An accounting software for startups is a vital resource, providing entrepreneurs with the tools they need to streamline financial management and drive business growth. It helps manage cash flow, track expenses, and ensure long-term financial stability.

Built to navigate the complex financial space and establish strong customer relationships, accounting software for startups simplifies tasks like invoicing, payroll, and tax preparation, saving time and reducing errors.

The best part? These tools offer tailored solutions, scalable to the unique needs and increased growth trajectories of startups.

If you’d love to know the top 17 accounting software for startups in 2025, keep reading. These are the options that, according to our extensive research, can cater specifically to the dynamic needs of startup companies.

Let’s get started!

Quick Summary: Best Accounting Software for Startups by Type

- Best Accounting Software for Cloud-Based Accounting: Xero, QuickBooks, ClearBooks

- Best Accounting Software for Enterprise-Level Management: Oracle NetSuite, Odoo

- Best Accounting Software for Simplified Small Business Accounting: Wave Accounting, ZarMoney, ZipBooks, QuickBooks, FreeAgent

- Best for Traditional Desktop Accounting: AccountEdge, OneUp, Kashoo

- Best for Online Invoicing and Financial Management: Zoho Books, FreshBooks, ZipBooks

- Best Accounting Tools with Free Trial: ZipBooks, Zoho Books, Xero, AccountEdge, OneUp, Synder

How We Chose the Best Accounting Software for Startups

- Core Accounting Features: Our criteria emphasize platforms that encompass fundamental accounting features, including inventory management and financial reporting. The majority of the accounting software for startups options listed cater perfectly to startups, providing an essential suite of features coupled with additional capabilities.

- Analytics: Recognizing the importance of analytics and financial reporting, we’ve considered varying levels of analytical capabilities in our chosen accounting software for startups. Each selection offers a blend of robust accounting functionalities and analytical tools.

- Additional Functionality: Beyond core accounting features, our selection of accounting software for startups embraces a diverse range of software that integrates additional functionalities. This encompasses accounting, along with project management, customer service, marketing, and other versatile features.

- Pricing: When picking the best accounting software for startups, we acknowledged budget constraints for small businesses. We’ve prioritized affordability and included free plan options.

- Exceptional Customer Support: Recognizing the pivotal role of customer support in the overall customer experience, we’ve selected accounting software for startups that are renowned for their responsiveness and effective support channels. Seamless utilization of accounting tools necessitates reliable customer assistance.

- Integration Capabilities: Understanding the significance of integrations, our list of accounting software for startups includes essential integration options. Your choice should align with certain small business requirements, ensuring optimal functionality.

- Customization: Lastly, we’ve evaluated the ease of customizing accounting software to align with individual business needs. Recognizing the importance of flexibility and avoiding common accounting pitfalls, our handpicked accounting software for startups offers varying levels of customization capabilities.

17 Best Accounting Software for Startups

Accounting software helps startups navigate the complexities of financial management. It offers streamlined solutions to contribute to their success.

We’ve compiled a list of 17 of the best startup accounting software for 2025. The list comprises both paid and free accounting software, ensuring there’s an option for every budget.

When choosing the best accounting software for startups, consider factors like scalability, ease of use, and specific features tailored to your business needs.

Let’s dive in!

1. Xero

Image via Xero

Xero is one of the best online accounting software for startups that helps streamline essential financial data with finesse. It excels in accounting tasks, such as invoice management and bank reconciliation. Xero also effortlessly captures bills and receipts.

The best part?

Xero collaborates with Gusto to extend its capabilities. It includes comprehensive payroll services for an additional $40.

While this comprehensive accounting software for startups excels in meeting the needs of small businesses, larger corporations may not benefit as much. Its features are designed specifically with the needs of startups in mind.

Key Features

- Invoice management

- Bulk bank reconciliation

- Bills and receipts tracking

- Project and expense tracking

- Inventory and order management

- Multi-currency transaction capability with detailed analytics and reporting

Pros

- Intuitive interface for user-friendly navigation

- Robust invoicing and billing capabilities to minimize errors for startups

- Seamless integration with third-party applications

- Efficient bank reconciliation for accurate financial tracking

- Comprehensive reporting and analytics tools

- Scalability to accommodate startup business growth

Cons

- Costs you more money than other comprehensive accounting software for startups

- Steeper learning curve for complex functionalities

- Limited customization options for certain reports

- Additional cost for some advanced features

- Less intuitive mobile app

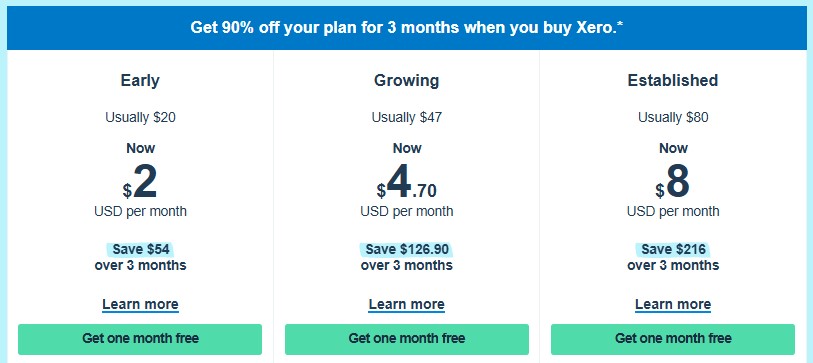

Pricing

Xero offers three pricing plans. When you choose the Growing and Established plans, you get 75% off for 3 months.

- Early: $20/month

- Growing: $47/month

- Established: $80/month

Image via Xero

Tool Level

- Beginner

Usability

- Easy to use

You May Also Like:

2. QuickBooks

Image via QuickBooks

QuickBooks is one of the best accounting software for your startup. It combines affordability with a robust set of features.

Like most QuickBooks alternatives, this tool can handle a wide range of accounting tasks, such as expense tracking, inventory management, and financial reporting.

Despite not having a free plan, QuickBooks remains a preferred accounting software for startups and freelancers. After all, the platform offers cost-effective starter plans with outstanding features.

