You have to juggle restricted grants, oversee donor funds, and ensure that every dollar aligns with your organization’s goals while adhering to the rules and regulations.

Most guides either oversimplify nonprofit accounting or bury the important financial information under technical jargon.

This guide strikes a balance between basic nonprofit bookkeeping and complex nonprofit accounting practices. It covers everything from basic principles to financial statements and compliance requirements, explained in clear, practical terms that are easy to understand and apply.

By the end of this guide, you’ll have the skills to confidently manage your nonprofit’s accounting needs.

What Is Nonprofit Accounting?

Let’s start with the basics.

Nonprofit accounting is a specialized method of tracking finances, emphasizing accountability and mission impact over profits. Even your choice of accounting software must align with the unique tracking requirements because regular business tools often fail to do so.

While for-profit organizations track bottom-line earnings, nonprofit accounting focuses on demonstrating good stewardship of financial resources. This affects everything from how you handle financial transactions to how you prepare your financial statements.

But who needs these financial records?

Donors want assurance that their financial support is put to good use. Board members use them to make smart decisions about programs. Government agencies, like the IRS, expect detailed reports for compliance. And everyone served by your programs counts on solid financial management to keep services running.

Most nonprofit accounting challenges come from managing different types of funds. That grant for your youth program can’t cover administrative costs. While the general donations are more flexible, they still need to be carefully tracked. And if you’re selling products or services, that’s another layer to manage.

Here is the key to successful nonprofit accounting:

- Track every dollar by its purpose and restrictions

- Keep detailed records of how funds support your mission

- Follow specific rules for reporting different types of income

- Maintain transparency with all your stakeholders

Nonprofit accounting might sound complicated, but it’s really about keeping track of financial resources to demonstrate to all stakeholders—including donors and regulatory bodies—that the organization is using its resources wisely and adhering to its core mission.

Understanding Nonprofit vs. For-Profit Accounting

The difference between nonprofit and business accounting? It’s all about the end goal. While businesses track profits, nonprofits track if they’re achieving their goals. These are the key differences in how the books are managed.

Let’s discuss the main differences between business and nonprofit accounting.

Revenue Tracking

For-profit organizations have it simple; they just track net income from sales. Whereas, nonprofit organizations need to monitor multiple sources, including fundraising events and grants, while maintaining their financial position.

Each type of income needs its own tracking system. The same applies to multiple funding sources. Each has its own rules and reporting requirements you need to adhere to.

Assets and Ownership

In a regular business, the owners have a claim to the company’s assets, but nobody owns a nonprofit. Instead, the organization holds its assets in trust to serve its mission.

This means different rules for how to record and manage these resources. For example, when a nonprofit buys equipment or property, these assets are managed differently than in a business setting.

Financial Reports

While businesses focus on profit and loss statements, nonprofits use different reports:

- Instead of an income statement, there’s a statement of activities

- The balance sheet becomes a statement of financial position

- There’s a special report showing how money is spent on programs versus overhead

These reports need to show how they helped advance the organization’s mission.

Tax Treatment

Here’s a big one: nonprofits that qualify as 501(c)(3) organizations don’t pay federal income tax.

This key difference in the LLC vs. nonprofit comparison comes with strict requirements for financial reporting and public disclosure. You’ll need to file Form 990 with the IRS, which anyone can look up online.

This public accessibility means your financial management needs to be spotless.

Expense Categories

Nonprofits split their expenses into three main buckets:

- Program services (the actual work of helping people)

- Administrative costs (keeping the lights on)

- Fundraising expenses (getting more support)

This split helps donors see how much of their money goes directly to the cause. Most nonprofits aim to keep administrative and fundraising costs reasonable while maximizing program spending.

Finding the right balance is key to maintaining donor trust and organizational sustainability.

You May Also Like:

Nonprofit Accounting vs. Bookkeeping

While often used interchangeably, nonprofit accounting and bookkeeping serve different functions. Understanding these differences helps organizations ensure they have the right expertise for their financial management needs.

Nonprofit accounting involves complex financial management strategies, compliance oversight, and strategic planning. It goes beyond basic transaction recording to include fund allocation, restriction management, and financial decision-making support.

A nonprofit accountant helps interpret financial data to guide organizational strategy and ensure that operations align with the organization’s mission.

Bookkeeping, however, focuses on the day-to-day recording of financial transactions. A bookkeeper handles tasks like:

- Processing payroll

- Reconciling bank statements

- Maintaining the general ledger

- Recording donations and expenses

- Managing accounts payable and receivable

Here’s a detailed comparison of these crucial financial roles:

| Aspect | Nonprofit Bookkeeping | Nonprofit Accounting |

| Primary Focus | Transaction recording and organization | Financial strategy and compliance |

| Time Horizon | Day-to-day operations | Long-term planning and oversight |

| Expertise Level | Basic accounting principles | Advanced nonprofit financial management |

| Software Usage | Basic data entry and organization | Complex financial analysis and reporting |

| Stakeholder Interaction | Limited external contact | Regular board and donor communication |

| Decision-Making Role | Provides data | Interprets data for strategic decisions |

| Compliance Responsibility | Basic record maintenance | Overall compliance oversight |

| Audit Involvement | Provides documentation | Manages audit process and responses |

When Does Your Nonprofit Need Both?

As your nonprofit grows, you’ll likely need bookkeeping and accounting expertise. Small nonprofits may begin with basic bookkeeping support, but there are times when professional nonprofit accounting oversight becomes necessary.

Most organizations need dedicated nonprofit accounting support when their annual budget exceeds $500,000, when managing multiple funding sources, or when dealing with complex grant requirements.

