Looking for the best ecommerce accounting software? As your ecommerce business expands, accounting tasks become increasingly vital for its development.

You need a way to monitor financial transactions, assess business performance, and meet regulatory requirements. While managing financial data may not be thrilling, it’s essential for IRS compliance and reducing the risk of audits.

A competent accounting software program can assist with these tasks and beyond. It streamlines operations, minimizes mistakes, and offers valuable insights for making informed business decisions.

Lucky for you, we’ve compiled a comprehensive list of the best ecommerce accounting software, making it easier for you to find the perfect fit for your business needs.

Our research includes an in-depth analysis of various factors including pricing, customer support, features, ease of use, and more.

So, explore our curated list of the best accounting software for ecommerce businesses and take control of your finances.

Let’s get started.

Quick Summary: Best Ecommerce Accounting Software by Type

- Best for Invoicing: QuickBooks, Zoho Books, FreshBooks

- Best for Inventory Management: ZarMoney, QuickBooks, Zoho Books

- Best for Growing Businesses: QuickBooks, Zoho Books, Xero

- Best Tools with Free Trial or Free Plan: Wave, Zoho Books, QuickBooks

How We Chose the Best Ecommerce Accounting Software

When assessing the value of a tool, it’s important to consider a range of factors. Each carries a different weight depending on the business.

Nevertheless, there are key criteria that matter universally. In crafting this compilation of the best ecommerce accounting software, we examined these essential benchmarks:

- Features: Key functionalities, including professional invoices, expense tracking, and inventory management, were carefully examined for their effectiveness. We also acknowledged that it’s important for the best ecommerce accounting software to have a mix of software options that can either do everything or focus on specific tasks.

- Pricing: The best ecommerce accounting software needs to be affordable. Our range of cloud-based accounting solutions includes both free choices and higher-end options. We have also analyzed the affordability and value proposition of various subscription tiers. Moreover, we value transparency and avoid platforms with hidden expenses.

- Scalability: To prepare for future expansion, we opt for the best ecommerce accounting software with scalability in mind. It’s vital that the platform can grow alongside the business, accommodating more users and handling higher transaction volumes. This helps avoid the hassle of switching tools later on, ultimately saving both time and money.

- Integrations: We examined the software’s compatibility with popular ecommerce platforms (e.g., Shopify, WooCommerce) and other essential business tools. The majority of the best ecommerce accounting software listed here provide essential integrations, with many offering a broad selection of integrations.

- Customer Support: The availability of customer support and the team’s responsiveness are crucial considerations. Access to support channels like live chat, phone, and email is essential for effectively using software. Thus, we’ve prioritized the best ecommerce accounting software recognized for providing excellent customer support.

- Ease of Use: Our goal is to suggest the best ecommerce accounting software that minimizes the learning curve for users. To assess a tool’s user-friendliness, we examine factors such as intuitiveness, ease of navigation, and accessibility for users with varying levels of expertise.

- User Reviews: Finally, we incorporated feedback from actual users to gain insights into the performance of the best ecommerce accounting software. This involved identifying common concerns raised by users and evaluating overall user satisfaction.

7 Best Ecommerce Accounting Software for 2025

Managing finances, especially for ecommerce business owners, can be quite challenging.

Moreover, with regulations constantly updated, there are numerous moving parts to manage.

The worst part?

Not complying with financial reporting standards can lead to legal risks.

Investing in the best ecommerce accounting software can help you completely avoid these risks. Additionally, many of these platforms provide automation tools, which can save valuable resources.

Here are additional benefits of utilizing accounting software:

- Efficient tracking of sales and expenses

- Streamlined inventory management

- Simplified sales tax compliance

- Comprehensive financial reporting

- Reduction of errors and improved accuracy

- Enhanced decision-making

If you’re seeking the ideal accounting software for your ecommerce business, explore this list of the best ecommerce accounting software.

1. Zoho Books

Image via Zoho Books

Image via Zoho Books

Zoho Books is a top-notch cloud-based accounting solution and one of the best ecommerce accounting software. It also offers automation features that efficiently manage recurring tasks, such as billing and payment reminders, helping to save time and reduce administrative workload.

As discussed in this detailed Zoho Books review, its comprehensive reporting tools provide insights into sales trends and financial health.

You also get access to robust accounting tools and a very practical mobile application for iOS and Android devices. This is a huge plus for those looking to execute their accounting tasks on the go.

And the best part?

Zoho Books’ affordability makes it an appealing bookkeeping option for small businesses, but it’s also well-suited for larger enterprises with more complex accounting requirements.

Additionally, Zoho Books supports 10 languages, including Portuguese, Dutch, and Chinese. This is an excellent addition for those with multilingual teams or clients.

