More people are buying iOS computers for their many benefits, with one of the standout features being seamless integration across various business platforms. However, despite their impressive performance, finding the right accounting software for Macs can be challenging.

For a start, Macs aren’t as heavily adopted by businesses as Windows. So, finding reliable accounting software for the macOS platform isn’t as easy as Windows.

Additionally, the limited accounting software options that are compatible with Mac tend to be expensive. This can discourage small businesses and startups from switching to the macOS ecosystem.

The good news is that supply is meeting the demand, and Mac users now have multiple good accounting software options.

Each of these software provides essential accounting features like invoicing and inventory management. And here, we’ll look at their pros and cons to help you make an informed decision.

Let’s get to it!

Quick Summary: Best Accounting Software for Macs by Type

- Best Tools with Free Trial or Free Plan: Kashoo, Odoo, FreshBooks, Zoho Books, Wave Accounting, KashFlow, ZipBooks

- Best for Inventory Management: Oracle NetSuite, Sage Intacct, Xero, QuickBooks Online, AccountEdge

- Best for Growing Businesses: Sage Intacct, KashFlow, Xero, QuickBooks Online, Oracle NetSuite, ZipBooks

- Best for Freelancers and Solopreneurs: Odoo, Neat, Kashoo, Zoho Books, Wave Accounting, FreshBooks, AccountEdge

- Best for Invoicing: KashFlow, Kashoo, QuickBooks Online, Zoho Books, FreshBooks, ZipBooks

How We Chose the Best Accounting Software for Macs

You need to consider different factors when choosing the right accounting software for Macs. Hence, we carefully checked the factors below to compile this list.

- Pricing: Affordability is an important factor for businesses, especially for startups and small businesses. So, our list of accounting software for Macs contains platforms with free trials and scalable pricing tiers that fit different needs and budgets. The price of these accounting solutions varies depending on different factors.

- Core Accounting Features: The accounting software for Macs on our list can handle core ecommerce accounting capabilities like reporting, expense and income tracking, and invoicing. They also provide features like collaboration tools, mobile apps, and bank reconciliation.

- User Base: Business accounting needs vary by size. For example, a small business would need accounting software for Macs to include features for tracking expenses and invoicing. So, in our list, we included accounting software solutions that cater to freelancers, small businesses, and large enterprises.

- Ease of Use: We aim to recommend easy-to-use accounting software for Macs. That’s why we assess each platform’s user-friendliness, ease of navigation, and accessibility, especially for bookkeeping beginners.

- Customer Support: Having excellent and knowledgeable customer support ensures the software’s smooth integration into your workflows. Hence, we’ve curated accounting software for Macs that provides responsive customer support, consistent training, and onboarding assistance.

- Data Security: Data security is a priority when handling sensitive information like your financial details. So, we focused on accounting software for Macs that provide data backups and encryption to mitigate this risk of data breaches or loss.

- Integration Capabilities: Seamless integration with your existing tools is important in ensuring there’s no disruption to your business operation. That’s why we looked at accounting software that integrates seamlessly with popular business services to improve your overall process efficiency.

- Customization: We considered accounting software for Macs that allow customizations. They allow you to create workflows and accounting reports according to your specific requirements or needs.

- Third-Party Reviews: We took a look at popular third-party review sites with real user reviews, like Capterra, G2, and Trustpilot. This helped us to gauge users’ opinions of each accounting software for Macs.

13 Best Accounting Software for Macs

We have a ton of accounting software for Macs on the market. That’s why it can often get overwhelming to choose the right one.

Not to worry though! We’ve helped simplify your decision-making process by highlighting the top 13 accounting software for Macs in 2025.

We’ll explore their key features, pros, and potential drawbacks. This way, you can save time testing different solutions and quickly find a solution that fits your requirements.

That said, here are the best accounting software for Macs you can consider.

1. QuickBooks Online

Image via QuickBooks Online

QuickBooks Online is a comprehensive accounting software for Macs that serves businesses of all sizes. You can handle payrolls, generate business financial reports, track expenses, and billings, and monitor income.

Even more, you have access to professional tax help when filing your taxes. And, as a beginner, the platform provides expert help from bookkeeping professionals.

This consistent assistance provided by this Mac accounting software helps you easily review your business reports and reconcile your accounts. You can also automate your financial management workflows, like tax calculations, depending on your business requirements.

One of the great things about QuickBooks Online is its seamless integration with 750 business apps like Salesforce, Zoho, and PayPal. This way, you don’t have to input data manually.

Key Features

- Seamlessly integrates with online sales platforms like Shopify, Amazon, and Etsy.

- Custom access feature for collaborating with ecommerce accountants, tracking employee time, and sharing reports with investors and stakeholders.

- Automates sales tax calculations to identify non-taxable and taxable sales.

- Automatic smart invoicing to track payments.

- Easily tracks expenses, incomes, and receipts.

- Automatically reconciles and syncs bank transactions

- Allows real-time inventory tracking to avoid overstocking or understocking.

- Cash flow management for a comprehensive view of your balances.

Pros

- It’s scalable, making it suitable for businesses of various sizes.

- Offer robust security features for protecting your sensitive financial data.

- Offers a 30-day free trial.

- Its user-friendly interface allows non-accountants to navigate the solution easily.

Cons

- Limited users in all its pricing tiers.

- Some advanced add-ons and features incur extra costs.

- Slight learning curve for novices

Pricing

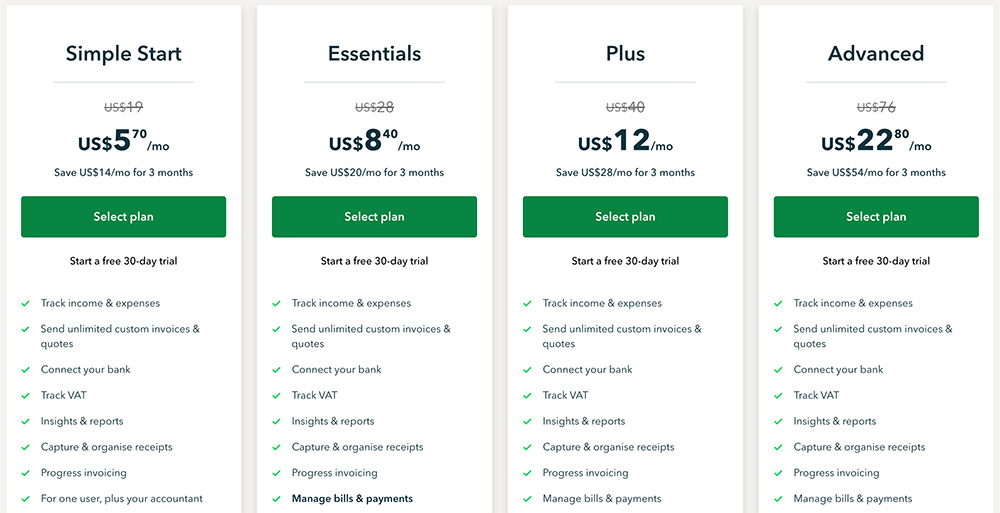

QuickBooks offers a free 60-day trial and four paid plans.

- Simple Start: $5.70 per month

- Essentials: $8.40 per month

- Plus: $12 per month

- Advanced: $22.80 per month

Image via QuickBooks Online

Tool Level

- Beginner/Intermediate

Usability

- User-friendly but with a slight learning curve for novices.

