Looking for the best Xero alternatives? We’ve got it sorted.

Choosing reliable accounting software is crucial for your business’s financial efficiency.

Xero, a popular choice for small businesses, is known for its extensive features, user-friendly interface, and mobile-friendly design. It offers three plan options to cater to various business sizes and industries.

But like most other accounting software, Xero has its drawbacks. For instance, it comes with a learning curve, making it less suitable for those with limited financial accounting knowledge. Additionally, its customization options are somewhat limited.

If Xero doesn’t suit your needs, you might want to consider other alternatives to Xero.

This article explores the best Xero alternatives, examining their features, pricing, pros, and cons. The goal is to help you find the perfect accounting software solution for your specific needs.

Quick Summary: Best Xero Alternatives by Type

- Best for Freelancers and Self-Employed Individuals: : Kashoo, FreeAgent, Wave Accounting, ZipBooks

- Best for Growing Businesses: QuickBooks Online, Sage, Zoho Books

- Best for Invoicing: Kashoo, Sage, QuickBooks Online

- Best for Inventory Management: Zoho Books, QuickBooks Online, Sage, ZarMoney

- Best Tools with Free Trial or Free Plan: Zoho Books, ZipBooks, Wave Accounting, ZarMoney

How We Chose the Best Xero Alternatives

When figuring out a tool’s worth, you need to consider various factors. Typically, each factor holds varying importance for different businesses. Yet, there are some universally crucial factors.

In creating this list of Xero alternatives, we’ve carefully checked these key criteria:

- Features: While choosing the best Xero alternatives, we carefully assess the features of each accounting tool. Essential elements like bank reconciliation, multi-currency support, and integrations are vital for efficient financial management. We also gauge the sophistication of these features, considering both all-in-one solutions and specialized features to cater to diverse needs.

- Ease of use: Our objective is to recommend Xero alternatives that reduce the learning curve for users. To gauge a tool’s user-friendliness, we evaluate the intuitiveness of its interface, ease of navigation, and accessibility for users with different skill levels.

- Customer support: Efficient and responsive customer support ensures that users don’t get stuck along the way. We seek Xero alternatives with readily available support channels, such as live chat, phone, and email. Additionally, tools with a pool of other educational resources such as podcasts, blog articles, community forums, etc, are prioritized.

- Pricing: Acknowledging the varied budget constraints within our audience, our selection of Xero alternatives spans from free options to premium solutions. We prioritize transparency, steering clear of platforms with hidden costs. Moreover, we carefully evaluate the features included against the subscription price to determine the tools’ value.

- Customer reviews: The experiences of existing users can help gauge the real-world performance and satisfaction of tools. We consider factors such as reliability, performance, and overall user satisfaction to help you choose the right accounting software.

- Scalability: Finally, we plan for future growth by selecting Xero alternatives that offer scalability. It’s crucial that the software can accommodate an expanding user base and handle increased transaction volumes. This eliminates the need to switch tools at a later point, thus saving time and money.

11 Best Xero Alternatives for 2025

Handling finances involves numerous precise accounting tasks that can be overwhelming.

And that’s not all.

Failure to adhere to financial reporting standards poses legal risks, potentially resulting in penalties and damage to the company’s reputation.

By investing in accounting software like Xero, it is possible to streamline this complex process. However, Xero may not be the optimal choice for every business.

Luckily, you have various options to help you make the right decision.

Here are some benefits of using accounting software:

- Streamlined financial management

- Enhanced accuracy and reduced errors

- Time efficiency

- Improved compliance

- Real-time financial insights

- Simplified invoicing and billing

If you’re looking for powerful accounting software, consider these top Xero alternatives.

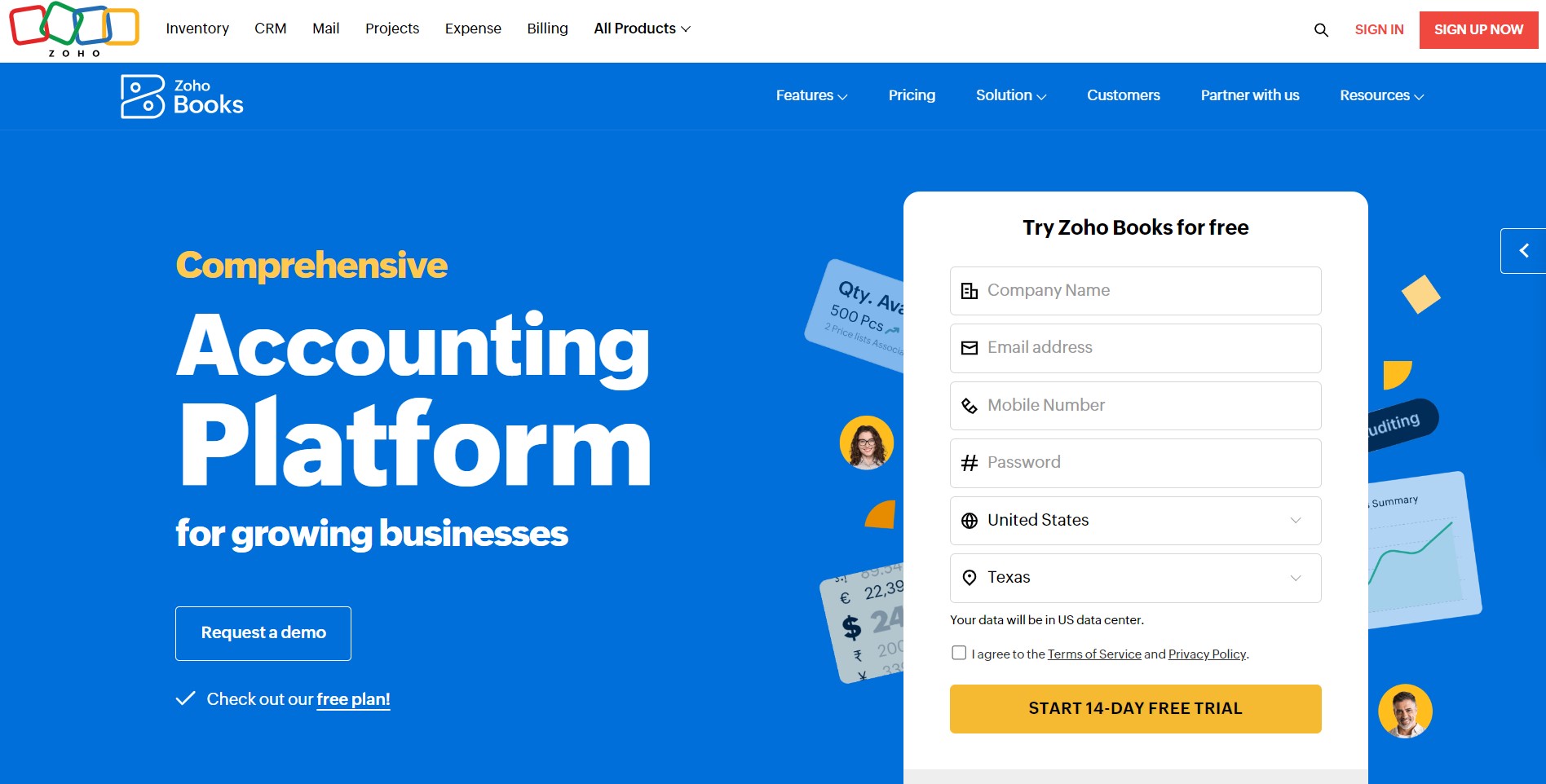

1. Zoho Books

Image via Zoho Books

Zoho Books is an excellent online accounting software for small businesses. It’s part of the Zoho One Suite—an extensive suite for all-in-one business management.

It provides features such as tax compliance, invoicing, automated payment reminders, and custom reports, as detailed in this Zoho Books Review.

Zoho Books is more than just a typical “accounting software.” It also comes with robust features for project management and inventory management, giving it a slight edge.

While small businesses appreciate its affordability, Zoho Books is also suitable for large enterprises with sophisticated accounting needs.

What’s more?

Zoho Books supports 10 languages, including Swedish, Chinese, and Japanese. This allows multilingual teams to access various features in their preferred language.

Additionally, if your business deals with multilingual clients, know that the software can create and send invoices in several languages.

Key Features

- Tailored for organizations handling multiple locations, departments, teams, and facilities, irrespective of distance

- Comprehensive accounting software streamlining invoicing and account receivables management effortlessly

- Seamless bill management, assisting businesses in tracking outstanding payments to vendors effectively

- Enables clients to create customer portals for enhanced relationship management

- Integration with diverse payment platforms, simplifying online payment for your customers

- Fetches and categorizes bank statements, facilitating efficient account reconciliation

- A variety of customizable reports easily exportable to Microsoft Excel

- It has a robust inventory management software that monitors your products to ensure you never run out of stock

- Advanced inventory management to ensure proactive monitoring and prevent stock shortages

