With most business operations taking place online, it makes sense for freelancers and small businesses to send online invoices to get paid quickly.

That’s why you might be looking for the best invoicing software for small businesses and freelancers.

But when you need to choose invoicing software, there are numerous options out there, including both free and paid software. This can make it confusing to choose the right one for your use case.

Luckily, your hunt for it ends here.

We’ll discuss the 23 best invoicing software for small businesses in detail to help you pick the right one for your use case.

The right invoicing software makes it simple for you to track project estimates and invoices and get paid on time.

In addition, some invoicing software provide client portals so you can get approval for estimates and track billable hours.

Moreover, automatically converting quotes into invoices and tracking billable hours are the standard features of the best invoicing software for small businesses and freelancers.

Let’s discuss the best invoicing software for small businesses in detail.

Disclaimer: This content contains affiliate links, which means we’ll earn a commission when you click on them (at no additional cost to you).

Best invoicing Software for Small Businesses and Freelancers

Facing any challenges with your financial accounting? Here are some of the best invoicing software for small businesses and freelancers:

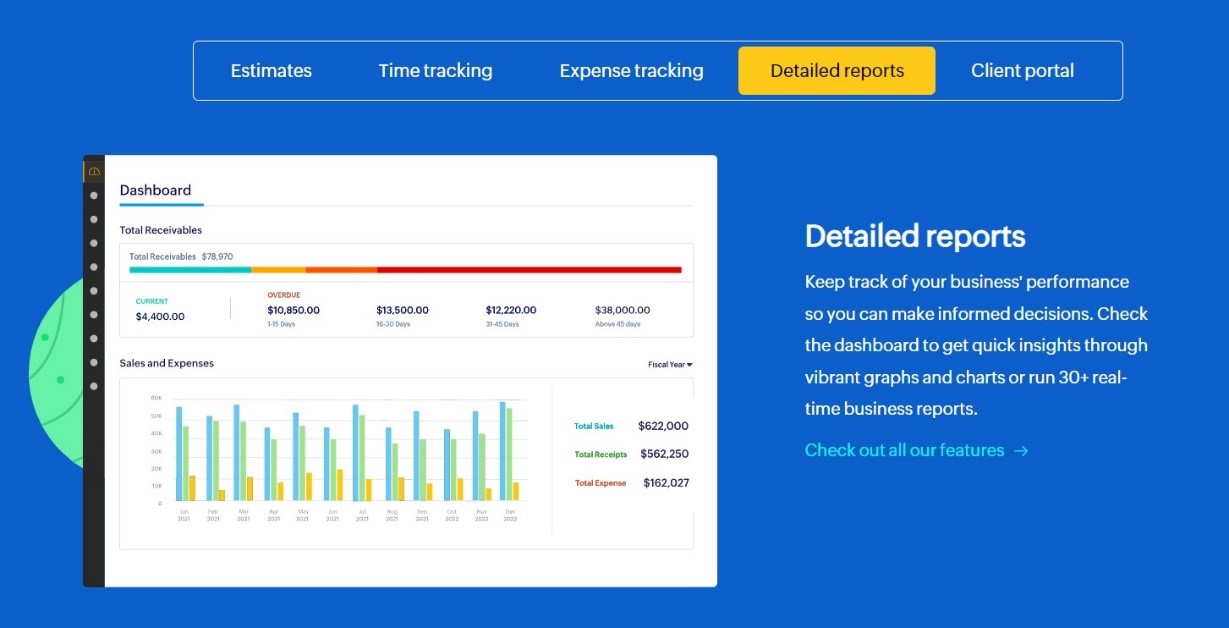

1. Zoho Invoice

Image via Zoho Invoice

This is an entirely free cloud-based invoicing solution that provides customizable templates and multilingual support, along with a host of other necessary features for small businesses.

The platform offers unlimited clients and allows small businesses and freelancers to create up to 1,000 invoices per year.

Zoho Invoice also goes beyond invoicing by enabling you to create estimates, track expenses and time, manage contacts, and establish and manage projects.

The platform offers a user-friendly interface to make it possible for freelancers and small businesses, who don’t have much experience with invoicing software, to create and track invoices in minutes. For more help managing your finances, consider learning about small business bookkeeping for beginners.

Using Zoho Invoice, you can send reminders too, and most importantly, accept payments via credit card, debit card, and bank transfers, all in one place.

Moreover, if you already use any tools from the Zoho Suite, this invoicing software is bliss for you. It can easily integrate with other Zoho products, like Zoho Books, to make invoicing effortless.

Highlighted Features

- Multi-currency support

- Customizable templates

- Multilingual support

- Invoice scheduling

- Automating recurring invoices

- Payment reminders

- Dedicated client portal

- Invoice estimate generator

- Income tax calculator

- Expense report generator

- SKU generator

- Revenue forecaster

- Integrates with Stripe, PayPal, Google Workspace, and Dropbox

Pros

- Great centralized dashboard

- Offers business analytics

- Supports invoice branding

- Invoice creation and reminder automation

- Open API for easy integration with existing business applications

- Seamless integration with Zoho applications

- Mobile app support

- Forever free

Cons

- Mobile app doesn’t offer all the website’s features

- Integration with third-party business applications is complex

- Isn’t suitable for advanced custom/recurring invoice creation

- No auto BCC feature

- Doesn’t support multiple business branches

Pricing Plans

- Forever free

Image via Zoho Invoice

You May Also Like:

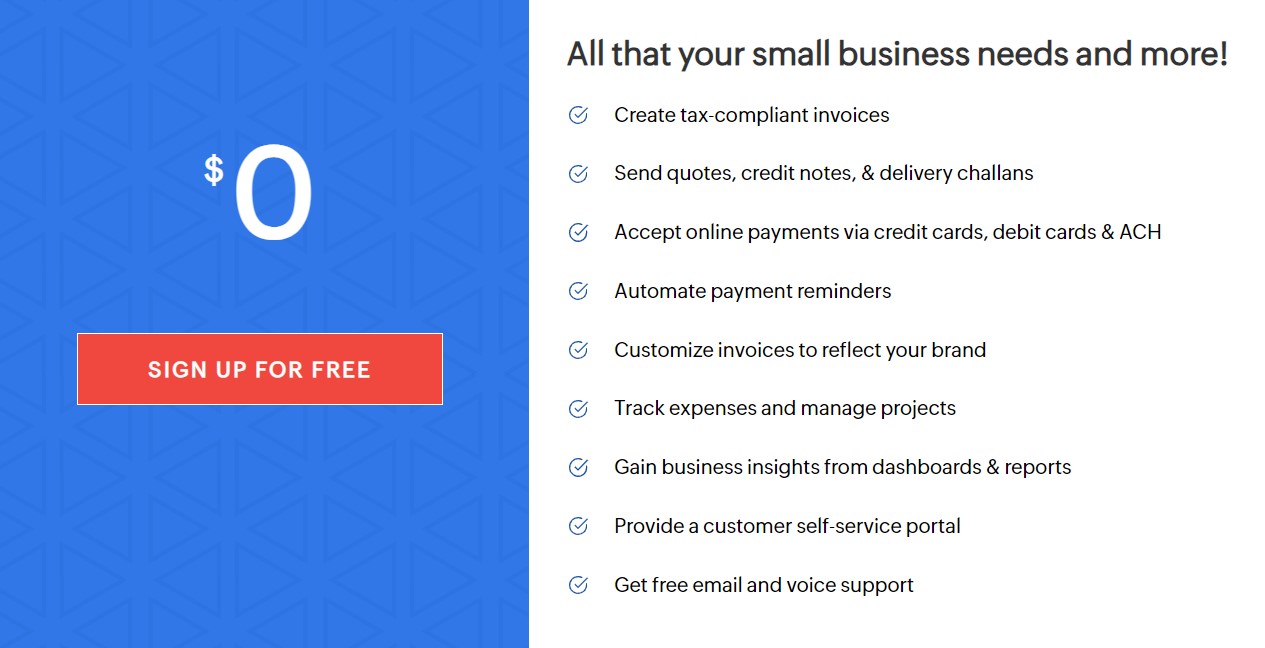

2. FreshBooks

Image via FreshBooks

If you are a freelancer or a small business owner seeking the best invoicing software for small businesses with accounting capabilities, look no further than FreshBooks.

FreshBooks provides double-entry accounting, journal entries, and bank reconciliation, as well as other basic and advanced accounting features.

The basic FreshBooks plan includes invoicing functionalities. But if you want more, you can go with the more expensive plans.

You can send as many invoices and estimates as you like with FreshBooks. Also, the invoicing software has a number of time-saving automations built in.

Besides time tracking, expense management, and project management, FreshBooks also allows you to complete other critical business tasks.

Depending on the plan you select for your small business, you may also get access to bank reconciliations, reports, journal entries, and proposals.

Moreover, FreshBooks integrates with over 100 enterprise applications and payment gateways, and its customer service is excellent. Another reason why FreshBooks is one of the best invoicing software for small businesses is because of the numerous positive reviews from its users. For more insights on selecting the right software, go through this guide on choosing the best accounting software.

Highlighted Features

- Expense tracking for small businesses

- Simple and intuitive UI

- Mobile app

- Financial reporting

- Time tracking

- Invoice sending reminders

- Automated client follow-ups

- Income forecast

- Customizable invoicing payment terms

- Discount functionality

- Tax calculation

Pros

- Supports credit card and ACH payments

- Multiple currency support

- Supports invoice branding

- Invoice creation and reminder automation

- Mobile app support

- Comes with a bookkeeping software

- Helps collect late fees on delayed invoices

Cons

- Doesn’t offer reports via the mobile app

- Doesn’t carry past due balance into new invoices

- No accountant access or bank reconciliation in the lowest-tier plan

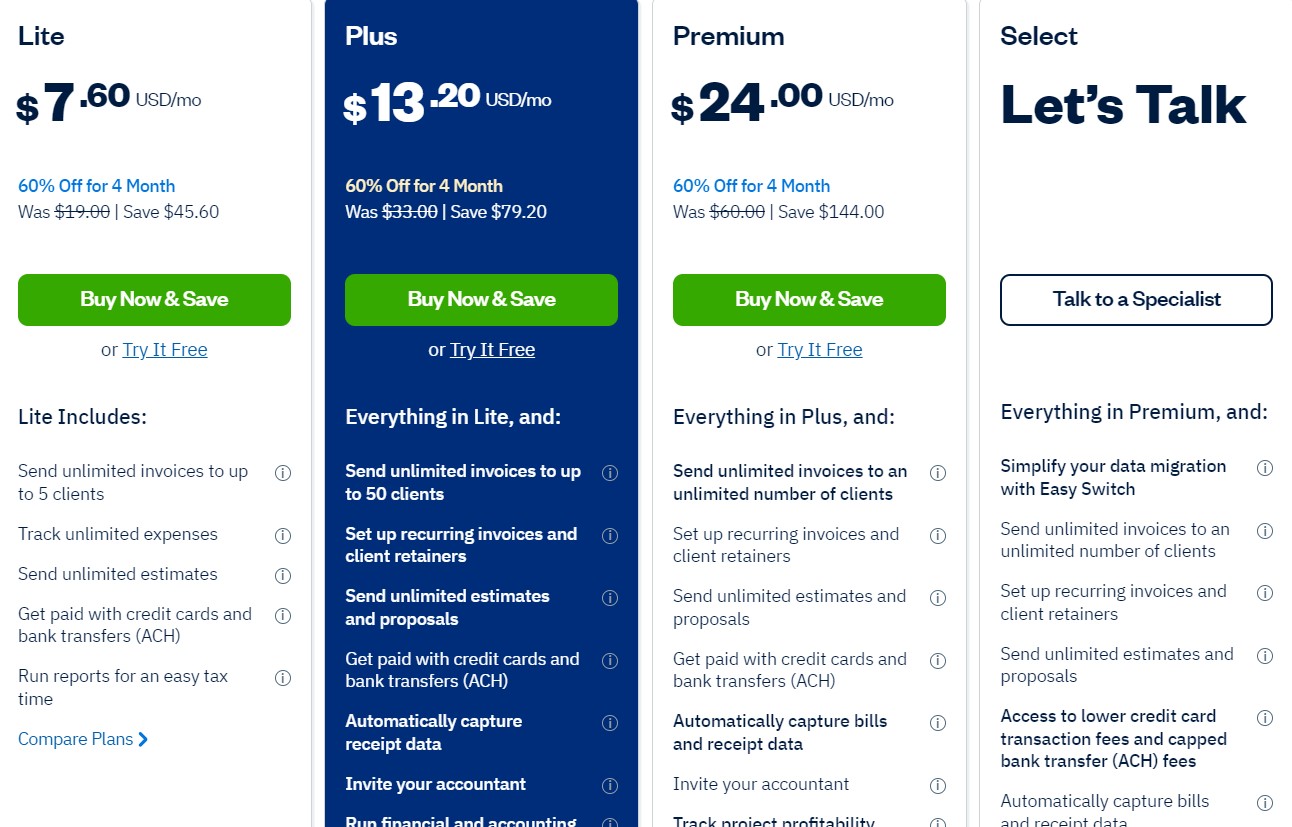

Pricing Plans

Keep in mind that all paid FreshBooks plans currently come with a 60% discount for the first four months.

