Finding the right accounting software for your organization is one of the most crucial decisions you’ll make.But what is accounting software?

Accounting software helps businesses with their financial transactions. But it goes beyond just recording transactions; it’s about gaining insights into your company’s financial health and cash flow.

Choosing an appropriate accounting system is no easy feat, as there are many variables involved. These include:

- The size of the business

- A business’s accounting needs

- Price of the software solution

- Its features

These factors and many more will come into play. Here is an exhaustive analysis of everything you need to know to answer the burning question, “What is accounting software?”

Let’s get started!

What is Accounting Software?

Accounting software is a computer program or application that a business uses to record and process accounting transactions for various financial functions. These functions include taxation, payroll, billing and invoicing, and tracking cash flows.

Accounting for startups can be subject to both internal and external review. And because businesses have different complexities in their structures, there are different types of accounting systems for them to choose from.

Some of the core features of all accounting software include:

- Billing and invoicing

- Payroll management

- Inventory management

These features are useful for all businesses, making accounting software beneficial to businesses of all sizes and types.

But what is a good accounting software solution?

A good accounting software solution should provide a quick summary of your profits and losses. It should also keep you up to date with the appropriate legal requirements necessary for your business operations.

It is important to consider the most important accounting features for your business when selecting any accounting tool. Let’s discuss the important features of accounting software in detail in the next section.

Also Read:

What are the Key Features of Accounting Software?

To fully understand ‘What is accounting software?’, we need to explore its key features.

Accounting software simplifies the different financial aspects of your business, from financial reports to invoice management.

Some tools also automate financial processes, so your business will require fewer employees to process large amounts of data. Simply put, it enables the efficient and fast processing of financial transactions.

What are some of the important features that you should look for in an accounting software solution, and why?

Let’s find out

Accounting

You might be asking, “What is accounting software’s most important feature?” A major aspect to consider is its ability to support full-cycle accounting.

These features constitute:

- Accounts receivable

- Accounts payable

- Bank reconciliations

- Fixed assets

- General ledger

Advanced accounting software features may include more complex financial management tools.

Invoicing and Billing

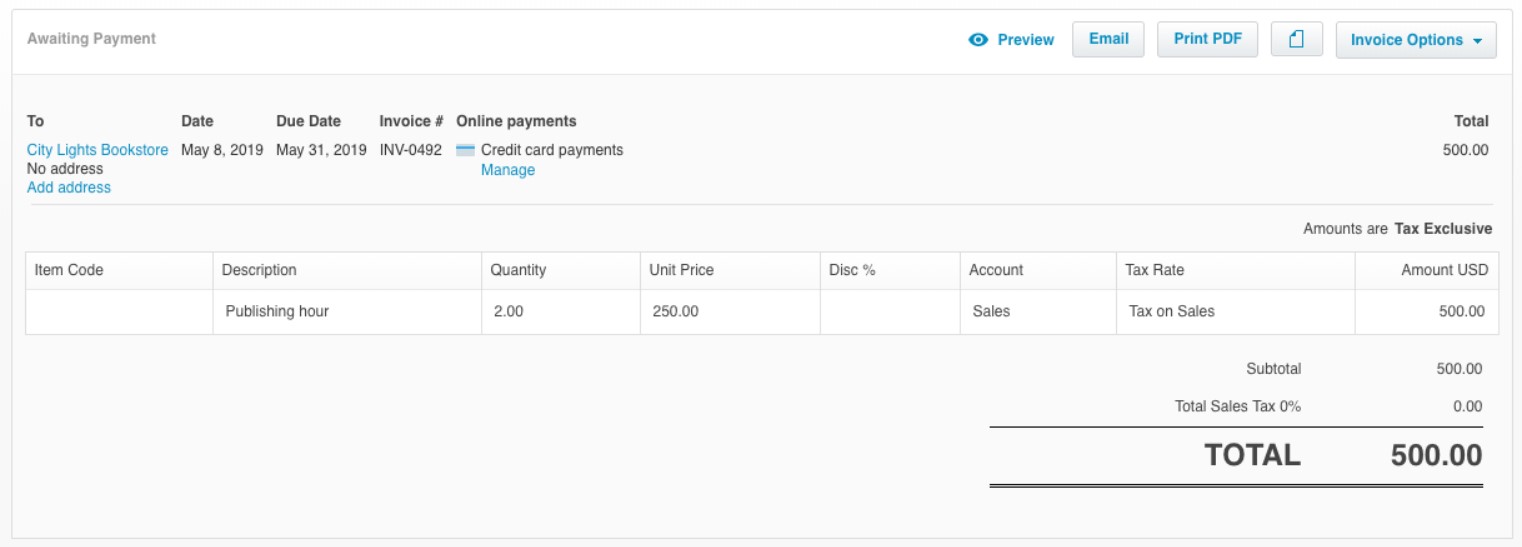

When asking, ‘What is accounting software?’, invoicing and billing are the first features that come to mind.

This foundational feature of cloud accounting software allows customers to automate invoice processing, capture, and organize invoice data on time.

It also provides them with payment methods that work effectively within the industry. Cloud-based accounting software often offers more flexibility in customizing invoices and managing billing processes.

Businesses that sell fast-moving consumer goods, for instance, would need software with this particular focus.

