Bookkeepers do an important job when it comes to tracking the money flowing in and out of your business. They use full cycle accounting to paint a complete picture of your finances during an accounting period.

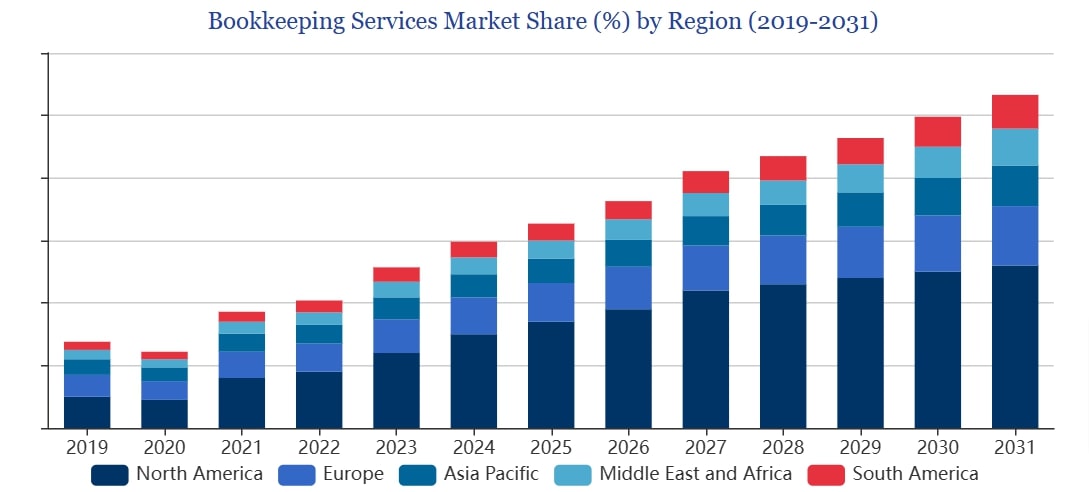

No wonder bookkeeping services are in great demand. The numbers speak for themselves. The Global Bookkeeping Services Market Report 2024 projects that the bookkeeping service market will see significant growth in the next 7 years.

Image via Cognitive Market Research

As a small business owner, full-cycle accounting might seem overwhelming at first. However, understanding these numbers is crucial to gaining a clear picture of your company’s financial health and setting goals for your future.

This article aims to help you understand the full cycle accounting process and how to execute it effectively.

Let’s get started.

What is Full Cycle Accounting?

Full cycle accounting refers to the comprehensive process of managing all financial activities within a specific accounting period, such as a fiscal year.

This process includes documenting, summarizing, analyzing, and reporting all transactions during the accounting cycle.

A company’s accounts team performs various tasks, including translations, financial statement generation, and quarter-end book closing. While manual full cycle accounting can be laborious, small businesses can use top accounting software to sustain overall efficacy.

The complexity and duration of full cycle accounting depend on several factors, including the volume of transactions, their sources, and the tools used. Additionally, the type of financial close, such as monthly, quarterly, or annual, also plays a significant role.

When you nail the entire full cycle accounting process, you’ll find it easier to streamline business finances. Plus, it helps keep you in compliance with financial and tax regulations and, best of all, empowers you to make smarter decisions for your business.

You May Also Like:

Key Components of Full Cycle Accounting

The full cycle accounting components may vary slightly depending on the full cycle account structure. However, here are the key elements of full cycle accounting to include in your company’s financial statement for comprehensive reporting.

Accounts Payable

Every dollar your business spends gets tracked in accounts payable. This includes all the money you owe to suppliers, vendors, and service providers.

Staying on top of your bills isn’t just good practice, it’s essential for building strong relationships with your vendors and keeping your reputation solid.

Better still, when you pay on time, you might snap up early payment discounts that’ll ultimately help you reduce costs and improve cash flow.

Using the best accounting software, you can track your outstanding bills and generate reports. This smart approach to full cycle accounting helps you monitor cash flow, plan ahead for financial needs, and spot ways to save.

The good news is that most modern accounting software solutions offer automation features for scheduling payments, setting up alerts for due dates, and syncing with bank accounts.

Accounts Receivable (AR)

AR is an important part of the general ledger, which is equally vital to the full cycle accounting process. It accounts for all the money customers owe your business when they purchase goods or services on credit.

Maintaining AR ensures healthy cash flow and smooth business operations. Here are some tips for proper AR management for efficient full cycle accounting:

- Send automated invoices promptly after delivering goods or services, and include all necessary details such as due date, payment methods, and contact information.

