However, by following the payroll best practices, businesses can streamline the payroll process, reduce errors, and maintain compliance.

In this article, we’ll explore best practices to help you with the payroll process so that you don’t have to invest hours in calculations and paperwork.

Why Startups Should Follow Payroll Best Practices?

Having a feature-rich accounting software and setting up good payroll practices is key to running things smoothly and building trust with your employees and stakeholders.

Here is why startups should follow payroll best practices:

- Build Employee Trust: Late or incorrect payments harm morale and increase turnover. Ensuring timely payments is one of the key payroll best practices to build employee trust.

- Stay Audit-Ready: Payroll errors, such as tax mistakes or misclassification, can lead to audits and fines. Keeping records clean ensures compliance.

- Prevent Productivity Loss: Fixing errors drains resources. Meanwhile, streamlined payroll systems minimize disruptions and support growth.

- Manage Complexity: A growing workforce or changing laws can complicate payroll. Following payroll best practices ensures adherence to regulations.

11 Payroll Best Practices to Implement

The payroll process requires attention to detail, as errors can lead to significant financial losses.

For instance, in 2024, the Department of Labor recovered over $273 million in back wages and damages for nearly 152,000 workers, underscoring the importance of following payroll best practices.

While tools like Freshbooks can make managing payroll easier, understanding these payroll best practices is essential.

Let’s talk about the payroll best practices in detail:

1. Classify Your Employees Accurately

Proper employee classification is the bedrock of an effective payroll system and essential if you want to follow payroll best practices. Misclassification can lead to compliance violations.

Similarly, labeling an employee as an independent contractor to avoid payroll taxes can trigger audits from the IRS (Internal Revenue Service) and damage your business’s reputation.

