If you run an ecommerce business, maintaining accurate accounting records is crucial to business success. Proper ecommerce accounting and financial reporting give you invaluable insights into your business’s financial health, which helps with decision-making.As such, if you don’t have the in-house capability to maintain accurate records, outsourcing is a great option.

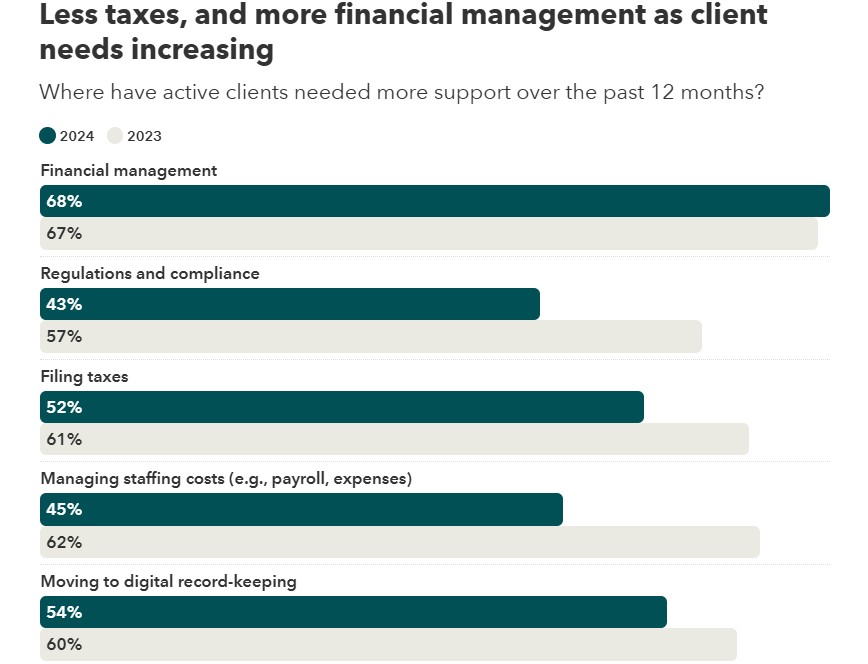

According to a QuickBooks survey, businesses are increasingly relying on accountants for various tasks, as shown in the image below.

Image via QuickBooks

However, before you decide whether you should outsource ecommerce accounting, you should understand its basics. With the right ecommerce accounting software, you may be able to manage your books in-house, without having to hire an accountant.

In this post, we’ll equip you with all the necessary information you need about ecommerce accounting, which will help you make an informed decision.

Let’s get started with the basics.

What is Ecommerce Accounting?

As you know, accounting involves tracking and managing the financials of a business, which includes all business expenses and income. Ecommerce accounting is the process of doing this for an online retail business.

In the simplest terms, it’s the process of recording all financial transactions of an ecommerce business in a way that’s easy to understand and analyze.

Here are some key characteristics of ecommerce accounting that you should understand before you delve deeper into the how aspect of things.

- Ecommerce businesses have a high volume of low-ticket transactions, which makes recordkeeping extremely important.

- Ecommerce accounting deals with tax calculations for different regions, which complicates the process.

- Inventory management and tracking are key aspects of ecommerce accounting, which is not the case with service businesses.

- Lastly, ecommerce businesses deal with platform fees and transaction fees for multiple platforms, which further adds to the complexity of ecommerce accounting.

Also, when you add returns and refunds to the mix, it makes the process even more complex.

Overall, ecommerce accounting has its roots in traditional accounting but needs to factor in a lot more things.

You May Also Like:

- Best Accounting Software for Self-Employed Professionals

- Benefits of Using Accounting Software for Small Businesses

Two Types of Ecommerce Accounting Methods

Now that you understand the fundamentals of ecommerce accounting, let’s discuss the key types of accounting methods retail businesses use.

Here are the two methods you can choose from.

Cash-Based Accounting

This is a simple accounting method where transactions are recorded when cash flows in or out of the business.

This makes bookkeeping easier as your records will match perfectly with your bank transactions. You simply need to record the movement of money and that’s it.

While it’s a good way to start, as you scale your ecommerce business, this method would not be enough to deal with all the complexities of ecommerce accounting.

Pros

- It’s simple to understand and execute and can be used by anyone, without much technical expertise.

- Managing cash flow becomes much easier since you record each inflow and outflow of cash in your business.

Cons

- It doesn’t give the most clear picture of business profitability in cases where payment is received long after a sale is made.

- For certain types of businesses, this is not feasible both for practical reasons and because the regulations dictate them to use accrual accounting.