Key Features

- Income and invoice tracking

- Streamlined invoice and payment management

- Simplified tax deductions

- Comprehensive receipt organization

- Mileage tracking

- Cash flow calculations

- Automated workflows

- Simplified tax deductions

Pros

- Affordable plans for various business sizes

- Intuitive interface for easy navigation

- Robust invoicing and payment tracking

- Comprehensive expense and tax management

- Versatile features adaptable to different industries

Cons

- No free plan is available

- May take some time for beginners to learn

- Limited customization options for some reports

- Additional cost for some advanced features

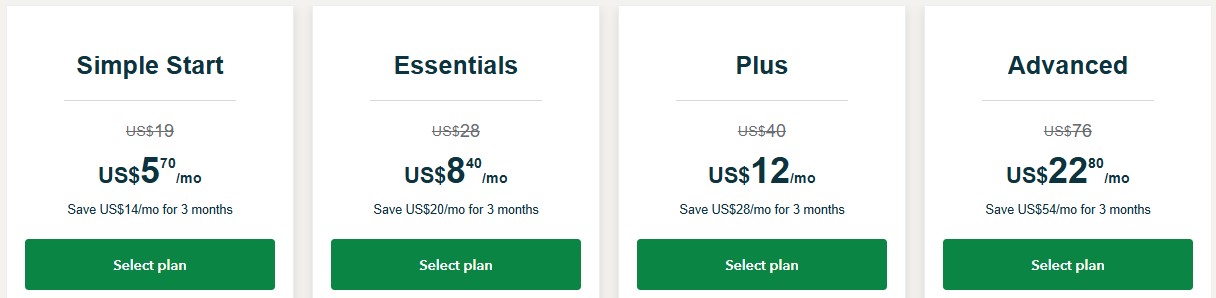

Pricing

QuickBooks currently offers a discount across all pricing plans—$1 per month for 3 months. It also offers a 30-day free trial.

Here are the standard pricing plans:

- Simple Start: $19/month

- Essentials: $28/month

- Plus: $40/month

- Advanced: $76/month

Image via QuickBooks

Tool Level

- Beginner/Intermediate

Usability

- Easy to learn and use

3. FreshBooks

Image via FreshBooks

FreshBooks is an easy-to-use startup accounting software with advanced features. It streamlines your financial tasks with an easy-to-use interface.

It covers everything from financial management to invoicing and automating repetitive processes.

FreshBooks is one of the most affordable accounting software for startups, offering advanced tools without a hefty price tag. Perfect for freelancers and solopreneurs, it’s a single-user solution that grows with your business. Unlike FreshBooks competitors, this tool also allows unlimited invoicing even on the basic plan.

Key Features

- Expense tracking

- Automated invoicing

- Mobile app for on-the-go management

- Customizable reports for insightful analytics

- Integration capabilities with third-party apps

- Multi-currency support for global flexibility

Pros

- Efficient invoicing and expense tracking to maintain financial clarity

- Automated features to save time and reduce human error

- Affordable plans tailored for budget-conscious startups

- Robust customer support

- Continuous updates and improvements for enhanced functionality

Cons

- Limited scalability for larger businesses with complex needs

- Less advanced features compared to other accounting software for startups

- Learning curve may be steeper for certain functionalities

- Limited integration options

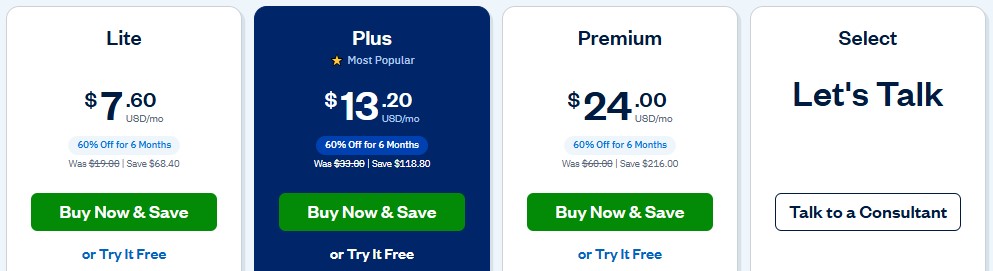

Pricing

FreshBooks offers 60% off for 6 months on all pricing plans, except Select. Here are the standard pricing plans without the discount:

- Lite: $19/month

- Plus: $33/month

- Premium: $60/month

- Select: Custom pricing

Image via Freshbooks

Tool Level

- Beginner

Usability

- Easy to use

4. Zoho Books

Image via Zoho Books

Zoho Books is a versatile accounting software that simplifies financial management for startups.

It provides functionality for essential tasks like invoicing, order and payment management, and credit notes.

With advanced features like inventory management and in-depth analytics, Zoho Books caters to diverse business needs.

The platform’s seamless integration with other Zoho Suite tools ensures a comprehensive and unified solution for efficient business operations.

Key Features

- Invoice management with up to 1,000 invoices annually in the free plan

- Online and offline payment processing

- Expenses and mileage tracking

- Bank reconciliation

- Automated payment follow-up reminders

- Basic analytics and reporting

- Integration with Zoho apps and select third-party applications

- Advanced inventory management

Pros

- Free plan with essential features

- High scalability for startups

- Seamless online and offline payment options

- Effortless expense and mileage tracking to reduce errors

- Advanced inventory management capabilities

- Integrated with Zoho and select third-party apps

Cons

- May be challenging for new users to learn

- Some advanced features are limited to paid plans

- May not be as customizable as other accounting software for startups

- Limited integration options

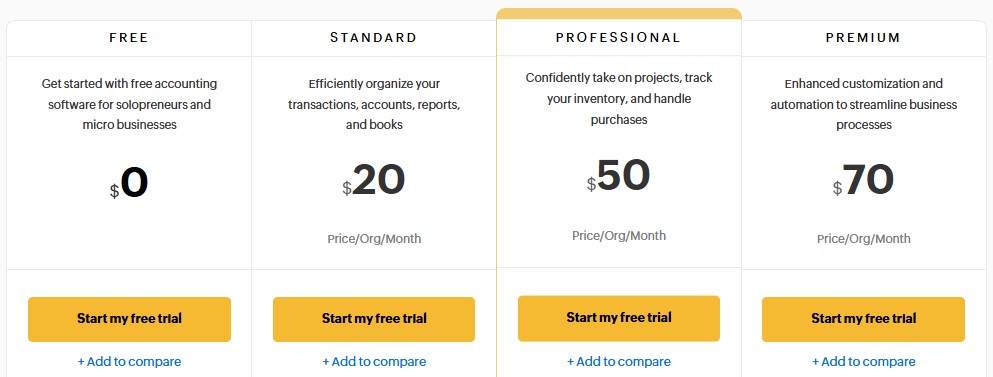

Pricing

Zoho Books offers two price categories depending on your business needs:

Plans to get you started

- Free: $0/month

- Standard: $20/month

- Professional: $50/month

- Premium: $70/month

Image via Zoho Books

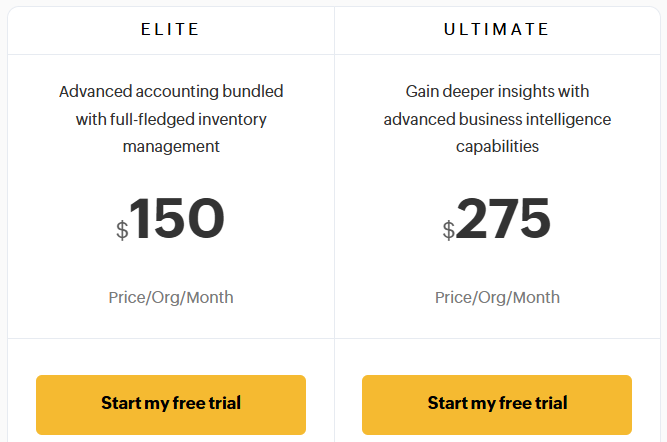

- Plans beyond the basic

- Elite: $150/month

- Ultimate: $275/month

Image via Zoho Books

Tool Level

- Intermediate

Usability

- Has a bit of a learning curve

5. Oracle NetSuite

Image via Oracle NetSuite

NetSuite ERP is a robust cloud accounting software that transcends traditional financial management of startups.

