A checking account is a basic deposit account for managing money and making payments. Knowing what to look for in a checking account before choosing one is highly important.

The market is awash with checking account issuers, from online banks to brick-and-mortar banks and credit unions. Plus, banks offer several checking account options to fit varying banking needs.How do you sift through the crowd of checking account issuers and account variations to find what works best for you?

Look no further. We’ve compiled a comprehensive list of what to look for in a checking account so you can make an informed choice. Keep reading to discover what these are.

What to Look for in a Checking Account

If you already know what a checking account is, then the next thing you need to know is what factors to look for when choosing one. Here are the top 14 things you must consider:

1. Fees

The number one thing you want to look for when choosing a checking account is the fees involved. A checking account can come with numerous recurring fees, such as:

- Monthly maintenance fees

- Minimum balance fees

- Foreign transaction fees

- Non-sufficient funds (NSF) fees

- Paper statement fees

- Check reorder fees

- Account closure fees

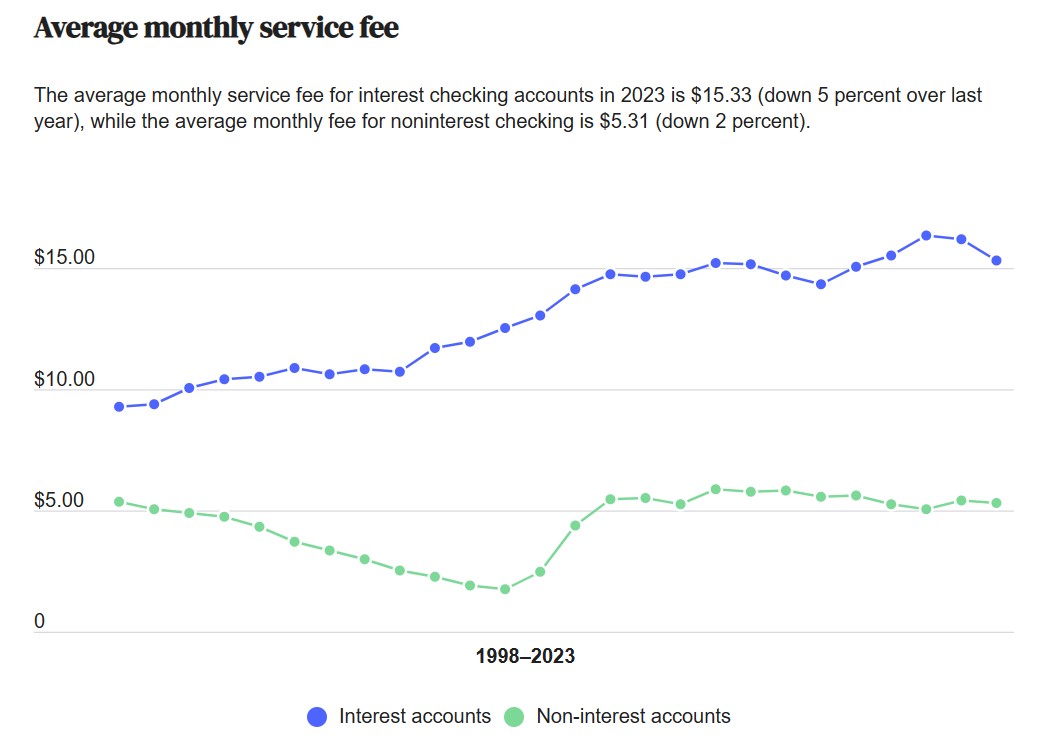

Fees like these accumulate in the background. They’re charged to your account every month or otherwise. According to a study by Bankrate, the average monthly maintenance fee for checking accounts ranges between $5.31 and $15.33.

Image via Bankrate

Checking account fees are determined by various factors, such as account balance, monthly transaction volume, and transaction types.

