Are you a small business owner wondering what the benefits of using accounting software for small businesses are?

You’ve come to the right spot.

Accounting forms a large part of every business and as a small business owner, you may wear many hats, including that of an accountant.

If that’s your situation, you might find accounting processes challenging, especially if you have little experience with them.

And even if you are experienced, having a software solution can really help to simplify and speed up the accounting process so that you can focus on other tasks, like project management or managing inventory.

But that’s not the only benefit that accounting software platforms offer small businesses.

Let’s take a look at the benefits of using accounting software for small businesses in detail.

What is Accounting Software?

Before we get into the benefits of using accounting software for small businesses, let’s first take a look at what accounting software is all about.

Simply put, it’s a platform that helps you manage and automate your accounting processes. The goal of this software is to reduce the time you spend on accounting and simplify it.

You’d typically have to manually create a journal entry for a payment made or received, for example. In the case of software solutions, however, a great benefit is that these entries are created automatically, reducing manual tasks and data entry.

If you’ve got a few entries, then manual data entry might be feasible. Once the number of financial transactions increases, however, it becomes a massive challenge, as you have to spend a lot of time entering the data.

That’s where accounting software helps: it saves time and also reduces opportunities for manual errors. One of the key benefits of using accounting software for small businesses is the automation of these repetitive tasks.

So without further ado, let’s take a look at the numerous benefits of accounting software.

Benefits of Accounting Software

Here are the biggest benefits of using accounting software for small businesses:

1. Data Availability

You never know when your accounting data will be needed immediately. If you’re using a traditional accounting system, then finding this data quickly or carrying it around isn’t always feasible.

The data might be stored physically or in a spreadsheet. Luckily, this isn’t the case when it comes to small business accounting software platforms, which is a huge benefit when it’s time to whip that data out. Almost all accounting software can be used on multiple devices, including PCs and mobile devices.

That’s not all.

Another benefit of accounting software platforms is that the data is stored online. This means that you can access it from pretty much anywhere as long as you’re connected to the internet.

This flexibility also means that you’ll have the ability to download financial statements and accounting reports on the go with just a couple of clicks.

And that’s not the only benefit of account software.

Because all the data is stored online, you won’t have to worry about losing it, which, unfortunately, is a risk when it’s all stored offline.

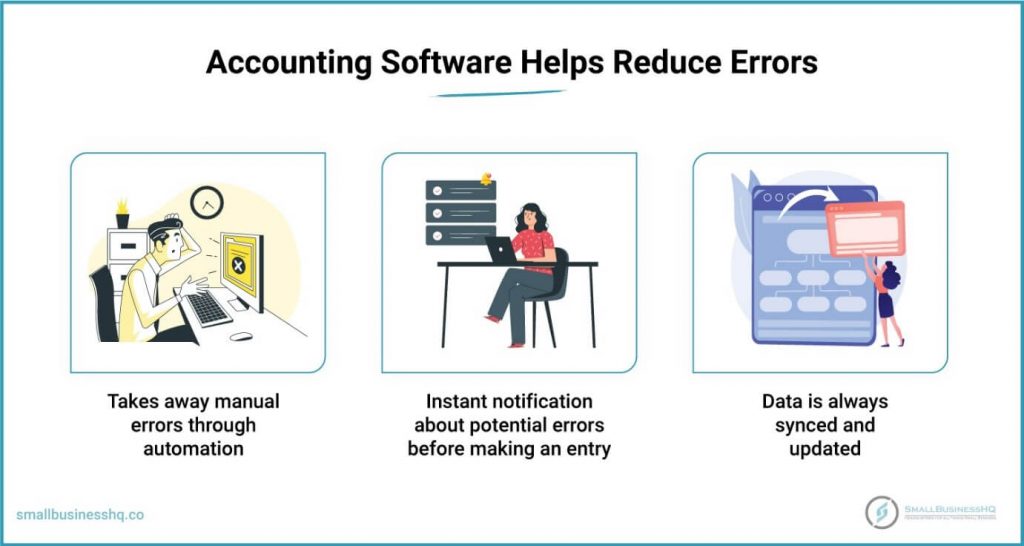

2. Minimal Errors

As mentioned above, the traditional accounting system requires you to manually enter all of the data. However, accounting software automates data collection and entry, which is a huge benefit of using accounting software for small businesses.