Seamlessly integrating with broader enterprise functionalities, it unifies essential business processes into a centralized platform.

NetSuite ERP streamlines financial operations, offering comprehensive modules for accounting, invoicing, and expense management.

Its real-time analytics empower informed decision-making, while automated workflows enhance efficiency.

Key Features

- Unified platform for enterprise resource planning

- Accounting module for comprehensive financial management

- Streamlined invoicing

- Real-time data analytics

- Order management

- Expense management tools

Pros

- Integrated business processes to ensure data is automatically updated

- Real-time analytics enabling data-driven decisions

- Automated workflows for enhanced operational efficiency

- Scalable solution to cater to evolving business needs

- High level of customization and flexibility

Cons

- Steeper learning curve for new users

- Potentially time-consuming Implementation

- Higher cost compared to other accounting software for startups

- Customization may require advanced technical expertise

- Limited integration with third-party apps

Pricing

- Netsuite ERP doesn’t display its pricing. You have to contact Netsuite support to inquire.

Tool Level

- Intermediate

Usability

- Has a bit of a learning curve for new users

Also Read:

6. Wave Accounting

Image via Wave

Wave is an exceptional cloud accounting software designed for startups. It offers a suite of financial management tools with a focus on simplicity and affordability.

This cloud-based platform helps manage recurring invoices, track expenses, and scan receipts to streamline day-to-day financial operations.

Wave also supports payroll processing, allowing businesses to uphold payroll best practices and manage employee payments efficiently.

The software’s robust reporting tools provide insights into income, accounting reports, and overall financial health.

What sets Wave apart from other accounting software for startups is its commitment to free access to core accounting features. This makes it an accessible choice for entrepreneurs and startups looking for comprehensive yet cost-effective solutions to manage their finances.

Key Features

- Recurring invoicing and automatic payments

- Payroll management

- Tax payments and filings

- Direct deposit for employee paychecks

- Unlimited receipt scanning for expense tracking

- Unlimited credit card and bank connections

- On-the-go financial management with the Wave App

- Access to personalized support with Wave Advisors

Pros

- Free core accounting tools

- User-friendly interface for easy navigation

- Affordable for small businesses and startups

- Comprehensive features, including payroll processing

- Robust financial reporting tools for financial analysis

- Secure cloud-based accounting for flexibility

- Active community support for assistance

Cons

- Limited advanced features compared to other accounting software for startups

- Payroll service is available only in the US and Canada

- Potentially basic mobile app functionality

- Limited integration options with third-party apps

- Customer support is primarily community-based, lacking live assistance

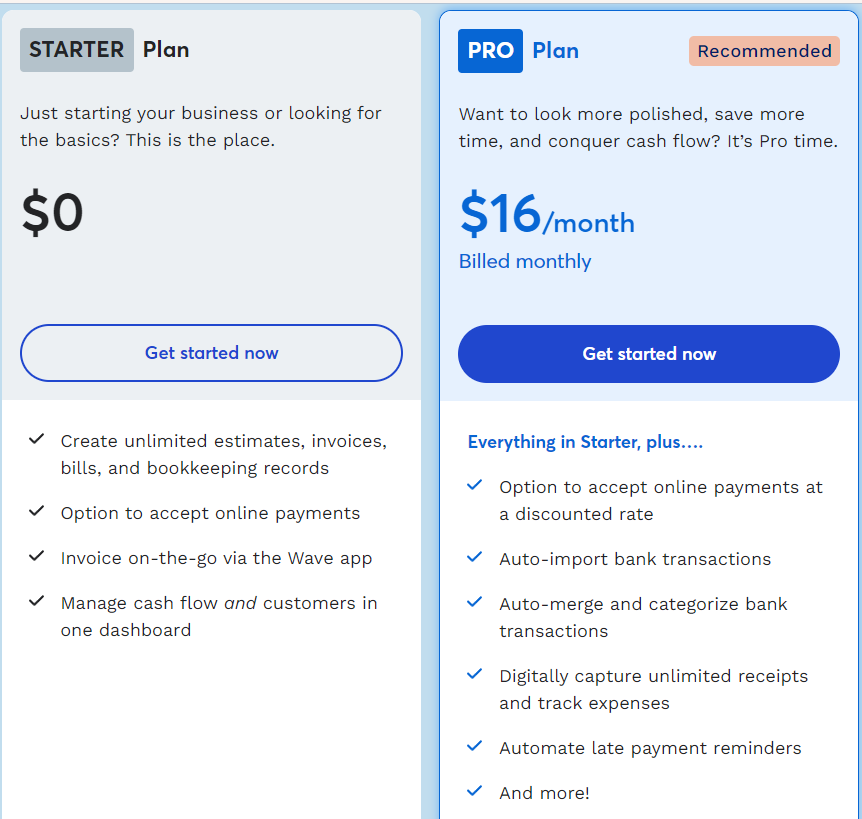

Pricing

- Starter Plan: Free

- Pro Plan: $16/month or $170/year

Image via Wave

Here are the prices for add-ons:

- Unlimited Receipt Scanning: $11 per month for free plan

- Bookkeeping support: $149 per month

- Accounting and payroll coaching: $379 one-time fee

- Payroll: $40 per month for tax service states; $20 per month for self-service states

Tool Level

- Beginner

Usability

- Easy to use

7. Sage 50 Accounting

Image via Sage

Sage 50 Accounting is a leading cloud-based accounting software for startups designed to help small and growing businesses achieve financial precision and scalability.

This accounting software for startups provides a comprehensive suite for core accounting, invoicing, and expense management. Its real-time reporting and analytics empower users with actionable insights, fostering informed decision-making. Sage 50 Accounting is an excellent choice for agile and data-driven entrepreneurs.

With multi-dimensional capabilities, it adapts to evolving business needs, offering robust project accounting and revenue recognition.

