From startups to large enterprises, choosing the right accounting system is crucial for any business. With the advancement in technology, the days of using Excel spreadsheets and manual processes are over.

You can now get real-time insights into your business’s financial health using some of the best SaaS accounting software solutions. Not only does it simplify small business bookkeeping for beginners, but it also enhances accuracy and streamlines your financial processes.

But with so many SaaS accounting software on the market, it can be overwhelming to choose the best fit for your business needs. In this blog post, we’ll explore the best SaaS accounting software based on features, ease of use, pricing, and overall value.

Whether you’re seeking scalability, advanced features, or affordability, our curated list will help you make an informed decision.

Let’s get started.

Quick Summary: Best SaaS Accounting Software by Type

- Best for Freelancers and Solopreneurs: FreshBooks, Wave Accounting, Zoho Books, Kashoo, Neat, Odoo, ZipBooks

- Best for Growing Businesses: QuickBooks Online, Xero, Sage Intacct, Oracle NetSuite

- Best for Invoicing: FreshBooks, Zoho Books, QuickBooks Online, Kashoo

- Best for Inventory Management: QuickBooks Online, Xero, Oracle NetSuite, Odoo

- Best Tools with Free Trial or Free Plan: Wave Accounting, Zoho Books, FreshBooks, Odoo, Kashoo, ZipBooks

How We Chose the Best SaaS Accounting Software Solutions

- User Base: Business needs vary by size. For instance, the best accounting software for a small business should include features like invoicing and tracking expenses. Our listed SaaS accounting solutions cater to small businesses and freelancers but also offer enterprise-grade capabilities.

- Core Accounting Features: At the minimum, the best SaaS accounting software should handle invoicing, income and expense tracking, and reporting. We included solutions that offer a robust set of features like bank reconciliation, mobile apps, and collaboration tools.

- Integration Capabilities: The modern business environment is interconnected, so seamless integration with your existing tools is crucial. We considered some of the best SaaS accounting software that offer good integration capabilities with popular business apps, such as CRM (Customer Relationship Management) and communication, to enhance your overall workflow efficiency.

- Affordability: Cost is a significant factor for businesses, especially small enterprises and solopreneurs. Our list of the best SaaS accounting software contains scalable pricing tiers with free trials, so you can choose one that matches your budget and needs.

- Data Security: Cybersecurity is one of the top challenges of financial accounting, which is understandable, considering the sensitive nature of financial information. That’s why data security is paramount when choosing the best SaaS accounting software. We prioritized platforms with robust security protections, data encryption, and backups to reduce the risk of data loss and breaches.

- Customer Support: Having knowledgeable customer support is essential for addressing issues or queries. Therefore, we included the best SaaS accounting software options with responsive customer support, onboarding assistance, and ongoing training for a smooth user experience.

11 Best SaaS Accounting Software

If you’re hunting for a game-changing accounting solution, your search ends here. We’ve simplified your decision-making process by spotlighting the top 11 best SaaS accounting software tailored for businesses in 2025.

We’ll explore the outstanding features, potential drawbacks and benefits of each accounting software. Don’t waste productive hours testing different tools. Leverage our insights so you can quickly identify the best SaaS accounting software for your business.

1. QuickBooks Online

Image via QuickBooks

Owned by Intuit, QuickBooks Online is an industry-standard accounting software for businesses of all sizes. It’s one of the best SaaS accounting software around, meaning it’s comprehensive, allowing you to track income and expenses, generate financial reports, and more.

It offers access to expert tax help, saving you time on tax filing. You can also get help from Intuit’s bookkeeping experts if you’re new to QuickBooks Online.

The experts automate financial management, reconcile accounts, and review reports, ensuring you start strong with the best SaaS accounting software options and run your business confidently.

QuickBooks Online is compatible with all devices. It also integrates with 750 business apps such as PayPal, eBay, and Square. These integrations eliminate manual data entry and make accounting easy, making QuickBooks one of the best SaaS accounting software available.

Key Features

- Mobile app to access QuickBooks Online data on the go.

- Real-time reporting tools to monitor cash flow and business performance.

- Streamline bill payments to keep up with vendor due dates.

- Track receipts, incomes, expenses, and bank transactions with ease.

- Cash flow management to get a bird’s eye view of your business balances and make informed financial decisions.

- Real-time inventory tracking to prevent understocking and overstocking.

- Smart invoicing to automatically track payments based on estimates.

- Automatic sales tax calculation to identify your taxable and non-taxable sales.

- Grant custom access to multiple users for accountant collaboration, employee time tracking, and limited report sharing with stakeholders

- Sync with online sales platforms like Etsy, Amazon, and Shopify to automatically access ecommerce data.

Pros

- Offers 30-day free trial

- Covers all kinds of businesses — product sellers, freelancers, startups, non-profits, making this a well-rounded option for the best SaaS accounting software.

- Has a user-friendly interface, enabling non-accountants to navigate the software with ease

- Every plan offers a free expert-guided setup session

Cons

- Access to 24/7 support and training resources is only available in the QuickBooks Online advanced plan

- Has expensive monthly plans compared to its competitors

- Each plan has limited users with QuickBooks Online Advanced, the highest tier, capped at 25 users