This, in turn, would mean that many avoidable manual errors can be eliminated. As a result, your financial statements and records will be free of errors.

Another benefit?

Even if you’ve made manual entries to your accounting database using your accounting software platforms, the software itself will prevent errors.

How does it do this?

Well, the accounting solutions will instantly notify you if they see that your entries don’t balance. Additionally, they’ll display the potential error causing the issue in the first place so that you can resolve it even before you’ve actually made the mistake. This particular benefit of accounting software is sure to save you from plenty of headaches!

Keep in mind too that when you use spreadsheets, you may end up with multiple versions. Reconciling this data to ensure that it’s updated everywhere requires a lot of time.

However, accounting software solves this problem for you as the data will always remain updated because it’s synced to the cloud. This reduction of mistakes means that your accounts will always remain clean, and represents a major benefit to you.

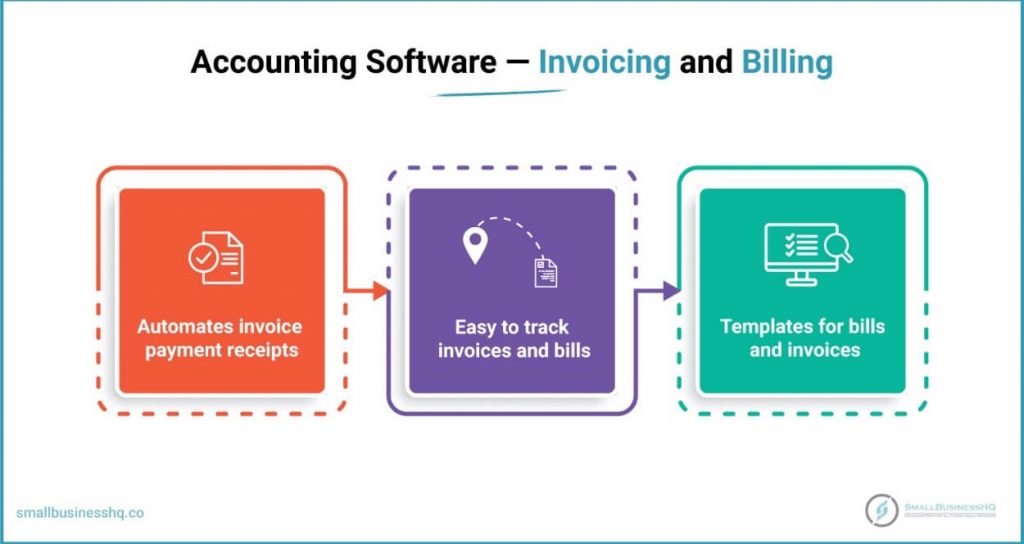

3. Easy Invoicing and Billing

Invoicing and billing are essential for the normal functioning of your business. In fact, they’re used on a daily basis. Your bulk of bills and invoices to manage and keep track of can be a major stressor. Trust us, we know!

Keeping them all in order can be a particularly challenging task, especially if you’ve got physical invoices and bills; finding a particular one can be time-consuming and exhausting.

Physical records are also prone to getting lost, which leads to even more wasted time

Creating these physical copies takes time too…even if it’s all digitized.

One of the significant benefits of using accounting software for small businesses is that it takes all these hassles away by simplifying the way you create recurring invoices and bills in the first place.

You May Also Like:

4. Easy Collaboration

Collaboration is important between various teams and within the accounting department. Collaboration can especially get challenging in large organizations. But even in small businesses, you do need to be able to share bills, invoices, financial statements, and reports with ease.

In a traditional setup, you’d have to share physical copies or search for files to share. This is greatly simplified when you use accounting software platforms, as all the data is in the cloud. As a result, your team is able to access the data based on their access privileges without having to wait for it, keeping everyone on the same page.

Another benefit of accounting software?

Even if you need to share it, the process is pretty simple: modern-day accounting software can help you share important documents with the click of a button.

