QuickBooks Online launched in 1992 as a basic accounting solution. Now, it provides small and medium-sized businesses with cloud-based accounting features, such as expense tracking and invoicing. However, did you know that there are popular accounting software options on the market with similar functionalities?

Yes, QuickBooks Online is one of the top accounting software that businesses worldwide use to manage their cash flow and expenses seamlessly. However, it has some constraints, so it may not be able to address all your financial planning needs.

Whether you’re looking for advanced features, flexible pricing structures, or industry-focused solutions, we have good news for you!

We’ve collated a review of 13 best QuickBooks alternatives, including a Zoho Books review. These platforms can provide top accounting solutions with intuitive interfaces for small businesses at affordable rates.

Here we go.

Quick Summary: Best QuickBooks Alternatives by Type

- Best for Growing Businesses: Xero, FreeAgent, FreshBooks

- Best with a Free Plan: Zoho Books, Wave Accounting, FreshBooks

- Best for Invoicing Management: Invoicera, Square Invoices, Quicken

- Best for Freelancers: Wave Accounting, Invoicera, Square Invoices

- Best for Financial Planning: Bench, Xero, FreshBooks

How We Chose the Best QuickBooks Alternatives

While compiling this comprehensive list of QuickBooks Alternatives, we didn’t just skim the surface of their accounting features. We conducted thorough research, considering the options that would be a good fit for a wide range of small business needs.

Our final list comprises QuickBooks alternatives that offer similar services to QuickBooks Online, including unique financial planning options among other features. Here’s an overview of the factors we considered.

- Cost and Pricing Model: Before choosing a QuickBooks alternative for your business, you must understand its pricing structure to determine if it aligns with your financial goals. This includes subscription fees and scaling costs.

- User-Friendliness: The ease of use of anyaccounting software directly impacts productivity. Keeping this in mind, we prioritized QuickBooks alternatives with intuitive interfaces and user-friendly designs.

- Customer Support: The QuickBooks alternatives we chose provide reliable customer support, contributing to a positive user experience. We evaluated the quality of their customer support, ensuring that they provided prompt responses to customer complaints and feedback.

- Scalability: When choosing an accounting software you should see if it accommodates the expansion of your business operations without compromising on performance. With this in mind, we assessed the scalability of the QuickBooks alternatives on this list. We evaluated their capabilities to cater to small businesses and large enterprises alike.

- Integration Capabilities: We explored the integration capabilities of these accounting tools. We looked at their compatibility with other business tools, such as CRM software and project management tools.

- Features: The QuickBooks alternatives on this list offer a wide set of features that can address the various aspects of financial management. From invoicing to expense tracking, financial reporting, and payroll management, you’re covered!

- User Reviews: Finally, we selected the best QuickBooks alternatives based on customer feedback and reliable user reviews. These alternatives have a track record of consistently delivering satisfactory accounting features to their users—sometimes exceeding expectations.

The QuickBooks alternatives on this list offer a wide set of features that can address various aspects of financial management. From invoicing to expense tracking, financial reporting, and payroll management, you’re covered. Additionally, we evaluated how each platform handles receipt data processing and provides secure accountant access for professional oversight.

13 Best QuickBooks Alternatives for 2025

Whether you’re a small business or an established enterprise, maintaining accurate financial records is crucial in evaluating your cash flow and profit margins.

Conventional bookkeeping practices often involve the manual creation of recurring invoices on paper—a process that can be laborious and time-intensive. However, the digital age has made things much easier with innovative accounting software like QuickBooks Online.

While QuickBooks is still a good option, you can still explore several other alternatives to find what works best for your financial health. Here are the best QuickBooks alternatives to consider in 2025.

1. Zoho Books

Image via Zoho Books

Zoho Books is one of the top cloud-based QuickBooks alternatives with great workflow automation features.

Besides its innovative accounting features, it offers comprehensive workflow automation capabilities that streamline routine tasks, making it especially valuable for established businesses looking to optimize their operations. Its comprehensive suite of project management and customer relationship management tools helps to streamline all your business operations on an easily accessible database.

Zoho Books offers customizable invoicing tools that enable you to create invoices, send, and keep track of your invoices. It provides automatic payment reminders and follow-ups while allowing you to accept payments with digital signatures.

Zoho Books also has a credit notes and retainer invoice feature that enables users to manage refunds and collect deposits or advance payments.

Aside from invoicing, Zoho Books can also automatically categorize your transactions for easy bank reconciliation. This helps foster financial transparency in your business.

If you’re looking for QuickBooks alternatives that also offer audit trails and give you access to certified accountants, Zoho Books is one of your best bets.

Although it’s less popular than QuickBooks, this accounting software offers features similar to QuickBooks Online, such as financial reporting and automatic expense reconciliation. Take a look at some of its key features:

Key Features:

- Provides automated workflows for recurring transactions and project tracking management

- Seamlessly compiles business reports like balance sheets, cash flow statements, and profit and loss statements

- Provides tools to set default tax rates on all expenses and automate sales tax calculations

- Offers easy connection to bank accounts and payment gateways and tracks when users receive online payments for goods and services

- Uses Snail Mail to send hard copy invoices and other documents to customers across the world when necessary

Pros

- Completely free plan available

- Live chat support and 24/5 customer service

- Easy onboarding process

Cons

- Limited integration with other non-Zoho tools

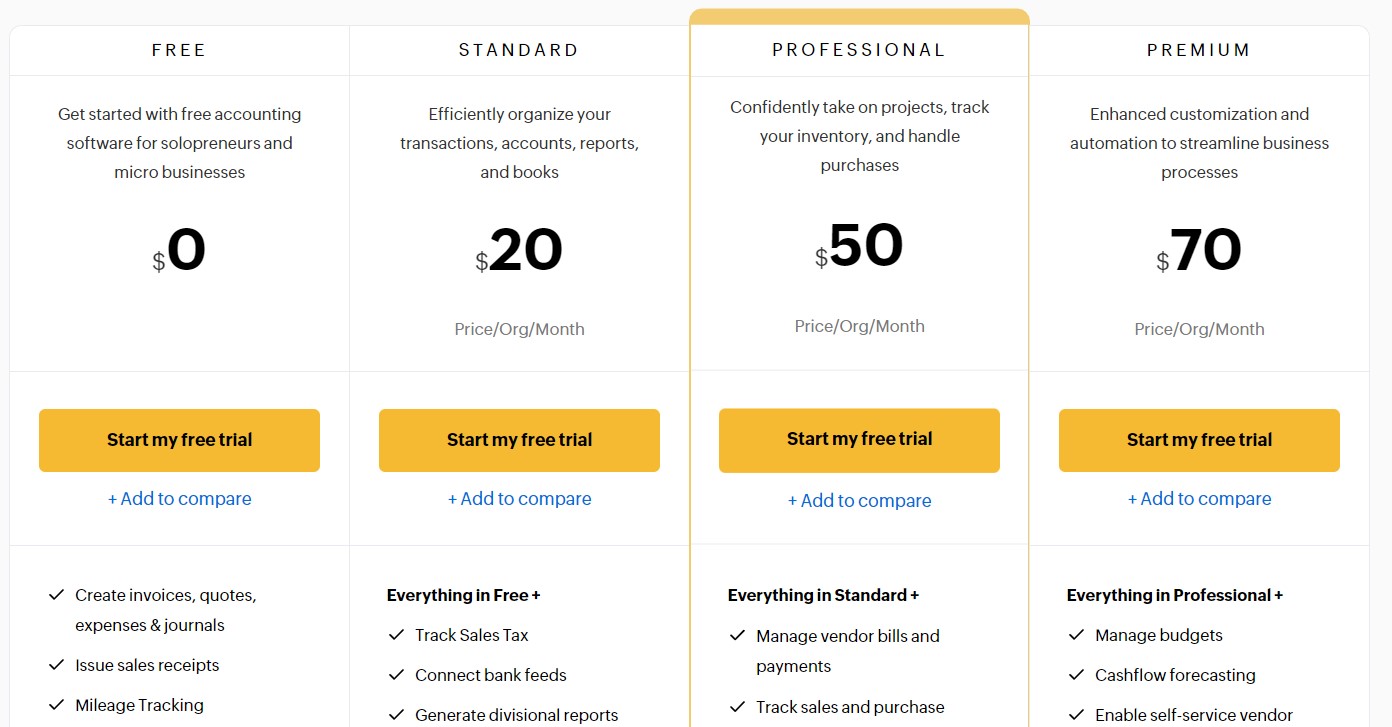

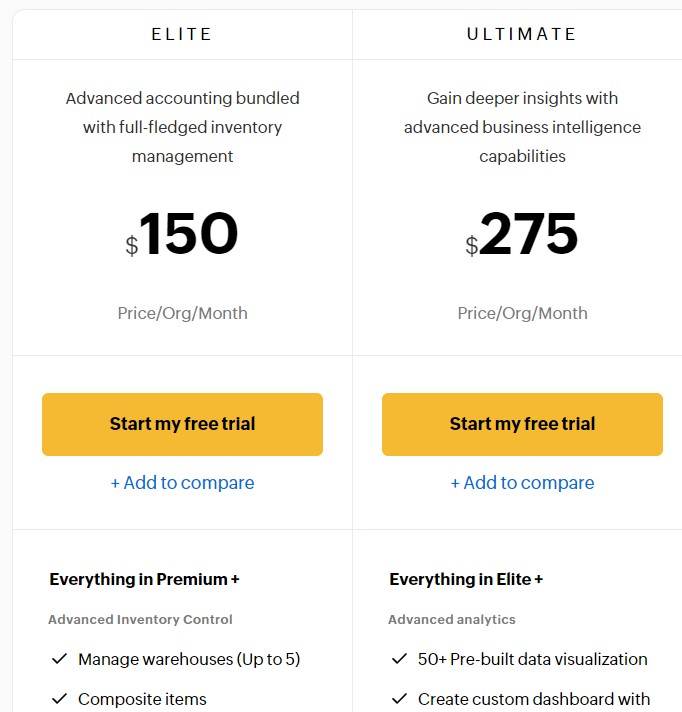

Pricing

Zoho Books offers a free plan with limited benefits and several tiered plans with add-on benefits. You can also get a 14-day free trial with access to the full program.

- Free: 1 user + 1 accountant

- Standard: $20 per month

- Professional: $50 per month

- Premium: $70 per month

- Elite: $150 per month

- Ultimate: $275 per month

Image via Zoho Books

Image via Zoho Books

Zoho Books also offers annual subscriptions that are much cheaper. For example, the Ultimate plan will only cost $200 per month if you pay annually. This allows you to save $75 per month.

Tool Level

- Intermediate

Usability

- Easy to use

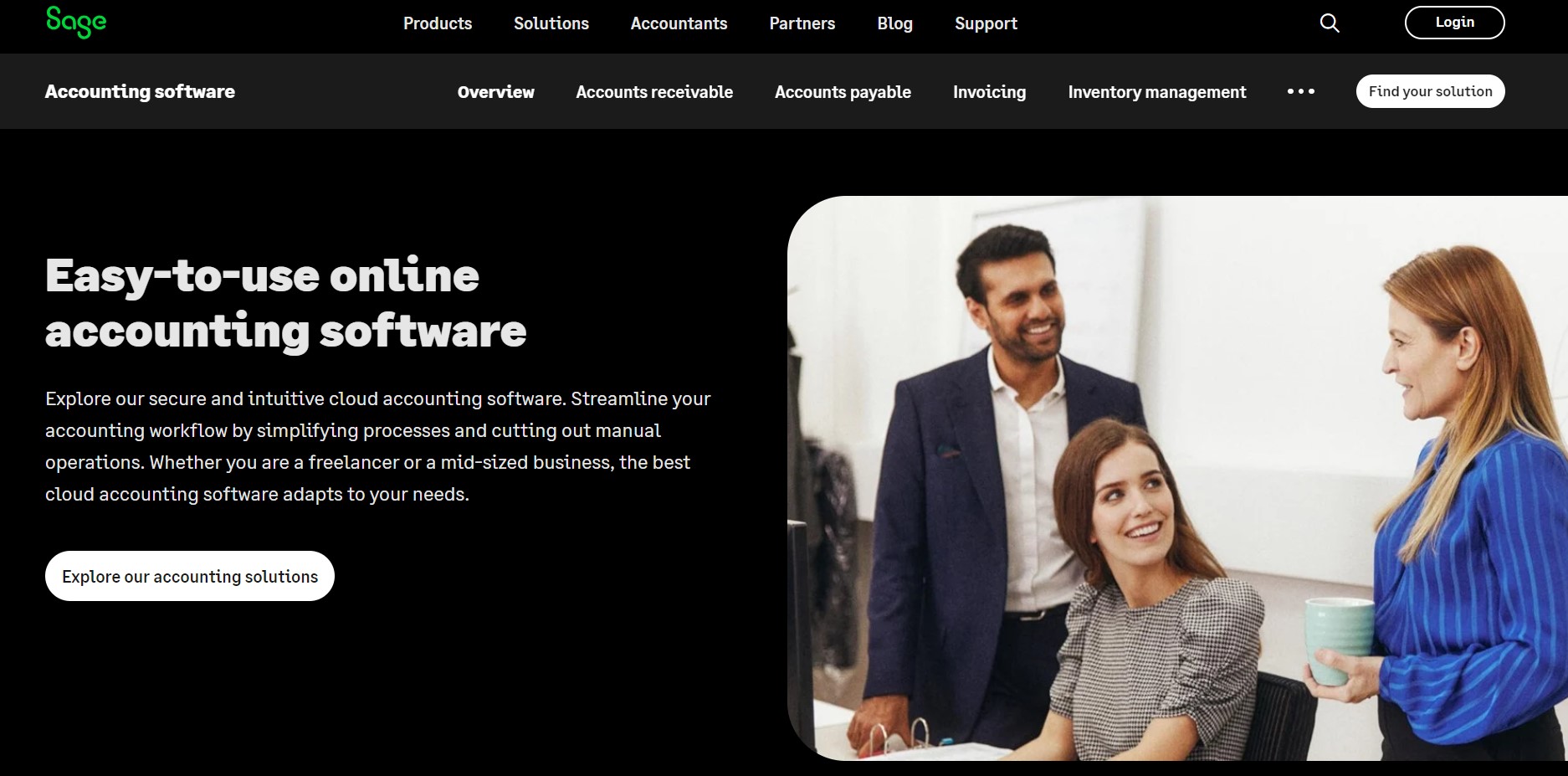

2. Sage Accounting

Image via Sage Accounting

This QuickBooks alternative is an accounting software with essential bookkeeping features, such as inventory management and expense report compilations. It’s one of the most affordable QuickBooks alternatives that offers basic invoicing tools.

