The best accounting software for small business owners helps track income and expenses, send invoices and late payment reminders, and keep your business finances in check.

Good accounting software solutions also help with sales taxes, expense management, financial reporting, and more, which is great because outsourcing these services can cost a lot of money. Clearly, the benefits of accounting software are numerous.

The key challenge, however, is finding the right accounting software that suits your business needs and budget.

Don’t know where to start? We’ve got you covered.

In this article, we’ve curated a list of the best accounting software for small business needs to help you make an informed decision.

But before we get to that, you must first understand what makes a great accounting software for small business and the key features that you should consider.

Disclaimer: This content contains affiliate links, which means we’ll earn a commission when you click on them (at no additional cost to you).

What Are the Key Features of Good Small Business Accounting Software?

Here are some of the key features you should look for in the best accounting software for small business use:

- Billing and Invoices: Your accounting app should be able to send automatic invoices and payment reminders and should support recurring bill management. This streamlines the process of invoice processing and helps ensure you get paid on time.

- Core Accounting: Accounts receivable and payables, bank reconciliation, and general ledger are some core accounting data features that every small business accounting software should have. These are the nuts and bolts that allow you to record financial information accurately.

- Inventory Management: The best accounting software for small business operations integrates inventory management with billing and invoicing to provide a seamless workflow. This is especially important if you track inventory and need to stay on top of stock levels and costs.

- Tax Management: The best accounting software for small business needs should be able to do complex sales tax calculations and ensure compliance with rules and regulations. Streamlining tax prep can save you major headaches come tax time.

- Budgeting and Forecasting: Accounting apps that can assess financial reports for the current year and forecast a budget for the next year are really useful. The best accounting software for small business can also help with personal finance planning so you can make informed decisions.

- Analytics and Reporting: In-depth analytics and customized financial reporting are must-have features of the best accounting software for small business owners.

- Error Resolution: The best accounting software for small business operations should be able to detect and fix errors and do complex calculations automatically.

Other than these features, you should also consider the price, user-friendliness, and customer support before you make your choice. Think about what essential features your business needs in order to track expenses, manage vendors, handle purchase orders, track receipts, generate reports, and address financial challenges.

Mobile apps are also increasingly important, especially for service-based businesses with teams on the go. Scanning receipts, mobile signatures, and the ability to track mileage and manage expenses from anywhere, anytime, can really streamline processes for many smaller businesses.

Now that you have a fair idea of what to look for, let’s get to our top picks for the best accounting software for small business owners available on the market today.

Best Accounting Software for Small Business Needs

Here is our list of the best accounting software for small business operations. This includes both free and paid options that will be great for your small business needs.

We recommend making a list of requirements before you go through this list to find the best option for your small business. Also, consider the number of user accounts, compatible devices, and pricing plans before you make your choice.

With that in mind, let’s get started.

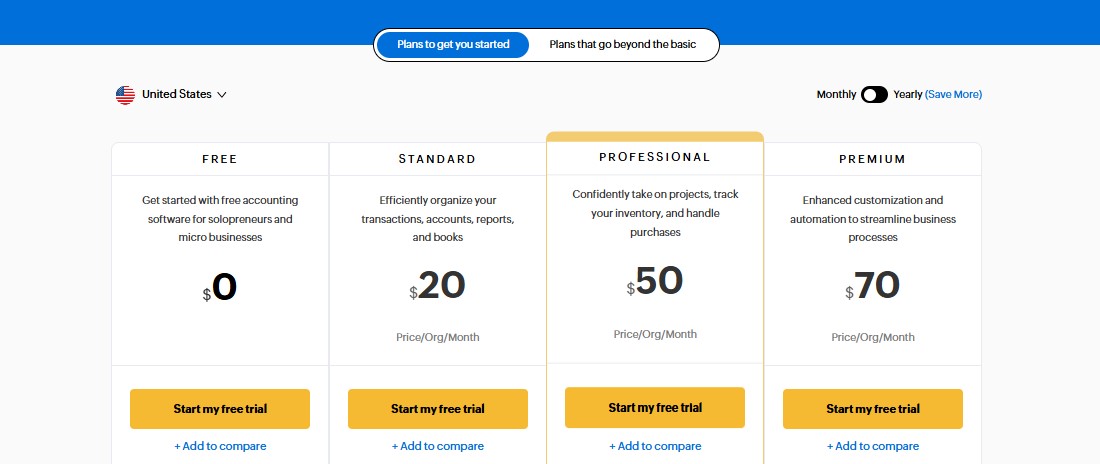

1. Zoho Books

Image via Zoho Books

Zoho Books is an end-to-end accounting software solution that is great for both small businesses and enterprises. Apart from a full suite of accounting features, it also offers financial features.

The free plan allows you to manage invoices, orders, bills, payments, credit notes, and more. However, advanced features like inventory management and advanced analytics are available only with the paid plans.

So, what makes Zoho Books one of the best free accounting software for a small business?

For one, the platform has a free forever plan with all the basic accounting functionalities a small business would need initially. Once your business grows, you can upgrade to paid plans.

Also, if you’re using any of the other tools in the Zoho Suite, like Zoho CRM and Zoho Analytics, you’ll be able to access them all on a single platform.

Read our detailed Zoho Books review to learn more about this tool.

Key Features

- Invoice management (up to 1,000 invoices per year on the free plan)

- Record offline and online payments

- Expense and mileage tracking

- Bank reconciliation

- Automated payment reminders

- Integration with all Zoho apps and some other apps

- Advanced inventory management

- Basic and advanced analytics and reporting

- Email, voice, and chat support

Pros

- Invoicing features like multilingual invoicing and recurring invoices are available with the free plan.

- Offers a lot of basic accounting features, even with the free plan.

- Multiple pricing plans to cater to clients with different needs and budgets.

- Full suite of accounting features and customization options, more than most other accounting software solutions offer.

Cons

- The free plan can have only 1 user and 1 accountant.

- Only email support is available with the free plan.

Pricing

Apart from the free plan, this accounting software for small business users also offers paid plans:

- Standard: $20/month

- Professional: $50/month

- Premium: $70/month

- Elite: $150/month

- Ultimate: $275/month

Image via Zoho Books

Tool Level

- Intermediate

Usability

- Easy to use

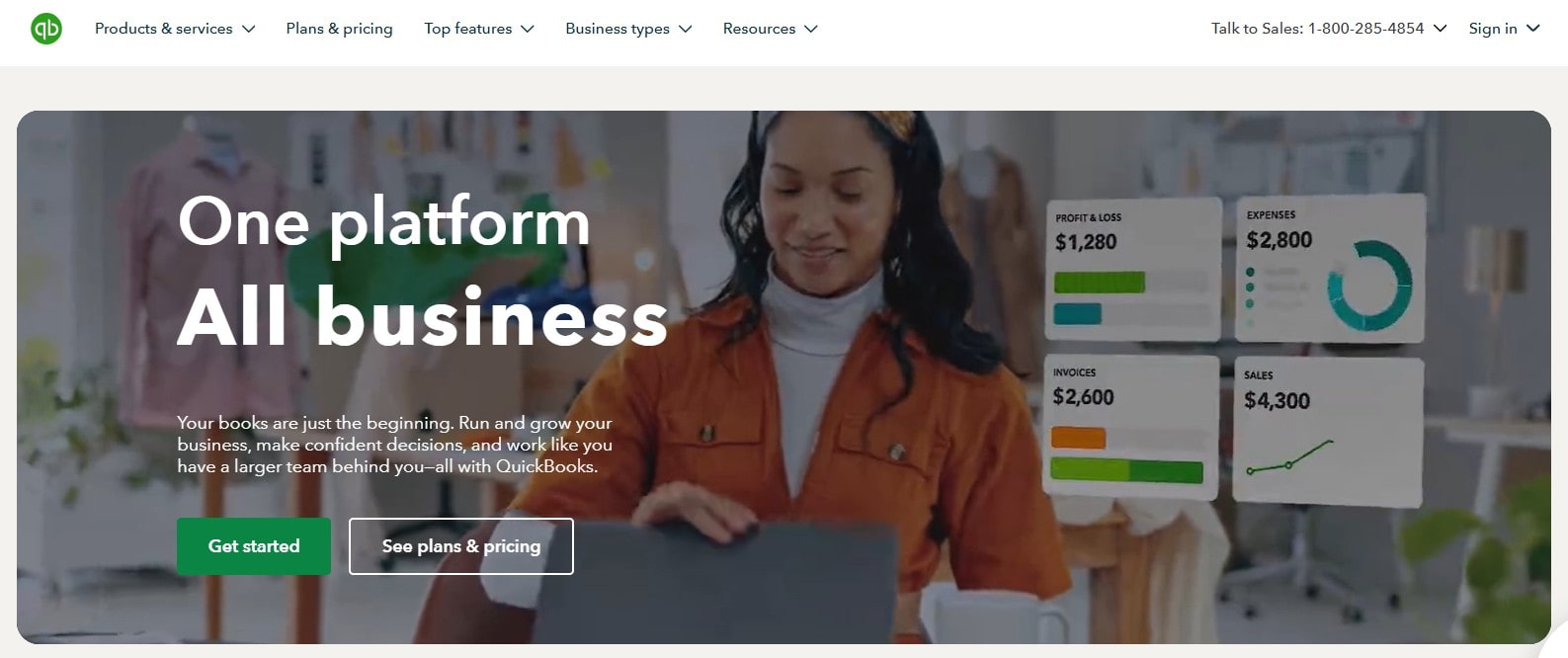

2. QuickBooks

Image via QuickBooks

QuickBooks Online is another of the best accounting software for small business needs. Though affordable, QuickBooks Online does not offer a free plan. You will get a 30-day free trial if you want to test out its features.

QuickBooks offers a full suite of accounting features and is great not just for small businesses but also for large ones.

With QuickBooks Online, you can easily manage expenses, create purchase orders, track inventory, and generate financial reports. The Intuit Assist feature offers AI accounting, allowing you to automate financial transactions and administrative tasks.

This accounting software for small businesses also has mobile apps that allow you to handle accounting data and financial information on the go. These apps come equipped with features like mobile signatures, scanning receipts, and the ability to track mileage automatically.

Another big advantage is the ability to integrate with 750+ third-party applications, which really allows you to customize it for your specific needs. Whether you need CRM software, time tracking, project management tools, or other software, chances are it integrates with QuickBooks Online.

All in all, QuickBooks Online is a powerful solution for small business accounting, offering unmatched depth, flexibility, and essential features. The company also provides solid customer support, tutorials, and other resources.

While it may be overkill for some smaller businesses, it’s an excellent choice for growing businesses that want an all-in-one accounting app that can scale with them over time.

Here are the features offered by this best accounting software for small business owners and some of its pros and cons.

Key Features

- Income and expense tracking

- Invoice and payment management

- Tax deductions

- General reports

- Receipt captures

- Mileage tracking

- Cash flow calculations

- Tax calculations and estimates

- Bill management

- Inventory management

- Business analytics

- Workflow automation

Pros

- Offers a generous 30-day free trial.

- Access to live experts for bookkeeping best practices and tax return preparation.

- Flexible tiered pricing to cater to the needs of all types of businesses.

Cons

- Does not have a free forever plan.

