Thinking about turning your rental property into a reliable income source?Smart move!

Before you can start renting out your space, you must get a business license for rental property. This document can help you comply with local laws and protect you from hefty fines.

Beyond that, it protects your investment and gives your business a legal foundation.

Sure, navigating property licenses and regulations can feel like an uphill task, especially if you’re new to it. To help you out, we’ll walk you through the top requirements for getting a business license for rental property to ensure its success.

What Is a Business License for Rental Property?

A business license for rental property permits you to operate a rental property and collect rent. It also adds credibility to you as a landlord and property owner, earning trust with tenants. Plus, it helps you access local resources and get help with resolving disputes in the future.

The rules for obtaining this document depend on location, property type, and how long you plan to rent out the place.

The process, however, is pretty straightforward. Simply apply to the local government or licensing authority and bring ownership documentation, zoning compliance, and any fees required.

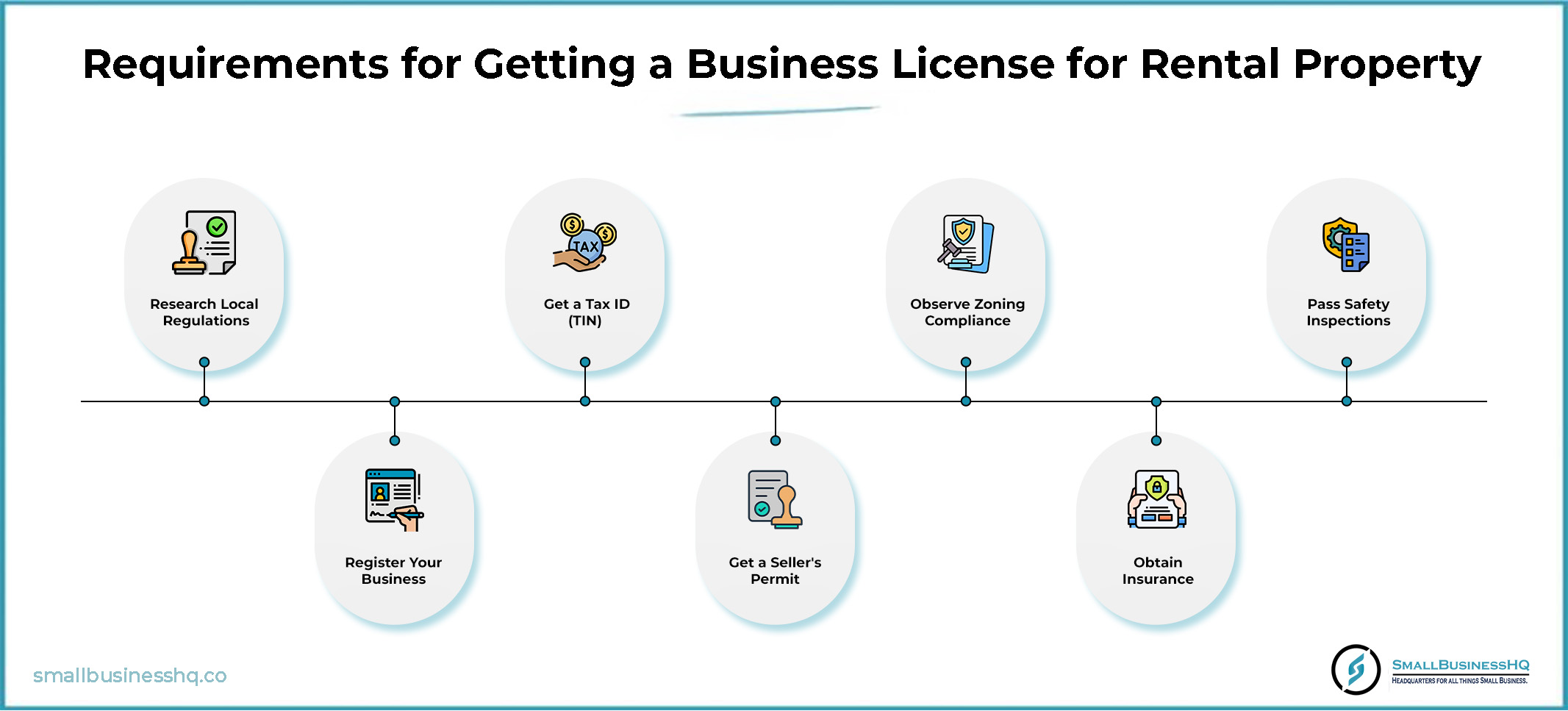

The Requirements for Getting a Business License for Rental Property

Now that you know what a business license for rental property is, you’re a step closer to turning your property into a steady income stream. But before you start collecting those rental checks, here are several must-haves:

1. Research Local Regulations

Before anything else, it’s essential to know that the rules for obtaining a business license for rental property aren’t one-size-fits-all. Every city and county is different when it comes to rental property. While some require landlords to have a business license, some may only need a simple registration.

Fortunately, most information is available online. Just visit your local government’s website or call the business licensing office for the exact requirements. You wouldn’t want to pay those hefty fines!

2. Register Your Business

The next step in getting a business license for rental property is to choose a business structure so you can register it with the state or local authorities. This puts your business name on file, so it’s official and legal. Plus, it provides access to tax benefits and adds credibility with tenants.

If the paperwork seems overwhelming, business formation services like LegalZoom, Bizee, or ZenBusiness can simplify the process. You can also use online tools provided by some local authorities.

