Looking for the best FreshBooks alternatives?

We’ve got you covered.

Freshbooks is one of the best accounting software for small businesses. The tool offers a wide range of features that appeal to freelancers and small businesses such as a user-friendly interface, advanced invoicing capabilities, and time tracking.

However, despite its strengths, FreshBooks has some drawbacks that make it less ideal for certain users.

For instance, its pricing can be relatively high for users on a tight budget, and it has limits on the number of users and billable clients. Additionally, some users find its reporting capabilities to be somewhat limited.

So, if FreshBooks isn’t the right tool for you, you may want to look at other alternatives.

This article explores the best FreshBooks alternatives you can consider to streamline your financial processes. We’ll take a comprehensive look at their features, pricing, pros, and cons to help you find the perfect tool for your needs.

Quick Summary: Best FreshBooks Alternatives by Type

- Best Tools With a Free Plan: Zoho Books, Wave Accounting, ZipBooks

- Best for Freelancers and Sole Business Owners: Invoicera, Kashoo, Hiveage

- Best for Growing Businesses: QuickBooks Online, Sage Accounting, Xero

- Best for Invoicing: Zoho Books, Invoicera, QuickBooks Online

How We Chose the Best FreshBooks Alternatives

If you know what accounting software is, you’re likely aware that there are many tools for managing financial transactions. Nevertheless, to find the best FreshBooks alternatives, we delved deeper. Below are the factors we looked at when preparing this list.

- Features: We analyzed the features of each FreshBooks alternative thoroughly to understand the breadth and depth of its functionality. Some of the features we are interested in include invoicing, expense tracking, financial reporting, payroll management, and collaboration capabilities. This analysis allows us to recommend comprehensive alternatives that are comparable to FreshBooks.

- User-friendliness: A user-friendly interface is important when selecting an accounting software as a FreshBooks alternative To determine the user-friendliness of a FreshBooks alternative, we assess the intuitiveness of its interface, ease of navigation, and accessibility for users of varying skill levels. Our aim is to recommend FreshBooks alternatives that minimize the learning curve for users.

- Pricing:Cost is a key consideration when selecting an accounting software, especially for small businesses. We assess the pricing of each FreshBooks alternative, taking into account the features available in each package. We look for affordable plans that offer good value for money.

- Customer support: Efficient and responsive customer support is crucial for businesses that use accounting software to manage their finances. We assess the customer support options offered by each FreshBooks alternative to ensure users can get help when they run into problems. Some of the customer support options we look for include phone support, email support, live chat support, and knowledge base materials. We prioritize alternatives to FreshBooks that offer great customer service.

- User reviews: We also consider user reviews, customer feedback, and online ratings to determine the best FreshBooks alternatives for small businesses. This step helps us assess overall user satisfaction and uncover any recurring issues or concerns.

- Scalability:Finally, we evaluate whether the FreshBooks alternatives can scale effectively to meet businesses’ accounting and financial management as they grow. Scalability ensures that the chosen solution remains a suitable long-term investment, eliminating the need to change providers as business needs evolve. We look for alternatives to FreshBooks that support global operations and offer multi-currency support for businesses expanding internationally.

9 Best FreshBooks Alternatives for 2025

Most small business owners may initially use spreadsheets to track their finances. However, as the business grows, keeping track of business transactions becomes challenging, and many opt to get accounting software to do this exercise.

The benefits of using an accounting software for small businesses include:

- Easy invoicing and billing

- Fewer errors

- Simple expense tracking and management

- Better data accuracy

- Simplified payroll

While FreshBooks is a reliable tool, its shortcomings may force you to look for other alternative options. If you’re in the market for robust accounting software, here are the best FreshBooks alternatives you should consider.

1. QuickBooks Online

Image via QuickBooks

QuickBooks is a powerful accounting software solution and one of the best FreshBooks alternatives for small businesses. It has millions of users worldwide who trust the tool for their accounting, project management, and inventory management needs.

With QuickBooks Online, you can easily create professional-looking invoices and handle your banking-related assignments with ease.

This alternative also has powerful reporting capabilities. Each plan gives you access to basic reports like balance sheets and profit and loss statements. Higher-tier plans offer even more robust accounting reports such as profitability and inventory reports.

This FreshBooks alternative has a generous free trial that gives you access to all the features to help you decide if the tool is right for you.

Key Features

- Advanced expense management capabilities to help you know where your finances are going

- Create customizable invoice templates and get paid faster with QuickBooks Payments

- Comes with a mobile app to help you access your data and manage transactions from anywhere

- Offers real-time business reporting to help you track business performance

- Comes with a checking bank account integration for seamless transaction reconciliation

Pros

- Organizes your bills in one place to help you manage your business with confidence

- Integrates with other apps to help you run your business smoothly

- Comes with a mobile app to help you access and manage your accounting data from anywhere