However, nonprofit accounting is vital when handling restricted funds from multiple sources, managing government grants, or preparing for audits. Organizations planning major program expansions or dealing with complex compliance requirements also benefit from professional nonprofit accounting oversight.

For effective financial management, both roles should work together seamlessly. While bookkeepers maintain the accurate daily records that accountants need for analysis, accountants set up the systems and procedures for the bookkeepers to follow.

You May Also Like:

The 4 Essential Financial Statements for Nonprofits

Getting your financial statements correct involves more than just checking boxes—these documents use financial information to tell your organization’s mission story.

Understanding how to prepare financial statements properly helps your board make informed decisions.Statement of Financial Position

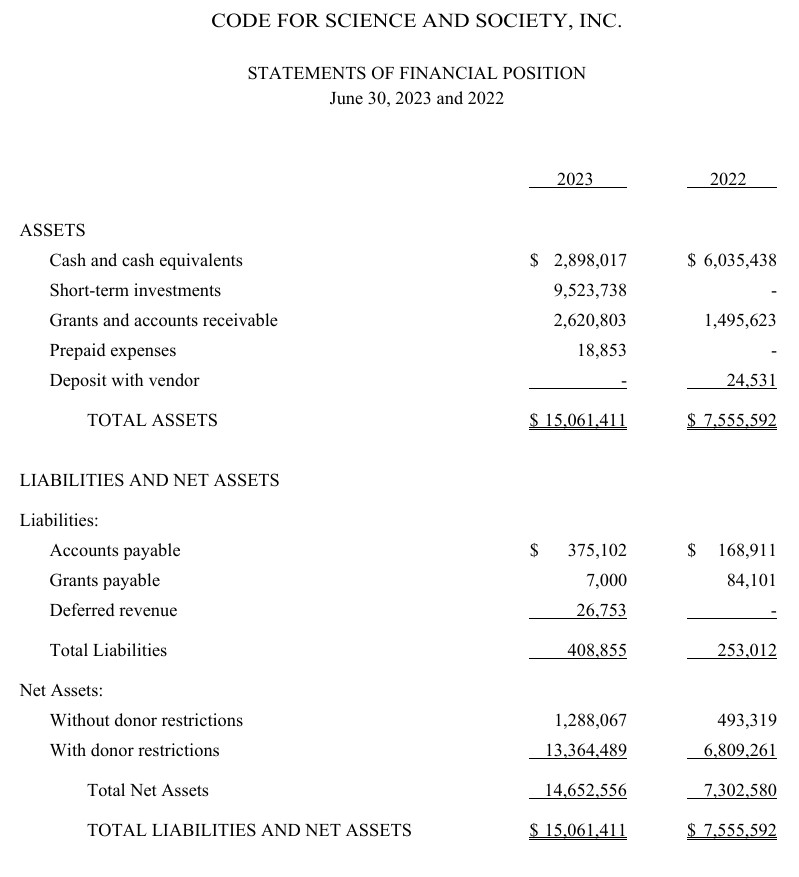

Think of the statement of financial position as your snapshot of financial health. While traditional businesses use a balance sheet, nonprofit organizations track their financial position through assets, liabilities, and net assets at a specific time. Here’s what you’ll track:

- Cash and investments in both restricted and unrestricted accounts

- Property, equipment, and other physical assets

- Outstanding bills, loans, and long-term debt

- Restricted funds from grants or specific donations

- Unrestricted funds available for general use

Each category in your financial statements needs clear documentation. Following the nonprofit accounting rules, if you have a $50,000 grant for a new computer lab, that money shows up as a restricted asset until you spend it on computers.

For example, your statement for financial position should look like this:

Image via Code for Science and Society

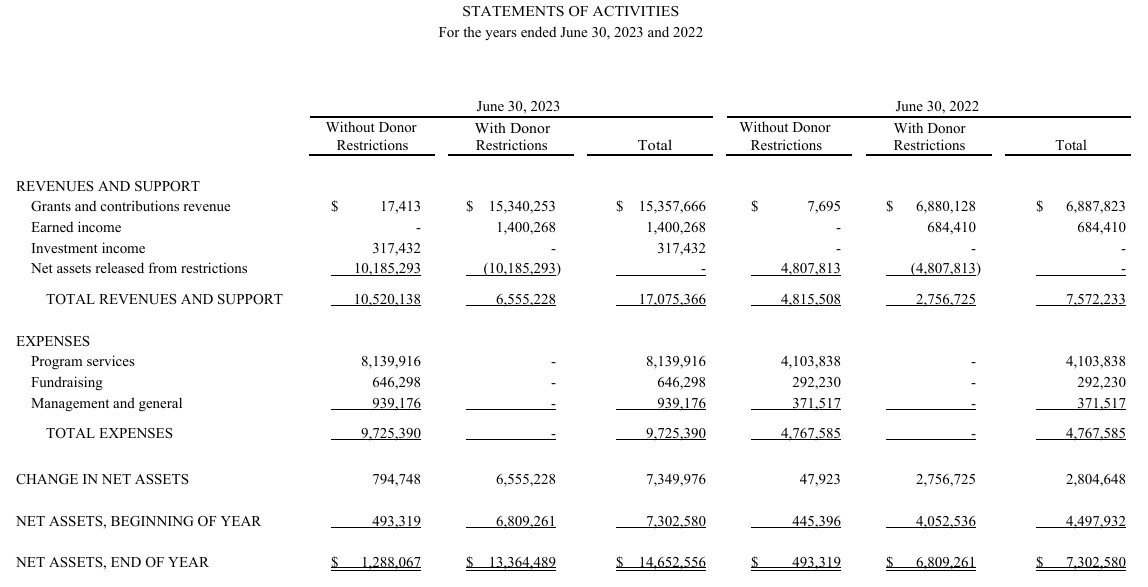

Statement of Activities

This report shows how your financial position changed over time. Unlike a business’s income statement, it focuses on:

- Net income from all sources (grants, donations, program fees)

- Expenses by function and purpose

- Changes in donor restrictions

- Overall change in net assets

- Investment gains or losses

The key to proper nonprofit accounting is tracking and understanding how financial resources align with donor restrictions and nonprofit accounting rules. A $10,000 unrestricted donations are managed differently from a $10,000 grant earmarked for specific programs.

