Read on to find out more.

The Benefits of Having an Accountant for Ecommerce Businesses

Managing finances is one of the most critical aspects of running a successful ecommerce business. While many entrepreneurs handle bookkeeping on their own, partnering with a professional accountant for ecommerce can provide significant advantages.

1. Accurate Financial Recordkeeping

Tracking every coin that comes and goes is difficult, especially when your ecommerce business picks up. An ecommerce accountant can take this responsibility off your plate.

Accurate bookkeeping is the backbone of any business. It gives you a good idea of where your business stands. An ecommerce accountant is trained to have an eye for detail, helping them catch any discrepancies.

A good accountant for ecommerce also needs to understand the benefits of using accounting software to automate ecommerce transactions and streamline financial reporting.

2. Budgeting and Financial Planning

Having the capital for an online business is one thing. Budgeting correctly is a different ball game that’s best handled by an ecommerce accountant.

They can assist in creating realistic budgets, planning for future expenses, and forecasting cash flow. Additionally, they can help control unplanned spending, minimize waste, and improve financial efficiency.

This level of oversight can help your ecommerce business navigate lean periods more effectively.

3. Sales Tax Compliance and Optimization

Navigating the tax jungle isn’t easy — and it gets even murkier when there’s an ecommerce business involved. You have to deal with sales taxes, income taxes, VAT, and state taxes, which can be overwhelming, especially if you’re also taking care of a million other things to run the business.

This is another area where an accountant for ecommerce can help. They can assist you in navigating through the sales tax compliance maze and save you from costly penalties by filing taxes on time.

A good ecommerce accountant also knows how to leverage tax deduction cheat sheets to help you save money on taxes.

You May Also Like:

4. Cash Flow Management

Cash flow management involves more than just receiving revenue from sales, saving the profits, and reinvesting the remainder into the business.

An accountant for ecommerce ensures you never run out of cash by monitoring your business’s cash flow meticulously. Furthermore, they provide stability to ensure you don’t fall into the never-ending cycle of debt.

5. Inventory Management

Ecommerce businesses can’t afford an inventory malfunction. Low stock can lose you clients as potential customers look for alternatives. At the same time, having too much stock can throw your finances out of balance when they don’t clear fast enough.

By analyzing sales trends, seasonal demand, and market data, an accountant for ecommerce can provide valuable insights to optimize your stock levels.

They can work with you to create budgets and forecasts that align inventory purchases with cash flow, ensuring you’re not over-investing in slow-moving products or understocking high-demand items.

6. Assistance With Business Growth Strategies

An ecommerce accountant is a great asset for elevating your ecommerce business. They analyze financial feasibility and weigh potential risks to help you make the right moves.

Additionally, an accountant for ecommerce is in the best position to help you attract investors or secure loans for your business. They achieve this by preparing meticulous and compelling financial records that showcase your company’s financial health and potential.

With their expertise, an accountant ensures your business growth is in line with your profits.

You May Also Like:

7. Fraud Prevention and Detection

According to a 2022 Juniper Research survey, ecommerce businesses around the globe lost $48 billion in 2023 alone, up from $41 billion the previous year. The threat of fraud is real, and therefore, should be taken seriously.

An accountant for ecommerce can set up internal controls that protect your business against all threats. This includes secure payment gateways and robust financial checks.

8. Risk Management and Mitigation

Running a business will always involve risks. It’s what you do to minimize their impact that separates successful ecommerce sellers from failures.

Ecommerce accountants can catch little discrepancies that may escape your attention. They analyze your financial history to spot anything that looks out of place and take proactive measures right away.

Furthermore, an accountant for ecommerce can help you set up emergency funds. This ensures you have something to fall back on if the worst happens.

9. Support During Audits

Audits are crucial for your business as they provide an objective assessment of your financial health. It’s particularly important if you hope to attract investors who always need reassurance that their investments aren’t at risk.

An accountant ensures all your financial records are in order at all times, minimizing surprises during audits. They also act as the primary point of contact for auditors, managing inquiries and facilitating the process.

This allows you to focus on running your business without the added stress of audit preparations.

You May Also Like:

10. Strategic Business Advice

Business decisions don’t always go the way you expect them to. That said, your chances of success significantly go up when you have a professional ecommerce accountant by your side.