Sage Accounting gives you access to audit trails to help you track your expenses. With this accounting software, you can automate data entry and create VAT returns on all your transactions.

If you need to get insights into how well your business is doing, you can use its financial planning report feature to generate a comprehensive report.

Although Sage Accounting may not be as popular as other QuickBooks alternatives, it remains a worthy option for established businesses due to its robust functionalities. Here are its key features:

Key Features

- Offers inventory project tracking and comprehensive expense reports like cash flow statements and ledger reports

- Equipped with online bank feeds to automate and handle bank reconciliation

- Allows you to track your inventory and set up automatic out-of-stock notifications

- Generates reports to track your best-selling products automatically

- Connects users with Sage Accounting experts, bookkeepers, and other business partners

- Processes payment processing for online credit and debit bank payments

Pros

- Affordable pricing compared to competitors

- Offers a 30-day, cardless free trial

- Reliable phone support and customer service options

- Allows additional users for $2 per user

Cons

- Limited third-party integration options

- Additional costs to access time-tracking features and other advanced features

Pricing

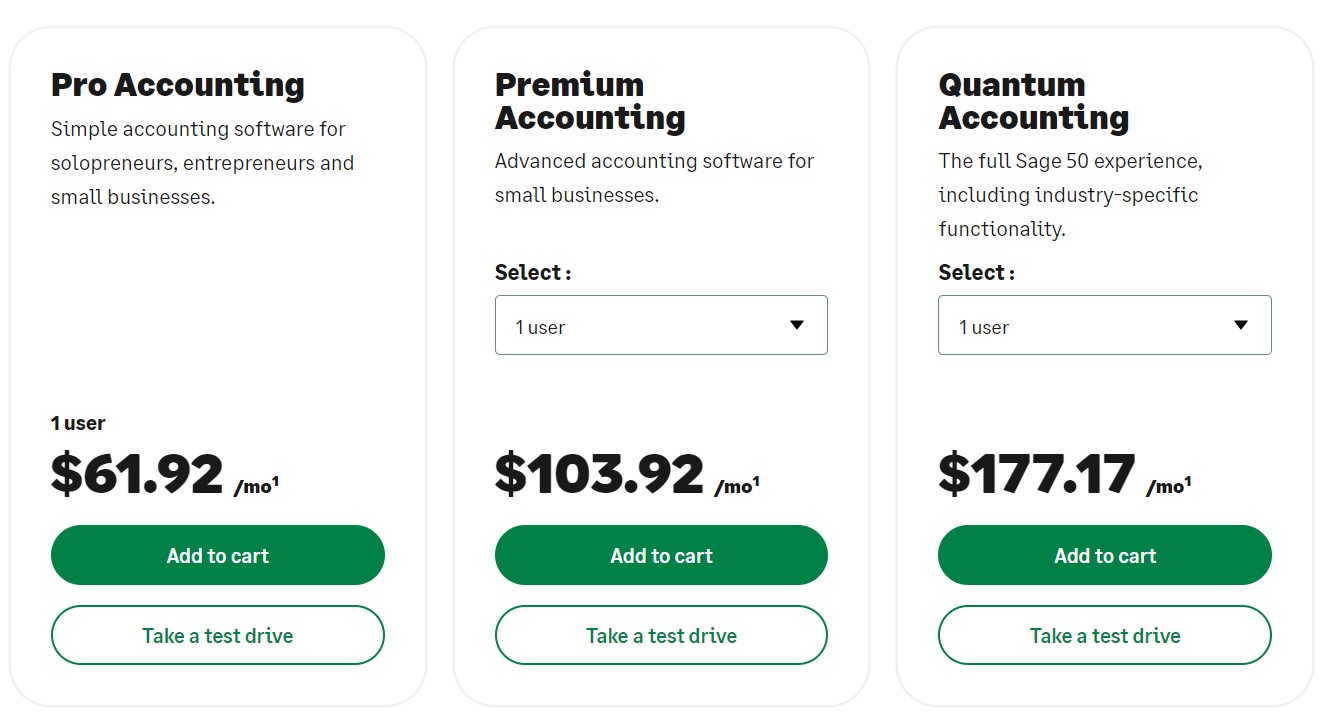

This QuickBooks alternative offers three paid plans and a 30-day free trial with access to full benefits.

- Pro Accounting: $61.92 per month

- Premium Accounting: $103.92 per month

- Quantum Accounting: $177.17 per month

Image via Sage Accounting

Tool Level

- Intermediate

Usability

- Easy to use

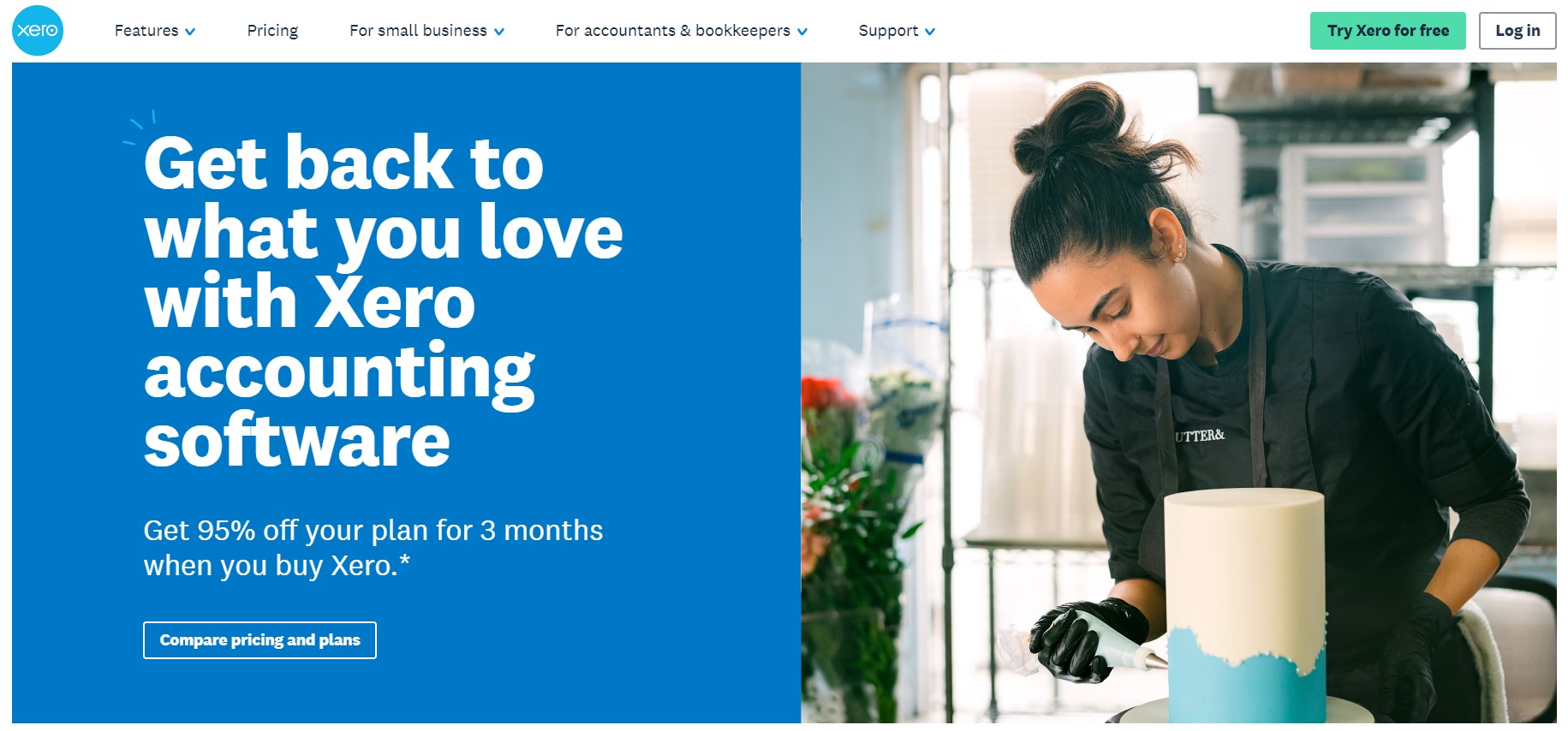

3. Xero

Image via Xero

Established in 2006, Xero is one of the most competent QuickBooks alternatives due to its extensive user base and wide range of functionalities. It makes your work easy by using workflow automation to simplify inventory management and cash flow records.

Xero doesn’t just track expenses; it also provides an audit trail to help you improve how you manage your expenses. If you need to talk to a professional, Xero also provides accessible accountants for that.

Among the suitable QuickBooks alternatives, Xero has some of the best seamless integration capabilities. This enables you to streamline your business operations with comprehensive cloud-based services.

It also offers a simple and beginner-friendly double-entry accounting system. So, for new business owners still learning the ropes in accounting, this is a good pick for them.

Here are the key features that make Xero a worthy QuickBooks alternative.

Key Features

- Features robust expense report customization tools with an intuitive user interface

- Provides a mobile app for project tracking compatible with both Android and IOS

- Emphasizes data security to protect users’ financial information

- Uses automation to import PayPal payments and other bank account transactions as live feed

- Has a customizable dashboard with a simple layout

- Allows you to import pre-existing receipt data and records from Excel, Google Docs, or PDF documents

Pros

- Affordable, with the lowest plan at $15 per month

- High integration capabilities with over 1000 business tools

- Offers unlimited users on all levels

- 30-day free trial

Cons

- Inadequate customer service options

- Limited number of transactions and invoices allowed in the Early plan

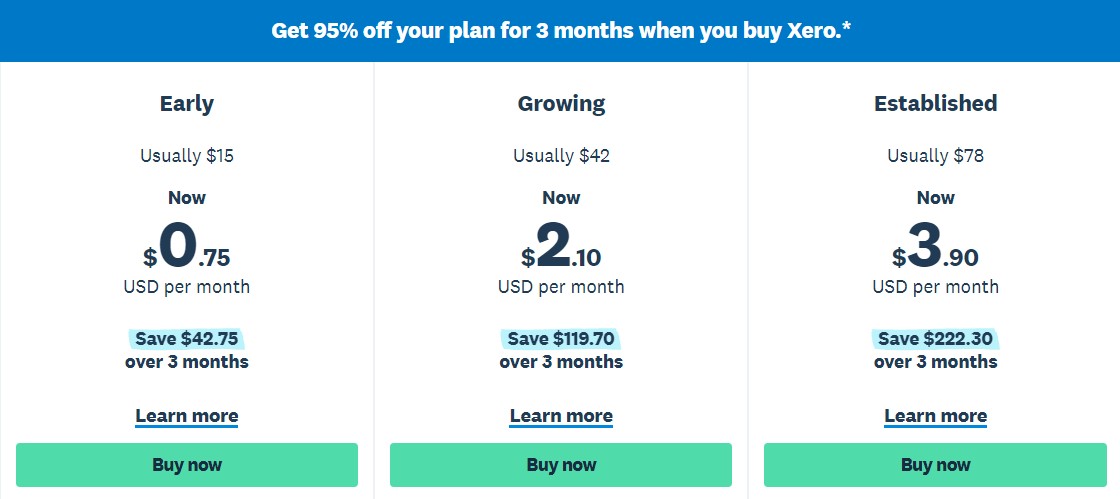

Pricing

After its 30-day free trial, Xero offers a 3-month, 95% discount on all its plans. Here’s what you pay with Xero.