Here’s an example of a statement of activities:

Image via Code for Science and Society

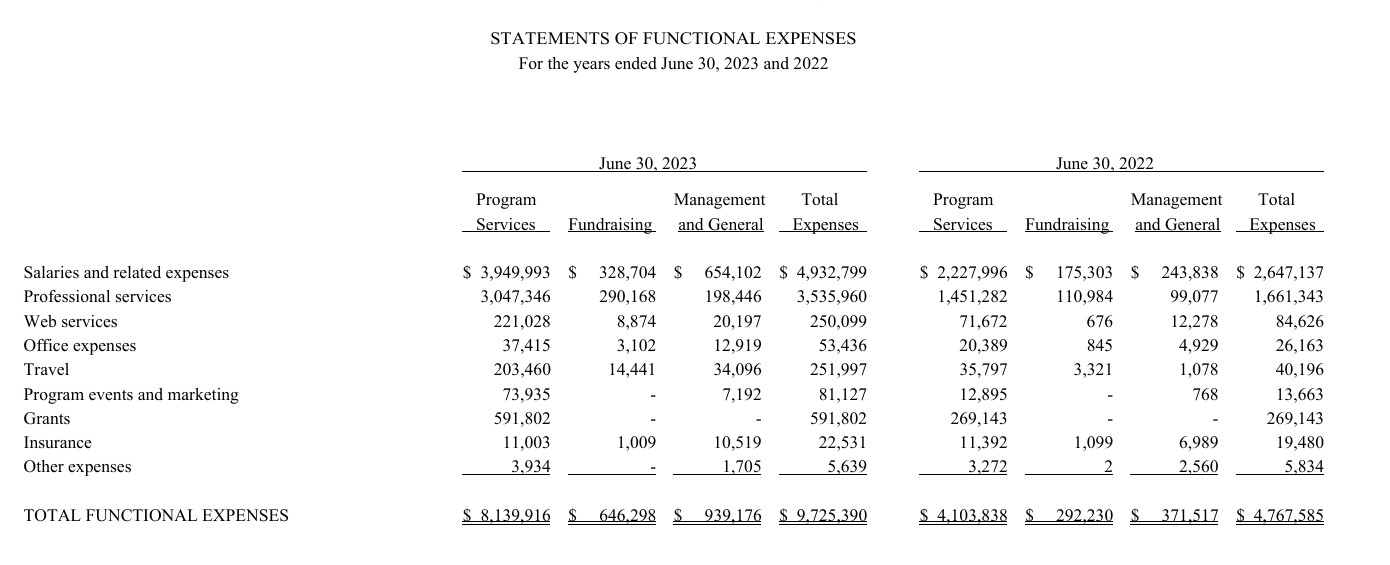

Statement of Functional Expenses

Here’s where you show donors and regulators how you’re spending their money:

- Program costs (direct service expenses like supplies, and program staff salaries)

- Management costs (office rent, utilities, admin staff, insurance)

- Fundraising expenses (event costs, grant writing, donor management)

Most nonprofits aim for a healthy ratio. They try to keep program expenses high while managing necessary overhead costs. Your donors want most of their money to go directly to your cause.

Here’s a great example of a statement of functional expenses from Code for Science and Society:

Image via Code for Science and Society

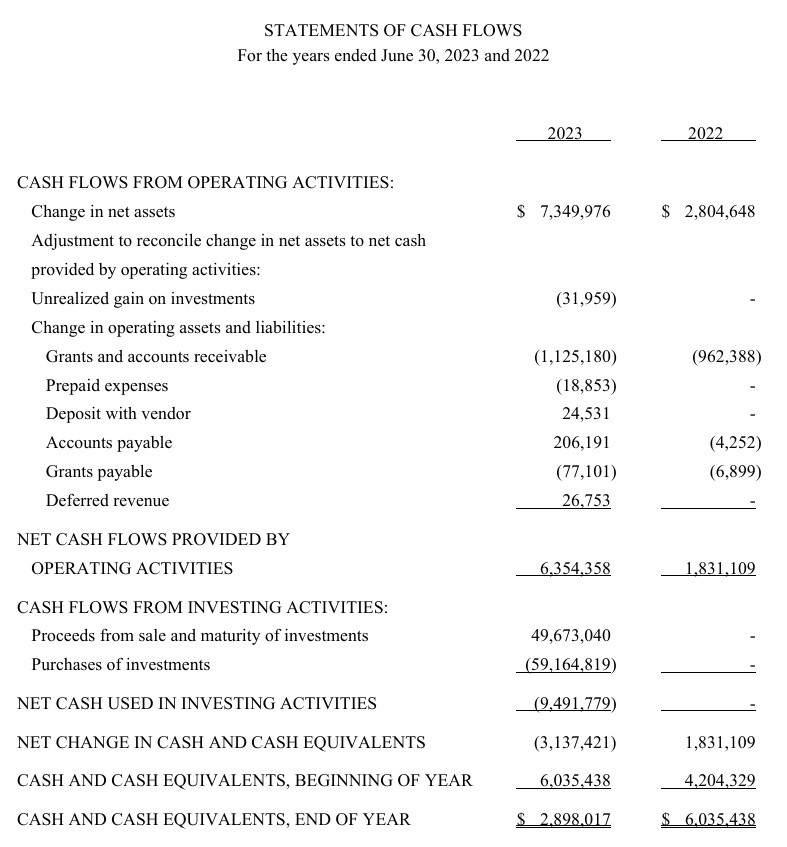

Statement of Cash Flows

Cash flows matter—even when profit isn’t your goal. The statement of cash flows tracks your financial transactions, including investing activities and operating expenses.