- Free Trial for 30 days

- Lite: $7.60/month

- Plus: $13.20/month

- Premium: $24/month

- Select: Custom

Image via FreshBooks

3. Square Invoices

Image via Square

Square is another one of the best options for small businesses to accept POS and online payments. With Square Invoices, you can create invoices and track unpaid and paid invoices from any digital device, no matter where you are.

When you register for a Square account, you can use Square Invoices as well as its other tools for your small business instantly. It’s terrific that sending invoices to your customers is cost-free with Square Invoices, making it an ideal option for small businesses and freelancers.

Square invoicing software has a simple interface that is very straightforward to use. There’s only one invoice template, but it can be customized by altering the colors or adding your logo.

You can send invoices directly from your smartphone or other connected devices using Square Invoices.

In addition to mobile billing, Square Invoices provides other services to assist small businesses in managing and developing their company, including estimates, employee management, contact management, sales tracking, and advanced inventory management functions. For more information on accounting software, consider exploring the best accounting software for small businesses.

You may even generate contracts and attach them to your invoices.

Highlighted Features

- Automatic payment reminders

- Recurring invoices

- Instant payments via SMS, email, or URLs

- Real-time invoice tracking

- Cash flow estimates

- Digital contracts

- Deposits

Pros

- Forever free plan, greatly helpful for small businesses

- Invoice creation and reminders automation

- Mobile app support

- Supports credit card and ACH payments

- Multiple currency support

- Offers business analytics

- Includes basic accounting functionality

- Integrates with Square POS and other Square tools

Cons

- Invoice processing fees

- Free version doesn’t support invoice customization

- No multiple business support in the free version

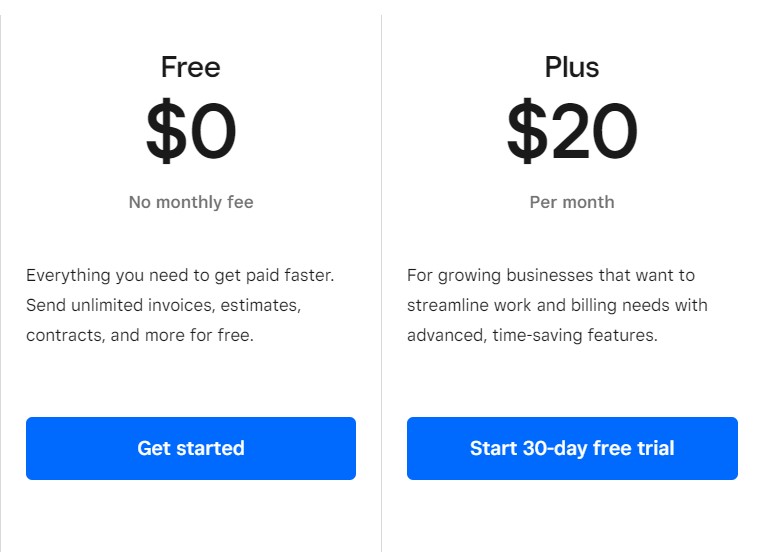

Pricing Plans

- Forever free plan + processing fees

- Plus: $20/month + processing fees

Image via Square

4. QuickBooks

Image via QuickBooks

QuickBooks easily makes the list of one of the best invoicing software for small businesses. It falls in the FreshBooks category of bookkeeping software suites and helps small businesses monitor their transactions effectively. For those new to managing finances, learning about small business bookkeeping for beginners can prove to be very helpful.

This invoicing solution ensures easy access to sales and customer management modules, allowing small businesses and freelancers to handle all their invoices in one place.

While invoicing software typically doesn’t include the numerous features an accounting software does, QuickBooks Online is among the exceptions.

If you want to save money on your subscription or don’t need all the features that this accounting software offers, you might be better off with another invoicing software on our list.

However, QuickBooks is a great option if you want a comprehensive accounting solution for your small business.

What’s enticing is that you can create, send, and track invoices from any digital device effortlessly using QuickBooks.

Hence, if you own a small retail establishment, this comprehensive accounting software is ideal. Daily transactions can be monitored by connecting QuickBooks to your bank account.

Highlighted Features

- Custom invoices

- Automatic time tracking with QuickBooks Time and Google Calendar

- Invoice sending reminders

- Automated client follow-ups

- Progressive invoices

- Payment split-ups based on the project, stages, etc.

- Financial reporting

- Team collaboration

- Tax calculation

- Income forecast

- Expense tracking

- Mobile app

- Discount functionality

Pros

- Automatic accounts sync and reconciliation

- See the undeposited funds on a single screen

- Send journal entries to clients

- Multiple currency support

- Invoice creation and reminder automation

- Comes with a bookkeeping software

- Supports credit card and ACH payments

Cons

- Inefficient customer support

- Bit more expensive than other accounting and invoicing software

- Doesn’t offer a free plan

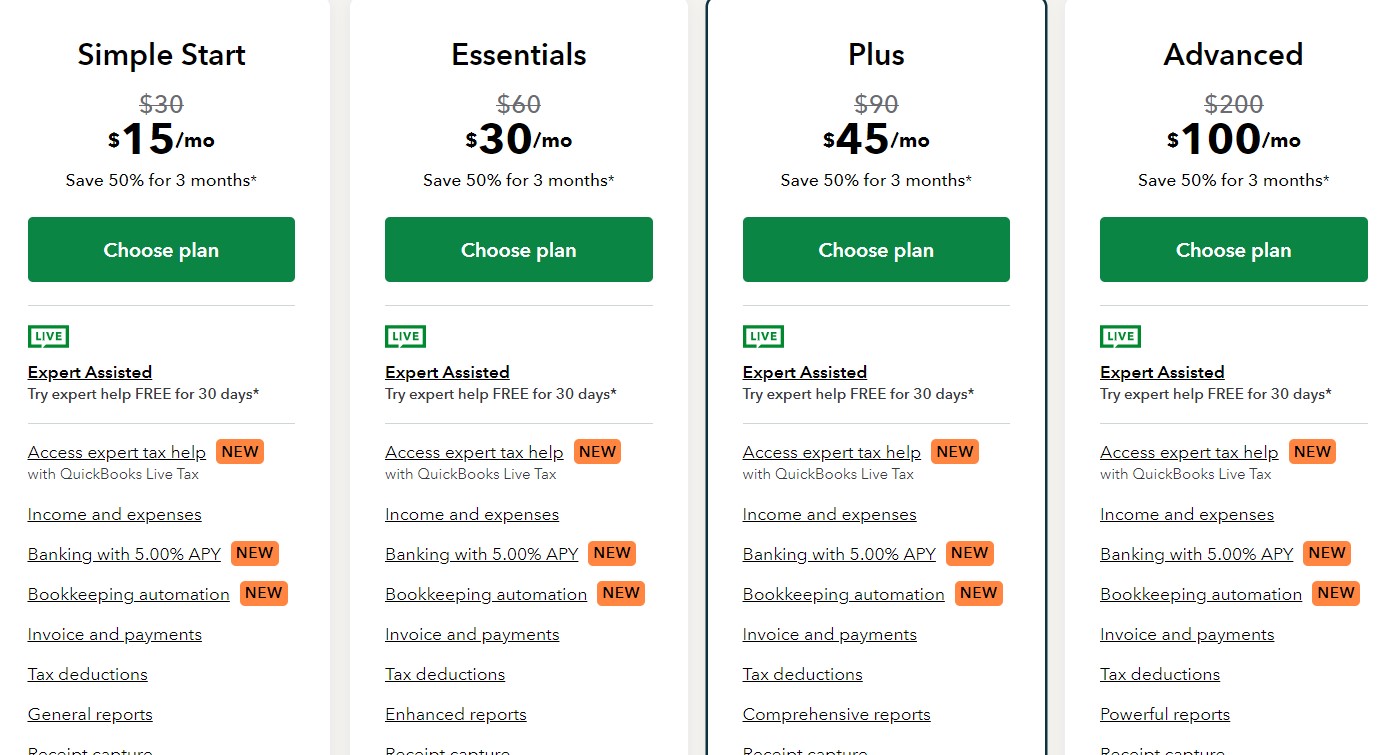

Pricing Plans

You get 50% off for the first three months, and the prices look like these:

- Simple Start: $15/month

- Essentials: $30/month

- Plus: $45/month

- Advanced: $100/month

Image via QuickBooks

You May Also Like:

5. Invoicera

Image via Invoicera

Invoicera is an online invoicing and billing software that can be customized to suit the requirements of small businesses.

You may use this free invoice software to automatically generate invoices for your clients. This way, you can focus on other critical tasks for your small business. For more options tailored to new and upcoming businesses, explore accounting software for startups.

In addition to sending invoices and payment reminders to your clients, you can also manage your suppliers, customize invoice layouts to make them appear more professional, and ensure team collaboration with centralized data management.

You can get started with this invoicing software with its 15-day free trial to get a feel for its features. This can be a great starting point for freelancers and small businesses so you can get a feel for the platform before paying for it. For more advice on selecting the right tool, check out this guide on how to choose accounting software.

Signing up for Invoicera is quite simple. You can simply generate a username and password to get started with the free trial.