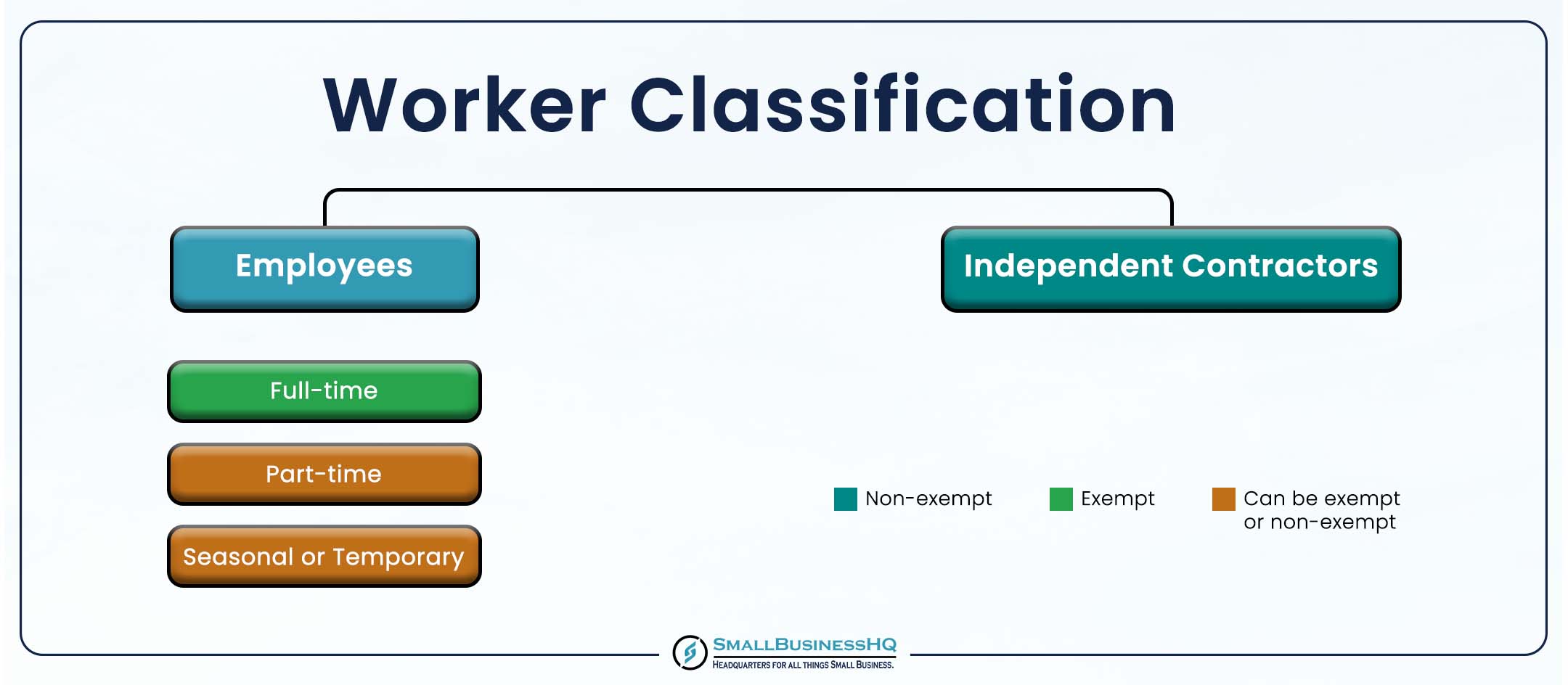

Generally, workers are classified as employees or independent contractors, with employees further categorized as exempt or non-exempt.

For payroll best practices, here’s what each category entails:

- Full-Time Employees: Typically work 40 hours a week, are salaried, and are often eligible for benefits like health insurance, paid time off, and retirement plans.

- Part-Time Employees: Work fewer hours and may or may not qualify for benefits.

- Seasonal or Temporary Employees: Hired for specific periods or projects.

- Independent Contractors: Self-employed and responsible for their own taxes.

These classifications are based on the Fair Labor Standards Act (FLSA), a federal law designed to protect employees by regulating things like minimum wage, overtime pay, recordkeeping, and child labor laws.

For instance, classifying a non-exempt employee as exempt denies them access to overtime pay, which violates the Fair Labor Standards Act. Following payroll best practices helps ensure this doesn’t happen. Beyond legal penalties, such infractions create a cultural deficit, where employees feel undervalued and exploited, ultimately undermining morale.

Consider the cautionary tale of Nike, a global giant employing over 79,000 individuals across the world, whose payroll practices came under intense scrutiny. The company committed severe misclassification errors, which could be attributed to its heavy reliance on a vast network of independent contractors.

These mistakes allegedly opened Nike to potential tax penalties exceeding $530 million and the looming threat of class-action lawsuits.

This example acts as a critical lesson in payroll best practices — accurate worker classification isn’t optional.

Image via author

You May Also Like:

2. Automate the Payroll Process

Given the rise of remote work and ever-changing tax laws, implementing a manual payroll process increases the risk of mistakes.

Automating payroll is one of the most significant payroll best practices that reduce the potential for human error. Thankfully, businesses of various sizes and needs can easily automate the payroll process with multiple FreshBooks alternatives.

The key benefits of an automated payroll system include:

- Efficiency: Automation speeds up payroll tax filing, calculating wages, and withholding deductions.

- Accuracy: The time-tracking integration ensures proper recording of working hours, preventing over or underpayments. For instance, by integrating biometric scanners, such as fingerprint or facial recognition systems, payroll software can automatically record attendance.

- Security: Protect sensitive employee data, like bank account details from unauthorized access.

- Compliance: Easily track changes in tax laws to avoid missed deadlines and fines.

