It’s not just about keeping track of your finances—it’s about finding a solution that matches your business goals and makes complex tasks easier.

With so many online accounting software options available, it can be challenging to find the perfect software for your business.

That’s why we’ve put together this guide on how to choose accounting software that’s just right for you.

Here we’ll focus on the essentials of selecting user-friendly, efficient accounting software, tailored to your business’s unique needs.

Here’s a step-by-step guide.

Step 1: Identify Your Business’s Unique Accounting Needs

The first step in learning how to choose accounting software is to identify your business’s unique accounting needs. This section is about understanding your unique business needs before you choose an accounting software solution.

Let’s explore how to pinpoint the exact accounting requirements of your business from an accounting software solution.

Understand Why You Need an Accounting Software Solution

As a small business owner, choosing the right accounting software begins with having a clear picture of your business finances. Every business, whether a startup or a small enterprise, has unique financial processes and requirements.

This is especially true when it comes to small business bookkeeping, where the scale and nature of transactions can vary greatly.

For instance, a retail business might need software with strong inventory management features, while a service-based business might look for excellent time-tracking and invoicing capabilities.

That said, accounting software makes it easier to track income and expenses, generate reports, and manage cash flow.

As such, understanding the volume of your transactions and the complexity of your business accounting is critical for selecting software that aligns with the unique accounting demands of your small business.

Whether you need basic accounting functions or more advanced features, the right accounting software makes managing your finances a lot easier.

You May Also Like:

Identify the Right Accounting Software for Your Needs: Cloud-Based, Desktop, or Hybrid

The next step in this guide on how to choose accounting software is to understand the various types of accounting software and determine which one you need.

When selecting software for your business, consider whether you prefer desktop and cloud software or a hybrid solution.

Here are the three common types of accounting software to choose from:

Cloud-Based Software: This type of software, accessible via the Internet, is perfect for businesses seeking flexibility.

It allows you to access your financial data from anywhere with an internet connection, making it ideal for businesses with remote teams or those requiring frequent access to financial data. Xero is a popular cloud accounting software to consider.

Desktop Accounting Software: Installed directly on your computers, desktop software solutions are known for their robust features.

Desktop software is an ideal choice if your business operates offline or if it doesn’t require a constant internet connection.

Hybrid Solutions: Combining the best of both worlds, Hybrid accounting software solutions offer the flexibility of cloud access with the comprehensive features of a desktop application.

It’s a versatile choice for businesses aiming for both accessibility and robust features.

Consider your business requirements and decide which of these would best meet your business demands.

Whether you choose desktop software or cloud accounting software, the right solution will streamline your accounting tasks and give you more control over your business accounting.

Step 2: Make a List of Tools with Must-Have Features

The next step in this guide on how to choose accounting software is making an initial list of tools with all the must-have features you want.

Though the requirements will differ from business to business, here are some key things to look for when choosing an accounting software solution.

Core Accounting Features

Any accounting software solution you choose must have certain essential features.

Top accounting software providers offer these basic accounting functions, such as invoicing and payment processing, to streamline your business accounting software and simplify accounting tasks.

Let’s discuss some of the most important ones.

- General Ledger Management: At the heart of any basic accounting software is the general ledger. It’s your financial command center, tracking every transaction.

- Payment Processing: A smooth payment process is essential for maintaining a steady cash flow. This feature streamlines your payment workflow and ensures you get paid on time.

- Bank Reconciliation: This feature is a lifesaver for reconciling transactions and ensuring your accounting data matches up with your bank accounts. It’s a must-have for maintaining accurate financial records.

- Tax Preparation and Filing: For tax compliance, choose accounting software that helps with tax deductions and filing. This can be a huge time-saver and stress-reducer during the tax season.