Pro Tip: QuickBooks Online has one of the most advanced automation among the best accounting software for Macs. You can use this to handle recurring tasks without the risk of manual errors cropping up.

You May Also Like:

2. FreshBooks

Image via FreshBooks

FreshBooks is another reliable accounting software for Macs suitable for businesses of any size. It helps take the hassle out of financial management. And provides customized training for when you transition from your manual accounting workflow.

With FresBooks, you get access to seamless client invoicing, cash flow management, and payment processing. Plus, you can easily track employee time, manage client projects, and create estimates and proposals.

This solution also makes it easy to manage subscriptions and invoices. You can even access online payment channels like FreshBooks Payments, AMEX, PayPal, Apple Pay, and Stripe.

Additionally, this accounting software for Macs comes with advanced accounting features that let you track your loans, inventory, assets, unique incomes, and expenses. You can even create business reports to check your business’ performance.

This desktop accounting software also allows you to collaborate with your team members. It allows you to manage roles and permissions. And you get a detailed view of the performance of every project your team is handling.

You can also read our FreshBooks alternatives breakdown to see how it compares with other options.

Key Features

- Supports payments via Stripe, PayPal, ACH transfer, and credit cards.

- Allows collaboration with your team members, associates, and consultants on projects, tasks, and files to boost productivity.

- Accurate time tracking for charging billable hours.

- Multi-currency billing.

- Ability to create customizable invoices with automated payment reminders that notify clients of overdue payments.

- Credits tool for tracking overpayments, prepayments, and credit notes.

- Automated bank reconciliation with exportable summaries.

- Advanced accounting features that allow you to track expenses, income, assets, and loans.

Pros

- Transforms estimates into invoices easily.

- Offers multiple customer support channels to easily resolve your issues and complaints.

- Scalable and affordable pricing plans for growing businesses.

- Has an easy-to-navigate and intuitive interface.

Cons

- Its basic inventory management features may not fit businesses with robust inventory needs.

- You need a separate add-on to process payroll, which increases its overall cost.

- Its Lite and Plus pricing plans have a 5 and 50 client limitation.

- You need to sign up for third-party apps, like Stripe and PayPal, to receive or make payments.

Pricing

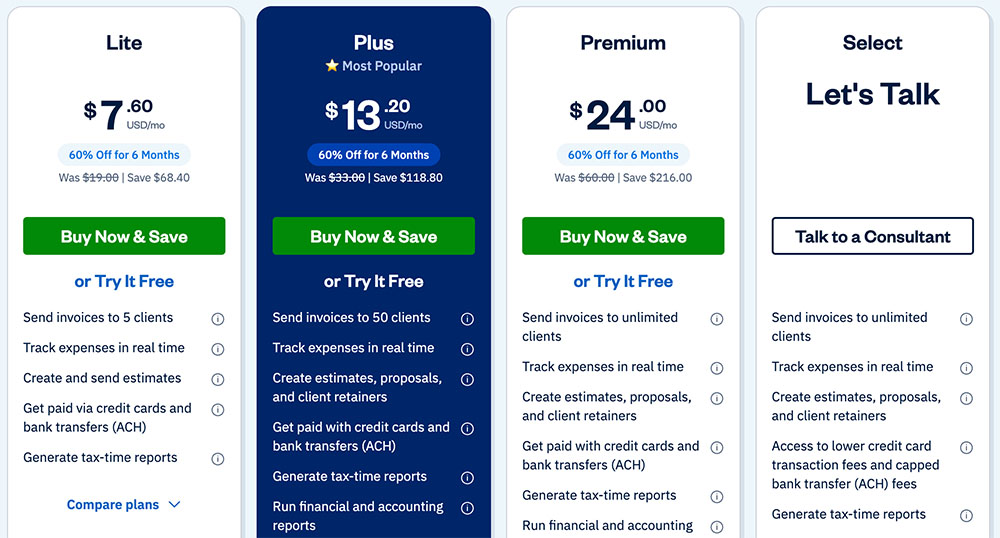

FreshBooks comes with a 30-day free trial and four pricing plans.

- Lite: $7.60 per month

- Plus: $13.20 per month

- Premium: $24 per month

- Select: Custom

Image via FreshBooks

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: FreshBooks is one of the best desktop accounting software that offers support for multiple payment platforms. Take advantage of this to provide your customers with varied methods of payment to make checkout processes convenient and easy.

3. Zoho Books

Image via Zoho Books

Zoho Books is an affordable accounting software for Macs with a 2-in-1 solution. You get access to customer relationship management solutions and inventory and project management systems.

Even more, with Zoho Books, you can automate your financial processes like payroll, time tracking, and invoicing. Plus, you can create personalized invoices and track your expenses and bills. However, these features are also offered by most Zoho Books alternatives.

The accounting software for Macs also integrates seamlessly with other business solutions, which helps streamline your accounting operations. And, it allows for improved financial planning by letting you manage your accounts payable.

In addition, Zoho Books provides you with insights into how your business resources are spent. And you can connect your bank account to the platform to gather and organize your business transactions.

Key Features

- A document management system that matches your bank transactions with uploaded files for easy online access.

- Schedulable financial reporting tools for insights into your cash flow, balance sheets, and profit and loss.

- Advanced inventory management features for organizing and monitoring stocks and products.

- Bill management feature for tracking accounts payable.

- A customer portal that provides you with a comprehensive view of payments, transactions, and feedback.

- Online sales order processing and management feature for customizing and converting sales orders into purchase orders or invoices.

- A project feature for tracking billable hours and managing multiple projects and their matching expenses.

- Customizable invoices for online payments.

- Sales Tax liability tracking that allows you to stay compliant.

- A vendor portal for notifying vendors of payments.

Pros

- Intuitive and easy-to-use interface.

- Seamless integration with Zoho’s suite for better financial operations management.

- Its two-factor encryption and authentication ensure secure transactions.

- Provides a 14-day free trial for its paid subscriptions.

Cons

- Its highest subscription plan is limited to 15 users.

- Limited integration with third-party apps outside of the Zoho suite.

Pricing

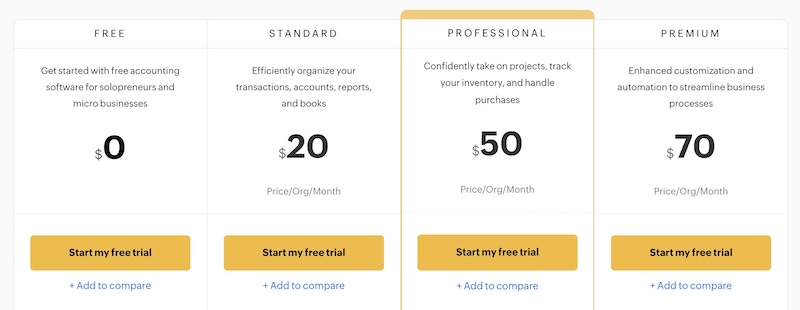

Zoho Books offers a limited free plan and five paid plans that come with a 14-day free trial.

- Free: $0

- Standard: $20 per month

- Professional: $50 per month

- Premium: $70 per month

Image via Zoho Books

Tool Level

- Beginner/Intermediate

Usability

- Intuitive and easy to use

Pro Tip: Zoho Books has a helpful customer portal that you can use to keep an eye on every transaction from one place. This reduces the chances of mixing up things.

4. Wave Accounting

Image via Wave

Wave Accounting is one of the best accounting software for Macs built for freelancers and small businesses. You get access to key accounting software features for free, making it an excellent option if you’re on a tight budget.