- Early: Usually $15 per month (currently $0.75)

- Growing: Usually $42 per month (currently $2.10)

- Established: Usually $78 per month (currently $3.90)

Image via Xero

Tool Level

- Beginner

Usability

- Easy to use

You May Also Like:

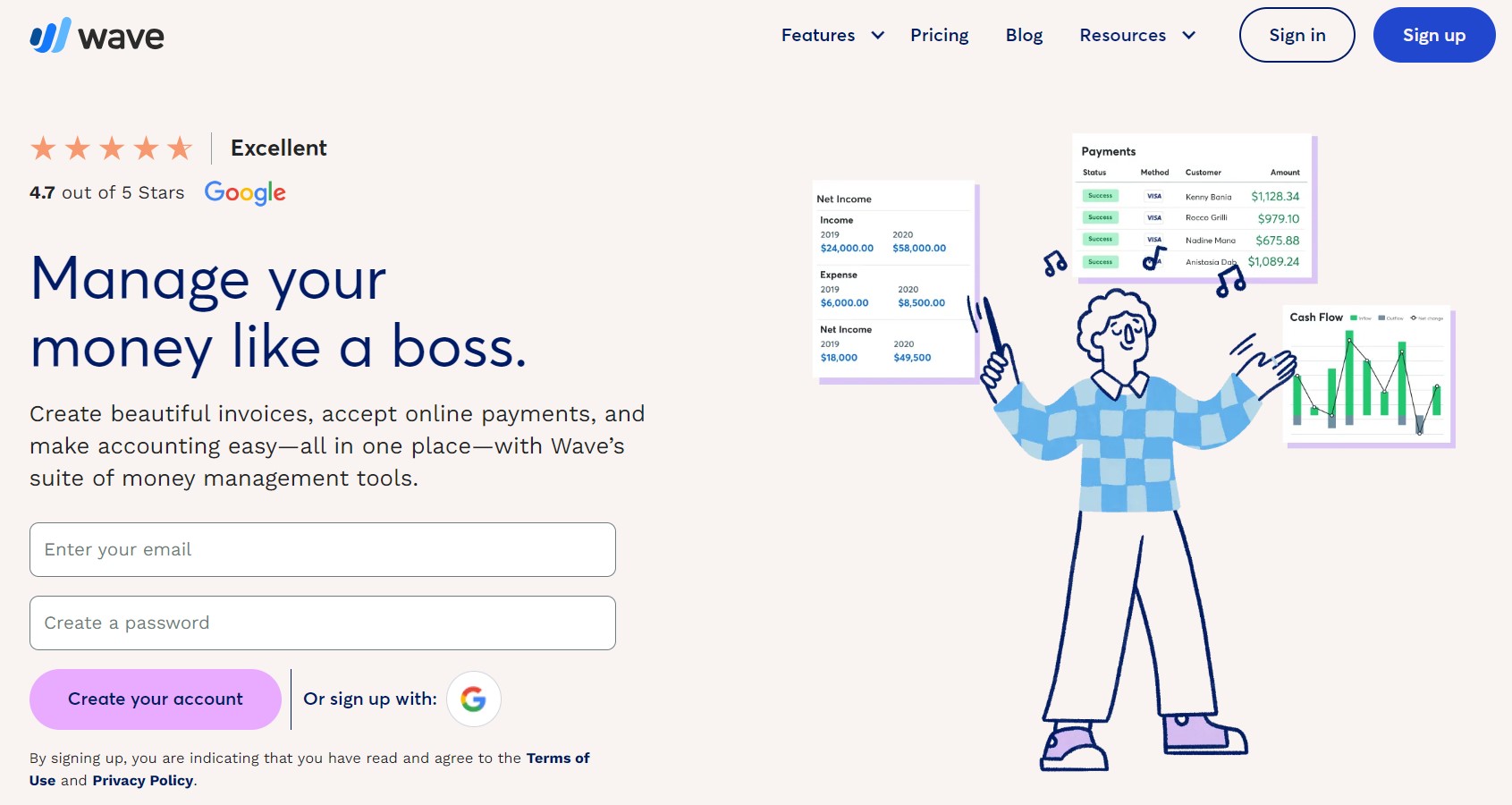

4. Wave Accounting

Image via Wave

Wave Accounting is a unique accounting software that focuses on the needs of small businesses. It uses cloud-based capabilities that cater to the accounting needs of freelancers, solopreneurs, self-employed contractors, and other small businesses.

For over 10 years, Wave Accounting has provided advanced features like tracking expenses, inventory management, and bill management automation to businesses of varying industries across the globe. Currently, it caters to the accounting needs of over 10 million businesses.

The platform excels at helping businesses efficiently track cash flow and categorize expenses, making it particularly valuable for entrepreneurs transitioning from basic spreadsheets to professional accounting software.

Unlike other QuickBooks alternatives, such as Zoho Books, that require you to subscribe to gain access to benefits, Wave offers a completely free plan with a wide range of benefits.

If you’re a one-man team or the owner of a startup business, this QuickBooks alternative is a good place to start your bookkeeping journey. It’s a user-focused accounting solution helping you track income quickly and invoicing clients professionally.

So, what are the key features that place Wave Accounting on this list of the best QuickBooks alternatives? Here they are.

Key Features

- Provides a double-entry accounting system to help you accurately track your transactions

- Allows you to create budgets and estimates that can easily be converted to invoices when the transaction is complete

- Allows you to send invoices on the go with its free app for Android and iOS

- Enables recurring invoices and automated credit card payment processing for repeat clients

- Provides easy access to accountants for a reasonable fee for consultation sessions

- Showcases a simple software design and an easy-to-use, intuitive user interface

Pros

- Offers a free starter plan with unlimited expense and invoice tracking

- Easy access to accountants

- Robust inventory-tracking functionalities

Cons

- Only integrates with other Wave applications

- Doesn’t offer audit trails

- Limited scalability

Pricing

Wave Accounting offers a free plan and a paid plan:

- Starter: $0 per month

- Pro: $16 per month

Image via Wave

Tool Level

- Beginner

Usability

- Easy to use

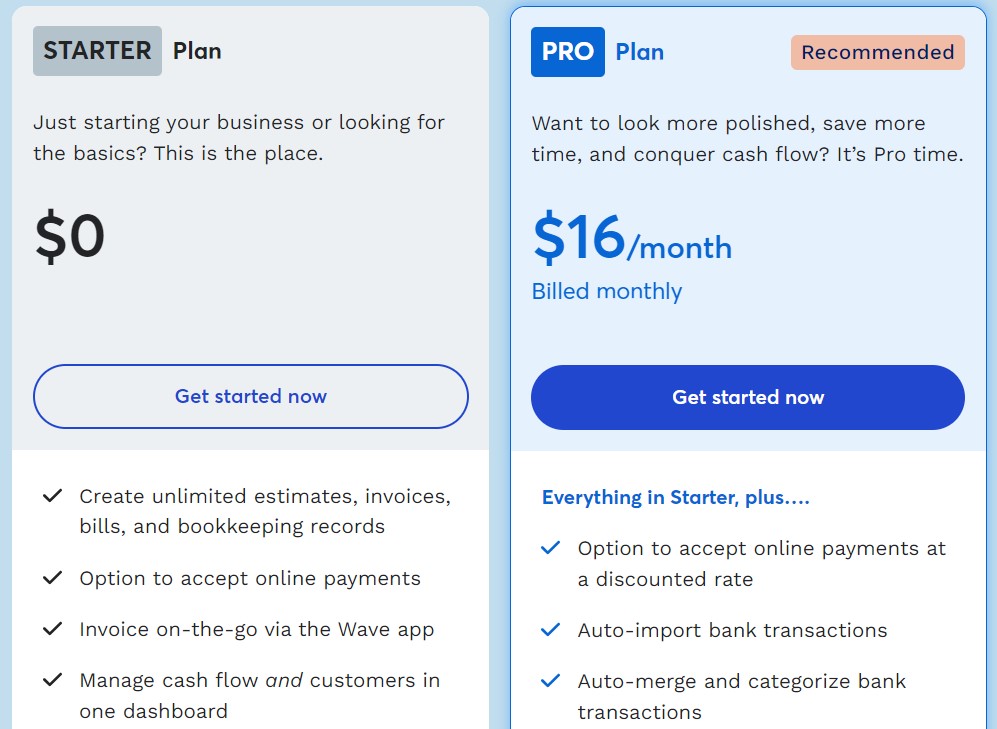

5. FreeAgent

Image via FreeAgent

With over 150,000 users, FreeAgent is a cloud-based accounting software that provides advanced expense-tracking tools to monitor cash flow and tax bills.

FreeAgent is equipped with numerous features, like payroll management and invoicing. You can use it to generate, send, and track invoices, which can be monitored on an easily customizable dashboard.

This QuickBooks alternative allows you to upload expense receipts. All you have to do is take a picture and let your FreeAgent app do the rest.

Such features help you streamline all your business expenses more accurately. They are also great for financial planning and projecting your business profitability.

Take a look at some of its key features.

Key Features

- Provides access to business insights with expense reporting tools

- Tracks and automates recurring income and expenses using its built-in project management tools

- Provides essential time-tracking tools like smart timesheets and an in-built stopwatch

- Enables UK accounts to run HMRC-recognized payroll for streamlining employee compensation

- Allows you to easily file VAT, Self Assessment and RTI returns from a dashboard, enabling you to remain tax compliant.

- Seamlessly integrates with payment processing gateways like PayPal, Stripe, and Zapier

- Enables you to create estimates and invoices in over 25 languages and different currencies

Pros

- 30-day free trial and 50% off for the first six months after signing up

- Payroll function available on all UK membership plans

- Seamless API integration capabilities

- Award-winning customer support

Cons

- May be pricey after the 50% off period

- Limited customer service options

Pricing

FreeAgent comes with just one plan:

- Universal: $22 per month ($11 per month for the first six months thanks to a 50% discount)

Image via FreeAgent

Tool Level

- Beginner to Intermediate

Usability

- Moderately easy to use

You May Also Like:

- What is Accounting Software? Everything You Need To Know

- Tax Deduction Cheat Sheet – How to Save Money On Taxes

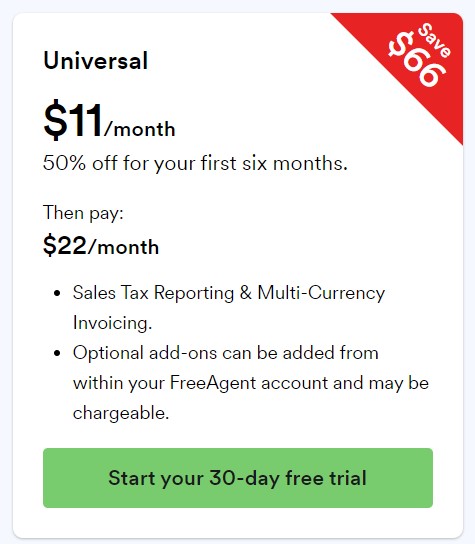

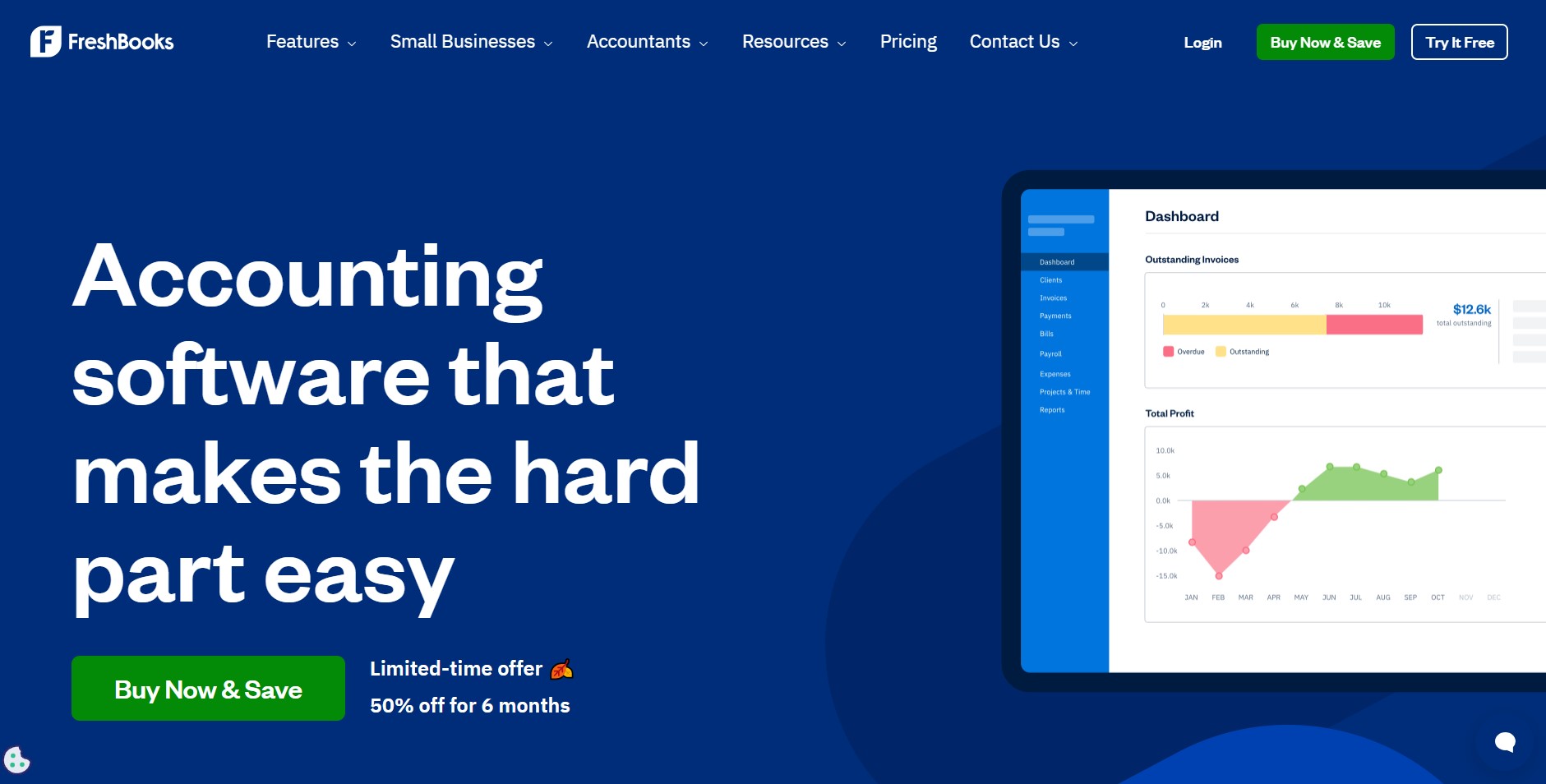

6. FreshBooks

Image via FreshBooks

FreshBooks is an accounting software famous for its invoice management features. It uses a cloud-based system to help businesses fill in their general ledgers, set automatic payment reminders, and manage invoices.