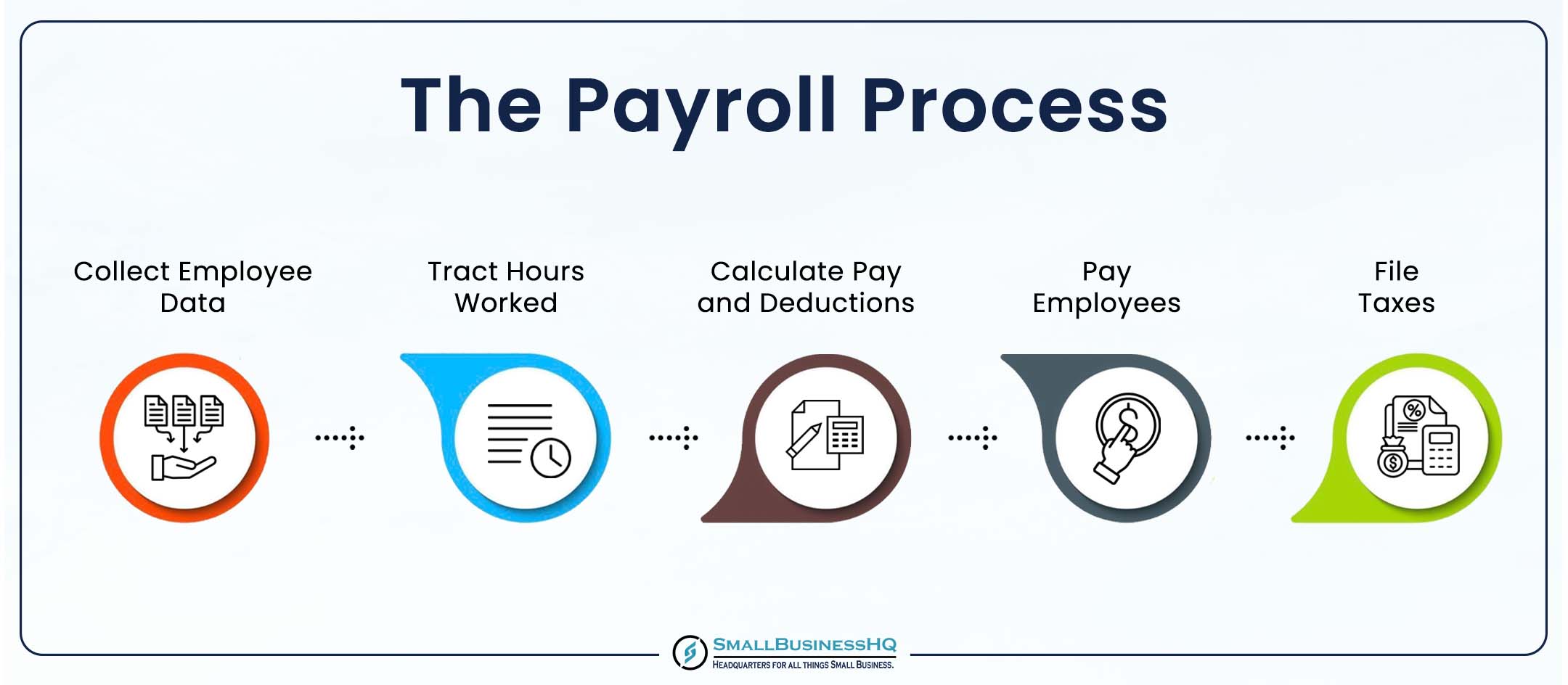

Here is a quick overview of how the payroll process works:

Image via author

3. Keep up with Tax Laws and Regulations

This is one of the most important payroll best practices for any business owner. Payroll involves several taxes, including withholding taxes like federal income tax, Social Security, and Medicare deductions.

Calculate and submit these taxes on time to avoid the IRS imposing various fines on your business.

Aside from meeting deadlines, keeping up with varying rules, workforce dynamics, and shifting regulations is one of the most essential payroll best practices to keep in mind:

- State-Specific Payroll Tax Laws: As your business expands across states, tax laws can become more complex. For example, some states require mandatory contributions for state disability insurance, while others don’t. Similarly, payroll tax rates for unemployment insurance or family leave programs may vary, requiring businesses to adjust their payroll management practices accordingly.

- Cross-Border Tax Laws: If you hire remote employees overseas but your business is in the US, you must follow payroll best practices to adhere to specific tax rules in the overseas jurisdiction. Missteps here can lead to double taxation.

- Retroactive Tax Law Changes: This occurs when a new tax rule or tax credit (a discount on taxes) is applied to past payroll periods even though the rule wasn’t in place when those payrolls were processed.

This prompts revisiting and adjusting past payroll records to make sure everything aligns with the new tax regulations. By adhering to payroll best practices, business owners can ensure they don’t miss out on savings or face penalties for underreporting.