Key Features

- Holistic accounting software that effortlessly streamlines invoicing and accounts receivable management

- Customer portals for enhanced relationship management

- Effortless bill management, aiding businesses in effectively tracking outstanding payments to vendors

- Automatically retrieves and categorizes bank transactions

- Customizable reports exportable to Microsoft Excel

- Robust inventory management to prevent stock shortages

- Integration with various payment platforms to simplify online payments for customers

- Designed for organizations managing multiple locations, departments, teams, and facilities

Pros

- Accessible on both iOS and Android devices via a user-friendly mobile app

- Seamlessly integrates with the Zoho Books software suite for efficient business operations

- Smooth integration with Zoho CRM (Customer Relationship Management)

- Supports a diverse range of languages

Cons

- Some features have usage limits, requiring add-ons to exceed them

- Restricted to a maximum of 15 users, even with the highest-tier plan

Pricing

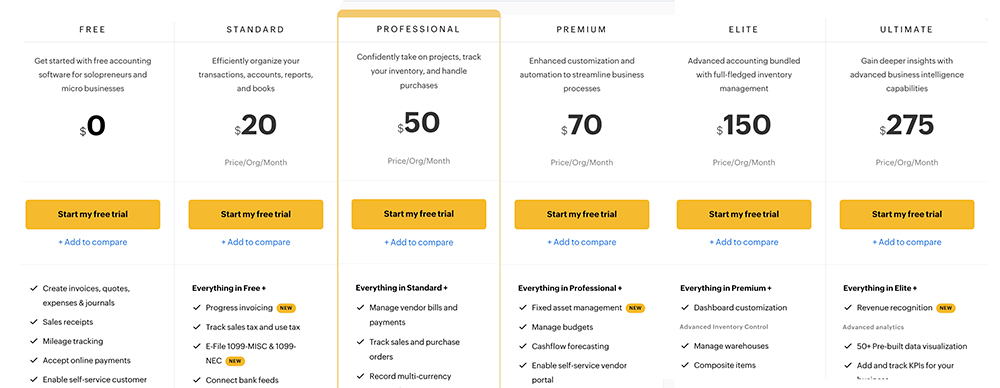

Zoho Books provides a free forever plan along with five paid options tailored to businesses of varying sizes:

- Free: 1 user + 1 accountant

- Standard: $20 per month

- Professional: $50 per month

- Premium: $70 per month

- Elite: $150 per month

- Ultimate: $275 per month

Image via Zoho Books

Image via Zoho Books

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: When sending credit notes to customers, include additional vital information by embedding a QR code in the PDF for easy access.

2. FreshBooks

Image via FreshBooks

Image via FreshBooks

FreshBooks ranks high among the best ecommerce accounting software on our list for its reliable functionality. It initially began as a simple invoicing program but has since evolved and expanded its features. Today, it offers tools for invoicing, expense tracking, and time management, making it easier to handle daily accounting tasks.

With its user-friendly interface, FreshBooks makes it easy for businesses to manage their finances effortlessly and stay organized. Additionally, you can also save time by reducing manual data entry. For instance, it can automatically reconcile credit and debit amounts and easily import financial data from various sources.

The introduction of FreshBooks’ Accounting Partner Program encourages collaboration between users and their accountants. This is a great way to promote transparency and efficiency in financial operations.

Having a comprehensive accounting reporting system helps ecommerce businesses monitor their financial health and make informed decisions.

Key Features

- Customizable invoicing tools to meet specific needs

- Efficient expense management and category

- Integration with Gusto for payroll processing

- Unlimited invoices and clients available with higher-tier subscriptions

- Mileage Tracking feature for automatic tracking and potential tax deductions

- Time tracking for monitoring project progress

- Retainer option for accountants and consultants with recurring billing needs

- Intuitive dashboard providing a clear overview of financial data

- Team collaboration through the addition of members, including employees, associates, or consultants

