When starting a new venture, one of the most important decisions you’ll make is choosing the right business structure.

Two popular options are LLCs and nonprofits. While both offer liability protection, they differ in terms of tax treatment, ownership, and purpose.

In this post, we’ll explore the key differences between LLC vs nonprofit business structures and help you determine which one is right for you.

By the end of this post, you’ll learn how each structure operates and how they differ from each other.

For instance, there are differences in the registration of LLCs vs. nonprofits, how each handles assets during dissolution, and more.

Let’s get started!

What is an LLC?

Before diving into the LLC vs nonprofit comparison, let’s first understand what an LLC is and how it operates.

A Limited Liability Company (LLC) is a hybrid business structure that operates similarly to a corporation, partnership, and sole proprietorship all at once.

It combines some of the best features of each structure, such as liability protection, pass-through taxation, and single-member ownership. This means that your personal assets are shielded from the company’s debts and liabilities.

One of the most significant advantages of a limited liability company is its flexibility. You can choose how you want to be taxed (as a sole proprietorship, partnership, S-corp, or C-corp), and you have more freedom in how you structure your management and ownership. LLCs can also generate revenue and distribute profits to their private owners.

LLCs are governed by an operating agreement, which outlines the roles, responsibilities, and ownership percentages of each member.

Apart from that, LLCs are directed by state laws and regulations that business owners need to know before formation. That is, unless, of course, you get help from LLC formation services. In this case, they’ll take care of everything on your behalf, including drafting an operating agreement for your LLC.

You May Also Like:

What is a Nonprofit?

Now that we’ve covered LLCs, let’s explore the other side of the LLC vs nonprofit comparison—nonprofit corporations.

A nonprofit corporation is a legal entity that is organized for a charitable purpose rather than to generate profits for shareholders. As such, nonprofits enjoy some tax exemption from state, federal, and local taxes, unlike LLCs.

Many nonprofit organizations typically take the form of corporations as far as their structure goes but with some significant differences in operation. They can also take the form of nonprofit LLCs in some states, which offer liability protection to their members.

Now, nonprofit corporations are governed by nonprofit bylaws and overseen by a board of directors.

To qualify as a nonprofit entity under federal law, you must apply for 501(c)(3) status with the IRS. If approved, your organization will typically be exempt from federal income tax and can receive tax deductible contributions from donors.

However, you’ll still need to follow state law requirements for nonprofits, such as registering with your state’s attorney general and filing annual reports.

LLC Vs. Nonprofit: Similarities and Differences

This section will provide a detailed LLC vs nonprofit comparison, highlighting the similarities and differences between these two business structures.

Differences

The amount of paperwork and regulations that go into forming LLC vs. nonprofit entities differs significantly. Here’s a summary of the differences between these two structures.

| LLC | Nonprofit | |

| Formation Process | You can form and operate your LLC in the state of your choice with minimal effort, restrictions, and paperwork. To ensure you cover all required steps, use this LLC formation checklist. | There’s more paperwork involved during registration and more restrictions on how your nonprofit corporation should operate, as outlined in its organizational documents. |

| Economic Motivation | An LLC is a for profit entity that aims to generate revenue for its owners. | Nonprofits operate for a charitable purpose and reinvest any profits back into the organization. |

| Ownership | LLCs are run by members (who are also private owners) who distribute profits among themselves. | Nonprofit corporations are run by a board of directors and are not owned by individual founders or directors. |

| Taxation | LLCs have to pay state and federal income taxes but can be eligible for some tax breaks. They can also choose their tax status. For more information on services that can aid with this, consider reading this ZenBusiness review. | Nonprofits that qualify for 501(c)(3) status are typically exempt from federal income tax |

| Fundraising | LLCs raise capital through investments from owners or loans from banks. | Nonprofits rely heavily on donations and grants from charitable organizations to fund their activities. Donors can claim a deduction on their taxes for tax deductible contributions made to 501(c)(3) organizations. |

| Insolvency | If an LLC gets dissolved, the assets are divided among the members. | Any assets left in a nonprofit entity get distributed to other nonprofits or the state, local, or federal government for public use. |

You May Also Like:

Similarities

Here are some similarities between LLCs and Nonprofit organizations.