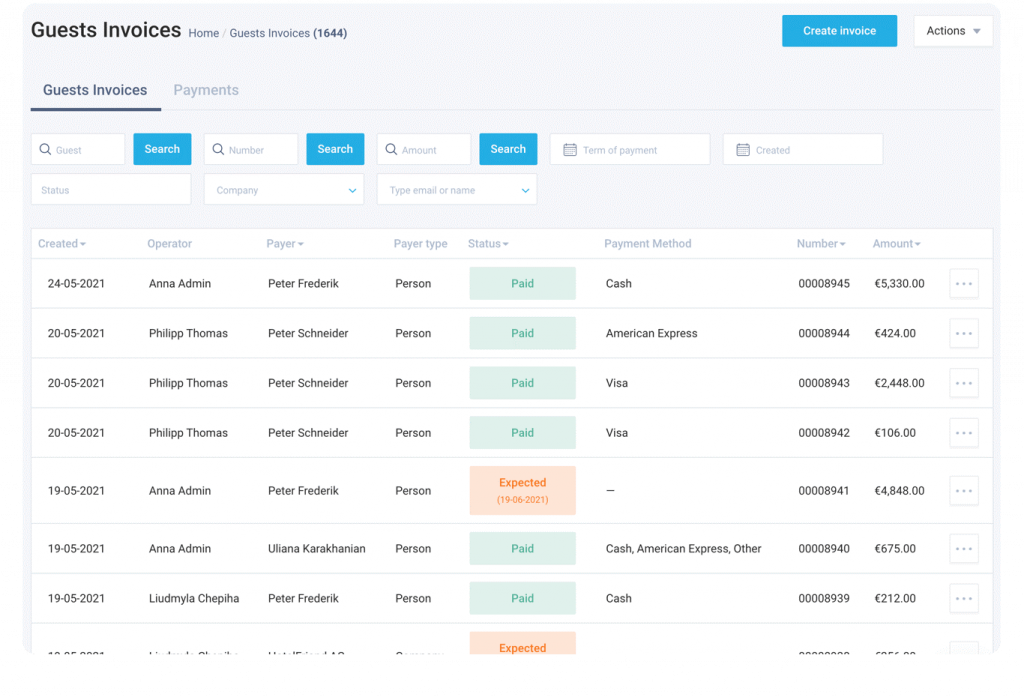

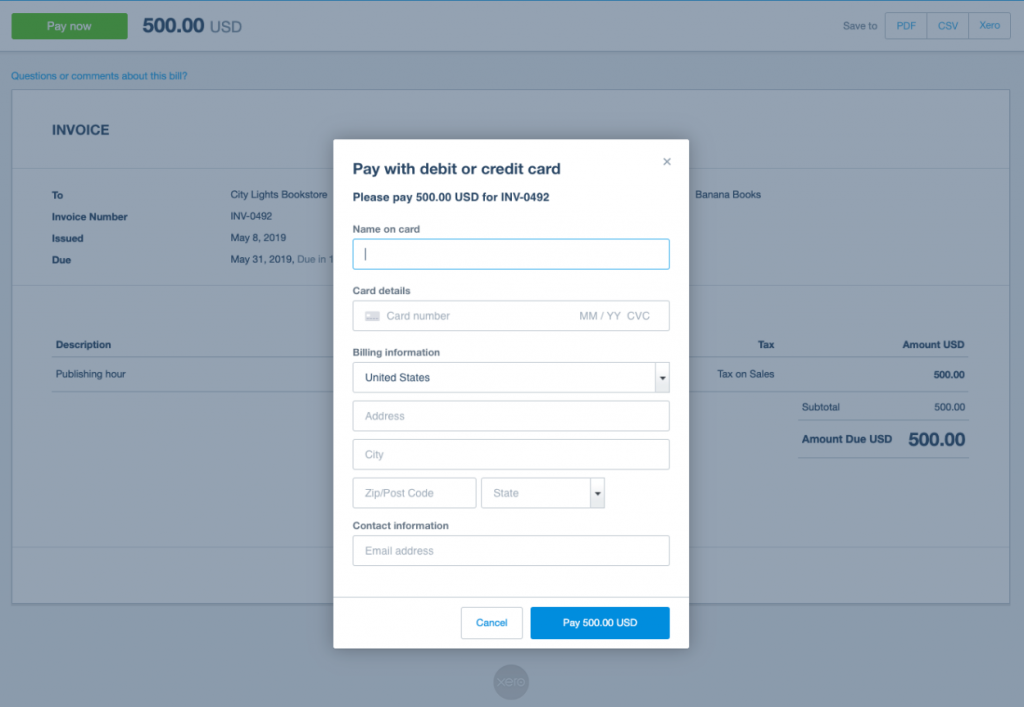

Such businesses produce numerous invoices, including proforma or commercial invoices for their clients at a time. Here is an example of an invoice generated by an accounting system:

Image via Xero

However, there are also accounting systems that have invoices and billing as one feature, among others. These are good for businesses that do not generate numerous invoices daily.

An invoicing and billing feature is crucial, as a delay or mistake in invoices can lead to delayed revenue collection. And that spells an unfavorable situation for any business.

Not only does online accounting software ensure smooth billing, but it also helps you keep track of transactions.

For credit transactions, it shows you the amount of money someone owes you, when it was owed, the amount, and when to expect payment.

A common feature of most accounting software is providing customers with the ability to pay their bills electronically. This makes billing even easier to track.

Payroll

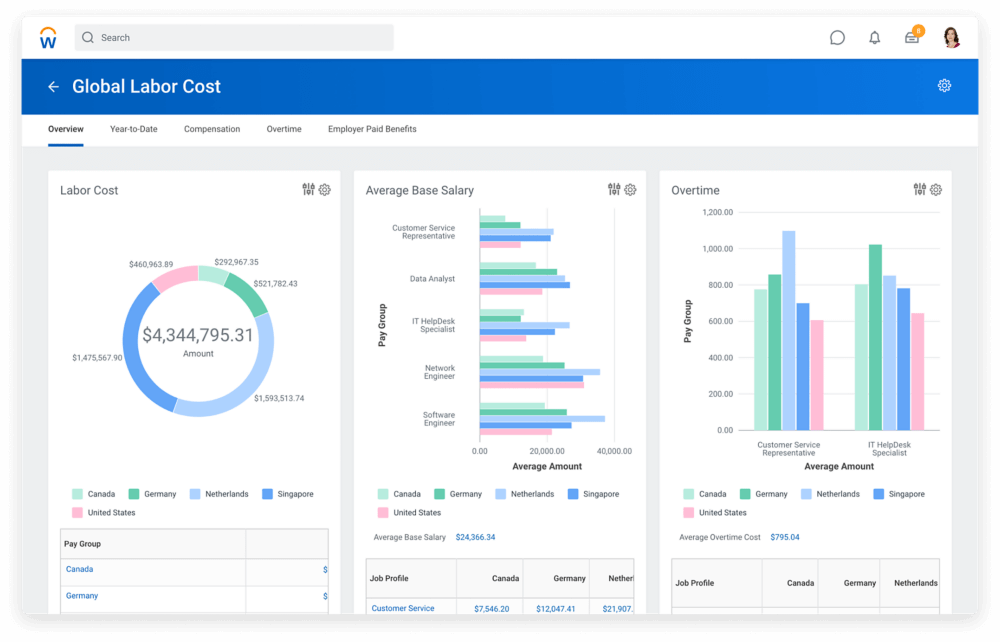

When exploring ‘What is accounting software?’, payroll management is a key functionality to consider

The calculation and processing of employee payments are the functions of the payroll feature of accounting software. It prepares and prints salary checks on time and keeps track of employee income tax and other statutory deductions.

Basically, the payroll features enable you to align with payroll best practices, and manage your employee payments easily and efficiently. Some advanced accounting software features may also include managing retirement benefits and other complex payroll tasks.