Cons

- Some users complain that customer support is not reliable

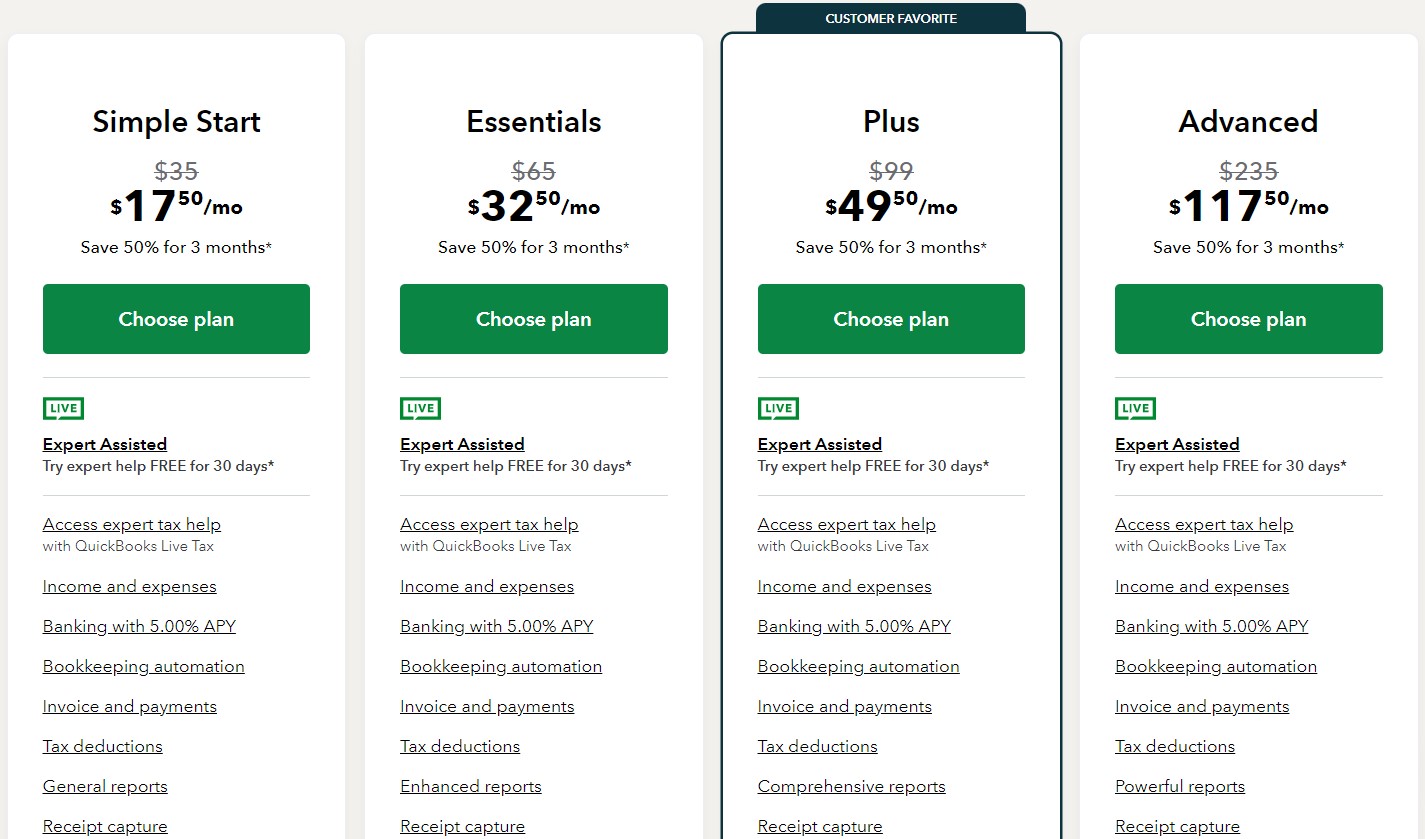

Pricing

QuickBooks Online has 4 paid plans that come with a 30-day free trial. Each plan also has a 50% discount for the first three months.

- Simple Start: Usually $35 per month (currently $17.50)

- Essentials: Usually $65 per month (currently $32.50)

- Plus: Usually $99 per month (currently $49.50)

- Advanced: Usually $235 per month (currently $117.50)

Image via QuickBooks Online

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: Link your bank accounts, credit cards, PayPal, Square, and other accounts to automate the importing and categorization of your transactions.

2. Zoho Books

Image via Zoho Books

Zoho Books is an affordable online accounting tool. It delivers excellent value for money and is perfect for functions such as invoicing, cash flow management, banking, tax compliance, and report generation as you can see in this Zoho Books review.

While small businesses revere this FreshBooks alternative for its low price tag, Zoho Books is very scalable and can be used by enterprises with advanced accounting needs. This alternative integrates with other business solutions to streamline your business operations too.

With Zoho Books, you can convert your quotes into invoices to ensure you’re paid quickly. This alternative will also help you manage your payables so you can know how you are spending your resources.

What’s more?

This FreshBooks alternative also connects with your bank account to make it easy to fetch and categorize your bank transactions.

Key Features

- All-in-one accounting tool that makes invoicing and managing account receivables effortless

- Allows clients to create client portal to manage their relationships and accelerate payments

- Fetches and categorizes your bank feeds to help you reconcile your accounts

- Offers seamless bill management for businesses to help you track how much you owe your vendors

- It has an advanced inventory management software that monitors your products to ensure you never run out of stock

Pros

- Calculates your sales tax liability to help you stay compliant

- Integrates with Zoho CRM and Zoho’s 50+ apps to make it easy for you to manage your business operations

- Allows users to create custom professional-looking invoices

Cons

- Doesn’t integrate well with other tools beyond the Zoho ecosystem

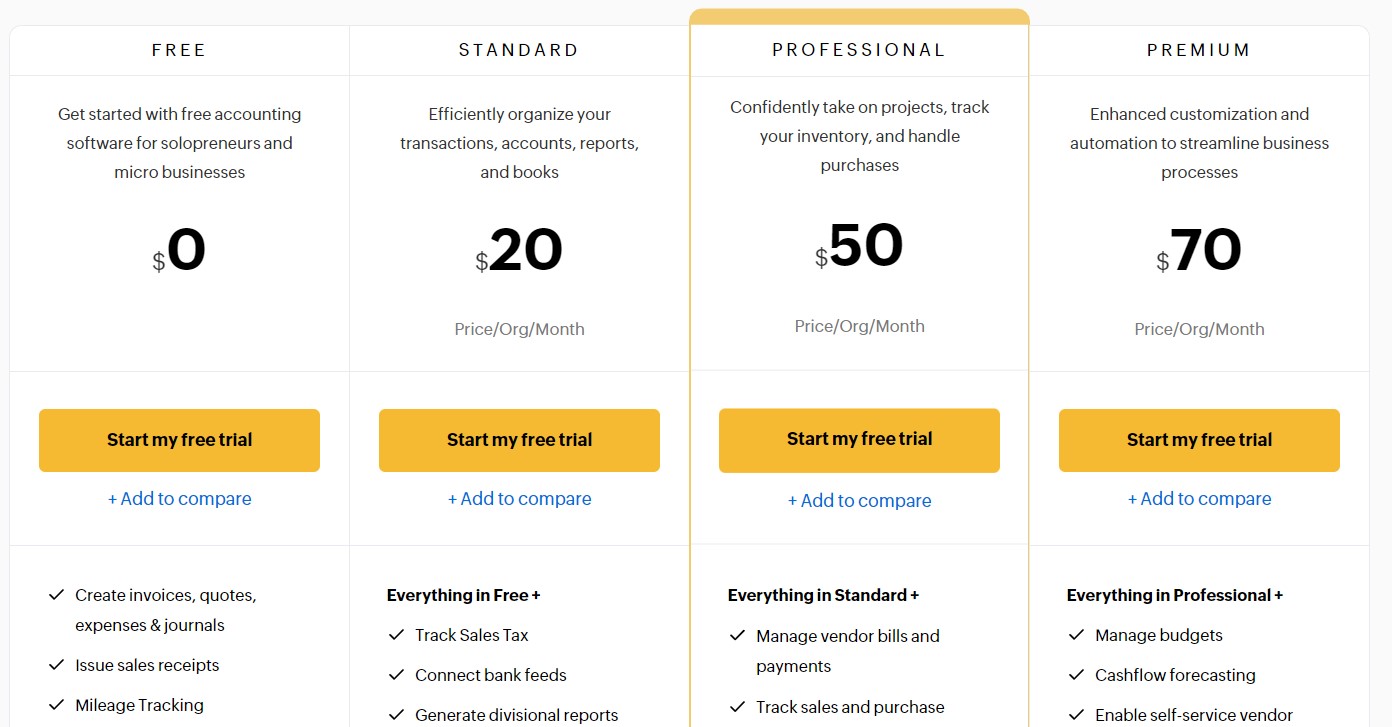

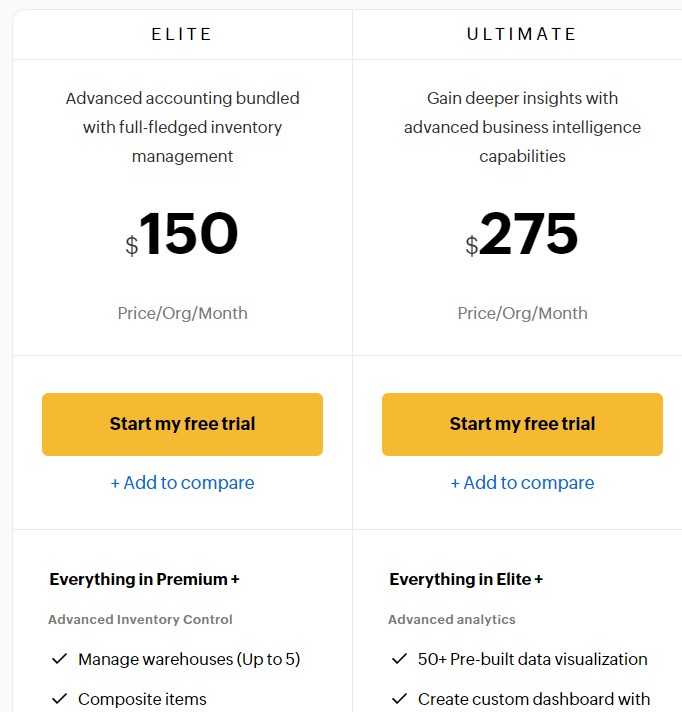

Pricing

Zoho Books has a limited free plan and five premium plans for businesses of varying sizes and needs.