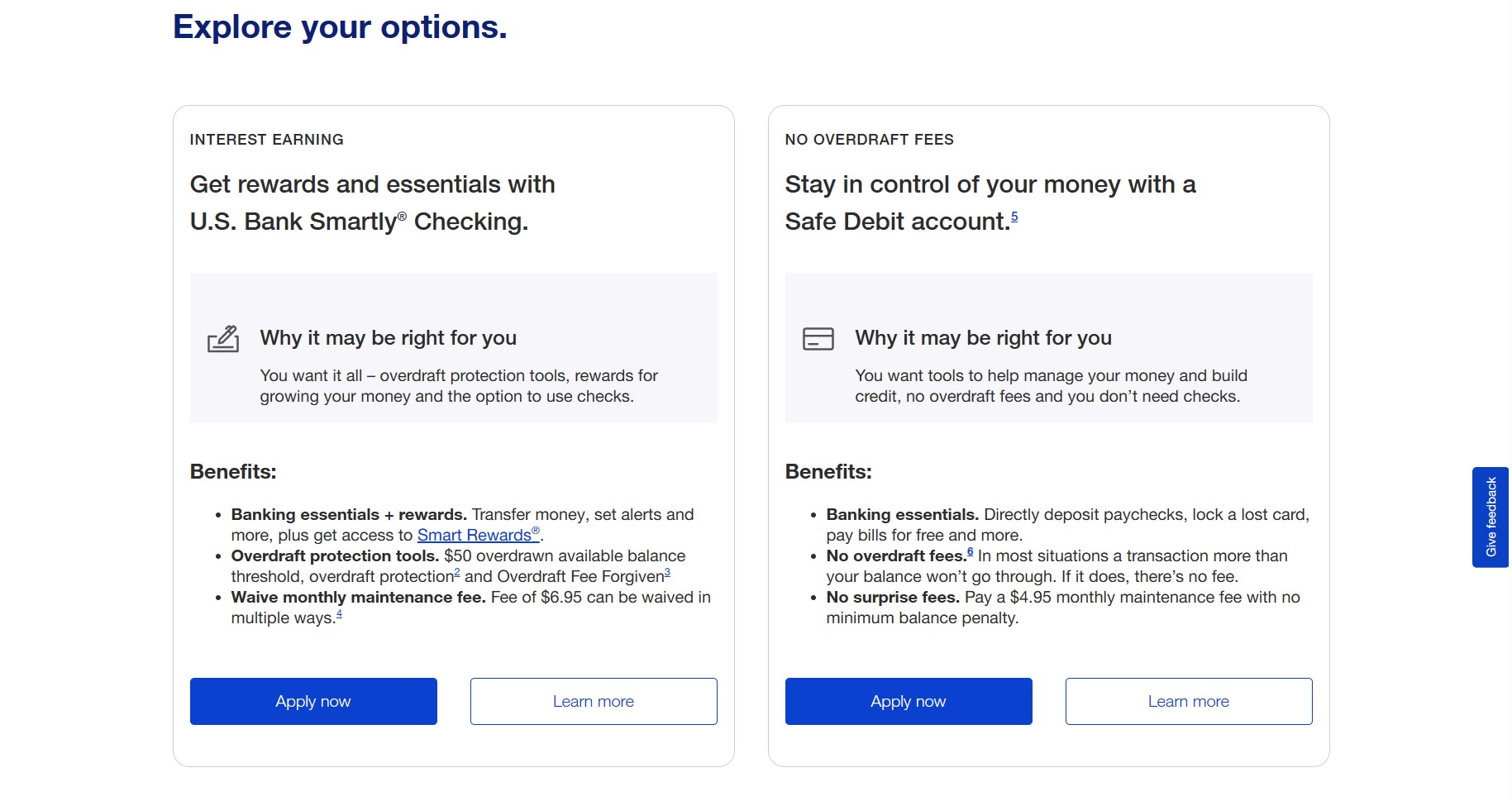

That said, many financial institutions offer opportunities to waive the monthly fee for a checking account if certain conditions are met. These conditions could include maintaining a minimum balance, setting up direct deposit, or enrolling in paperless statements.

