Managing your business finances is an important part of running your financial operations. With the rise of technology, cloud accounting software has emerged, offering solutions to streamline your accounting processes.

Cloud accounting software offers many benefits over traditional accounting software, including real-time access to financial data and automatic backups.

After extensive research, we’ve selected some of the best cloud accounting software for streamlining business finances.

Our list comprises different types of business accounting software suited for different business sizes or technical expertise.

So, let’s dive in and explore the 13 top options we’ve curated for your business.

Quick Summary: Best Cloud Accounting Software by Type

- Best All-in-One Accounting Software: Odoo, Bonsai, Zoho Books, Sage Accounting, Quickbooks

- Best Cloud Accounting Software with Project Management Features: Bonsai, FreeAgent, Kashoo

- Best Cloud Accounting Software for Small Businesses: FreeAgent, Xero, Kashoo, QuickBooks Online

- Best Software with Free Plan: Zoho Books, Odoo, ZipBooks

- Best Software for Ecommerce Accounting: Kashoo, ZarMoney, Xero

How We Chose the Best Cloud Accounting Software for Businesses

There are several cloud-based accounting software programs, each with its own feature set and pricing structure.

To help you cut through the clutter, we followed specific factors to identify the best cloud accounting solutions for businesses of all sizes and industries. Here’s how we evaluated our options:

- Software Features: We dug deep into the functionalities offered by different cloud accounting software. Our list comprises the best cloud accounting software with essential features like invoicing, expense tracking, bank reconciliation, financial reporting, and inventory management.

- User Interface and Usability: An easy-to-use interface is essential for both accounting professionals and small business owners. We prioritized straightforward accounting software that offered a user-friendly experience with intuitive navigation.

- Security and Integration: Maintaining security of financial data is one of the challenges financial accounting businesses face. We ensured the software offered robust security measures and seamless integration with other business software you might already use.

- Scalability and Growth: We looked for software that could scale alongside your company’s growth, accommodating an increasing number of users and more complex financial operations.

- Cost: Our list comprises a range of free software options for basic accounting needs and paid cloud accounting software that caters to different needs.

13 Best Cloud Accounting Software for Your Business

Whether you’re a small startup or a multinational business, harnessing the capabilities of cloud-based accounting software can help you manage your finances with ease and precision.

Online accounting software offers a wide range of features, including invoicing, expense tracking, bill payment, real-time financial reporting, and more. With these features, you can automate accounting tasks and save time on manual data entry.

Here are 13 of the best cloud accounting software options to consider for your business:

1. FreeAgent

Image via FreeAgent

FreeAgent is one of the best cloud accounting software designed for small businesses and freelancers.

With FreeAgent, you can manage all your finances in one place. It streamlines tasks like invoicing, expense tracking, and bookkeeping.

The software offers a real-time view of your cash flow, and automated reminders to ensure you get paid on time.

Key Features

- Expense categorization with receipt scanning

- Automatic bank feeds for transaction import and real-time financial data tracking

- Automated invoicing and payment reminders.

- Project management and time tracking

- Collaboration tools for accountants and bookkeepers

- Mobile app for on-the-go management

Pros

- Easy to use, even for beginners without an accounting background

- Automates time-consuming tasks like invoicing and expense tracking.

- Allows real-time cash flow tracking.

Cons

- Limited customization options

- Lacks advanced features sought by larger businesses or those with complex accounting systems

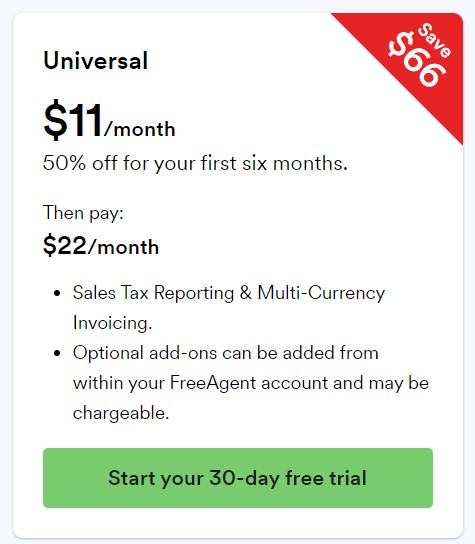

Pricing

FreeAgent offers a 30-day free trial for potential users to test its capabilities before committing.

The paid plan starts at a monthly subscription fee of $11 for the first six months, and $22 for subsequent months for sales reporting and invoicing features.

However, additional features like multiple users, payroll, and more are available at an additional cost.

Image via FreeAgent

Tool Level

- Beginner

Usability

- Easy to use

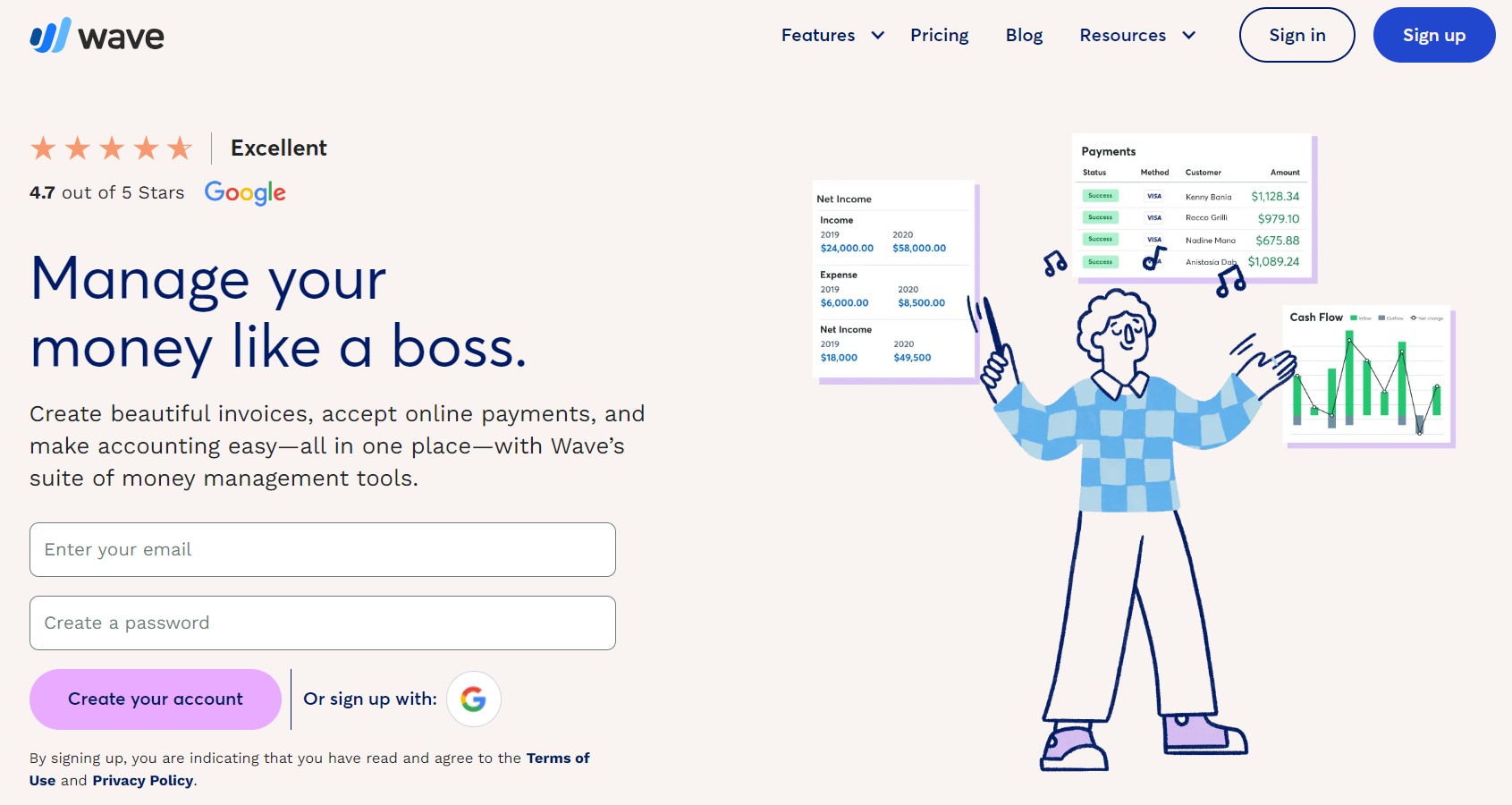

2. Wave

Image via Wave

One of the standout features of Wave Accounting as one of the best cloud accounting software is its invoicing system. You can create and send invoices to your clients in just a few clicks, with customizable templates and automated payment reminders.

You can also connect your bank account and credit card to the platform, allowing for automatic transaction tracking and categorization.

Key Features

- Automated invoicing, recurring billing, and payment reminders.

- Real-time tracking of invoices and payments

- Bank and credit card account integration for automatic transaction tracking and categorization.

- Automatic payroll entry and tax filings.

- Financial reports and mobile receipt features.

- Tax, accounting and payroll coaching.

Pros

- User-friendly interface

- Robust features for invoicing and financial management

- Affordable pricing for small businesses and entrepreneurs

- Integration with other business software, such as payment processors and payroll systems.

Cons

- Users with complex accounting needs may find Wave’s capabilities limited.

- Limited integration with other tools.

Pricing

Wave accounting software offers a tiered pricing structure with a free plan and a paid option:

- Starter: $0/month

- Pro: $16/month

Image via Wave

Tool Level

- Beginner

Usability

- Easy to use

3. Xero

Image via Xero

Xero stands out among the best cloud accounting software for its user-friendly interface and automation capabilities.

This is one of the accounting tools that automates tasks like bank reconciliation, invoice creation, and expense tracking.

Users can create custom reports, charts, and graphs to track their financial health and make informed business decisions.

