A Forbes study found that poor financial management is one of the leading causes of small business failure, with 38% of businesses citing cash flow problems as a primary reason. For small and growing businesses, consistent and accurate bookkeeping can increase the chances of long-term success.

Luckily, there are small business bookkeeping tips that can help make managing finances easier. It is possible to maintain a clear financial picture and make informed decisions by implementing straightforward practices.

This post will walk you through practical small business bookkeeping tips that are easy to implement. Learn how to automate tasks, stay on top of accounts, and organize receipts effectively.

Why Every Small Business Needs a Bookkeeping System

For small businesses, implementing a bookkeeping system can be a lifeline to financial stability and growth. Setting up a good accounting software from day one can reduce stress in handling business transactions and improve decision-making.

Here’s why every small business needs a structured bookkeeping system:

- Avoid Cash Flow Issues: A good bookkeeping system can provide a clear picture of a business’s cash flow. You gain complete visibility of where the money is coming from and where it’s going.

-

By tracking income and expenses closely, a business owner can spot cash shortages before they become a problem and act proactively in case there are any signs of problems.

A reliable bookkeeping system helps you efficiently manage bills, payroll, and other expenses, reducing the risk of overdrafts or delays.

- Simplify Tax Preparation: Tax season can be stressful for a small business owner, But with an organized bookkeeping system, preparing taxes becomes much easier.

-

A well-maintained system can keep accurate financial records o]f cash payments, business expenses, and monthly financial statements throughout the year.

This allows for easy access to reports, uncovering potential deductions, and filing taxes accurately. Plus, it eliminates the last-minute scramble to gather documents.

- Boost Chances of Loan Approval: If you plan to apply for a loan to scale your business, lenders require solid evidence of your financial stability.

-

This includes detailed financial reports that demonstrate steady income and effective expense management. An organized bookkeeping system provides exactly that.

With an up-to-date accounting system in place, you’ll have the data you need to build a case for your loan application. This also demonstrates to lenders that you’re a responsible manager.

- Improve Financial Decision-Making: A reliable bookkeeping system helps you make informed decisions. By tracking costs, identifying trends, and analyzing profitability, you can plan for sustainable growth.

-

You’ll have a clear view of which products or services are most profitable and where to cut costs. When considering expansion, these insights will guide in making informed and confident decisions.

Key Small Business Bookkeeping Tips for Financial Management

For small businesses to thrive, proper financial management is essential. Here are a few small business bookkeeping tips that can help you maintain detailed records of your business accounts more efficiently.

1. Separate Personal and Business Finances

One of the best small business bookkeeping tips to follow is to keep your personal finances separate from your business accounts. This distinction is important to maintain clean, accurate financial records.

When business finances have dedicated accounts, it becomes easier to manage cash flow and assess the company’s financial health.

Additionally, separate business accounts can enhance your business’s credibility. It signals to clients, vendors, and investors that your business is well-organized and serious about managing its finances professionally.

Beyond financial transparency, separating your finances can also protect you legally. Blurring the lines between business and personal funds may lead to complications if your business ever faces legal action or financial scrutiny. By keeping separate accounts, you create a clear boundary that could protect your personal assets in case of disputes.

To do this, start by opening a dedicated business bank account and applying for a business credit card as soon as your business is up and running. The process itself is simple — choose a bank with low fees and flexible options, and set up a business account under your registered business name.

Link this account to your accounting tool to automatically import transactions, saving you time on manual entries. Make sure that all business income is deposited into this account, and use it exclusively to pay business-related expenses.

You May Also Like:

2. Track Every Expense

Small business owners must be diligent about recording every expense, no matter how minor. Tracking every expense is one of the essential small business bookkeeping tips that can improve your financial management.

Many small expenses may seem trivial on their own, but over time, they can add up. When recorded properly, these small costs can give a clearer picture of where your money is going, enabling you to make informed spending decisions.

Forgetting to log smaller transactions can lead to inaccuracies that distort profit margins. By regularly recording every expense, you can keep these small details from slipping through the cracks.