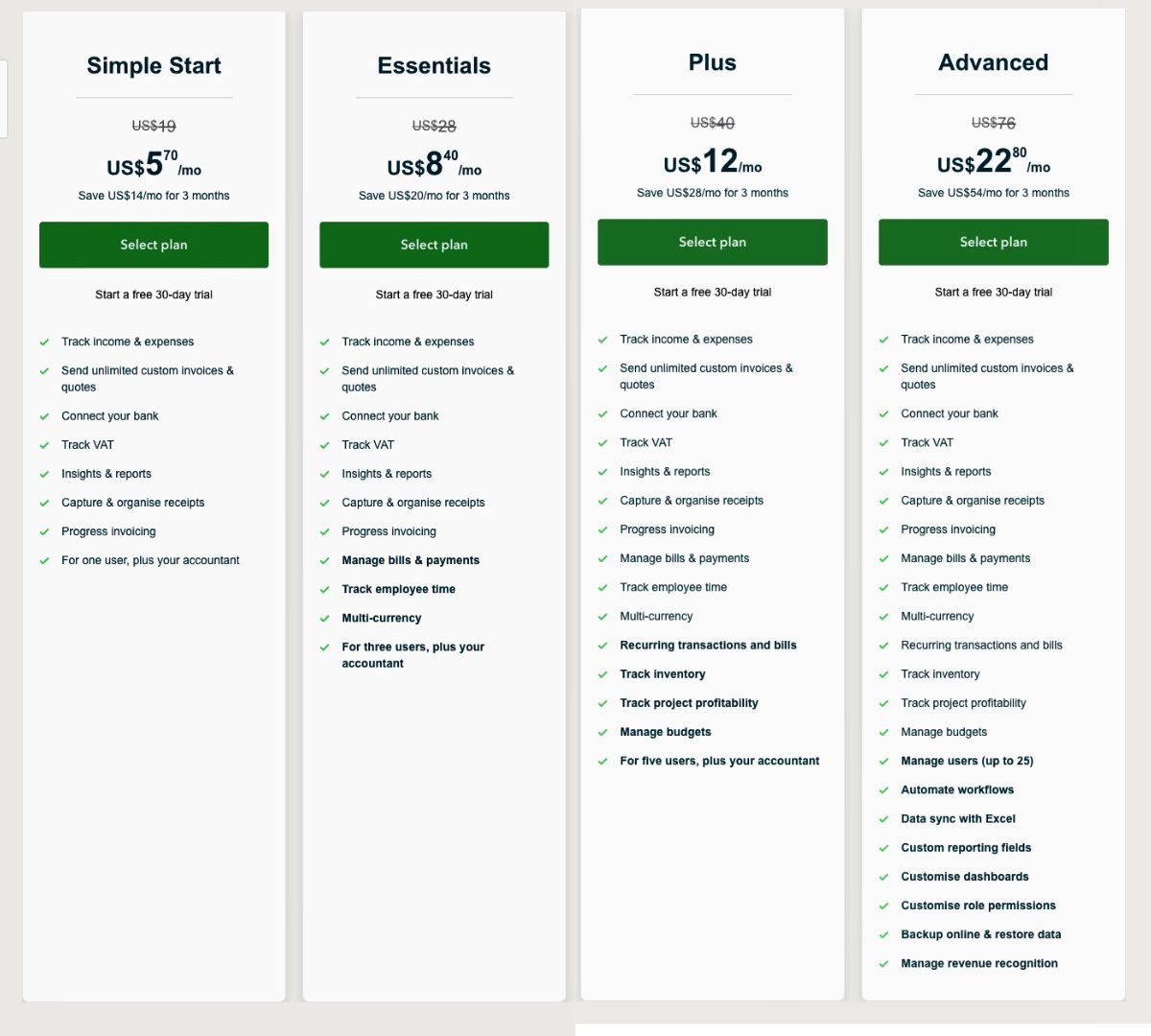

Pricing

QuickBooks Online is a popular SaaS accounting software that allows you to try its features for 30 days. It offers the following plans:

- Simple Start: $19 per month

- Essentials: $28 per month

- Plus: Usually $40 per month

- Advanced: $76 per month

Image via QuickBooks

Tool Level

- Intermediate

Usability

- Has a learning curve

2. Xero

Image via Xero

Xero is one of the best SaaS accounting software solutions for SMBs (small and medium-sized businesses). It provides financial management and accounting tools such as invoicing, reporting, bill payment, and bank reconciliation.

When it comes to project planning and implementation, Xero is one of the best SaaS accounting software options because it enables you to track project profitability using project account metrics. You’ll also enjoy the benefits of financial planning by allocating adequate resources for similar projects.

With Xero, you can work with your employees or finance and accounting teams in real-time, from any part of the world. You can also customize the SaaS accounting software to include the apps you need, reinforcing its position as one of the best SaaS accounting software choices.

Key Features

- Track bills from any location to facilitate timely payments

- Expense management tools for tracking and approving paperless expense claims

- Contact management tool stores contacts of suppliers and customers, including invoices and payments

- A simplified accounting dashboard for tracking account balances, reconciliations, cash flow, and outstanding invoices

- Track fixed assets online, update your books, and access financial reports all in one place

- Safely accept online payments via debit and credit cards straight from your Xero invoice

- Set up multiple sales tax rates, automatically calculate sales tax, and then use the reports to complete sales tax returns, to avoid costly tax mistakes

- Multi-currency tool converts financial transactions in over 160 currencies for accurate international business accounting

- Xero analytics tracks short-term and future cash flow, which helps avoid financial accounting challenges

Pros

- Allows you to try its accounting software for 30 days before making a payment

- Simple user interface for navigating complex processes like bank reconciliations

- Has an extensive knowledge center with courses, videos, and webinars for inexperienced users of the best SaaS accounting software tools

- Provides multiple layers of protection to secure the personal and financial information of users

- Permits unlimited users on one account

Cons

- Multi-currency is only available in the highest subscription plan

- The least subscription plan has several limitations such as 20 invoices and 5 bills monthly

Pricing

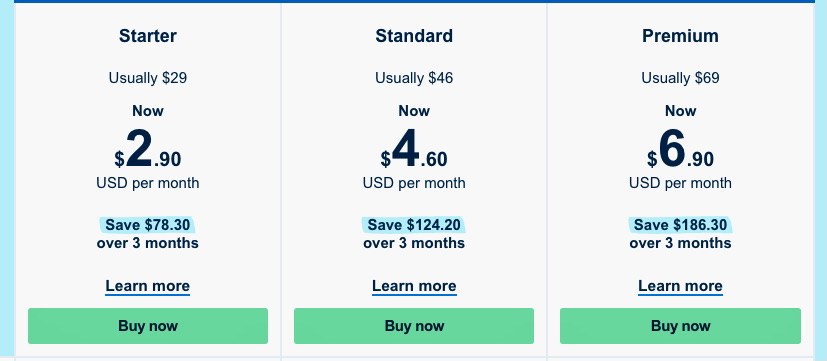

Xero has a 30-day free trial, and its paid plans include the following:

- Starter: $29 per month

- Standard: $46 per month

- Premium: $69 per month

Image via Xero

Tool Level

- Intermediate

Usability

- Moderately easy to use

You May Also Like:

3. FreshBooks

Image via FreshBooks

With over 30 million small businesses trusting FreshBooks and users saving an average of 553 hours per year, accounting has never been easier. It’s one of the best SaaS accounting software solutions ideal for any size of business — freelancers, self-employed, and businesses with contractors or employees.

The best SaaS accounting software should simplify complex financial processes, and FreshBooks does precisely that. It offers a helping hand through customized training to ensure standardization. The support team comprises real humans who are willing to stay on the line until you’re satisfied.

Additionally, like FreshBooks competitors, recurring tasks like invoicing, payrolling, and other admin tasks can be done easily with this tool. The software puts everything on autopilot using the right integrations so you can focus more on building your business.

