Selecting a reliable accounting platform is essential for the smooth financial operation of your business finances.

While Zoho Books is undoubtedly a popular choice, it’s important to look for Zoho Books alternatives to ensure you find the perfect fit for your unique needs.

Managing your finances is not a one-size-fits-all endeavor, and different businesses have varying requirements.

That’s why we want to help you make an informed choice based on your business needs, ultimately leading to more efficient financial management.

In this article, we’ll take a closer look at the top Zoho Books alternatives, evaluating each tool’s features, pros, cons, and pricing.

Let’s dive in.

Quick Summary: Best Zoho Books Alternatives by Type

- Best for Small Businesses: FreshBooks, Wave, ZipBooks

- Best for Comprehensive Accounting and Financial Management: Quickbooks Online, Xero, ZarMoney

- Best for Specialized Accounting Needs: Odoo, Sage, Saasu

- Best for Streamlined Accounting and Payroll: Patriot, ZarMoney, OneUp

- Best Tools with Free Trial: Sage, Xero, Odoo, ZarMoney, FreshBooks

How We Chose the Best Zoho Books Alternatives

- Features: Our selection process is driven by a thorough examination of each accounting tool’s number and diversity of features. We aim to provide a comprehensive range of Zoho Books alternatives that suit various business needs. Our list of Zoho Books alternatives encompasses both all-in-one solutions and niche tools, ensuring there’s something for everyone.

- Data Accuracy: We prioritize data freshness and accuracy in evaluating contact databases and business intelligence tools. Zoho Books alternatives that offer real-time data verification take precedence, as accurate information is vital for making informed business decisions and effective business processes.

- Pricing: Recognizing the diverse budget constraints of our audience, our list of Zoho Books alternatives encompasses a wide spectrum of tools, ranging from free versions to enterprise-grade premium solutions. We emphasize the importance of considering your budget in conjunction with the features offered, ensuring a well-informed choice.

- Customer Reviews: In addition to examining features and pricing, we place significant importance on user feedback. We scour customer reviews to gauge a tool’s user-friendly design, customer support, and overall usability. Our rigorous assessment excludes Zoho Books alternatives with significant customer-reported issues to ensure a positive user experience.

- Analytics Capabilities: Beyond functioning as a mere contact database, we also consider a tool’s advanced analytics capabilities. Zoho Books alternatives that offer basic analytics features receive preference, as these capabilities enable businesses to derive valuable insights from their data, contributing to smarter decision-making and strategic planning.

- Scalability and Customization: Scalability and customization options are vital considerations. We look for tools that can grow with your business and be tailored to your unique requirements, ensuring long-term relevance and adaptability.

11 Zoho Books Alternatives You Should Try

The accounting process can be overwhelming, with myriad financial processes demanding precision and attention.

One way to streamline this intricate process is by investing in accounting software like Zoho Books. However, it’s important to recognize that Zoho Books might not be the best option for all businesses.

That’s because Zoho Books may not offer the specific features or scalability required by some enterprises. Additionally, some businesses might prefer Zoho Books alternatives due to differences in user interface or integration capabilities.

However, it’s reassuring to know that there are Zoho Books alternatives available, offering comparable or even superior features to assist you in managing your financial matters more efficiently.

These tools can help you simplify bookkeeping, invoicing, and financial analysis, providing viable options for businesses of all sizes.

Read on to discover the best Zoho Books alternatives that can boost your accounting efforts.

1. FreshBooks

Image via FreshBooks

FreshBooks is one of the best cloud-based accounting software, excelling in simplifying income and expense tracking.

Its user-friendly design streamlines financial processes, making it an ideal choice for entrepreneurs and small businesses.

The best part?

This Zoho Books alternative has introduced the Accounting Partner Program, fostering collaboration between users and their accountants.

This innovative initiative enhances transparency and efficiency in financial operations, allowing seamless communication and data sharing.

With features like invoicing, time tracking, and insightful reporting, FreshBooks empowers businesses to maintain a firm grip on their finances while fostering productive partnerships.

Features

- User-friendly interface for easy navigation

- Customizable invoices with various options

- Time tracking to monitor project progress

- Expense tracking and categorization

- Robust reporting for financial insights

Pros

- Exceptional user-friendliness

- Efficient invoicing

- Time tracking

- Streamlined expense tracking and categorization

- Robust reporting tools provide valuable financial insights

Cons

- FreshBooks may not be the best choice for businesses requiring extensive inventory tracking

- FreshBooks may lack certain advanced accounting features

- Has limited multicurrency support, which can be a drawback for businesses operating globally

- FreshBooks doesn’t offer full payroll services, which might be a limitation for businesses with extensive payroll needs

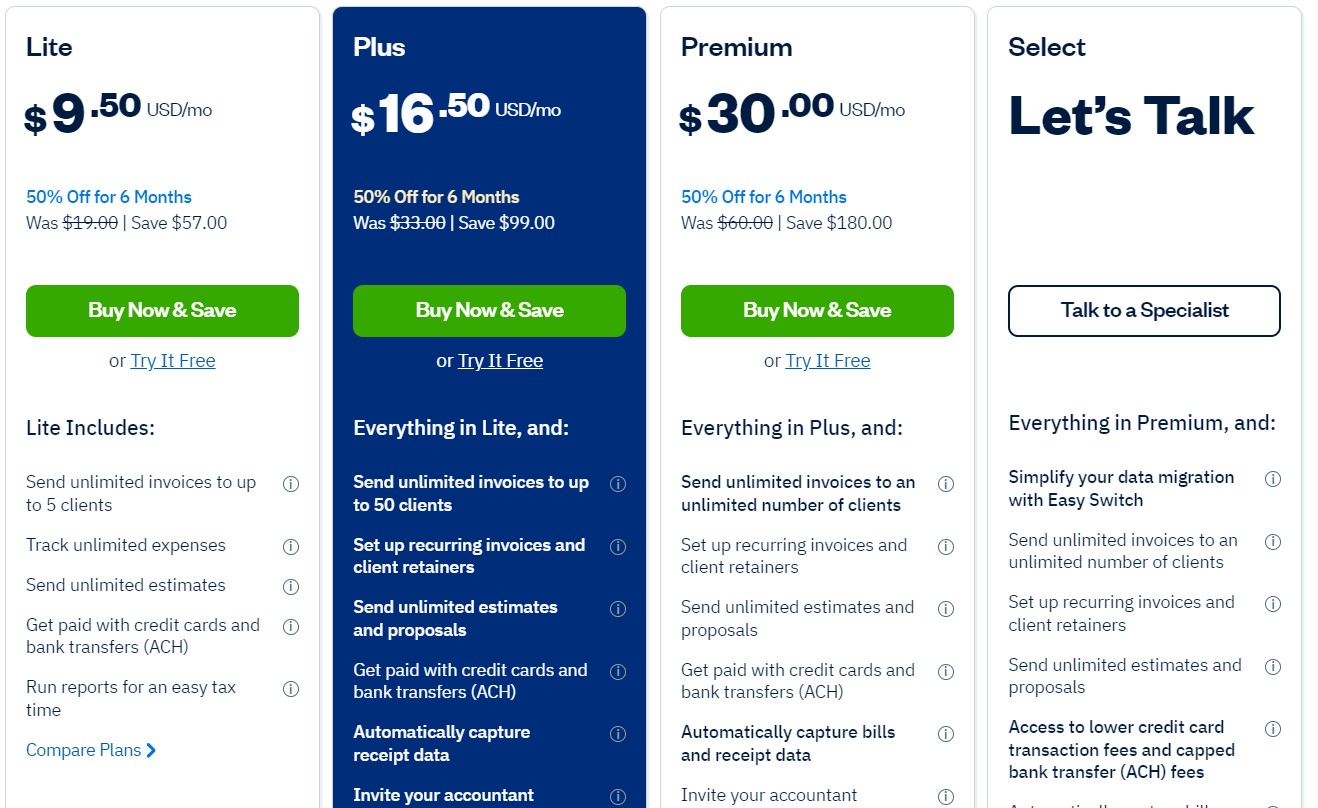

Pricing

FreshBooks offers four pricing plans with a 30-day money-back guarantee.