The platform also offers paid plans without any usage restrictions. This allows you to collaborate with as many people as needed. And you can generate as many invoices as you want for your clients.

Additionally, this accounting software for Macs goes beyond basic small-business bookkeeping. You get access to features like financial reports, billing subscriptions, and estimates.

However, you have to pay for other features like accepting payments online, mobile receipts, and payroll, depending on your business needs.

Wave Accounting also encrypts your financial data and protects its servers electronically and physically. This ensures solid data security.

Key Features

- Bookkeeping support that allows you to outsource your bookkeeping.

- Payroll, accounting, and tax coaching for easy setup.

- Recurring billing feature for batching invoicing, time zone control, and flexible scheduling.

- Secure payment links for processing online payments via bank deposits, credit cards, and Apple Pay.

- Automated bank reconciliation by connecting bank accounts and credit cards.

- Invoice tool for automatically syncing your payment information.

- Receipt scanning allows you to track sales and expenses.

Pros

- Allows you to add an unlimited number of partners and collaborators with different permission levels, making it one of the best free accounting software programs for Mac.

- Has an intuitive and easy-to-navigate interface.

- Simplifies complex financial operations so you can perform tasks easily.

- Free, unlimited access to basic accounting capabilities.

Cons

- Round-the-clock customer support is only available when you pay for an add-on or one of its subscription plans.

- May lack advanced inventory management and time tracking capabilities.

- You pay an extra fee for uploading and scanning receipts.

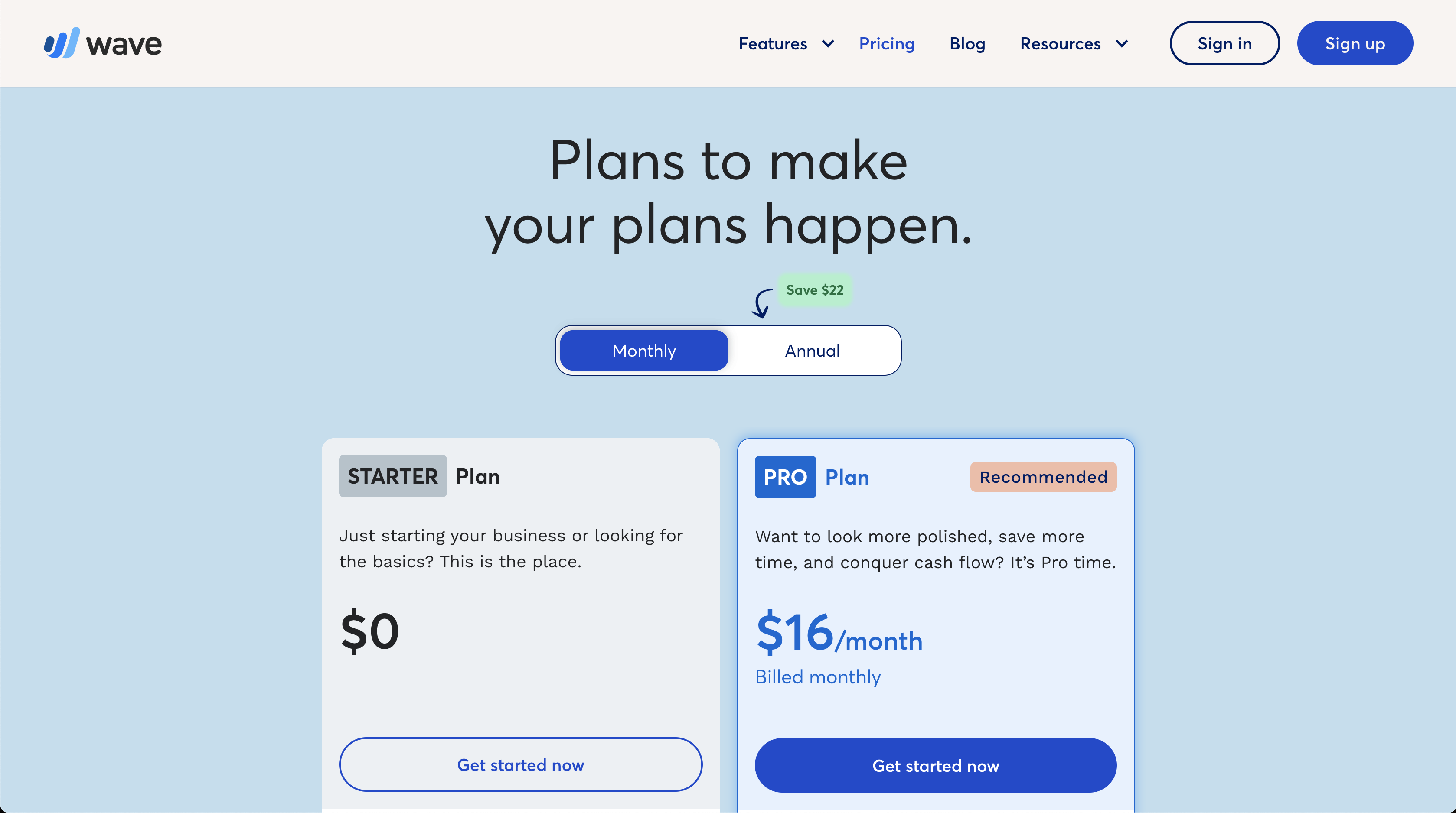

Pricing

- Starter Plan: Free

- Pro Plan: $16 per month

Image via Wave

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: Take advantage of Wave Accounting’s bookkeeping support to outsource all your accounting needs anytime the workload becomes overwhelming.

5. Oracle NetSuite

Image via Oracle NetSuite

NetSuite is another paid accounting software for Macs that helps you manage receivables and payables and record transactions. It also simplifies how you manage and track tax deductions and close your financial banks.

The platform also gives you better control of your financial assets and provides accurate reports.

Even more, it gives you real-time access to your financial data. This way, you can easily resolve issues and always stay compliant with regulations like ASC 606 and GAAP.

Additionally, this accounting software for Macs provides you with real-time insights into different metrics like cash positions, taxes, fixed assets, and inventory margins.

What else?

You can automate repetitive accounting tasks, like reconciling account statements and creating journal entries. And, since NetSuite is a cloud-based accounting software, you can access your data from anywhere with an internet connection.

Key Features

- Payment management tool that lets you accept payments via ACH transfers, direct deposit, and debit and credit cards.

- Fixed assets management allows asset tracking and lease and depreciation accounting.

- Tax management capabilities enable you to stay compliant with global tax regulations in 110 countries.

- Automatic account reconciliation helps you match transactions quickly and identify discrepancies in your financial statements.

- Accounts payable and receivable feature for automating your entire procure-to-pay workflow and generating invoices.

- Cash management feature for optimizing cash flows, monitoring bank accounts, and managing liquidity.

- Close management helps you accelerate the financial close by automating tasks like intercompany transactions and variance analysis.

Pros

- Supports multiple payment channels.

- Easily access to financial data in real time.

- Its automated processes help you reduce the risks that come with manual financial management tasks.

- Offers a comprehensive knowledge center that helps with using the platform.

- All its subscriptions come with 24/7 customer support.

Cons

- Comes with a one-time implementation fee for your initial setup which counts as extra costs.

- May have a learning curve for smaller businesses that need only basic accounting features.

Pricing

Oracle NetSuite’s pricing plan comprises a one-time implementation fee for initial setup, an annual license fee made up of the core platform, optional modules, and the number of users you need.

