For any startup, accounting is the backbone of financial health. Without proper accounting for startups, you risk losing control over your cash flow, which can quickly lead to failure. In fact, 38% of startups fail because they run out of money, according to CB Insights.

Whether you’re handling accounting for startups on your own, using accounting software, or working with an accountant, understanding the basics is crucial. Accounting for startups isn’t just about tracking expenses—it’s about ensuring your finances are in order, spotting opportunities to grow, and avoiding costly mistakes.

In this article, we’ll cover everything you need to know about accounting for startups, enabling you to manage your finances and position your business for long-term success.

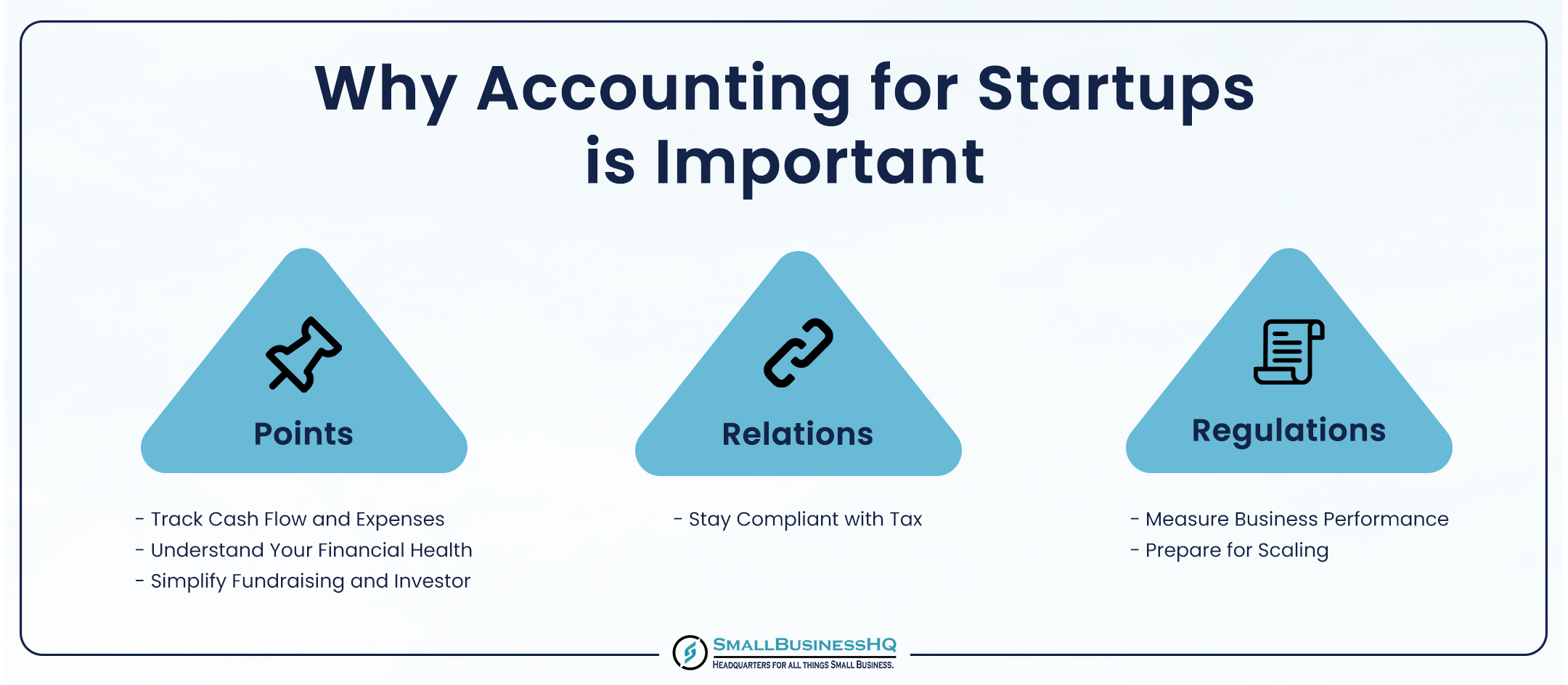

Why Accounting for Startups Is Important

Accounting isn’t just about crunching numbers—it’s a cornerstone of business success. It provides valuable insights guiding strategic financial decisions that drive sustainable business growth.

But, beyond that, here’s why proper accounting for startups is important.

