Checking accounts are one of the most popular accounts for everyday financial management. There are different types of checking accounts. In this article, we’ll discuss the features of each type.

Contrary to savings accounts, checking accounts don’t have a limit on transactions and users can set up recurring payments.

This includes regular transactions like utility bill payments, debit card purchases, and even writing out checks.

Most checking accounts are meant to hold your money temporarily and typically do not earn you interest. However, some types of checking accounts do and therefore have more requirements.

This post discusses the types of checking accounts to help you decide the best type for your needs.

What is a Checking Account?

Also referred to as a transactional account, a checking account is a deposit account that’s meant to keep money for short-term expenses.

This type of deposit account makes it easy to withdraw funds, make transfers, and conduct day-to-day transactions.

You can open a checking account from a traditional bank, online bank, or credit union. It allows easy access with an ATM, debit card, mobile application, or more.

How Does a Checking Account Work?

Now that you understand what a checking account is, let’s dive into how it works. Checking accounts are generally an easy account type to open and use. As mentioned, they allow you to easily deposit or withdraw money into your account for continuous use.

Here are a few ways to deposit money into your checking account:

- Wire transfers: These are mostly suitable for large sums of deposits or withdrawals. Wire transfers are made to other bank accounts, either domestically or globally.

- Bank branch deposit: Deposits can be made in person through a teller at a traditional bank branch.

- Direct deposit: Here, you’ll provide your bank account details and have money added directly to your account. For instance, most employers deposit paychecks into their employees’ accounts this way.

- ATM deposit: You can use ATM cards to withdraw and deposit money at ATMs but not to process payments.

- Debit cards: Visa and Mastercard debit cards can be used to make retail purchases and other payments online. You can also use them to deposit and withdraw money at ATMs.

- ACH transfers: These are electronic transfers that enable you to schedule payments, deposits, or withdrawals from your checking accounts.

- Mobile check deposit: This allows you to take a picture of a paper check and deposit the funds into your account. It offers convenience since you don’t have to physically visit a bank.

- P2P payments: This allows you to send money from your bank account to someone else’s bank account using their bank account information or email address.

Another common way to use your checking account in this digital age is through a secure mobile wallet.

Many banks offer this feature. It allows you to deposit money into a safe wallet and make transactions online. For instance, you can link your debit card to Apple Pay and shop online.

Types of Checking Accounts

There are different kinds of checking accounts depending on use and where you decide to bank. Here are the most common types of checking accounts.

1. Traditional Checking Account

This refers to the standard checking account that you use for basic needs, including paying bills, making purchases, and writing checks. It’s the most popular type of checking account offered by banking institutions.

Standard checking account features vary by institution.

Some checking accounts have a minimum balance requirement that users need to maintain to avoid maintenance charges, while others don’t.

You may also need to deposit a minimum amount to open a traditional checking account. Other than that, these accounts are pretty straightforward.

You’ll have unlimited access to your funds. You can also easily manage your money online through the bank’s website or mobile application.

Traditional checking accounts offer a debit or ATM card, as well as the option to pay bills online or using checks.

2. Online Checking Account

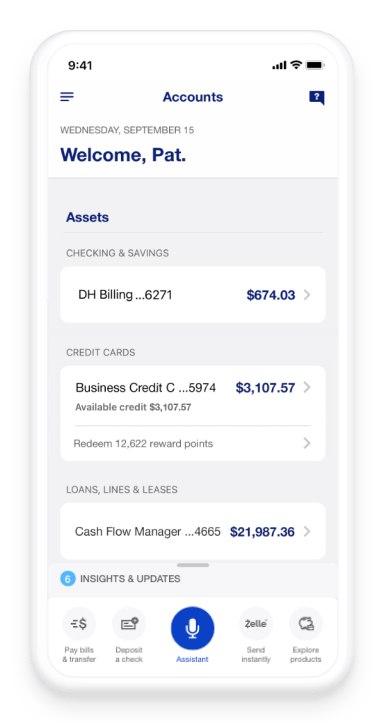

Online checking accounts are offered by digital and traditional banks and online fintech companies.