Key Features

- Cash flow management

- Automated bank reconciliation

- Job cost control via cost codes, unique records, and phases

- Purchase order monitoring

- Inventory management

- Cloud-based accounting for accessibility

- Unlimited reports on profits, expenses, and more

- Integration options for seamless workflows

Pros

- Cloud accessibility to support remote startup setups

- Automated core accounting processes

- Scalable solution for businesses of all sizes

- Comprehensive project accounting functionality

- Real-time reporting to enhance decision-making

- Robust revenue recognition capabilities

Cons

- Implementation may require time and resources

- You’ll pay more money than other accounting software for startups

- Steeper learning curve for new users

- Customization options may be too complex for some users

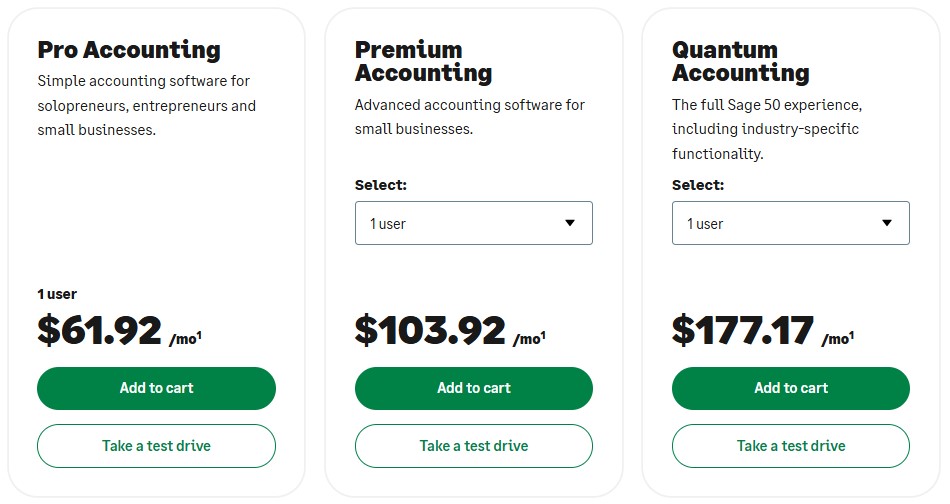

Pricing

Sage 50 Accounting has three plans. For the Premium and Quantum plans, the price increases as you add more users. Here is the pricing for 1 user:

- Pro: $61.92/month

- Premium: $103.92/month

- Quantum: $177.17/month

Image via Sage

Tool Level

- Intermediate

Usability

- Has a steeper learning curve

Also Read:

8. ZarMoney

Image via ZarMoney

ZarMoney is a comprehensive accounting software for startups that seamlessly integrate invoicing, inventory management, billing, and payment capabilities.

With a user-friendly interface, it simplifies the creation and customization of invoices, allowing convenient customer payments through a “pay now” option.

The platform’s advanced analytics and reporting features, offering over 40 customizable financial reports, empower businesses with insightful data, making it a strong contender as one of the top accounting software for startups.

Suited for both small and large enterprises, ZarMoney provides powerful tools while maintaining accessibility.

Key Features

- Invoicing and inventory management

- Customizable invoices with a convenient “pay now” option

- Advanced analytics and over 40 customizable reports

- Advanced role-based entry system

- Bank reconciliation

- Automated sales tax calculation

- Purchase and sales orders

Pros

- Comprehensive all-in-one accounting solution

- User-friendly interface for ease of use

- Premium plan with extensive features for enterprises

- Dedicated account representative for personalized assistance

- Specialized training and priority support for premium users

Cons

- May have a learning curve for new users

- Limited customization options for certain features

- Advanced features may require additional training

- Some startup founders may find the tool interface too simplistic

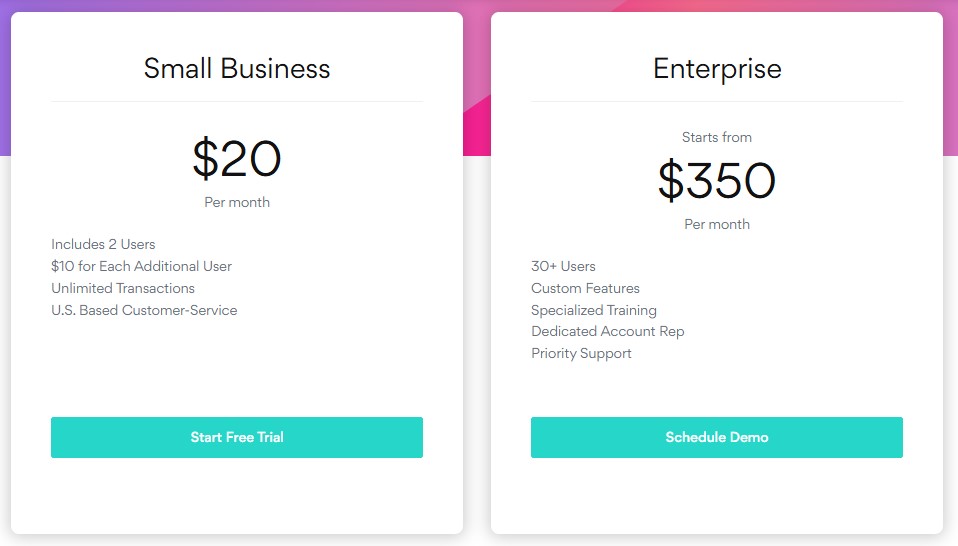

Pricing

- Small Business: $20/month

- Enterprise: $350/month

Image via ZarMoney

Tool Level

- Beginner

Usability

- Easy to use

9. AccountEdge

Image via AccountEdge

AccountEdge is a desktop accounting software designed for startups and small to medium-sized businesses.

Mentioned in the Forbes Best Accounting Software 2025 list, AccountEdge boasts that customers save an average of up to 55% compared to other accounting software for startups.

This desktop-based software streamlines core accounting solutions, including invoicing, expense tracking, and payroll processing.

AccountEdge ensures accuracy with cash management and provides detailed financial statements, providing insights into your company’s financial health.

Its multi-user capabilities facilitate collaborative financial management, while inventory tracking and management features enhance control over stock.