So, to get accurate pricing, you need to contact their customer support.

Tool Level

- Intermediate

Usability

- Easy to use, with a learning curve for novices.

Pro Tip: Oracle NetSuite is one of the most tax-compliant accounting software for Macs, enabling you to meet tax requirements in over 110 countries with ease.

Also Read:

6. Xero

Image via Xero

Xero is a cloud-based accounting software for Macs with automated features that help you organize and simplify your accounting tasks.

The platform uses AI for your bank reconciliation. And, like Xero alternatives, this tool provides other accounting and financial management capabilities like bill payment, reporting, and invoicing.

There’s more!

Xero also offers project implementation and planning capabilities. This way, you can track your project profitability using project account metrics. And, you get to enjoy the benefits of financial planning when you properly allocate resources for projects.

Even more, this accounting software for Macs seamlessly integrates with payroll solutions like Gusto. Plus, it offers cloud storage and provides automatic backups for important financial documents.

Key Features

- Analytics for tracking future and short-term cash flows to assess your business’s financial performance.

- Multi-currency support for converting transactions into over 160 currencies, enabling proper international business accounting.

- Sales tax management tool for setting up sales tax rates, calculating sales tax, and completing sales tax returns.

- Supports invoice generation for online payments via debit and credit cards.

- Online fixed asset management for tracking and updating your books and accessing financial reports from a single place.

- Simplified accounting dashboard that allows you to track outstanding invoices, cash flow, reconciliations, and account balances.

- Customer management feature for storing suppliers’ and customers’ contacts, payments, and invoices.

- Expense management tools for reimbursing expense claims and managing your spending.

Pros

- Allows unlimited users on a single account.

- Provides multi-layer protection for securing your personal and financial information.

- Offers a huge knowledge center with useful webinars, videos, and courses.

- Seamless integration with third-party services and apps.

- Provides cloud-based storage for real-time financial data access and management.

Cons

- Its entry plan only comes with 5 bills and 20 quotes and invoices.

- Multi-currency support, expense claiming, and project tracking only come with its highest subscription plan.

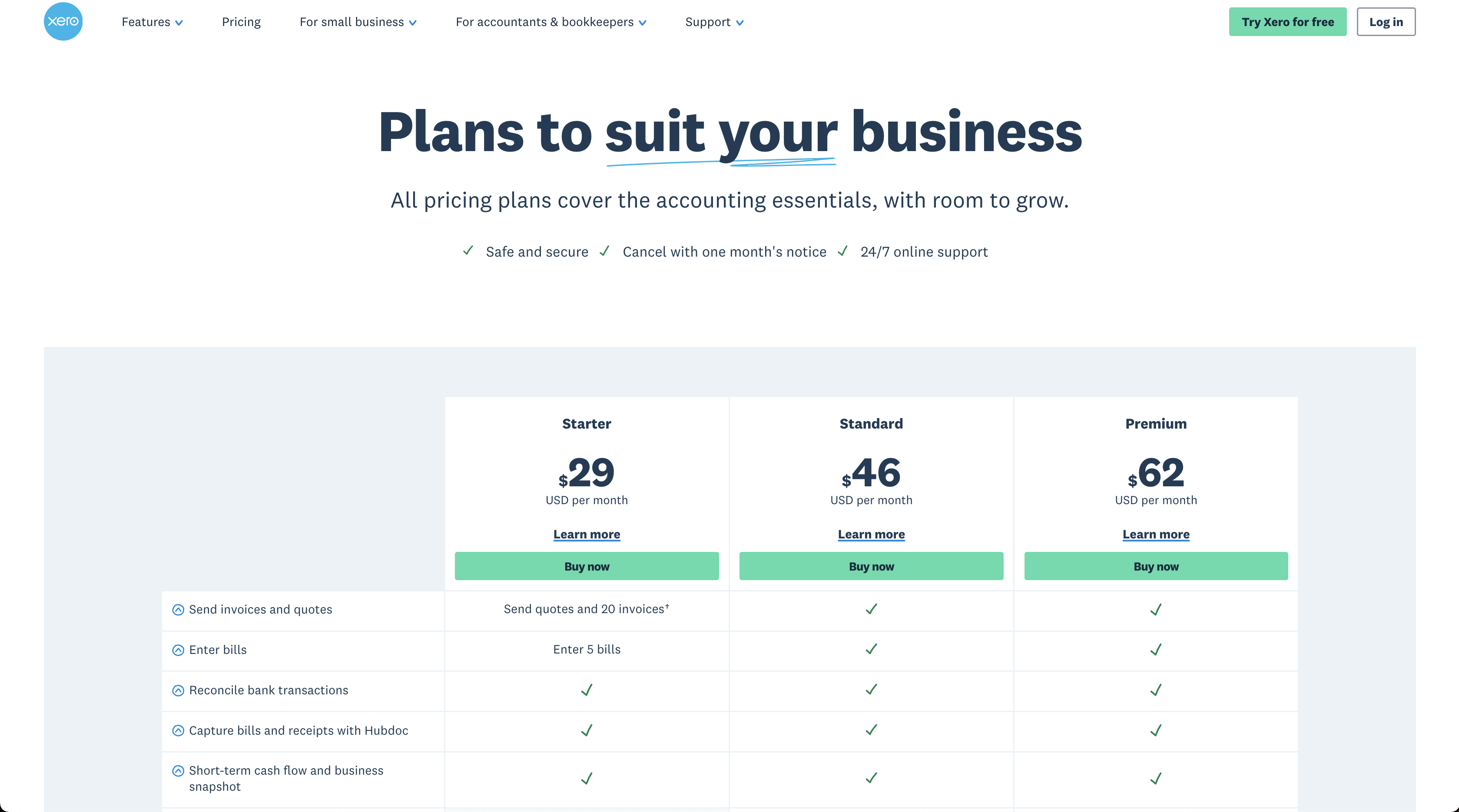

Pricing

Xero has three paid plans that each come with a 30-day free trial.

- Starter: $20 per month

- Standard: $47 per month

- Premium: $80 per month

Image via Xero

Tool Level

- Intermediate to advanced

Usability

- Moderately easy to use, but may have a slight learning curve when using advanced features.

Pro Tip: Xero provides top-notch security that you can use to ensure all your accounting transactions are secure from any cyber-related threats.

7. Neat

Image via Neat

Next on our list is Neat – an accounting software for Macs that combines accounting tools with document management capabilities. This way, you can streamline how you handle your paperwork while optimizing your financial tasks.

The platform also helps you extract accounting information from your documents and categorize scanned receipts. And, you can track your sales, spending, income, and expenses. This allows you to file and report taxes easily.

Additionally, this accounting software for Macs helps you stay organized. You can upload important documents and create folders and subfolders categorized by month, client, or project.

Plus, the platform allows you to have multiple users on one account. This way, you can share files and folders and collaborate with others, whether they’re Neat users or not.

Key Features

- Invoicing tool that lets you create personalized invoices and send reminders to clients and vendors.

- Sufficient data storage capability for storing and sharing unlimited files with clients, vendors, or other team members.

- Tax Prep tool that matches your receipts and invoices to your bank transactions or credit card to file taxes accurately and more efficiently.

- Reconciliation features for consolidating your financial data on a single dashboard for a comprehensive view.

- Automatic report generation allows you to view insights and trends from your total sales, expenses, and cash balance.

- Receipt management tool that lets you upload receipts and group them into categories.

Pros

- Seamlessly integrates with third-party business apps like Turbotax, Mailchimp, and Microsoft Outlook.