Track Cash Flow and Expenses

Financial tracking lets you easily monitor every dollar coming in and going out. Accounting for startups is important because it helps you track your cash flow, identify unnecessary expenses, and prioritize spending to ensure smooth operations.

Understand Your Financial Health

Proper accounting for startups gives you a clear picture of your business’s financial health. You can use balance sheets, profit and loss statements, and cash flow reports to check if you’re making money or wasting resources.

Simplify Fundraising and Investor Relations

Investors want to see solid financial records and well-maintained books. Accounting for startups simplifies the process of providing clear financial reports to investors, building trust and credibility. It also helps you track funding progress and showcases your effective management of resources.

Stay Compliant with Tax Regulations

Taxes are complicated, and mistakes can lead to penalties. Good accounting for startups ensures accurate tax filings, helps maximize deductions, and keeps your business compliant with local and federal laws.

Measure Business Performance

Proper accounting for startups allows you to track key performance indicators (KPIs) like revenue growth, profit margins, and operational efficiency. It gives you the necessary insights to adjust business strategies as needed to ensure you meet your business goals.

Prepare for Scaling

Accurate accounting helps startups identify growth opportunities and manage increased financial complexity. Accounting for startup practice provides a solid foundation for scaling operations while maintaining financial control. You’ll be ready to manage payroll, inventory, and larger budgets without hiccups.

You May Also Like:

- How To Choose Accounting Software: A Complete Guide

- What Is Accounting Software? Everything You Need To Know

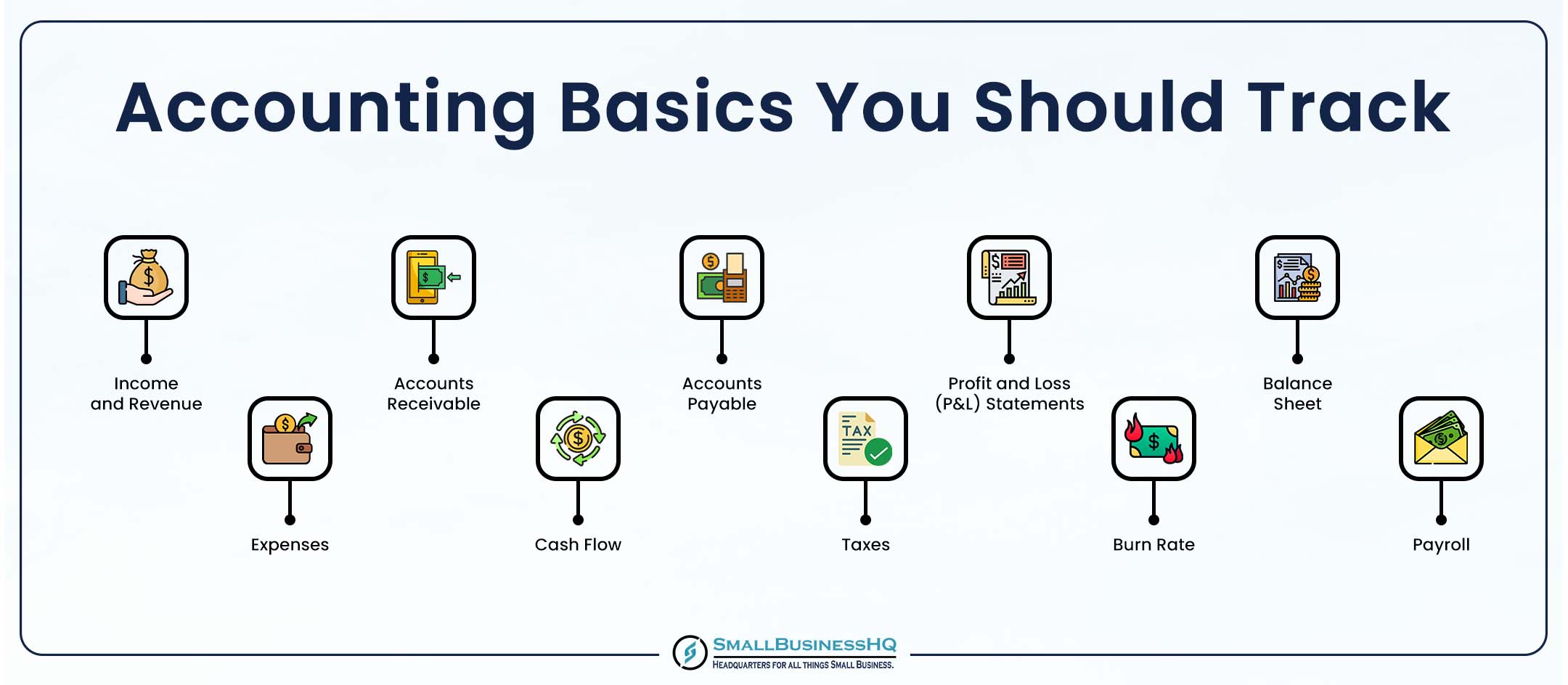

Accounting Basics You Should Track

For effective accounting for startups, you need to track some key accounting data. Regularly tracking the basics helps ensure financial stability and informed decision-making.

So, let’s discuss these essential financial records you should track.

- Income and Revenue: Track all income sources, whether from product sales, subscriptions, or services. Knowing where your money comes from helps you identify your most profitable streams and measure growth over time. This is an important aspect of accounting for startups.

- Expenses: An essential record to track as a startup is your expenses. Categorize your spending into fixed costs, like rent and salaries, and variable costs, like shipping and utilities. This helps you identify where you can cut back and save. Effective accounting for startups means understanding your spending patterns and adjusting as needed.

- Cash Flow: Monitor your cash inflow and outflow to ensure you have enough liquidity to stay in business. Maintaining positive cash flow is essential for ensuring the sustainability and growth of your startup.

- Accounts Receivable: Track money your customers owe you. Late payments can affect your cash flow, so follow up on any outstanding invoices.

- Accounts Payable: You need to keep tabs on your bills and vendor payments. This helps you avoid penalties or damaged relationships.

- Profit and Loss (P&L) Statements: With a P&L statement, you get a summary of your revenue, expenses, and profits over a specific period. A P&L statement is a critical tool in accounting for startups to evaluate profitability and make strategic adjustments.

- Balance Sheet: Your balance sheet provides an overview of your assets, liabilities, and equity. Regularly reviewing it is essential in accounting for startups to ensure financial stability.

- Taxes: Track all your tax obligations, including sales tax, income tax, and payroll tax. Staying organized with tax records is a vital part of accounting for startups to avoid penalties and maximize deductions.

- Burn Rate: This measures how quickly you’re spending your cash reserves. Understanding your burn rate is crucial in accounting for startups to manage cash flow and plan for fundraising.

- Payroll: If you have employees, ensure payroll is accurate and on time. This includes salaries, benefits, and tax withholdings. Late payroll damages morale and can result in penalties.

You May Also Like:

- Benefits Of Using Accounting Software For Small Businesses

- How To Choose Accounting Software: A Complete Guide

Does Your Startup Need an Accountant?

Managing your finances can quickly become overwhelming when running a startup. But do you really need an accountant, or can you handle it yourself?

When A Startup Might Not Need an Accountant

In the early stages of a startup, you may not need a full-time accountant if your financial needs are simple. For example, as a solo app developer, you might only track software subscriptions, small marketing costs, and occasional client payments.

However, accounting for startups is still crucial for tax compliance, proper record-keeping, and financial clarity. While you may not need a full-time accountant, using accounting software or consulting a professional can help keep your finances organized and compliant.

In this case, using cloud-based accounting software is more cost-effective than hiring a professional accountant. Some other scenarios where you might not need an account include:

- Simple Business Structure: If your startup has a low volume of income and expenses—like a freelancer handling a handful of clients—you can likely manage your books using accounting software like QuickBooks, Xero, or FreshBooks. These tools automate tasks like expense tracking, invoicing, and payment reminders.

- Basic Tax Requirements: Early on, your tax situation may not be so complex. For example, if you’re a sole proprietor, you can file simple tax returns yourself using software like TurboTax or H&R Block.

- Small Cash Flow: If you’re operating on a tight budget and don’t yet have investors or employees, you can manually monitor your cash flow and ensure your expenses don’t exceed your income.

When A Startup Should Hire an Accountant

As your startup grows, managing your finances becomes more complicated. That’s when an accountant becomes a smart investment. Here’s why:

- Fundraising or Investor Relations: When seeking funding or pitching to venture capital, investors want detailed, professional financial statements to assess your startup’s viability and credibility. This could be balance sheets, cash flow statements, and profit/loss reports. An accountant ensures these documents are accurate, clean, and meet investor expectations.