Who Should Use It

New ecommerce businesses that are still growing, have a manageable cash flow, and low volume of transactions.

Accrual Accounting

In this method, you record revenue when it’s earned and expenses when they’re incurred, irrespective of when the actual payments are made.

You may buy something and pay for it later but it will be recorded as an expense when you’ve bought it. Similarly, when a customer purchases something from you, with a promise to pay later, the transaction will still be recorded when you’ve earned the revenue.

Pros

- This method helps you to accurately assess the profits for a period because there’s no delay in revenue recognition.

- This is a better way for new businesses to show their financial health to investors since they can prove profitability based on transactions done and not cash received.

Cons

- It’s more difficult to track expenses and revenue since your records will not mirror your bank statements or payment records.

- The flip side is that it may hide cash flow problems and appear profitable only on paper.

Who Should Use It

Most ecommerce businesses use this ecommerce accounting method as it can adapt to different revenue recognition scenarios. This is perfect for large ecommerce businesses with high transaction volumes.

You May Also Like:

Key Components of Ecommerce Accounting

Ecommerce accounting involves numerous tasks, which can be categorized under some key categories. Let’s discuss the most important ones in this section.

Basic Bookkeeping

This involves tracking key financial metrics and keeping detailed financial records.

Some common tasks include:

- Tracking and recording sales transactions, including data on refunds, returns, discounts, and channel-wise sales.

- Keeping track of Cost of Goods Sold (COGS) and other important financial metrics.

- Reconciling accounts with bank statements and payment processor transactions.

- Tracking various expenses, such as platform fees, transaction fees, and shipping costs.

- Managing accounts payable and receivable, for ecommerce businesses with B2B clients.

There are many moving components in ecommerce accounting and bookkeeping, these are just some of the important ones.

Sales Tax Compliance

One of the most important tasks in ecommerce accounting is calculating sales tax accurately and staying compliant with local tax rules.

Different products are taxed differently, and the tax rates and rules differ from country to country and sometimes even on a state level. Calculating how much tax to apply for each transaction is a key component of ecommerce accounting.

The good news is that there are numerous ecommerce accounting software solutions that automate the process and calculate the taxes for ecommerce transactions.

Inventory Management

Given that inventory comprises one of the biggest expenses for any ecommerce business, inventory management becomes a part of accounting.

Tracking the volume and cost of inventory bought and sold is important for maintaining perfect financial records.

Financial Reporting

This is one of the basic accounting tasks for any business, and ecommerce businesses are no different.

Here are some of the important financial reports you will need to prepare for your ecommerce business.

- Income Statement: It records a company’s revenues, costs, and expenses over a specific period, typically a year. It’s also called a profit and loss statement as it helps you assess your company’s profitability within a period.

- Balance Sheet: This financial statement provides a snapshot of your company’s assets, liabilities, and equity at any given point in time. It is used to get an overall picture of your company’s financial position at any time.

- Cash Flow Statement: As the name suggests, this statement tracks the movement of cash in and out of your business. This helps you analyze your company’s cash position and anticipate potential cash shortages or surpluses.

- Cost of Goods Sold (COGS): This analyses all the direct costs associated with products sold by an ecommerce company. These include manufacturing, warehousing, and shipping costs. It provides insights that help you optimize product pricing and sourcing.

- Sales Reports: These reports track and analyze sales data for an ecommerce business. You can analyze sales by channel, product, location, category, customer segment, and more. As such, you can prepare numerous sales reports, based on which metrics are most important for your business.

- Expense Report: Unlike COGS analysis, this report analyzes all the operating expenses of an ecommerce business. These include marketing and advertising costs, software subscription fees, shipping fees, payment processor fees, and more.

Cash Flow Management

Ecommerce accounting also involves proper cash flow management. Accountants need to monitor cash inflows and outflows, ensuring that the business has sufficient funds to cover expenses.

Some key tasks involved are:

- Recording sales transactions, accounting for returns and refunds

- Monitoring, categorizing, and recording all business expenses

- Preparing accurate cash flow statements

- Analyzing these statements to assess the company’s cash situation

- Anticipating potential cash shortages or surpluses

Forecasting and Planning

Lastly, an essential component of ecommerce accounting is financial planning.

Based on the detailed records you keep and the financial statements you prepare, you need to make short-term and long-term financial forecasts.

This will give you clarity on your company’s financial position in the future and help you understand your funding needs.

You May Also Like:

- Best Accounting Software for Nonprofit Organizations

- Best SaaS Accounting Software for All Businesses

Top Ecommerce Accounting Software

Choosing the right ecommerce accounting software solution is key to maintaining accurate records and streamlining financial management for your business.