Having a good business instinct is important, but you can’t always rely on that. An accountant helps you make sensible data-driven decisions. They handle research and create reports so you can gain access to data that will help you make the best decisions for your business.

Qualities to Look for in an Ecommerce Accountant: Things to Consider

There are different types of accountants with varying expertise. Choosing the right one can be an uphill task. Here are some qualities you should be mindful of in your search.

1. Expertise in Ecommerce Accounting

Expertise goes beyond certifications. The right accountant for ecommerce needs to understand your business structure and the unique challenges your industry faces.

They need to have hands-on skills for tracking sales, managing inventory, and ensuring sales tax compliance. Even knowing how to choose the right accounting software can make a huge difference in streamlining your operations.

Experience with high-volume transactions is invaluable, as is their ability to offer strategic advice when critical decisions arise. With the right accountant for ecommerce, you gain not only financial accuracy but also a trusted partner to guide your business growth.

2. Familiarity with Ecommerce Platforms

One thing that sets ecommerce accountants apart from regular accountants is their familiarity with ecommerce platforms like WooCommerce, Shopify, or Etsy. Each platform has distinct payment gateways, fee structures, and reporting formats that require specialized knowledge to manage effectively.

An accountant for ecommerce doesn’t necessarily need to set up your shop but should understand the nuances of these platforms to optimize your financial processes.

For instance, they should be skilled in integrating multiple ecommerce platforms with your accounting software. This ensures seamless synchronization of sales, expenses, and inventory data. This expertise saves time, minimizes errors, and provides a clearer financial picture for your business.

3. Proficiency in Ecommerce Accounting Software

The ideal ecommerce accountant should be familiar with modern accounting software. You need someone proficient in commonly used software like Xero, Sage, QuickBooks, and more.

A tech-savvy accountant for ecommerce can automate repetitive tasks like invoice creation, financial reporting, and expense tracking. This will save you valuable time that would have been wasted on mundane manual data entry. It also reduces the risk of human error.

You May Also Like:

4. Knowledge of International Tax and Currency Exchange

If you ever see your business expanding to the international market, that’s when you should hire an accountant for ecommerce who’s also conversant with international tax.

They should be able to help you navigate global markets and varying tax laws from different jurisdictions. Furthermore, they should help your business adjust to currency conversion charges without hurting your bottom lines.

An ecommerce accountant who understands import duties and tariffs is a necessity if your business goes international.

5. Proven Track Record with Ecommerce Businesses

Any accountant for ecommerce who’s worth their salt should have a proven track record in the industry.

An accountant with hands-on ecommerce accounting experience understands the ebb and flow of demand in your industry. They can help you prepare for peak seasons, manage slow periods effectively, and navigate challenges like inventory fluctuations or sudden market shifts.

Beyond just crunching numbers, their insights can inform strategic decisions, such as pricing adjustments, cash flow management, and scaling operations. Their expertise becomes a vital asset in guiding your business through both opportunities and challenges with confidence.

6. Excellent Communication Skills

Accounting language can be confusing to a layman and this can create communication issues, which isn’t ideal. That’s why you must pick an accountant for ecommerce who can break down complicated jargon into actionable, easy-to-understand information.

They should also communicate regularly, providing you with financial updates, reports, or alerts promptly. An ideal ecommerce accountant takes the time to explain your financial situation thoroughly, answering your questions with patience and ensuring you fully understand the details.

You May Also Like:

7. Updated with Tax Law Changes

Tax laws change all the time, and failure to keep up can be costly. Therefore, choose an accountant for ecommerce who keeps up with trends and changes in tax laws.

This is beneficial because you won’t have to scramble last minute to find tax deductions or file the right tax returns. A well-informed accountant will advise you on new tax strategies that reduce the amounts you pay without breaking the law.

8. Trustworthiness

Ecommerce transactions involve a lot of sensitive financial and personal data. So, you need to look for a specialized ecommerce accountant with a good reputation, integrity, and professionalism.

They need to be upfront about their fees so you can avoid awkward conversations later on. A trustworthy accountant for ecommerce should also respect confidentiality and be open to signing a nondisclosure agreement to protect their customer’s data.

9. Good Time Management Skills

A good accountant for ecommerce should be aware of important deadlines and seek to wrap things up much earlier. This is especially important for tax compliance, and payment of vendors — the two lifelines of an ecommerce startup business.

