As a self-employed professional, keeping your books in order is a critical but often overwhelming task. With the rise in remote work and side hustles, more people find themselves managing their own financial health without the infrastructure of a company behind them.

And that’s why finding the best accounting software for self-employed needs is paramount.

That said, not all bookkeeping software applications are created equal; some may align with your needs and preferences better than others, especially when it comes to project management and the ability to track expenses.

Lucky for you, we’ve done the research and documented our findings. In this post, we discuss 19 of the best accounting software for self-employed individuals and microbusinesses in the US.

Here, we have reviewed and compared the top accounting software, breaking down their offerings and use cases into bite-size chunks. We also discuss the benefits of using accounting software and answer other pressing questions related to the topic.

But first, some quick background information.

Quick Summary: Best Accounting Software for Self-Employed Professionals By Type

- Best for Client Management: Fiverr Workspace, FreshBooks, Xero, AccountEdge Pro, CustomBooks

- Best for Functionality: Zoho Books, QuickBooks Solopreneur, OneUp, Xero, ZarMoney, Quicken

- Best for Tax Tracking: QuickBooks Solopreneur, FreeAgent, Patriot Software, Neat, Collective

- Best for Cost-Effectiveness: FreeAgent, Wave, Xero, Fiverr Workspace, OneUp, Moxie

- Best for integrations: Zoho Books, Kashoo, TrulySmall Accounting, Neat, Fiverr Workspace, ZipBooks, Quicken

How We Chose the Best Accounting Software for Self-Employed Professionals

We created this list of the best accounting software for self-employed individuals using the following criteria as our measuring yardstick

- Ease of Use: We prioritized the best accounting software for self-employed people that had a decent intuitive user interface and seamless navigation, ensuring that even those without extensive accounting expertise could find their way around effortlessly.

- Self-Employed Focus: We gave preference to platforms built specifically for the needs of solopreneurs, freelancers, contractors, and consultants vs. generic small business software.

- Automation: With no dedicated bookkeepers, automation of reconciliations, transaction categorization, reminders, reporting, and other workflows is important for self-employed users. As such, we scanned for the automation capabilities of the tools listed here.

- Cost-Effectiveness: For many running a freelance business, cost-effectiveness is a must. And that is why we considered the pricing plans and value propositions offered by each software.

- Integration Capabilities: As a business owner or solopreneur, the chances that you’re juggling multiple project management tools and platforms are high. As such, we looked for tools that seamlessly integrate with your business bank account and popular apps and services used by self-employed professionals.

- Accounting Features and Functionality: From invoicing and expense tracking to payroll preparation and financial reporting, we covered it all. We conducted a thorough examination of the features offered by each software to establish that they could help you track income and expenses and handle essential accounting tasks for the self-employed.

- Tax Handling: As a self-employed professional, you are most likely handling your own taxes. So, we looked for tools with seamless support for quarterly tax payments, contractor 1099s, the ability to upload receipts, and integrated features to help you file taxes at tax time.

19 Best Self-Employed Accounting Software for 2025

Here is a list of the best accounting software for self-employed professionals with features, pricing, and other details to help you make an informed choice in 2025.

1. QuickBooks Solopreneur

Image via QuickBooks Solopreneur

QuickBooks Solopreneur is an easy-to-use accounting solution designed specifically for freelancers and solopreneurs. This tool is part of the broader QuickBooks Online ecosystem and seamlessly integrates with its full suite of accounting products.

The platform helps sole proprietors track expenses, maximize tax deductions, manage invoices, capture and upload receipts, log mileage, run expense reports, and calculate estimated quarterly taxes owed.

Here’s a look at some of QuickBooks Solopreneur’s offerings, pricing, USPs, and setbacks.

Key Features

- Financial reports and balance sheets

- Mileage tracking for deductions

- Auto-transaction categorization

- Real-time reporting and insights

- Syncing of business bank accounts and credit accounts

- Easy invoicing and the ability to accept payments

- Automatic sales tax calculations and optimizations

- Perfectly optimized for growing businesses

- Captures business expenses from linked bank accounts or credit card accounts

Pros

- Offers support from CPAs

- It is very easy to use, even for beginners

- Fully integrated with the QuickBooks Online ecosystem

- Real-time reporting that provides insights into your cash flow

Cons

- Limited project and inventory management features

- QuickBooks Solopreneur is tuned for single-user access and is not suitable for growing teams

Pricing

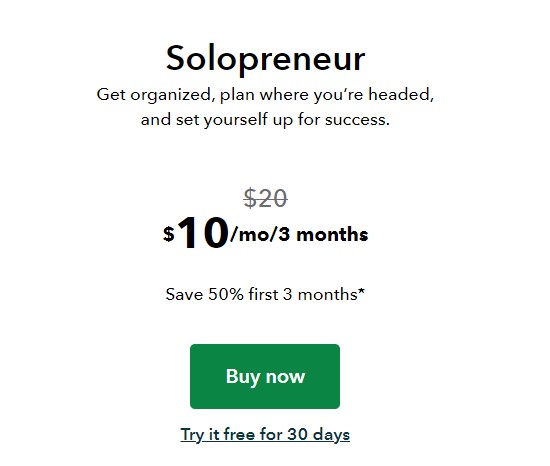

You should know that QuickBooks Solopreneur offers a 50% discount for the first 3 months and a 30-day free trial on its single plan.

- Solopreneur: Usually $20 per month, now $10 per month for 3 months

Image via QuickBooks Solopreneur

Tool Level

- Intermediate

Usability

- Easy to use; designed with the end-user in mind

2. Zoho Books

Image via Zoho Books

Zoho Books is one of the best accounting software for self-employed professionals, with a focus on automation and integration. Zoho Books is part of the Zoho suite of products, which offers a range of solutions for project management, productivity, and collaboration.

And you know what that means?

Zoho Books gets access to all Zoho apps, features, and integrations, giving solopreneurs a wider range of features and project management functionalities.

This full-featured online bookkeeping software goes beyond basic small business bookkeeping. It provides a comprehensive set of accounting and compliance features for solopreneurs looking to improve their financial health and manage cash flow.

Take a look at how Zoho Books can serve you.

Key Features

- Financial reporting

- Payroll integrations

- Workflow automation

- Multi-currency support

- Expense and time tracking

- Basic analytics and reports

- Order and inventory management

- Professional invoicing and recurring invoices

- Automated workflows for approvals and collaboration

- Financial statements, ledgers, and payment reconciliations

Pros

- Offers multilingual and multi-currency support

- Zoho Books has a user-friendly and intuitive interface

- Smooth integration with other features and services

- Its forever-free plan is perfect for businesses with less than $50,000 in revenue per year

Cons

- Zoho Books is less suitable for simple personal finances

- It has a steep learning curve compared to other beginner accounting tools

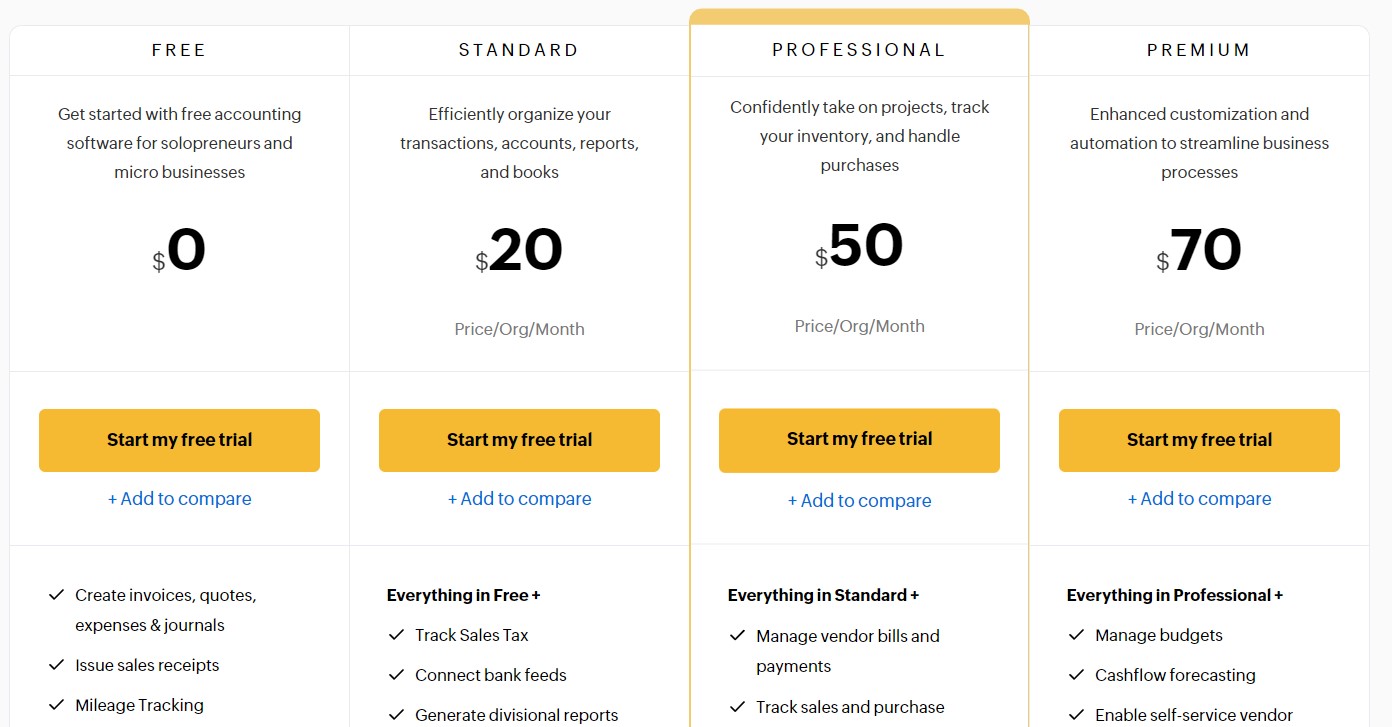

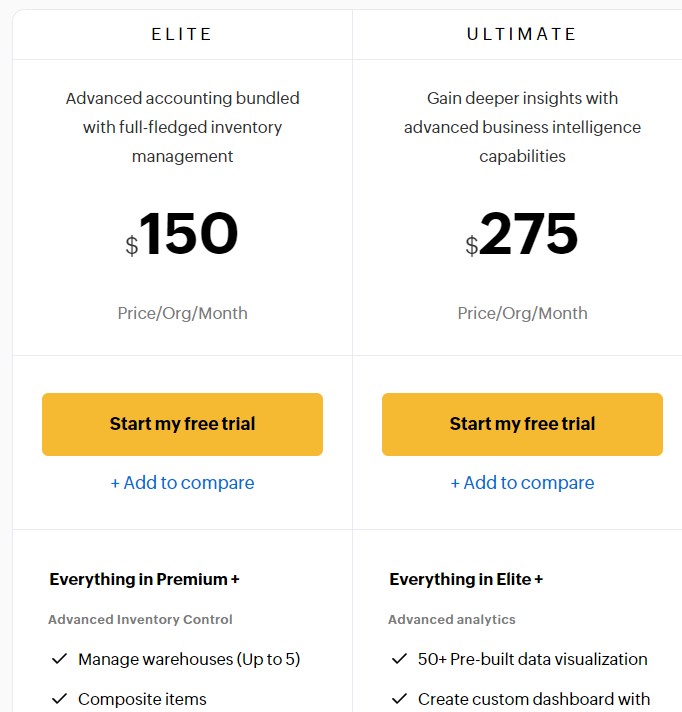

Pricing

Zoho Books offers five paid plans:

- Free Plan: $0

- Standard Plan: $20 per month

- Professional Plan: $50 per month

- Premium Plan: $70 per month

- Elite Plan: $150 per month

- Ultimate Plan: $275 per month

Image via Zoho Books

Image via Zoho Books

Tool Level

- Intermediate

Usability

- Steep learning curve for beginners

3. FreshBooks

Image via FreshBooks

FreshBooks is another excellent choice for accounting software for self-employed professionals in 2025. Founded in 2003 in Toronto, Canada, FreshBooks is an early pioneer of cloud accounting software.

One of its primary aims is to provide an easy-to-use solution for independent professionals to track time and expenses, manage cash flow, and gain financial insights.

And FreshBooks backs its status as a veteran in the field with a slew of features and offerings.

Key Features

- Time tracking

- Payment reminders

- Inventory management

- Mobile mileage tracking

- Financial reporting and insights

- Project management and client management

- Expense tracking and management

- Customizable invoicing and ACH payments

Pros

- It offers automated workflows to save time on invoicing and follow-ups

- FreshBooks has an intuitive design for beginners and non-accountants

- This self-employed accounting software has excellent customer support and resources

- FreshBooks also has mobile apps that are available for iOS and Android users

Cons

- There is no free plan, only a free trial.