That’s why we’ve curated a list of the top five tools that you can consider for your ecommerce business.

1. QuickBooks Online

QuickBooks Online is one of the best ecommerce accounting software, known for its bookkeeping automation and expert assistance.

It’s a cloud-based solution, which means that you can manage your business accounts from anywhere, anytime. It’s a great choice for ecommerce businesses because it seamlessly integrates with ecommerce platforms like Shopify and payment processors like Paypal.

It offers a 30-day free trial to allow users to test the features and user interface and then make an informed choice. Currently, it’s offering free live expert assistance for 30 days, if you choose a 3-month plan.

Look at its key features to decide if it’s the right tool for you or if you need to look at QuickBooks alternatives.

Key Features

- Seamless integration with ecommerce platforms, such as Amazon, Shopify, and Etsy

- Real-time inventory tracking to effectively manage stock levels

- Powerful bookkeeping automation to cut down time on tedious tasks

- Automatic tax calculations to serve customers across countries, without hassle

- Effective invoice management and the option to create customizable invoices

- Mileage tracking, bill management, and other accounting and bookkeeping features

- Multi-currency support to enable international transactions

- Integrations with payment processing platforms for seamless transactions

Price

- Simple Start: $35 per month

- Essentials: $65 per month

- Plus: $99 per month

- Advanced: $235 per month

2. Zoho Books

Zoho Books is an all-in-one cloud-based ecommerce accounting platform that helps with all aspects of bookkeeping and accounting. You can use it to manage bills and invoices, send automated payment reminders, manage inventory, track expenses, and more.

It’s affordable but still offers a comprehensive feature set. The best part is that it offers great integration capabilities, which means it will work seamlessly with your entire tech stack.

If you want to test it out, start with the free plan to get an idea about its UI and features before making an investment. Also, review Zoho Books on its key features and pricing before choosing it.

Key Features

- Robust invoicing and accounts receivables management

- Billing and payments management, with multi-currency support

- Integrates with Zoho Inventory to provide seamless inventory management

- Sales order tracking, budgeting, and cash flow forecasting

- Mileage tracking, bank reconciliation, and automated payment reminders

- Templates for P&L, balance sheet, and 50+ financial reports

- Self-service customer portal for quick problem resolution

- Option to set up recurring expenses and recurring invoices

Price

- Free: For 1 user and 1 accountant

- Standard: $20 per month

- Professional: $50 per month

- Premium: $70 per month

- Elite: $150 per month

- Ultimate: $275 per month

3. Xero

Xero is another one of the best ecommerce accounting software solutions that simplify financial management for retailers. Its seamless integration with ecommerce platforms like Shopify, WooCommerce, and Amazon allows it to track sales data effortlessly.

It’s an affordable cloud-based solution designed primarily for small and medium-sized businesses but doesn’t lack any important features.

It automates many ecommerce accounting tasks, from invoicing to bank reconciliation, streamlining financial management for businesses.

Xero provides great insights into a company’s finances with its advanced reporting tools. The best part is that you can try it for free before you buy a plan.

Compare its features and price with Xero alternatives to decide if it’s the right tool for you.

Key Features

- Integrations with all major ecommerce platforms to sync sales data

- Robust inventory tracking and management features

- Automated invoicing and payment reminders, and quotes management

- Automatic sales tax calculator and multi-currency payment support

- Bulk bank reconciliation, expense tracking, and other accounting features

- Robust financial analytics and reporting features

- Numerous integrations with numerous apps and tools

Price

- Early: Usually $15 per month (currently $0.75)

- Growing: Usually $47 per month (currently $2.35)

- Established: Usually $80 per month (currently $4.00)

4. FreshBooks

FreshBooks is one of the best ecommerce accounting solutions for invoice management. You can send unlimited invoices to a specified number of clients, depending on your plan. It also allows you to set up recurring invoices.

It’s a cloud-based solution with a mobile app, so you can manage ecommerce accounting on the go.

Like other tools on this list, FreshBooks also automates several accounting and bookkeeping tasks to simplify financial management. The analytics and reporting features are also robust, as good as those offered by FreshBooks alternatives.

Key Features

- Automated invoicing, recurring invoices, and overall invoice management

- Expense tracking and proposals and estimates management

- Integrations with all major ecommerce platforms like Shopify

- Automated payment reminders and multi-currency payments

- Billing and receipts management, and mileage tracking

- Payroll processing powered by Gusto

Price

- Lite: $9.50 per month

- Plus: $16.50 per month

- Premium: $30.00 per month

- Select: Custom pricing

5. Wave

Wave offers a suite of accounting and financial management tools for businesses. These cover various aspects of financial management, from invoicing and accounting to payroll.

