FreeAgent is one of the best accounting software for small businesses. Its user-friendly interface and project management and collaboration features make it a powerful tool.

However, the need for more affordable options has businesses trying out FreeAgent alternatives like Zoho Books and QuickBooks.

That’s why, in this post, we’ll explore the best 7 FreeAgent alternatives for 2025. These platforms offer a range of features and pricing structures, each with its unique advantages and strengths.

We’ll also take a look at their pros and cons to help you find the perfect fit for your business.

But first…

Quick Summary: Best FreeAgent Alternative by Type

- Best FreeAgent Alternatives for Invoicing: QuickBooks Online, Zoho Books

- Best FreeAgent Alternatives With a Free Plan: Wave Accounting, Zoho Books

- Best FreeAgent Alternatives for Growing Businesses: Xero, QuickBooks Online, KashFlow

- Best FreeAgent Alternatives for Freelancers and Solopreneurs: Wave Accounting

- Best FreeAgent Alternatives for Inventory Management: FreshBooks, QuickBooks, Zoho Books

How We Chose the Best FreeAgent Alternatives

You need to consider various factors to decide if a tool is right for you. Each factor might differ in priority for different businesses. Still, some factors are crucial regardless of the business.

Hence, to curate this list of FreeAgent alternatives, we carefully checked the factors below.

- Business Needs: We assess the capacity of each of these FreeAgent alternatives to meet diverse businesses’ financial accounting requirements. This includes project management, tax support, sales and expense tracking, and invoicing so you can avoid common tax errors.

- Pricing: While we try to focus on free FreeAgent alternatives, we also consider options with additional paid features. We carefully evaluate these features to ensure a balance between cost and functionality.

- Ease of Use: Our goal is to recommend FreeAgent alternatives without a steep learning curve for users. To do this, we assess the intuitiveness of the platform’s interface, accessibility for users at various skill levels, and ease of navigation.

- Scalability: As a business grows, so should its tools. To determine the scalability of these FreeAgent alternatives, we evaluate their potential to grow alongside businesses, accommodating expanding needs.

- Integration Capabilities: Easy integration allows for enhanced collaboration, automation, efficiency, and reduced costs. So, we prioritize how seamlessly these FreeAgent alternatives integrate with other tools like CRM systems, project management platforms, and payment processors.

- Features: While choosing the best FreeAgent alternatives, we consider the range of functionalities offered by each platform. These features include payroll management, collaboration capabilities, financial reporting, sales and expense tracking, and invoicing.

- Customization Options: Excellent customization options allow small businesses to tailor a tool to fit specific needs. Hence, we assess how easy it is to customize these FreeAgent alternatives to specific business preferences and needs for a satisfying user experience.

- Customer Support: Finally, we look for FreeAgent alternatives with different customer support options. Some of the options we consider include live chat support, email support, phone support, community forums, and knowledge base resources.

Now that you know how we choose the best FreeAgent alternatives, let’s look at the platforms that made the list.

7 Best FreeAgent Alternatives for 2025

As a small business owner with budget constraints, you may initially go with a spreadsheet to track your finances.

However, tracking business transactions becomes more tasking as you expand. That’s why you need accounting software for small business to streamline the process.

Aside from saving time and effort, some other benefits of using accounting software include:

- Simplified payments

- Real-time updates

- Easy collaboration

- Minimal errors

- Easy invoicing and billing

That said, let’s dive into the best FreeAgent alternatives and discuss their key features.

Don’t get me wrong; FreeAgent is a reliable tool. But like most accounting software, it has its drawbacks.

So, if you’re looking for FreeAgent alternatives, here are the best ones out there that you can consider.

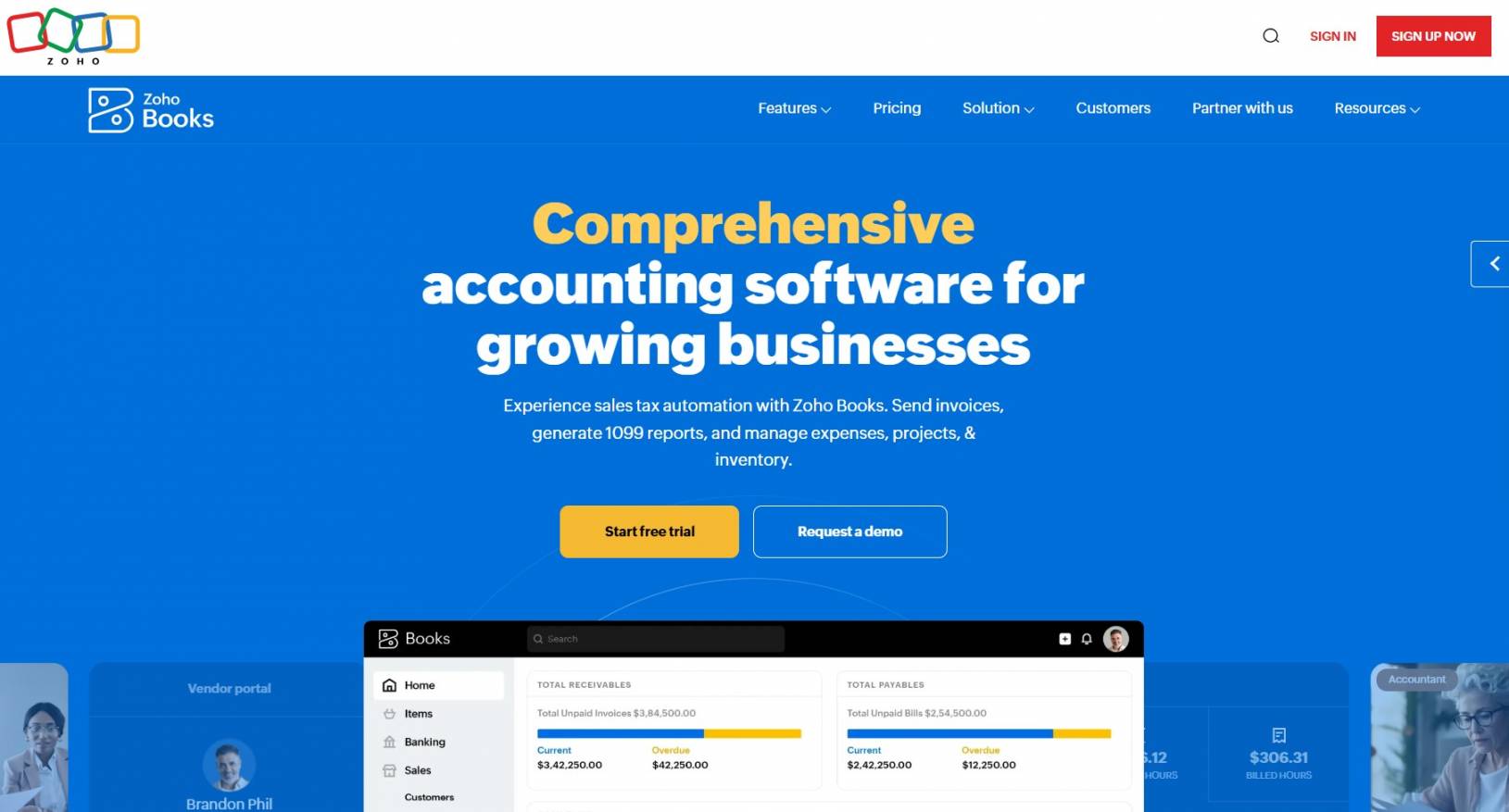

1. Zoho Books

Image via Zoho Books

Zoho Books is a solid and affordable cloud-based business accounting software solution. It’s one of the best FreeAgent alternatives that comes with project and inventory management systems and a customer relationship management solution, as detailed in this Zoho Books Review.