Highlighted Features

- Time tracking

- Expense management

- Auto billing

- Multi-business support

- Estimate management

- Client management

- Project management

- Integrate with legacy systems

- Workflow automation

- Task management

- Credit note management

- Multi-currency and language support

- Accounts receivable and payable management

- Financial forecasting

- Invoice template customization

- Offers PDF protection

Pros

- Effortless Invoicing

- Automation features work well

- Offers forever free plan

- Multi-business support

- Automated payment reminders

- Offers team collaboration for up to 10 members, perfect for small businesses

Cons

- Free plan only supports up to 3 clients

- Doesn’t facilitate time tracking via the mobile app

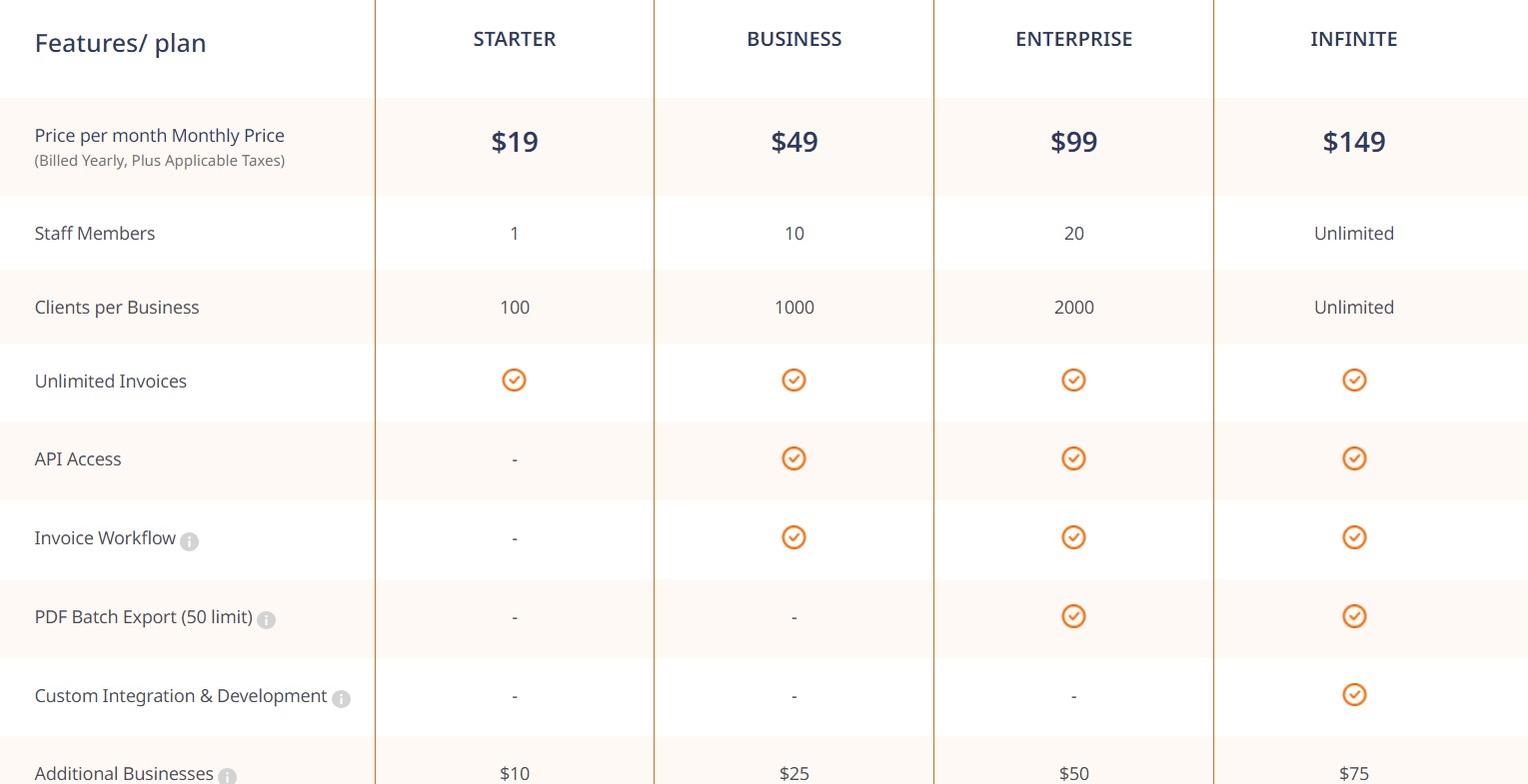

Pricing Plans

- Starter: $19/month

- Business: $49/month

- Enterprise: $99/month

- Infinite: $149/month

Image via Invoicera

6. Sage Intacct

Image via Sage Intacct

Although Sage Intacct isn’t solely focused on invoicing, it offers several useful accounts payable and receivable features that make it a great choice for small businesses that want more features in their invoicing software.

Sage Intacct accounts receivable module streamlines your invoicing process, leading to quicker payment cycles.

This invoicing software offers automation through which you can generate recurring invoices, send emails, and offer more payment options. Also, you can keep better records by attaching customer documents to transactions, subscriptions, and more.

With regards to accounting and the billing process, the software can connect with your existing accounting or CRM solutions to help you track quotes, sales orders, and invoices.

It automatically records order transactions in the general ledger and AR accounts to streamline accounting and billing.

Sage Intacct can even provide up-to-date and accurate sales tax assessments for your small business.

Highlighted Features

- Automated invoice creation and sending

- Recurring invoices

- Seamless integration with Salesforce CRM

- Accounts receivable ledger

- Automatically adds transactions to the ledger

- Built-in configurable dashboards

- Reports on deferred revenue, invoice analysis, customer aging, recurring invoices, etc.

- Configurable payment reminders

- Team management in terms of invoice ownership

- Financial reporting

- Tax calculation

- Income forecast

- Expense tracking

- Mobile app

Pros

- See undeposited funds on a single screen

- Multiple currency support

- Supports invoice branding

- Invoice creation and reminder automation

- Comes with bookkeeping features

- Supports credit card and ACH payments

- Free 30-day trial

Cons

- Costs higher than its competitors

Pricing Plans

- Available on demand

You May Also Like:

7. Invoice Ninja

Image via Invoice Ninja

With Invoice Ninja’s forever-free invoicing software for small businesses, you get everything that you would with premium invoicing software, including invoices, time and expense tracking, item lists, project management, estimates, and contact management. For more options tailored to small businesses, explore accounting software for startups.

Invoice Ninja’s voice commands are a particularly unique function that allow you to send invoices and perform specific tasks using your voice.

The reason we liked Invoice Ninja is that it will enable your small business to serve a lot more clients than most of its competitors that offer forever-free plans.

You can add deposits and discounts to the invoices you create on this tool using the time-tracking integration, ask for upfront deposits, and include taxes and discounts.

Moreover, the paid versions include features like bulk billing, but the free version is so powerful that small businesses and freelancers may never need to upgrade.

Highlighted Features

- Branded invoices

- Dynamic dashboards packed with data

- Professional invoice templates

- Track product inventory levels

- Link up to 10 companies with one login

- Recurring invoices and auto-billing

- Attach third-party files to invoices

- Customizable invoices

- Create and manage projects and tasks to track time

- Send invoices and quotes from Gmail

- Seamless group workflow

- Kanban boards for project management

- Custom domain

- Zapier integration

- Customizable default emails

- Payment auto-reminders

- Bulk emailing of invoices

- Multiple currency support and formatting

- Default BCC addresses

Pros

- Customizability

- Free plan offers unlimited quotes and invoices for up to 20 clients

- Feature-loaded forever-free plan

- Create quotes and track time, and include both in invoices

- Integration with 40+ payment gateways

- Payment in multiple currencies including cryptos

Cons

- Doesn’t seamlessly integrate with bookkeeping or accounting software

Pricing Plans

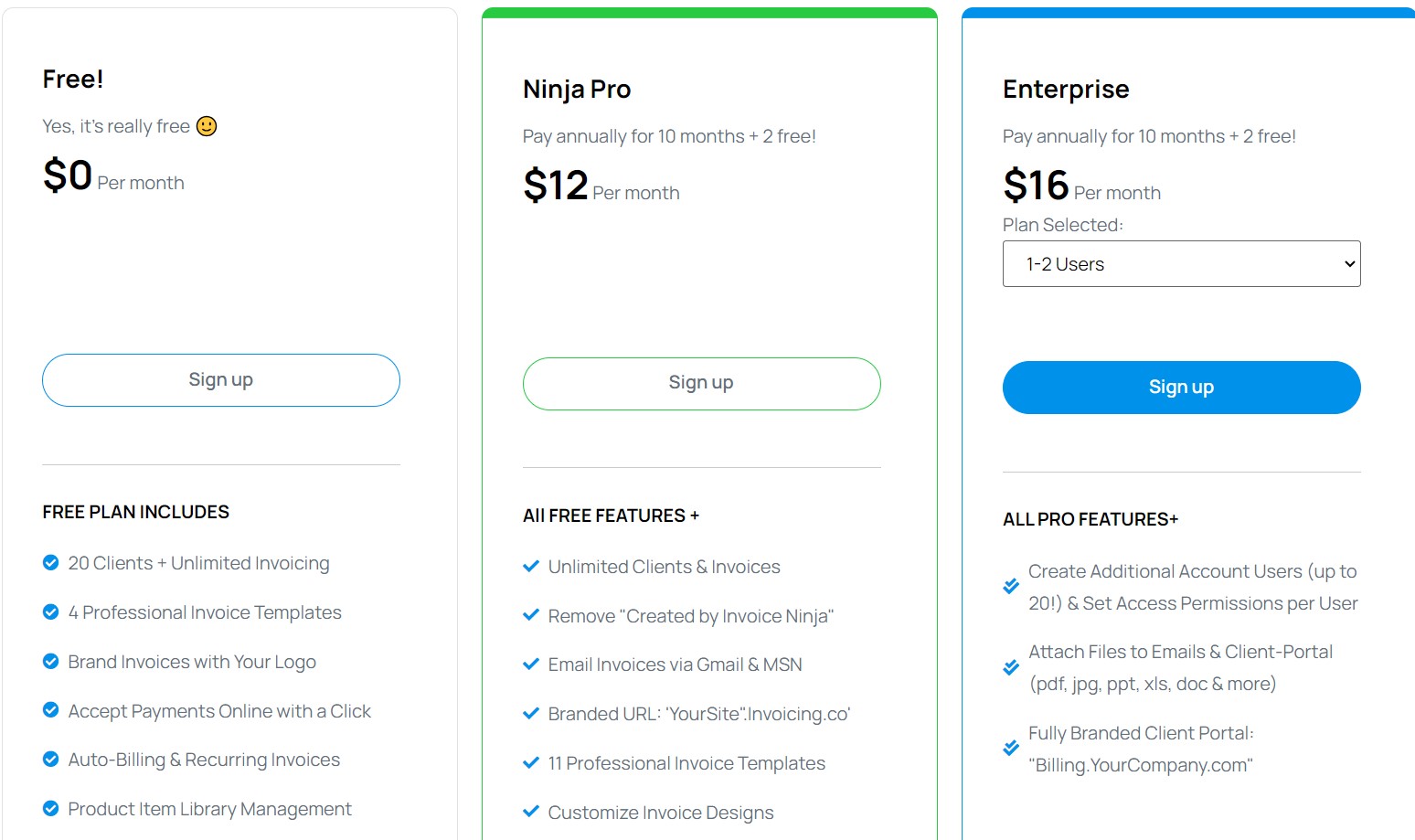

- Forever Free

- Ninja Pro Plan: $12/month

- Enterprise Plan: $16/month

Image via Invoice Ninja

8. Hiveage

Image via Hiveage

Hiveage enables small businesses and freelancers to send invoices and estimates, accept payments online, and a lot more.

You can send professional online invoices with custom branding and make sure clients pay on time. Additionally, you can send invoices immediately after adding data or create an estimate and turn it into an invoice instantly.

The best part is that there’s a free plan.

The free plan of this invoicing software lets you send unlimited invoices to up to 5 clients, making it a bit expensive for most small businesses with more clients.

Hiveage enables small businesses to accept online payments through more than a dozen popular payment gateways, including Stripe, PayPal, and Braintree.

Users can also track time, expenses, mileage, create estimates and quotes, send recurring invoices, and charge subscriptions automatically, as well as manage multiple businesses and teams with different levels of access—all via a single account.

Using Hiveage’s clear invoice status labels, users can see if an invoice is saved as a draft, sent to the client, viewed by the client, or has received full or partial payment.

Hiveage also allows users to save an unlimited number of tax, discount, and shipping fee entries as percentages or amounts and then lets you add them to invoice line items or subtotals.

On top of it all, Hiveage automatically generates payment reminders and statements, whether they are intended to remind clients of overdue payments or thank them for paying on time. For more information on accounting software options for small businesses, consider exploring the best accounting software for small businesses.