It’s one of the most affordable ecommerce accounting software with a generous free plan that allows you test the UI and features to your heart’s content.

Whether you choose the free plan or the paid one, there are no restrictions on the number of invoices, estimates, and bills you can send. Some advanced features, however, are available only with the paid plan.

Key Features

- Unlimited invoices, estimates, bills, and more

- Option to create unlimited bookkeeping records

- The ability to auto-merge and categorize transactions

- Automated late payment reminders

- A robust analytics dashboard with all key reports

- White-labeling and branding options

- A mobile app to manage transactions on the go

- Live-person chat and email support

- Bookkeeper, payroll, and receipts as paid add-ons

Price

- STARTER: Free

- PRO: $16 per month

You May Also Like:

How to Choose the Right Ecommerce Accounting Software Solution

Given the plethora of ecommerce accounting software solutions available in the market, choosing the right one is more difficult than ever.

We recommend shortlisting and comparing the options based on the following key parameters.

Features

The first and foremost thing you need to consider is what accounting features you need. Some tools will provide basic bookkeeping and accounting, without any bells and whistles.

Others may offer numerous additional features related to financial management, such as invoicing, payments, payroll, and more.

Shortlist the best options based on your company’s needs and then consider other parameters to find the best option.

Integrations

Even if your accounting solution doesn’t offer tons of features, it can make up for it by seamlessly integrating with other tools to provide a robust financial management solution for your business.

Look for ecommerce accounting platforms that provide direct integrations with other financial management tools and ecommerce platforms. This will also allow them to sync your ecommerce store’s financial data, making it easy to record sales transactions.

User Interface

Even the best ecommerce accounting tools are worthless if you struggle to use them to their full potential.

That’s why, it’s important to check each tool’s user interface before making the final decision. Luckily, most tools offer free trials or demos to help you assess how easy they are to use.

Leverage those options and choose a tool that you’re comfortable using.

Customer Support

When comparing ecommerce accounting platforms, make sure you also consider the customer support options they provide.

Prefer tools that not only offer multiple support channels but are generally known for their responsiveness.

Pricing

Lastly, and most importantly, look for options within your budget. In our list of tools, we’ve included options to suit different budgets, so you can get started there.

You May Also Like:

Ecommerce Accounting Best Practices

If you want to maintain accurate and error-free books, follow the ecommerce accounting best practices listed below.

1. Always Automate Bookkeeping and Data Entry

When you start a new ecommerce business, you may get away with manual data entry and record-keeping. However, as your business grows, automation becomes necessary.

Even if you have hired a professional accountant and bookkeeper, record-keeping for large volumes of transactions is difficult to do manually. Even professional accountants need useful ecommerce accounting software solutions that can automate tedious tasks.

Choose a system that can automatically keep track of sales, transactions, and expenses, without requiring much human input. This will save you tons of time and money in the long run, even if there’s an initial cost.

Here are some tips:

- Ensure your ecommerce accounting software solution connects with your ecommerce platform so that your store data directly syncs with it.

- Also, integrate your chosen payment gateway with your ecommerce store and ecommerce accounting software solution to ensure they all work in harmony.

- Choose the right software solutions and set up automation rules that automate bookkeeping.

Luckily for you, most good ecommerce accounting software solutions offer bookkeeping automation. In fact, most can automate multiple accounting and inventory management tasks.

2. Sync Inventory Management with Ecommerce Accounting

Accounting, invoicing, and inventory management are three important business functions that should work hand-in-hand. You can’t automate accounting and forget about inventory management or do it manually.

These processes should work in sync and should ideally be handled by one robust ecommerce accounting system. Even if you handle these separately, these should be in sync.

Wondering why it’s important?

It’s because inventory affects various aspects of a company’s financial management and health.

Here’s why inventory management is an integral part of ecommerce accounting:

- Real-time inventory management helps with the accurate calculation of the Cost of Goods Sold (COGS), which is required for ecommerce accounting. Each sale or new stock arrival should be recorded for popper accounting and it won’t be possible without good inventory management.

- Inventory is one of the biggest expenses for ecommerce businesses. Ordering too much is wasteful while ordering too less could result in lost revenue. Proper inventory management saves money, boosts revenue, and helps improve the overall cash flow of an ecommerce business.

- Since inventory is one of the key expenses, recording inventory movements and values is essential for accurate financial reporting. You can’t manage your books without keeping track of your inventory costs.