- FreshBooks is not suitable for the complex needs of larger businesses.

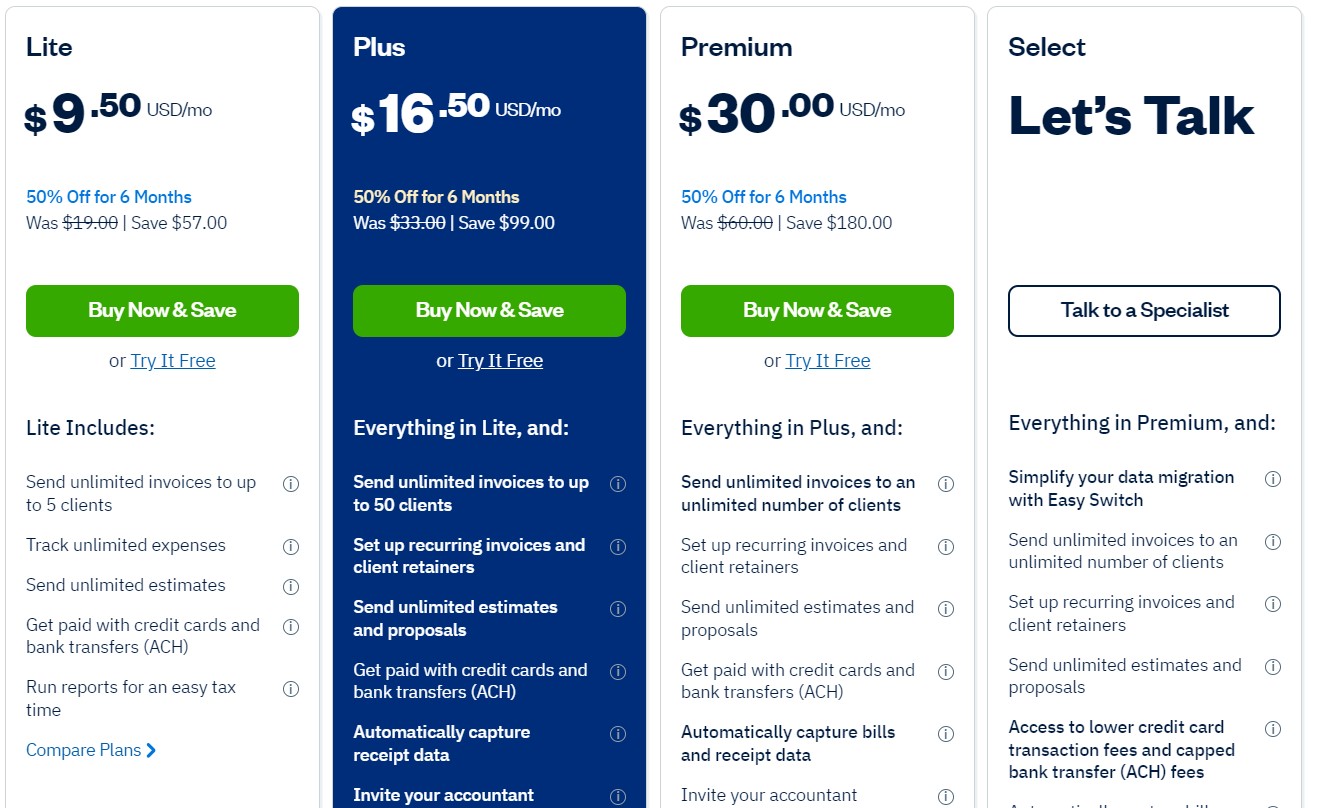

Pricing

FreshBooks offers a 50% discount on all plans for the first six months.

- Lite: Typically $19 per month but currently $9.50 per month

- Plus: Typically $33 per month but currently $16.50 per month

- Premium: Typically $60 per month $30.00 per month

- Select: Custom pricing

Image via FreshBooks

Tool Level

- Beginner

Usability

- It is very easy to use across all plans

You May Also Like:

4. Xero

Image via Xero

Xero is one of the best accounting software programs for self-employed professionals and provides online accounting software for small businesses worldwide.

This New Zealand-based cloud-based accounting software connects with your business bank account and financial institutions to automatically import and categorize transactions.

Xero also seamlessly integrates with popular ecommerce platforms such as Shopify and WooCommerce to streamline order and inventory management.

What’s more?

One of Xero’s USPs is its ability to connect freelancers and sole proprietors like yourself with a nearby certified CPA or accounting firm at the click of a button.

Let’s look under the hood to see what you get with Xero.

Key Features

- Payroll integration

- Inventory monitoring

- Automated bank reconciliation

- Automatic sales tax calculation

- Seamless invoicing and quotes

- Expenses and receipts tracking

- Real-time reporting and analytics

- Convenient multi-currency handling

- Data imports from over 21,000 financial institutions

Pros

- It scales from freelancers to larger businesses.

- Xero has a strong set of core accounting features.

- Xero allows for seamless integration with third-party platforms.

- You can easily locate CPAs and accounting firms in your area (for US residents) for a more personal consultation.

Cons

- Xero has limited features beyond accounting.

- Xero has a steep learning curve for beginners and new users.

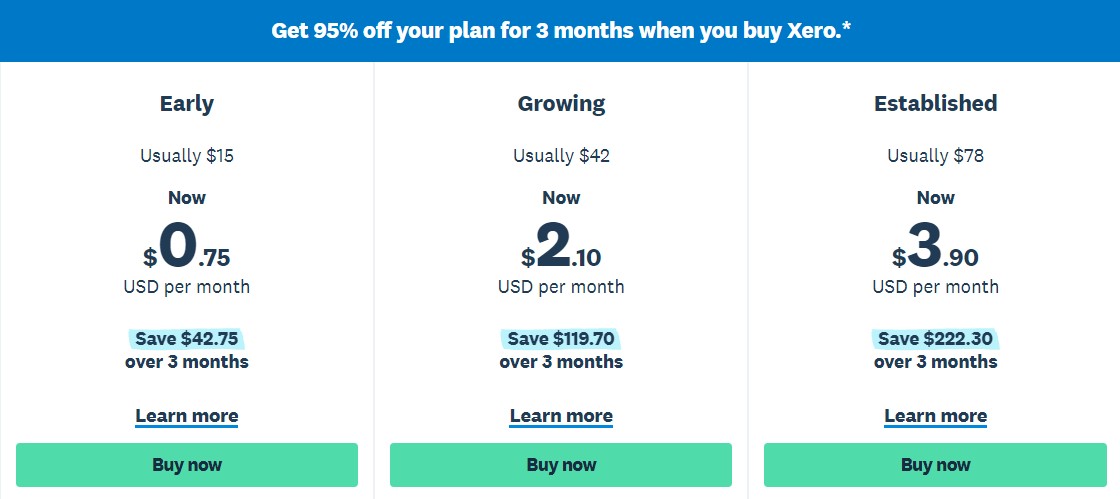

Pricing

Xero offers a three-month, 95% discount window. This could come in handy for solopreneurs on a tight starting budget.

- Early: Usually $15 per month (currently $0.75)

- Growing: Usually $42 per month (currently $2.10)

- Established: Usually $78 per month (currently $3.90)

Image via Xero

Tool Level

- Intermediate

Usability

- Easy to use; clean interface and straightforward navigation

5. FreeAgent

Image via FreeAgent

Of course, FreeAgent makes the list of the best accounting software for self-employed individuals. This tool focuses on delivering the core accounting essentials that self-employed freelancers and independent contractors need without complexity. These include estimates, invoicing, time tracking, expense management, and financial insights.

As one of the best freelance accounting software platforms for self-employed professionals, FreeAgent provides an easy-to-use solution optimized for managing the finances of client work. The client dashboards allow for smooth collaboration workflows between self-employed professionals and their customers.

But it doesn’t end there.

FreeAgent’s direct integration with tax systems in various regions, including the UK’s HMRC, makes it exceptionally useful for managing your sales tax efficiently at tax time.

FreeAgent also stands out for its user-centric design, prioritizing ease of use and accessibility. This attribute allows even those with little to no accounting experience to effortlessly navigate their finances.

Key Features

- Time tracking

- Expense management

- Insightful financial reporting

- Interactive client dashboard

- Seamless and customizable invoicing

- Multiple payment channel integrations

- A specialized accounting tool for landlords

- Available in mobile apps, including for iOS and Android

- Tax calculation, filing, and compliance (for UK-based self-employed professionals)

Pros

- It provides client dashboards for smoother invoice workflows.

- FreeAgent offers comprehensive tax support for UK-based freelancers.

- It is very quick and easy to get started for most self-employed professionals.

Cons

- FreeAgent is limited to UK taxes only (no US tax support).

- FreeAgent is not very suitable for the complex needs of larger businesses.

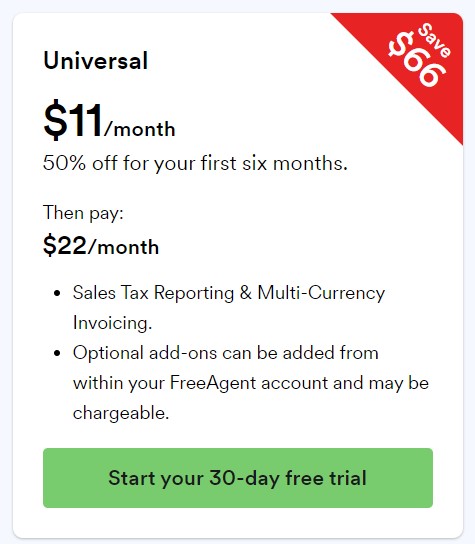

Pricing

The “free” in FreeAgent is there for a good reason, as this tool goes all out when it comes to pricing for solopreneurs.

FreeAgent offers a single-paid plan with a 50% discount for the first six months.

- Universal: $22 per month ($11 per month for the first six months)

Image via FreeAgent

Tool Level

- Beginner

Usability

- Easy to use for beginners

You May Also Like:

6. Wave

Image via Wave

Undeniably one of the best accounting software for self-employed individuals and solopreneurs, Wave provides a massive basket of features, including invoicing and payroll management, at a low cost.

Wave takes cost-effectiveness to a whole new level by offering one of the most feature-rich free plans for small business owners and sole proprietors.

Wave’s commitment to cost-effective financial management and bookkeeping democratizes access to high-quality accounting resources. And this makes it one of the top choices for those just starting out or operating on a tight budget.

Take a look at how Wave matches up against the competition.

Key Features

- Receipt scanning

- Multi-user access

- Multi-currency support

- Integration with business bank accounts

- Generate accounting reports

- Payment and expense tracking

- Seamless invoicing capabilities

- Hands-on support and advisory

- Payroll and credit card processing

Pros

- Wave has an incredible docket for free users on a budget

- It also offers direct credit card and bank account connections for automated transaction import

- Wave provides a user-friendly interface that is accessible to non-accountants and beginners

Cons

- Wave has limited customization options for invoicing and reporting

- It also has limited features compared to heavyweights such as QuickBooks Online

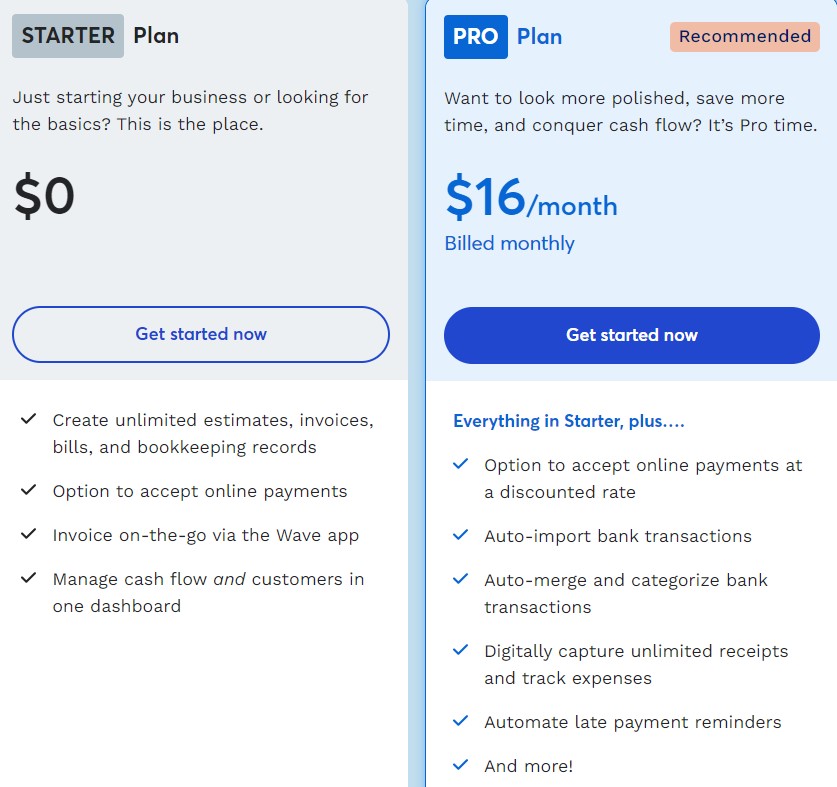

Pricing

Wave has one of the best offerings for its free package users and only offers one paid plan.

