Having set up your business entity as an S-Corporation, you may get to a point where you feel the business structure no longer serves your interests.

In this case, you may want to convert your S-Corp to an LLC to enjoy the benefits of running your business as a Limited Liability Company.

That said, converting your S-Corporation to an LLC can be complicated if not handled properly. In this article, we will show you how to handle the S-Corp to LLC conversion process as well as the tax consequences that come with this move.

Reasons to Convert S-Corp to LLC

While an S-Corporation has many advantages, many businesses end up feeling that it would be easier to run their business as an LLC. As such, they work with the best LLC services to convert S-Corp to LLC.

Here are some reasons for making this transition.

Management Flexibility

LLCs are much easier to manage than S-Corporations.

S-Corps are required by state law to have a board of directors and hold annual meetings. Meanwhile, LLCs are member-managed and don’t have to do any of these activities to stay compliant.

It’s also easier for LLCs to gain approval for specific activities since they only need the approval of the members. On the other hand, most decisions made by an S-Corporation need the board’s full approval and a majority vote from the shareholders.

In addition, an S-Corporation can only have a maximum of 100 shareholders. LLCs don’t face such limitations and can have an unlimited number of members.

Flexibility in Sharing Profits

An LLC offers more flexibility when sharing profits than S-Corporations. In an S-Corporation, profits are shared based on one’s shareholding in the business. This means that those with more shares receivUe a larger portion of the company’s profits.

Profits are also divided according to ownership interest in an LLC, but they can also be distributed separately. Members can decide how the profits will be distributed based on their individual roles and responsibilities.

For example, an LLC member with a 10% ownership stake in the business but who works full-time for the organization can receive a higher profit contribution without changing their ownership in the business.

Tax Consequences of Converting an S-Corp to an LLC

The main reason any business owner, like yourself, seeks the best LLC services to change their entity type is to enjoy the tax advantages that come when you convert S-corp to LLC.