Time management goes beyond just working faster. It involves knowing what to prioritize to keep the business operational.

You May Also Like:

Where Can Online Sellers Find an Accountant for Ecommerce?

Like other specialized professionals, ecommerce accountants can be sourced through specific channels. Below are some effective strategies and places to help you identify the ideal candidate for your business needs.

Posting Online Job Listings

There are countless platforms, both free and premium, you can use to post job listings online.

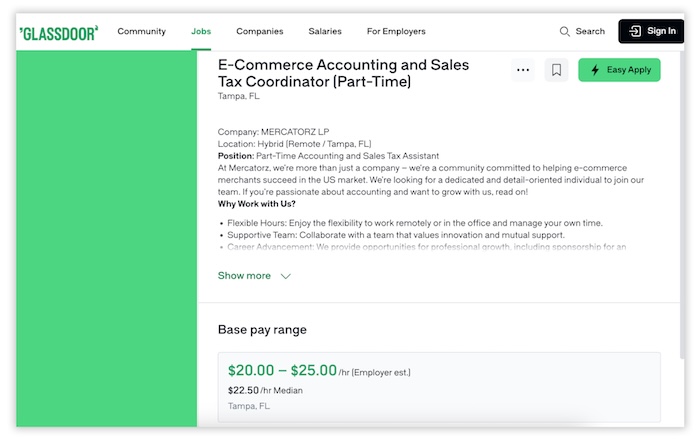

They include sites like LinkedIn, Glassdoor, Indeed, and Craigslist. Here’s an example of the kind of job listing you can create on a platform like Glassdoor.

Image via Glassdoor

For the best results, ensure you provide enough information on your qualifications and the job description. To filter serious candidates, consider adding a small challenge or specific instruction within the listing to identify those who carefully read and follow directions.

Online Job Boards

Freelancers and skilled professionals often use online job boards to showcase their availability and expertise. Popular platforms like Upwork, Freelancer, and Fiverr are excellent places to find an accountant for ecommerce.

However, it’s essential to exercise caution, as these platforms may also host fake profiles. Look for accountants with verified experience, client reviews, and references to make background checks easier.

Accounting and Bookkeeping Websites

You can get an accountant for ecommerce on official accounting and bookkeeping websites.

Sites like Xero Advisors Directory are dedicated to connecting online businesses with reliable accountants. You can search for accountants by state as showcased below:

Image via Xero

These directories are more trustworthy because they vet professionals before listing them on their sites. However, you may have to pay to access these websites.

You May Also Like:

Professional Networking Sites

Sites like LinkedIn are a valuable resource for finding qualified professionals, including ecommerce accountants. Many industry-specific groups and forums regularly feature posts from individuals seeking work, making it easy to discover potential candidates.

LinkedIn profiles are typically public, allowing you to review a candidate’s credentials and experience before reaching out.

Lastly, the platform’s recommendations feature can help you find accountants through your mutual connections. This allows you to search for candidates that you already trust.

Accounting Associations and Directories

Consider checking out associations like the American Institute of CPAs and the Chartered Institute of Management Accountants. You can use their directories to find niche-specific accountants for your business needs.

The biggest advantage of this option is that every listed accountant for ecommerce is certified and vetted.

Networking Events and Meetups

Networking events are another goldmine for landing the perfect accountant for ecommerce businesses.

A good example is the Accounting and Financial Women’s Alliance (AFWA). It organizes networking events for women in accounting where they can meet future employers and other opportunities.

You May Also Like:

Challenges of Hiring and Working With Ecommerce Accountants

Nothing is ever guaranteed in business. You may do everything by the book and still end up with an incompetent accountant for ecommerce. Some of the challenges you should be prepared for include the following:

1. High Service Fees

Ecommerce accountants don’t come cheap. They have specialized skills that are in high demand. You’ll have to part with money to get the best ones.

This can be challenging for small ecommerce businesses working with overstretched budgets. Some accountants even charge by the hour, which can be costly in the long run.

To avoid breaking the bank, go for an affordable accountant for ecommerce with flat-rate packages. Additionally, you can negotiate a retainer agreement to stop the costs from going over the budget.