Key Features

- User-friendly interface and automation capabilities

- Integration with 1000+ third-party applications

- Real-time bank feeds and customizable reporting features

- Mobile app for on-the-go access anywhere with an internet connection

- Automation features for accounting tasks such as invoicing, bill payments, and expense tracking.

Pros

- It offers a comprehensive feature set covering various aspects of financial operations

- Allows integration with numerous third-party applications for enhanced functionality

- Offers multi-currency support which facilitates international business operations

- It automates accounting tasks, saving time and reducing human error

Cons

- May not be suitable for businesses with complex inventory needs.

- Additional features require separate subscriptions.

- Limited offline functionality as it is reliant on an internet connection.

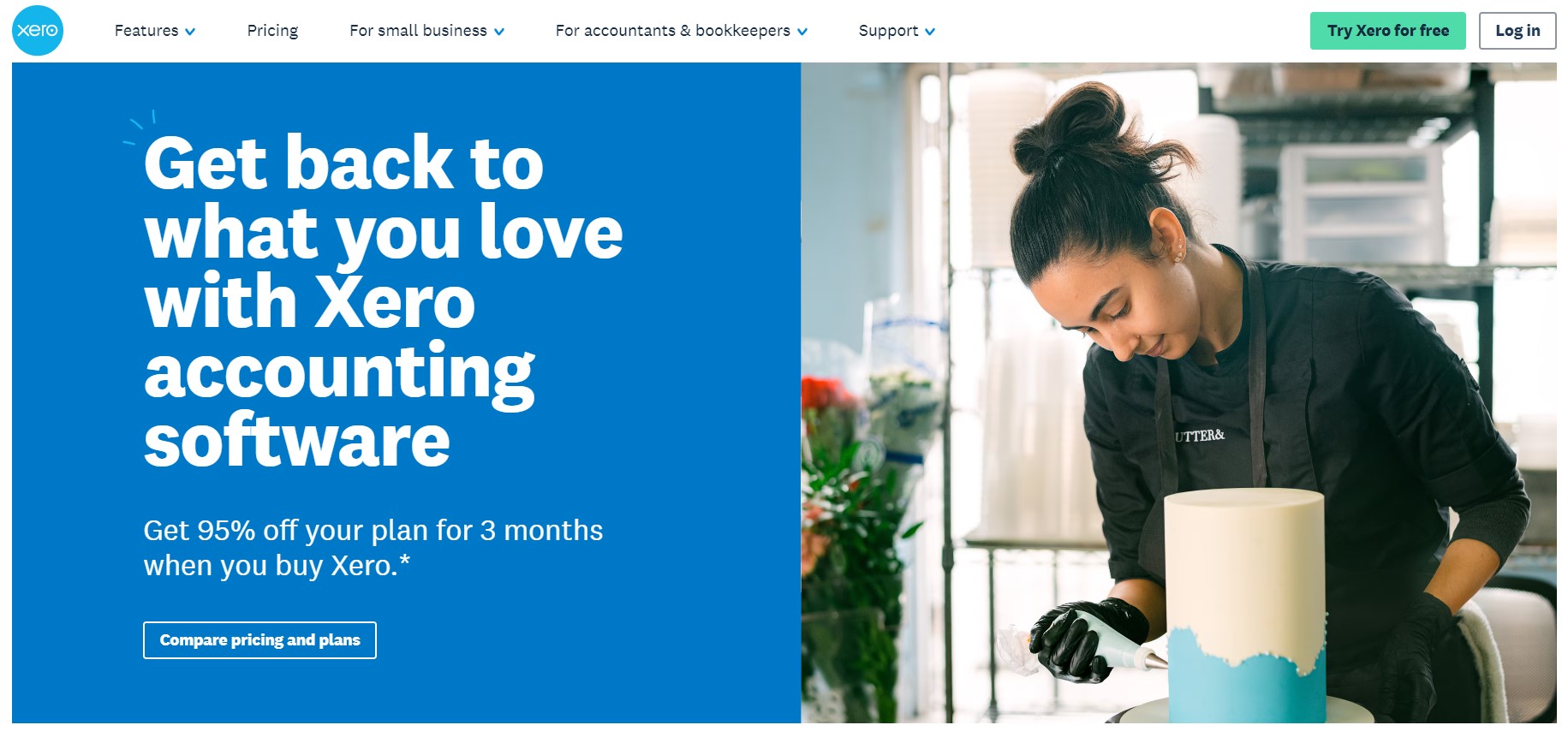

Pricing

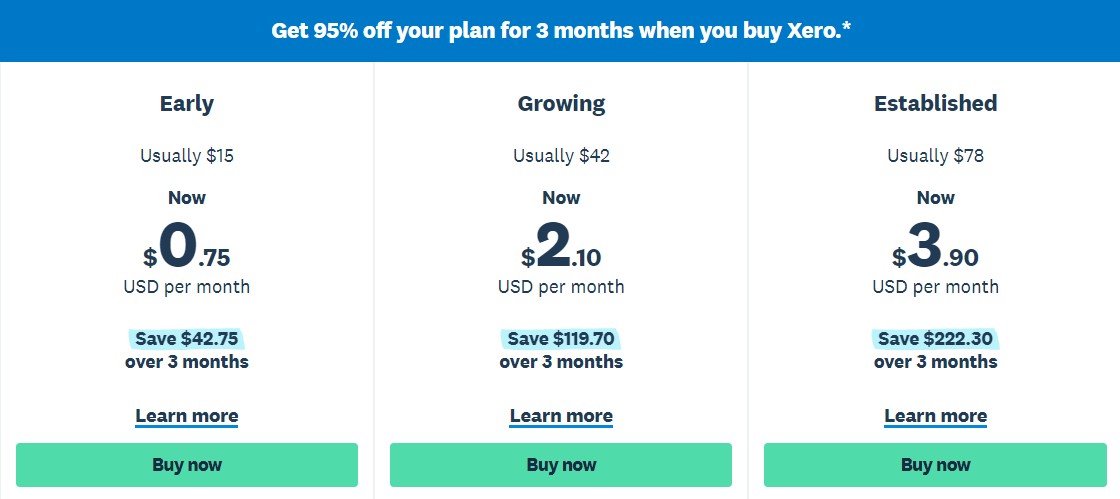

Xero offers tiered pricing plans for small businesses, including:

- Early: Usually $15 per month (currently $0.75)

- Growing: Usually $42 per month (currently $2.10)

- Established: Usually $78 per month (currently $3.90)

Image via Xero

Tool Level

- Intermediate

Usability

- Moderately easy to use

You May Also Like:

4. Kashoo

Image via Kashoo

Kashoo is an accounting software for small businesses seeking an affordable way to manage their finances. Its intuitive interface, automatic features, and mobile app make it one of the best cloud accounting software for keeping track of your books.

Kashoo also features an Inbox for viewing and editing imported bank transactions, providing a centralized hub for financial data.

Key Features

- Invoicing with customizable templates and automated late payment reminders

- Expense tracking with bank reconciliation and categorization

- Multi-currency support

- Basic inventory management tools

- Customizable chart of accounts

- Financial reports, including profit and loss charts, balance sheets, and history logs, are exported to Excel, CSV, HTML, PDF, and Google Sheets

- Project management and expense tracking by project

- Offers a mobile app with transaction recording features

- Supports double-entry accounting for organized financial records

Pros

- It offers integration options to connect with other business software and services

- It is mobile-accessible

- Several accounting tasks can be automated on Kashoo which saves time

- Offers customization options for reporting

Cons

- Lacks time tracking

- No advanced inventory management

Pricing

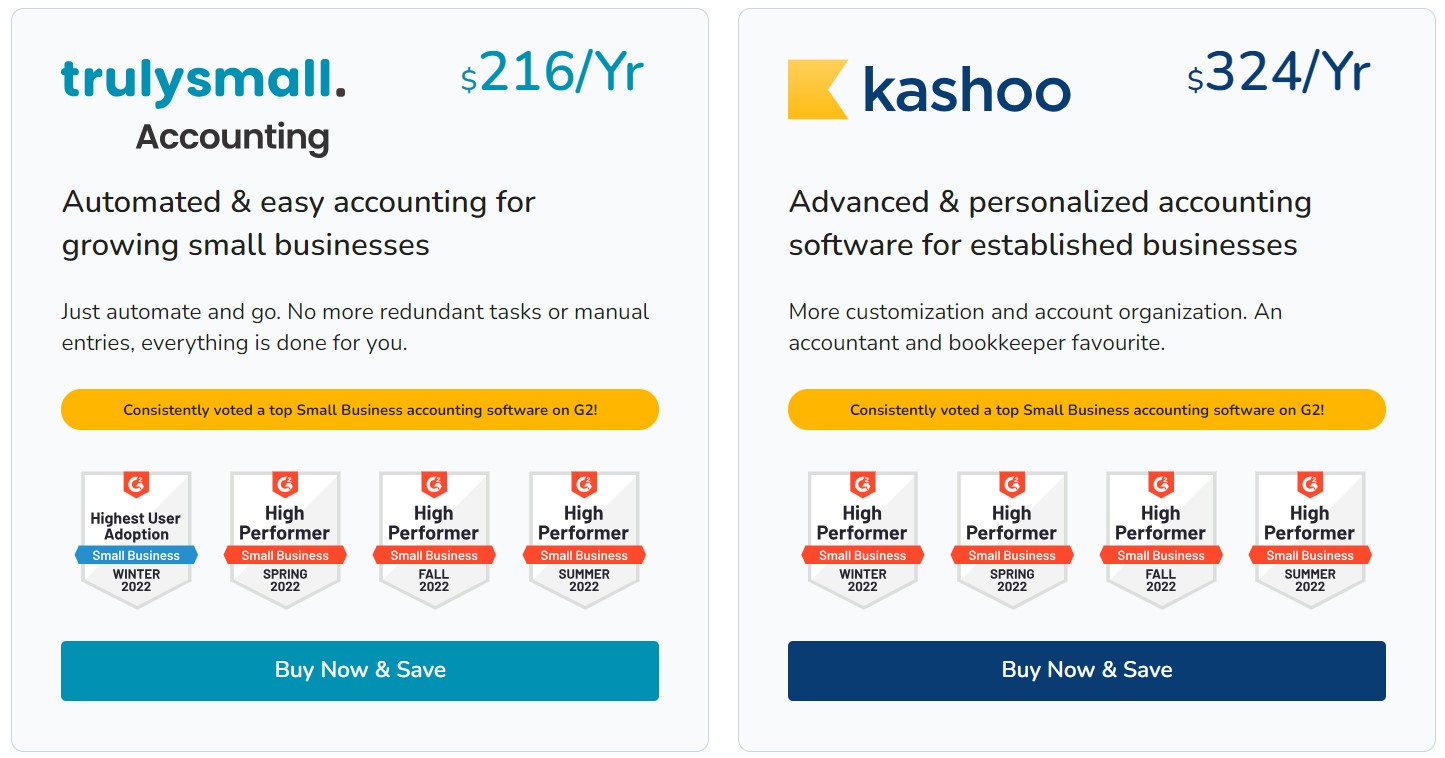

Kashoo offers a free trial period of 14 days which you can use to try out all the features. The paid plans are billed annually, and they include:

- Trulysmall.accounting: $216 per year

- Kashoo: $324 per year

Image via Kashoo

Tool Level

- Intermediate

Usability

- Moderately easy to use.

5. Oneup

Image via OneUp

As a cloud-based accounting software, OneUp offers a range of features that simplify accounting, inventory management, invoicing, CRM, and more.

One of OneUp’s USPs is its inventory management features, which allow users to track inventory levels, manage purchase orders, and create invoices.

Whether you are a solo entrepreneur, a startup, or a growing company, OneUp provides the flexibility and scalability to meet your specific online accounting needs.

Key Features

- Syncs with your bank for automatic transaction categorization and record keeping.

- Invoicing and inventory management, including monitoring stock levels, automating reordering, and validating orders.

- Customizable client portal and CRM integration for digital marketing.

- Quote templates and customization options

Pros

- Saves time with automation and streamlined business operations

- Offers a 30-day free trial with unlimited users and features included.

- Offers similar features across different devices for seamless user experience.

- Offers scalability for growing businesses.

Cons

- May not be as feature-rich as other online accounting software as it has no payroll functionality

- Limited integration with third-party apps

Pricing

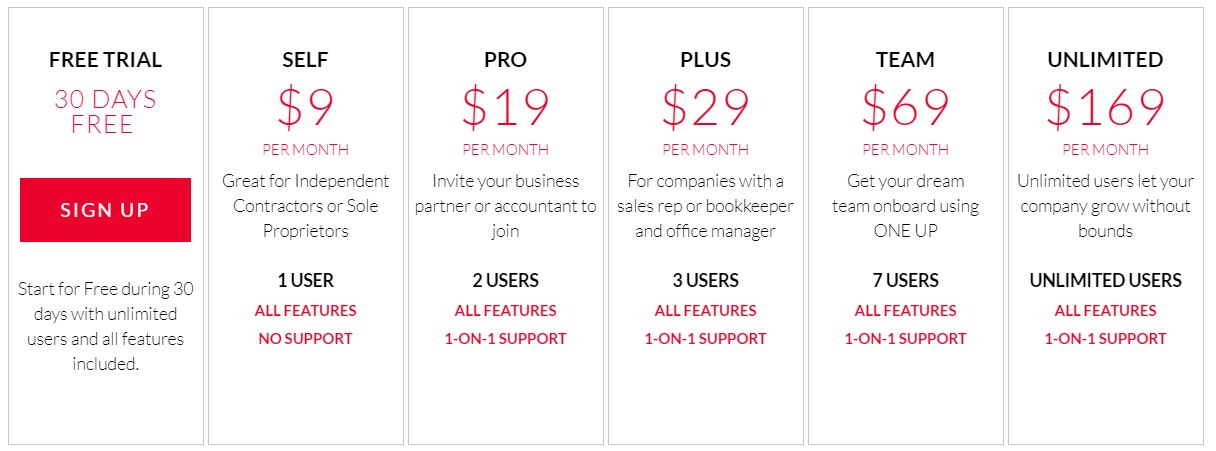

OneUp offers a 30-day free trial with no credit card required and no hidden costs. It also offers a range of pricing plans tailored to different business needs. The pricing plans are as follows:

- Self: $9 per month for 1 user

- Pro: $19 per month for 2 users

- Plus: $29 per month for 3 users

- Team: $69 per month for 7 users

- Unlimited: $169 per month for unlimited users

Image via OneUp

Tool Level

- Intermediate

Usability

- Moderately easy to use

You May Also Like:

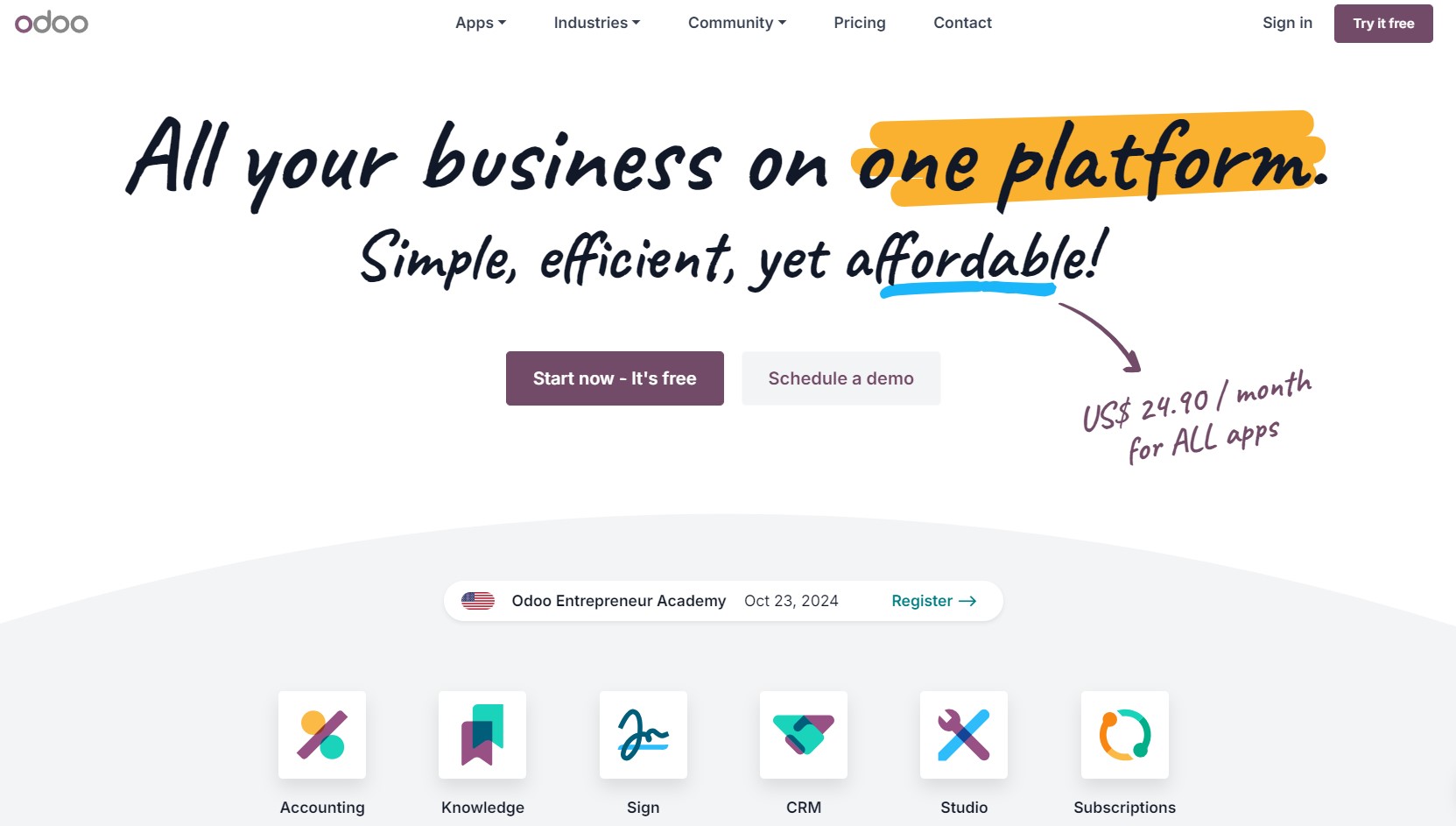

6. Odoo

Image via Odoo

Odoo is a free accounting software for startups and businesses of all sizes. What makes Odoo stand out as one of the best cloud accounting software is its all-in-one business management functionality.

It offers a variety of integrated apps for finance, inventory, sales, HR, and digital marketing services, potentially replacing the need for multiple disconnected software programs.

Key Features

- Real-time reporting on financial insights and data visualization.

- Automated workflows for tasks like invoicing and follow-ups.

- Inventory management tools for tracking stock levels and automating purchase orders.

- Manage projects across borders with automatic tax calculations based on location

- Integrated platform connecting accounting with other business functions (CRM, sales, inventory, HR).

- Automated sales tax calculations and audit trails

- Accounting features for managing accounts receivable and payable.

Pros

- Easy to use, even for non-accountants.

- It is suitable for businesses of all sizes, from startups to large enterprises.

- Flexible platform that can be customized to fit business operations

- Odoo saves time and reduces errors with automated accounting tasks.

- It integrates with other Odoo apps to create a unified business management system

- Offers a free plan with basic accounting features.

Cons

- The free tier has limitations on features and data storage.

- Integrating with other apps requires additional subscriptions.