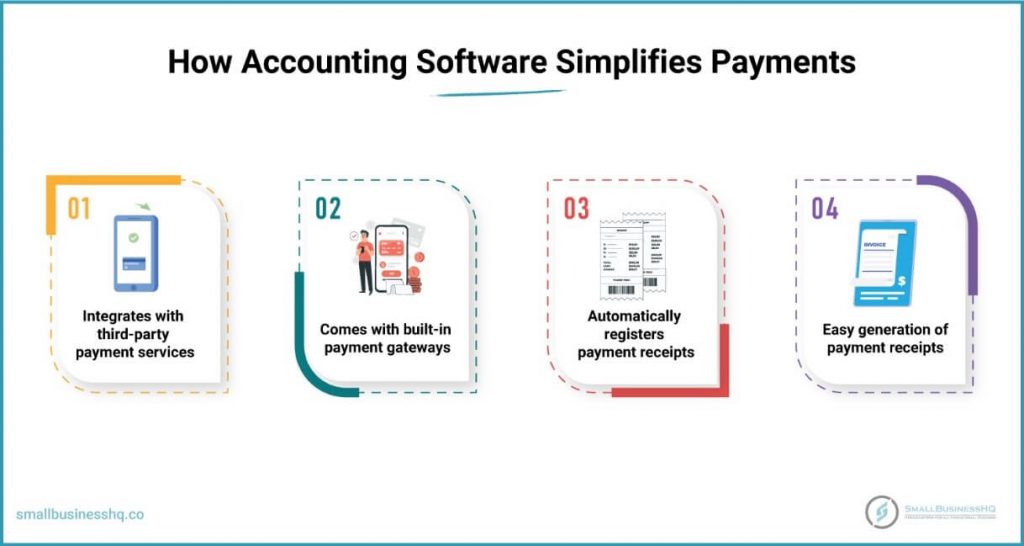

5. Simplified Payments

Like many other small business owners, you invoice your clients for the products or services you offer them. Once the invoice is sent, the next step is, naturally, that the payment be made.

A traditional accounting system means that you’d have to decide with your clients what particular system to use for a payment method. This can both be overwhelming and time-consuming.

But this isn’t the case with accounting software platforms.

Modern-day accounting software platforms offer integration with many types of payment gateways. Another benefit of using accounting software for small businesses is that it gives your customers the flexibility to choose a method of their choice to make the payment, including credit card and online payments.

And guess what?

It may not even be necessary, as many accounting software solutions already have built-in integrations.

They typically include payment gateways like PayPal and Stripe. As a result of these integrations, you’ll even be able to accept payments in various currencies! This enables small businesses like yours to accept payments from all over the world.

You May Also Like:

6. Expense Tracking

One of the most important accounting processes for businesses is to keep track of the expenses they incur.

Now, with a traditional accounting system, this would be a task in itself as you’d have to manually go through the statements and records to understand your expenses.

This changes with accounting software platforms, though.

Another benefit of using accounting software for small businesses is that you can track expenses and even segregate them into different categories so that you understand where your money is going.

When else can you do?

It’s also possible to upload expense receipts to your accounting software so that you don’t need to store paper receipts anywhere.

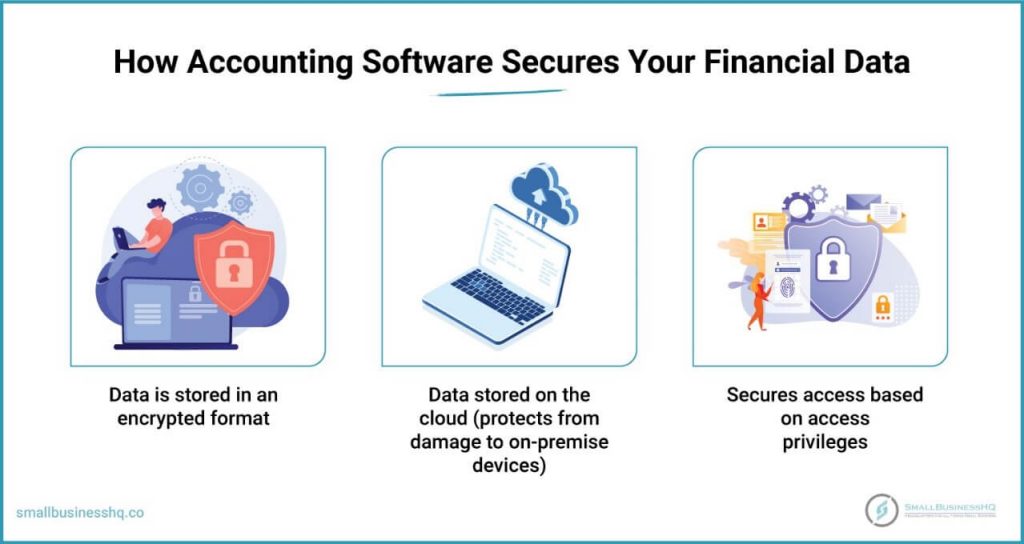

7. Improved Security

Data security is exceptionally important, especially when you’re dealing with sensitive financial information like your accounts.