The unique aspect of these types of checking accounts is that they’re opened and managed entirely online. As opposed to traditional checking accounts that may require in-person interactions, this gives users more convenience.

Image via US Bank

Online checking accounts also tend to have lower fees and higher interest rates. This is because online banks don’t have to pay any overhead costs that come with running physical branches.

Besides convenience, online checking accounts offer the following advantages:

- They provide 24/7 secure access to your account.

- They tend to charge fewer fees compared to traditional bank accounts.

- They have user-friendly websites and apps.

The downside of this type of checking account is that banks lack an in-person customer support team, which may be inconvenient for some customers. Also, making cash deposits into online checking accounts can be difficult due to the lack of physical branches and a limited network of ATMs.

3. Interest-earning Checking Account

Interest-earning checking accounts, as the name suggests, allow you to earn interest on your account balance. However, the returns may be lower than what you’d earn on a savings account, as most checking accounts aren’t typically made to earn interest.

The amount of interest you earn will also depend on the bank’s policies.

Some interest checking accounts pay a flat rate, while others pay interest based on the balance in your account. You’ll be required to maintain a minimum balance for these types of accounts.

Before opening an interest-earning checking account, it’s important to check how your interest compounds over time. Is the interest paid daily, monthly, quarterly, or annually?

You must also check the maintenance fees for your interest-earning checking account. High maintenance fees can easily exceed the amount of interest earned, particularly if your account balance is low. In cases like this, you’d be better off with a regular checking account.

4. Premium Checking Account

A premium checking account is an upgraded type of a standard checking account. It’s typically made for customers with high bank balances and may require a higher initial deposit and higher maintenance fees.

Depending on the financial institution, some of the benefits of a premium checking account include:

- Free checks

- Higher interest rates

- Free wire transfers

- Discounts on some bank services

You can get more benefits if you sign up for more of your bank’s financial products. Each financial institution has different requirements for opening these accounts.

Before opting for a premium account, it’s important to assess its benefits against the costs. It may not be the right type of checking account for you.

For instance, if the benefit they’re offering is higher interest rates, you may be better off with an interest-bearing checking account.

Premium accounts are suitable for people who have larger sums of recurring expenses, such as mortgage payments, student loan payments, and insurance premiums.

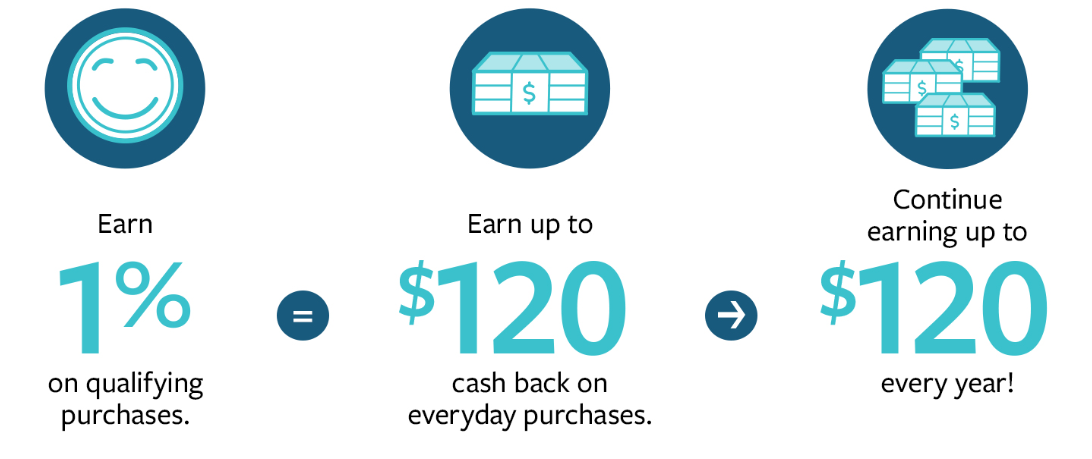

5. Rewards Checking Account

Checking accounts that offer additional perks to their users are called rewards checking accounts.

For instance, you can be offered reward points or discounts for debit card transactions.