- Starter: $0 (completely free)

- Pro: $16 per month

Image via Wave

Tool Level

- Beginner

Usability

- Very easy to use with beginners in mind

7. Fiverr Workspace

Image via Fiverr Workspace

Without a doubt, Fiverr is one of the best self-employed professionals and freelancers to get accounting and bookkeeping solutions.

For self-employed professionals who want an all-in-one solution for financial management and running their solo business, Fiverr Workspace has the answers. Fiverr Workspace offers a robust platform combining invoicing, time tracking, client collaboration, and other features that help enhance financial health.

Fiverr Workspace integrates all these features into its online freelancing marketplace to make it even better.

This creates an avenue for independent contractors across various specializations and niches to connect with more clients and showcase their services. It also seamlessly manages workflows, invoices, ACH payments, and accounting in one place.

As one of the best accounting software for self-employed users, Fiverr Workspace simplifies managing the business and finances of freelancing.

The gist of it is that Fiverr Workspace is a one-stop shop for everything freelancing and is a great tool for growing businesses.

Take a look at what Fiverr Workspace is offering.

Key Features

- Gig listings and services

- Expense and time tracking

- Client communication tools

- Exceptional task management

- Invoicing and payment integration

- Profile and reputation management

- Tailor-made for freelancers and solopreneurs

- A forever-free plan with industry-standard features

- Real-time visibility of financial metrics and performance

Pros

- No complicated setup or double-entry accounting is needed

- Payment collection and processing are handled in-house

- Fiverr Workspace allows you to directly find and acquire clients online

- It offers a fully integrated freelancing platform and financial workspace

Cons

- This tool is more suited for selling services than product inventory

- Fiverr Workspace has some limitations in terms of custom branding and financial reporting

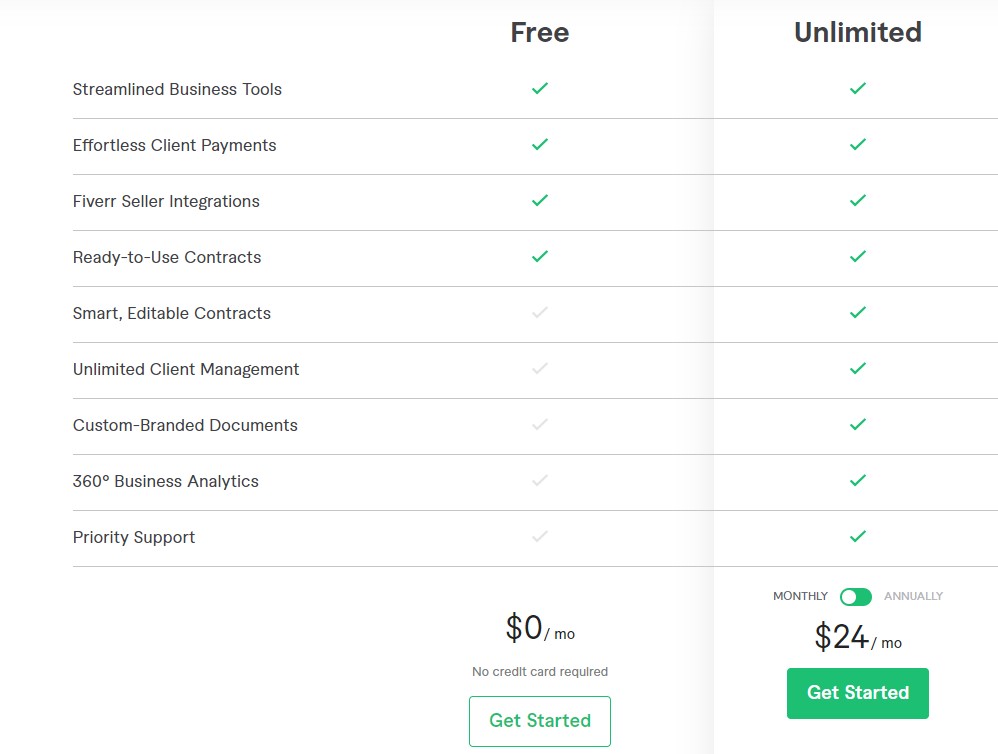

Pricing

Like Wave, Fiverr Workspace allows freelancers a lot of room with its free plan and offers only one paid plan.

- Free: $0 (completely free)

- Unlimited: $24 per month

Image via Fiverr Workspace

Tool Level

- Intermediate

Usability

- Easy to use for beginners

You May Also Like:

8. Kashoo

Image via Kashoo

Kashoo is one of the best accounting software for self-employed users looking for financial features that grow with their businesses.

Kashoo positions itself as an accounting solution that grows with your business. It starts with straightforward tools for basic bookkeeping, invoicing, payment management, and reporting. However, it can scale up to handle multi-location inventory tracking, enhanced analytics, and revenue recognition needs.

What’s more?

It aims to deliver robust accounting capabilities for small and medium businesses (SMBs) in an intuitive interface that business owners can easily use themselves. It couples this with fair pricing that smooths the transition as solo businesses grow without overwhelming non-accountant owners.

To sum up, Kashoo suits the end-to-end accounting needs of SMBs from starting out to maturing with seamless transitions and training resources.

Key Features

- Real-time reporting

- Multi-currency support

- Reliable customer support

- Inventory and time tracking

- Expense and receipt tracking

- Bank sync and reconciliations

- Custom invoices and payments

- Multiple custom report templates to choose from

Pros

- Kashoo has robust inventory management capabilities

- Kashoo has seamless integration with over 5,000 banks

- Kashoo’s interface is easy to learn and adapt for business owners

- Kashoo provides a comprehensive accounting solution for SMEs across all tiers

Cons

- Kashoo has a rigid pricing plan

- It also has a steeper-than-normal learning curve

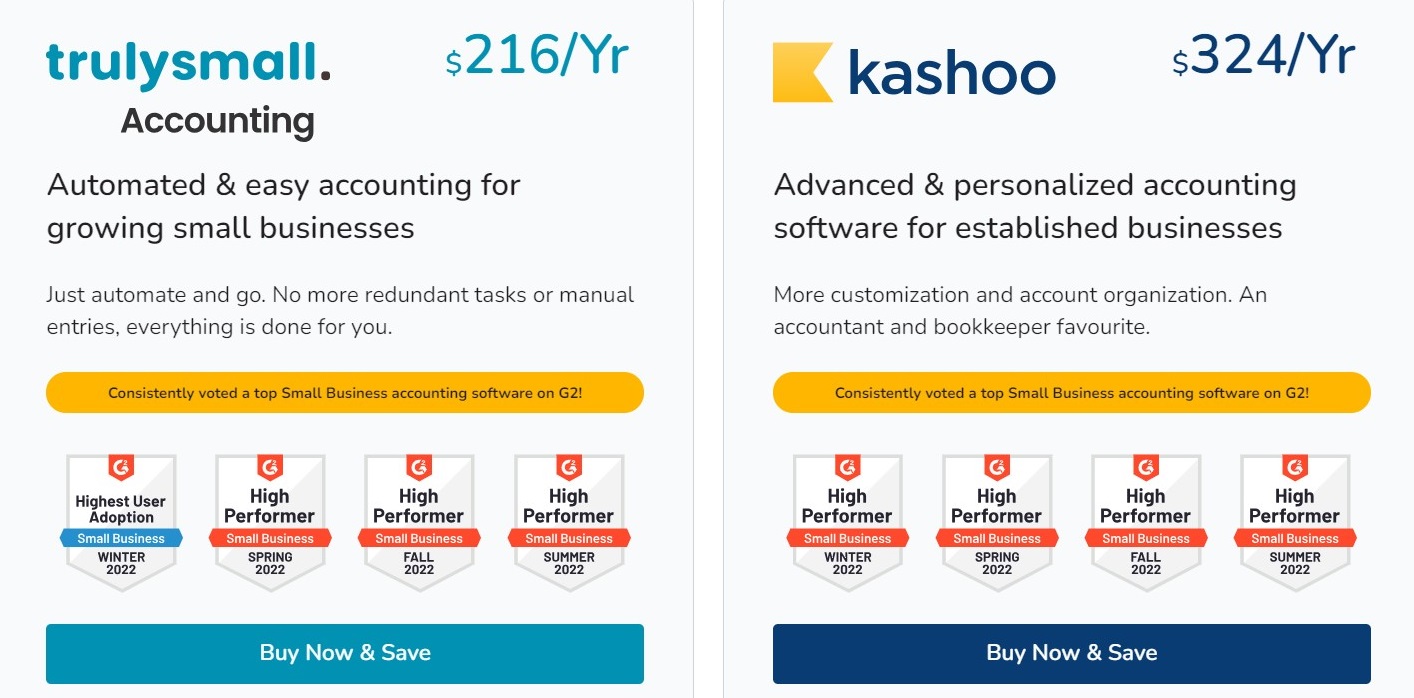

Pricing

Kashoo offers just one pricing plan, and it is an annual plan. Kashoo also displays pricing for a sister accounting tool for small business owners: TrulySmall Accounting.

- Kashoo: $324 per year

- TrulySmall: $216 per year

Image via Kashoo

Tool Level

- Intermediate

Usability

- Slightly steep learning curve

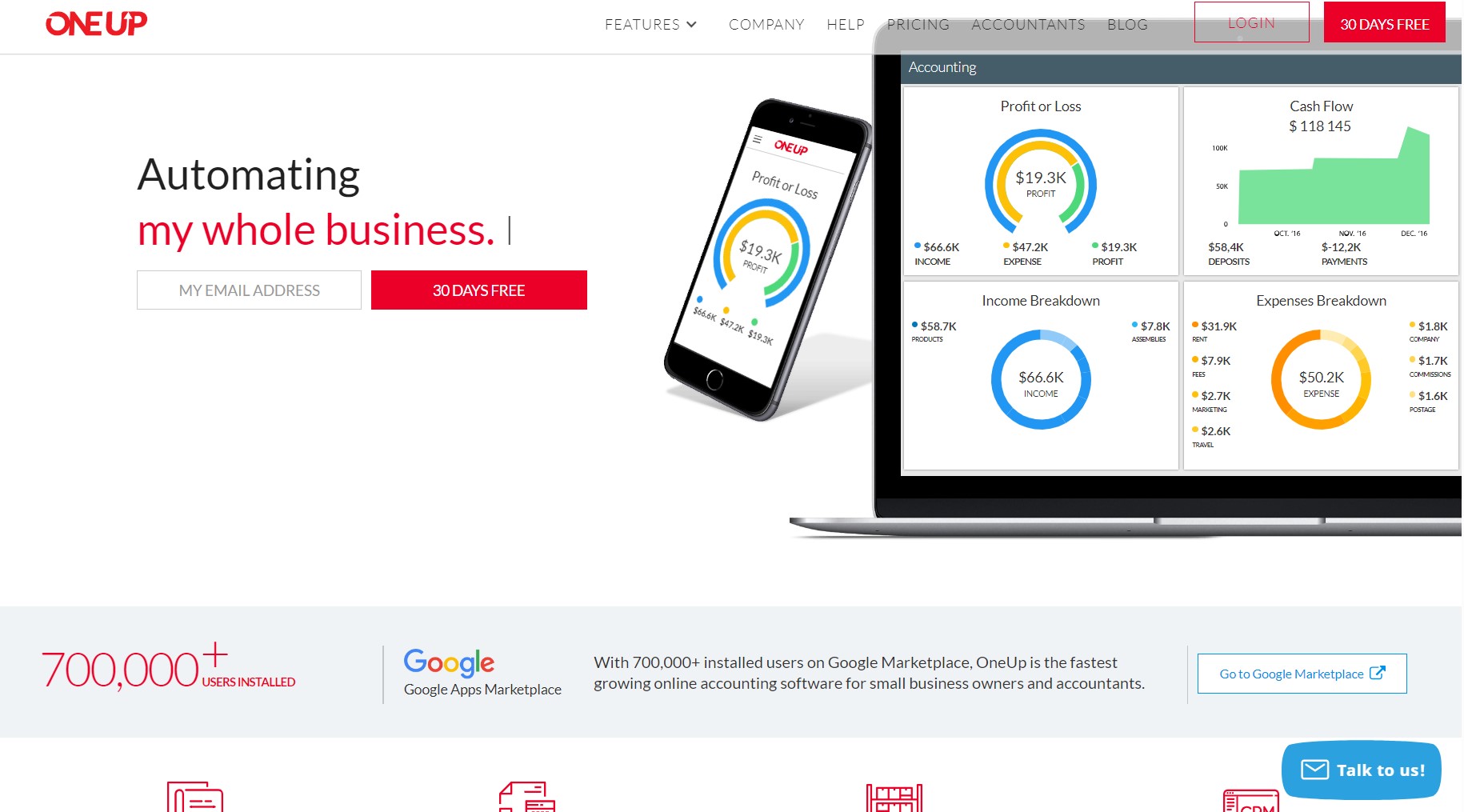

9. OneUp

Image via OneUp

OneUp provides self-employed entrepreneurs and solopreneurs with an integrated accounting platform tailored to ecommerce businesses selling online.