Meanwhile, some banks offer free checking accounts that don’t charge any fees for transactions. Opting for issuers that waive the fees or offer no-fee accounts can cut your recurring fees to a minimum.

For instance, U.S. Bank’s checking account framework looks like this:

Image via U.S. Bank

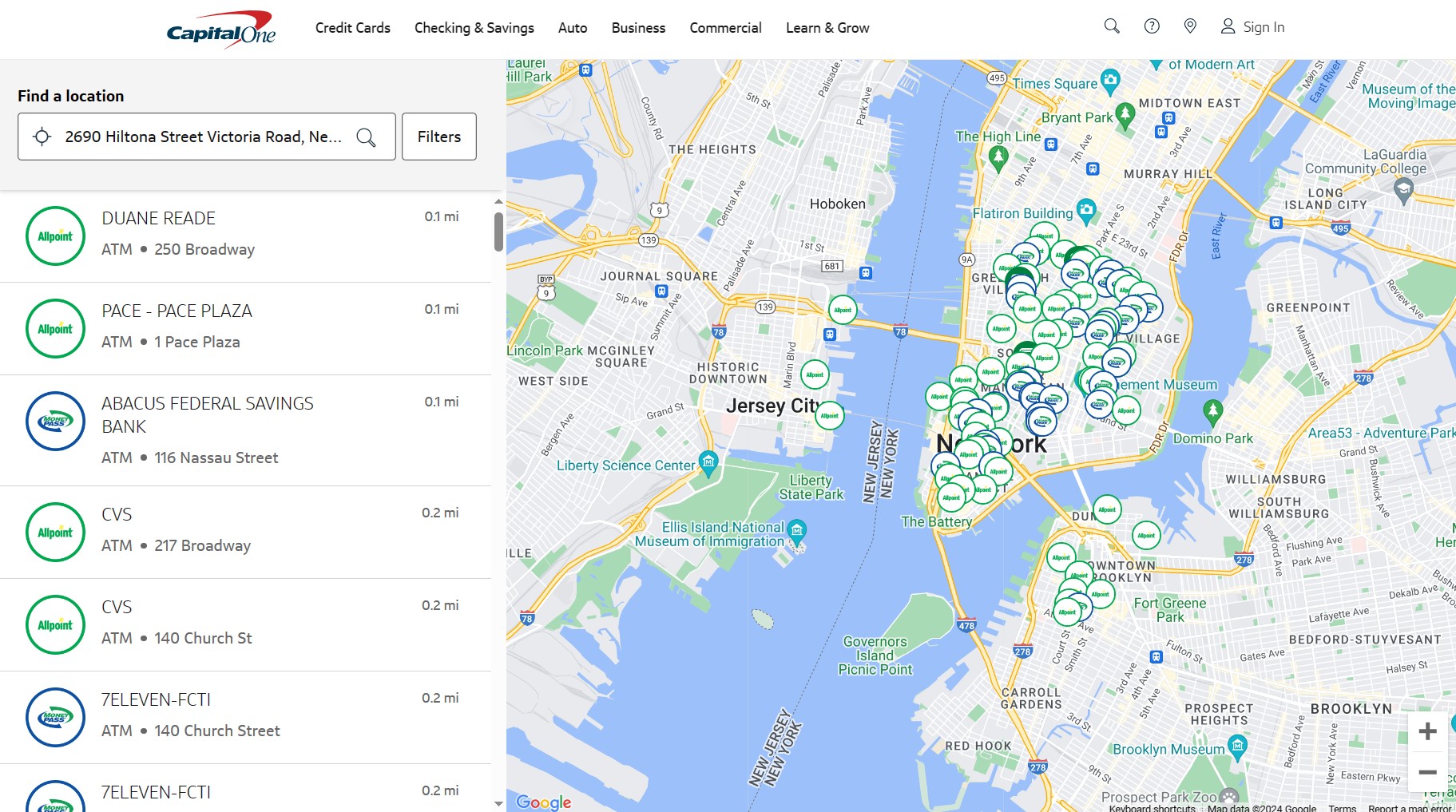

2. ATM Network

Easy access to cash without having to walk into a bank is one of the most sought-after features for bank users. That said, you want your selected checking account to have a wide network of ATMs.

Thankfully, most checking account providers have hundreds, if not thousands, of ATMs spread across the country.

Using ATMs within your bank’s network (in-network ATMs) should come at little to no cost. However, using out-of-network ATMs typically incurs a fee.