- Personal Limited Liability: The same personal liability protection afforded to for-profit businesses like LLCs also applies to nonprofit corporations. This means that a nonprofit organization’s directors, members, workers, or other similarly positioned officials are exempt from personal liability for the company’s debts.

- Tax Benefits: Both LLCs and Nonprofit organizations enjoy tax benefits. An LLC will enjoy pass-through taxation, unlike other forms of businesses like Corporations.

Nonprofit organizations, on the other hand, are eligible for a wide variety of tax breaks under 501(c)(3). They can also raise capital from both the government and private institutions.

You May Also Like:

Advantages and Disadvantages of an LLC

When considering an LLC vs nonprofit, it’s important to weigh the advantages and disadvantages of each structure. Let’s start with the pros and cons of forming an LLC.

Advantages

Here are some advantages to choosing this structure for your business entity:

- Liability Protection: Since an LLC is legally considered a separate legal entity, this protects its members from personal financial loss. The personal assets of members cannot be used to pay business debts and a member’s liability is capped at the value of their initial investment.

- Pass-through taxation: Limited Liability Companies operate as pass-through entities. This means that the profits, losses, deductions, and gains of the company pass through to its member(s) in their ownership proportions.

- Flexible management structure: Members of a limited liability company can choose how to manage their business. This includes whether they want to manage it themselves or choose managers to do it on their behalf. For help in forming your LLC, consider exploring the best LLC services.

They then report these taxes as part of their individual tax returns.

This makes LLCs a suitable structure for a few business owners who want to run a business together or for many owners who live far apart.

Disadvantages

- Attracting Investors: It can be more difficult to attract investors with an LLC as opposed to structures like corporations, for instance. Everything about S-Corps and C-Corps is more favorable for investors, from the way they are taxed to the way they interact with shareholders, unlike LLCs.

- Filing and Renewal Fees: LLCs in most states require filing fees during registration and consequent renewal fees every other year. These fees could be high, depending on the state law where your business was formed.

- Transfer of Ownership: Unlike Corporations, LLCs make it more difficult to transfer ownership interest. Adding new members to an LLC or changing the ownership percentages of current members typically requires the approval of all members.

However, this is only relevant if you’re looking to build a large enterprise and may not be as important for small businesses.

You May Also Like:

Advantages and Disadvantages of a Nonprofit

Nonprofit organizations mostly have the structure of corporations. However, they have some significant traits that differ from those of for-profit corporations.

Here are some advantages and disadvantages to starting a nonprofit business:

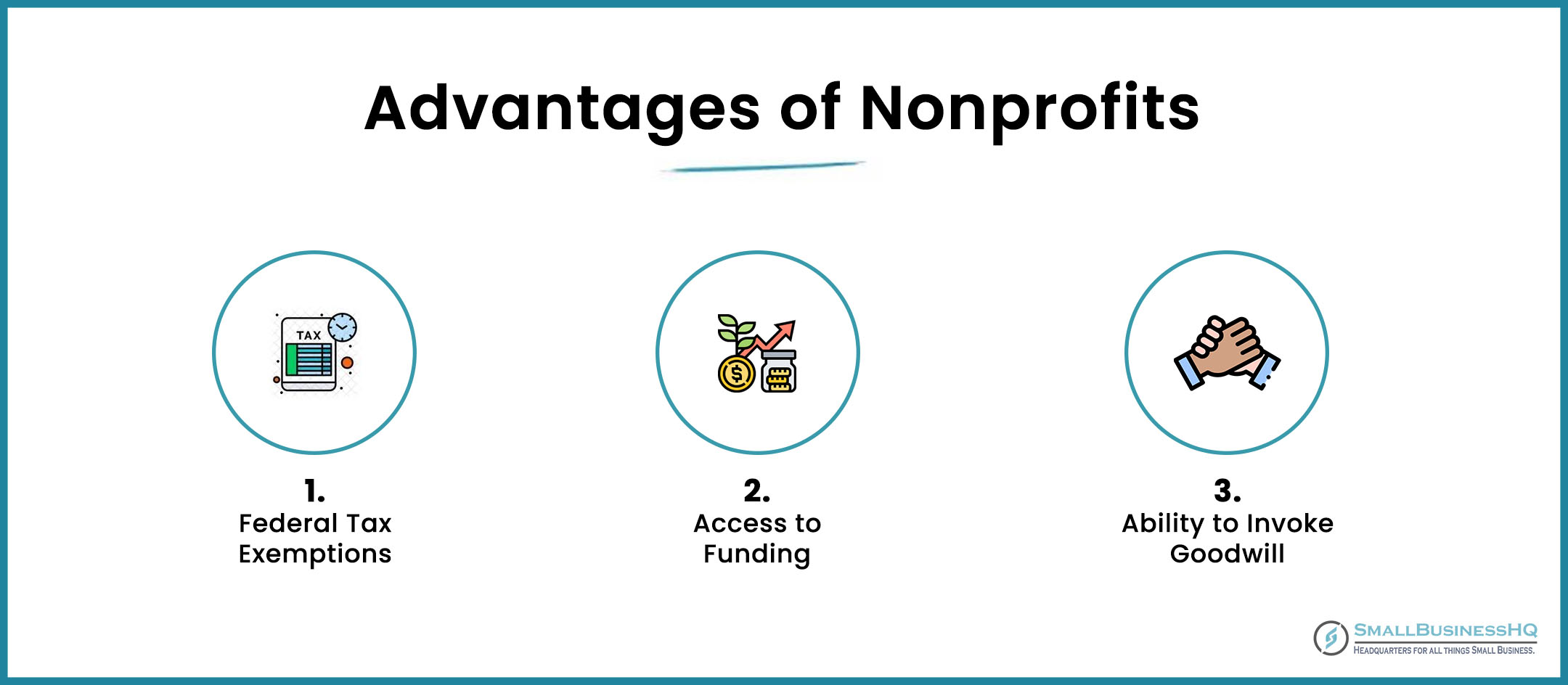

Advantages

- Exemptions from Federal Taxes: This is one of the biggest advantages of starting a nonprofit corporation. By being tax-exempt, nonprofits can retain more finances and use them for their charitable purposes.

- Funding from Both Public and Private Sources: Nonprofits can raise capital by applying for charitable grants from public and private institutions as well as receiving donations from willing contributors. They also get discounts on products from corporations looking to give back to society.

- Goodwill: Nonprofits fill a unique position in society that attracts goodwill from individuals. This helps them acquire resources that may not come easily for profit-making businesses.