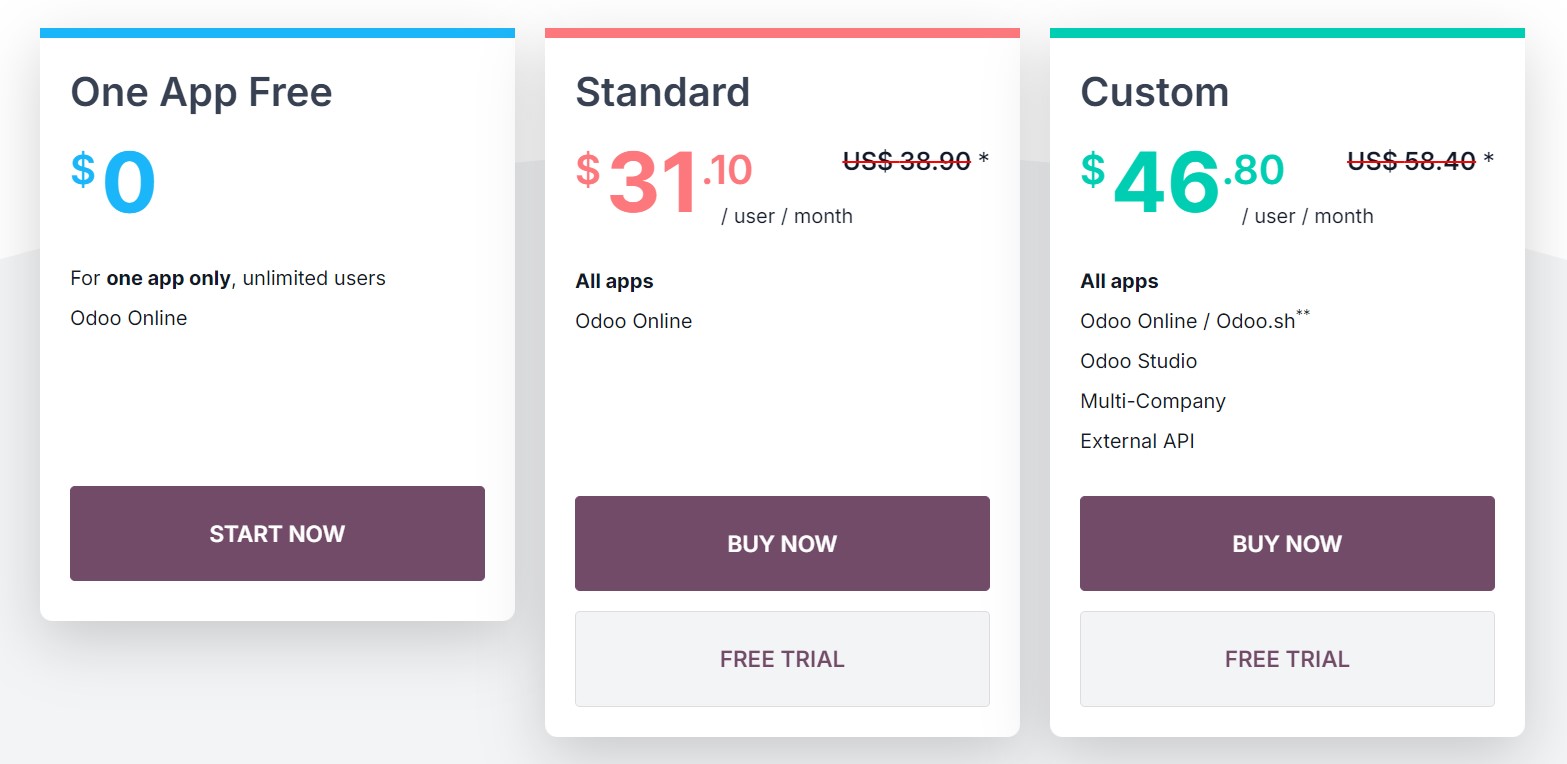

Pricing

Odoo Accounting offers a free plan and paid subscriptions. Pricing for paid plans depends on the number of users and features needed.

- One App Free: $0

- Standard: $31.10/user per month

- Custom: $46.80/user per month

Image via Odoo

Tool Level

- Intermediate

Usability

- Moderately easy to use

7. Quickbooks

Image via Quickbooks

QuickBooks Online is among the best cloud accounting software that can streamline financial management for small and medium-sized businesses.

It automates time-consuming tasks like bookkeeping, invoicing, expense tracking, and reporting, allowing you to focus on running your business.

It also offers integration with other business software, such as payment processors and bank accounts, to help streamline financial management processes.

Key Features

- Create professional invoices and estimates, send them to clients electronically, and track outstanding payments.

- Real-time financial data insights monitoring and customizable reports.

- Multi-currency support for financial transactions.

- Sales tax tracking and automatic calculations.

- Customizable invoices and automated payment reminders

- Bank feeds and automatic transaction reconciliation and management

- Data migration via CSV files.

- Mobile accounting app for managing accounting transactions and reports on the go.

- Integration with ecommerce, CRM, expense management, time tracking software.

Pros

- It integrates with several third-party applications, allowing for seamless data transfer.

- It’s easy to track income and expenses

- Securely stores your financial data in the cloud

- Accessible from any device

- Offers a free 30-day trial

- Allows easy collaboration.

Cons

- Limited features are available on the mobile app.

- Lacks payroll and project management features.

Pricing

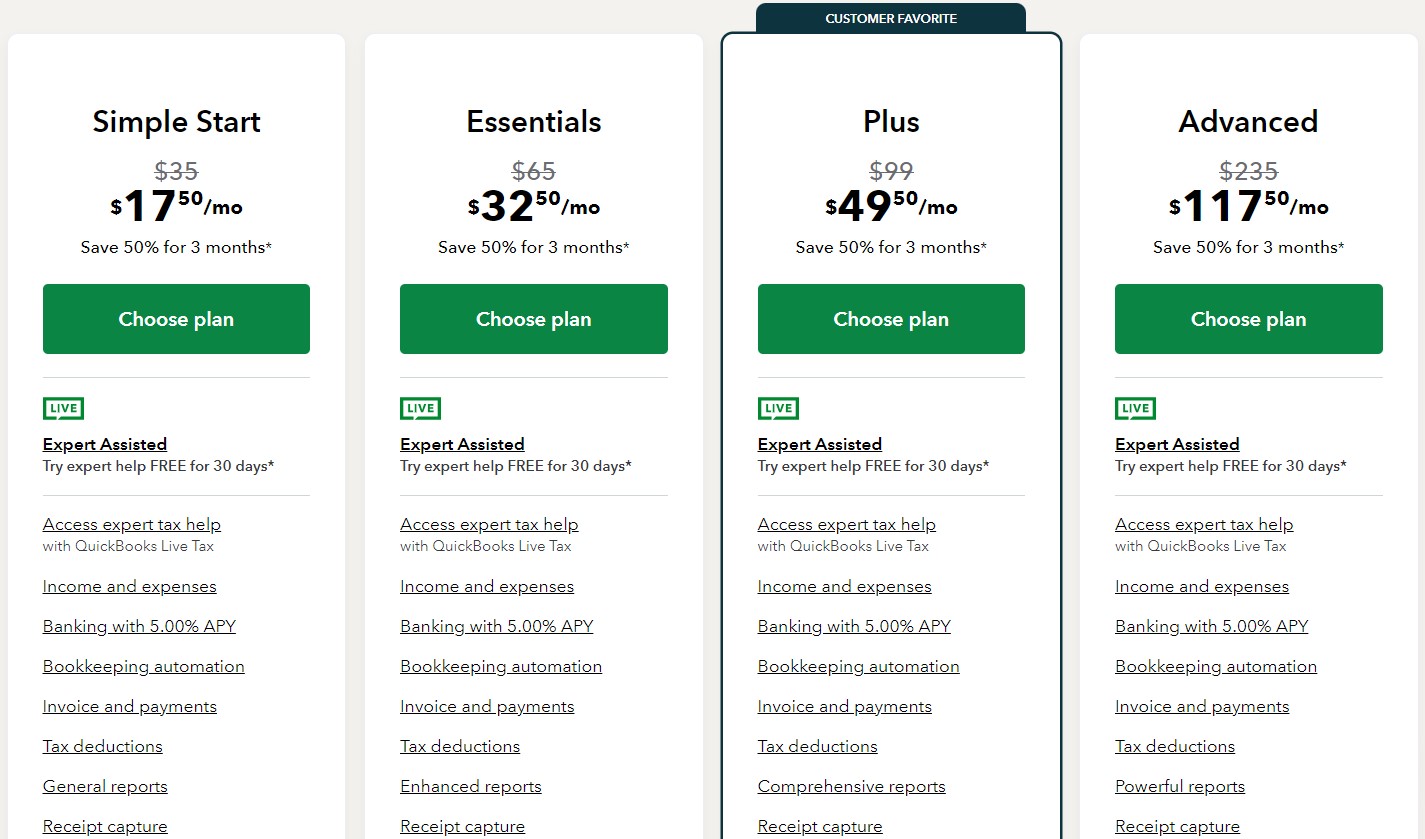

QuickBooks offers four pricing tiers.

New customers can enjoy a 50% discount on all plans for the first 3 months. New users are also entitled to a 30-day free trial period on all plans.

- Simple Start: $35 per month (currently $17.50)

- Essentials: $65 per month (currently $32.50)

- Plus: $99 per month (currently $49.50)

- Advanced: $235 per month (currently $117.50)

Image via Quickbooks

Tool Level

- Beginner/Intermediate

Usability

- Moderately easy to use

You May Also Like:

8. MYOB Essentials

Image via MYOB

As one of the best cloud accounting software, MYOB Essentials offers features for managing invoicing, expenses, payroll, and more.

MYOB Essentials has a simple and intuitive interface that makes it easy to manage financial operations and generate reports.

The software also offers customizable templates for invoices, statements, and other documents, allowing users to personalize their branding and messaging.