Citing the Bankrate study, the average cost for an out-of-network ATM withdrawal is $4.73. However, some banks may reimburse a certain amount of the fees incurred from out-of-network ATM withdrawals.

To minimize the fees, choose a checking account that offers a robust network of ATMs across the country.

Banks with a robust network of ATMs include:

- Capital One (70,000 ATMs)

- Citibank (60,000 ATMs)

- Discover Bank (60,000 ATMs)

- PNC Bank (60,000 ATMs)

- Ally Bank (43,000 ATMs)

Most banks provide a map of their ATM network. Here’s an example of Capital One’s ATM network in New York:

Image via Capital One

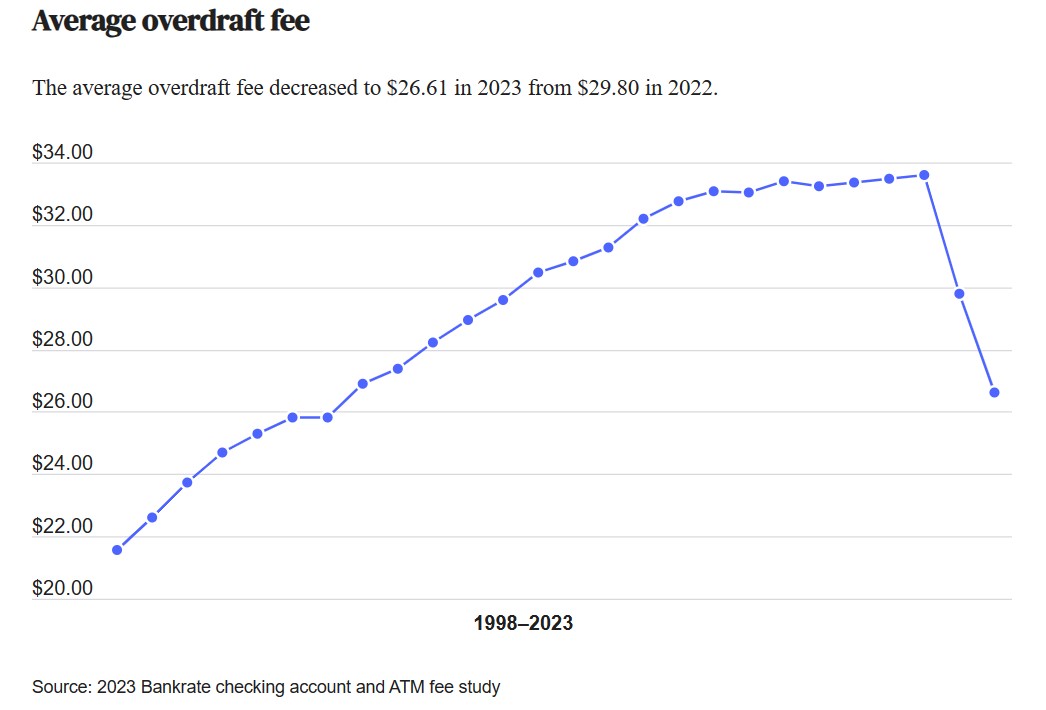

3. Overdraft Protection

Another feature to look for in a checking account is overdraft protection.

