binding. It helps streamline the purchasing process by ensuring both parties are aligned on the terms before proceeding with the transaction.

Example of a Proforma Invoice

Imagine a small electronics manufacturer that receives an inquiry from a retailer interested in purchasing 50 units of a new tablet model.

Before finalizing the deal, the manufacturer sends a proforma invoice outlining the following:

- Product Description: Tablet Model X

- Quantity: 50 units

- Unit Price: $300

- Estimated Shipping Cost: $150

- Total Estimated Cost: $15,150

This proforma invoice vs commercial invoice example demonstrates how the proforma invoice helps the retailer assess costs. It also gives the retailer time to secure the necessary payment before committing to the purchase.

When Should You Use a Proforma Invoice?

Issue a proforma invoice in the following situations:

- When providing an estimate or quote for a customer

- When you need to secure financing for a transaction

- When preparing for customs clearance

- If you’re a seller setting up a sale and want to confirm all details before sending the actual commercial invoice

It’s important to note in this proforma invoice vs commercial invoice overview that proforma invoices are particularly useful for international shipments. They provide all the necessary information for customs officers without requiring a commitment from the buyer.

You May Also Like:

What is a Commercial Invoice?

A commercial invoice, on the other hand, is a legal document that requests payment after goods or services have been delivered. Unlike the proforma invoice, the commercial invoice is legally binding and confirms the details of the completed transaction.

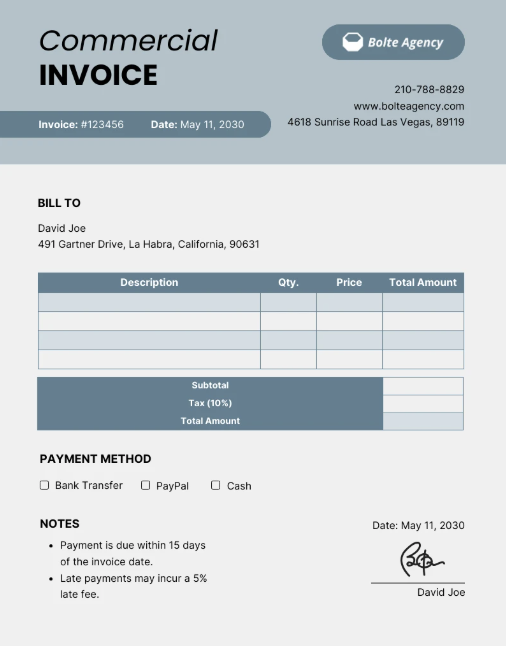

Here is a sample of a commercial invoice:

Image via Venngage

A commercial invoice typically includes:

- Buyer and seller details

- A description of the goods or services

- Quantities and unit prices

- Final cost

- Terms of payment (e.g., net 30 days)

- Payment details, methods, and conditions

- Tax details, including VAT or sales tax

- Shipping Information (if applicable)

This type of invoice is essential for accounting purposes and customs clearance. It also ensures businesses comply with international trade regulations, tax laws, and primary tax documents.

Example of a Commercial Invoice

Following the earlier example, once the tablets have been shipped to the retailer, the manufacturer issues a commercial invoice detailing the actual transaction:

- Seller Information: ABC Electronics

- Buyer Information: XYZ Retailers

- Product Description: Tablet Model X

- Quantity Shipped: 50 units

- Unit Price: $300

- Shipping Cost: $150

- Total Amount Due: $15,150

- Payment Terms: Due within 30 days

This proforma invoice vs commercial invoice example illustrates how the commercial invoice serves as an official request for payment after goods have been delivered.

When Should You Use a Commercial Invoice?

A commercial invoice should be used when:

- You have completed a sale or delivered goods/services

- You are requesting payment from the buyer

- You need to comply with tax regulations or submit documentation for customs

- The actual sale is finalized, and you’re closing the transaction

This invoice is essential for legal purposes, ensuring that both parties uphold their responsibilities. This proforma invoice vs commercial invoice overview emphasizes that a commercial invoice is required for proper documentation and internal record-keeping.