- Complex Tax Management: As your startup grows, tax filings become more complex, and tax mistakes can cost you hefty fines. If your startup hires employees or expands internationally, payroll taxes, employee benefits, and sales tax filings need professional oversight. Here, an accountant helps ensure compliance with tax laws, identifies eligible deductions, and files on time. They can also optimize your tax structure to minimize liabilities.

- Cash Flow Monitoring: Cash flow is the lifeblood of startups, and mismanaging it can be fatal. An accountant tracks inflows and outflows, ensuring you always have enough cash to pay operating costs like salaries, rent, and supplies. For instance, suppose your business receives payments in 30- or 60-day cycles but needs to pay suppliers upfront. An accountant helps you project cash flow so you can avoid shortfalls.

- Financial Forecasting and Budgeting: Planning for the future requires detailed financial projections, which may be challenging to create yourself. Accountants analyze historical data and market trends to help you forecast revenue, anticipate expenses, and allocate budgets effectively. For example, if you plan to expand operations, an accountant can project how much funding you’ll need, how long it will last, and what return you should expect.

You May Also Like:

- Best SaaS Accounting Software For All Businesses

- Best Cloud Accounting Software For All Business Sizes

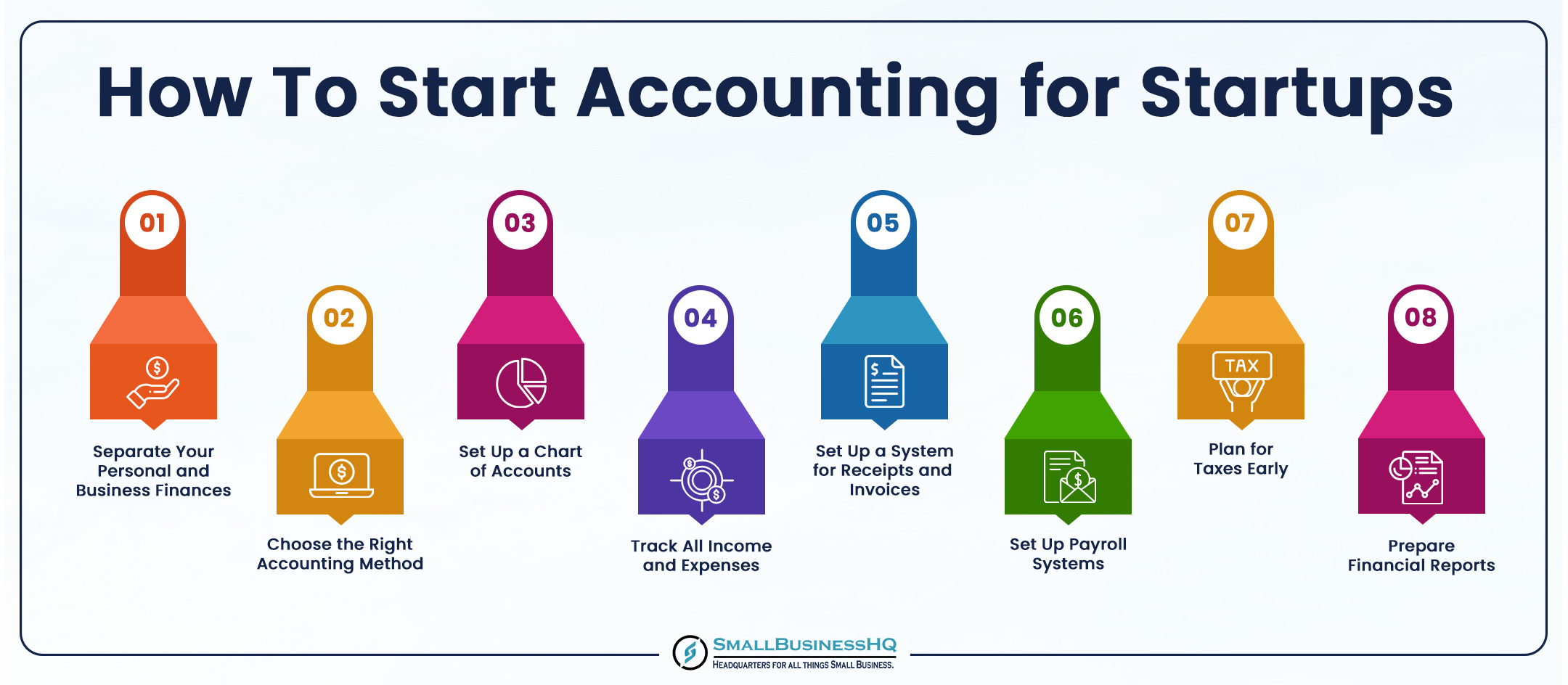

How To Start Accounting for Startups

Starting accounting for your startup doesn’t have to be overwhelming. You can break this down into manageable steps to build a solid financial foundation. Here’s how to get started with accounting for startups:

Separate Your Personal and Business Finances

Open a dedicated business bank account and credit card to separate personal and business transactions. This helps simplify tracking income and expenses and is essential for accurate financial reporting.

Choose the Right Accounting Method

There are two main accounting methods for startups: cash accounting and accrual accounting. With cash accounting, you record transactions when cash is exchanged, while accrual accounting records expenses or revenue when a transaction occurs, regardless of when payment is made or received.

Let’s break this down. For example, a SaaS startup secures a 6-month contract with a client for $6,000 in March. Under a cash accounting framework, you would recognize that $6,000 as revenue, which would conclude the client’s financial interaction for the remainder of the year. However, you are still responsible for delivering that service for the rest of the year.

With accrual accounting, you only recognize $1,000 of the $6,000 each month. What’s left would remain on your balance sheet as deferred revenue. This approach gives a more accurate and predictable view of your income. It shows consistent revenue streams, and investors prefer that.

Set Up a Chart of Accounts

With a chart of accounts, you can organize your financial transactions into income, expenses, assets, and liabilities. This makes it easier to track where money is coming from and where it’s going.

With a chart of accounts, you can organize your financial transactions into income, expenses, assets, and liabilities. This structure helps you easily track where money is coming from and where it’s going.