This is where online accounting software platforms have a huge edge over traditional means of accounting.

Typically, physical documents related to accounts aren’t secure; after all, anybody could gain access to them. Additionally, these documents can go missing or be destroyed.

Even spreadsheets aren’t very secure and can potentially lead to data breaches. In addition to that, the on-premise storage of these sheets means that they’re still prone to being destroyed or corrupted when hard drives are compromised.

One major benefit of using accounting software for small businesses is that data stored in business accounting software platforms is encrypted using high-end algorithms, which makes it difficult for anyone to access it without permission.

Because the data is stored on the cloud, it’s protected from being destroyed, wiped, or corrupted due to issues that occur in physical storage devices.

In addition to this, another benefit of accounting software is that the cloud-based nature of these platforms means that your data will always remain updated and synced. As a result, you’ll not be required to back it up regularly — something you’d have to do if it were stored on-premises.

You May Also Like:

8. Bank Reconciliation

One of the other core features of a small business is that of bank reconciliation. Your accounting records need to match those with your bank accounts.

Now, when you’re using spreadsheets to do it, you’ll have to manually go through your bank account statements and your accounting records to reconcile them accordingly.

With accounting software platforms, however, all these issues are taken care of, which is yet another major benefit of using accounting software for small businesses.

All you have to do is connect your business bank accounts with the accounting software, and it will directly fetch bank statements.

You can then set up bank rules through which these transactions can be matched with those that are in your accounting records. This way, all the matching is done by accounting software.

Simply verify and confirm these transactions to reconcile your accounts. This will make it so that your business will always be ready for audits throughout the year, an exceptionally large benefit of accounting software!

9. Real-time Updates

Another big benefit that you can get by leveraging accounting software platforms is real-time visibility of your accounting data while using it.

When you connect your bank account with your accounting software, you’re easily able to track various transactions and parameters like sales, credits, expenses, and more in real-time data, a big benefit!

This data also shows up in the form of interactive charts and graphs that make it easy for you to understand and derive insights from it.

There’s no need to manually skim through a vast number of rows and columns to derive these insights, as you’d need to do if you did your accounting the traditional way. This real-time access to key metrics is one of the significant benefits of using accounting software for small businesses.

You May Also Like:

10. Simplified Tax Compliance

One of the key benefits of using accounting software for small businesses is that it simplifies tax filing for businesses.

Most accounting software solutions automatically calculate taxes and help you stay in compliance with the IRS. They have built-in tax rules and you simply have to select your country to apply those. This feature of automatic tax calculations can save you a lot of time and headaches during tax season.

This feature is also especially beneficial for companies that operate in different countries, as complying with local tax regulations can be tedious.

Good accounting software solutions can calculate taxes based on the tax rates and laws of different countries, thus simplifying tax filing for your business.

They can also apply appropriate sales taxes to invoices and other documents, thus saving manual effort from your end.

Please note that many software solutions provide tax compliance for a limited number of countries. As such, you should check whether the countries you serve are supported when you choose accounting software for your business. Some accounting software platforms even help you identify potential tax credits you might be eligible for.

11. Reduced Paperwork

Accounting software solutions can take care of all your accounting processes online. You don’t need physical ledgers, bills, or any other documents.

From your financial statements to invoices, everything is handled online, thus reducing your paperwork and business costs associated with physical storage.

This also helps you avoid instances of lost or misplaced documents, which may cause serious business risks. It also reduces manual errors that may occur if someone makes entries with paper and pen.

Saving financial information online also helps improve your data security. You can protect your data with layers of encryption, role-based access management, and other security measures.

Lastly, reducing the use of paper is an environmentally sustainable business practice that your customers will appreciate.