- Can have more advanced analytics and reporting features

Pricing

As one of the best accounting software for small business operations, QuickBooks offers the following plans:

- Simple Start: $35/month

- Essentials: $65/month

- Plus: $99/month

- Advanced: $235/month

Image via QuickBooks

Tool Level

- Advanced

Usability

- Easy to use

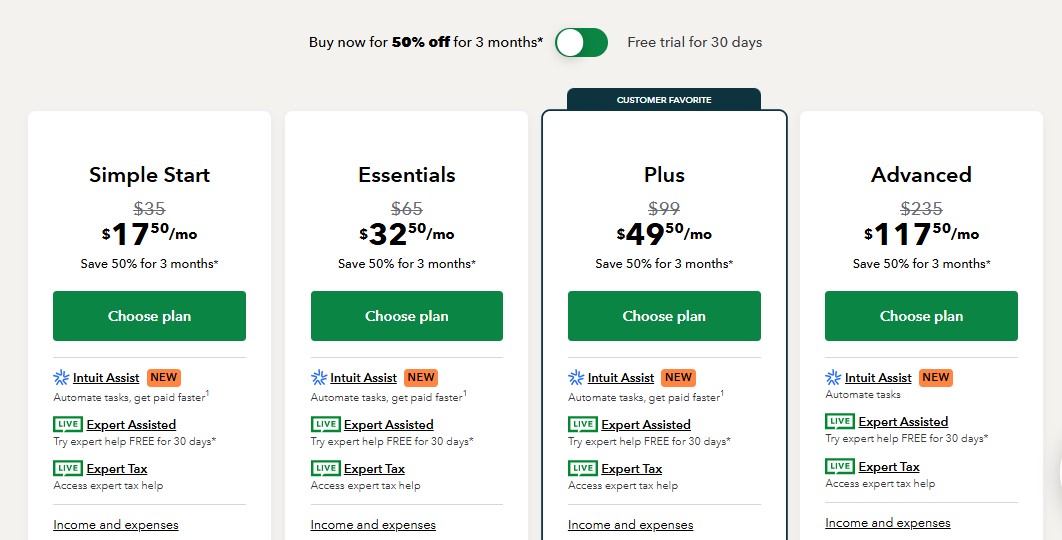

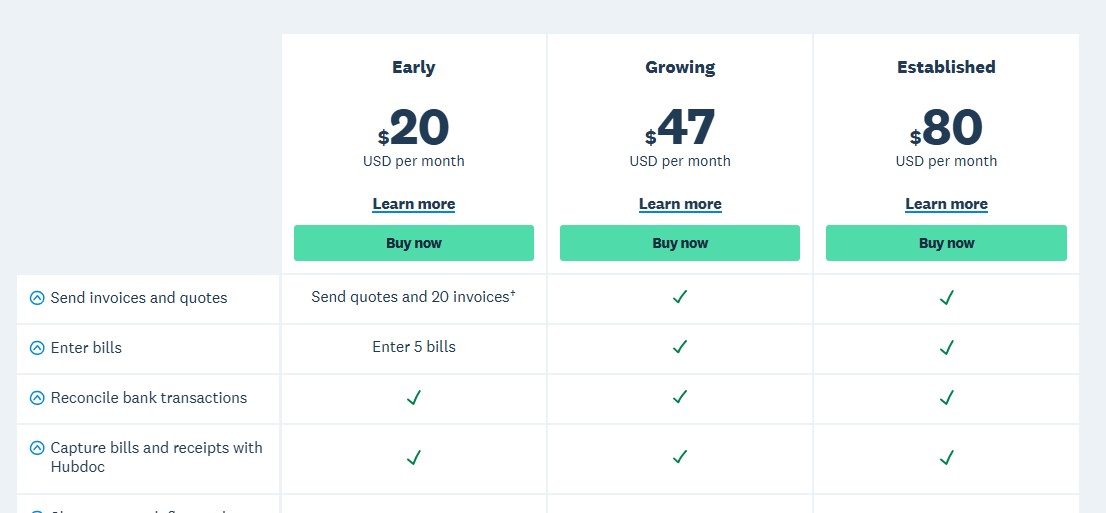

3. Xero

Image via Xero

Xero is another top contender for the best accounting software for small business owners. It is top-rated by users on review sites like Trustpilot.

And that’s why Xero made it to this “best accounting software for small businesses” list.

Even the starter plan offers powerful features like sending invoices, expense management, and bank reconciliation. Plus, Xero integrates with over 1,000+ third-party apps, including time tracking, mobile signatures, scanning receipts, and more.

In collaboration with Gusto, Xero also offers comprehensive payroll services as an add-on for an extra fee.

While it provides all the important features a small business would need, it is not designed for large enterprises.

For growing businesses looking for feature-rich accounting software at an affordable price point, Xero is definitely worth considering.

Check out some of its features, pros, and cons to decide if it has what you want from an accounting software solution.

Key Features

- Invoice management

- Bulk bank reconciliation

- Bills and receipts tracking

- Project and expense tracking

- Inventory and order management

- Multi-currency transactions

- In-depth analytics and reporting

Pros

- Offer a 30-day free trial.

- Has a simple, user-friendly interface.

- Offers tons of features at competitive prices.

- Even the basic plan allows bank reconciliation.

- Offers 24/7 online support.

Cons

- Multi-currency transactions are only possible with the most expensive plan.

- Reporting could be more visual and advanced.

Pricing

You can access all the features of this accounting software for free for 30 days and cancel anytime, no questions asked. Here are the paid plan details:

- Early: $20/month

- Growing: $47/month

- Established: $80/month

Image via Xero

Tool Level

- Beginner

Usability

- Easy to use

Also Read:

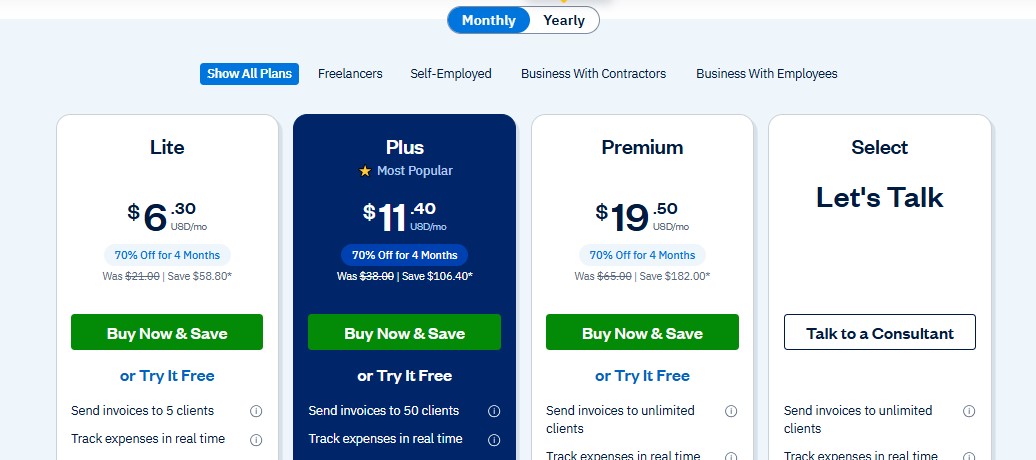

4. FreshBooks

Image via FreshBooks

If you want a double-entry accounting software for small businesses that has advanced features but is easy to use, then FreshBooks should be your first choice. It’s among the best choices for solopreneurs or consultants who need a single-user account.

It offers everything you need for accounting and bookkeeping records, from expense tracking to automated online payments. It’s also just as affordable as the tools already discussed, if not more. For beginners seeking to learn more about small business bookkeeping, consider exploring small business bookkeeping for beginners.

Even its most basic plan allows you to send unlimited invoices and estimates and track unlimited expenses.

Key Features

- Unlimited invoices, estimates, and proposals

- Unlimited automatic expense tracking

- Bank reconciliation

- Accept online payments

- Automatic receipt capturing

- Mobile mileage tracking

- Automated late payment reminders

- Customizable email marketing features

- Recurring billing and client retainers

- Advanced analytics and reporting

- White-labeling options

Pros

- The cheapest plan also has great features like unlimited invoice and expense tracking.

- Offers a 30-day free trial for all features.

- Allows subscription-based payments, which most other accounting software don’t.

- Also available as iOS and Android apps.

Cons

- Double-entry accounting reports are only available on the higher-tier plans.

- Need to pay extra for every new user account, which can spike the costs, especially for large businesses.

Pricing

As one of the best accounting software for small businesses, FreshBooks offers a free 30-day trial, after which you can upgrade to one of the following paid plans:

- Lite: $21/month

- Plus: $38/month

- Premium: $65/month

- Let’s Talk: Custom pricing

Please note that these prices are for a single user account, and you need to pay $11 extra for every additional user.

Image via FreshBooks

Tool Level

- Beginner/Intermediate/Expert

Usability

- The tool is extremely easy to use, despite offering advanced features.

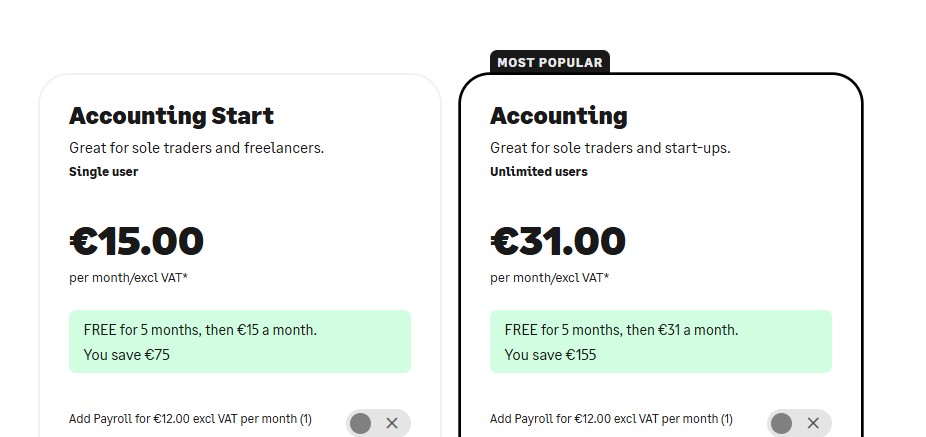

5. Sage Business Cloud Accounting

Image via Sage Business Cloud Accounting

Sage is another online accounting software solution that’s best for a small business.

The accounting tool is part of a suite of Sage products that include payroll, HR, and CRM solutions.

Sage Accounting was designed for small to medium-sized businesses, and the pricing plans reflect that.

The best services you’ll find while using this tool are invoicing and payroll, among others. Other features that make it the best accounting software for small business needs are:

Key Features

- Invoice management

- Income tracking

- Automatic back reconciliation

- Quotes and estimates

- Cash flow forecast

- Multicurrency transactions

- Email, voice, and chat support

Pros

- Offers a protracted free trial.

- One of the most budget-friendly accounting software for a small business.

- It’s a cloud-based accounting solution with multiple useful integrations.

Cons

- Offers only basic accounting features.

- Suitable only for very small businesses.

Pricing

Sage offers two paid plans:

- Accounting Start: €15/month ($16.20/month)

- Accounting: €31/month ($33.47/month)

*Conversions are done at a 1:1 conversion rate as of March 26, 2025.

Image via Sage Business Cloud Accounting

Tool Level

- Beginner

Usability

- Anyone can use this accounting software solution without much training.