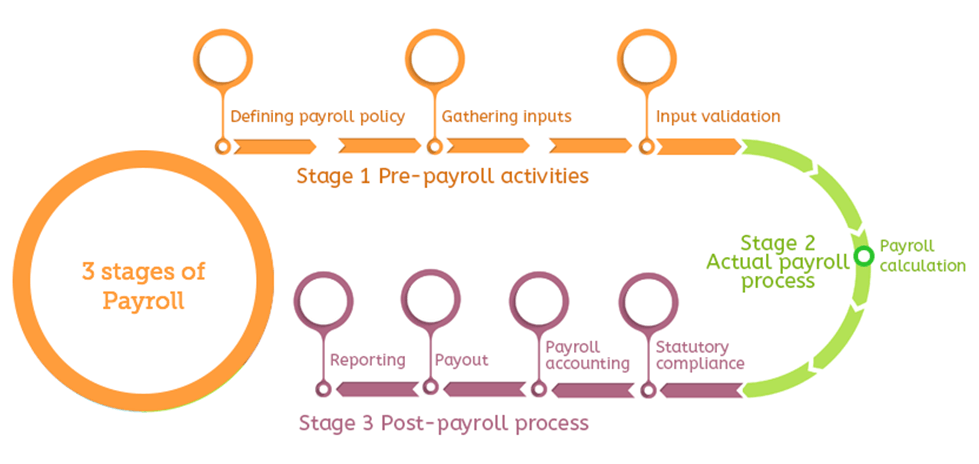

Here’s an overview of what a payroll system looks like:

Image via Workday

Large businesses have a dedicated system for payroll management. Smaller businesses, however, can have the system as a module in their business accounting software solution.

Also Read:

What are the Key Features of Acc

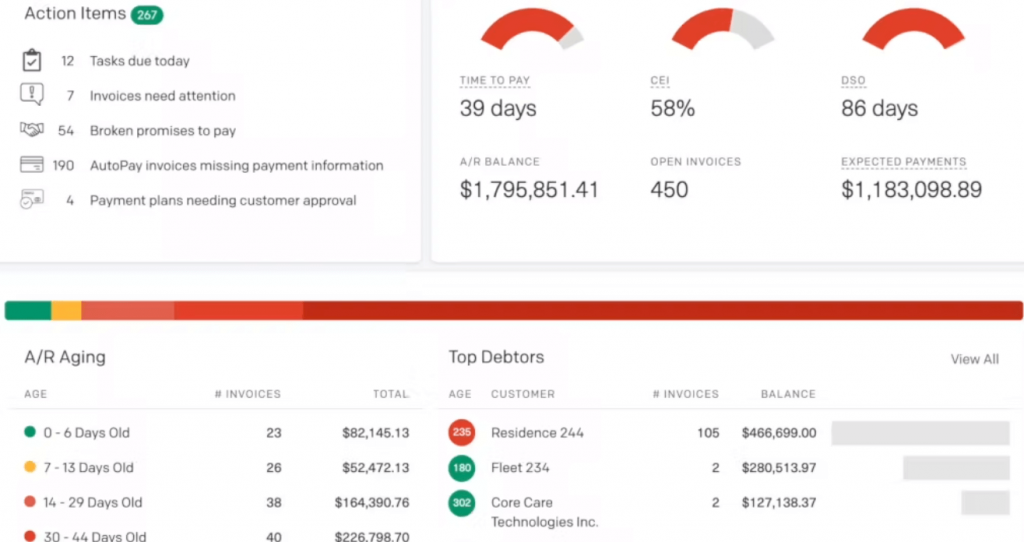

Analytics and Reporting

Another important aspect when considering ‘What is accounting software?’ is its reporting capabilities.

This feature helps you track and manage your business’s financial data for a given period. That includes your inventory, receivables, payables, and other current transactions.

Accounting software makes it easier to generate financial reports and analyze your company’s financial health. It derives information from records of previous fiscal years, helping you make future financial estimations. This includes tracking account balances over time.

These estimates form the basis for your planning and budgeting. Using the financial reports produced by accounting software’s analytical tools, you can easily make policy changes and grow your business.

For instance, keeping track of bad debts will help you manage your credit terms.

Below is an example of analysis provided by an accounting system.

Image via Invoiced

Management of Fixed Assets

Fixed assets are, for the most part, considered to be the business’s tangible value. That’s what makes their management crucial to business success. A common feature you’ll discover when researching ‘what is accounting software’ is the fixed asset management functionality.

The fixed asset management feature helps with:

- Keeping track of the cost records of fixed assets

- Calculating asset depreciation

- Keeping records of asset audit history

- Determining resource allocation, e.g., equipment distribution

Proper management of your business’s fixed assets helps prevent a loss in company value due to over-depreciating assets.

Project Accounting

Project accounting involves managing the finances and resources related to a project, such as expenses, time, and people. Modern accounting software often includes project accounting features, allowing for detailed tracking of project-specific finances.

This feature is aimed at ensuring a project is completed within the allocated budget. The success of any project, after all, depends on how well its finances are managed.

Proper accounting for projects is crucial, especially for maintaining the lowest possible costs. You want to get the most returns out of a project while still minimizing the resources used.

Here’s one example of a project accounting dashboard within an accounting software solution:

The main beneficiaries of the project accounting feature are construction operators and software developers.

The main functions of the project accounting feature are:

- Estimation of labor costs

- Equipment costs and allocation

- Material cost estimation

- Detailed tracking of project expenses

- Other calculations involved

Fund Accounting

For non-profit organizations asking, ‘What is accounting software?’, fund accounting features are particularly important. This feature is mainly designed for non-profit organizations and government agencies.

Fund accounting systems are used for tracking expenditures, donations, resource allocations, and grant management.

Mismanagement of funds in non-profit organizations and government institutions is common. Hence, the purpose of fund accounting is accountability, as opposed to profitability like in other businesses.

Fund accounting systems can be used to manage different types of monetary allocations depending on the size of the non-profit.