Pros

- User-friendly interface for easy navigation

- Mobile app available for convenient use and mileage tracking

- Cost-effective with features comparable to many enterprise solutions

- Includes time tracking functionality

- Great support team

Cons

- Not ideal for businesses with extensive inventory tracking needs

- Lite and Plus plans limit clients to 5 and 50, respectively

Pricing

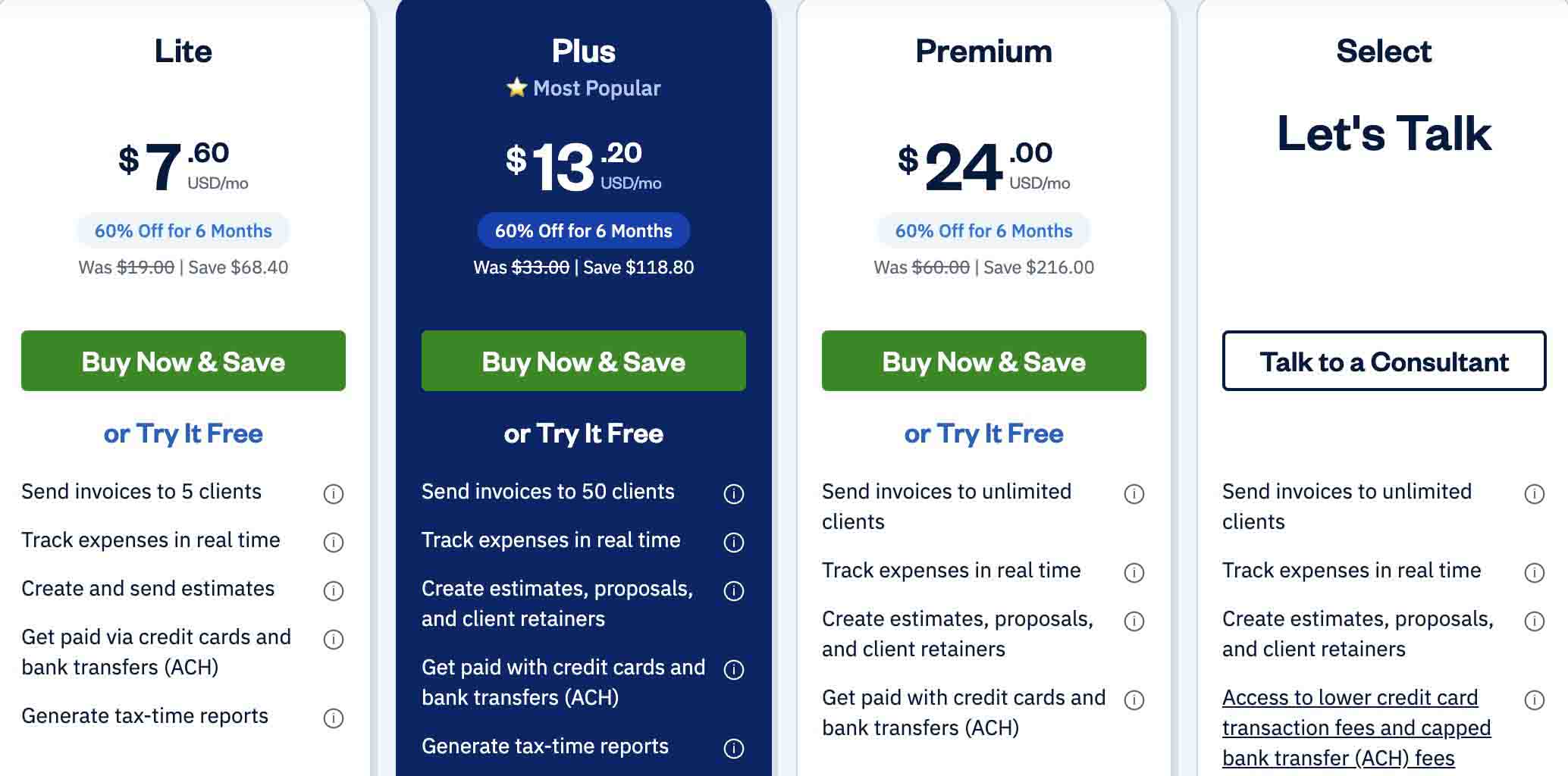

FreshBooks provides four paid plans, each accessible for exploration via a complimentary 30-day trial:

- Lite: $19.00 per month

- Plus: $33.00 per month

- Premium: $60.00 per month

- Select: Custom pricing

Image via FreshBooks

Image via FreshBooks

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: Utilize Partial Payments in your invoicing to collect a portion of the payment upfront, whether it’s a percentage or a fixed amount.

3. Xero

Image via Xero

Image via Xero

Next up on our lineup of the best ecommerce accounting software is Xero. With millions of users, it caters specifically to small and medium-sized businesses.

If you prioritize time-saving automation, Xero is a solid choice. It offers a range of automated features, from sending invoice reminders to reconciling bank statements, thus streamlining your financial tasks effectively.

Xero also provides real-time updates across multiple devices, ensuring ecommerce business owners have access to the latest information from anywhere. Plus, this level of centralization ensures all your financial information is in one place. With this, maintaining your records becomes easier.

Additionally, Xero stands out by seamlessly integrating with various online sales platforms. This means your sales data flows directly into your accounting system, reducing manual data entry and potential errors.

Moreover, it’s known for its user-friendly interface and offers onboarding experts for 90 days to help users maximize their Xero experience. This level of flexibility makes Xero one of the best ecommerce accounting software for anyone looking to scale up their ecommerce business.

Key Features

- Automate reconciliation by connecting Xero with your business bank account

- Accept online payments directly from Xero invoices, and speed up payment collection

- Streamline spending and manage finances with Xero’s expense management tools

- Track project progress and profitability with project accounting software

- Maintain customer and supplier details easily with contact management

- Perform business transactions and reporting in multiple currencies, with automatic exchange rate updates

- Track and manage fixed assets, including depreciation calculations

- Robust security features including data encryption, two-step authentication, and regular data backups

Pros

- Simple and user-friendly layout

- Stores and organizes documents in the cloud

- Includes Hubdoc in all plan tiers for automatic receipt and bill capture

- All pricing plans offer unlimited users

Cons

- No phone support

- The entry-level plan restricts users to 5 bills and 20 invoices per month

- Project tracking and expense claiming are available only on the most expensive plan

Pricing

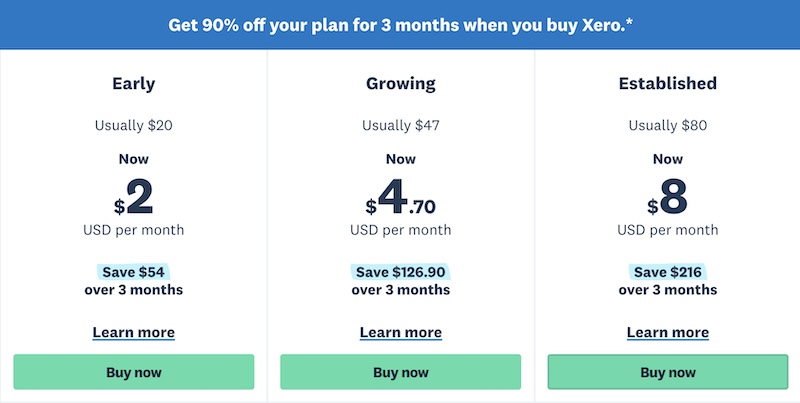

Xero currently offers a 3-month, 95% discount on all its paid plans.