- Use accounting software to generate aging reports, which help you identify overdue accounts early and take proactive measures.

- Send automated reminders for upcoming due dates or overdue payments.

- Establish and communicate clear credit terms to customers before any transactions occur.

Revenue Cycle

The revenue cycle kicks off when a customer places an order and wraps up when the payment is received and the return window is closed.

Getting this cycle right allows you to accurately track and recognize income according to accounting standards and get a clear picture of profitability.

Let’s break down what’s included in this key element of full cycle accounting:

- Sales Order Processing: Capturing, verifying, and processing customer orders.

- Billing: Generating invoices that accurately reflect the order details, including itemized charges, taxes, and total payment due.

- Credit Management: Evaluating a customer’s creditworthiness, implementing credit policies, and developing a standardized process for following up on overdue accounts.

- Revenue Recognition: Recognizing revenue only when goods or services are delivered and performance obligations are met, per accounting standards.

- Record Reconciliation: Reconciling payments received with invoices issued to ensure all revenue is accounted for accurately.

Payroll Processing

This weekly or monthly process in full cycle accounting ensures employees receive their salaries on the given payday. It involves calculating wages, withholding taxes, and ensuring compliance with labor laws.

Getting payroll right is a key part of the full cycle accounting process, as it ensures legal compliance while keeping employees satisfied. It will also help you streamline tax reporting, budgeting, and cash flow management.

Here are some tips to simplify payroll processing and streamline full cycle accounting:

- Set up secure and efficient direct deposit systems for timely payment. For physical checks, ensure they are prepared and delivered on time.

- Provide detailed pay stubs showing earnings, deductions, and gross pay for transparency.

- Create an audit trail for every payroll transaction to facilitate reviews and compliance checks.

Bookkeeping

Bookkeeping involves keeping a record of all the financial transactions in an accounting cycle. You can automate this part of the full accounting process and enjoy the benefits of an accounting solution.

When you automate your bookkeeping tasks, you’ll find it easier to keep your data organized, breeze through tax preparation, and reduce the risk of errors during audits.

You May Also Like:

Tax Preparation

Well-defined tax preparation is a vital aspect of full cycle accounting. It’s necessary to ensure your business complies with the tax regulations in your state while minimizing tax deductions. This helps you pay taxes and file timely returns to maintain good credit records.

Accurate tax preparation in full cycle accounting minimizes the risk of audits, penalties, and legal issues. This is achieved by ensuring all tax-related information is thoroughly documented and reported correctly.