Key Features

- Double-entry accounting tools to stay organized for tax calculation and filing

- Advanced accounting tools for tracking loans, assets, income, and expenses

- Ability to find an accountant and invite up to ten of their team members to help you file taxes, update your Chart of Account, and more

- Automated bank reconciliation with options to create summaries and export them to Excel

- Credits feature for tracking credit notes, prepayments, and overpayments

- Customizable invoices with automated payment reminders to nudge clients when it’s overdue

- Multi-currency billing process for sending invoices in your client’s preferred currency

- Easily transform your estimates into invoices

- Time tracking allows you to charge the right amount for billable hours

- Collaborate with your team on projects, share files, and keep tabs on tasks on the go using the project overview screen

- Accept credit cards online, ACH transfer, PayPal, and Stripe for global payments

- With over 100 integrations to simplify your accounting process, FreshBooks stands out as a top choice on the list of the best SaaS accounting software

Pros

- Offers a 30-day free trial; no credit card required

- Has an attractive user interface with an intuitive system that makes it beginner-friendly

- Has multiple channels for customer support — live chat, phone, email, knowledge base — and ensures easy access for non-accountants to explore and try the best SaaS accounting software options

- Provides mobile apps for Android and iOS users for on-the-go access

- Affordable and scalable pricing tiers as your business grows

Cons

- The least subscription plan lacks certain capabilities, such as customized onboarding services and double-entry accounting reports, which may deter freelancers

- Requires additional cost per month to add team members

- You can’t pay or receive payments unless you sign up for third-party apps like PayPal and Stripe.

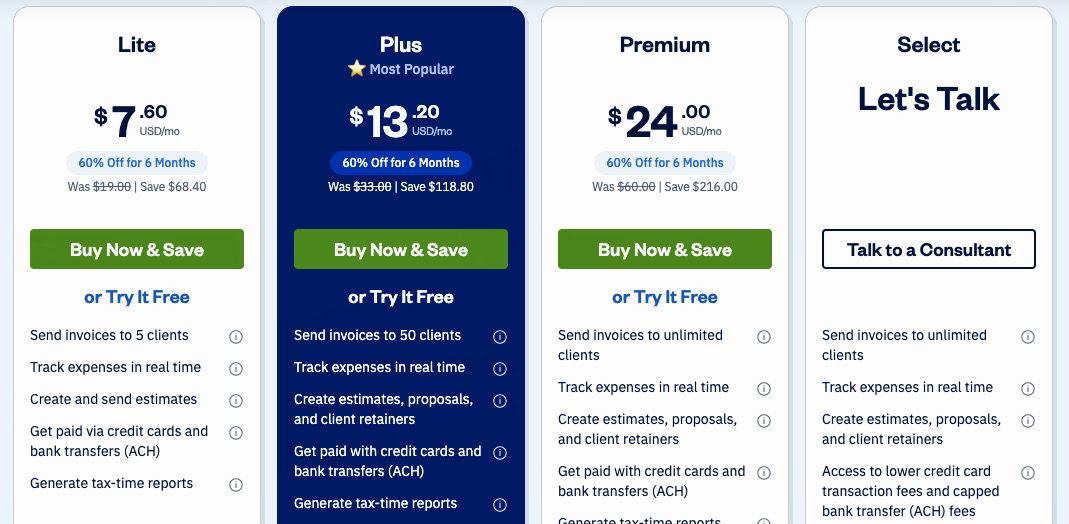

Pricing

FreshBooks offers a 30-day free trial and you don’t have to input your card details, which makes it a desirable option for Best SaaS accounting software. Below is its pricing information:

- Lite: $19 per month

- Plus: $33 per month

- Premium: $60 per month

- Select: Contact sales team

Image via FreshBooks

You can speak with FreshBooks’ specialist to get a custom plan if you run a business with employees.

Tool Level

- Beginner

Usability

- Easy to use

Also Read:

4. Wave Accounting

Image via Wave

Wave Accounting is among the best SaaS accounting software built for small businesses, freelancers, and self-employed entrepreneurs. It offers basic accounting services for free, which makes it a great option if you’re running a business with a tight budget.

You’ll get features like invoicing, estimates, billing, bookkeeping, and financial reports. However, you can access advanced features like accepting customer payments and running payroll at a fee.

When it comes to data security, which is often a crucial factor when choosing the best SaaS accounting software, Wave ensures your financial data is encrypted. It also protects its servers physically and electronically.

Key Features

- Double-entry accounting software, which is ideal for finance and accounting teams, enhances accuracy and saves time

- Invoice software that automatically syncs with your payment information, helping you maintain invoice best practices

- Unlimited credit card and bank connections for automated bank reconciliation

- Money management app for Android and iOS users, lets users manage businesses remotely with one of the best SaaS accounting software

- Mobile receipts automatically convert paper receipts into bookkeeping records for accurate tax filing

- A secure payment link for online payment processing via Apple Pay, credit cards, and bank deposits

- Automatic payroll helps you stay compliant with federal and state tax laws

- Recurring billing with flexible scheduling, time zone control, batch invoicing, and more

- Tax, accounting, and payroll coaching for new users to set up accurately

- Bookkeeping support for busy business owners looking to outsource bookkeeping tasks

Pros

- Offers a range of accounting features for free, which is an attractive point for businesses searching for the best SaaS accounting software with budget constraints

- Simplifies complex financial processes, allowing users to perform tasks with ease

- Enables unlimited invoicing, which is an excellent feature compared to paid accounting platforms

- Allows you to add an unlimited number of users with different levels of permissions

- Has accounting and payroll education centers, which are helpful guides for both first-time users and veterans looking for a refresher

Cons

- 24/7 customer support is only available on the paid plan or when you purchase an Add-on

- Charges extra fee for scanning and uploading receipts

- Lacks third-party integrations and advanced accounting features like inventory management and time tracking