A great way to stay on top of expenses is by categorizing them. Grouping similar expenses, like utilities, travel, and supplies, makes your records more organized and meaningful.

Categorization makes it easier to see spending patterns over time, which helps identify areas to cut costs or increase investments. The more accurately expenses are categorized, the easier it becomes to interpret your financial data.

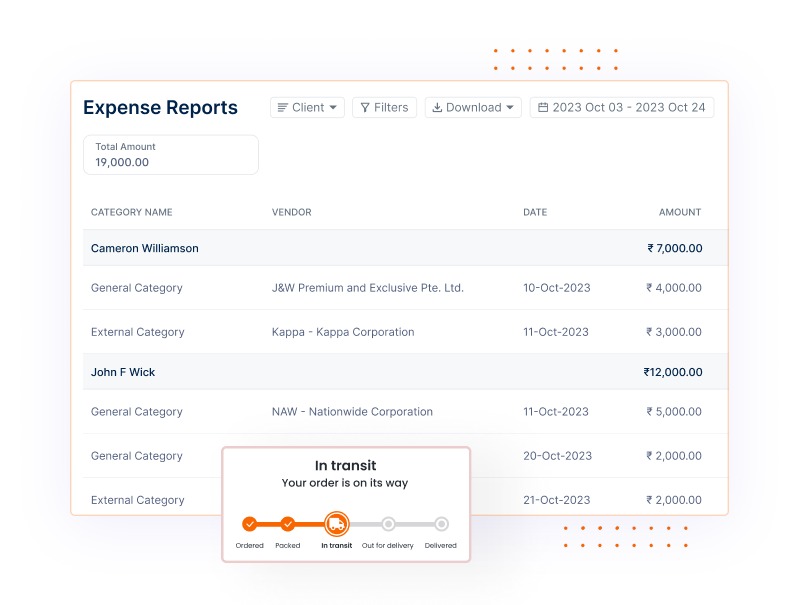

Most accounting software for small businesses, like Invoicera and others, offer business accounts with tools and features that simplify financial tracking. This can include transaction categorization and expense reports, which can streamline your bookkeeping process.

Image via Invoicera

As you assign each expense to a category, you’ll create a clean, organized record that’s easy to review.

3. Invest in Reliable Bookkeeping Software

Managing your business’s finances effectively often comes down to having the right tools. A reliable bookkeeping software can simplify the process and save you time.

By organizing your financial information in one place, it becomes much easier to access, analyze, and manage your business’s financial health. One of the best small business bookkeeping tips you can follow is to invest in software that suits your needs. To select the right bookkeeping software for your small business, keep these factors in mind:

- Ease of Use: Look for software that is user-friendly and intuitive. A simple, easy-to-use interface will save you time during both setup and daily operations.