You May Also Like:

Proforma Invoice vs Commercial Invoice: Use in International Trade

Proforma and commercial invoices are indispensable in international trade. These documents streamline transactions and help navigate the complexities of cross-border regulations.

In this proforma invoice vs commercial invoice section, we’ll explore the valid uses of each type of invoice in international trade.

Below are the uses of both types of invoices in international trade:

Proforma Invoice:

- Provides an official price estimate during negotiations to set clear expectations for buyers and sellers

- Used to apply for import licenses, financing, or permits in advance of shipping

- Helps both parties align on terms and costs before finalizing a contract or agreement

- Acts as a reference document for buyers when seeking financing or budgeting for the purchase

- Can be used to initiate the export process, as many authorities accept it as preliminary documentation

Commercial Invoice:

- Functions as the final transaction document after goods are shipped, specifying the agreed terms

- Required for customs clearance as a legal declaration of the shipment’s value

- Used to calculate duties, taxes, and other customs fees accurately

- Provides essential details for insurance claims in case of lost or damaged goods during transit

- Serves as an accounting document for both exporters and importers to record the transaction officially

Proforma Invoice vs Commercial Invoice: Key Differences

Here is a table summarizing the key differences between proforma invoice vs commercial invoice:

| Feature | Proforma Invoice | Commercial Invoice |

| Purpose | Estimate or preview of costs | Official request for payment after delivery |

| Binding Nature | Not legally binding | Legally binding document and part of the contract between buyer and seller |

| Usage | Used for providing cost details or securing financing/import permits | Used for payment processing, financial records, and customs clearance |

| Time of Issue | Issued before goods are shipped or services are rendered | Issued after the sale is completed and goods/services are delivered |

| Details Included | Estimated cost, item description, and quantity | Full details, including total due amount, taxes, and payment terms |

| Customs | Used for customs clearance in international shipments | Required by customs authorities to clear goods and assess duties |

| Payment Requirement | No payment is required | Payment is required upon receipt |

| Follow-up Document | May lead to a commercial invoice | Often accompanied by shipping documents |

| Tax Documentation | Not typically used for tax reporting | Used for tax reporting and clearance |

| Modifications Flexibility | Flexible and easy to amend | Amendments require re-issuance due to legally binding |

You May Also Like:

Proforma Invoice vs Commercial Invoice: Common Mistakes to Avoid

In this proforma invoice vs commercial invoice section, we’ll highlight common pitfalls every business owner should be aware of.

Here are common invoicing mistakes to avoid when issuing your invoice:

- Incomplete Information: Failing to include all necessary details (like item descriptions or payment terms) can lead to confusion and delays in payment processing.

- Mislabeling Documents: Always label documents clearly. Confusing proforma invoices with commercial invoices can result in legal complications.

- Neglecting Updates: Not updating proforma invoices with actual quantities and prices once sales are finalized can lead to discrepancies.

- Ignoring Local Regulations: Different regions may have specific requirements regarding invoicing. Always ensure compliance with local laws to avoid penalties.

- Overlooking Follow-Up: After issuing an invoice, follow up with clients to confirm receipt and address any questions they may have.

Proforma Invoice vs. Commercial Invoice: Regulatory Differences

The requirements for commercial and proforma invoices can vary significantly across regions. Understanding these differences is crucial for compliance in international trade.

This section on proforma invoice vs commercial invoice outlines some country-specific regulatory requirements to help businesses navigate these variations and ensure smooth cross-border transactions.

United States:

- Proforma invoices are often used to provide preliminary information about the shipped goods. They help with the process of securing export licenses, financing, or import permits. While not a direct regulatory requirement, these invoices assist in export control procedures.

- Commercial invoices must include specific details, such as the harmonized tariff code and country of origin, to meet U.S. customs requirements and avoid delays in clearance. These details are necessary for U.S. Customs and Border Protection (CBP) to correctly classify goods and calculate duties and taxes.

- U.S. businesses should also be aware that the format and information required on commercial invoices can vary depending on the goods being shipped (e.g., food, electronics, or machinery).