Beyond just managing finances, OneUp offers freelancers and independent store owners tools to handle taxes, legal paperwork, shipping, CRM, analytics, and inventory under one umbrella.

What’s more?

OneUp aims to provide online merchants, consultants, and digital freelancers with a unified platform to streamline their freelance business operations with automation. This way, they get a unified view of the business and make data-driven decisions.

Take a look at the pros, cons, and pricing of OneUp and decide if it’s what you need.

Key Features

- 700,000+ installed users

- Integrated CRM functionality

- Real-time sync with sales channels

- Invoicing and cash flow management

- Inventory tracking across multiple warehouses

- Onboard employees and manage payroll in one place

- KPI dashboards for business metrics and performance

- Manage corporate records and contracts in a secure online vault

- Sales tax calculations, filings, and compliance for US businesses

Pros

- OneUp is known for secure online document storage and sharing

- OneUp offers a unified platform for complete business management

- It also handles everything from core accounting to advanced business analytics needs

Cons

- OneUp is largely focused on US-based businesses

- OneUp is less suited for simple personal finance needs

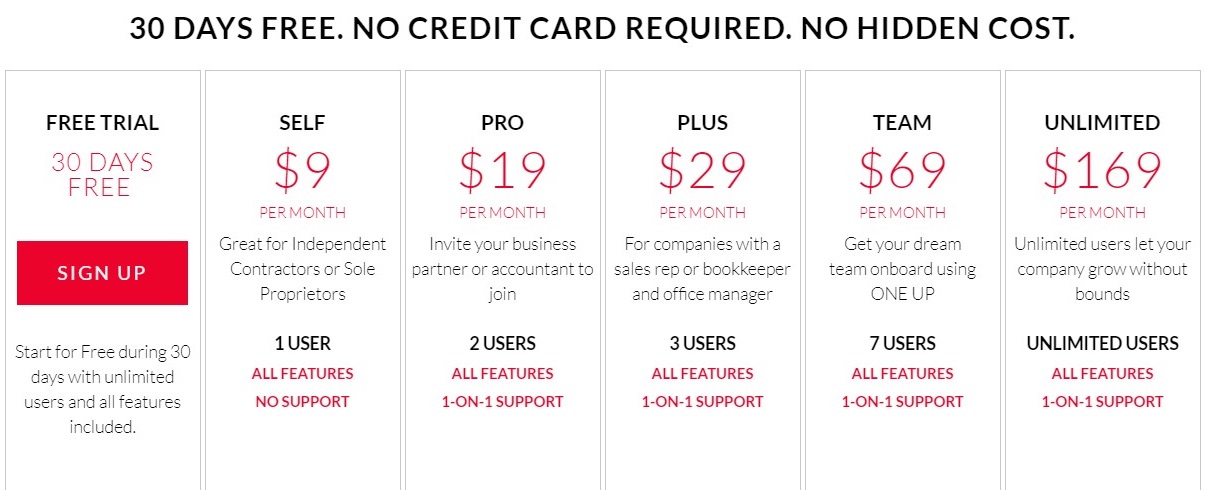

Pricing

OneUp offers a complete 30-day free trial window that comes with unlimited user slots and features for new entrants. After this honeymoon period, the payment plans include:

- Self: $9 per month

- Pro: $19 per month

- Plus: $29 per month

- Team: $69 per month

- Unlimited: $169 per month

Image via OneUp

Tool Level

- Intermediate

Usability

- Steep learning curve for beginners

You May Also Like:

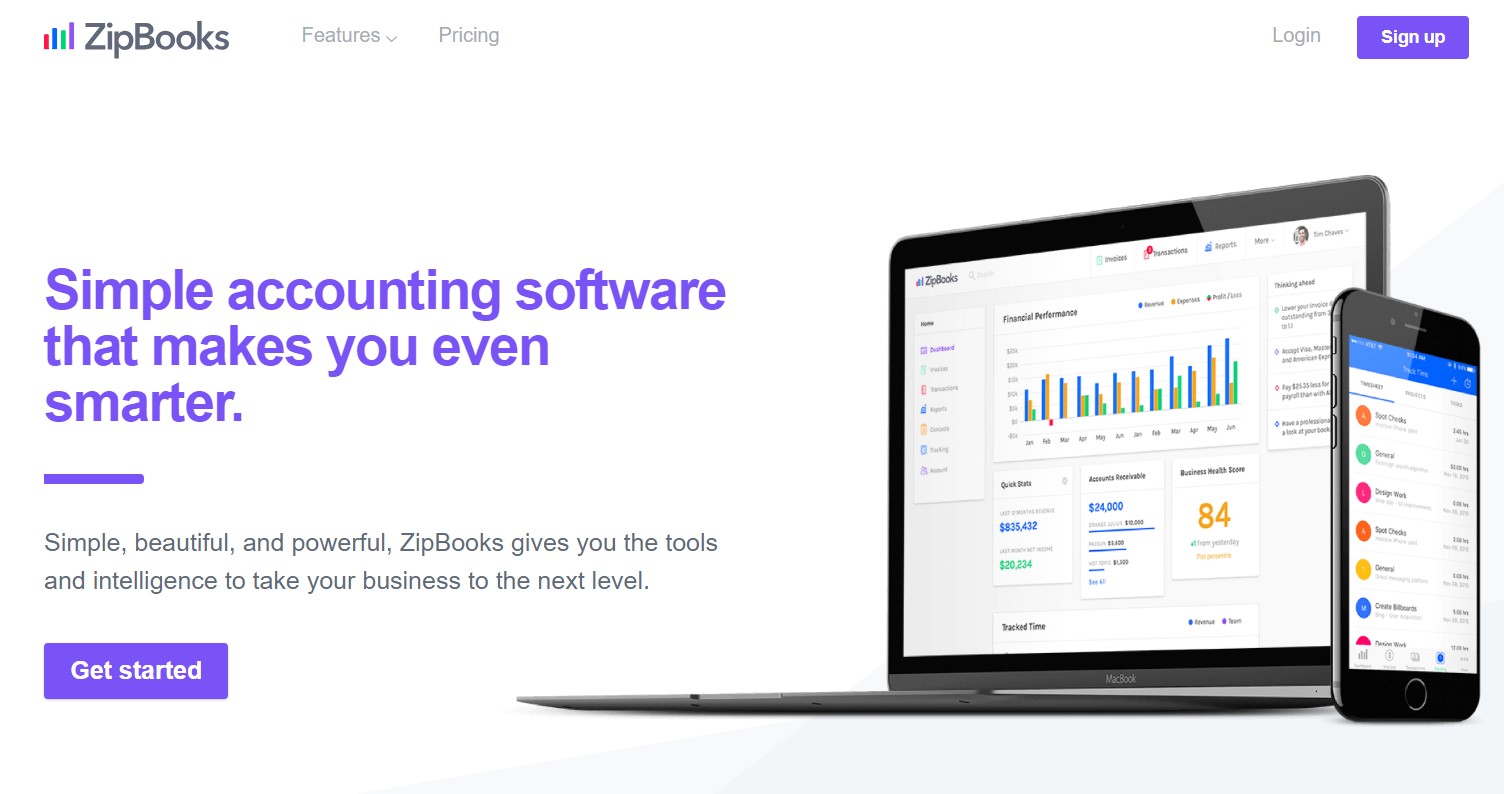

10. ZipBooks

Image via ZipBooks

ZipBooks is regarded as one of the most user-friendly accounting platforms for self- employed solopreneurs and freelancers. It provides an intuitive invoicing, payments, expense tracking, reporting, and contact management solution without overwhelming non-accountants with complex general ledger functions.

With a user-friendly interface and a flexible pricing model that includes a free starter option, ZipBooks makes professional accounting tools accessible to a wider range of self-employed individuals.

As one of the best accounting software for self-employed individuals in terms of simplicity, ZipBooks aims to help streamline the core financial operations of solopreneurs.

Key Features

- Smart invoicing

- Available in mobile apps

- Expense and time tracking

- Intelligent financial reporting

- Contact and client management

- Multi-user access for collaboration

- Income and profit tracking and reports

- Integration and sync are available for ecommerce and payment platforms such as PayPal, Stripe, and Gusto

Pros

- ZipBooks has multi-user collaboration support.

- ZipBooks is particularly designed to be beginner-friendly.

- ZipBooks has over 800 integrations with other business tools.

Cons

- It is not suitable for advanced accounting needs.

- ZipBooks has relatively limited features compared to bigger players such as Zoho Books or Zoho Books alternatives for small businesses.