With about 5 million worldwide users, FreshBooks is one of the most popular accounting software options. It started as an invoicing platform before it evolved into full accounting software.

This software appeals to small business operations due to its beginner-friendly interface and accounting features. Even if you’re fairly new to bookkeeping, you’ll have no trouble navigating this software.

FreshBooks cloud-based system allows you to access the platform from anywhere with an internet connection. It also compiles your financial data on a streamlined dashboard that makes it easy to toggle between expense reports and other functions.

Here are the key features that make this QuickBooks alternative stand out.

Key Features

- Allows you to pay bills, manage invoices, and streamline payroll on a simple dashboard

- Categorizes expenses to enable you to run reports that can be shared with your accountant for easy tax filing purposes

- Allows you to send invoices on the go, track expenses, and scan receipts by simply taking a picture

- Integrates with over 100 third-party applications to streamline project management and business operations

- Automatically categorizes transactions and monitors invoices even after you send it, telling you when the recipient has received and viewed it

Pros

- Small-business friendly

- Detailed time-tracking features

- Multiple integration capabilities with third-party applications

- Risk-free 30-day moneyback guarantee

- Offers unlimited invoices across all paid plans

Cons

- Not suitable for large or midsize businesses with more accounting needs

- Low plans don’t offer access to accountants or audit trails

- Limited functionalities compared to other QuickBooks alternatives

Pricing

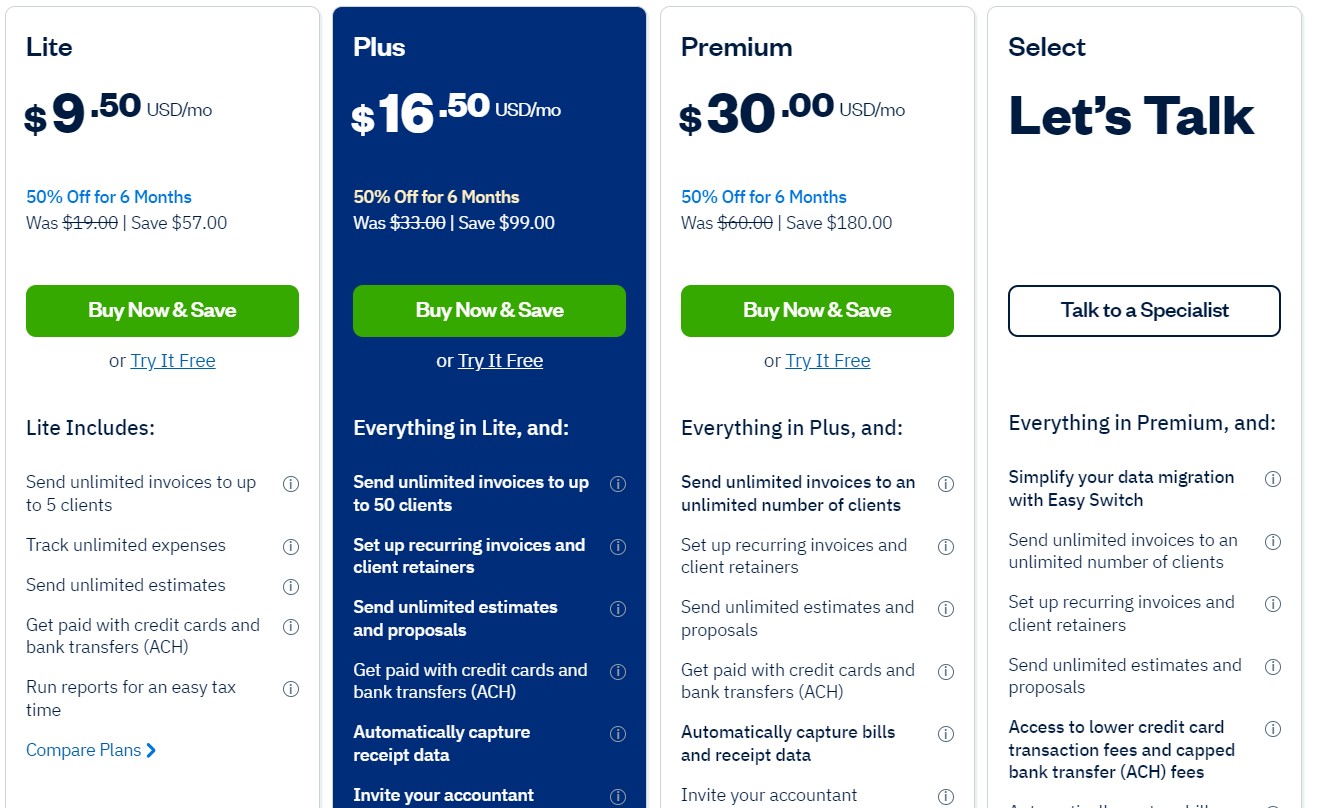

Lite, Plus, and Premium plans provide a 50% discount for 6 months.

- Lite: Typically $19 per month but currently $9.50 per month

- Plus: Typically $33 per month but currently $16.50 per month

- Premium: Typically $60 per month $30.00 per month

- Select: Custom pricing

Image via FreshBooks

Tool Level

- Beginner to intermediate

Usability

- Easy to use

7. KashFlow

Image via KashFlow

KashFlow is a cloud-based accounting software that offers similar functionalities to most QuickBooks alternatives. Since 2005, this award-winning software has been used by business owners to customize invoices, produce quotes, and handle bank reconciliation.

Although this software was designed with small business owners in mind, it can also cater to the needs of established businesses without compromising its performance. Whether you’re familiar with accounting features or not, you’ll find KashFlow easy to use.

One of the most common financial accounting challenges small businesses face is keeping up with tax laws. KashFlow takes care of this by automating tax filing.

This alternative to QuickBooks helps business owners automate recurring purchases and inform the recipient when a payment processing has been made. This helps you save time, allowing you to focus on other aspects of your business.

Here are the key features that make KashFlow stand out.

Key Features

- Complies with the MTD initiative to help you keep track of taxes with automated VAT filing

- Allows you to access your financial records whenever, wherever

- Uses automated credit-control features to track recurring payments from loyal customers

- Automatically converts quotes to invoices, enabling you to accept payments easily

- Allows you to share your books with your accountant directly for easy project tracking

- Provides payroll functionalities for a set fee

- Allows you to create personalized reports of cash in-flow and out-flow and export them to PDF and CSV

Pros

- 24/7 online customer support

- Automatic credit control

- 14-day free trial

Cons

- Limited functionalities compared to other QuickBooks alternatives

Pricing

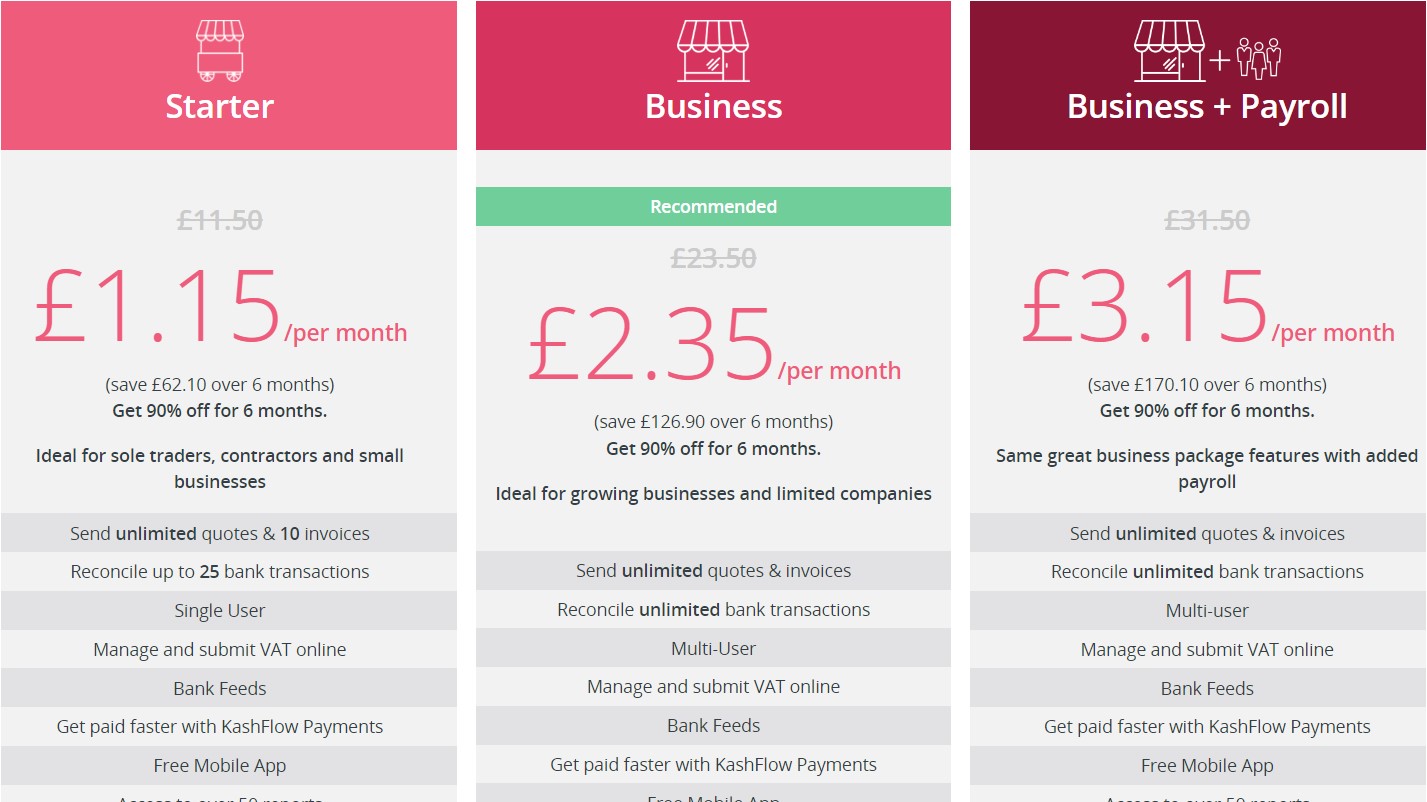

KashFlow offers a 90% discount on all its plans for the first 6 months.