Important Steps in an Accounting Cycle

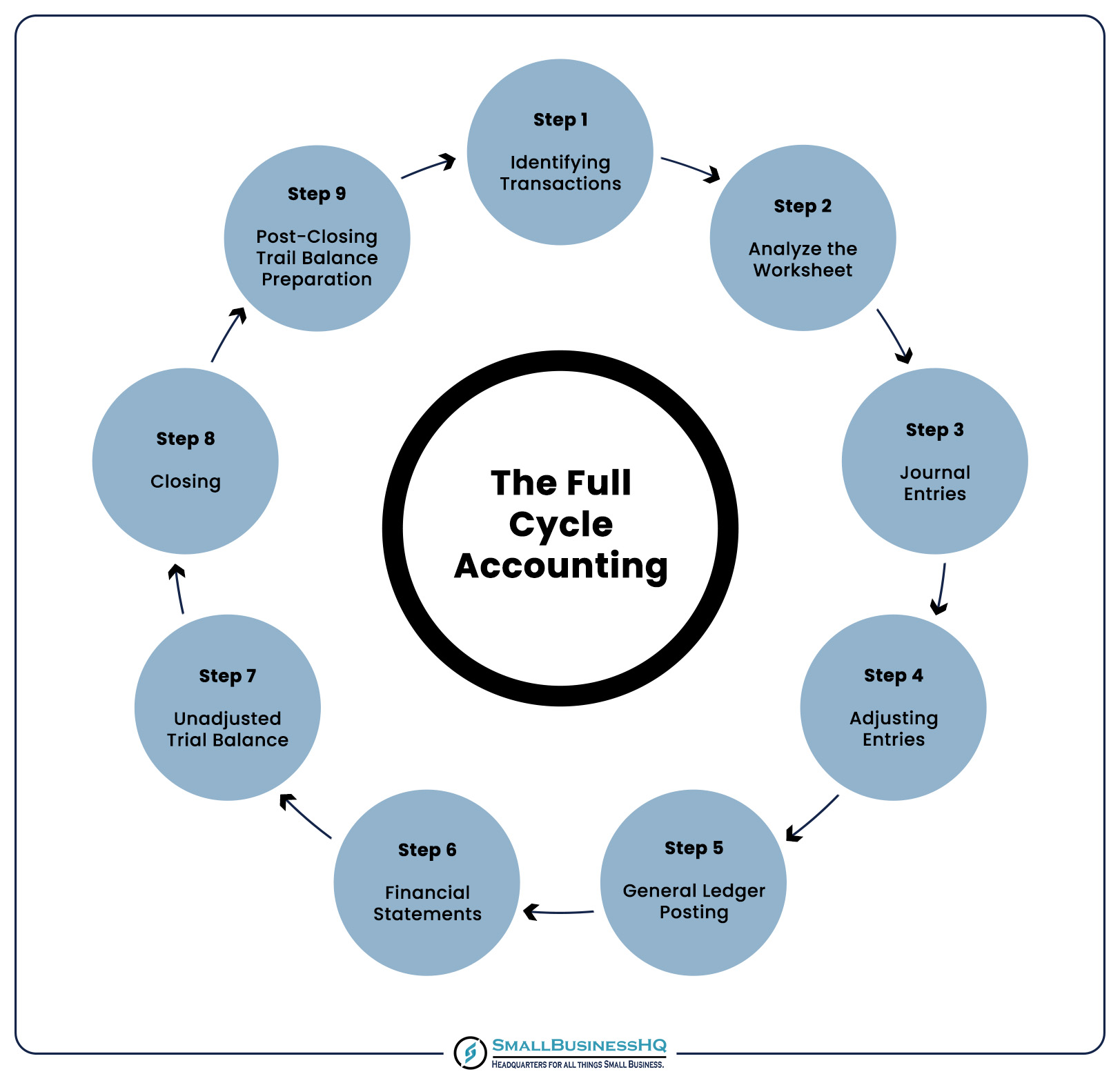

The goal of full cycle accounting is to ensure accounting accuracy and transparency. Follow these 9 core steps when manually using an accounting tool for a small business or conducting a financial accounting cycle.

Let’s discuss the 9-step accounting cycle you should follow to evaluate your company’s financial position.

Step 1: Identifying Transactions

The full cycle accounting process begins with identifying all business transactions within a specific accounting period.

Your small business may have one or more capital, financial, revenue, and expense accounts consisting of various financial transactions that you did during an accounting cycle.

Here’s what counts as business transactions in full cycle accounting:

- Revenue Transactions: Sales, service income, or royalty income

- Expense Transactions: Rent, utilities, salaries, or supplies

- Capital Transactions: Owner investments or withdrawals

- Financing Transactions: Loans obtained or repaid

For events to qualify as financial transactions, they must be measurable in monetary terms and directly impact your company’s financial position.

There must also be verifiable evidence recording transactions, such as purchase orders, receipts, invoices, or contracts.

Think about it this way. If you sell a product for $200, that’s a financial transaction because you can see the money move and track how it boosts your revenue. Hiring someone new, however? That’s not a financial transaction until you start paying them.

This step ensures that your full cycle accounting records capture all relevant financial data, making it possible to track and analyze your business’s financial activities. Linking your accounting software with point-of-sale systems can further streamline this process.

Once you recognize the financial transactions, you can label them as rent payoffs, utility expenses, purchase of assets, employees’ salaries, and sales revenue. They are the foundation for the full cycle accounting process and are crucial in creating your balance sheet.

Step 2: Journal Entries

The next step in full cycle accounting is organizing your business transactions by making journal entries.

These entries are the first formal record of your company’s financial transactions in an accounting period that capture all the necessary details to ensure accurate financial statements.

Whether you make entries manually in a book or use an accounting program, make sure you’re recording everything in chronological order. This gives you a clear timeline of your financial activity and helps you track business transactions easily.

Most businesses prefer a double-entry accounting method while recording transactions in journal entries for the full cycle accounting procedure.

It involves at least two accounts, where you record each transaction as a debit in one account and a credit in another to balance the accounting equation.

Let’s say you’ve got a subscriber paying a $199 monthly fee. In your books (during full cycle accounting), this shows up as a $199 debit in the AR sub-ledger and a $199 credit in your revenue account.

You can use a good SaaS accounting solution to streamline journal entries.