- Early: $20 per month

- Growing: $47 per month

- Established: $80 per month

Image via Xero

Image via Xero

Tool Level

- Beginner to intermediate

Usability

- Easy to use

Pro Tip: Use Hubdoc to extract data from your supplier bills. It seamlessly integrates this data into Xero at no additional cost for standard and premium subscriptions.

Also Read:

4. Wave

Image via Wave

Image via Wave

Wave was once completely free, only charging for extra features like online payments and mobile receipts. While introducing premium plans may have caused a few ripples for longtime users, Wave is still one of the best ecommerce accounting software around.

Online businesses seeking free accounting software can still rely on the free version of Wave that can handle tasks like handling professional invoices, accepting online payments, and more.

One standout feature is its seamless integration between invoicing and accounting. When you send an invoice through Wave, it automatically updates your accounting records, saving you time and reducing errors.

Plus, Wave’s online payment processing allows your customers to pay invoices directly online, speeding up your cash flow. Additionally, its plans offer unlimited usage, allowing for unlimited invoices and collaborators.

As one of the best ecommerce accounting software, Wave also offers mobile apps for invoicing and payments, so you can manage your business finances on the go. Its user-friendly dashboard provides a clear overview of your business health, helping you stay organized and prepared for tax season.

Upgrade to a paid plan provides additional features such as auto-import bank transactions, unlimited receipt capture, and automated late reminders.

Now, let’s delve deeper into its features, pros, and cons.

Key Features

- Access Wave advisors for financial coaching or comprehensive assistance

- Seamlessly sync transactions and expenses with your accounting software

- Easily create professional-looking invoices and send overdue reminders for prompt payments