That’s not all!

This tool also provides features like custom reports, automated payment reminders, invoicing, and tax compliance. All of which makes it one of the best FreeAgent alternatives.

Even more, while Zoho Books is appreciated by small businesses for its affordability, it’s also one of the more scalable FreeAgent alternatives. It’s a go-to choice for large companies with advanced financial accounting needs.

This accounting software also streamlines your operations by integrating seamlessly with other business solutions.

Plus, it helps you convert quotes into invoices for quick payments. And it allows you to manage accounts payable for better financial planning and insights into how resources are spent.

Additionally, Zoho Books lets you connect your bank account to compile and sort your transactions for better bank reconciliation.

Key Features

- Comprehensive accounting software for streamlining invoicing and managing account receivables.

- Allows clients to create customer portals for a detailed view of transactions.

- Seamless bill management to track accounts payable.

- Fetches bank transactions to categorize and reconcile accounts easily.

- Advanced inventory management feature to monitor fast-selling products and keep them well-stocked.

- Allows you to send sales orders and track Sales Tax liability.

- Schedules financial reports for real-time data on sales, accounts receivable, and expenses.

Pros

- Integrates seamlessly with the entire Zoho suite for easy business operations management.

- Has a clean and easy-to-use interface.

- Keeps users tax season ready and compliant with Sales Tax liability tracking.

- Provides customizable invoices for online payments.

Cons

- Doesn’t integrate well with third-party solutions out of the Zoho suite.

- Has a limit of 15 users, even with the highest-paid plan.

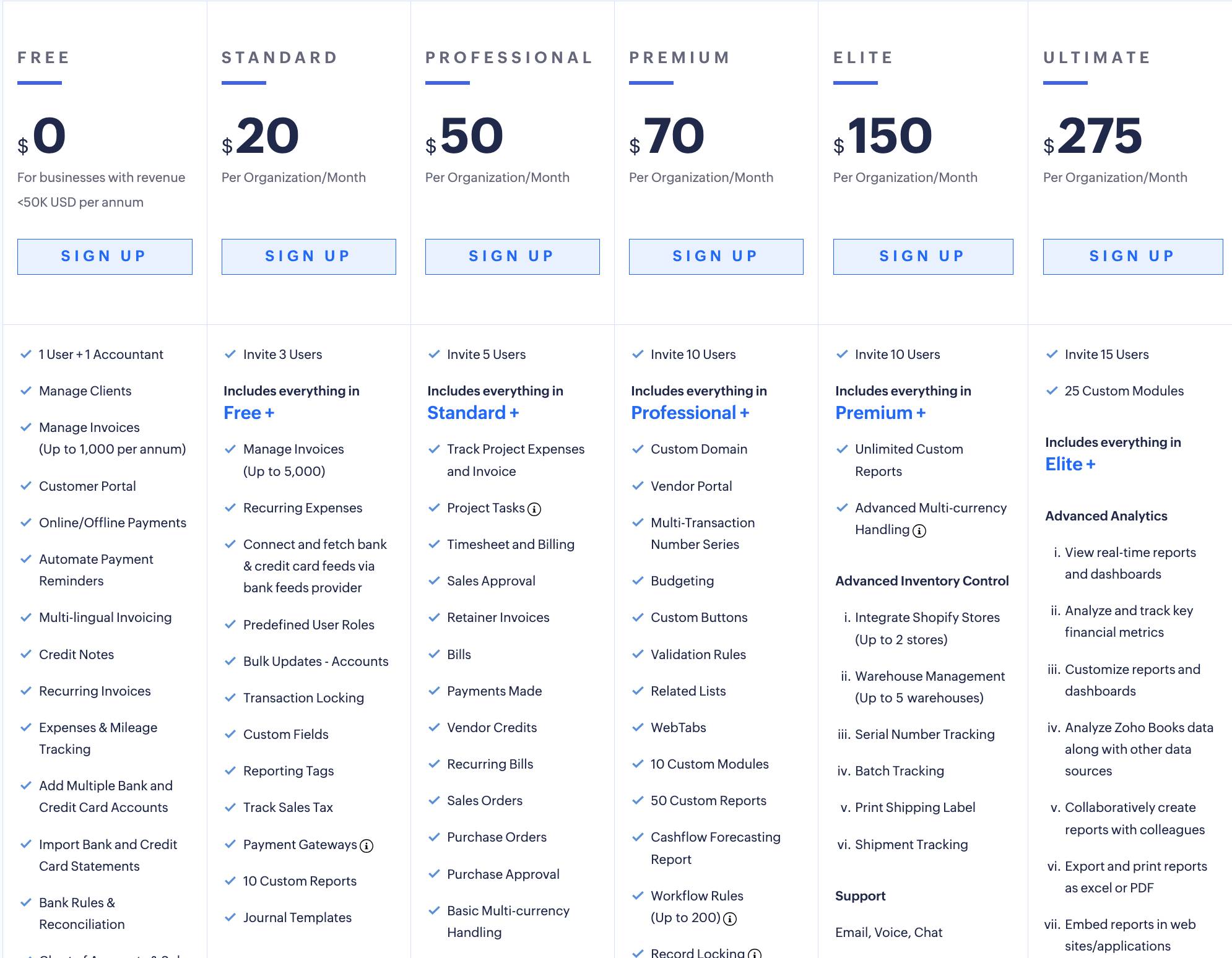

Pricing

Zoho Books comes with a limited free plan and five paid plans for companies of various sizes.

- Free: 1 user and 1 accountant

- Standard: $20/month for 3 users

- Professional: $50/month for 5 users

- Premium: $70/month for 10 users

- Elite: $150/month for 10 users

- Ultimate: $275/month for 15 users

Image via Zoho Books

Tool Level

- Beginner/Intermediate

Usability

- User-friendly and intuitive

Pro Tip: Create professional invoices and estimates using Zoho Book’s customization options.