- Starter: £11.50 per month (currently £1.15 per month)

- Business: £23.50 per month (currently £2.35 per month)

- Business + Payroll: £31.50 per month (currently £3.15 per month)

Image via KashFlow

Tool Level

- Intermediate

Usability

- Moderately easy to use

You May Also Like:

8. Quicken

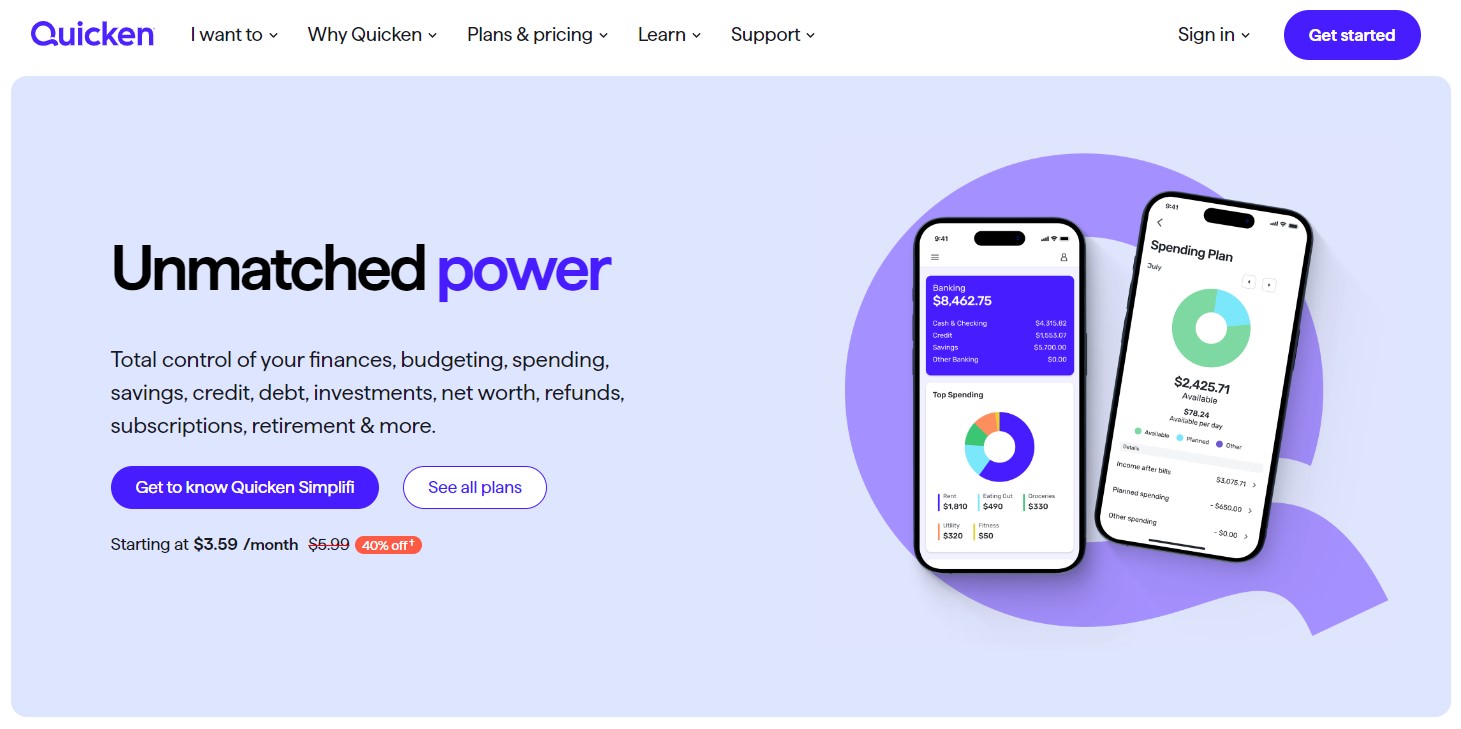

Image via Quicken

Quicken is one of the oldest finance management platforms. It has helped over 20 million customers in a span of 40 years.

Although it was established as a personal finance management tool, it has expanded its functionalities to cater to small and large businesses alike.

This QuickBooks alternative provides an all-in-one accounting solution that tracks your spending and displays your bank account details on a centralized database.

Quicken seamlessly tracks your bill payments by connecting you to over 11,000 digital network billers. All you have to do is set up payment processing. Then, all your monthly bills and recurring business transactions can be processed and recorded on a single platform.

Real estate agents particularly prefer this accounting software due to its unique features. It’s equipped to track and manage the profitability of real estate investments.

These features are available on the Home & Business package, which includes rental property functions you can use to invest in properties and track income from tenant payments.

So, if you’re looking for accounting software that not only tracks expenses but offers investment options to help you grow, Quicken is a good place to start.

What else makes Quicken part of the worthy QuickBooks alternatives? Take a look at its key features.

Key Features

- Equipped with payment scheduling and tax planning features

- Offers a wide range of industry-specific accounting features with in-depth investment features

- Offers annual subscription fees instead of monthly plans

- Offers different software versions, so you have the flexibility of choosing what works best for your business

- Includes both cloud-based and desktop-based functions, depending on the plan you choose

- Enables you to create and send customized invoices via email

Pros

- Straightforward and easy to use

- Affordable subscription fees, with the lowest tier being only $2.99 per month

- Advanced financial data security

- 30-day moneyback guarantee

Cons

- Preferable for individuals or small business operations that don’t require scalability

- Lacks double-entry accounting systems

- Limited features on iOS and MAC interface compared to Windows

Pricing

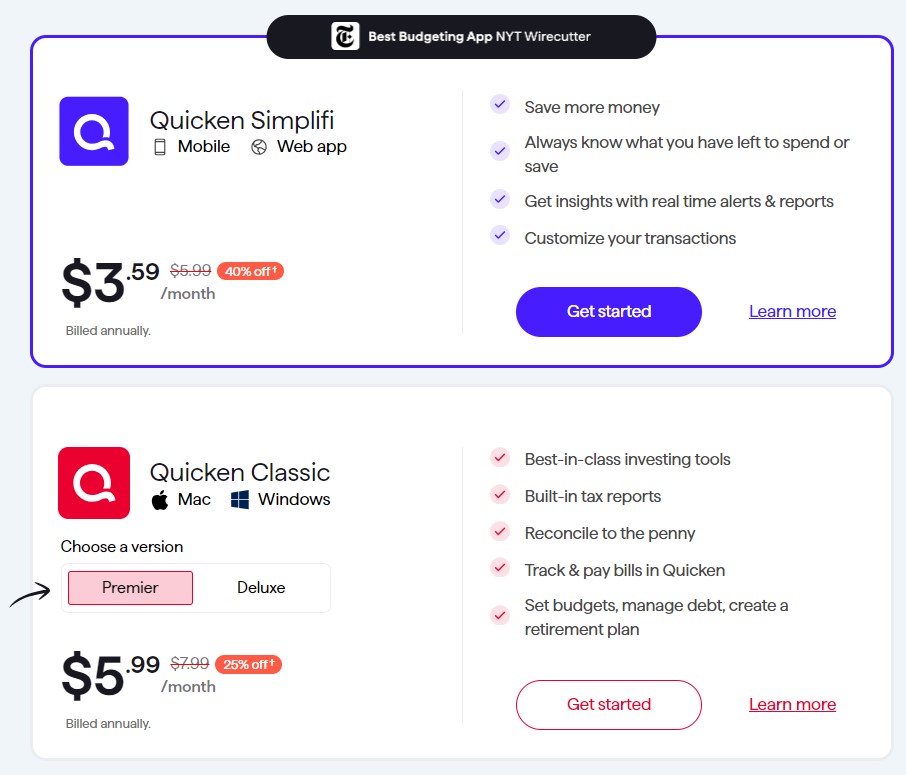

Quicken offers three plans that are billed annually. It currently offers 40%, 25%, and 16% off in the first year of the three plans, respectively. These include:

- Quicken Simplifi: Usually $5.99 per month, now $3.59 per month

- Quicken Classic Deluxe: Usually $7.99 per month, now $5.99 per month

- Quicken Classic Premier: usually $5.99 per month, now $4.99 per month

Image via Quicken

Tool Level

- Intermediate

Usability

- Moderately easy to use

9. Square Invoices

Image via Square Invoices

Square Invoices is an accounting tool powered by Square, a leading software company that offers a range of business software solutions.

This QuickBooks alternative is equipped with various features, such as sending invoices and scheduling automatic payment reminders. That way, you can receive timely and automated payments from customers.

With Square Invoices, you can easily attach relevant documents to invoices for proper accountability. You can also save customers’ information and credit card details, so the next time a payment is due, all you have to do is process it with the click of a button.

Square Invoices is a convenient invoicing tool that has seamless integration with other third-party apps, including accounting tools like QuickBooks, Zoho Books, and Xero. This makes it easy to transfer your financial data from one accounting software to another if you’re considering switching over.

Additionally, it allows you to accept tips and apply VAT or discount vouchers when sending an invoice to customers.

Here are the key features of this QuickBooks alternative.

Key Features

- Provides both standard and advanced editions, each offering distinct services tailored to address your company’s specific accounting features

- Includes customizable invoice templates with automatic payment reminders

- Allows you to approve payments with e-signature

- Integrates with Square’s suite of business tools like payroll software and retail POS systems

- Features a mobile-friendly interface to authorize invoicing and payments on-the-go

- Generates and sends digital receipts through email or text

Pros

- Easy to use

- Works well with payment processing gateways like PayPal, Google Card, Cash App, or ACH bank transfer

- Creates customer portal profiles to expedite recurring payments

- One-time payment with no monthly fees or hidden costs

Cons

- High processing fees

- Poor customer service

Pricing

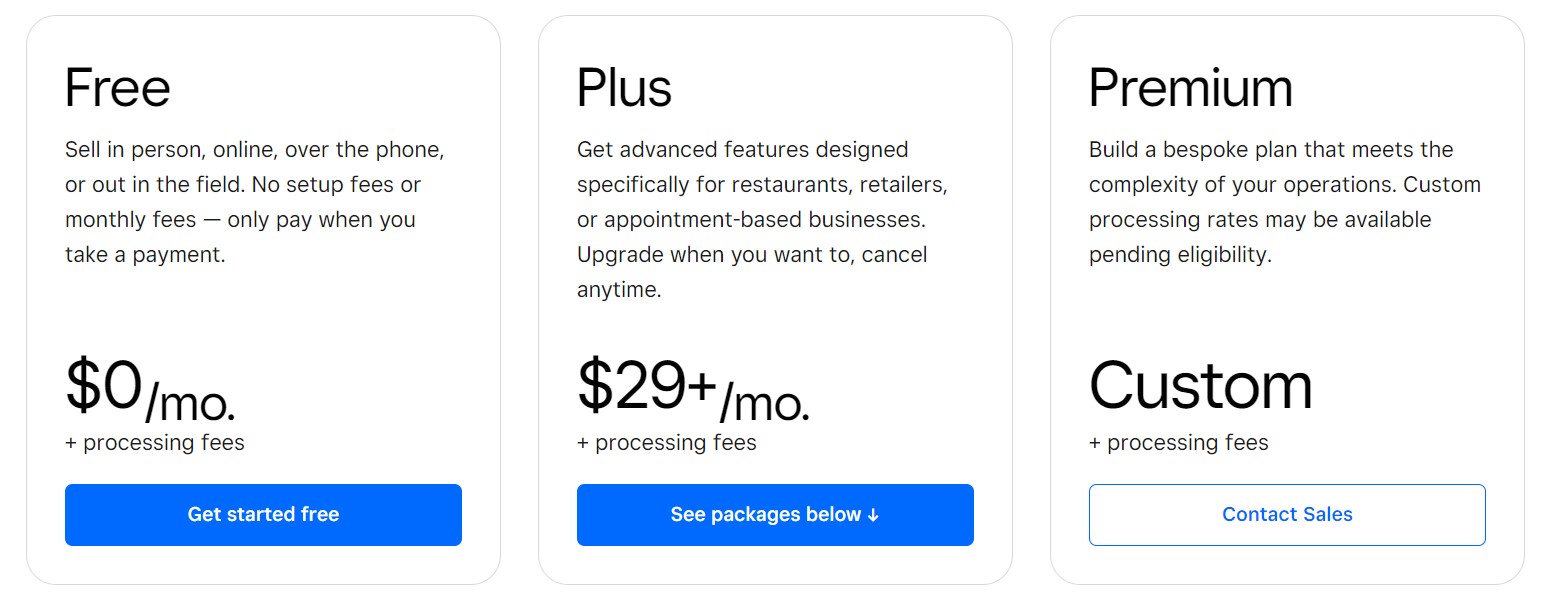

Square Invoices offers a limited free plan and a paid plan with a 30-day free trial. However, it charges a percentage on each payment you receive.