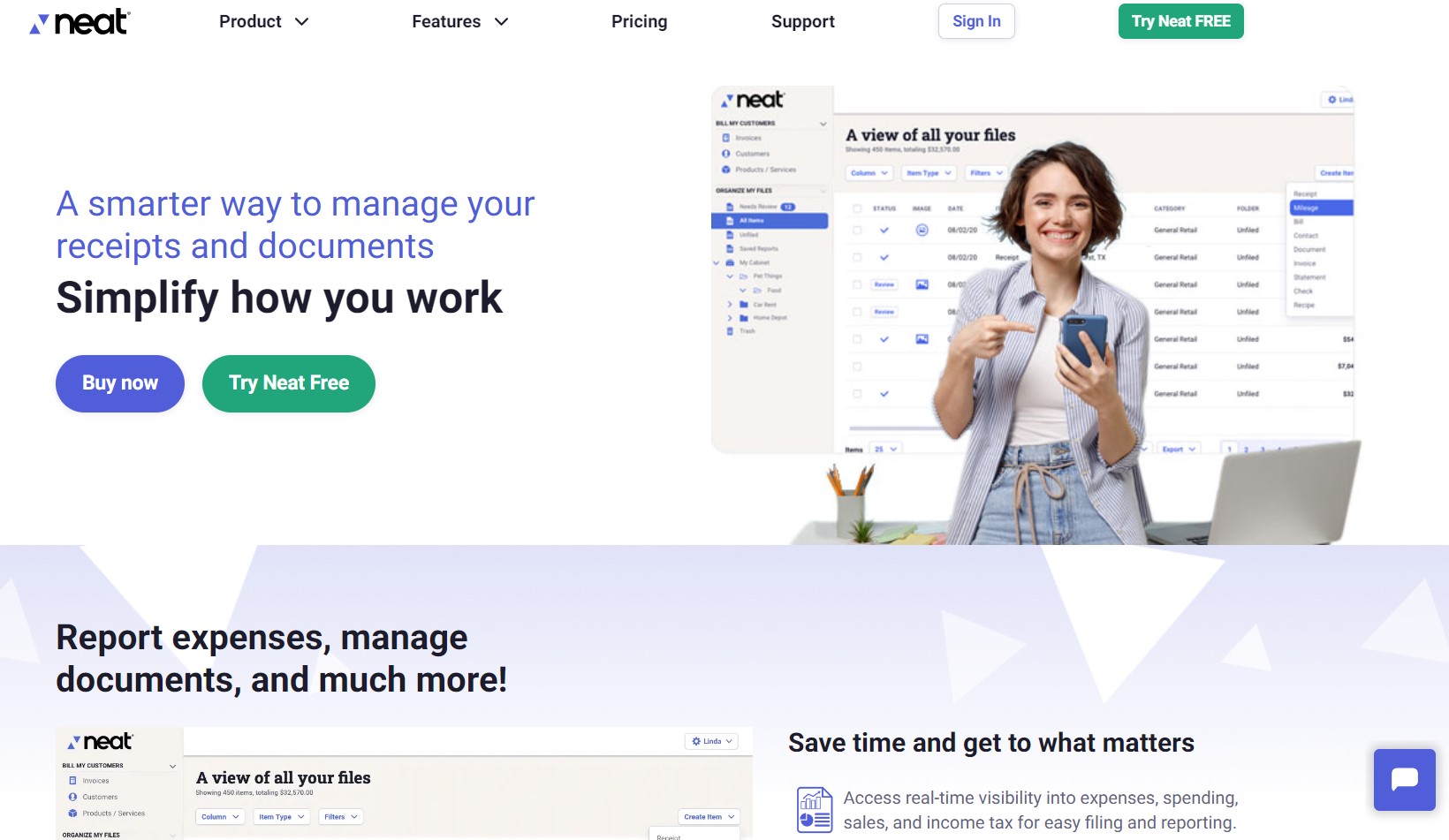

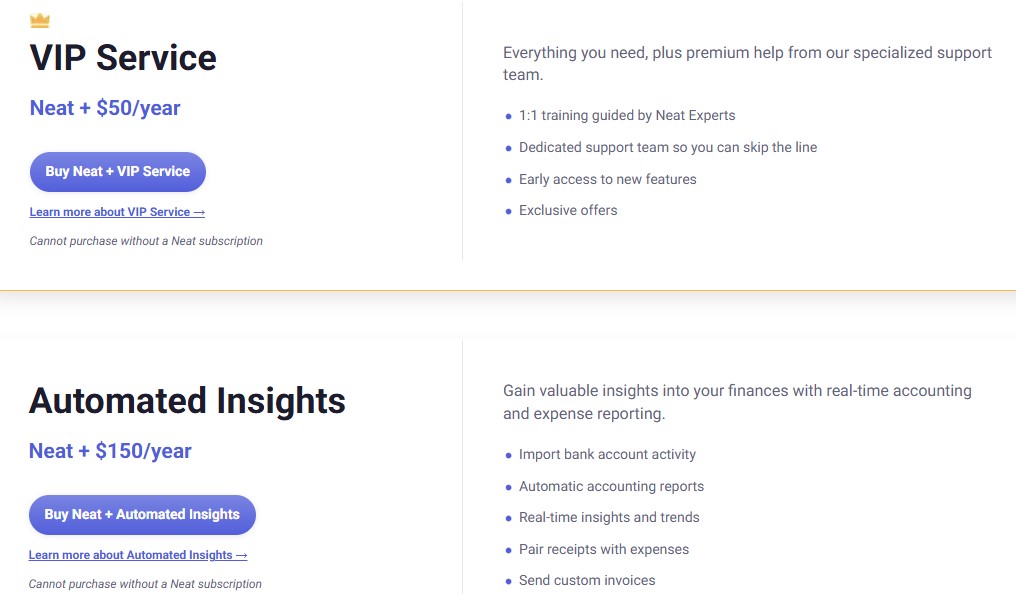

6. Neat

Image via Neat

Neat is a financial management toolkit with accounting, invoicing, and financial document management capabilities. It has everything a small business would need to manage its accounts and finances.

However, it is best suited for self-employed individuals or very small businesses, as it offers a single plan with no advanced features.

So if you’re looking for a simple tool to help store your documents and track your financial transactions, then this tool is for you.

What features make it the best accounting software for small businesses?

Check it out.

Key Features

- Invoice and payment management

- Free ACH or bank transfers

- Custom invoice templates

- Receipts and expense tracking

- Analytics and custom reports

- Data extraction with patented OCR technology

- Secure cloud storage for financial documents

Pros

- Offers a 14-day free trial

- Provides a decent set of features for a low price

Cons

- Offers only a single plan

- Not suitable for mid-sized or large businesses

Pricing

This accounting software for small business users costs $200/year. However, you can get some advanced features for an extra fee. These include:

- VIP Service: An extra $50/year for guided training, a dedicated support team, and exclusive offers.

- Automated insights: An extra $150/year for automatic account reports, real-time insights, importing bank account activity, etc.

Image via Neat

Tool Level

- Beginner

Usability

- Easy-to-use accounting software solution for solopreneurs and microbusinesses.

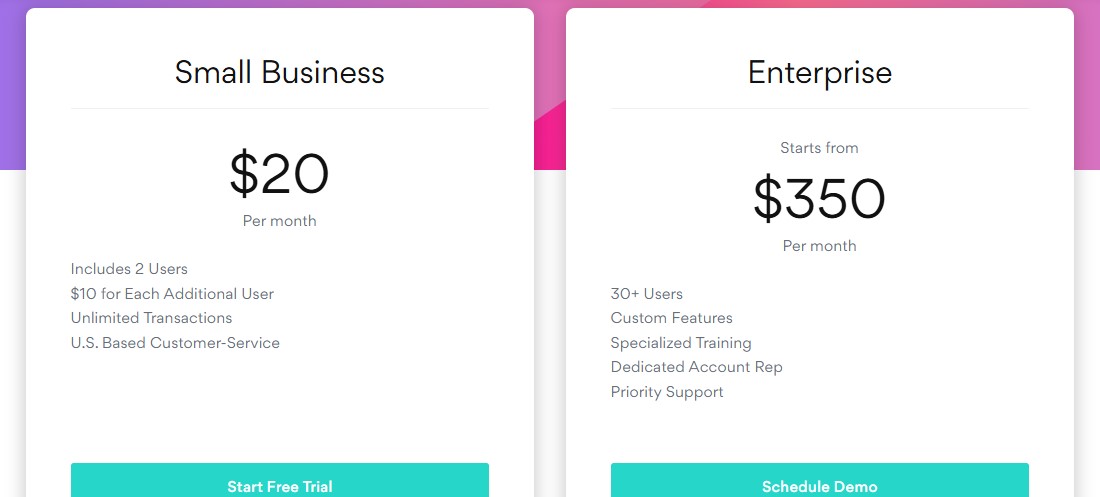

7. ZarMoney

Image via ZarMoney

This is an all-in-one accounting software solution with invoicing, inventory management, billing, and payment capabilities.

You can use it to create invoices the right way and accept online payments when your customers click the “pay now” option in invoices. Its advanced analytics and reporting feature gives you access to 40+ customizable reports.

Overall, this best accounting software for small businesses has a comprehensive set of features and plans. It’s also suitable for large businesses, making it among the best accounting software on the market.

In fact, it offers a premium plan for enterprises. This plan comes with an extensive set of advanced features, a dedicated account representative, specialized training, and priority support.

Despite having tons of advanced features, the user interface is simple and the tool is easy to use for small business owners or accountants.

Key Features

- Core accounting features

- Bill management

- Online payments

- Invoicing and estimates

- Bookkeeping

- Inventory management

- Accounts receivable

- Order management

- Analytics and reporting

- And more!

Pros

- Provides a 14-day free trial (no credit card required).

- Offers industry-specific solutions for ecommerce and other industries.

- ZarMoney is an end-to-end solution suitable for all types of businesses.

- Integrates seamlessly with tools like Mailchimp, Zapier, Shopify, Stripe, and other applications.

Cons

- The Enterprise plan is quite expensive but offers a lot of advanced features.

- Not enough reporting capabilities for cash-only businesses.

Pricing

This accounting software for small business operations has two paid plans:

- Small Business: $20/month for two users (Additional users cost $10/month each)

- Enterprise: $350/month for 30+ users

Image via ZarMoney

Tool Level

- Expert

Usability

- Despite having tons of advanced features, the user interface is simple and the tool is easy to use for small business owners or accountants.

Also Read:

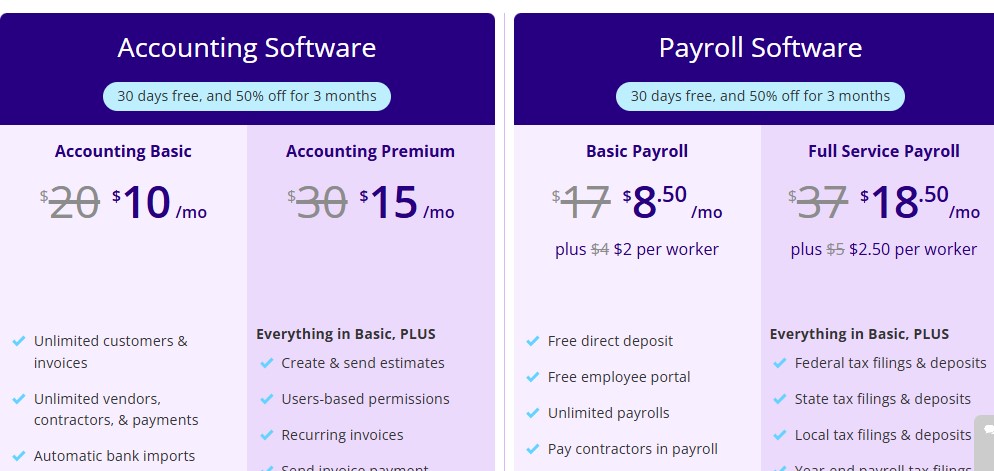

8. Patriot

Image via Patriot

Patriot is a payroll and accounting software for small businesses, but both products are sold separately, so you can choose only accounting if you prefer that.