- Lite: $9.50 per month

- Plus: $16.50 per month

- Premium: $30.00 per month

- Select: Custom pricing

Image via FreshBooks

Tool Level

- Beginner

Usability

- Easy to use

2. Xero

Image via Xero

Xero is an easy-to-use accounting software designed with a focus on small and medium businesses.

This Zoho Books alternative excels at simplifying financial processes. It offers comprehensive tools for income and expense tracking that enable businesses to maintain a firm grip on their financial health.

The good thing is that it’s cloud-based accounting software. Therefore, it allows for convenient access and collaboration from anywhere, while a wide array of integrations further enhance its capabilities. This ensures a seamless financial management experience for users.

Key Features

- Cloud-based platform for easy access from anywhere

- Comprehensive income and expense tracking

- Invoicing and payment processing

- Bank reconciliation for accurate financial records

- Payroll management and tax preparation tools

Pros

- Intuitive interface and easy navigation for users

- Offers a wide range of reporting options for financial insights

- Suitable for small and medium-sized businesses, accommodating growth

- Seamlessly integrates with numerous third-party apps and services

- Facilitates collaboration with accountants and team members

Cons

- Some users may find the initial setup and learning process challenging

- Pricing can be relatively higher for smaller businesses on a tight budget

- May not be ideal for businesses with complex inventory needs

- Offers multi-currency support, but not as extensive as some Zoho Books alternatives for global businesses

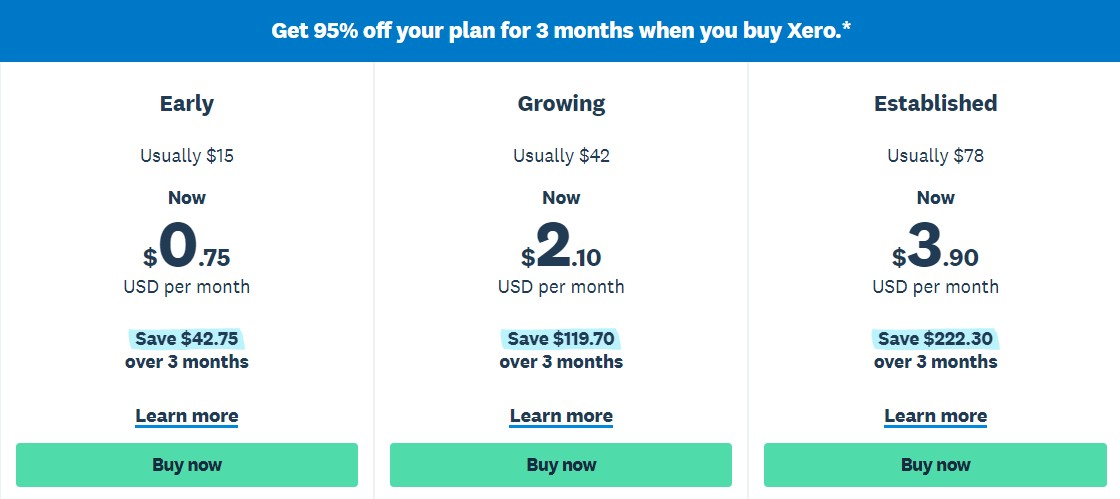

Pricing

Xero offers three pricing plans that currently come with a 3-month, 95% discount:

- Early: Usually $15 per month (currently $0.75)

- Growing: Usually $42 per month (currently $2.10)

- Established: Usually $78 per month (currently $3.90)

Image via Xero

Tool Level

- Intermediate

Usability

- Requires a bit of a learning curve

3. Wave

Image via Wave

Wave is another Zoho Books alternative designed to assist small businesses in streamlining their bookkeeping processes.

What makes Wave unique?

It’s free version provides essential financial tools without the burden of subscription fees.

Additionally, it covers core functions, including invoicing, and receipt scanning, making it a practical choice for startups and small enterprises. The business accounting software also simplifies tax calculations, preparing businesses for tax season.

However, it’s essential to note that while Wave offers an attractive cost advantage, it may lack some advanced features found in other Zoho Books alternatives, which could be a limitation for large businesses.

Key Features

- Free cloud-based accounting software

- Sales tax tracking

- Customizable invoices with various options

- Receipt scanning for easy expense management

- Simplified tax calculations

- Billing capabilities for efficient payment processing

Pros

- Wave is free, making it a budget-friendly choice for small businesses

- Its intuitive interface is easy for non-accountants to navigate

- Built-in tools make tax calculations and preparations straightforward

- Streamlines expense tracking through receipt scanning

- Accessible from anywhere, promoting real-time collaboration

- Efficient payment processing with built-in billing features

- Suitable for product-based businesses to manage their stock

Cons

- May lack some advanced features required by large businesses

- Not suitable for businesses with extensive international operations

- Free software often comes with limited customer support options

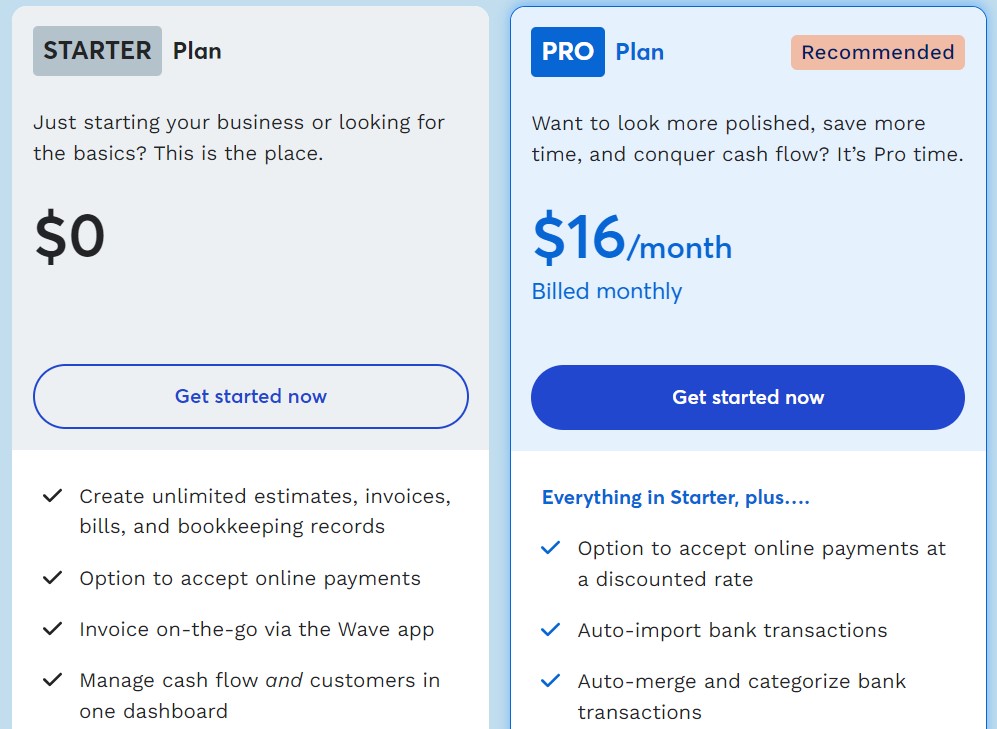

Pricing

This Zoho Books alternative offers just two plans: a free plan and a paid plan.

- Starter: $0 per month

- Pro: $16 per month

Image via Wave

Tool Level

- Beginner

Usability

- Easy to use

You May Also Like:

4. QuickBooks Online

Image via QuickBooks

QuickBooks Online is a user-friendly Zoho Books alternative that empowers business owners to efficiently track income, manage expenses, and organize their financial information.

QuickBooks Online simplifies the complex task of financial management through a cloud-based platform, ensuring access from anywhere with an internet connection.

What’s more?