- It’s not always that inventory management helps with ecommerce accounting, but it can be the other way around as well. By analyzing past financials, you can identify seasonal trends and demand patterns to improve your inventory management and prepare for peak seasons.

Overall, inventory management is a crucial part of ecommerce accounting. It’s up to you whether you want to sync the two functions or use a single solution that handles both.

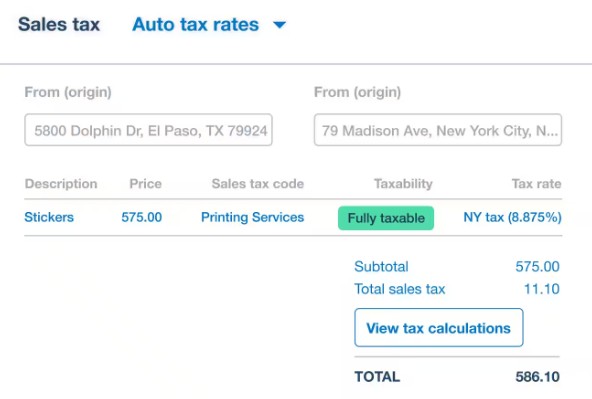

3. Invest in Tools That Automate Tax Compliance

If you plan to run an international business, you will need to comply with the tax regulations for different countries and regions. Sales taxes vary by region and ecommerce businesses need to calculate these for each transaction.

It’s simply not practical to do this manually—automation is the only way to go.

However, some ecommerce accounting tools can make this extremely easy while others have complex automation rules and functionality. You need to compare and test different ecommerce accounting software to determine which works intuitively.

If you’re still not convinced, here are some benefits of using accounting software to automate tax calculations.

- Automatically calculating taxes for hundreds or thousands of transactions saves a lot of time and effort. It’s practically impossible to do it manually.

- When you have preset rules for how to calculate taxes for different countries, the chances of error become negligible. Doing so manually can cause numerous issues and risk penalties.

- Tax rates vary by product and location, so applying the right taxes on each transaction is crucial for ecommerce businesses like yours. Automated tax compliance tools calculate the correct tax amount based on the customer’s location, product type, and current tax regulations, helping you stay compliant.

- Sales tax compliance doesn’t end with calculating the tax on each sale as you also need to file sales tax returns and remit the collected taxes. Many ecommerce accounting or tax compliance tools also help with tax filings and remittances.

- Also, tax regulations change from time to time, and keeping track of all changes, across geographies, can be daunting. Ecommerce accounting tools with automated tax compliance functionality maintain updated databases that incorporate these changes. This helps your business stay compliant with changing tax laws.

- Lastly, using an ecommerce accounting solution with transparent tax calculation rules also helps build customer trust. It also makes things much easier to audit, which helps build business credibility.

Many ecommerce accounting platforms like Sage and Xero offer automated tax compliance functionality. They often partner with more specialized tax compliance software like TaxJar and Avalara to offer this functionality.

Xero’s sales tax compliance features, for example, are powered by Avalara. Avalara updates the latest tax rules and rates for each product and region, so Xero can offer a seamless tax calculation functionality to its users.

Here’s an example of how sales taxes are calculated via Xero.