Here are the different types of journal entries you can make depending on your business needs and the stage of your accounting cycle:

- Simple Entries: These involve only two accounts—one debit and one credit

- Compound Entries: These are entries you make for complex transactions involving multiple accounts.

- Adjusting Entries: You make these entries at the end of an accounting period to account for accrued revenues, prepaid expenses, depreciation, or other timing differences.

- Closing Entries: You use these entries at the end of the full cycle accounting process to close temporary accounts. For instance, changing revenue and expense accounts into permanent ones like retained earnings.

You May Also Like:

Step 3: General Ledger Posting

Now that you’ve got your journal entries set, let’s move to the next step in the full cycle accounting process: posting entries in the general ledger.

Just like the journal, your general ledger works with debit and credit sides, bringing together all your accounts’ financial transactions.

The general ledger contains respective accounts for each asset, liability, equity, revenue, and expense. The organized double-entry bookkeeping system helps spot discrepancies and ensures that the accounting equation remains balanced.

Follow these steps to post all the financial transactions in your general ledger correctly:

- Identify Journal Entries: Review financial transactions recorded in the journal and identify accounts to be debited and credited along with their corresponding amounts.

- Locate Corresponding General Ledger Accounts: Identify the appropriate general ledger accounts for each financial transaction.

- Transfer Amounts: Transfer debit and credit amounts from the journal to the corresponding accounts in the general ledger.

- Update Account Balances: Calculate and record new account balances after each posting.

- Reference the Journal: Include the journal page number in the general ledger account for easy tracing and reconciliation.

The general ledger summarizes your company’s financial transitions in a particular accounting cycle.

Creating a master record is a crucial step in the full cycle accounting process. It lays the groundwork for preparing essential financial statements, including the balance sheet, income statement, and cash flow statement.

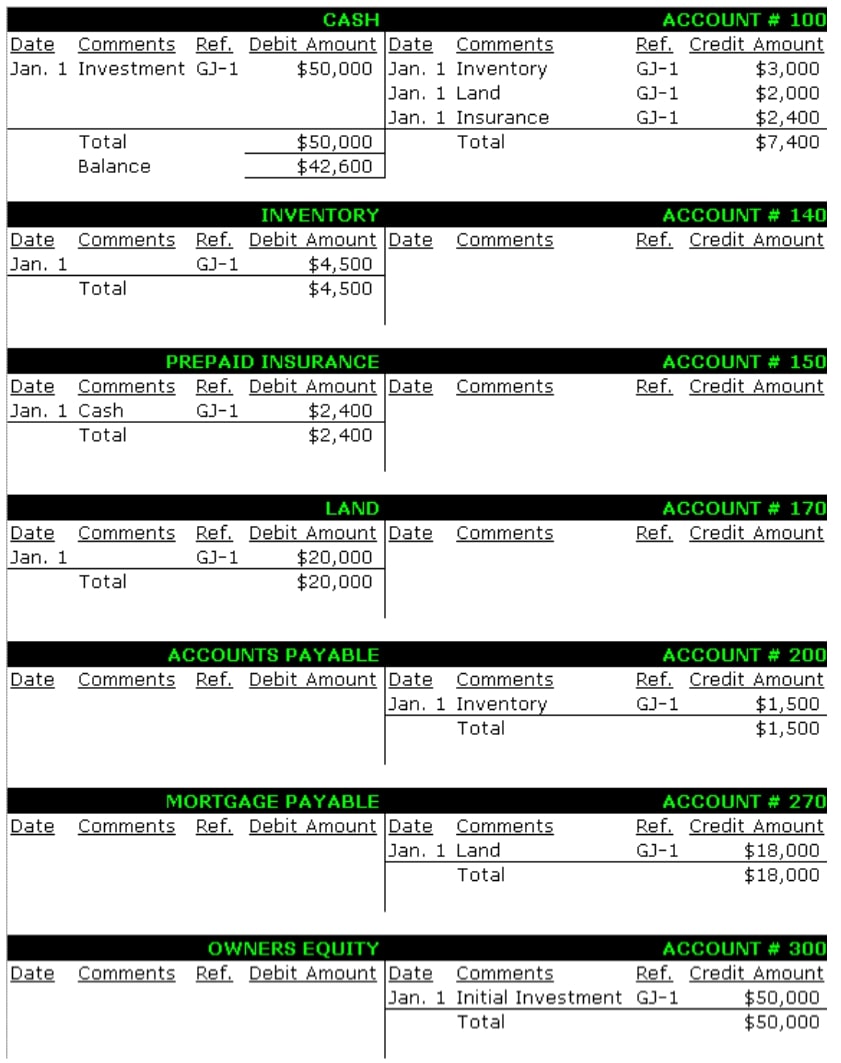

Here is an example of how a simple general ledger posting looks:

Image via Business Accounting Guides

Step 4: Unadjusted Trial Balance

We now move from record-keeping to analysis in the full cycle accounting process. An unadjusted trial balance lists the account closing balances from the general ledger at the end of an accounting period, before any adjustments.