- Free: $0 per month + processing fees

- Plus: $29 per month + processing fees

- Premium: Custom pricing + processing fees

Image via Square Invoices

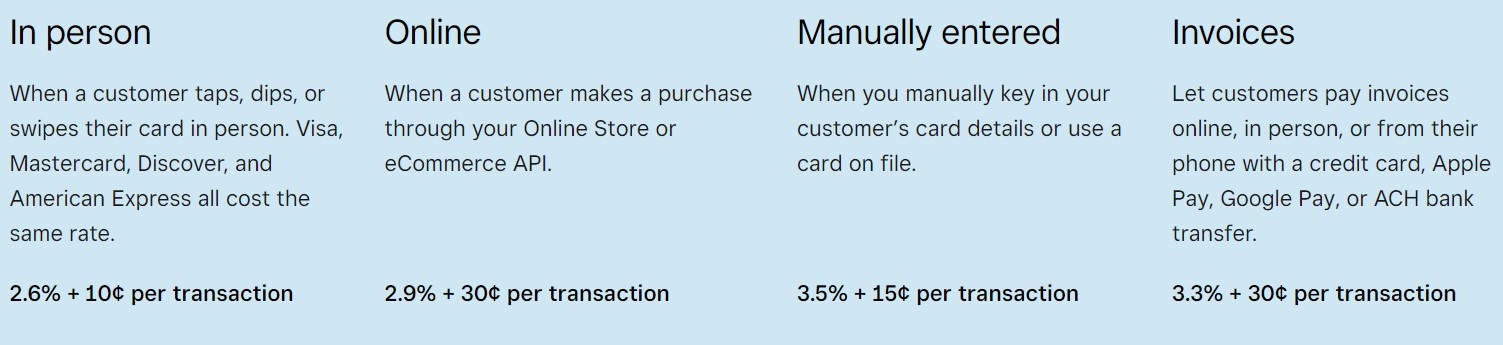

Processing Fees

- In-Person Transactions: 2.6% + 10¢ per transaction

- Online Invoices: 2.9% + 30¢ per transaction

- Manually Entered Transactions: 3.5% + 15¢ per transaction

- Invoice with Cash App Pay: 3.3% + 30¢ per transaction

Image via Square Invoices

Tool Level

- Intermediate

Usability

- Easy to use

You May Also Like:

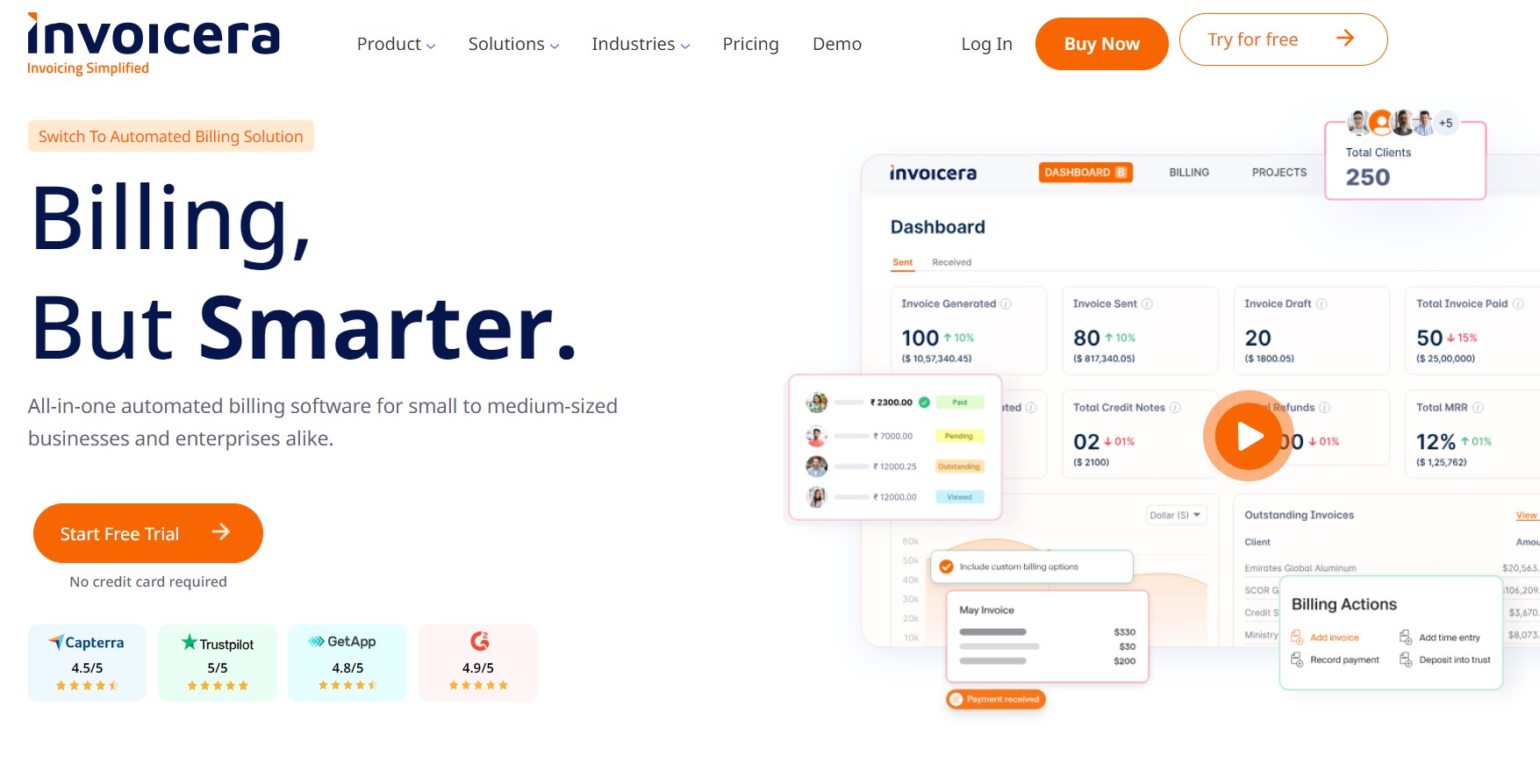

10. Invoicera

Image via Invoicera

Invoicera is a custom cloud billing solution for more than 75 global enterprises. It’s certainly one of the best QuickBooks alternatives in today’s market.

This accounting tool is equipped with all the cloud-based features you need to automate invoices, handle time-tracking, and manage business expenses.

Over the years, Invoicera has satisfied freelancers and business owners from small and growing companies in different industries.

Invoicera takes the hassle out of repetitive invoicing tasks by using automation to set up recurring invoices. It also encourages you to remain compliant with tax regulations with its GST invoicing capabilities, which give you automated tax calculations and simplify invoicing.

This QuickBooks alternative is also a great option for business owners who want to easily manage multiple vendors on a single platform.

Its secure customer portal allows you to view all your invoices and projects in a private space while being able to directly communicate with clients on the platform.

Here are its key features:

Key Features

- Supports 15+ languages and currencies from over 40 countries around the world

- Creates and sends invoices with professional templates

- Sets up recurring bills and late payment reminders

- Offers desktop and cloud-based solutions for easy accessibility

- Allows you to create projects and track their progress status to monitor expenses

- Provides a time-tracking feature to record billable hours for more precise payment processes

Pros

- Easily scalable

- Offers seamless integration with payment gateway

- Free version available

Cons

- Limited accounting features compared to other QuickBooks alternative

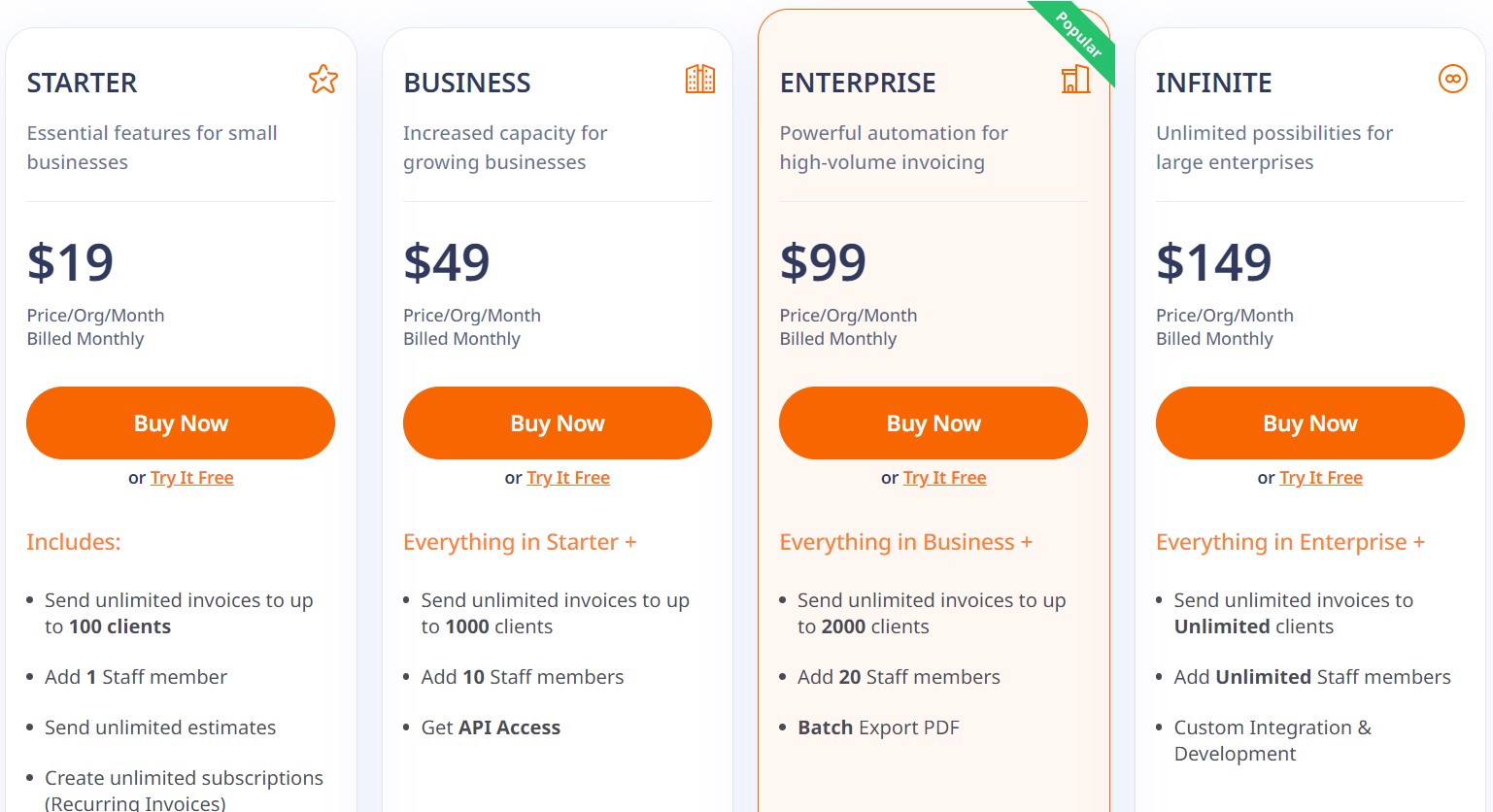

Pricing

Invoicera does not offer a free version. It offers paid plans with access to full benefits and a 30-day free trial.

- Starter: $19 per month

- Business: $49 per month

- Enterprise: $99 per month

- Infinite: $149 per month

Image via Invoicera

Tool Level

- Beginner to intermediate

Usability

- Easy to use

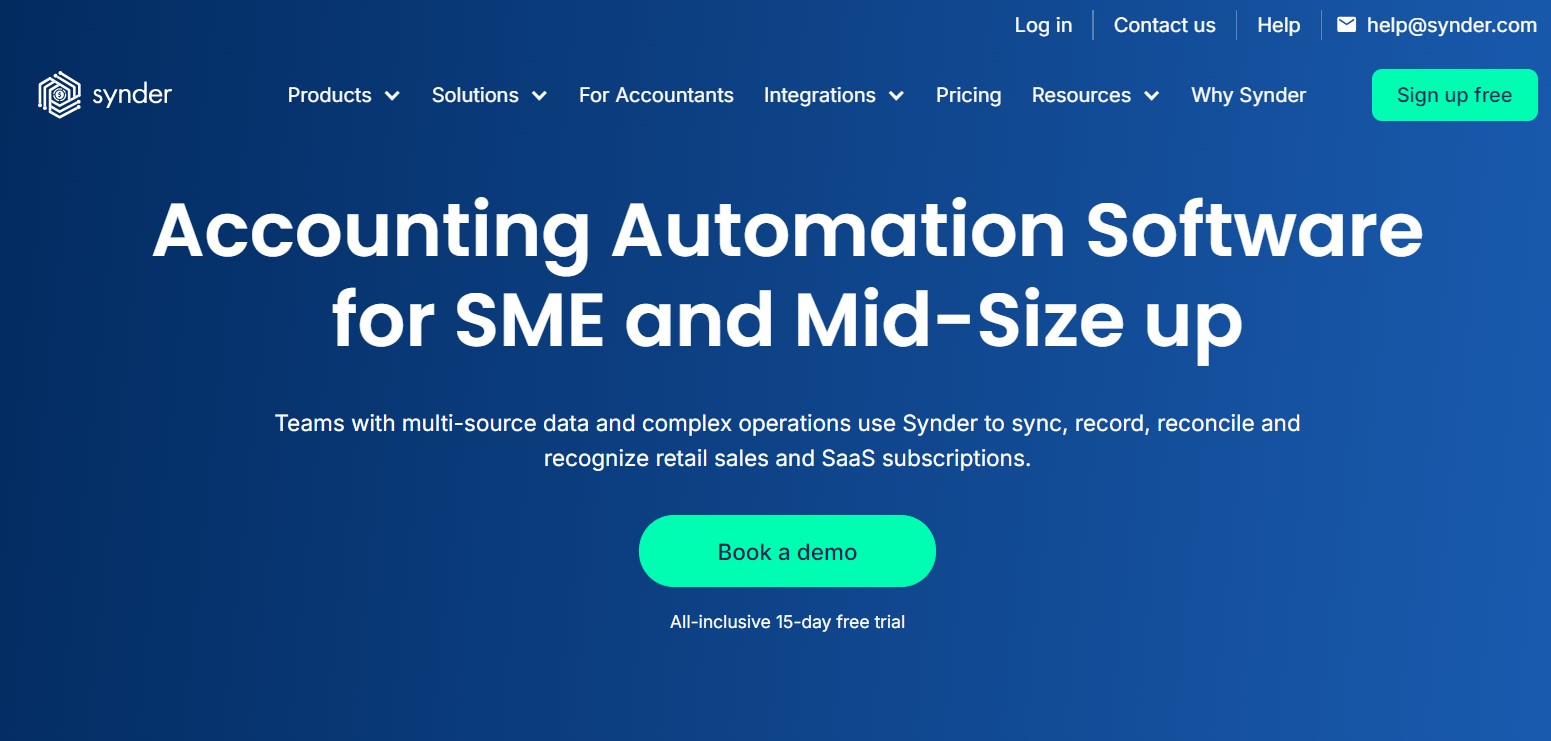

11. Synder

Image via Synder

If you’re looking for QuickBooks alternatives that make ecommerce business bookkeeping easy, Synder is one of your best bets. From bank reconciliation to inventory tracking and ledger management, this accounting tool has got you covered.