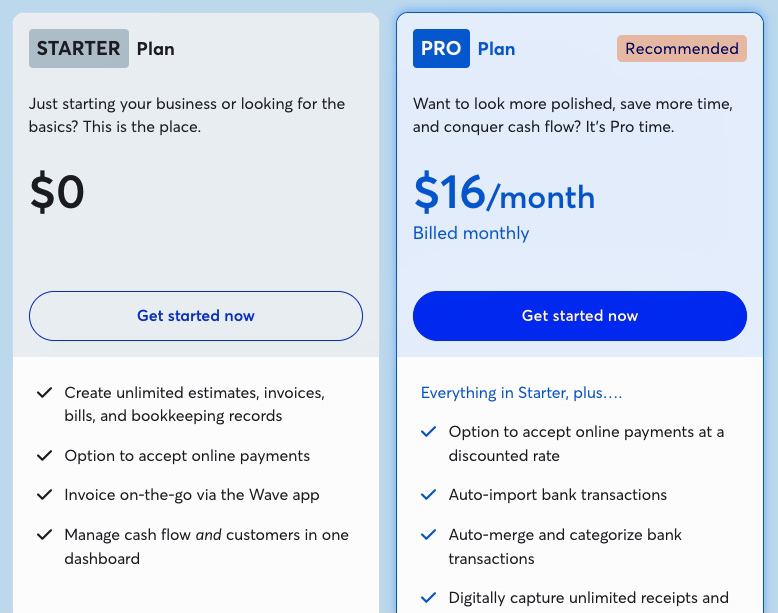

Pricing

- Starter Plan: $0

- Pro Plan: $16 per month

Image via Wave

Tool Level

- Beginner

Usability

- Easy to use

You May Also Like:

5. Zoho Books

Image via Zoho Books

Ranking among the best SaaS accounting software is Zoho Books. It’s an end-to-end online accounting software built to cater to the accounting needs of both startups and established enterprises. The accounting solution automates financial processes like invoicing, time tracking, inventory management, and payroll.

You can also manage your accounting on the mobile app, from creating personalized invoices to tracking expenses and bills. It’s compatible with Android, iOS, and Windows devices.

As your business grows, you can easily integrate Zoho Books with 50+ other apps from Zoho. This makes it the best SaaS accounting software for people who are already using one or more apps from the brand.

Key Features

- Customer portal for sharing quotes with customers, receiving bulk payments, and capturing customer feedback

- Vendor portal for updating vendors about payments, reducing the need for calls or emails

- Unified invoicing for sending customized invoices and getting paid in multiple currencies

- Retainer invoice for collecting advanced payment for projects

- Securely fetch transactions from bank and PayPal accounts and reconcile your accounts to stay tax-ready

- The projects feature enables you to track billable hours, manage multiple projects and related expenses, and more

- Inventory tracking organizes your inventory using categories like product images and SKUs and ensures you never run out of stock

- Online sales order management and processing enables you to customize sales orders and convert them into invoices or purchase orders

- Financial reporting tools offer insights into profit and loss, balance sheets, and cash flow, helping you make informed business decisions

- Document management system matches uploaded files with bank transactions so your accountant can access them online

Pros

- Offers a 14-day free trial for paid plans

- Has a wide range of features that integrate with other Zoho tools so you can have everything in one place. This is a crucial factor to look for in the best SaaS accounting software.

- Its tools are simple to use, making them beginner-friendly

- Provides customer support across its subscription tiers

- Uses two-factor authentication and encryption to secure transactions

Cons

- The highest subscription tier can only accommodate 15 users

- Limited integration with third-party apps

- Time tracking is only available for project management

Pricing

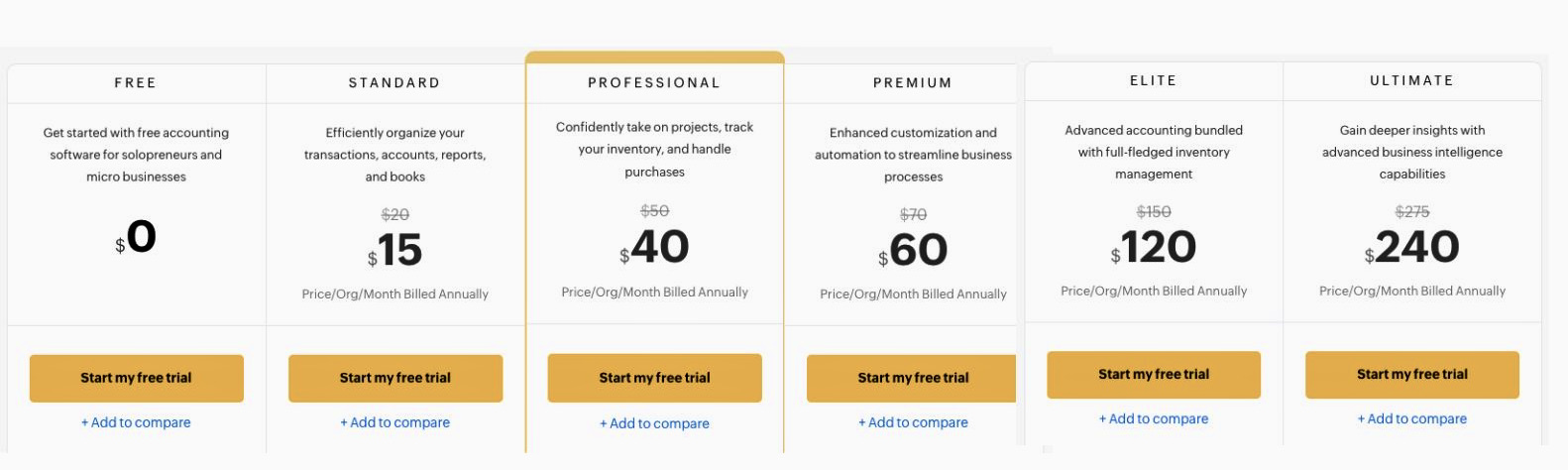

Zoho Books allows you to try its paid plans for 14 days. Here’s a list of its original plans and pricing:

- Free: $0

- Standard: $20 per month

- Professional: $50 per month

- Premium: $70 per month

- Elite: $150 per month

- Ultimate: $275 per month

Image via Zoho Books

Tool Level

- Beginner

Usability

- Easy to use

Also Read:

- Best Cloud Accounting Software For All Business Sizes

- Best QuickBooks Alternatives To Navigate Finances

6. Sage Intacct

Image via Sage

Sage Intacct is an enterprise-grade SaaS accounting solution with an intuitive interface that helps you achieve tasks with ease. It prides itself as the best SaaS accounting software solution that the American Institute of Certified Public Accountants (AICPA) recommends.

That’s because it combines AI-powered accounting with enterprise resource planning (ERP) tools to support overall business growth. And the good news is that this accounting software is scalable—your business can still fit in even if it’s growing rapidly.

With Sage Intacct accounting, payroll, and HR tools, you can automate manual tasks and increase your productivity by 40% or more. You can also utilize its extended accounting capabilities to manage your entire asset lifecycle and streamline global operations, making it a reliable option for your search for the best SaaS accounting software.

