Self-employment comes with many freedoms, but it also entails taking full responsibility for managing your finances. Basic bookkeeping for self employed individuals is vital for the continued survival of the business.Basic bookkeeping is essential for the self employed to manage income accurately and easily. You can manually track your income and expenses or use accounting software that automatically records transactions and collects financial records.

Bookkeeping is an entire department. In this article, we’ll discuss basic bookkeeping for self employed people and actionable strategies to enhance financial management and ensure business stability.

Why Basic Bookkeeping for Self Employed Is Necessary

Bookkeeping is the process of recording and organizing all business transactions. It’s the lifeline of self-employment. Without it, even the most promising business can collapse. Here are some notable reasons you need basic bookkeeping as a business owner.

Accurate Financial Tracking

Successful businesses are products of accurate financial tracking. If you fail to keep track of every dollar entering or exiting your organization, your business risks financial instability and potential failure.

Financial tracking includes keeping records of sales, expenses, rent, software subscriptions, and staff. Basic bookkeeping for the self employed is like GPS; it gives you a clear picture of where you are, where you’ve been, and where you intend to go.

Accounting for every dollar helps you budget correctly. Financial tracking is vital for adjusting your marketing efforts, reducing waste, and maintaining emergency cash reserves.

Tax Compliance

Uncle Sam doesn’t play around with his dues, and neither should you. Taxes can be complicated for the self employed as you are responsible for every single coin.

Basic own bookkeeping helps you manage your tax obligations so you can avoid painful visits by the IRS. Being tax-compliant helps save money and time, and this tax deduction cheat sheet has everything you need to know, from sales tax to tax deductions.

Most importantly, bookkeeping ensures you won’t accidentally underpay or overpay your taxes.

Boosts Credibility

Reputation is everything in business. A good brand name will open doors that money can’t. Credibility in basic bookkeeping for self employed comes with many benefits.

First, banks will be willing to do business with you, giving you access to instant loans in your bank account. It can also help attract investors because well-kept books are proof that you know what you’re doing.

Proper bookkeeping enhances your professional image, instilling confidence in your customers about your ability to deliver. Bookkeeping goes beyond balancing numbers; it’s essential for customer relations management.

Improved Budgeting

You can’t budget without accurate data, and this is where bookkeeping comes in. Budgeting involves setting aside money for every expense, whether renting new space or buying accounting software for your startup.

Purchasing equipment or hiring new staff before reviewing your books can jeopardize your operations. Overlooking even the smallest thing like petty cash flow can, in the long run, come back to bite you.

Basic bookkeeping for self employed helps you create a realistic budget and maintain accurate business reports.

Enhanced Financial Analysis

It’s easy to assume that your business is thriving when sales exceed expenses. However, this is a surface-level view that can be misleading. The most effective way of determining your financial health is through bookkeeping.

Basic bookkeeping or bookkeeping software can help uncover vital discrepancies when reviewing your net income statements, cash flow reports, or balance sheets. For instance, it can help you identify clients who don’t contribute positively to your bottom line.

An in-depth financial analysis of your books will reveal your weaknesses and strengths.

You May Also Like:

Basic Bookkeeping for Self Employed Individuals: Tips To Adhere To

Now you know why bookkeeping is essential, but how do you execute it? Here are simple bookkeeping tips for small businesses to get you started.

1. Do Not Mix Personal and Business Finances

The first law of basic bookkeeping for self employed is to never mix personal expenses with business finances. As a business owner, it’s tempting to dip your hands into your business coffers to address personal issues.

The same applies to using your personal bank account for your business transactions. Not only will this create a bookkeeping mess, but you’ll get into trouble with the IRS during audits.

Open a dedicated business bank account with a card not linked to your personal bank accounts. This will keep your bookkeeping organized and make it easier to identify tax-deductible expenses.

2. File Your Taxes

We can’t stress enough how important being tax-compliant is if you’re self-employed. Without a regular bookkeeping system, you run the risk of either underpaying or overpaying your taxes.

You can use a bookkeeping software or accounting software to track your income, expenses, and projected income taxes for the year. Set aside about 30% of your income for taxes in a separate bank account.

Using tax software like TurboTax is a key component of basic bookkeeping for self employed.