This feature saves you from the embarrassment and inconvenience of your transactions getting declined or your checks getting bounced. How? Your bank covers your shortfalls when you have insufficient funds in your account.

However, don’t get carried away; overdraft protection can also come with steep fees and risks, depending on your bank. As of 2023, Bankrate found that the average overdraft fee is $26.61.

However, more and more banks are rapidly moving away from this service. You can see this trend clearly in the Bankrate chart below, which shows the average overdraft fee since 1998:

Image via Bankrate

Ensure that the checking account you choose offers overdraft protection and that its overdraft fee is below the industry average. Also check out the terms and conditions of the service to see other requirements, such as the interest rate, transaction limit, and repayment arrangement.

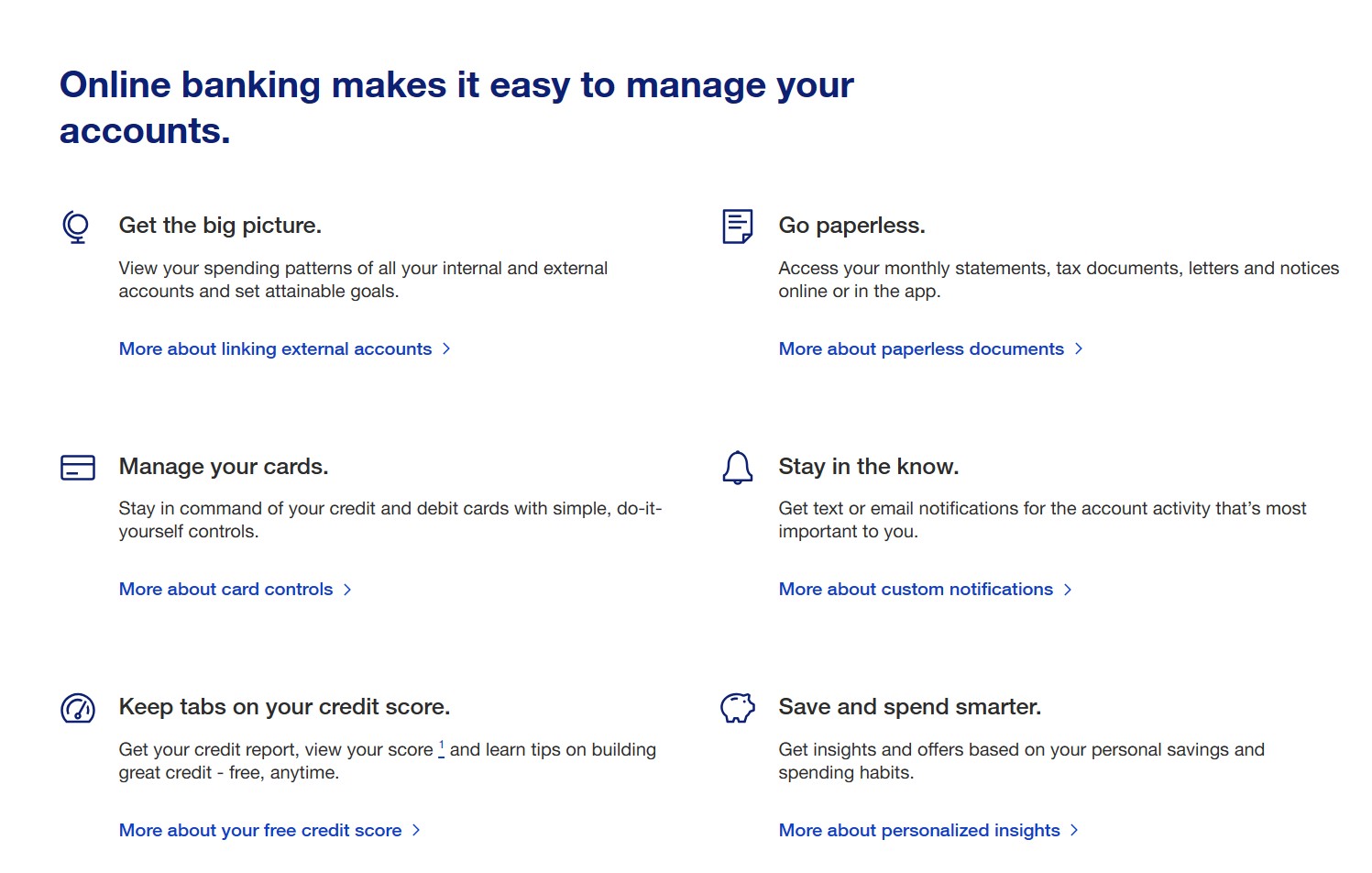

4. Online and Mobile Banking Capacity

We live in a digital era where virtually everything, including banking, is done online. Online banks offer so much convenience. Mobile banking has become a staple feature of most banks, including many brick-and-mortar banks.

Seek out banks that offer various mobile banking features. The more, the better.

Image via U.S. Bank

Look for the following features:

- An intuitive mobile app

- Multiple utility payment allowances

- P2P payment integration

- Lock or freeze functionality for bank cards

- Mobile check deposits

Go to mobile app stores to determine the reliability of a bank’s mobile banking feature. Similar to accounting software providers, decent mobile banking providers should have high ratings and positive customer reviews.

5. Minimum Balance Requirement

Most banks or credit unions will charge you a fee for not maintaining a minimum balance in your account. Earlier, we talked about the monthly fee charged to checking accounts, which was $5.31 to $15.33 on average. This fee factors in minimum balance defaults.

A Forbes report shows that most checking accounts have a minimum balance requirement between $25 and $100. It can be considerably higher for other account types, such as money market accounts ($100–$1,000) and certificates of deposit (CDs) ($1,000–$5,000).