Key Features

- Dashboards and reporting offer insight into your financial health in real-time

- Intelligent General Ledger leverages AI and automation to streamline your accounting processes and improve accuracy

- Accounts receivable and accounts payable processes are automated, eliminating inefficiencies and increasing cash flow

- Multi-entity insights enable multinational or multi-entity businesses to manage all entity from a central dashboard

- Dimensions feature simplifies chart of accounts, categorizes transactions, and offers quick access to critical insights

- Salesforce integration to connect sales, revenue operations, and finance without scripting or third-party services

- Marketplace provides a vast array of integrations for every kind of business function

- Sales and use tax compliance software simplifies digital tax processes, helps you avoid common tax mistakes, and ensures jurisdiction compliance

- Time and expense management is important to make the best SaaS accounting software. It streamlines project accounting, prevents revenue leakage, and saves time

- Spend management streamlines purchasing processes and ensures you stay within the corporate budget

Pros

- Provides tailored solutions for various industries, such as agriculture, healthcare, and non-profit

- Its core features go beyond the basic accounting features you can find on other accounting platforms

- Offers community membership so you can connect with industry experts and peers, take certification courses, and gain more insight to help your business

- Provides 24/5 expert human support by phone

- Permits an unlimited number of users on a single account

Cons

- The user interface may overwhelm new users and small business owners

- Requires working with a Sage partner or reseller for easy and accurate setup

- The pricing isn’t transparent

Pricing

- Contact customer support

Tool Level

- Intermediate

Usability

- Has a learning curve

You May Also Like:

7. Oracle NetSuite

Image via NetSuite

NetSuite is a household name in the ERP industry, and its comprehensive suite of applications can streamline various business operations. It’s one of the best SaaS accounting software, with its cloud-based accounting being a key component of the ERP suite and offering a robust financial management solution.

NetSuite’s accounting modules are designed for businesses of all sizes and provide a unified platform for managing financial operations. The best SaaS accounting software solutions are considered to be customizable. NetSuite allows you to create your own user interface and add third-party integrations.

Also, as your business grows, the accounting software seamlessly integrates with CRM, HR, ecommerce, inventory management, and other apps in the NetSuite family.

Key Features

- General ledger automates journal entries and simplifies financial and statistical data for fast financial reporting

- Cash management provides real-time insights into cash flow and automates bank reconciliations

- Accounts receivable enables quick invoice generation and offers multiple payment channels to speed up collections

- Accounts payable automates your entire procure-to-pay process

- Account reconciliation speeds up transaction matching and identifies discrepancies in financial statements

- Tax management enables global tax compliance for 110 countries, eliminates manual calculations, and saves cost

- Financial close management standardizes close processes by providing checklists and consolidating multiple subsidiaries

- Fixed assets management facilitates lease and depreciation accounting and asset tracking

- Payment management reduces payment delays by allowing you to accept payment via debit and credit cards, direct deposit, and ACH payment

Pros

- Its automated processes reduce manual efforts and risk of errors in financial management

- NetSuite’s accounting solution is scalable, making it one of the best SaaS accounting software choice for pre-revenue and large corporations

- It has a comprehensive knowledge center with helpful articles and videos for navigating the software

- All NetSuite’s subscriptions include 24/7 phone support

- NetSuite allows you to access financial data in real-time, from any location with internet connectivity

Cons

- May pose a learning curve for smaller businesses that need a simple accounting software

- Its robust features may increase the cost of the software, making it relatively expensive for small businesses

Pricing

- Contact customer support

Tool Level

- Intermediate

Usability

- Moderately easy to use

Also Read:

8. Kashoo

Image via Kashoo

Touted as one of the best SaaS accounting software in the world for its simplicity, Kashoo is ideal for freelancers, contractors, and small business owners. It enables you to create professional invoices, track transactions, manage expenses, and file tax returns without seeking professional assistance.

Its graphs and charts are color-coded, enabling you to track relevant data at a glance. You can also track transactions by project to identify which clients or projects are more profitable.

The software prepares you for tax season by categorizing all transactions into CRA and IRS-approved categories. It also helps you organize your tax documents. Kashoo also implements multiple levels of data security, such as two-factor authentication and non-storage of bank login details. As a result, it sits among the best SaaS accounting software options.

Key Features

- Automated bookkeeping categorizes your transactions and posts them in the right place

- Seamlessly connect to over 5000 banks and credit unions without worrying about financial fraud

- KashooPay allows you to send a payment link with your invoice

- Smart inbox automatically recognizes your regular vendors and categorizes transactions

- The reports feature provides critical report financial statements within five minutes

- Multi-currency allows you to send invoices and view balances and reports in any currency

- The expenses feature separates your business spending from personal spending, sets a spending limit, and notifies you when you’re reaching the limit

Pros

- Has a 14-day free trial so you can try all its features before deciding to commit your money to a solution in the list of best SaaS accounting software

- Offers customer support through live chat, email, and phone

- Provides helpful guides and downloadable resources to help you grow your small business

- Allows you to easily import your trial balance, vendors, and customers from another accounting platform

- You can download the mobile app and make journal entries offline — the data automatically syncs when you’re back online

- It integrates with Google Workspace and third-party payroll services like Stripe

Cons

- Mobile app is only available for iOS users

- Lacks advanced features like time tracking, payroll, and document management

Pricing

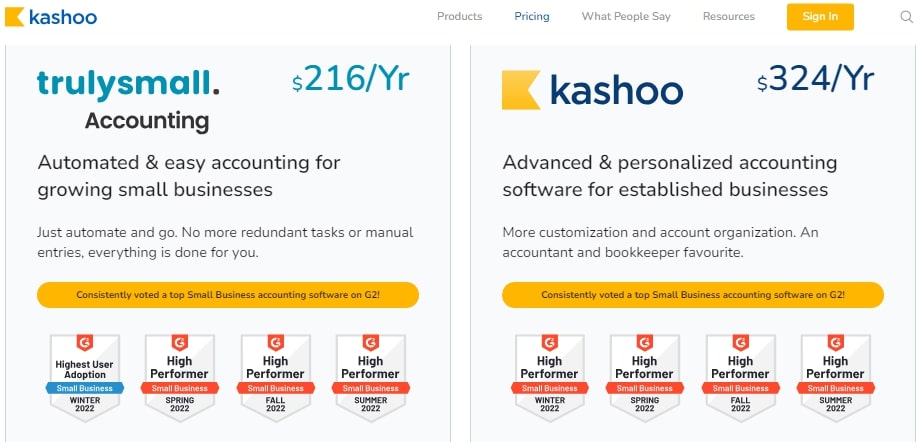

Kashoo offers 14 days free trial of some of the best SaaS accounting software tools, available in two subscription tiers:

- Trulysmall. accounting: $216 per year

- Kashoo: $324 per year

Image via Kashoo

Tool Level

- Beginner

Usability

- Easy to use

You May Also Like:

9. Neat

Image via Neat

Although Neat is primarily a document management tool, it joins the ranks of the best SaaS accounting software for how it combines document management with accounting functionalities. This helps streamline the way you handle paperwork and financial tasks. The platform is geared toward small businesses, offering tools for extracting vital accounting information from documents.