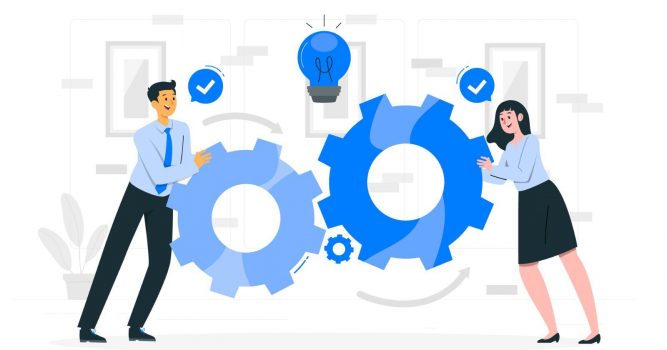

- Invoicing: This feature is key to maintaining a healthy cash flow. Efficient invoicing software should allow you to create, customize, and track invoices with ease, ensuring timely payments from clients.

Here is an invoice template from QuickBooks that showcases the streamlined design and functionality you can expect.

Image via QuickBooks

For many small businesses, QuickBooks Online is a popular choice due to its robust invoicing and reporting capabilities.

You May Also Like:

Automation Capabilities

Another important consideration for how to choose accounting software is automation. Automated accounting tasks, such as recurring invoices, payment reminders, and data backups, can save time and reduce manual errors.

The good news is that many software companies offer accounting tools that streamline these processes, helping small businesses manage their finances more efficiently.

Here are some important automation features you should look for when making your list of software to choose from:

- Automated Subscription Management: If your business relies on recurring billing models, choose software with robust automated subscription management features. It should be able to handle billing cycles and payment reminders efficiently, contributing to a consistent cash flow.

- Scheduled Reporting: The ability to receive automated reports, such as weekly profit and loss statements or monthly expense summaries, is essential. This feature ensures you stay informed about your business’s financial health without manual effort.

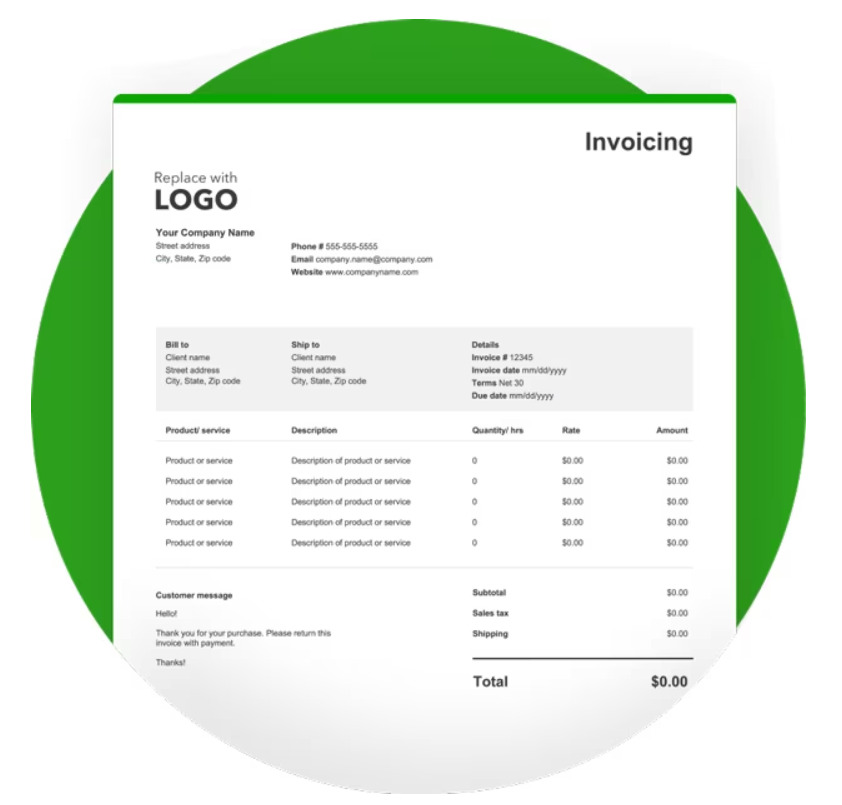

- Automatic Data Backup: Opt for software that automatically backs up your accounting data. This is crucial for safeguarding your financial information against accidental loss or technical issues.

The screenshot illustrates QuickBooks’ data backup interface, enabling users to easily manage and automate data backup. This ensures financial data is secure and retrievable.

Image via YouTube

The best accounting software should work efficiently and intelligently, automating routine tasks to free up your time for more strategic business activities.

