Ready to explore our tax deduction cheat sheet? Let’s dive deep into this comprehensive tax deduction cheat sheet and ensure you’re not leaving any money on the tax table.

Tax Deduction Cheat Sheet: The Basics

Tax deductions operate by diminishing the amount of your income that’s considered taxable. Think of them as discounts on your taxable income.

Before we break down the various types of deductions available, let’s clarify some fundamental concepts:

How Tax Deductions Work

When you have deductions, they reduce your taxable income. If, for instance, you earn $60,000 annually and accrue $12,000 in deductions, you’ll only be taxed on $48,000. This means a smaller tax bill at the end of the year.

To further understand tax deductions, it’s essential to differentiate between deductions, credits, and exemptions. Let’s break down these distinctions:

- Deductions: As we’ve highlighted, these reduce the amount of money on which you’re taxed.

- Credits: Think of credits as direct, dollar-for-dollar reductions off your tax liability. If you’re eligible for a $2,000 tax credit, that’s $2,000 less you owe to the government.

- Exemptions: Exemptions used to be specific amounts you could deduct for yourself, your spouse, and each of your dependents. However, following recent tax reforms, personal exemptions have been phased out, but other types still exist.

Another pivotal term to familiarize yourself with is “tax deductible.”

“Tax Deductible” Expenses

When an expense is termed “tax deductible,” it signifies that you can subtract its cost from your total income, thus lowering the amount upon which your tax is based. While it doesn’t erase your tax liability, it certainly lessens the base it’s calculated on.

With these foundational principles in mind, you’re better equipped to identify and leverage the tax deductions for which you qualify.

Remember, every deduction, no matter how small, can accumulate into substantial savings over time. As you prepare for tax season, keep track of all potential tax write-offs to maximize your savings.