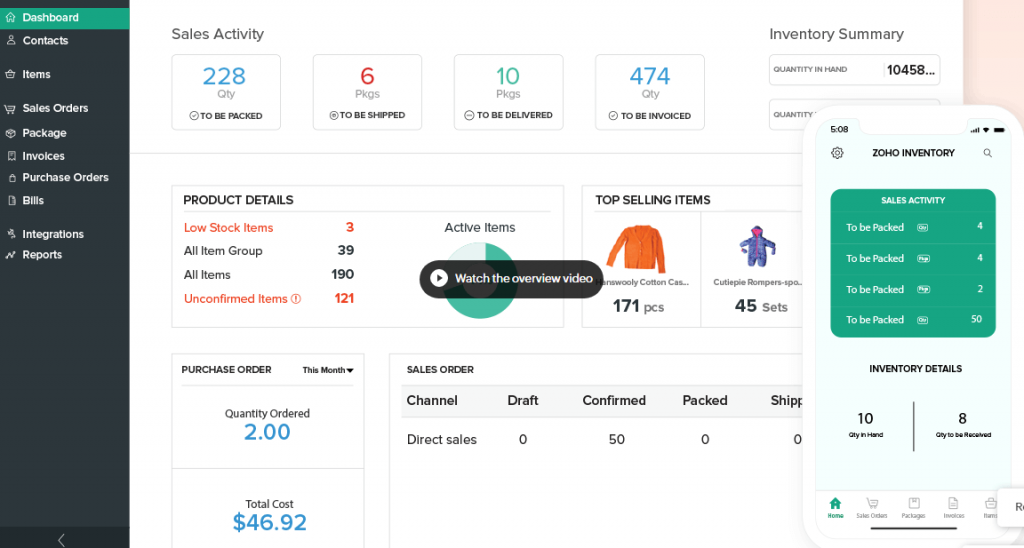

Inventory Management

Another crucial aspect when answering ‘What is accounting software?’ is its ability to handle inventory management.

The inventory management feature records and tracks a business’ stock and equipment. It enables you to control the availability and movement of one’s products.

It records what moves in and what moves out in terms of stocking. It also manages how stock movement occurs, for instance, on a first-in-first-out basis.

All in all, accounting software makes inventory tracking more efficient, helping you avoid issues like understocking or overstocking. Here’s an example of what inventory management software looks like:

Image via Zoho

Based on the above-mentioned features, there are different types of accounting software.

In the next section, we’ll look at what exactly these are.

What are the Different Types of Accounting Software?

As we continue to explore ‘What is accounting software?’, let’s look at the different types available.

Most accounting software packages can be placed in one of four broad categories, depending on their features and use cases.

However, it is possible to integrate the best features of each category to form a custom, comprehensive accounting suite for your business.

Here is an overview of the 4 types of accounting software:

1. Billing and Invoicing Systems

What is accounting software without robust billing and invoicing capabilities? These systems are crucial for managing your accounts receivable. Accounting software makes it possible to automate many aspects of billing, including recurring invoicing and electronic payments.

Billing is the process of creating and sending invoices. An invoice is a document sent to the buyer by the seller containing details of the trade.

It’s with this invoice that the seller demands payment. An invoice contains a breakdown of the various items that add up to make the total bill.

Accounting system vendors have different limitations for their clients on billing and invoicing. In some instances, your system can only send a certain maximum number of invoices per period.

This may depend on the accounting package you pick.

If your business issues numerous invoices to your clients per day, then this is a factor to consider before picking your software.

Here’s an example of an invoicing and billing system:

Image via HotelFriend

Invoices should be highly accurate and detailed. Errors could be a source of losses for the business.

Accounting systems have automation capabilities for billing and invoicing processes. This makes them more reliable.

It is only when a business can successfully and accurately control its finances that it can grow and outdo its competitors.

Proper management of finances using a reliable billing and invoicing system is crucial to business success.

Also Read:

2. Enterprise Resource Planning (ERP) Systems

ERP systems offer a comprehensive answer to ‘What is accounting software?’ by integrating various business functions into one system accessible via a single interface.

This type of accounting software effectively manages a company’s different resources. It minimizes redundancy by monitoring everything from a single platform.

What are some of the functions an ERP system integrates? Here are some examples:

- Project management

- Accounting functions like receivables, payables, and cash flow management

- Procurement functions, such as logistics and distribution

- Risk analysis

- Human resource functions like payroll and recruitment

- Marketing tools such as customer relations management software

- Analytics and financial reporting

By bringing together all of these functions, ERP systems manage the resources of the entire business. They also offer centralized access to resources, which makes their distribution easy and effective.

3. Payroll Management Systems

What is accounting software without an efficient payroll system? A payroll management system manages all the financial transactions between your business and your employees. This includes salaries, overtime, wages, bonuses, and other payments.

With a payroll system, you can both calculate these payments and process them easily to ensure everyone gets paid on time.

For small businesses processing salaries, payroll systems also help make the appropriate income tax deductions and produce payslips.

Here is an illustration of how the payroll system works:

Image via Freshbooks

The automation of most of these processes ensures minimal errors in the payroll system.

With businesses that issue time-based wages, payroll systems incorporate functions such as calculating total working hours. They then determine employee wages based on working hours.

The payroll system easily integrates with other human resource management systems such as recruitment. This ensures that most employee-based functions are carried out from a single, integrated platform.

Payroll systems also have automation features like, for example, filing a company’s tax returns and organizing tax documents.

4. Expense and Time Management Systems

These are systems designed to provide a summary of costs as they relate to time spent on projects.

Time management systems reduce costs by utilizing time optimally. It also makes billing clients easy by automating time-tracking.

As small businesses grow, expense management becomes increasingly important for controlling costs and ensuring financial stability. It encompasses overseeing expense reports, managing cost approvals, handling bookkeeping, and monitoring payments.

A business needs expenses to keep running, but without expense management, it can’t run properly. Therefore, the expense tracking feature of these systems is needed to minimize costs and maximize financial productivity.

Accounting and finance teams can use this software to track reimbursements and expense reports. As a result, every cash outflow is streamlined and any risks or errors are minimized.

Integration of time and expense management ensures time is valuably spent, and that every expenditure is necessarily approved.

Also Read:

5. Custom Accounting Software

For some businesses, the answer to ‘What is accounting software?’ might be a custom solution.

Simply put, custom software is accounting software that a business builds for itself.

A business may prefer to develop a software solution that‘s personalized to its individual accounting needs. This is as opposed to purchasing one and adding features as you grow.

This may happen by chance, especially if the business has a technology-savvy team that can come up with a solution. It may start by developing modules for specific accounting functions that, over time, can develop into a full-blown system.

You could also hire developers to design customized software for you.

Another reason for creating custom accounting software is if the ones available on the market do not serve your company’s needs.

When developing custom accounting software, it’s important to have it integrate with the following modules:

- Customer relations software: Easily accesses sales orders and creates quotations.

- Human resource software: Integrates human resource data and employee remuneration information.

- Bank accounting: Helps your system manage bank transactions in real-time across different bank accounts.

- Procurement system: Tracks your purchase orders and other payments.