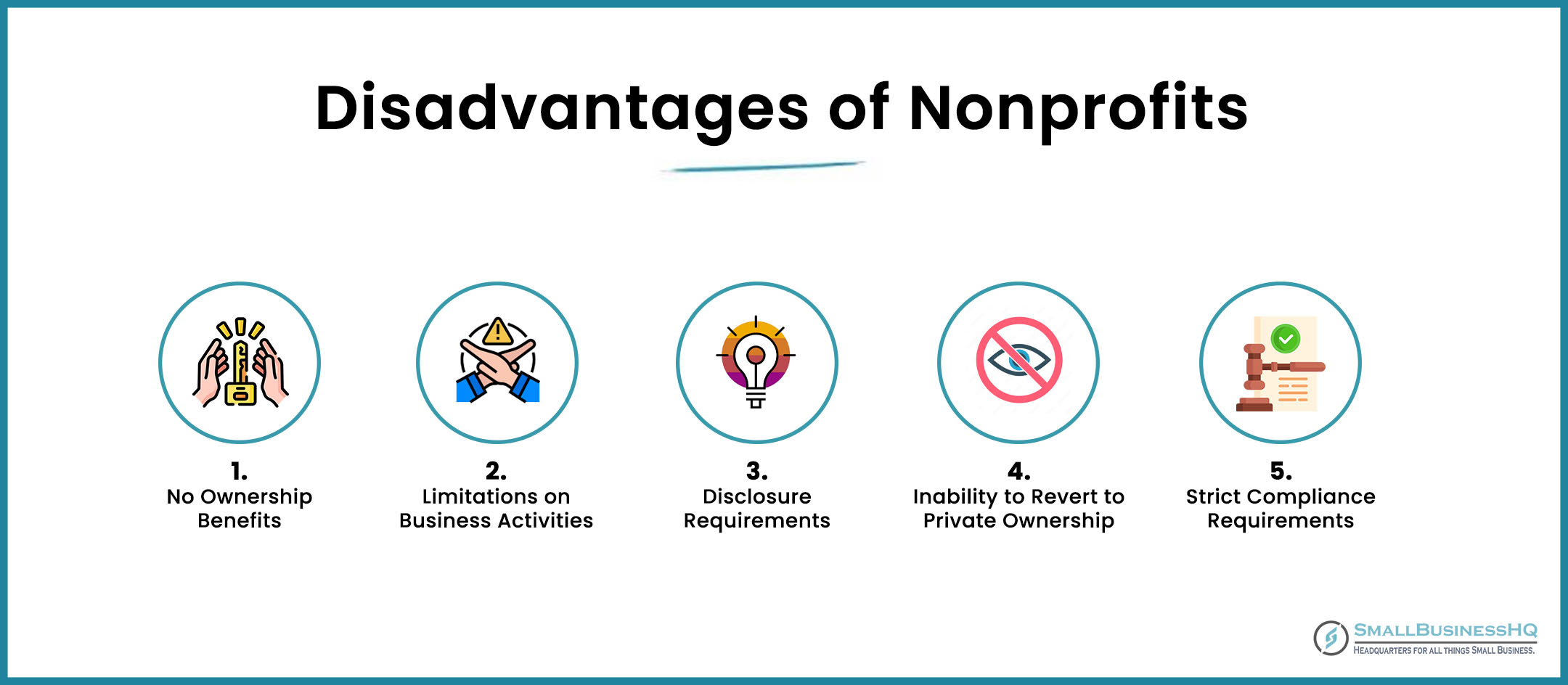

Disadvantages

- No Ownership: Being the founder of a nonprofit organization gives you minimal benefits. First, you can’t be the owner, meaning you may not get the upper hand in decision-making as you would in other business structures.

- Limitations on Business Activities: To retain their tax-exempt status, Nonprofit Corporations have to follow some restrictive guidelines, such as not being able to participate in political activities.

- Disclosure requirements: Nonprofits have no privacy in the way they handle their finances as they are required to share their financial reports publicly.

- Inability to revert to private ownership: Even if the value of a Nonprofit organization increases, the members are not allowed to recoup these benefits.

- Strict Ongoing Compliance Requirements: Nonprofit corporations can still lose their tax exemption benefits if they fail to follow the compliance requirements set by federal law and state law. This includes failure to file annual returns with the IRS, engaging in restricted activities, etc.

So it may not be the best form of business if you’re building value in the form of assets, etc. Once your investment goes in, its benefits may never come back to you.

You May Also Like:

Things to Consider Before Starting a Nonprofit

Nonprofit organizations can take different structures, the most common one being a Corporation.

Most states require nonprofit organizations to operate as corporations. However, some states, like California and Michigan, allow for nonprofit LLC registration.

Although a limited liability company (LLC) is not a tax exempt organization, a nonprofit that operates as an LLC typically is, provided the LLC chooses to be classified as a corporation for tax purposes. For further assistance with this, consider exploring the best LLC services.

Some states go a step further by requesting a statement of intent from nonprofits that choose to be structured as LLCs.

