With the right accounting tools, you can accurately track funding sources, ensure compliance with financial regulations, and make smarter decisions about resource allocation.

However, not all accounting software is built with nonprofits in mind. Some offer essential budgeting and reporting tools, while others provide specialized nonprofit features like fund accounting, grant tracking, and donor management.

To help you make the right choice, we’ve rounded up 13 of the best accounting software for nonprofit organizations in 2025.

Whether you’re a small nonprofit looking for a cost-effective solution or a larger organization needing advanced automation and reporting, there’s an option for you.

Quick Summary: Best Accounting Software for Nonprofit Organizations by Feature

- Best Nonprofit Accounting Software for Reporting: QuickBooks, Blackbaud, Fund EZ, Xero

- Best All-In-One Accounting Software for Nonprofit Organizations: AccuFund, MIP Fund Accounting, Aplos, QuickBooks, NetSuite, NonProfit+, Xero, FastFund

- Best Scalable Accounting Software for Nonprofit Organizations: Sage, MIP Fund Accounting

- Best Accounting Software for Small Nonprofit Organizations: Aplos, Fund EZ, FastFund

- Best Accounting Software for Nonprofit Organizations with Extensive Infrastructure: NetSuite, Blackbaud

- Best Affordable Accounting Software for Nonprofit Organizations: MoneyMinder, Xero, FreshBooks

- Best Desktop Accounting Software for Nonprofit Organizations: QuickBooks, MIP Fund Accounting, AccuFund

- Best Accounting Software for Global Nonprofit Organizations: Sage, NetSuite, MIP Fund Accounting, NonProfit+

How We Chose the Best Accounting Software for Nonprofit Organizations

Nonprofits have unique financial management needs, which is why we carefully evaluated each option based on the features that matter most to them.

Here’s what we considered when choosing the best accounting software for nonprofit organizations:

- Core Accounting Features: Each tool includes essential features for transparent, accurate, and compliant financial reporting.

- Additional Functionality: We prioritized accounting software with nonprofit-specific tools, such as donation tracking, grant management, and fund accounting.

- Ease of Use: A good accounting software solution should be accessible to all users. We included platforms with intuitive dashboards and simple workflows.

- Customer Support: We selected platforms that offer responsive customer support through multiple channels, including chat, email, and phone.

- Customization: Nonprofits have unique financial needs, so we chose software that allows customization.

- Cost: When it comes to nonprofit accounting, budget matters. We included a variety of options, from free and affordable plans to premium solutions.

You May Also Like:

10 Industry-Specific Accounting Software for Nonprofit Organizations

To kick off our list of the best accounting software for nonprofit organizations, we’ll highlight those that offer industry-specific features.

These tools make fund accounting easier, improve financial transparency, and ensure compliance with nonprofit regulations.

1. Aplos

Image via Aplos

Aplos is a top choice for accounting software for nonprofit organizations, especially faith-based organizations. It’s designed to simplify fund accounting, making it easy to track donations, grants, and expenses while maintaining transparency.

With features like fund-based balance sheets and income statements, this nonprofit accounting software helps you stay accountable and monitor your nonprofit’s financial health.

You can also create reports and compare the budget of your nonprofit to actual spending across different funds or tags, giving you a clear picture of where your money is going.

Beyond accounting, Aplos offers tools to help you boost donations, including online donation forms and a Text to Give feature.

Besides, its built-in CRM database lets you create donor profiles, segment your donor list, and personalize communication to strengthen donor relationships.

Key features

- Donation reporting

- Fund reporting

- Fixed asset tracking

- Automated donation tracking

- Customizable and mobile-friendly donation forms and widgets

- Recurring transactions

- Integrated CRM tool

- Website builder

- Text to Give feature

- Advanced budgeting tools

Pros

- Fundraising tools

- Reliable customer support

- Customizable chart of accounts

- Regular and free updates

Cons

- Need high-tier plans for fund, project, and campaign-specific budgeting

- Less intuitive reporting feature

Pricing

Aplos provides a 15-day free trial and three paid plans:

- Lite: $39.50/month

- Core: $49.50/month

- Advanced: Starts at $189 per month (First month free)

Image via Aplos

Tool Level

- Intermediate

Usability

- Moderately easy to use

You May Also Like:

2. AccuFund

Image via AccuFund

AccuFund is a robust accounting solution designed for large nonprofits and government organizations that need powerful financial management tools. Whether you prefer an on-premise or cloud-based system, nonprofit accounting software offers flexibility to fit your organization’s needs.

With features like fund accounting, in-depth reporting, a customizable dashboard, and automation tools, AccuFund simplifies complex financial tasks, saving your team time and effort.