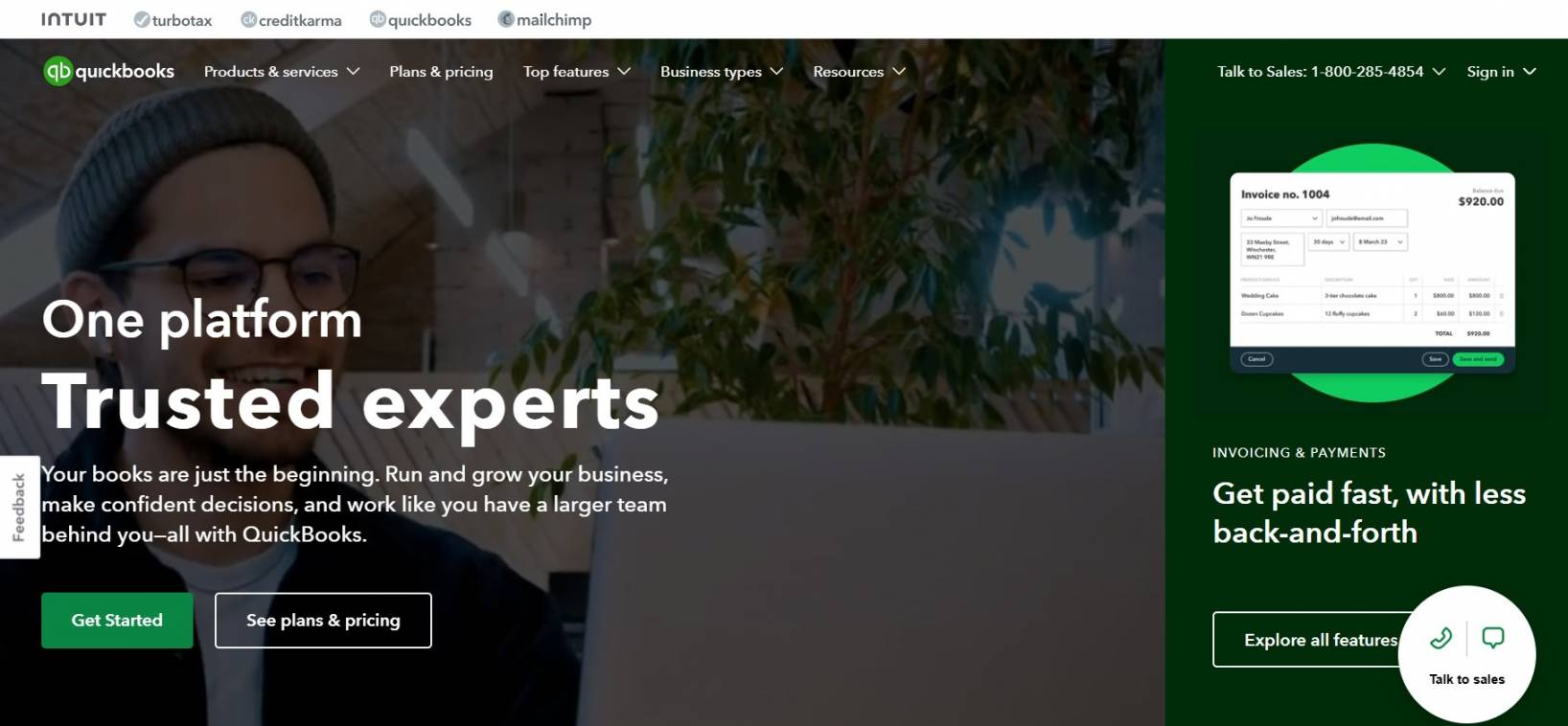

2. QuickBooks Online

Image via QuickBooks

QuickBooks Online is another cloud-based accounting software solution used by small businesses and personal finance for its powerful features. It allows clients to manage banking operations and create and send recurring invoices seamlessly.

As one of the most comprehensive FreeAgent alternatives, it offers robust tools that allow organizations to automate data collection and tax calculation. More so, it comes with features that support custom report generation and sales monitoring.

QuickBooks Online also offers innovative reporting capabilities. Every plan comes with the basics, like cash flow tracking, profit and loss statements, and balance sheets. The higher-tier plans, on the other hand, come with more advanced accounting reports.

Even better, this software solution is compatible with multiple devices and offers auto-syncing options. It’s one of the FreeAgent alternatives that ensures that you are always up-to-date.

Plus, you get a 30-day free trial to check out its features and decide if QuickBooks Online is the right fit for you.

Key Features

- Creation of professional invoices, automated reminders, purchase orders, financial reports, and expedited payments using QuickBooks Online Payments.

- Time-tracking capabilities to monitor billable hours.

- Seamless integration with checking bank accounts for transaction reconciliation.

- QuickBooks Online mobile app that allows you to handle transactions on the go.

- Third-party app integration to take care of tasks from a single place.

- Easy data migration that allows you to import data from different platforms using CSV files.

- Real-time reporting to keep track of business performance.

Pros

- Easily scalable, making it suitable for small and medium-sized businesses.

- Implements robust security measures to protect users’ sensitive financial data.

- Automatically syncs and reconciles bank transactions.

- Cloud-based software and a mobile app that allows users to access financial data from anywhere with internet connectivity.

Cons

- A slight learning curve, especially for those new to cloud accounting software.

- All pricing plans have limited users.

- Users can incur additional costs for certain advanced features and add-ons.

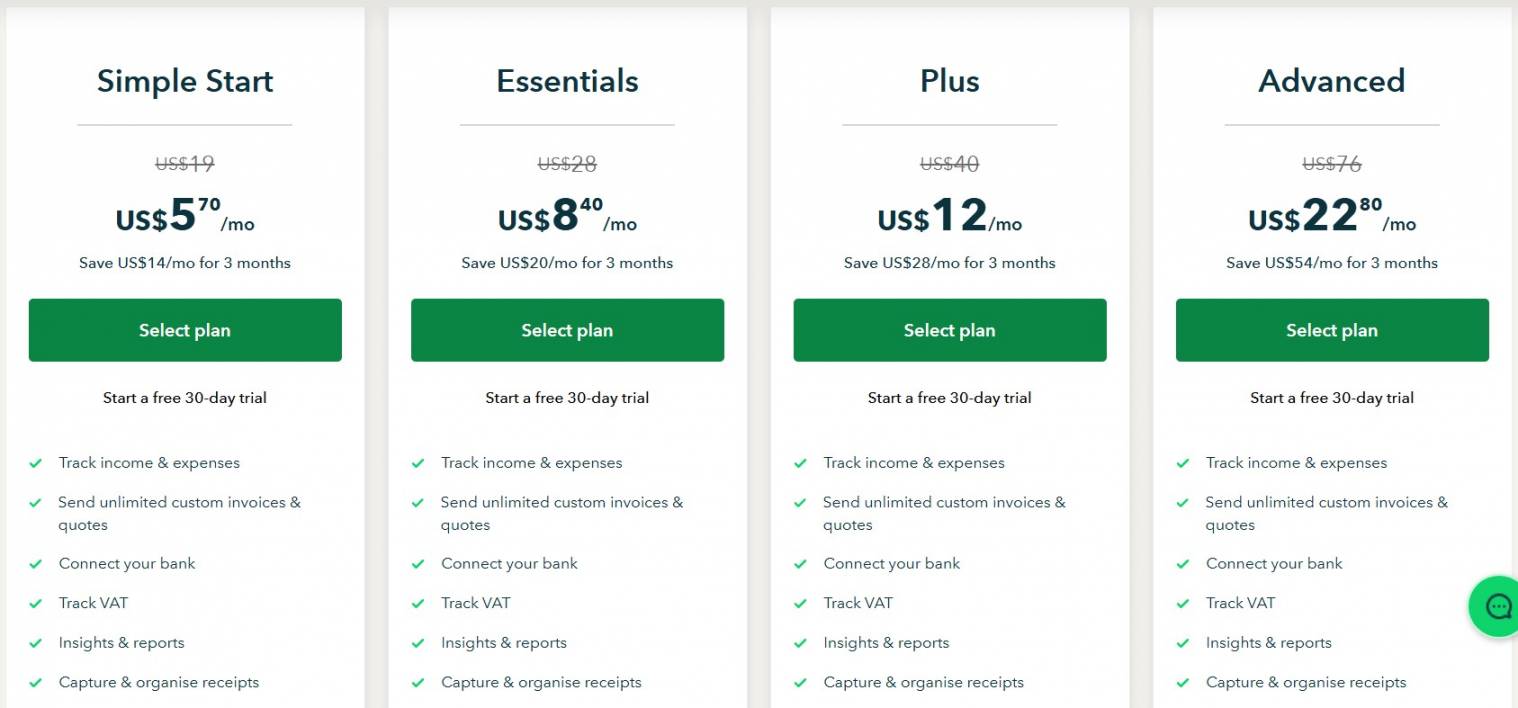

Pricing

Along with a free 30-day trial, QuickBooks Online also offers paid subscription plans.