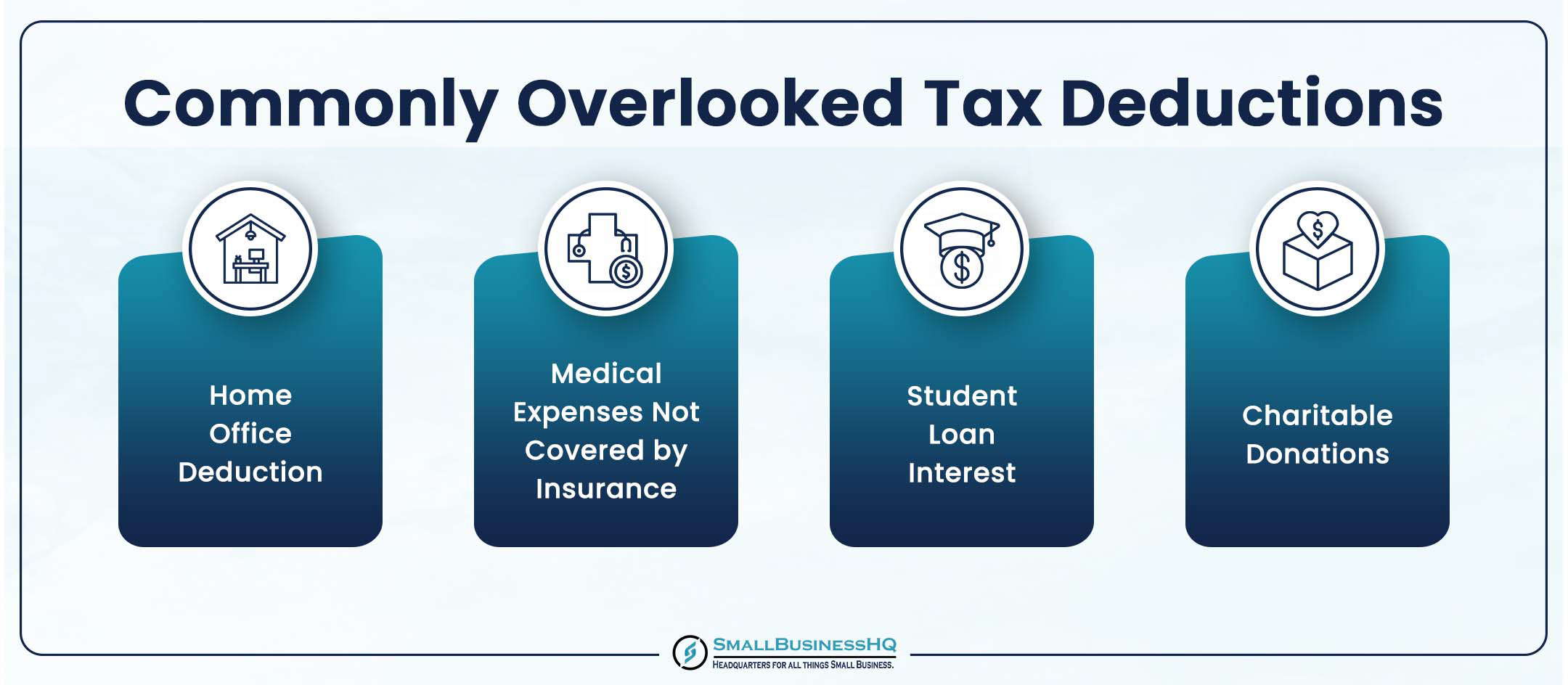

Tax Deduction Cheat Sheet: Commonly Overlooked Deductions

As taxpayers, it’s easy to miss out on some valuable deductions, especially when they aren’t as widely advertised or discussed. Yet, these overlooked tax write-offs can lead to significant savings. This section of our tax deduction cheat sheet sheds light on some of the most commonly missed ones:

Home Office Deduction

With the rise of remote work, this has become more relevant. If you use a part of your home exclusively for business purposes, you might be eligible. This can include a portion of rent, utilities, and even repairs.

It’s important to emphasize the “exclusive use” clause. A home office that doubles as a guest room, for instance, might not qualify. The square footage of the office space in relation to the total home size is typically the basis for calculating the deduction. Small business owners working from home should carefully consider this deduction when filing taxes.

Medical Expenses Not Covered by Insurance

Unexpected medical bills can be a burden, but many don’t realize some of these costs are tax deductible. If your medical expenses exceed 7.5% of your adjusted gross income, you can claim them.

As our tax deduction cheat sheet explains, deductions aren’t limited to hospital bills or doctor’s fees. They can encompass a range of out-of-pocket expenses, from prescription medications to certain medical aids or equipment. Health insurance premiums may also be deductible in some cases.

Student Loan Interest

Education is an investment, but it often comes with debt.

However, there’s good news:

You might be able to deduct up to $2,500 of paid student loan interest annually, depending on your income.

It’s worth noting that this is an above-the-line deduction, meaning you don’t need to itemize to claim it. This can be particularly beneficial if your itemized deductions don’t exceed the standard deduction.

Even if your parents are making the payments on a loan in your name, you can claim this deduction. This is one of the tax write-offs that many graduates overlook.

Charitable Donations

Beyond cash donations, did you know you can also deduct expenses like mileage driven for charitable service or the value of goods donated to charity?

When most think of charitable deductions, cash contributions come to mind. However, in-kind donations, like clothing or household items, can also be deducted based on their market value. Keep detailed records of these donations, as they can significantly impact your taxable income when filing taxes.