This accounting software for nonprofit organizations provides a full suite of nonprofit-specific tools, including:

- Payroll management

- Grants management

- Human resources management

- Loan tracking

- Automation workflow

- Budget development

Key features

- Powerful third-party integration capabilities

- Report scheduler

- User-defined financial reporting

- Encumbrance accounting capabilities

- Multiple budget versions

- A form designer for customized forms

- Database with complete data integration

- Capability to add supporting images for all transactions

- Accounts payable

- Employee self-service portal

Pros

- Employee management

- Highly scalable

- Diverse range of add-on modules

- User-based security

Cons

- Less intuitive reports feature

- May have a long learning curve for beginners

Pricing

- For AccuFund, pricing isn’t displayed on the platform’s website, but is available upon inquiry.

Tool Level

- Intermediate/Expert

Usability

- You need significant time to learn how to use some of the features.

3. Blackbaud

Image via Blackbaud

Blackbaud Financial Edge NXT is a robust fund accounting software for nonprofit organizations. It simplifies financial management by automating routine tasks and creating intuitive workflows, saving you time and effort.

What makes Blackbaud stand out is its ability to tackle common financial challenges while improving transparency.

With flexible reporting, you can track financial data by project, grant, or any custom category that fits your needs. Plus, budgeting tools help you manage restricted funds with ease.

When the need arises, you can show your stakeholders the financial activities associated with each fund and grant without running a report.

The nonprofit accounting software also integrates seamlessly with other Blackbaud tools like Raiser’s Edge NXT.

Key Features

- Automated reconciliation for bank accounts and credit cards

- Automated budgets and reports for easier tracking

- Centralized database for donor agreements, grants, and contracts

- Visual chart organizer for flexible reporting

- Financial performance dashboard for quick insights

- Insight designer for customizable financial metrics

- Advanced security to protect sensitive data

- Audit trails for compliance and transparency

- Smart expense management with automated rules and budget checks

- Blackbaud University offers free training and best practices

Pros

- Employee management

- A highly scalable accounting software

- Diverse range of add-on modules

- User-based security

Cons

- Less intuitive reports feature

- May have a long learning curve for beginners

Pricing

Just like AccuFund, Blackbaud doesn’t display the pricing information on its website. You have to contact the sales team for pricing information.

Tool Level

- Intermediate/Advanced

Usability

- The interface is not intuitive.

You May Also Like:

4. QuickBooks

Image via QuickBooks

Quickbooks is another top accounting software for nonprofit organizations, offering a range of features designed to streamline financial management, including cloud-based accounting tools.

While the core QuickBooks platform is great, QuickBooks Enterprise for Nonprofits goes a step further with tools tailored specifically to nonprofit budget needs.

Along with standard accounting features, you’ll get:

- 200+ built-in reports

- Donor management tools

- Pre-built templates

- Salesforce CRM integration

This nonprofit accounting software system is one of the top choices because it also integrates with other essential tools, like payroll software, making it a comprehensive solution.

While QuickBooks Enterprise is a desktop-based software, a cloud-access version is also available for added flexibility.

Key features

- Budget tracking by fund or program

- Easy expense sorting

- Grant and donor management

- Bank reconciliations

- Customizable bill and PO workflow approvals

- Class-based reporting

- Powerful reporting and charts to keep track of performance

- Bill management

- Employee expense management

- Online data backup

- App integration

Pros

- Financial statements and donor and grant management in one tool

- Seamless integration with popular tools for nonprofit organizations like Kindful