- Simple Start: $19/month

- Essentials: $28/month

- Plus: $40/month

- Advanced: $76/month

Image via QuickBooks

Tool Level

- Beginner/Intermediate

Usability

- User-friendly with a slight learning curve for beginners.

Pro Tip: Connect your bank accounts and credit cards to QuickBooks Online to automatically import and categorize your expenses and cash flow.

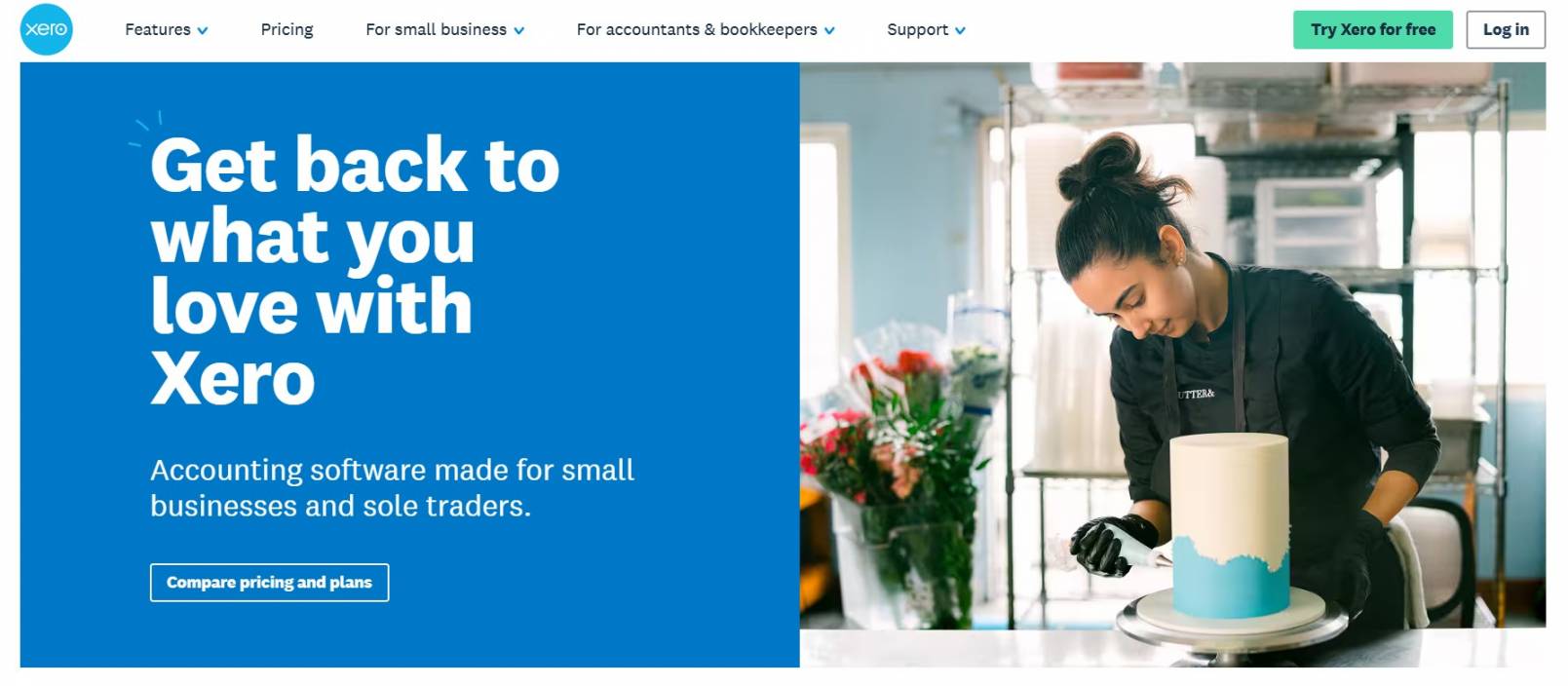

3.Xero

Image via Xero

Next on our best FreeAgent alternatives list is Xero — a popular accounting software with automated features that help you save time. These features also help simplify and organize accounting tasks, as you can see in this Xero review.

There’s more!

Xero uses AI effectively for bank reconciliation. More so, it offers companies advanced reporting capabilities, including 1099 visualization and management in reports.

Setting up this software is also easy. It has an easy-to-use interface and provides onboarding support for 90 days if you encounter any issues.

Even if you want to add payroll to your accounting, Xero integrates with payroll and HR solutions like Gusto to make it possible.

The best part is that this FreeAgent alternative offers storage. You can store important documents in the cloud and enable automatic backups to prevent any loss. This comes in handy for storing tax documents as well.

With Xero’s 30-day free trial, you can check out its features and decide if it fits your business needs.

Key Features

- Expense management tools for managing spending and reimbursing expense claims.

- Bank connection capabilities that allow users to get bank feeds and automate reconciliation, saving time on data entry.

- Customers can pay invoices online through multiple channels, increasing the likelihood of faster payments.

- Job tracking tools for invoicing, quoting, budgeting, and project planning.

- Contact management feature for storing supplier and customer information in a single platform.

- Track inventory, sales, purchase orders, accounts receivable, and expenses with accounting reports and a dashboard.

Pros

- Supports unlimited users regardless of the pricing plan.

- Integrates seamlessly with third-party apps and services.

- Cloud-based storage and mobile app for on-the-go management and access to financial data.

- Intuitive and user-friendly interface.

Cons

- You can only send 20 invoices and 5 bills per month with its entry plan.

- Only allows project tracking, expense claiming, and multiple currencies support in its highest-tier plan.