- Provides a knowledge center and 24/7 customer support via email and chat.

- Offers unlimited monthly data storage.

- Comes with a 14-day free trial.

Cons

- Doesn’t come with payroll capabilities.

- You need an add-on for invoicing, automated reports, and premium assistance.

- No monthly subscription plan.

Pricing

Along with its 14-day free trial, Neat has just one pricing plan.

- Neat: $200 per year

Image via Neat

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: Neat is one of the most versatile accounting software for Macs with rich integrations like Quickbooks, Turbotax, and more. This makes it easy to execute different accounting tasks on different platforms simultaneously.

8. Sage Intacct

Image via Sage Intacct

Sage Intacct is an enterprise accounting software for Macs that comes with an intuitive interface. The platform combines enterprise resource planning (ERP) with AI-powered continuous accounting capabilities.

On top of that, Sage Intacct is scalable as it offers tools that fit your business needs as you grow. It comes with HR, payroll, and accounting features, including automated invoice processing that allows you to automate your manual processes.

Even more, this accounting software for Macs seamlessly integrates with other business tools like Salesforce and Salesforce alternatives. Plus, it provides real-time, multi-dimensional dashboards and reports. This gives you visibility into your business’s financial performance.

Key Features

- Spend management tools that ensure you are always within your budget while streamlining your purchasing processes.

- Expense and time management for reducing revenue leaks and streamlining your project accounting.

- Sales and use tax compliance tool that helps you simplify your digital tax workflows and ensure you’re always compliant.

- Salesforce integration helps you connect your finance, revenue operations, and sales without needing a third-party service.

- Dimensions tool that helps you categorize your transactions with tags.

- An AI-powered General Ledger feature that scans your transactions to identify and flag anomalies.

- Reporting and Dashboard features that help you turn data into insights and generate real-time financial reports and dashboards.

- Multi-entity insights for simplifying and streamlining your multi-entity or multi-national business from a single platform.

Pros

- Allows you to add an unlimited number of users on a single account.

- Provides online training, a vast resource center, and 24/7 expert human support.

- Offers tailored solutions for small and medium-sized businesses in different industries, like Construction, Healthcare, Manufacturing, and more.

- Has a community that helps you connect with peers and industry experts.

Cons

- Initial setup may require a Sage reseller or partner to ensure accuracy.

- No standard pricing plan.

Pricing

- Contact Sage Intacct’s customer support.

Tool Level

- Intermediate to advanced

Usability

- Comes with a learning curve.

Pro Tip: Take advantage of Sage Intacct’s General Ledger feature that helps you detect and flag anomalies before they become unmanageable.

9. Kashoo

Image via Kashoo

Kashoo is a customizable accounting software for self-employed professionals and small business owners.

The platform allows you to easily file tax returns, manage your expenses, track business transactions, and generate personalized invoices.

What’s more?

Kashoo provides color-coded charts and graphs that give you insights into relevant financial data. On top of that, you can match transactions to their associated project to compare projects and clients.

Additionally, this accounting software for Macs allows you to categorize transactions according to IRS and CRA categories. This way, you can be well-prepared for tax audits and prevent costly tax mistakes often made by self-employed individuals.

Kashoo also provides multi-level data security features like non-storage of bank login information and two-factor authentication.

Key Features

- Advanced accounting tools that let you upload receipts, auto-import bank transactions from multiple accounts, and check the status of transactions.

- TrulySmall Accounting feature that automatically categorizes and sorts your transactions.

- KashooPay tool that lets you send payment links with your invoices.

- Income and expense tracking capabilities help you separate personal and business. expenses and create budgets that notify you when you’re getting to your limit.

- Downloadable customized invoicing templates for creating and sending professional invoices.

Pros

- Seamlessly integrates with Google Workspace and third-party payroll platforms like Stripe.

- Provides downloadable resources and helpful guides for growing your business.

- Offers multiple customer support channels, like phone, email, and live chat.

Cons

- Doesn’t provide advanced accounting features like document management, payroll, and time tracking.

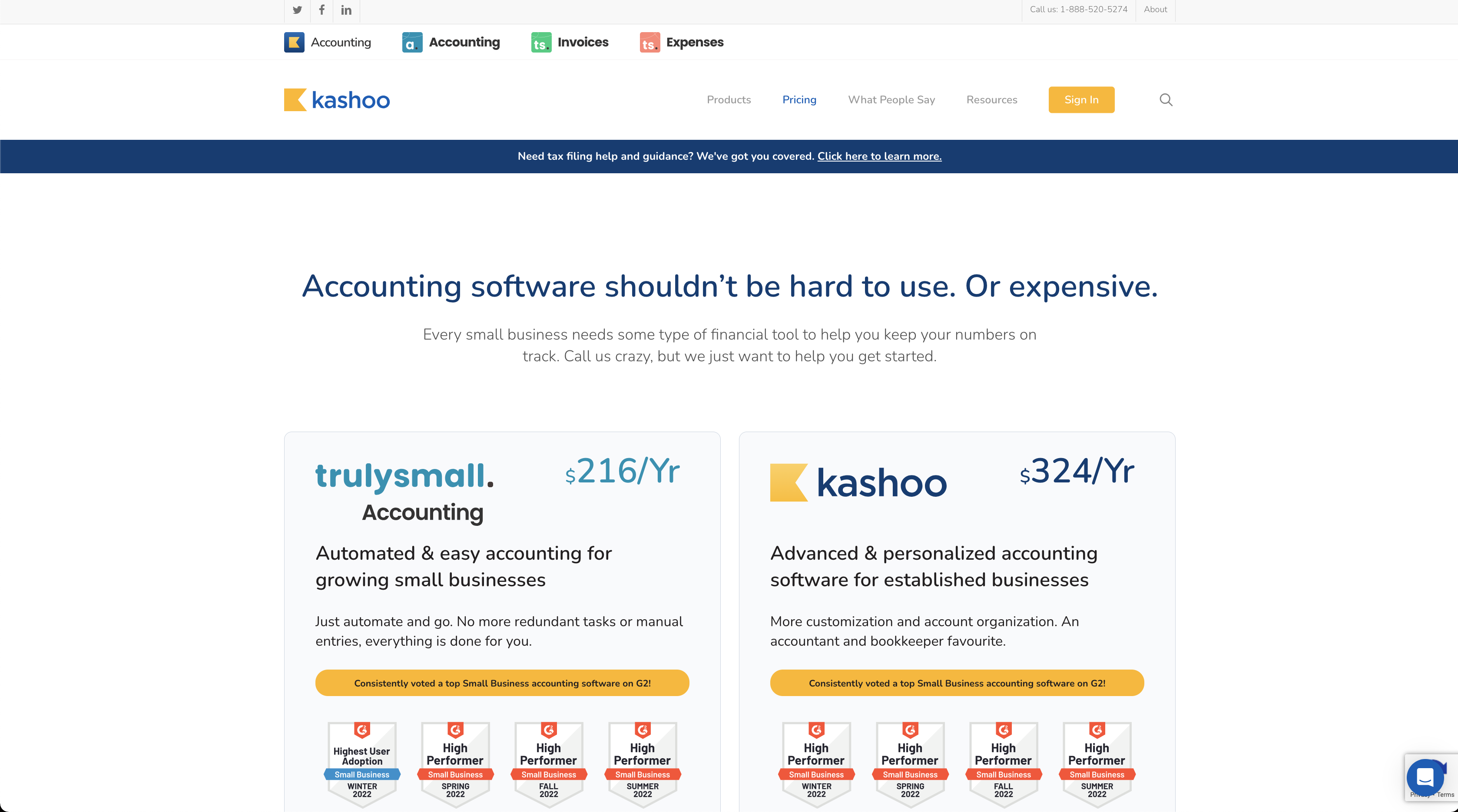

Pricing

Kashoo provides a 14-day free trial and two subscription plans.