- Payroll management directly from QuickBooks

- A wide range of advanced features, particularly in reporting

Cons

- Extra cost for additional user license

- Can be challenging for beginners to set up

Pricing

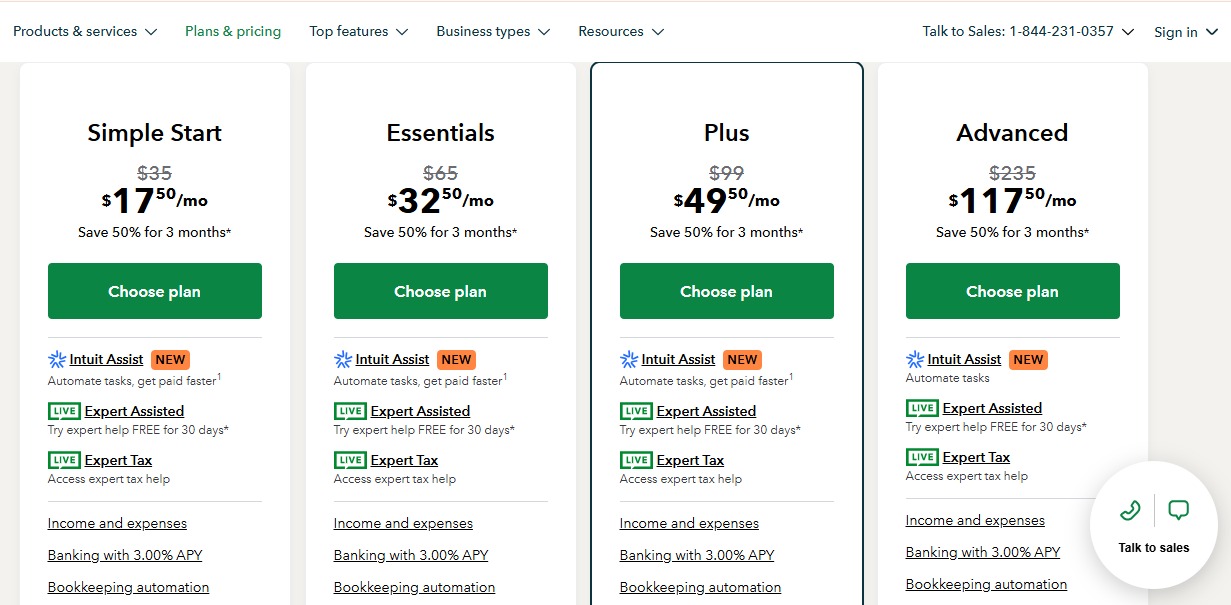

With QuickBooks, you can choose either to get a 30-day free trial or a 50% off discount for 3 months if you buy right away. The paid plans are:

- Simple Start: $35/month for 1 user

- Essentials: $65/month for 3 users

- Plus: $99/month for 5 users

- Advanced: $235/month for 25 users with custom access

Image via QuickBooks

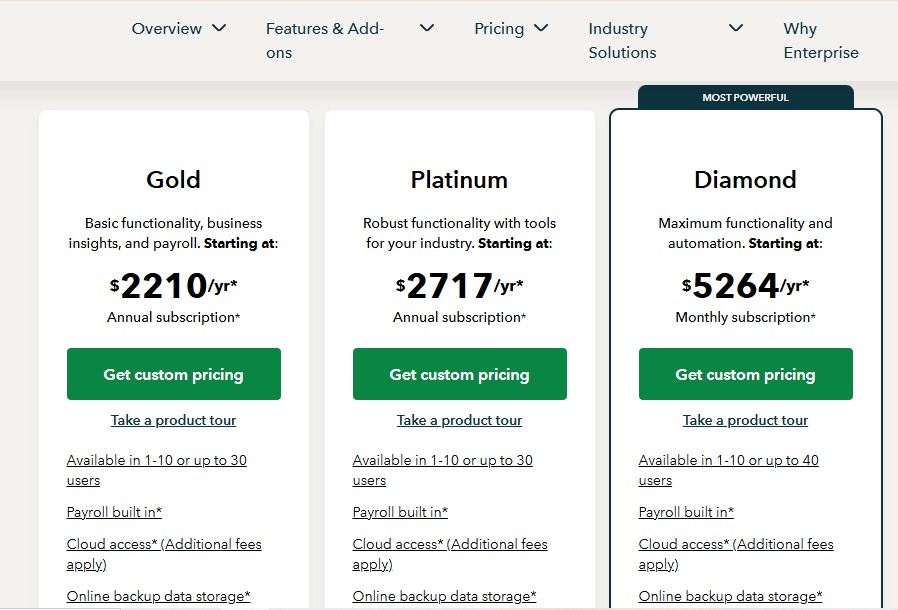

There are also Enterprise plans available, with the following starting prices:

- Gold: $2210/year

- Platinum: $2717/year

- Diamond: $5264/year

Image via QuickBooks

Tool Level

- Intermediate/Advanced

Usability

- The learning curve may be steep for some beginners.

5. FastFund by Araize

Image via Araize

FastFund by Araize is a powerful accounting software for nonprofit organizations, designed by experts who understand nonprofit accounting.

With FastFund, you can:

- Generate FASB-compliant financial statements

- Easily manage cash receipts and disbursements

- Instantly pull data for IRS Form 990 N, 990-EZ, and 990

What makes it one of the best accounting software for nonprofits is that you get the option to integrate fundraising and payroll services into the system.

The premium plan includes accounts payable, accounts receivable, and direct cost allocations. Indirect cost allocations and purchase orders are available as an add-on.

Users also get expert training in nonprofit accounting and bookkeeping. This ensures that you’re always equipped to manage your organization’s finances with confidence.

Key features

- ASU 2016-14 compliant reports

- Customizable user-defined chart of accounts

- Integration with bank accounts through Plaid

- Powerful database filtering to create customized reports

- Automated budgets by grants, departments, programs, or funds

- Cost reporting based on grants or the organization’s operations

- Strict internal controls to maintain accuracy in the books

- Comprehensive audit trails

- Ability to create multiple control accounts for accounts payable, each with its subsidiary ledger

- Automatic posting of client activity into the general ledger and client subsidiary ledgers

Pros

- Option to pay for one service or a bundle of services

- No fixed contract, allowing users to cancel at any time

- Free support from nonprofit accounting experts

- User-friendly interface

Cons

- Limited customization of reports compared to other accounting tools like QuickBooks