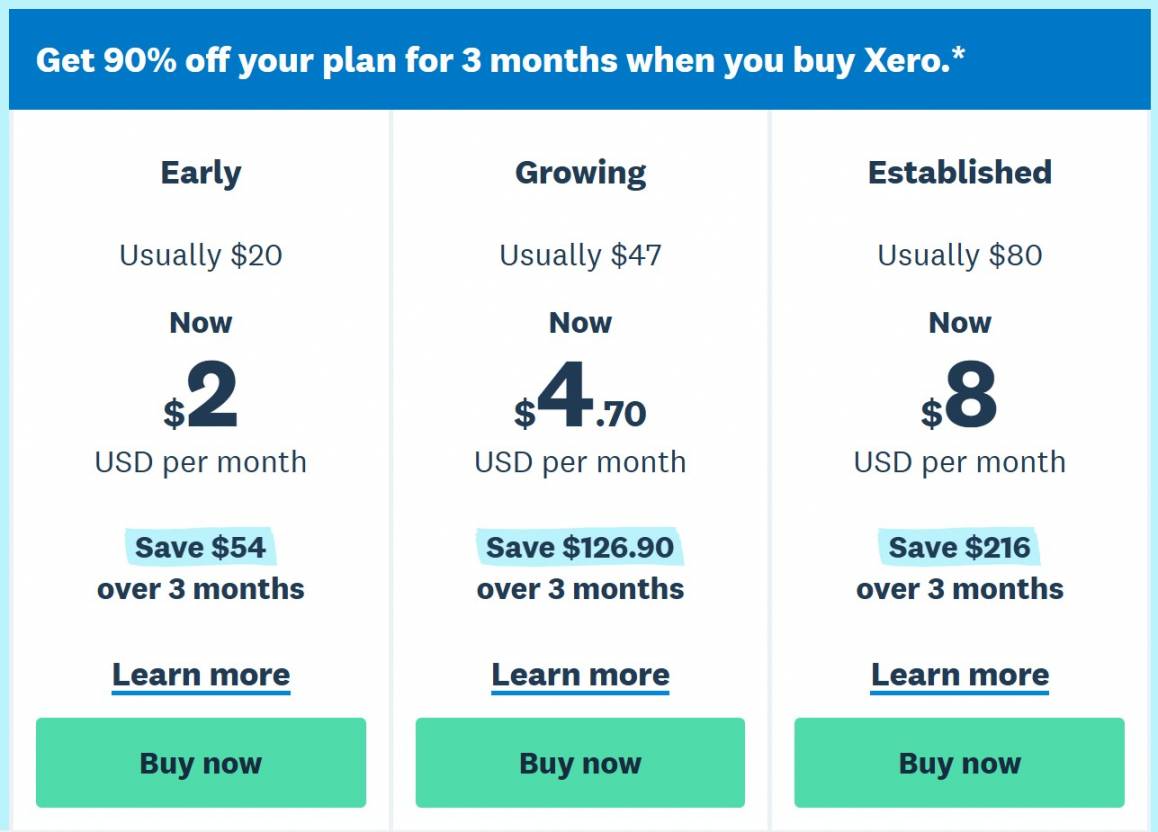

Pricing

This FreeAgent alternative offers a 30-day free trial for all its paid plans.

- Early: $20/month

- Growing: $47/month

- Established: $80/month

Image via Xero

Tool Level

- Intermediate to advanced

Usability

- Easy to use, with a steeper learning curve for advanced features.

Pro Tip: Integrate time-tracking tools with Xero Projects to automatically capture staff hours and match them with specific projects.

4. KashFlow

Image via KashFlow

KashFlow is one of the best FreeAgent alternatives that ticks off many accounting features that small businesses expect from an accounting solution.

The software offers numerous features like bank feeds, quotes and invoices, and tracking mileage that improve your accounting experience. It also provides a collection of ready-made reports to help users monitor different aspects of their accounting operations.

Even more, KashFlow offers Payroll features along with an Apps section for connecting external services like PayPal.

Though it doesn’t come with a built-in option to store documents, KashFlow is one of the FreeAgent alternatives that let you connect a Dropbox account. This way, you can save invoices and receipts to track sales and expenses.

You can also set up multiple payment methods with KashFlow. Moreover, your customers can pay invoices online through a “pay now” button on your invoice.

There’s more!

KashFlow gives you a full view of your finances and expenses. It also allows you to send automatic notifications to customers as a reminder about late or missing payments.

Key Features

- Create quotes and estimates and easily convert them to invoices.

- KashFlow Go mobile app that allows users to work from anywhere with an internet connection.

- Purchase invoice creation and customization.

- Mileage features for tracking, logging, and calculating business travel expenses.

- Integration with HMRC to easily submit VAT returns.

- Bank reconciliation feature for keeping financial records accurate and up to date.

Pros

- Cloud-based access allows easy access to financial reports from anywhere.

- Allows users to create and send professional invoices, track accounts payable, and set up automated reminders.

- Integrates seamlessly with third-party apps and payroll systems, streamlining your payroll process.

- Supports multi-currency functionalities for companies performing international transactions.

- Access to unlimited quotes regardless of the pricing plan.

Cons

- Its entry plan is limited, with access to only 10 invoices.

- Payroll features are available only in its highest-tier plan and capped at 5 employees.

Pricing

Along with a 14-day trial, KashFlow offers three pricing plans.

- Starter: $14.60/month

- Business: $29.84/month

- Business + Payroll: $40/month

(With £1 converting at $1.27)

Image via KashFlow

Tool Level

- Beginner/Intermediate

Usability

- Easy to use

Pro Tip: Connect your bank accounts for KashFlow to automate transaction imports, eliminating the need for manual data entry and minimizing errors.

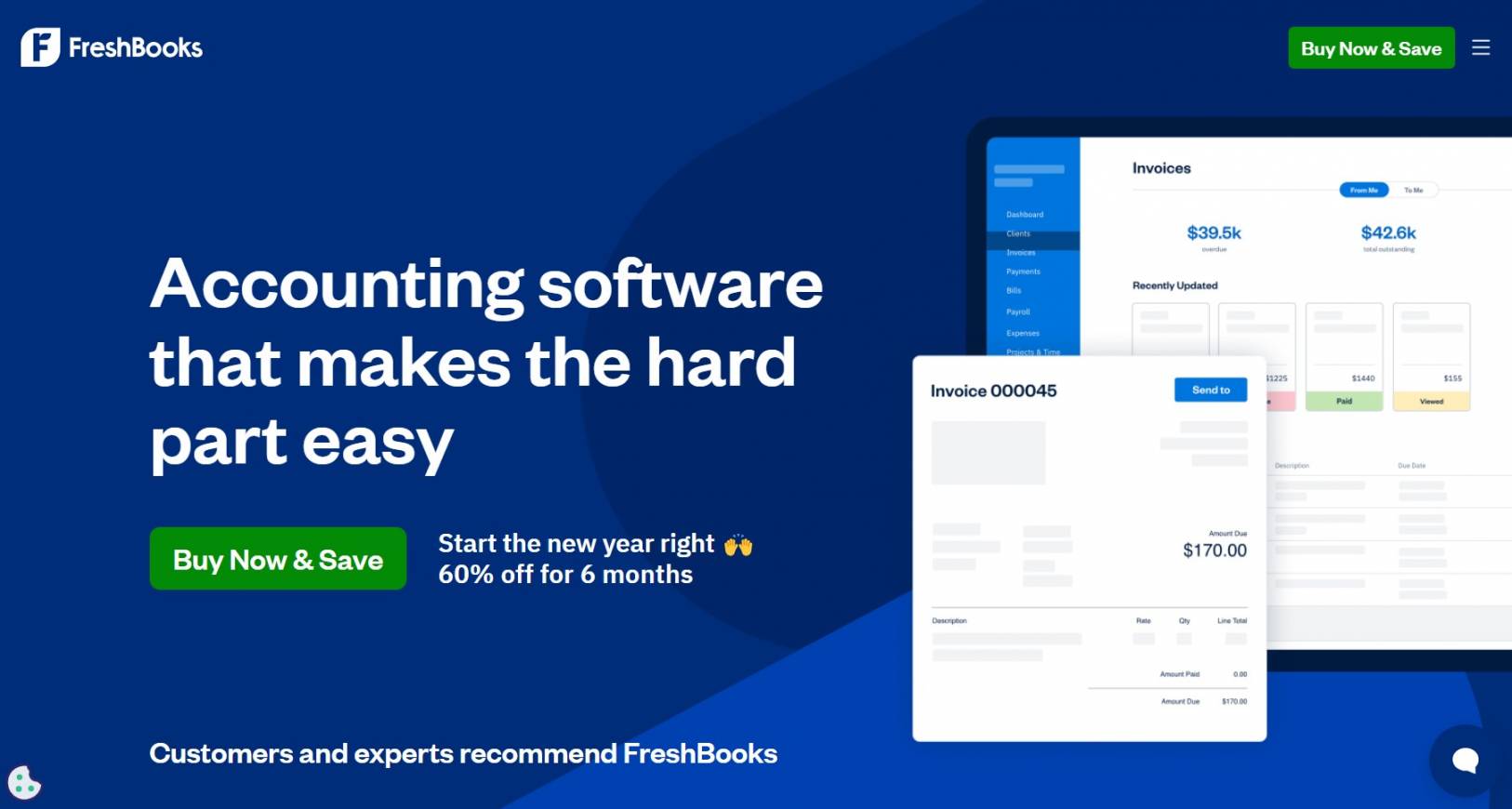

5. FreshBooks

Image via FreshBooks

FreshBooks is yet another of the most noteworthy FreeAgents alternatives for growing businesses. It’s a reliable accounting software that takes the hassle out of financial management.