- Simple expense tracking with receipt scanning

- Enjoy payroll services and automated tax reporting in supported locations

- Navigate financial data effortlessly with the user-friendly dashboard

- Follows double-entry accounting principles

- Link multiple cards and bank accounts to your Wave account

Pros

- Mobile invoicing accounting app

- Intuitive interface for easy navigation, suitable for non-accountants

- Unlimited invoice creation with customizable templates

Cons

- Lacks advanced features such as time tracking and inventory management

- Poor customer support

- Running payroll requires an add-on starting from $20 per month

Pricing

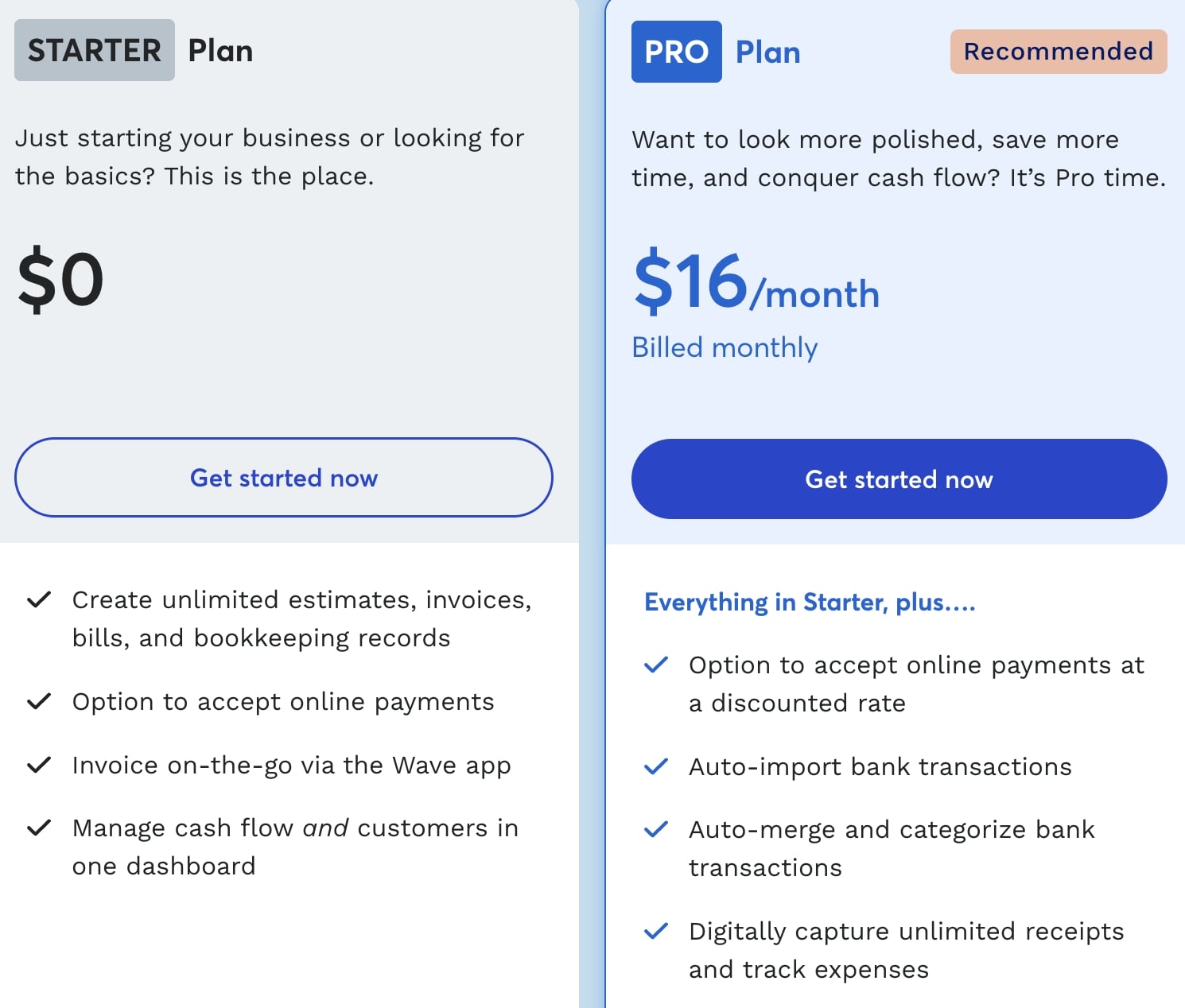

Wave’s updated pricing structure features two plans: a free plan and a paid plan.

- Starter: $0 per month

- Pro: $16 per month

Image via Wave

Image via Wave

Tool Level

- Easy to use

Usability

- Beginner

Pro Tip: When you sign up for Wave, you can try out the payroll software with a 30-day free trial.

5. QuickBooks Online

Image via QuickBooks Online

Image via QuickBooks Online

Next on our list of the best ecommerce accounting software is QuickBooks Online, a powerful ecommerce accounting solution by Intuit. It features a clean and simple interface, making it accessible even to beginners.

QuickBooks Online is a comprehensive solution, offering robust tools for automating data collection, sales tax calculation, and sales monitoring. You can also track sales, handle expenses, and monitor cash flow all in one place. This makes it easier to keep your business running smoothly.

Notably, it boasts advanced reporting capabilities. These include balance sheets and cash flow tracking in every plan, with more detailed accounting reports available in higher-tier plans.

Another key feature is its seamless integration with popular eCommerce platforms like Amazon, eBay, and Shopify. This automatic syncing of sales data saves you time and minimizes the risk of errors.

And that’s not it.

QuickBooks Online offers compatibility across multiple devices with auto-syncing options to ensure consistent access to information.

Plus, it offers a generous free trial that grants access to all features, helping users determine if the tool is suitable for their needs.

Key Features

- Track financial health with professional invoices, estimates, and forecasting

- Expedite payments with QuickBooks Payments and custom invoices

- Holistic cash flow management from accounts receivable to accounts payable

- Streamlined inventory management for product-based businesses

- Access all your transactions from anywhere with the mobile app

- Effortlessly reconcile transactions with bank account integration

- Track billable hours with time-tracking capabilities

- Audit trails and accountant access for convenience

- Real-time business reporting so that you never miss a beat

Pros

- Extremely advanced reporting tools

- Extensive tax assistance through add-ons and expert advisors

- Smooth integration with various third-party apps and services

Cons

- The abundance of features can sometimes feel overwhelming

- There’s a learning curve for newcomers

- Essential features available as add-ons, potentially increasing overall expenses

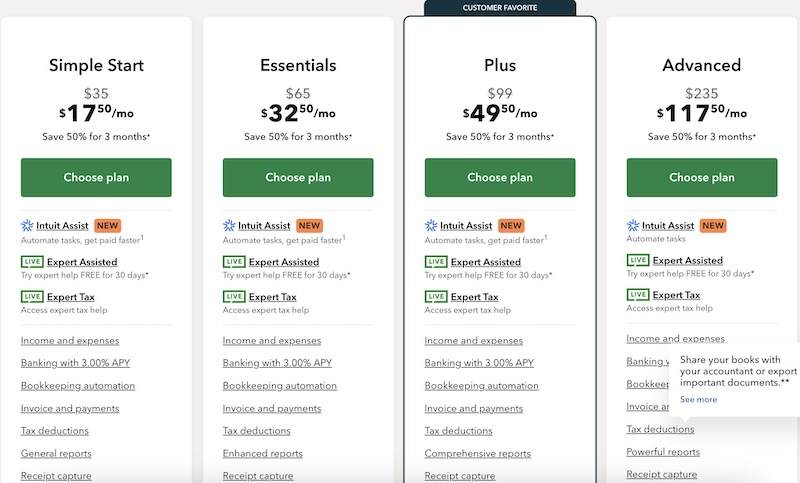

Pricing

QuickBooks Online offers four pricing options, all accessible with a free 30-day trial. The first three months of each plan include a 50% discount.

- Simple Start: $35 per month

- Essentials: $65 per month

- Plus: $99 per month

- Advanced: $235 per month

Image via QuickBooks

Image via QuickBooks

Tool Level

- Beginner to intermediate

Usability

- Comes with a slight learning curve

Pro Tip: With QuickBooks’ Receipt Management feature, simply use your mobile phone to snap a photo of a receipt. Then, upload it directly into the application and attach it to the corresponding expense.

Also Read:

6. Kashoo

Image via Kashoo

Kashoo’s small business accounting software automates much of the administrative work behind bookkeeping. With machine-learning algorithms, Kashoo becomes more adept at understanding your business over time.