- Not friendly to users without an accounting background

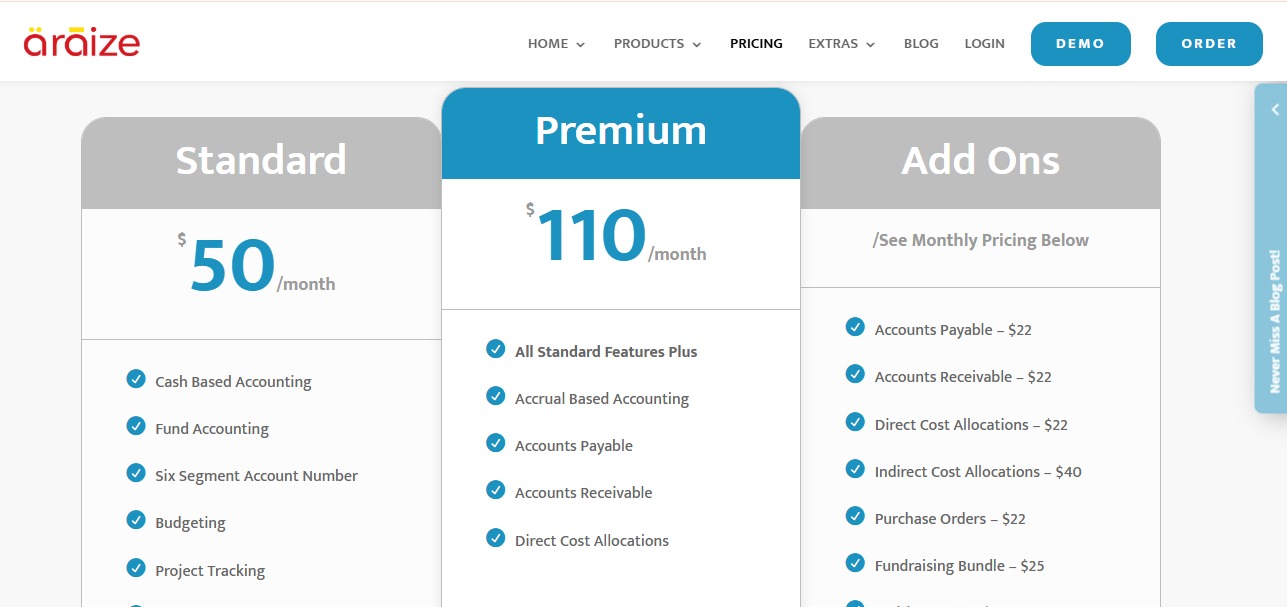

Pricing

FastFund provides a fully functional online trial version with a demo data set and two paid plans. Add-ons are also available, each at a certain monthly cost. Check out the pricing for the paid plans below:

- Standard: $50/month

- Premium: $110/month

Image via Araize

Tool Level

- Beginner/Intermediate

Usability

- Beginner-friendly

You May Also Like:

6. MoneyMinder

Image via MoneyMinder

MoneyMinder is the right accounting software for nonprofit organizations that can’t afford to hire accounting experts.

Designed with volunteers in mind, it simplifies bookkeeping by cutting out the confusing nonprofit accounting jargon and complex processes.

You can easily create a chart of accounts tailored to your organization’s activities, track budgets, and generate financial forecasts.

The MoneyMinder Store feature also makes it easy to sell merchandise, event tickets, and more. Plus, you can collect online payments, membership dues, and donations through Stripe, PayPal, and other payment options.

Key features

- Integration with bank accounts

- Customizable and budget-focused chart of accounts

- Membership and volunteer management tools

- Capability to track donations online and offline

- Unlimited bank registers

- Customizable templates

- Budget scenario analysis

- One-click reports

- Volunteer time tracking

- Document library

Pros

- Unlimited users

- Multilingual support

- Volunteer management tools

- Free version with limited features

Cons

- Additional cost for integration with bank accounts

- Limited donor management tools

Pricing

- MoneyMinder offers a free plan and a paid edition that costs $299/year. Both the free and the paid plans begin with a 30-day free trial. Once the trial period elapses, you can choose to subscribe or continue with the free version.

Image via MoneyMinder

Tool Level

- Beginner

Usability

- Very user-friendly

7. NetSuite Cloud Accounting

Image via NetSuite

NetSuite is a cloud-based ERP designed to handle everything from accounting and financial management to CRM and human capital management.

For nonprofits, it offers a comprehensive suite of cloud-based accounting software, including fund management, grant accounting, and spend tracking. It helps organizations streamline operations and stay on top of their finances.

With automation features, you can simplify transactions, ensure compliance, and close your books with ease. Real-time reporting also gives donors and stakeholders full transparency into your organization’s financial health.

Key features

- Real-time financial management

- GAAP-compliant fund accounting

- Personalized dashboard

- Automated grant accounting

- Built-in standard FASB reports

- General ledger

- Tax management

- Predefined GL custom segments

- Role-based metrics and analytics

- Charity Navigator-recommended scorecards

- Automated spend management processes

- Multicurrency and multilingual functionalities

Pros

- Supports the operations of global nonprofit

- Highly customizable interface

- Supports global tax management

- A powerful and complete set of tools to manage all financial processes

- Highly scalable due to its cloud-based nature

Cons

- A wide variety of features that can overwhelm new users

- May be hard for beginners to create custom reports

Pricing

- You need to get a custom quote from the customer care team based on the number of users and optional modules you’d like to employ.