Pros

- Available on both iOS and Android devices through a user-friendly mobile app

- Helps calculate your sales tax for compliance

- Easily connects with the Zoho software suite for seamless business functions

Cons

- Advanced features require investment in higher-tier plans

- Limited to a maximum of 15 users even with the highest-tier plan

Pricing

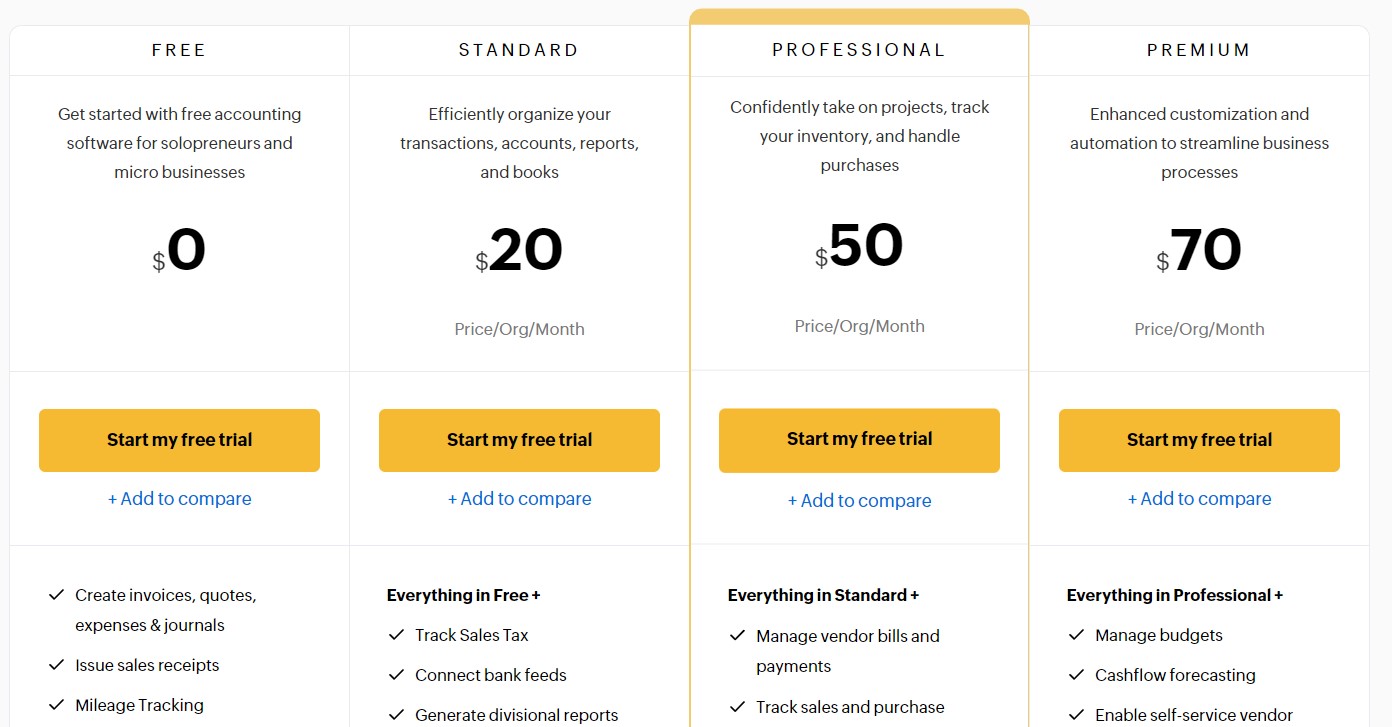

Zoho Books offers a free forever plan and five paid plans to meet the needs of businesses of different sizes:

- Free: 1 user + 1 accountant

- Standard: $20 per month

- Professional: $50 per month

- Premium: $70 per month

- Elite: $150 per month

- Ultimate: $275 per month

Image via Zoho Books

Image via Zoho Books

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: You can efficiently handle stock shortages in Zoho Books by creating partial invoices for available products.

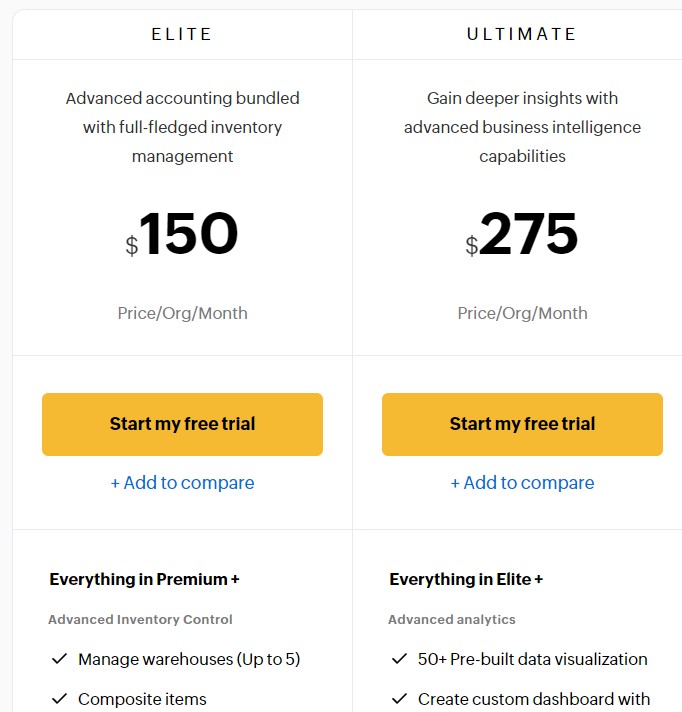

2. QuickBooks Online

Image via QuickBooks Online

QuickBooks Online, a widely recognized and favored business accounting software, empowers you to craft professional invoices and manage banking tasks seamlessly.

With robust tools automating data collection, tax calculation, and features for sales monitoring and custom report generation, QuickBooks Online proves to be a comprehensive Xero alternative.

Notably, it provides advanced reporting capabilities. This includes the basics such as balance sheets, cash flow tracking, and more, in every plan. Higher-tier plans enjoy more detailed accounting reports.

And the best part?

You get to enjoy compatibility across multiple devices with auto-syncing options, ensuring you stay consistently informed.

Plus, there’s a 30-day free trial for you to explore its features and assess its alignment with your business needs, thus making it one of the most sought-after Xero alternatives.

Key Features

- Comprehensive management of cash flow, covering accounts receivable to accounts payable

- Measurement of business performance over time through invoices and estimates, accompanied by report generation and forecasting

- Accessibility through a mobile app, allowing you to handle transactions from any location

- Seamless integration with checking bank accounts for effortless transaction reconciliation

- Creation of custom invoices and expedited payments with QuickBooks Online Payments

- Monitor billable hours using its time-tracking capabilities

- Product-based businesses can leverage inventory management within the platform.

- Incorporates audit trails and provides convenient access for accountants

Pros

- Comprehensive tax support through add-ons and human experts.

- Suitable for small businesses as well as larger corporations

- Seamlessly integrates with a diverse range of third-party apps and services

- There’s an option to avail QuickBooks Online at a 50% discount for the initial three months

Cons

- Each plan has limited users, with the highest-tier capping users at 25

- There’s a bit of a learning curve for beginners

- Several key features are available as add-ons, contributing to increased overall costs