You May Also Like:

3. Set Aside Some Money for Taxes

Tax time is unavoidable, so setting aside about 30% of your income for taxes is good practice. Avoid using emergency funds for taxes—it’s simply a backup.

One thing about self-employment and freelancing is that income is never consistent. You may have some good months and hit a difficult stretch without warning. Unfortunately, taxes don’t wait for no man. When they come knocking, you answer.

You can postpone most business expenses, like inventory restocking, but you can’t defer taxes. So, prioritize setting up an emergency tax savings account.

4. Set a Consistent Bookkeeping Schedule

Bookkeeping should be a consistent and ongoing process. It is essential for any operational business that maintains an active cash flow.

It can be exhausting to update your books after every sale or purchase. Instead, set aside time each week to manage your bookkeeping and adhere to that schedule religiously.

Consistency is vital in basic bookkeeping for self employed. It keeps you organized and reduces the temptation to procrastinate. The longer you put off updating your books, the messier things become.

You May Also Like:

5. Get a Bookkeeping Certification

While bookkeeping may seem like a basic skill every entrepreneur should have, it’s not always that simple. There may come a time when you need to get additional bookkeeping certification to improve your skills.

That said, you don’t need to spend a fortune to become a certified public accountant. A few free online bookkeeping courses can go a long way in elevating your skills. There are countless courses on Coursera and Udemy that could get you started.

6. Outsource When Needed

Sometimes, admitting that things are beyond your abilities is good business sense. Self-employment is complex, and as your small business grows, it becomes increasingly time-consuming.

Never wait until you’re drowning in unreconciled books to seek help. The moment you find yourself spending too much time on your books than on business activities, it’s time to outsource.

Occasionally, hiring a professional bookkeeper to streamline the bookkeeping can be a strategic move. Basic bookkeeping for self employed can be a daunting task, so ask for help.

You May Also Like:

7. Use Accounting Software

There are various accounting software that can help automate every single business operation, including bookkeeping.

Gone are the days when you had to hunch over your book scrutinizing your profit and loss statements. All you need is reliable accounting software for self employed professionals to handle repetitive tasks without errors.

Some of the best accounting software you can use include QuickBooks, Wave, and Freshbooks.

8. Keep All Receipts

Make it a habit to save every single receipt, physical or digital, for any purchase related to your business. This includes the coffee you bought when discussing business with a potential client.

Receipts are like your alibi when auditors come around. They also help you figure out the correct tax deductions as they provide proof of business expenses. Fortunately for the self-employed, there are multiple cloud-based accounting software for this task.

You can use Expensify and Shoeboxed to scan, categorize, and store receipts. This helps you avoid dealing with hard copies, which could take up unnecessary space.

You May Also Like:

Essential Financial Records Self-Employed Should Have On Hand

We have repeatedly mentioned how important it is to keep financial records. But what exactly are these financial records? Here are some essential financial records necessary for accurate bookkeeping.

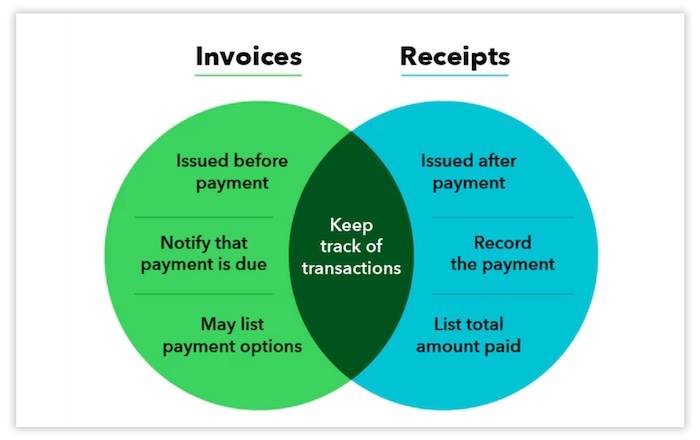

Invoices and Receipts

Image via QuickBooks

Invoices document the money others owe you, while receipts prove what you’ve spent. They provide a detailed record of every coin that comes in and goes out of your business.

Keeping these two records ensures that your bookkeeping is accurate and can withstand any audit. They’re also vital for claiming tax deductions.