Tool Level

- Intermediate/Expert

Usability

- Fairly easy to use

You May Also Like:

8. Fund EZ

Image via Fund EZ

Fund EZ is a great accounting software for nonprofit organizations that features a flexible multi-segment chart of accounts, giving you a clear view of your programs, projects, and funding streams.

To help you track progress from different angles, the platform offers unlimited dashboards with intuitive grids, pie charts, and bar graphs.

If you need custom reports for donors or board members, you can generate tailored reports and even apply allocation as needed.

This nonprofit accounting software lets you set up multiple cost centers. You can bill clients and allocate the revenue across your chart of accounts.

You can also enhance its capabilities with optional add-ons like fixed asset accounting and a fundraising platform.

Key features

- Standard and customizable chart of accounts

- Direct and indirect allocation capabilities

- Regular and free software updates

- Access to new features

- Automated data backups

- Daily bank reconciliations

- Management of accounts payable and accounts receivable

- Batch processing of transactions

- Capability to control user access

- A graphical view of the organization’s KPIs

- Can create and track separate budgets for each chart of accounts segment or create multiple budgets within the same period

Pros

- Top-level security

- Very easy setup

- Intuitive interface

- Superior customer support

Cons

- Extra cost for custom reporting

- Time-consuming customization of reports

Pricing

- Contact customer support for a custom price.

Tool Level

- Beginner/Intermediate

Usability

- Very intuitive interface

9. NonProfit+

Image via NonProfit+

NonProfit+ is one of the best all-in-one accounting software solutions designed specifically for nonprofit organizations.

Beyond fund accounting, it offers essential tools for:

- Grant management

- Donor management

- Board management

- Volunteer management

- Fixed asset management

The NonProfit+ accounting suite makes it easy to prevent the commingling of funds.

You can get additional features through the financial management suite. This includes accounts receivable and payables, currency management for global nonprofit organizations, and automated billing.

A procurement management suite is also available as an add-on.

Key features

- Flexible endowment accounting

- Encumbrance accounting to show your nonprofit’s true financial state

- Seamless grants management, including comprehensive reports

- Restricted fund management

- A budget checker tool that notifies users when going over the budget

- Donor management and customized reporting

- Streamlined communication with board members via a board management solution

- Volunteer management tool that enables volunteers to track time and expenses directly on the tool

- Automated audit trail

- A GL/Sub account structure for nonprofit fund accounting

Pros

- Unlimited users

- Powerful restricted funds management

- Built-in grant management

- A mobile app to keep track of your accounts anytime, anywhere

Cons

- Relatively outdated user interface compared to other nonprofit accounting software

- No free trial

Pricing

- Contact the customer support team for a custom quote.

Tool Level

- Intermediate/Advanced

Usability

- Fairly easy to use

You May Also Like:

10. MIP Fund Accounting

Image via MIP Fund Accounting

MIP Fund Accounting is another top cloud-based, SaaS fund accounting software for nonprofit organizations. Its scalability makes it a great choice for nonprofits that need a solution that grows with them. You can start with the modules you need and add more as your nonprofit expands.

With MIP Fund Accounting, you can generate detailed financial reports based on funding sources, programs, and locations. Its customizable chart of accounts lets you easily track grants, funds, projects, and more.

The accounting software for nonprofit organizations also allows you to create budgets for specific grants and across multiple periods. A standout feature that sets it apart is its ability to track volunteer hours, alongside managing inventory, fundraising, and even employee records.

Key features

- Automated requisition/purchase order workflows

- Grant management

- Fixed asset management

- Inventory management

- Automated backups

- FASB and GASB-compliant reports that follow ROMA and Community Services Block Grant guidelines

- Budget reporting

- Accounts payable and receivable

- Integrated payroll software and HRMS to generate payroll reports and manage benefits

- Form designer

Pros

- Available on the cloud or as an on-premise solution

- No extra costs for grant management

- HR management features

- Excellent customer support

Cons

- Not as user-friendly as other accounting software for nonprofits organizations

- Less comprehensive reporting

Pricing

- Contact customer report to get a customized price.

Tool Level

- Intermediate/Expert

Usability

- The interface is not as intuitive as other software.

You May Also Like:

Non-Industry-Specific Accounting Software for Nonprofit Organizations

The following accounting software cut across industry boundaries, but are still effective in streamlining the financial operations of nonprofit organizations.

They provide robust functionalities for fund and expense tracking, basic accounting tasks, compliance management, online donations, transparent reporting, and more.

1. Xero

Image via Xero

Xero is a great online accounting software for all businesses, nonprofits included. Its advanced analytics give you a clear view of the financial health of your nonprofit, helping you track key metrics, forecast short-term cash flow, and compare actual reports with different financial scenarios.

