For years, many small business owners have turned to KashFlow to handle their accounting needs.

However, as business requirements have evolved, many KashFlow alternatives have emerged. KashFlow may no longer be the optimal choice for your specific accounting needs.

New solutions exist that handle core financial management tasks like invoicing, expense management, budgeting, inventory, and reporting even at an affordable price.

You might want to consider KashFlow alternatives for your business priorities.

However, it is not all that simple.

There is a plethora of small business accounting software available, all claiming to provide the best quality of service. How can you find the one that meets your needs and budget?

This post will take you through the best KashFlow alternatives you can use for your financial management solution.

The important elements – core features, pricing, pros, and cons that surround our selection of the best KashFlow alternatives are also discussed.

Keep reading to find out.

Quick Summary: Best KashFlow Alternatives by Type

- Best KashFlow Alternatives for Invoicing and Billing: FreshBooks, Wave, Kashoo, MYOB , OneUp

- Best KashFlow Alternatives for Mobile Accessibility: Zoho Books, QuickBooks, FreshBooks

- Best KashFlow Alternatives for Robust Accounting Needs: QuickBooks, Xero, Zoho Books

- Best KashFlow Alternatives Tools with Free Plan or Free Trial: Wave, Zoho Books, ZipBooks

- Best KashFlow Alternatives for Multi-Currency Support: FreeAgent, AccountEdge, Sage, Clear Books

What Is KashFlow and Who Is it for?

KashFlow is one of the best accounting software for small businesses that offers simple and affordable tools for managing income, expenses, invoices, and reports.

KashFlow is ideal for freelancers, contractors, startups and other small business owners who want to streamline their financial processes without a large upfront investment.

Its user-friendly interface makes it an ideal choice for those with limited accounting expertise, while its robust features meet the needs of more complex financial scenarios.

Some of the core features of KashFlow include invoicing, bank reconciliation, expense tracking, reporting, and VAT management.

These fundamental features align with the standard offerings of top accounting software for small businesses.

How We Chose the Best KashFlow Alternatives

When considering how to choose accounting software, several factors come into play. These factors are specific to the needs of your business and their significance often varies for different businesses.

Several factors that are important to small business owners are considered when determining the best KashFlow alternatives.

- Functionality: We looked for options that provide end-to-end accounting and financial management to all your needs. This includes capabilities such as invoicing, expense tracking, reporting, and more.

- Ease of Use: The KashFlow alternatives we selected have clean, simple interfaces that are easy to navigate. You can quickly get up and running to handle essential tasks.

- Integration: Ensuring integration and collaboration across different business platforms is one of the benefits of using accounting software for small businesses. The options on our list of KashFlow alternatives offer integration with many of the most popular third-party services, allowing you to connect your financial data across tools.

- Affordability: The KashFlow alternatives we chose have pricing that fits within a modest budget. Some offer free trials, monthly subscriptions, or discounted annual plans. A few have special offers for small businesses, nonprofits, and startups.

- Customer Support: High-quality customer support ensures that you have needed assistance and resources to navigate and use the accounting software effectively. The KashFlow alternatives on our list provide helpful resources for getting started and ongoing assistance if you have any questions or issues.

Top 13 KashFlow Alternatives for 2025

As a small business owner, you have many options for accounting software to consider as an alternative to KashFlow. Here are 13 of the top choices:

1. Zoho Books

Image via Zoho Books

Zoho Books is one of the ideal KashFlow alternatives with a user-friendly interface and robust features for small businesses.

Zoho Books provides a complete set of accounting tools to track your income, expenses, invoices, bills, and more, helping you adhere to invoicing best practices.

You can categorize transactions, reconcile bank statements, and generate insightful reports to gain visibility into your financial performance.

With Zoho Books, you can also automate repetitive tasks like sending payment reminders, reconciling bank transactions, and scheduling recurring bills.

The software also integrates with payment gateways to automatically record transactions and update your books.

Explore the features and capabilities of Zoho Books in our comprehensive review, offering insights into its user-friendly interface and robust features tailored for small businesses.

Key Features

- Multi-user access with different roles and permissions.

- Secure data storage and backup.

- Integration with third-party apps and services.

- Integration with payment gateways for online transactions.

- Ability to handle transactions in multiple currencies.

- Connects to bank accounts for automatic transaction feeds.

- Inventory management

- Customizable and automated invoicing templates.

- Double-entry accounting system.

- Bank and credit card reconciliation.

- Financial statements analysis and customizable reports.

- iPhone and Android app available.

Pros

- Zoho Books offers a free plan for businesses with revenue less than $50,000 per annum.

- Zoho Books provides mobile apps for iOS and Android, allowing users to manage their finances on the go.

- Zoho Books has an intuitive interface that is easy to navigate.

Cons

- Limited number of users allowed.

- Limited number of integrations

Pricing

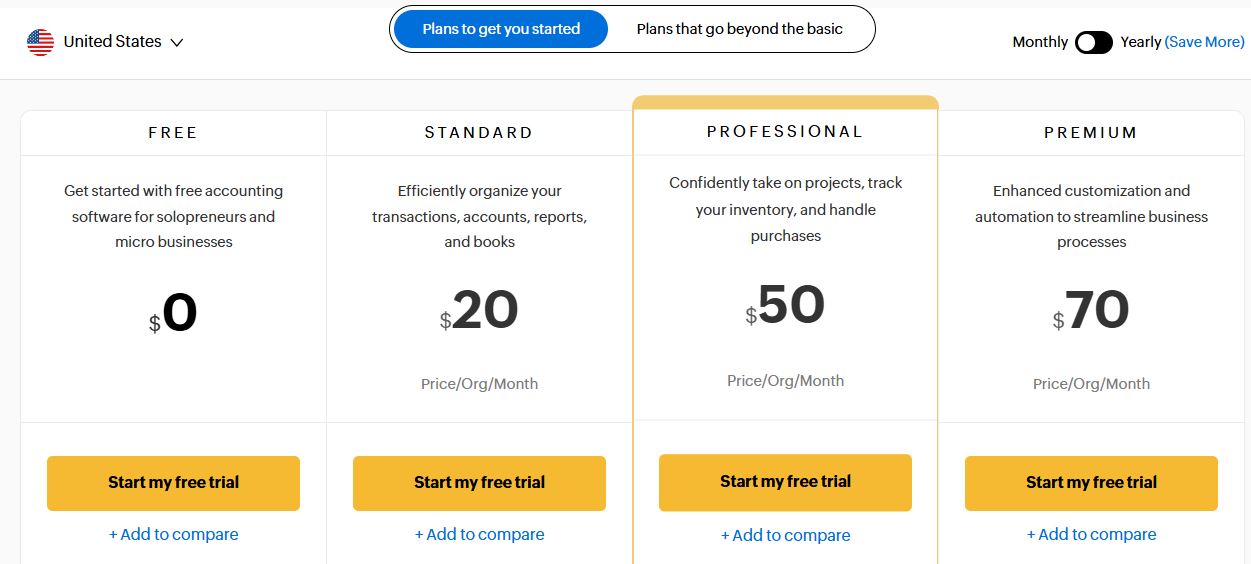

Zoho Books offers free and paid plans for businesses of different sizes. For businesses that are just getting started, there are low-tier plans to accommodate their needs:

- Free

- Standard: $20/per month

- Professional: $50/month

- Premium: $70/month

Image via Zoho Books

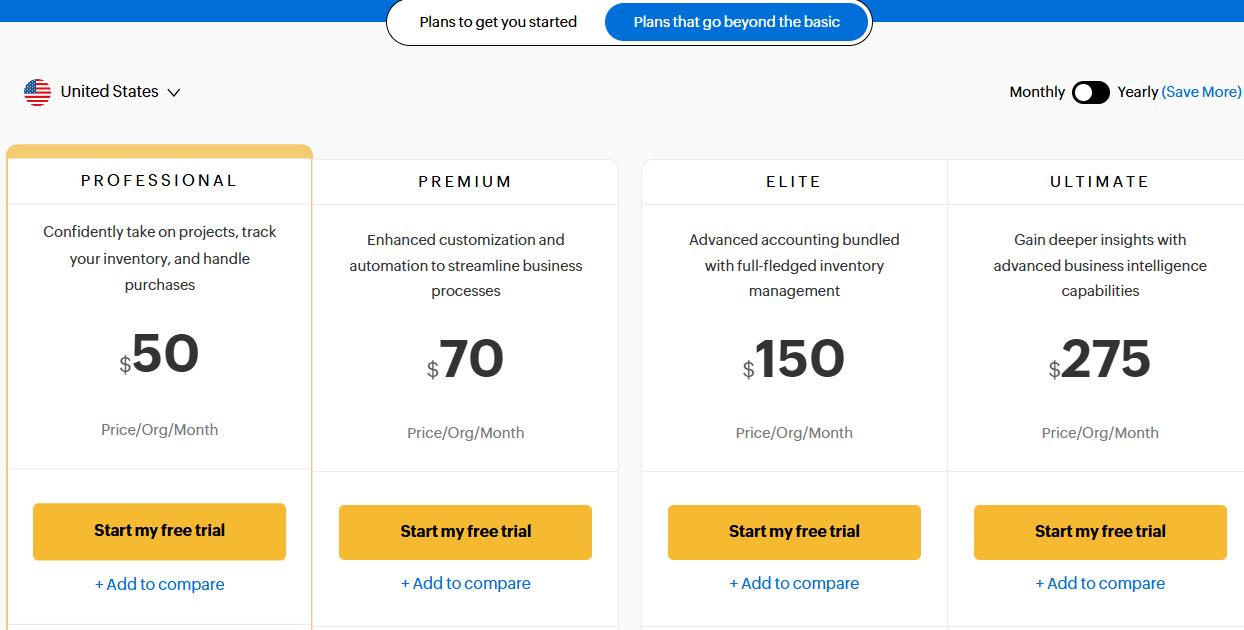

In addition to the Professional and Premium plans, there are two additional plans for growing businesses needing automation and customization:

- Elite: $150/month

- Ultimate: $275/month

Image via Zoho Books

2. QuickBooks

Image via QuickBooks

As one of the popular KashFlow alternatives, QuickBooks is used by over 2.2 million companies.