Key Features

- Expense and receipt management.

- Automated bank feeds and transaction reconciliation.

- GST/VAT tracking and management.

- Create and send invoices and quotes, and accept payments from your customers.

- Payroll processing including automated calculations and payslip generation.

- A customizable dashboard for cash flow monitoring and management.

- Financial reporting, including profit and loss, balance sheet, and cash flow reports.

- Integration with other business tools, including CRM software, time tracking apps, and ecommerce platforms.

Pros

- It offers multi-currency support for international transactions.

- Saves time by automatically importing bank transactions.

- MYOB has an intuitive interface with straightforward features.

- Offers integration with other business software

Cons

- There might be more cost-effective options depending on your business needs compared to MYOB.

- Reports are mainly in PDF format and lack the flexibility of spreadsheets.

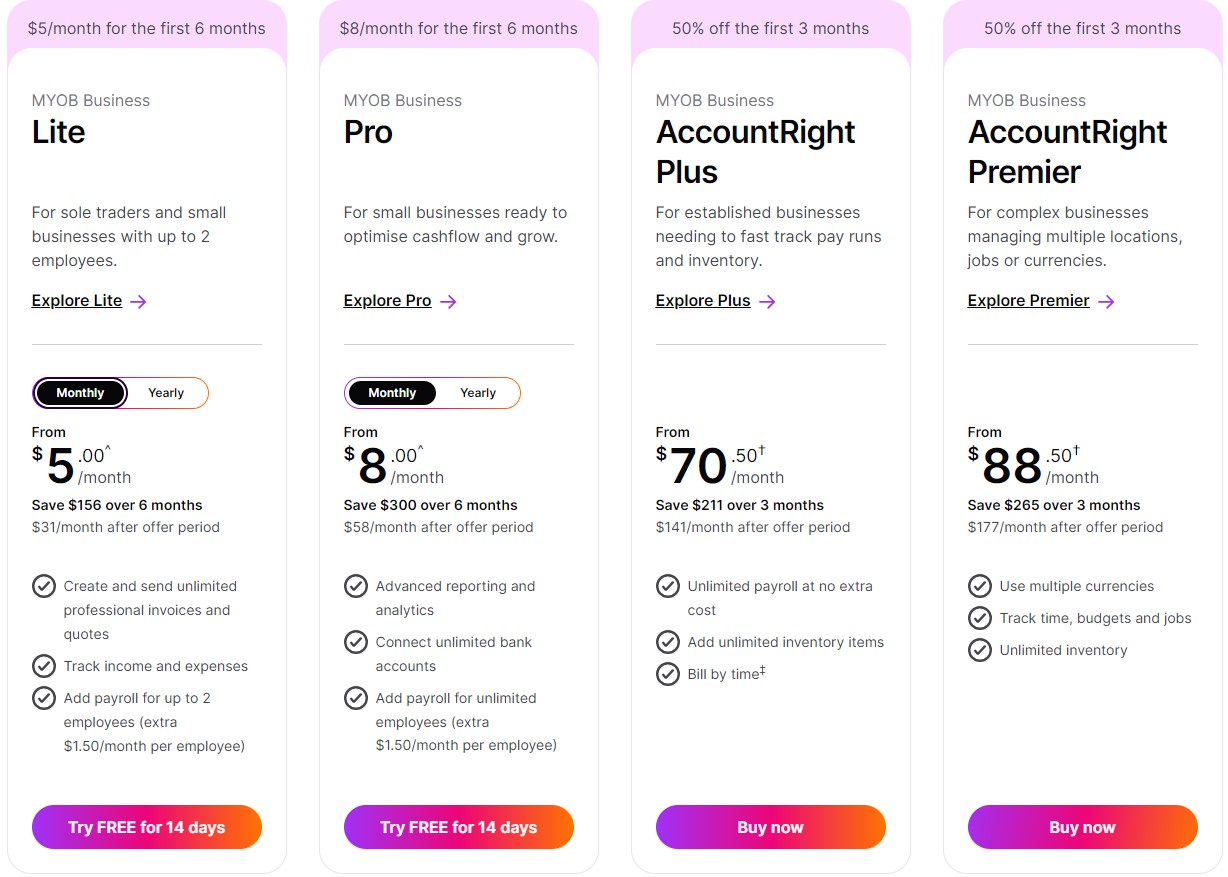

Pricing

MYOB offers a 30-day free trial for all its plans. The pricing plans cover accounting services like accounting and payroll.

For its accounting services, MYOB has four main pricing plans. These plans come with varying discounts for new users:

- Lite: $5/month (discounted price for the first 6 months)

- Pro: $8/month (discounted price for the first 6 months)

- AccountRight Plus: $70.50/month (505 off for the first three months)

- AccountRight Premier: $88.50/month (50% off for the first three months)

Image via MYOB

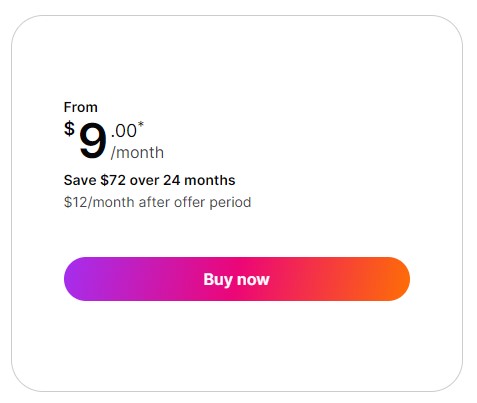

You can also opt for a standalone payroll function on MYOB for up to 4 employees, which is billed at $9 per month (discounted price).

Image via MYOB

Tool Level

- Beginner to Intermediate

Usability

- Easy to navigate even for those without extensive accounting knowledge

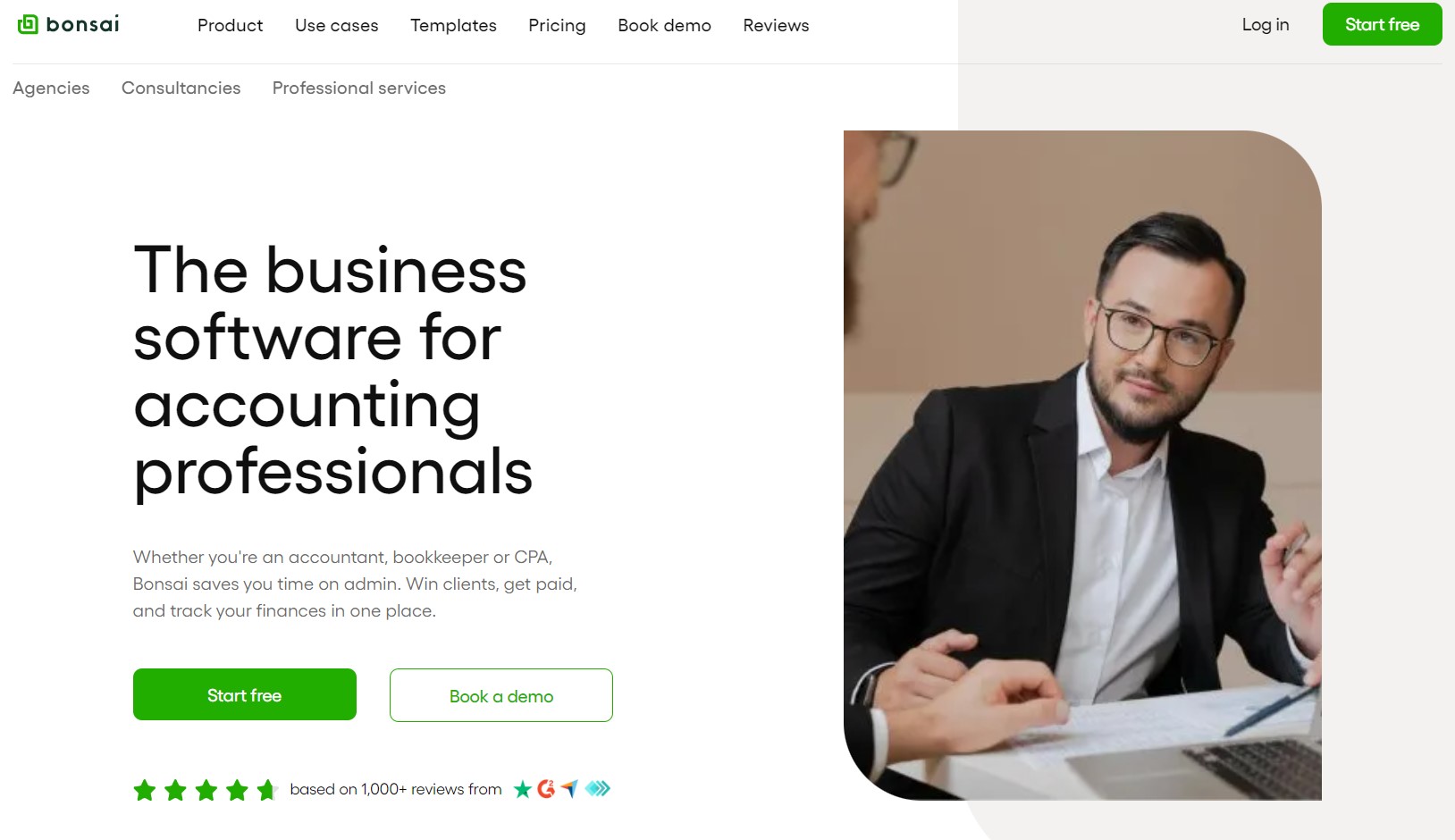

9. Bonsai

Image via Bonsai

Bonsai is one of the best cloud accounting software with project management capabilities designed for freelancers and small businesses.

It goes beyond accounting. The platform offers features like CRM, proposals, contracts, and task management, all in one place.

This makes it a good fit for businesses that need to manage their financial data, projects, and clients.