Good cash flow management helps avoid costly situations like borrowing money while waiting for grant payments.

Here’s an example of a statement of cash flows:

Image via Code for Science and Society

Here’s a simple example to show how these statements work in real life:

Say your youth mentoring program receives a $100,000 grant. The Statement of Financial Position shows this as a restricted asset.

The Statement of Activities tracks how you use it throughout the year—maybe $80,000 for mentor training, $15,000 for program staff, and $5,000 for required reporting.

The Statement of Functional Expenses breaks this down into program costs versus administrative expenses. The Statement of Cash Flows shows you received the money in January but spent it gradually through December.

Getting your nonprofit accounting statements right involves more than just compliance and building trust. Clear financial statements and financial records help you track your organization’s mission and:

- Show donors their money is making an impact

- Meet regulatory requirements without stress

- Make better decisions about programs and spending

- Plan for your organization’s future

- Build credibility with foundations and major donors

You May Also Like:

Compliance and Reporting Requirements

Let’s discuss the nonprofit accounting rules and requirements that keep organizations compliant. While handling annual tax forms and maintaining audited financial statements isn’t particularly exciting, proper accounting practices help maintain your nonprofit status and support your organization’s operations.

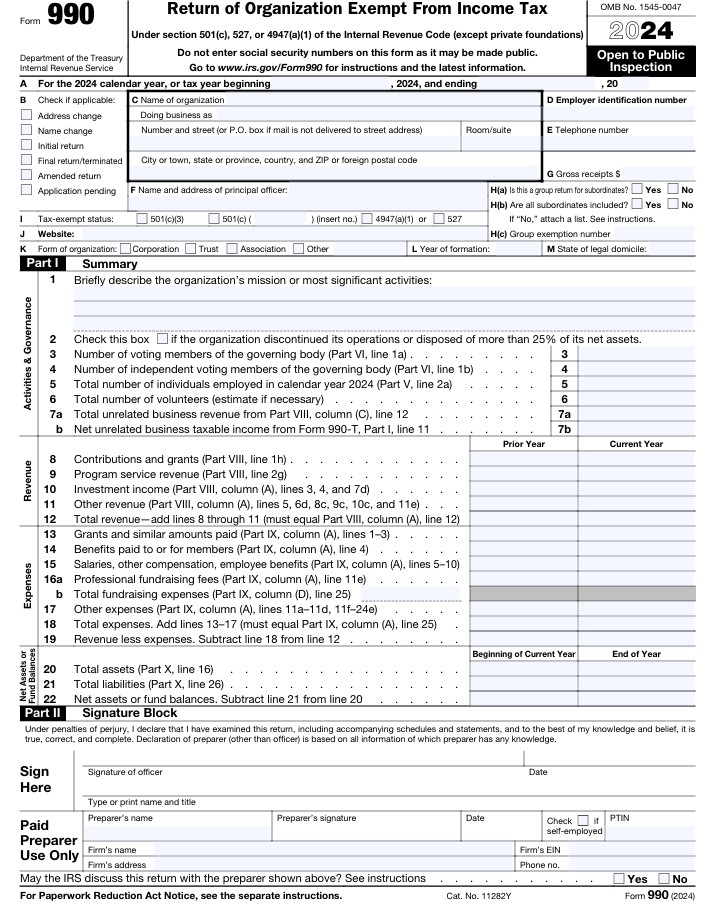

Form 990

Every tax-exempt organization needs to file Form 990 with the IRS. It’s like your nonprofit’s annual report card, showing:

- How much money came in

- Where it went

- Who’s on your board

- What you accomplished

- Top staff salaries

Here’s the catch: anyone can look up your 990 online. Donors often check these forms before making big gifts, so accuracy matters. You could lose your tax-exempt status if you miss the deadline or file incorrectly.

Small nonprofits might qualify for simpler forms (990-EZ or 990-N), but the basic requirements remain unchanged.

Here’s what the Form 990 looks like:

Image via IRS

FASB Guidelines

The Financial Accounting Standards Board (FASB) sets the rules for nonprofit accounting. Recent updates show how to:

- Report restricted funds

- Show expenses by function and nature

- Present investment returns

- Handle operating measures

- Report liquidity information

These guidelines help create consistency in how nonprofit organizations handle financial information and follow generally accepted accounting principles.

State Requirements

Each state has its own requirements for nonprofits. However, most require that you complete the following:

- Register before fundraising

- File annual financial reports

- Submit audit reports if you’re over certain income levels

- Renew registrations yearly

- Report significant changes in operations

Some states are stricter than others. For example, New York and California have detailed reporting requirements, while other states might be more relaxed. Check your state’s charity office website for specific rules.

When Do You Need an Audit?

Many nonprofit organizations need audited financial statements and internal audits, especially if they manage significant financial resources or federal funds over $750,000. Other factors could include:

- Your state requires it based on revenue

- A major grant demands it

- Your board requests one

Quality internal audits and audited financial statements aren’t cheap, but they’re worth it. They help mission-driven nonprofit organizations identify issues early and build trust with donors, unlocking additional funding opportunities.