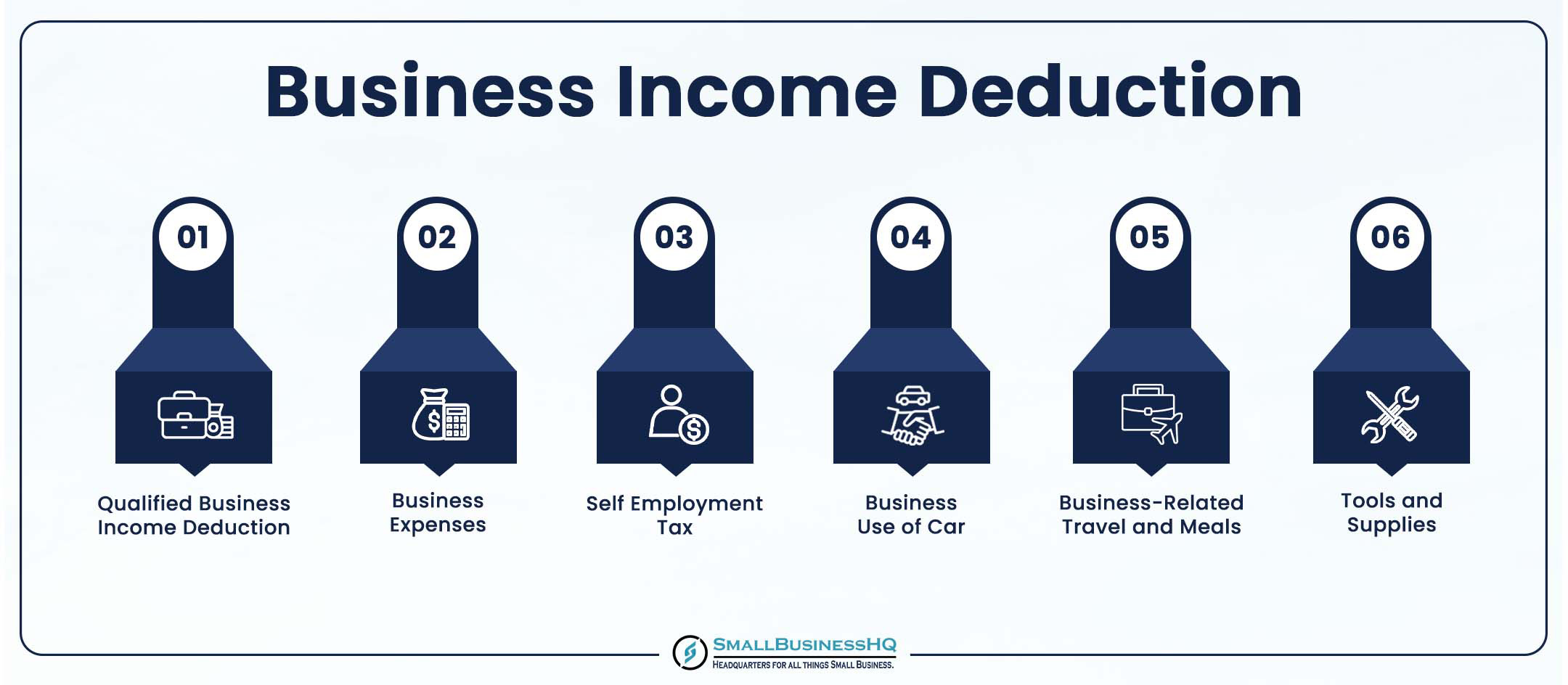

Business Deductions – Tax Deduction Cheat Sheet

Beyond understanding your industry, it’s also important you know the potential tax savings at your disposal. If you’re a business owner or freelancer, these deductions can significantly impact your bottom line. In this section of our tax deduction cheat sheet, we’ll delve into some pivotal ones:

Qualified Business Income Deduction

One of the newer and more impactful deductions, the qualified business income deduction, allows eligible taxpayers to deduct up to 20% of their qualified business income. It’s designed mainly for pass-through entities like LLCs, S-corps, and sole proprietorships, making it perfect for small business owners.

Pro Tip: Our LLC formation checklist and best LLC services guide are excellent starting points if you’re looking to learn more about LLCs and how they can benefit your business taxes.

Our tax deduction cheat sheet continues with one of the most crucial areas for business owners.

Business Expenses

The key here is to remember that to be deductible, an expense must be both ordinary (common in your trade) and necessary (helpful and appropriate for your trade). This can include:

- Advertising costs

- Office supplies and expenses

- Utilities

- Business-related subscriptions

Small business owners should keep meticulous records of these expenses to maximize their tax write-offs. Remember, even small expenses can add substantial savings to your tax bill.

Self-Employment Tax

If you work for yourself, you’re familiar with the self-employment tax. But did you know you can deduct the employer-equivalent portion of your self-employment tax when calculating your adjusted gross income?