For example, you might create categories like “rent,” “software subscriptions,” and “client payments.” Once you set up these categories, you can use accounting software like QuickBooks or Xero to customize and manage your chart of accounts, tailoring it to fit your specific business needs.

Track All Income and Expenses

Keep a detailed record of every income and expense, regardless of size. This includes sales revenue, office supplies, payroll expenses, and software subscriptions.

You can use a spreadsheet or accounting software to keep everything organized. This helps you understand your cash flow, prepare for taxes, and identify spending patterns. Ensure you categorize each transaction accurately in your chart of accounts.

Set Up a System for Receipts and Invoices

Create a system to save receipts, invoices, and financial documents. You can scan and organize receipts digitally using apps like Expensify or Shoeboxed. This system backups your important files, and you can easily access them anywhere.

Set Up Payroll Systems

If you’re paying yourself or your team, ensure you have a system for managing payroll. You can use tools like Gusto or ADP to automate salary payments, taxes, and deductions.

Plan for Taxes Early

Estimate your tax obligations and set aside funds regularly. Also, you need to factor in quarterly tax payments to avoid last-minute surprises.

If you can’t handle it yourself, hire a professional accountant or tax advisor. They can help you navigate deductions and compliance.

Prepare Financial Reports

Generate reports like profit and loss statements, balance sheets, and cash flow summaries. This way, you can monitor your startup’s performance.

These reports give you a clear picture of your business health. They also help with planning for the future of your business.

You May Also Like:

Accounting Software for Startups

Choosing the right accounting software for your startup can save time, reduce errors, and simplify financial management. Plus, investing in user-friendly software ensures smoother tracking of expenses, revenue, and overall cash flow.

But with so many options, how do you choose the right one? This depends on a few factors, especially when it comes to accounting for startups:

- Budget: Does it fit your startup’s financial constraints? Some tools are free, while others charge monthly fees.

- Ease of Use: Choose software that doesn’t require a steep learning curve.

- Features: You need an accounting software that offers features tailored to your business needs. A tool with additional features, including automation, payroll, invoicing, and inventory management.

- Integrations: Ensure the software integrates with other tools you’re using, like payment processors or CRMs.

- Scalability: Will the software grow with your startup? You need a tool designed to scale as your business grows.

That said, let’s look at some of the top accounting software options designed for startups.

1. QuickBooks Online

Image via QuickBooks

QuickBooks Online is one of the most popular accounting software options for startups. It automates essential tasks like invoicing, expense tracking, and generating financial reports.