Key Features

- Bonsai offers automated workflows and CRM systems, which CRM software for small businesses offers to streamline customer communication workflows.

- Project management tools like task management, timesheets, and project budgeting.

- Time tracking features for projects.

- Financial management features, including automated invoicing, billing, and bookkeeping.

- Real-time financial reports on income and expenses.

- Integration with payment gateways to accept credit card payments

Pros

- Bonsai has a user-friendly interface that is easy to learn and navigate, even for those with no prior accounting background.

- Offers collaboration features for task management.

- Bonsai automates many time-consuming tasks, such as invoice generation and expense tracking, which can save a significant amount of time.

- Offers a mobile app for on-the-go access and management of finances.

Cons

- Limited customization options

- Lacks high-end accounting features for businesses with complex accounting needs.

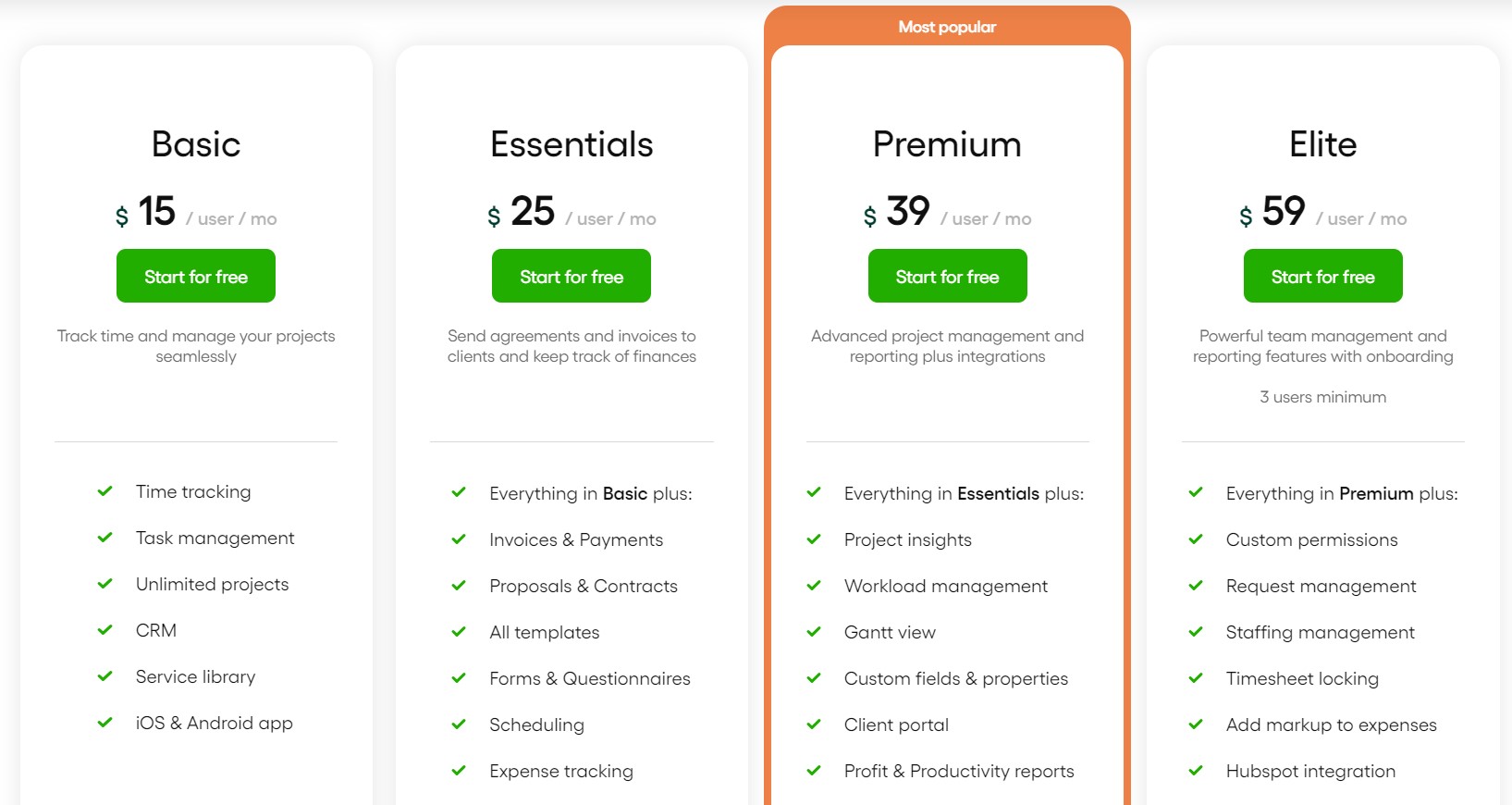

Pricing

Bonsai offers a free trial, so you can try it out before you commit to a paid plan. The pricing plans include:

- Basic: $15 per month

- Essential: $25 per month

- Premium: $39 per month

- Elite: $59 per month

There are also add-on options, such as Bonsai Tax for an extra $10 per month and Contractor Management for $99 per month.

Image via Bonsai

Tool Level

- Intermediate

Usability

- Moderately easy to use as users have to learn how to use CRM tools.

You May Also Like:

- What is Accounting Software? Everything You Need To Know

- How to Choose Accounting Software: A Complete Guide

10. Sage Accounting

Image via Sage

One of the key benefits of Sage Accounting as one of the best cloud accounting software is its ability to automate many of the manual tasks involved in financial planning and management.

It provides a comprehensive suite of accounting features, including invoicing, expense tracking, financial reporting, and budgeting.

Key Features

- Customizable dashboards to track key performance indicators (KPIs) in real-time.

- Financial reporting and analytics capabilities for deep insights into financial performance.

- You can create, track, and send personalized invoices.

- Automated financial data capture

- Payroll processing and management

- Advanced Inventory to track stock levels, automate purchase orders, and gain insights into your inventory performance.

- Debtor Manager with tools like automatic reminders and alerts to follow up on payments.

- Mobile accounting app to monitor your finances anywhere.

- Bank connections.

Pros

- Offers robust inventory management features

- Integrates with a variety of business apps

- Sage Accounting accepts multiple currencies, making it suitable for international business operations

- It offers a 30-day free trial to try out to the features.

Cons

- Lacks time tracking features compared to other online accounting software.

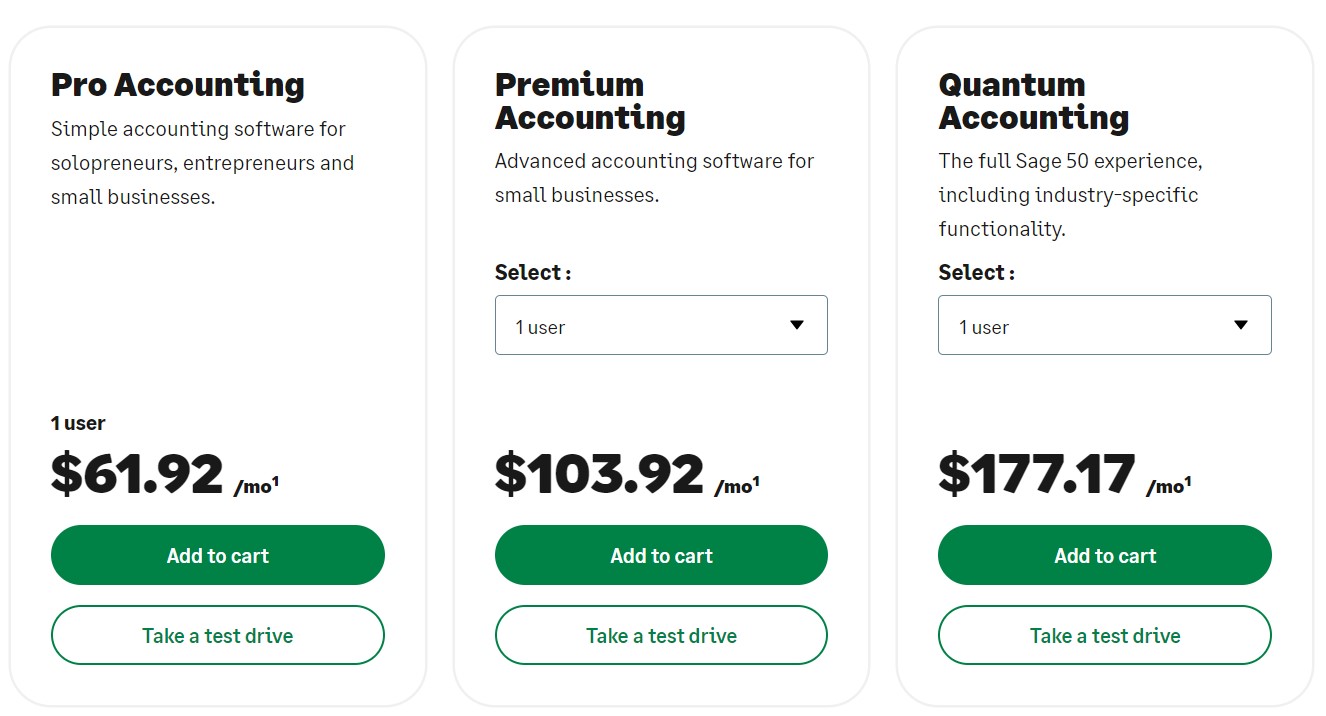

Pricing

Sage Accounting is a subscription-based service with three tiers:

- Pro Accounting: $61.92 per month

- Premium Accounting: $103.92 per month

- Quantum Accounting: $177.17 per month

Image via Sage

Tool Level

- Intermediate

Usability

- Fairly easy to use

11. ZipBooks

Image via ZipBooks

ZipBooks is one of the best cloud accounting software that simplifies financial management for businesses.

With ZipBooks, you can create professional invoices, track expenses effortlessly, and monitor project profitability. You can also generate detailed financial reports to gain insights into their business performance.

