In this article, we’ll look at automated invoice processing — its definition, how it works, and its benefits. We’ll also highlight key features to look out for in an automated invoice processing tool and some of the best options available.

Let’s get started!

What Is Automated Invoice Processing?

Automated invoice processing uses technology to handle invoices without the need for manual data entry. This means you can capture, read, and organize invoice data digitally, eliminating repetitive, time-consuming tasks.

Using technologies like Optical Character Recognition (OCR) and AI, invoicing software easily recognizes important details on your invoices. These are then stored in ERP software.

Instead of manually handling each invoice, your team can focus on more valuable tasks. This is especially useful if your company deals with numerous invoices where you need efficiency and accuracy.

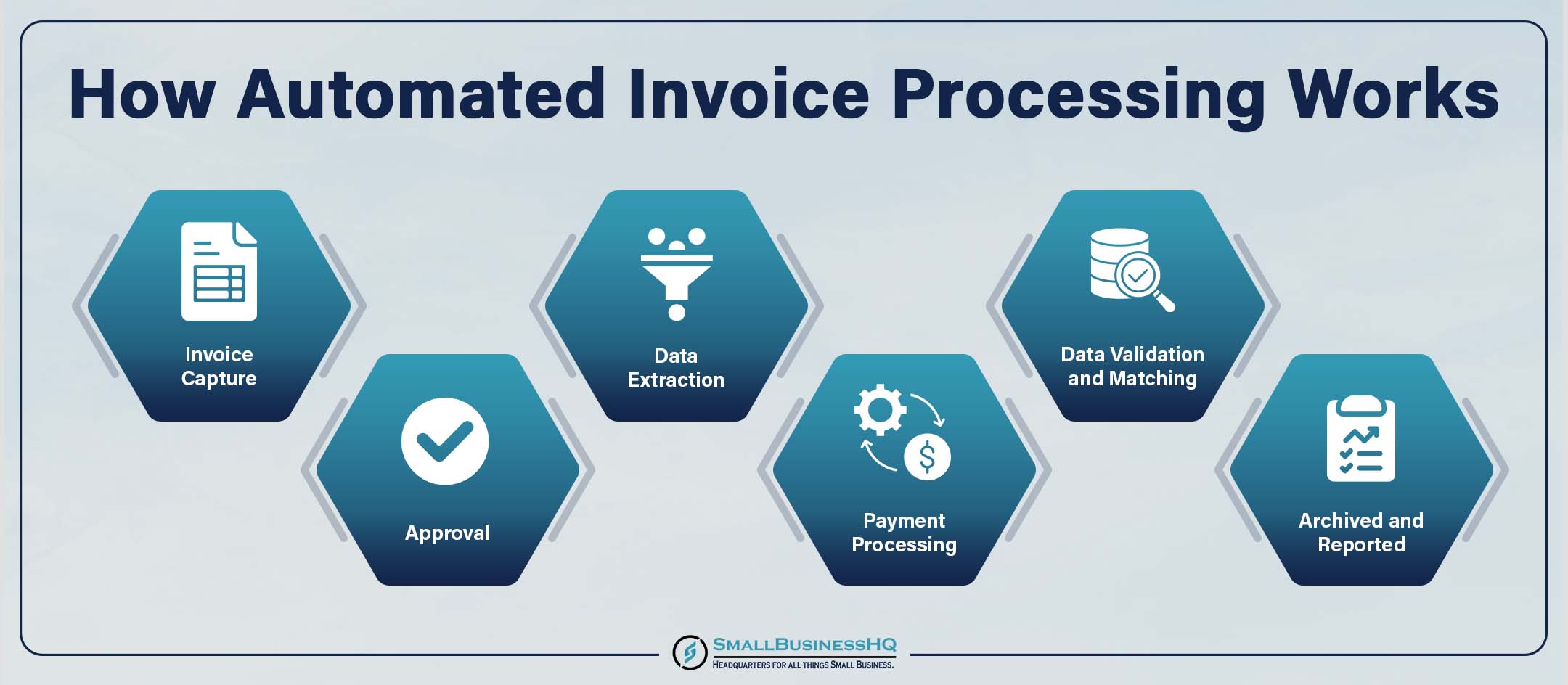

How Does Automated Invoice Processing Work?

Automated invoice processing simplifies accounts payable by digitizing and automating tasks like data capture, validation, and approval.