When considering what to look for in a checking account, keep the minimum balance requirement in mind. Search for banks or credit unions that require little to no minimum balance to give you more freedom and flexibility with your checking account.

Some banks that fall into the category of low minimum balance requirement include:

- Varo Bank ($0)

- SoFi ($0)

- Wells Fargo ($25)

6. Interest and Rewards

Though checking accounts aren’t intended to hold large amounts of money for long periods, they offer decent interest rates and rewards on deposits.

However, not all checking accounts offer interest rates. Checking accounts are split into:

- Traditional (non-interest) checking account:

- Basic checking account features

- Lower minimum balance requirement

- Zero or low fees (99% of non-interest checking accounts are either free or offer ways to avoid fees)

- Little to no interest

- Premium checking account:

- Higher minimum balance requirements

- Higher monthly maintenance or service fee

- Offers interest, rewards, and bonuses

- Offers perks (ATM and overdraft fee waivers)

- Interest checking account or interest-bearing checking account:

- Offers a relatively high interest (up to 5% APY, depending on the bank or credit union)

- May come with activity requirements to earn interest

- Offers perks

- Student checking account:

- No ATM fees

- No monthly maintenance fees

- No interest

- Offers grace periods for overdraft fees

- New account signup bonuses

- Rewards checking account:

- Offers daily rewards and up to 1% cashback on spending

- Special discounts

- Up to 0.7% interest on deposits

Compare the types of checking accounts and providers to find the interest and reward combination that suits your needs. For example, the best checking account for small businesses is one that balances low fees with the services that the business most frequently uses.

7. Security and Fraud Protection

The digital era comes with numerous ways to lose your money or assets to bad actors. That’s why you’ll want to look for a checking account that has reliable security and fraud protection features. Such measures include encryption, two-factor authentication, biometric verification, and alerts.