The platform integrates seamlessly with tools like PayPal, Stripe, and Shopify. If you plan to scale, QuickBooks Online provides advanced features like cash flow forecasting and payroll management, making it an ideal choice for accounting for startups.

2. FreshBooks

Image via FreshBooks

FreshBooks lets you create professional invoices, track expenses, and manage time-based billing effortlessly. If your startup is service-based, its built-in project management tools help you collaborate effectively with clients. FreshBooks streamlines key financial tasks, allowing you to focus more on growing your business, making it ideal for accounting for startups.

3. Xero

Image via Xero

Xero is an excellent choice if you’re a growing startup that needs collaboration and real-time insights. It offers a clean dashboard that seamlessly tracks cash flow, expenses, and inventory.

The accounting software also integrates with over 1,000 apps like HubSpot and Square, making it ideal for accounting for startups that already use business tools and need to sync financial data. Plus, its multi-user access feature is perfect if you have small teams managing accounts together.

4. Wave

Image via Wave

Wave provides basic accounting features like invoicing, receipt scanning, and unlimited income and expense tracking. It also has financial reporting tools, like profit/loss statements and balance sheets.

The tool even comes with a free plan, making it an excellent option for a cost-effective accounting for startups solution. With its user-friendly interface and essential features, Wave helps startups manage their finances without breaking the bank.

5. Zoho Books

Image via Zoho Books

This accounting software automates workflows like invoicing, expense tracking, and payment reminders. If your startup already uses Zoho’s ecosystem, like Zoho CRM, you’ll find Zoho Books a natural fit since it integrates seamlessly with other Zoho tools.

The tool also comes with real-time collaboration features, allowing your teams to manage finances efficiently and easily collaborate on financial tasks. It’s an excellent choice for accounting for startups.

You May Also Like:

FAQ

1. What are the accounting basics for startups?

Accounting basics for startups include:

- Tracking income, expenses, and cash flow: Set up a chart of accounts to categorize transactions like sales, costs, and assets.

- Maintaining accurate records: Monitor cash flow and reconcile bank statements monthly.

- Understanding key financial statements: Balance sheet (assets vs liabilities), income statement (profits and losses), and cash flow statement (money movement).

- Implementing an invoicing system: Ensure timely payments and track outstanding bills.

2. What is the best accounting method for startups?

The best accounting for startups depends on the business model, but most choose between cash and accrual accounting.

- Cash accounting records transactions when cash is exchanged. It’s simple, ideal for small startups with minimal transactions, and offers a clear view of available cash.

- Accrual accounting records income and expenses when they are earned or incurred, not when cash is exchanged. It provides a more accurate picture of your startup’s long-term financial health, especially as your business scales.

3. Does a startup need an accountant?

A startup can benefit from having an accountant, but it depends on its stage and needs. When starting out the budget is tight, you might handle accounting yourself using software like QuickBooks or Xero. However, as the business grows, an accountant becomes essential for tax compliance, financial strategy, and managing complex transactions.

4. Is QuickBooks good for startups?

QuickBooks is a popular choice for accounting for startups because of its affordability, user-friendliness, and robust features, including payroll management and cash flow tracking. You manage bookkeeping, invoicing, expense tracking, and financial reporting all in one place.

5. Why is accounting important for startups?

Accounting is crucial for startups because it gives you a clear picture of your finances. You can track income, expenses, and cash flow. This allows you to make informed decisions and manage resources effectively.

That’s not all! Proper accounting helps you maintain compliance with tax regulations, avoiding penalties and legal issues. It also prepares you for audits and investor scrutiny by providing accurate financial statements.

On top of that, it shows you areas to cut costs, improves budgeting and supports long-term planning. Without solid accounting practices, you risk overspending, cash flow issues, and financial mismanagement. And this can derail your business growth.

You May Also Like:

Wrapping It Up

As you’ve seen, accounting for startups is the backbone of every successful business. It helps you track your financial health and ensure compliance. When you understand the basics and choose the right accounting method, you can make more informed decisions.

So, start small by tracking your income and expenses, setting up a chart of accounts, and implementing a system that works for your business. As your startup grows, this will help you manage cash flow and attract investors.

Ready to take control of your startup’s finances? Choose the right accounting method and software that fit your needs and watch your business thrive!