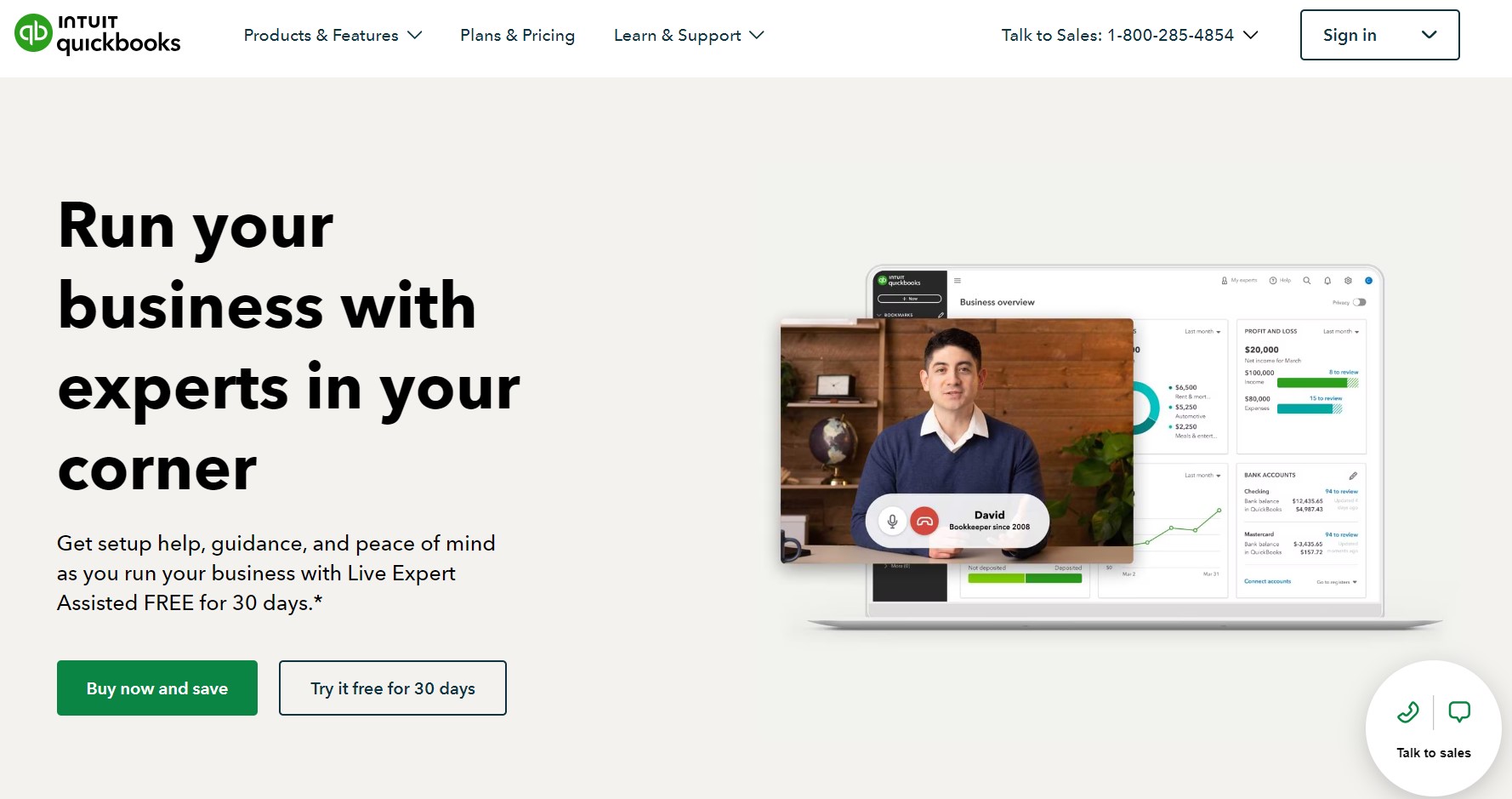

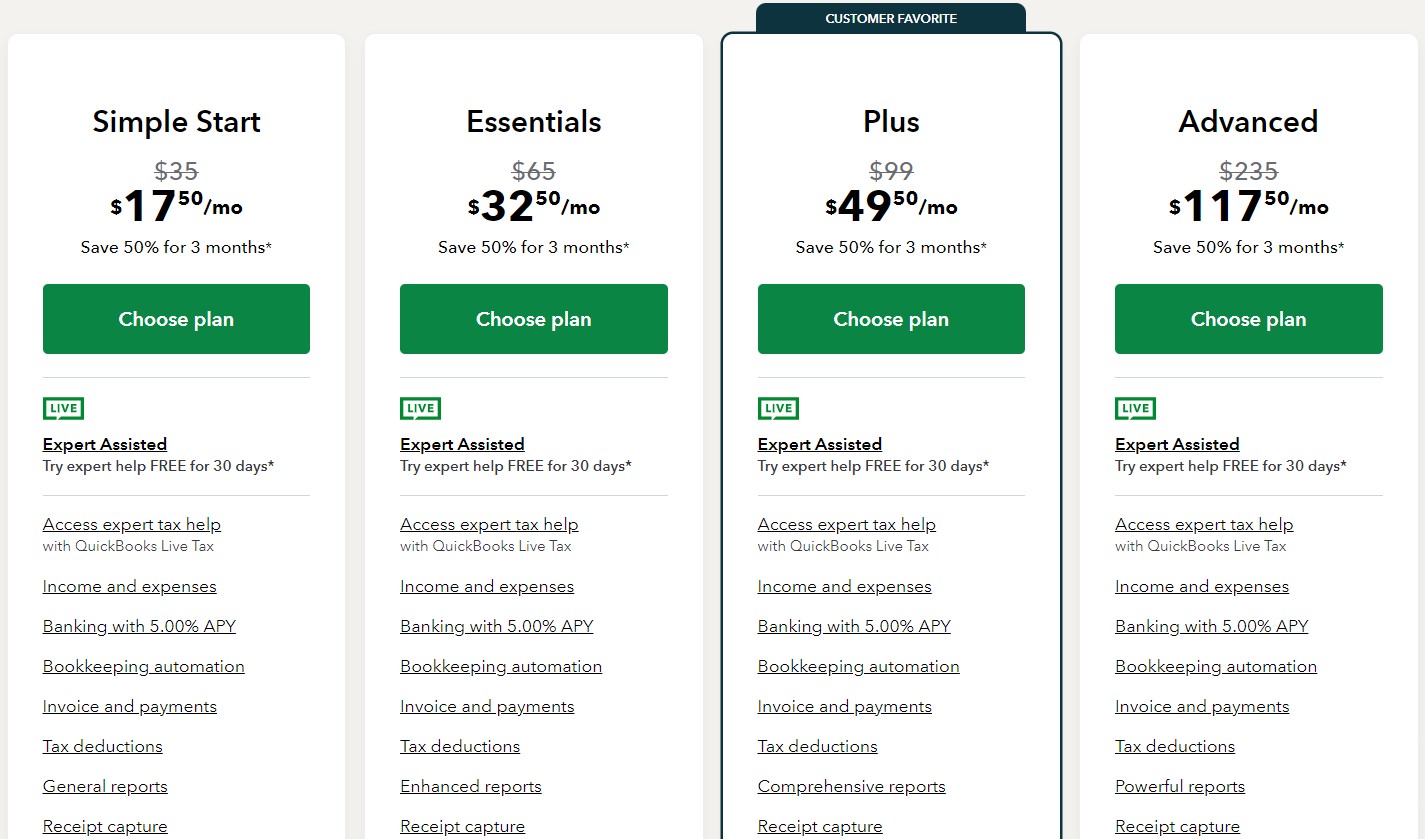

Pricing

QuickBooks Online provides four pricing options that you can explore for free using a 30-day trial. Each plan also comes with a 50% discount for the first three months.

- Simple Start: $35 per month (currently $17.50)

- Essentials: $65 per month (currently $32.50)

- Plus: $99 per month (currently $49.50)

- Advanced: $235 per month (currently $117.50)

Image via QuickBooks

Tool Level

- Beginner/Intermediate

Usability

- Comes with a slight learning curve

Pro Tip: Save time by connecting your bank and credit card accounts to QuickBooks Online using the Bank Feeds feature, instead of manually inputting data into each statement.

3. FreshBooks

Image via FreshBooks

FreshBooks emerges as a noteworthy Xero alternative. It offers a swift and dependable accounting software solution that transforms financial management into a breeze for you.

Its prowess lies in client invoicing, expense tracking, and seamless payment processing. Beyond these, it offers time tracking, project management, client estimates, and proposal creation.

One of its standout features is the effortless handling of subscriptions and invoices. This is coupled with the convenience of online payments via credit cards, PayPal, and Google Checkout—all within a unified system.

The rollout of FreshBooks’ Accounting Partner Program encourages active collaboration between users and their accountants. This initiative promotes transparency and efficiency in financial operations.

For users who want to explore FreshBook’s features for free, there’s a 30-day free trial.

Key Features

- The interface is designed to be user-friendly, ensuring effortless navigation

- Unlimited invoices and clients available for higher-tier subscriptions

- Invoicing tools, with the option to tailor invoices to specific needs

- Ability to efficiently manage and categorize expenses

- Retainer option, especially valuable for accountants and consultants with recurring billing needs

- Time tracking for monitoring project progress

- Payroll integration with Gusto

- Mileage Tracking feature for automatic mileage tracking, easy trip categorization, and potential tax deductions

- An intuitive dashboard that offers a user-friendly overview of your financial information

- Team collaboration is possible by adding members, whether they’re employees, associates, or consultants, to the plan

- Specialized reports like recurring revenue and retainer summaries, which is ideal for consultants

Pros

- The premium tier offers unlimited invoices and client accounts

- Mobile app available for convenient use and mileage tracking

- Remarkable user-friendliness

- Cost-effective with features comparable to many enterprise solutions

- Includes time tracking functionality

Cons

- Not the optimal choice for businesses with extensive inventory tracking needs

- May lack some advanced accounting features

- Lite and Plus subscribers are restricted to a maximum of 5 and 50 clients, respectively

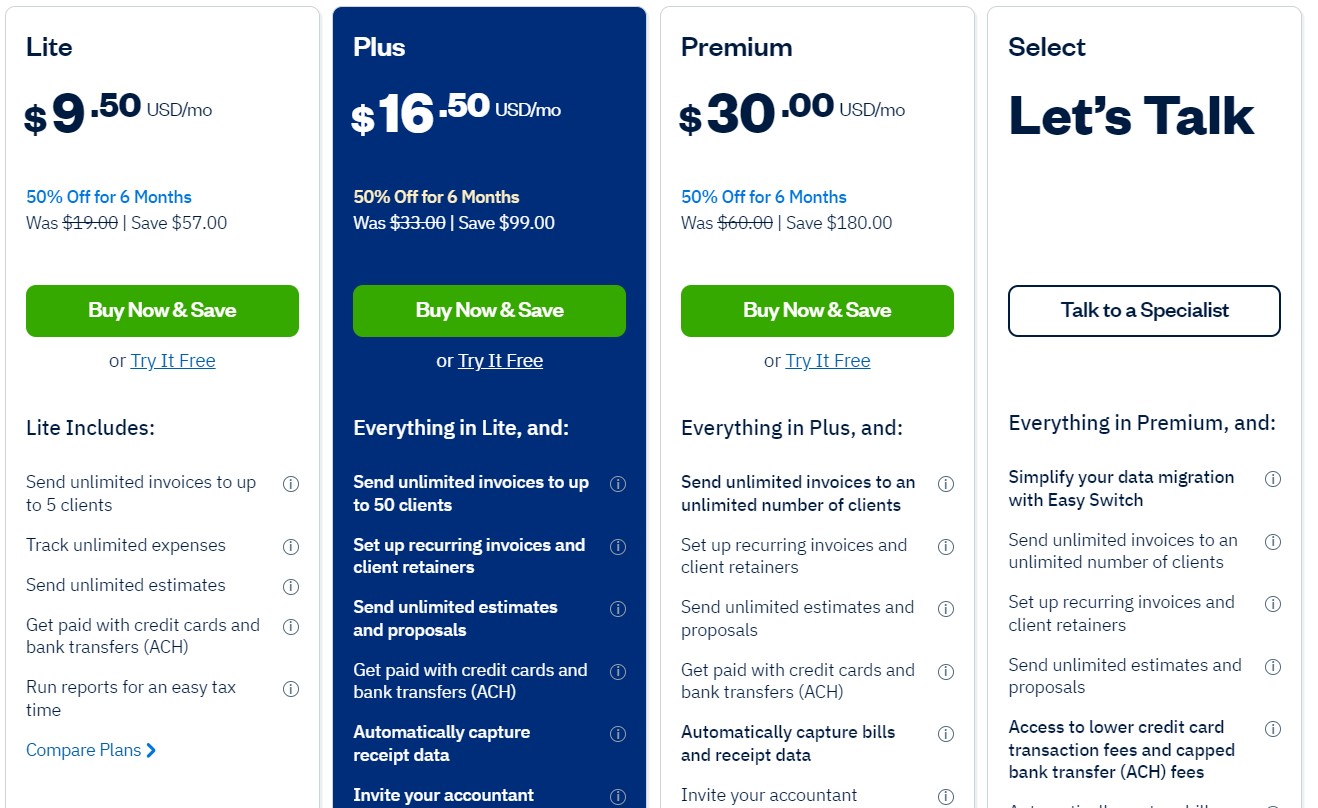

Pricing

FreshBooks offers four premium plans, all available for exploration through a free 30-day trial.

- Lite: $9.50 per month

- Plus: $16.50 per month

- Premium: $30.00 per month

- Select: Custom pricing

Image via FreshBooks

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: Using FreshBooks, effortlessly monitor outstanding balances and due dates by simply clicking on “Accounts Aging” at the bottom of your home screen.

You May Also Like:

4. FreeAgent

Image via FreeAgent

If you’re a freelancer or a small business owner, you might wonder which accounting software is best for you.