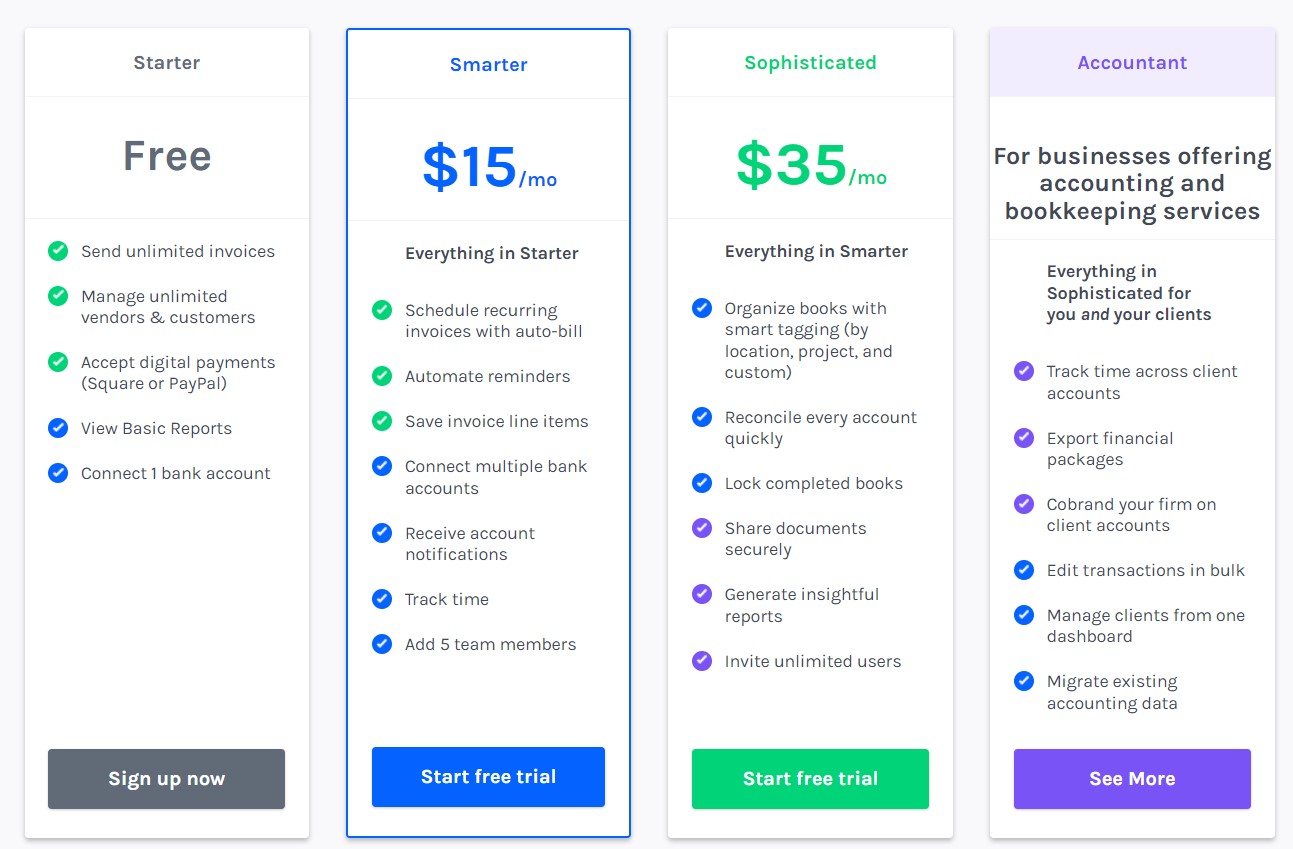

Pricing

- Starter: Free

- Smarter: $15

- Sophisticated: $35

- Accountant: Custom Pricing

Image via ZipBooks

Tool Level

- Beginner

Usability

- Easy to use

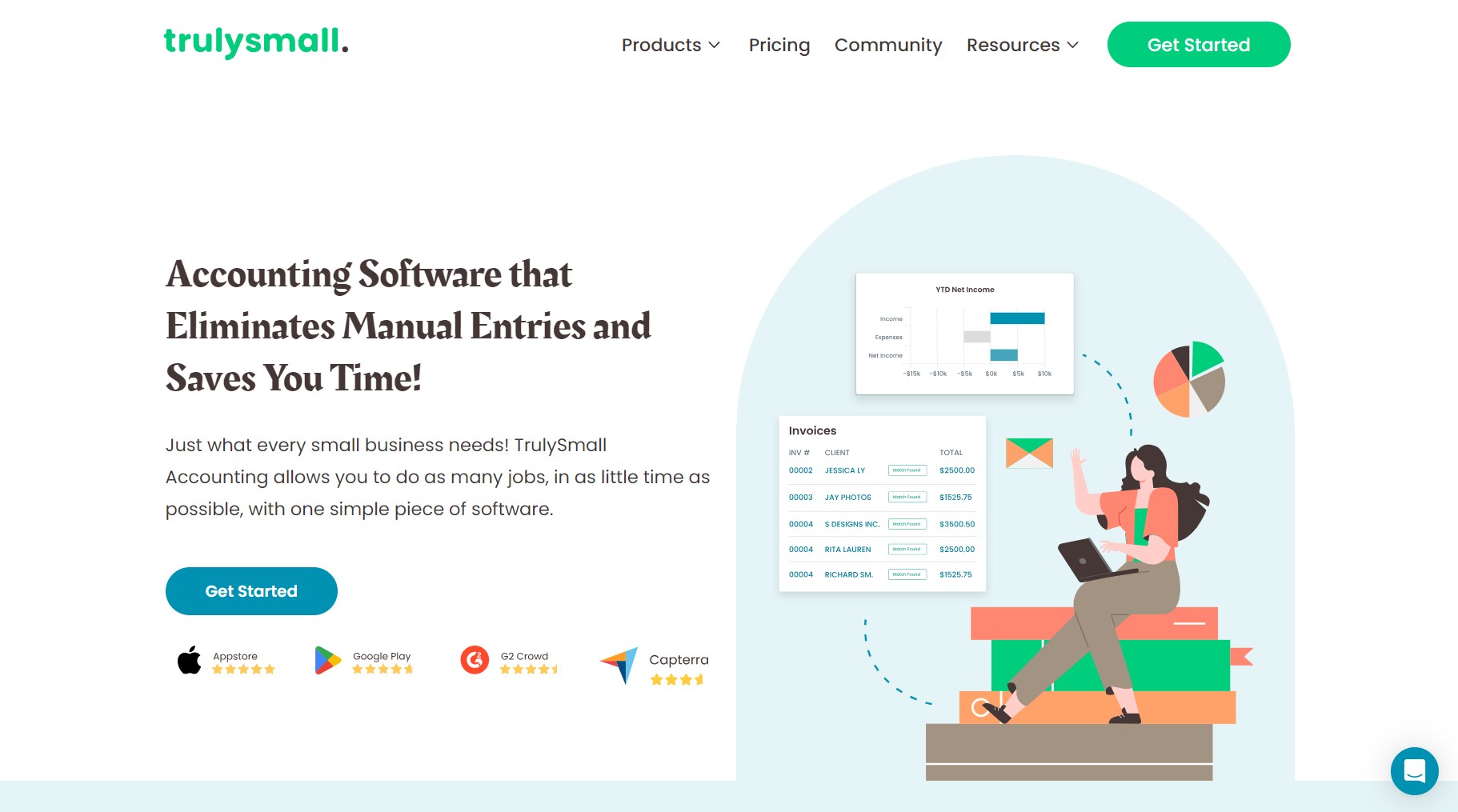

11. TrulySmall Accounting

Image via TrulySmall Accounting

TrulySmall Accounting is designed to cater specifically to the needs of freelancers, microbusinesses, and self-employed individuals who require simple and efficient accounting solutions.

TrulySmall Accounting offers a simplified suite focused on seamless invoice creation for clients, estimates management, payments tracking, expense reporting, and financial insights.

This focus on simplicity and user-friendliness positions TrulySmall as a top player among the best accounting software for self-employed individuals. It also appeals to those who value ease and efficiency over comprehensive, complex features.

TrulySmall Accounting embodies the principle that effective financial management should be accessible to all, regardless of business size or accounting expertise.

Interestingly, TrulySmall Accounting is a product of the folks at Kashoo.

So, take a look at what you get with TrulySmall Accounting.

Key Features

- Time tracking

- Multi-user allowance

- Financial reporting and insights

- Centralized client management

- Payments, expenses, and tax tracking

- Comprehensive invoicing and estimation tools

Pros

- It offers easy tax expense tracking and financial reporting.

- This tool is streamlined for freelancers; no complex accounting is needed.

- TrulySmall Accounting provides specialized tools for creating professional invoices and estimates.

Cons

- It has no integrated payment processing (except Stripe support for professional invoices).

- It has limited features compared to advanced platforms like Xero or top Xero alternatives for small businesses.

Pricing

TrulySmall Accounting has three pricing plans with limited features. They include:

- TrulySmall Invoices: $8.99 per month

- TrulySmall Expenses: $8.99 per month (14-day free trial)

- TrulySmall Accounting: $20 per month (14-day free trial)

Image via TrulySmall Accounting

Tool Level

- Beginner

Usability

- Easy to use

You May Also Like:

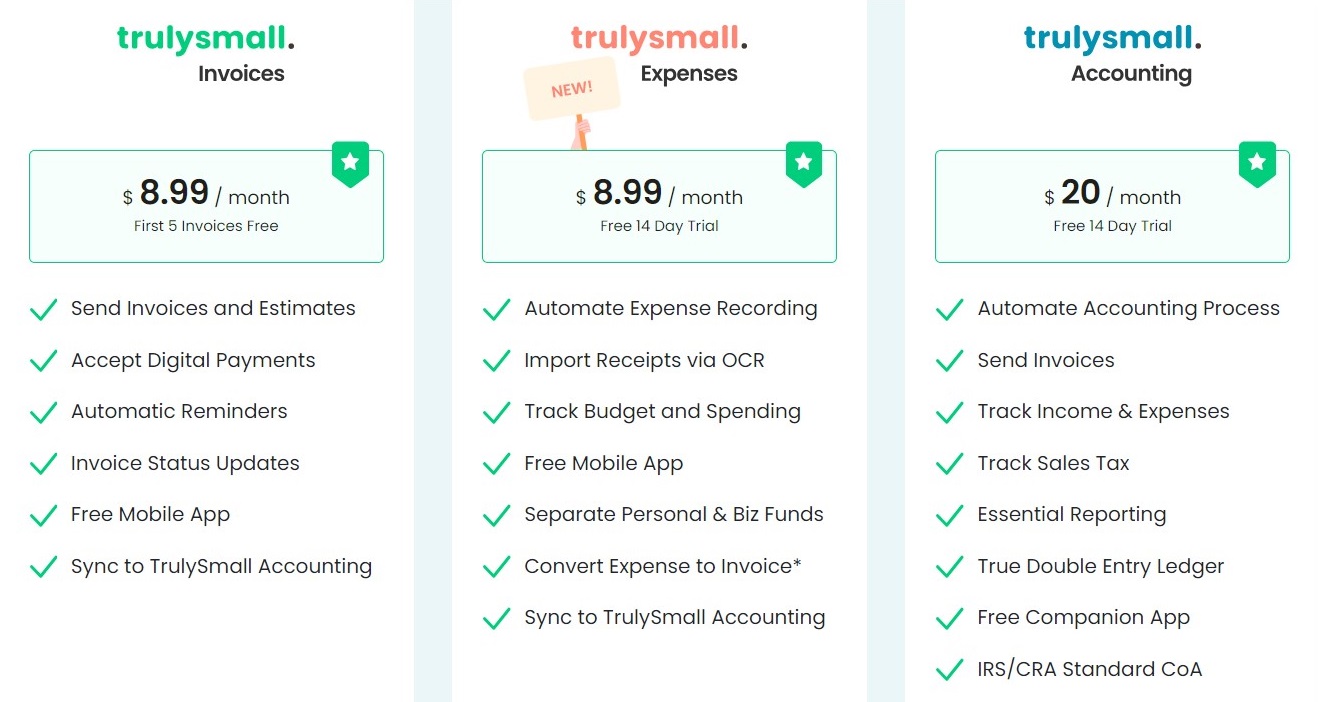

12. Patriot Software

Image via Patriot Software

Patriot Software offers a range of accounting, payroll, and tax solutions tailored for the needs of small businesses and their accountants. However, the accounting and payroll solutions come in separate packages, so you might have to purchase them individually if you want the full-range service.

By delivering robust features and guidance without the complexity of enterprise platforms, Patriot Software allows independent contractors and freelancers to manage their finances in a DIY fashion.

Patriot Software aims to deliver comprehensive yet accessible accounting and tax tools for small businesses and the accountants that support them. It caters to users without an accounting background while still providing robust financial features.

Interested? Take a look at what you get with Patriot Software.

Key Features

- Inventory management

- Simple accounting solutions

- Automotive bank feed importing

- Payroll processing (different package)

- iOS and Android-compatible mobile apps

- Tax forms and filing (1096, 1099, and W-2)

- Check printing for vendor payments right from the software

- Auditing assistance to simplify and reduce stress for DIY audits and IRS interactions

Pros

- Patriot Software has a 30-day free trial window

- This tool has dedicated customer support channels

- Patriot Software grows with SMBs by scaling from basic to advanced tools

- Patriot Software is designed for small business owners without accounting expertise

Cons

- Patriot Software has no free plan

- It has basic customization compared to enterprise platforms

Pricing

As mentioned, Patriot Software has different packages for its accounting and payroll solutions. The accounting packages include:

- Accounting Software:

- Accounting Basic: $20 per month

- Accounting Premium: $30 per month

- Payroll Software:

- Basic Payroll: $17 per month + $4 per employee

- Full Service Payroll: $37 per month + $4 per employee

Image via Patriot Software

Tool Level

- Beginner

Usability

- Easy to use

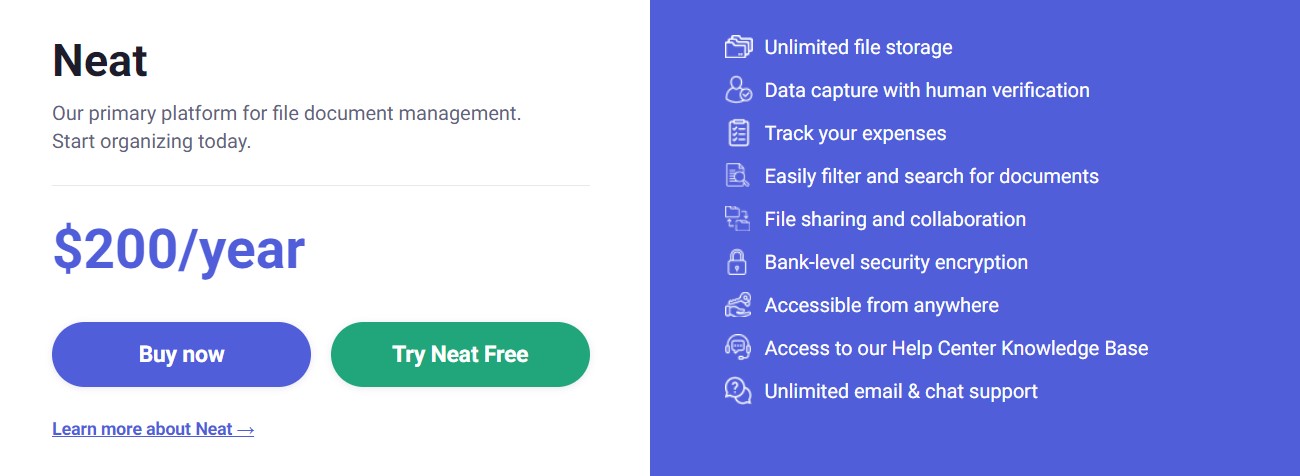

13. Neat

Image via Neat

Optimized for independent users, Neat offers one of the most innovative automated accounting software for self-employed solopreneurs. As its name suggests, Neat is primarily interested in helping you declutter your financial workspace and enhance spotless bookkeeping.