- Free: 1 user + 1 accountant

- Standard: $20 per month – 3 users

- Professional: $50 per month – 5 users

- Premium: $70 per month – 10 users

- Elite: $150 per month – 10 users

- Ultimate: $275 per month – 15 users

Image via Zoho Books

Image via Zoho Books

Tool Level

- Beginner/intermediate

Usability

- Moderately easy to use

Pro Tip: Save time on data entry by importing your bank statements directly into Zoho Books.

3. Wave Accounting

Image via Wave

Wave Accounting is one of the best accounting software for small businesses and a reliable free alternative to FreshBooks. Unlike other software that charges exorbitant fees, Wave Accounting offers free plans for invoicing and accounting.

Better still, these plans don’t have usage limitations, enabling you to create unlimited invoices and add as many collaborators as you need.

That said, this FreshBooks alternative does charge for other services, such as online payments, mobile receipts, and payroll services, and you can add the features you need as your business grows. This means you only pay for what you need, making Wave Accounting one of the best alternatives to FreshBooks for business owners on a tight budget.

Besides the standard accounting features, Wave Accounting also offers professional consulting services to help you optimize your key business functions and processes.

Key Features

- A user-friendly interface that provides an intuitive overview of your financial data

- Access to Wave advisors who will coach you to manage your finances better or do everything for you

- Offers seamless income and expense tracking to help you know the true state of your business

- Convenient payment support to make it easy for customers to settle their bills

- Create customizable templates for invoices in seconds and send overdue reminders to get paid quickly

Pros

- Gives users access to free and unlimited accounting features

- Offers unlimited partners and collaborators on all Wave Accounting products

- The additional features are available for a small fee

Cons

- Does not integrate with other third-party applications

- Free plan users don’t get customer support

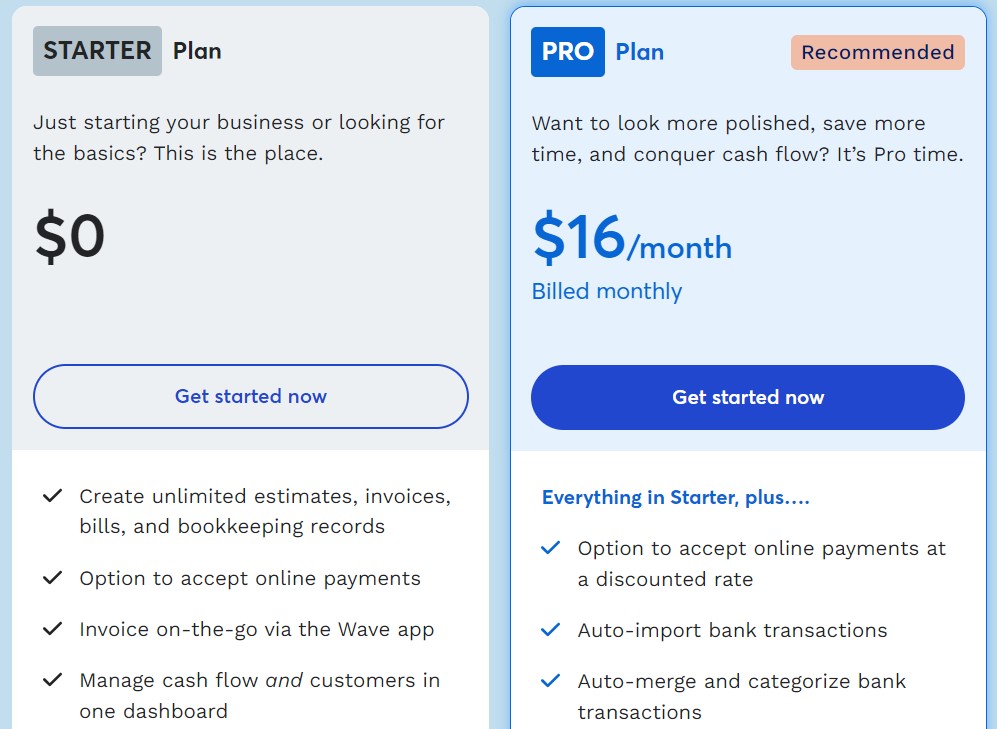

Pricing

Wave Accounting features two plans, a free plan, and a paid plan:

- Starter: $0 per month

- Pro: $16 per month

Image via Wave

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: Enable online payments and get paid faster through the secure link in your invoice.

You May Also Like:

4. Xero

Image via Xero

Xero is one of the best FreshBooks alternatives if you’re looking for accounting software with automated features to help you save time. From sending recurring invoices to reconciling bank transactions, Xero has the accounting tools you need to streamline your financial processes.

Furthermore, its user-friendly interface makes it easy to navigate the platform and manage finances effectively. Setting up the tool is easy and you’ll also get access to their onboarding experts for 90 days to help you get the most out of Xero.

This FreshBooks alternative delivers smart reports and insights that you can use to make data-driven decisions. It also offers cloud storage for important business documents. You can even enable automatic backups to prevent the loss of important documents.

You can try Xero for free for thirty days and check all its features to decide if it’s the right accounting tool for you.

Key Features

- Manage your spending and reimburse expense claims with Xero’s expense management tools

- Connect Xero with your business bank account to automate reconciliation and save time on data entry

- Accept online payments through different channels from your Xero invoice and increase your chances of getting paid in time

- Track projects, costs, and profitability with the project tracker software

- The contact management feature keeps your customer and supplier details in one place for easy management

Pros

- All pricing plans support unlimited users

- Stores and organizes all your documents in the cloud

- Simple and easy-to-use layout

Cons

- The entry-level plan limits users to 5 bills and 20 invoices per month

- Tracking projects and claiming expenses is only available on the highest-tier plan