The answer is FreeAgent. Trusted by over 150,000 businesses, this tool helps you manage your finances, covering everything from invoicing and expense management to project management and sales tax.

How does FreeAgent stand out from other accounting software?

Firstly, it takes a different approach to pricing. It offers only a single tier, making the decision to use this accounting software solution a simple ‘all or nothing’ decision.

For starters, new users enjoy a free 30-day trial. After that, users get a 50% discount for the 6 months before moving to the full price.

Additionally, FreeAgent provides unique features, including pension auto-enrolment, time off management, user permissions, and access control.

Key Features

- Invoice timeline displays recent invoices’ status, indicating what’s paid, due, or overdue

- Generate estimates in over 25 languages and any currency for international business

- eCommerce and payment solutions via partnerships with Stripe, PayPal, GoCardless, and Shopify

- You can Connect FreeAgent to your online bank for daily automatic import of bank transactions

- The option to automatically send invoices and thank-you emails after receiving payments

- A range of expense-tracking and inventory-tracking features

- The ability to create recurring invoices that are sent automatically

- Auto-enrolment for pensions allows employees to join a workplace pension scheme, and contributions are calculated automatically based on their earnings

Pros

- Its plan supports unlimited users, clients, and projects

- Easy data download for a smooth exit if FreeAgent isn’t suitable for any reason

- Mobile app accessible on both Android and iOS

- Straightforward account setup with customization questions to tailor the service to your business

Cons

- Limited to a single plan, lacking options for users seeking more flexibility

- Some advanced features found in sophisticated tools may be missing

- Primarily designed for UK-based businesses

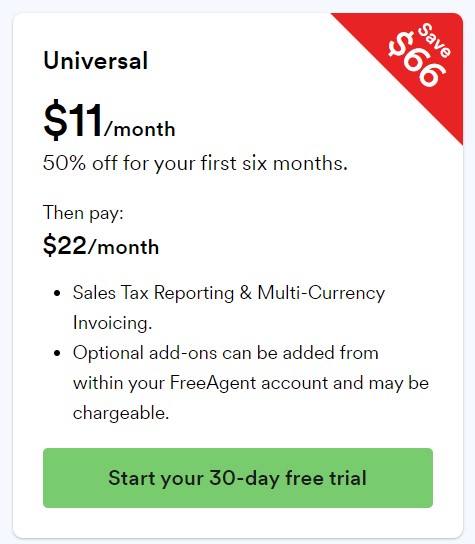

Pricing

FreeAgent provides one plan for users, and a 30-day free trial is available before subscription.

- Universal: $22 per month ($11 per month for the first six months)

Image via FreeAgent

Tool Level

- Beginner

Usability

- Very easy to use

Pro Tip: Effortlessly monitor expenses by capturing a picture with your smartphone and then uploading it to FreeAgent.

5. Kashoo

Image via Kashoo

Kashoo is yet another invaluable tool catering to sole proprietors, freelancers, and small businesses. Here’s why it secures a spot among the top Xero alternatives.

Kashoo doesn’t just offer standard invoicing; it provides the flexibility to create recurring invoices for those billed monthly—a particularly helpful feature for consultants.

Moreover, managing payments is a breeze. Once an invoice is settled, you can effortlessly enter payment details directly from the same screen.

A standout feature is Kashoo’s robust bill payment capability, allowing you to cut checks for vendor management.

You have the option to connect your Kashoo account to your bank account. But even if you opt otherwise, the tool provides alternative methods to track income and expenses.

Key Features

- Boasts an intuitive and user-friendly interface for effortless financial management

- Efficiently handle and categorize your expenses, ensuring your records are accurate and organized

- Compatible with over 5,000 banks worldwide

- A diverse array of reports for a thorough understanding of your business’s financial health

- Allows unlimited billable clients even on low-tier plans

- Categorizes records by project types and dates, simplifying accounting tasks

- Seamlessly integrates with payment processing tools like SurePayroll, Stripe, BluePay, and Square

- Adheres to double-entry accounting rules, effectively tracking income and expenses

- Automated bookkeeping and finance management

- Option to automate recurring workflows for time savings

Pros

- Inputting income and expenses is exceptionally straightforward, which is crucial if you choose not to link your bank account to Kashoo

- Customizable invoices for improving your brand image

- Support is available through email, phone, and chat

Cons

- Reporting options in Kashoo are restricted, with only eight available reports

- No monthly option; the commitment is for the entire year, posing a substantial financial commitment.

- Limited functionality in terms of payroll management, HR, inventory, and time tracking

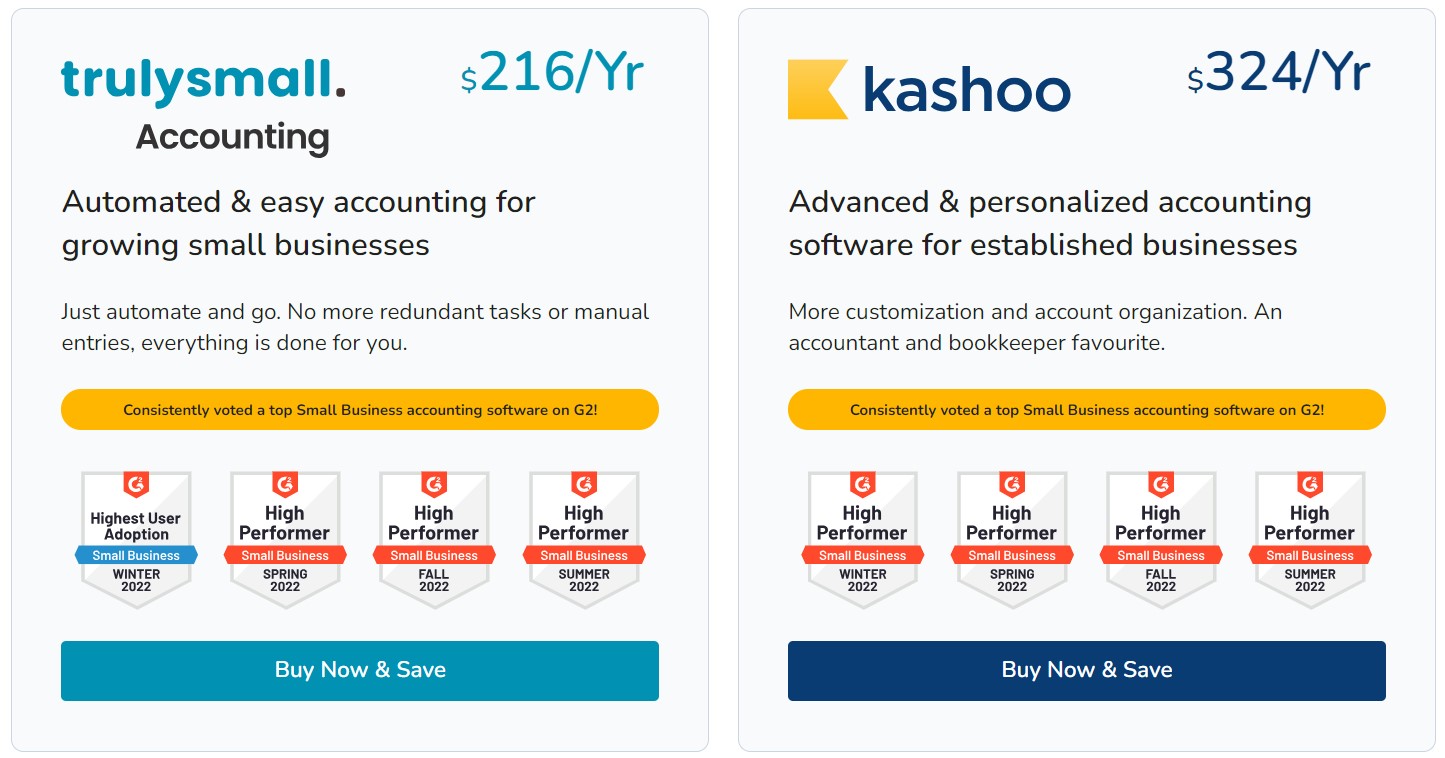

Pricing

This Xero alternative offers two paid plans with annual billing. There’s no free plan.

- Trulysmall Accounting: $216 per year

- Kashoo: $324 per year

Image via Kashoo

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: Connect your bank to Kashoo for quick generation of essential business reports, all within 5 minutes or less.

You May Also Like:

6. Sage

Image via Sage

Sage Business Cloud Accounting stands out as an extensive cloud accounting software that’s perfect for medium-sized companies. It provides a diverse set of features, including financial reporting, expense tracking, invoicing, and inventory management.

Sage offers impressive invoice customization along with providing convenient invoice templates. It is also equipped with time-saving automation features to streamline financial tasks.

Additionally, it seamlessly connects with your bank, facilitating the quick import of transactions for efficient reconciliation.

The best part?

All your data on the software is backed up, minimizing the risk of data loss. Sage Business Cloud Accounting has a cloud-based nature, which means you can access it from anywhere with an internet connection. This fosters effortless collaboration while ensuring real-time updates to your data.