- Trulysmall. Accounting: $216 per year

- Kashoo: $324 per year

Image via Kashoo

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: Use Kashoo’s income and expense tracking capabilities to separate personal and business finances. This is vital if you want to maintain the financial health of your business.

Also Read:

10. KashFlow

Image via KashFlow

KashFlow is another small business accounting software for Mac devices. You get access to accounting features like invoices, quotes, and bank feeds for improving your accounting workflows.

As one of the top accounting software for Macs, KashFlow also provides ready-made reports for monitoring different parts of your accounting processes. Plus, you can access Payroll features and an Apps section for integrating third-party services like PayPal.

Additionally, unlike KashFlow alternatives, this software allows integration with your Dropbox account so you can save receipts and invoices. This allows you to track your expenses and sales.

The platform also supports multiple payment channels. And you can add a “pay now” button to your invoices so that customers can make payments online.

Key Features

- Ability to generate and customize purchase invoices.

- Bank reconciliation tool for ensuring accurate and up-to-date financial records.

- Seamless integration with HMRC for submitting VAT returns easily.

- Cloud-based accounting for getting real-time financial reports from anywhere.

Pros

- Allows you to create and convert estimates and quotes into invoices.

- Seamlessly integrates with third-party apps and payroll platforms, which streamlines your payroll workflows.

- You have access to unlimited quotes in all its pricing plans.

- Easy-to-use, intuitive interface.

- Allows you to link your bank accounts to reconcile bank transactions.

Cons

- Payroll features are only available in its highest subscription plan with a 5-employee cap.

- Limited entry plan with access to only 10 invoices.

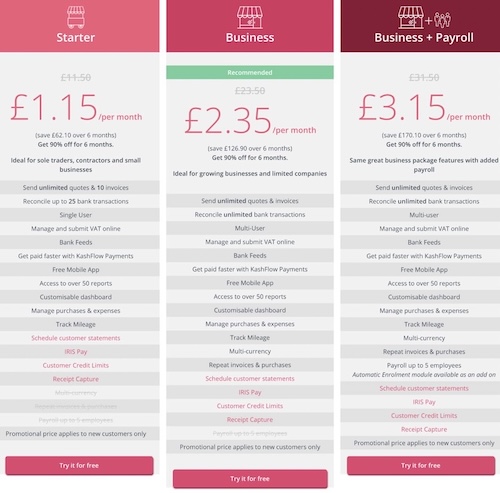

Pricing

KashFlow offers a 14-day trial and three pricing plans.

- Starter: $14.54 per month + VAT

- Business: $29.72 per month + VAT

- Business + Payroll: $39.84 per month + VAT

Image via KashFlow

Tool Level

- Beginner to Intermediate

Usability

- Easy to use

Pro Tip: KashFlow supports bank reconciliations. This takes away the need to constantly balance your books manually, eliminating the risk of human errors.

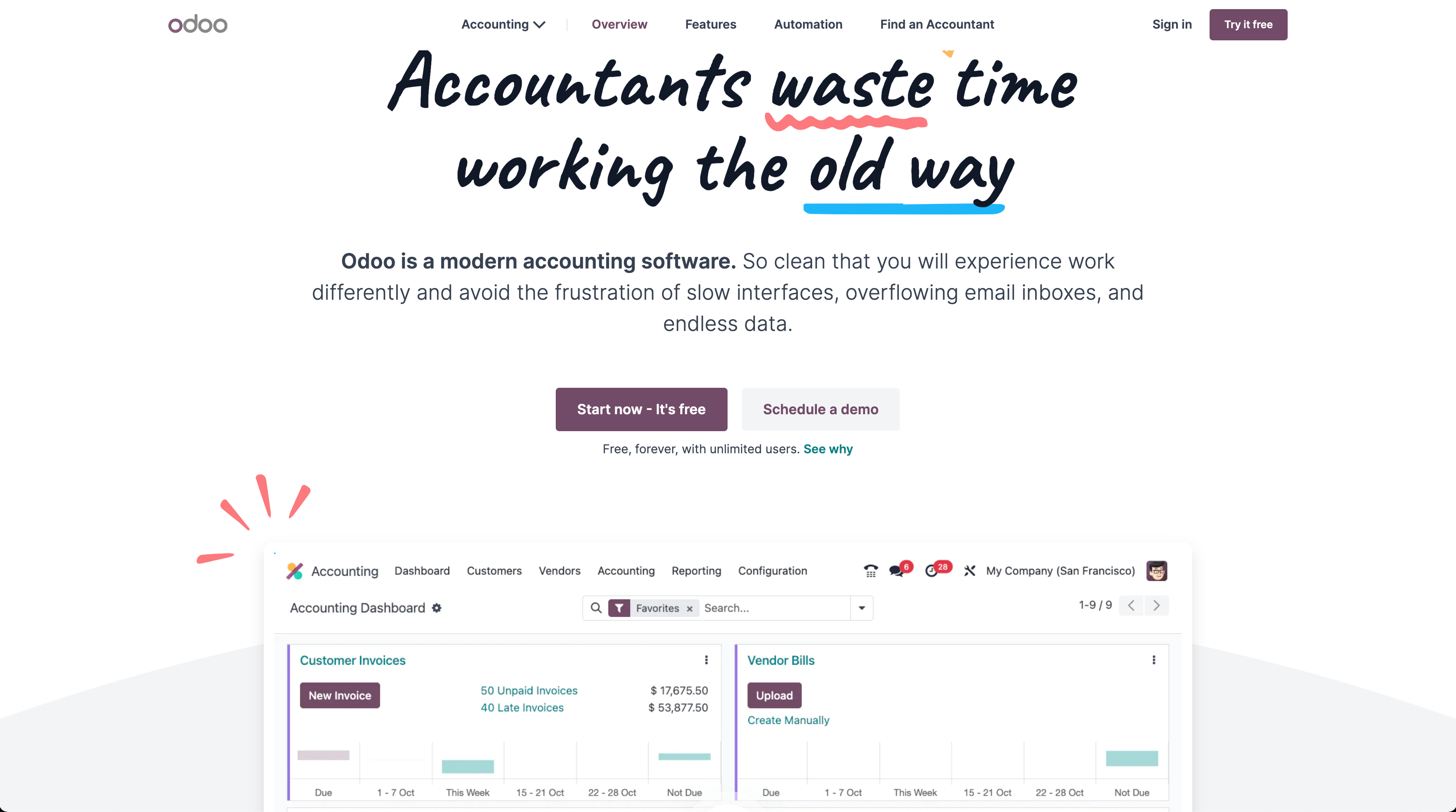

11. Odoo

Image via Odoo

Finally, on our list, we have Odoo — another accounting platform for Mac computers tailored for solopreneurs and small business owners seeking the benefits of cloud-based accounting automation.

The platform allows you to automate repetitive accounting tasks, like recurring invoices and synchronizing bank feeds.

Odoo also integrates with 28,000 banks around the world. This way, you can add your bank account and automatically import bank statements. Even more, the tool uses smart AI matching to match financial records with transactions.