Highlighted Features

- APIs for integration

- Centralized activity dashboard

- Bill and client categorization/grouping

- Dedicated client portal

- Contact database

- Credit and debit card processing

- Customized branded invoices

- Data import/export

- Finance estimating and analytics

- Expense and time tracking

- Invoice creation, history, processing, and management

- Dedicated mobile app

- Multi-currency support

- Real-time data

- Receipt management

- Recurring/subscription billing

- Payment reminders

- Sales tax management

- Task management

Pros

- Offers a forever free plan

- Allows creating quotes and tracking time, and include both in invoices

- Multi-business support

- Supports accounts receivable and payable

- Automated payment reminders

- Team collaboration features work well

Cons

- Forever free plan isn’t feature-loaded

- Non-customizable reports

- Not able to link to underlying data

Pricing Plans

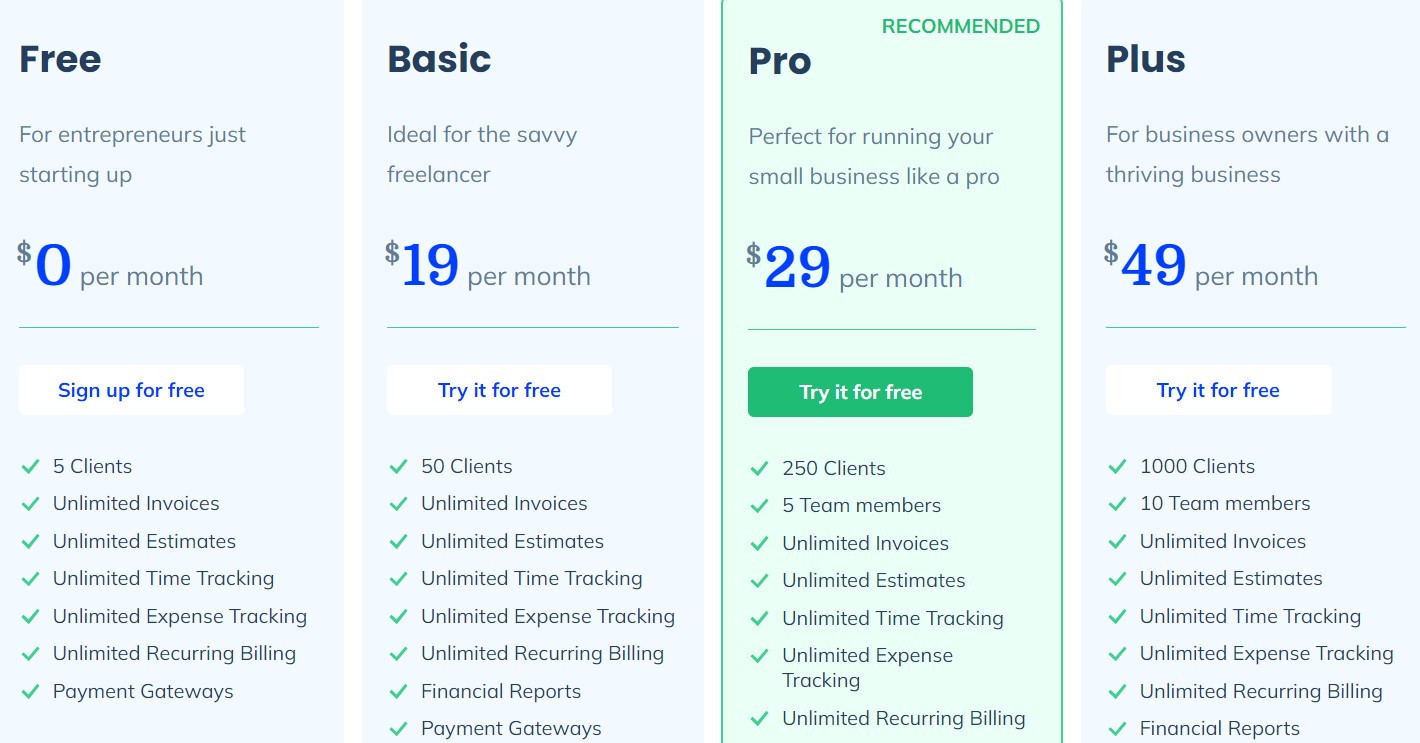

- Forever free

- Basic: $16/month

- Pro: $29/month

- Plus: $49/month

Image via Hiveage

You May Also Like:

9. Harvest

Image via Harvest

Harvest is a fantastic time tracking, project evaluation, and invoicing software for small businesses.

You can utilize Harvest to track your time, gain knowledge from former initiatives, and receive payment for your job by creating invoices based on the tracked time.

Harvest’s native mobile apps and integrations with platforms such as Asana and Slack make it simple for your small business’s workforce to utilize them.

You will be supported by visual reports that can help you track your projects too. The best part here is that the platform also offers online payment features so your clients can pay you for your work directly upon receiving the invoice.

Harvest is perfect for small business teams working on client service projects that require time and expense tracking. With reporting features, Harvest keeps projects on time and within budget.

You also get a time-tracking feature to help your team track their billable hours and projects.

This comes with custom reminders to help track time more accurately and regularly, which helps your team focus on their tasks.

Highlighted Features

- Activity tracking

- Billable & non-billable hours

- Billing & invoicing

- Expense tracking

- Mobile time tracking

- Multiple billing rates

- Offline time tracking

- Project tracking

- Time tracking features allow you to track time by client and project, making it helpful for analytics too

- Timesheet management

Pros

- Supports unlimited seats and projects

- Business analytics features are great additions

- Advanced time-tracking features

- Team collaboration feature works well

- Offers a forever-free plan

- Allows creating quotes and tracking time, and includes both in invoices

- Multi-business support

Cons

- Free plan doesn’t support necessary features like branding and templates

- Limited pricing options

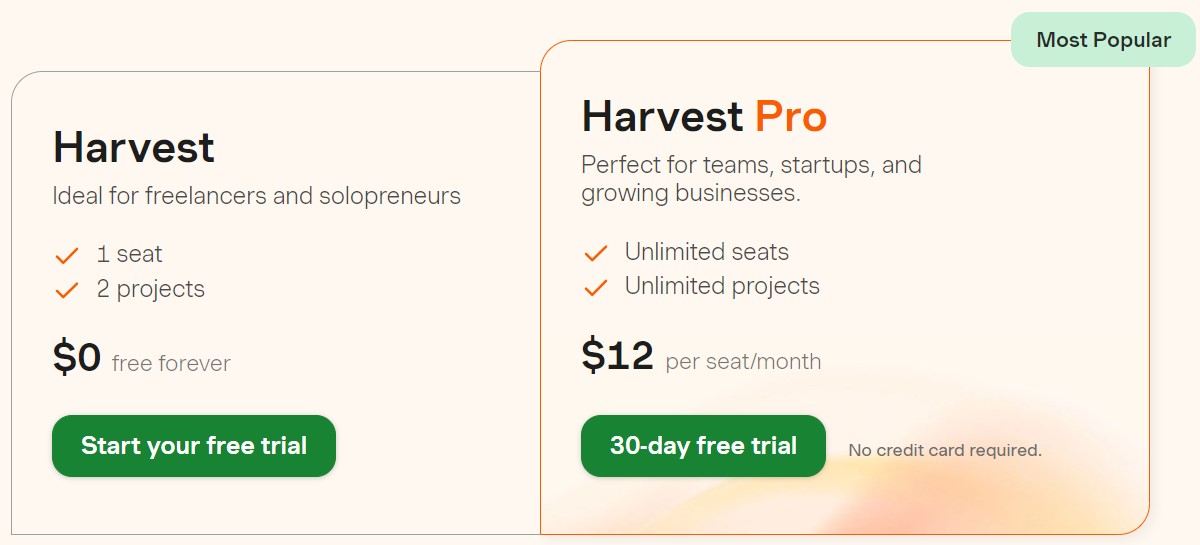

Pricing Plans

- Harvest: Forever free

- Harvest Pro: $12/seat/month

10. Invoice2go

Image via Invoice2go

If you need on-the-go, professional-looking invoicing software, Invoice2go should be on your list of considerations. Invoice2go is a cloud-based invoicing software that is simple to use, making it among the best options for small businesses.

For a small business with low invoicing volumes, Invoice2go is probably a good choice. The best part is that you can send your first invoice in just a few minutes after setting up the software.

Also, with Invoice2go’s powerful Android and iPhone apps, it’s now easier than ever to create professional invoices on the go.

In addition to sending invoices, Invoice2go provides features like expense tracking, time tracking, invoice templates, estimates, and purchase order management.

Small businesses and freelancers can even send invoices via SMS, mobile apps, or, if they prefer, through a cloud-based desktop application.

However, Invoice2go is not an all-inclusive business accounting software for small businesses, so if you’re hoping for features like tax preparation, bank feeds, and detailed reports, you should go with FreshBooks or QuickBooks.

Highlighted Features

- Invoice templates

- Instant cost estimates

- Expense and time tracking

- Ability to send invoices

- Invoice tracking

- Client portal

- Performance reports

- Banking integration

- Powerful mobile app

- Payroll management

- Website creation

Pros

- Professional invoices on the go

- Easily navigable dashboard

- Advanced time-tracking features

- Expense-tracking features

- Team collaboration features work very well

- Unlimited storage

- Easy to use

Cons

- Limited features

- Limited integrations

- Expensive

- Doesn’t offer a free plan

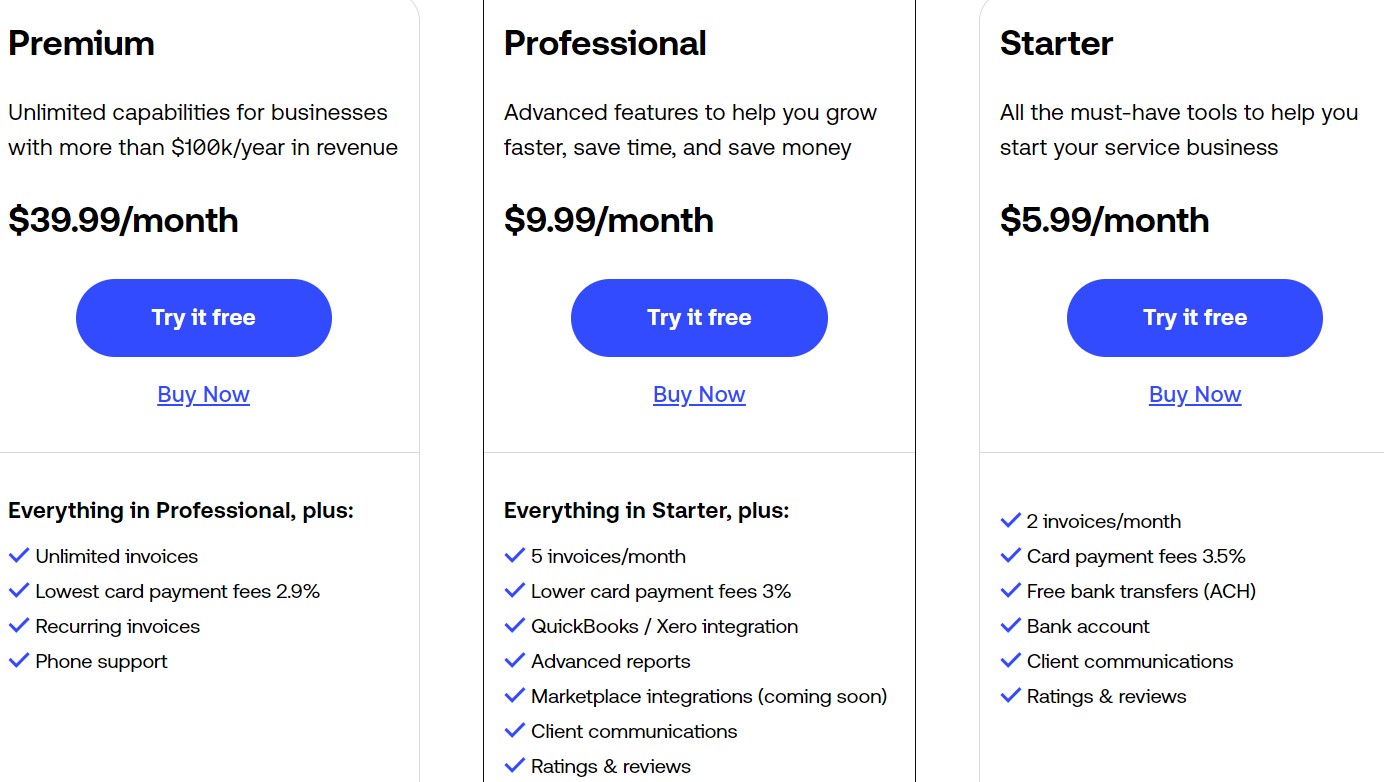

Pricing Plans

- Starter: $5.99/month

- Professional: $9.99/month

- Premium: $39.99/month

Image via Invoice2go

You May Also Like:

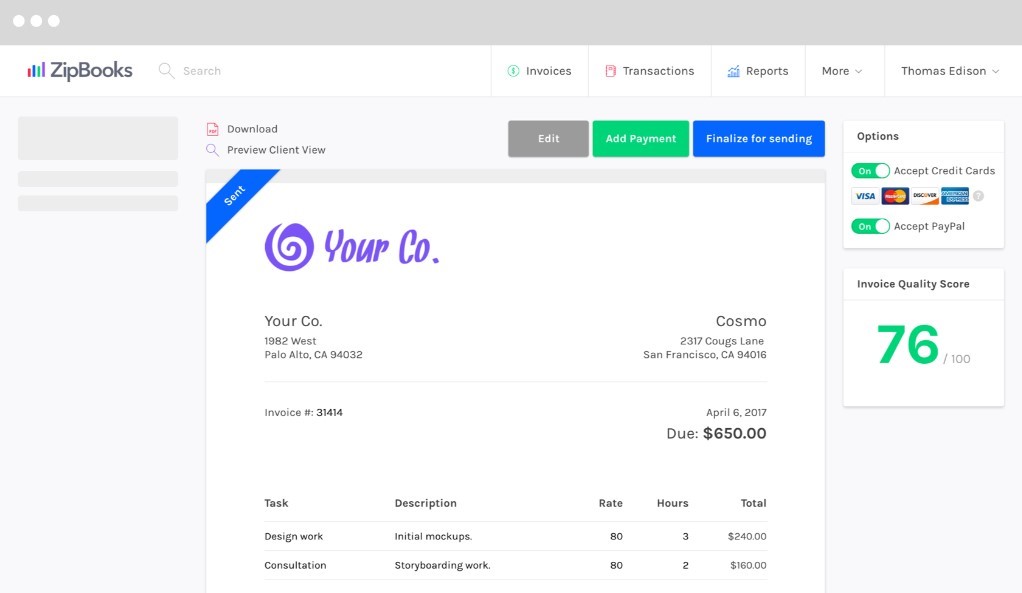

11. ZipBooks

Image via ZipBooks

ZipBooks is among the best invoicing software for small businesses and also offers accounts payable and accounting functionalities.