Bank Statements

Image via Investopedia

Bank statements are a reliable paper trail for your business, and I believe you need one. A bank statement corroborates the story told by the invoices and receipts and is indispensable during audits.

A bank statement proves your income streams and spending habits. It is also a good way to track your business’s financial health.

Tax Returns

Image via Investopedia

Tax returns show the financial journey your freelance business has taken since its start. Having them on hand is important for loan applications and future tax filings.

Additionally, tax returns help you spot growth or shrinking trends in your business. Studying your income or losses can help you know where you’re headed. This is best illustrated by how much tax you file every cycle.

Profit and Loss Statements

Image via Investopedia

A profit and loss statement (P&L) is like a business report card. It summarizes expenses, revenues, and net profit over a specific period of time.

Without these records, you won’t know where your business is coming from or going. The good news is that most accounting software for self-employed professionals can automate P&L tracking.

P&Ls are crucial for planning and decision-making. So you need to keep a clean record of each for your bookkeeping processes.

You May Also Like:

Common Bookkeeping Mistakes to Avoid

Besides the bookkeeping tips discussed above, you can further tighten the ship by avoiding the following mistakes.

- Not backing up data: Whether you’re doing it manually or using an accounting program, always backup your data. Things can get costly if you lose your data through cyber attacks, accidental deletions, or hardware failures. Consider having a cloud-based backup plan.

- Throwing away receipts: Receipts are evidence of transactions, so every single one counts. Throwing away receipts can lead to incorrect records, which can complicate expense verification. The IRS even recommends keeping records like receipts for at least three years.

- Relying on guesswork: Vague recollections and rough estimates don’t cut it for bookkeeping. This type of guesswork leads to inaccurate records and complicated future budgeting and forecasting. You must record transactions as they occur, and accounting software is perfect for this.

- Procrastinating: Postponing your scheduled bookkeeping sessions can quickly snowball into a mess you can’t handle. Going a single day without recording anything results in piles of unorganized paperwork. This, in turn, causes inaccurate records, leading to missed tax deadlines, which culminates in heavy penalties.

- Misclassifying expenses: Never miss-classify business expenses. For example, recording capital expenditures as operational expenses will lead to incorrect tax deductions. This single error can lead to higher tax liabilities, which will cost you.

- Miscommunication: If you outsource bookkeeping to a professional, ensure communication is clear as day. Provide all the necessary documents and don’t hold back anything as that can cause costly discrepancies.

- Petty cash nonchalance: Don’t assume that petty cash is small enough to be mishandled. Unrecorded petty cash eventually accumulates significantly, which can disown your budgeting. Implement a petty cash log and appoint someone to oversee the usage strictly. Every coin counts.

You May Also Like:

FAQ

1. How Much Should I Charge for Basic Bookkeeping?

The amount you can charge for basic bookkeeping depends on the scope of the work, your skill level, and the software involved. You’ll likely charge more if the business you’re auditing is big.

2. Can You Do Bookkeeping by Yourself?

Yes, you can do bookkeeping yourself if you have any knowledge of basic bookkeeping for self employed individuals. There are countless accounting software you can use to make your work easier.

3. What Are the Basic Steps of Bookkeeping?

The most common basic bookkeeping steps involve analyzing financial transactions, recording them in a journal, posting the transaction to a general ledger, and then determining the unadjusted trial balance. These steps vary depending on the scale of the business.

4. How Can I Simplify Bookkeeping for My Business?

You can simplify bookkeeping for your business by separating your business and personal finances and automating tasks. Furthermore, you can hire a professional bookkeeper if handling it yourself becomes overwhelming.

5. What Are the 3 Golden Rules of Bookkeeping?

The three golden rules of bookkeeping are: debit all expenses and losses and then credit all incomes and gains. Credit the giver, and then credit the receiver. Debit whatever comes in and credit whatever goes out.

Wrapping Up

Basic bookkeeping for the self employed is a necessary skill. It is the memory bank that your business requires to survive. Fortunately, bookkeeping has gone digital, and the benefits of using accounting software are widely documented.

Follow the tips we provided in this write-up and then drop us a comment below. We always appreciate feedback on what works best for your business, as your insights can also help others.