Key Features

- Get started from anywhere on any device with a quick and easy setup

- Stay updated in real time with an intuitive dashboard

- Achieve precise inventory control with advanced management tools

- Gain advanced financial insights with powerful revenue management tools

- Integration of Stripe into invoices for expanded payment options

- Conduct global operations effortlessly with multi-entity and multi-currency support

- Simplified automation processes for time-saving and error reduction

- Comprehensive financial reporting and analysis

- Create custom reports effortlessly with the user-friendly report designer module

Pros

- Tailored from the ground up to support business intelligence

- Several integrations with third-party apps

- No restrictions on billable clients and invoices

Cons

- User interface and implementation lack intuitive simplicity

- May be a bit expensive for smaller businesses

- Some users may need help to fully utilize its feature set

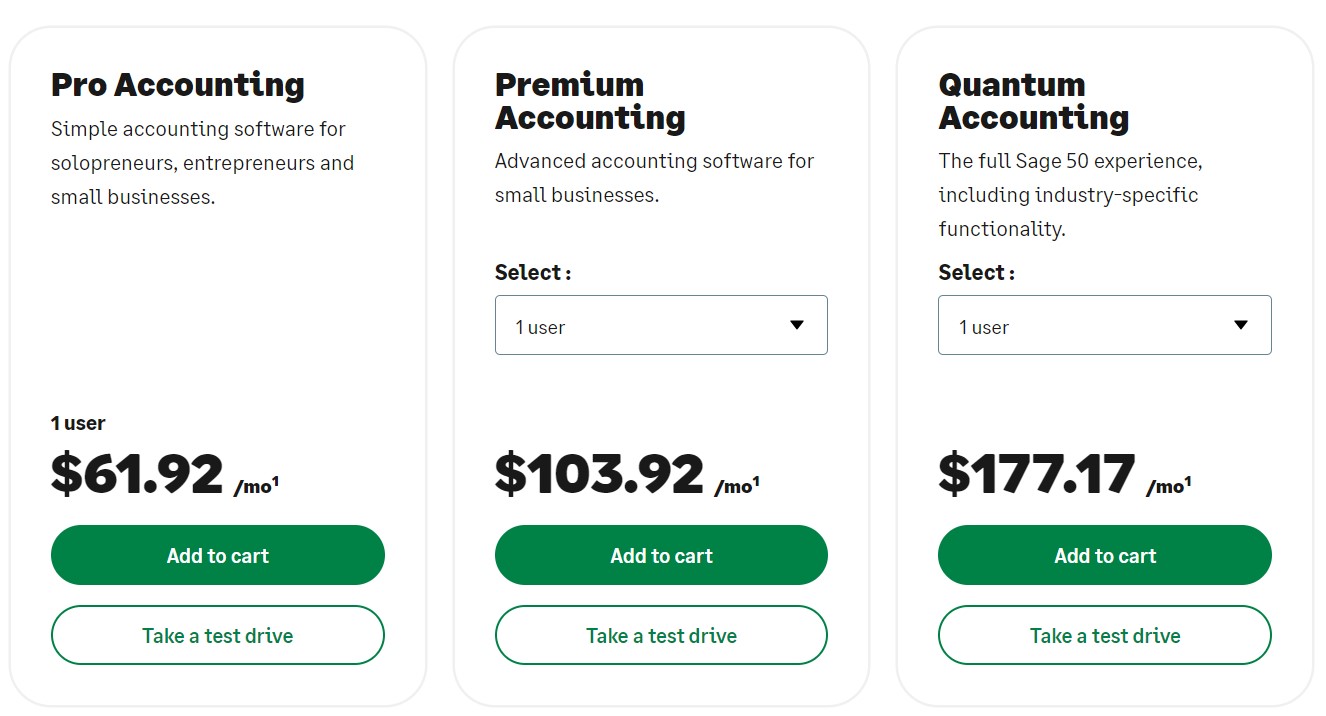

Pricing

Sage Business Cloud Accounting offers three paid plans:

- Pro Accounting: $61.92 per month

- Premium Accounting: $103.92 per month

- Quantum Accounting: $177.17 per month

Image via Sage

Tool Level

- Intermediate

Usability

- Comes with a slight learning curve

Pro Tip: Sage’s AutoEntry snap and post feature will help you speed up the processing of invoices and expense receipts.

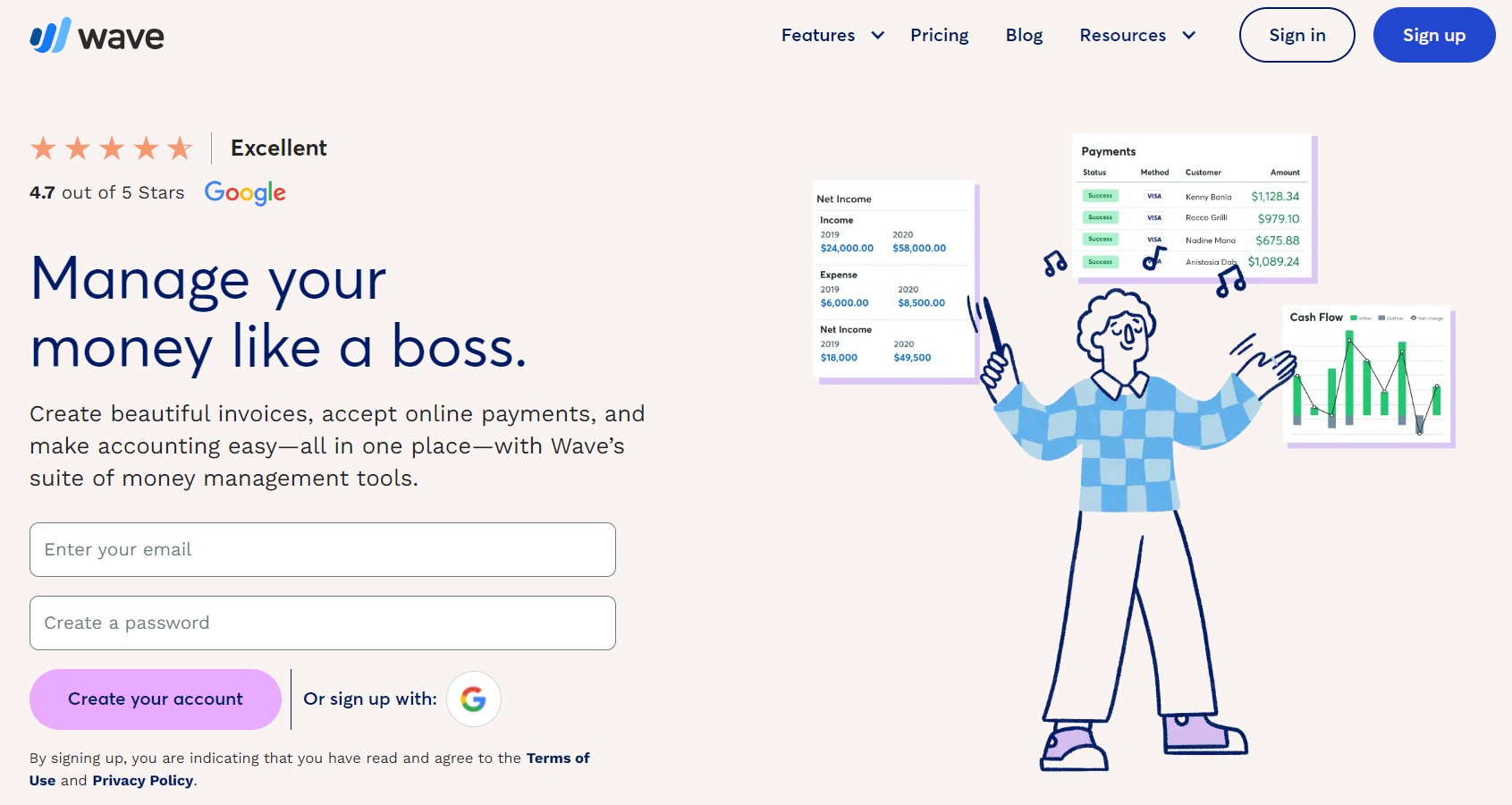

7. Wave Accounting

Image via Wave

For small business owners seeking free, cloud-based accounting software, Wave Accounting stands out as a worthy option. This holds especially true if you’re new to accounting and desire a user-friendly, fully functional tool.

As one of the few free options available, Wave Accounting provides a convenient platform to manage all your accounting processes.

And that’s not it.

Its plans come with no usage restrictions, allowing you to generate unlimited invoices and collaborate with as many people as you want.

That said, Wave Accounting does charge for features like online payments, mobile receipts, and wave payroll. This means that you can pay only for what you need, making Wave one of the top Xero alternatives.

Beyond cost considerations, Wave covers essential features like invoicing and receipt scanning, while also simplifying tax calculations for you.

Key Features

- Access Wave advisors for financial management coaching or comprehensive assistance

- Customize invoices effortlessly and send overdue reminders for prompt payments

- Simplify expense tracking with receipt scanning functionality

- The option to link any number of cards and bank accounts to your Wave account

- Benefit from payroll management and automated tax reports and filing in supported locations

- Sync all transactions and expenses seamlessly with your accounting software

- Navigate your financial data effortlessly with the user-friendly dashboard

- Follows the principles of double-entry accounting

Pros

- Provides free and unlimited access to basic features

- Intuitive interface for easy navigation, even for non-accountants

- Allows unlimited partners and collaborators across all Wave Accounting products

Cons

- Customer support is poor

- May lack advanced features necessary for large businesses

- Missing features like time tracking and inventory management offered by many of its competitors

Pricing

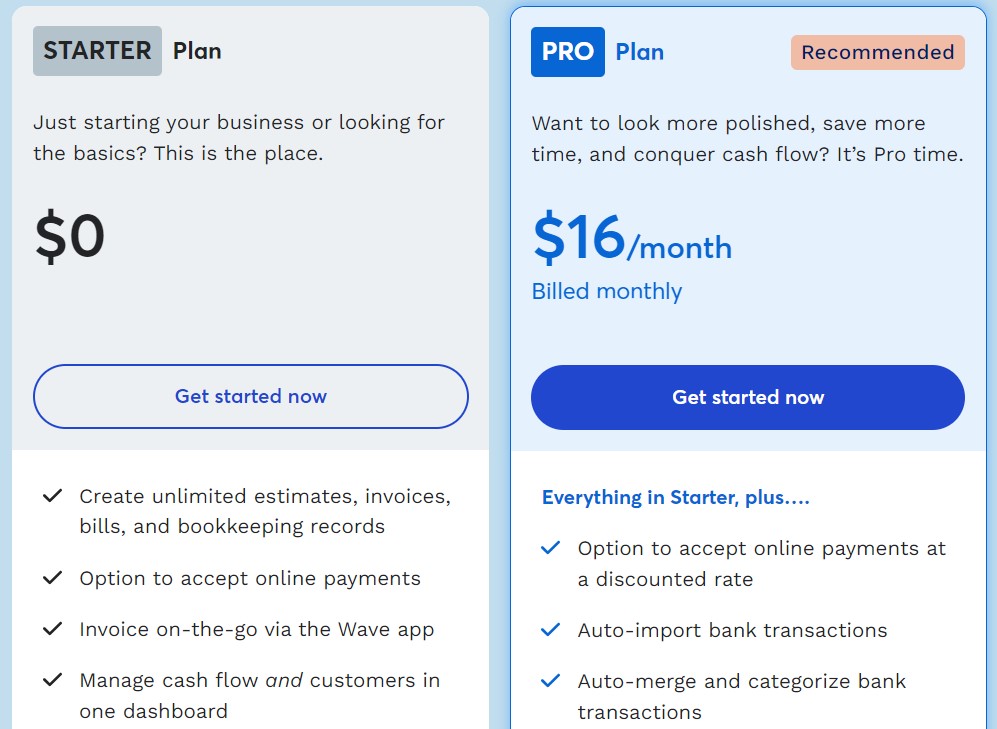

Wave’s updated pricing structure features two plans:

- Starter: $0 per month

- Pro: $16 per month

Image via Wave Accounting

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: When you sign up for Wave, you can opt for a 30-day free trial to explore the payroll software.