By reducing paperwork and handling everything online, accounting software solutions offer not one but many benefits for your organization.

You May Also Like:

12. Cost and Time Savings

Accounting software platforms can accomplish a lot of tasks much faster than you can do manually. This results in significant cost and time savings for your business, which is one of the biggest benefits of using accounting software for small businesses.

Online accounting not only reduces paper and other material costs but also makes things more efficient. Instead of having an employee balance your sheets, you can have the software do automatic calculations.

Accounting software that can automate tasks like invoicing and expense tracking can especially help save a lot of time for your team. Features like recurring billing and scheduling bank payments can further streamline your accounting processes.

13. Ease of Working Remotely

Lastly, using an accounting software solution enables various teams to access financial data online. This makes it easier for you to work with remote employees or offer remote or hybrid work opportunities to employees.

In this post-COVID era, many businesses have adopted the remote-working model. In such a scenario, it’s become even more important to track and manage data online and accounting software solutions can help you achieve that.

That brings an end to this section on the benefits of using accounting software for small businesses. Now, let’s discuss some of the features you should look for when selecting the best accounting software for your business.

You May Also Like:

Top Accounting Software Features to Look For

1. User-Friendliness

In a small business setup, administrative staff use accounting software more than accountants. Small businesses can’t afford to hire a team of accountants; that’s why they prefer to invest in accounting software to begin with.

So, it’s crucial that the accounting solution you choose is user-friendly and has a shallow learning curve.

This will ensure that anyone can use the software solution and access data. An accountant would only be needed to supervise.

But how will you ensure a tool is user-friendly?

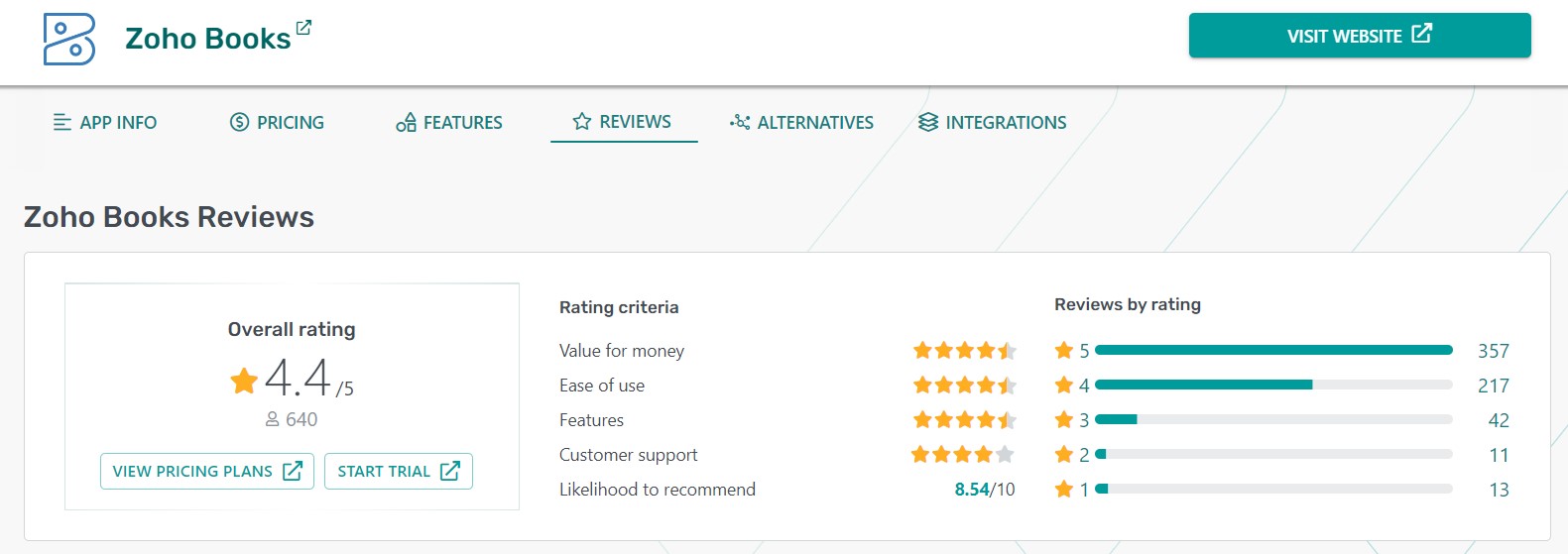

You do so by reading the customer reviews and testimonials. See what the existing customers are saying about the user interface and customer support to take a call.