Financial Activity Tracking and Analytics

Comprehensive financial tracking and analytics are crucial factors to consider when exploring how to choose accounting software for your business.

Here are some essential features to look for:

- Real-Time Financial Reporting: Regular, detailed reports are essential for monitoring your business’s performance. This feature allows you to make informed decisions based on your company’s financial data.

- Expense Tracking: Keep your spending in check with robust expense tracking. This feature is essential for understanding where your money goes and for maintaining financial discipline.

- Analytics and Insights: To truly understand your financial performance, choose software that offers deep insights and analytics. This can guide your business decisions and help you identify areas for improvement.

- Inventory Management: If your business involves keeping inventory, you need software that excels in inventory tracking and management. This ensures you’re never caught off guard by stock shortages or surpluses.

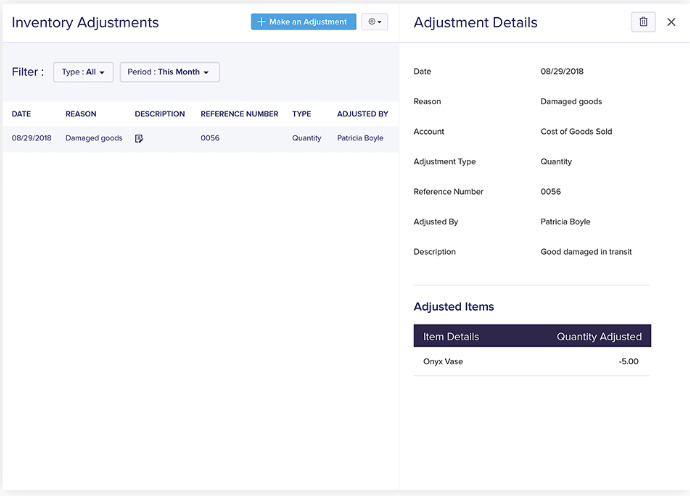

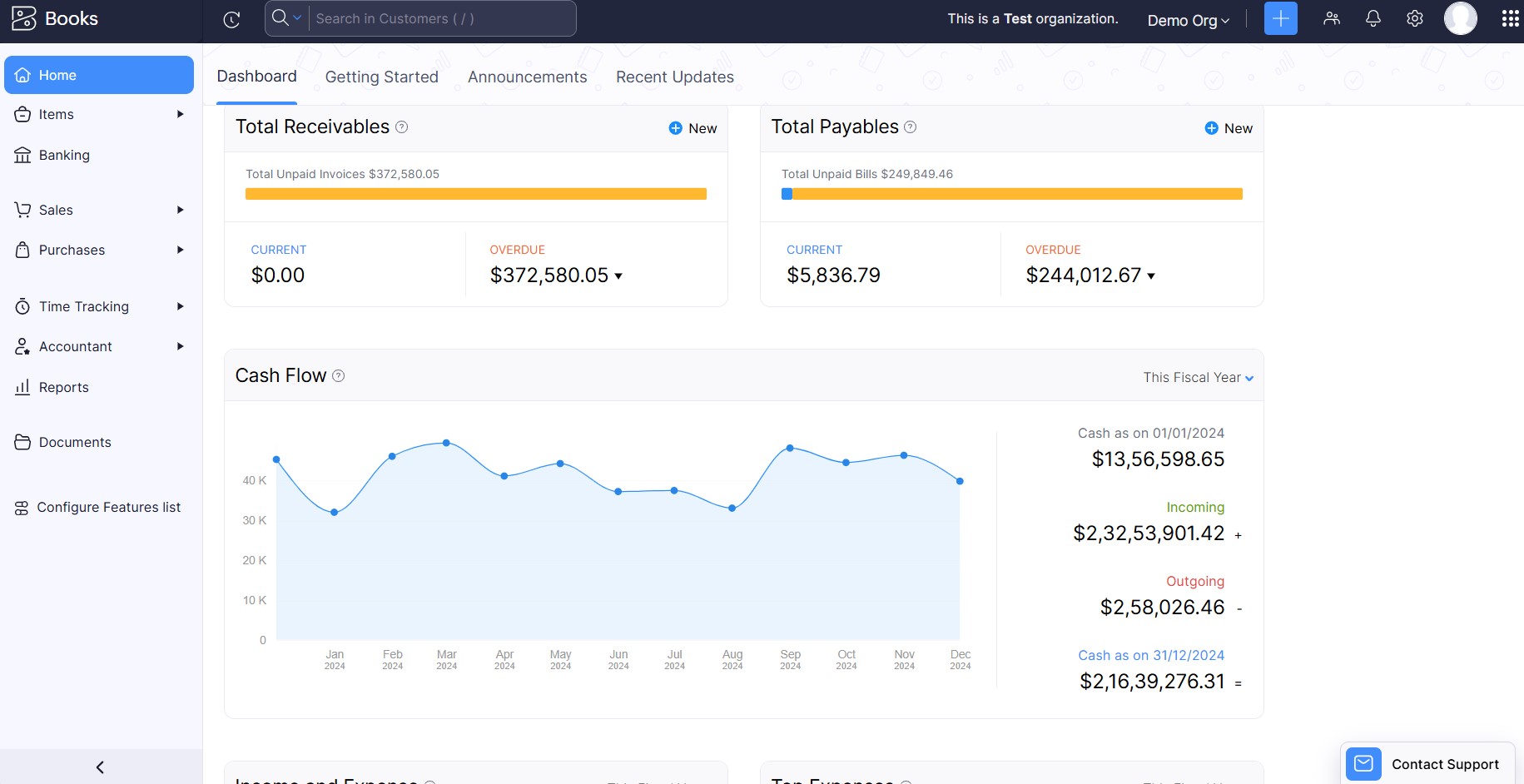

Below is a screenshot of Zoho Books’ inventory management interface, showcasing how to record adjustments for items like damaged goods in real time.

Image via Zoho Books

Prioritizing these key features will guide you in choosing the best accounting software that aligns with your business objectives.

Step 3: Compare Tools Based on These Important Parameters

By now you should have a list of tools that have all the essential features you need from an accounting software solution. However, comparing these tools based on essential parameters is a crucial aspect of how to choose accounting software’ for your business.

Here are some of the key parameters on which you need to compare your shortlisted options.

Scalability

When considering how to choose accounting software for your small business, look for an accounting system that can grow with your business. This is one of the most important tenets of learning how to choose accounting software.

Here are some things to consider when assessing the scalability and growth potential of accounting software:

- Adapts to Growth: As your business grows, the volume of financial transactions increases. The best accounting software should be able to adapt to your growing business needs. Choose accounting software that offers multiple pricing plans catering to businesses of all sizes.

- Multi-Location Support: Another thing to look out for when learning how to choose accounting software for your business is the ability to consolidate financial data seamlessly. You want to pick cloud-based software that can handle multiple users and locations, especially if you have more than one business/business location or require accountant access.