If a Nonprofit organization takes the incorporation route, it must follow all the rules applicable to Corporations in their chosen state. Some of these rules are:

- Have a board of directors in place.

- File Articles of Incorporation with the state Secretary of State.

- Draft company bylaws.

The only difference will be that the Corporation will apply for tax-exempt status and won’t have to pay state and federal income taxes, and in most states, sales taxes as well.

To become tax-exempt organizations, nonprofit businesses need to fill out Form 501(c)(3) with the Internal Revenue Service (IRS).

It’s worth noting that to receive federal tax exemptions from the IRS, an LLC must have members who are all nonprofit organizations in their own right.

For instance, if four different 501(c)(3) organizations decide to form a Nonprofit LLC, that entity will be free from federal income taxation.

Sounds too complex? Applying for a 501(c)(3) federal tax-exempt status can be difficult and time-consuming. Luckily, business formation services like Incfile or LegalZoom can help you start your Nonprofit hassle-free.

You May Also Like:

How to Incorporate a Nonprofit

If you’ve decided that a nonprofit is the better option in the LLC vs nonprofit debate, here’s a step-by-step guide on how to incorporate your nonprofit organization.

- Step 1: Choose your company name and make sure it’s not already taken by conducting a business name search.

- Step 2: Draft and submit Articles of Incorporation to the proper authorities. If you don’t know where to begin with this, you can get a customizable draft from Inc Authority or ZenBusiness.

- Step 3: Create company bylaws that will govern your company’s daily operations. This step is optional but highly recommended. In fact, most business formation services like Incfile, ZenBusines, or LegalZoom include a draft of nonprofit bylaws as part of their paid packages.

- Step 4: Hold your first meeting where you’ll appoint your trustees or board of directors and formally present your bylaws. During this meeting, you’ll discuss your annual budget and fundraising strategy and make important business decisions. You’ll also need to record the minutes of the meeting.

- Step 5: Get an EIN (Employer Identification Number) as required by the IRS for tax purposes. You can either apply for one on the IRS website or seek the help of business formation services like Incfile or any other Incfile alternatives, for a fee.

- Step 6: Apply for tax exemption. Your Nonprofit Corporation will be required to pay all applicable taxes (federal, state, and local) until it is granted tax-exempt status by the IRS.

Differences Between Nonprofit and For-Profit Corporations

While most nonprofits have the structure of a corporation, there are significant differences between them and corporations that are built to make profits.

Here are a few key differences.

| Nonprofit Corporations | For-profit Corporations | |

| Ownership | They are built to help the public and therefore can’t have individual owners. | They are built to make profits and therefore have individual owners. |

| Dissolution | Assets are transferred to other institutions serving the public. | Assets can be divided among shareholders. |

| Tax Exemptions | They’re exempt from some or all state or federal income taxes. | They are subject to double taxation, once at the federal level and once at the state level. |

| Profits | Must reinvest profits back into the business. | Can share profit among shareholders. |

| Limitations on Activities | Can only carry out the tasks mentioned in the federal tax exemption regulations to retain its tax-exempt status. | Minimal limitations on business activities. |

| Public Inspection | Their finances and activities are open to public scrutiny. | Their finances are private unless their shares are listed to be traded in the stock markets. |

Tools to Help You Form Your LLC or Nonprofit Organization

Starting an LLC or a Nonprofit organization can be daunting, especially if you’re a beginner with little to no knowledge of the process.

Luckily, there are numerous business formation services in the market that can help you with that. They also provide services to help get your business off the ground.

These include drafting an LLC operating agreement or corporate bylaws, applying for an EIN, compliance reminders, tax consultations, and more.

Here’s a quick overview of some of the best LLC services to help form your LLC or Nonprofit business.

1. Bizee (formerly Incfile)

Image via Bizee

Best for entrepreneurs looking for affordable formation services.

Bizee offers business formation services for LLCs, Nonprofit organizations, and other business entities. It was formed in 2004 and has since helped form over 1 million businesses. You can read more about it in this detailed Incfile review.