Some review websites, such as GetApp, rate a tool on specific parameters, which include ease of use. Here’s how Zoho Books is rated on the platform, for example.

Image via GetApp

2. Security

Accounting software handles a company’s financial data. It also handles customers’ personal data, which can often be confidential.

So, it goes without saying that you should choose one that offers complete data protection and security.

Check for the safety and security measures that a company takes to ensure their software solution is safe.

NetSuite, for example, uses various safety measures including data encryption, role-based access, and multi-factor authentication.

Image via NetSuite

3. Accounting & Bookkeeping

Of course, the core features of any accounting software are its accounting and bookkeeping capabilities. When comparing various options do an in-depth comparison on this aspect.

Here are some important features to look for:

- Income and expense tracking

- Bank reconciliation

- Tax calculation

- Payroll and deductions management

- Appreciation/depreciation tracking

- Financial reporting

- Forecasting and financial projections

- General ledger maintenance

Accounting software that can automate routine tasks can help you save time and money. So, prefer software that can help you automate most of the manual tasks of accounting and bookkeeping.

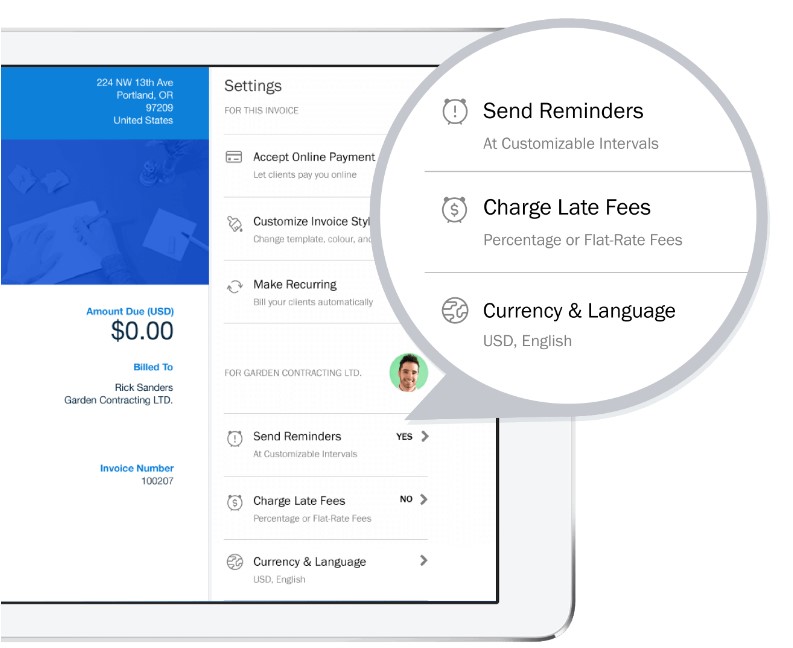

4. Payments & Invoicing

Good accounting software is adept at managing invoices and tracking accounts payable and receivable. It should be able to show you how much someone owes you or how much you owe, and when the payment is due.

It should also be able to generate and send invoices automatically and receive payments.

While most accounting software can help with invoicing in one way or another, you should choose ones that can automate invoicing and help you create recurring invoices.

FreshBooks, for example, can automate various invoicing tasks and run your business on autopilot. It sends automatic invoices and payment reminders and accepts payments as well.

Image via FreshBooks

5. Inventory Management

If you run a retail business, ensuring that you don’t run out of hot-selling products is critical to business success. Proper inventory management can help ensure that you have just enough stock of each product at any given point in time.

Most good accounting software solutions provide inventory management as one of their features.

But what you should be looking for is a solution that can automate ordering new stock, as and when needed. It should be able to predict when you’ll run out of stock for a product and order in advance based on predicted demand.

6. Taxes

As mentioned earlier, an important function of an accounting software solution is to calculate and charge appropriate sales tax on all payments.

That’s why, when choosing the right accounting software, you should look for features related to tax filing compliance.