Through its mobile app, you can track expenses, income, spending, and sales for easy tax filing and reporting. You can also scan and upload receipts and Neat will automatically categorize them. This way, you’ll see what you’re spending on.

Although Neat’s accounting system is relatively new, the parent company has been around for some time. It prioritizes security and uses the highest bank standard encryption to prevent breaches, which is highly desirable for the best SaaS accounting software seekers. So, you can rest assured that your data is safe.

Key Features

- Receipt management for entering receipts and organizing them into categories

- Automated insights for viewing trends and insights from your cash balance, total sales, top expense categories, and more

- Reconciliation consolidates your data in one screen so you don’t have to worry about missing transactions

- Tax prep matches invoices and receipts to your credit card or bank transaction so you can file taxes quickly and accurately

- Data storage enables unlimited file sharing with your accountant or tax preparer, vendors, and clients

- Invoicing tool creates customized invoice and sends professional reminders

Pros

- Offers 14-day free trial, granting you full access to Neat’s standard plan

- Has unlimited monthly storage so you can keep storing documents and receipts to reduce paperwork

- Great for new businesses who are searching for the best SaaS accounting software that is easy for employees to master

- Provides unlimited email and chat support with access to a knowledge center

- Integrates seamlessly with various business apps like Microsoft Outlook, Mailchimp, and Turbotax

Cons

- Doesn’t have a monthly plan

- Can only access premium assistance, automated reports, and invoicing as an add-on

- Lacks payroll functionality

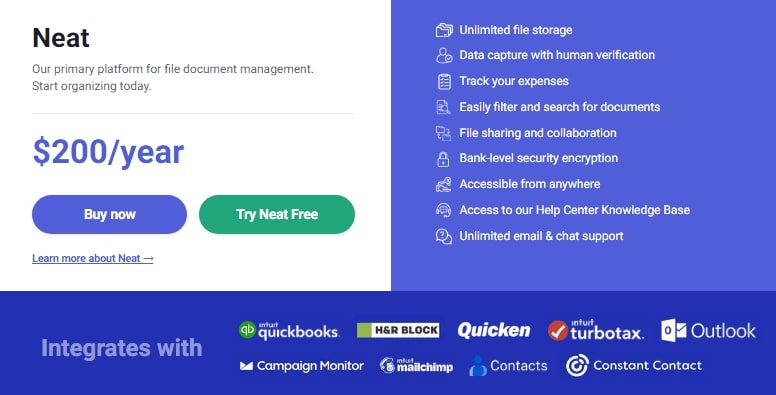

Pricing

You can try Neat free for 14 days, and then subscribe to its paid plan if you find it helpful.

- Neat: $200 per year

Image via Neat

Tool Level

- Beginner

Usability

- Easy to use

Also Read:

- What is Accounting Software? Everything You Need To Know

- Cloud Accounting vs Traditional Accounting: The Key Differences to Note

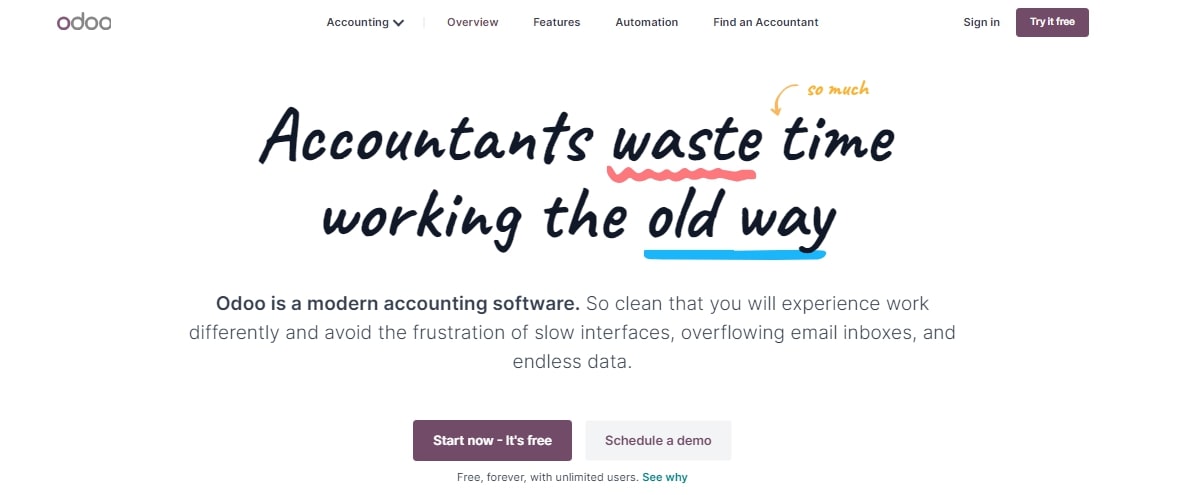

10. Odoo

Image via Odoo

Odoo is an open-source ERP system that houses various business applications, including cloud-based accounting. It’s the best SaaS accounting software for small businesses and solopreneurs who want a modern interface with accounting automation.

This accounting software automates bank feed synchronization, recurring invoices, and other repetitive accounting tasks. It also supports unlimited users and multiple company management.

What makes Odoo one of the best SaaS accounting software is its seamless integration with a wide range of apps across software categories like sales, HR, and productivity. You can also connect third-party apps using Odoo web service API.