The unadjusted trial balance is vital in full cycle accounting since it serves as a starting point for identifying and making necessary adjusting entries.

These changes ensure that your financial statements accurately reflect your company’s financial performance and position.

The trial balance plays a vital role in the full cycle accounting process. It helps identify discrepancies in journal entries or unbalanced debits and credits, ensuring accuracy and reliability.

Some common errors you might detect in your trial balance include:

- Transposition Errors: Reversing digits, e.g., recording $1,200 as $2,100.

- Omitted Transactions: Failing to post a journal entry to the general ledger.

- Double Posting: Recording the same financial transaction twice.

- Reversed Entries: Accidentally debiting an account that should have been credited, or vice versa.

Your accounting team can fall back on this list if there are errors while preparing financial statements for the full cycle accounting period. For example, if you use an ecommerce accounting tool for bookkeeping, you can skip this step as the software will automatically tally the closing balances.

If you’re doing things old school with a manual accounting system, here’s how to create an unadjusted trial balance for the full cycle accounting period:

- List All Accounts: List all accounts from the general ledger, preferably in a specific order (assets, liabilities, equity, revenues, expenses).

- Record Balances: Enter the ending balance of each account in the appropriate debit or credit column.

- Calculate Totals: Add up the totals of the debit and credit columns from the general ledger accounts separately.

- Verify Balance Equality: Confirm that the total debit balances equal the total credit balances in the general ledger accounts.

You May Also Like:

Step 5: Analyze the Worksheet

The next step in the full cycle account process is a crucial one. Your worksheet bridges the gap between raw numbers and polished financial statements. It provides a clear overview of the accounting cycle, minimizing errors when preparing financial statements.

Analyzing the worksheet helps you spot discrepancies in the unadjusted trial balance and ensure all accounts are accurately classified.

It also simplifies the preparation of key financial statements, including the income statement, balance sheet, and statement of retained earnings. This is achieved by categorizing accounts into revenue, expenses, assets, liabilities, and equity.

If and when a bookkeeper recognizes discrepancies in the unadjusted trial balance, they must analyze the worksheet to identify errors.

They’ll need to backtrack through journal entries to find where things went sideways. Mostly, they’ll need to check the translation data and spot the anomalies to streamline the full cycle accounting process.

What’s more, bookkeeping for small businesses also involves suggesting corrective adjustments to balance the numbers in the trial balance accurately.

It streamlines the trial balance adjustment process by providing a clear format for recording changes and calculating adjusted balances. Additionally, it helps segregate accounts for reporting purposes.

By carefully analyzing the worksheet, you can ensure the accuracy of your financial reporting and make informed business decisions.

Step 6: Adjusting Entries

Now, it’s time to adjust discrepancies and fix errors in the full cycle accounting process. Adjusting journal entries ensures accurate financial reporting and compliance with accounting standards.

It is common to encounter inaccuracies when you have numerous business transactions flowing from one accounting cycle to another.

To address this, your accounts team will make adjusting entries to capture any unrecorded transactions from the current quarter. They include:

- Accruals: These include revenues earned but not yet paid or recorded, as well as expenses incurred but not yet paid or recorded. They are categorized as accrued expenses and accrued revenues in the adjusted trial balance.

- Deferrals: These are expenses paid in advance but not yet used or consumed, such as prepaid rent. They also include revenues received in advance but not yet earned.

- Depreciation: This involves spreading the cost of physical business assets over their useful lives, like recording depreciation for office equipment.

- Inventory Adjustments: These are changes to inventory values to account for shrinkage, damage, or obsolescence.

Adjusting entries ensures that your accounting team records income and expenses in the correct accounting period to reflect the true financial position of your business.

What’s more, adjusting entries aligns your financial statements with full cycle accounting standards.

When adjusting entries, be sure to keep a clear record of all adjustments, including calculations and supporting documents. If you’re self-employed, you can use accounting software to automate adjustments and minimize errors when posting the adjusted trial balance.

Step 7: Financial Statements

With your accounts up-to-date, you’re now ready to move to the next stage of full cycle accounting: preparing financial statements.