It analyzes everything from receipt categorization to sales tax tracking, offering personalized recommendations to save money, reduce waste, and enhance efficiency.

One of its most notable features that makes Kashoo one of the best ecommerce accounting software is its robust bill payment capabilities that enable you to issue checks for vendor payments quickly.

Its robust bill payment capability enables you to issue checks for vendor payments.

Additionally, you can connect your Kashoo account to your bank accounts for seamless transaction recording. And if you choose not to, the tool offers alternative methods for recording your income and business expenses.

Key Features

- Efficiently manages and categorizes expenses, ensuring accurate accounting records

- An intuitive and user-friendly interface, suitable for all users

- Allows unlimited billable clients even on low-tier plans

- Provides the option to automate recurring workflows for time savings

- Option to categorize records by project types and dates, thus simplifying accounting tasks

- Strong integrations with payment processing tools such as BluePay, Square, and Stripe

- Adheres to double-entry accounting rules, effectively tracking income and expenses

- Wide range of reports for an accurate understanding of your business’s financial health

- Automation tools for your bookkeeping needs

- Compatible with more than 5,000 banks globally

Pros

- Customizable invoices to enhance brand image

- Users can access support via email, phone, and chat

- Easy input of income and expenses, especially beneficial if not linking your bank account to Kashoo

Cons

- Features like time tracking and inventory management are missing

- It lacks a monthly option, meaning annual commitment is required

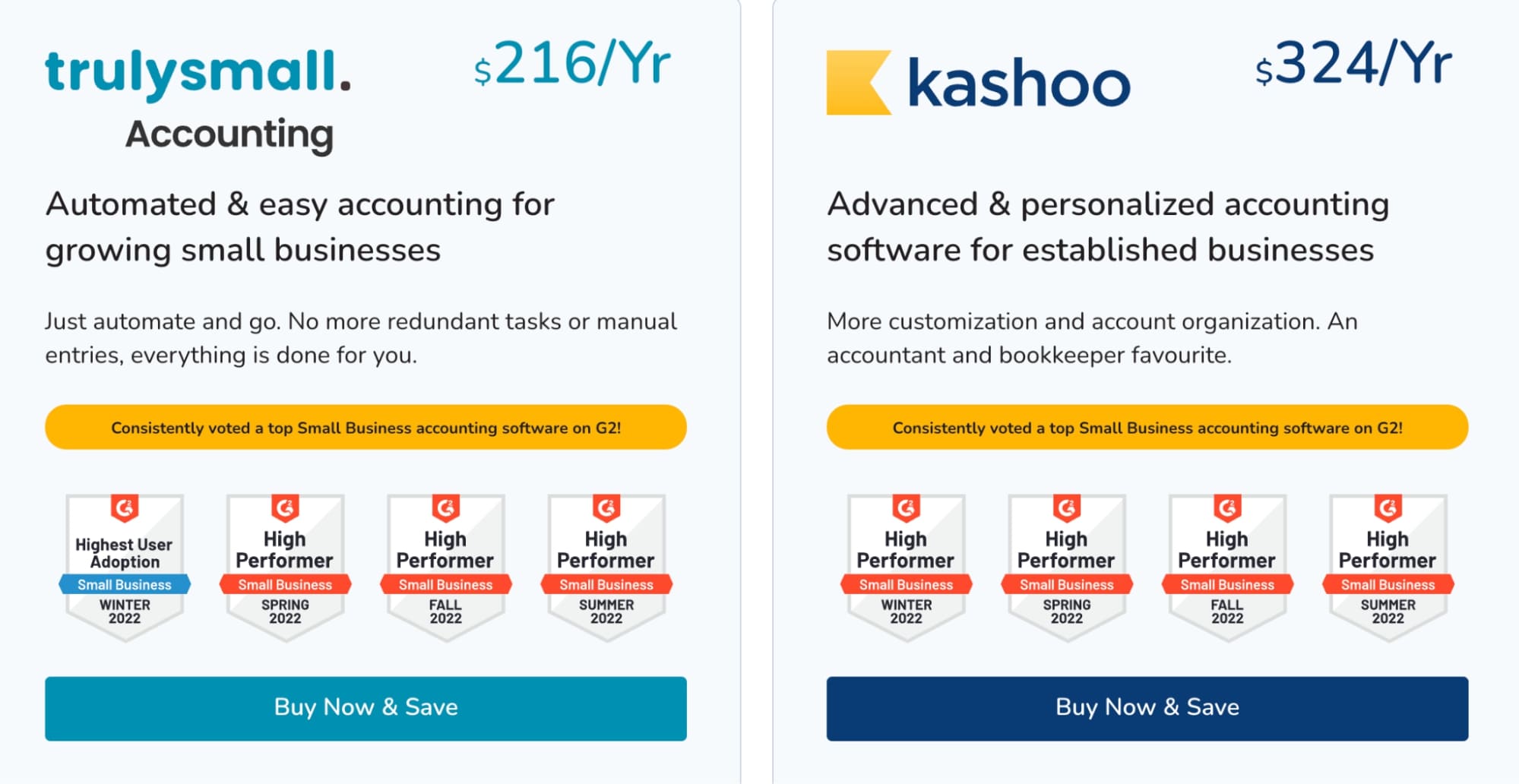

Pricing

Kashoo does not offer a free plan, but it does offer a 14-day free trial. There are two paid plans with annual billing.