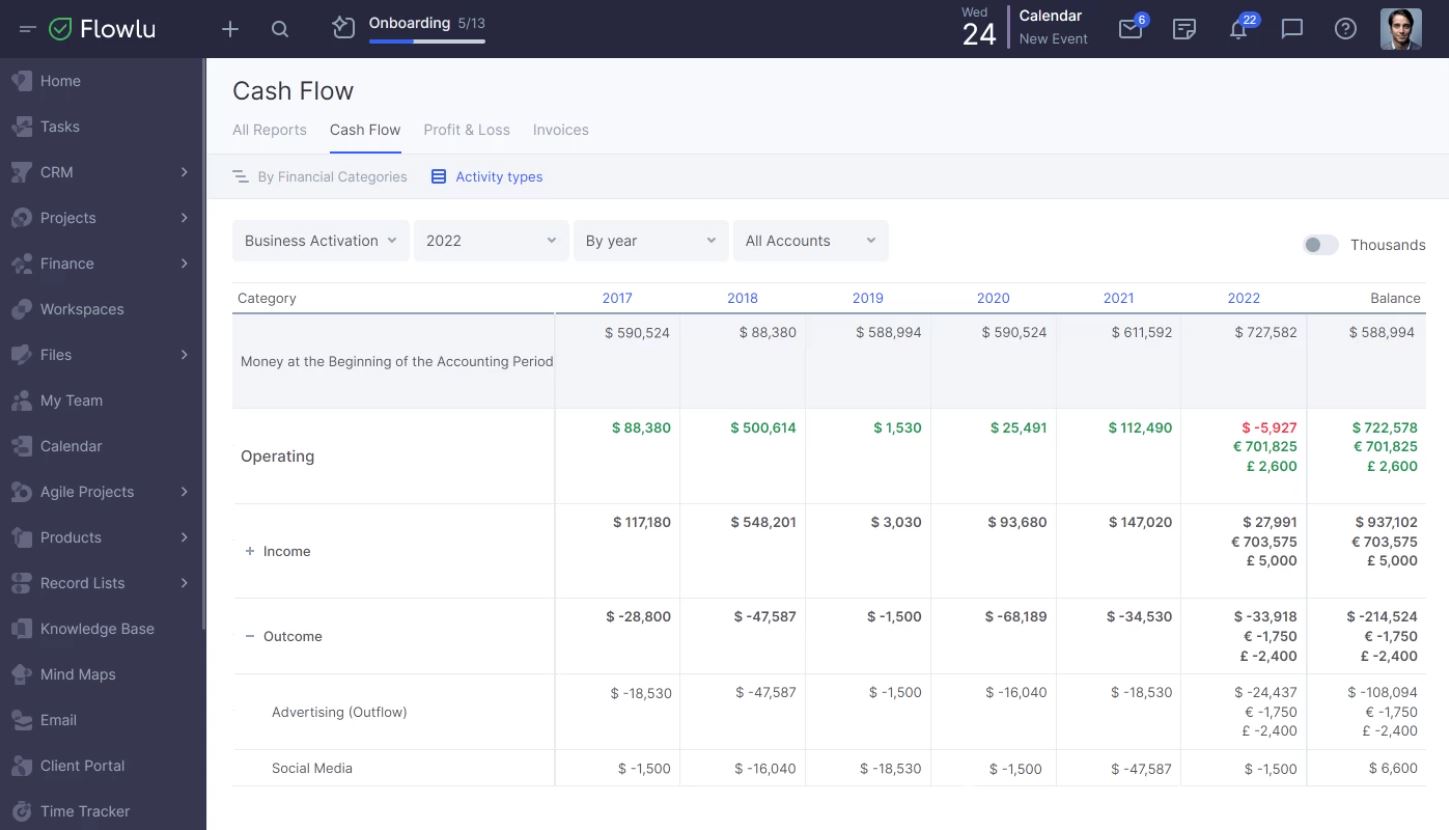

- Features: Consider what features are essential for your business. Some programs focus on basic bookkeeping tasks, while others like Flowlu offer advanced features like income and expense tracking for your business account.

![]()

Image via Flowlu

- Scalability: Opt for a software that can grow with your business. As your operations expand, you may need additional features or increased capacity.

- Cost: Evaluate your budget and find software that provides good value for the features offered. Many options operate on a subscription model, so consider long-term costs when making a decision.

- Customer Support: Reliable customer support is vital. Check if the software provider offers multiple support channels, such as phone, email, or live chat, to assist you when you have questions or issues.

- Security: Since financial data is highly sensitive, prioritize software that offers robust security measures. Features like encryption and secure backups are essential to protect your information.

- Reporting Capabilities: Strong reporting features can help you analyze your finances. Look for software that generates comprehensive reports on income, expenses, cash flow, and other key metrics.

- Mobile Access: If you’re often on the move, consider cloud accounting software with mobile access. This allows you to manage your finances from anywhere with an internet connection.

- Integration: Check if the software can integrate with other tools you already use, such as payment processors, ecommerce platforms, or CRM systems. With these integrations, you can streamline your operations.

You May Also Like:

4. Reconcile Your Accounts Regularly

Small business bookkeeping tips, like reconciling accounts routinely, can help you maintain an organized financial record.

Reconciling your accounts involves balancing your checkbook. This means comparing your internal financial records with those from your bank and credit card statements. This process helps identify discrepancies and ensures your books are accurate.