Here’s what it means:

While self-employed individuals are responsible for both the employee and employer portions of Social Security and Medicare taxes, they can deduct the employer portion.

It’s similar to how traditional employers aren’t taxed on matching contributions. This valuable deduction can be claimed directly on your tax return without needing to itemize.

You May Also Like:

Business Use of Car

If you use your car for business, specific vehicle expenses can be deducted. This doesn’t include commuting but does encompass traveling to clients, meetings, or other business-related ventures.

There are two methods to calculate this deduction:

The standard mileage rate changes yearly, or the actual expense method could include fuel, repairs, and insurance.

Whichever method you choose, accurate record-keeping is crucial to validate your claims and maximize your deduction. This is one of the tax write-offs that many small business owners overlook or underutilize.

Business-Related Meals and Travel Expenses

Trips taken exclusively for business purposes can be tax deductible. This includes transportation, lodging, and 50% of your business meals.

However, it’s important to differentiate between business and leisure. If a trip combines both, only the business-related portions are deductible.

Tools and Supplies

Items that last less than a year and are used in your business can often be deducted in the year they’re purchased.

Think of items like office supplies, software subscriptions, or even job-specific materials. These short-term assets are distinct from larger, long-term equipment, allowing businesses to quickly reclaim a portion of their costs. Small businesses should track these expenses carefully throughout the year to maximize their deductions at tax time.

The next section of our tax deduction cheat sheet focuses on one of the most valuable areas for homeowners.

Also Read:

- 23 Best Invoicing Software For Small Businesses In 2024

- 18 Best Accounting Software For A Small Business In 2024

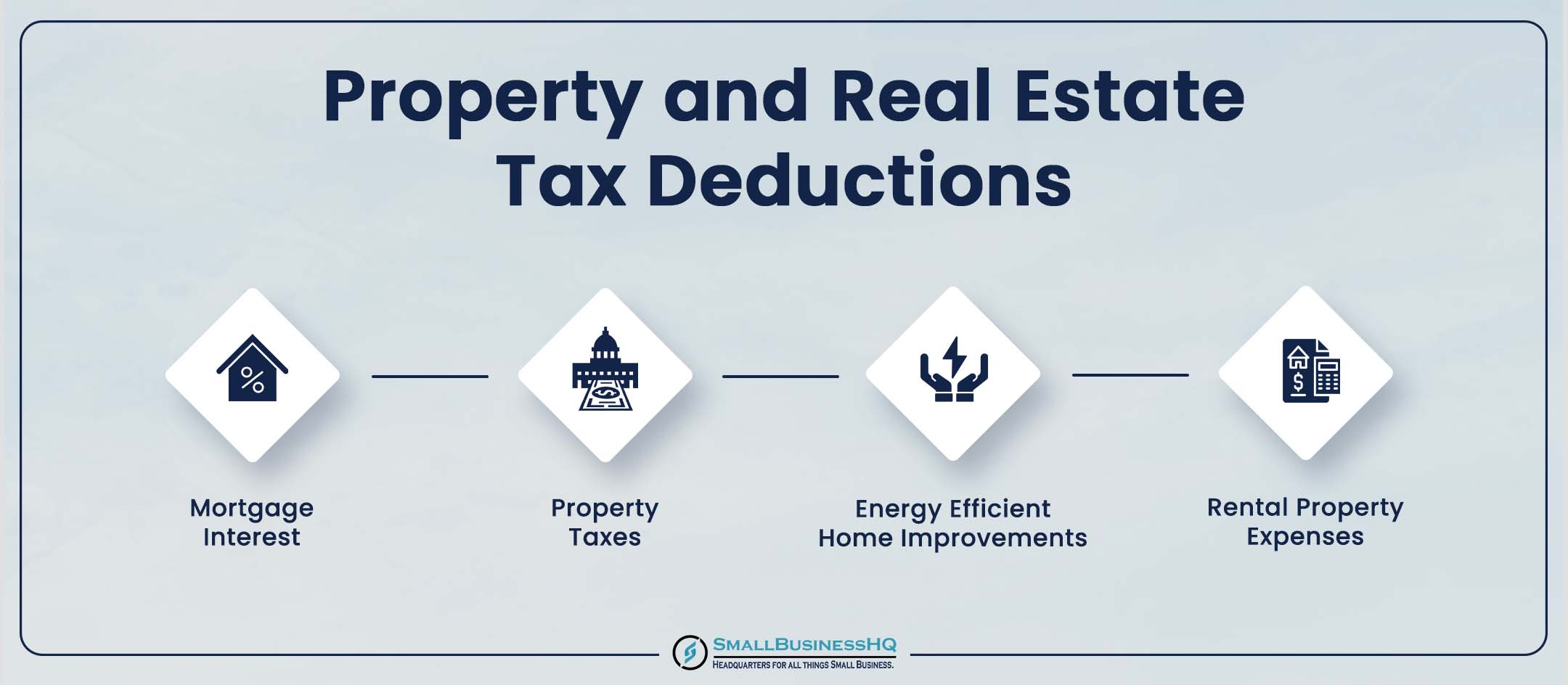

Property and Real Estate Deductions – Tax Deduction Cheat Sheet

Real estate and business property-related expenses form a sizable portion of many taxpayers’ annual expenses, making the related deductions incredibly valuable. Our tax deduction cheat sheet uncovers some deductions you shouldn’t miss:

Mortgage Interest

For many, this is a primary deduction. If you’ve taken out a loan to buy, build, or improve your home, the interest you pay on that loan may well be deductible.

This deduction essentially recognizes the financial challenges of homeownership. Especially in the early years of a mortgage when interest payments are at their highest, this deduction can offer considerable tax relief.

Property Taxes

Local property taxes, often a substantial expense, can be deducted. This includes taxes paid for real estate and other personal property.

It’s worth highlighting that this deduction, combined with the mortgage interest deduction, is capped at $10,000 for most taxpayers due to recent tax reforms. This cap applies to your total itemized deductions for state and local taxes.

For those in high-tax states or with multiple properties to accurately estimate potential deductions. Consult with a tax advisor if you’re unsure how this might affect your tax liability.

Energy-Efficient Home Improvements

If you’ve made specific energy-saving home improvements, such as installing solar panels or energy-efficient windows, there are credits available. These can offset the costs and benefit the environment simultaneously.

These credits reward homeowners for green initiatives and stimulate the broader adoption of sustainable technologies. It’s a win-win, providing financial incentives while promoting environmental responsibility. Remember, a tax credit directly reduces your tax bill, making it even more valuable than a deduction in many cases.

Rental Property Expenses

If you rent out property, many associated expenses are deductible. This can include the following:

- Advertising for tenants

- Property management fees

- Travel related to property management

Being a landlord comes with responsibilities and costs. The tax code acknowledges this, allowing business property owners to offset some of these costs. Just remember to factor in potential tax write-offs when evaluating the profitability of these ventures.

Pro Tip: Considering starting a rental business? Here are dozens of rental business ideas you could explore.

You May Also Like:

- What is Accounting Software? Everything You Need To Know

- How to Choose Accounting Software: A Complete Guide

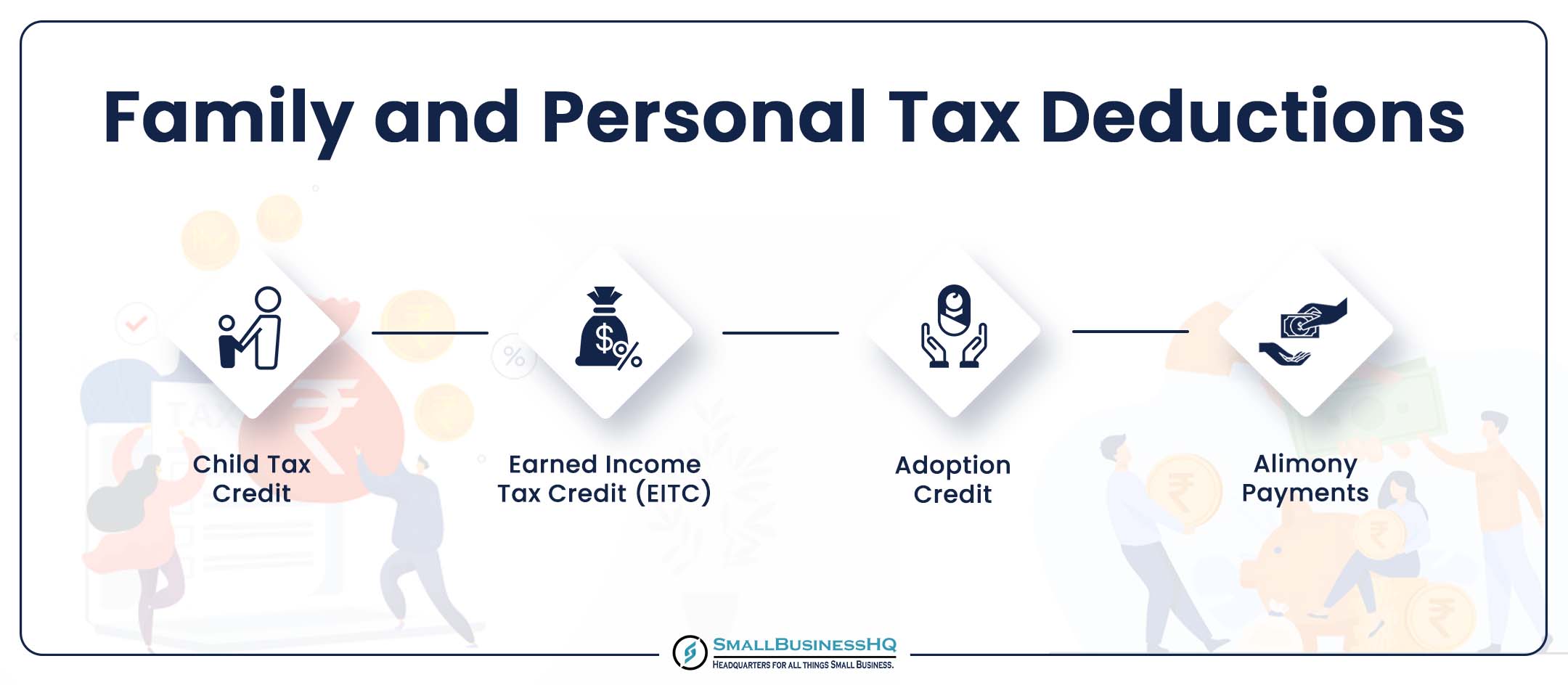

Family and Personal Deductions – Tax Deduction Cheat Sheet

While businesses and properties offer a variety of tax-saving opportunities, there are numerous deductions linked to personal and familial responsibilities that taxpayers often overlook. These can significantly alleviate financial burdens for families.

This section of our tax deduction cheat sheet highlights some key ones to consider:

Child Tax Credit

Raising a child comes with numerous expenses. The Child Tax Credit offers relief by allowing eligible parents to reduce their tax liability by up to $2,000 for each qualifying child.

What’s especially significant about this credit is its potential refundability. If the credit amount exceeds the total tax owed, families might receive a refundable tax credit for the remaining amount. This can make a significant difference for families managing tight budgets, especially during tax season.

Earned Income Tax Credit (EITC)

Designed for low to moderate-income earners, EITC can result in a substantial tax refund. The amount varies based on gross income and the number of children in the household.

EITC is one of the most impactful credits for boosting the incomes of working families, especially those with children. It’s not merely a tax reduction but can often result in a direct financial boost through a larger refund. This refundable tax credit can benefit self-employed individuals and small business owners with modest incomes.

Adoption Credit

Adopting a child is a commendable act but can be financially taxing. The adoption credit can help offset some of these costs, covering adoption fees, legal fees, and even travel expenses related to the adoption process.

It’s worth noting that this credit isn’t just for international or private adoptions. Even adopting from the foster care system, which might have lower upfront costs, can still come with eligible expenses that the credit can cover.

Alimony Payments

Following tax reforms, alimony payments for divorce or separation agreements executed or modified after December 31, 2018, are no longer deductible by the payer or included in the recipient’s income.