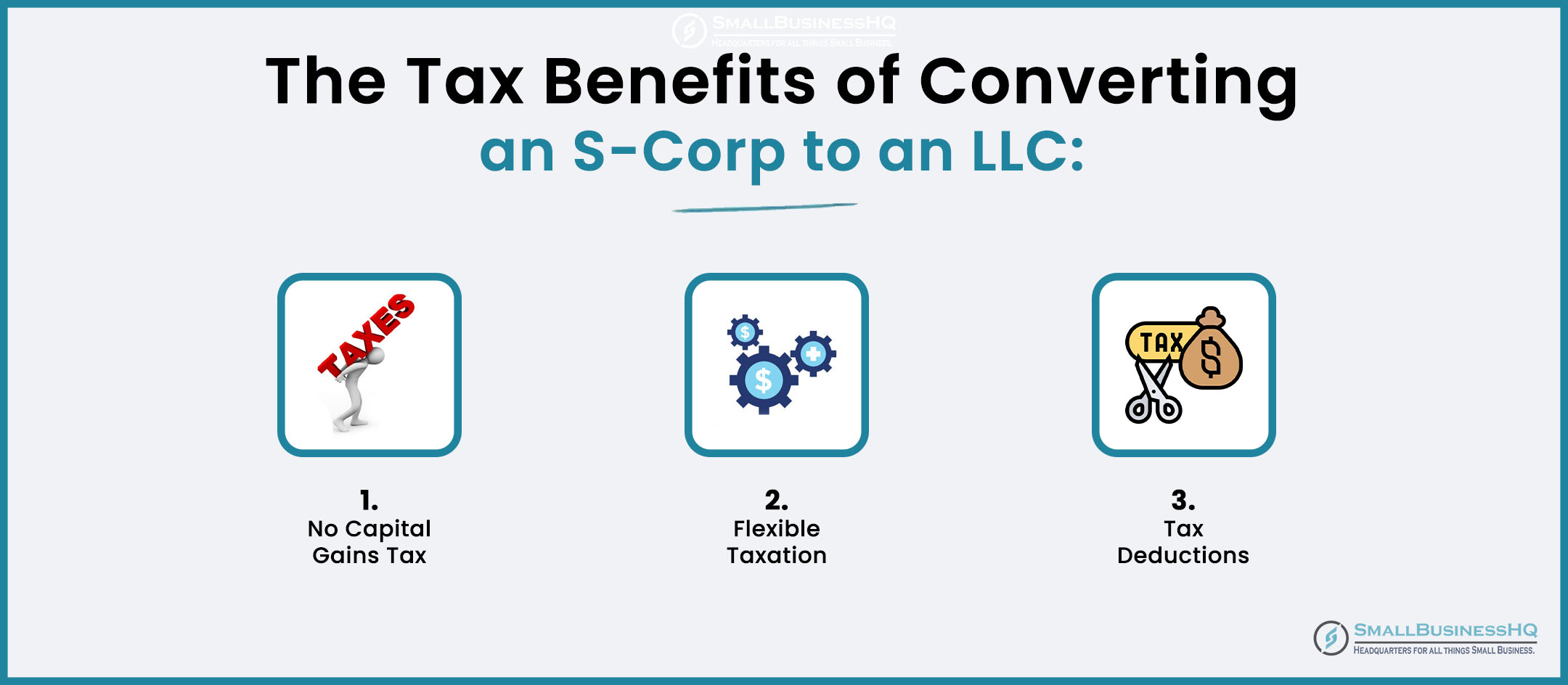

The key tax benefits when you convert S-corp to LLC include:

No Capital Gains Tax

S-Corporations are required to pay capital gains tax after selling capital assets and investments. LLCs are not subject to this requirement and are free to sell their corporation’s assets without any penalties.

Flexible Taxation

The other tax benefit of the conversion process is the flexibility to choose how you want to be taxed. As such, you’re free to choose the tax status with the greatest advantages for tax purposes.

S-Corps only enjoy pass-through taxation benefits. They don’t enjoy the flexibility of choosing their tax status, as is the case with a limited liability company.

With your new LLC, you can choose to be taxed as an S-Corporation to reduce your self-employment tax. And since your business will be registered as an LLC, you will not have to form a board and hold regular meetings to make simple decisions.

This flexibility in taxation is one of the main reasons many businesses choose to convert S-Corp to LLC.

Tax Deductions for Capital Expenditure

S-Corps cannot deduct capital expenses when filing returns since the IRS doesn’t deem this to be necessary. However, LLCs can deduct capital expenditures, such as equipment and machinery over one year.

With these tax advantages, it becomes easier to manage your organization and retain most of your profits for business operations.

You May Also Like:

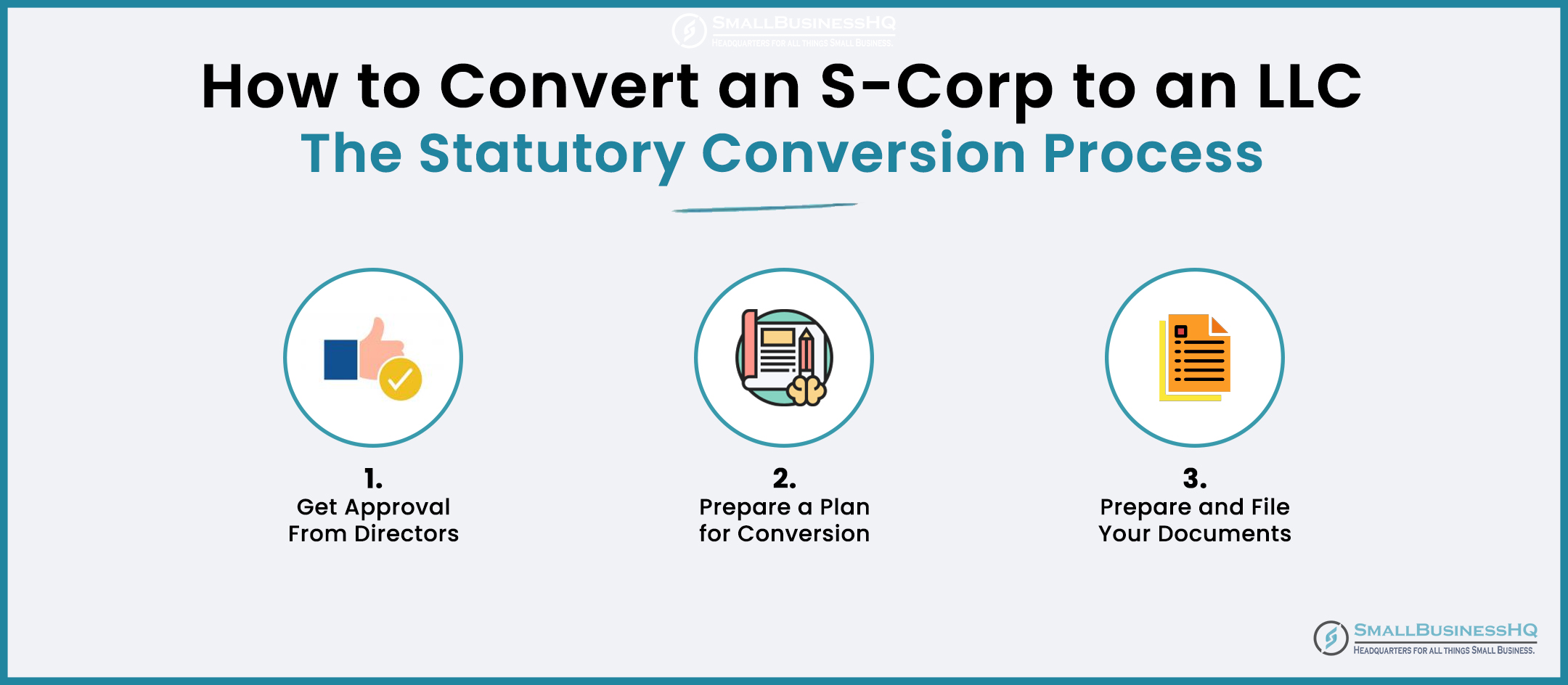

How to Convert S-Corp to LLC: Statutory Conversion Method

The statutory conversion process is a streamlined conversion method that’s available in many states. The method allows S-Corporation owners to convert S-Corp to LLC by filling out a few forms with the Secretary of State.

Follow the steps below to convert S-Corp to LLC using the statutory conversion process.

1. Get Approval From Other Directors and Shareholders

The statutory conversion process starts with getting the appropriate approval of your S-Corporation’s directors. Call a board meeting to discuss the need to change your business entity type from an S-Corporation to an LLC.

Share the benefits and tax consequences of operating your business as an LLC. Also, highlight the legal and financial obligations of making this move.

Once the board approves your plan to convert S-Corp to LLC, take this decision to your shareholders.

The shareholders will then vote to allow the conversion to take place or not. If your Articles of Incorporation require a specified majority for a vote, you’ll have to obtain this majority to continue with the plan to convert S-Corp to LLC.

You May Also Like:

2. Prepare a Plan for Conversion

With shareholder approval, you can now proceed to create a conversion plan. In most cases, the state will require you to submit a plan that outlines the details of the conversion from an S-Corporation to an LLC.

This plan should address how membership interests will be distributed and how the management structure will change.

However, keep in mind that the statutory conversions vary from state to state. As such, you should contact your Secretary of State to find out what details they need to approve your transition.

3. Prepare and File Your Conversion Documents

The next step is to prepare and file your S-Corporation to LLC conversion form with the state. This form has different names in different states. Some of the names you should be on the lookout for include “Certificate, Articles, or Statement of Conversion.”

Since the process involves creating a new LLC, you’re also required to file Articles of Incorporation.

To prepare the required documents correctly and save time, it’s advisable to work with the best LLC services during this process. This Inc Authority vs Bizee (formerly Incfile) review discusses two LLC formation companies you can work with to convert S-Corp to LLC.

Once the state approves your conversion, the business ceases to be an S-Corp and starts operating as an LLC. The assets and liabilities of the S-Corp are immediately transferred to the new LLC.