One of the best things about this particular accounting software for Macs is its worldwide compatibility. The platform is configured to address your specific country requirements, including fiscal positions, audit files, and taxes.

Key Features

- Automated follow-ups for scheduling and sending reminders and identifying late payments.

- Expense and revenue recognition capabilities for managing multi-year contracts and automating expense entries and deferred revenue.

- Electronic invoicing feature that allows you to receive and send electronic invoices in different formats and standards, like Peppol.

- Dynamic accounts and taxes that help you calculate the right taxes from expense or income accounts.

- A real-time reporting tool that provides you with up-to-date financial performance reports.

- Pay Bills features that automate wire transfers and allow batch payments.

- Bank and Cash tools for automating bank feeds, managing cash registers, and importing bank statements.

- Legal statement capabilities for managing advanced tax computations and generating tax reports, dynamic and in-depth reports, and reporting expenses and income.

- Assets management tool for automatically generating amortization entries and tracking assets.

Pros

- Supports multiple currencies with currency rates that are updated daily.

- Comes with emergency lines and support tickets for customer support.

- Provides a 15-day free trial for its paid subscriptions.

Cons

- Lacks payroll capabilities.

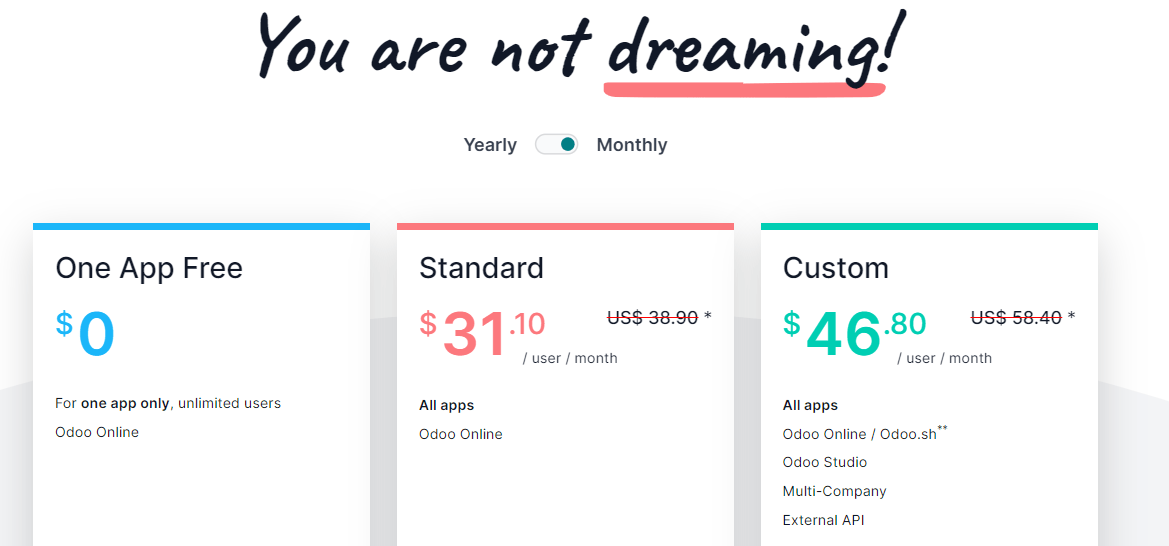

Pricing

Odoo provides a free plan and two paid plans with a 15-day trial.

- One App Free: $0

- Standard: $31.10/user per month

- Custom: $46.80/user per month

Image via Odoo

Tool Level

- Beginner

Usability

- Easy to use

Pro Tip: You can use Odoo’s electronic invoicing to handle different formats of invoices for easier transactions.

Also Read:

12. AccountEdge

Image via AccountEdge

Next on our list of the top accounting software for Macs is AccountEdge. Whether you’re looking to sell products, offer services, or bill for time, AccountEdge has all the necessary tools to make all these processes seamless.

You can create invoices and send them to your customers without missing deadlines. AccountEdge also allows you to handle your business’s expenses by keeping track of all the cash flow as well as banking transactions.

Furthermore, there’s an option for managing payroll, inventory, contact management, time billing, and data management. In short, AccountEdge is an all-around accounting software for Macs that centralizes all the important things in one place.

Key Features

- Creating and sending invoices for products, services, or time.

- Managing expenses as well as tracking purchases and vendor payments.

- Banking capabilities where you can monitor money movements with integrated bank feeds.

- Handling employee payroll and payments via check or direct deposit.

- Tracking inventory

- Managing all your business contacts in one place for easy access across different macOS systems.

- Monitoring time billing and work-in-progress efficiency.

Pros

- Offers a wide range of accounting tools in one package

- Easy to navigate, even for those without extensive accounting knowledge

- Cost-effective

Cons

- Limited cloud integration

Pricing

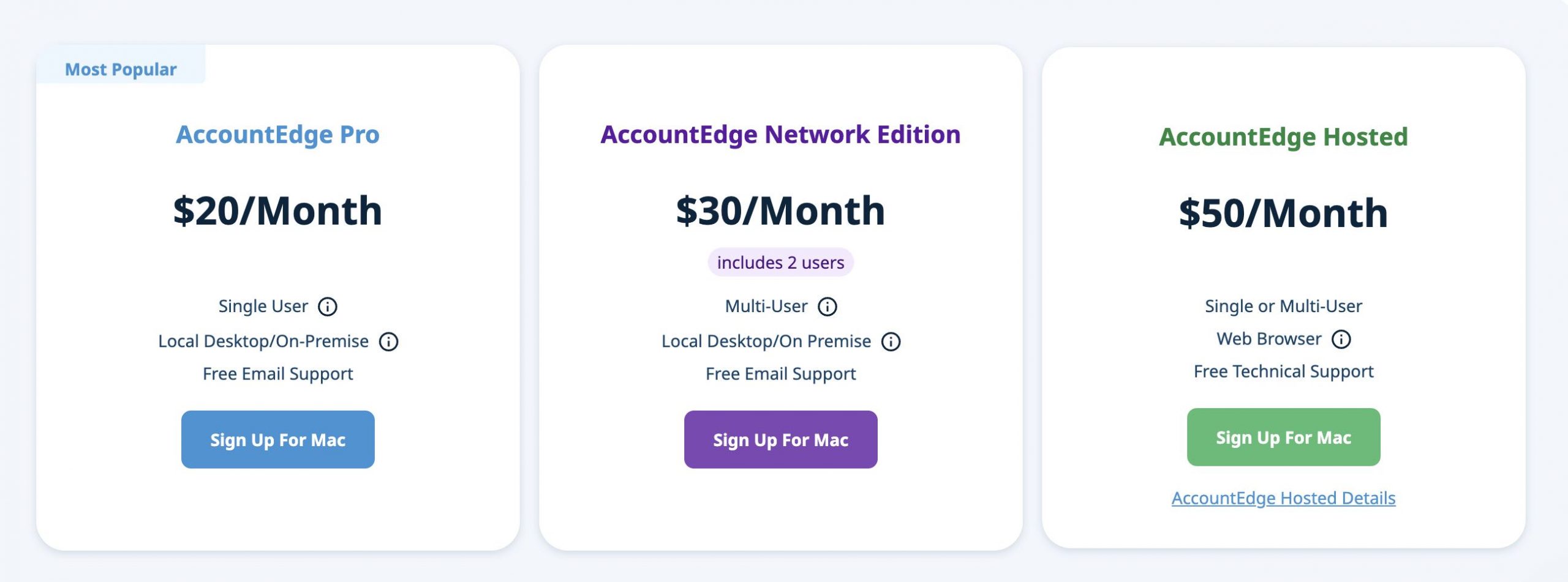

AccountEdge comes with three price plans.