Start by gathering your bank and credit card statements for the period you’re reconciling, which is typically done monthly. Next, review each transaction in your bookkeeping system and match it to the corresponding entry on your bank or credit card statement.

Pay attention to amounts, dates, and descriptions. If you notice any discrepancies, such as a missing transaction or an amount that doesn’t match, make a note of it. Investigate these differences by looking at receipts or other documentation to find the source of the issue.

If everything matches up perfectly, that’s great. However, if there are errors, adjust your records accordingly. For instance, if an expense was recorded incorrectly, update it to reflect the correct information, ensuring your financial statements are accurate.

To simplify the reconciliation process, consider designating a specific day each month for this task. By making it a regular habit, you’ll streamline the process and save time in the future.

This proactive approach allows you to catch discrepancies early on, preventing a buildup of issues that require extensive corrections later.

5. Hire a Professional Bookkeeper When Needed

While you might feel confident managing your own books, outsourcing bookkeeping tasks can save you time, reduce stress, and cut costs. This is one of many important small business bookkeeping tips to keep in mind as you run your business.

Here are some signs that it might be time to bring in a professional:

- You’re Feeling Overwhelmed: If keeping up with financial records is starting to feel like a burden, it might be time to seek help. Bookkeeping requires attention to detail and can be time-consuming. By outsourcing this task, you can offload this responsibility, freeing up your time to focus on running your business.

- Lack of Expertise: If numbers aren’t your forte or you don’t have a background in finance, it can be challenging to maintain accurate records. An experienced bookkeeper can help you better understand your financial position, provide insights, and ensure compliance with regulations.

- Your Business is Growing: As your business expands, so does the complexity of your financial transactions. More clients, increased sales, and new employees create a higher volume of transactions. A professional bookkeeper can help navigate these complexities, ensuring everything is recorded accurately.

- Consistently Missed Deadlines: If you’ve missed tax deadlines or are unsure about your tax obligations, it’s a clear indication that professional help is needed. A qualified accountant can ensure your taxes are filed on time and that you take advantage of any tax deductions or credits.

6. Automate Your Bookkeeping Tasks

Automation is one of the best small business bookkeeping tips for beginners to ensure accounting accuracy. In fact, 49% of small and medium businesses have already implemented digital solutions to streamline and automate business transactions.

Digital tools can help you automate repetitive financial tasks and save you hours of manual work. Besides saving time, automating your bookkeeping process also reduces the risk of errors.

By automating your tasks, you can also keep your bank transactions organized. Many digital solutions securely store documents, eliminating the need for a paper trail. Accessing information for a quick financial update becomes much easier with all financial records in one place.

Another key advantage of automation is gaining real-time insights into your cash flow. These tools can connect to your bank account and automatically categorize transactions.

This means you always know where your money is going without spending hours sorting through receipts or manually entering data.

Automation also helps small business bookkeeping by creating reminders for important dates, such as tax deadlines or invoice due dates.

With reminders in place, you can avoid late fees, protect your credit, and maintain a steady cash flow.

Additionally, you can even set up automatic bill payments, ensuring you never miss a deadline again. This is one of the easiest small business bookkeeping tips that can have a big impact on managing your finances.

You May Also Like:

7. Schedule Regular Financial Reviews

As one of the key small business bookkeeping tips, regular check-ins are important to ensure business stability. Expenses, even the small ones, require consistent oversight to avoid any unnecessary costs slipping through unnoticed.

By conducting timely and accurate reviews of accounting reports, you get a clear picture of your cash flow, revenue, and expenses, enabling better decision-making to strengthen your business.

Start by scheduling a regular review time – whether weekly or monthly – and marking it on your calendar. These reviews don’t need to be lengthy; even a quick overview can reveal valuable insights.

However, the key is to be consistent. With a regular schedule, reviews can become routine. It may feel like a small step, but staying consistent with your financial reviews is one of the accounting tips that can ensure financial transparency and stability.

When conducting these reviews, examine all key financial records, including income statements, balance sheets, and cash flow statements.

Pay close attention to accounts receivable (money owed by customers) and accounts payable (outstanding bills) to stay on track with your payment schedules..