Synder makes your work easy by automating a good chunk of your financial transactions. It automates repetitive processes like recurring bill payments and can easily track real-time metrics to provide financial health insights.

Here are its key features:

Key Features

- Generates invoices and time-saving smart payment links to enable you to accept payments fast

- Equipped with multi-currency online payment channels, records taxes, and smoothly reconciles multi-channel sales

- Synchronizes transactions from 25 + payment processors and eCommerce platforms

- Centralizes your transactions and other financial operations on an activity dashboard

- Enhances data accuracy with smart duplicate detection mechanism and one-click roll back

- Integrates with popular sales channels like Amazon, Shopify, Etsy, eBay, and WooCommerce

Pros

- Wide integration capabilities

- User-friendly interface

- Responsive 24/7 customer support team

Cons

- More pricey than other QuickBooks alternatives on this list

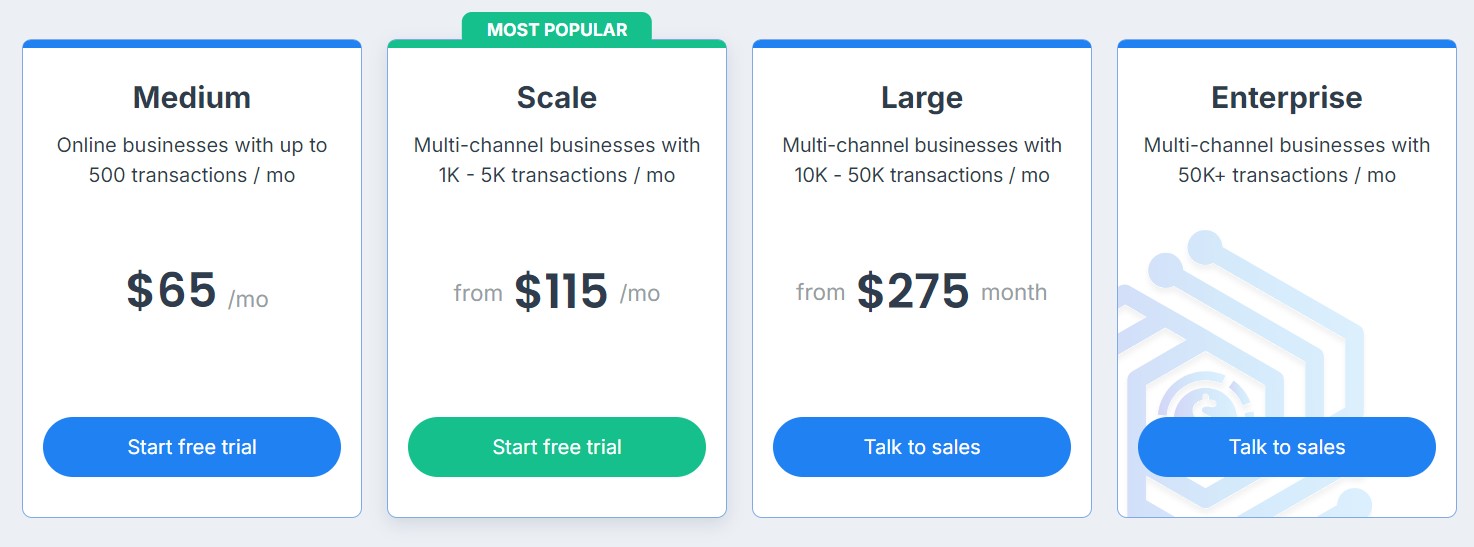

Pricing

Synder offers pricing plans in four tiers with access to different benefits and other add-ons.

- Medium: $65 per month

- Scale: $115 per month

- Large: $275 per month

- Enterprise: Custom Pricing

Image via Synder

Tool Level

- Intermediate

Usability

- Easy to use

You May Also Like:

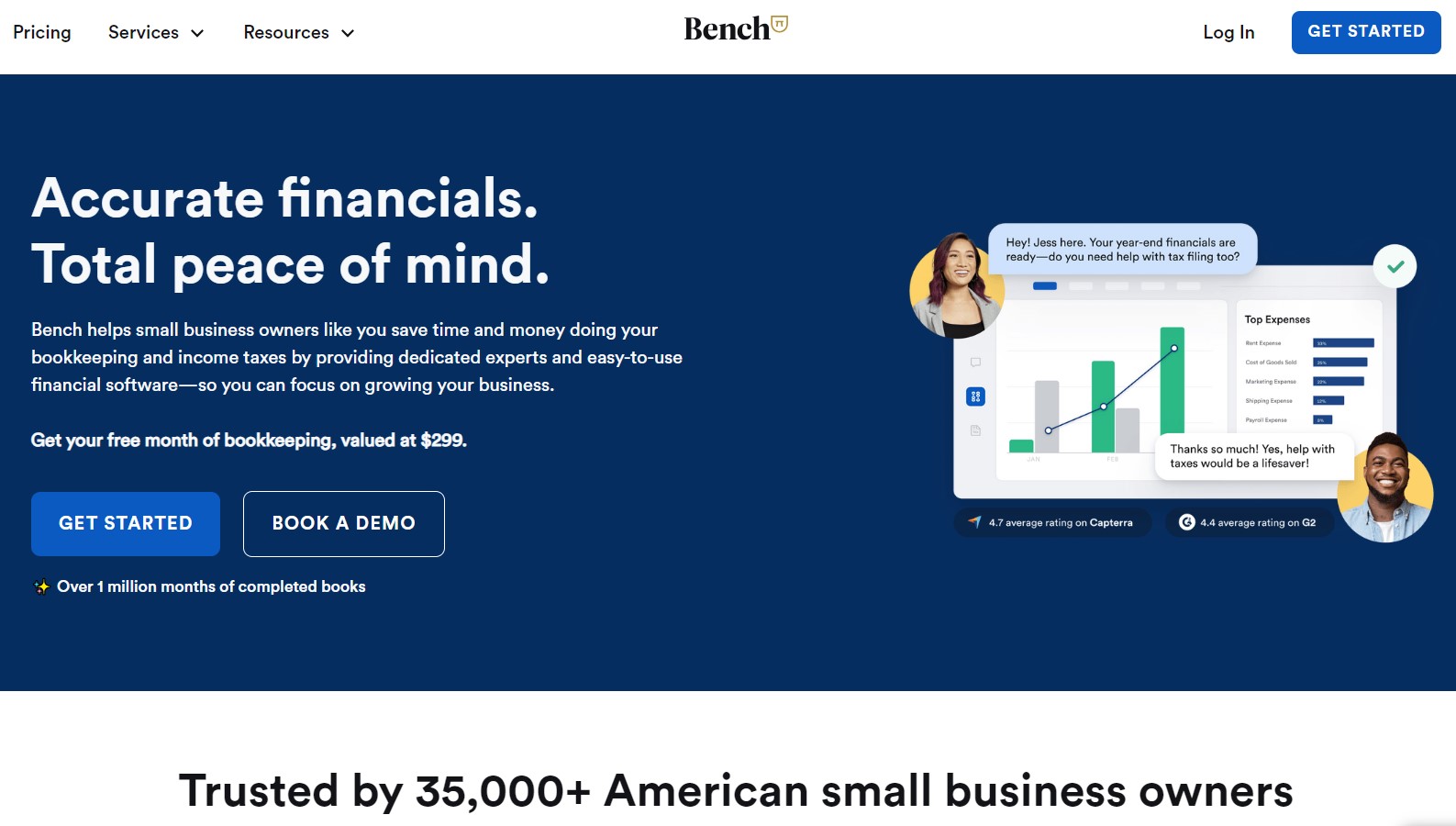

12. Bench

Image via Bench

Bench offers a unique approach to accounting software by combining powerful technology with professional bookkeeping services. Unlike traditional alternatives, Bench provides small business owners with dedicated bookkeepers who handle their financial records using proprietary accounting tools.

This hybrid solution stands out by offering real human expertise alongside automated features. Your dedicated bookkeeper handles your monthly bank reconciliation, categorizes expenses, and ensures your books are always tax-ready.

For business owners who want hands-off financial management without sacrificing accuracy, Bench delivers exceptional value.

The platform excels in providing clear financial insights through its intuitive dashboard. You can easily track your cash flow, monitor your financial health, and access detailed reports that help inform business decisions.

Bench’s project tracking capabilities help you understand exactly where your money is going.

What sets Bench apart is its comprehensive approach to accounts payable and financial reporting. The combination of human expertise and sophisticated software ensures accuracy while saving you valuable time.

Key Features

- Dedicated bookkeeping team for personalized financial management with monthly reviews

- Real-time financial planning insights through interactive dashboard with customizable reports

- Comprehensive monthly bank account reconciliation and transaction categorization

- Detailed financial reporting and year-end tax packages with audit protection

- Advanced cash flow management and forecasting tools with trend analysis

- Essential features for tax season preparation and compliance

- Advanced bill management system that automatically tracks and categorizes vendor payments

Pros

- Hands-off bookkeeping with expert support and dedicated account manager

- Intuitive reporting interface with customizable dashboards

- Tax-ready financial statements with year-round support

- Direct communication with dedicated bookkeepers through secure messaging

- Seamless integration with major banking and payment platforms

Cons

- Higher price point compared to self-service alternatives

- Limited direct payment processing features

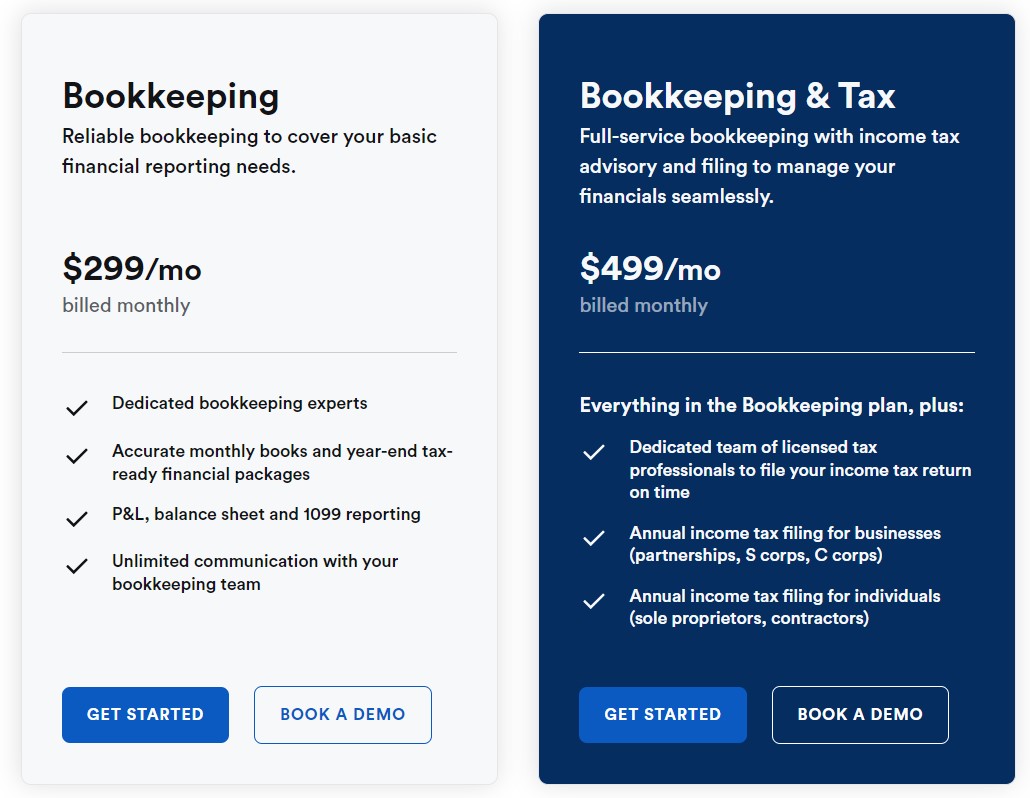

Pricing

- Bookkeeping: $299 per month

- Bookkeeping and Tax: $499 per month

Image via Bench

Tool Level

- Beginner (with expert support)