Image via Xero

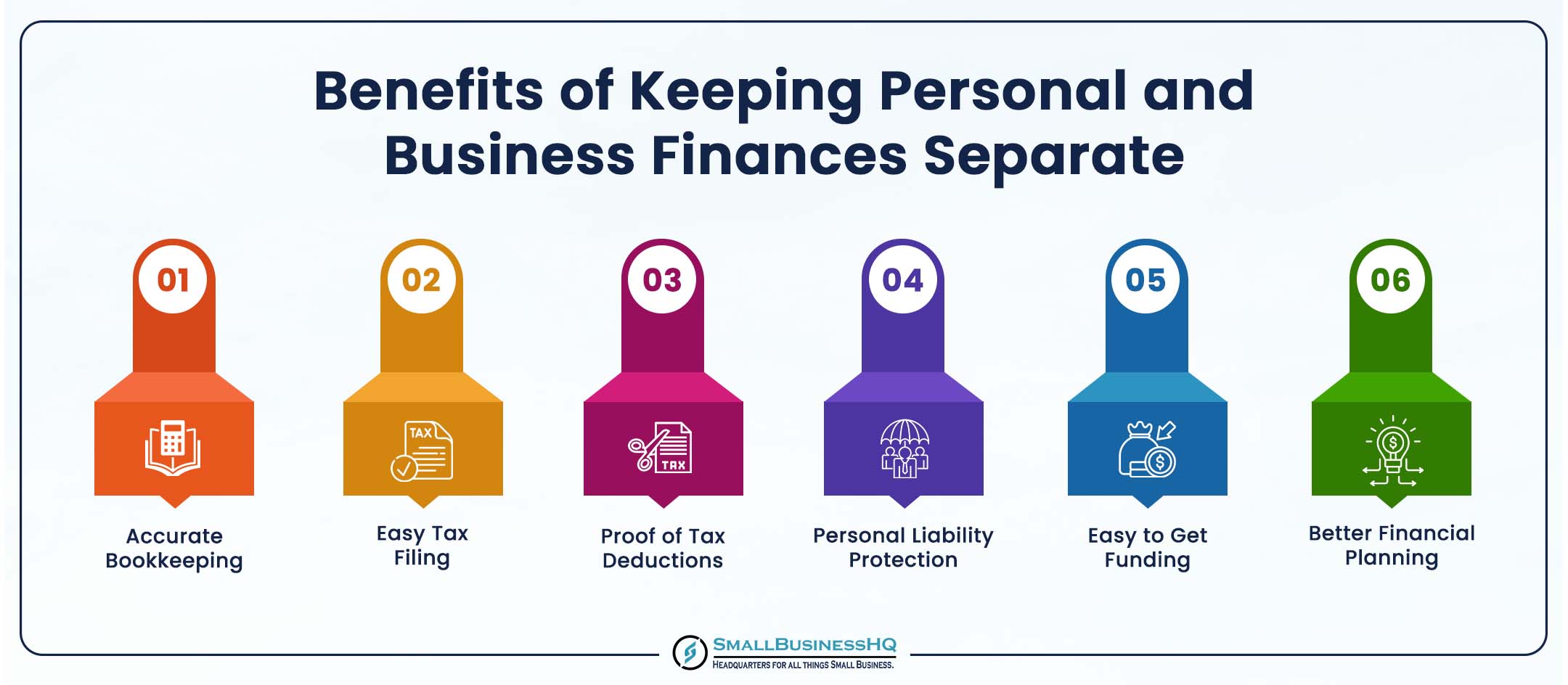

4. Keep Personal and Business Finances Separate

This should be a no-brainer for you, whether you’re a new entrepreneur or an expert. Still, we thought it prudent to emphasize the importance of keeping business and personal finances separate for better ecommerce accounting.

This is a given for corporations and other business entities that pay corporate taxes and have multiple owners or shareholders.

However, for single-member LLCs or sole proprietors, the line often blurs. Just because you are the sole owner of a business does not mean you can mix personal and business finances.

Keeping your finances separate is crucial for maintaining clean and accurate financial records for your business and staying compliant with regulations.

Here are some reasons why you should ensure that your business and personal finances are completely separate.

Accurate Bookkeeping

If you mix your finances, then identifying business expenses becomes difficult, which results in inaccurate bookkeeping and accounting. This also makes it difficult for you to assess your company’s financial health, as the numbers are not entirely accurate.

Easy Tax Filing

Tax filings can be a nightmare if you have made personal and business expenses using the same bank account or credit card. You would find it difficult to identify which expenses you can write off. Any error or wrong write-offs could cause severe consequences and may trigger an audit.

Proof of Tax Deductions

Speaking of write-offs and tax deductions, maintaining a separate business bank account gives you clear proof of your business transactions. Even if you’re audited, you can provide undeniable proof of business expenses. However, if you use your personal account, even legitimate business expenses could be questioned.

Personal Liability Protection

One of the most important benefits of financial separation is that it helps protect you from liability if the business is in debt or fails to meet its obligations. If you keep clear boundaries between your assets and business assets, you will have better personal liability protection.

Easy to Get Funding

If you’re planning to get a bank loan to finance your business, having a business bank account is a must. It helps build a credit history for your business, which is important for getting a business loan.

If you have a business account with a bank and have a good credit history, getting a loan from that bank would be much easier. However, getting a business loan with a personal bank account is extremely difficult.

This stands true for other business lenders and investors as well. They would also look at your business’s financials and credit history before investing in it. Moreover, this demonstrates professionalism and financial stability, which are also factors that investors consider when investing in a business.

Better Financial Planning

Maintaining separate business financial records ensures that you get a clear picture of your company’s financial health as all numbers are accurate.

Accurate ecommerce accounting is the foundation for better financial analysis, which aids in better financial planning.

When you have a clear view of business cash flow, income, and expenses, you will find it easier to set budgets and make informed financial decisions.

Overall, financial separation will help you manage and plan your business finances more accurately, which will help you in the long term.