Be sure to look for any unusual transactions or discrepancies. Errors in bookkeeping can easily happen, whether from a misplaced decimal point, forgotten expense, or missing transactions.

By adhering to small business bookkeeping tips like reviewing your finances regularly, you can catch mistakes and issues early. This would prevent them from escalating into costly problems that could hurt your bottom line.

8. Monitor Cash Flow Closely

Cash flow reflects the amount of money coming in and going out of your business. When your cash flow is steady, it’s easier to cover expenses, pay employees, and allocate resources for growth.

On the other hand, cash flow issues can lead to problems like missed payments, cash shortages, or missed opportunities for investments.

For small business owners, tracking cash flow means understanding where your money is, how it’s being used, and planning for both expected and unexpected expenses. To ensure accuracy of all financial transactions for your business, this is one of the key small business bookkeeping tips to follow.

Here’s an example of a yearly cash flow monitoring dashboard, which shows the money entering and exiting the account.

Image via Flowlu

With the best accounting platform, you can monitor your cash flow based on your preferred schedule, which can be monthly, quarterly, or annually.

One of the most effective cash flow monitoring tips is to create a cash flow forecast. This allows you to predict when cash will come in and go out to avoid surprises. By estimating inflows and outflows, you can plan for lean periods and adjust spending as needed.

To create a forecast, look at your business’s historical data, seasonal trends, and any upcoming changes in expenses.

Some small business bookkeeping software offer built-in cash flow forecasting features, making it easier to generate accurate projections. Many programs also sync with your bank, giving you an accurate view of your cash flow.

9. Plan for Taxes Early

Taxes are often one of the most stressful aspects of bookkeeping for small business owners. Tax season can be challenging, especially for filing, but early preparation can make it less overwhelming. Planning for your tax obligations is one of the best small business bookkeeping tips to stay compliant.

When it comes to early tax planning, setting up a tax savings account can make a huge difference. Many small business owners are often caught off guard by the amount they owe because they haven’t consistently set aside funds.

By allocating a portion of your income each month into a separate account, you can build a reserve, ensuring you’re not scrambling for funds at the last minute.

It’s a smart way to prevent cash flow issues during tax season. Plus, it gives you peace of mind knowing that your tax obligations are covered.

Additionally, maintaining organized records is vital in making tax preparation easier. Ensure to keep records of all business-related purchases, from office supplies to equipment repairs, and save digital copies of receipts and invoices. This makes it easy to access the documentation you need for filing taxes.

While you can handle tax preparation on your own, using the services of a tax expert can come in handy. An expert can help you identify deductions and credits you might overlook. Understanding which expenses are tax-deductible can have a significant impact on your bottom line.

You May Also Like:

10. Establish a Consistent Invoicing Process

One of the key small business bookkeeping tips that can help you keep your financial records organized is to establish a consistent invoicing process.

A well-structured invoicing system can help minimize misunderstandings with clients regarding payment terms, ensuring smoother transactions.