Key Features

- Digital invoicing that leverages the power of AI to capture data from sales orders, timesheets, or subscriptions

- Get paid feature supports popular online payment gateways like PayPal, Stripe, and Alipay

- Pay bills enable automated wire transfer within the SEPA zone

- Bank and cash allows you to track financial transactions and import bank statement in different formats

- Tax engine supports various tax computations such as partial exemptions and percentage

- Budget management tracks your spending and compares account performance with other budgets

- Automatic entries enable you to adjust several journal entries at once

Pros

- Offers a 15-day free trial for its paid plans

- Has a mobile app for both Android and iOS users and works well with low internet connectivity

- Compatible with all countries, allowing you to configure the accounting software based on your country’s tax laws

- Odoo is scalable, which means that businesses in their growth stage can adapt one of the best SaaS accounting software to their changing needs

- Provides emergency lines and support ticket for customer support

Cons

- Odoo’s customer support doesn’t include configuration guidance unless you subscribe to one of its success packs

- No payroll software

Pricing

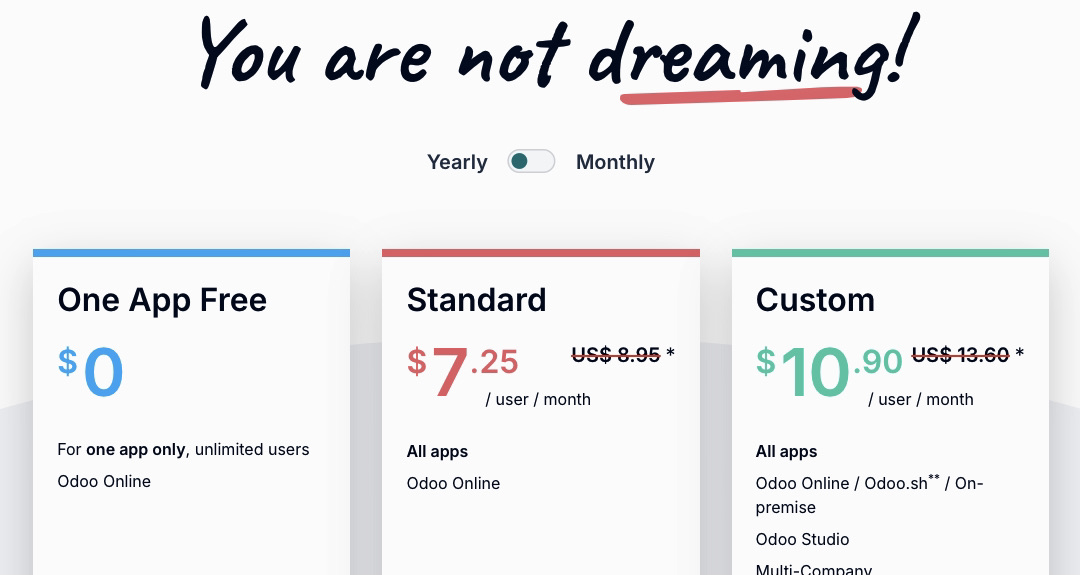

Odoo allows you to access all its apps for 15 days before making a payment. Its pricing plans are outlined below.

- One App Free: $0

- Standard: $7.25 per user per month

- Custom: $10.90 per user per month

Image via Odoo

Tool Level

- Beginner

Usability

- Easy to use

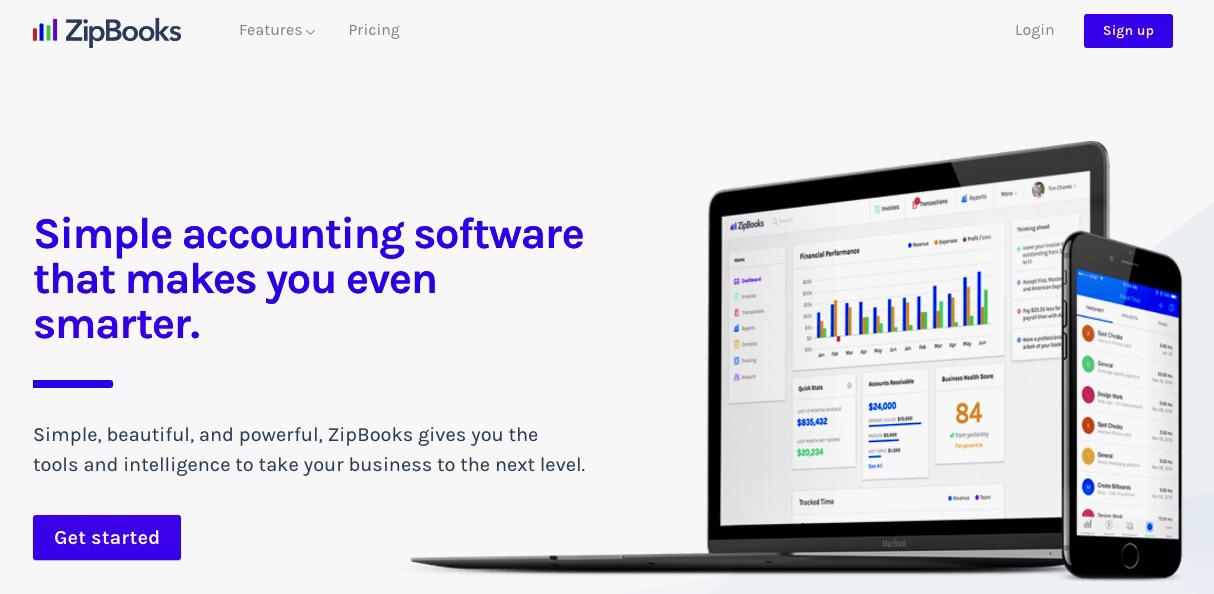

11. ZipBooks

Image Via ZipBooks

Oftentimes small startups or growing enterprises may not prioritize managing finances because of time constraints or lack of accounting expertise. ZipBooks is among the best SaaS accounting software that offers a cloud-based solution that automates bookkeeping, invoicing, and financial reporting.

Unlike enterprise-level systems that require extensive onboarding, ZipBooks delivers an intuitive experience with automated workflows and real-time cash flow insights. With no steep learning curve, it has become a top choice among the best SaaS accounting software.

Key features

- Create branded automated invoices with custom payment terms

- Credit card and bank transfer payments through services like Stripe, Square, and PayPal, you can accept online payments and get paid faster

- Get real-time financial reports, including profit & loss statements and tax summaries, for easy decision-making

- Automated recurring billing generates and sends invoices for subscriptions, retainers, or recurring payments, reducing manual invoicing tasks.

- Time tracking for billable hours to link them directly to invoices for accurate client billing.