- Asset management software: Contains data on your fixed assets and on how they’re utilized and maintained.

- Inventory tracking software: Helps your accounting software access data on your stock/inventory, its value, and movement.

Also Like:

Uses of Accounting Software

To further answer ‘What is accounting software?’, we need to examine its various uses in business. Let’s explore some of them.

Invoicing

One of the primary reasons to use accounting software is to automate and streamline various accounting tasks. This can include everything from recording transactions to generating automatic invoices.

Businesses that manually send their invoices face several financial accounting challenges, including inaccuracies and time delays. Accounting software makes this process more efficient and accurate.

With features like recurring invoicing, you can save time and ensure consistent billing for regular clients.

Data Storage and Security

An often overlooked aspect when considering ‘What is accounting software?’ is its role in data security and storage.

The basic function of every accounting system is to store a business’s financial data.

Since most of these transactions are made through the software, maintaining this history gets much easier.

Other than financial transactions, the system also stores customer details.

Both of these are crucial groups of data that need to be protected. As such, accounting systems ensure that these details are secure.

What does that look like?

First, they limit the number of users accessing certain pieces of information on the platform. This is done by authorizing only specific users, using password protection, and through data encryption.

Second, having financial records backed up on these platforms prevents the loss of data due to misplacement or physical damage.

Financial Data Analysis

When discussing ‘What is accounting software?’, we can’t overlook its data analysis capabilities.

As mentioned earlier, accounting software stores historical data relating to a business’s financial transactions. So what is the importance of data analysis in accounting software?

Accounting systems analyze stored data to provide useful insights in the form of reports that help with strategic business decisions.

This makes it easy for you to track your business performance on metrics like profits and losses, as well as other financial data.

Accounting software makes it easy to generate accurate financial statements like income statements and balance sheets.

Such reports are stored on the platform, and you can easily access them from your software to use them. Many systems offer built-in reports that can be customized to provide the insights you need.

This allows you to make comparisons between financial statements, identify disparities, and fix them.

By helping you analyze data effectively, accounting software platforms allow you to make informed business decisions.

Facilitating Financial Transactions

One of the key benefits of cloud accounting software is its ability to streamline financial operations. Cloud accounting software facilitates transactions both ways—from the client to the business or from the business to its suppliers.

These tools can help streamline various payment processes, including helping businesses pay bills on time, manage accounts payable, and reconcile bank statements.

For international financial transactions, these systems enable multi-currency options based on location. This makes commercial transactions easier across multiple locations.

There are several different kinds of invoices that these systems can generate, depending on the nature of the transaction.

These include:

- Credit notes: These are issued if you want to make refunds to a client.

- Debit notes: Issued if you need to increase the amount owed by a client.

- Mixed invoice: These are issued if you want to provide both a refund and an increase in the amount owed. The result could be either a debit or a credit. Either way, it incorporates two different transactions.

- Commercial invoice: Issued for international sales, these include customs duty and shipment details.

- Pro forma invoice: This can be sent to a client before servicing their order. It contains estimated prices for the payment they’ll need to make.

These are the most common invoices that accounting software products can generate to facilitate transactions.

Besides invoices, there are other proofs of payment that accounting systems are able to generate, such as receipts.

For international financial transactions, these systems enable multi-currency options based on location. This makes commercial transactions easier across regions.

Maximizing Productivity by Efficient Resource Management

A key consideration in ‘What is accounting software?’ is how it can maximize productivity through efficient resource management.

Accounting software maximizes productivity by automating tasks that were previously done manually. This saves time and helps avoid human error.

But what resources do accounting systems manage?

Well, as suggested above, two of the main resources include time and human resources.

Accounting systems minimize human effort for tasks such as producing income statements. Automation also frees up your employees’ time and lets them focus on more important tasks.

The fixed project management aspect of accounting software also helps boost productivity. For instance, you can know where and when equipment is in use, and also manage their schedules to maximize productivity.

Through the fixed asset management system, accounting software determines a business’s value by keeping track of asset depreciation or appreciation.

This way, every single resource allocation decision can be made with certainty without any risk of error.

Tax Administration

Tax management is a major beneficial aspect to talk about when considering ‘what is accounting software’. For a business to succeed, it has to work within the legal requirements of its region. The Internal Revenue Service (the IRS) has tax requirements every business needs to abide by.

Most accounting software packages have these basic tax capabilities, including 1099 forms.

Good accounting software should be equipped with different tax features. Besides 1099s, these include forms for filing:

- W-2s

- W-3s

- 1096s

- 944s

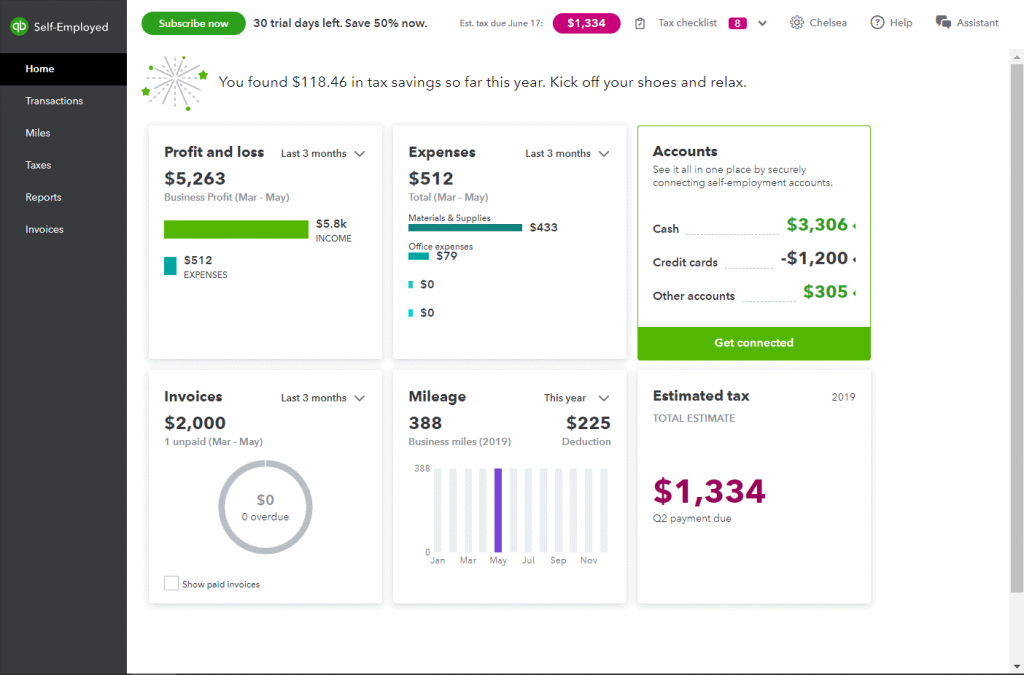

This ensures you stay compliant with tax regulations and can easily generate reports for tax purposes. Here’s an example of what an accounting software solution’s tax interface looks like:

Image via Quickbooks

Also Read:

What are the Benefits of Accounting Software?