One of the key payroll best practices here is to choose the right accounting software or payroll software that offers payroll flexibility. Consider using payroll automation software that integrates tax law updates directly into their systems. This is one of the key payroll best practices.

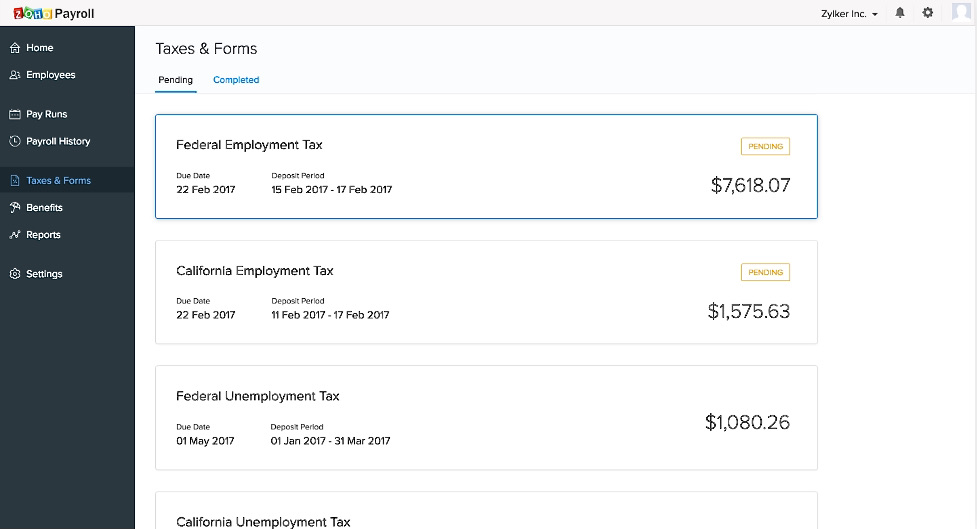

For instance, FreshBooks alternatives like Zoho Books’ payroll tool can help track tax payment schedules, notify users of due dates, and provide a dedicated dashboard to manage upcoming and completed tax payments and filings.

Image via Zoho

For a more detailed overview of how Zoho Books works in accounting and payroll management, Zoho Books review can help you understand the nuances.

You May Also Like:

4. Ensure Payroll Data Protection

Data protection is the central pillar of payroll best practices. It is about safeguarding sensitive employee information from both external and internal threats. You’re managing paychecks and protecting Social Security numbers, bank account details, home addresses, and tax records from unauthorized access and breaches.

Data protection and data security in payroll best practices involve the following:

- Encryption: Sensitive data should be encrypted (turning it into unreadable code) so that if it’s intercepted, it’s useless. However, not all encryption is created equal. Consider adopting end-to-end encryption as part of your payroll best practices. This ensures that data remains protected across all stages — from transmission to storage.

- Access Control: Payroll staff should have specific access rights, with strict control over who can see what. In practice, this could involve the use of multi-factor authentication (MFA). This security measure requires users to verify their identity through multiple steps before gaining access. Payroll best practices like these make it difficult for unauthorized users to gain initial access.

- Regular Audits: Your payroll system should undergo regular security audits to ensure it’s working as expected. Payroll best practices for security audits go beyond checking compliance; they aim to anticipate threats and ensure that potential security gaps are promptly addressed.

5. Train Your Payroll Team Regularly

Training the people who manage payroll, such as the HR and the accountants, is an ongoing process of payroll best practices. They manage the finances and payroll data and are current with payroll laws.

Here are a few things to consider while training them to ensure they adhere to the payroll best practices:

- Understanding the System: Your team must be comfortable with payroll software features to leverage it to the best of its ability.

- Real-time Problem-Solving: Train the team to manage and resolve problems quickly. For example, if there’s a discrepancy in an employee’s pay period or a wage calculation, they need to know how to fix it before the issue escalates.

- Continuous Education: Provide regular information like software updates and tax regulations to ensure your payroll management system runs smoothly.

To take your payroll team’s expertise even further, consider formal certification like the Certified Payroll Professional (CPP) credential. Certified by the American Payroll Association (APA), the CPP is made for payroll professionals. It boosts their expertise in maintaining compliance and following payroll best practices.