- Trulysmall Accounting: $216 per year

- Kashoo: $324 per year

Image via Kashoo

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: Link your bank account to Kashoo to generate crucial business reports quickly, in 5 minutes or less.

7. ZarMoney

Image via ZarMoney

Wouldn’t it be beneficial for your ecommerce business to have accounting software with robust inventory management features? ZarMoney offers precisely that

ZarMoney’s amazing inventory capabilities earned it a spot on our list of the best ecommerce accounting software. Most of these features are generally seen on larger platforms, yet ZarMoney makes them available to all users across all plans. These include multisite inventory, barcodes, and split transactions.

In terms of accounting features, ZarMoney excels in bookkeeping, time tracking, and invoicing. It also provides numerous financial reports, including sales tax reports.

Finally, ZarMoney seamlessly integrates with Shopify, Stripe, Zapier, Gusto, Mailchimp, and other platforms to enhance data synchronization.

As if that weren’t enough, ZarMoney is reasonably priced, making it appealing to businesses of all sizes.

Key Features

- Access real-time product information and vendor evaluation reports

- Use email and text tools to notify customers of outstanding payments

- Create customizable professional invoices for instant delivery

- Record scheduled payments with the payables calendar tool

- Track billable hours with time-tracking capabilities

- Review all locations simultaneously with a split view in inventory management

- Access 40+ pre-built reports and customize over 1,000 options

- Create personalized data labels with real-time updates

- Sync deliveries, customer calls, and tasks with Google Calendar or iPhone calendar

Pros

- Boasts an exceptionally intuitive interface for seamless navigation

- Partners with more than 9,000 banks across the United States and Canada

- Advanced inventory management features

Cons

- There’s no mobile application

- No free tier

- Limited functionality for capturing receipt photos to justify expenses

Pricing

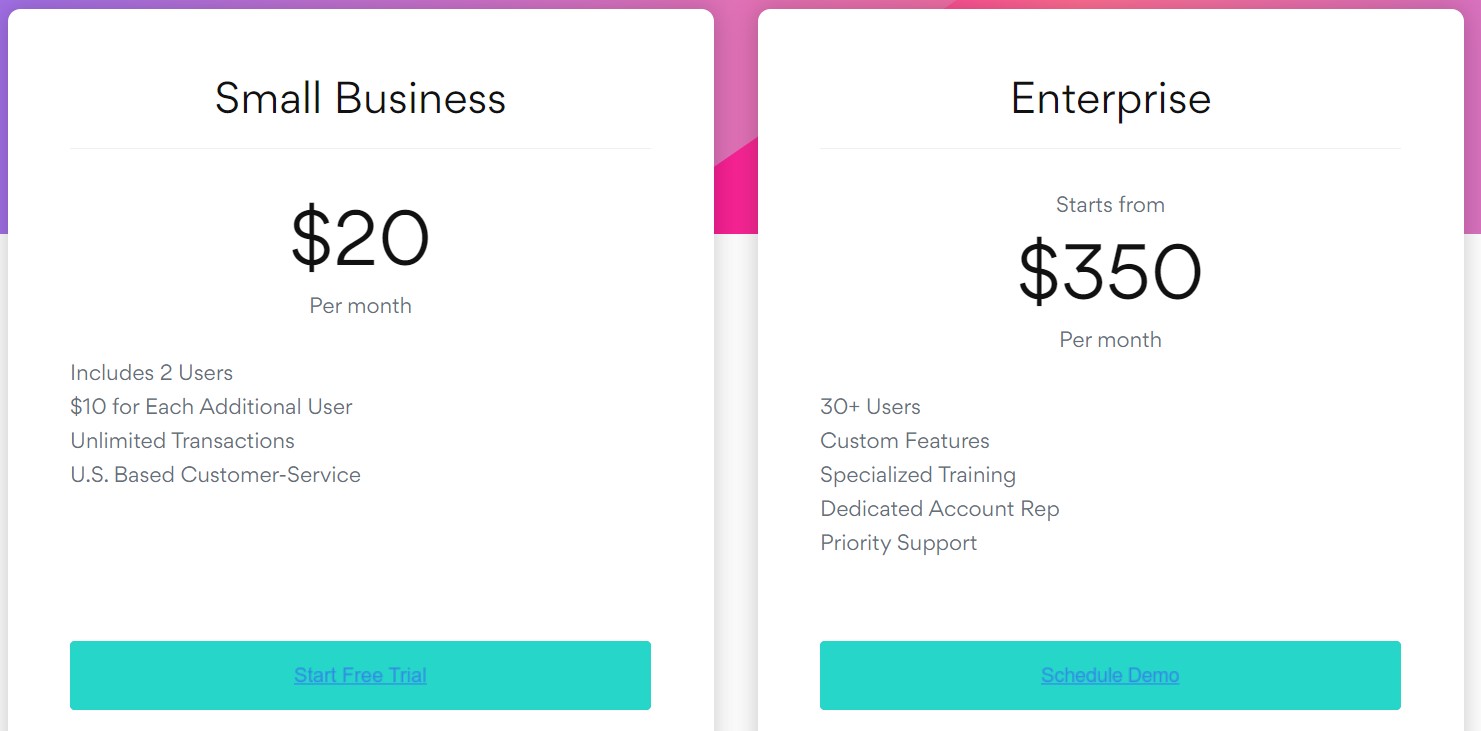

ZarMoney offers two subscription plans, with a 15-day free trial available on both plans:

- Small Business: $20 per month

- Enterprise: Starting from $350 per month

Image via ZarMoney

Tool Level

- Beginner to intermediate

Usability

- Pretty easy to use and navigate for new users

Pro Tip: Utilize ZarMoney’s calendar view to conveniently manage all outstanding payables. From this view, you can efficiently process bulk vendor payments and seamlessly add invoices.