3. Obtain a Tax Identification Number (TIN)

Before you can begin enjoying your hard-earned rental income, you need to visit the IRS for a TIN. To do so, complete an application with the IRS and provide all the necessary documentation.

However, if you already have one from another business you own, you don’t need to get another one for the rental business. Once the IRS hands you the TIN, you can report the rental income and pay all the associated taxes.

A TIN is one of the few must-haves in the rental business so you don’t get in trouble with the government.

Also Read:

4. Get a Seller’s Permit

While not a must-have in every city, a seller’s permit may be necessary if your rental business involves selling goods or additional services.

For example, landlords selling products like cleaning supplies or maintenance services to tenants might be required by local laws to obtain this license.

Consult your city’s licensing department to determine if this step is necessary for you when obtaining a business license for rental property.

5. Observe Zoning Compliance

Zoning compliance ensures your property is located in an area designated for rentals. Every city enforces zoning laws to protect neighborhoods and maintain order. Check with local authorities to confirm if your property is eligible for rental use.

You may need to apply for a zoning variance if your unit isn’t zoned for rentals. Getting authorization from local authorities lets you use a property in a way that’s not generally allowed under the area’s zoning rules. Obtain one so you can legally operate and avoid fines.

6. Obtain Insurance

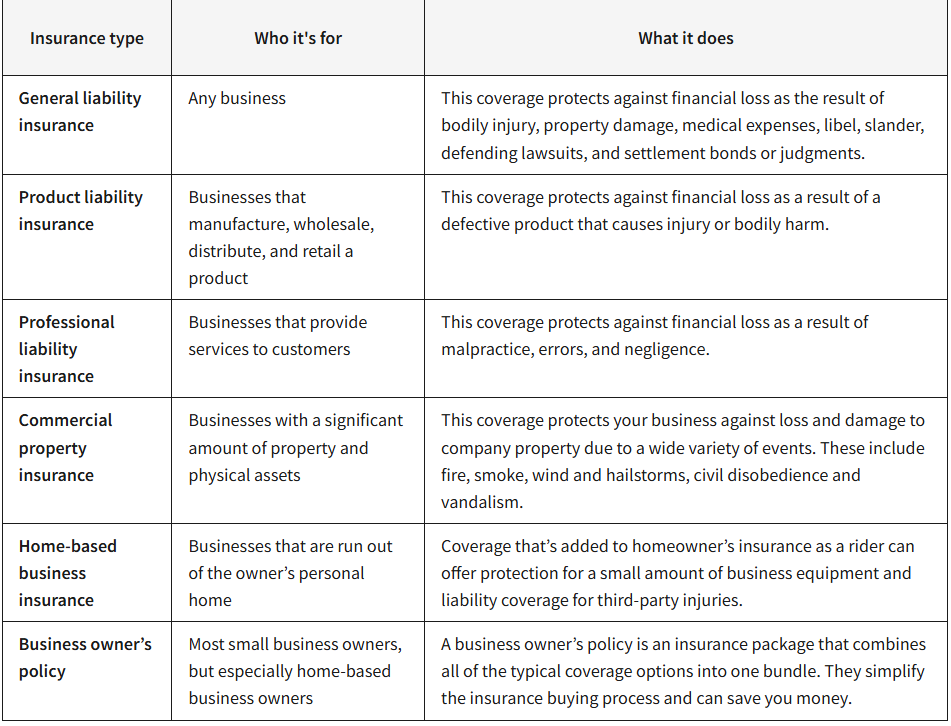

Insurance is a must for rental property owners. Beyond protecting your assets, landlord insurance covers damages, liability issues, and loss of rental income. Most cities require proof of insurance before issuing a business license for rental property.

Also, insurance can keep your business financially secure by protecting you from unexpected expenses. Besides landlord insurance cover, you can also obtain any of the following covers for your rental business:

Image via U.S Small Business Administration

7. Pass Health and Safety Inspections

These inspections ensure that your rental property meets the standards for occupancy. As a landlord, you must comply with local building codes, provide safe living conditions, and make necessary repairs before renting to tenants.

Passing these inspections helps you obtain a business license and builds trust with your tenants. Invest in a pre-inspection consultation with a licensed inspector to identify any potential issues in advance.

Also Read:

FAQ

1. Do I need a business license for a rental property if I only own one unit?

It depends on your local laws. Many cities require a license regardless of how many units you own, so consult your local authorities.

2. How much is the license fee for rental property?

License fees vary by city and can range from $50 to $300 annually. Check with your local licensing office to know the exact licensing fee amounts for your rental property.

3. What happens if I don’t get a business license for rental property?

If you fail to obtain a business license, you might face costly fines, legal issues, or even have your rental business shut down.

4. What documents do I need to register my rental property?

Required documents typically include:

- Duly filled registration forms

- Inspection report

- Proof of ownership

- Registration fees

- Inspection fee

- Lease agreement

- Insurance documentation

5. How often do I need to renew my business license?

Where your rental assets are located will determine the renewal periods, but they’re usually annual. Check the expiration date on your license to ensure you stay compliant.

Also Read:

Wrapping Up

Obtaining a business license for rental property doesn’t have to be intimidating. Just understand local regulations and stay proactive about compliance to protect your assets, satisfy tenants, and set your rental business up for long-term success.

And if you’re still undecided, our rental business ideas guide can give you some insight into some of the most lucrative options in this industry.