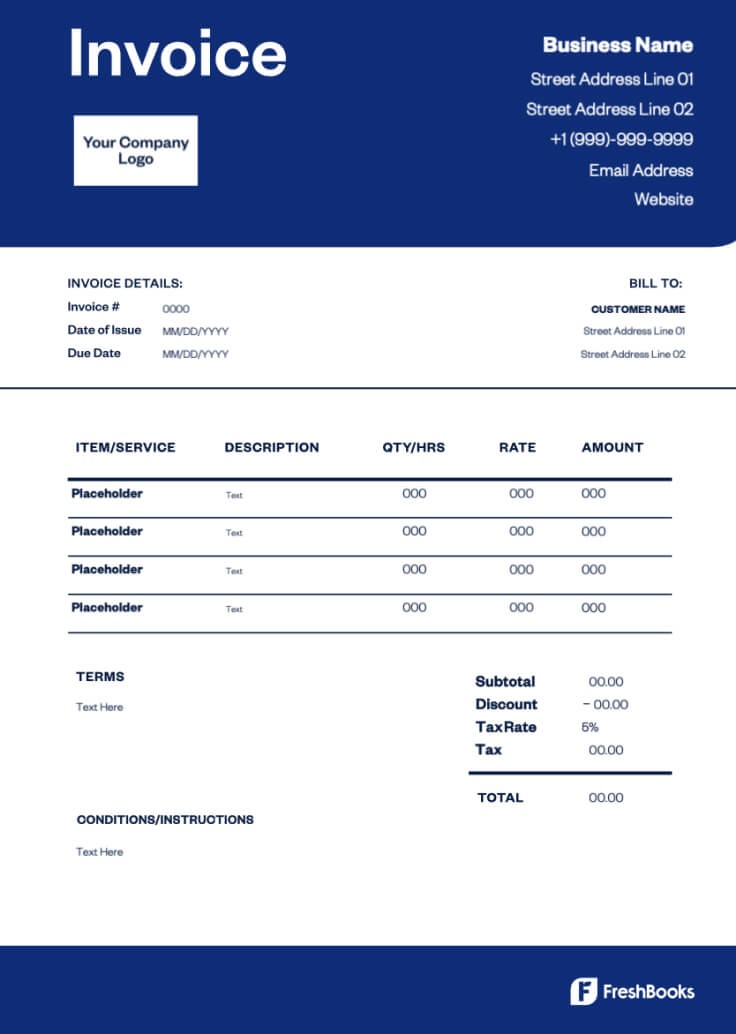

Consider creating a standardized invoice template using reliable invoicing software. The template should include all necessary details such as your business name, contact information, and payment terms.

For inspiration, see an example of an invoice template by FreshBooks with important fields, including itemized charges, description, amount, and due date.

Image via FreshBooks

Using a consistent invoice format not only makes it easier for clients to understand the information involved but also reinforces your brand’s identity. You might also want to include a unique invoice number for tracking purposes.

Establish a regular invoicing schedule, whether weekly, bi-weekly, or monthly. Having a routine will help you stay consistent for all your billing cycles.

You can use calendar reminders or top accounting software to automate this process. This way, you won’t forget to send an invoice after completing a project or providing a service.

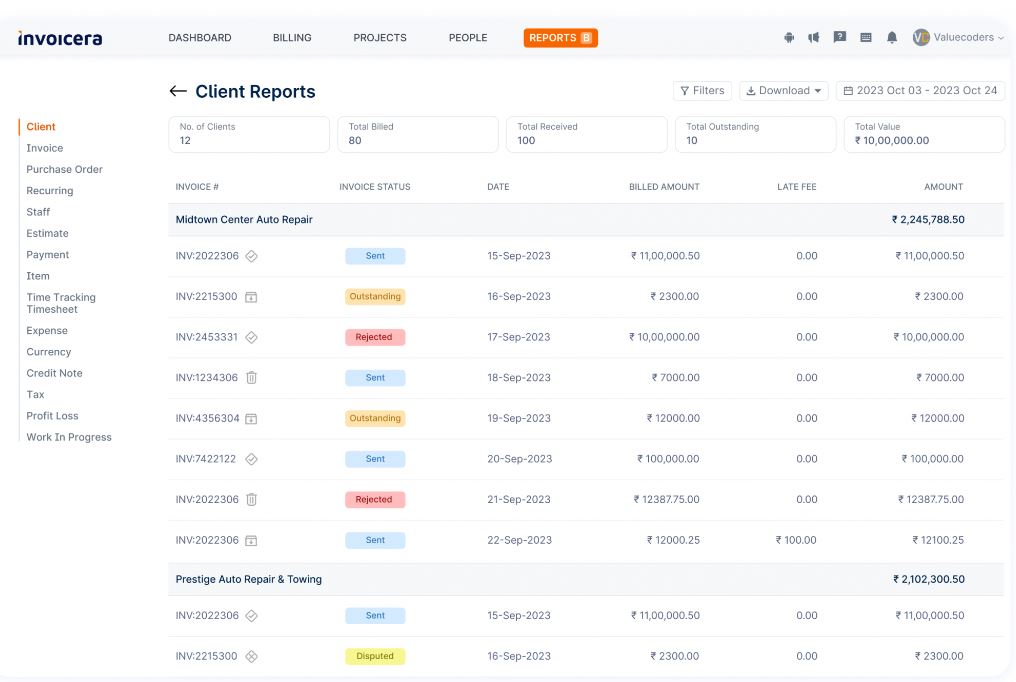

Moreover, ensure to keep track of all invoices sent and payments received. Tools like Invoicera allow you to generate reports, monitor outstanding payments, and follow up with clients on overdue invoices or disputes.