2. Difficulty Finding Ecommerce Specialists

Finding an accountant for ecommerce who truly understands the unique needs of your business can be challenging. It’s important to find a professional who not only offers competitive rates but also brings specialized experience to the table.

To ensure you’re choosing the right fit, conduct thorough background checks by reviewing online testimonials and requesting proof of past work. Ask if they’ve worked with the accounting software you’re using.

If possible, consult official accountant directories, as these resources often list qualified professionals with a proven track record.

3. Potential Data Security Risks

An accountant for ecommerce will need access to financial information, including private customer data like bank accounts. As a result, it’s crucial to prioritize data security to protect your business and your customers.

Data breaches are very common in the ecommerce industry, and an ecommerce accountant who lacks strong security practices can cause a lot of damage. They need to be well-versed in security practices when using accounting software.

You May Also Like:

4. Inconsistent Quality of Work

Inconsistency in work quality can result in inaccurate financial reports — even when using the best ecommerce accounting software. This can lead to misguided company decisions or missed sales tax deadlines with heavy penalties.

To maintain high standards, it’s important to set clear expectations with your accountant for ecommerce. Also, review their previous work to gauge their reliability.

Ensure they’re fully committed to providing attention to detail and thoroughness in every aspect of their job. By establishing these expectations early, you create a foundation for a strong, consistent working relationship.

5. Limited Availability During Peak Seasons

Peak periods, such as tax season and Black Friday, are critical for ecommerce businesses, particularly when it comes to inventory management. During these times, it can be challenging to secure the support of a reliable accountant due to high demand.

Limited availability during these busy seasons can delay important financial decisions, potentially leading to missed opportunities or the need for last-minute adjustments.

To ensure you’re well-prepared, it’s a good idea to plan ahead by scheduling key financial activities well before peak seasons arrive. Additionally, consider securing an accountant early in the year to ensure their availability during your busiest times.

6. Delays in Delivering Financial Reports

Timely financial reports are essential for making informed business decisions, as opportunities often require quick action. An unreliable accountant for ecommerce can delay the delivery of crucial bookkeeping reports that your ecommerce business depends on.

Such delays can mess with business account budgeting, ecommerce marketing, inventory management, or tax obligations. Without financial reports, your business will be flying blind, forcing you to abandon data-driven insights.

To ensure punctuality, set clear deadlines and include them in the contract. Regular check-ins, such as weekly updates, can help keep progress on track and ensure that everything runs smoothly.

7. Communication Barriers

An accountant for ecommerce should be able to relay their findings in an understandable language. Communication hurdles can arise from language barriers and the lack of understanding of your ecommerce business goals.

The inability to ask the right questions is another stumbling block that could affect the accuracy of vital reports.

To avoid misunderstandings, it’s important to establish open communication from the start. Regular check-ins are necessary. They should also use charts and other graphical resources to explain their findings.

You May Also Like:

FAQ

1. What does an ecommerce accountant do?

An ecommerce accountant audits your online business, creates financial reports, handles sales tax filing, and conducts vital research. All these are efforts aimed at improving your ecommerce business.

2. What is the accounting process of ecommerce?

The accounting process of ecommerce involves tracking, analyzing, and recording financial data for an online business. This is then used to create a more efficient business operation.

3. What does an ecommerce bookkeeper do?

An ecommerce bookkeeper manages and records all the financial activities of an ecommerce business. This includes recording transactions, handling invoices, tracking inventory, and reviewing budgets.

4. What accounting method does Shopify use?

Shopify uses cash and accrual accounting methods. In the cash accounting method, transactions are recorded and filed when cash is paid out or received. In accrual accounting, transactions are recorded only when they’re incurred, whether or not cash is exchanged.

5. How do I find the right accountant for my ecommerce business?

You can find the right accountant for ecommerce in many ways. You can use accounting services job boards, attend networking events, leverage networking platforms like LinkedIn, or gain referrals from other online business owners.

Conclusion

An accountant for ecommerce is a necessity for the survival of an online business. The skills and expertise they bring to the table make them an indispensable cog in the ecommerce machine. They generate financial reports, see to sales tax obligations, manage cash flows, and protect your business from hefty fines.

While they may sometimes be costly, the value they add to your sales channels far outweighs the expense. Therefore, if you’re an online seller looking to grow the business, it’s time you got yourself an ecommerce accountant.