Many foundations won’t even look at grant applications without audited statements.

You May Also Like:

Managing Donors in Nonprofit Accounting

Every dollar a nonprofit receives has an origin and intended purpose. That’s why donor management is essential. It’s more than just relationship building; it’s a crucial part of nonprofit accounting that ensures every contribution is properly recorded, tracked, and used according to donor wishes.

Types of Donors and Their Nonprofit Accounting Needs

Different funding sources come with different nonprofit accounting requirements. Understanding these variations helps nonprofits set up appropriate tracking systems and maintain compliance with each donor type’s expectations.

Individual Donors: They are the backbone of many nonprofits. These supporters range from small one-time givers to major philanthropists, and their donations require careful tracking of gift dates, amounts, and restrictions. Nonprofit accounting ensures that these donors receive accurate tax documentation and impact reports, encouraging continued support.

While managing individual gifts might seem easy, they often require sophisticated tracking systems. These systems handle recurring donations, matching gifts, and varying restriction levels.

- Corporate Donors: These organizations often provide both financial and non-monetary support. Nonprofit accounting practices must accurately value and track these various contribution types, manage gift programs, and provide detailed documentation that meets corporate reporting requirements.

Corporate donations frequently come with specific recognition requirements and usage restrictions that need careful monitoring in your nonprofit accounting system.

- Foundation Donors: Foundations generally offer larger, restricted grants that require the most rigorous nonprofit accounting oversight. Their gifts need careful tracking to ensure funds are used as specified, with detailed reporting on spending and impact.

Nonprofit accounting systems must be equipped to handle complex grant requirements and reporting schedules. These donors often require separate bank accounts and detailed expense tracking.

- Government Funders: This is the most demanding category in terms of compliance and documentation. Government funding requires specialized nonprofit accounting procedures to track every dollar spent, often with specific cost allocation requirements and detailed audit trails.

These funds often come with strict spending guidelines and reporting requirements that demand robust nonprofit accounting controls.

Managing Donations in Your Nonprofit Accounting System

Once you understand your donor types, the next step is ensuring your nonprofit accounting system accurately manages donations in these three broad areas:

Initial Processing

Every donation must be accurately documented, and this entails more than recording the basic transaction details. It also involves documenting the donor’s restrictions, designations, or special handling requirements.

Effective nonprofit accounting requires promptly recording the amount and date of each donation, noting any donor restrictions, and ensuring that necessary acknowledgments and tax documentation are provided. This initial step sets the foundation for all future tracking and reporting.

Ongoing Management

Different donations require different levels of tracking and oversight. A one-time unrestricted gift needs basic transaction recording, while a multi-year restricted grant requires continuous monitoring.

Your nonprofit accounting practices should include regularly monitoring restricted fund usage, tracking pledge payment schedules, managing matching gift requirements, and documenting compliance with donor terms.

This ongoing oversight helps prevent the accidental misuse of restricted funds and ensures compliance with donor requirements.

Reporting and Stewardship

Finally, donors should see the impact of their contributions. Good nonprofit accounting practices help you create accurate, timely financial reports, demonstrate proper fund usage, track program outcomes against expenses, and provide clear impact measurements.

Likewise, regular reporting builds donor trust and often leads to continued support. Your nonprofit accounting system should make it easy to generate standard financial reports and customized impact statements showing donors how their support advances your mission.

By maintaining these three focus areas, your nonprofit accounting system helps build donor trust while ensuring compliance with all requirements. This comprehensive approach to donor management through proper nonprofit accounting practices helps create sustainable funding relationships that support your organization’s long-term success.

You May Also Like:

Fund Accounting Deep Dive

Managing finances through a proper nonprofit accounting system means dealing with different types of funds.

Unlike for-profit organizations, where there is a unified tracking system, nonprofit organizations are restricted to separate tracking of financial transactions.

Good fund management keeps donors happy, auditors satisfied, and your programs running smoothly.

Types of Funds

Nonprofits typically handle three kinds of money:

- Unrestricted funds: The flexible money you can use for any legitimate purpose. Think general donations or program fees.

- Temporarily restricted funds: Money earmarked for specific projects or time periods. Maybe it’s a grant for next year’s youth program or donations for a new building.

- Permanently restricted funds: Here you can only use the interest, not the principal. These funds need extra careful handling and often have specific investment rules.

Managing Multiple Funding Sources

Let’s say you run a food bank. You might have:

- A grant specifically for buying fresh produce

- General donations for any food purchases

- A special fund just for warehouse equipment

- Monthly donor contributions for operating costs

- A capacity-building grant for staff training

- Restricted funds for a new delivery truck

Each funding source comes with its own nonprofit accounting rules and reporting requirements. Following generally accepted accounting principles helps prevent issues with donors and audited financial statements.

Tracking Restricted Funds

Here’s what good fund tracking looks like:

- Separate accounts in your books for each restriction type

- Clear documentation of donor restrictions

- Regular checking to make sure funds go where they should

- Systems to track when temporary restrictions expire

- Reports showing how the restricted money was used

- Clear processes for handling mixed-purpose donations

Common mistakes include using restricted funds for the wrong purpose or forgetting to “release” funds from restriction when you’ve met the requirements. Both can cause major problems during audits.

Best Practices for Fund Management

The key to a good fund accounting system involves more than just tracking money. It includes establishing internal controls and following nonprofit accounting rules that help prevent mistakes. This helps nonprofit organizations maintain their financial health while serving their mission. Some best practices include:

- Setting up separate bank accounts for major restricted funds

- Using accounting software with strong fund-tracking features

- Creating approval processes for expenses from restricted funds

- Training all staff who handle money on restriction rules

- Regular reconciliation of restricted fund balances

- Clear communication with donors about fund usage

- Monthly review of restriction requirements and deadlines

Nonprofit-Specific Financial Metrics

Measuring success through nonprofit accounting takes different metrics than for-profit accounting. Here’s how successful nonprofit organizations track their financial health and monitor key financial statements.