It provides an all-in-one solution for your business accounting needs. It allows you to manage and process invoices, pay bills, track expenses, and more.

You can monitor where the funds are going and take charge of your cash flow with the help of real-time statistics and dashboards.

Another thing to note is that there is a 30-day free trial for you to explore its features.

So, what does QuickBooks offer to establish itself as one of the top KashFlow alternatives? Let’s find out.

Key Features

- Create professional-looking invoices to bill your customers while on QuickBooks. Send online or print and mail physical invoices.

- Keep track of business expenses with QuickBooks by recording expense receipts and generating expense reports.

- Ability to process payroll for your employees, including direct deposits, tax withholdings, and year-end tax forms.

- Ability to generate essential financial reports like profit and loss statements, balance sheets, cash flow statements, and sales tax reports.

- Connect your business bank accounts and credit cards to automatically import transactions and match expenses.

- QuickBooks also integrates with popular tax software to prepare sales tax and W-2 tax forms, helping you avoid tax mistakes.

Pros

- Offers a 30-day free trial.

- Seamless integration with numerous third-party apps and services.

- Flexible pricing structure for all business sizes and types.

Cons

- QuickBooks does not offer a free plan.

- Limited customization options.

Pricing

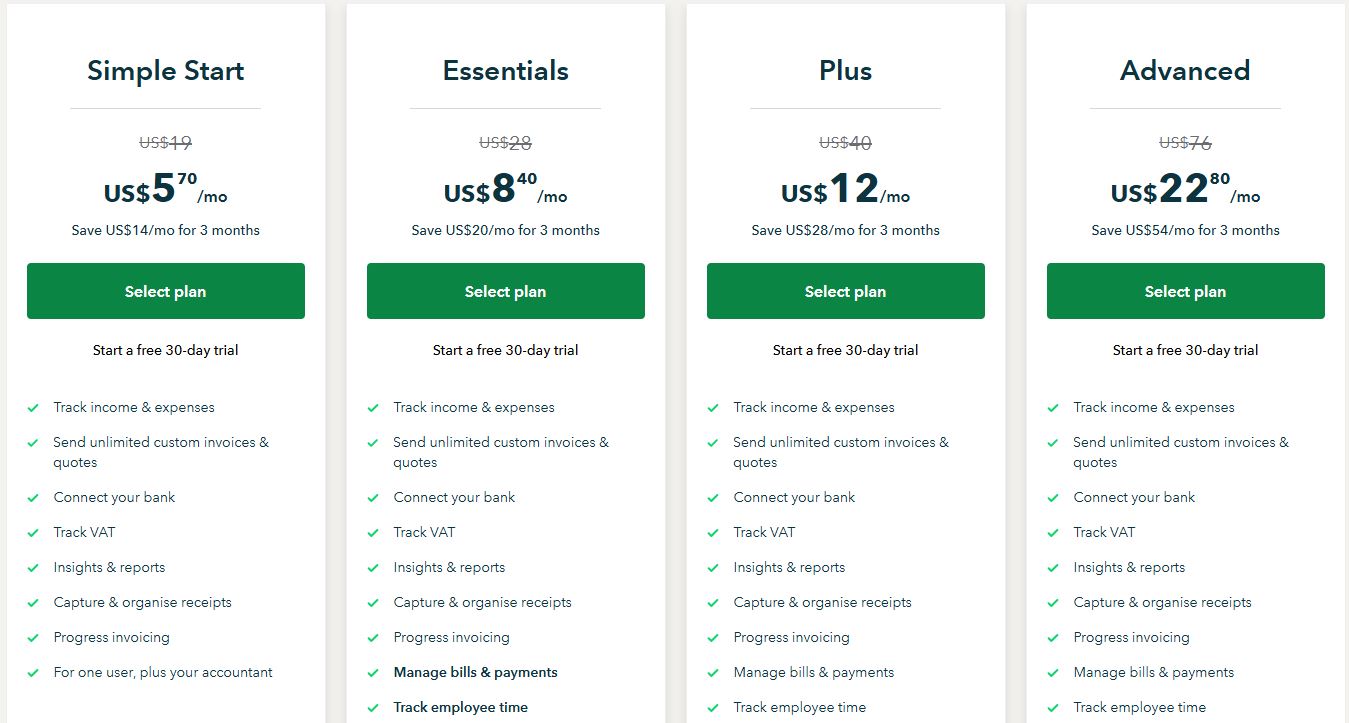

QuickBooks offers several plans with different features and pricing levels. Pricing may vary based on the country and specific plan chosen.

The pricing structure for the paid plans at QuickBooks includes:

- Simple Start: $19/month

- Essentials: $28/month

- Plus: $40/month

- Advanced: $76/month

These plans currently run for 50% off for the first three months you sign up. Once the three months elapse, the prices return to their normal rate.

Image via QuickBooks

3. FreshBooks

Image via FreshBooks

FreshBooks is an award-winning cloud accounting software.

This is one of the best KashFlow alternatives that checks all the boxes for technical support, customer relations management, accounting, and payment processing features.

It works for a wide range of business accounting needs including freelancers, self-employed professionals, businesses with employees, and businesses with contractors.

Key Features

- Easily create and customize professional invoices to match your brand.

- Automated recurring invoices. You can set up recurring invoices for clients on monthly or annual billing cycles, automatically charge clients’ credit cards, and offer discounts or credits.

- Track expenses and attach receipts.

- Categorize expenses for accurate reporting.

- Track billable hours and project expenses.

- Integrated timer for accurate timekeeping.

- Generate various financial reports.

- Collaborate with clients on projects.

- Integrates with major payment gateways to process payments directly through invoices.

- FreshBooks mobile mileage tracking analyzes and reports possible tax deductions for every business trip.

Pros

- Offers a 30-day free trial for all the plans.

- iOS and Android apps available.

Cons

- Limited accounting features for complex business needs.

- FreshBooks does not have a free plan

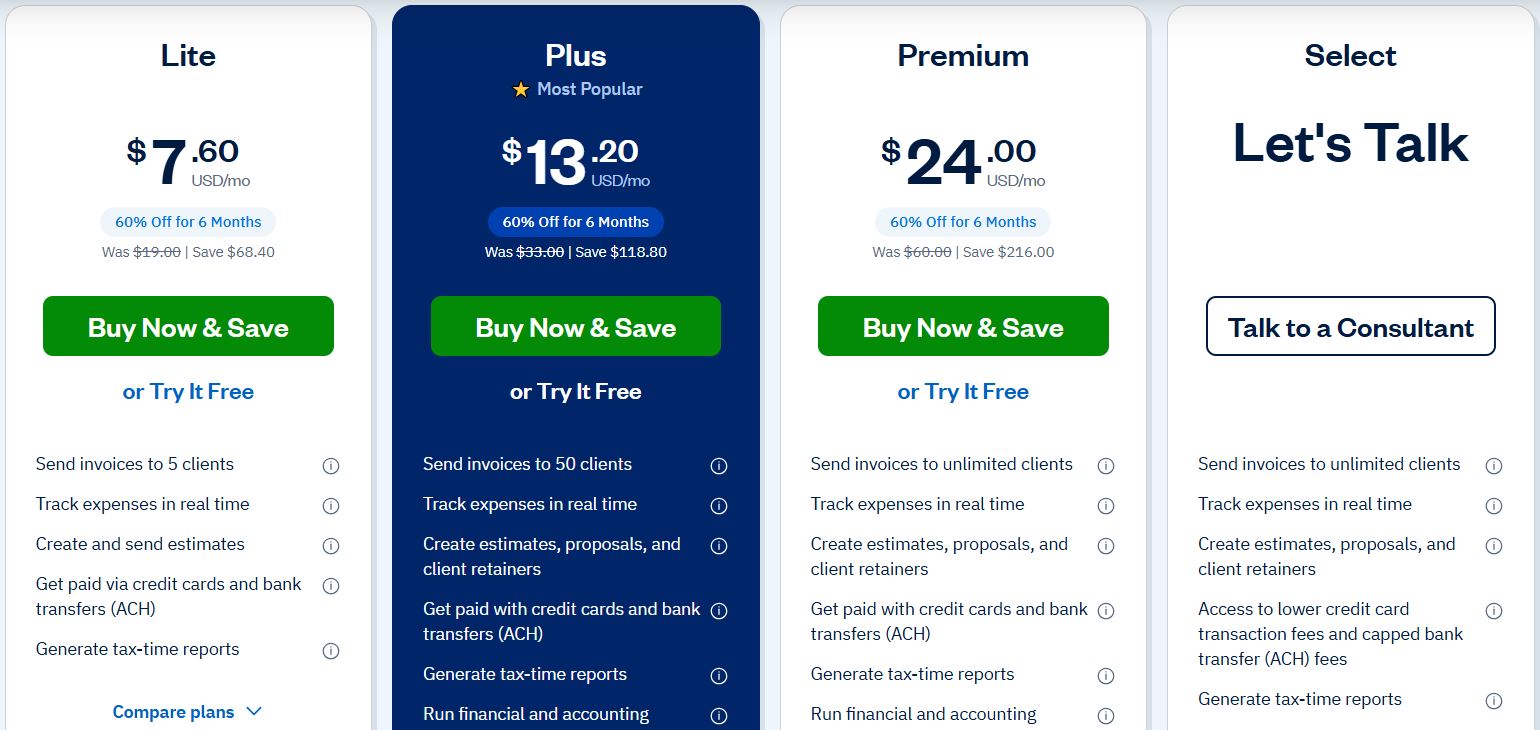

Pricing

Pricing can change on FreshBooks. At the moment, there is a 60% off for 6 months on all paid plans on FreshBooks. Subscribers can upgrade to any of the following paid after the 30-day free trial.

- Lite: $7.60/month

- Plus: $13.20/month

- Premium: $24/month

- Custom Plan: Let’s Talk

Image via FreshBooks

4. Xero

Image via Xero

Xero is one of the robust KashFlow alternatives that streamline financial management for small and medium-sized businesses.