The QuickBooks online system caters to businesses of various sizes. While it provides a comprehensive accounting solution, some users may find its pricing slightly higher than other Zoho Books alternatives.

Let’s check out what QuickBooks Online offers.

Key Features

- Payroll management to streamline employee compensation

- Customizable invoices with automation options

- Inventory management for product-based businesses

- QuickBooks Online provides robust financial reporting and analysis tools

- Time tracking capabilities for billable hours

- Secure data backup and easy data recovery

Pros

- Offers comprehensive accounting and financial management functionality

- The intuitive interface simplifies complex accounting needs

- QuickBooks Online is suitable for both small businesses and larger enterprises

- Easily integrates with various third-party apps and services

- With QuickBooks Online, you can access your financial data from anywhere

Cons

- Higher pricing tiers may be cost-prohibitive for some small businesses

- Some users may take time to master the software’s full capabilities

- QuickBooks Online may not be ideal for businesses with extensive international operations

- The quality of customer support can vary depending on the subscription level

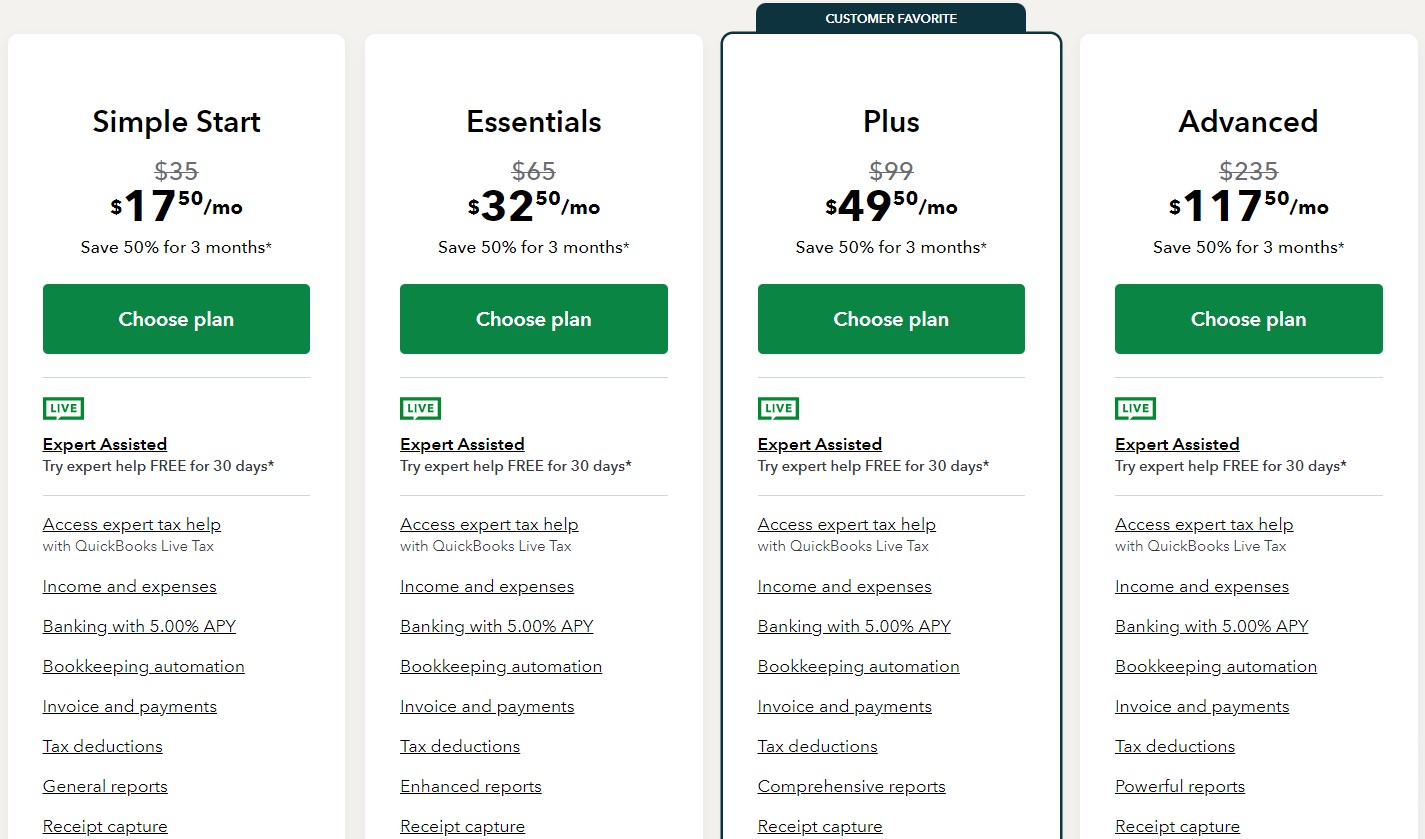

Pricing

QuickBooks Online offers four pricing plans with a 50% discount for the first three months.

- Simple Start: $35 per month (currently $17.50)

- Essentials: $65 per month (currently $32.50)

- Plus: $99 per month (currently $49.50)

- Advanced: $235 per month (currently $117.50)

Image via QuickBooks Online

Tool Level

- Beginner/Intermediate

Usability

- QuickBooks requires a bit of a learning curve

5. Sage

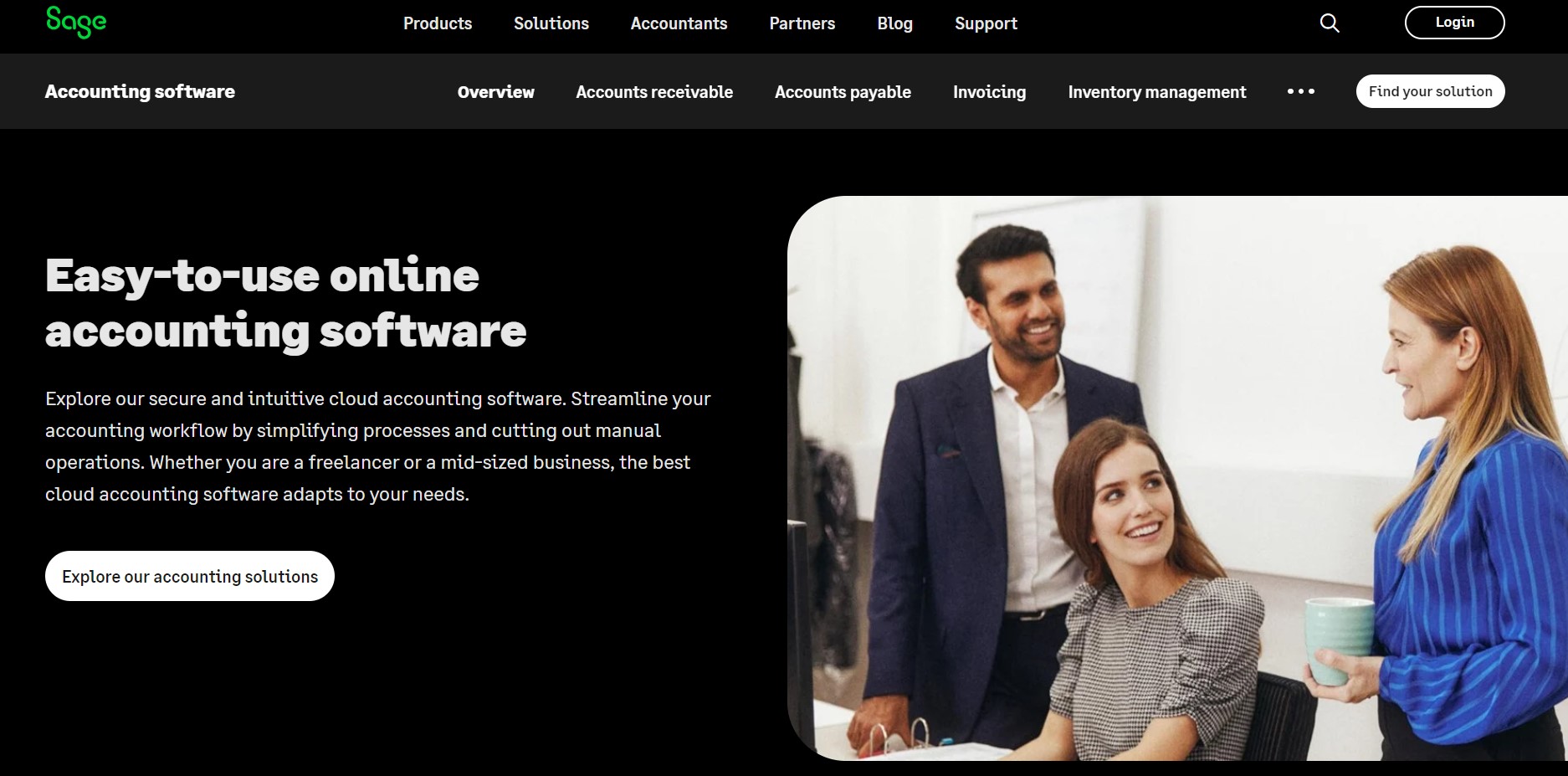

Image via Sage

Sage is a robust business accounting software designed for medium-sized businesses seeking comprehensive financial management software.