Let’s break down the key steps in this process.

- Invoice Capture: An automated invoice processing software obtains invoices digitally and scans them. OCR then reads and converts printed or handwritten text into digital data.

- Data Extraction: The invoicing software then identifies and pulls important details from the invoice, such as vendor name, invoice number, date, and total amount. AI-powered algorithms help recognize and organize this information, regardless of the format.

- Data Validation and Matching: After extraction, the system cross-references the invoice details with your purchase orders and receipts. If any figures don’t match, it flags them for your review. This ensures that only correct data is processed.

- Approval: Once validated, the invoice moves to the approval workflow. Following preset rules, the invoicing software routes it to you and whoever needs to approve it. You can even add automated reminders to notify team members of pending approvals, speeding up the process.

- Payment Processing: After approval, the system schedules payments either through direct integration with payment platforms or via an accounting/ERP system.

- Archived and Reported: The system securely stores all processed invoices for easy access once payment is made. You can then generate insights on processing times, payment status, and even vendor history.

Benefits of Automated Invoice Processing

Using automated invoice processing comes with many benefits, including:

- Increased Efficiency and Speed: Automated invoice processing eliminates manual data entry, significantly reducing the time it takes to process invoices. With automated workflows, your invoices move through the system quickly, resulting in faster approvals and payments.

- Reduced Errors and Improved Accuracy: Another benefit of automated invoice processing software is that it minimizes human errors in data entry and validation. This leads to more accurate records, preventing costly mistakes and delays.

- Cost Savings: Because it reduces the need for manual labor, automated invoice processing lowers operational costs. Fewer errors also mean fewer resources spent on resolving issues, contributing to overall savings.

- Enhanced Productivity: With repetitive tasks handled by automation, you can focus on higher-value work, such as scaling your business and optimizing workflows. This improves productivity and allows your team to engage in more strategic activities.

- Better Compliance and Audit Readiness: Automated systems maintain detailed records of every invoice processed, making it easier to track transactions and comply with regulations. This clear audit trail is important for transparency and compliance.

- Improved Vendor Relationships: Faster and more accurate payments lead to better relationships with your vendors. Automation helps you ensure timely payments, leading to favorable terms and stronger partnerships.

- Scalability: Automated systems can handle growing invoice volumes without additional strain, making them ideal for those planning to expand their business.