With ZipBooks, users can create branded invoices with logos, themes, and text. The software facilitates bank integration, allowing the system to import transactions and generate real-time expense reports.

Furthermore, ZipBooks’s project management tools, such as time trackers, allow small businesses to create tasks, assign them to team members, and monitor their performance.

Accountants can text their clients directly from the app for efficient communication and reconciliation.

Besides providing generic financial reports, ZipBooks also uses data-driven intelligence to provide useful insights.

Such insights include your invoice quality score, business health score, and a smart search to help you find anything you want across all your ZipBooks records.

ZipBooks offers paid as well as forever-free plans that are suitable for small businesses. With the free plan, you can send invoices and keep track of an unlimited number of clients and suppliers.

Highlighted Features

- Billable expenses

- Credit card processing

- Cost estimates

- Invoice templates

- Customers management

- Mobile app

- Multi-currency support

- Recurring billing option

- Payment reminders

- Team collaboration and management

- Time tracking

Pros

- Allows tracking of the time of each member for every project

- Invoice feedback functionality is a unique feature

- Historical reporting is bliss for business insights

- Recurring bills and reminder automation

- Seamless integration with third-party tools including Google Workspace, Asana, Slack, etc.

Cons

- Basic mobile app functionalities

- Poor customer support

- Finance reporting is very basic

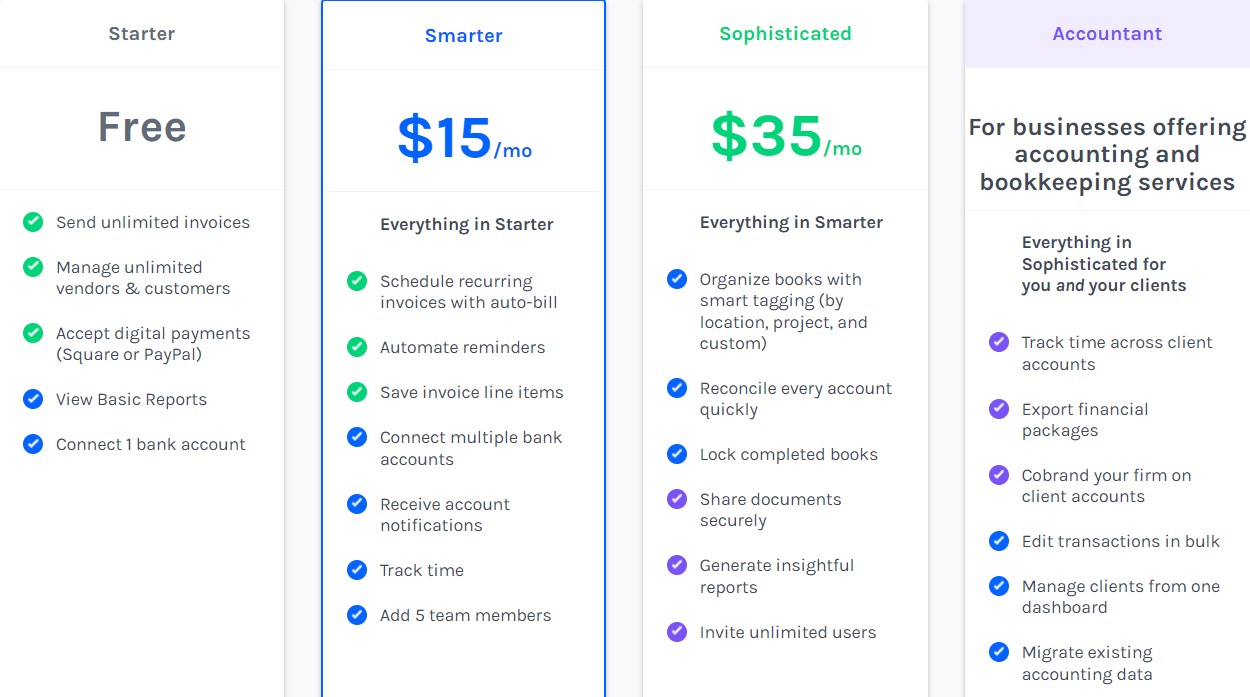

Pricing Plans

- Starter: Free forever

- Smarter: $15/month

- Sophisticated: $35/month

- Accountant: Custom pricing

Image via ZipBooks

12. TimeTracker by eBillity

Image via TimeTracker by eBillity

TimeTracker by eBillity is a time tracker and an invoicing software solution for small businesses.

This invoicing software from eBillity is especially helpful for small businesses that rely on tracking time to invoice their customers. It’s got a built-in time tracker and invoice creation features. For more options tailored to small businesses, explore the best accounting software for small businesses.

Regardless of where your employees are, TimeTracker can help you keep track of the time they spend on each task so that you can bill it to the clients.

You also get built-in project settings that help you save time and manage projects, money, and activities.

What’s more?

You can also use the platform to create a team and find clients for your project.

TimeTracker helps you determine regular and overtime pay, as well as set billing rates for customers.

You can keep your projects profitable by adjusting the rates you pay your employees and the prices you bill your clients. You’ll be able to monitor the time taken for each activity.

Every account includes mobile apps for iOS and Android, invoicing functionality, timesheet approval workflows, time entry reminders, notifications, time rounding, integrations, free assistance, and many more features.

Highlighted Features

- Customizable time tracking

- Mobile app

- Time clock attendance tracking

- Real-time GPS location tracking of employees

- Employee scheduling

- Time entry approvals

- Expense tracking

- Online payments via ACH and credit cards

- Client portal

- Customizable invoices and payment terms

Pros

- The time logs are easy to comprehend and use

- Very user-friendly apps, perfect for small businesses

- Integrates with Concur

- Offers company structure features

Cons

- Mobile app is buggy

- Not versatile in terms of invoicing

- No editing option once the billable hours are submitted

Pricing Plans

- Time Tracker: $7.2/user/month + $12 per month base fee

- Time Tracker Premium: $12/user/month + $20 per month base fee

- LawBillity: $24/user/month

![]()

Image via TimeTracker by eBillity

13. Wave

Image via Wave

In addition to being a renowned FinTech company, Wave also offers invoice creation and management services.

Wave helps you create and send professional-looking invoices to your customers within minutes. And you can create your invoices to match your brand’s look and feel using it. For more tools to streamline customer relationships, consider exploring the best CRM software for small businesses.

You can also send automated invoice reminders to your customers so they can make their payments on time.

Through its mobile apps for iOS and Android, it is effortless to track the status of these invoices on the go too. Here are some of Wave’s best invoicing features:

- Send invoices to customers in a snap

- Set up regular billing for frequent clients

- Accept payments online

- Track customer spending habits

- Gain insights into cash flow, and more!

And the reason why Wave is one of the best invoicing software for small businesses and freelancers is that it‘s free forever.

Not only is its invoicing function free, but there are other accounting features too. These include expense tracking, access to your bank details, and useful reports.

Highlighted Features

- Instant invoicing and payment notifications

- Professional-looking customizable invoice templates

- Reminder automation

- Facilitates credit card, bank payments, and Apple Pay payments

- Recurring invoices

- Syncs with Wave’s free accounting software

- Customer data management

- Payment tracking and communication

Pros

- Expense tracking and allocation features are great

- Supports ACH and EFT payments

- Data synchronization with other Wave apps works well

- Easy to switch between automatic and manual billing

- Supports unlimited invoices

- Handles payment processing and cash flow

Cons

- Electronic payments cost extra

- No credit notes features

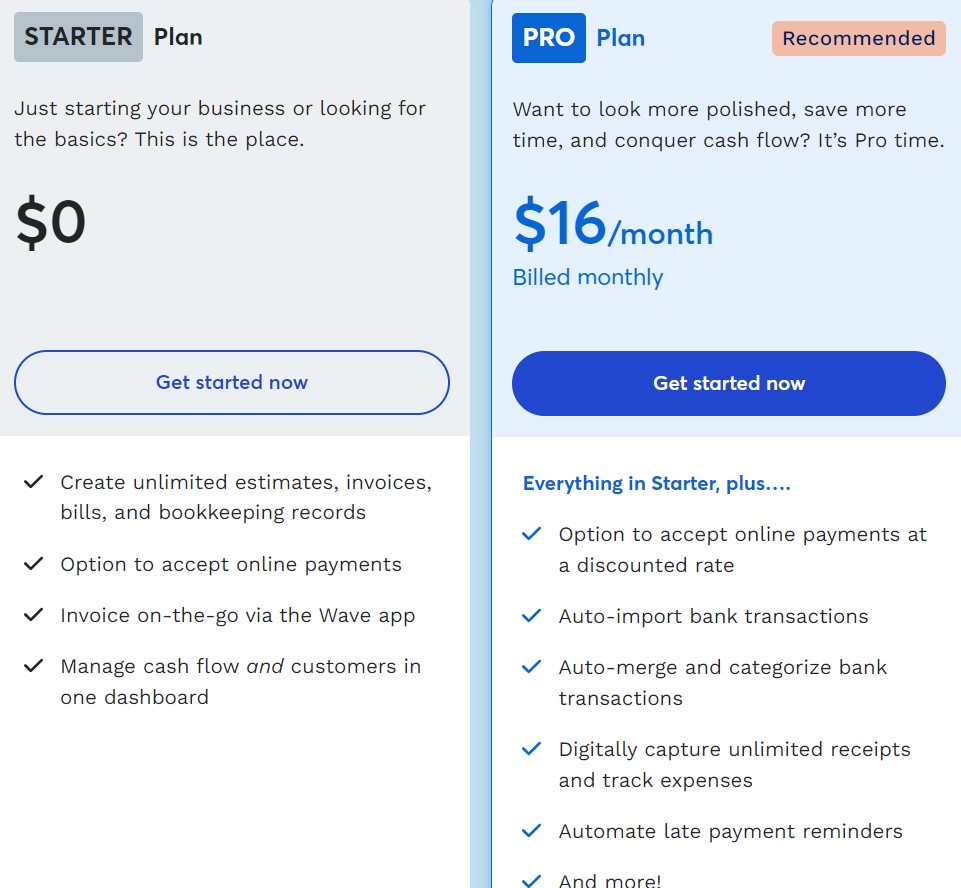

Pricing Plans

- Starter Plan: Free

- Pro Plan: $16/month

Image via Wave

You May Also Like:

14. Nutcache

Image via Nutcache

Nutcache is a project expense management system that also offers invoicing software. Small businesses can use Nutcache to track expenses and manage their budgets.

You can also create invoices to bill your customers using this platform. With Nutcache, you can easily monitor late bills and send out reminders to your clients for them.

The best part is that all of your past-due invoices are accessible from one location, and you can view your clients’ typical payment delays and send reminders with ease.

You can also create recurring invoices. You’ll also be able to get your payments faster by accepting credit cards and online payments through platforms like PayPal.

The software boasts several other features, including task management, time tracking, and expense management.