What sets Xero apart is its highly customizable reporting, featuring an intuitive drag-and-drop interface that makes it easy to tailor financial insights to your needs.

While there are many other Xero alternatives, few offer this level of flexibility and depth in financial reporting.

Beyond accounting, Xero simplifies payroll management and record-keeping. With integrations for over 20 of some of the best CRMs, reporting tools, and expenses apps, you can easily connect it with your existing systems for a more streamlined workflow.

Some popular integrations include Keela, MembershipWorks, and Hubdoc.

Key features

- Online payments via credit card, debit card, or direct debit

- Simple online recurring pay runs

- Invoicing and online quote creation tool

- Bill tracking

- Bulk reconciliation of bank transactions

- Support for multiple currencies

- Contact management

- Fixed asset management

- Online file storage

- Connection with over 21,000 banks

Pros

- Mobile app for on-the-go monitoring of your nonprofit’s financial status

- Integration with over 1,000 apps for additional functionalities

- Import of data from over 21,000 banks

- 25% discount for registered nonprofit organizations

- Accurate and convenient sharing of financial data

Cons

- Extra cost for payroll management

- A limit of 5 bills for bill tracking in the lowest-tier plan

Pricing

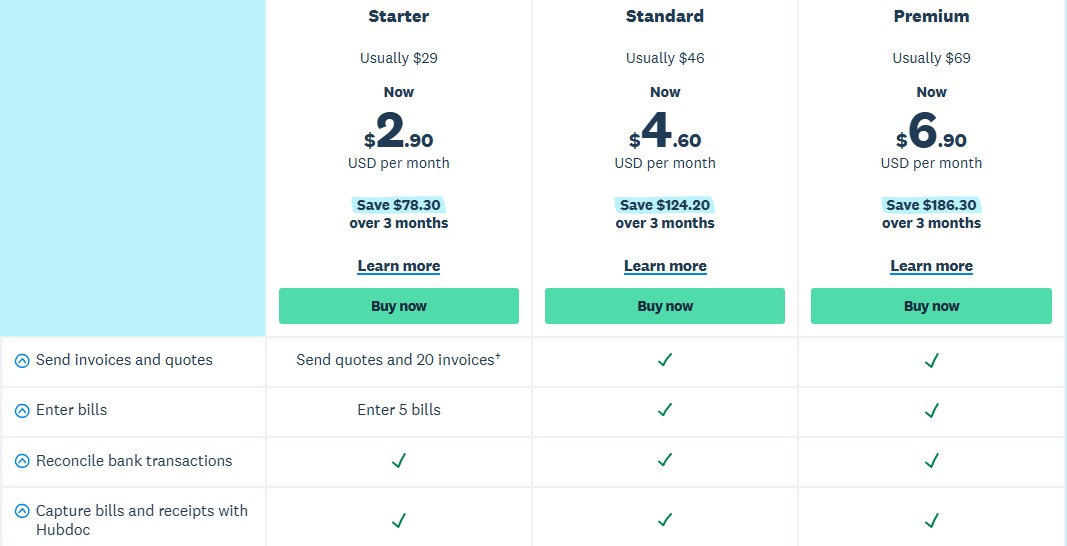

This accounting software for nonprofit organizations offers a 30-day free trial and three paid plans:

- Starter: $29/month

- Standard: $46/month

- Premium: $69/month

Image via Xero

Tool Level

- Beginner/Intermediate

Usability

- Beginner-friendly interface

You May Also Like:

2. Sage Intacct

Image via Intacct

Sage Intacct is a cloud accounting tool for all types of businesses, including nonprofit organizations with a global presence.

With built-in support for multi-currency transactions and tax filing across different jurisdictions, it simplifies financial management for organizations with an international reach.

One of the key benefits of Sage Intacct is its powerful AI-driven automation. With just one click, you can consolidate accounts, generate real-time performance insights, and streamline your financial reporting.

Its robust nonprofit accounting features allow you to create detailed statements based on revenue sources. You can also customize accounts for each funder and more.

Key features

- A multidimensional database

- Digital board book that shows your nonprofit’s impact and financial health

- Capability to manage finances by dimensions, such as grants, donors, programs, and locations

- Budgets based on events, campaigns, programs, and funders, with the capability to track the actual figures

- Revenue recognition

- Grants tracking and billing

- Capital budgeting

- AI-powered general ledger

- Accounts receivable and accounts payable automation

- Native integration with ADP for payroll services

Pros

- High level of accuracy in cash management

- Multi-entity reporting and insights

- Automated revenue recognition feature

- Sage University for comprehensive training solutions

Cons

- Extra cost for essential tools, such as grants tracking and billing and digital board book

- Limited integrations with other third-party software

Pricing

- Contact customer support for a custom price.