Like the other accounting software for small businesses on this list, it also offers a 30-day free trial without any obligation.

But what makes it one of the best accounting software for small business operations?

Patriot’s features and pricing plans are designed with small businesses in mind. It offers only 2 plans, both of which are affordable and offer great value for money. The tool is also mobile-friendly.

Key Features

- Unlimited custom invoices

- Bank reconciliations

- Recurring billing

- Payment reminders

- Income and expense tracking

- Receipts management

- Estimates

- Error identification and corrections

Pros

- Provides expert support with both plans.

- Is one of the most cost-effective options for a small business.

- Offers tons of features for the price point.

- Provides a 30-day free trial.

- Simple, no-frills, and transparent pricing.

Cons

- Suitable only for small businesses.

- Lacks inventory tracking and management.

Pricing

Here are the plans that it offers:

- Basic: $20/month

- Premium: $30/month

Image via Patriot

Tool Level

- Intermediate

Usability

- This accounting software solution is user-friendly, according to customer reviews.

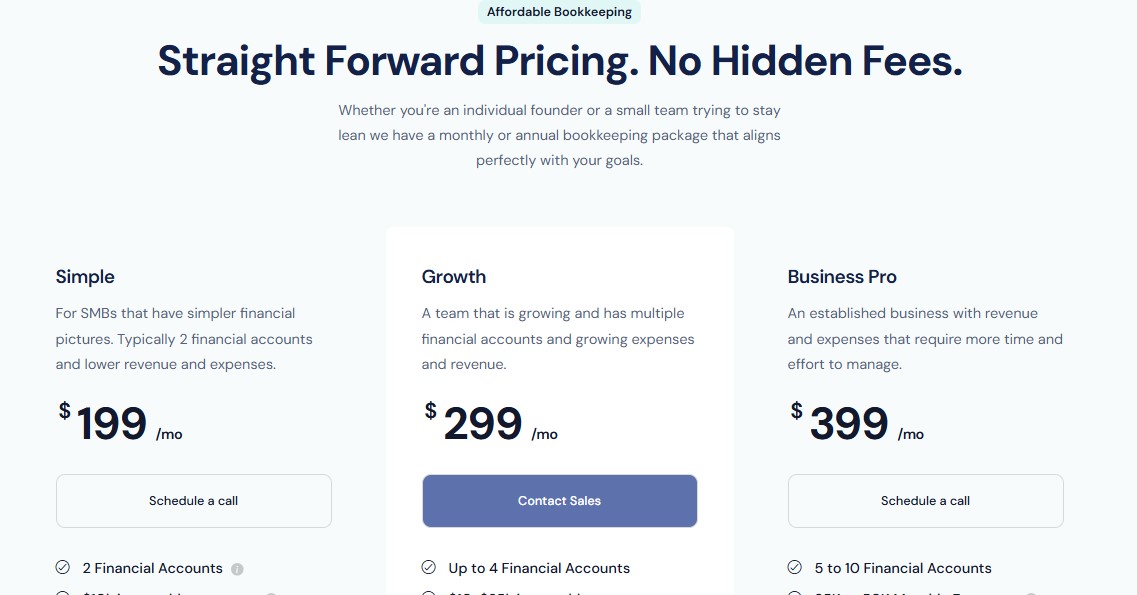

9. LessAccounting

Image via LessAccounting

This is an accounting and invoicing software solution that provides basic invoicing features for free. However, for a full suite of features, you’ll need to invest in a paid plan.

Why did we include it in our list of the best accounting software for small business needs?

Because it is an easy-to-use tool with a clean interface that provides basic invoicing and payment capabilities that most small businesses need.

It provides a simple way for consultants, freelancers, and small business owners to handle their bookkeeping or get help from their experts.

Less Accounting also offers templates you can use as a starting point and edit to produce unique business proposals. You can then quickly convert these proposals into invoices for your clients.

Moreover, even its paid plans are not very expensive, and it is overall a good accounting software for small business users.

Key Features

- Unlimited custom invoices

- Customer management

- Payments with Stripe, Paypal, and Square

- Expense tracking

- Estimates

- Tax reports

- Unlimited team members

- Bank reconciliation

- Time tracking

- Bookkeeping

- Late payment reminders

Pros

- Easy-to-use intuitive interface

- Powerful reporting and analytics capabilities

Cons

- Advanced features like analytics, bank reconciliation, etc. come with paid plans

- Relatively expensive plans

Pricing

Here are the premium plans of this accounting software for small businesses:

- Simple Bookkeeping: $199/month (up to 2 financial accounts)

- Growth Bookkeeping: $299/month (up to 4 financial accounts)

- Business Bookkeeping: $399/month (5 to 10 financial accounts)

- A La Carte Offerings: Schedule a consultation

Image via LessAccounting

Tool Level

- Beginner

Usability

- Easy to use

10. Kashoo

Image via Kashoo

Kashoo is a double-entry accounting software, offering a simple accounting solution for small businesses. It offers different apps for different small business accounting needs, from invoicing to advanced accounting.

You can simply track your invoices and expenses if you’re a small business, and you can get automated accounting as your business grows. Small businesses can get the TrulySmall Accounting package, offering quick financial reports for tax season.

If you’re a small business owner looking for budget-friendly accounting software for your small business, then you should definitely consider Kashoo.

Wondering why we added it to the list of best accounting software for small businesses? Here are some of its best features.

Key Features

- Create invoices with templates

- Accept online payments with KashooPay

- Connect to 5000+ bank accounts

- Bank reconciliation

- Critical reports, such as cash flow, income statement, and balance sheet

Pros

- Invoicing is completely free forever

- Paid plans offer a free trial and competitive pricing

- Offers 24/7 customer support via live chat, email, and phone

Cons

- Only caters to small businesses; not suitable for enterprises

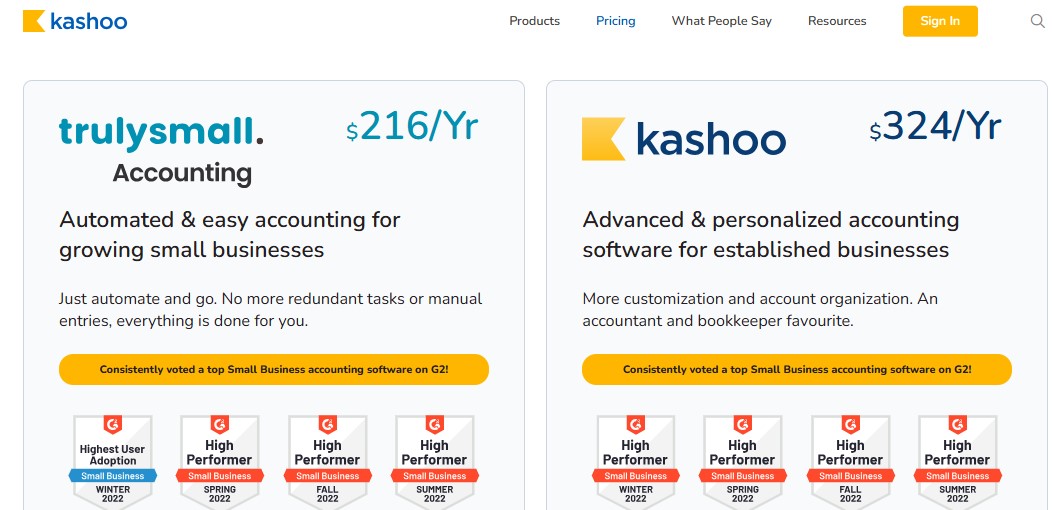

Pricing

This accounting software for small business owners offers the following plans:

- TrulySmall Accounting: $216/year

- Kashoo: $324/year

Image via Kashoo

Tool Level

- Beginner

Usability

- It is an easy-to-use accounting software program for small businesses.

11. Wave

Image via Wave

Unlike other accounting software for small business owners on this list, Wave offers separate tools for different accounting functions. These include invoicing, accounting, banking, payments, and payroll. It also offers advisory services.

What makes it one of the best accounting software for small business operations?

The invoicing, accounting, and banking tools are completely free for use by anyone. In fact, it is one of the accounting software programs that offers the most features for free.

What’s more?

You can track your expenses easily on the go with their mobile receipts. The feature allows you to scan receipts and back them up in the cloud.

Let’s look at some of Wave’s key features.

Key Features

- Double-entry accounting

- Invoice management

- Custom invoices

- Automated reminders

- Income and expense tracking

- Reports like overdue invoices, profit & loss, etc.

- Simplified taxation

- Instant payouts

Pros

- Invoicing, accounting, and banking features are 100% free to use

- The tool offers almost everything a small business needs to get started

- Also offers advisory services to improve your accounting and bookkeeping skills

Cons

- Best suited for Sole Proprietors in the US and not larger businesses or businesses in other countries

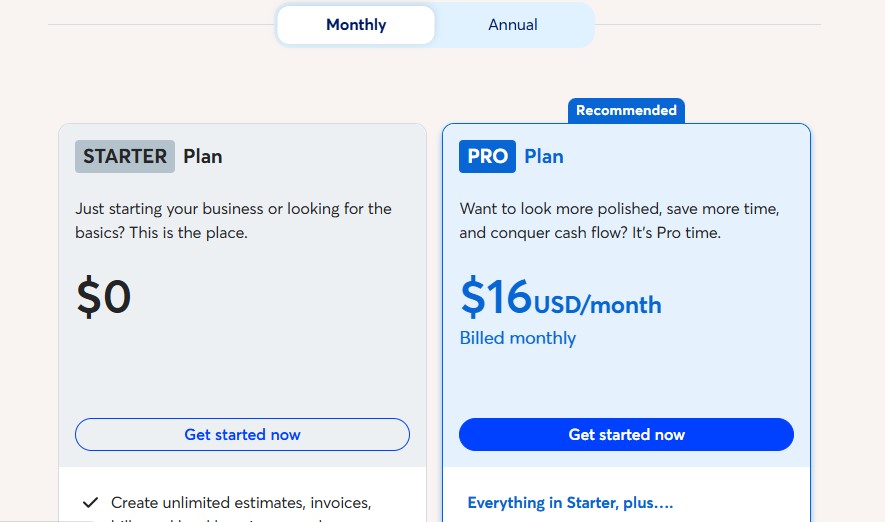

Pricing

Here’s what the pricing of this accounting software for small business owners looks like:

- Starter: Free

- Pro: $16/month

Image via Wave

Tool Level

- Beginner

Usability

- Easy to use

Also Read:

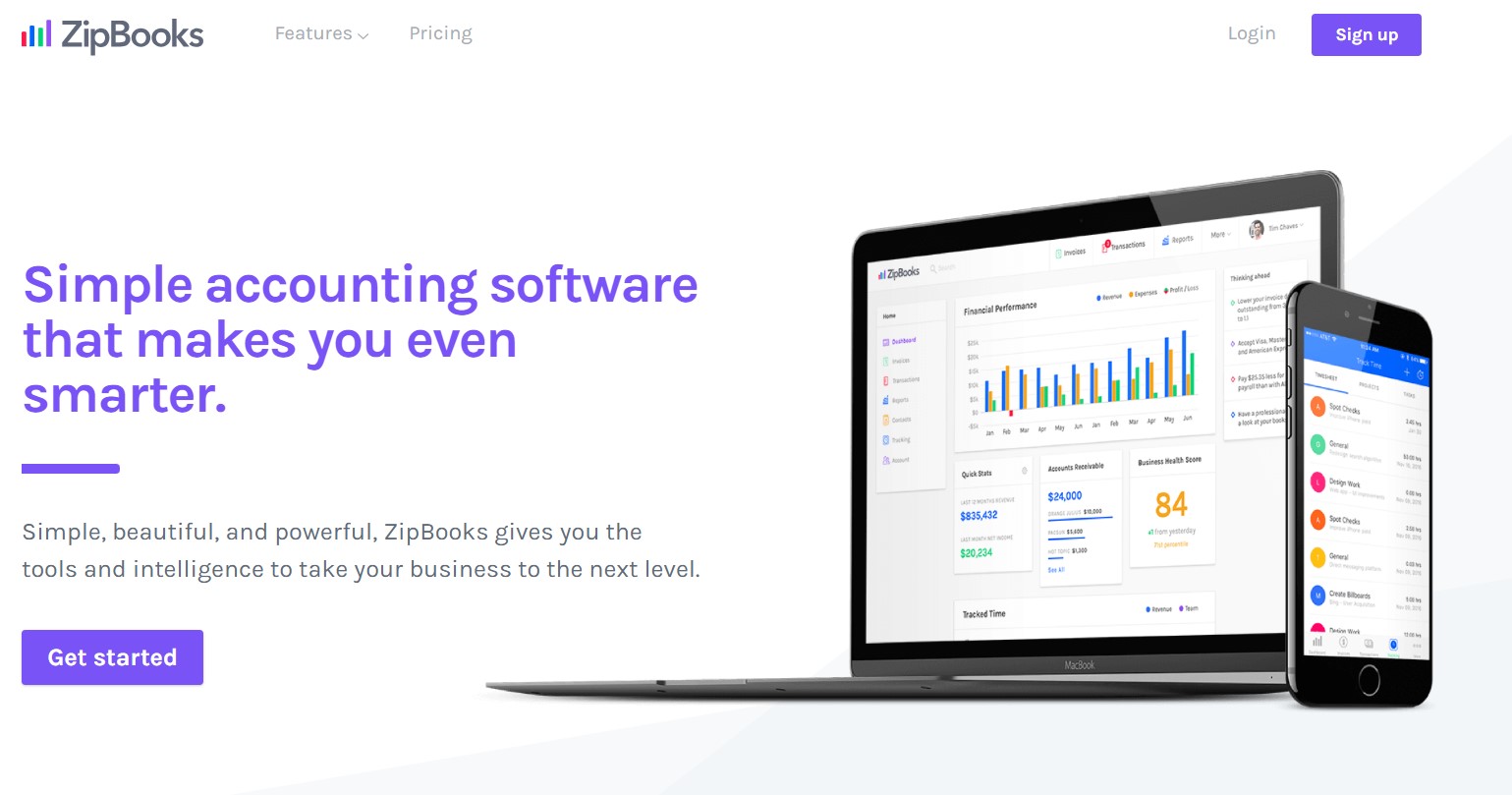

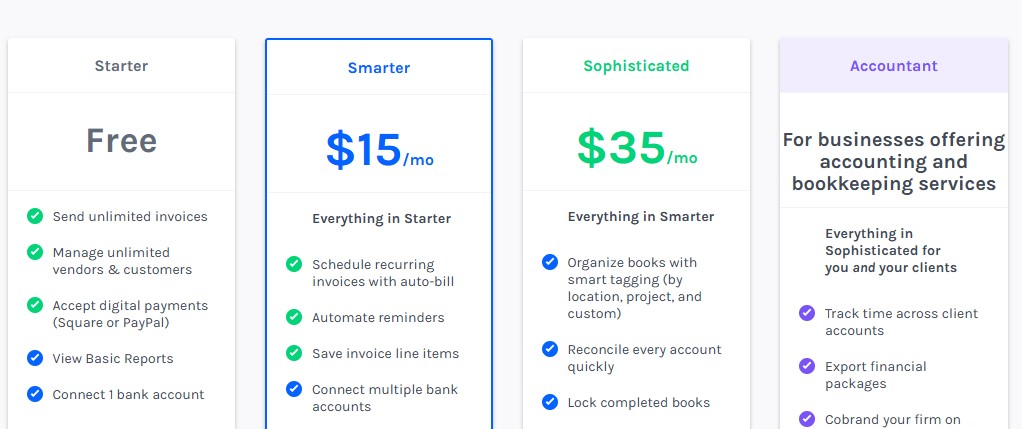

12. ZipBooks

Image via ZipBooks

ZipBooks is one of the free accounting software programs that offers a forever-free plan but with limited features. You can send unlimited invoices, manage unlimited customers, and view basic reports with the free plan.

You can customize your invoices and include your logo, brand colors, and contact information. You can also keep track of client payments and invoice history, late balances, and taxes.

What’s more?

ZipBooks provides you with reports and analytics that give actionable insights to help you make data-driven decisions.

The paid plans are also quite affordable and provide decent features. Check out the features, pros, and cons of this best accounting software for small businesses and see if it fits your needs.

Key Features

- Unlimited custom invoicing

- Recurring billing

- Automated payment reminders

- Core accounting features

- Smart client management

- Square and PayPal integrations

- Multicurrency payments

- Receipt tracking

- Bookkeeping

- Custom reports

Pros

- Enables unlimited transactions and invoicing for free.

- Offers a free forever plan with basic accounting features.

- Is easy to use.

Cons

- Lacks advanced features (like inventory management) and integrations.

Pricing

Here are the plans you can avail from this accounting software for small businesses:

- Starter: Free

- Smarter: $15/month

- Sophisticated: $35/month

- Accountant: Custom pricing

Image via ZipBooks

Tool Level

- Beginner

Usability

- The tool is easy to use

13. Lendio

Image via Lendio

This is one of the best accounting software solutions that offers a free plan. With Lendio’s free plan, you can send invoices, manage income and expenses, and generate profit and loss reports.

Lendio also helps you connect your bank account easily so that your costs and revenue are imported automatically. This way, you get real-time insights that you can act on right away.

It also provides easy access to a profit-and-loss statement, balance sheet, tax summary, and accounts receivable reports. This best accounting software for small businesses allows you to access funding options for your small business.

The paid plan allows access to financial insights and forecasts and an expense categorization feature. It also supports payment integrations with PayPal, Square, and Stripe.

Key Features

- Invoice management

- Income and expense tracking

- Financial insights

- Expense categorization

- Multicurrency payments

Pros

- Simple and easy to use

- Robust set of accounting features

- Customizable reporting

- Time tracking capabilities

Cons

- Offers only basic features, not suitable for mid-sized or large businesses.

Pricing

- The pricing of this accounting software for small business owners is available on demand

Tool Level

- Beginner

Usability

- It is easy to use

Also Read:

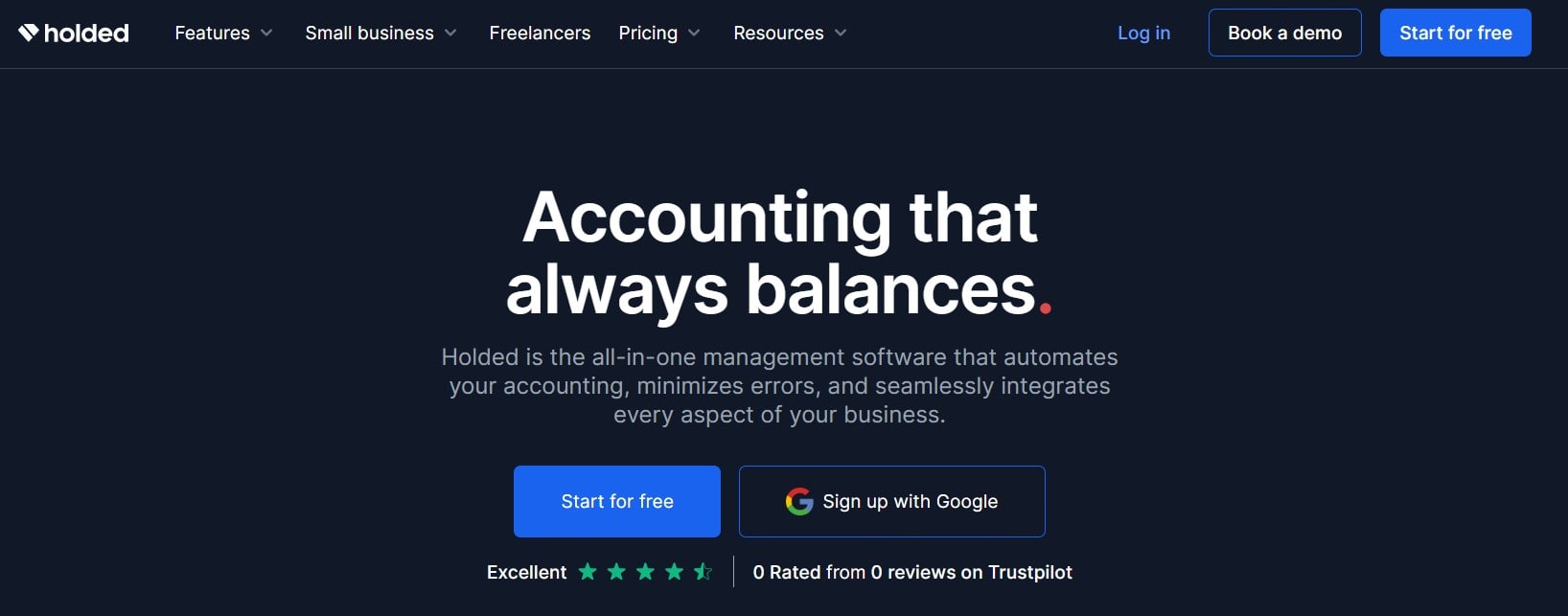

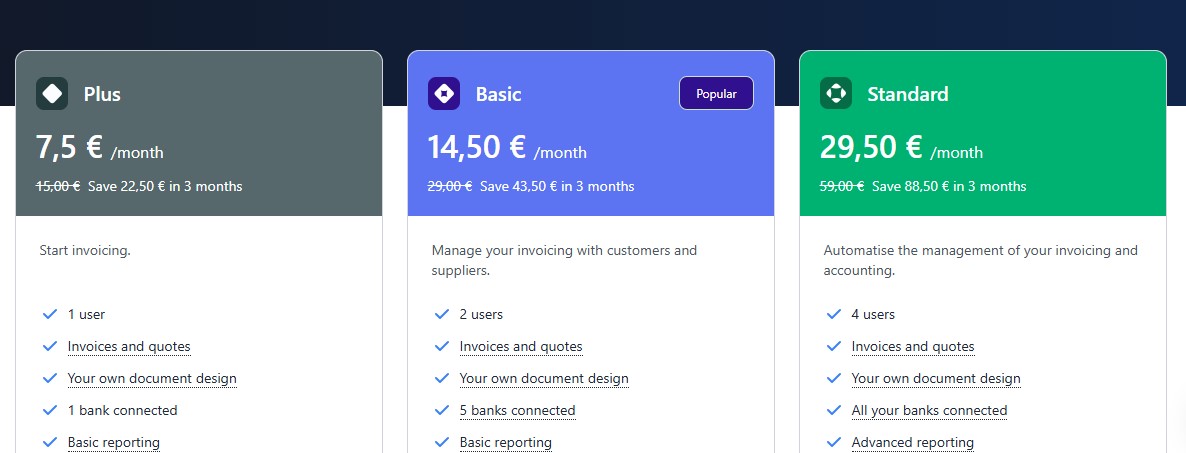

14. Holded

Image via Holded

Holded is another one of the best accounting software solutions that provides multiple pricing tiers for different types of clients. It has a free plan, an affordable plan for freelancers, and multiple plans for businesses of different sizes.