European Union:

- Proforma invoices are accepted for VAT calculations during importation, but they must clearly indicate that they are not final invoices.

- Commercial invoices must comply with the EU’s Intrastat reporting requirements, which track the movement of goods between EU member states for statistical purposes.

- Businesses shipping goods to the EU should ensure that commercial invoices include the correct commodity codes to comply with tariff classifications and avoid potential fines.

Asia:

- Many Asian countries, including China and India, may require notarized commercial invoices for customs purposes, particularly for high-value or restricted goods.

- In China, commercial invoices typically need to be written in both English and Chinese and may require an export license for certain goods.

- India requires proforma invoices to obtain import permits for certain products like electronics, chemicals, and machinery, though not all goods need this documentation.

Failure to meet these country-specific regulatory requirements can result in shipment delays, penalties, or even confiscation of goods. Businesses must stay informed about the invoicing standards and legal requirements of the countries they trade with.

You May Also Like:

Proforma Invoice vs Commercial Invoice: Best Practices

Creating effective proforma and commercial invoices requires attention to detail. In this section on proforma invoice vs commercial invoice, we’ll highlight the best practices for both invoice types.

Best practices for creating proforma invoices:

- Clearly label the document as a “Proforma Invoice”

- Include all relevant details such as item descriptions, quantities, prices, and terms

- Specify that it is an estimate and not a payment request

- Provide contact information for both parties

- Indicate the shipping costs and the delivery timelines

Best practices for creating commercial invoices:

- Clearly label the document as a “Commercial Invoice”

- Include complete billing information (seller’s name, address, contact details)

- List items with detailed descriptions, quantities, unit prices, and total amounts

- Include payment terms (e.g., due date) and any applicable taxes or discounts

- Ensure compliance with local regulations regarding invoicing

How to Transition from a Proforma Invoice to a Commercial Invoice

The transition from a proforma invoice to a commercial invoice involves updating preliminary estimates to finalized details for accuracy and compliance.

In this proforma invoice vs commercial invoice section, we’ll guide you on how to transition from a proforma invoice to a commercial invoice.

Here’s a step-by-step guide:

- Review the Proforma Invoice: Ensure all preliminary information is accurate and agreed upon by both parties

- Verify Shipment Details: Update quantities, product descriptions, and shipping costs based on actual figures

- Add Legal and Tax Information: Include applicable taxes, duties, and other regulatory details required for the commercial invoice

- Incorporate Payment Terms: Specify payment deadlines, accepted payment methods, and any late payment penalties

- Finalize and Issue: Double-check for errors, then send the commercial invoice to the buyer and relevant authorities

This process ensures the transition is seamless, minimizing discrepancies and avoiding disputes. A robust invoicing system or software can further help you streamline this task.

FAQ

Q1. What is the main purpose of a proforma invoice?

The main purpose of a proforma invoice is to provide an estimate of costs before a sale occurs.

Q2. When should I issue a commercial invoice?

A commercial invoice should be issued after goods have been delivered or services have been rendered.

Q3. What information should I include on a proforma invoice?

A proforma invoice should include the following:

- Item descriptions

- Quantities

- Estimated prices

- Shipping costs

- Terms of sale

- Contact information

Q4. How do I convert a proforma invoice into a commercial invoice?

To convert a proforma invoice into a commercial invoice, update it with actual quantities delivered and final pricing details once the sale has been completed.

Q5. What are the benefits of using a proforma invoice for my business?

Proforma invoices clarify costs upfront for buyers. They help facilitate negotiations and assist in securing financing or import permits.

Additionally, they set clear expectations for transactions, which reduces the risk of miscommunication.

You May Also Like:

Conclusion

Understanding the differences between proforma invoice vs commercial invoice allows you to confidently navigate both domestic and international trade, ensuring smoother invoice management.

By following best practices, and staying compliant with legal requirements, you can streamline your invoicing process and keep your transactions running seamlessly.

Real-life examples of proforma invoice vs commercial invoice have shown how understanding these distinctions helps businesses stay on track and meet legal standards.

Ensure smoother transactions — apply your knowledge of proforma invoice vs commercial invoice today!