To make matters worse, there is too much information online that doesn’t provide any solutions and could potentially put you in even more problems with the IRS.

That’s why if you want to protect yourself and your business from any financial or legal problems, here are the 5 tax mistakes self-employed people make that you should definitely avoid.

1. Poor Bookkeeping

One of the biggest tax mistakes self-employed people make is having poor bookkeeping in their business. This could make filing taxes extremely difficult and create more problems in the future.

This mistake could lead small business owners like you to face potential fraud charges, expensive penalties, and other issues with the IRS.

Especially if you are not using one of the best accounting software for self-employed people to help you avoid the following bookkeeping mistakes.

Inaccurate Financial Reporting

Inaccurate financial reporting during tax season is one of the common tax mistakes that can cause serious economic losses to your business when filing your tax returns.

This mistake could happen to any business owner who intentionally or by accident submits inaccurate receipts or financial statements to the IRS.

Once this happens, the regulatory bodies may suspect your business wants to avoid paying taxes or is trying to commit fraud, compromising your business success in the long term.

The good news is you can avoid such tax mistakes by using tools like QuickBooks to manage everything and automate this process with just a few clicks.

Additionally, you can also use QuickBooks alternatives that are free and offer features that are useful for both beginners and professionals.

Auditing Challenges

After you file taxes and show inaccurate financial reports to the IRS, your business may be audited by a special agent for not providing detailed records of your finances.

This special agent will look through all your tax returns three years from their original filing date to see if you are making mistakes from underreporting income and if necessary, issue the appropriate penalties for your tax mistakes.

For these audits, you may have to send over documentation of your business income through correspondence, visit the office of the special agent, or have them show up on a working day for a field inspection.

Legal Compliance Issues

Another one of the common tax mistakes, which happen due to poor bookkeeping, is not complying with tax laws and reporting requirements from the IRS.

This mistake will trigger a tax compliance inspection that could turn into a tax audit if you do not follow the rules of the IRS and other regulatory bodies.

In this case, the compliance inspector will not act as a sanctioning authority and instead will try to guide you in the right direction so your business complies with the law.

However, keep in mind that each tax compliance inspection could eventually turn into a tax audit if you do not follow the rules of the IRS and other regulatory bodies.

If you want to prevent legal compliance issues, you can make use of accounting software for self-employed people to keep track of all your records and receipts of your business.

Using a good software solution will help you avoid many of the tax mistakes self-employed people make.

2. Not Claiming Tax Deductions from Business Expenses

Not claiming tax deductions is very common among small business owners. This typically happens if you don’t know which expenses could represent a tax break or a write-off when calculating your tax returns.

Here are some examples of tax deductions.

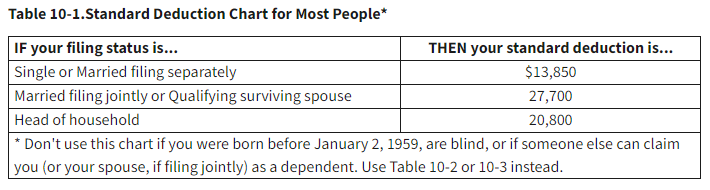

Image via IRS

As a result of this mistake, your business tax bill could be much higher than it needs to be, preventing you from saving hundreds or thousands of dollars in the following deductions:

- Home office expenses

- Business equipment

- Subcontractors

- Cell phone bills

- Vehicle expenses

One of the tax mistakes you can make is not making the right choice between itemized or standard deductions, making you pay more income tax each time you file your paperwork to the IRS.

3. Mixing Personal Expenses with Business Expenses

Another one of the tax mistakes you could make when filing your taxes is to mix your personal and business expenses since it leaves you open to more problems with the IRS. It also leads to higher financial risks in the future.

First of all, you could increase your liability by accidentally paying for a business asset with your personal account, making that asset vulnerable to lawsuits and potentially losing it down the line.

To make matters worse, you could even deal with bigger problems if you mix your personal and business expenses, which include the following:

- Negative impact on credit score

- Inaccurate tax reports

- Misuse of business funds

- Higher audit risks

This is why mixing personal and business transactions is considered one of the major tax mistakes self-employed people make each year.