Besides accounting and invoicing, you get project management features like Kanban boards, lists, and Gantt charts. You also get to automate most of your accounting processes for greater accuracy.

The free plan of this accounting software for small business owners has invoicing and expense tracking features, while the paid plans offer tons of other accounting features like personalized client portals and more invoices.

Accountants and bookkeepers can request payments from clients, give estimates to prospects, and generate financial reports using Holded’s invoicing module.

Here’s a list of features that make Holded the best accounting software for small businesses:

Key Features

- Invoice and expense tracking

- Project management

- Core accounting features

- CRM tools

- Payment reminders

- Bookings management

- Recurring invoices

- Tax calculations

- Cash management

- Inventory management

- HR management

Pros

- Offers a free plan as well as a 14-day free trial on the paid plans.

- An all-in-one solution catering to all types of business.

- Industry-specific solutions for ecommerce businesses.

- Multiple free integrations.

Cons

- Only the top-tier plan provides unlimited invoicing.

- The free plan doesn’t have much to offer.

Pricing

Here are the plans available in this accounting software for small businesses:

- Plus: €15/month ($16.13/month)

- Basic: €29/month ($31.19/month)

- Standard: €59/month ($63.46/month)

- Advanced: €99/month ($106.48/month)

- Premium: €199/month ($214/month)

- Custom ERP: Custom billing

*Conversions are done at a 1:1 conversion rate as of March 26, 2025.

Image via Holded

Tool Level

- Intermediate

Usability

- Some users complain about the translation feature not working perfectly, which could be difficult for non-Spanish users.

15. AccountEdge

Image via AccountEdge

If you’re looking for a great accounting software solution designed for both Mac and Windows laptops, then look no further than AccountEdge.

It is a premium solution that allows you to choose your home currency and calculates taxes according to your region’s rules. The analytics reports are also customizable and give you the exact information you’ll need for your specific tax forms.

The accounting software for small businesses comes with relatively cost-effective plans that allow access to its full suite of features. It also offers an ERP solution with customized pricing if you want an all-in-one solution for your small business.

AccountEdge offers features for the following business functions:

Key Features

- General ledger

- Banking

- Sales

- Payments

- Time billing

- Invoicing

- Payroll

- Purchases

- Mileage tracking

- Inventory

- Contacts

Pros

- The most comprehensive accounting software solution, suitable for all types of businesses.

- Features like inventory management and seamless payments make it great for ecommerce businesses as well.

Cons

- Doesn’t allow unlimited users.

Pricing

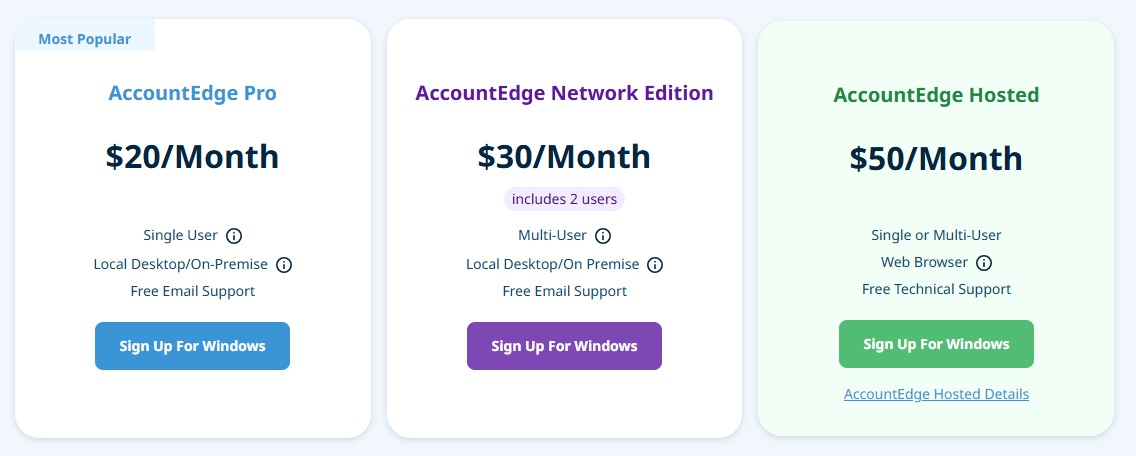

This best accounting software for small businesses offers the following paid plans:

- AccountEdge Pro: $20/month

- AccountEdge Network Edition: $30/month

- AccountEdge Hosted: $50/month

Image via AccountEdge

Tool Level

- Expert

Usability

- There are tons of learning resources available, which make it easy to understand and use the tool even as a beginner.

Also Read:

16. OneUp

Image via OneUp

Another accounting and bookkeeping software solution that would be best for your small business is OneUp. You can use this tool to overcome the challenges of financial accounting for your startup.

This accounting software for small business owners considerably reduces the time required to handle accounting tasks by automating some of them. It will sync with your business bank accounts and automatically validate entries, making bookkeeping feel like a breeze.

For instance, you get an automated inventory management tool that allows you to review and send orders to suppliers with a single click.

You can also receive the inventory when a vendor shipment comes in, and it will be updated in Square and any other relevant integrations.

What makes it one of the best accounting software for small business needs? The fact that it offers a full set of features at an affordable price.

Here’s a list of OneUp’s main features:

Key Features

- Invoicing

- Inventory management

- Core accounting

- Bank reconciliation

- Cash flow and profit reporting

- Bookkeeping

- Customer relationship management (CRM)

Pros

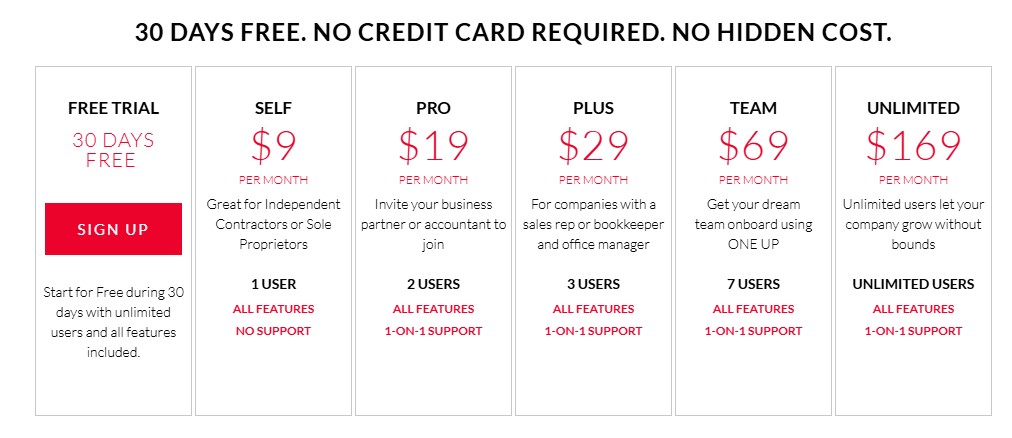

- Offers a 30-day free trial.

- All plans include the same features but differ in terms of the number of users.

- All plans except the basic (Self) one offer one-on-one customer support.

- Can be accessed from all devices.

Cons

- Provides only basic reporting and no advanced analytics.

- Does not offer time-tracking and billing.

Pricing

Here are the pricing plans offered by OneUp:

- Self: $9/month (1 user)

- Pro: $19/month (2 users)

- Plus: $29/month (3 users)

- Team: $69/month (7 users)

- Unlimited: $169/month (unlimited users)

Image via OneUp

Tool Level

- Intermediate

Usability

- The user interface could be cleaner and more user-friendly

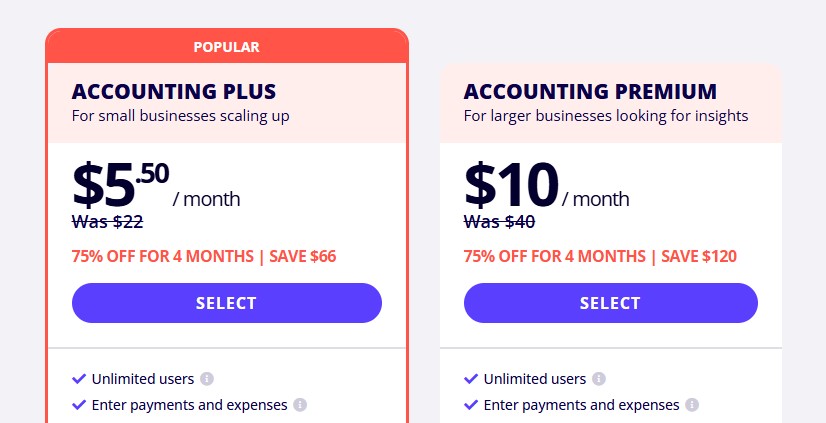

17. Reckon One

Image via Reckon One

This is one of the most affordable accounting software for small business owners. Apart from basic accounting features, it also offers project management, payroll, and time tracking.

Want to know the best part?

Reckon One is power-packed with features and still offers competitive prices, making it extremely cost-effective.

You can automate invoicing with a “Pay now” prompt for credit card payments to increase cash flow. Timesaving tools like recurring invoices, payment reminders, and templates also ensure that your customers pay you on time.

It is suitable for businesses of all sizes and offers custom plans for enterprises that want to build their own packages. Overall, it’s an all-in-one accounting solution with something for everyone.

Key Features

- Unlimited invoicing and billing

- Income and expense tracking

- Tax reporting

- 1000 bank transactions

- Unlimited payroll

- Budgets and forecasts

- Unlimited timesheets and employee expenses

- Analytics and reporting

Pros

- It’s a cloud-based solution with mobile access.

- Offers a 30-day free trial

- Simple, user-friendly interface.

- Industry-specific accounting solutions.

Cons

- Lacks inventory management.

- Some useful features come only with the premium plans.

Pricing

We’ve chosen Reckon One as the best accounting software for small businesses because of its affordable pricing. Here are the plans that you can choose from:

- Accounting Plus: $22/month

- Accounting Premium: $40/month

Image via Reckon One

Tool Level

- Intermediate

Usability

- It is easy to use, with tons of learning resources available on the website for beginners.

Also Read:

18. Spendesk

Image via Spendesk

This is the only spend management platform on this list designed to help you save time and money on every transaction. It can be used for everything from business travel to subscription management and digital advertising to keeping office expenses in check.