Usability

- Easy to use

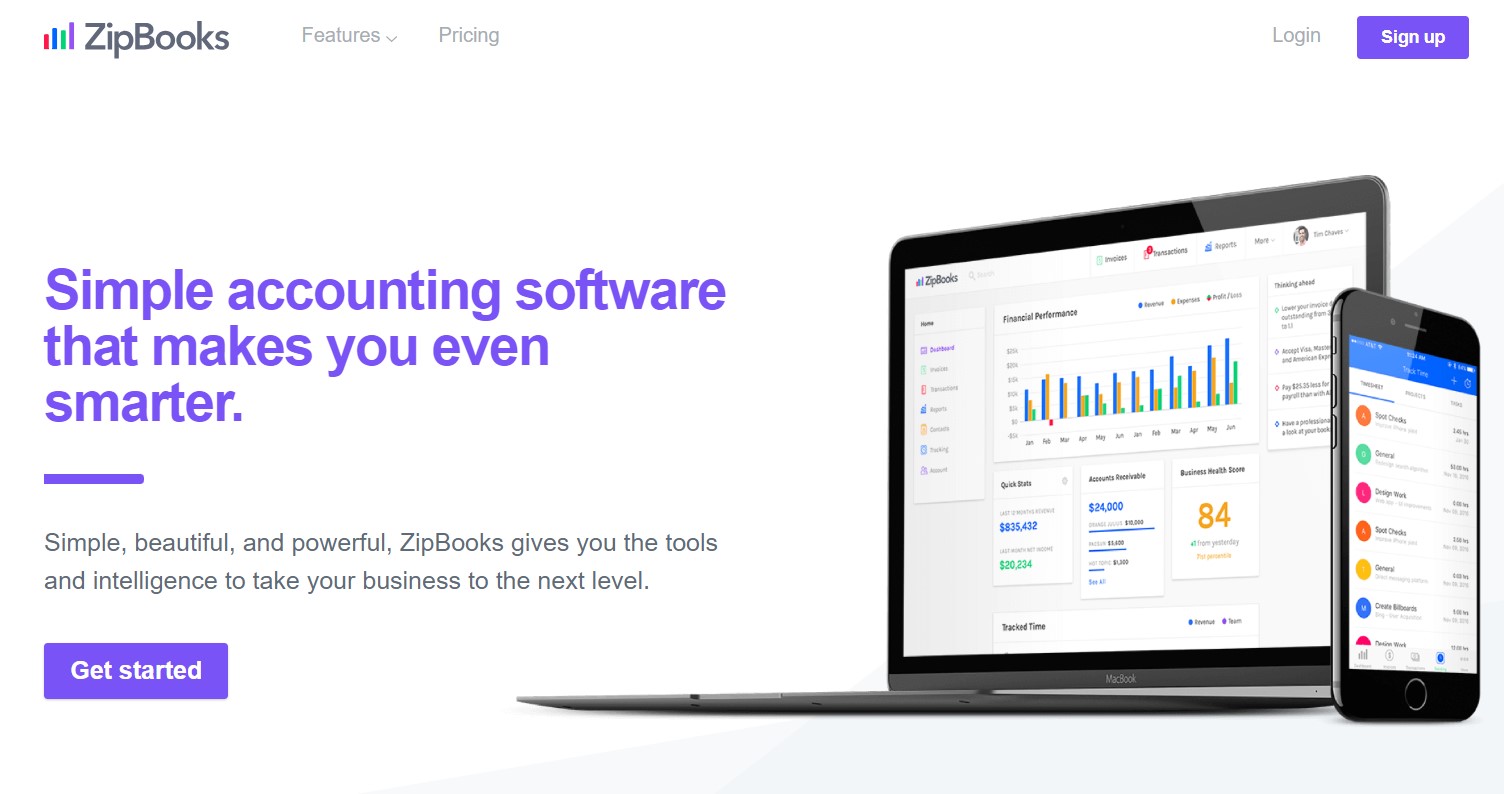

13. ZipBooks

Image via ZipBooks

ZipBooks is a modern cloud-based accounting software that combines simplicity with powerful features. Designed specifically for small business owners and freelancers, ZipBooks offers an intuitive user interface that makes financial management less daunting.

The software’s scalable architecture caters to both small and midsize businesses, offering features that can grow alongside your company while maintaining its user-friendly approach.

This accounting platform stands out for its intelligent automation features. It learns from your previous actions to auto-categorize transactions, streamline bank reconciliation, and simplify payment processing.

The platform’s machine learning capabilities help improve your bookkeeping accuracy over time.

ZipBooks excels in project management and time tracking tools, allowing you to monitor billable hours and convert them directly into invoices. Its invoicing tools include professional templates and the ability to set up recurring invoices with automated reminders.

For businesses focused on growth, ZipBooks provides valuable insights through its intelligent scoring system, which evaluates your financial health based on various metrics and suggests improvements.

Key Features

- Auto-categorizes transactions for efficient accounts payable management with AI-powered suggestions

- Provides enterprise resource planning tools with customizable business performance insights

- Features comprehensive built-in time tracking and project management capabilities

- Offers customizable invoicing templates with online payments integration and automated reminders

- Includes comprehensive reporting tools for cash flow monitoring and forecasting

- Provides a centralized hub for managing multiple bank accounts

- Smart invoice tracking system with automatic payment matching

Pros

- Clean, modern interface with intuitive navigation

- intelligent automation features for routine tasks

- Seamless integration with popular payment gateways

- Built-in time tracking and project management

- Customer portal for client collaboration and document sharing

Cons

- Limited third-party integrations

- Some advanced features are only available in higher tiers

- No inventory management features

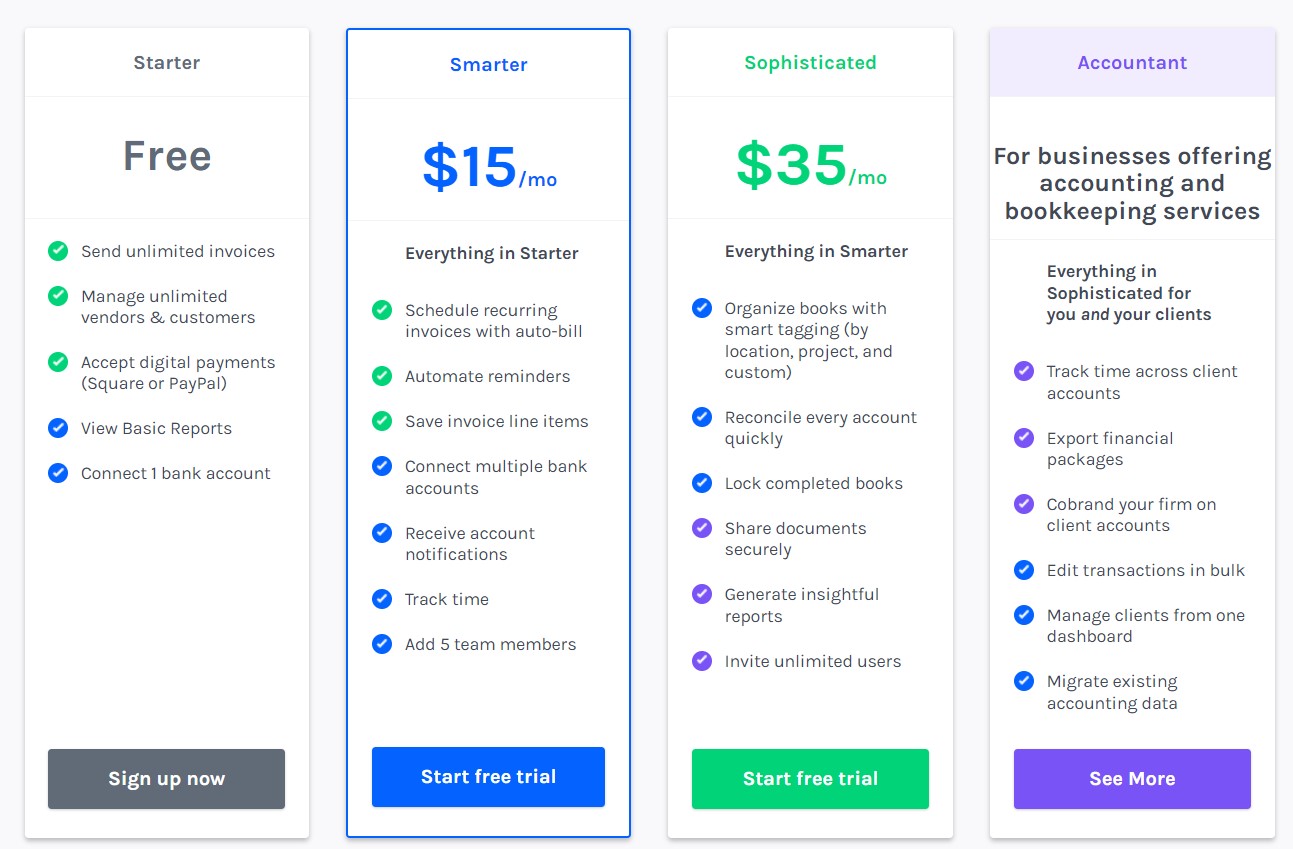

Pricing

- Starter: Free

- Smarter: $15 per month

- Sophisticated: $35 per month

- Accountant: Custom Pricing

Image via ZipBooks

Tool Level

- Beginner to Intermediate

Usability

- Easy to use

You May Also Like:

FAQ

Q1. What program is the equivalent of QuickBooks?

A. Several QuickBooks alternatives can deliver the same results without compromising on quality. They include:

- Zoho Books

- Xero

- FreeAgent

- Synder

- Wave

- KashFlow

- FreshBooks

- Quicken

- Sage Accounting

- Square Invoices

- Invoicera

- Bench

- ZipBooks

Q2. What is the least expensive QuickBooks option?

A. QuickBooks offers various benefits under its tiered membership plans: Simple Start, Essentials, Plus, and Advanced. Simple Start is the lowest and least expensive QuickBooks option, priced at $15 per month for the first three months.

Q3. Do accountants prefer QuickBooks?

A. According to 6sense, QuickBooks has a market share of 85.10%. This indicates that at least 8 out of 10 accountants and business owners use QuickBooks. It’s a popular accounting software among bookkeepers because it’s an efficient tool for streamlining financial records.

Q4. Is there a Google alternative to QuickBooks?

A. Although it has limited accounting functions and integration capabilities, Google Sheets can be used as an alternative to QuickBooks. This spreadsheet application was the preferred platform for finance management until more innovative software like QuickBooks came along.

Q5. Is there a free version of QuickBooks?

A. QuickBooks doesn’t have a free version, but it offers a 30-day free trial period to enable you to test-drive the software to see if it’s a good fit for you. If you’re interested in QuickBooks alternatives with free accounting software options, you can consider using Wave and Zoho Books.

Q6. Can I use Excel instead of QuickBooks?

A. Excel can be used to track and manage expenses just like QuickBooks. However, it requires you to do the work from scratch, while QuickBooks automates most of the processes for you. Excel also lacks the bank reconciliation and invoicing features QuickBooks offers.

Q7. Is Zoho similar to QuickBooks?

A. Zoho Books is one of the best QuickBooks alternatives you can try in 2025. It has similar functions to QuickBooks, including invoice customization, expense reports, and payment automation.

Q8. Are there any alternatives that provide professional bookkeeping services?

A. Yes, Bench offers a unique hybrid solution that combines accounting software with dedicated professional bookkeepers. While most alternatives focus on self-service tools, Bench provides hands-on expertise alongside its accounting tools, making it ideal for business owners who want professional support with their bookkeeping.

Q9. What should I consider when choosing between these accounting software alternatives?

A. When selecting QuickBooks alternatives, consider these key factors:

- Your budget and pricing preferences

- Required accounting features (like time tracking, project management, etc.)

- Need for professional bookkeeping support

- Bank reconciliation requirements

- Integration needs with other business tools

- Payment processing capabilities

- Scalability for business growth

- Level of customer portal access needed

- Quality of customer support

- Ease of use and learning curve

Q10. Can I switch between different accounting tools during the year?

A. Yes, you can switch between different accounting software platforms during the year, but it’s best to do so at the start of a fiscal period. When switching:

- Export all financial data from your current system

- Ensure proper bank account reconciliation before switching

- Double-check all accounts receivable and accounts payable

- Maintain backup records of all transactions

- Consider using professional migration services (offered by platforms like Bench)

- Verify that historical financial planning data transfers correctly

- Test the new system thoroughly before fully transitioning

You May Also Like:

- Best SaaS Accounting Software for All Businesses

- Best Accounting Software for Self-Employed Professionals

Explore the Top QuickBooks Alternatives

Although QuickBooks remains the most widely used accounting tool that can effectively streamline your financial records, you can now explore thirteen robust alternatives to find the perfect fit for your business.

Searching for suitable QuickBooks alternatives is a nuanced process that depends on your unique business needs. As such, what works for one business might not work for you.

Keep your business needs in mind. Choose QuickBooks alternatives that align with your budget and business goals for the year.

Before you commit, test-run the software first to see how well it integrates with your other business tools. You can easily do this using free plans or trial periods.

Finally, remember that all accounting tools have their pros and cons. Keeping this in mind, why don’t you go ahead and explore the top QuickBooks alternatives we’ve outlined above? These tools may just be what you need to transform your approach to bookkeeping in 2025. Good luck!