These statements summarize your company’s financial performance during a specific accounting period, such as quarterly or monthly.

Preparing financial statements is vital to full cycle accounting since these reports provide insights into your company’s financial health. They also help gauge the effectiveness of operational and financial strategies in the long term.

Your business may generate any one of these four common financial statements during the full cycle accounting process:

- Balance Sheet: A detailed overview of your business’s assets, liabilities, and equity shares, evaluating its financial health.

- Cash Flow Statement: Tracks cash movement in and out of the organization, juxtaposing revenue generation with business expenditures.

- Income Statement: This full cycle accounting financial statement is also called a profit and loss statement. An income statement reports all the income and expenditures in cash and credit forms in an accounting cycle.

- Statement of Retained Earnings: Outlines changes in retained earnings for a specific accounting period, representing the portion of net profits reinvested in the company.

You May Also Like:

Step 8: Closing

After preparing financial statements, the next step in the full accounting cycle process is closing the existing revenue and expense accounts before you begin the next accounting cycle.

This essential step in full cycle accounting ensures that revenues, expenses, and dividends (if applicable) are only associated with the current accounting period.

Closing temporary accounts ensures that these accounts start with a zero balance in the next accounting period. This, in turn, allows for accurate recording of new business transactions.

You’ll need to record the balance and transfer temporary account balances to a permanent account. Once you’re done, set the temporary accounts to zero to prepare them for the next full cycle accounting process.

Here’s how to close your temporary accounts and set them up for the next accounting period:

- Transfer all revenue account balances to the income summary account.

- Transfer expense account balances to the income summary account.

- Transfer the income summary account balances to the retained earnings account.

Step 9: Post-Closing Trial Balance Preparation

The final step in the full cycle accounting process is preparing a post-closing trial balance.

This last full cycle accounting procedure ensures that the ledger is ready for the next accounting period and that all temporary accounts have been properly closed.

It also reinforces the principles of the double-entry bookkeeping system and helps maintain the integrity of the financial records made throughout the entire process.

The post-closing trial balance is a list of all permanent accounts and their balances after making the closing entries in full cycle accounting.

Unlike previous trial balances that include temporary account balances, the post-trial balance only contains permanent accounts categorized into:

- Assets: Cash, Accounts Receivable, Inventory, Property

- Liabilities: Accounts Payable, Notes Payable, Bonds Payable

- Equity: Common Stock, Retained Earnings Account

A fit-for-purpose accounting software solution can help you generate a post-closing trial balance list. This can come in handy for maintaining your general ledger and planning your business’ financial activities for the next accounting period.

However, if you don’t have an accounting software solution, follow these steps to create a post-trial balance using your manual accounting system:

- Prepare a list of all permanent ledger accounts along with their balances.

- Record the ending balance of each account in the appropriate debit or credit column.

- Calculate the total debits and credits.

- Ensure that the total of all debit balances equals the total of all credit balances. If they don’t, it indicates an error in the closing process that needs correcting.

You May Also Like:

FAQ

1. What are the four phases of accounting?

The four vital phases of accounting are:

- Recording

- Classifying

- Summarizing

- Interpreting

The four fundamental building blocks help a bookkeeper to analyze financial data and generate reports.

2. What does a full cycle bookkeeper do?

A full cycle bookkeeper maintains the comprehensive full cycle accounting process. He will systematically record, organize, and analyze financial transitions in an accounting period to provide a realistic picture of a company’s financial position.

3. What is considered full cycle payroll?

A payroll cycle in full cycle accounting refers to the frequency of payment an employee receives. A full cycle payroll occurs when an employee is paid his salary on the designated payday every month.

4. Why should you use accounting software?

Some of the core advantages of using accounting software for small businesses are:

- Saves time

- Organizes and syncs financial data effectively

- Generates financial reports in a quick time

- Ensures data accuracy

- Streamlines tax filing

5. What is the difference between accounts payable and receivable?

These terms are the two ends of your company’s financial statement in full cycle accounting. Account payable represents the amount you must pay others, including various bills, salaries, and other expenditures. Accounts receivable represents the payments owed to your company by clients and customers.

You May Also Like:

Conclusion

Full cycle accounting, in a nutshell, is the process of tracking, organizing, and reporting your company’s financial transitions in an accounting period. It ensures improved financial accuracy and provides you with quality insights to make more informed business decisions.

Go ahead and implement full cycle accounting in your business and maintain your company’s financial health.