- Machine learning auto-categorization analyzes past transactions to predict expense categories like rent or utilities — a game changer for the best SaaS accounting software

- Manage 1099 contractors by tracking payments to independent contractors and generating 1099 tax forms for compliance

- Leverage the smart tagging feature to categorize transactions using custom tags for better organization and easier financial analysis

- High-level encryption with 256-bit SSL security used by banks and financial institutions to prevent unauthorized access and data breaches

Pros

- ZipBooks offers a user-friendly interface with a free tier that has core accounting features

- Built for non-accountants, making it highly intuitive for freelancers and small businesses seeking the best SaaS accounting software

- Offers payroll integration

- Supports bank transfers, credit cards, and digital wallets

- Available on both Android and iOS, allowing users to manage finances on the go

Cons

- May not be ideal for larger businesses with more complex accounting needs that require advanced financial forecasting, audit trails, and inventory management in the best SaaS accounting software

- ZipBooks integrates with fewer external apps. So, businesses may need manual workarounds for advanced tax software, CRM systems, and ERP platforms

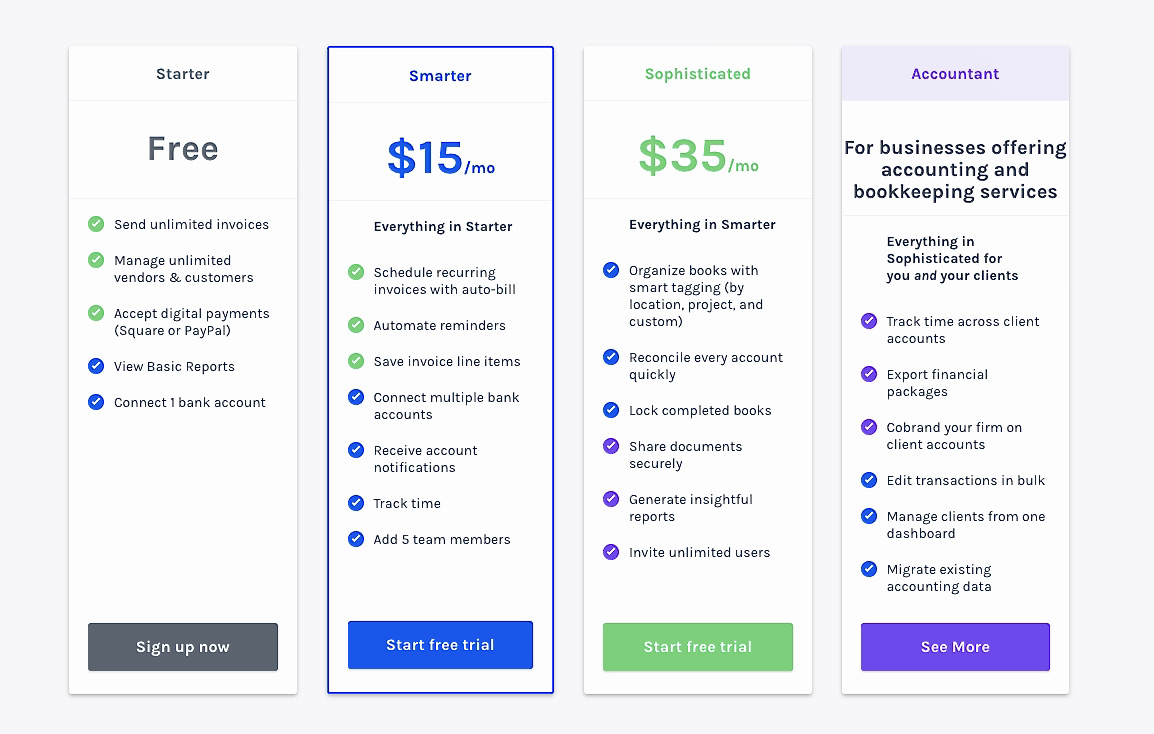

Pricing

- Starter: $0

- Smarter: $15 per month (with a free trial)

- Sophisticated: $35 per month (with a free trial)

- Accountant: Sign up to get more information

Image Via Zipbooks

Tool level

- Beginner

Usability

- Easy to use

Also Read:

- Top Challenges of Financial Accounting Businesses

- Benefits of Using Accounting Software for Small Businesses

FAQ

1. What is SaaS Accounting System?

A Software as a Service (SaaS) accounting system is an accounting software that’s hosted in the cloud. Users can access the software via internet connectivity instead of downloading and installing it locally. Many of the best SaaS accounting software options provide access to financial data at any time.

2. What are the key benefits of a SaaS accounting solution?

The key benefits of the best SaaS accounting software solutions are as follows:

- No software installation required

- Automatically scales up or down as needed

- Accessible from anywhere via the internet

- Integrates with banks, payment processors, and other business tools

3. What is the best accounting software for SaaS companies?

SaaS companies require crucial accounting features like subscription billing, CRM integration, online payment processing, and cash flow management — all of which are part of the best SaaS accounting software options. These features are available in different cloud-based accounting software. They include Sage Intacct, Xero, and QuickBooks Online.

4. How do I choose the best SaaS accounting software?

To choose the best SaaS accounting software, you should start by identifying your business needs based on the business size and number of users. Also, compare key features like invoicing and payroll, then evaluate ease of use, mobility, and integrations. If the pricing is within your budget, use the free trials before deciding.

5. Is spreadsheet software more powerful than financial planning and accounting software?

No, financial planning and accounting software is generally more powerful than spreadsheet software. Although spreadsheets are flexible, most accounting platforms are cloud-based and provide more automation and analysis capabilities. In fact, the best SaaS accounting software offers robust security and backup of financial data.

6. What is the accounting policy for SaaS?

SaaS companies use cash-basis or accrual accounting. Cash-basis records revenue upon payment, while accrual recognizes it when earned. The choice depends on company size, regulations, and reporting needs.

7. What software do most accountants use?

Most accountants use some of the best SaaS accounting software, like QuickBooks Online, Xero, and FreshBooks, for reporting, automation, and collaboration. Larger firms prefer NetSuite for complex financial management.

8. What is the main purpose of accounting software?

Accounting software manages finances by tracking income, expenses, and invoices. Choosing the best SaaS accounting software helps reduce errors, save time, and offer real-time insights into cash flow and profitability.

Also Read:

- Cloud Accounting vs Traditional Accounting: Key Differences to Note

- Nonprofit Accounting: A Complete Guide for Organizations

Which SaaS Accounting Software Should You Choose?

The top 11 accounting software we reviewed in this post represent some of the best SaaS accounting software solutions you can find in 2025. From FreshBooks excellent invoicing to Sage Intacct scalability, there are suitable options for companies of different sizes and industries.

As you decide on which accounting software to choose, carefully evaluate your budget, the features you need, user skill level, and future growth trajectory. Utilize free trials to experience the software. If you decide to subscribe to the paid version, make sure it checks all the boxes and has the capacity to take your financial management to the next level.