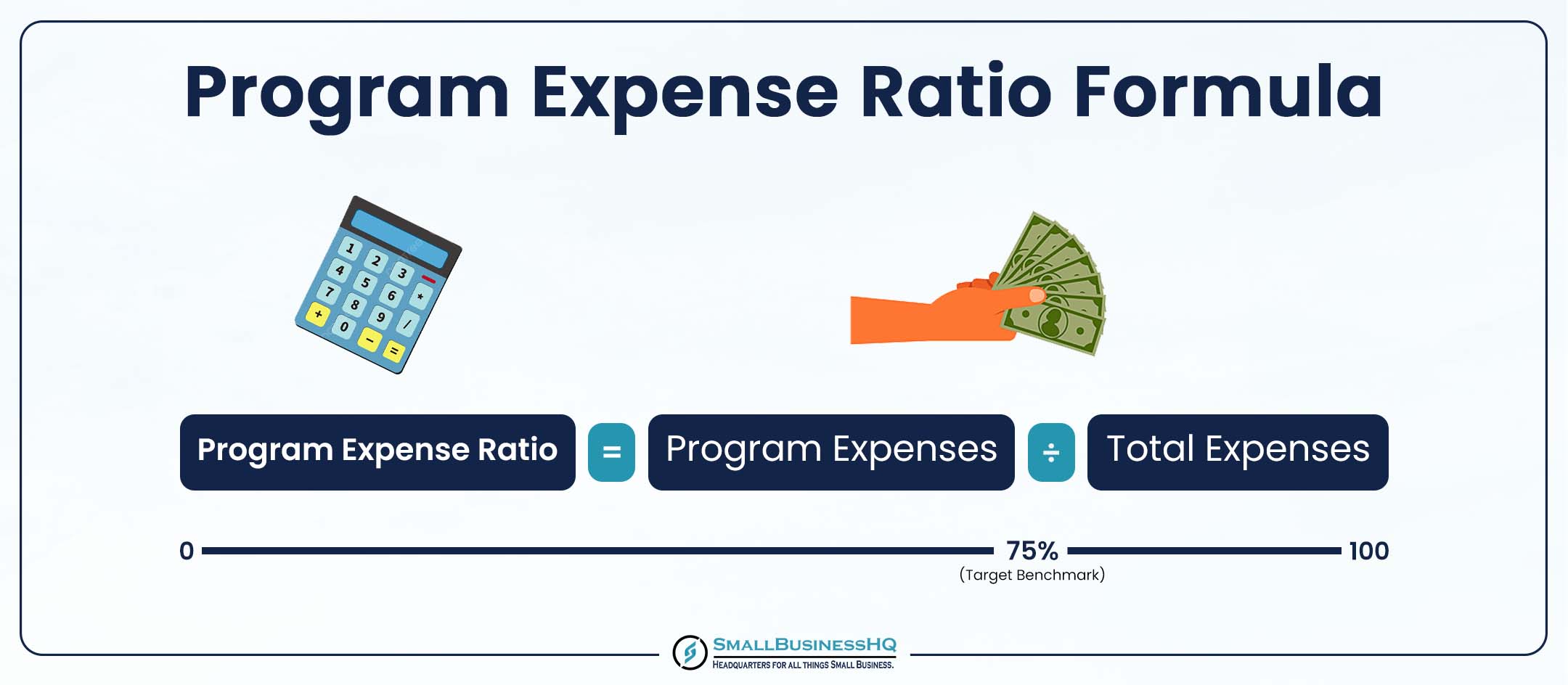

Program Expense Ratio

This shows how much of your money goes directly to your mission. To calculate it:

Program Expenses ÷ Total Expenses = Program Expense Ratio

Most nonprofits aim for 75% or higher. However, it’s important not to obsess over this figure. A small nonprofit might need to spend more on overhead costs to build a strong foundation. Whereas your type of work might need more administrative support than others.

For instance, mental health nonprofits often have high administrative costs because of licensing and compliance requirements.

Fundraising Efficiency

Want to know if your fundraising efforts are worth the cost? Here’s the math:

Total Fundraising Expenses ÷ Total Contributions = Cost Per Dollar Raised

For example, if you spent $50,000 on fundraising and brought in $500,000, that’s 10 cents to raise each dollar.

Most nonprofits try to keep this under 35 cents per dollar. But this varies by fundraising method. Direct mail might cost more per dollar than major donor outreach. New donor acquisition usually costs more than keeping current donors.

Operating Reserve Ratio

This tells you how long you could keep running if all income stopped tomorrow:

Net Assets Without Donor Restrictions ÷ Average Monthly Expenses = Months of Operating Reserve

Aim for at least three months of reserves. Six months is even better, but a reserve of less than one month can cause potential cash flow problems.

Your specific needs might vary—organizations with government contracts might require bigger reserves to handle payment delays.

Administrative Cost Ratio

This shows how much you spend on overhead:

Administrative Expenses ÷ Total Expenses = Administrative Cost Ratio

The old rule was to “keep it under 20%,” but that’s changing. Many experts now say focusing too much on low overhead can hurt your mission because you underinvest necessary tools and talent. Strong administrative systems often lead to better program outcomes.

Using These Metrics Wisely

Don’t look at any financial health metric in isolation. Successful nonprofit organizations consider their complete financial position when making decisions.