With Xero, customers can effectively manage operations like payroll, bank reconciliation, cost monitoring, and invoicing because of its comprehensive set of features.

Like KashFlow, Xero streamlines accounting processes, making them more accessible and efficient for businesses of all sizes.

This cloud accounting software provides real-time updates for business finances and cash-flow statements, making it easier for you to stay on top of all of your spending and transactions.

It has an easy-to-use interface and cloud-based accessibility which enables simple navigation and usage.

It can be used by anyone with varying levels of accounting competence.

Key Features

- Clear overview of accounts payable and cash flow.

- Expense manager tools for easy reimbursement.

- Bank feeds and automated reconciliation.

- Job tracking tools for project planning, budgeting, and invoicing.

- Centralized contact management and CRM integration for maintaining communication with customers and suppliers.

- Automatic data and document storage.

- Offers finance tracking support with accurate accounting reports.

- Up-to-date exchange rates and instant currency conversions.

- Cloud-based orders and delivery tracking.

- Online payments by credit or debit card directly from Xero invoices.

- Finance tracking, accurate accounting reports, and real-time collaboration with advisors.

Pros

- Easy-to-use interface with intuitive design.

- No long-term contracts. Pay monthly and you can cancel at any time.

- Helpful support. Xero provides phone, email, and chat support as well as an extensive help center.

- Multi-currency support for international businesses.

- Comprehensive feature set for small businesses.

Cons

- Pricing may be relatively higher for some small businesses.

- Learning curve for new users.

- Transactions involving several currencies can only be completed using the most-priced plan.

Pricing

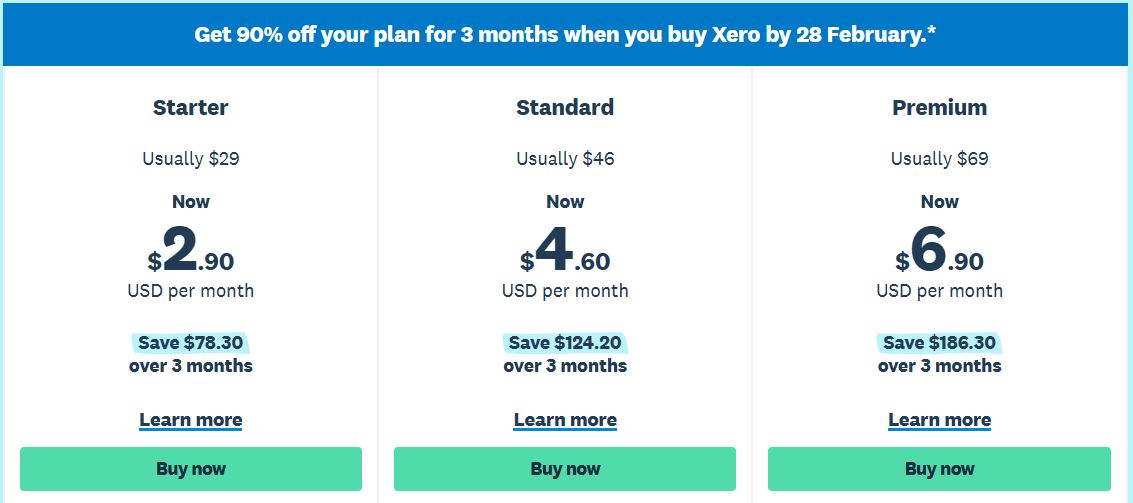

You can access all Xero features for free for 30 days, then decide which plan best suits your business. The pricing plans that are offered include:

- Starter: $29/month.

- Standard: $46/month

- Premium: $69/month

Image via Xero

For the first 3 months, users can enjoy a 90% discount on all the paid plans.

5. Wave

Image via Wave

If you are looking for one of the budget-friendly KashFlow alternatives with an impressive set of accounting tools for small businesses, Wave is a hard option to beat.

Wave offers basic accounting and invoicing features at no cost, making it one of the most accessible KashFlow alternatives for startups and small businesses.

You can manage revenue and expenses, create invoices, and establish an unlimited number of bank and credit card connections with the free edition.

Are there any associated charges then?

While using the basic features is free, there are competitive costs for credit card payments, bank transactions, payroll services, and access to professional advisors.

Key Features

- One-click payment options, including credit cards, bank transfers, and Apple Pay.

- Free unlimited income and expense tracking.

- Create and send professional invoices, accept online payments, and track invoices with Wave invoicing feature.

- Cloud-based mobile receipt system.

- Offers payroll features for handing payment of employees and contractors, and filing payroll taxes.

- Accounting tools for tracking income and expenses.

- Accounting and payroll advisory and coaching.

Pros

- Accounting and invoicing features are free to use with no hidden fees.

- Simple and easy to use for small businesses.

- Customer service and support are available for free users.

- Data is encrypted and accounts are protected.

Cons

- Limited advanced accounting features compared to paid KashFlow alternatives.

Pricing

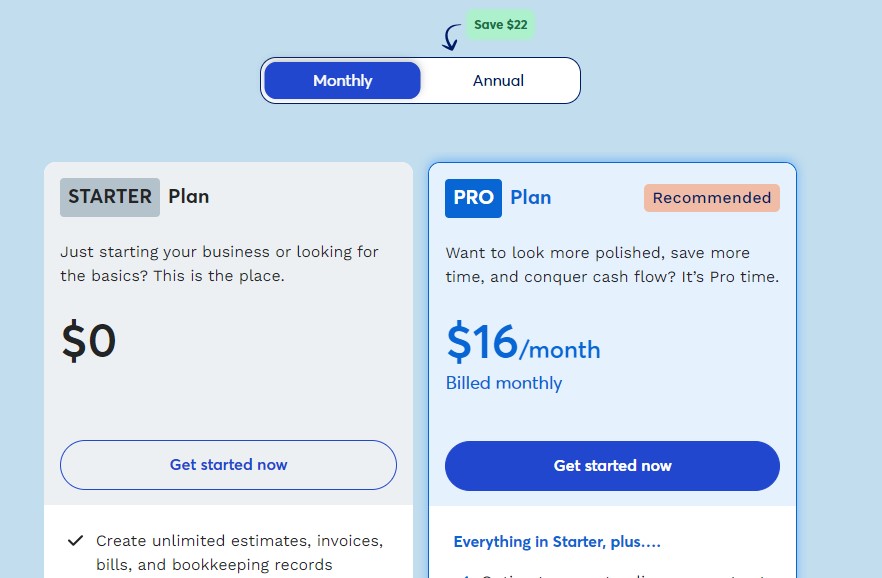

Each feature on Wave has its separate pricing plan. Here are the available plans at Wave.

- Starter Plan: $0

- Pro Plan: $16

Image via Wave

Also Read:

6. Sage Accounting

Image via Sage Accounting

For companies on a tight budget, Sage Accounting is among the least expensive KashFlow alternatives to try out.

It is an affordable and full-featured accounting solution that provides tools to manage invoicing, expense tracking, reporting and more.

This accounting software has an easy-to-use interface and a range of integrations with other business tools making it one of the viable KashFlow alternatives.

Key Features

- Create and send professional invoices to your customers with Sage Accounting invoicing tools. You can set up recurring invoices for repeat clients and allow customers to pay online.

- Income and expenses tracking.

- Tax management including VAT calculations and other tax types like corporation tax, payroll tax, and self-assessment tax.

- Real-time reporting.

- Quotes and estimates.

- Multi-currency for accounting.

- Automated business inventory system.

- Budgeting tools to keep track of performance against predetermined business targets.

Pros

- Sage Accounting offers a 30-day free trial to test the features.

- Affordable yet full-featured solution to efficiently manage your books and gain financial visibility into your business.

- There are no long-term contracts and the paid plans can be canceled at any time.

Cons

- There is no free plan available.

- Limited accounting features provided compared to competitors.