You May Also Like:

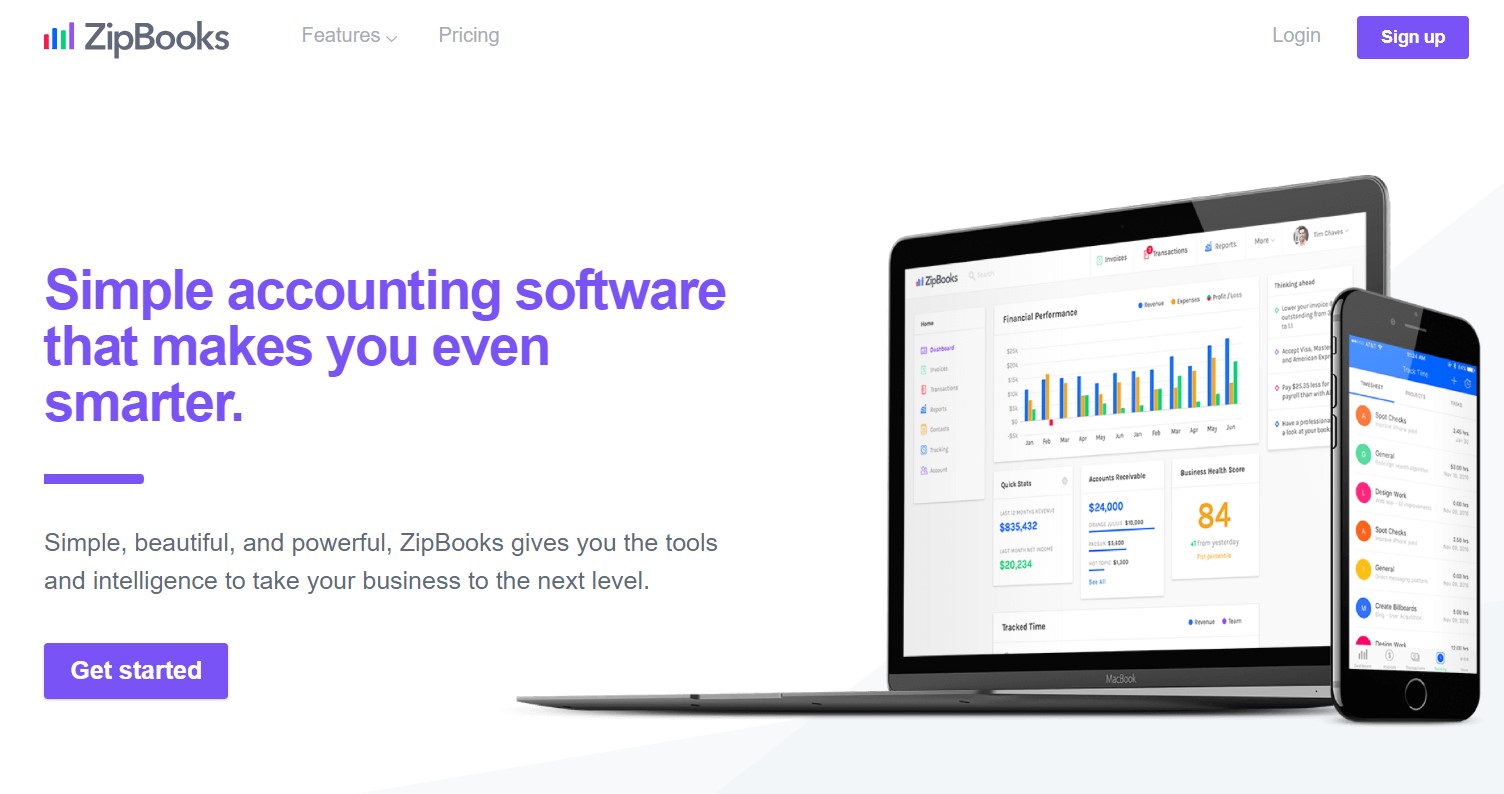

8. ZipBooks

Image via ZipBooks

Next on the list of top Xero alternatives is ZipBooks. It has earned acclaim for its user-friendly interface and robust features despite being relatively new to the market.

With a generous free plan, it surpasses some competitors’ paid plans by allowing unlimited invoice sending—an invaluable feature for small businesses.

For enhanced capabilities beyond the free plan, you can always upgrade to a paid version. This unlocks advanced features such as income and expense tracking, detailed reporting, multi-bank account connections, and automated reminders.

ZipBooks further distinguishes itself with a striking dashboard. It offers a visual overview of your company’s financial performance over the last 12 months.

While ZipBooks’ dashboard lacks Xero’s to-do reminders, it compensates with insightful charts for tracked time, sales by customer, monthly revenue, and expenses.

Key Features

- Effortlessly track your expenses, so you always know where your money is going

- Double-entry accounting to keep your financial records accurate and organized

- Impeccable transaction records for a seamless understanding of your financial situation

- Invoice quality scores based on data from over 250,000 invoice performances

- An automatic billing feature to create and share professional invoices in no time

- If you’re a professional looking to extend ZipBooks functionality to your clients, check out the custom “Accountant” tier

- Easily track both customers and vendors from the same screen

- Diverse financial reports across Sales, Team & Tracking, Accounting & Tax, and Expenses categories

- Set up automated reminders, so you never miss a payment deadline

- Access your financial data from anywhere with the cloud-based platform

Pros

- All plans, even the free one, offer unlimited invoices, vendors, and customers

- User-friendly interface accessible to users of all skill levels

- Digital payments are accepted across all subscription tiers

Cons

- Limited integration with third-party apps compared to some other accounting tools

- Advanced reporting and analytics options are a bit restricted

- Subscribers on the free plan can only have one user and one connected bank account

Pricing

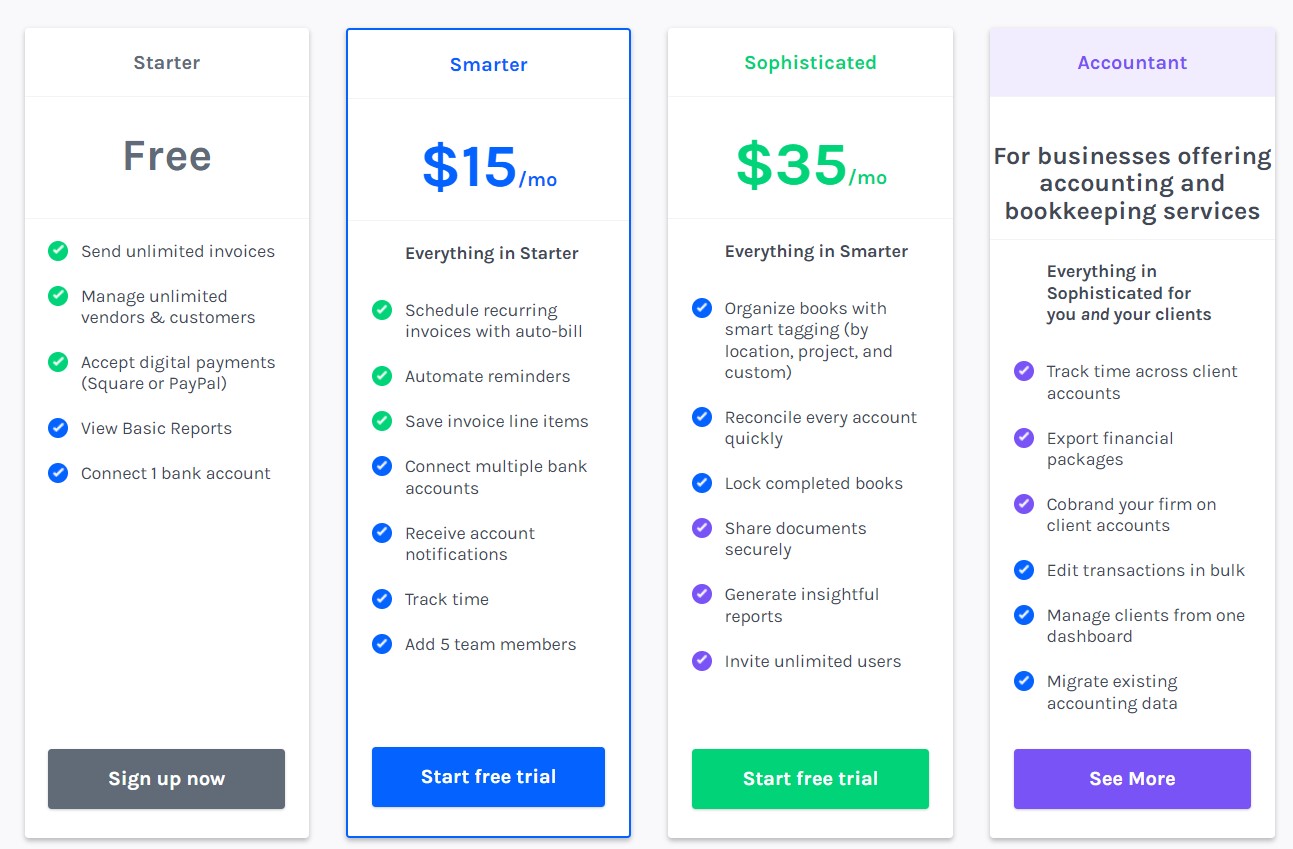

ZipBooks offers a free plan and three paid plans to choose from:

- Smarter: $15 per month

- Sophisticated: $35 per month

- Accountant: Custom pricing

Image via ZipBooks

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: Make the most of ZipBooks’ valuable feedback to improve your daily operations and steer clear of unnecessary fees.