To earn this certification, individuals must meet eligibility requirements, which typically include about three years of payroll experience and passing a comprehensive exam. After this, they should then get recertified every five years.

By pursuing the CPP certification, payroll professionals can ensure that they align themselves with key payroll best practices.

This also enhances their ability to handle complex payroll tasks, manage tax deductions, and adhere to evolving tax codes. As a result, they improve their accuracy and efficiency in payroll management.

This badge shows that a payroll professional is CPP certified:

Image via PayrollOrg

You May Also Like:

6. Establish a Clear Payroll Approval Process

A formalized payroll approval process ensures that all payroll calculations, deductions, and employee records are reviewed by multiple authorized people before processing.

Let’s discuss some key elements of the approval process:

- Defined Roles and Responsibilities: Designate specific team members to handle approvals for various parts of the payroll process.

- Set Specific Checkpoints: Double-check tax payment confirmation, employee records validation, and overtime pay verification before moving to the next step.

- Transparent Documentation: Maintain a record of who approved what and when. This simplifies future audits and ensures alignment with payroll best practices.

- Clear Timeline and Deadlines: Establishing a clear timeline and deadlines for each step of the approval process ensures that nothing is rushed or delayed.

7. Reconcile Payroll Accounts for Accurate Financial Management

From our list of payroll best practices, this one ensures all payroll-related financial transactions align with bank statements and accounting records.

Here’s how to approach this step effectively:

- Match Payroll Transactions to Bank Records: Regularly compare payroll deposits, such as direct deposit payments, with withdrawals with your bank statements to ensure all transactions are accounted for and free from discrepancies.

- Validate Payroll Liability Balances: Ensure that payroll liability accounts align with the total amounts for employee wages, taxes withheld, and other deductions. Any mismatches should be promptly addressed to maintain the integrity of the payroll system.

- Reconcile Tax Payments: Confirm that amounts in tax withholding accounts match the actual payments submitted for payroll taxes and tax filing.

- Verify Third-Party Deductions: Ensure all third-party payments, such as health insurance premiums, retirement fund contributions, or garnishments, correspond with employee deductions and are remitted accurately.

- Investigate and Resolve Inconsistencies: Any differences between payroll records and financial statements should be thoroughly reviewed. These payroll best practices refine your payroll procedures.

You May Also Like:

8. Leverage Payroll Analytics for Better Decision-making

Often integrated into payroll and accounting software, such as FreshBooks alternatives, payroll analytics helps gain insights into financial performance, workforce efficiency, and compliance.

By tracking overtime, turnover rates, and labor costs, businesses can increase financial visibility and identify where resources are being spent. Such payroll best practices allow businesses to make informed decisions.

Historical payroll data also improves forecasting, allowing companies to predict and reduce future expenses.

The following key metrics should be considered:

- FTE (Full-Time Equivalent): A calculation that converts the total number of work hours into full-time employee equivalents. This is a key component for payroll best practices when analyzing overall workforce demand, especially comparing part-time/seasonal workers to full-time staff.

- Labor Utilization Rate: A measure of how effectively a company is utilizing its employees, usually by comparing hours worked to hours paid. High utilization rates indicate that employees are working efficiently, while low rates may signal overstaffing or underutilization.

- Wage Growth Analysis: The percentage of increase in wages over a given period. Payroll analytics can track wage growth across departments, positions, or the entire company.

- Absenteeism and Attendance Rates: This metric keeps track of how many days employees are unexpectedly absent within a certain time period. Here, payroll best practices involve leveraging this metric to spot which days or months tend to have higher absence rates.

9. Establish a Robust Backup and Disaster Recovery Plan

This is one of the payroll best practices often overlooked by businesses but is every important in the event of system failures. It helps companies retrieve payroll data quickly to minimize downtime.

A system failure may include either:

- Hardware Failure: Where your hard drives crash and your data is inaccessible

- Software Failure: Your payroll software malfunctions and corrupts your payroll records

Instead of recalculating everything from scratch, it’s best to follow payroll best practices for payroll data backup. This involves storing copies of your payroll data on USB drives or implementing digital backups like cloud-based software that stores your payroll data on remote servers located in different geographical locations.