FAQ

1. What accounting software is best for ecommerce?

The best ecommerce accounting software businesses depend on various factors. These include the size of your business, budget, and preferred features.

That said, some popular options are:

- Zoho Books

- FreshBooks

- Xero

- Wave

- QuickBooks Online

- Kashoo

- ZarMoney

These platforms offer features tailored to ecommerce, including inventory management, invoicing, sales tracking, and integration with major ecommerce platforms.

2. Is QuickBooks Online good for ecommerce businesses?

Yes, QuickBooks Online is suitable for ecommerce businesses due to its robust features and flexibility. It’s one of the best ecommerce accounting software that offers specialized tools for managing ecommerce transactions. This includes invoicing, inventory management, and sales tax calculations.

QuickBooks also seamlessly integrates with major ecommerce platforms like Shopify, WooCommerce, and BigCommerce. Additionally, QuickBooks Online provides advanced reporting capabilities, allowing ecommerce entrepreneurs to analyze their financial health effectively.

3. What is accounting software in ecommerce?

Accounting software in ecommerce is essential for efficient financial management. It ensures compliance management with tax regulations and enables better decision-making.

Automating tasks like invoicing and expense tracking saves time and improves productivity. Moreover, detailed financial reports allow businesses to analyze performance and identify growth opportunities.

Finally, as your ecommerce venture expands, the best ecommerce accounting software scales with you, accommodating increased transaction volumes seamlessly.

4. How to do accounting for an ecommerce business?

To manage accounting for your ecommerce business, follow these steps:

- Choose the best ecommerce accounting software

- Set up accounts accurately

- Track sales data and expenses meticulously

- Monitor cash flow and inventory levels

- Reconcile accounts regularly

- Generate comprehensive reports

- Stay sales tax compliant

- Seek professional advice if needed

5. How can I integrate my accounting software with my ecommerce platform?

First, research compatible options for integrating your accounting software with your ecommerce platform. Choose a suitable integration and follow the installation instructions to connect the two platforms.

Then, test the integration to ensure accurate financial data synchronization and monitor it regularly for smooth operation. Done right, integration streamlines processes, enhances data accuracy and provides valuable insights into your ecommerce finances.

6. How does cloud-based accounting software benefit ecommerce businesses?

Cloud-based accounting software offers several advantages for ecommerce businesses, including:

- 24/7 access to financial data from any device

- Real-time collaboration with team members and accountants

- Automatic updates and backups

- Scalability to accommodate business growth

- Enhanced security measures to protect sensitive financial information

7. What features should small business owners look for in ecommerce accounting software?

Key features for small business owners to consider when choosing the best ecommerce accounting software include:

- Integration with popular ecommerce platforms

- Automated sales tax calculation and reporting

- Inventory level tracking

- Multi-currency support

- Customizable professional invoices

- Mobile apps for on-the-go management

- Accurate accounting reports for better decision-making

8. How can ecommerce accounting software help during tax season?

The best ecommerce accounting software can significantly ease the burden during tax season by:

- Automatically categorizing transactions

- Tracking business expenses for deductions

- Generating detailed sales data and financial reports

- Calculating sales tax liabilities

- Simplifying the preparation of tax returns

- Providing audit trails for compliance management

9. How does ecommerce accounting software handle credit card payments and bank transfers?

Most of the best ecommerce accounting software solutions efficiently manage credit card payments and bank transfers by:

- Automatically reconciling transactions with bank accounts

- Categorizing different payment types for easy tracking

- Providing real-time updates on cash flow

- Offering integrations with popular payment gateways

- Generating reports on payment methods and trends

- Ensuring accurate accounting of all transaction fees

10. What role does ecommerce accounting software play in managing inventory levels for online businesses?

The best ecommerce accounting software is crucial for managing inventory levels in online businesses by:

- Tracking stock in real-time across multiple sales channels

- Automating stock updates when sales occur

- Providing low stock alerts to prevent stockouts

- Offering insights into best-selling products and slow movers

- Calculating the cost of goods sold (COGS) accurately

- Helping forecast future inventory needs based on sales data

- Integrating with popular ecommerce platforms for seamless inventory syncing

Also Read:

Wrapping Up

With a plethora of options available, every business has the opportunity to select the best ecommerce accounting software for its specific requirements.

It is important to meticulously assess the features and level of sophistication offered by each platform. Moreover, consider not only your current needs but also anticipate future requirements as your business expands.

Upon identifying a promising tool, take advantage of free trials or free plans to familiarize yourself with its capabilities. Only transition to a paid plan once you are confident it meets your needs.

After making your decision, ensure seamless integration with all necessary systems and automate processes wherever possible. This will enhance efficiency and save valuable time for business owners.

If you still need more help, get in touch with us and we will help you find the right accounting solutions for your ecommerce startup.