Now that we’ve covered ‘What is accounting software?’, let’s explore its benefits.

Every business needs accounting software for the use cases discussed above. Through those functions, your financial transactions become more streamlined.

Maintaining records on spreadsheets is strenuous, even for small businesses. That’s where accounting software comes in.

Here are the benefits of using accounting software.

Cost Savings

When considering ‘What is accounting software?’, many businesses are interested in its potential for cost savings.

With a good accounting software solution, you won’t have to outsource financial management to a third party. Instead, you can take control of your finances yourself.

Accounting software makes it possible to reduce the need for manual data entry, potentially lowering your staffing costs. The systems also store sensitive data online, reducing the costs related to document management.

Accounting software can help reduce costs for companies by reducing the requirement for manual data entry and analysis. This way, you don’t have to employ more people or overwhelm your existing team.

This will allow your employees to focus on other, more important tasks.

Financial Transparency

Transparency is a core characteristic of good accounting software.

What makes financial transparency so important?

Accounting reports need to be transparent so that investors can easily understand a company’s financial details. They need to know how the company is managing its debts, profits, and overall cash flow.

Accounting software allows them to watch in real-time how their investments are performing and evaluate the company’s overall performance. This real-time data access is a key benefit of modern accounting software.

Accurate Forecasting

With a clear overview of your current financial status, you will find it easier to develop smart strategies and allocate resources correctly.

It’s not always easy to identify trends and patterns in your financial performance. Therefore, you should use accounting software to produce and customize reports and analytics that make this easier for you.

Accounting software makes accurate forecasting possible by providing detailed financial information. This gives insights that help you understand what to forego and what to invest.

The best accounting software solution will also help you develop smart strategies and allocate resources to the right channel.

Productivity Improvements

There are different types and features of accounting software. All these work hand-in-hand to ensure that your finances are efficiently managed.

It increases your business’ productivity by adequately managing and utilizing the resources available to their maximum potential.

Although different types of accounting systems could integrate to work together, expense and time management systems prioritize productivity.

What’s more?

They specialize in time utilization and expense reduction to increase business profits.

Other types of accounting software such as the resource planning system ensure that your business utilizes available resources optimally to improve productivity.

Improved Scalability

As businesses grow, their financial needs become more complex. So what is accounting software’s major function here?

Accounting software solutions help the business adapt to these changes, as they are built to handle increased transaction volumes and more intricate financial reporting.

For companies expanding into new markets or diversifying their operations, accounting software allows them to integrate additional features as needed.

Companies can add modules for inventory management, payroll processing, or in-depth financial forecasting without needing to overhaul their entire system.

Also Read:

Tax Compliance

Every business needs to comply with the tax laws of the region they operate in. Most accounting software packages are designed to automatically comply with such taxation laws. This includes handling sales tax calculations and generating the necessary tax reports.

Accounting software prevents you from incurring penalties that would have been imposed on your business for non-compliance with these laws.

Avoiding these penalties assists your business in maintaining a good reputation with the region’s authorities. It also leads to increased profits.

Enhanced Customer Relations

Keeping customers happy is the key to the success of any business. It is, therefore, important to ensure that you maintain a healthy relationship with them.

Accounting software helps you send invoices on time, provides convenient payment options, and offers many features that help maintain smooth transactions.

Such smooth transactions encourage more business between you and the client. This is because professional business conduct assures the clients of your business’s credibility.

Simplified Accounting Processes

At its core, the answer to ‘What is accounting software?’ is about simplifying and streamlining accounting processes

It performs automated calculations for your business, minimizing errors and improving accuracy.

Accounting software makes it easier to handle a large amount of transactional data, reducing the time spent analyzing this data manually.

Accounting software also keeps track of and stores all your financial transactions in an organized format. This makes it easier for you to access historical transactions and financial statements.

Security

Accounting systems protect a company’s financial data from falling into the wrong hands or getting lost. This is extremely important, as financial data is a company’s most valuable information.

What do accounting systems do to ensure high levels of security?

For one, accounting systems cover your data under layers of high-end encryption algorithms. Believe it or not, this makes it much safer than keeping it on an office shelf.

With accounting software, you never have to worry about backing up information because the system does it for you.

In most cases, you can design a security structure of your own and decide who will have access to siloed data.

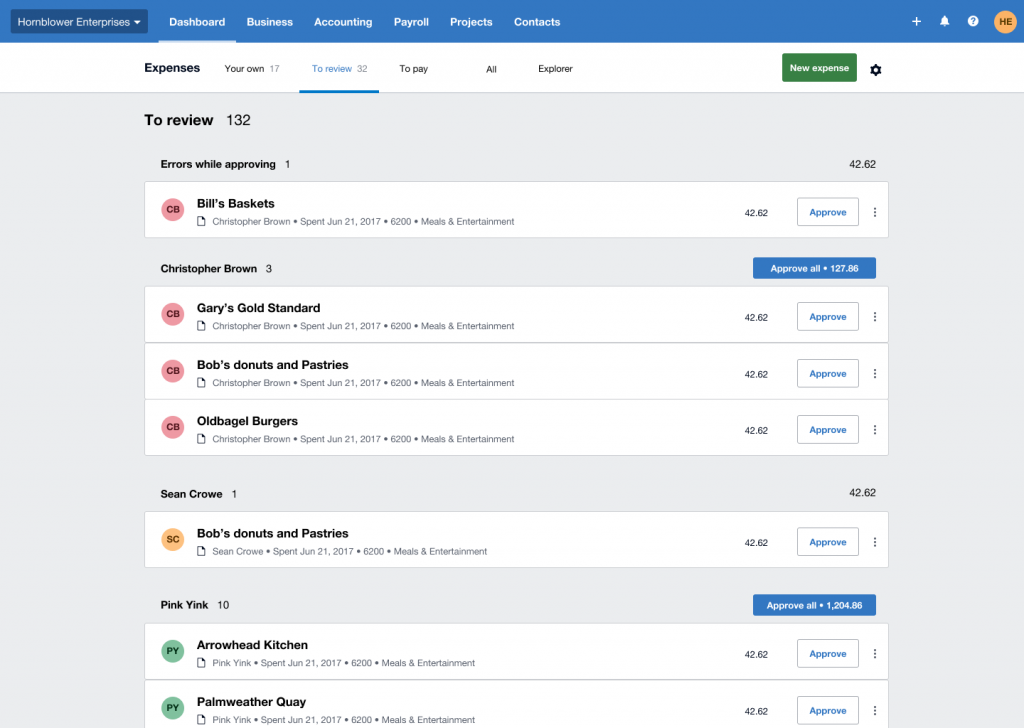

For instance, you can give approval rights to specific employees, as shown below.