This accounting tool offers a versatile platform for financial tracking, analysis, and reporting. Its cloud-based nature ensures accessibility from anywhere, promoting seamless collaboration and real-time data updates.

Key Features

- Advanced inventory management for precise control

- Robust revenue management tools for enhanced financial insights

- Multi-entity and multi-currency support for global operations

- Automated accounts receivable processes

- In-depth financial reporting and analysis

- Seamless integration with various third-party applications

Pros

- Accommodates the growth and complexity of medium-sized businesses

- Offers detailed financial reporting for strategic decision-making

- Automates accounts receivable, improving efficiency

- Multi-entity and multi-currency support facilitates international business

- Easily integrates with other software, expanding functionality

Cons

- Some users may require time and training to utilize its full feature set

- Higher pricing may not be suitable for smaller businesses with limited budgets

- Extensive customization may be complex for some users

Pricing

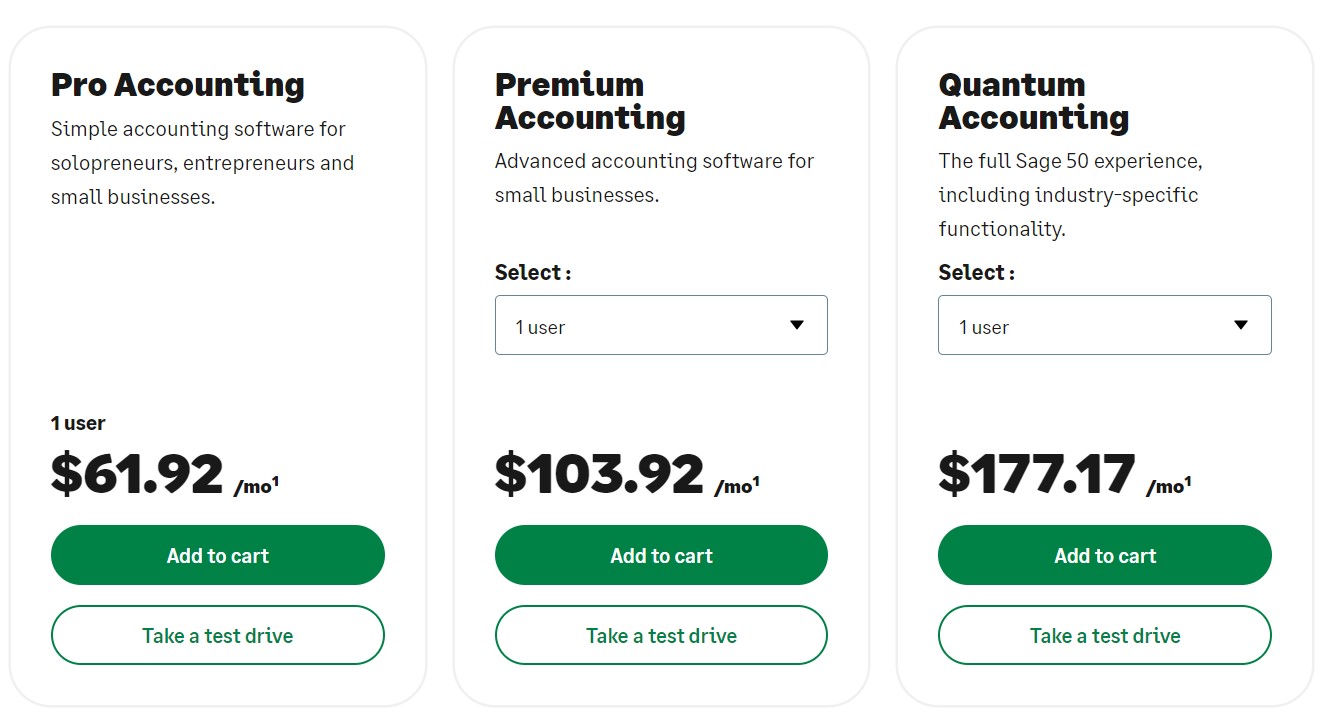

Here are the pricing plans:

- Pro Accounting: $61.92 per month

- Premium Accounting: $103.92 per month

- Quantum Accounting: $177.17 per month

Image via Sage

Tool Level

- Intermediate

Usability

- Requires a bit of a learning curve

You May Also Like:

6. Odoo

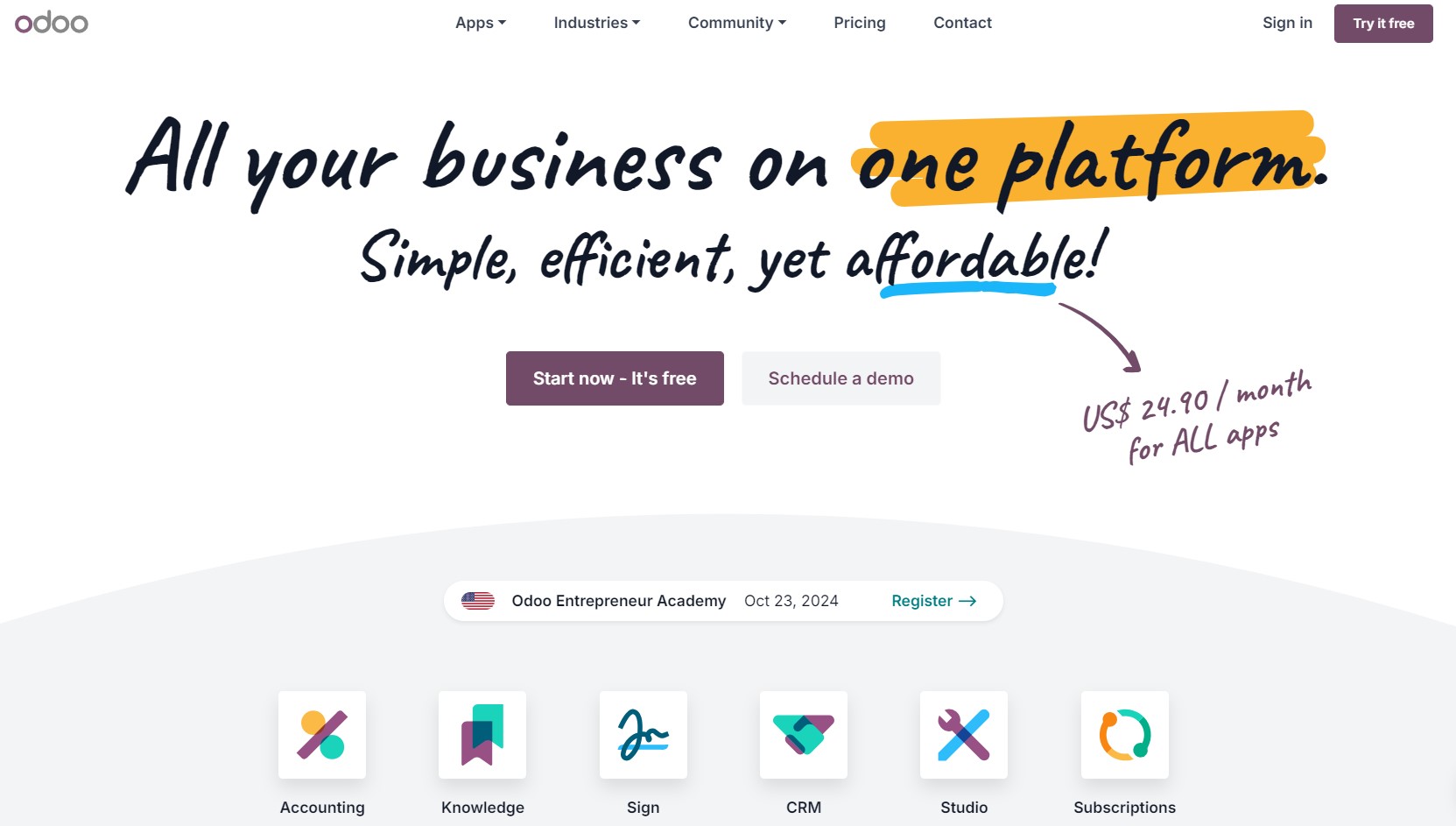

Image via Odoo

Odoo is a versatile Zoho Books alternative designed to cater to the needs of both accountants and business owners. This comprehensive accounting software offers a robust platform for efficient financial management.

It allows users to seamlessly integrate accounting with other business operations, such as inventory management and CRM, enhancing workflow efficiency.

What makes Odoo unique?

While its open-source nature provides flexibility for customization, it also offers scalability, making it suitable for businesses of all sizes.

Key Features

- Comprehensive all-in-one accounting software

- Integration with other business processes, such as invoice management

- Invoicing and payment processing capabilities

- Multi-currency and multi-language support

- Open-source for flexibility and customization

Pros

- Provides a complete suite for managing various business functions

- Seamlessly integrates accounting with other operations

- Suitable for businesses of all sizes and industries

- Open-source nature allows for tailoring to specific business needs

- Ideal for global businesses

Cons

- The extensive feature set may require some time to master

- Self-hosting can result in additional costs

- Quality of phone support can vary depending on the service level

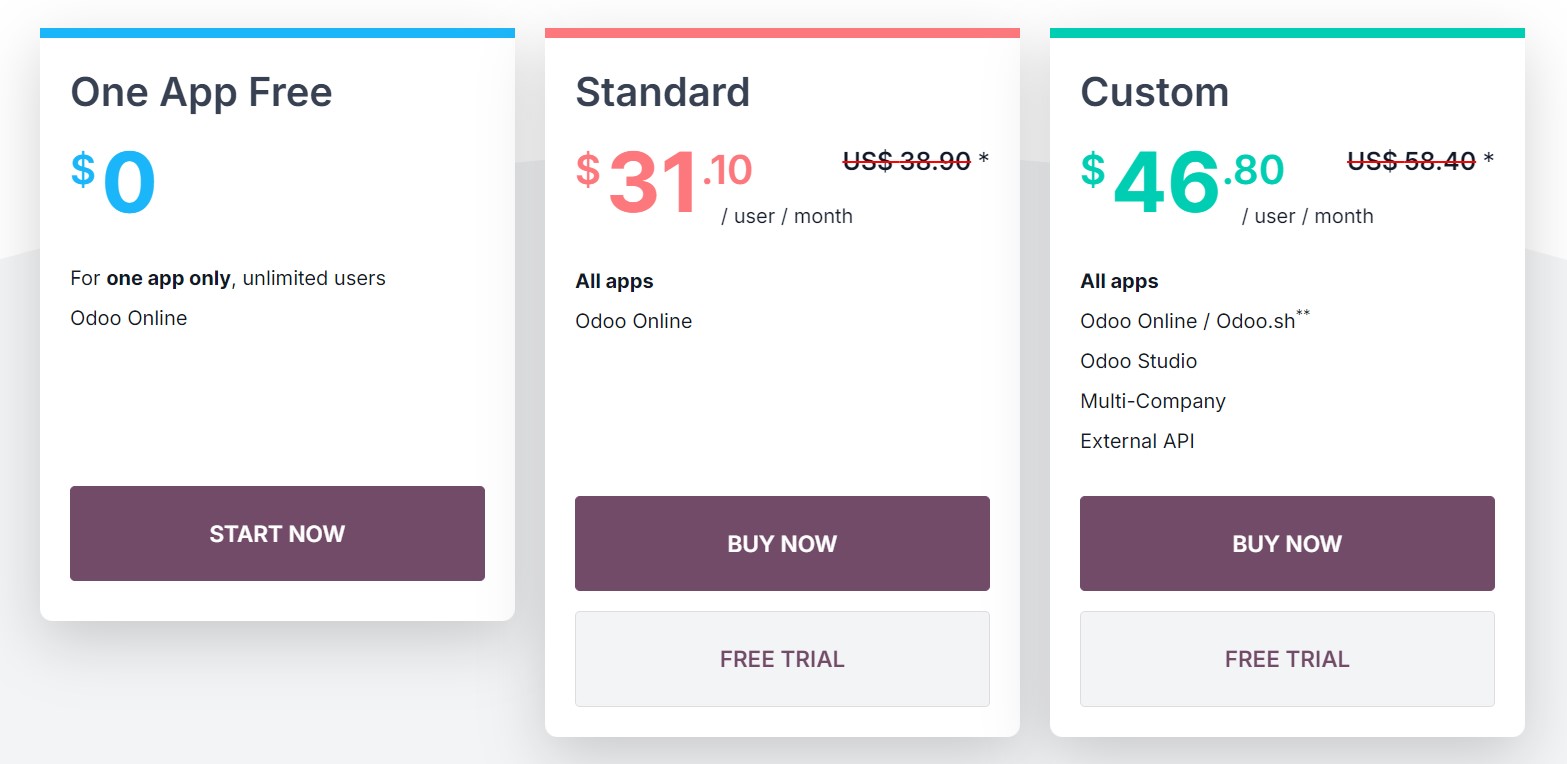

Pricing

Odoo comes with a forever-free plan and two paid plans.

- One App Free: $0

- Standard: 31.10 per month

- Custom: $46.80 per month

Image via Odoo

Tool Level

- Beginner/Intermediate

Usability

- Has a bit of a learning curve

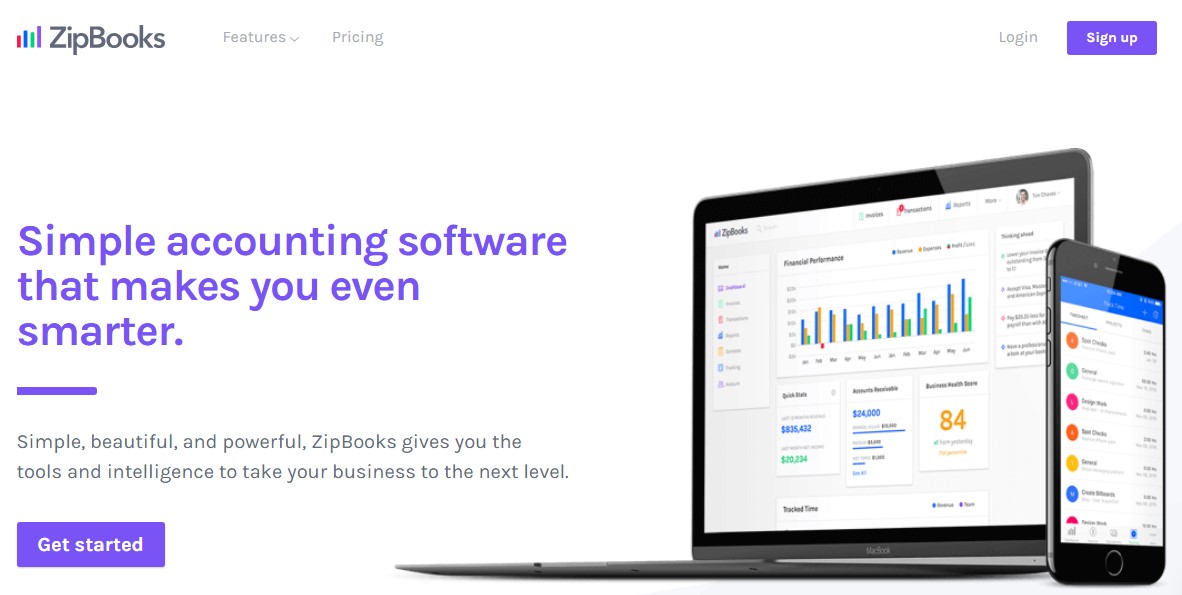

7. ZipBooks

Image via ZipBooks

ZipBooks is a versatile accounting and bookkeeping tool designed to empower small businesses and accountants with various financial capabilities.