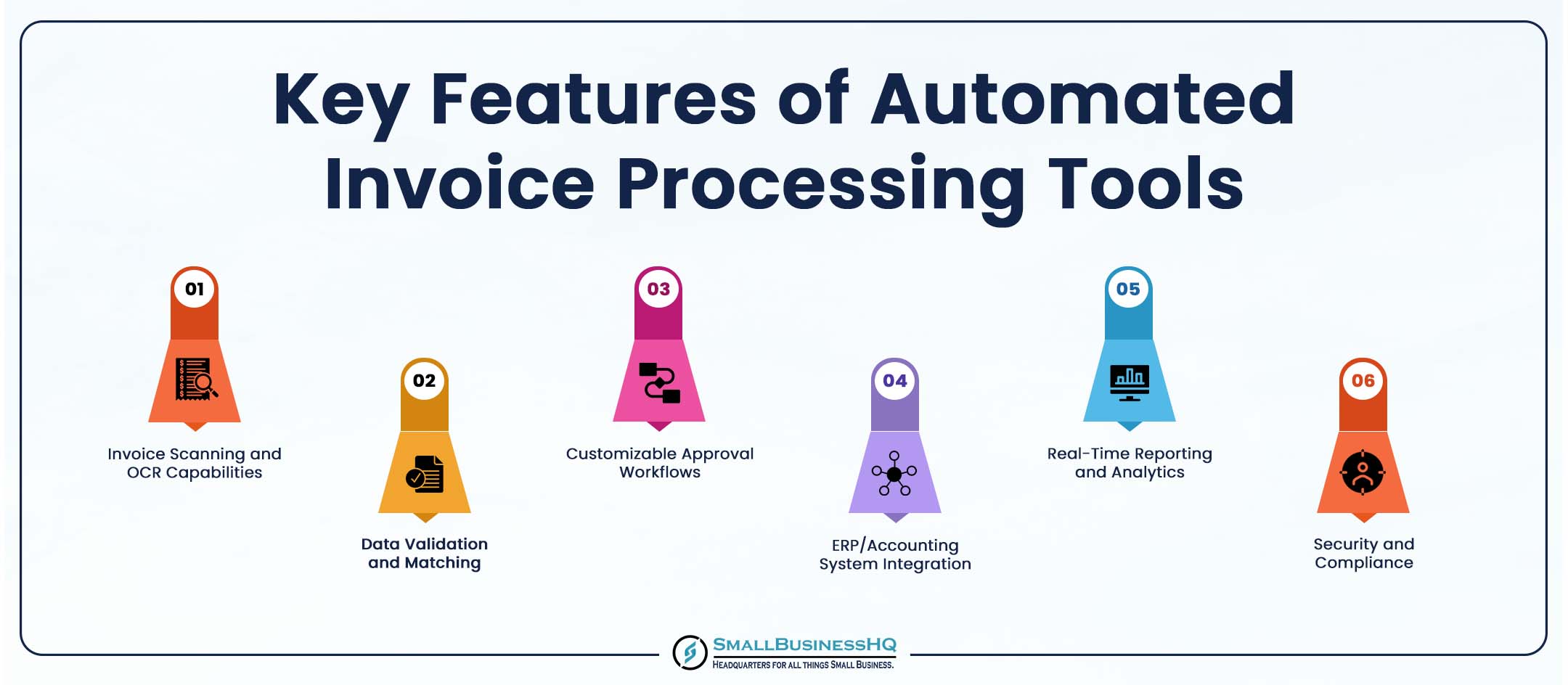

Key Features to Look for in Automated Invoice Processing Tools

When choosing an automated invoice processing software, you must choose one that meets your specific needs. Not all tools are designed equal, and knowing which features to look for can help you make the right choice.

That said, what are the key features to look for in an automated invoice processing system?

Invoice Scanning and OCR Capabilities

Look for a tool that includes OCR to digitize paper invoices and capture data accurately. This feature ensures that key information, such as invoice numbers and amounts, is automatically extracted without manual input.

Data Validation and Matching

A good automated invoice processing system should validate your invoice data by cross-referencing it with purchase orders or receipts. This feature catches discrepancies early, reducing errors and ensuring that only accurate invoices move forward in the workflow.

Customizable Approval Workflows

Approval workflows should be customizable to fit your company’s structure. The tool should allow you to set up approval hierarchies, send reminders, and automatically route invoices to the right approvers to speed up the process.

ERP/Accounting System Integration

Choose a tool that integrates seamlessly with your existing ERP or accounting software. This integration ensures that processed invoices are transferred smoothly into your financial system. Having this integration eliminates manual uploads and improves data consistency.

Real-Time Reporting and Analytics

Reporting capabilities are important for tracking invoice processing metrics, such as approval times and payment status. With real-time analytics, you gain insights into workflow efficiency and, ultimately, make data-driven improvements.

Security and Compliance

The tool you choose should meet security standards when it comes to protecting sensitive financial data, including encryption and access controls. Compliance features, such as audit trails and regulatory support, are also critical to maintain transparency and meet legal requirements.

You May Also Like:

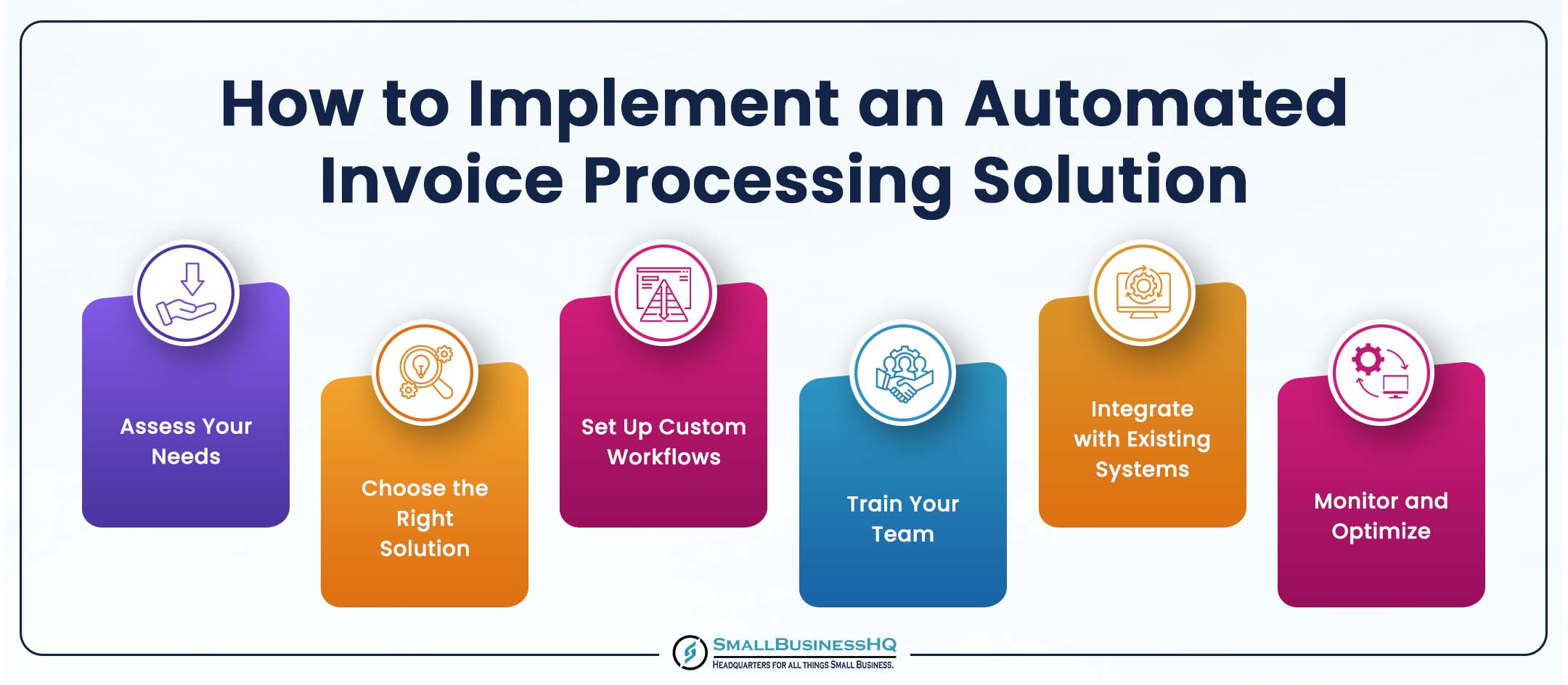

How to Implement an Automated Invoice Processing Solution

Implementing automated invoice processing systems can streamline your accounts payable workflow and reduce manual work — if you do it right.

Here’s a step-by-step guide to help you set up your system efficiently:

Step 1: Assess Your Needs

Start by evaluating your current invoice processing workflow. Identify pain points, such as bottlenecks, frequent errors, or time-consuming steps. This assessment will help you choose the right features in an automated invoicing software.

Step 2: Choose the Right Solution

Choose a tool that aligns with your business requirements. Look for the essential features mentioned earlier. This includes OCR, data validation, and customizable approval workflows. Also, ensure it integrates well with your existing ERP or accounting software.

Step 3: Set Up Custom Workflows

Configure workflows to fit your organization’s needs. Define approval hierarchies and routing rules based on invoice amounts, vendors, and other criteria.

Step 4: Train Your Team

Provide thorough training to everyone involved in the invoice process. Ensure they understand how to operate the new tool, follow workflows, and troubleshoot common issues. Training your team helps reduce initial errors and ensures a smooth transition.

Step 5: Integrate with Existing Systems

Link your automated solution to your ERP or accounting software to streamline data flow and avoid duplication. Integration helps ensure that processed invoices are recorded accurately in your financial systems.

Step 6: Monitor and Optimize

After implementation, monitor performance to identify areas for improvement. Review processing times, error rates, and bottlenecks. Use this data to fine-tune your workflows and improve overall efficiency.

5 Best Automated Invoice Processing Solutions

With so many automated invoice processing tools available, finding the right solution can feel overwhelming. That’s why we’ve done the research to help you.

Here are five of the best automated invoice processing solutions that suit your business needs.

1. Sage Intacct

Image via Sage Intacct

Sage Intacct is a powerful invoicing software for small businesses designed to automate and streamline your accounts payable (AP) processes. This makes invoice processing easier and more efficient.