Key Considerations With the S-Corporation to LLC Statutory Conversion Method

- The stockholders of the S-Corp become LLC members after the conversion.

- The S-Corporation’s assets and liabilities become assets and liabilities of the newly formed limited liability company.

- The S-Corp ceases to exist after the conversion.

You May Also Like:

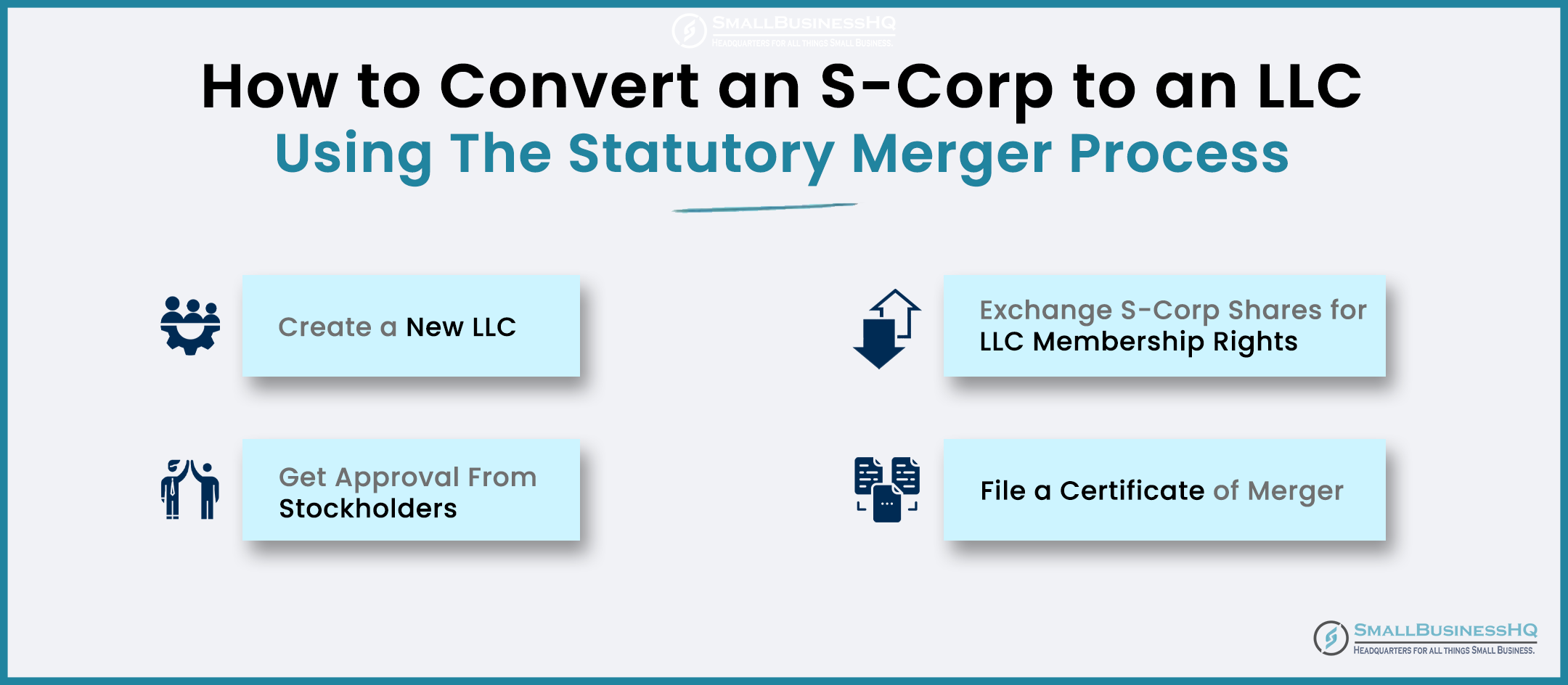

How to Convert S-Corp to LLC: Statutory Merger Process

The statutory merger process is more complicated than the statutory conversion process. However, some states don’t allow statutory conversions and S-Corp owners have to use the merger process to convert S-Corp to LLC.