The other aspect of payroll best practices here is disaster recovery. This involves implementing critical steps to ensure you’re not walking blindly into a disaster.

Here are some payroll best practices that build the foundation of a solid disaster recovery plan:

- Diagnose the issue by determining whether the disaster is due to a cyberattack or server failure, and determine the scope of its impact.

- Retrieve data from your latest backup, which is either stored on the cloud or a physical device.

- Crosscheck restored data against independent records, such as bank statements that align with recent payroll disbursements or payroll reports saved in email attachments.

- If the compromise was caused by a vulnerability in your payroll management system, consider upgrading your payroll solutions or working with payroll services that specialize in recovery support.

You May Also Like:

10. Maintain a Contingency Fund for Payroll Emergencies

A contingency fund ensures that you have a financial cushion to cover payroll expenses when cash flow is tight. This is one of the crucial payroll best practices, particularly for businesses that face challenges like delayed customer payments or seasonal fluctuations in revenue (lower sales during off-peak months).

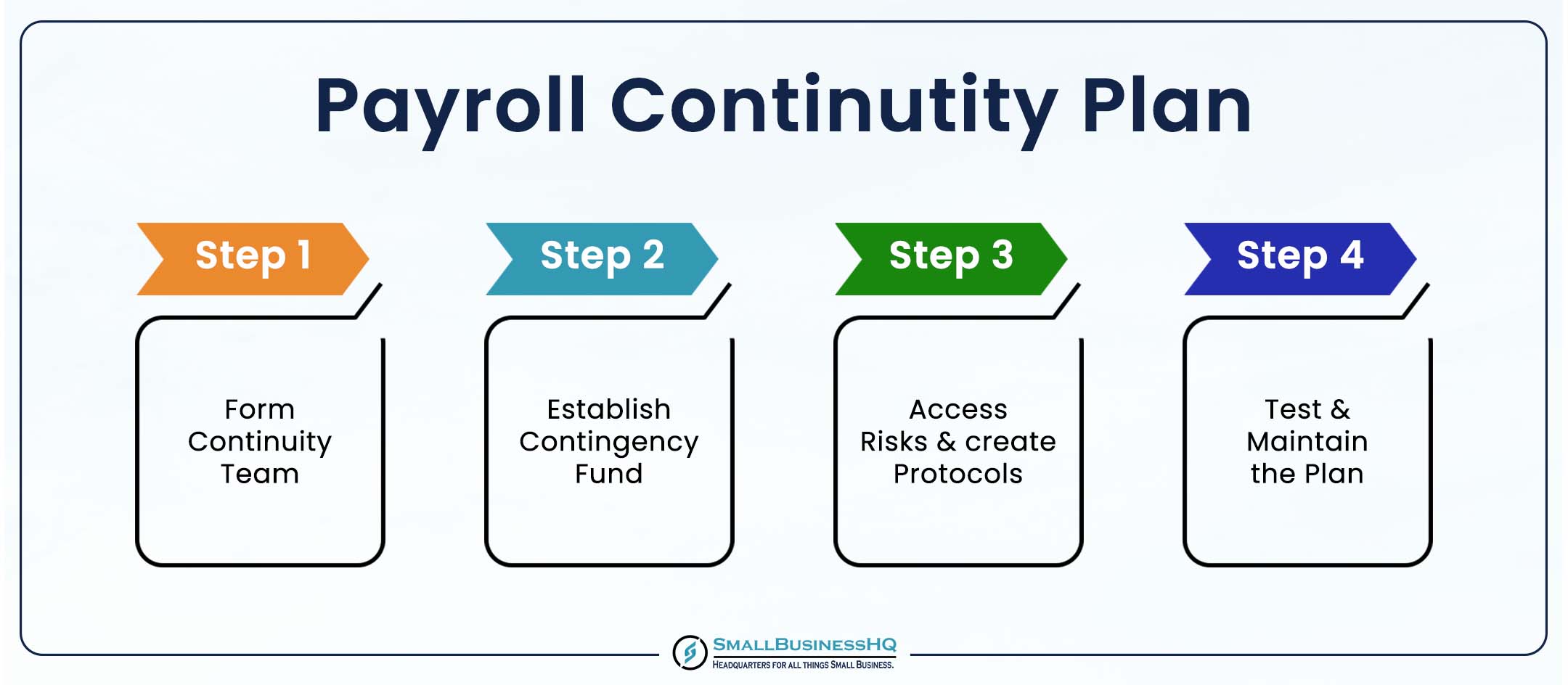

When such emergencies arise, it’s best to be prepared ahead of time. Here’s how to create a solid contingency plan:

- Establish a Reserve Fund: This dedicated amount is set aside specifically for payroll purposes. In line with payroll best practices, you should have at least one or two payroll cycles’ worth of funds in reserve. The amount should be based on your payroll tax obligations and employee wage expenses, but it should also have flexibility for bonuses or overtime pay.

- Ensure Easy Access to Contingency Fund: This may involve using a savings account with minimal withdrawal restrictions for quick fund transfers during emergencies.

- Form a Payroll Continuity Team: A continuity team is a designated group within the payroll department that’s responsible for ensuring payroll operations continue without disruption during emergencies.In practice, the team follows payroll best practices to ensure the contingency fund is kept separate from regular operating funds yet easily accessible.

They may also regularly assess the fund’s adequacy based on payroll cycles and potential risks, adjusting the amount to cover anticipated emergency scenarios. This proactive management ensures that payroll obligations are met consistently.

Image via author

11. Avoid Procrastination

For businesses, failing to adhere to payroll best practices due to procrastination on tax filings and missed deadlines can result in compliance issues. Payroll staff may tackle this by breaking down tasks into manageable steps.