This significant shift in tax treatment has implications for divorce negotiations and settlement agreements. Previously, the deduction often played a role in how alimony amounts were determined, given the tax relief it provided to the payer. It’s crucial to consult with a tax professional if you’re dealing with alimony payments, as the tax implications can be complex.

This comprehensive tax deduction cheat sheet now turns to educational expenses, an often overlooked area of tax savings.

Education Deductions and Credits – Tax Deduction Cheat Sheet

Education is a pathway to personal and professional growth, but it often comes with a hefty price tag. Fortunately, the tax code provides several deductions and credits, featured in our tax deduction cheat sheet, to help offset some of these costs.

Let’s explore some primary educational tax-saving opportunities:

Tuition and Fees Deduction

This deduction can reduce the taxable income subject to tax by up to $4,000. It’s designed for taxpayers who are paying post-secondary tuition and fees for themselves, a spouse, or a dependent.

Notably, this deduction is particularly beneficial for those who might not qualify for other education credits because of income restrictions or other factors. It serves as a catch-all, providing relief for many facing the rising costs of higher education.

American Opportunity Credit

Aimed at undergraduate students and those footing the bill, this credit can cover 100% of the first $2,000 of qualified education expenses and 25% of the next $2,000. That’s a total benefit of up to $2,500 annually.

It’s worth highlighting that this credit isn’t just restricted to tuition. It also covers course materials, making it invaluable for students whose course requirements come with hefty textbook or equipment costs. This tax credit can significantly reduce your tax liability or even result in a refund.

Lifetime Learning Credit

Unlike the American Opportunity Credit, this isn’t restricted to undergraduate expenses. It offers a credit of up to $2,000 per tax return for post-secondary education tuition, fees, and even courses to acquire or improve job skills.

You May Also Like:

Deductions for Investors – Tax Deduction Cheat Sheet

Investing is an integral part of wealth-building and financial planning. However, alongside potential profits come costs and income tax.

The silver lining?

The tax code provides specific deductions for investors to mitigate these costs.

This section of our tax deduction cheat sheet highlights some of these deductions:

Investment Interest Expenses

Following our tax deduction cheat sheet, remember that if you’ve borrowed money to invest in taxable investments, the interest on that loan may be tax deductible. However, the deduction is capped at your net investment income.

Capital Losses

Not all investments pan out. If you sell an investment at a loss, you can use that loss to offset capital gains. If losses exceed gains, you can deduct up to $3,000 ($1,500 if married filing separately) against other income.

Dividend Reinvestment

Many investors choose to reinvest dividends. When calculating the cost basis for a sale, don’t forget to include these reinvested amounts. This increases the basis and can reduce taxable gains or amplify a loss.

Tax Deduction Cheat Sheet: Tips for Maximizing Deductions

The key to capitalizing on tax deductions is knowledge and a proactive approach. As we wrap up our comprehensive tax deduction cheat sheet, here are some actionable tips to ensure you’re making the most of every deduction opportunity:

1. Keep Thorough Records

Without detailed records of expenses, you risk missing out on eligible deductions. The Internal Revenue Service (IRS) might also request these records in the event of an audit. Adopt a consistent system for storing all receipts, invoices, and financial statements.

2. Stay Updated on Tax Laws

Staying updated can mean the difference between leveraging a new deduction or unknowingly violating a new rule. Make it a habit to keep yourself informed. This could be through subscribing to tax-related newsletters, joining relevant forums, or periodically consulting with a tax professional. Remember, tax laws can change annually, affecting everything from business taxes to personal deductions.

3. Use Tax Software or Consult a Professional

While personal diligence is commendable, leveraging technology or professional expertise often reveals overlooked deductions.

Updated tax software guides users through potential deductions, ensuring nothing is missed. On the other hand, a tax professional brings a wealth of experience tailored to various financial scenarios.

4. Understand the Difference Between Standard and Itemized Deductions

For many taxpayers, choosing between taking the standard deduction or itemizing can significantly impact their tax liability. The standard deduction has increased in recent years, making it the better choice for many.