5. Stay on Top of Cash Flow Management

Maintaining a healthy cash flow is vital for running your ecommerce business smoothly and scaling it over time. If you’ve started a new business, then this becomes even more crucial because poor cash flow management could lead to business failure.

If you follow good ecommerce accounting practices and have a great tool to aid you, managing cash becomes easier.

Here are some ecommerce accounting best practices you should follow for better cash flow management.

Track Cash Flow Regularly

Tracking the inflow and outflow of cash in your business is crucial for anticipating potential cash shortages. If you have started a new business, then running out of cash is one problem you should avoid at all costs because it could lead to hasty and poor business decisions.

One simple ecommerce accounting best practice is to stay on top of cash flow management at all times by monitoring cash movement closely. You should be aware of your company’s cash flow situation at any point in time.

This ensures that if you anticipate a cash shortage, you can take preemptive measures to avoid it.

Optimize Inventory Management

Since inventory is one of the biggest expenses for an ecommerce business, you should manage it optimally.

Since we’ve already discussed this, we won’t go into the details again. Just remember that proper inventory management is the foundation for optimal cash flow management.

Make Accurate Forecasts

A good ecommerce accounting best practice is to periodically make short-term and long-term cash flow forecasts. This helps you anticipate future cash needs and gather funds before you run out of cash.

We recommend you create monthly, quarterly, and yearly cash flow forecasts to stay on top of things. Use these to adjust your budget, plan for season variations in inventory, and stay financially resilient.

Monitor and Cut Down on Expenses

Expense tracking is an integral part of ecommerce accounting as it helps you understand your spending patterns and identify avoidable expenses.

Carefully examine your expenses to find out discretionary spending that could be reduced or eliminated. Categorize expenses and optimize spending on each category to optimize your overall business spending.

Luckily for you, most ecommerce accounting solutions provide comprehensive expense tracking and analysis. So, invest in a good tool that can help you monitor and cut down on expenses.

Create Cash Flow Statements

Another common, yet important, ecommerce accounting best practice is to create periodic cash flow statements and use them for business decision-making.

These statements give you a clear picture of your company’s financial health, specifically in terms of cash flow. Analyzing these can help you make smart decisions about future spending and identify the need for cost-cutting.

It could also help you identify seasonal trends. So, if your cash flow tends to decrease in specific months, you can focus more on cost-cutting during that time.

Automate Cash Flow Management

Lastly, and most importantly, the best ecommerce accounting tip we can give you is to automate your company’s cash flow management.

Use a good ecommerce accounting software solution to automate time-consuming tasks to save time and reduce manual errors.

From generating cash flow statements to making forecasts, there are ecommerce accounting tools available in the market that can help you optimize your company’s cash flow management.