What’s more?

As a specialist in receipt tracking and expense management, Neat helps transform physical documents into digital data through its sophisticated scanning technology. This feature can dramatically simplify bookkeeping and tax preparation for non-accounting-savvy professionals.

Apart from that, Neat allows for seamless integration with a deluge of business tools, making it one of the best accounting software for self-employed individuals.

Let’s take a look at some critical information on Neat.

Key Features

- Tax filing and tracking

- Active customer support

- Instant expense reporting

- Automated insights and reporting

- Robust integrations with business tools

- Automated data capture and categorization

- Creation and tracking of professional invoices

- Invoice, income statement, and balance sheet templates

- Bi-directional data sharing and matching with 10,000+ financial institutions

Pros

- Neat offers a 14-day free trial window

- Neat’s focus on automation makes accounting easy for anyone

- It offers sync for bank accounts and integration for up-to-date financial data

Cons

- Neat has limited customization options

- Neat is too ‘neat’ for complex multi-user business accounting

Pricing

Like Kashoo, Neat offers only one pricing plan, and it is a yearly plan. This plan comes with a 14-day free trial period to allow you to test-run the service and decide if it’s what you want.

Neat’s single-plan pricing is:

- Neat: $200 per year

Image via Neat

Tool Level

- Beginner

Usability

- Automation makes things a lot easier

You May Also Like:

14. ZarMoney

Image via ZarMoney

In ZarMoney, we found one of the best accounting software for self-employed professionals tailored for invoicing, expense tracking, impressive financial insights, and much more. It consolidates core financial workflows for clients into an integrated platform for solopreneurs.

This tool allows you to sync feeds from over 9,500 US and Canadian banks and collaborate with employees and contractors, all from an easy-to-use interface for non-accountants.

Best of all?

We found that ZarMoney is one of those tools carefully designed for freelancing and small business operations but imbued with enterprise-grade functionality and features.

Let’s take a look at some of these features and how they match up.

Key Features

- Robust integrations

- US-based customer service

- Financial statements and reporting

- Expense tracking with receipt capture

- Bank data syncing with 9,500+ banks

- Customizable estimates and invoices

- Contractor time tracking and invoicing

- Simple collaboration and data sharing

- Automated notifications and reminders

- 15-day free trial window on paid services

Pros

- ZarMoney is easy to use for non-accountants.

- ZarMoney scales its capabilities as your business grows.

- This tool is designed specifically for self-employed and solo professionals.

- ZarMoney has many useful integrations with business and payment tools, such as Stripe, Mailchimp, and Shopify.

Cons

- There is no free plan.

- There is no payroll support.

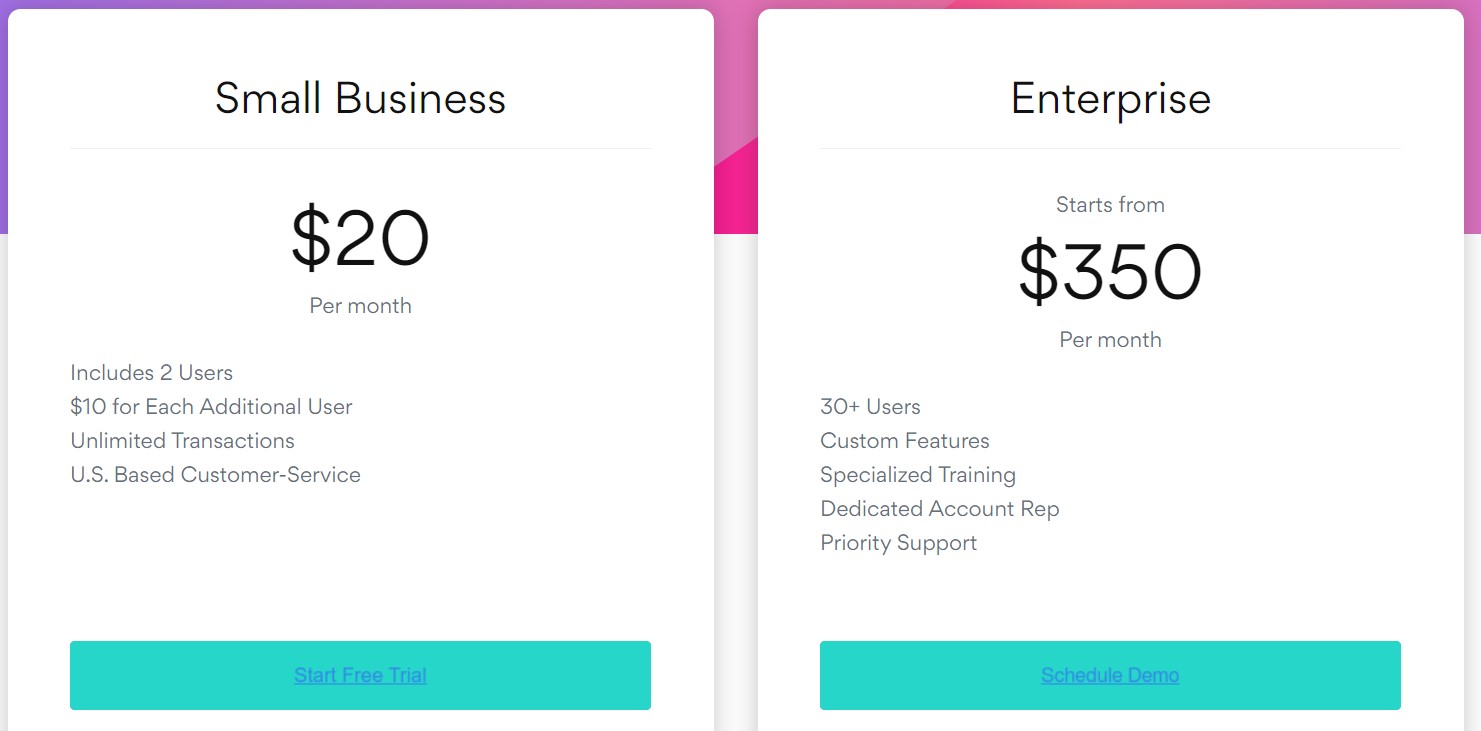

Pricing

ZarMoney has no free plan but comes with a 15-day trial period.

- Small Business: $20 per month

- Enterprise: $350 per month (custom pricing)

Image via ZarMoney

Tool Level

- Intermediate

Usability

- Easy to use

15. AccountEdge Pro

Image via AccountEdge Pro

AccountEdge Pro is a desktop-based accounting solution that savvy self-employed professionals like yourself would find very useful. With advanced accounting capabilities built for scalability, AccountEdge Pro is regarded as one of the best accounting software for professional solopreneurs and business owners.

AccountEdge Pro delivers powerful financial controls that are well-suited for self-employed users ready to scale beyond their basic bookkeeping needs. It seamlessly combines advanced accounting tools with inventory, order, and customer management in a complete solution.

Because it features enterprise-grade functionality, AccountEdge Pro is perfect for advanced self-employed professionals running mostly high-transaction product-based businesses.

These are some of the features you will gain access to by using this tool.

Key Features

- Scalable multi-user access

- A/R, A/P, and project costing

- Automated billing and invoicing

- Budgeting and cash flow controls

- Inventory and order management

- Hundreds of customizable reports

- Seamless ecommerce integrations

- Complete general ledger accounting

- Rules-based automation for workflows

Pros

- This tool handles multi-location operations well

- AccountEdge Pro seamlessly links with ecommerce

- It effectively manages staff permissions and access

- AccountEdge Pro has advanced accounting and inventory management

Cons

- AccountEdge Pro is only available on desktops

- This tool is designed for the accounting-savvy

Pricing

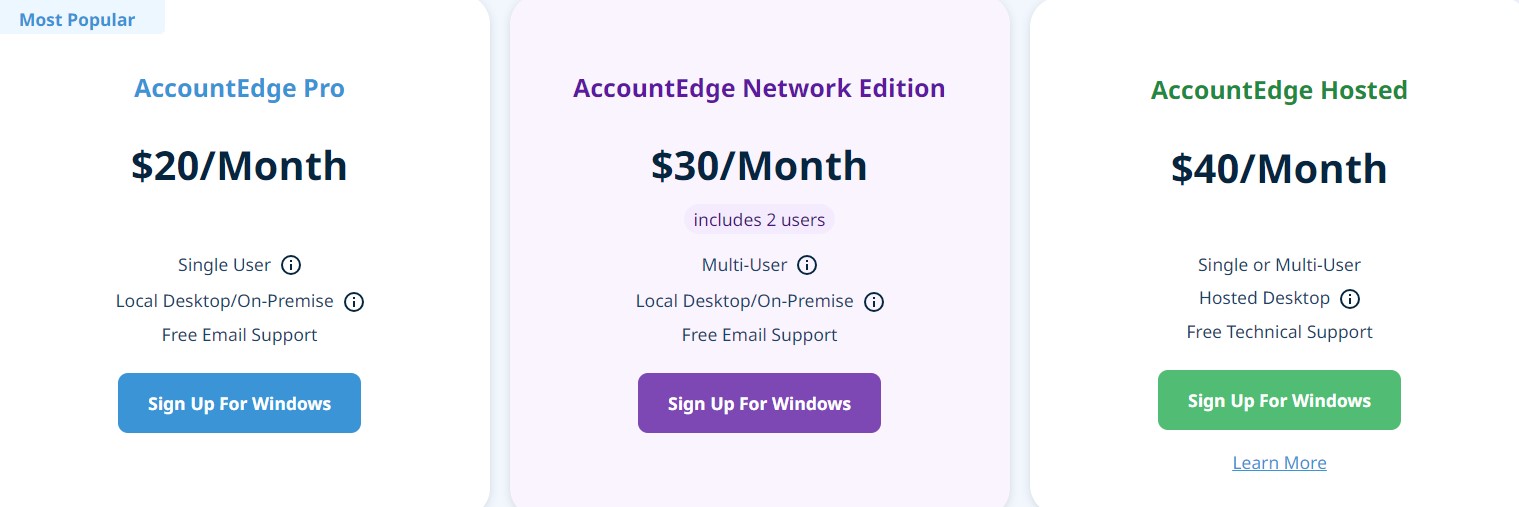

It was not surprising to find that AccountEdge Pro offers no free plan, given its intermediate-expert-focused nature. Also, its monthly subscription plans only offer basic features; additional features, such as payroll processing and bank feeds, have to be purchased.

- AccountEdge Pro: $20 per month

- AccountEdge Network Edition: $30 per month

- AccountEdge Hosted: $40 per month

Image via AccountEdge Pro

Tool Level

- Intermediate-Expert

Usability

- Requires accounting knowledge

You May Also Like:

16. Moxie

Image via Moxie

Moxie stands out in the accounting software for self-employed by taking an education-first approach to freelance financial management. Unlike traditional accounting platforms that focus solely on transactions, Moxie’s Moxie Academy combines practical tools with a robust learning ecosystem.

What truly distinguishes this platform is its holistic approach to freelance business management.

Beyond standard accounting features, Moxie provides an integrated environment. It allows freelancers to manage client relationships, handle projects, and access educational resources while maintaining their financial health.

The platform’s sales pipeline management includes custom qualification forms and progress tracking, addressing many sole proprietors’ crucial needs in managing potential client relationships.