The good news is that you can avoid all these problems by keeping your business expenses in a dedicated checking account and tracking them with any of the accounting solutions for the self-employed available in the market.

You May Also Like:

4. Failing to Pay Taxes On Time

Failing to pay your taxes on time is one of the most common tax mistakes self-employed people make, which forces them to pay significant amounts of money in penalties or fees.

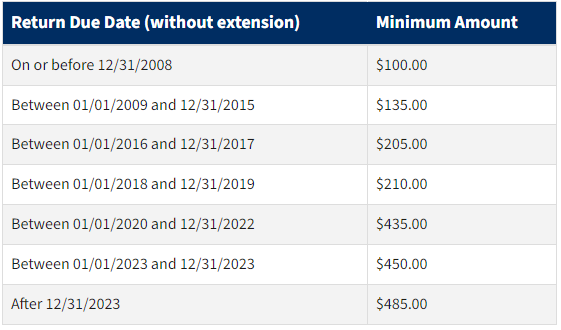

Here is a table with all the minimum amounts in penalties people had to pay the IRS from 2008 up until today, after not filing their taxes on the due date.

Image via IRS

Don’t forget that after this, you could pay even higher amounts of money if you add in the number of penalties you could face. Also, factor in the interest rate each penalty has after a certain amount of time.

Failure-to-File Penalty

This penalty applies to everyone who owes taxes and doesn’t turn in all their important tax documents like Form 1040 on time.

According to the previously cited IRS resource, once you are hit with this penalty you will have to pay 5% of the taxes you owe for each month your return is late, to a maximum of 25% of your bill.

However, if your return is late by more than 60 days you could end up paying the minimum amount of $510 or the total amount you owe in taxes.

Late-Payment Penalty

In addition to that, you could also get hit with the late payment penalty, which is a fee that is issued each time you don’t pay your tax bill before the deadline.

For each month your outstanding taxes remain unpaid, you will have to pay a penalty of 0.5% of your unpaid bill. This can go up to 25% of your outstanding bill plus the interest accumulated.

This penalty can even be enforced on top of the previous failure-to-file penalty if both your bill and return are already overdue.

Penalty Relief

The only thing you can do after this mistake to reduce the damage is to apply for penalty relief if you can meet certain conditions.

For example, one of these conditions is to provide reasonable cause as to why you couldn’t fulfill your tax obligations on time.

5. Not Having Enough Money for Tax Returns

One of the tax mistakes you can make is not setting aside enough money for your tax returns. This will make you miss the deadline and leave you unable to fulfill your tax obligations.

This means you will have to deal with the failure-to-file penalty we mentioned earlier until you can gather all the money you owe to the IRS.

Additionally, you will also have to pay the late payment penalty, which is another financial problem added to your business. All because you didn’t plan ahead and set aside money for your tax bill.

You May Also Like:

FAQ

1. What are the biggest tax mistakes self-employed people make?

Some of the common tax mistakes self-employed people make are selecting the wrong filing status, misspelling names, or typing the wrong social security number.

2. How long should I keep my tax returns?

The IRS recommends that you keep your tax returns and other related documents for at least three years. Not doing so, is one of the the tax mistakes that can cost you.

3. How can I choose between standard deduction or itemized?

It’s better to itemize your tax deductions if the expenses you can itemize are greater than the standard deduction.

4. What are the standard deduction amounts for 2025?

For single and married people filing separately it’s $15,000, for heads of households $22,500, and for married taxpayers filing jointly it’s $30,000.

5. How can I keep track of every transaction?

Use professional bookkeeping software that is linked to your bank account and provides detailed financial reports. Not using one is one of the tax mistakes you can make.

You May Also Like:

Ready to Avoid the Tax Mistakes Sel-Employed People Make?

Now that you know about the tax mistakes self-employed people make in their business, you need to update your tax strategy before filing any paperwork with the IRS. We also recommend that you seek professional help to manage your tax deductions, to ensure things go smoothly.

Doing this will help you reduce the level of risk in your business and avoid facing serious consequences from the tax authorities. All the best!