Image via Citadel

Here are the requirements that often come with a rewards checking account:

- A minimum account balance

- A minimum number of card transactions per month

- A minimum amount on monthly transactions

Financial institutions have varying requirements for customers to meet so they can earn rewards.

You should go through them so you’ll know how to qualify and make the most of your rewards checking account.

Some checking accounts with benefits may have complex requirements or charge higher fees, making it difficult to take advantage of the rewards.

6. No-Fee Checking Account

Also known as free checking accounts, these types of accounts don’t charge recurring fees, such as a monthly service fee. They also don’t have a minimum balance requirement, unlike standard checking accounts.

However, the no-fee aspect of these checking accounts stops there. For instance, you may still have to pay ATM fees, overdraft fees, foreign transaction fees, and more.

These accounts may not offer any interest on your account balance, as they have no minimum balance requirement. Their greatest benefits are that they are simple and cost-effective.

Before opening a no-fee checking account, it’s important to make sure that there are no limitations on transactions or hidden fees.

7. Student Checking Account

Another specialized checking account is the student account. These types of checking accounts are designed with high school and college students in mind. They cater to students between the ages of 18 to 23.

Banks and financial institutions offer special requirements for students who are just getting started with managing their finances.

Here are the student-friendly benefits offered by these student checking accounts:

- No ATM fees

- Low to no monthly maintenance fees

- Signup bonuses

Parents looking to help their children with their finances or students just starting college can opt for this checking account.

In some cases, once a student completes college, their student checking account loses its benefits and may be reverted to a regular checking account.

It’s important to know what your bank’s policy is in such instances so you can decide what to do with your account in the future.

8. Senior Checking Account

Senior checking accounts are available to people aged between 55 to 60 years. They offer benefits for retirees or those on a fixed income. These may be suitable for you, depending on the senior account you choose.

For instance, you may choose a purely transactional senior checking account or one that provides high interest rates.

The benefits of this type of checking account include:

- Waived monthly service fees if you maintain a minimum balance

- Free checks

- Discount on safe deposit boxes

While senior checking accounts are meant for a specific demographic, it’s always best to check other types of checking accounts. You may find that they offer perks that address your needs better.

9. Checkless Checking Account

If you don’t need checks, then this may be the type of account you’re looking for. A checkless checking account doesn’t include checks, but they offer other ways to access your funds.

It’s more suitable for minors since it provides limited transactions, thereby reducing the risk of overspending. Parents looking to open a checking account for their children can start here.

Checkless accounts are also suitable for people who have been denied a regular checking account. This may be due to a history of bad checks or overdrafts.

They can opt for a checkless checking account instead of a second-chance checking account. Due to the limitations on checkless accounts, they’ll likely be approved for one.

Here are some advantages and disadvantages of checkless checking accounts.

Pros

- Low to no minimum initial deposit

- Helps reduce overspending

- Helps improve banking history

- Allows minors to open an account alongside adults

Cons

- Harder to have your monthly fees waived

- Mostly doesn’t offer overdraft protection

We do need to note that although you can’t write checks against checkless checking accounts, you can still make check deposits.

10. Joint Checking Account

These types of accounts are designed for people looking to share their accounts with another person, e.g., a family member or spouse.

Joint checking accounts allow both members to deposit, withdraw, and manage funds on the account. Unlike authorized access accounts, where the authorized party’s access can be limited, joint checking accounts allow equal access for both parties.

This can present either perks or downsides depending on your situation. Here are some perks.

- Streamlines budgeting: This is especially so if you and your loved one have shared expenses. It can make budgeting easier compared to having separate accounts. It’s also ideal if you’re planning a one-off event, such as a wedding, where you’ll be spending money together for the event.

- Provides additional oversight: This helps if you open a joint account with a vulnerable person, such as a child or an aging parent. You’ll be able to monitor their accounts and alert them of any discrepancies that may occur.

- Simplifies bill payment: For instance, partners can pull money into a joint account to help offset utility bills. This makes it easier to track expenses and simplify bill payments.

Here are some disadvantages associated with these types of checking accounts.