Pricing

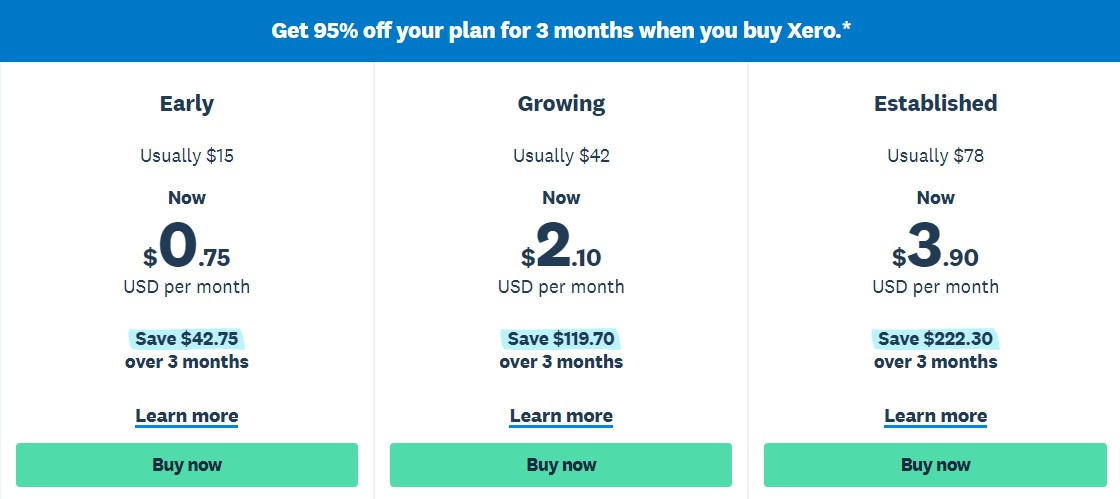

This FreshBooks alternative has a 30-day free trial for all its plans. Xero also offers a 3-month, 95% discount on all its plans.

- Early: Usually $15 per month (currently $0.75)

- Growing: Usually $42 per month (currently $2.10)

- Established: Usually $78 per month (currently $3.90)

Image via Xero

Tool Level

- Intermediate

Usability

- Moderately easy to use

Pro Tip: Use your Xero account to store important documents online. Manage and share bills, contracts, receipts, and other documents from anywhere with Xero.

5. Sage Accounting

Image via Sage

If you want to enjoy the benefits of financial planning, then you need a comprehensive tool like Sage Accounting that offers a wide range of features such as financial reporting, expense management, bank reconciliation, and inventory management.

This FreshBooks alternative offers all of this and much more to help you achieve better financial control and planning for your business. The tool is incredibly easy to use and comes with time-saving automation features to streamline your accounting tasks.

All the information you feed into the software is secure and backed up to prevent the potential loss of important data. It also connects with your bank to make it easy to import your transactions for quick reconciliation.

Sage Accounting adds a layer of professionalism to your business operations, allowing you to send quotes and invoices that look as good as the services you provide. The FreshBooks alternative also delivers insightful reports that will help you make informed business decisions.

Key Features

- Quick and easy setup to help you get started with the tool from anywhere and on any device

- Comes with simple automation processes to save time and minimize errors

- Create professional invoices and track them automatically to ensure you get paid quickly

- Integrate Stripe into your invoices to give customers more options to pay you

- Has an intuitive dashboard that updates your account in real time to help you stay on top of your finances

Pros

- There are no limits on invoices and billable clients

- Premium plans are more affordable than other FreshBooks alternatives

- The highest-tier plan supports unlimited users

Cons

- Some users say the tool has a steep learning curve

- Doesn’t offer time and mileage tracking

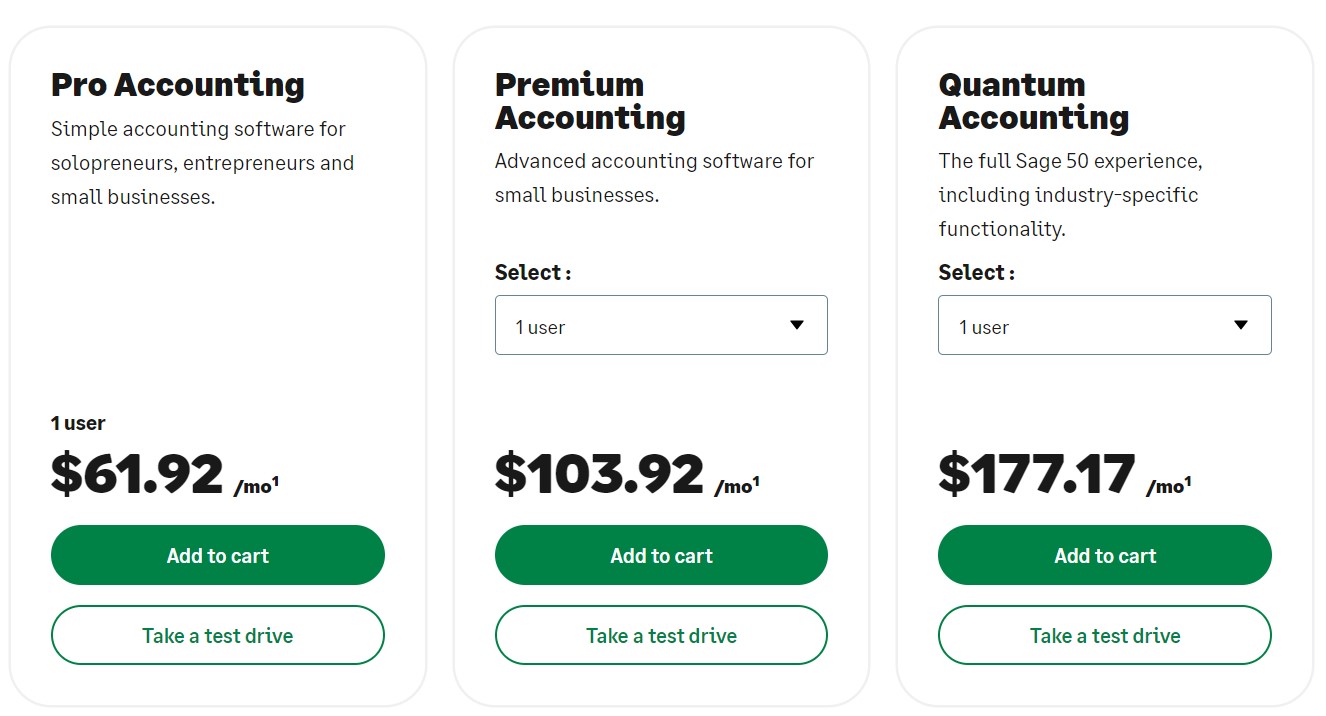

Pricing

Sage currently offers three paid plans, namely:

- Pro Accounting: $61.92 per month

- Premium Accounting: $103.92 per month

- Quantum Accounting: $177.17 per month

Image via Sage Accounting

Tool Level

- Intermediate

Usability

- Moderately difficult to use

Pro Tip: Expedite invoice and receipt processing with Sage Accounting’s AutoEntry snap and post feature.

You May Also Like:

6. ZipBooks

Image via ZipBooks

ZipBooks is among the top FreshBooks alternatives that provide the tools, insights, and intelligence to take your small business to the next level. The tool simplifies your accounting tasks, eliminating the need to hire an expert to manage your accounts.

ZipBooks’s free plan makes it one of the best accounting software for small business as it comes with all the necessary features you need for your financial operations. The free plan allows you to:

- Send unlimited invoices

- Manage unlimited customers and vendors

- Accept online payments

- Access basic reports

- Connect to one bank account

But if you find yourself needing more advanced capabilities, this FreshBooks alternative offers affordable premium plans with advanced features like expense tracking, detailed reporting, multi-bank account connections, and time tracking. Whether you’re just starting or looking to expand, ZipBooks has you covered for comprehensive financial management.