With Sage Intacct, you can automatically capture, route, and approve invoices, reducing manual entry and eliminating bottlenecks. The platform’s AI-powered data entry captures key invoice details and matches them with existing purchase orders.

Even more, the tool includes automated workflows for approvals, which can be customized based on user roles and hierarchy. For example, you can set up approval rules that route high-value invoices to senior team members. Meanwhile, smaller transactions are approved automatically.

Sage Intacct also integrates with popular ERP systems, enabling seamless data transfer between platforms. This enhances accuracy and reduces the risk of duplicate payments and entries.

In addition, with real-time reporting, you can monitor outstanding supplier invoices, track payment statuses, and analyze AP performance. These insights help you make informed decisions and manage cash flow more effectively.

Pros

- Reduces manual data entry with AI-powered capture

- Customizable approval workflows

- Real-time reporting for invoice and cash flow tracking

- Integrates with popular ERP systems

Cons

- Limited customization options for smaller businesses

- Higher price point for smaller companies

Pricing

- Sage Intacct offers custom pricing based on your business needs.

2. Tipalti

Image via Tipalti

Tipalti is an automated invoice processing solution that simplifies accounts payable by handling everything from invoice capture to global payments.

The platform’s AI-driven invoice matching automatically cross-references invoices with purchase orders, reducing errors and speeding up approval times. This feature is ideal if you work with large volumes of invoices, as it eliminates the need for manual matching.

Additionally, Tipalti offers multi-entity and multi-currency support. This allows you to process invoices across different subsidiaries and currencies seamlessly.

For example, as a multinational, you can approve payments in various currencies, ensuring compliance with local tax and regulatory requirements. The tool’s built-in compliance and tax features also help you manage tax form collection and reporting.

With real-time dashboards, you can track invoice statuses, payment timing, and cash flow. You get full visibility into the accounts payable process.

On top of that, automated approval workflows allow you to customize routing and approvals based on the invoice amount and vendor type.

Pros

- AI-driven invoice matching reduces manual work

- Multi-entity and multi-currency support for global operations

- Real-time dashboards for tracking and transparency

- Built-in tax compliance features

Cons

- Limited customization for smaller businesses

- Can be costly for small companies with fewer transactions

Pricing

Tipalti offers three pricing plans:

- Starter: $99/month

- Premium: Custom pricing

- Elite: Custom pricing

3. Rossum.ai

Image via Rossum

Rossum.ai is an AI-powered platform that automates invoice processing by capturing and interpreting invoice data accurately.

Using intelligent data extraction, Rossum identifies key invoice information, such as vendor details, line items, and totals, without template-based setups. The tool is ideal if you use various invoice formats, as it adapts to different layouts effortlessly.

The platform’s automated validation checks also ensure that extracted data aligns with purchase orders and internal standards. This reduces errors and the need for manual review.

For instance, if an invoice total doesn’t match the purchase order, Rossum flags it for verification. So, you get to focus on resolving discrepancies instead of routine checks.

Additionally, its real-time analytics provide insights into invoice processing times, approval bottlenecks, and overall AP efficiency. This way, you can optimize workflows accordingly.

Pros

- High accuracy in data extraction with AI

- Works with various invoice formats without templates

- Real-time analytics for process optimization

- Integrates with ERP and accounting systems

Cons

- Limited advanced workflow customization

- May require a setup for smaller teams

Pricing

Rossum.ai provides a four-tired pricing plan — all with custom pricing.

- Starter

- Business

- Enterprise

- Ultimate

You May Also Like:

4. BILL

Image via BILL

BILL is a comprehensive account payable solution designed to automate invoice processing and streamline payments.

With automated invoice capture, BILL uses OCR technology to extract essential information from invoices. It then enters that information directly into the system, saving time and reducing manual data entry.

Even better, the platform’s customizable approval workflows allow you to set up specific routing rules. This can be based on invoice amounts, vendor types, or other criteria.

For instance, invoices over a certain threshold can be routed to a manager for approval, while smaller amounts are processed automatically.

BILL’s real-time tracking feature also lets you monitor the status of each invoice. This provides complete transparency from approval to payment.

Another standout feature is integration with popular accounting software like QuickBooks, Xero, and Zoho Books. This integration ensures data consistency and prevents duplicate entries.