Image via Xero

You can use this feature to prevent unauthorized personnel from accessing confidential information. To top that, some systems also provide internal and external audits to track changes made to financial records.

The best part is that all of your accounting data is synced at all times. Not only is it secure, it’s also up-to-date.

Also Read:

7 Best Accounting Software Solutions for Small Businesses

What are some of the best accounting software solutions on the market?

This section takes a look at the top 7 accounting software packages that are great for small businesses. We discuss their key pros, cons, and pricing.

This list should give you an overview of where to start when you choose accounting software.

Let’s get started!

1. Xero

Image via Xero

Xero is a cloud-based accounting software solution that has a user-friendly interface. This makes it one of the simplest accounting software products to use.

You can also integrate it with third-party software, such as payroll systems and payment options like Stripe.

Besides its basic financial functions, Xero also offers expense management, project management, and multicurrency functions.

Xero is widely used worldwide with over 3 million users and lots of positive customer reviews compared to some Xero alternatives.

Pros

- Excellent customer support

- Easy to use

- Has a mobile app

- Web-based

- Learning resources for new users

Cons

- Provides only Basic analytics

Pricing

Xero currently offers a 90% discount for the first three months on all of its plans.

- Early: $20/month

- Growing: $47/month

- Established: $80/month

Also Read:

2. QuickBooks

Image via Quickbooks

QuickBooks is a popular accounting software solution for small business owners and professional accountants.

What makes it stand out among QuickBooks alternatives?

First, this platform has a single, integrated dashboard where you can access all the modules. This makes it very easy to use and navigate.

Also, it has numerous features, including payroll, inventory tracking, and different tax capabilities.

It’s easily customizable depending on a user’s needs, especially if you use the mobile app. Quickbooks also provides learning materials to help set up and use their platform.

Pros

- Cloud-based accounting system

- Allows third-party integrations

- Has a mobile app

- 30-day free trial

- Affordable

Cons

- Lower packages are limited to just a few users

Pricing

QuickBooks currently offers a 50% discount for the first three months on most of its plans.

- Simple Start: $19/month

- Essentials: $28/month

- Plus: $40/month

3. Sage Intacct

Image via Sage Intacct

Another top accounting platform for small businesses is Sage Intacct. This software is among the most popular accounting and resource planning software applications on the market.

Here’s what Sage Intacct does well.

It has AI-based accounting capabilities and analytical and budgeting features that make your accounting process easy.

Sage Intacct has an accounting solution for every industry.

Pros

- Detailed analytics

- Seamless integrations

- Cloud-based platform

- Great customer support

Cons

- User interface is not very user-friendly

Pricing

- Pricing available on demand

Also Read:

4. FreshBooks

Image via FreshBooks

FreshBooks is a great option for small businesses that use the invoicing feature heavily. It offers lots of customizable options for sending, receiving, editing, and approving invoices.

You can also change the appearance of your invoice to fit a specific client. This feature sets it apart from most accounting software that doesn’t provide such flexibility with invoices.

Simply put, invoicing is what FreshBooks does best. This, however, doesn’t mean there aren’t other excellent features on this platform just like on FreshBooks alternatives.

Other equally effective functions of FreshBooks include budgeting, payment collection, and financial estimates.

Pros

- Customizable invoices

- Seamless third-party integrations

- Affordable payment plans

Cons

- No stock management or payroll services

Pricing

FreshBooks offers a 70% discount for the first four months on all plans.

- Lite: $21/month

- Plus: $38/month

- Premium: $65/month

- Select: Custom pricing

Also Read:

5. Wave

Image via Wave

Wave is among the most-used free accounting software programs on the market.

So what is it best known for?

Besides being free, Wave offers unlimited packages for accounting and invoicing functions. It’s one of the best options for growing small businesses with a low budget, especially ones that don’t have much structure yet.

For instance, a service-based startup business that just needs basic invoicing software will likely find everything it needs with Wave.

The free version for such businesses covers all basic accounting and invoicing functions. This includes generating reports for tax purposes.

Pros

- Free accounting and invoicing

- Multiple user access

- Mobile app

Cons

- No inventory management tool

Pricing

- Starter Plan: Free

- Pro Plan: $16/month

Also Read:

6. Zoho Books

Image via Zoho Books

Zoho Books is a cloud-based accounting software solution, one of the many business applications provided by Zoho. Zoho Books has a mobile app that you can use on your Android or iOS device.

It’s suitable for small businesses as it lets you upgrade and add more features as your business grows. Also, if you’re using any other Zoho tools, it offers seamless native integrations with the entire suite.

What’s more?

You get customizable invoices, expense tracking, banking, time tracking, expense reporting, and taxation features, among others.

Pros

- Free trial available

- Easy to use

- Affordable plan options

Cons

- No payroll management feature

Pricing

- Free

- Standard: $20/month/org

- Professional: $50/month/org

- Premium: $70/month/org

7. ZarMoney

Image via ZarMoney

Last on the list is ZarMoney, a cloud-based accounting software that offers a comprehensive suite of features for small businesses. This includes tools for invoicing, expense tracking, inventory management, and financial reporting.

One of ZarMoney’s standout features is its ability to handle multiple companies within a single account, making it ideal for businesses with multiple entities or locations.

What’s more?

The platform supports multi-currency transactions, which is beneficial for businesses operating internationally.

Pros

- User-friendly interface

- Unlimited transactions on all plans

- Robust inventory management

Cons

- Limited third-party integrations compared to some competitors

Pricing

- Small Business: $20/month

- Enterprise: Starts from $350/month

Factors Affecting the Price of Accounting Software

As we continue to explore the ‘What is accounting software?’ question, let’s look at what influences its cost.

You need accounting software that meets your business needs but is also within your budget. So when you set out to choose accounting software products, you may want to consider more than just the pricing.

So what exactly should you consider?

Expensive doesn’t always mean effective, and neither does cheap mean inadequate. There are a couple of factors that contribute to the differences in the pricing of the tools we just discussed.

These next sections discuss what these factors are.