Key Features

- The auto-billing feature lets you send professional invoices in seconds

- Expedite payments with automated reminders

- Keep impeccable records and track all your transactions seamlessly to understand your true financial situation

- Delivers smart reports and insights to let you know who your most valuable customers are

- Automated expense tracking to help you figure out where your money is going

Pros

- Offers free and unlimited invoicing

- Integrates with Square and PayPal to accept online payments

- It has an intuitive interface that’s easy to navigate

Cons

- The free plan can only be used by one user

- There’s no live customer support for free plan users

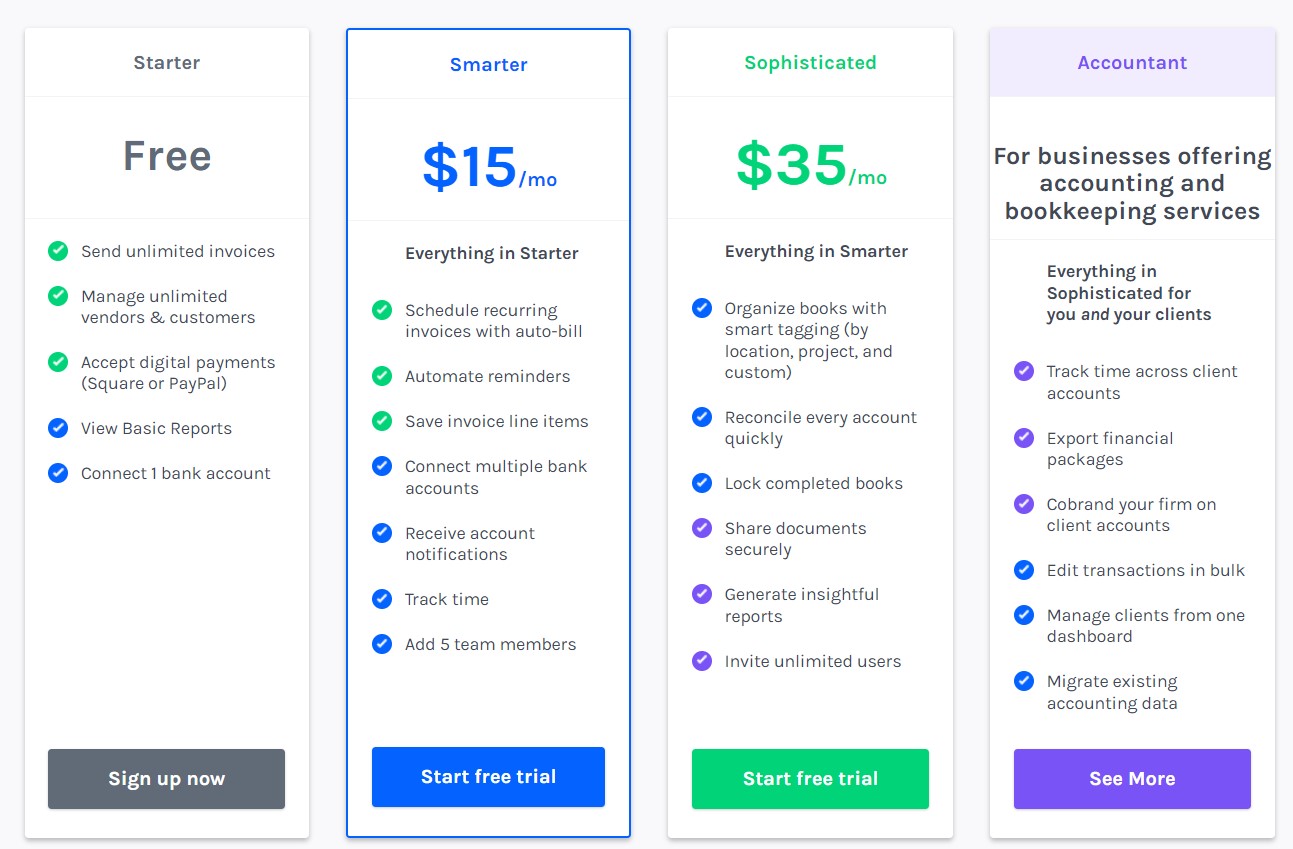

Pricing

ZipBooks has a free plan and 3 paid plans

- Starter: Free

- Smarter: $15 per month

- Sophisticated: $35 per month

- Accountant: Custom pricing

Image via ZipBooks

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: Use the data insights from ZipBooks reports to make changes in your business to improve your financial health.