It offers features like seamless payment processing, cash flow tracking, and client invoicing. Even more, it allows you to create proposals and client estimates, manage projects, and track time.

Another feature that makes FreshBooks one of the best FreeAgent alternatives is how it makes handling invoices and subscriptions effortless. Plus, you have access to different transparent online payment channels like PayPal, Stripe, Apple Pay, AMEX, and FreshBooks Payments.

What’s better?

FreshBooks’ advanced accounting allows you to track expense categories, unique incomes, new assets, inventory, and loans. Users can also create reports to see how well their company is doing.

Additionally, this accounting software encourages collaboration. You can manage your business using team member roles and permissions and get insight into your team’s performance on every project.

With its 30-day free trial, you can check out FreshBooks’ features and decide if it’s what your business needs.

Key Features

- Invoicing tool that allows the easy creation of professional-looking invoices.

- FreshBooks Payments for seamless and fast online payments directly through invoices.

- Time tracking to show how much time is spent on clients and projects.

- Seamless project management and team collaboration to boost productivity.

- Ability to create and send proposals and purchase orders.

- Automated mileage tracking to log business trips and save travel history.

- A mobile app to stay connected with clients and handle accounting tasks from anywhere.

- Expense tracker to connect bank accounts or credit cards and track business expenses.

- Team collaboration allows you to add members, including consultants, associates, and employees, to a paid plan.

Pros

- The mobile app allows mileage tracking and project management on the go.

- Comes with a clean and intuitive interface that’s easy to navigate.

- Robust invoicing features for sending automated recurring invoices, tracking their status, and accepting online payments securely.

- Allows users to track team time and assign tasks easily.

- Excellent automated features for invoices, expenses, sales, and payment reminders, minimizing manual work.

Cons

- Payroll processing requires a separate add-on, increasing the overall cost.

- May lack advanced accounting features for scalability.

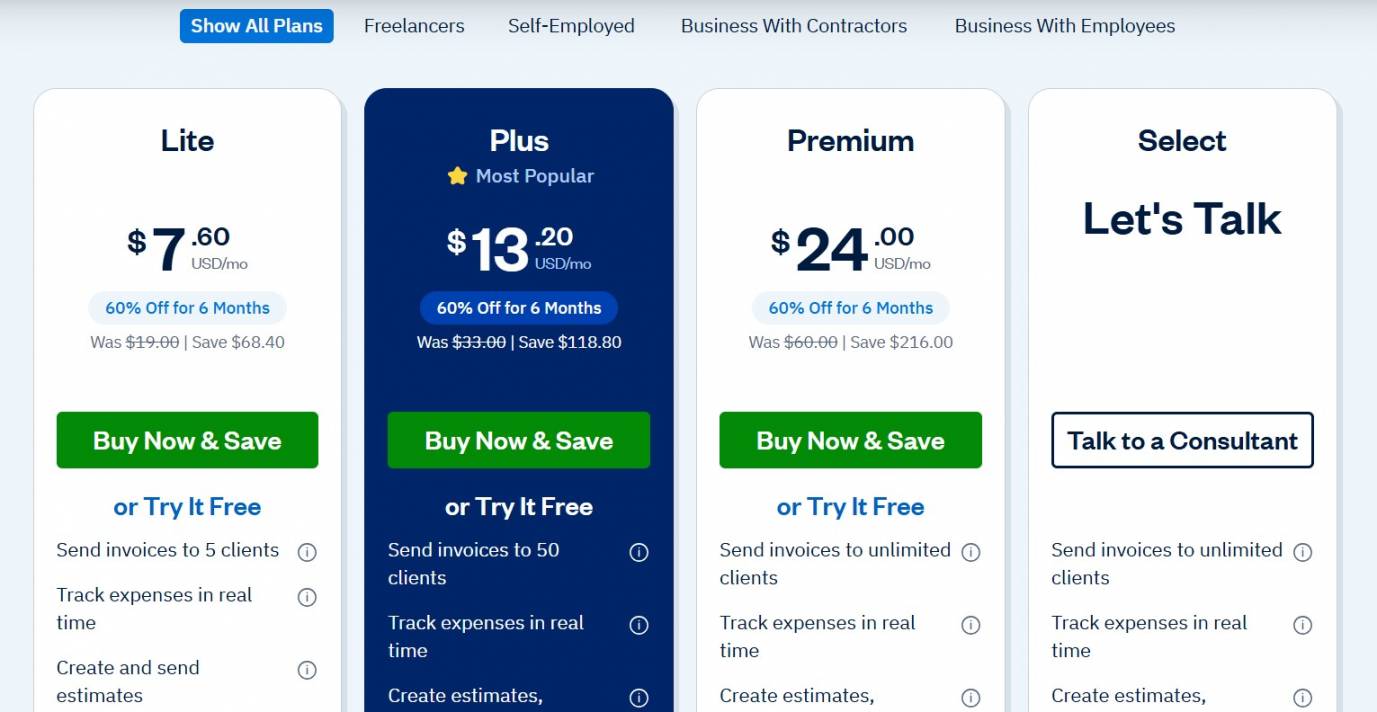

- The Lite and Plus pricing plans are limited to 5 and 50 clients, respectively.

- Inventory management features may not be suitable for businesses with advanced inventory needs.

Pricing

FreshBooks offers a 30-day free trial with its four pricing plans.

- Lite: $19/month

- Plus: $33/month

- Premium: $60/month

- Select: Custom pricing

Image via FreshBooks

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: Use FreshBooks to grant clients access to project details like documents, time logs, and invoices to increase transparency and build trust.

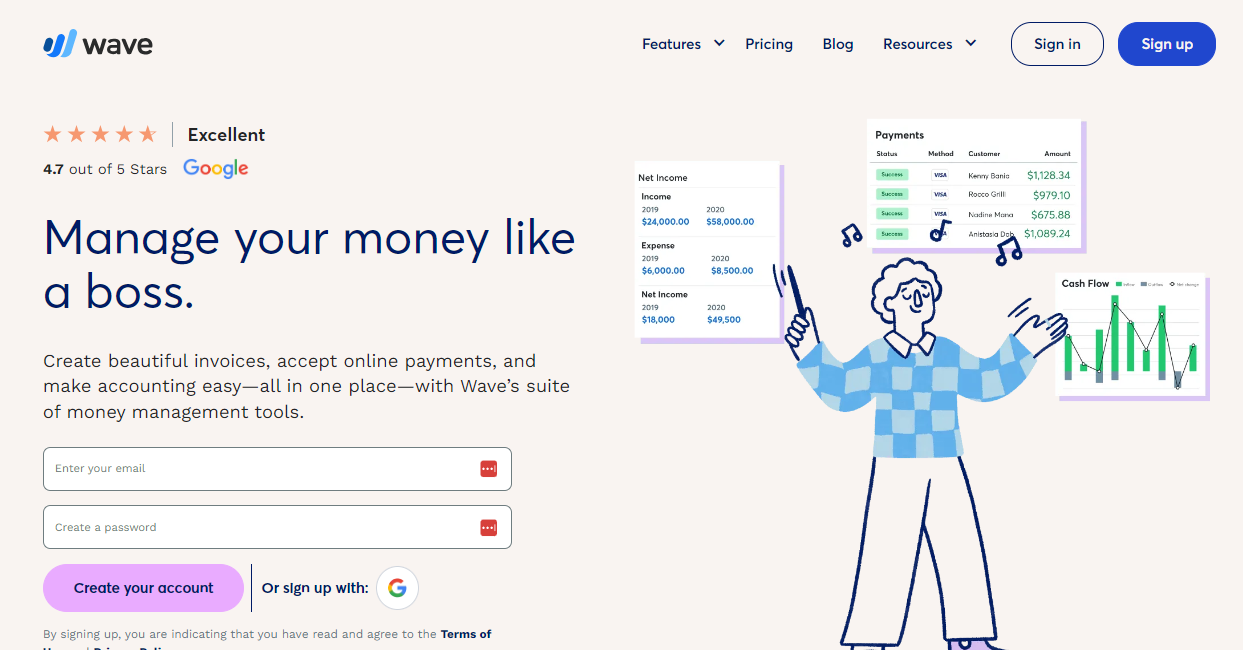

6. Wave Accounting

Image via Wave

Wave Accounting is a great option for small and medium-sized businesses looking for free online accounting software. It is fully functional with a user-friendly interface.