This accounting software offers a user-friendly platform to efficiently process credit card transactions, track financial data, and generate and send invoices.

The best part?

The accounting software offers insights into revenue and expense trends, promoting informed decision-making.

Let’s check out what this Zoho Books alternative offers.

Key Features

- Credit card processing capabilities

- Invoice creation and sending

- Expense tracking and categorization

- User-friendly interface for easy navigation

- Insights into revenue and expense trends

- Cloud-based platform for accessibility from anywhere

Pros

- The intuitive interface simplifies financial tasks for users

- Streamlines expense management and categorization

- Efficiently able to create and send invoices

- Provides valuable data on revenue and expense trends

Cons

- May not suit businesses with complex accounting needs

- Fewer third-party integrations compared to larger accounting systems

- Advanced analytics and reporting options are limited in comparison to comprehensive Zoho Books alternatives

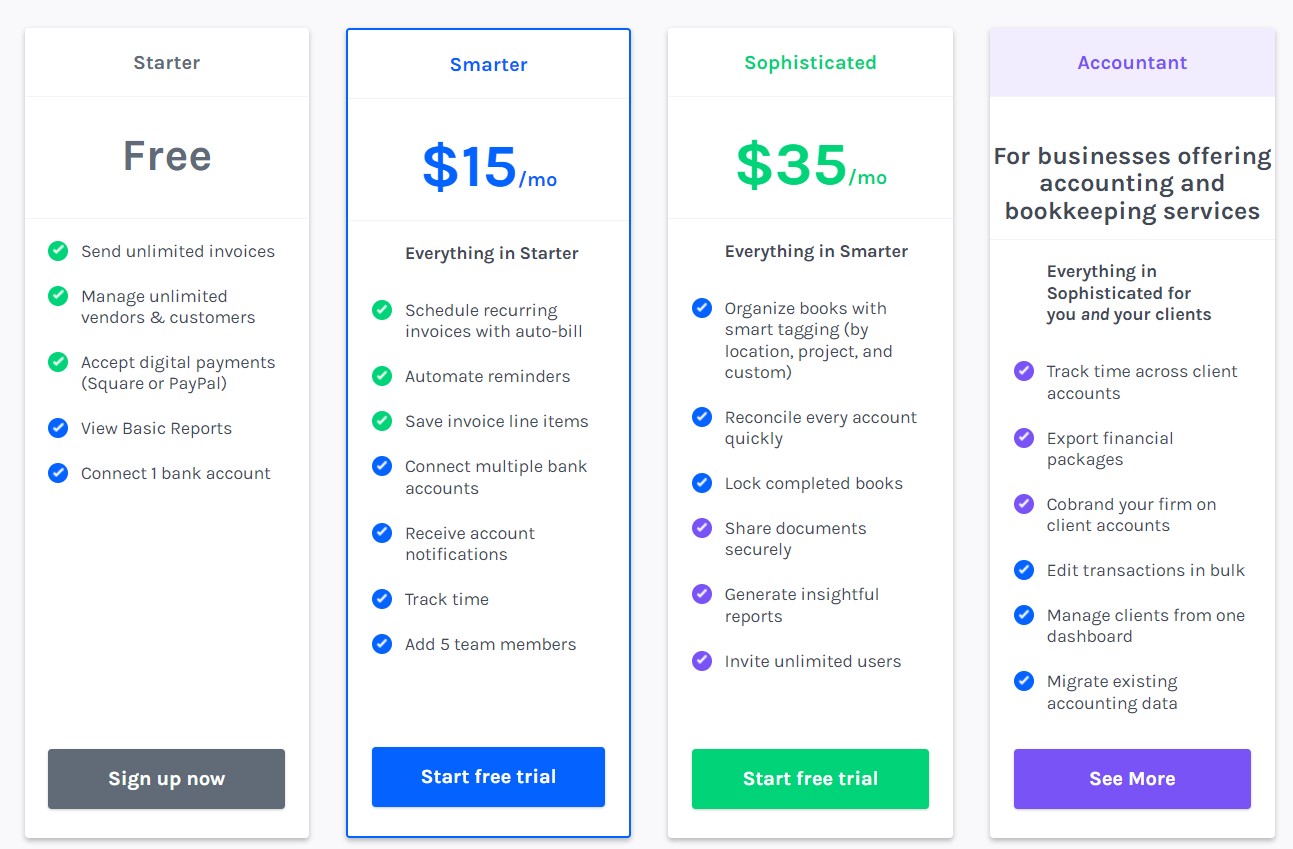

Pricing

ZipBooks offers a free plan. It has four plans:

- Starter: Free

- Smarter: $15 per month

- Sophisticated: $35 per month

- Accountant: Custom

Image via ZipBooks

Tool Level

- Easy to use

Usability

- Beginner

You May Also Like:

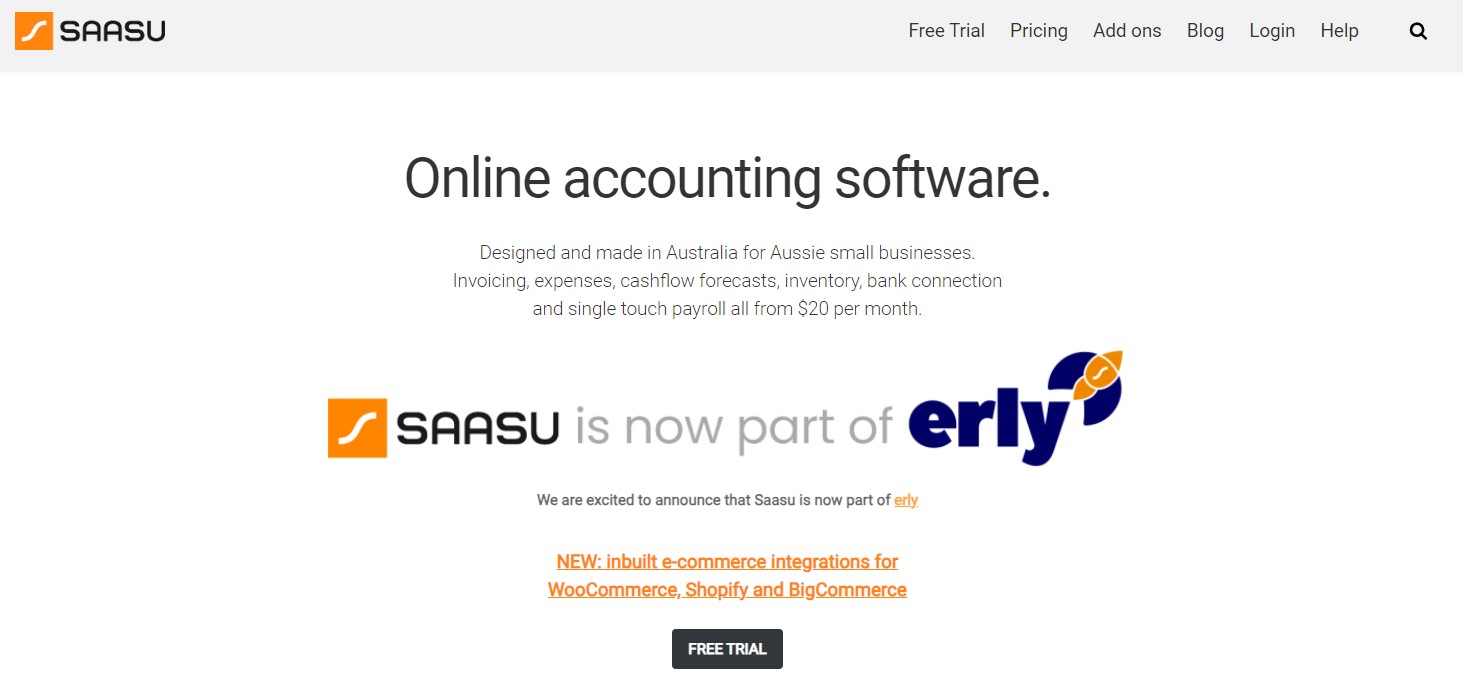

8. Saasu

Image via Saasu

Saasu is a dynamic Zoho Books alternative tailored for small business owners seeking streamlined financial management.

This accounting software simplifies the complexities of financial operations, offering a robust platform for tasks like invoicing and financial reporting.

While it’s easy-to-use software, some users may find that it lacks certain advanced features found in more comprehensive accounting software.

Key Features

- Invoicing with customization options

- Inventory management for product-based businesses

- Cash flow forecast for financial planning

- Sales tax tracking and categorization

- Financial reporting and analytics

- Payroll management for employee compensation

Pros

- The intuitive interface simplifies financial tasks

- Accommodates businesses of varying sizes

- Accessibility from anywhere for real-time collaboration

- Tailor features to specific business needs

Cons

- May not meet complex accounting requirements

- Fewer third-party app integrations compared to larger accounting systems

Pricing

Saasu doesn’t offer a free plan but you get a generous 30-day free trial. Its pricing depends on your business size.

- Small: $20 per month

- Growing: $35 per month

- Medium: $50 per month

- Large: $90 per month

- X-Large: $250 per month

Image via Saasu

Tool Level

- Beginner

Usability

- Easy to use

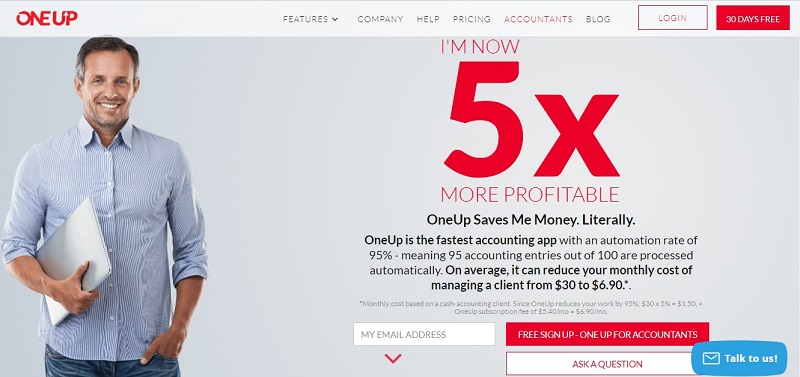

9. OneUp

Image via OneUp

OneUp is a remarkable Zoho Books alternative designed for automated bookkeeping.

This business accounting software offers a seamless solution for small businesses and startups seeking to streamline their financial operations.

What makes OneUp unique?

This Zoho Books alternative automatically synchronizes bank accounts, simplifying income and sales tax tracking. Additionally, the accounting software provides robust features for invoicing, inventory management, and financial reporting.

Key Features

- Automated bank account synchronization for effortless tracking

- Invoicing and payment processing capabilities

- Inventory management for product-based businesses

- Detailed financial reporting and analysis tools

- Mobile app for on-the-go accessibility

- Multi-currency and multi-language support for global operations

Pros

- Simplifies income tracking

- Intuitive interface reduces the learning curve for users

- Convenient mobile app for remote financial management

- Ideal for global businesses

Cons

- May not meet complex accounting requirements

- Fewer third-party app integrations compared to larger accounting systems

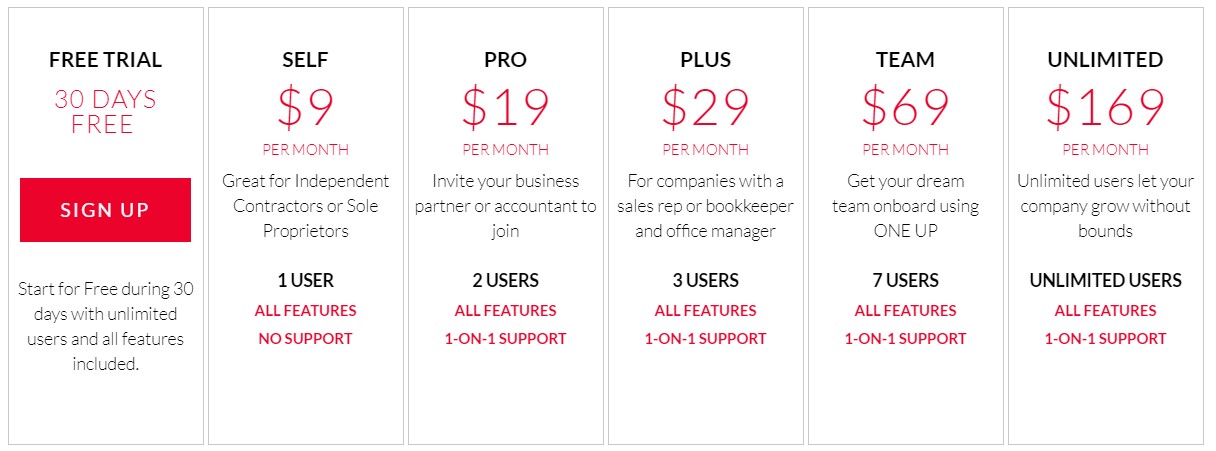

Pricing

With OneUp, you get to enjoy 30 days for free without using a credit card. Here are the paid plans.

- Self: $9 per month, up to one user

- Pro: $19 per month, up to two users

- Plus: $29 per month, up to three users

- Team: $69 per month, up to seven users

- Unlimited: $169 per month, unlimited users

Image via OneUp

Tool Level

- Beginner

Usability

- Easy to use

You May Also Like:

10. Patriot

Image via Patriot

Patriot is a versatile payroll and accounting software designed to cater to a wide range of business accounting needs.

This business accounting solution empowers small and medium businesses with tools for precise financial management, including payroll processing, invoicing, time tracking, and comprehensive financial reporting.

What’s more?

Patriot is an easy-to-use software that is accessible to those without an accounting background.

Key Features

- Payroll processing for employee compensation

- Invoicing and payment processing capabilities

- Comprehensive financial reporting and analysis

- User-friendly interface for ease of use

Pros

- Easy to use software making it accessible for non-accountants

- Budget-friendly for small and medium-sized businesses

- Accessibility from anywhere for real-time collaboration

- Efficient handling of employee compensation

- Streamlines invoicing and payment processing

Cons

- May not meet complex accounting requirements

- Limited third-party integrations

- More suitable for small and medium businesses

Pricing

Patriot offers pricing depending on the software

- Accounting Software:

- Accounting Basic: $20 per month

- Accounting Premium:$30 per month

- Payroll Software:

- Basic Payroll: $17 per month + $4 per employee

- Full Service Payroll: $37 per month + $4 per employee

Image via Patriot

Tool Level

- Beginner

Usability

- Easy-to-use software

11. ZarMoney

Image via ZarMoney

ZarMoney is another Zoho Books alternative that caters to businesses seeking comprehensive financial management solutions.

This business accounting software provides a versatile platform for efficient bookkeeping, time-tracking capabilities, and invoicing.

The best part is that this Zoho Books alternative is cost-effective, making it a budget-friendly choice for small to medium businesses.