The task management feature has project boards that are visually organized using colors, lists, and cards. This helps you keep up with important tasks, assign tasks, and stay on track with project goals. For more comprehensive tools for handling small business finances, explore the best accounting software for small businesses.

Highlighted Features

- Customizable professional-looking invoices

- Automatic recurring invoices

- Overdue invoice tracking

- Supports credit cards and online payments

- Employee scheduling

- Time entry approvals

- Expense tracking

Pros

- The platform is easy to use

- The flow of invoicing to payments is smooth

- Bang for your buck

- Free plan offers unlimited clients and project management

Cons

- Supports only six invoice formats

Pricing Plans

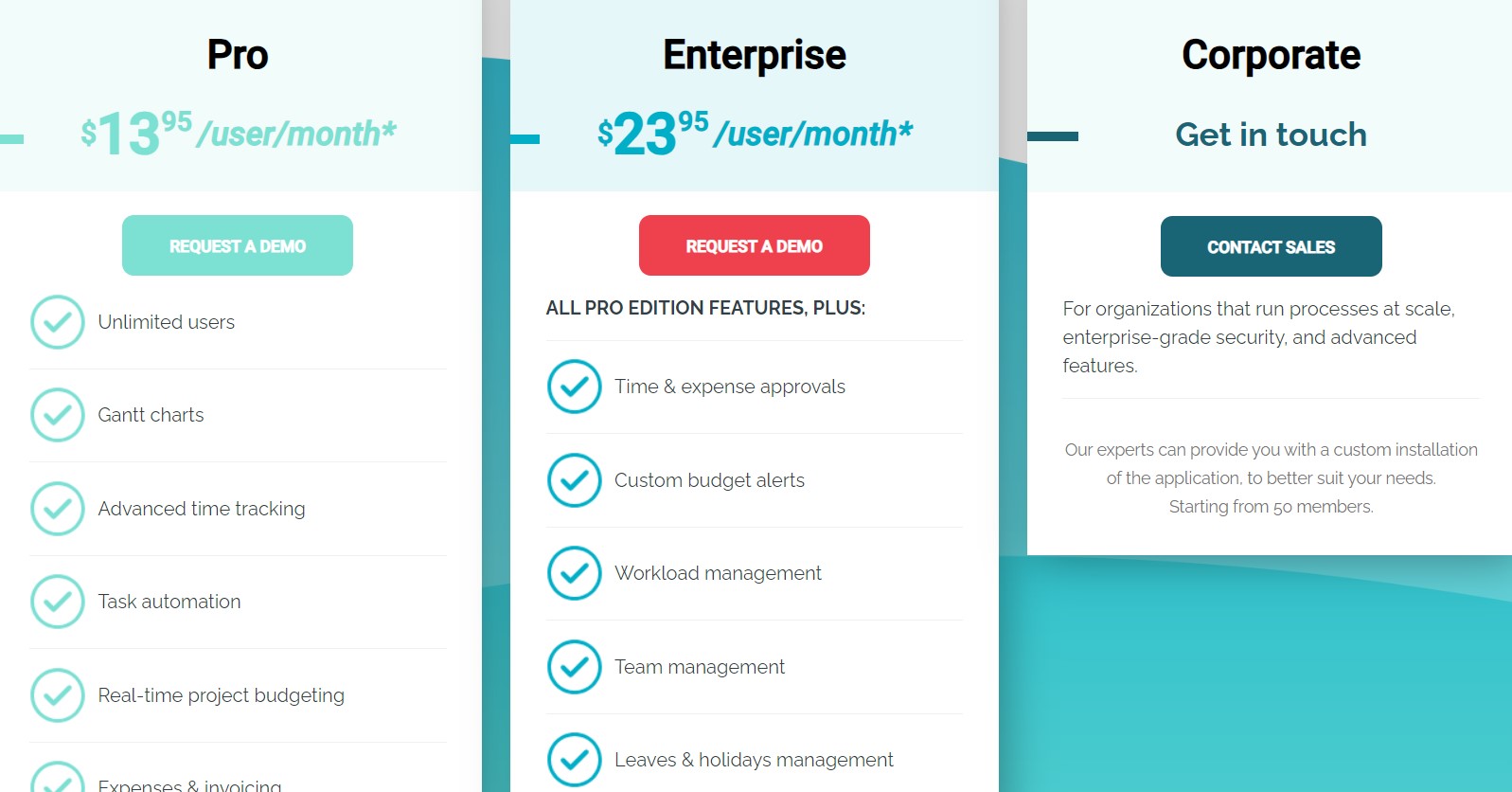

- Pro: $13.95/user/month

- Enterprise: $23.95/user/month

- Corporate: Custom

Image via Nutcache

15. Brightbook

Image via Brightbook

Brightbook is a bookkeeping and invoicing solution specially created for freelancers and small businesses. One of its main features is invoicing. For those new to handling finances, learning about small business bookkeeping for beginners can be very helpful.

And while it may not boast advanced features, small businesses and freelancers, in particular, may find this free accounting software perfectly satisfying.

The straightforward approach of the creators towards accounting makes this software among the best choices for invoicing your customers.

You can also import your banking transactions, convert quotes to invoices, categorize your sales, etc., to simplify your invoicing and accounting processes.

Highlighted Features

- Professional Invoicing

- Multi-currency support

- Real-time business insights

- Banking reconciliation

- Safe and secure

- Basic-level accounting

- Bills and expenses management

- Online payments support

- Expense tracking

Pros

- Forever-free access

- Unlimited support for users and invoices

- Seamless quote-to-invoice functionality

- Invoices support taxes & discounts

- Multi-currency invoices are easy to make

- Accounting features are a great addition

- Banking integration is helpful

Cons

- No mobile app

- Lacks third-party integrations

- Minimal reporting

Pricing Plans

- Forever Free, offers extras for an added price

You May Also Like:

16. Xero

Image via Xero

Xero is web-based invoicing software for small businesses. It provides outstanding functionalities, including automatic reminders, customizable templates, and worldwide payments.

Payments on Xero are handled by payment gateways like Stripe, GoCardless, and others. In addition, it ensures secure storage of all shared bills.

What’s more, Xero has one of the best reputations among small business owners.

However, it’s an expensive option for those who just want simple invoicing software. For instance, freelancers, advisors, and solopreneurs whose main goal is to send invoices, get paid, and keep track of income may be better off with other options.

But if you’re looking for the best invoicing software for small businesses that has accounting features too, you’ll enjoy the advanced functionalities and integrations this software offers.

Xero is a comprehensive accounting solution with advanced features for small to medium-sized businesses, and sometimes even larger ones.

Highlighted Features

- Customizable invoice templates

- Invoice payment reminders

- Branded invoices

- Facilitates payment support from debit and credit cards via Stripe

- Real-time invoice tracking

- Recurring invoice support

- Turn quotes into invoices

- Bulk invoice sending features

- Import invoices in .CSV format

- Sales tax reporting

Pros

- Easy to operate

- Offers a free trial

- Multiple payment processor choices

- Built-in accounting features

- Project tracking support on top-tier plan

- Advanced integration functionality

- Powerful mobile app

Cons

- Purchase side features are basic

- No free plans

Pricing Plans

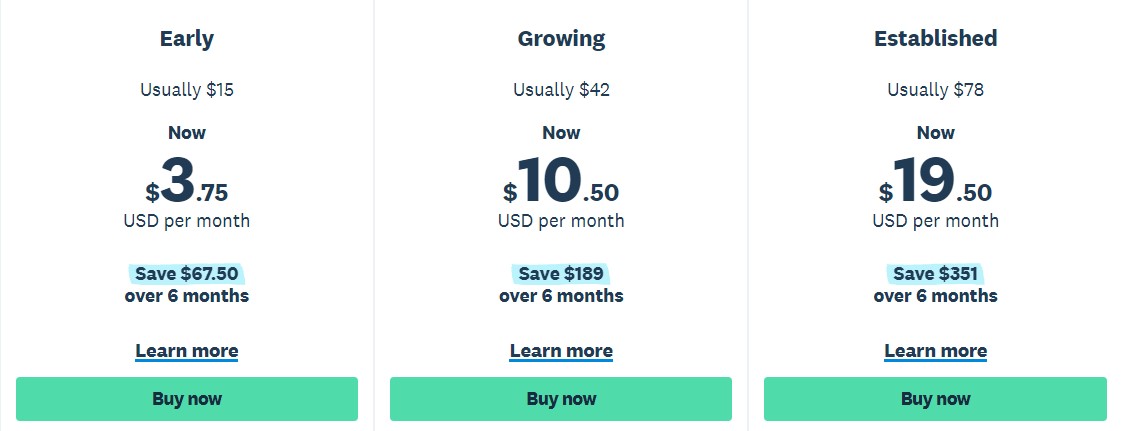

Xero offers a 75% discount on all its plans for the first six months.

- Early: $3.75/month

- Growing: $10.50/month

- Established: $19.50/month

Image via Xero

You May Also Like:

17. PaySimple

Image via PaySimple

PaySimple is one of the best invoicing software for small businesses with complex, meticulous client bases like legal offices, medical services, and schools.

In addition to invoices, you can handle payments, keep track of clients, and create recurring payment programs without needing specialized knowledge with PaySimple.

Also, your small business will be assigned a merchant account with a separate processor if you choose to sign up for PaySimple’s payment gateway and software suite. For more options suitable for startups, explore accounting software for startups.

The invoicing feature of PaySimple is powerful enough to meet the needs of a small business, with features like automated reminders and late fees.

In addition to including payment terms, invoice items, and taxes, you can easily accept credit cards along with ACH payments.

Moreover, invoices and payments are automatically tracked by the platform to simplify things for you. You may also track account receivables, view outstanding invoices, monitor cash flow and purchasing trends, and much more on a real-time dashboard. For comprehensive tools to handle your small business finances effectively, explore the best accounting software for small businesses.

Highlighted Features

- Customizable invoice templates

- Instant cost estimates and quotes

- Quotes to invoices conversion

- Expense and time tracking

- Ability to send invoices automatically

- Accounts receivable and payable support

- Invoice tracking

- Client portal

- Banking integration

- Powerful mobile app

Pros

- Expense-tracking features

- Professional invoices on-the-go

- Easily navigable dashboard

- Unlimited storage

Cons

- Limited integrations

- Expensive

- Doesn’t offer a free plan

- Only one pricing plan

Pricing Plans

- Available on demand

18. Indy

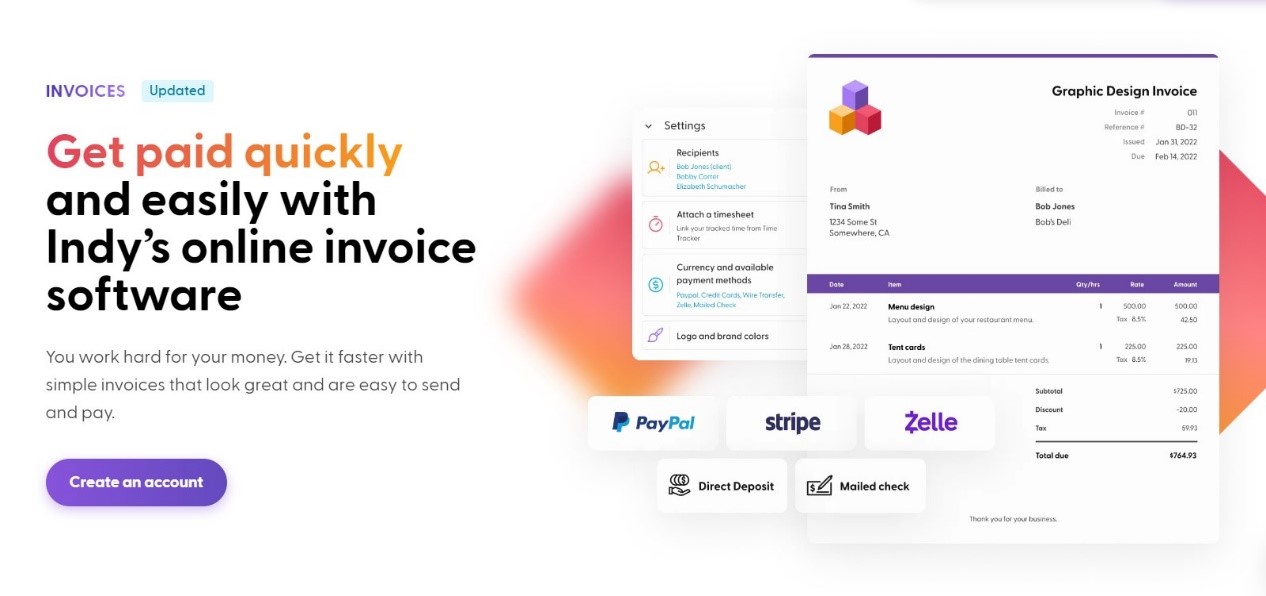

Image via Indy

Indy is one of the best invoicing software for small businesses and freelancers who want to work independently but still need the resources that only larger firms can typically afford.