The statutory merger process varies from state to state, but the basic steps usually include:

1. Create a New Limited Liability Company (LLC)

Prepare and file your Articles of Incorporation with the filing office to form your new LLC. Considering that you’re busy with other things, you should engage the best LLC services to help prepare and file your LLC formation documents. Be prepared to pay any required filing fees.

Once approved, the shareholders of the S-Corporation will become members of the new LLC.

2. Stockholders Should Vote to Approve the Merger

Next, the stockholders must vote to approve the merger of your S-Corp with the new LLC. They must also agree to their new roles as members of the LLC.

If you need a specific majority to approve any activity, ensure get it done during the vote.

3. Exchange Shares for LLC Membership Rights

The S-Corp stockholders must exchange their Corporation shares for membership rights in the new LLC through a formal agreement.

4. File a Certificate of Merger

Finally, you must file a certificate of merger and other legal documents, like your operating agreement, with the filing office. These documents will outline how the same business will continue to operate under the new LLC structure.

Meanwhile, in the operating agreement, you must state that the newly formed LLC is the surviving member of the merger.

You May Also Like:

Key Considerations of the Statutory Merger Method

- A statutory merger transfers the assets and liabilities of the S-Corp to the new LLC.

- You may need to dissolve your S-Corporation by filing an application with the state.

How to Convert S-Corp to LLC: Nonstatutory Conversion

This is, by far, the most expensive and complicated way to convert S-Corp to LLC.

Here’s the process:

- Create a new LLC and file the necessary documents with the state.

- Exchange the S-Corp shares for LLC membership interests.

- Transfer the assets and liabilities of the old S-Corporation to the new LLC. This includes money in the corporate bank account, existing tax bills, and insurance policies.

This process is done through an asset purchase agreement where a value is attached to each asset. The agreement will then state that the assets will be owned by the newly formed LLC once the conversion is complete.

- And as the transfer is going on, you have to liquidate the old S-Corporation and file the necessary documents with the state.

- You also have to notify the IRS that you’re liquidating the S-Corporation and inform your clients, creditors, and employees about the change in business structure.

As you can see, the method is very complicated. That’s why you should hire a business attorney before starting the conversion process. This service will cost you hundreds or a couple of thousand dollars in legal fees, so keep that in mind when seeking external legal help.

Key Considerations with the Nonstatutory Conversion Method

- The nonstatutory method is most commonly used when you want to convert multiple subsidiaries into one.

- The nonstatutory conversion method varies from state to state, so get expert advice from a business attorney before making a switch.

You May Also Like:

Important Tax Considerations When You Convert S-Corp to LLC

While there’s a lot to gain when you convert S-Corp to LLC, there are some drastic tax consequences to keep in mind.

For example, you should note that you’ll have to pay corporate taxes when you transfer the assets of the old S-Corp to the new LLC.

The IRS views the conversion as a liquidation of the Corporation. If the assets have increased in value, shareholders will have to pay the applicable capital gains tax based on the fair market value of the assets.

As such, before you convert S-Corp to LLC, ensure the increase in value is not substantial so as not to expose your shareholders to higher tax liabilities.

It’s important to consider the fair market value of your assets and consult with a tax advisor to structure the conversion in a way that’s as tax-free as possible.

You May Also Like:

FAQs

Q1. Why do business owners choose to convert S-Corp to LLC?

A. Many business owners make the switch from S-Corp to LLC for the following reasons:

- Flexibility in management: LLCs are much easier to manage than S-Corporations. S-Corps are required by law to have a board of directors and hold regular meetings. Meanwhile, LLCs are member-managed and don’t have to do any of these activities to stay compliant.

- Flexibility in sharing profits: LLCs also provide more flexibility when sharing profits than S Corporations. In an S Corporation, profits are shared based on one’s shareholding in the business. This means that those with more shares receive a larger portion of the company’s profits.

Profits are also divided according to ownership interests in an LLC, but they can also be distributed separately.