Pros

- Automated invoice capture with OCR technology

- Customizable approval workflows for streamlined processing

- Real-time tracking for invoice status transparency

- Integrates with major accounting software

Cons

- Limited advanced reporting options

- Additional fees for certain payment features

Pricing

BILL offers four-tiered pricing based on business needs and usage.

- Essentials: $45/month/user

- Team: $55/month/user

- Corporate: $79/month/user

- Enterprise: Custom pricing

You May Also Like:

5. QuickBooks

Image via QuickBooks

QuickBooks is a popular invoicing software that includes automated features for streamlining invoice processing.

With smart invoice capture, QuickBooks uses AI to extract details from invoices, reducing manual entry and saving time. You can upload invoices directly, then the tool automatically pulls information like vendor names, amounts, and due dates.

This cloud accounting software also offers customizable approval workflows. You can set up approval hierarchies based on vendor or invoice amount. For instance, you can set up approvals so only invoices above a certain value need management review.

The tool’s real-time tracking also provides complete visibility into the status of each invoice. This way, you can keep track of pending approvals and payments.

Additionally, QuickBooks integrates seamlessly with various payment processors and bank accounts, including checking accounts. This allows you to automate payments and ensure all transactions are recorded accurately.

Pros

- Smart invoice capture with AI for reduced manual work

- Customizable approval workflows to fit business needs

- Real-time tracking for complete transparency

- Integrates with banks and payment processors

Cons

- Limited scalability for large enterprises

- Fewer advanced reporting features

Pricing

QuickBooks offers four pricing plans.

- Simple Start: $35/month

- Essentials: $65/month

- Plus: $99/month

- Advanced: $235/month

You May Also Like:

FAQ

Q1. How do I automate invoice processing?

To automate invoice processing, first choose an automated invoice processing tool with features like OCR (Optical Character Recognition) and AI-powered data extraction. Then, configure workflows within the tool to capture, validate, and route invoices for approval.

Next, integrate the solution with your ERP or accounting software to streamline data transfer and eliminate manual entry. Set up approval rules based on invoice criteria and provide training for your team.

Once implemented, monitor performance and optimize the process to ensure accuracy and efficiency. This setup allows invoices to be processed quickly, reducing errors and saving time.

Q2. What is AI invoice processing?

AI invoice processing uses artificial intelligence to automate and streamline invoice handling.

Unlike traditional methods, AI-driven systems can read and interpret invoice data using technologies like OCR and machine learning. These tools extract key information, such as vendor details, invoice numbers, and amounts, without manual data entry.

AI also enables intelligent data validation by cross-referencing invoice details with purchase orders, identifying discrepancies automatically. This reduces errors, speeds up approval workflows, and enhances accuracy.

Q3. What are the 3 main steps involved in invoice processing?

The three main steps in invoice processing are:

- Invoice Capture: Invoices are received and key details are extracted using OCR or manual entry. This includes data like vendor name, invoice number, and amount.

- Approval: The invoice is routed to relevant team members for validation. It’s reviewed and approved, often following predefined rules based on value or vendor.

- Payment: Once approved, the invoice is scheduled for payment. The payment is processed through your accounting or ERP system, and the transaction is recorded.

Q4. What is auto invoicing?

Auto invoicing is a process that uses automation to generate, send, and manage invoices without manual intervention.

This system automatically creates invoices based on predefined data, such as sales orders or subscription plans, and sends them to customers via email or integrated platforms.

Auto invoicing also tracks payment statuses and can send reminders for unpaid invoices. This way, you don’t need to send manual follow-ups. Automating these tasks can improve efficiency, reduce errors, and ensure timely billing. As a result, it enhances cash flow and saves valuable time.

Q5. What is the best invoicing system for small businesses?

The best invoicing system for small businesses depends on your business needs and budget. Some popular options are Sage Intacct, Tipalti, Rossum.ai, BILL, and QuickBooks.

These platforms offer features tailored to small businesses. You get customizable approval workflows, real-time tracking, and seamless integration with major accounting software.

Wrapping It Up

As you can tell, automated invoice processing transforms how you handle accounts payable. It helps reduce manual work, improve accuracy, and speed up payments.

The best part? There’s a platform for every need, from tools like QuickBooks to advanced solutions like Tipalti and Rossum. Make sure to implement the right tool to help you streamline workflows, save time, and enhance financial control.

So, are you ready to upgrade your invoice processing? Explore these tools, assess your needs, and start automating today to boost efficiency.