This platform’s goal is to provide freelancers with the tools they need to be successful, enabling their growth.

With this invoicing software application, freelancers and small businesses can create proposals, draft contracts, send invoices, and get paid.

Besides invoicing, Indy is also an excellent project management tool. Indy’s dashboard helps you keep track of tasks and deadlines with ease, which gives you insights across projects.

You get a bird’s-eye view of all your projects at once without getting buried in tabs or notifications. Additionally, you can see your monthly income, outstanding invoices, documents that need signing, and pending tasks on a single platform.

The Indy invoicing software for small businesses and freelancers does offer a forever-free plan that supports only up to 2 invoices. This means you’ll have to opt for the paid plan to get access to an unlimited number of contracts and invoices.

Highlighted Features

- Customizable professional-looking invoices

- Automated recurring invoices

- Overdue invoice tracking

- Supports credit cards and online payments

- Time tracking

- Invoice templates

- Invoice tracking

- Custom branding

- Stripe and PayPal integration

- Automatic recurring invoices

- Client communication

- Basic CRM capabilities

Pros

- Supports direct deposit or mail check

- Easy to use

- Offers forever-free plan

- All-in-one solution for freelancers and small business

- Chatting feature enables seamless communication

Cons

- Forever-free plan only supports up to 2 invoices/month

- Only supports USD invoicing

- Basic templates

- Doesn’t integrate with third-party software applications like CRM, ERP, etc.

Pricing Plans

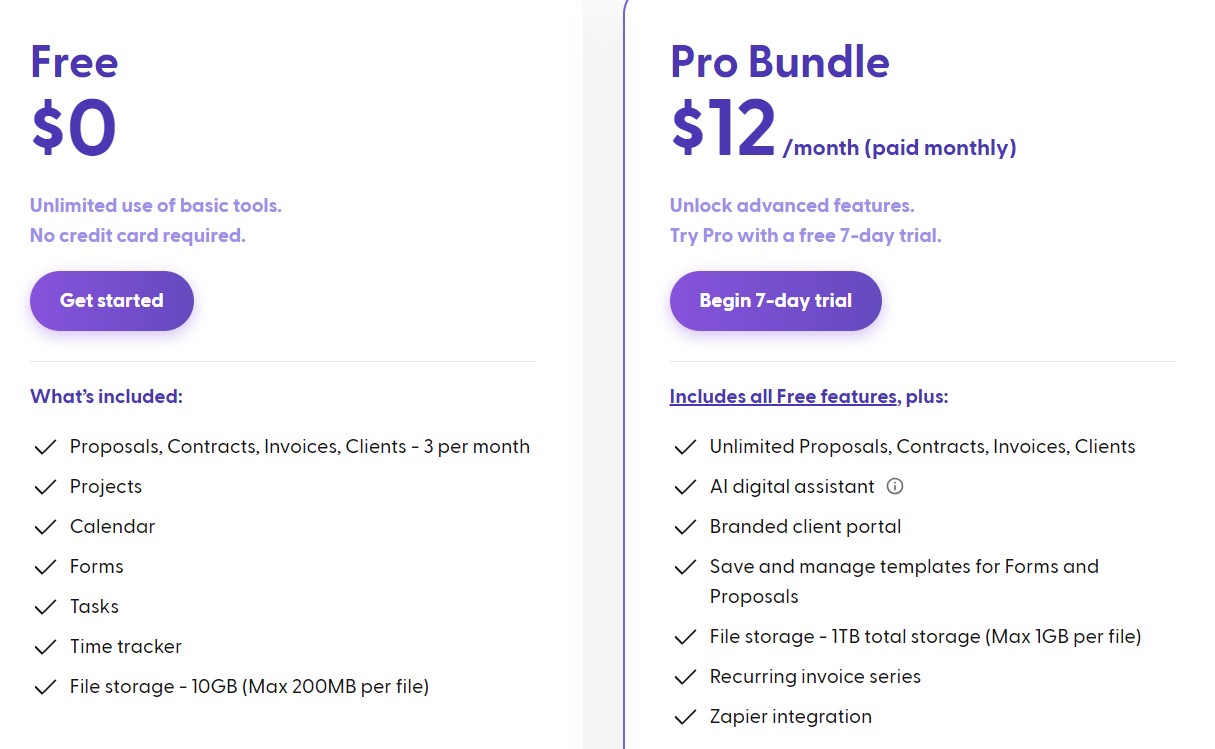

- Forever Free

- Pro Bundle: $12/month

Image via Indy

19. FreeAgent

Image via FreeAgent

FreeAgent is an online accounting software that’s specifically designed for small businesses, startups, accountants, and bookkeepers.

The platform is simple and straightforward to use, without accounting jargon, making it amongst the best choices for freelancers too.

Using this accounting-cum-invoicing software, small business owners can handle day-to-day administration tasks, including managing expenditures, sending invoices, running RTI-compliant payroll and timekeeping, and monitoring cash flow.

Here’s what you’ll get with FreeAgent’s invoicing tool:

- Good-looking pre-made invoice templates.

- You may add your own brand to invoice templates that already include all the information HMRC needs.

- Automated personalized email payment reminders and confirmations.

- Integrations with online payment gateways like Stripe and PayPal for accepting customer payments.

- Scheduled automated recurring invoices.

- Ability to create a price list of your most frequently sold items to help you generate invoices more efficiently.

Highlighted Features

- Actionable business insights

- Customizable invoicing templates

- Branded invoices

- Invoice payment reminders

- Payment support via debit and credit cards

- Multi-currency support

- Real-time invoice tracking

- Recurring invoice support

- Bulk invoice sending

- Import invoices in .CSV format

Pros

- Professional-looking invoices

- Integration with PayPal, GoCardless, and Stripe

- Easy to operate

- Offers free trial

- Built-in accounting features

- Advanced integration functionality

- Powerful mobile app

Cons

- Electronic payments cost extra

- Not versatile in terms of invoicing

- Only one pricing plan

Pricing Plans

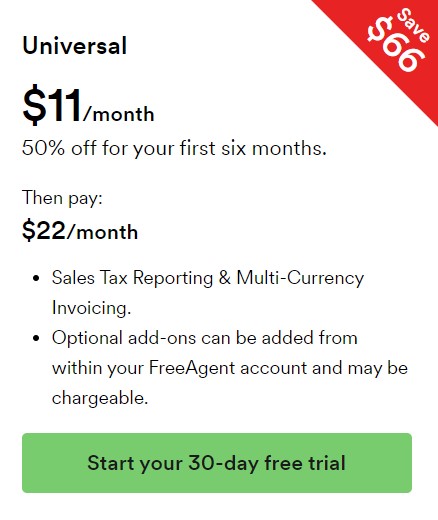

- Universal: $11/month for the first six months, $22/month afterward

Image via FreeAgent

You May Also Like:

20. Zervant

Image via Zervant

Zervant is an invoice management system suitable for independent contractors, small business owners, and individual traders. It allows you to generate, send, and track your invoices.

The platform gives users the ability to personalize invoice templates to suit their needs, as well as send invoices as PDFs, emails, or paper copies.

Quotes generated for clients can be transformed into invoices and receipts too. Zervant also provides tools for tracking late payments and monitoring company finances.

This invoicing software’s simple yet powerful interface is the best for those unfamiliar with accounting and invoicing. There are several invoice-sending options available, as well as late-payment reminders, to keep your small business operations streamlined.

For more comprehensive tools to handle your small business finances effectively, explore the best accounting software for small businesses.

One of the most differentiating features of Zervant is the invoicing via post feature. The company will physically mail invoices for you if needed.

Highlighted Features

- Quotes and estimates

- Mobile app

- Payment schedules

- Bank reconciliation

- Project time tracking

- Expense management

- Multi-business support

- Client management

- Integration with legacy systems

- Workflow automation

- Task management

- Multi-currency and language support

- Accounts receivable and payable management

- Financial forecasting

- Invoice template customization

- Offers PDF protection

- Invoice via post

- Payment scheduling

Pros

- Offers forever-free plan

- Effortless invoicing

- Invoice automation

- Multi-business support

- Offer team collaboration for up to 10 members

- Automated payment reminders

- Sends invoices via mail

Cons

- Starter plans don’t offer unlimited customer support

- Limited integrations

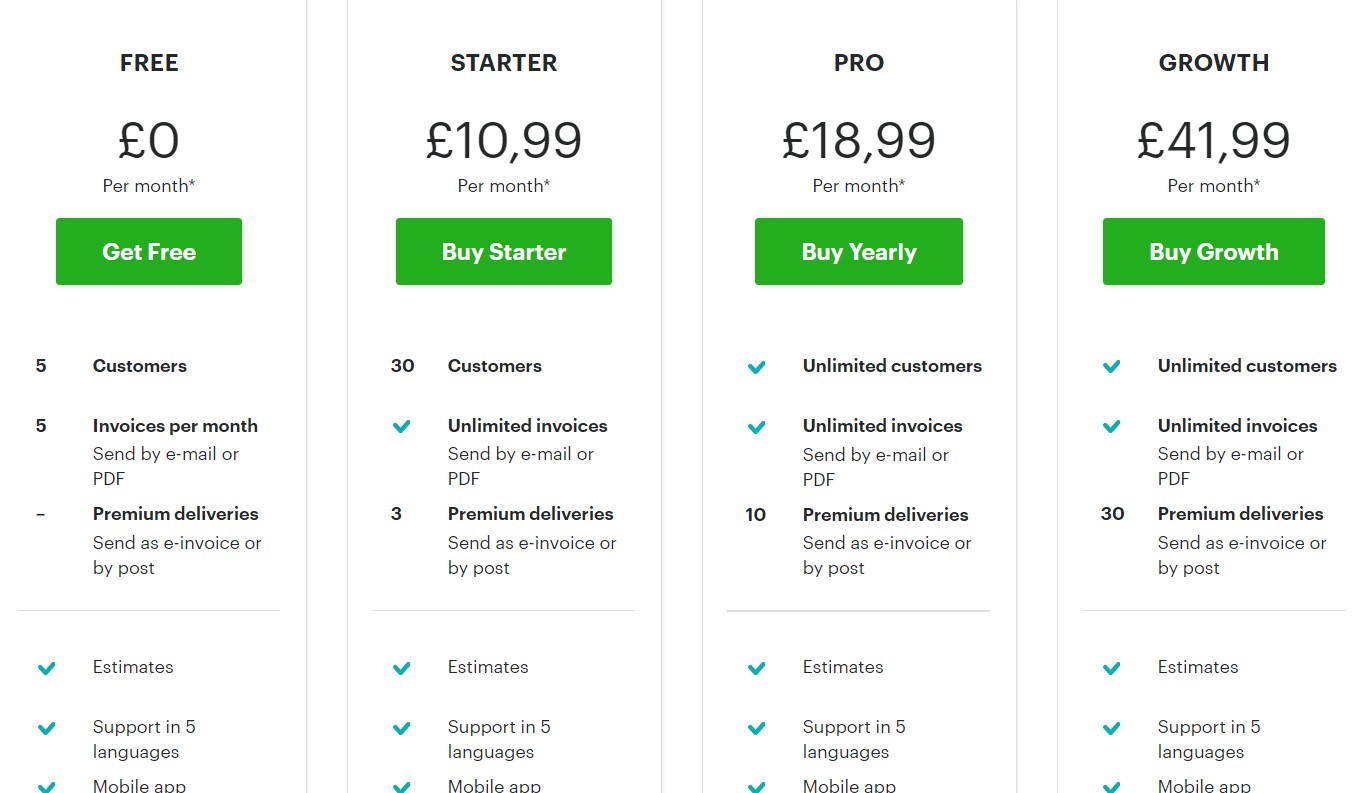

Pricing Plans

- Free forever

- Starter: £10.99 ($14)/month

- Pro: 18.99 ($24.20)/month

- Growth: £41.99 ($53.60)/month

Image via Zervant

21. Tipalti

Image via Tipalti

Tipalti is a one-of-a-kind invoicing software, best for small businesses and freelancers. It provides system infrastructure to help small businesses scale, with robust tax and regulatory compliance and native financial controls to streamline accounts payable and receivable.