Type of Software

One way to classify accounting software is to determine whether it’s cloud-based (online) or traditional accounting (desktop-based).

Desktop accounting software mostly charges annual fees, whereas cloud-based software offers monthly plans to its users.

Depending on your preference, you can choose between either. Additionally, developing desktop accounting software can be cheaper than subscribing to cloud-based tools.

However, you’d probably need a tech-savvy team to maintain it, ensure security, make updates, upgrade it as your business grows, etc.

On the other hand, paying for cloud-based software comes with recurring payments, but everything else is taken care of as far as maintenance goes. What you choose depends on your business model.

Features of the Software

Depending on the number of features offered, the developer may charge you differently.

They may opt to either charge a standard fee for all features or charge you based on the number of features your business requires. These are commonly known as add-ons. Accounting software makes it possible to customize your package based on your specific needs.

Meanwhile, you may also be charged according to how many times you have used the software solution.

Getting the right accounting software with the necessary features requires you to choose wisely.

So what’s the importance of checking features before paying for your accounting software?

If you’re not careful, you might find your business paying for many unwanted features. You may even have to pay extra for add-ons to get a fully functional system.

So, carefully search for the software solution with the most useful features for your business. Then later, if the need arises, you can pay extra for any necessary add-ons.

For instance, some basic features found in most software include invoicing and records of payments.

However, additional features such as payroll integration, facilitation of credit card payments, and having invoice payment reminders would require extra cost.

Here’s an example of an add-on for which you’d incur extra costs:

Image via Xero

Customer Support

While all vendors will offer some form of customer support, the ones that provide 24/7 support through various channels are the best. Some premium tools may offer better customer service or something else that would reflect on their price.

Some companies offer different tiers of support, so be sure to check that before choosing an accounting system.

The Number of Customers and Vendors

There are different ways in which accounting software sellers choose what to charge you.

Some charge based on the number of invoices you send in a particular period, while others may charge more for multiple users.

So be sure to carefully calculate the price you may have to pay based on your business requirements.

Add-on Charges

What are add-ons, and how do they affect the pricing of accounting software?

As mentioned, add-ons are additional features offered by accounting software over and above basic plans.

Be sure to figure out any hidden fees linked to add-ons, as these could make the use of the platform costly.

Some of the common hidden fees associated with add-ons in accounting software are:

- Start-up fees

- Customer service fees

- Cancellation fees

- Fees for additional users

- Annual upgrade fees

Without your knowledge, these fees can accumulate and increase the cost of something that your business might not have accounted for.

Also Read:

FAQ

1. What exactly do you mean by “accounting software”?

Accounting software is an application that helps accountants or accounting firms record and analyze a company’s financial transactions.

An accounting system automates many financial transactions, such as billing, invoicing, and payroll management. It also makes forecasts about the business’s future budgets from already processed financial data.

Accounting software makes it easier to manage your accounts receivable and payable, as well as generate accurate financial reports.

2. What is the most commonly used accounting software?

QuickBooks, Xero, and FreshBooks are some of the most popular and commonly used accounting software. These cloud accounting software solutions offer a range of features suitable for businesses of various sizes.

3. What are the types of accounting software?

Here are the major types of accounting software by use:

- Payroll management systems

- Business resource planning systems

- Expense and time management systems

- Billing and invoicing systems

- Custom accounting software

Another categorization of accounting software classifies them as on-premise or cloud-based accounting software.

On-premise or desktop-based accounting software is installed locally on devices and servers. Cloud-based accounting software is hosted by the vendor and accessed over the internet.

4. What are the uses of accounting software?

Accounting software performs many functions. Among other things, the list includes:

- Invoicing and billing

- Payroll functions

- Resource management

- Data storage and security

- Cashflow tracking

- Data analysis and reporting

- Inventory tracking

- Managing bank transactions

- Facilitating electronic payments

5. What is the simplest accounting software?

The most commonly used accounting software applications are popular for their ease of use. Examples include Xero, Wave, and Quickbooks. These cloud accounting software products often have user-friendly interfaces and offer features that simplify various accounting tasks.

6. What are the top accounting software programs?

The top accounting software applications are:

- Xero

- Quickbooks

- Sage Intacct

- FreshBooks

- Wave

- Zoho Books

- ZarMoney

These tools top the list because of their easy usability, integration with third-party apps, and the different accounting functions they offer.

7. What factors should I consider when choosing an accounting software solution?

Here are the key items to consider before choosing an accounting solution for your small business:

- Your accounting needs

- Your budget

- User-friendliness

- Key and add-on features

- Type of Software

- Integrations with other tools

- Price

- Ability to generate reports and analyze data

- Detailed tracking capabilities

- Electronic payments processing

These should help you pick the best option for your small business.

8. When is accounting software for a small business necessary?

Spreadsheets may be enough to run your business’s accounting operations at the beginning. As time goes on, however, you’ll need an accounting system. Here are the signs that it’s time:

- When your business starts growing rapidly

- If you start spending too much time on routine accounting tasks

- When you start noticing a lot of accounting errors

- If you can’t quickly access the financial information you want

- If you lack the proper accounting skills

- When you need to track key metrics more effectively

- If you need more detailed financial reports

All of these signals tell you that it’s time to get your practices automated to save time and reduce your room for error.

9. Do I have to use accounting software?

No. Using accounting software is not a prerequisite for the success of your small business.

However, the benefits of accounting software far outweigh the costs.

Furthermore, most accounting software offer cost-effective services that will save you a lot of time and money.

10. Why do we need accounting software?

Your small business needs accounting software for various reasons:

- Having accurate accounting transactions

- Saving time by automating tasks

- Storing financial data securely

- Generate customizable reports for financial predictions and budgeting

- Managing accounts receivable and accounts payable efficiently

- Simplifying tax compliance

- Providing real-time data on your company’s financial health

- Reducing human error in financial processes

- Facilitating electronic payments

- Improving inventory tracking

Cloud accounting solutions offer these benefits with the added advantage of accessibility from anywhere with an internet connection. This makes it easier for small business owners to stay on top of their finances, even when they’re away from the office.

Also Read:

Ready to Start Using Cloud Accounting Software?

If you’ve been keeping your accounting records manually and it’s getting tedious, it’s time to invest in a good accounting software solution.

Now that we’ve answered the question, “What is accounting software?” and you know what to look for in one, picking the right tool for your business should be much easier.

Accounting software can make your accounting and financial processes more efficient and streamlined. It will help you avoid errors and get things running smoothly, saving a lot of time, effort, and money in the long run.

Use this post as your guide and choose the best accounting software for your business based on your requirements. Good luck out there!