For instance, a low program expense ratio might mean you’re investing in technology that will improve efficiency later. Likewise, high fundraising costs may be justifiable if you build a donor base from scratch.

What matters is the overall picture of your organization’s financial health and impact.

You May Also Like:

Common Nonprofit Accounting Challenges

Running a nonprofit brings unique financial challenges that require careful attention. Understanding these common hurdles in nonprofit accounting helps organizations better prepare for and address them.

1. Restricted Fund Management

One of the biggest challenges in nonprofit accounting is managing restricted funds. When donors specify how their money should be used, organizations must track these funds separately and ensure they’re only used for designated purposes.

This becomes especially complex when:

- Managing multiple restricted grants simultaneously

- Tracking partial restriction releases

- Allocating shared costs across restricted and unrestricted funds

- Documenting compliance with various donor requirements

2. Staff Turnover and Training

Many nonprofits struggle with maintaining consistent financial management due to staff changes. High turnover in nonprofit accounting positions can lead to:

- Loss of institutional knowledge about specific donor requirements

- Gaps in compliance procedures

- Inconsistent reporting methods

- Disrupted audit preparation

- Delayed financial reports

Finding qualified replacements who understand both accounting principles and nonprofit-specific requirements is challenging.

3. Resource Constraints

Financial limitations affect nearly every aspect of nonprofit accounting operations. When budgets are tight, organizations often can’t afford the robust accounting software that would streamline their work.

Many nonprofits struggle to properly separate duties because their staff frequently take on multiple responsibilities. When budgets are constrained, professional development and training frequently become the first areas to face reductions, resulting in staff struggling to adapt.

These constraints create a challenging cycle: limited resources make it harder to implement efficient systems, while inefficient systems strain already limited resources.

4. Compliance and Reporting Burden

The sheer volume of reporting requirements can overwhelm even well-staffed nonprofits. Beyond the annual Form 990, organizations often juggle multiple grant reports, each with its own deadline and format requirements.

State charitable registrations need regular updating, while donor restriction compliance demands ongoing documentation. Board members expect regular financial updates, and program managers need budget reports.

Managing this reporting maze requires careful planning and robust nonprofit accounting systems that produce accurate, timely information in multiple formats.

5. Multiple Revenue Stream Management

Most organizations rely on various funding sources, creating complex nonprofit accounting requirements.

For instance, government grants demand specific reporting formats and deadlines, while foundation grants might operate on different fiscal years. Likewise, individual donations come with their complexity and varying restrictions.

While many start with basic tools, growing nonprofits often need robust accounting software for nonprofit organizations to handle complex funding streams effectively. Every source requires a tailored accounting strategy to align with the organization’s comprehensive financial framework.

6. Technology Adoption and Integration

The promise of improved efficiency through technology often comes with its own hurdles in nonprofit accounting. Understanding the benefits of accounting software can help organizations make better decisions about technology investments, even with limited resources.

Organizations must carefully evaluate accounting software options against their specific needs, considering current requirements and future growth. For instance, cloud-based accounting solutions offer particular advantages for nonprofits, allowing remote access and automatic backups.

You May Also Like:

7. Audit Preparation Challenges

Annual audits often reveal gaps in nonprofit accounting practices. Common issues include:

- Incomplete documentation of transactions

- Missing support for restricted fund usage

- Inadequate tracking of in-kind donations

- Poor expense allocation documentation

- Insufficient internal control documentation

The audit process strains resources, taking staff time away from regular duties and often revealing areas needing improvement.

8. Cost Allocation Complexities

One of the most nuanced challenges in nonprofit accounting is the art of cost allocation. Determining how to distribute these expenses equally becomes a complex puzzle when multiple programs share staff, space, and resources.

Different donors may have conflicting requirements on cost allocation. So, the program managers need accurate cost information to make decisions.

Organizations must develop allocation methods that are fair, defensible, and consistently applied across all programs and funding sources. This delicate balancing act requires technical expertise and careful documentation to satisfy various stakeholder requirements.

9. Financial Strategy and Planning

Strategic financial planning poses a unique challenge in the nonprofit sector. Unlike businesses that can focus primarily on profit margins, nonprofits must balance mission impact with financial sustainability.

Creating realistic budgets becomes challenging when funding isn’t guaranteed. In such situations, the immediate needs of the program take precedence over the building of operating reserves.

Organizations must constantly weigh program expansion opportunities against financial constraints, all while managing irregular cash flow patterns typical of grant funding cycles.

10. Board Communication and Oversight

Effective board oversight requires a delicate balance in financial communication. Board members bring varying financial expertise, yet all need to understand the organization’s financial position well enough to fulfill their fiduciary responsibilities.

Financial staff must translate complex nonprofit accounting concepts into clear, actionable information without oversimplifying critical details. Regular updates need to provide enough detail for non-financial experts to make informed decisions.

11. Risk Management

Financial risk takes on special significance in nonprofit accounting. Even small financial missteps can have major consequences when an organization operates on public trust and donor confidence.

Beyond basic fraud prevention, nonprofits must consider how their financial decisions affect their reputation and donor relationships. Create robust systems for protecting funds, donor data, and organizational assets.

Investment decisions can be incredibly complex when managing endowments or restricted funds. It is essential to strike a careful balance between preserving the principal and generating the necessary income.

Nonprofit Accounting Best Practices

Now that we’ve discussed the common challenges in nonprofit accounting let’s explore proven practices that help organizations overcome these obstacles. While every nonprofit faces unique circumstances, these fundamental strategies help build strong financial management systems that work.

1. Establish Strong Internal Controls

Small mistakes can turn into big problems without proper internal controls. Implementing internal controls means creating checks and balances, with accounting professionals helping separate financial transactions among team members.