Key Features

- Invoicing with customizable templates

- Time tracking capabilities for billable hours

- Order management for streamlined operations

- Bank reconciliation for accurate financial records

- Comprehensive financial reporting and advanced analytics

Pros

- Budget-friendly solution for small businesses

- Intuitive interface for easy navigation

- Streamlines invoicing processes for faster payments

- Order management makes ecommerce easier

- Suitable for growing businesses with scalable features

Cons

- Fewer integrations compared to larger accounting systems

- Some users may require time to master its feature set

- The quality of customer support may vary, with potential room for improvement

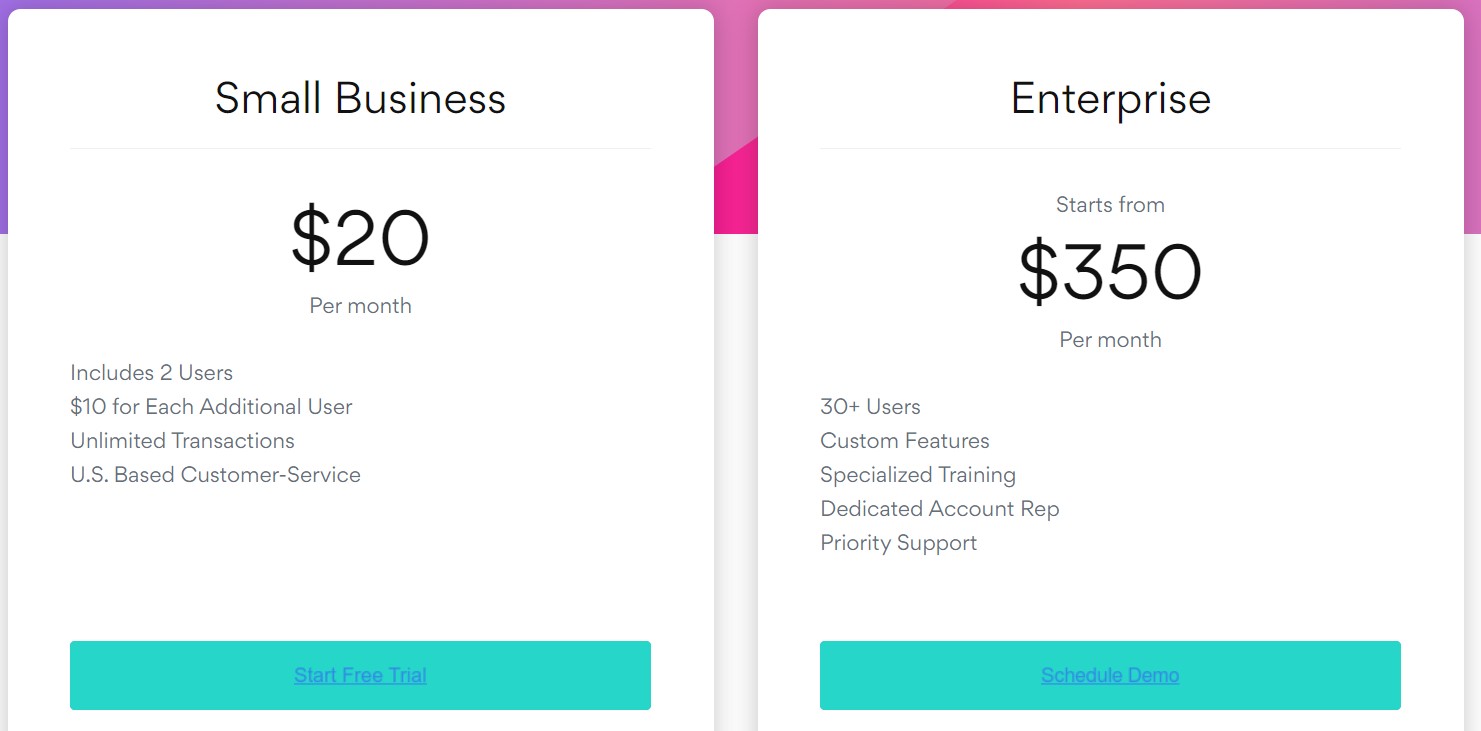

Pricing

ZarMoney doesn’t offer a free plan. Here are the paid options:

- Small Business: $20 per month for up to two users with $10 for each additional user

- Enterprise: $350 per month for 30+ users

Image via ZarMoney

Tool Level

- Beginner/Intermediate

Usability

- Has a slight learning curve

You May Also Like:

FAQ

Q1. How do I decide which Zoho Books alternative is right for my business?

Selecting the right Zoho Books alternative depends on several factors specific to your business. Start by identifying your business needs and priorities.

Consider aspects like your budget, the size and complexity of your business, the features you require (e.g., payroll, inventory management, invoicing), and your industry. Research and compare various Zoho Books alternatives to see which one aligns most closely with your specific needs.

Q2. Is Zoho Books the same as QuickBooks Online?

No, Zoho Books and QuickBooks Online are not the same. While both are accounting software solutions, they come from different companies and offer distinct features. Each has its strengths and may be better suited for different types of businesses depending on their unique requirements.

Q3. What if I’m currently using Zoho Books? Can I migrate my data to one of these alternatives?

Yes, many Zoho Books alternatives offer data migration options to help you transfer your financial data seamlessly. It’s essential to check with the specific alternative you’re considering to ensure that they support Zoho Books data migration. This process can help you save time and maintain continuity in your financial processes.

Q4. What are the disadvantages of Zoho Books?

Zoho Books is a powerful accounting software, but it does have some limitations. Disadvantages include:

- Limited payroll capabilities

- Complexity for some users

- While it’s flexible, advanced customization may be limited

- It may not integrate with some niche or industry-specific software

Q5. Can I integrate these alternatives with other business tools I use?

Most Zoho Books alternatives offer integrations with other popular business tools and software. The range of integrations may vary depending on the alternative.

Q6. Can these Zoho Books alternatives handle multiple currencies?

Most Zoho Books alternatives, such as QuickBooks Online, Xero, and Sage, offer robust multi-currency support. However, the extent of this feature may vary between platforms. Always check the specific capabilities of your chosen software to ensure it meets your international business needs.

Q7. Do these Zoho Books alternatives offer double-entry accounting?

Yes, all the major Zoho Books alternatives discussed in this article, including QuickBooks Online, Xero, and FreshBooks, support double-entry accounting. This feature ensures accurate bookkeeping and helps maintain the integrity of your financial records.

Q8. How do these Zoho Books alternatives compare in terms of mobile app availability?

Most Zoho Books alternatives offer mobile apps for both iOS and Android devices. These apps typically allow users to manage invoices, track expenses, and access key financial data. QuickBooks Online, FreshBooks, and Xero are known for their robust mobile capabilities. They cater to the needs of small businesses and entrepreneurs who require flexibility in managing their finances.

Q9. How do these Zoho Books alternatives handle accounts receivable?

Most of the Zoho Books alternatives in this article offer robust accounts receivable features. These typically include automated invoicing, payment reminders, and aging reports. Some platforms also provide customer portals for easier payment processing, helping small businesses improve cash flow and reduce manual work tracking payments.

You May Also Like:

Which is the Best Zoho Books Alternative for Your Business?

While Zoho Books is undoubtedly a remarkable accounting tool, it’s essential to explore the variety of Zoho Books alternatives available to meet your specific business requirements.

What makes this exploration worthwhile?

All the Zoho Books alternatives featured in this article have the potential to enhance your prospecting efforts, ultimately boosting your bottom line.

Many of these Zoho Books alternatives are designed to cater to different niches and business sizes, ensuring that there’s an option suitable for your unique needs. Some excel in multi-currency support, while others offer powerful features for small or growing businesses.

To make an informed business decision, compare the features and capabilities of these Zoho Books alternatives. Consider user limits, customizable invoices, advanced analytics, and phone support. Keep this list as a valuable reference in your quest for the perfect accounting solution. All the best with your business accounting!