Key Features

- Creative project-based billing

- Integrated deliverable review system

- Milestone-based payment scheduling

- Portfolio-style client dashboards

- Usage-based project budget tracking

- Creative asset delivery integration

- Client feedback-to-invoice workflow

Pros

- Perfect for creative professionals who charge based on deliverables

- Eliminates the disconnect between project management and billing processes

- Reduces payment delays through integrated deliverable approval

- Highly visual interface suited for creative professionals

- Automatically creates expense reports based on project milestones

Cons

- Not well-suited for product-based businesses

- May be too specialized for general business use

Pricing

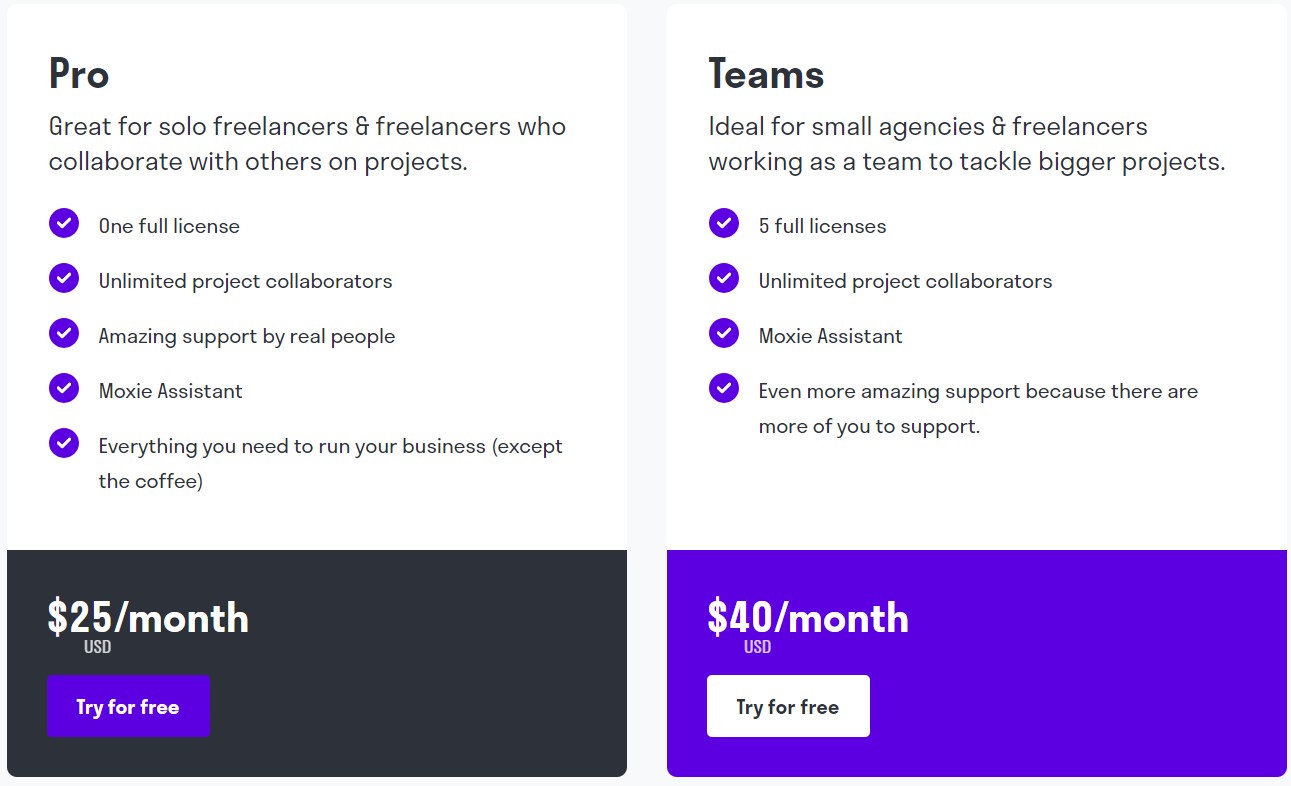

Moxie comes with just two pricing plans:

- Pro: $25 per month

- Teams: $40 per month

Image via Moxie

Tool Level

- Beginner to intermediate

Usability

- Highly intuitive for freelancers

17. Collective

Image via Collective

Collective has made its mark on the accounting software for self-employed space with its comprehensive approach to freelancer financial management.

Founded in San Francisco by Hooman Radfar, Ugur Kaner, and Bugra Akcay, this platform uniquely positions itself as a complete business formation and financial management solution for sole proprietors earning over $80,000 annually.

What sets Collective apart is its integration of AI technology (specifically GPT-4) into financial workflows. Collective leverages AI to automate expense categorization and account reconciliation, allowing freelancers to focus on their work rather than manual data entry.

The platform excels at providing personalized support through dedicated ‘Member Relationship Managers’ who serve as primary points of contact.

This human-AI hybrid approach ensures that growing businesses receive automated efficiency and expert guidance for complex financial decisions.

Key Features

- AI-powered transaction categorization

- Business formation and LLC setup services

- EIN acquisition assistance

- Business bank account integration

- Monthly financial reconciliation

- Comprehensive tax time planning

- Access to dedicated financial advisors

Pros

- Complete business formation and management solution

- AI-powered automation reduces the administrative burden

- Includes registered agent services

- Professional guidance for tax optimization

- Seamless integration with Gusto for payroll

Cons

- Higher-income threshold for ideal users ($80,000+)

- More expensive than basic accounting software

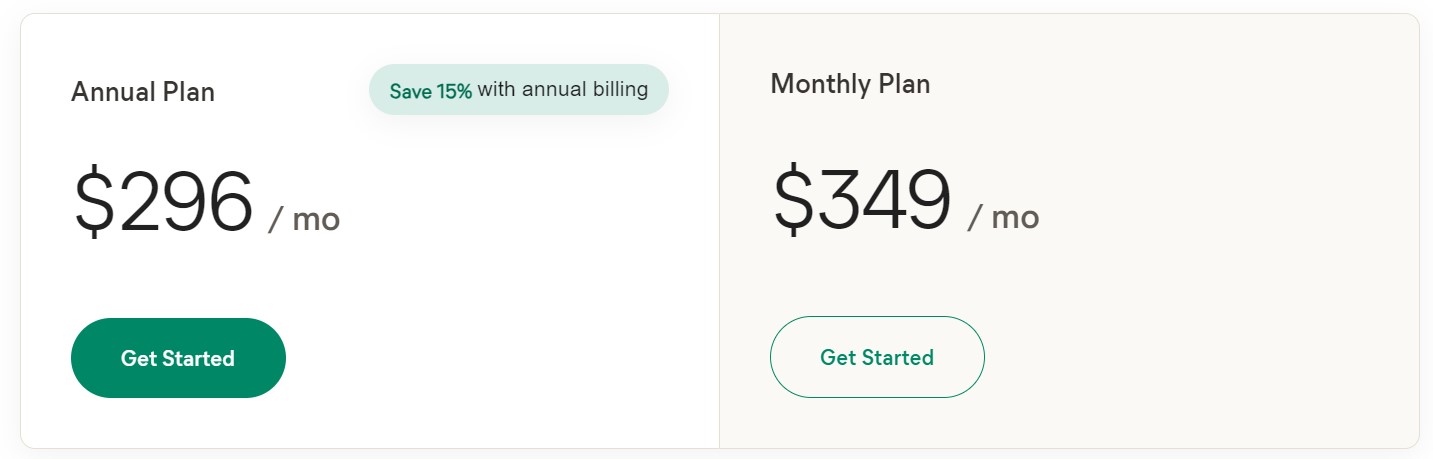

Pricing

Collective operates on a subscription model that includes:

- Annual Plan: $296 per month

- Monthly Plan: $349 per month

Image via Collective

Tool Level

- Intermediate to Advanced

Usability

- Easy to use with guided support

You May Also Like:

18. CustomBooks

Image via CustomBooks

CustomBooks distinguishes itself in the self-employed accounting software market by emphasizing flexibility and extensive customization features. CustomBooks allows sole proprietors to tailor every aspect of their financial management system, from custom fields to conditional formatting across the platform.

One of CustomBooks standout features is its TRUE Inventory Tracking system, which enables businesses to monitor stock across multiple warehouses, handle consignment tracking, and manage assembly from raw materials. This makes it especially suitable for small businesses that combine service offerings with physical products.

The platform’s integration with major ecommerce platforms like Shopify, WooCommerce, and Amazon, combined with its ability to sync with over 15,000 banking institutions, creates a comprehensive ecosystem for managing online and offline cash flow.

Key Features

- Cloud-based accessibility with unlimited users

- Advanced project management capabilities

- Real-time project profitability tracking

- TRUE Inventory Tracking system

- Automated bank account reconciliation

- Rapid customization development

- SOC II compliant security protocols

Pros

- Unlimited user access without additional fees

- Comprehensive inventory management

- 15-minute backup intervals for data security

- Extensive customization capabilities

- Strong ecommerce integration options

Cons

- May require initial setup assistance

- Customization options can be overwhelming

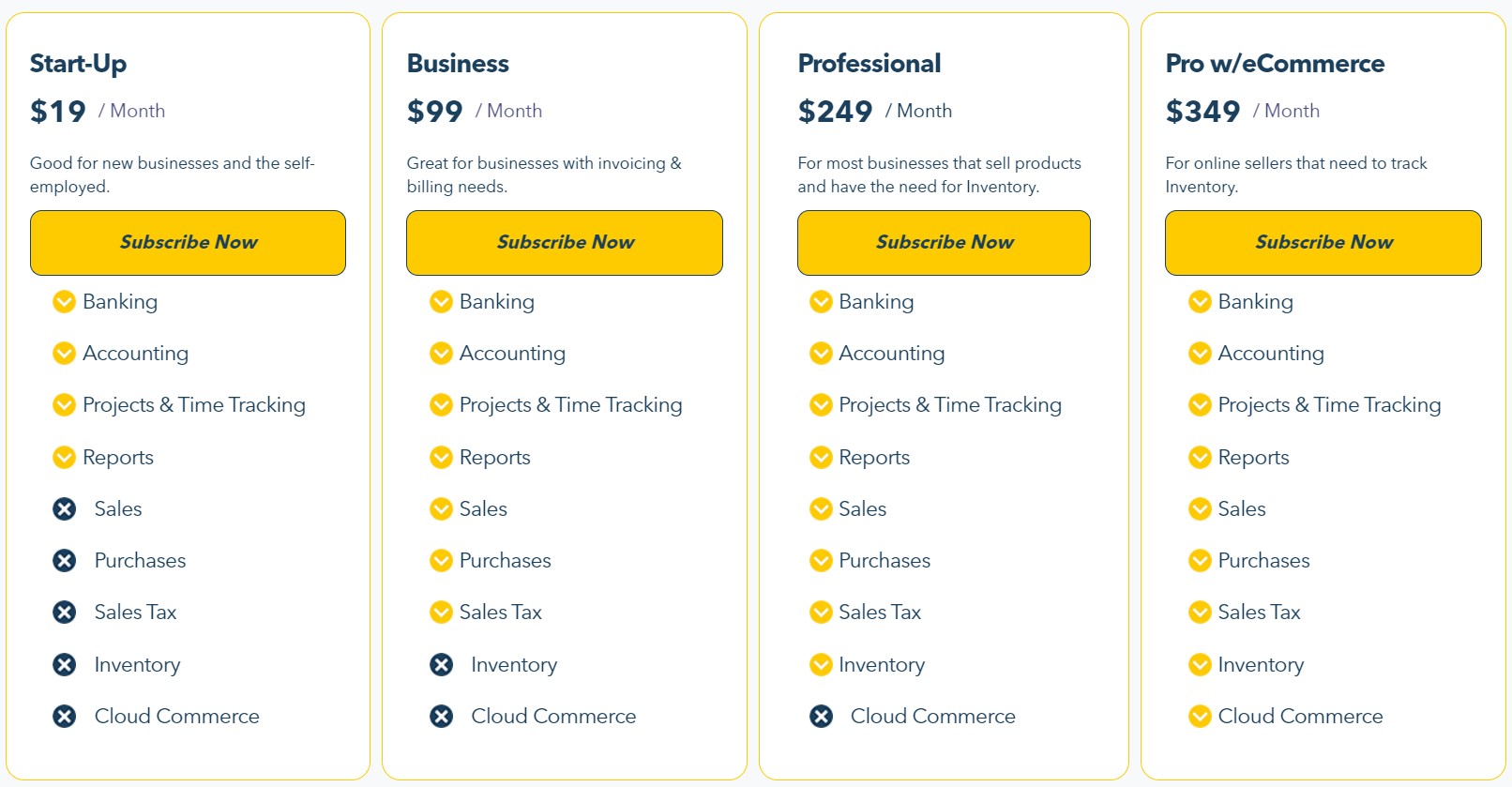

Pricing

CustomBooks offers flexible subscription options:

- Start-Up: $19 per month

- Business: $99 per month

- Professional: $249 per month

- Pro w/eCommerce: $349 per month

Image via CustomBooks

Tool Level

- Intermediate to Advanced

Usability

- Moderate learning curve with template support

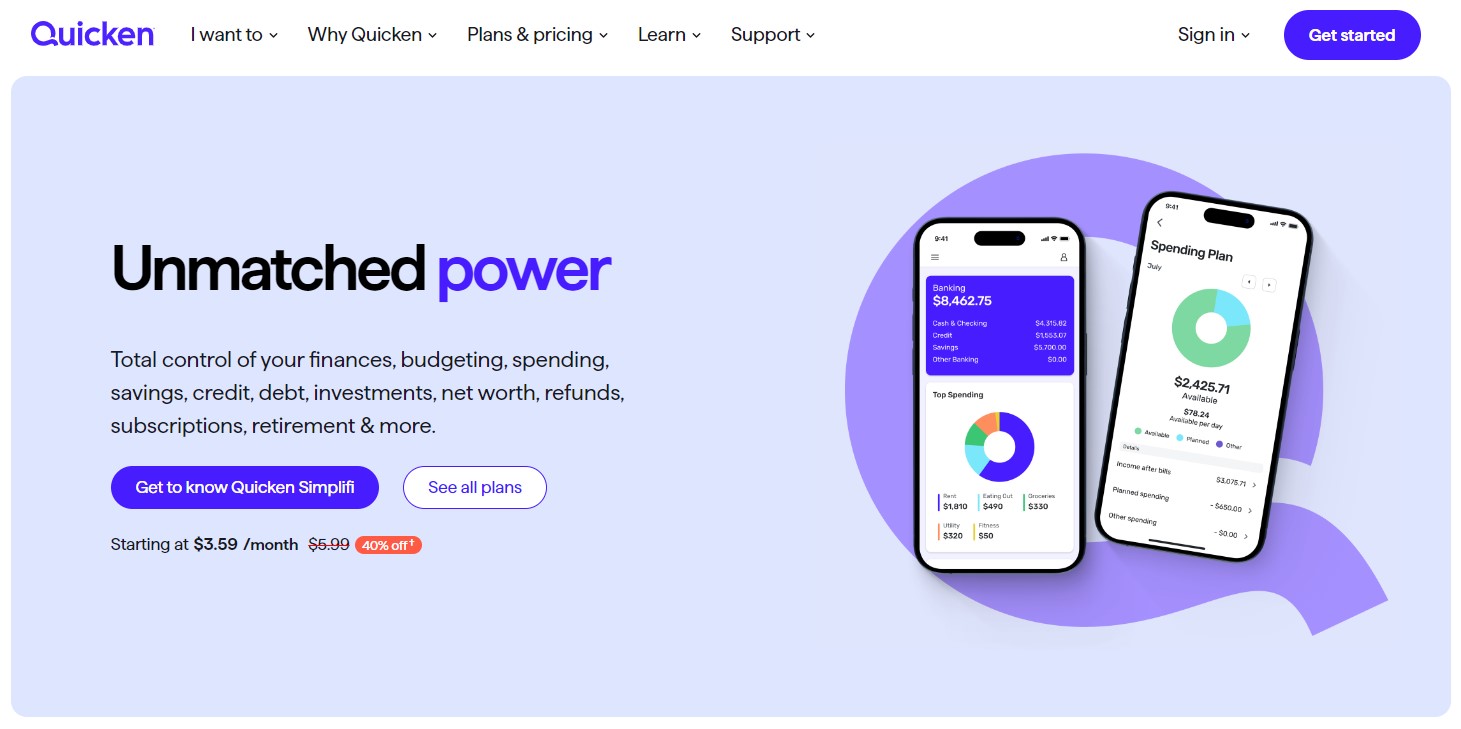

19. Quicken

Image via Quicken

Since its inception in 1984, Quicken has evolved beyond personal finance to become a robust self-employed accounting software solution, particularly through its Home & Business version.

With over 20 million users, it stands out by offering a unique blend of personal and business financial management. This offering is especially valuable for sole proprietors transitioning from traditional employment to self-employment.

Its comprehensive investment tracking capabilities and standard business accounting features set Quicken apart. Freelancers can now manage their business operations and personal investment portfolios on one platform.

The software’s integration with TurboTax streamlines managing sales tax and preparing for tax time.

Unlike cloud-only solutions, Quicken’s desktop-first approach with web and mobile companions offers a robust local data management option while still providing the flexibility of on-the-go access through synchronized apps.

Key Features

- Consolidated financial account management

- Advanced investment portfolio tracking

- Automated transaction categorization

- Customized budget creation tools

- Bill payment and tracking system

- Direct TurboTax integration

- Track expenses across accounts

- Real-time budget monitoring

- Business bank account syncing

Pros

- Comprehensive personal and business finance integration

- Strong investment tracking capabilities

- Established track record and reliability

- Robust data security with 256-bit encryption

- Extensive customer support options

Cons

- Desktop-centric approach may feel dated

- Limited cloud-based capabilities

Pricing

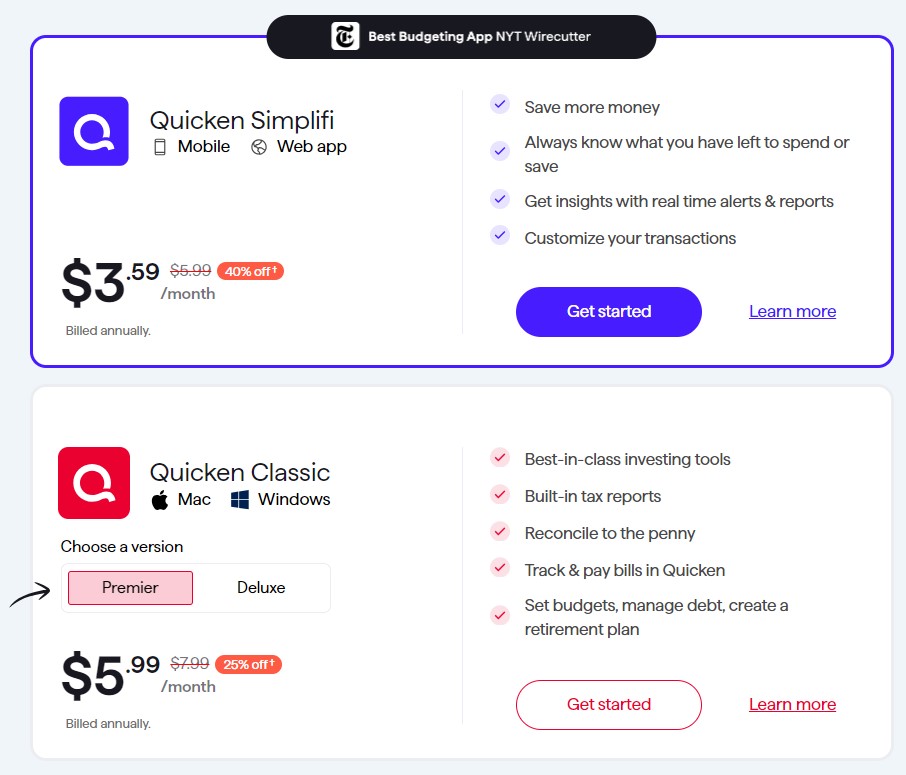

Quicken offers three yearly plans that are billed annually. It currently offers 40%, 25%, and 16% off in the first year of the three plans, respectively. These include:

- Quicken Simplifi: Usually $5.99 per month, now $3.59 per month

- Quicken Classic Deluxe: Usually $7.99 per month, now $5.99 per month

- Quicken Classic Premier: Usually $5.99 per month, now $4.99 per month

Image via Quicken

Tool Level

- Intermediate

Usability

- Easy to use with familiar interface

You May Also Like:

FAQ

Q1. What are some of the best accounting software for self-employed professionals?

A. Here are our top 19 picks for the best accounting software for self-employed professionals:

- QuickBooks Solopreneur: Best for overall functionality

- Zoho Books: Best for automation and Integration

- FreshBooks: Best for invoicing and client management

- Xero: Best for scalability and comprehensive features

- FreeAgent: Best for UK-based self-employed professionals

- Wave: Best for free accounting solution

- Fiverr Workspace: Best for freelance business owners

- Kashoo: Best for straightforward, no-frills accounting

- OneUp: Best for automation in inventory management

- ZipBooks: Best for intelligent reporting and insights

- TrulySmall Accounting: Best for simplicity and ease of use

- Patriot Software: Best for tax prep and compliance in the US

- Neat: Best for document organization and expense tracking

- ZarMoney: Best for US customer service

- AccountEdge Pro: Best for professional and expert business needs

- Moxie: Best for freelancer education and development

- Collective: Best for comprehensive business formation and management

- CustomBooks: Best for inventory and ecommerce integration

- Quicken: Best for combined personal and business finance

Consider these when looking for the best accounting software for self-employed professionals.

Q2. Why do I need accounting software and what key things should I look for when choosing one?

A. As a sole proprietor or freelancer, having the right accounting software for your business needs is critical. These tools allow you to seamlessly handle financial workflows such as invoicing clients, managing expenses, processing payments, and estimating taxes at tax time.

DIY accounting software optimized for the self-employed allows you to manage your entire freelance or solo business finances in one place and remain compliant. The automated features save time on manual data entry while giving you insights into key financial metrics.

On how to choose the best accounting software for self-employed professionals like yourself, some key features to look for include:

- Integration with other tools you use

- Expense and mileage tracking for deductibles

- Collaboration features to work with contractors

- Bank feeds and income/payments reconciliation

- Scalability to grow as your solo operation expands

- Intuitive interface for beginners and non-accountants

- Invoicing capabilities to bill clients and get paid faster

- Automated tax features if you are a US-based solo business

- Finance reporting, such as profit and loss and balance sheets

Choosing a platform that aligns with your independent business needs and user experience comfort will ensure you choose an ideal accounting solution.

Q3. Should I use free or paid accounting software?

A. One major consideration when choosing a bookkeeping software tool suited for sole proprietors and freelance business owners is whether to use free or paid self-employed accounting software.

Free plans on tools such as Wave or FreeAgent work well for basic solopreneur accounting needs. However, paid plans provide a more robust docket tailored for the self-employed, such as:

- Mileage logging for deductibles

- Expense receipts and tracking features

- Quarterly self-employment tax estimations

- Robust invoicing and management of clients

- Time tracking and online payments processing

The productivity benefits and specialized tools make paid self-employed accounting software worth the monthly fees for most full-time, self-employed users. However, if you have very limited accounting needs for your small business, then choosing a free platform should be fine.

Q4. How much does self-employed, optimized accounting software cost?

A. Pricing for paid self-employed accounting software can range from as little as $1 (discount included) to as much as $350 per month, depending on the features and platform.

Entry-level plans on platforms such as Xero, FreshBooks, and TrulySmall start around $3.75 to $9 monthly. Mid-tier plans with extra capabilities on platforms such as QuickBooks Self-Employed and OneUp can range from $20 to $35 monthly. And enterprise plans on feature-rich platforms like Zoho Books or ZarMoney can get as high as $350 per month.

That said, the monthly cost of your self-employed accounting software plan may be fully deductible as a business expense for self-employed users.

Q5. What tax features should I look for in a self-employed accounting software?

A. Since self-employed users have to handle their own income taxes when it’s tax season, some important tax-related capabilities to look for include:

- Easy importing of 1099s from clients

- Deductible home office use calculations

- Integrations with TurboTax or equivalent

- Quarterly estimated income tax planning

- Support for quarterly profit/loss reporting

- Automatic mileage tracking for deductions

- Automated quarterly and annual tax payments

- Generating all required tax statements and forms

Having the right tax handling features maximizes write-offs and smooth, compliant filing for self-employed professionals.

Q6. How often should I expect updates from these accounting software providers?

A. Most self-employed accounting software providers offer regular updates every 1-3 months. These updates typically include security patches, new features, and improvements to existing functionality. Cloud-based solutions usually update automatically, while desktop software like Quicken may require manual updates.

Q7. Can I switch between different accounting software platforms if I’m not satisfied?

A. Yes, most modern accounting software allows you to export your data in standard formats, making it easier to switch platforms. However, some customizations, historical project management data, and specific reports might not transfer perfectly. Switching at the end of a financial quarter or year is best to maintain clean records.

Q8. Should I choose cloud-based or desktop accounting software for my business?

A. For most sole proprietors, cloud-based solutions offer better flexibility with features like automatic updates, remote access, and easier collaboration. However, you might prefer desktop solutions like Quicken if you have limited internet connectivity, specific security requirements, or need to maintain local control over your financial data. Consider your business needs, internet reliability, and security requirements when making a choice.

You May Also Like:

Now You Know: 19 Best Accounting Software for Self-Employed Individuals

Choosing the best accounting software for self-employed freelancers, solopreneurs, or independent consultants is critical to effectively managing your finances.

When in doubt, the right accounting software provides easy invoicing, payment collection, expense tracking, tax planning, collaboration, and financial insights, all on an intuitive platform.

With the advancement of easy-to-use yet powerful accounting technology, self-employed users like yourself have more choices than ever before.

Taking advantage of these DIY solutions can save time, effort, and money over brick-and-mortar bookkeeping and accounting. This way, you get more room to focus on growing your solo or freelancing business. Good luck!