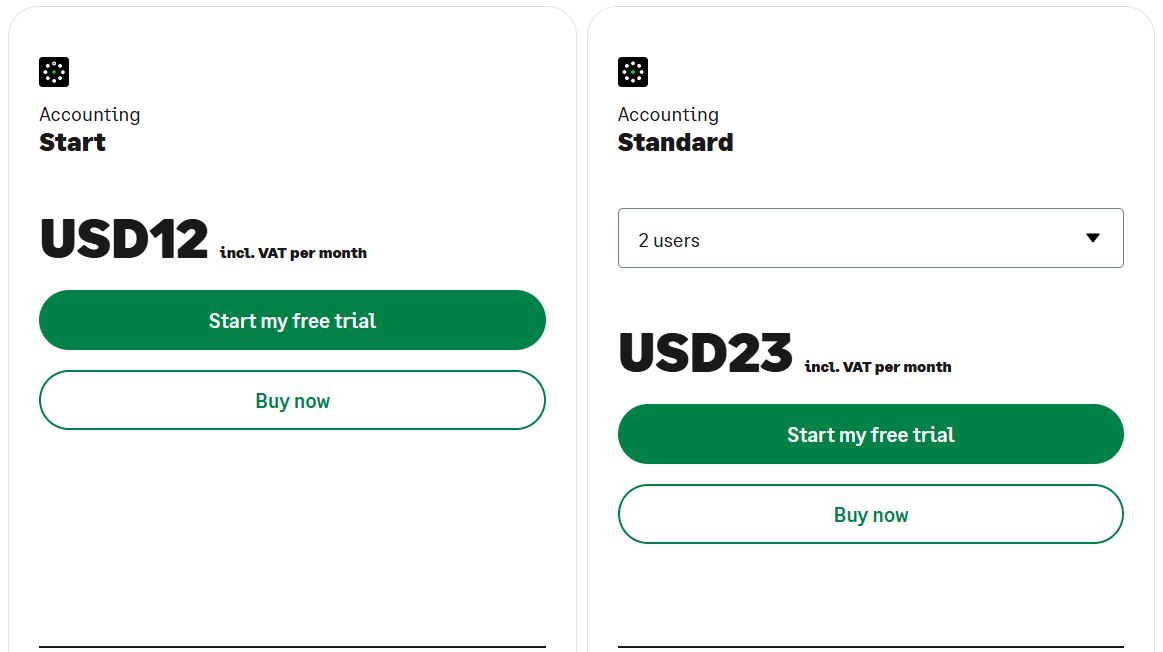

Pricing

- Accounting Start: $12/month

- Accounting Standard: $23/month

Image via Sage Accounting

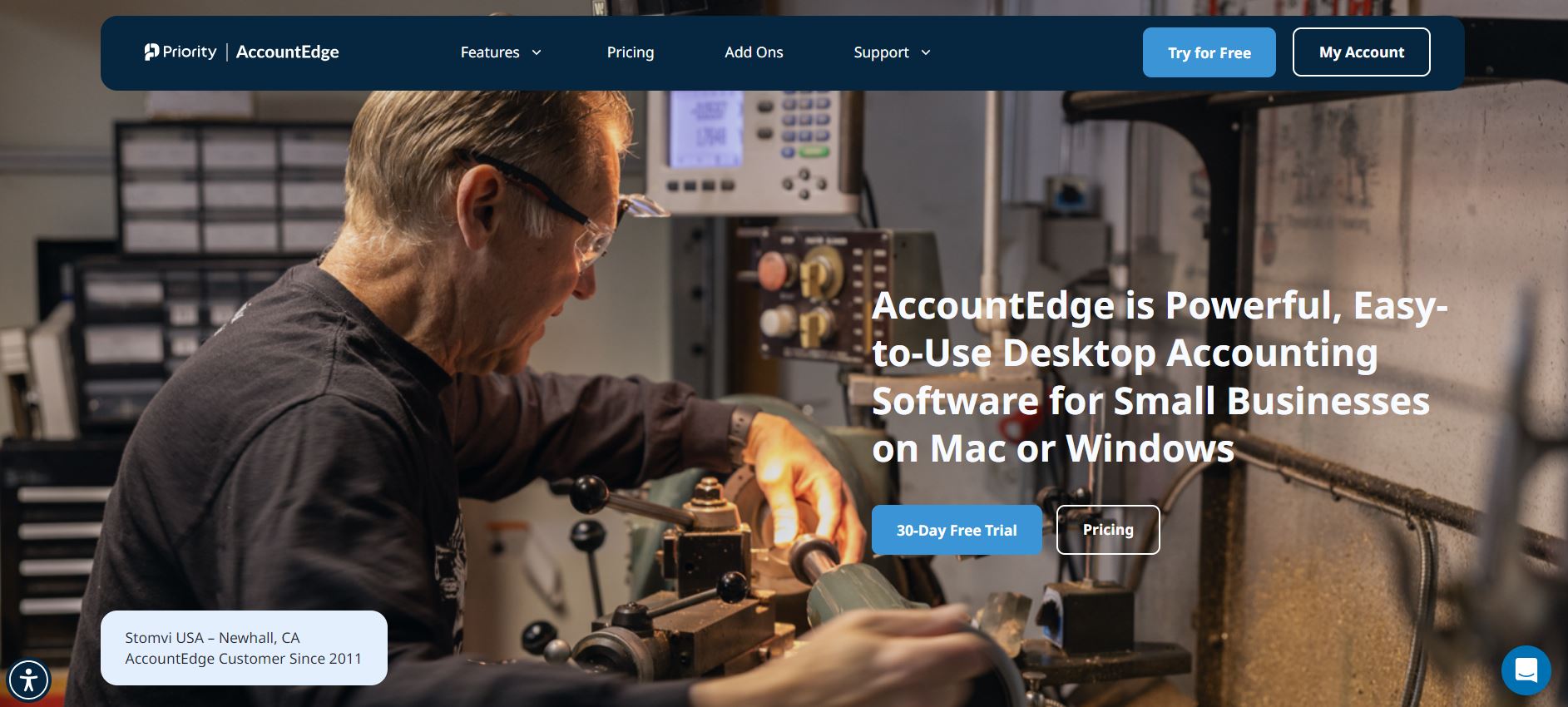

7. AccountEdge

Image via AccountEdge

AccountEdge is one of the KashFlow alternatives with powerful accounting solutions tailored for Mac and Windows.

AccountEdge is designed to meet the needs of small and medium-sized businesses, offering tools to handle accounting tasks while maintaining user-friendly interfaces.

Here’s why it is one of the top KashFlow alternatives.

It provides tools for tracking income and expenses, running payroll, and generating reports to gain insights into your business’s financial health.

Key Features

AccountEdge offers a full suite of accounting features including:

- Payroll service for accurate payroll and tax processing.

- Bank reconciliation

- Invoicing and bill payment services.

- Customization options for invoices, reports, and other documents to align with their brand identity.

- Contact management tool to maintain communication with customers, leads, and employees.

- Integration with other business applications and services.

- Financial reporting tool to generate various financial reports such as profit and loss, balance sheets, and cash flow statements.

- Multi-currency support.

- Multi-user collaboration option.

- Inventory tracking and management service.

Pros

- On-premises solution so your data stays private.

- Available for Mac and Windows.

- Allow multiple users to access the software simultaneously for the Network Edition and Hosted plan.

- Free email and technical support available.

Cons

- Limited third-party integrations compared to cloud-based accounting software.

- Requires manual updating which can lead to running outdated versions.

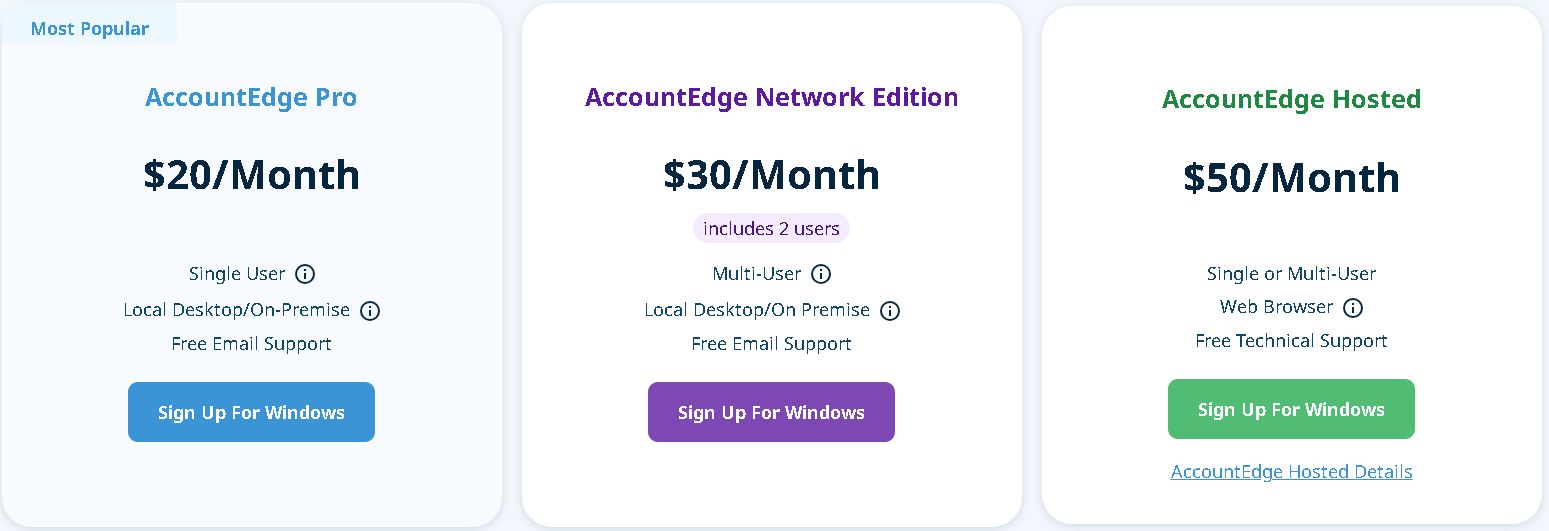

Pricing

For both Mac and Windows, AccountEdge provides premium plans with robust features including inventory, time billing, purchases and costs, sales and invoicing, and more.