Key Features

- Invoicing and expense tracking

- Bank reconciliation

- Payroll management

- Pay employees by direct deposit or check

- Inventory management

- Job and budget tracking

- Multi-currency support

- Contact management

- Time billing

- Data management

- Connect from anywhere with AccountEdge Connect and Hosted

Pros

- Robust financial management for small to medium-sized businesses

- Desktop accessibility for offline use

- Multi-user capabilities to enhance collaboration

- Accurate inventory tracking to enhance stock control

- Flexible integration with various business applications

Cons

- Lack of a mobile app

- May have a steeper learning curve for new users

- Limited functions for cloud-based options than other accounting software for startups

- Limited scalability for larger enterprises

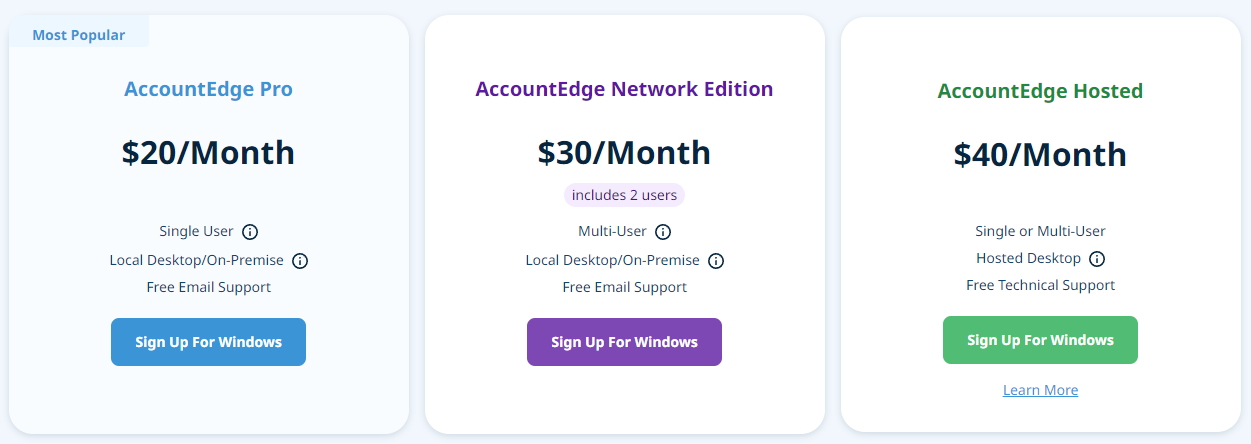

Pricing

- Pro: $20/month

- Network Edition: $30/month

- Hosted: $40/month

Image via AccountEdge

Tool Level

- Expert

Usability

- May have a learning curve for new users

10. OneUp

Image via OneUp

Boasting a 95% automation rate, OneUp is another stellar accounting software for startups and small businesses seeking streamlined financial operations.

Addressing the challenges of financial accounting for startups, OneUp excels in automation, significantly reducing the time invested in tasks like syncing with business bank accounts and validating entries effortlessly.

It also includes an automated inventory management tool that helps facilitate quick order reviews and seamless communication with suppliers.

Upon vendor shipment, real-time updates across Square and other integrations ensure accuracy.

What sets OneUp apart is that it offers a full set of features at an affordable price, making it an ideal and cost-effective accounting software for startups.

Key Features

- Full-cycle invoicing solution

- Periodical sales tax calculationBuilt-in email system

- Automated inventory management

- Bank reconciliation

- Cash flow statements

- Periodical sales tax calculation

- Integrated CRM

Pros

- Allows recurring invoices

- Affordable pricing for small businesses

- User-friendly interface for ease of use

- Cloud-based accessibility for convenience

- Available on mobile and desktop

- Offers identical features across multiple devices

Cons

- May lack some advanced features

- Limited scalability for larger enterprises

- Limited integration options compared to the other accounting software for startups

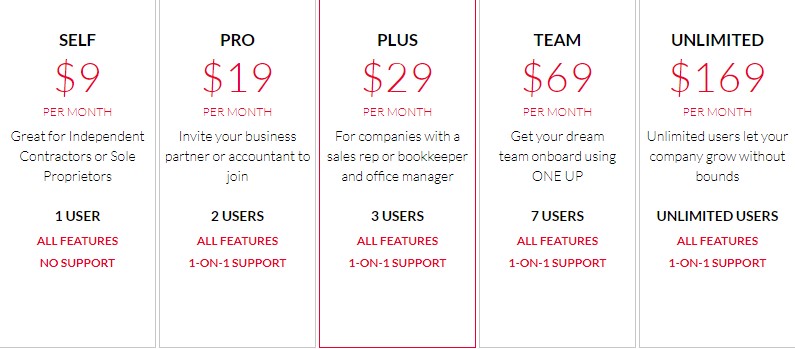

Pricing

OneUp offers a 30-day free trial that includes all features.

Aside from that, here are the pricing plans:

- Self: $9/month for 1 user

- Pro: $19/month for up to 2 users

- Plus: $29/month for up to 3 users

- Team: $69/month for up to 7 users

- Unlimited: $169/month for unlimited users

Image via OneUp

Tool Level

- Expert

Usability

- Easy to use

11. ZipBooks

Image via ZipBooks

ZipBooks is a free and user-friendly accounting software for startups designed to streamline financial management for businesses.

With an enduring free plan, users can send unlimited invoices, manage customers seamlessly, access basic reports, and connect to one bank account.

Easily create invoices that are professional and visually appealing. Efficiently track client payments, invoice history, and late balances.

This accounting software for startups doesn’t stop at bookkeeping; it provides actionable insights through detailed financial reports and analytics.

Affordable paid plans unlock additional features for enhanced functionality. ZipBooks empowers businesses with the tools they need to manage finances effectively and make informed decisions to unlock their growth potential.

Key Features

- Enduring free plan with unlimited invoices

- Expense management

- Customer management

- Bank connect and reconciliation

- Team management

- Time tracking

- Smart tagging

- Basic reporting for financial insights

- Client payment tracking

- Invoice history monitoring

- Integrated late balance and tax tracking

Pros

- Free starter plan for basic financial management

- Unlimited invoices and customer management

- Mobile app for on-the-go financial management

- Affordable paid plans with enhanced features

- User-friendly interface

Cons

- Lacks payroll management

- Basic customization options

- Unlike most accounting software for startups, ZipBooks has a steeper learning curve for advanced features

- Limited integration options

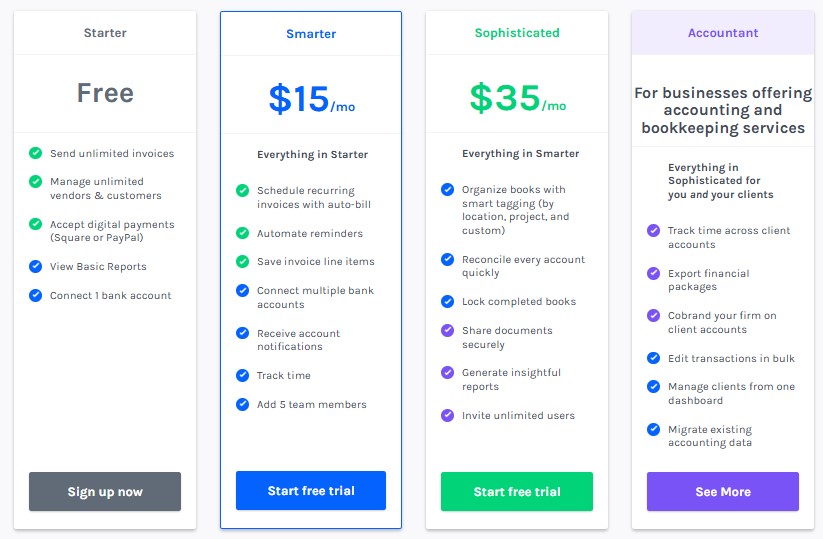

Pricing

- Starter: Free forever

- Smarter: $15/month

- Sophisticated: $35/month

- Accountant: Custom pricing

Image via ZipBooks

Tool Level

- Beginner

Usability

- Easy to use

Also Read:

12. Kashoo

Image via Kashoo

Kashoo is a powerful double-entry accounting software that redefines financial management for small businesses.