Key Features

- Recurring invoices and automated payment reminders.

- Business expenses tracking with automatic transaction categorization and mobile receipt capture.

- Financial reporting capabilities including sales and tax reports to gain insights into your business finances.

- Bank reconciliation features to automatically import transactions and reconcile them for accurate bookkeeping.

- Time tracking of billable hours for project management.

- Secure file sharing and permission controls.

- Double-entry bookkeeping and accounting features.

Pros

- A free software plan is available with essential accounting features for businesses with limited budgets.

- ZipBooks has an easy-to-use interface, making it accessible even for users with minimal accounting knowledge.

- Offers time tracking features, which can be useful for service-based businesses or freelancers who bill by the hour.

Cons

- Limited customization options for invoicing.

- Limited reporting capabilities compared to other best cloud accounting software.

Pricing

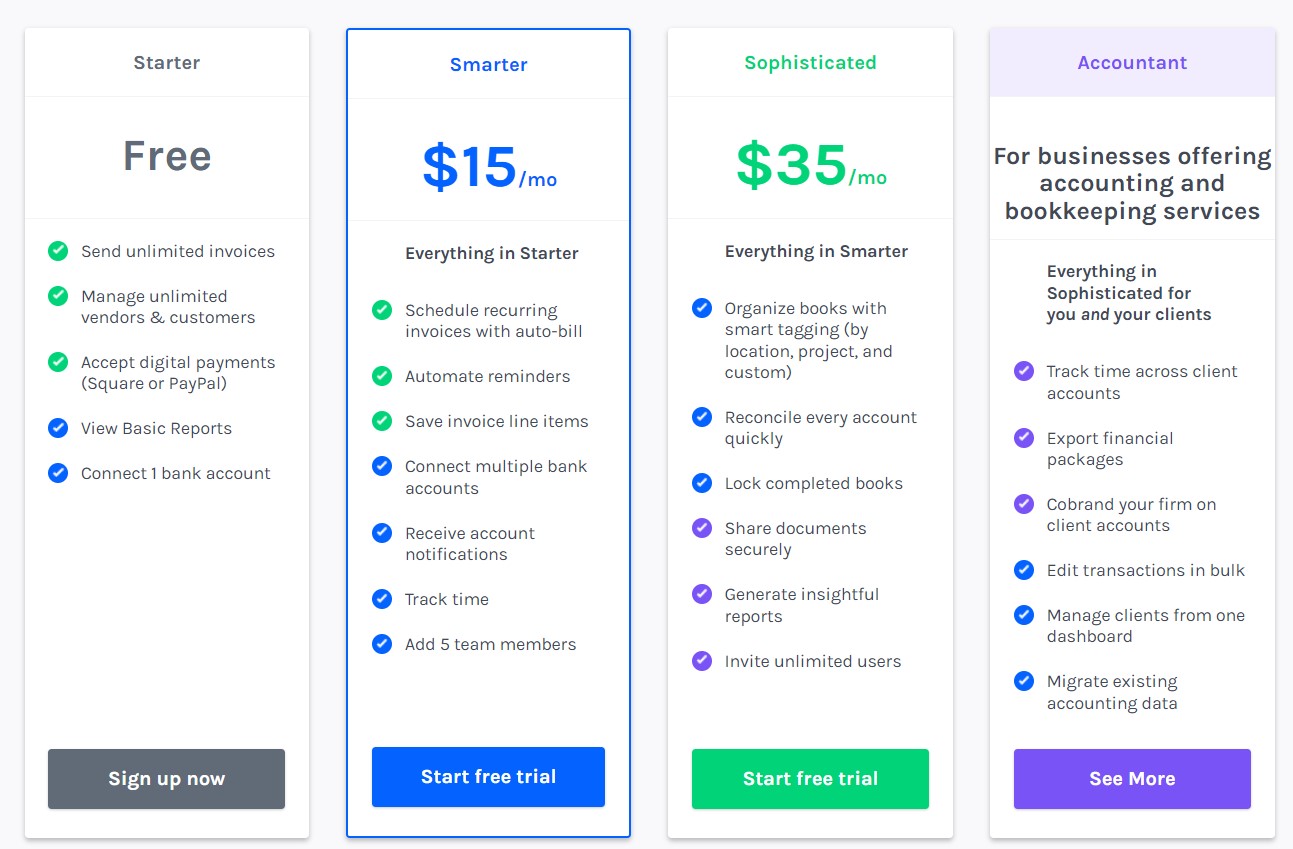

ZipBooks offers a free tier with basic features and paid tiers with more advanced functionalities. Here’s the pricing structure of the available plans:

- Starter: Free

- Smarter: $15 per month

- Sophisticated: $35 per month

- Accountant: Custom pricing

Image via ZipBooks

Tool Level

- Intermediate

Usability

- Fairly easy to use

You May Also Like:

12. ZarMoney

Image via ZarMoney

This is one of the best cloud accounting software that allows you to customize the workflows and reports to meet the specific needs of your business.

Being one of the best ecommerce accounting software, ZarMoney offers a range of features, including inventory management, order management, and time tracking.

Key Features

- Inventory management features like stock tracking, purchase orders, and sales orders.

- Bank connections with 9600+ financial institutions in the US and Canada.

- Automated accounting controls and reconciliation feature.

- Customer management tools for managing your customer information, including contact details, order history, and payment terms.

- Customizable dashboard that displays key metrics.

- You can create and send professional invoices quickly and easily. You can also accept online payments through credit cards, ACH, and more.

- Time tracking tools for tracking billable hours.

- Payable calendars to track payables and manage cash flow.

- Automated tax calculation, payment, and report filing.

Pros

- ZarMoney offers a comprehensive range of features including invoicing, inventory management, and reporting.

- ZarMoney simplifies bank data entry through its integration with 9600+ banks in the US and Canada.

- Compared to other accounting software, ZarMoney is a budget-friendly option.

Cons

- Bank connections are limited to certain countries.

- No free software available.

Pricing

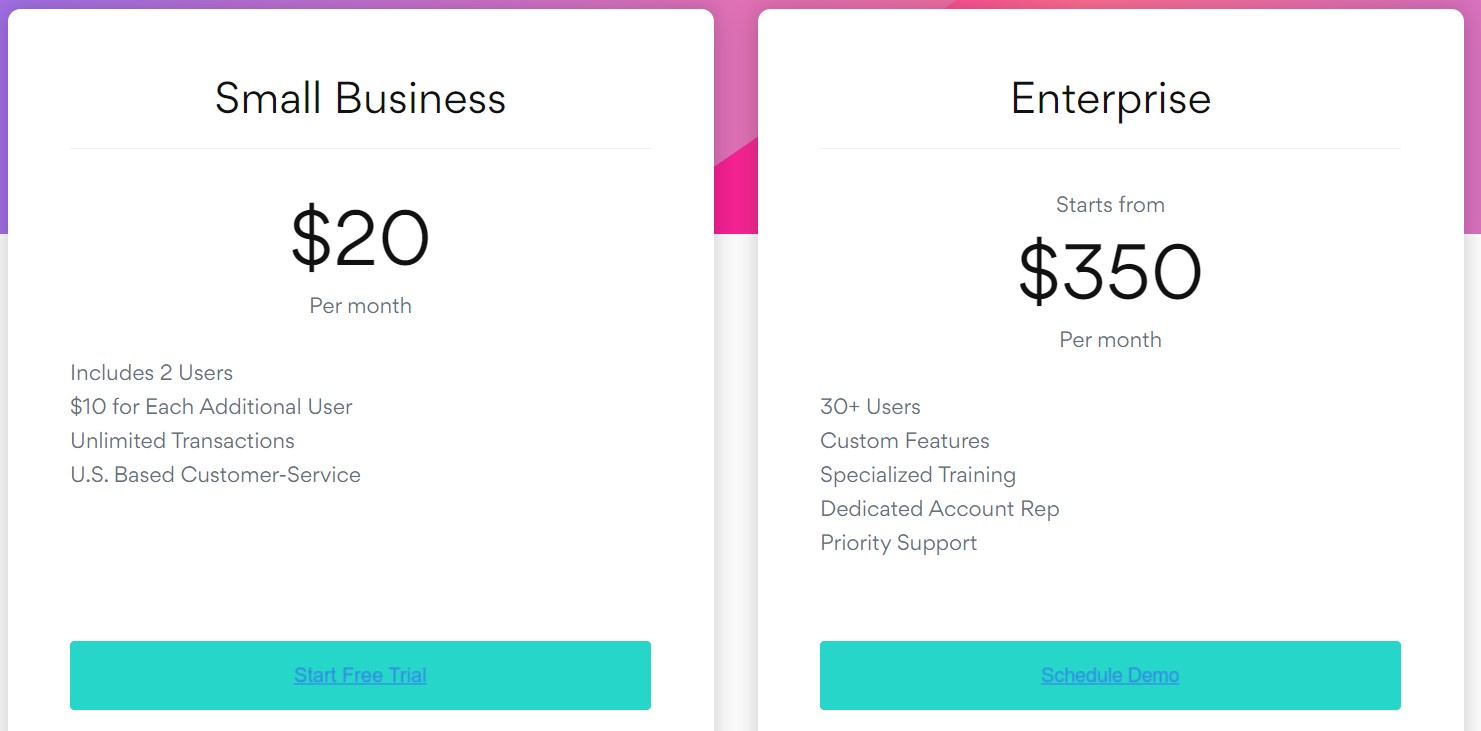

ZarMoney offers a variety of pricing plans to fit the needs of different businesses. They include:

- Entrepreneur: $15 per month for one user.

- Small Business: $20 per month for up to two users.

- Enterprise: $350 per month for 30+ users.

There is a 30-day free trial available for the Entrepreneur and Small Business plans.

Image via ZarMoney

Tool Level

- Intermediate/Expert

Usability

- Fairly easy to use with a slight learning curve for new users.