- AccountEdge Pro: $20/month for a single user

- AccountEdge Network Edition: $30/month for multi-user

- AccountEdge Hosted: $50/month for single or multi-user

Image via AccountEdge

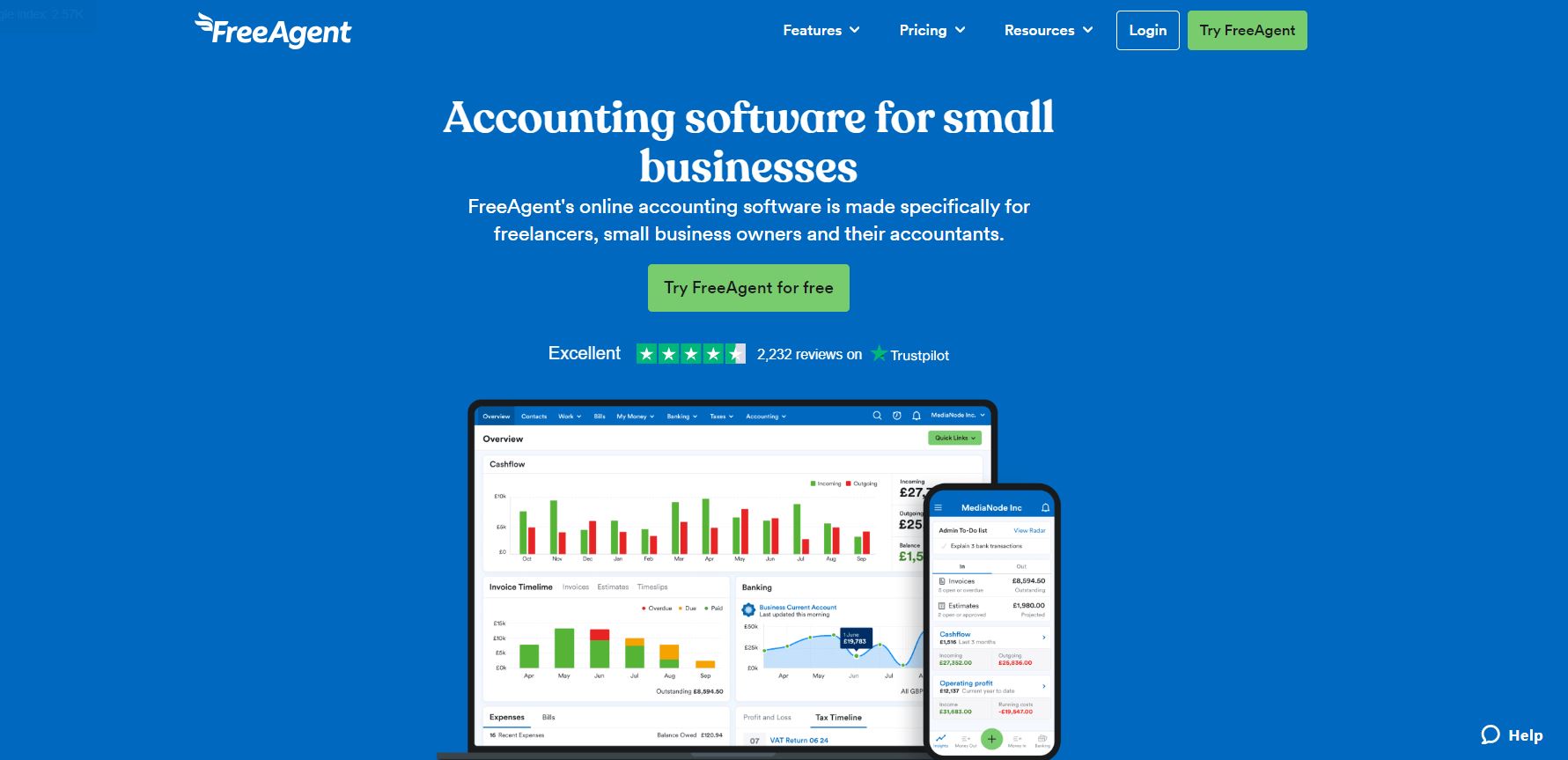

8. FreeAgent

Image via FreeAgent

FreeAgent is a user-friendly accounting software for small businesses in need of easy-to-use KashFlow alternatives.

FreeAgent serves as an accounting solution particularly well-suited for businesses based in the European Union, given its origin in the United Kingdom.

Although organizations in the US or Canada can still use it, some functions could only be available to users in Europe. In this case, businesses operating outside these regions can consider other FreeAgent alternatives.

FreeAgent has a comprehensive set of features ideal for freelancers, small business owners, and their accountants.

These features cover business accounting activities from invoice and expense management to project management and sales tax.

What distinguishes FreeAgent from other KashFlow alternatives?

FreeAgent adopts a distinctive pricing strategy by providing a sole tier. This makes it easier for users to make decisions about whether or not to utilize this accounting solution.

Key Features

- FreeAgent offers invoicing and estimate tools to create professional invoices, estimates, and quotes.

- You can set up recurring invoices for repeat clients and FreeAgent will automatically issue invoices according to the schedule.

- Expense tracking feature.

- Built-in time tracking and project management tools.

- Automatic bank feeds to import transactions.

- Multi-currency and multi-language invoicing.

- Flexible timesheet reporting to track unbillable and billable time.

Pros

- New users enjoy a free 30-day trial.

- Full-featured accounting solution for small businesses.

- Intuitive interface that is easy to navigate.

- Helpful support resources and an active online community.

Cons

- Limited payroll features compared to other options.

- FreeAgent offers a set of predefined features and layouts, with limited options for customization.

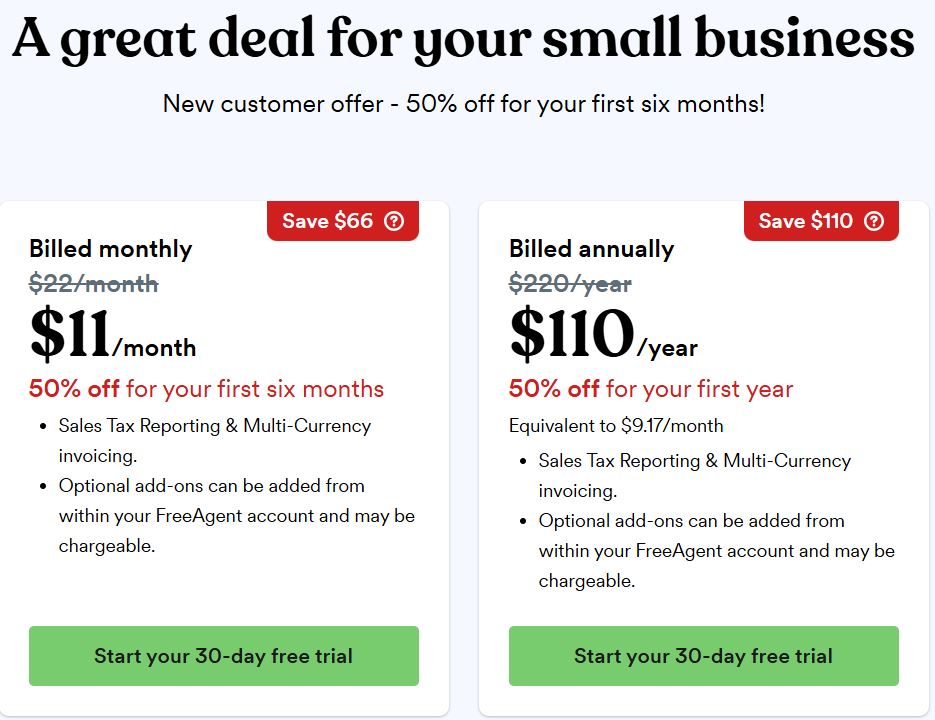

Pricing

FreeAgent has a 30-day free trial. Paid plans start at $22 per month and include unlimited users, invoices, expenses, and support. New customers are eligible for 50% off for the first six months.

Image via FreeAgent

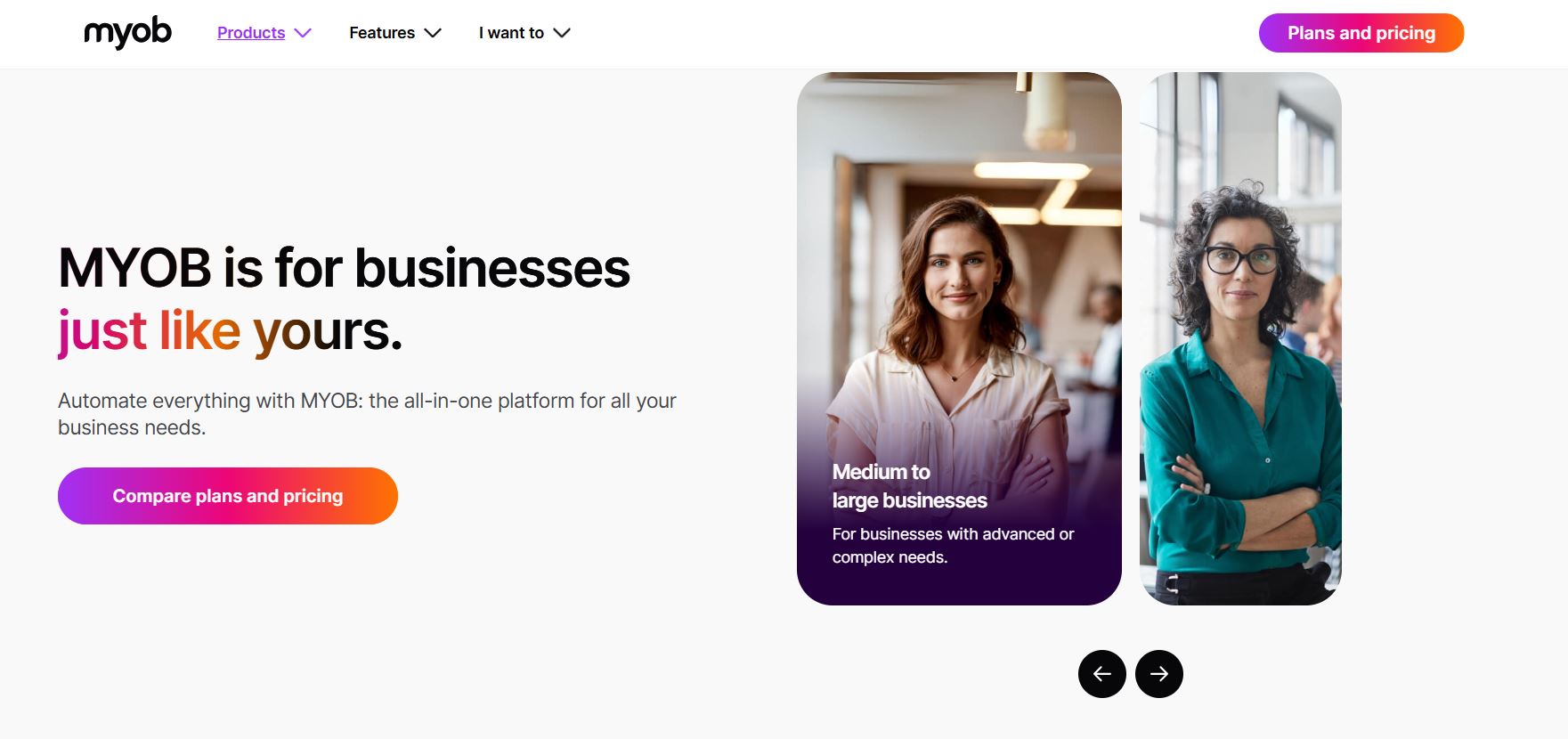

9. MYOB

Image via MYOB

Whether you’re a new business just getting started or an expanding company, MYOB has got you covered. MYOB is one of the versatile KashFlow alternatives with an all-in-one solution for full-cycle accounting and business management.

It makes it easy for businesses of any size to streamline their financial planning and operational tasks.