Image via Bank of America

Ensure that your checking account provider offers the highest level of security and fraud protection. Likewise, you must do your part by using strong passwords, regularly reviewing your statements, and reporting suspicious activities immediately.

8. Insurance Coverage

Reiterating the subject of security and protection, verify that the bank or credit union provides insurance coverage. Apart from protecting you from security breaches, insurance coverage ensures that you get compensated if the bank goes bankrupt.

For instance, some banks may offer federal insurance, such as the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA). This insurance covers up to $250,000 of your deposit.

If you plan on opening a small business checking account, insurance coverage provides financial stability, risk mitigation, and trust and credibility among customers, suppliers, and partners.

Some banks offer private insurance, such as the Depositors Insurance Fund (DIF) or the Excess Share Insurance Corporation (ESI), which covers significantly more amounts than the federal limit.

Image via Sun Federal

When considering what to look for in a checking account, make sure it offers insurance coverage for your deposits. This way, you don’t lose your hard-earned money in a Black Swan event or the like.

9. Brick-and-Mortar Branch Availability

Though an online bank offers so much more convenience and lower fees, you may be one of those bank users who prefer visiting a bank in person. You may prefer speaking face-to-face with a customer service agent or physically withdrawing cash over the counter.

In that case, you know what to look for in a checking account issuer—one with a brick-and-mortar bank or credit union.

However, it’s not enough for your bank to offer brick-and-mortar branches. It also has to offer a large network of branches, so you don’t have to travel long distances just to visit them in person. You also won’t have a hard time locating a branch when you need to visit one.

10. Customer Service

Customer service efficiency can affect your satisfaction, trust, and overall experience with the bank or credit union you choose. That’s why it’s an important factor to look for in a checking account. They need to be able to promptly resolve issues or complaints that may arise.

In a Salesforce study, 88% of respondents said that customer service was as important as the service or product being rendered.

Image via Salesforce

With that, you want to ensure that your checking account provider provides round-the-clock customer service channels, such as phone, email, chat, and social media.

You can gather ideas about a bank’s customer service by checking their reviews and ratings on platforms like Yelp or Trustpilot.

11. Bill-Pay Features

Another factor that bank users look for in a checking account is bill-pay features. This feature can help you stick to a budget, automate payments, and make punctual payments. Bill-pay functionality offers immense convenience and efficiency, saving you time, money, and a lot of headaches.

Some bill-pay features seen with many banks and credit unions include payment scheduling, reminders, e-bills, and utility provider compatibility.

When choosing a checking account provider, check the quality and reliability of the bill payment service. Also, check the level of customer service and support.

12. Ease of Opening and Closing Accounts

When considering what to look for in a checking account issuer, think about the simplicity and convenience of opening or closing an account with them. This is important because it might affect your plans, especially for time-sensitive tasks.

That said, the ease of opening and closing a checking account can vary based on the type of account or the issuing financial institution.

For instance, some banks may offer online banking and mobile applications, instant approvals, and fast funding for opening a checking account. Likewise, these banks could offer zero fees, no penalties, and no complications for closing a checking account.

However, we can’t say the same for other banks and credit unions.

That’s why it’s important to prioritize your freedom and convenience. Choose a bank that offers the easiest opening and closing process for your account. Take time to check the steps and documents involved and the time and cost required.

13. Financial Education Commitment

A bank or credit union that prioritizes the financial literacy of its customer base is a great addition to our list of what to look for in a checking account.

Some banks can help improve your financial literacy in areas like budgeting, saving, investing, and planning. Financial education can help you make better financial decisions, ensuring that you achieve your financial goals and avoid financial mistakes.

Additionally, some banks offer financial planning for small businesses to support their growth and stability. It also helps maintain healthy banking relationships.

Look for banks that offer financial education through channels like online courses, webinars, podcasts, newsletters, blogs, and videos. Financial education can also be in the form of personal consultations, workshops, seminars, and events.