13. Zoho Books

Image via Zoho Books

One of the key features of Zoho Books, one of the best cloud accounting software, is its inventory management capabilities. You can easily track their inventory levels in real-time, set up automated reorder alerts, and manage purchase orders.

Additionally, you can automatically import bank and credit card transactions, making it easier to reconcile your financial records.

Key Features

- A customer portal that allows your customers to view their invoices, make credit card payments, and update their account information.

- A vendor portal that allows you to manage your vendors, including sending and receiving payments, and tracking bills.

- Project finance tracking including income, expenses, and profitability.

- Reconciles your bank statements and automates bank feeds.

- Tracks your inventory levels, including purchase orders, sales orders, and inventory adjustments.

- Manages your bills from vendors, including bill payments and approvals.

- Automates repetitive tasks, such as sending invoices and paying bills.

- Generates reports on your business operations, including income statements, balance sheets, and cash flow statements.

- Mobile accounting app to access your Zoho Books account on any mobile device.

Pros

- Zoho Books offers robust customization options to fit your specific business needs.

- It integrates well with several business tools such as payment gateways, CRM software, and project management tools.

- It has an intuitive interface that makes it easy for beginners to navigate and manage their finances.

- Offers a free plan.

Cons

- Zoho Books only allows a maximum number of 15 users per organization even for the highest paid plan. Adding more users incurs additional costs.

- Some advanced features are limited and require add-ons to extend their usage limits.

Pricing

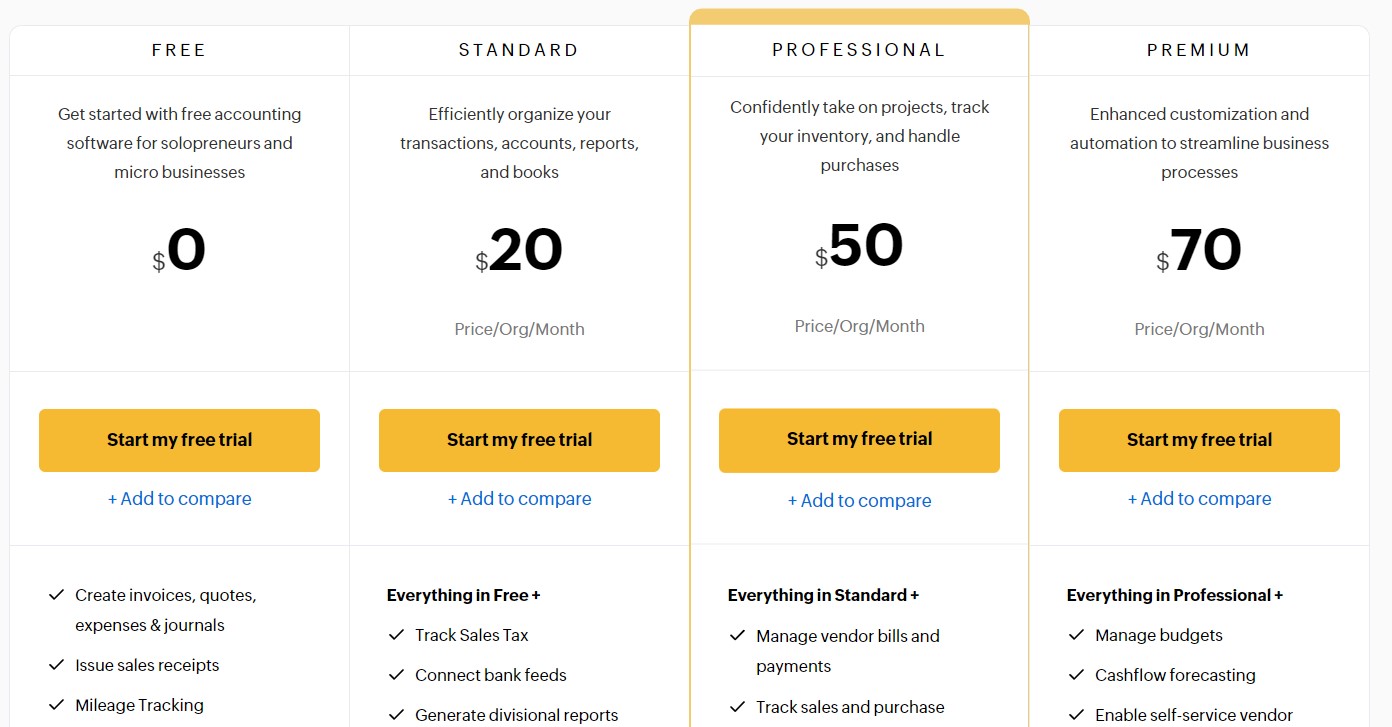

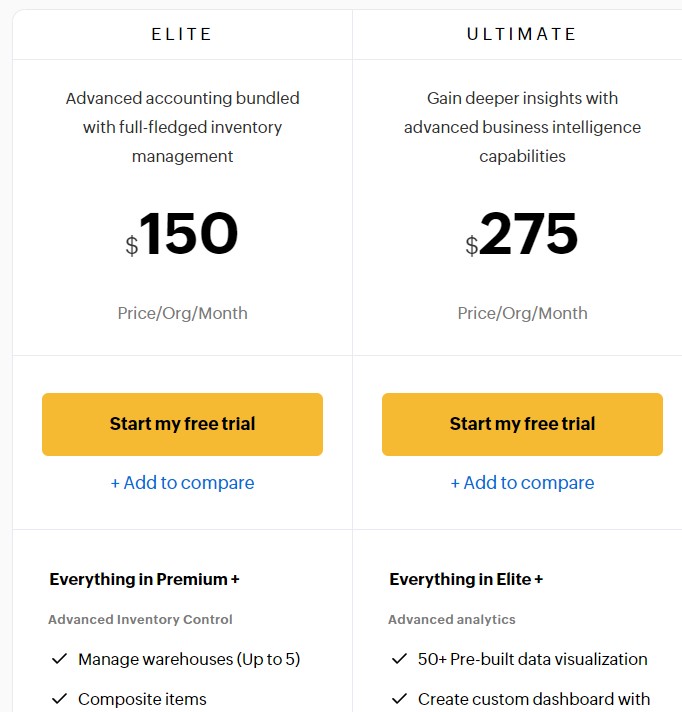

Zoho Books offers a free plan in addition to five paid plans. Here’s a breakdown of their pricing:

- Free: $0 per month

- Standard: $20 per month

- Professional: $50 per month

- Premium: $70 per month

- Elite: $150 per month

- Ultimate: $275 per month

Image via Zoho Books

Image via Zoho Books

Tool Level

- Beginner

Usability

- Easy to use

You May Also Like:

FAQ

Q1. What are the benefits of using cloud accounting software for my small business?

A. Cloud-based accounting software offers several advantages over traditional software, including:

- Real-time access to financial data anytime

- Automatic data backups

- Improved efficiency

- Simplified collaboration

- Scalability

Q2. What are some of the best cloud accounting software options for small businesses?

A. The best cloud accounting software for your business will depend on your specific needs and budget. However, some of the most popular options for small businesses include:

- QuickBooks Online

- Xero

- FreeAgent

- Wave Accounting

- Zoho Books

- Kashoo

- OneUp

- Odoo

- MYOB Essentials

- Bonsai

- Sage Accounting

- ZipBooks

- ZarMoney

Q3. How much does cloud accounting software typically cost?

A. Cloud-based accounting software pricing plans vary depending on the features offered and the number of users you need. Many software options offer free plans with basic features while there are paid plans available in different tiers.

Q4. What factors should I consider when choosing cloud-based accounting software for my business?

A. Here are some key factors to consider when choosing cloud accounting software for your business:

- Ease of Use: Consider how user-friendly the software is, especially if you have little accounting experience

- Features: Make sure the software has the features you need, such as invoicing, expense tracking, and reporting.

- Scalability: Choose software that can grow with your business.

- Integration: Consider whether the software integrates with other business tools you use, such as your CRM or payment processing system.

- Cost: Compare the pricing plans of different software options to find one that fits your budget.

Q5. Is cloud accounting software secure?

A. Cloud accounting software uses high-level security measures to protect your financial data. However, it’s important to choose a reputable software and to follow best practices for protecting your data, such as using strong passwords and enabling two-factor login authentication.

Q6. Can I access my online accounting software without an internet connection?

A. Most of the best cloud accounting software requires an internet connection for full functionality. However, some solutions offer limited offline capabilities with data synchronization once you’re back online.

Q7. How do small business owners switch from traditional to cloud accounting software?

A. Most online accounting software provides data migration tools and support to help transfer your existing financial records. Many also offer free trials to test the system before fully transitioning your financial operations.

Q8. Do I need to pay extra to process payments and accept credit card payments through these accounting platforms?

A. While basic online accounting features are included in the subscription, most platforms charge additional transaction fees for processing credit card payments and other payment processing services. Check each provider’s payment processing fees before choosing a platform.

Q9. How do accounting firms collaborate with clients using cloud-based software?

A. Most online accounting software offers multi-user access and permission settings. These enable accounting firms to work directly in their clients’ books while maintaining security. This enables real-time collaboration and easier sharing of financial data between businesses and their accountants.

Q10. What sales tax features should I look for in cloud accounting software?

A. The best online accounting software should include automated sales tax calculations, support for multiple tax rates and jurisdictions, and built-in tax reporting features to help you stay compliant at tax time. Many platforms also automatically update tax rates and rules to ensure accuracy.

You May Also Like:

- Best Accounting Software for Self-Employed Professionals

- Best Accounting Software for Nonprofit Organizations

Wrapping Up

With several options available, you have the opportunity to choose the best cloud accounting software that suits your needs.

Remember, the best cloud accounting software for your business depends on your specific requirements. Consider factors like your business size, industry, budget, and the features you need most.

You can take advantage of the free trial or plan to test-drive the software before making a decision.