This cloud-based platform simplifies complex accounting processes, offering features like invoicing and bank reconciliation with ease.

Kashoo’s intuitive interface ensures accessibility for users with varying accounting expertise.

Users can effortlessly create and send professional invoices, track expenses, and reconcile bank transactions for accurate financial reports.

The software’s real-time reporting provides insights into business performance to help startups make informed decisions.

With affordable pricing plans, Kashoo emerges as an ideal accounting software for startups seeking efficient, user-friendly accounting tools that seamlessly adapt to their evolving financial needs.

Key Features

- Advanced accounting

- Automated accounting

- Simplified accounting

- Expense tracking and budgeting

- Invoice templates

- Connect to over 5,000 banks and credit unions in real-time

Pros

- Streamlined invoicing and expense tracking for lean startup operations

- Intuitive interface for easy navigation

- Real-time financial reporting

- Multi-currency support for global businesses

- Scalable to meet evolving business requirements

Cons

- May lack some advanced features

- Learning curve for new users

- Limited integrations with third-party apps

- Mobile app functionality may be basic

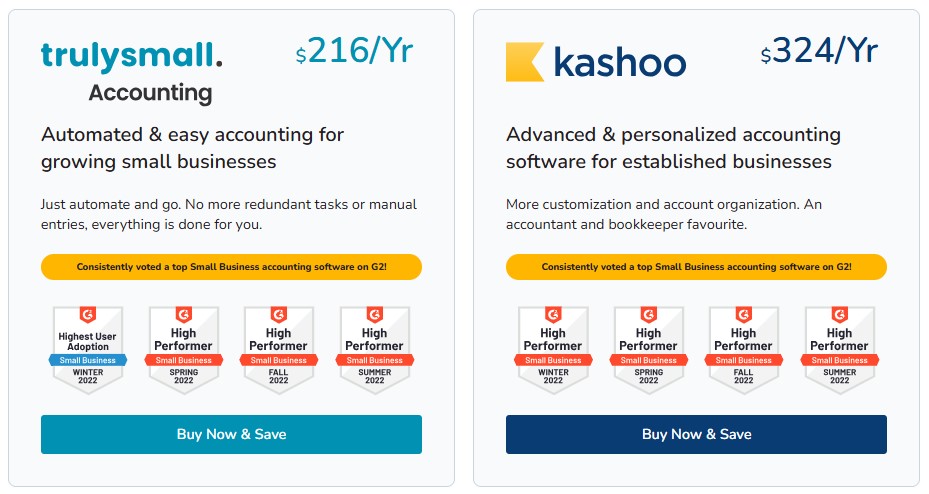

Pricing

Kashoo offers two pricing plans:

- Truly Small Accounting: $216/year

- Kashoo: $324/year

Image via Kashoo

Tool Level

- Intermediate

Usability

- Has a bit of a learning curve

13. Odoo

Image via Odoo

Odoo, a comprehensive business management suite, extends its prowess to accounting, delivering a seamless financial solution for enterprises.

This all-in-one accounting software for startups integrates core accounting features, including invoicing, expense tracking, and bank reconciliation.

Odoo’s modular structure allows businesses to customize their accounting setup to ensure scalability and adaptability to diverse financial needs.

The software’s real-time reporting capabilities provide valuable insights for strategic decision-making.

Odoo topples other accounting software for startups for its holistic approach, covering not only accounting but also other business aspects. It is ideal for organizations seeking an integrated solution that unifies financial processes with broader operational functionalities.

Key Features

- Smart AI matching

- Smart bank reconciliation

- Advanced invoice data capture powered by AI

- Integrated invoicing and expense tracking

- Automated bank reconciliation for accuracy

- Real-time financial reporting for insights

- Multi-currency support for global transactions

- Integration with other business modules

Pros

- Supports up to 28,000 banks

- Fast interface

- Provides customizable solutions for startups

- User-friendly interface ensures accessibility

- Cloud-based accessibility

Cons

- Complexity may pose a learning curve

- Customization may require technical expertise

- Possibly less intuitive interface for some users

- Limited customer support options for certain plans

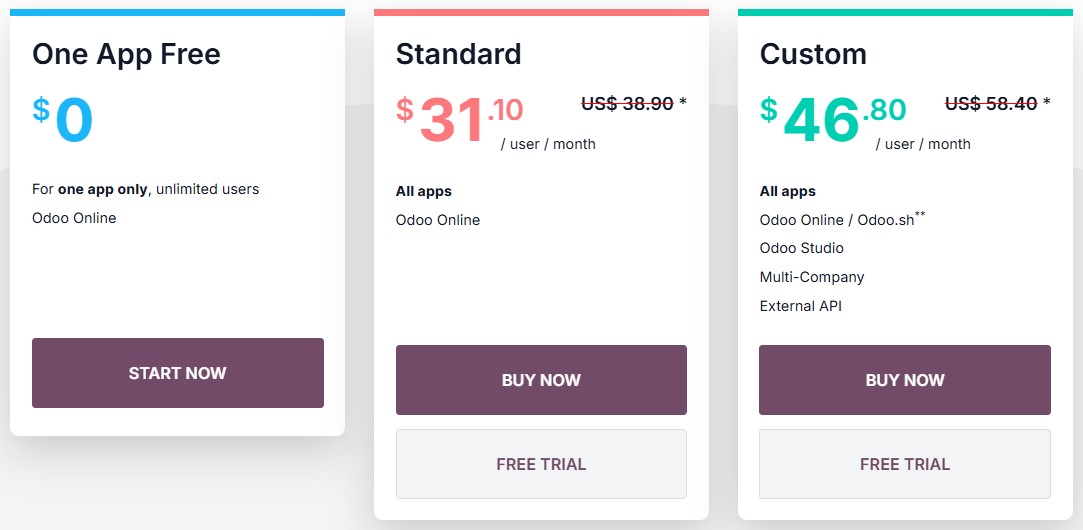

Pricing

Both Standard and Custom plans include all apps for one fee, including sales, marketing, accounting, HR, CRM, inventory, and more.