Specifically, check for the number of countries for which a software solution can automatically calculate and apply taxes. Some accounting software platforms even include the most common tax forms to make tax filing easier.

7. Payroll

Not all accounting software will provide payroll management, but it’s a good add-on feature to have.

A solution that can help you manage accounting, banking, taxes, and payroll is a winner. These are all interrelated functions, and it’s extremely convenient to manage everything from one platform.

Many software solutions will not have built-in payroll functionalities but will integrate with other tools to facilitate this. This is also fine as long as it’s a seamless integration and doesn’t cost a lot of extra money. Look for features like direct deposits, processing wages, and calculating hours worked.

FreshBooks, for example, collaborates with Gusto to offer payroll management to its clients.

Image via FreshBooks

You May Also Like:

FAQ

1. How can accounting software be beneficial for small businesses?

Some of the key benefits of using accounting software for small businesses are:

- Data availability

- Minimal errors in financial transactions

- Easy invoicing and billing, including the ability to create recurring invoices

- Simplified collaboration among team members

- Streamlined payments and the ability to accept credit card payments

- Efficient expense tracking

- Improved security of financial information

- Automated bank reconciliation with connected bank accounts

- Real-time updates and access to real-time data

- Simplified tax filing and compliance

- Reduced paperwork and manual tasks

- Cost and time savings

- Ease of working remotely

2. What are the features of accounting software?

The various features offered by accounting software include:

- Core accounting

- Invoicing and billing, including recurring billing options

- Inventory management tools to help you manage inventory efficiently

- Customer management tools

- Financial reporting and analytics, including profit and loss statements and balance sheets

- Tax management with automatic tax calculations

- Asset management capabilities

- Payroll tools for processing wages and managing employee payments

- The ability to handle multiple currencies for international businesses

- Project management features to track project tasks and budgets

3. What are the 3 biggest benefits of accounting?

The biggest benefits of accounting are:

- It helps maintain accurate business records, including detailed financial statements

- It helps you understand your financial health and cash flow

- It simplifies tax filing and ensures compliance with tax laws

These are just a few of the numerous benefits of accounting and using an accounting software solution can further enhance these.

4. What is the significance of accounting software?

Accounting software is aimed at simplifying finance and bookkeeping for businesses. They help you track your financial transactions and generate reports with ease, as well.

There are numerous benefits of using accounting software for small businesses, not the least of which is reduced time and effort spent on manual tasks.

5. What is the impact of accounting software on business performance?

When you use accounting software for your small business, you typically end up saving both time and money. Additionally, the quality of your accounting data will be much better, which will help you make more informed decisions.

Accounting software helps improve overall business performance by providing real-time insights into your financial statements, automating accounts payable processes, and helping you stay on top of unpaid invoices. This leads to better cash flow management and more efficient operations.

6. How does accounting software increase productivity?

Accounting software automates numerous tasks that would otherwise require a lot of manual effort. This automation also reduces the number of errors, which can lead to significant time savings, hence boosting productivity.

This is one of the key benefits of accounting software.

7. What are the types of accounting software?

The various types of accounting software are:

- Cloud accounting software

- Offline accounting software

- Enterprise accounting software

8. How does accounting software add value?

Accounting software adds value to your business by improving team collaboration, data quality, security, and productivity. These are just a few among the many benefits of using accounting software for small businesses.

9. Why is accounting important for small businesses?

Accounting helps small businesses keep track of their invoices and bills and also simplifies taxation. Additionally, it helps business owners get an idea of their assets and liabilities through balance sheets and income statements so that they can make better business decisions.

10. Why do most businesses use computerized accounting software?

Businesses use accounting software as it helps simplify accounting processes. Additionally, the data security it offers helps businesses ensure that their financial information is always secure. The added boost in terms of productivity also makes computerized accounting software a must-have tool for businesses.

You May Also Like:

Final Thoughts

Accounting is an integral part of running your small business and growing it. However, if you rely on legacy accounting methods, you risk wasting a lot of time and money on accounting and managing the accounts.

Cloud-based accounting software solutions provide many benefits, like helping to automate most of your accounting tasks, simplifying taxation, making it easier to collaborate, and securing your financial data.

All of these factors combine to make accounting software solutions an absolute no-brainer for small businesses.

Still have questions about the benefits of accounting software? Ask them in the comments section.