- Reduced privacy: Due to the transparency of a joint checking account, you get to see how your partner spends money. For some people, this may cause conflict.

- Less control: Since each co-owner of the joint account has equal access, individuals don’t have full control over the money they put in. This can be disadvantageous in case of a conflict between the parties.

- Shared liability: In the case of a lawsuit where a creditor gains access to one person’s account, the other will be equally liable. The creditor will be allowed to go after money in the joint account.

11. Multicurrency Checking Account

If you travel a lot or constantly send money to other countries, this may be a suitable checking account type for you. Multicurrency checking accounts provide the option to use different currencies to withdraw, deposit, send, and manage funds.

It’s also suitable for businesses with a global presence that transact in different currencies.

This helps you cut down on foreign transaction fees that you’d otherwise have to pay when using your regular debit card.

The number of currencies you can access globally using one of these accounts will depend on the financial institution.

Compare the conversion rates offered by different financial institutions to find the best option.

Here are some pros and cons of using a multicurrency checking account to conduct foreign transactions.

Pros

- Some banks offer a competitive exchange rate compared to a conventional bank account.

- It’s easier to have a single multicurrency checking account than several standard checking accounts in different countries.

- You don’t need to constantly convert your money into different currencies.

- Some accounts may come with perks, such as earning interest in different currencies.

Cons

- Unlike credit or debit cards linked to regular accounts, multicurrency checking accounts may not protect you from fraud. This is because not all companies offering multicurrency accounts are licensed banks.

- Since some financial institutions that offer these accounts aren’t banks, they may not protect you in case they face a financial crisis.

- You may end up incurring more charges that exceed the amount you save using these accounts. This includes monthly charges, ATM fees, charges for exceeding withdrawal limits, and more.

12. Business Checking Account

Businesses need a checking account to track their revenue, expenses, and overall cash flow. They also need them to process payments, streamline bookkeeping, and easily file taxes.

These business checking accounts are also a great way for business owners to separate their personal finances from their business finances. They may also offer the following perks:

- Interest on your balance

- Automatic ATM refunds

- Cash back on debit card spending

- Cash bonuses for businesses that deposit certain amounts

- Low monthly fees

It’s best to choose a business checking account that not only allows you to track money but also helps you run your business more smoothly. For instance, some checking accounts for small businesses offer tax planning and basic accounting tools.

Larger businesses may need an account that integrates with other crucial business software or offers free invoicing.

13. Second-chance Checking Account

As the name suggests, second-chance checking accounts allow you to start over after a poor financial history.

Sometimes, you can be denied a regular checking account when you’ve had a record of irresponsible banking habits with previous financial institutions.

Your name gets listed with the ChexSystem registry as high risk. Other banks can access these records and deny you their regular banking services. This may include records of:

- Unpaid overdrafts

- Excessive negative bank balance

- Unpaid fees

- Forced account closures

Some credit unions and banks offer second-chance checking accounts to allow you to regain a good financial standing. Typically, these checking accounts don’t offer the same benefits as standard accounts.

If anything, due to the higher risk involved, they may have stricter terms. For instance, you may be required to pay higher mandatory maintenance fees and denied the ability to overdraw.

For some banks, you’ll be required to adhere to these new terms for a certain period, usually 6 to 12 months.

If you remain consistent, your account may be reverted to a regular checking account with the full benefits. This may happen automatically or upon the customer’s request.

Here are some pros and cons of a second-chance checking account:

Pros

- It gives high-risk account holders a chance to enjoy the benefits of a checking account, such as using ATM cards and depositing money.

- Customers with no access to regular checking accounts can avoid buying money orders to pay bills or being exploited by check-cashing stores.

- They help improve your overall banking history on the ChexSystem records.

Cons

- They lack the benefits that may come with standard checking accounts, such as overdraft protection.

- You’ll need to pay mandatory monthly account fees.

- Limits will be imposed on your debit card spending.

How to Choose a Checking Account

Before settling on any of the checking accounts mentioned above, here are some factors you need to assess.