- One App Free: $0

- Standard: $38.90/user/month

- Custom: $58.40/user/month

Image via Odoo

Tool Level

- Beginner

Usability

- Easy to use

Also Read:

14. ClearBooks

Image via ClearBooks

ClearBooks is the UK’s leading dynamic accounting software for startups, supporting over 15,000 small businesses. It’s also crafted to streamline financial management for businesses of all sizes.

A user-friendly platform, ClearBooks allows users to enjoy the benefits of cloud-based accounting, simplifying complex accounting tasks through invoicing, expense tracking, and bank reconciliation features.

ClearBooks goes beyond standard bookkeeping. It provides real-time reporting for actionable insights into business performance.

Key Features

- Expense tracking

- Bank reconciliation

- Real-time reporting

- Multi-currency support for global transactions

- CIS accounting

- Payroll management

- Automated VAT returns for compliance

- Integration with various business applications

Pros

- Cloud-based accessibility for flexibility

- Streamlined invoicing and expense tracking to minimize errors

- User-friendly interface to ensure accessibility

- Simplified compliance through automated VAT returns

Cons

- The refunds and credits system is somewhat hard to understand

- Some reports need some work

- Pricier than most accounting software for startups

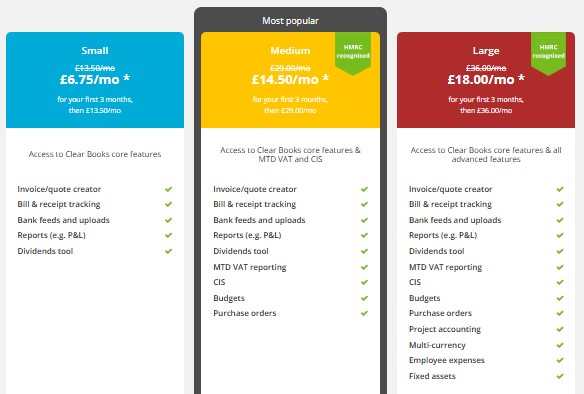

Pricing

- Small: $14.17/month (£6.75/month)

- Medium: $30.43/month (£14.50/month)

- Large: $37.78/month (£18.00/month) 78/month

* Euro/dollar exchange rate: $1.05

Image via ClearBooks

Tool Level

- Intermediate/Expert

Usability

- Has a bit of a learning curve

15. Patriot

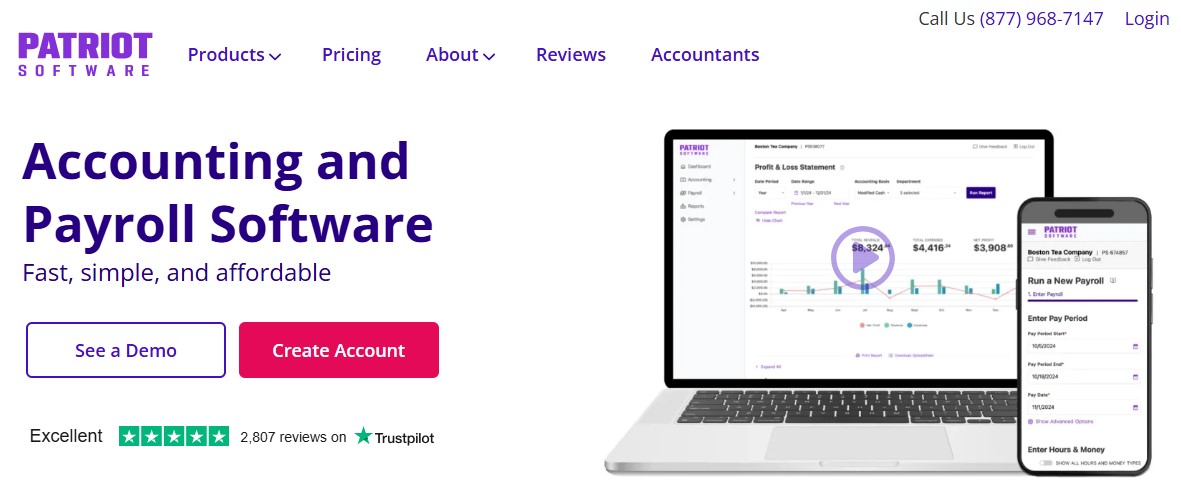

Image via Patriot

If you need reliable and easy-to-use accounting software for startups, Patriot is an ideal choice.

With a user-friendly interface, Patriot simplifies accounting and payroll tasks, such as invoicing, expense tracking, bank reconciliation, financial reporting, payroll processing, and ensuring compliance with tax regulations.

True to its innovative nature, Patriot also owns the patent on toggling between accrual and cash-basis accounting.

Although it doesn’t provide a mobile app, Patriot’s 100% cloud-based accounting platform enhances accessibility. It allows users to manage their finances anytime, anywhere.

On top of accounting and payroll, users can add time and attendance tracking and HR features.

Key Features

- Unlimited invoicing

- Expense tracking

- Bill payments

- Financial reporting

- Bank reconciliation

- Toggle between accrual and cash-basis accounting

- Customizable payroll

Pros

- All USA-based customer support

- Provides a 30-day free trial

- No training required

- Unlimited users

Cons

- Doesn’t have a mobile app

- Customer support can sometimes take a while to respond

- Limited integrations

- It’ll cost you more money than other accounting software for startups on this list

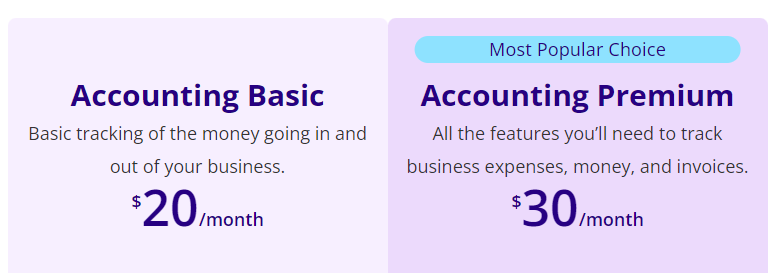

Pricing

Patriot offers a 30-day free trial.

- Accounting Basic: $20 per month

- Accounting Premium: $30 per month

Image via Patriot

Tool Level

- Beginner

Usability

- Easy to use

Also Read:

16. Synder

Image via Synder

Synder is a versatile accounting software for startups, particularly those engaged in ecommerce and multi-channel sales. Designed to simplify financial management, Snyder streamlines bank transactions, expense tracking, and invoicing, saving you time while ensuring financial accuracy.