Tool Level

- Intermediate/Expert

Usability

- Very beginner-friendly interface

3. FreshBooks

Image via FreshBooks

FreshBooks is a comprehensive accounting software for nonprofit organizations. With a customizable chart of accounts, you can tailor it to fit your nonprofit’s unique needs — whether that’s to track restricted funds, grants, donations, or program expenses.

One of the best capabilities of this financial accounting software is the ability to manage time tracking and invoicing in one platform. Time tracking enables you to use your volunteers’ time efficiently.

FreshBooks Payments makes it easy to accept donations and payments via credit cards, ACH, and checkout links. You can also keep track of expenses and keep your tax records ready for tax season.

Besides, with automated notifications for invoices and payment receipts, you can keep donors and stakeholders in the loop with ease.

Key features

- Credits feature to track prepayments, overpayments, and credit notes

- Email and invoice templates

- Unlimited proposals

- Profitability tools for projects, including a widget, summary, and detailed reports

- Double-entry accounting reports

- Performance dashboard with easy-to-read graphs

- Unlimited time tracking

- Connects with over 14,000 banks and credit cards for easier bookkeeping

- Unlimited estimates to set clear expectations with project financiers

- Unlimited expense tracking and reporting

Pros

- A comprehensive yet affordable set of tools

- Powerful expense-tracking tools

- Wide variety of online payment options to accelerate donations

- Extensive project management tools

Cons

- Extra cost for each additional user

- The number of billable clients is restricted in the lower-tier plans

Pricing

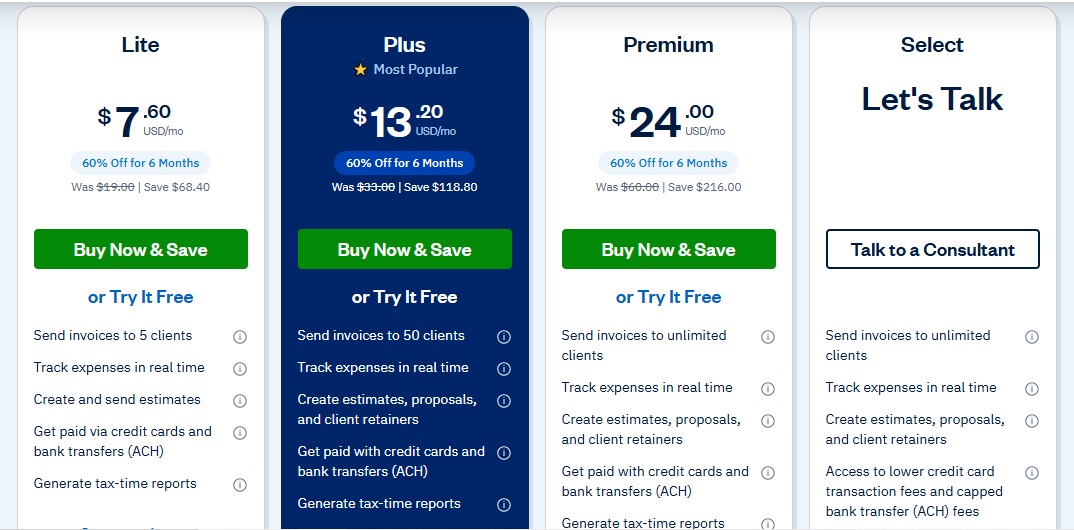

The accounting software for nonprofit organizations offers a 30-day free trial and four paid plans:

- Lite: $7.60/month for the first 6 months then $19/month thereafter

- Plus: $13.20/month for the first 6 months then $33/month thereafter

- Premium: $24/month for the first 6 months then $60/month thereafter

- Select: Custom pricing

Image via FreshBooks

Tool Level

- Beginner/Intermediate

Usability

- User-friendly tool

You May Also Like:

4 Tips for Choosing Accounting Software for Your Nonprofit

With so many great accounting software for nonprofit organizations, finding the right accounting software can feel overwhelming. To help you make the best choice, here are four key factors to consider:

1. Cost

While cost is an important factor when choosing the best accounting software for nonprofit organizations, it’s essential to look beyond the initial price.

Many nonprofit accounting tools offer different pricing models, including subscription-based plans or one-time purchases. When choosing an accounting software, pay close attention to additional fees, such as setup costs, transaction fees, or charges for extra users.

Here’s what to consider:

- Total cost: Look at all expenses, including subscription fees, setup fees, and extra costs for features or support.

- Nonprofit discounts: Many software providers offer special pricing for nonprofits, so check if you qualify.

- Value vs price: A cheaper tool might lack essential features, leading to inefficiencies or additional software costs.

- Scalability of pricing: Some platforms charge based on users or transaction volume, so ensure it remains affordable as you grow.

2. Features

Not all accounting software is built for nonprofits. Some tools cater primarily to businesses and may lack essential nonprofit-specific functionalities.