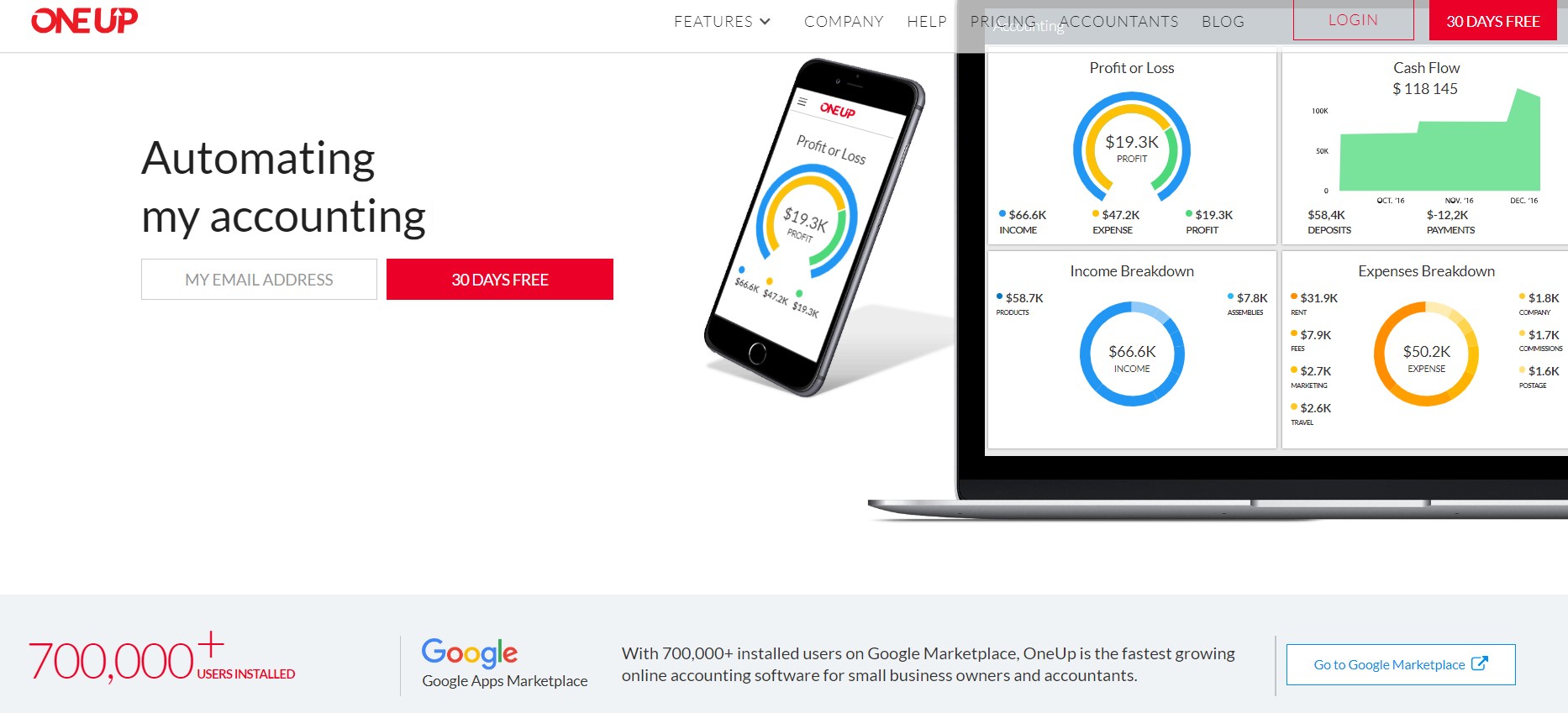

9. OneUp

Image via OneUp

OneUp may be one of the best Xero alternatives out there. It’s an ideal choice for small businesses and startups aiming to streamline financial operations.

With excellent custom invoicing, seamless handling of customer quotes, and the ability to accept online payment in invoices, OneUp stands out.

But what makes this Xero alternative unique?

Instead of feature-driven, OneUp’s pricing is user-based, granting access to the same robust features across all plans. This means that you’ll only need to scale up when adding users, not to unlock more robust features.

Moreover, although designed with a mobile-first approach, recent interface changes ensure a smooth experience across browsers.

Key Features

- Effortlessly track expenses with automated bank account synchronization

- Gain an overview of your business’s financial details through the accounting dashboard

- Manage your invoicing and payment tracking needs seamlessly

- Minimize data-entry errors with exceptional conversion capabilities

- Customize sales price lists based on customers, price families, or quantity to suit your preferences

- Simple Customer Relationship Management (CRM), referred to on the software as “Opportunities”

- Effectively manage inventory for product-based businesses

- A mobile app to stay connected on-the-go

- Access detailed financial reporting and analysis tools tailored to your business needs

- Conduct global operations with ease, thanks to multi-currency and multi-language support

Pros

- Immediate access to all features, regardless of the chosen plan

- Efficient mobile app for managing finances remotely

- Guidance for setting up features whenever you access them for the first time

Cons

- Dedicated time tracking functionality is missing

- May not cater to advanced accounting requirements

- The number of third-party app integrations and add-ons is limited

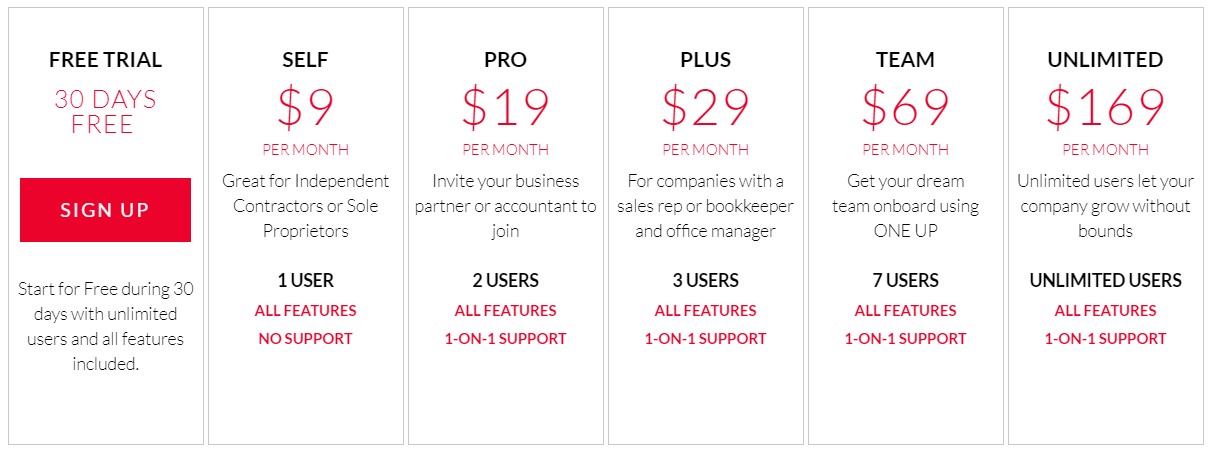

Pricing

With OneUp, you can enjoy a 30-day free trial. Additionally, there are five paid plans for you to choose from:

- Self: $9 per month

- Pro: $19 per month

- Plus: $29 per month

- Team: $69 per month

- Unlimited: $169 per month

Image via OneUp

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: Click the Help icon for context-sensitive assistance that adapts as you move between screens.

You May Also Like:

10. ZarMoney

Image via ZarMoney

If you’re in search of online accounting software rich in inventory management features, ZarMoney is an excellent choice.

It provides inventory capabilities typically found in larger and pricier platforms. What’s more, these features are available to all users across plans. They include pick lists, multisite inventory, barcodes, real-time data, and split transactions.

Beyond inventory management, ZarMoney excels in bookkeeping, time tracking, and invoicing. It also offers some of the best reporting capabilities in the market.

But it doesn’t stop there.

As an alternative to Xero, ZarMoney is cost-effective, making it a budget-friendly choice for small to medium-sized businesses.

Overall, ZarMoney helps businesses boost productivity while minimizing costs and errors associated with manual processes.