However, if your itemized deductions exceed the standard deduction, it’s worth the extra effort to itemize. This decision can affect small business owners with substantial business expenses.

5. Don’t Overlook Business Start-up Costs

For new entrepreneurs, remember that certain business startup costs can be deducted. This includes expenses incurred before your business officially opens its doors.

Up to $5,000 of business startup costs can be deducted in your first year of business, with additional costs amortized over time. This can be a significant tax write-off for new small business owners.

You May Also Like:

- Best Cloud Accounting Software for All Business Sizes

- Best SaaS Accounting Software for All Businesses

FAQ

Q1. What deductions can I claim without receipts?

A. While it’s always recommended to keep receipts for all expenses, certain deductions like the standard deduction, student loan interest, and some IRA contributions don’t specifically require receipts. However, always maintain as much documentation as possible.

Q2. Who qualifies for the 20% pass-through deduction?

A. The 20% pass-through deduction, also known as the Qualified Business Income (QBI) Deduction, is mainly for self-employed individuals, sole proprietors, and owners of S corporations, LLCs, or partnerships. However, there are income thresholds and limitations, especially for specified businesses. Consult with a tax professional to determine if you qualify.

Q3. How do you calculate tax?

A. Tax is calculated based on your taxable income, which is your total income minus deductions and exemptions. This adjusted amount is then taxed at various rates depending on your income tax bracket. Also, consider tax credits, which can further reduce your tax liability. Your filing status also plays a crucial role in determining your tax calculation.

Q4. What can I claim a tax deduction on?

A. You can claim deductions on various expenses, depending on your situation. Common deductions include mortgage interest, student loan interest, medical expenses, charitable donations, and certain business expenses. For small business owners, deductible expenses might include office supplies, vehicle expenses, business insurance, and professional fees. Always consult the latest IRS guidelines or a tax professional to ensure you’re claiming all eligible deductions.

Q5. What is the $500 tax deduction?

A. The $500 tax deduction typically refers to the tax credit available for energy-efficient home improvements under certain tax provisions. You might be eligible for this credit if you’ve made qualifying improvements, like adding insulation or energy-efficient windows. This is one of many potential tax write-offs for homeowners.

Q6. What are some common tax write-offs for small business owners?

A. Common tax write-offs for small business owners include office supplies, business insurance, vehicle expenses, professional fees, business meals (50% deductible), home office deductions, and startup costs. Keep detailed records of all business expenses to maximize your deductions during tax season.

Q7. How does the standard deduction compare to itemized deductions?

A. The standard deduction is a fixed amount that reduces your taxable income, while itemized deductions are specific expenses you can deduct. For 2024, the standard deduction is $14,600 for single filers and $29,200 for married couples filing jointly. If itemized deductions exceed these amounts, itemizing may lower your tax liability more than the standard deduction.

Q8. What’s the difference between a tax deduction and a tax credit?

A. A tax deduction reduces your taxable income, while a tax credit directly lowers your tax bill. For example, a $1,000 deduction might save you $220 if you’re in the 22% tax bracket, whereas a $1,000 tax credit would reduce your tax liability by $1,000. Credits are generally more valuable than deductions of the same amount.

Q9. What is bad debt and how does it impact my taxes?

A. Bad business debt refers to money owed to your business that you can’t collect. For small business owners, uncollectible accounts receivable can be claimed as tax-deductible business expenses.

To claim bad debt, you must have previously included the amount in your gross income. Ensure you have documentation showing attempts to collect the debt before claiming it on your tax return. This deduction can help offset your taxable income and reduce your overall tax liability.

You May Also Like:

Conclusion

From the freelancer understanding business nuances to the homeowner seeking property deductions, every bit of information is an opportunity to keep more of your hard-earned money.

As we wrap up this tax deduction cheat sheet guide, take advantage of the insights provided. Approach each tax season with confidence, ensuring that no stone is left unturned and no deduction is overlooked.

With our tax deduction cheat sheet by your side, both tax deductions and the tax filing process become easy paths to navigate. Here’s to making smarter, more informed financial decisions!