What’s more?

It’s one of the FreeAgent alternatives that come with plans without any usage restrictions. You can collaborate with as many people as you want and generate unlimited invoices for clients.

However, Wave Accounting charges for other features like payroll, mobile receipts, and online payments. So, you can pay for only what your business needs.

Even better, Wave provides expert consultation, which is especially great for accounting newbies.

Key Features

- Expert advisors for assistance and financial management coaching.

- Send invoices and reminders for faster online payments.

- Receipt-scanning capability for tracking expenses and sales.

- Connect bank accounts and cards for easy bank reconciliation.

- Automated tax reports and payroll services.

- User-friendly dashboard for navigating financial data.

Pros

- Free, unlimited access to accounting capabilities.

- Allows unlimited collaborators and partners.

- Intuitive interface that is easy to navigate.

Cons

- May lack advanced inventory management features.

- Limited customer support for the free plan.

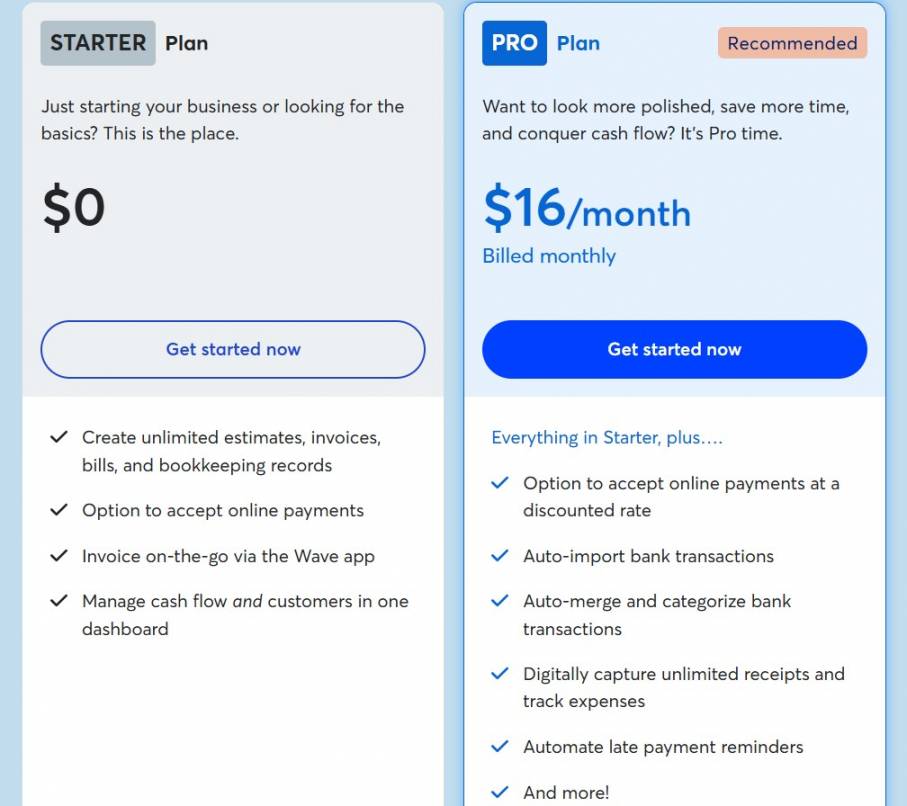

Pricing

- Starter Plan: Free

- Pro Plan: $16/month

Image via Wave

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: Connect your bank accounts to Wave Accounting to import and categorize transactions automatically.

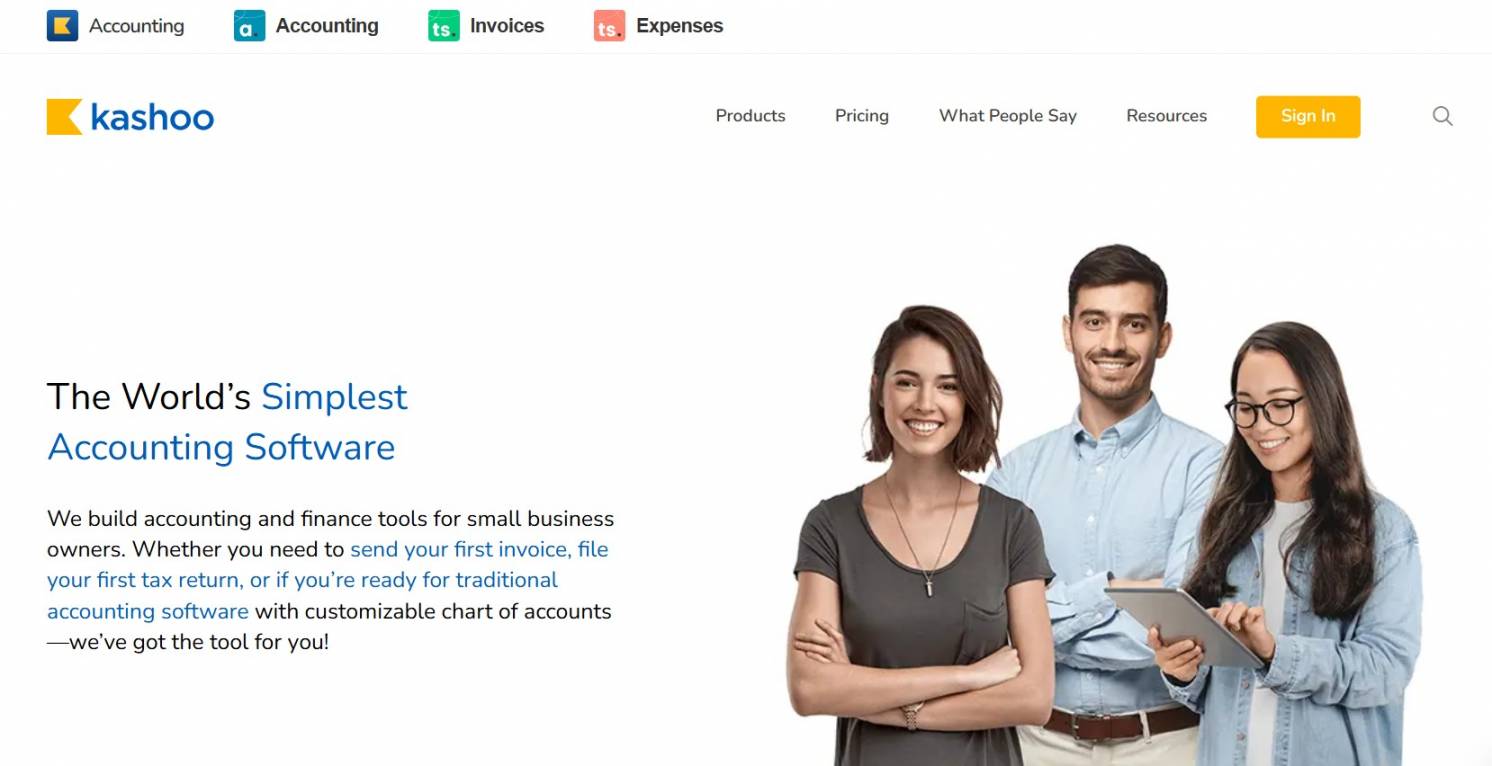

7. Kashoo

Image via Kashoo

Kashoo is a standout option among FreeAgent alternatives for small businesses, particularly those seeking streamlined accounting software.