Q2. What are the tax advantages when you convert S-Corp to LLC?

A. One of the main reasons entrepreneurs change their business framework to LLC is for tax purposes. The key tax benefits of changing your S-Corporation to an LLC include:

- No capital gains tax: S-Corps are required to pay a capital gains tax after selling capital assets and investments. LLCs are not subject to this requirement and are free to sell their assets without any penalties.

- Flexible taxation: The other tax benefit of the conversion process is the flexibility to choose how you want to be taxed. When you change your business structure and form a new LLC, you can opt to be taxed as a partnership, C-Corporation, or even S-Corp. Essentially, you’re free to choose the structure with the greatest tax advantages for your business.

- Deductions for capital expenditure: S-Corps can’t deduct capital expenses when filing tax returns since the IRS doesn’t deem this to be necessary. However, LLCs can deduct capital expenditures such as equipment and machinery over one year.

Q3. Can I convert S-Corp to LLC?

A. Yes, you can. There are three methods to convert S-Corp to LLC. They include:

- Statutory conversion: This is a streamlined conversion method that’s available in many states. The statutory conversion method allows S-Corporation owners to convert S-Corp to LLC by filling out a few forms with the Secretary of State.

- Statutory merger: This method involves creating a new LLC, merging it with the old S-Corp, and then declaring the LLC as the surviving member of the merger. This process created two separate entities before completing the conversion.

- Nonstatutory conversion: This method involves creating a new LLC, transferring the assets and liabilities of the S-Corporation to the LLC, and dissolving the old S-Corporation. You must also file documents with the state to dissolve the S-Corp and form the LLC.

Q4. Is converting from an S-Corporation to an LLC taxable?

A. Yes, it is. You’ll have to pay corporate taxes when you transfer the assets of the old S-Corporation to the new LLC.

The Internal Revenue Code views the conversion as a liquidation of the corporation. If the assets have increased in value, shareholders will have to pay the applicable capital gains tax.

However, in some cases, the conversion can be structured to be tax-free. It’s crucial to consult a tax advisor to understand the specific tax implications of your situation.

Q5. What happens when you convert S-Corp to LLC?

A. When you convert S-Corp to LLC, the old S-Corporation ceases to exist and the business now operates as a Limited Liability Company. The stockholders also exchange their shares for membership interests in the LLC.

The management structure changes, often becoming more flexible. However, it’s important to note that with some conversion methods, you can maintain the same entity while changing its form.

Q6. Is it better to tax an LLC as an S-Corp?

A. Deciding if this option is better for your business depends on a basket of factors, including your income level, business framework, and long-term goals. Many businesses find that once they reach a certain profit level, the tax savings of an S-Corp election outweigh the additional administrative costs.

However, it’s crucial to consult with a tax advisor or tax attorney to determine the best approach for your specific situation. They can help you understand the tax consequences and potential benefits based on your unique business entity circumstances.

Q7. What is the difference between an S-Corp and an LLC?

A. Basically, an S-Corp is a tax classification, while an LLC is a business structure. S-Corps offer tax benefits like pass-through taxation and potential savings on self-employment taxes. LLCs provide liability protection and flexibility in management.

When you convert S-Corp to LLC, you’re changing the business structure while potentially maintaining S-Corp tax status. The choice depends on your specific business needs, tax situation, and management preferences.

Q8. Can an S-Corp revert back to an LLC?

A. Yes, an S-Corp can convert back to an LLC. This process is similar to converting an S-Corp to LLC initially, involving state filings and potential tax implications. However, it’s crucial to consider why you’re reverting and the potential consequences.

Consult with a tax professional and attorney to ensure the conversion aligns with your business goals and to navigate any complexities in the process.

Conclusion

Changing your business structure from an S-Corporation to an LLC gives your business greater flexibility. You can choose how your business is taxed, distribute profits more effectively, and easily transfer ownership rights to investors.

When you decide to convert S-Corp to LLC, work with the best LLC services to simplify the process.

Seeking professional help will help you navigate the legal, financial, and tax aspects of the conversion with ease and position your business for success in the new business structure.