Image via Invoicera

11. Maintain an Emergency Fund

You can’t talk about small business bookkeeping tips without highlighting the importance of an emergency fund. This step is one of the most impactful small business bookkeeping tips for financial security.

But why is an emergency fund important for small businesses?

The reality is that nearly every business faces financial uncertainties at some point. According to a 2024 Forbes survey, 67% of small and medium-sized businesses (SMBs) identified financial concerns as their top challenge for the year ahead, particularly due to the unpredictable economic climate.

An emergency fund is essential for businesses to navigate unexpected challenges without resorting to loans or credit.

Common uses for this fund include emergency repairs, covering payroll during a slow month, or seizing a sudden business opportunity that requires immediate cash.

Start by setting a realistic goal for your emergency fund. A good idea is to save enough to cover at least three to six months of essential expenses.

To calculate this, review your business’s monthly costs, including payroll, rent, utilities, and inventory expenses. Keep in mind that the ideal fund size may vary based on your industry and business model.

Once you have your target amount, open a separate business savings account dedicated solely to this fund. This way, you won’t accidentally dip into it for regular expenses.

Set up a gradual savings plan, such as allocating a fixed percentage of your monthly revenue to the fund. For convenience consider enabling automatic transfers from your business checking account to your savings account.

You May Also Like:

FAQ

1. How often should I update my bookkeeping records?

A. One of key small business bookkeeping tips is to monitor and update your records regularly. Doing this weekly or monthly is a good practice. This helps you keep track of your finances, identify any mistakes early, and ensure you’re always prepared for tax time. Regular updates also provide a clearer understanding of your business’s financial health.

2. What’s the best bookkeeping software for small businesses?

A. The best bookkeeping software for small businesses depends on your needs. Popular options include QuickBooks, Xero, FreshBooks, and others. These programs are user-friendly and offer features like expense tracking, invoicing, and financial reporting. Consider your budget and the specific features you need when choosing software.

3. Do I need an accountant if I’m using bookkeeping software?

A. Following small business bookkeeping tips like using accounting software and automating your bookkeeping tasks can help you manage your finances, but it doesn’t replace an accountant. An accountant can provide valuable insights, assist with tax planning, and handle complex financial issues. It’s a good idea to consult an accountant, especially if your business grows.

4. How can I track expenses if I don’t have software?

A. You can track expenses manually if you don’t have software. Use a notebook or a spreadsheet to record your expenses. Record each expense, noting the date, amount, and purpose. Keep receipts and invoices in a folder for easy access. While this method might take more time, regular reviews will help ensure your records stay accurate and complete.

5. Is bookkeeping important for small businesses?

A. Yes, bookkeeping is important for businesses of any size. By following effective small business bookkeeping tips like automation, expense tracking, and more, you can monitor income and expenses, prepare your estimated tax payments, and maintain organized records with ease. This way, you’ll have a clear picture of your business’s financial health and will be able to identify areas for improvement and plan for future growth.

You May Also Like:

Conclusion

Bookkeeping is a crucial aspect of financial management. For small businesses, bookkeeping doesn’t have to be overwhelming if approached methodically.

By staying organized and consistently tracking income and expenses, you can build a financially resilient business with a good bookkeeping system.

Small business bookkeeping tips, like regular expense tracking, scheduling routine financial reviews, and using bookkeeping software can simplify your process.

As you implement these small business bookkeeping tips, remember that consistency is key. Embrace these practices consistently, and you’ll be well on your way to building a strong financial foundation for your small business.