True to its tagline as “the world’s simplest accounting software,” Kashoo delivers an uncomplicated approach to financial management.

What makes Kashoo special?

This cloud-based accounting solution emphasizes ease of use without sacrificing essential accounting functionality. It’s designed specifically for small business owners who want professional-grade bookkeeping without the steep learning curve.

From invoicing and expense tracking to bank reconciliation and financial reporting, Kashoo provides all the essential tools to keep your finances in check.

For entrepreneurs looking for FreeAgent alternatives that prioritize simplicity, Kashoo offers a clean and intuitive interface. It allows users to navigate easily through various accounting tasks, reducing the learning curve typically associated with accounting software.

Key Features

- Monitor and categorize expenses to maintain accurate financial records.

- Create and send professional invoices, track payments, and manage unpaid bills.

- Connect bank accounts for seamless transaction imports and reconciliation.

- Handle transactions in multiple currencies, which is ideal for international business.

- Generate insightful reports to understand your business’s financial health.

- Access your accounts on the go with Kashoo’s mobile applications.

Pros

- Exceptionally user-friendly interface with minimal learning curve

- Ability to add an unlimited number of users to your Kashoo account

- Excellent customer support across multiple channels

Cons

- Limited integrations with other software

- Kashoo doesn’t offer a free version

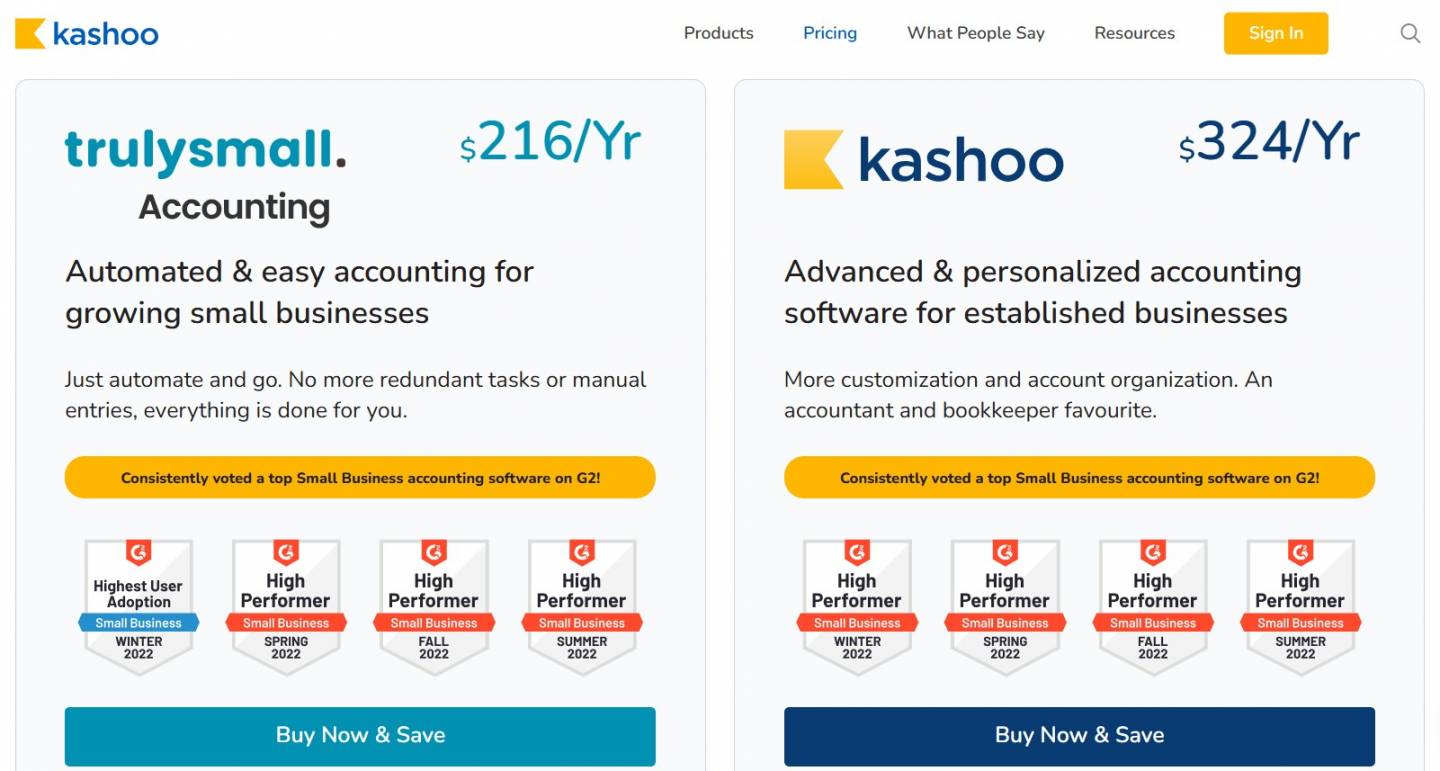

Pricing

- trulySmall Accounting: $216/year

- Kashoo: $324/year

Image via Kashoo

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: Utilize Kashoo’s iOS and Android mobile apps to manage your finances on the go. This ensures you stay updated with your business’s financial status anytime, anywhere.

FAQ

1. Why should I use FreeAgent?

FreeAgent focuses on small business accounting. It is easy to use and comes with useful features that help growing businesses make smart decisions.

2. Which banks is FreeAgent free with?

FreeAgent is ideal for small businesses in the UK. However, it is especially good for companies with accounts in Mettle, Ulster Bank, Royal Bank of Scotland, or NatWest.

3. Can QuickBooks replace my accountant?

While QuickBooks Online, and in fact other FreeAgent alternatives, analyze and store data for you, you still need an accountant for financial advice and to ensure compliance with tax legislation.

4. Do I need an accountant if I have FreeAgent?

If your books are straightforward, you can use FreeAgent accounting software without an accountant.

5. Why should I use FreeAgent?

FreeAgent is an online accounting software that helps with financial management. It also comes with numerous features like financial reporting and expense tracking, easing the accounting experience of small business owners.

Also Read:

- Nonprofit Accounting: A Complete Guide for Organizations

- What Is Full Cycle Accounting & What Are the Steps Involved?

Wrapping Up

While FreeAgents is a reliable accounting management software, you may need a more budget-friendly alternative, especially as a growing business.

But, when picking your FreeAgent alternatives, ensure you examine its features to determine if it fits your accounting requirements. From the list we’ve curated, you’ll find online accounting tools that are cost-effective with excellent functionality.

You’ll also discover scalable options that are great for small, medium, and large organizations.

Additionally, take full advantage of their free trials. Try out their features and only go for a paid plan if they have everything you need.