1. Online or Traditional Banking

The first step would be determining whether you want all your transactions online or in person. This depends on your flexibility and how comfortable you are with technology.

Online accounts offer the convenience of 24/7 access, so they may be the preferable option for busy people.

2. Initial Deposit Requirements

Most banks require customers to deposit a minimum amount when opening a checking account. This amount helps activate your account and cover any initial fees that come with it.

The amount varies depending on the type of checking account you choose. However, it could range from $25 to $100 or more. For instance, premium accounts require higher initial deposits.

3. Monthly Fees

Some accounts charge monthly maintenance fees for users who go below the minimum account balance. It’s important to check your bank’s policies on monthly fees to know what their requirements and penalties are.

For instance, you may be eligible for monthly fee waivers if you meet certain conditions.

4. Account Benefits

Some checking accounts come with certain benefits, such as discounts on debit card purchases, cashback rewards, and more. These largely depend on the checking account type.

Before picking a bank, you should assess the account benefits and choose one that fits your preferences.

5. Overdraft Protection

Some checking accounts allow you to overdraw funds from your account to cover transaction costs. However, this can come with substantial fees. So, if you’re looking to open a checking account with overdraft protection, it’s important to understand the policies.

6. ATM Usage and Fees

Your checking account should provide convenient access to ATMs, especially if you’re a frequent user.

This means that you should choose a bank with a wide network of ATMs to avoid additional fees. Alternatively, you can choose one that can reimburse ATM fees for transactions made outside their network.

7. Mobile Banking

This is another important feature to consider when opening a checking account, especially in today’s digital world. Choose institutions that offer mobile banking applications that help you deposit, send, and track your finances on the go.

8. Interest Rates

Unlike savings accounts, not all checking accounts offer interest. However, some banks offer interest-earning checking accounts that usually require higher minimum balances.

If you’d like to earn interest from your checking account, then this is an important feature to assess beforehand.

How to Open a Checking Account

The process of opening a checking account is pretty straightforward. You’ll only need to provide standard documentation.

To avoid delays, here are some of the documents you’ll need to have beforehand:

- A government-issued ID

- Social Security Number or a tax identification number

- Proof of address, such as a utility bill with your official address

- The initial minimum deposit amount

For special checking accounts, such as student checking accounts, you’ll need a student ID. For minors, they’ll need to be accompanied by an adult with a primary ID.

Each bank has specific requirements for opening a checking account. It’s always safe to browse through their website or call ahead of time to make sure you have everything in order.

FAQs

Q1. What are the main types of checking accounts?

Checking accounts come in different types to address different user needs. They offer varying benefits and have specific requirements. Here are some of the top checking accounts:

- Standard checking accounts

- Online checking accounts

- Premium checking accounts

- Student checking accounts

- Interest-earning checking accounts

- Rewards checking accounts

- No-fee checking accounts

Q2. What is the most widely used type of checking account?

The most common type of checking account is the traditional checking account. It provides all the basic features for your everyday banking needs, including debit cards, checks, online banking, and payment processing.

Q3. Which is the most common use of a checking account?

Checking accounts are meant for everyday transactions. Customers open them to be able to easily deposit, withdraw, and spend money regularly with fewer restrictions.

Q4. How many checking accounts can I have?

There are no restrictions as to how many checking accounts one can have. However, only open accounts that you can manage depending on your capacity.

Consider the charges that come with each account, such as monthly maintenance fees and ATM charges, before making a decision.

Q5. How can I avoid checking account fees?

The best way to minimize checking account fees is by choosing a financial institution that charges fewer fees. Another thing you can do is to use only ATMs in your bank’s network to avoid ATM fees.

You can also avoid overdraft fees by setting reminders to alert you when your bank balance gets too low.

Types of Checking Accounts: Wrap-Up

Checking accounts helps you manage your day-to-day finances and keep track of your everyday expenses.

Whether you’re just looking to offset your bills and consolidate your finances or gain interest from your transactional account, there’s a type of checking account for your every financial need.

Just make sure to check your potential bank’s policies before opening a checking account with them. Verify important information, such as bank fees, availability of ATMs, and minimum balance requirements.