- AccountEdge Pro: $20/month

- AccountEdge Network Edition: $30/month

- AccountEdge Hosted: $50/month

Image via AccountEdge

Tool Level

- Beginner

Usability

- Overall, AccountEdge provides a simple user interface that even beginners can hack.

Pro Tip: AccountEdge is an accounting software for Macs that provides a centralized option for managing different business-related activities besides just accounting. If you run multiple businesses, this tool can streamline your processes and help you stay organized.

13. ZipBooks

Image via ZipBooks

Wrapping up our list of the top accounting software for Macs is ZipBooks. It offers a host of features necessary to keep the financial side of your business running smoothly.

One of the standout features of ZipBooks is its intuitive invoicing system. You can create and send professional invoices in seconds, helping you clear payments much faster. The software also offers automated payment reminders, reducing the time spent on follow-ups.

This accounting software for Macs also comes with something called smart categorization. It’s designed to help you manage all your business expenses without errors. It also provides real-time updates to ensure you have the right data in your hands at any given moment.

Key Features

- Simple time tracking to monitor billable hours.

- Estimate and invoice templates for professional communication.

- Integration with major payment processors like PayPal and Square.

- Comprehensive financial reporting for informed decision-making.

- Automated expense tracking to streamline financial management.

- Collaboration tools for team access and real-time updates.

Pros

- User-friendly interface tailored for Mac users

- Automated features save time on repetitive tasks

- Unlimited invoicing

Cons

- Advanced features may require a paid subscription

- Some users might find the feature set limited compared to other accounting software for Macs

Pricing

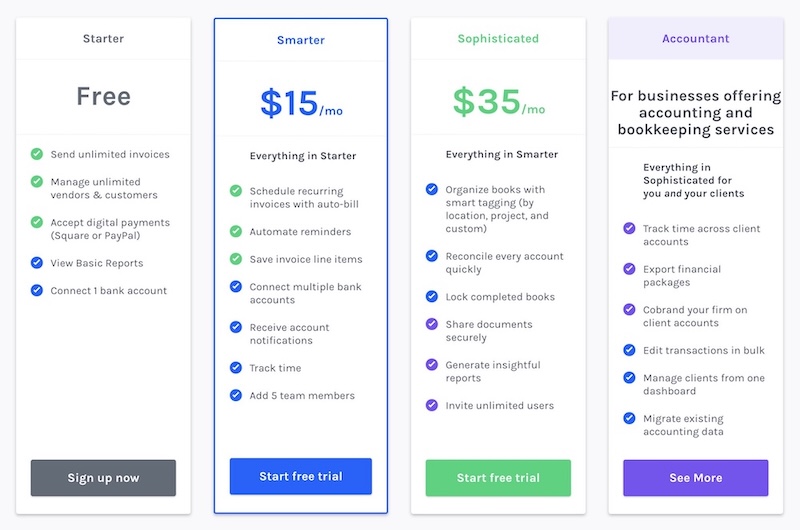

ZipBooks comes with four price plans.

- Free: $0

- Smarter: $15/month

- Sophisticated: $35/month

- Accountant: Custom pricing

Image via ZipBooks

Tool Level

- Beginner

Usability

- ZipBooks is a straightforward accounting software for Macs. It has an intuitive user interface perfect for macOS systems.

Pro Tip: ZipBooks has comprehensive reporting capabilities that you can use to keep track of all the minute details of your day-to-day business transactions.

Also Read:

- Top Challenges of Financial Accounting Businesses

- How To Choose Accounting Software: A Complete Guide

FAQ

Q1. Does Mac have an accounting program?

A. Apple computers don’t have a built-in accounting app. However, there are third-party accounting software for Macs, like Zoho Books, FreshBooks, QuickBooks Online, and Wave Accounting.

Q2. Is there a free alternative to QuickBooks for Mac?

A. Wave Accounting is one of the best free accounting software for Macs that you can use as an alternative to Quickbooks. It has a free Starter plan that allows you to create unlimited invoices, bookkeeping records, bills, and estimates. You can even accept online payments and manage your cash flow and customers.

Q3. Is Xero Mac-Friendly?

A. Xero is one the best accounting software for Macs with an intuitive and user-friendly interface. It allows you to manage expenses and contact, as well as track accounts receivable, purchase orders, sales, and inventory.

Q3. Does FreshBooks work with Mac?

A. Yes, FreshBooks works with Mac. FreshBooks is noteworthy accounting software for Macs. You can access it from Safari, Chrome, or any browser. It also comes with user-friendly apps for iPhones and iPads.

When used on a Mac, FreshBooks lets you create financial reports and invoices, and track expense categories, and new assets. It also connects to your bank, so transactions update automatically. No more typing in numbers.

Q4. What can QuickBooks do that Excel can’t?

A. QuickBooks accounting software can perform several functions that Excel can’t. For example, QuickBooks can manage automatic bank syncing, tax tracking, and real-time reports.

With Excel, you mostly have to enter everything manually, and that can lead to errors. In contrast, QuickBooks simplifies tax management by automatically tracking deductions, categorizing expenses, and even estimating taxes. This makes it one of the best accounting software for Macs.

QuickBooks can also generate profit and loss statements in seconds while Excel requires custom formulas. So overall, QuickBooks gets the job done better than Excel as far as accounting needs are concerned.

Q5. How do I choose an accounting software for Macs?

A. You need to consider different factors when choosing accounting software for Macs. Look at their pricing, core accounting features, user base, ease of use, customer support channels, and data security capabilities.

6. What is the most popular accounting software for Mac?

The most popular accounting software for Macs is Quickbooks Online. It’s easy to use, works on multiple devices, automates bookkeeping, and helps businesses organize their finances.

QuickBooks Online also connects to your bank, tracks expenses, and generates reports instantly. It works better than spreadsheets and keeps everything in a centralized location.

7. Why not use Excel for accounting on Macs?

While Excel may seem like a good choice for the fact that it’s free and compatible with multiple devices, it cannot be compared to accounting software for Macs for the following reasons.

- Spreadsheets may work fine for basic math, but they lack key features that real accounting software for Macs offers.

- Excel doesn’t automate reports. You’ll have to build formulas and fix errors yourself.

- Excel lacks bank syncing. You’ll have to type transactions manually, which takes forever.

- Excel won’t track taxes. If you forget a formula or enter the wrong data, tax season becomes a nightmare.

- Excel files aren’t encrypted, and losing them is easy if you don’t keep saving it constantly as you work.

Also Read:

- What Is Full Cycle Accounting and What Are the Steps Involved?

- Tax Deduction Cheat Sheet – How to Save Money On Taxes

Which Accounting Software for Macs Should You Choose?

Now that we’ve reviewed 13 of the best accounting software for Macs in 2025, you should have an idea of the one that fits your needs.

Remember though; when picking one, ensure you assess its accounting features, pricing, ease of use, and data security features. From our list of the best accounting software for Macs, you’ll easily find solutions that are cost-effective, scalable, and come with excellent functionalities.

In addition, ensure you take advantage of their free trials. Test their features to make sure they meet all your requirements. And if you decide to go for a paid subscription, ensure it checks the right boxes when it comes to financial management.

If you’re a startup in need of more accounting advice, check out our blog for more informative content. Feel free to connect with us at any time.