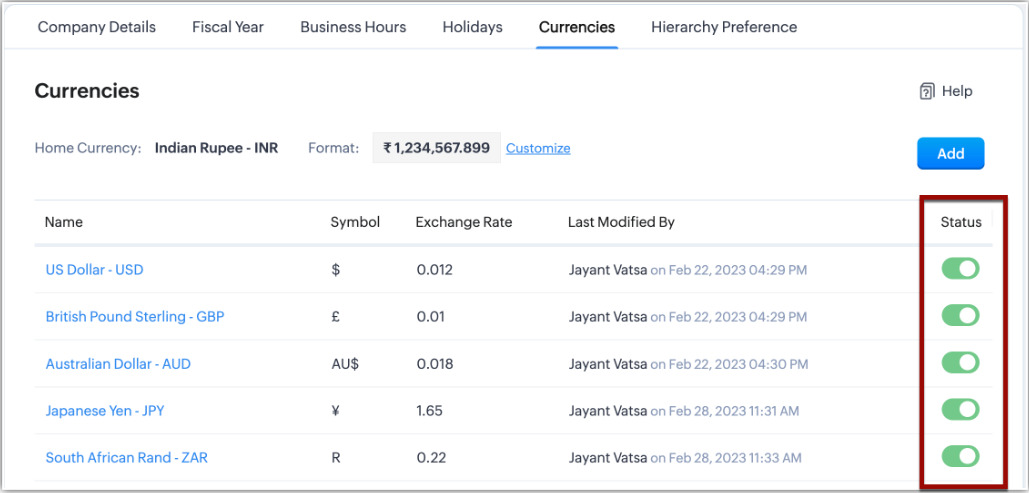

- Flexible Feature Scaling: Choose software solutions that offer plans with varying features, starting from basic functions and scaling up to advanced ones like payroll management and multi-currency support as needed. This way, you pay only for what you use, making it a cost-effective solution.

The image showcases Zoho’s multi-currency interface, where users can manage and enable different currencies for their business transactions, reflecting the platform’s adaptability to global business operations.

Image via Zoho

Integrations

The ability to integrate your accounting software solution with other tools is crucial. It streamlines accounting activities, reduces manual data entry, and ensures that your company’s financial data is up-to-date and accurate.

For example, integrating CRM software for a small business with your accounting solution can greatly enhance customer relationship management while keeping financial data in sync.

This integration can lead to improved customer service, better financial decision-making, and more efficient management of both customer and financial data.

Popular accounting software companies offer integrations with a range of tools, including:

- CRM systems

- Ecommerce platforms

- Payroll services

- Banking apps

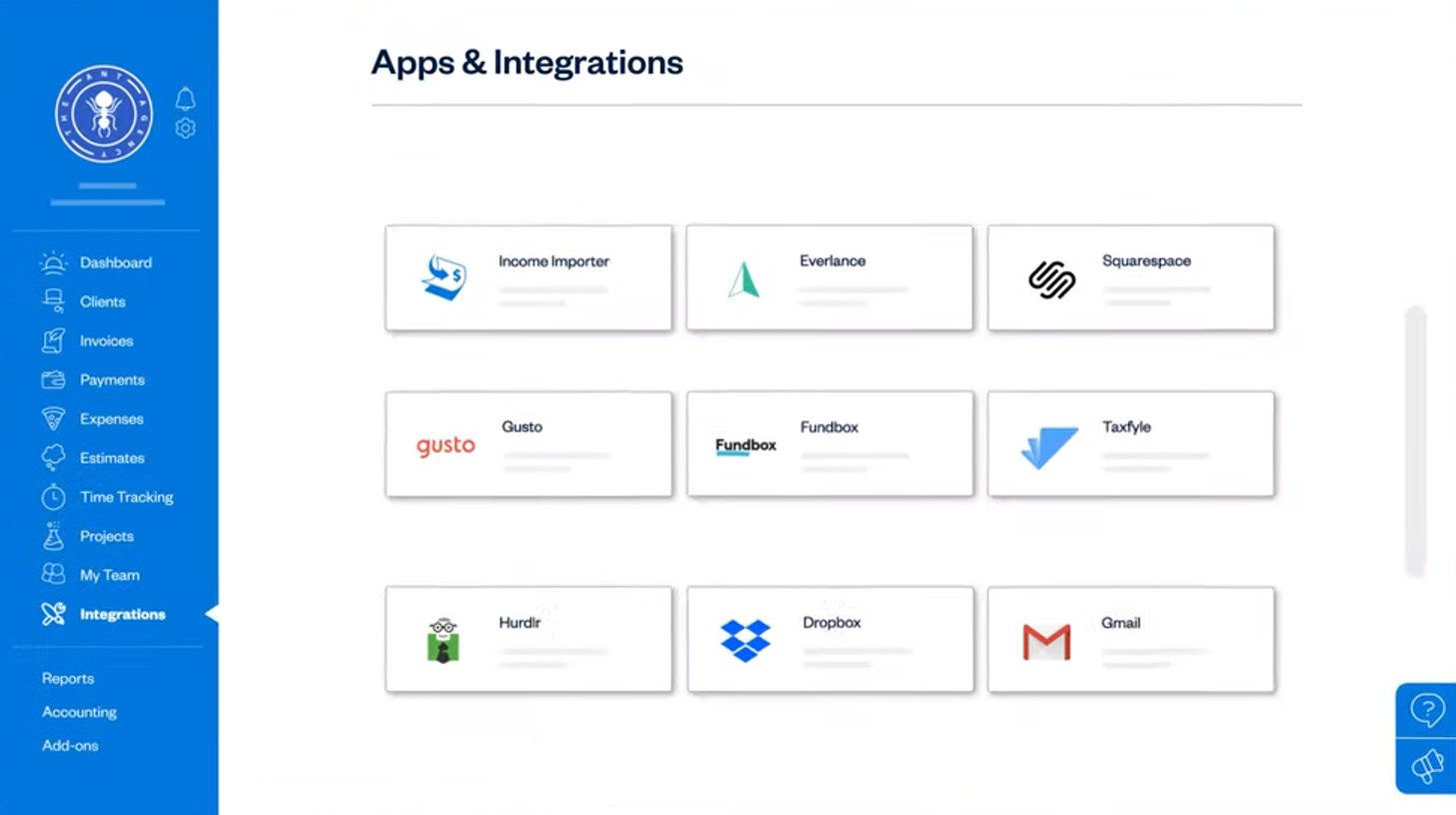

The image below showcases the integration options provided by FreshBooks.

Image via YouTube

These integrations provide a seamless workflow, allowing for efficient management of financial records and better financial performance analysis.

You May Also Like:

Customization Options

The ability to customize software according to specific business requirements is vital. As you navigate how to choose accounting software, look for options with industry-specific features, custom fields, and custom workflow automation.

A retail business, for instance, might need custom fields for inventory management, while a consulting firm might prioritize workflow automation for time tracking and billing.

Customized reporting allows for deeper insights into financial data, while industry-specific modules cater to the unique requirements of sectors like construction or healthcare.

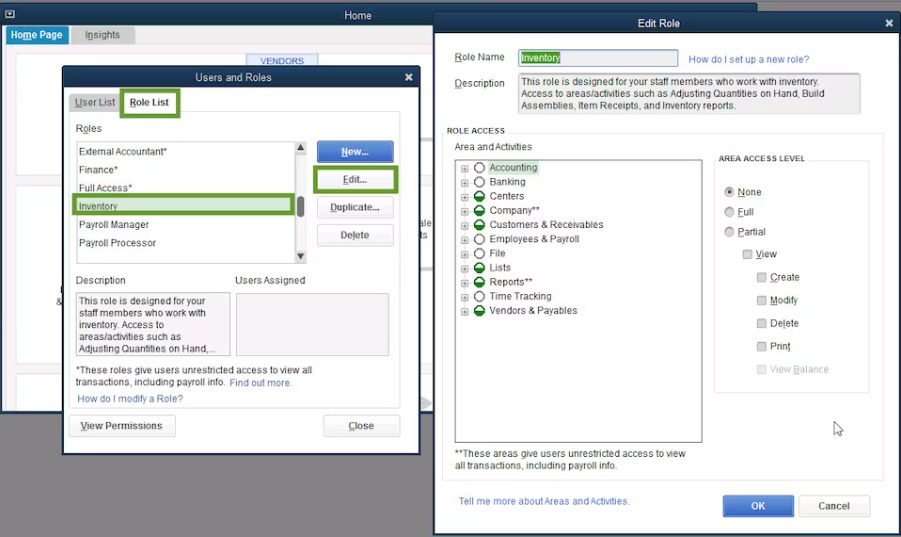

Additionally, the ability to create custom user roles and permissions enhances data security and operational efficiency. It ensures that employees can access only the data and functions they need for their specific roles.

Here is an image showing how you can assign user roles in QuickBooks.

Image via QuickBooks

The more customization options you get, the better you’ll be able to use an accounting solution to its full potential.

Price

Understanding the total cost of ownership is a key aspect of how to choose accounting software that fits your business budget. It’s not just about picking a tool; it’s about understanding the financial commitment you’re making.

Choosing the right accounting software isn’t just about the upfront cost. It’s a blend of various expenses that add up over time.

Let’s look at what makes up the total cost of ownership of an accounting software solution.