Key Features

- Create customizable invoices for printing, emailing, or faxing in seconds

- Email and text tools to keep customers informed about outstanding payments

- Access 40+ pre-built reports and over 1,000 customizable reporting options

- Create personalized data labels with real-time updates

- Ability to review all locations side by side using the split view option in inventory management

- Access real-time product information, demand predictions, and vendor management reports

- Track billable hours with time-tracking capabilities

- Use the payables calendar tool to record scheduled payments, aiding in cash flow management

- Schedule deliveries, customer calls, and other tasks, synchronizing them with Google Calendar or your iPhone calendar

Pros

- Highly intuitive interface for effortless navigation

- Offers advanced inventory management features, especially for a low-cost accounting software platform

- Affiliated with more than 9000 banks across the United States and Canada

Cons

- Free plan is missing

- Limited features for capturing receipt photos to generate or justify expenses

- Fewer integrations compared to some other Zero alternatives

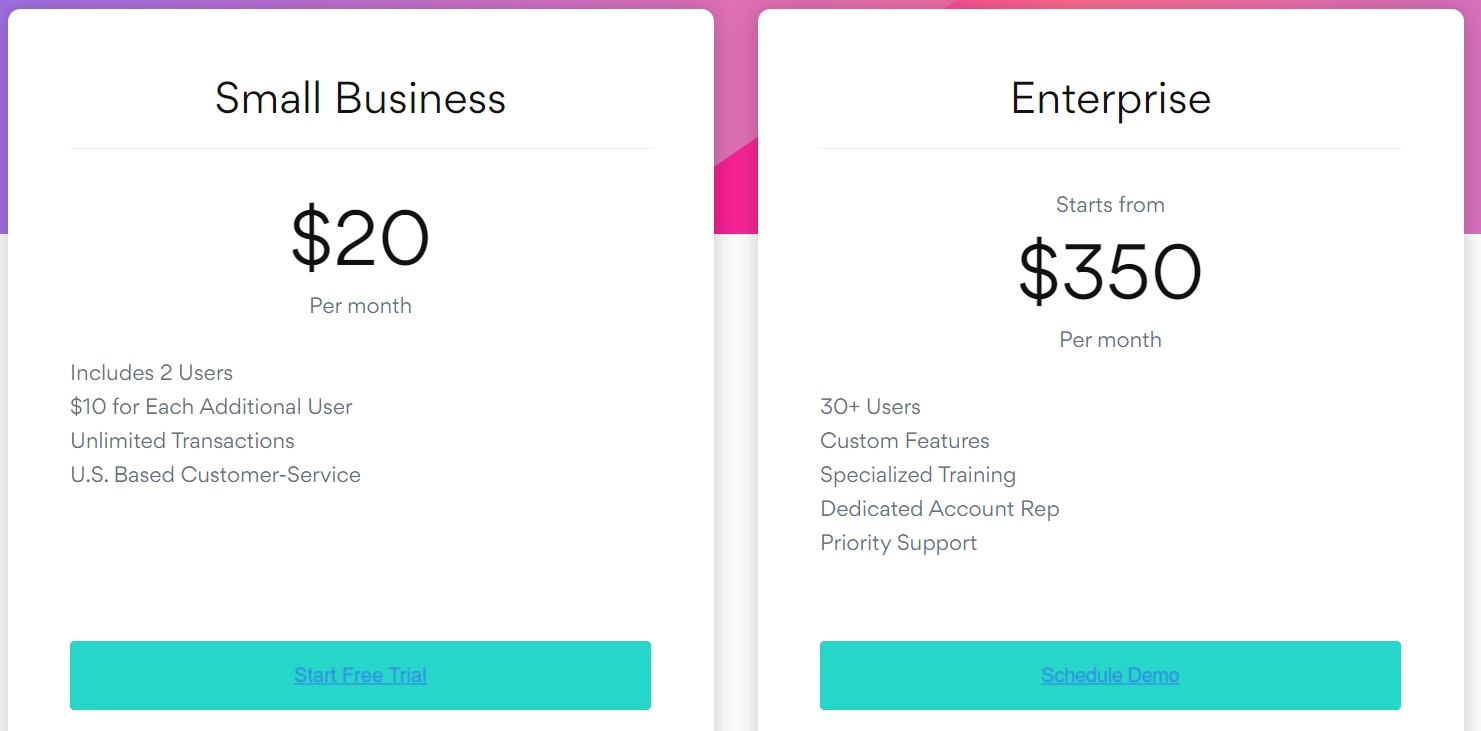

Pricing

ZarMoney provides two paid plans, and you can enjoy a 15-day free trial on both plans.

- Entrepreneur: $15 per month

- Small Business: $20 per month

- Enterprise: Starts from $350 per month

Image via ZarMoney

Tool Level

- Beginner/Intermediate

Usability

- Users may experience a slight learning curve

Pro Tip: Effortlessly transfer customer and vendor data from your existing accounting systems to ZarMoney during onboarding.

11. Patriot

Image via Patriot

Closing our top Xero alternatives, Patriot is an ideal pick for small businesses seeking straightforward and budget-friendly income and expense tracking.

What’s more, its standout customer support makes it particularly beginner-friendly.

As far as features are concerned, expect functionalities covering payroll management, invoicing, time tracking, and thorough financial reporting.

Notably, it provides unlimited users and invoicing, features that often come at an additional cost with other software.

To test out the tool’s features, you can always enroll in its free 30-day trial.

Key Features

- Payroll management to compensate employees efficiently

- User-friendly interface that enables seamless navigation

- Robust invoice and payment tracking capabilities

- Personalize estimates, invoices, and credit memos with templates, logos, and accent colors

- Conveniently manage asset, liability, equity, income, and expense accounts

- Robust reports and analytics covering categories like accounting, payroll, time & attendance, and HR

- Categorize expenses and income by departments to identify profitable areas and areas that may require cost-cutting measures

- Easily import Chart of Accounts, trial balance, customers, vendors, and contractors, thus saving time

- Support for unlimited vendors, customers, and invoices

- Includes unlimited users

- Accessible customer support via email, phone, and chat

Pros

- Patriot offers affordable pricing

- It boasts an easy-to-use interface, catering to both accountants and non-accountants

- The mobile app enhances accessibility from anywhere

- Positive feedback on customer support

- The website includes informative videos for each feature, providing detailed insights into their usage

Cons

- Limited software integrations, except for Patriot Payroll

- It may not meet the needs of complex accounting requirements

- Time-tracking features come with an additional cost

Pricing

Patriot provides pricing based on the selected software. You can test both out using a 30-day free trial.

- Accounting Software:

- Accounting Basic: $20 per month

- Accounting Premium: $30 per month

- Payroll Software:

- Basic Payroll: $17 per month + $4 per employee

- Full Service Payroll: $37 per month + $4 per employee

Image via Patriot

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: Edit or delete transactions as necessary, and rest assured with the recorded changes in Patriot’s Modified Transactions Report for your reference.

You May Also Like:

- Best SaaS Accounting Software for All Businesses

- Best Accounting Software for Nonprofit Organizations

FAQ

Q1. Is there an alternative to Xero?

A. Yes, there are various Xero alternatives that you can utilize for efficient financial management. They include:

- Zoho Books

- QuickBooks Online

- FreshBooks

- KashFlow

- Kashoo

- Sage Business Cloud Accounting

- Wave Accounting

- ZipBooks

- OneUp

- ZarMoney

- Patriot

Many of these tools offer either a free plan or a trial period. This allows you to effortlessly explore their features and determine the optimal fit for your business.

Q2. Is there a free version of Xero accounting?

A. Unlike some Xero alternatives mentioned in this article, Xero itself lacks a free plan. However, every paid plan includes a 30-day free trial, enabling you to evaluate the tool’s features before committing.

Q3. How different is Xero from QuickBooks Online?

A. Xero and QuickBooks Online differ in several aspects. QuickBooks Online is suitable for businesses outsourcing accounting to a bookkeeper, with a user limit of up to 25 users for the highest plan.

In contrast, Xero supports unlimited users, making it ideal for businesses with in-house accounting teams.

QuickBooks Online has a more user-friendly interface and excels in inventory management. Xero, on the other hand, is great for tracking project profitability in real time and offers multicurrency support. This makes it a better fit for businesses expanding globally.

Q4. What are the disadvantages of Xero?

A. Xero, like any software, has some downsides.

It has a learning curve, making it less user-friendly for those with limited accounting knowledge. The customization options are somewhat restricted.

Additionally, premium features like unlimited invoices and multi-currency support are exclusive to the high-tier plans. There’s also no free plan.

Q5. How can I choose the right Xero alternative for my business?

A. Choosing the right Xero alternative requires you to consider various factors. Here’s a step-by-step guide:

- Identify your business needs and priorities.

- Take into account factors such as your budget, business size, and complexity.

- Evaluate the features you need, such as invoicing, inventory management, payroll management, and time tracking, based on your industry.

- Research and compare several alternatives to find the one that best matches your requirements.

Q6. Can I switch from Xero to another accounting software easily?

A. Most Xero alternatives offer data import features, making the switch relatively smooth. However, the ease of transition depends on the complexity of your financial data and the specific software you’re moving to. Remember to always back up your data on Xero before migrating.

Q7. Do these Xero alternatives offer multi-currency support?

A. Many of the Xero alternatives mentioned above, including QuickBooks Online, Zoho Books, and Sage Business Cloud Accounting, offer multi-currency support. However, this feature is often available only in higher-tier plans. Make sure to check the specific software’s features to ensure it meets your multi-currency needs.

Q8. Are there industry-specific versions of these accounting software alternatives?

A. Some Xero alternatives, such as QuickBooks Online, offer industry-specific versions tailored for retail, nonprofit, manufacturing, and other sectors. If not, others provide customizable features that can be adapted to various industries. Research each option to find the best fit for your type of business.

Q9. How do these Xero alternatives handle tax payments and filing?

A. Many of these Xero alternatives offer features to help with tax calculation and filing. For instance, QuickBooks Online and Sage Business Cloud Accounting provide tax calculation tools and generate tax reports.

However, the extent of tax support varies, so it’s crucial to check each software’s specific tax-related features, especially if you have complex tax requirements.

Q10. Do these Xero alternatives offer integration with third-party apps?

A. Most of the Xero alternatives mentioned offer integration capabilities with various third-party apps. For example, QuickBooks Online and Zoho Books have extensive app marketplaces, which allow integration with hundreds of business tools.

However, the number and types of integrations vary between software options. When choosing a Xero alternative, consider which integrations are crucial for your business operations and verify that your preferred accounting software supports them.

You May Also Like:

- What Is Accounting Software? Everything You Need To Know

- Best Cloud Accounting Software for All Business Sizes

Wrapping Up

While Xero serves as a reliable accounting software, beginners seeking user-friendly options or advanced customization may want to explore suitable alternatives.

Robust features like unlimited invoices on low-tier plans may also drive the need for a Xero alternative.

During the selection process, carefully examine the features to ensure they align with your business needs. Additionally, assess the responsiveness of customer support.

The Xero alternatives in this article deliver excellent functionality at reasonable prices, catering to small businesses, self-employed individuals, and enterprises seeking scalable solutions.

When you find a tool worth considering, acquaint yourself with its capabilities using a free trial or free plan. Commit to a paid plan only when you’re sure it aligns with your requirements.