Therefore, before making a decision, outline your organization’s financial management needs. Here are some features to look out for:

- Fund accounting: Helps track restricted and unrestricted funds separately

- Grant tracking: Allows you to monitor grant allocations and compliance

- Donation management: Simplifies donor contributions and tax reporting

- Automated reporting: Ensures compliance with IRS and nonprofit financial reporting standards

- User access control: Allows different permissions for staff, board members, and volunteers

You May Also Like:

3. Scalability

Your nonprofit might be small now, but as you expand, your financial management needs will grow. The last thing you want is software that becomes a limitation instead of a solution.

So opt for scalable accounting software for nonprofit organizations that:

- Can handle more transactions: As your nonprofit grows, so will your financial complexity. Ensure the software can keep up.

- Is cloud-based, not on-premise: Cloud-based software allows for remote access, automatic updates, and easy expansion.

- Supports additional users: As your team expands, you may need more user accounts with different permission levels.

- Has advanced reporting capabilities: Growing nonprofits require more in-depth financial insights to secure grants and funding.

4. Seamless Integration

The selected accounting software for nonprofit organizations shouldn’t work in isolation, it needs to integrate with the other tools your nonprofit relies on.

Before choosing an accounting platform, check if it connects smoothly with your payroll system, donor management software, fundraising tools, and grant tracking systems.

The key integrations to look out for include:

- CRM integration: Syncs donor and fundraising data for accurate financial tracking

- Payroll system compatibility: Helps record employee and contractor payments properly, ensuring adherence to payroll best practices

- Fundraising and donation platforms: Automates donation tracking and reconciliation

- Grant management tools: Helps maintain compliance and accurate fund allocation

You May Also Like:

FAQ

1. What is nonprofit accounting software and how is it different from regular accounting software?

Nonprofit accounting software is a specialized financial management tool designed specifically for charities, foundations, churches, and other nonprofit organizations.

It uses fund accounting to track multiple revenue streams separately, distinguishing between restricted and unrestricted funds. This ensures accurate fund management and compliance with donor restrictions and financial regulations.

In contrast, regular accounting software focuses on tracking income, expenses, and profitability for businesses aiming to maximize profits without the need to manage funds based on donor-imposed limitations.

2. Do nonprofits need fund accounting software?

Yes, fund accounting software is crucial for nonprofits because it ensures that donor-restricted and unrestricted funds are properly tracked and used for their intended purposes.

It also simplifies reporting to stakeholders, grant providers, and tax authorities. Many nonprofit accounting software solutions offer built-in fund accounting features.

3. Is there free accounting software for nonprofit organizations?

Yes, there are free accounting software options that cater to nonprofit organizations, offering essential financial management tools without the hefty price tag.

A great example of accounting software for nonprofit organizations that offer a free plan is MoneyMinder.

The platform’s free version has limited yet essential features, including:

- Custom budgets

- Custom chart of accounts

- Budget forecasting and scenarios

- Online store management

- Membership tracking

- Running and exporting membership reports

4. Is there a QuickBooks version for nonprofit organizations?

Yes, QuickBooks offers one of the best accounting software for nonprofit organizations. It’s known as the QuickBooks Enterprise nonprofit software. It’s available as a desktop program, but you can also opt for cloud access.

5. What is the best accounting method for nonprofit organizations?

The accrual accounting method is the best approach, as it ensures compliance with GAAP. However, since it’s a complex method, it’s more appropriate for large nonprofit organizations.

On the other hand, the cash accounting method is the most suitable for small nonprofit organizations due to its simplicity.

6. What accounting is used for nonprofit organizations?

Nonprofit organizations use fund accounting. It employs a unique approach to tracking donations and expenses. Money from various sources, such as donations, membership fees, and grants, is accounted for separately. Each source has its own set of accounts and financial statements.

7. What is the best accounting software for a small charity?

Some of the best nonprofit accounting software for small charities include:

- Aplos

- Fund EZ

- FastFund by Araize

8. Can accounting software help nonprofits with tax compliance?

Yes, many accounting software for nonprofit organizations include automated tax reporting, Form 990 preparation, and compliance tracking to ensure organizations follow IRS and state regulations. These tools help nonprofits maintain tax-exempt status and simplify financial audits.

You May Also Like:

- What Is Accounting Software? Everything You Need To Know

- Cloud Accounting vs Traditional Accounting: The Key Differences to Note

Which Is the Best Accounting Software for Your Nonprofit Organization in 2025?

Now that we’ve listed 13 of the best accounting software for nonprofit organizations, you should have a good idea of which one works best for you.

However, we simply can’t decide the perfect accounting software for your nonprofit organization. Your choice will depend on your budget, unique organizational needs, and scalability requirements.

What we’d recommend is that you compare each of the listed software’s features, pros, and cons. Pick a handful of tools that you think would be a good fit for your organization. Then, sign up for their free trials to make an informed decision on which one best fits the criteria you’re looking for.

For more in-depth resources on nonprofit accounting, bookkeeping best practices, and expert tips, check out our accounting resource hub. It’s packed with guides and tools to help your organization manage its finances more effectively.