For example, Wells Fargo offers financial education resources like this:

Image via Wells Fargo

14. Ethical and Social Responsibility

If you’re big on the ethics and social responsibility of the companies you patronize, then this should be on your list of what to look for in a checking account.

The ethical and social responsibility of a bank refers to its commitment and contribution to the environment, society, and community. It also encompasses the bank’s values, principles, and standards.

Some banks may demonstrate ethical and social responsibility by adopting green and sustainable practices. They can also demonstrate this by supporting social and community causes, such as donating to charities, volunteering for nonprofits, and sponsoring events.

Knowing the social causes a bank or credit union supports will help you decide if they align with your personal and professional values. From there, you can open a checking account with a financial institution that matches your expectations and preferences.

FAQ

Q1. What are the things to look for in a checking account?

Here are the top 14 things to consider before choosing a checking account:

- Fees

- ATM network

- Overdraft protection

- Online and mobile banking capacity

- Minimum balance requirement

- Interest and rewards

- Security and fraud protection

- Insurance coverage

- Brick-and-mortar branch availability

- Customer service

- Bill-pay features

- Ease of opening and closing accounts

- Financial education commitment

- Ethical and social responsibility

Keep these factors in mind when you go looking for a checking account.

Q2. How do I open a checking account and what do I need to do so?

You can open a checking account by applying online, by phone, or in person at a bank branch. You’ll need to provide some personal information, such as your name, address, date of birth, Social Security number, income, and employment.

You’ll also need to verify your identity by providing a government-issued ID, such as a driver’s license or a passport.

Finally, depending on the bank or credit union, you’ll also need to make an initial minimum deposit to activate your checking account (usually between $25 and $100).

Q3. How do I compare different checking accounts and options?

Compare and contrast different checking accounts and options by applying various research methods. They could include:

- Online comparison tools

- Bank websites

- Customer reviews

- Review websites

- Ratings

- Reports

- Media coverage

- Awards

You can also go the conventional route by physically visiting the banking institution and asking questions directly.

Q4. How do I manage and use my checking account effectively and efficiently?

Here are some tips on how to use your checking account effectively:

- Monitor your account activity and balance regularly using mobile banking, account alerts, or monthly statements.

- Avoid or reduce the accumulation of fees, such as monthly maintenance fees, ATM fees, overdraft fees, or foreign transaction fees, by meeting the bank’s requirements.

- Seek out opportunities to earn interest or rewards by choosing the bank that offers them.

- Maximize the features that your bank offers to improve your financial habits and goals.

Q6. What is the difference between checking accounts and savings accounts?

The main differences between a checking account and a savings account are:

- Checking accounts are designed for day-to-day banking transactions, while savings accounts are designed with long-term savings in mind.

- A checking account generally doesn’t have a limit on the number of transactions, while a savings account typically has withdrawal limits.

- Most checking accounts pay little to no interest, while savings accounts are expected to pay interest (up to 5%) on account balances.

How do I report or resolve a problem or error on my checking account?

Contact your bank as soon as you notice suspicious or unauthorized activities on your account. This could be an unauthorized charge, a missing deposit, or a statement discrepancy.

Be prepared. You’ll be required to provide some information, such as your account number, transaction details, or evidence of the issue. You may also need to file a dispute or follow up with the bank or the merchant.

Reporting a problem or error on your checking account can help you guarantee the safety of your funds, avoid undue fees, or get a refund.

You Now Know What to Look for in a Checking Account

And there you have it. You have just learned what to look for in a checking account that meets your needs, saves you money, and supports your financial growth.

Remember to keep these 14 factors in mind when looking for a checking account, whether it’s for your small business or personal transactions.

But don’t stop there. Choosing a checking account is just the first step in managing your finances.

You’ll also need to learn how to use your checking account optimally and take advantage of the features, benefits, and services that it offers. Good luck!