This can be achieved through a well-organized tax payroll calendar that lists out the specific filing and payment dates. The calendar should be shared with the payroll team to ensure consistency with payroll best practices.

However, there may be times when deadlines can’t be met. In such cases, it’s important to understand how to request an extension.

The IRS allows businesses to request a tax filing extension for certain forms, such as Form 941 (quarterly tax returns for payroll taxes). However, extensions only provide more time to file; they don’t extend the time to make tax payments.

Moreover, the Tax Penalty Abatement by the IRS refers to the process of waiving penalties for businesses that miss tax filing or payment deadlines due to circumstances beyond their control, such as natural disasters.

However, keep in mind that while the IRS may offer this relief, businesses must act quickly to request penalty abatement to avoid accumulating further fees.

You May Also Like:

FAQ

1. What is considered the biggest challenge in payroll?

The biggest challenge in payroll often arises from a lack of standardization, such as inconsistent data entry, discrepancies in tracking hours or overtime, and confusion over employee classifications. Adopting payroll best practices can help address these issues.

2. What is a payroll questionnaire?

A payroll questionnaire is a tool used to check how well a company manages its payroll processes. It covers areas like removing terminated employees, processing pay correctly, and adhering to relevant laws.

3. What is key when managing payroll?

Ensuring accurate record-keeping is essential for managing payroll. Records may include taxes withheld, pay rates, and hours worked; these are necessary for future references or audits.

4. What are the five basic steps of payroll?

These include:

- Onboarding

- Time Tracking

- Calculate pay and taxes

- Pay employees

- File taxes

5. What are the two key safeguards in payroll management?

The two key safeguards in payroll management and payroll best practices are splitting responsibilities to reduce errors or fraud and the approval process. These ensure that payroll changes are authorized by a manager or supervisor for added oversight.

Final Perspective

Payroll best practices establish fairness and order, ensuring employees are paid accurately and on time, reinforcing compliance with tax laws, and protecting your business from fines.

You can streamline operations and focus on growth by classifying employees correctly, automating payroll, safeguarding data, training your payroll team, and setting up an approval process. You must also reconcile payroll accounts, leverage payroll analytics, establish a backup and disaster recovery plan, maintain a contingency fund, and avoid procrastination.

Choosing the right payroll service provider that supports your payroll process is key to ensuring its reliability and efficiency.