7. Invoicera

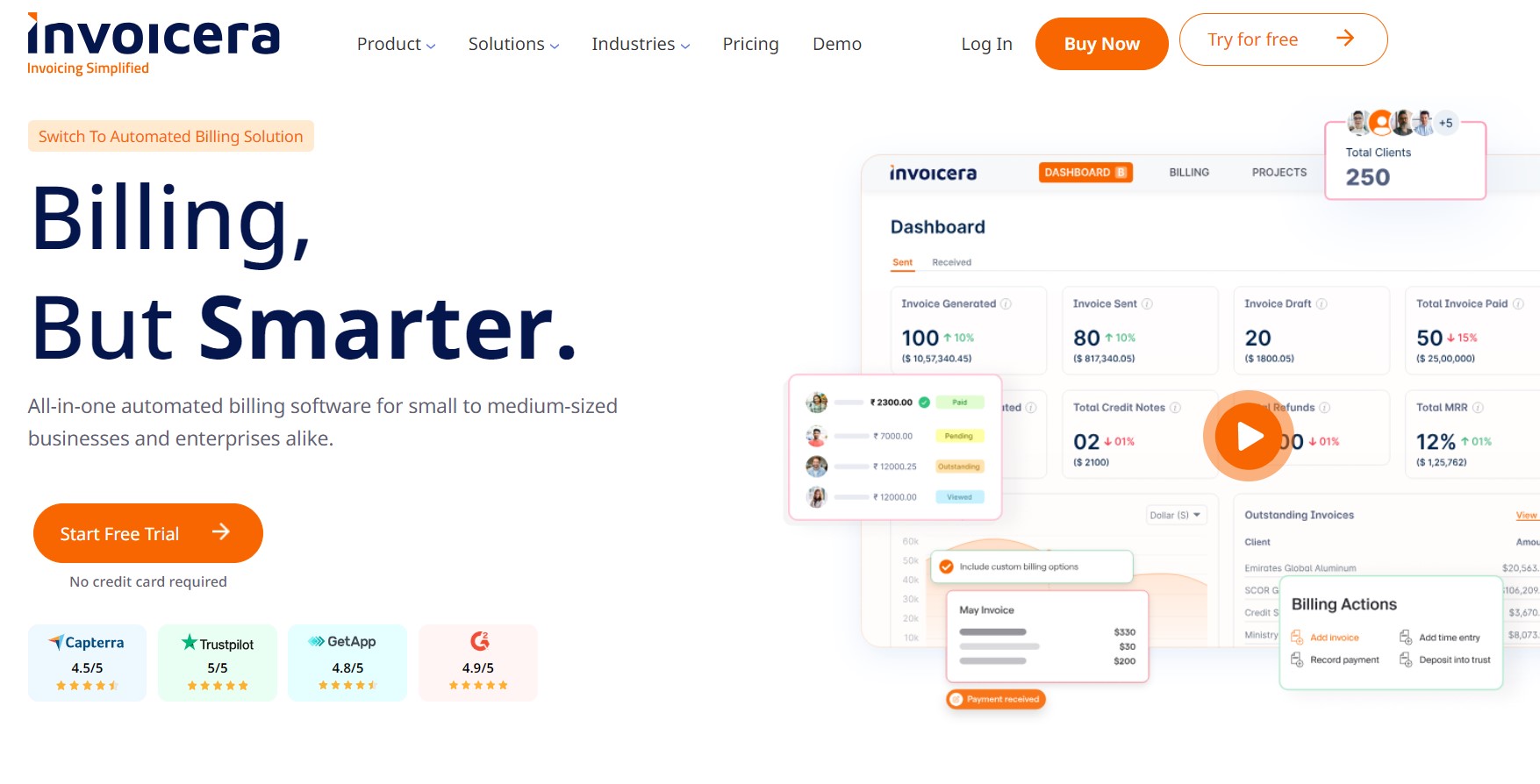

Image via Invoicera

Invoicera is a robust accounting tool with advanced automation features. With this tool, you can automate your billing, invoicing, time tracking, and workflows to save time and reduce errors. The invoices you can generate with Invoicera are professional-looking and increase your chances of getting paid on time.

This FreshBooks alternative saves everything in the cloud to guarantee the safety of your documents. The invoicing software is ideal for freelancers and small businesses but is quite scalable to meet all your needs as your business grows.

This FreshBooks alternative also makes it easy for you to receive payments from different channels as it integrates with 30+ payment gateways. This feature will ensure you’re paid faster since it accommodates diverse payment preferences and simplifies the payment process for your clients.

Key Features

- All-in-one accounting solution that automates the invoicing process to help you get paid faster

- 3-layered security system to ensure the safety of your documents

- Custom workflow management to help you optimize your business processes and save time

- Supports 30+ payment gateways to accommodate the diverse payment preferences of your clients

- Access Invoicera from anywhere through its dedicated mobile app

Pros

- Offers customizable invoice templates to help you enhance your brand image

- Supports multiple currencies to make it easy to engage in global operations

- Provides time-tracking capabilities, which is beneficial for businesses that charge hourly rates

Cons

- Some users complain that customer support takes longer to respond

- It’s relatively expensive compared to other FreshBooks alternatives

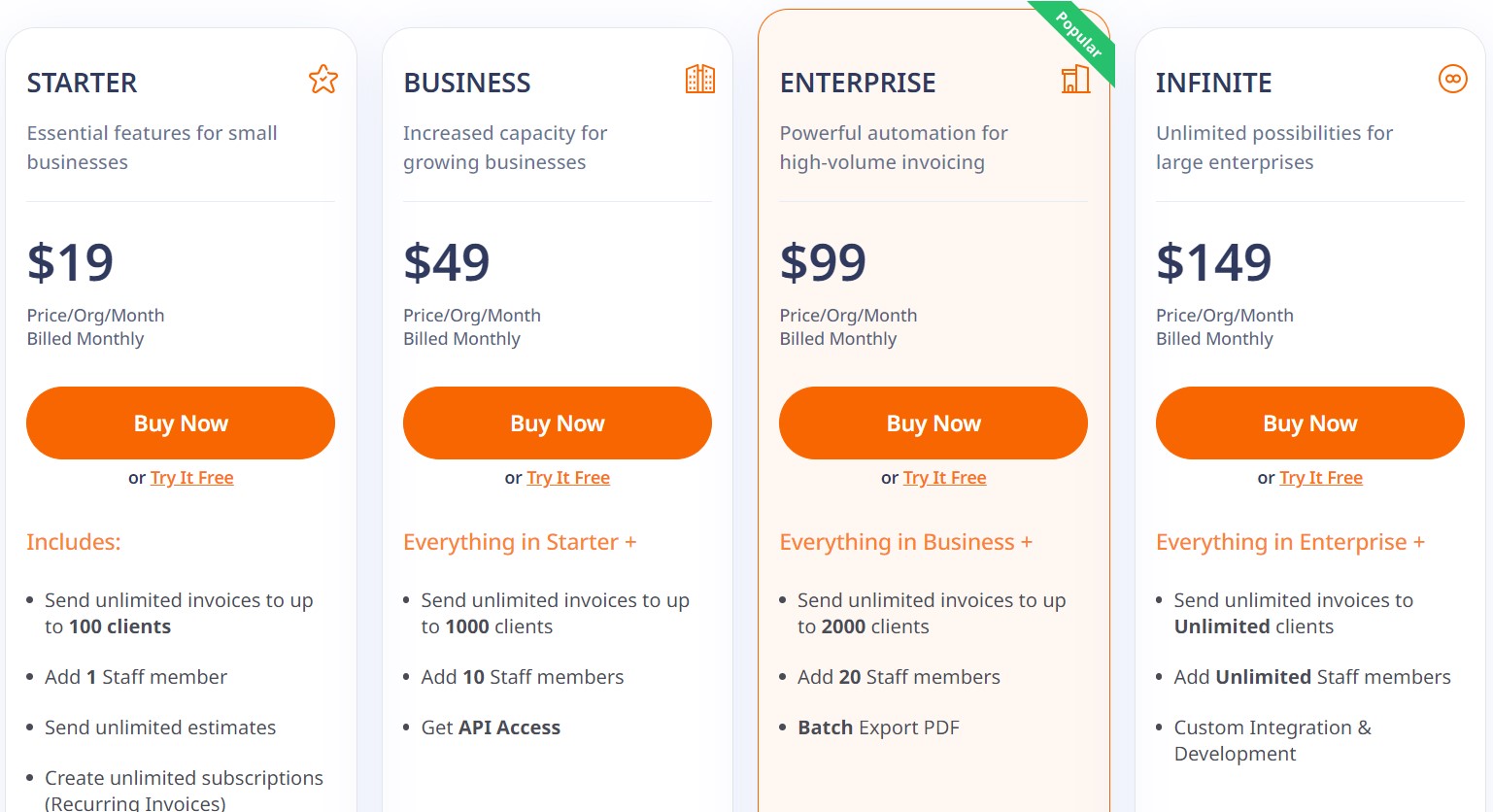

Pricing

This FreshBooks alternative doesn’t have a free version. Instead, it has 4 paid plans that come with a 30-day free trial.

- Starter: $19 per month

- Business: $49 per month

- Enterprise: $99 per month

- Infinite: $149 per month

Image via Invoicera

Tool Level

- Beginner/Intermediate

Usability

- Easy to use

Pro Tip: Take advantage of Invoicera’s automated invoicing feature to save time and reduce errors. Set up recurring invoices for regular clients to streamline your billing process.