2. Inc Authority

Image via Inc Authority

Best for business formation and growth packages.

Inc Authority is best known for its free LLC formation services and excellent customer reviews.

The platform also offers other business growth services like business funding and trademarks. Read more on this solution here.

You May Also Like:

3. LegalZoom

Image via LegalZoom

Best for businesses that need ongoing legal services.

This is another one of the most popular online business formation tools that has been in business for over 20 years.

The platform has aided in the formation of over 2 million businesses since its formation. If you find that LegalZoom is not ideal for your business formation needs, you can consider some LegalZoom alternatives.

4. ZenBusiness

Image via ZenBusiness

Best for businesses looking for popular LLC formation services.

This LLC formation service provider helps businesses get started for free and provides additional services to help them run smoothly.

However, if you’re looking to form a Nonprofit, you may want to consider LegalZoom. Here’s a ZenBusiness vs. LegalZoom comparison showing services provided by each platform.

5. Rocket Lawyer

Image via Rocket Lawyer

Best for businesses seeking legal advice and document creation.

Launched in 2008, Rocket Lawyer is an online legal service that helps you create legal documents, including those needed to form an LLC or a nonprofit entity. They offer their 20 million+ users a user-friendly interface and step-by-step guidance, making it easy for you to navigate the process of creating an operating agreement or nonprofit bylaws.

You can read more about Rocket Lawyer in this detailed guide to the best Incfile alternatives.

You May Also Like:

Frequently Asked Questions

Q1. What are the benefits of an LLC over a Nonprofit?

Some of the benefits of starting an LLC over a Nonprofit include:

- You’ll be able to generate profits and recoup on any investments in an LLC as opposed to a nonprofit.

- Ownership in an LLC comes with several benefits, such as more power in decision-making.

- In the case of LLCs, there is no public scrutiny involved, and businesses have the freedom to make any financial decisions without being accountable to the public.

Q2. Are most Nonprofits LLCs or Corporations?

Most Nonprofit organizations take the form of Corporations as opposed to LLCs. As such, they have to follow state laws for Corporations.

However, some states like California allow for Nonprofits to be LLCs. In this case, they’re guided by state LLC laws.

Q3. What is the difference between a Nonprofit and a Limited Liability Company?

Some differences between a Nonprofit and an LLC include:

- LLCs are formed to make profits while Nonprofits are formed for the good of the public. Some examples of Nonprofit organizations include religious foundations, schools, research centers, etc.

- Forming Nonprofit organizations involves a lot more paperwork than forming LLCs.

- Nonprofits are not owned by any individuals but are instead run by a board of directors. LLCs are owned and run by members.

- Nonprofits are exempt from paying federal and state income taxes while LLCs are subject to pass-through income taxation.

- If an LLC gets dissolved, assets are shared among the owners. With Nonprofits, the assets are transferred to other charities, NGOs, or government bodies for public use.

Q4. What is the best business structure for a Nonprofit?

It’s more convenient to structure your Nonprofit as a C-Corporation. This is because structures like LLCs can be limited by certain state laws.

In fact, some states do not allow for the formation of Nonprofit LLCs, which can be an additional hurdle. You’ll also face some difficulties trying to acquire tax-exempt status for a Nonprofit LLC.

Q5. Where do Nonprofits get the most money?

Here are some of the top ways nonprofits generate revenue or get their funding:

- Donations

- Charitable grants from private foundations

- Corporate sponsorships

- Membership fees

- Selling goods and services

LLC vs. Nonprofit: Wrap-Up

It’s important to choose a business structure that protects your personal assets and aligns with your long-term objectives. If you want to create value and reap financial rewards, then an LLC may be a better option for you.

However, if you’re looking to build a business dedicated to serving a charitable purpose, then you can choose a nonprofit corporation. Be sure to check the state regulations before registering your business anywhere in the US.

Having trouble with business formation in general? Here are a few business formation services you could explore.