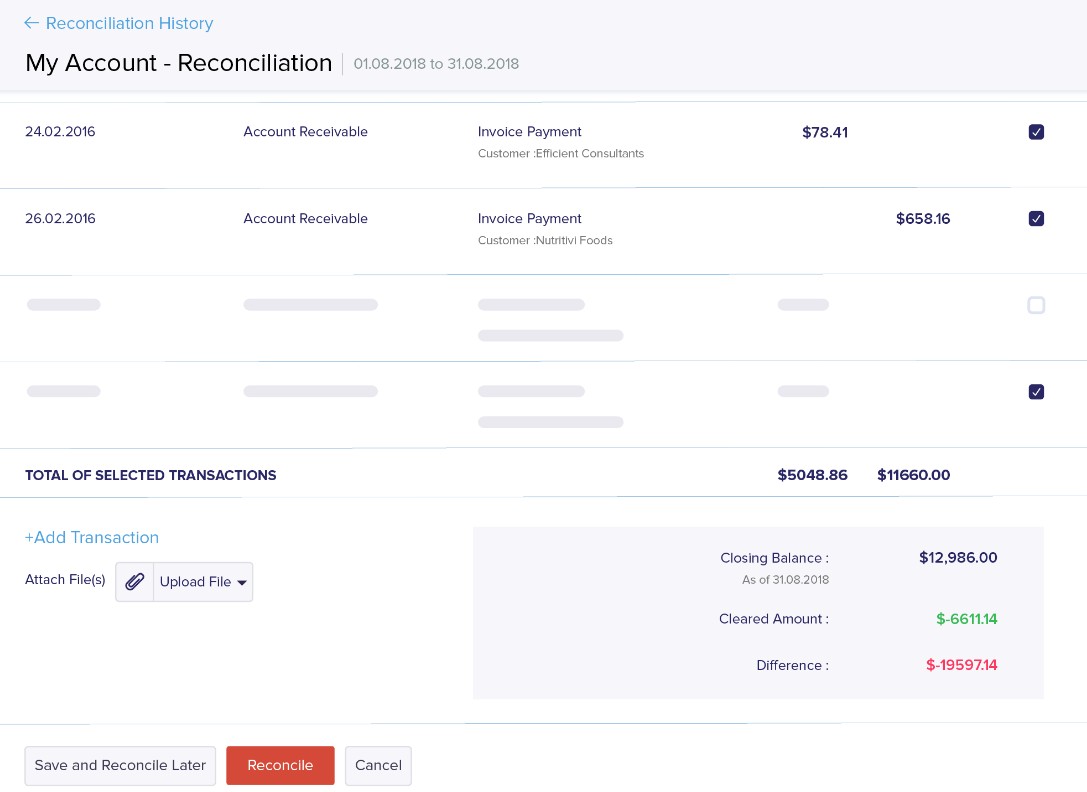

6. Reconcile Accounts Regularly

Waiting till the end of a year to reconcile accounts is one of the biggest ecommerce accounting mistakes you can make.

It leaves you vulnerable, with scope for errors. Moreover, resolving issues at the last minute can be daunting and is not a good practice.

Instead, you should make it a habit to regularly reconcile accounts with bank statements to ensure everything matches and is on point. This gives you a chance to identify issues early and resolve them before the year ends.

This enables better financial reporting and also gives you more clarity on your company’s financial health throughout the year.

Regular bank reconciliation helps you:

- Identify issues like unauthorized transactions, duplicate charges, etc., and resolve them as soon as possible.

- Ensure accurate financial reporting, not allowing errors to pile up for year-end reporting.

- Get a clear picture of your company’s cash flow situation and optimize cash management.

- Maintain accurate, organized, and perfectly balanced books, which makes tax reporting easy.

- Gain important insights into your company’s finances to make strategic business decisions.

The good news is that most, if not all, ecommerce accounting solutions enable automatic bank reconciliation. As such, if you choose the right accounting tool, it will do all the work for you.

Zoho Books, for example, is one such accounting tool that offers automatic bank reconciliation.

Image via Zoho Books

7. Opt for Cloud Accounting Software

The best ecommerce accounting solutions allow you to manage your books from anywhere, anytime. The simplest way to do this is to choose a cloud-based ecommerce accounting solution, preferably one that also has a mobile app.

Using cloud-based accounting software will simplify accounting and bookkeeping for you, irrespective of the type of business you run.

FAQ

1. What is ecommerce accounting?

It’s the process of recording all financial transactions of an ecommerce business in a way that’s easy to understand and analyze. It involves bookkeeping, inventory management, cash flow management, financial reporting, financial planning, and more.

2. What does an ecommerce bookkeeper do?

An ecommerce bookkeeper tracks the income and expenses of an ecommerce business and maintains accurate financial records.

Some of their key tasks include:

- Keeping track of all sales transactions for the business

- Tracking order refunds and returns

- Tracking Cost of Goods Sold and other key metrics

- Keeping detailed records of inventory movement and prices

- Reconciling bank and payment processor accounts

- Managing accounts payable and receivable

- Tracking, categorizing, and recording business expenses

- Optimizign tax management and compliance

- Preparing financial statements and reports

- Helping with financial forecasting and planning

3. How can I manage ecommerce accounting?

You can handle ecommerce accounting in-house or by hiring a professional accountant or bookkeeper. If you choose to do it in-house, you’ll need a good ecommerce accounting tool that can automate most processes to save time and reduce errors.

4. Which is the best ecommerce accounting software solution?

There are numerous ecommerce accounting software in the market, suited for different budgets and needs.

We’ve shortlisted the five best options to get you started. Go through their features and pricing to choose the one that best meets your needs.

Here are our top five picks:

- QuickBooks Online

- Zoho Books

- Xero

- FreshBooks

- Wave

5. How can I improve ecommerce accounting?

Use the following best practices to improve ecommerce accounting:

- Always automate bookkeeping and data entry

- Sync inventory management with ecommerce accounting

- Invest in tools that automate tax compliance

- Keep personal and business finances separate

- Stay on top of cash flow management

- Reconcile accounts regularly

- Opt for cloud accounting software

Conclusion

This post details everything you need to know about ecommerce accounting and the tools you need to do it right. Use it as your starting point to set up accounting and bookkeeping processes for your ecommerce business.

We, at SBHQ, aim to help small businesses succeed. So, make sure you check out other resources on our website to help you with different aspects of your business.