You May Also Like:

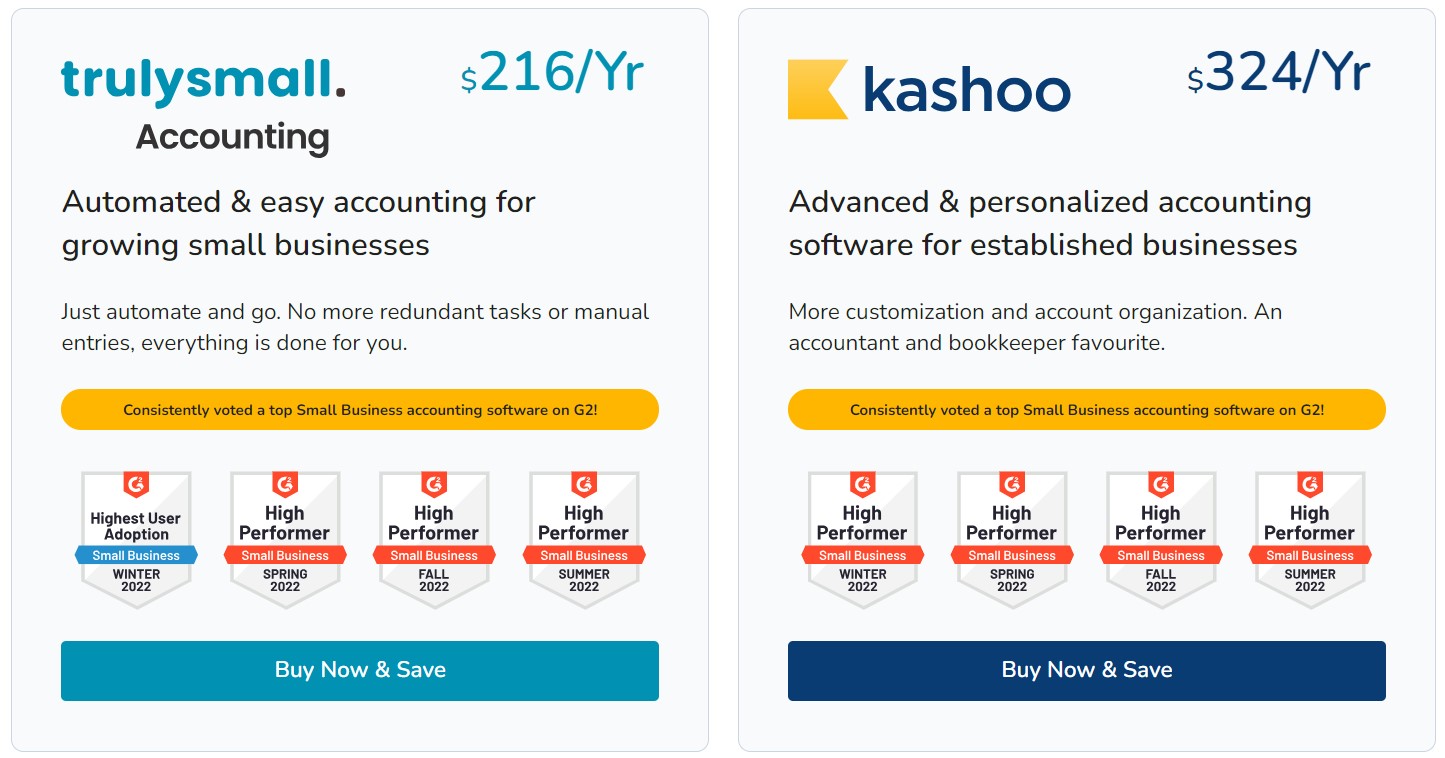

8. Kashoo

Image via Kashoo

Most of the FreshBooks alternatives in this post are for small businesses looking to expand in the future. But what if you’re a sole business owner or contractor who works alone? Which is the best accounting software for you?

The answer is Kashoo. While the tool has advanced features to satisfy the needs of established enterprises, it also has a low-priced plan for freelancers, sole proprietors, and contractors.

This FreshBooks alternative allows you to create custom invoices and add a payment gateway to facilitate user payment processing.

You can easily connect your Kashoo account to your bank account to reconcile your transactions. But even when you choose not to do that, the tool provides other ways to record your income and expenses.

Kashoo’s cheapest plan costs just $216 per year and supports unlimited billable clients and users. This allows you to send unlimited invoices, track expenses, and manage transactions efficiently without worrying about additional costs.

Key Features

- It has an intuitive and user-friendly interface that makes it easy to manage your finances.

- Manages and categorizes your expenses effectively to help you keep accurate records.

- Provides a wide range of reports you can use to understand the financial health of your business.

- Unlimited billable clients even on the cheapest plans

Pros

- Allows you to automate repeat workflows to save time

- Offers invoice customization to enhance your brand image

Cons

- Reporting capabilities are not as advanced as some other FreshBooks alternatives

- Limited third-party integrations

Pricing

This FreshBooks alternative has two paid plans with yearly billing.

- Trulysmall Accounting: $216 per year

- Kashoo: $324 per year

Image via Kashoo

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: Regularly reconcile your bank transactions to ensure accurate financial records and minimize errors.