Spendesk consolidates all your spending management into a single, intuitive, AI-powered platform. Their consultants offer expert advice to help you with spend management strategy and operational hurdles. Its key features include:

Key Features

- Automated data entry

- Full compliance with spend policies

- Procurement from request to payment

- Unlimited secure virtual cards

- Expense claims and reimbursements

- Integrates with accounting, ERP, and HR tools

- Invoicing and payment

- Built-in budgeting and expense tracking

- Managed through a mobile app

Pros

- Boosts efficiency with automation

- Ensures compliance with built-in policies

- Offers an intuitive, user-friendly interface

Cons

- Learning curve for advanced features

- Integration limitations

Pricing

- Pricing for this accounting software for small business operations is based on specific business needs and requires a custom quote

Tool Level

- Expert

Usability

- Requires some amount of learning and is not the easiest small business accounting software but after an initial learning curve, it can become relatively easy

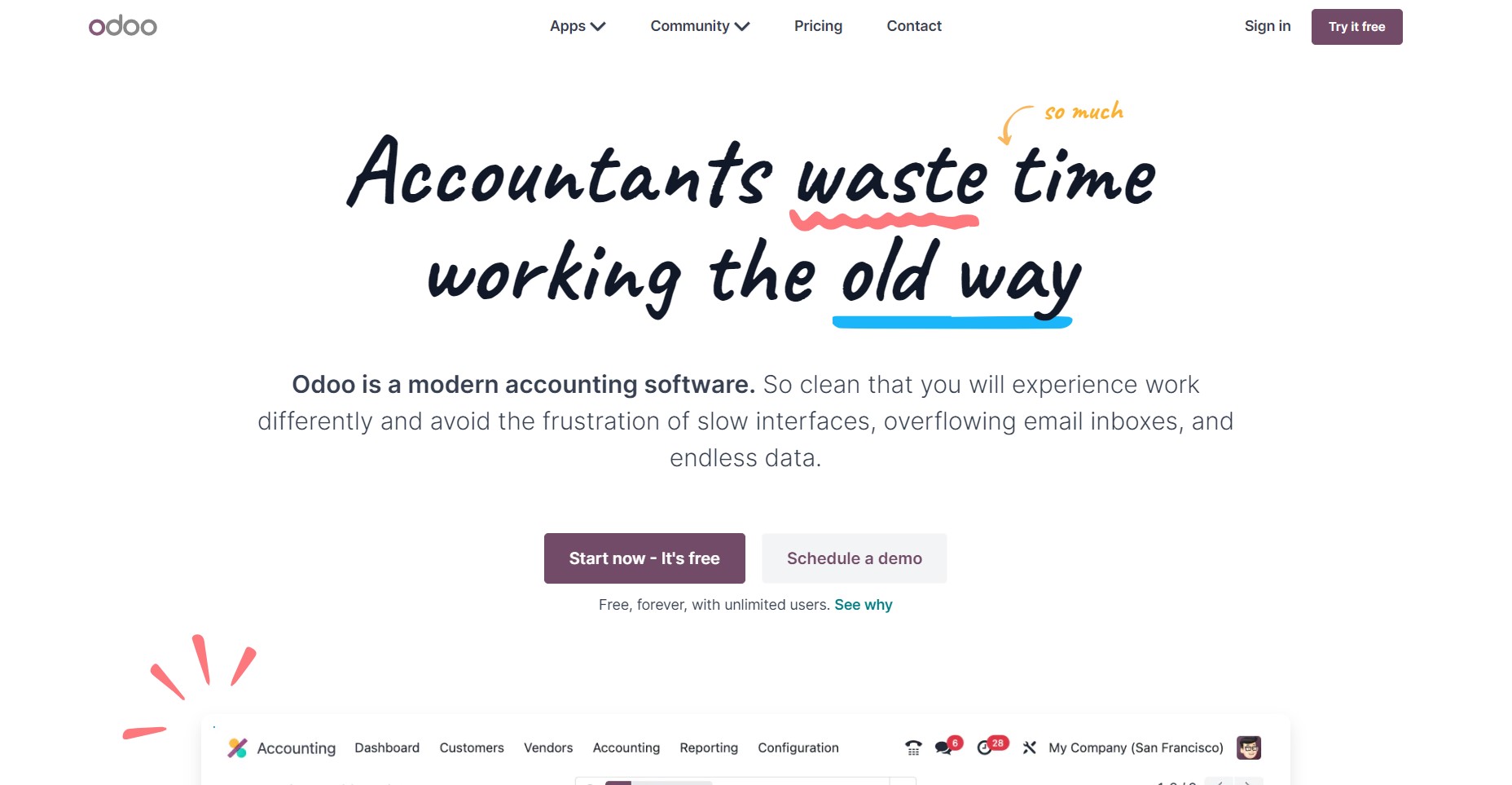

19. Odoo Accounting

Image via Odoo

Odoo Accounting is a comprehensive accounting software solution that’s part of the larger Odoo suite of business management tools. This makes it the right software for small businesses that want an integrated approach to managing their operations.

With Odoo Accounting, you can handle all your financial needs in one place, from invoicing and expense management to financial reporting and tax preparation. Odoo Accounting is designed to automate many of the tedious tasks associated with accounting, saving you time and reducing the risk of errors.

One of the standout features of this accounting software for small businesses is its user-friendly interface. Even if you don’t have a background in accounting, you’ll find the software easy to navigate and use.

What’s more?

The dashboard provides a clear overview of your financial situation, with key metrics like cash flow, income, and expenses displayed in an easy-to-understand format. Let’s see other features that make it the best accounting software for small businesses.

Key Features

- Invoicing and billing

- Track income and expenses

- Bank reconciliation

- Accept payments via multiple gateways

- Financial reporting

- Tax preparation

- Inventory management

- Purchase orders and vendor management

- Mobile app for on-the-go accounting

Pros

- Comprehensive accounting features

- Automates deferred revenue, which is great for subscription-based businesses

- Integrates with other Odoo apps

- Suitable for businesses of all sizes

Cons

- Can be more expensive than some other accounting software options

- Requires some training to fully utilize all features

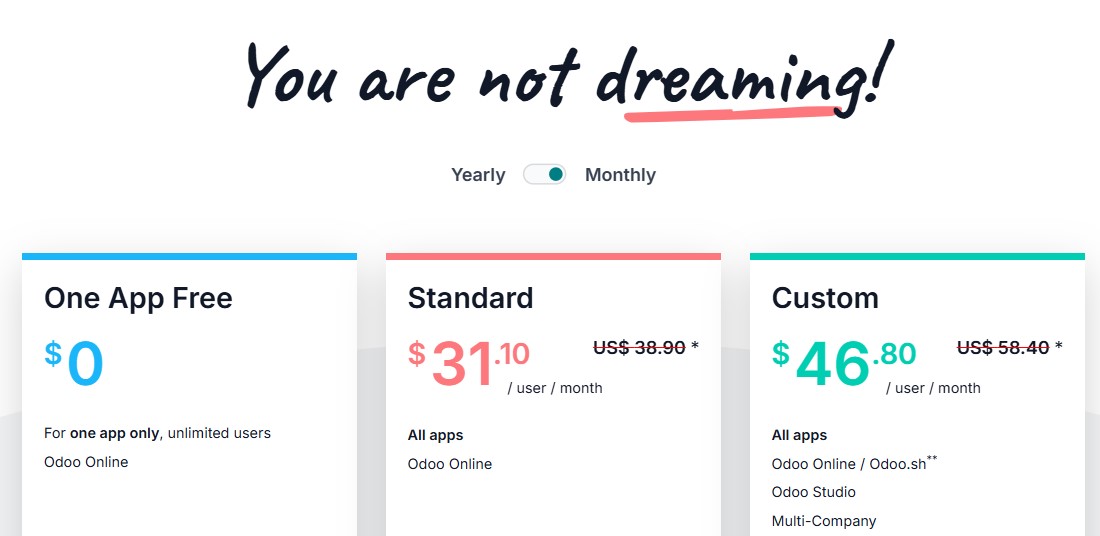

Pricing

This best accounting software for small businesses offers a free version with unlimited users and two advanced plans:

- Standard: $38.90/user/month (includes fees for other Odoo apps and features)

- Custom: $58.40/user/month (includes fees for other Odoo apps and features)

Image via Odoo

Tool Level

- Intermediate to Advanced

Usability

- More advanced features may require some training

Also Read:

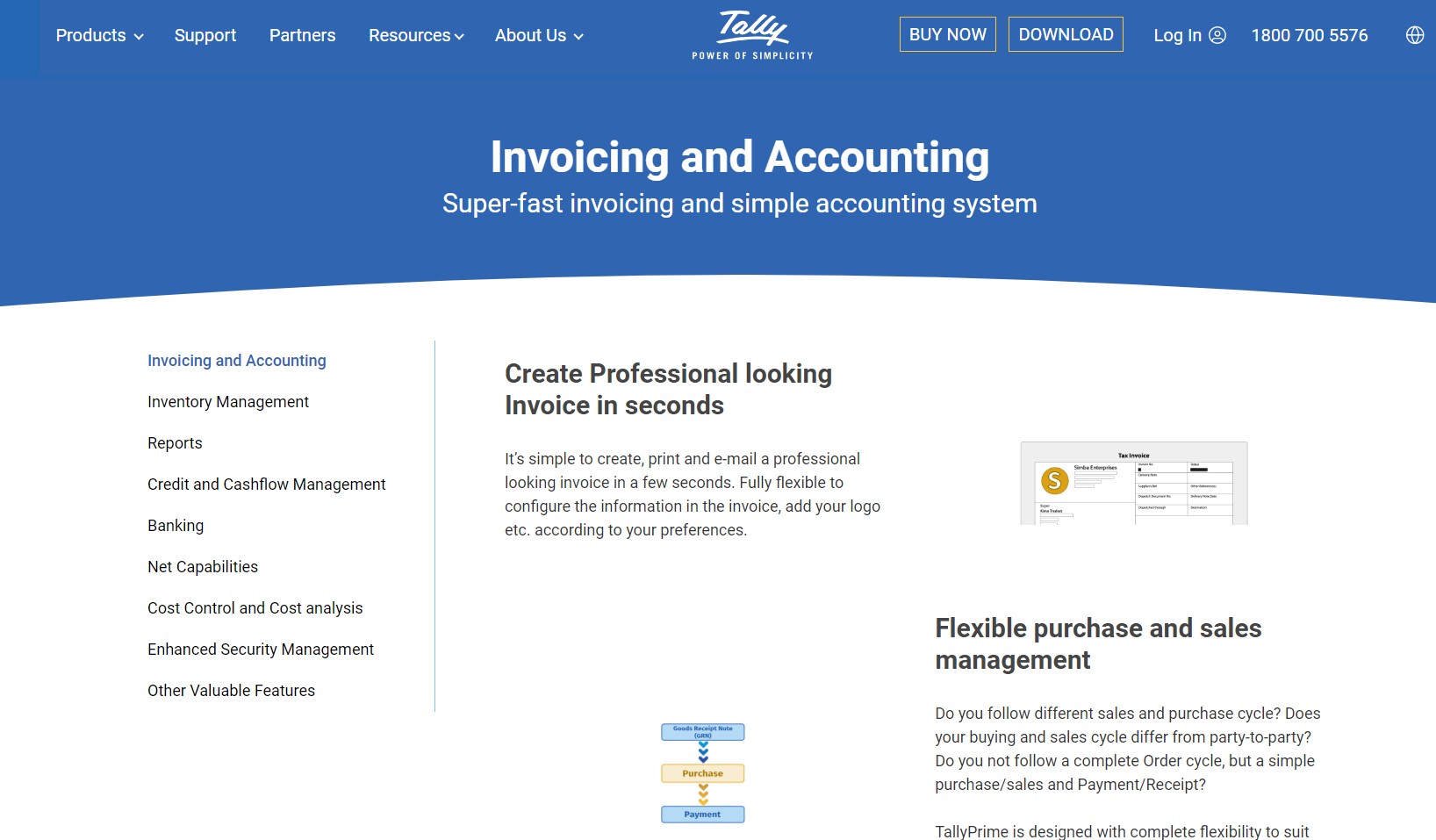

20. TallyPrime

Image via TallyPrime

TallyPrime is one of the best accounting software for small business owners and service-based businesses. Developed by Tally Solutions, a leading Indian software company, TallyPrime offers a range of features to help you manage your finances, inventory, and statutory compliance.