You can compute your goods and services tax, update your tax tables automatically, and generate regular reports for your business using MYOB.

Let’s check out what this KashFlow alternative offers.

Key Features

MYOB offers features, such as:

- Invoicing and billing

- Bank reconciliation

- Inventory and asset management

- Payroll management

- Job costing

- Budgeting tools

- Reporting and analysis

- Integration with various third-party applications to streamline business processes.

Pros

- MYOB offers a wide range of accounting features.

- MYOB supports integration with various third-party applications.

- For businesses engaged in international transactions, MYOB supports multiple currencies.

- MYOB offers cloud-based solutions that facilitate real-time updates and collaboration among team members.

Cons

- The pricing structure of MYOB may be relatively high for small businesses with limited budgets.

- Limited scalability as the business grows.

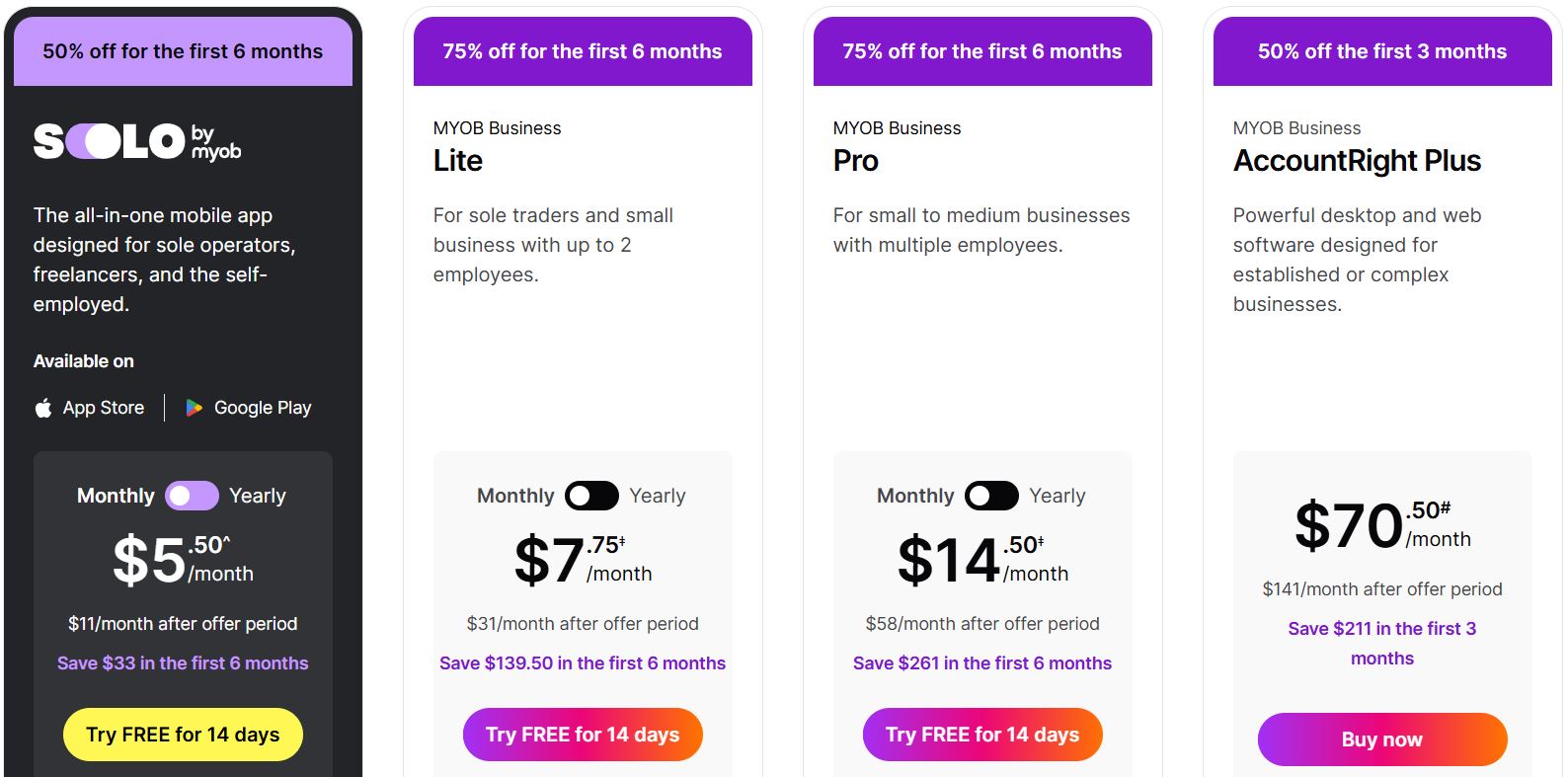

Pricing

MYOB has four main pricing plans for business management:

- Solo: $11/month

- Lite: $31/month

- MYOB Business Pro: $58/month

- AccountRight Plus: $141/month

Image via MYOB

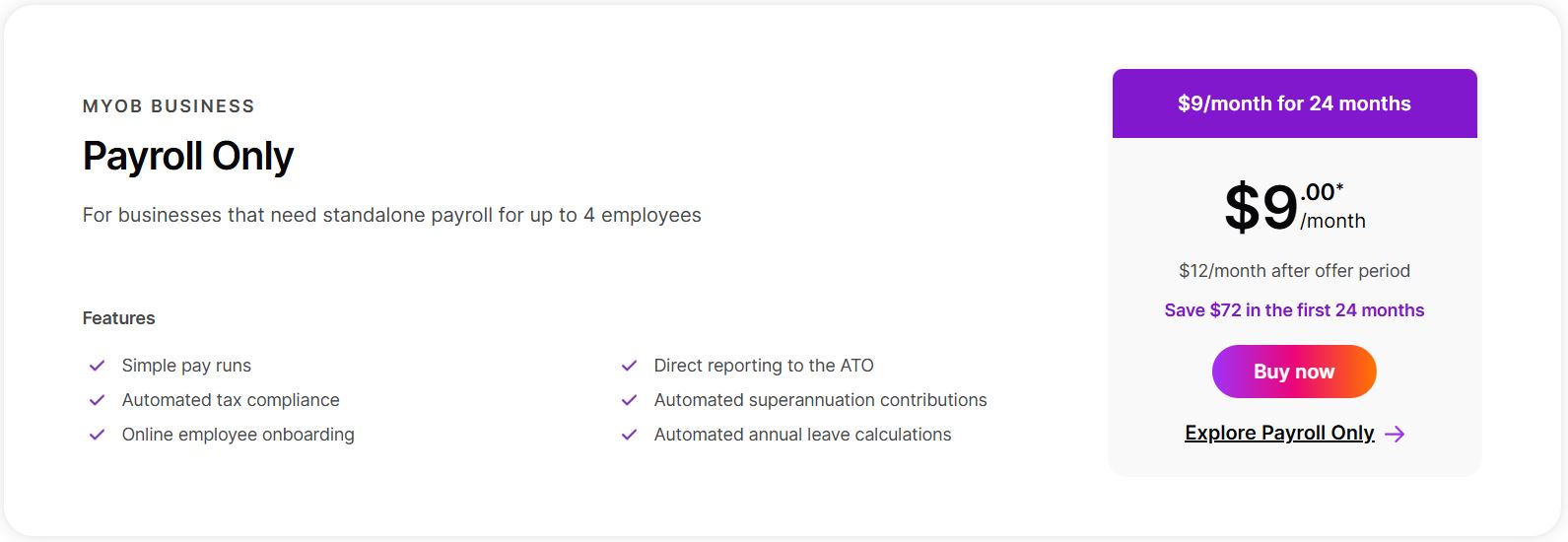

For businesses that need standalone payroll functions, you can subscribe to MYOB payroll plan for $12 per month with a discount price of $9 for the first 24 months.

Image via MYOB

Also Read:

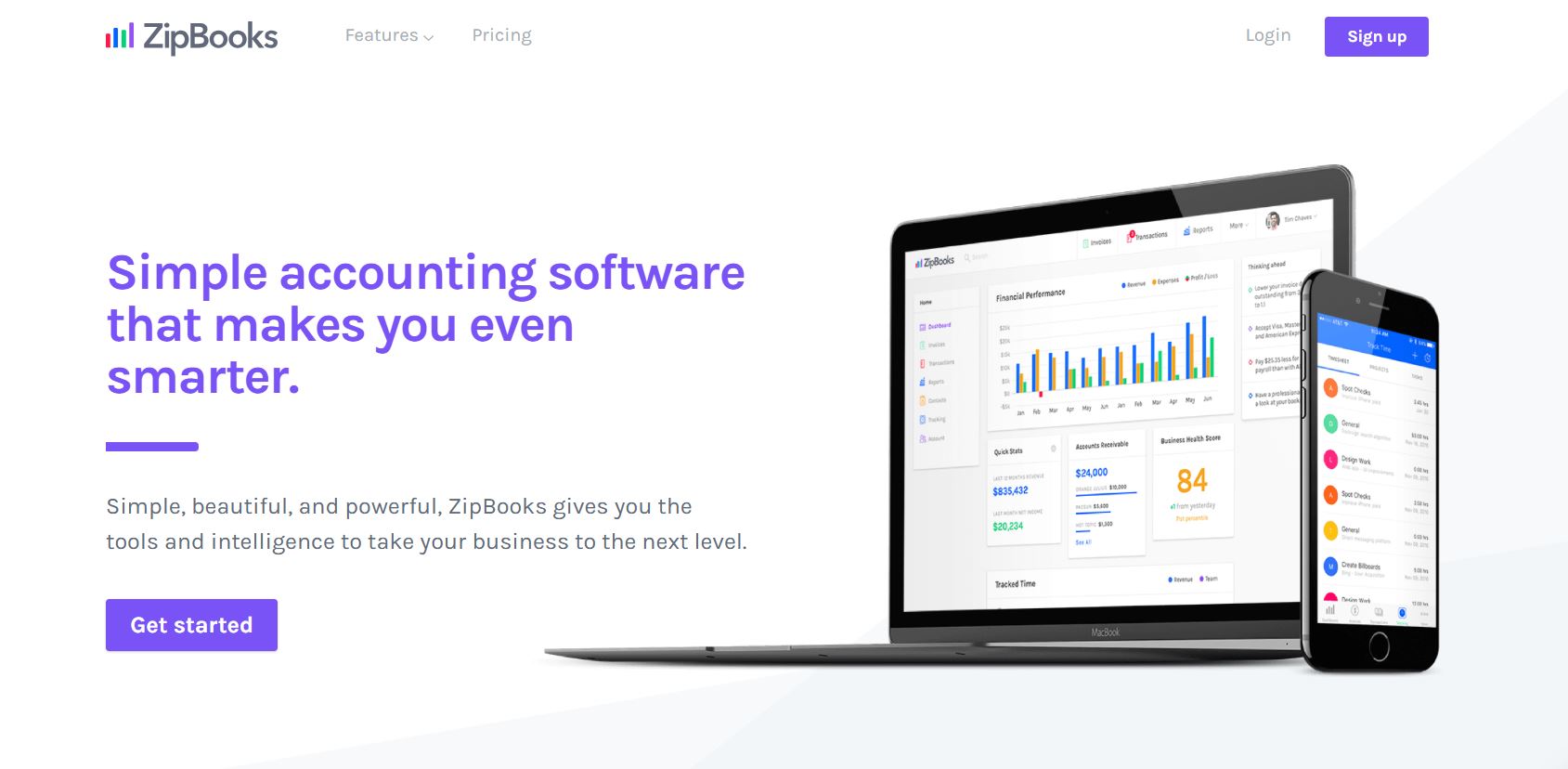

10. ZipBooks

Image via ZipBooks

ZipBooks is one of the affordable KashFlow alternatives ideal for small businesses.

It has simple interfaces to create professional invoices, track bills, and run reports.

What’s more?

ZipBooks integrates with payment processors to accept credit card payments directly through invoices.

It also syncs with business banking accounts to automatically import transactions and reconcile accounts. These integrations reduce time spent on manual data entry.

For project-based businesses, ZipBooks has tools to create estimates, track time and expenses, and bill customers.

Let’s see what this KashFlow alternative has to offer.

Key Features

- Core accounting tools for double-entry accounting, automated expense tracking, and financial reporting.

- Web and mobile app functionality.

- Management of general ledger, accounts payable, and accounts receivable.

- One-time and recurring billing management.

- Invoicing system with credit card payments from 22 different countries.

- Professional invoice creation and customization.

- Bank reconciliation.

- Multiple currency compatibility.

Pros

- ZipBooks offers a free plan with unlimited invoices.

- Low-cost accounting software with useful features for small businesses.

- Integrations with payment processors and business banking to reduce manual data entry.

- Mobile access to create and send invoices as well as log expenses on the go.

- Scalable plans to suit the needs of businesses at different growth stages.

Cons

- Lacks some advanced features like inventory or payroll management.

- Primarily designed for service-based businesses. May lack some specialized tools for product-based companies.

Pricing

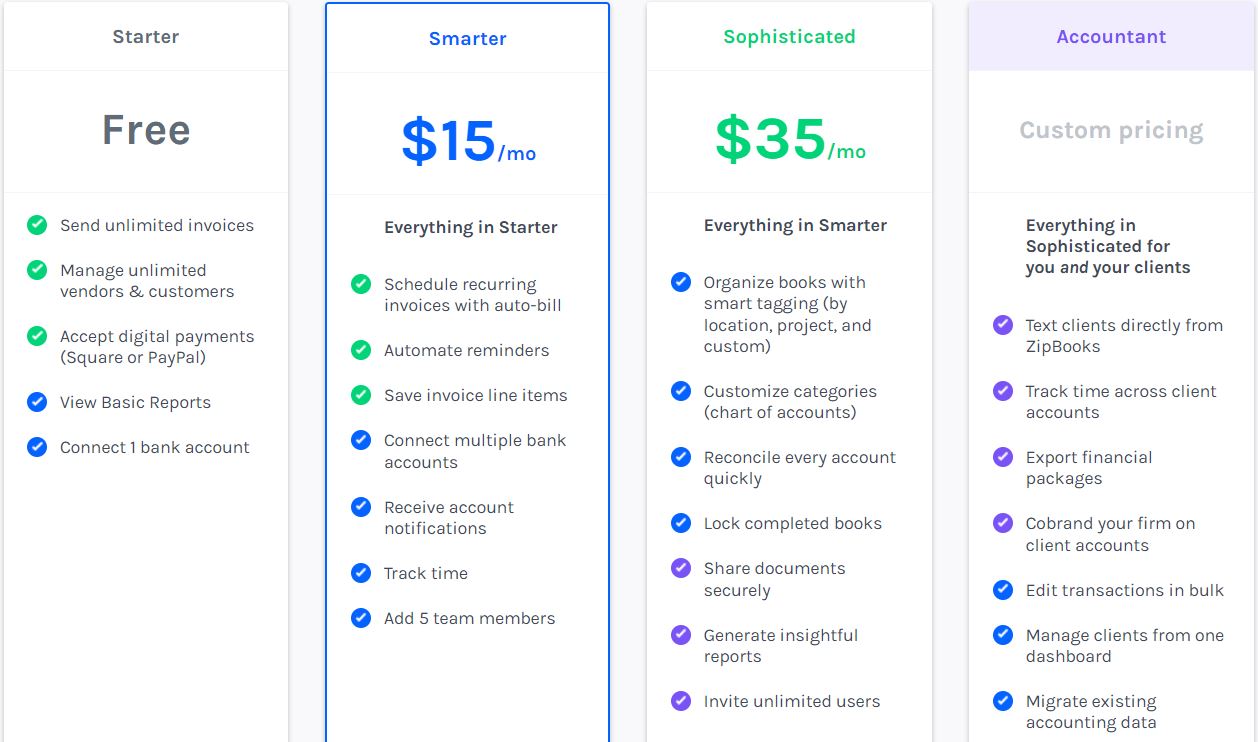

ZipBooks offers four plans including a free plan.

- Starter: Free

- Smarter: $15 per month.

- Sophisticated: $35 per month.

- Accountant: Custom pricing

Image via ZipBooks

11. Kashoo

Image via Kashoo

Kashoo stands out as one of the versatile KashFlow alternatives equipped with features for financial accounting, invoicing, and handling tax documents and other financial documents.

It’s an all-in-one solution designed with the resources you need to manage your accounts and money with ease.

It is best suited for small business owners, accountants, and bookkeepers.

What feature sets Kashoo apart from other KashFlow alternatives?

Key Features

- Cloud-based double-entry accounting capability.

- Automated expense tracking and budgeting.

- Basic bookkeeping, including invoicing and managing accounts.

- Bank account connections with over 5,000 banks globally.

- Multi-currency transaction capability.

- Mobile accessibility for iOS and Android devices.

- Customization and integration with various applications.

- Automation solution for recurring workflow.

Pros

- Easy to set up and navigate even for non-accountants. The interface is simple and intuitive.

- Automates time-consuming tasks like invoicing, bill pay, expense tracking, and reporting.

- Integrates with many popular small business tools such as Stripe, PayPal, Gusto, and TSheets.

- Provides useful reports and insights to help you make better business decisions.

- Customer support is available via phone, email, or live chat.

Cons

- Lacks advanced accounting features like payroll and inventory management.

- No monthly plans. The annually-billed plans may be too expensive for some small businesses.

Pricing

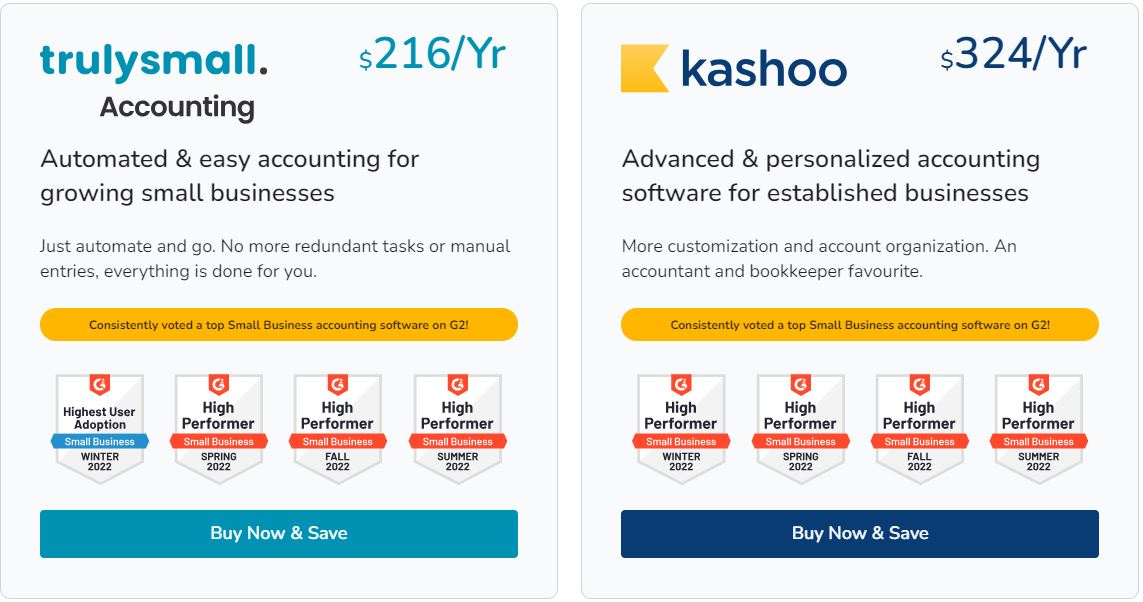

Kashoo is one of the KashFlow alternatives that offer no free plan. It has two paid plans that are billed annually.

- Trulysmall Accounting: $216 per year

- Kashoo: $324 per year

Image via Kashoo

Also Read:

12. OneUp

Image via OneUp

OneUp offers a comprehensive suite of essential tools, including accounting, invoicing, inventory management, and CRM on a single platform. These tools are available on both mobile and desktop devices.