1. Initial Purchase or Subscription Fees: The upfront cost or the recurring subscription fees are just the starting point. Consider costs like setup fees, software licenses, and integration expenses. However, remember that the cheapest option isn’t always the most cost-effective in the long run.

2. Setup and Training: Implementing new software often involves training your team and setting up the system, which can add to the costs. It’s crucial to factor these in to avoid surprises later.

3. Maintenance and Support: Ongoing support and maintenance costs are involved to ensure your software stays updated and functional. Think of it as regular servicing to keep your software solution running smoothly.

4. Integration and Compatibility Costs: If your accounting software needs to integrate with multiple tools, integration costs can add up. Ensuring seamless operation with your existing tech stack is key but can come at a price.

5. Downtime and Disruption Costs: During updates or initial implementation, there might be disruptions, potentially affecting your business operations and finances. Planning for these can mitigate unexpected losses.

6. Scalability Costs: As your business grows, so will your software needs. Anticipate future costs for adding features or users to avoid getting boxed in by a system that can’t grow with your business.

Remember, the true cost of accounting software goes beyond the initial price tag. It involves considering long-term expenses like maintenance, integration, and scalability.

Make sure your accounting software solution is cost-effective in the long run for your business.

You May Also Like:

Customer Support

Reliable customer support is crucial when implementing a new accounting system. Poor customer support can cause a poor user experience, even if a tool offers the best features.

That’s why it’s important to compare accounting software solutions on their quality of support before you choose one.

Here’s what to look for when comparing support options:

- Round-the-Clock Support: Opt for software providers that offer round-the-clock support. If you’re working late or on weekends, knowing help is available can be a lifesaver.

- Multiple Support Channels: Look for providers offering support via multiple channels—phone, email, and live chat. This diversity ensures you can get help in a way that suits your preferences and situation.

- Fast Response Times: In the fast-paced world of business, waiting for a support response for several days isn’t practical. Choose a provider known for quick, efficient support.

When you’re choosing an accounting software solution, don’t just think about what it does. Consider the availability of technical support, especially if you have limited internet access or encounter issues outside of regular business hours.

Good customer support is a partnership that can help your business thrive, providing peace of mind and valuable assistance whenever you need it.

Security and Compliance

As you explore how to choose accounting software, prioritize solutions that offer robust security features and comply with relevant industry regulations.

Here are key security features you should look for to ensure safety and compliance in your accounting software solution:

1. Perimeter and Internal Firewalls: Look for an accounting software solution that provides strong perimeter and internal firewalls. These are critical in preventing unauthorized access to your business accounting data, both from external and internal threats.

2. Event Logging and Tracking: Opt for accounting systems that include event logging trackers. This feature helps in monitoring security breaches and identifying potential threats, enhancing the overall safety of your financial records.

3. Encryption of Stored Data: Ensure that the accounting software solution you choose encrypts data, both in transit and at rest. This is especially important for cloud-based accounting software, as it safeguards sensitive information stored online.

4. User Authentication and Authorization: Accounting software should have robust user authentication and authorization mechanisms. This ensures that only authorized personnel can access your business’s financial information.

5. Continuous SSL Encryption: Secure Sockets Layer or SSL encryption is a security technology used for establishing an encrypted link between a server and a client. Ensure the accounting software has SSL encryption to protect your real-time financial data.

As you compare accounting software solutions, pay special attention to the safety features that they offer.

Whether it’s a desktop accounting software solution or a cloud-based solution, prioritize those that offer robust security measures without compromising on functionality.

A secure accounting solution not only protects your data but also fortifies your business against potential cyber threats.

You May Also Like:

Step 4: Get a Demo or Trial to Test Usability When Choosing Accounting Software

Testing the usability of shortlisted accounting software solutions is our final tip on how to choose accounting software that meets your business needs. That said, small business owners should take advantage of the free trials or demos offered by most business accounting software providers.

This allows you to test the software’s features, evaluate its ease of use, and determine if it has what it takes to boost your business’s success.

For instance, you can consider factors such as internet access, data storage, and mobile apps to ensure the software aligns with how your business operates.