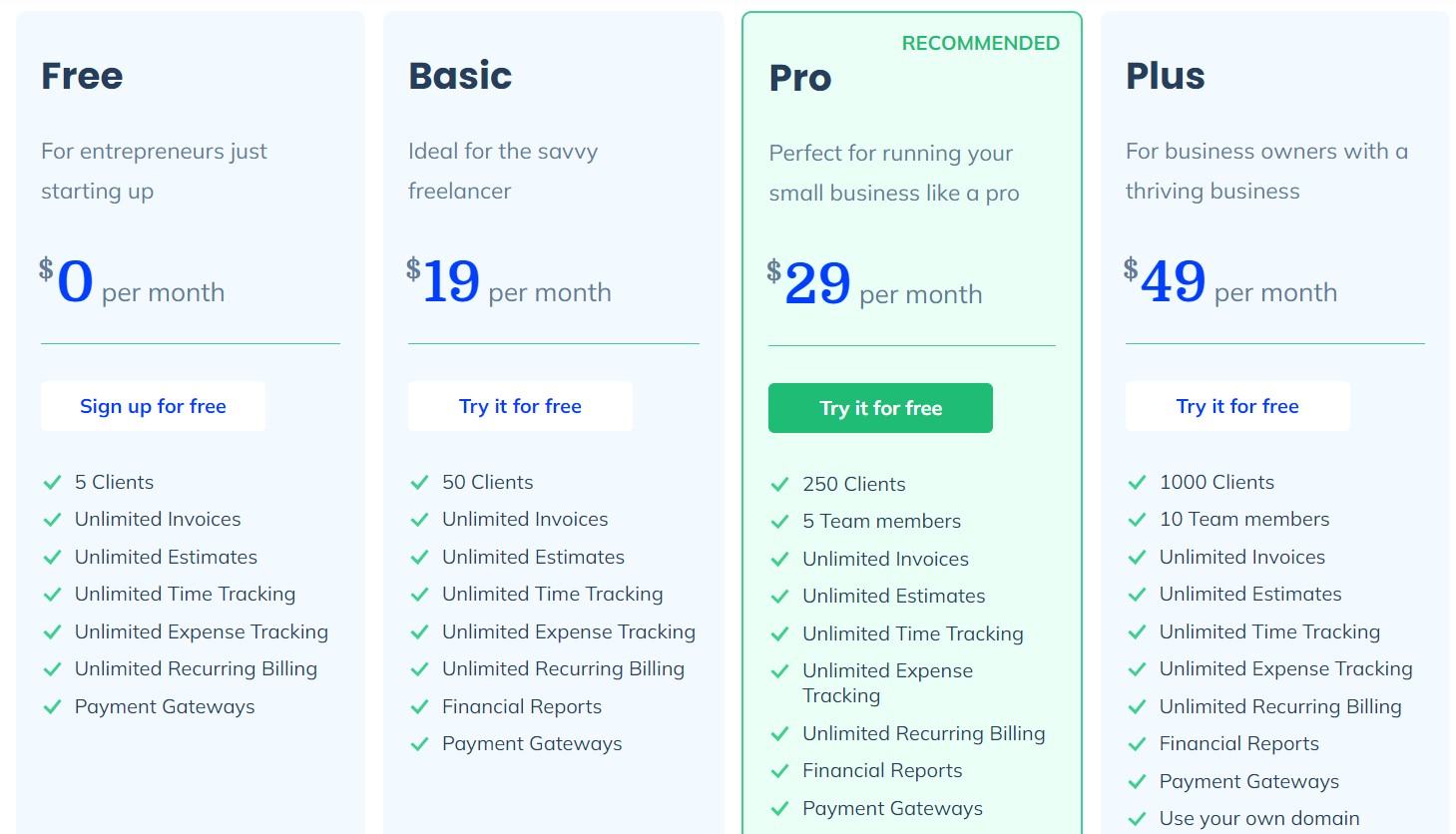

9. Hiveage

Image via Hiveage

If you’re looking for a simple tool for sending invoices and accepting payments, then Hiveage is one of the best accounting software you can consider. This FreshBooks alternative has an intuitive interface that’s easy to navigate and makes financial management hassle-free.

This FreshBooks alternative appeals to small business owners and freelancers because its feature-rich free plan allows you to send unlimited invoices and make unlimited estimates. The free plan also supports unlimited time tracking for contractors who charge an hourly rate.

You can easily accept online payments on any Hiveage plan, but you’ll have to upgrade to the highest-tier plan to accept offline payments. The tool integrates with other third-party software through Zapier, and you can increase its functionality.

Key Features

- Offers branded invoices and quotes to enhance your brand image

- Supports seamless time tracking and billing

- Delivers smart financial reports to help you make informed decisions

- Supports multiple payment gateways to make it easy for you to accept online payments

Pros

- The free plan allows unlimited invoicing with a maximum of five clients

- Fast and convenient online payments

- Detailed financial reports support decision-making

Cons

- All plans have a limit on the number of billable clients

Pricing

Hiveage has a free plan and 3 paid plans.

- Free

- Basic: $19 per month

- Pro: $29 per month

- Plus: $49 per month

Image via Hiveage

Tool Level

- Beginner

Usability

- Moderately easy to use

Pro Tip: Use the tool to manage subscription payments and recurring fees and offer online payment options for added convenience.

You May Also Like:

- Best Cloud Accounting Software for All Business Sizes

- Best Accounting Software for Self-Employed Professionals

FAQ

Q1.What is the best alternative to FreshBooks?

There are several FreshBooks alternatives you can use to manage your finances effectively. They include:

- QuickBooks Online

- Zoho Books

- Wave Accounting

- Xero

- Sage Accounting

- ZipBooks

- Invoicera

- Kashoo

- Hiveage

Q2. What are the disadvantages of FreshBooks?

While FreshBooks is a reliable accounting software solution for small businesses, it has some drawbacks that push users to find suitable FreshBooks alternatives.

For instance, its pricing can be relatively high for businesses on a tight budget. It also has limits on the number of users and billable clients. Additionally, some users find that FreshBooks has limited features when it comes to its reporting capabilities.

Q3. Which is the best option between Xero and FreshBooks?

Both accounting tools have unique features that make them ideal for different users. FreshBooks has intuitive invoicing capabilities, making it ideal for freelancers and small business owners who send a lot of invoices.

On the other hand, Xero has robust accounting features and automated processes, making it ideal for businesses in need of a powerful, yet affordable accounting system.

Q4. Which is easier to use: QuickBooks or FreshBooks?

Both QuickBooks and FreshBooks have user-friendly interfaces that make it easy to navigate the platform. However, QuickBooks has a lot more features that elongate the learning curve.

Q5. Can I use FreshBooks for free?

FreshBooks doesn’t have a free plan like a few of the FreshBooks alternatives in this post. Nonetheless, each paid plan comes with a 30-day free trial that gives you access to the tool’s key features.

Q6. Do any of these FreshBooks alternatives offer mobile receipt capture?

Yes, several alternatives offer mobile receipt capture features. QuickBooks Online and Xero are well-known for this feature, but Sage and Zoho Books also provide robust receipt capture capabilities. This allows users to easily scan and upload receipts using their smartphone cameras, streamlining expense tracking and reducing manual data entry.

Q7. Which FreshBooks alternative is best for businesses with global operations?

Xero and QuickBooks Online are excellent choices for businesses with global operations. Both offer robust multi-currency support, allowing you to manage transactions in multiple currencies and automatically handle currency conversions. They also provide features tailored to international business needs, such as country-specific tax reporting.

Q8. Are there any FreshBooks alternatives that excel in handling sales tax?

Yes, several FreshBooks alternatives offer robust sales tax features. QuickBooks Online and Xero stand out with their comprehensive sales tax capabilities, including automatic tax calculation, reporting, and assistance with filing for various jurisdictions. Zoho Books and Sage Accounting also offer strong sales tax management features, helping businesses comply with local tax regulations.

Q9. Can these FreshBooks alternatives handle recurring invoices?

Yes, most FreshBooks alternatives mentioned in this post offer recurring invoice functionality. Tools like Zoho Books, Invoicera, and Hiveage allow you to set up and automate recurring billing, saving time on repetitive invoicing tasks. This feature is particularly useful for businesses with subscription-based models or regular billing cycles.

Q10. Which FreshBooks alternative offers the most user-friendly interface for someone new to accounting software?

While all the alternatives aim to be user-friendly, Wave Accounting and ZipBooks are often praised for their highly intuitive and user-friendly interfaces. These tools are designed with simplicity, making them excellent choices for sole business owners or those new to accounting software. Kashoo and Hiveage also offer clean, modern interfaces that cater well to beginners in accounting software.

You May Also Like:

- What is Accounting Software? Everything You Need To Know

- Benefits of Using Accounting Software for Small Businesses

Wrapping Up

While FreshBooks is a reliable accounting software, you may need to explore suitable FreshBooks alternatives if you want to add more team members and billable clients to your accounting software without breaking the bank.

Additionally, a FreshBooks alternative may be necessary if you want a free accounting software solution that allows you to send unlimited invoices.

When selecting your FreshBooks alternative, examine its features keenly to ensure it has everything you need to manage your finances optimally. The accounting tools listed above offer great functionality without being too expensive, making them ideal for small businesses, freelancers, and enterprises in need of scalable solutions.

When you find a suitable alternative, take advantage of the free trial to familiarize yourself with its capabilities and only sign up for a plan when you are sure it has the features you need to manage your finances effectively.