With over 700,000 users on Google Marketplace, it provides daily cash flow and profit information, keeping you informed and in control of your finances.

Let’s look at other OneUp features that set it apart from other KashFlow alternatives.

Key Features

- Create, customize, and send invoices with OneUp in just a few clicks to streamline billing and payments.

- Track stock levels, get automated reorder alerts, and prevent stockouts with up-to-date inventory data.

- Manage leads, set follow-up reminders, and streamline sales processes with built-in CRM features.

- Monitor and measure sales efficiency over a period using a comprehensive dashboard.

- Categorize expenses, generate financial reports, process payroll for employees, and easily gain insights into business spending.

- Match transactions automatically, making bank reconciliations quick and hassle-free.

Pros

- 30-day free trial with access to all features.

- Multi-functional platform with invoicing, inventory, and CRM.

- Seamless bank synchronization to reduce accounting effort.

Cons

- No free plan after the trial ends.

- Customer support is not available on the lowest-tier plan.

Pricing

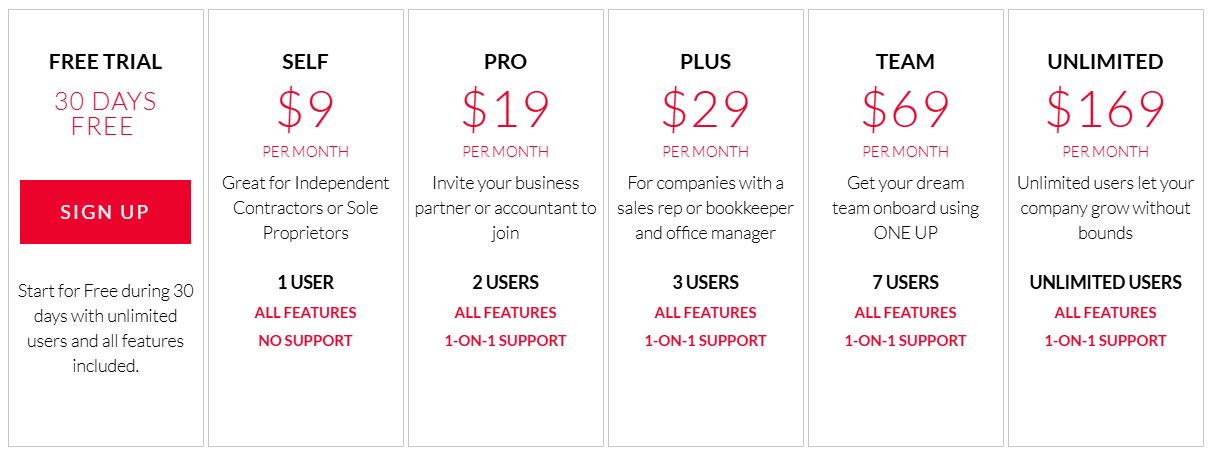

Just like some KashFlow alternatives, OneUp offers a 30-day free trial with full feature access and no credit card required.

- Self: $9/month

- Pro: $19/month

- Plus: $29/month

- Team: $69/month

- Unlimited: $169/month

Image via OneUp

13. Clear Books

Image via Clear Books

Clear Books is one of the cloud-based KashFlow alternatives that offer a comprehensive solution for managing invoices, expenses, payroll, and financial reporting.

The tool also supports multi-currency accounting, making it ideal for businesses with international clients.

Additionally, Clear Books integrates seamlessly with various banking and tax services, ensuring compliance with HMRC regulations.

Key Features

- Create and send professional invoices with customizable templates and automated payment reminders.

- Record and categorize business expenses to gain better financial insights.

- Connect your bank accounts for automatic transaction imports and reconciliation.

- Manage international transactions and exchange rates seamlessly.

- Generate VAT returns, submit to HMRC, and ensure compliance with UK tax laws.

- Access to real-time profit and loss statements, balance sheets, and cash flow reports.

Pros

- AI-powered automation reduces manual bookkeeping tasks

- Strong compliance with UK accounting regulations and tax laws

- Multi-currency support benefits businesses with international clients

Cons

- No free plan, unlike some KashFlow alternatives

- Payroll functionality is only available as an add-on

Pricing

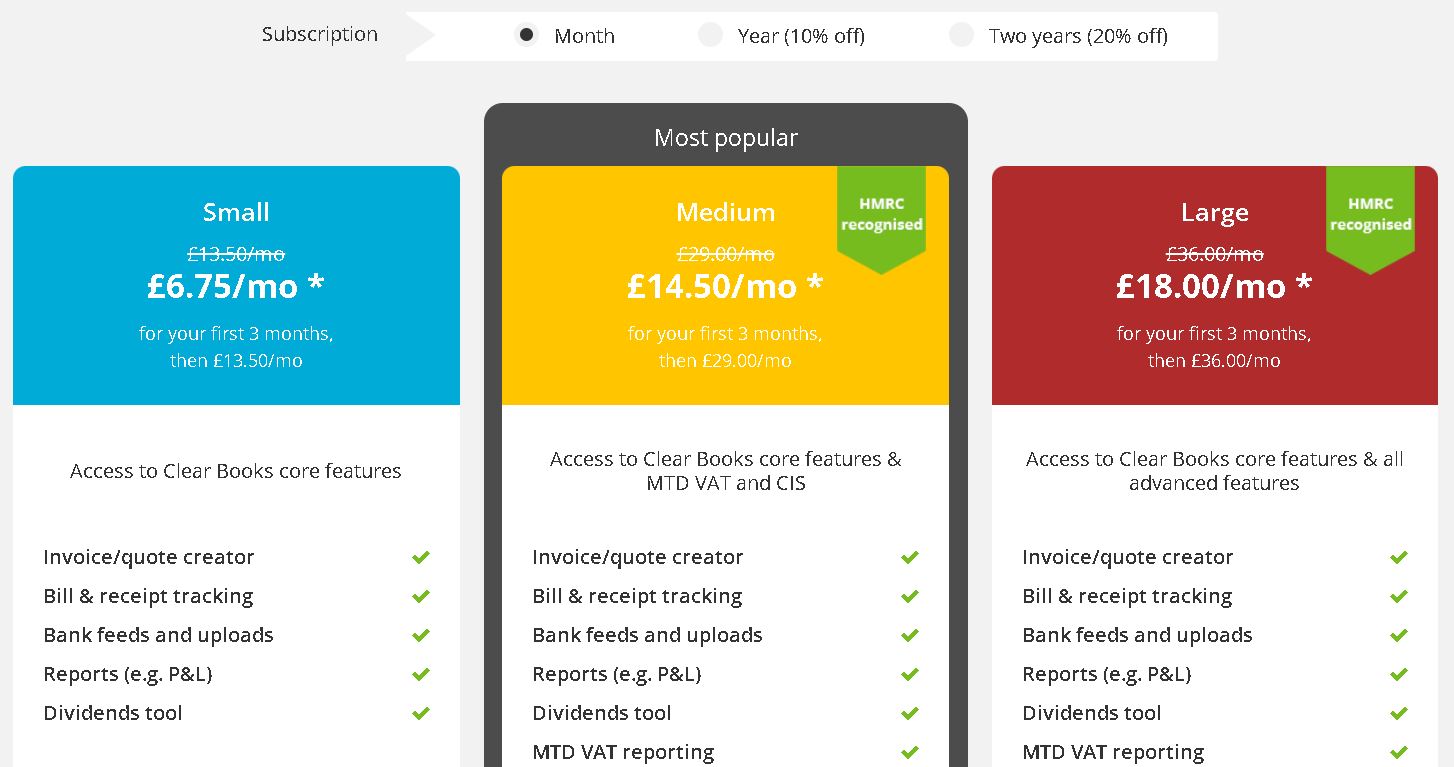

Clear Books offers three pricing tiers, each with a 50% discount for the first three months.

- Small: $13.50/month

- Medium: $29/month

- Large: $36/month

Image via Clear Books

Also Read:

FAQ

1. Can I find accounting business software that offers affordability and robust features?

Yes, several KashFlow alternatives including ZipBooks, Zoho Books, and QuickBooks, strike a balance between affordability and robust features.

They offer various pricing plans, including free options, and provide essential features like invoicing, expense tracking, reporting, and more.

2. How do I ensure the accounting software I choose integrates well with my existing tools and services?

Integration is a crucial factor in choosing the best accounting software.

The KashFlow alternatives listed here are known for their compatibility with popular third-party services, such as payment gateways, payroll providers, and banking platforms. This ensures seamless connectivity across your financial tools.

3. How can I choose the KashFlow alternative that’s best for my business’s needs?

The best KashFlow alternative for your company will depend on a variety of business-specific considerations.

Consider factors like functionality, ease of use, integration with other software, affordability, and reliable customer support.

4. How important is customer support when choosing any KashFlow alternatives?

High-quality customer support ensures you have assistance when needed and can navigate the software effectively.

Choose KashFlow alternatives that provide resources like knowledge bases, video tutorials, phone support, live chat, and active user communities.

5. Can data be easily migrated from KashFlow to any KashFlow alternatives?

Migration processes can vary, and it’s recommended to check with the specific accounting software for guidance. Many platforms offer tools or support to assist in data storage and transfer.

When considering KashFlow alternatives, it’s important to ensure compatibility with your existing data structure. Some alternatives may offer more seamless integration, while others may require additional steps for data migration.

Also Read:

- Top Challenges of Financial Accounting Businesses

- How To Choose Accounting Software: A Complete Guide

Wrapping Up

With the top KashFlow alternatives discussed in this post, you have a better sense of the range of features and pricing available.

Whether you need a simple tool for traditional or cloud-based accounting, there are several solutions to suit any small business.

Although KashFlow is an excellent accounting software, take some time to consider the range of KashFlow alternatives available and choose which ones best suit your business needs.

When you come across a tool that catches your interest, take the time to explore its features through a free trial or by trying out its free plan. Only make the leap to a paid plan once you’re confident that it suits your needs.