That said, here are some things you should test to evaluate which tool is easiest to use:

1. Intuitive Navigation and Design: An accounting tool’s user interface should be clear and easy to navigate. This involves straightforward menus, accessible features, and a layout that simplifies workflows.

Take a look at this well-designed and intuitive Zoho demo dashboard.

Image via Zoho Books

2. Learning Curve: Consider how much training and time it will take for you and your team to become proficient in using the software solution. Software that is easy to understand and use right away can significantly enhance productivity.

3. User Reviews and Feedback: Look for feedback from current users about their experiences with the software. This can give you insights into any usability issues or benefits you might not notice during a short demo.

4. Performance and Compatibility: It’s essential to test how well the tool performs on your existing hardware and network. This includes its response time, stability, and resource utilization. Ensure that the software is compatible with your current systems, including any other business applications you use, to avoid costly infrastructure changes.

5. Data Migration: Assess how straightforward it is to import your existing financial data into the new system. Efficient data migration is key to minimizing disruptions and ensuring continuity in your business operations.

6. Vendor Reputation: Evaluate the vendor’s track record in the industry. Consider their customer support, updated policies, and the overall user community’s satisfaction.

By focusing on these key aspects, you can select accounting software that not only meets your business needs but also contributes to a smoother, more efficient financial management process.

Remember, the right accounting software is a powerful ally in your business’s financial management.

FAQs (Frequently Asked Questions)

Q1. How Do I Choose Good Accounting Software?

A. Choosing the right accounting software involves a step-by-step process that caters to your specific business needs. Here’s a brief overview of the four steps:

Step 1: Identify your business’s unique accounting needs

Step 2: Make a list of tools with must-have features, such as core accounting features and analytics

Step 3: Compare tools based on important parameters, such as scalability, integrations, customization options, etc.

Step 4: Get a demo or trial to test usability and make a choice

By following these steps, you can select accounting software that not only aligns with your business’s current needs but also supports its future growth.

Q2. What are the Criteria for Choosing Accounting Software?

A. When choosing accounting software, look at the provider’s reputation, make sure it’s affordable, and check if it has the features you need. Good customer support is also important, so you can get help if you have problems or questions.

Q3. What Factors Should I Consider When Learning How to Choose Accounting Software?

A. When selecting accounting software, consider the following factors:

- Your business’s unique accounting needs, the complexity of your accounting tasks, and your budget

- Core accounting features like general ledger management, bank reconciliation, invoicing, etc.

- Having a detailed understanding of your requirements will help you choose the best solution for your small business

- Look for software that offers basic accounting functionality, scalability, and integration capabilities

- Customization options; the easier it is to customize the better you’ll be able to use it to its full potential

- User-friendly interface that is easy to navigate

- Data migration capabilities; the easier it is the better

- Quality and responsiveness of customer support and the kind of learning resources available to new users

- Security and compliance features, especially those related to data protection

By taking these factors into account, you can choose accounting software that effectively supports your business operations and adapts to its changing needs.

Q4. What Is the Difference Between AIS and Accounting Software?

A. Accounting Information Systems (AIS) focus on financial records and reports. Enterprise Resource Planning (ERP) systems, which include AIS, cover more business areas.

ERP systems link financial results with other business activities, offering a wider view of your business. They are better for businesses that want to manage many different areas together.

Q5. Do Accountants Use AIS?

A. Yes, accountants use Accounting Information Systems (AIS) a lot. They depend on AIS for detailed financial processing, which helps in keeping accurate records and making good decisions.

AIS is now a key part of modern accounting for its precision and efficiency.

You May Also Like:

Conclusion

Choosing the right accounting software is a big decision for your small business or startup. It’s more than just keeping track of money. It’s about picking a tool that helps your business grow and makes daily tasks easier.

We’ve put together this guide to help you understand what’s important. By understanding your business accounting needs, evaluating essential features, and comparing accounting software providers, you can find the perfect software for your business.

By following this step-by-step guide on how to choose accounting software, you can streamline accounting tasks and improve your business’s success.

Are you ready to empower your financial management with the right software?

Make a list of tools, compare various features, and then try the shortlisted platforms before you make an informed decision. Good luck!