Most importantly, document who can access what and review these controls regularly. Even small nonprofits can implement basic controls. If you’re short-staffed, get board members involved in regular financial reviews.

You May Also Like:

2. Create a Rock-Solid Documentation System

Think of financial records as insurance for your organization. Nonprofit accounting best practices include keeping detailed documentation of every transaction. This helps nonprofit accountants maintain transparent financial records and track their mission progress.

When you receive restricted donations, maintain clear financial records that help nonprofit accountants and board members properly track limitations.

Set up a logical filing system that anyone can understand, and always maintain digital backups. Yes, it takes time, but good documentation makes everything else easier—from grant reporting to tax preparation. Likewise, keep a tax deduction cheat sheet handy for quick reference during donor inquiries.

3. Make Monthly Reconciliation Non-Negotiable

Don’t wait until the annual tax form season to review your books. Set aside time monthly for internal controls, matching bank cash flow with your financial records.

Check that payroll taxes were paid correctly and look for any unusual patterns. If you spot discrepancies, investigate them immediately. Regular reconciliation catches problems while they’re still small and manageable.

4. Monitor Key Performance Indicators

Strong nonprofit accounting isn’t just about tracking transactions; it involves measuring your organization’s financial health. Modern accounting software can automate this monitoring process, generating regular reports that help organizations track their financial health indicators.

Beyond basic financial ratios, track indicators that show your resource efficiency and program sustainability. Monitor trends in donor retention rates, program cost per beneficiary, and operating reserve levels.

Regularly reviewing these metrics helps spot potential issues before they become problems. It also helps identify areas where your organization can improve its financial efficiency.

5. Build Trust Through Transparency

Open communication through transparent financial records builds donor confidence. Regular financial statements help board members and stakeholders understand your financial health.

Share regular financial updates with your board. You can also post clear, understandable annual reports on your website.

Respond promptly and honestly when donors ask questions about how you used their money. Make your financial policies public and explain complex financial matters in simple terms.

6. Develop Succession Planning for Financial Roles

Financial knowledge often resides in the heads of key staff members. Create systems that ensure continuity in your nonprofit accounting practices.

Document unique donor requirements, special handling procedures, and the reasoning behind key financial policies. Cross-train staff on essential functions and maintain clear process documentation. This preparation helps your organization maintain strong financial management even when key personnel changes occur.

7. Plan for the Unexpected

Don’t let surprises derail your organization’s operations. Strong internal controls and proper financial resource management help protect your mission.

So, keep your insurance coverage up to date. Back up financial data regularly and store copies offsite. Ensure more than one person knows how to handle key financial tasks.

Review and update your financial procedures yearly. Stay informed about changes in nonprofit regulations that might affect you.

Solid nonprofit accounting practices and a strong fund accounting system help nonprofit organizations avoid issues with their financial position and maintain their nonprofit status.

Key features:

- Member database integration

- Event management tools

- Automated bookkeeping

- Donation tracking

- Website builder included

You May Also Like:

FAQ

1. What is nonprofit accounting?

Nonprofit accounting is a specialized system for tracking, managing, and reporting financial activities in nonprofit organizations.

Unlike traditional business accounting, which focuses on profit, nonprofit accounting monitors how organizations use their funds to achieve their mission.

Nonprofit accounting includes tracking restricted and unrestricted funds, program expenses, and donor contributions while ensuring compliance with specific regulations for tax-exempt organizations.

2. What accounting method do most nonprofits use?

Most nonprofits use accrual-based accounting rather than cash-based. They record income and expenses, not just when money is exchanged.

The accrual accounting method gives a more accurate picture of the organization’s financial health and helps track grants and restricted funds more effectively.

3. What is the formula for nonprofit accounting?

While there’s no single formula, nonprofit accounting follows this basic equation: assets = liabilities + net assets.

Net assets replace the “Owner’s Equity” seen in for-profit accounting.

Nonprofits don’t have owners but rather steward resources for their mission. Net assets can be with or without donor restrictions.

4. What is NGO accounting?

NGO (Non-Governmental Organization) accounting follows similar principles to nonprofit accounting but often deals with international funding sources and reporting requirements.

It typically involves managing multiple currencies, tracking restricted grants from various countries, and following different reporting standards depending on funding sources and operating locations.

5. How does fund accounting differ from regular accounting?

Fund accounting, commonly used by nonprofits, separates resources into different “funds” based on restrictions and purposes. This differs from regular accounting, which tracks your expenses and income. It helps ensure donor restrictions are honored and funds are used as intended.

6. How often should nonprofits conduct internal financial reviews?

Beyond annual audits, nonprofits should conduct monthly internal reviews of their financial position. This regular monitoring helps catch issues early and ensures proper fund management.

For instance, quarterly reviews of financial statements provide opportunities to assess trends and make strategic adjustments. Board finance committees should also review financial reports at least quarterly to maintain proper oversight.

7. How do nonprofits handle in-kind donations in their accounting?

In-kind donations require special handling in nonprofit accounting systems. These non-cash contributions must be recorded at fair market value at the time of donation. Organizations need clear policies for valuing different in-kind gifts, from simple supply donations to complex assets like real estate. Proper documentation of the valuation method is crucial for audit and tax reporting purposes.

You May Also Like:

Wrap Up

Nonprofit accounting can be especially tricky. However, you don’t need to be a CPA to get it right.

Focus on the basics: keep accurate records, track your funds carefully, and adhere to your policies. When things get complicated, don’t hesitate to seek help from your board, an accountant, or other nonprofits in your network.

When you get your finances in order, you can spend more time on what really counts—serving your community. Good luck!