Send invoices efficiently and generate accurate expense reports with Synder’s robust accounting automation features. Additionally, integrating this accounting software with multiple platforms saves you time, allowing you to focus on growing your client base

Key Features

- Automated bank transaction tracking and reconciliation

- Customizable invoice templates

- Expense tracking and receipt uploads

- Real-time financial reporting and analytics

- Multi-currency support

- Integration with third-party apps

- Payroll management

Pros

- Simplifies complex accounting tasks

- Reduces manual data entry through accounting automation

- Provides accurate expense reports

- Enhances cash flow management

- Offers scalability to support business growth

Cons

- Higher pricing than other accounting software for startups

- Additional costs for premium integrations

- Limited customization options for advanced reporting

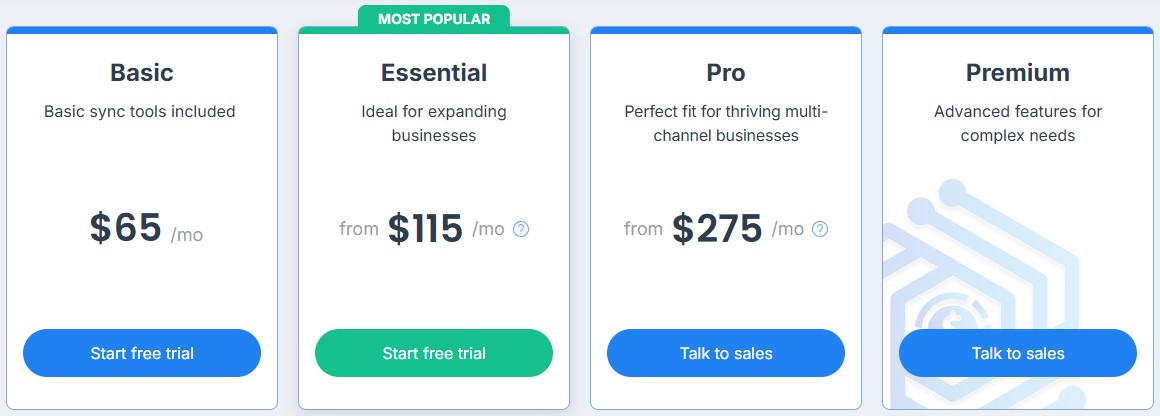

Pricing

- Basic: $65/month

- Essential: $115/month

- Pro: $275/month

- Premium: Custom

Image via Synder

Tool Level

- Beginner

Usability

- Easy to use

17. FreeAgent

Image via FreeAgent

FreeAgent is a robust accounting software for startups, small companies, and freelancers. It offers a comprehensive suite of tools to handle bank transactions, expense reports, and invoicing, making it a top choice for many startups looking to save time and streamline their finances.

FreeAgent automatically imports and categorizes bank transactions, keeping your books up to date. It also allows you to send invoices, track expenses, and generate detailed financial reports, all from one intuitive platform.

With its user-friendly interface and robust features, FreeAgent has become an industry standard accounting software for startups and small businesses. It’s particularly popular among accounting firms and freelancers who need a reliable solution to manage their client base efficiently.

Key Features

- Automated bank transaction tracking and reconciliation

- Send invoices directly

- Expense tracking and receipt uploads for accurate expense reports

- Project time tracking and profitability analysis

- Tax management tools

- Multi-currency support

- Integrates with CRMs, payment solutions, banking and bank feeds, ecommerce, and more

Pros

- Saves time with accounting automation and intuitive workflows

- Comprehensive invoicing and expense tracking features

- Real-time financial insights to help you make informed decisions

- Scalable with your business and client base

- Excellent customer support and resources

Cons

- No payroll feature for businesses outside the UK

- Limited customization for advanced reporting

- No free plan

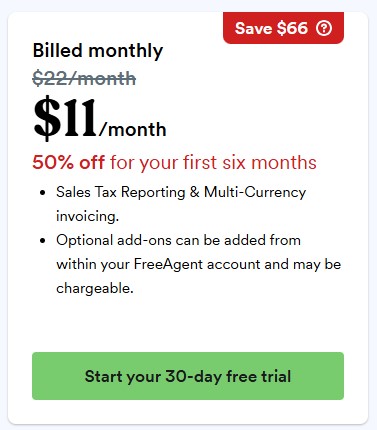

Pricing

FreeAgent offers a 30-day free trial, followed by an $11 monthly pricing.

Image via FreeAgent

Tool Level

- Beginner

Usability

- Easy to use

Also Read:

FAQ

1. Which accounting tools are best for startups?

The best accounting software for startups varies depending on the company’s specific needs. However, these are our top five picks based on certain criteria.

- Zoho Books: Tailored for accountants needing seamless mobile access

- QuickBooks: Recognized as the best overall solution, suitable for various business types

- Xero: Offers exceptional value, particularly beneficial for micro-businesses

- FreshBooks: Known for its user-friendly interface and straightforward accounting

- Wave: The go-to free accounting software for small businesses

2. What essential features define the best accounting software for startups?

The best accounting software for startups should include core accounting and general ledger functionality, invoicing capabilities, bank reconciliation, multi-currency support, expense tracking, and financial reporting features. These features are necessary for almost every startup business.

3. Which accounting tools are mostly used by startups?

QuickBooks, Xero, and FreshBooks are frequently embraced by startups for their user-friendly interfaces, robust features, and scalability.

4. Is QuickBooks a good accounting tool for startups?

Yes, QuickBooks is a widely used and trusted accounting tool for startups.

Its user-friendly interface, comprehensive features, and scalability make it an excellent choice for managing the financial aspects of a startup business.

5. Which startup accounting software is the easiest to use?

FreshBooks is known for its user-friendly design. Its intuitive interface simplifies accounting tasks, catering to users with varying levels of financial expertise. Even non-accounting experts can easily figure out how to use FreshBooks.

6. Are free accounting software for startups as effective?

Yes, they are. Startups can initially rely on free accounting software like Wave to handle their basic accounting needs effectively. However, as the business expands, they may need to upgrade to a paid plan to unlock advanced features, such as payroll processing and inventory management.

7. How does accounting software help startups save time?

Accounting software for startups automates repetitive tasks like bank transaction reconciliation, invoicing, and expense reports, reducing manual effort and errors. The founders can then focus more on strategic tasks and less on spreadsheets.

8. Is cloud-based accounting software better for startups?

Yes, cloud-based accounting software options are ideal for startups because they offer flexibility, remote access, and automatic updates. Plus, they require less expensive on-premise hardware, making them cost-effective for small companies.

Also Read:

Final Thoughts

Accounting is one of the most important aspects of the journey of a startup, particularly during the early stages. It ensures financial health, regulation compliance, and strategic decision-making according to reports and analytics.

Startups may not be able to afford an accountant or bookkeeper yet. This is where the accounting software for startups comes in handy. It can help streamline and simplify this crucial process.

We’ve highlighted the 17 best accounting software for startups in 2025 that we believe offer a diverse range of features catering to the specific needs of startups.

Remember to identify your startup needs and utilize the free trial before fully committing to a platform. We wish you luck as you embark on this exciting financial management journey for your startup!