The software supports all types of accounting methods, including cash-based, accrual-based, and mixed-mode. It also offers advanced features like multi-currency support, bank reconciliation, and financial reporting.

With TallyPrime, you can generate over 400 different types of reports, including balance sheets, profit and loss statements, and cash flow statements.

Key Features

- Advanced accounting capabilities

- Multi-currency support

- Robust inventory management

- Statutory compliance management for Indian taxes and regulations

- Unique “Go To” navigation functionality

- Customizable invoicing and reporting

- Multiple billing formats

Pros

- Comprehensive accounting and inventory management features

- Strong statutory compliance support for Indian businesses

- Unique navigation and customization options

- Regular updates to reflect changes in tax laws and regulations

Cons

- Primarily designed for Indian businesses, may not be as suitable for international companies

- Limited third-party integrations compared to some other accounting software

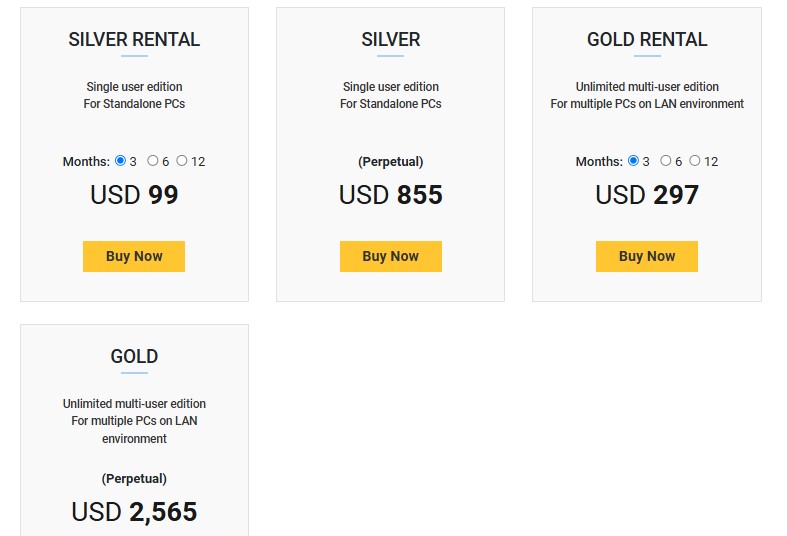

Pricing

Here are the plans available on this accounting software for small business owners:

- Silver Rental: $99/three months (single user)

- Silver: $855 (perpetual; single user)

- Gold Rental: $297/three months (unlimited multi-user)

- Gold: $2,565 (perpetual; unlimited multi-user)

Image via TallyPrime

Tool Level

- Intermediate to Advanced

Usability

- Steep learning curve due to the breadth of features and options

21. FreeAgent

Image via FreeAgent

FreeAgent is, without a doubt, one of the best accounting software for small business operators, freelancers, and independent contractors.

This UK-based platform offers a comprehensive set of tools to help you manage your finances, including invoicing, expense tracking, and project management.

One of the standout features of this accounting software for small business owners is its focus on automation. Thanks to this, FreeAgent can take the hassle out of accounting with features like automatic bank reconciliation, recurring invoices, and real-time financial insights.

What’s more?

FreeAgent is also a great accounting software pick when it comes to preparations for tax season. The software includes tools to help you calculate and file your self-assessment tax return (for UK users), as well as VAT returns.

It also generates real-time tax estimates, so you always know how much you owe and can avoid any surprises come tax time.

Key Features

- Invoicing and billing

- Expense tracking and mileage tracking

- Time tracking and project management

- Self-assessment tax and VAT return filing (UK)

- Real-time tax estimates

- Mobile apps for iOS and Android

- Bank reconciliation and cash flow management

- Multi-currency support

Pros

- Simple and easy to use, even for those without accounting experience

- Robust set of accounting features for small businesses and freelancers

- Mobile apps for on-the-go financial management

- Affordable pricing plans

Cons

- Some limitations on customization options for invoices and reports

- Payroll features are only available for UK users

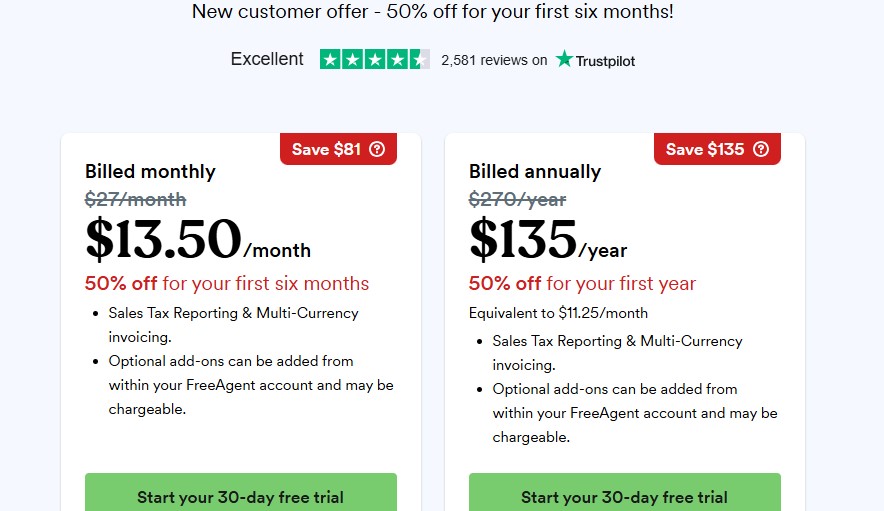

Pricing

This accounting software for small businesses offers a 30-day free trial on its plan:

- Flat rate of $27/month or $270/year

Image via FreeAgent

Tool Level

- Beginner to Intermediate

Usability

- Very user-friendly and easy to navigate

Also Read:

22. Oracle NetSuite

Image via Oracle NetSuite

Oracle NetSuite is the complete business management package. While it’s targeted primarily at larger businesses and enterprises, it is also the best accounting software for small businesses that need a more advanced solution.

NetSuite offers a full range of accounting features, including a general ledger, accounts payable and receivable, financial reporting, and more.

It also comes with extra modules for tasks like inventory management, order management, and HR, making it a true all-in-one solution for managing your business operations.

But that’s not all!

NetSuite also has an impressive cloud-based architecture. Because the software is hosted in the cloud, you can access it from anywhere with an internet connection. This makes it easy to manage your finances on the go and collaborate with remote team members in real-time.

Key Features

- General ledger

- Accounts payable and receivable

- Advanced financial reporting and analytics

- Inventory management and order management

- Financial planning and budgeting tools

- Cloud-based architecture

- High customizability

- HR management

Pros

- Comprehensive suite of accounting and business management tools

- Highly scalable to accommodate business growth

- Powerful reporting and analytics capabilities

- Cloud-based for easy access and collaboration

Cons

- More expensive than many other accounting software options

- Can be complex to set up and require significant training

Pricing

- Pricing for this accounting software for small business operations is based on specific business needs and requires a custom quote

Tool Level

- Advanced

Usability

- Steep learning curve due to advanced features and customization options

23. Vic.ai

Image via Vic.ai

Vic.ai is an AI-powered accounting software that automates and streamlines accounts payable and accounts receivable processes for small businesses and larger ones alike.

Capitalizing on its artificial intelligence and machine learning capabilities, Vic.ai aims to reduce manual data entry, minimize errors, and provide real-time insights into your financial performance.

One interesting feature of this best accounting software for small businesses is its proprietary intelligent invoice processing. The software can automatically capture, read, and categorize incoming invoices, extracting key data points like vendor names, amounts, and due dates.

It can also match invoices to purchase orders and receipts, reducing the need for manual reconciliation.

Key Features

- AI-powered invoice processing

- Intelligent approval workflows for invoices and expenses

- Real-time financial analytics

- Vendor management tools

- Supports electronic payment methods like ACH and virtual cards

- Robust integration capabilities

Pros

- Automates and streamlines AP and AR processes, saving time and reducing errors

- Provides real-time visibility into financial performance with AI-powered analytics

- Improves vendor relationships with electronic onboarding and payment options

- Scalable solution that can grow with your business needs

Cons

- Requires significant setup and configuration to match your specific AP and AR processes

- May require changes to your existing vendor management and payment workflows

Pricing

- Pricing for this accounting software for small business owners is available on demand

Tool Level

- Advanced

Usability

- Requires some training to fully utilize AI-powered features and automation workflows

Also Read:

FAQ

1. What are some of the best accounting software for small business owners?

Here are our top five picks for the best accounting software for small business owners:

- Zoho Books: Best for accountants who need mobile access

- QuickBooks Online: Best overall, suitable for all types of businesses

- Xero: Most value-for-money option for micro-businesses

- FreshBooks: The most user-friendly and simple-to-use accounting software

- Wave: Best free accounting software for a small business

2. Which accounting software is the easiest to use?

FreshBooks is one of the easiest accounting software programs to use, making it perfect for beginners. It is especially useful for freelancers and self-employed professionals.

3. What software do most accountants use?

QuickBooks, Xero, FreshBooks, and Zoho Books are some of the most popular accounting software for small business operations used by accountants worldwide.

4. Which is the best free accounting software?

Wave is the best free accounting software solution for a small business as it offers tons of invoicing, accounting, and banking features for free.

Here are our top five picks for free small business accounting software:

- Wave: Best free accounting software overall

- Zoho Books: Best free accounting software with mobile access

- LessAccounting: Best free software in terms of user-friendliness

- ZipBooks: Best free accounting software for invoicing for small businesses

- GnuCash: Best free open-source accounting software

5. What are the key features of the best accounting software?

Here are some of the features of the best accounting software for a small business:

- Core accounting and general ledger

- Unlimited custom invoicing

- Bank reconciliation

- Multi-currency payments

- Inventory management

- Income and expense tracking

- Time tracking

- Mileage tracking

- Contact management

- Multi-user and multi-device access

- And more!

6. Which is better for small business, Sage Business Cloud or QuickBooks?

Your choice of the best accounting software for small business owners depends on your needs. QuickBooks is better for growing businesses due to its user-friendly interface, affordability, and advanced features. Sage, on the other hand, is beginner-friendly, offering only basic accounting software for small businesses.

7. Why not use Excel for accounting?

Excel lacks automation and real-time collaboration for multiple users, making accounting tedious and prone to errors. Also, it doesn’t integrate with online payment platforms or tax systems, so you’ll have to enter data manually. However, the best accounting software for small business owners, such as Zoho Books, QuickBooks, and Xero, have features that save time and reduce errors in financial management.

8. Which system of accounting is most widely used?

The double-entry accounting system is the most widely used accounting method. It has debit and credit entries for financial transactions to ensure accuracy and balance. Businesses prefer this system because it supports auditing and complies with accounting standards like GAAP and IFRS.

Also Read:

Wrapping Up

Accounting and bookkeeping are the two most tedious yet important business functions, especially for a small business. However, if you have the right accounting software to help you, these processes can become extremely streamlined.

Choose from our top picks for the best accounting software for small business operations and manage your accounts like a pro. Compare the features, user-friendliness, customer support, and compatible devices before you make a selection.

Also, don’t forget to utilize the free trials before you commit to any tool. It will help you check out the user interface and understand how easy or difficult it is to use a particular tool.

Which small business accounting software solution will you choose? Comment below.

Disclaimer: This content contains affiliate links, which means we’ll earn a commission when you click on them (at no additional cost to you).