Tipalti comes with Optical Character Recognition (OCR) software so you won’t have to enter invoice information manually.

You can scan your invoices into your system and Tipalti will intelligently identify and override changes you make and use that for upcoming invoices. This ensures your invoice data is fed into your system accurately.

Used by leading companies like Twitch, GoPro, ClassPass, Roblox, GoDaddy, and Zola, Tipalti is recognized as one of the best invoicing software for small businesses in the financial space.

In addition, Tipalti offers automation features to make the invoicing process a breeze. You can easily convert purchase orders to receipts and invoices and even pay suppliers through the software directly.

The software is PCI and SSAE16 SOC audit-certified. It also boasts AES encryption and white-listing to ensure that your supplier and customer data are secured.

Highlighted Features

- Invoice importing and management

- Duplicate invoice protection alerts

- OCR scanning

- Built-in communications hub

- Purchase order matching

- Payment process integration

- Accounts payable support

- Automated supplier communication

- Real-time bank reconciliation

- ERP integration

- Tax compliance

- Fraud detection

- Money transmitter license

Pros

- Minimize delays in obtaining invoice approvals

- Touchless straightforward processing saves time

Cons

- Doesn’t offer a free trial

- Non-transparent pricing

- Expensive for most small businesses

Pricing Plans

- Available on demand

You May Also Like:

22. InvoiceOwl

Image via InvoiceOwl

One of the best invoicing and estimating tools, InvoiceOwl, has been specially created for small businesses and freelancers to help them create and send professional estimates and invoices on the go.

This invoicing software’s purpose is to make it simple for everyone to create and manage invoices, even those who are less tech-savvy and have limited financial knowledge.

Although the functionality and ease of use that come along with InvoiceOwl can be useful to everyone, small- to mid-scale contractors are the best customers of this invoicing software.

InvoiceOwl offers everything that a standard invoicing software should, but at a nominal price, making it one of the best invoicing software for small businesses.

Besides invoicing, InvoiceOwl allows you to create purchase orders, manage multiple companies, get real-time notifications about your invoice payouts, and track your financial reports.

You can also send professional quotes to prospects to win business and create professional-looking invoices that represent your brand. You also get a review feature to collect customer feedback and improve your business. For more comprehensive tools to manage your small business finances effectively, explore the best accounting software for small businesses.

Highlighted Features

- Estimates creation

- Credit memo creation

- Purchase orders management

- Reporting and analytics

- Online payments

- Invoice templates

- Expense and time tracking

- Sending invoices

- Accounts receivable and payable support

- Invoice tracking

- Banking integration

- Powerful mobile app

Pros

- Easily navigable dashboard

- Time-tracking features are extremely good

- Professional invoices on-the-go

- Expense-tracking features

- Team collaboration features are helpful

- Unlimited storage

- Easy to use

Cons

- Growth plan doesn’t offer unlimited invoices

- Limited features

- Limited integrations

Pricing Plans

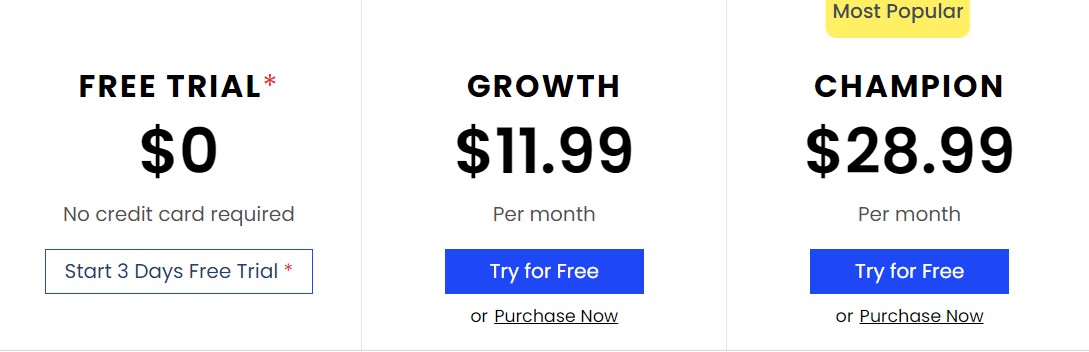

- Free trial for 3 days

- Growth: $11.99/month

- Champion: $28.99/month

Image via InvoiceOwl

You May Also Like:

23. PayPal

Image via PayPal

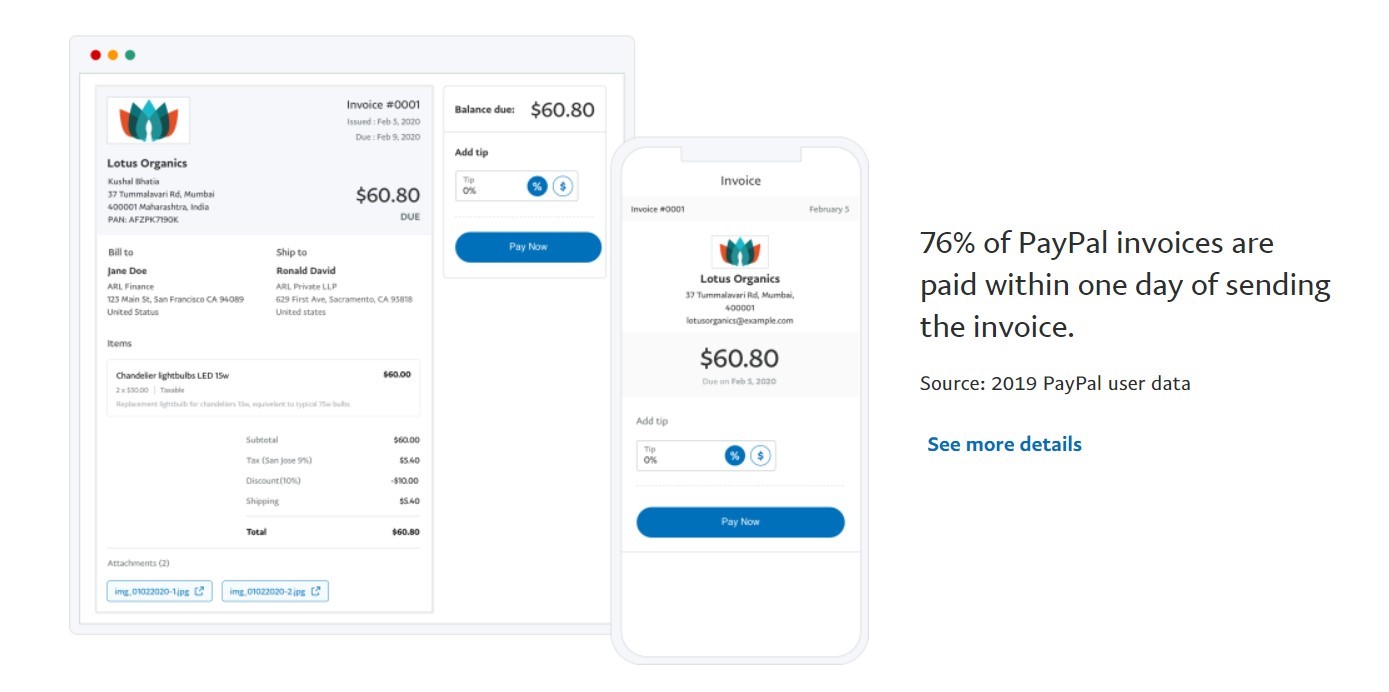

PayPal may best be known for its payment services, but to facilitate requests for payment, it also has built-in invoicing software.

Using PayPal’s mobile-friendly free invoicing software, you can create and send invoices in minutes, save invoice templates for quick entry, and automate payment reminders.

For small businesses and freelancers, PayPal Invoicing software can be of great help, as it’s totally free to use. Using it, you can draft and share invoices right away with your customers.

Additionally, the customers can make the payment directly through PayPal, which helps you record the payment too. Customers may also pay in part and even add gratuities to their payments via the PayPal Invoicing APIs.

Since it was released more than 20 years ago, this free mobile invoicing software has been a mainstay in the industry.

Also, as the invoicing software doesn’t require any upfront payment, it’s among the best picks for small businesses and freelancers.

Highlighted Features

- Powerful API

- Invoice activity tracking

- Real-time alerts

- Billing portal

- Contact database management

- Credit and debit card payment processing

- Customizable invoices and templates

- Email management

- Invoice history

- Multi-currency support

- Online invoicing and payments

- Recurring/subscription billing

- Payment reminders

- Sales tax management

Pros

- Quick and straightforward invoicing

- Free to use

- Seamless integration with other PayPal products

- Supports unlimited invoices

- Handles payment processing and cash flow

Cons

- Few POS features

- Payment processing fees

Pricing Plans

- Free forever

FAQs

Q1. What are the 10 best invoicing software for small businesses?

Following are the ten best invoicing software for small businesses:

- Zoho Invoice

- FreshBooks

- Square Invoices

- Bill.com

- QuickBooks

- Invoicera

- Sage Intacct

- InvoiceNinja

- Hiveage

- Harvest

Q2. What features should I look for in an invoicing software for my small business?

The invoicing software you choose for your small business must have the following features:

- Multi-currency support

- Customizable templates

- Multiple language support

- Invoice scheduling

- Automated recurring invoices

- Payment reminders

Q3. What is the best invoicing software for small businesses with accounting features?

If you’re looking for an invoicing software for your small business that also has bookkeeping and accounting functionality, consider the following:

- FreshBooks

- QuickBooks

- ZipBooks

- Wave

- Brightbook

- Xero

- FreeAgent

- Zoho Invoice (can be upgraded to Zoho Books)

Q4. What are the top free billing software I can use for my small business?

If you’re running short on funds and looking for a free invoicing software for your small business, consider the following invoicing software:

- Zoho Invoice

- Square Invoices

- Invoicera

- Invoice Ninja

- Brightbook

- Hiveage

- Harvest

- ZipBooks

- Wave

- Nutcache

- Indy

- PayPal

- Zervant

Q5. What are the benefits of using invoicing software for small businesses?

Following are the most common benefits of invoicing software for small businesses:

- More efficiency

- Professional appeal

- Easy auditing

- Easy follow-ups

- Improved cash flow

- Improved invoicing accuracy

- Simplified taxes and accounting

Q6. How can invoicing software help me get paid faster?

Invoicing software can help you get paid faster by automating the billing process. When you use invoicing software, you can create and send professional-looking invoices with just a few clicks. This saves you the stress of creating invoices manually, which, by the way, can be time-consuming and prone to human errors.

Plus, many invoicing solutions offer features like automatic payment reminders and online payment options, which can encourage your clients to pay their invoices promptly.

Q7. Is it worth paying for invoicing software, or should I just use a free option?

Whether it’s worth paying for invoicing software depends on your business’s specific needs and budget. While free invoicing solutions can be a good choice for businesses with basic needs, paid options often offer more advanced features and functionality.

For instance, paid invoicing software may offer more customization options, allowing you to create branded invoices that reflect your business’s unique style.

Q8. Can invoicing software help me stay compliant with tax laws and regulations?

Yes, many invoicing software options offer features that can help you stay compliant with tax laws and regulations. For example, some invoicing solutions like Zoho Invoice and Sage Intacct allow you to track sales tax and generate reports that can help you file your taxes accurately and on time.

However, we should note that while invoicing software can be a helpful tool for staying compliant with tax laws, it’s not a substitute for professional tax advice. Make sure you consult with a qualified accountant or tax professional to ensure that you’re meeting all of your obligations and taking advantage of any available deductions or credits.

Wrapping Up

Invoicing software is great for businesses of all sizes, especially small businesses that may not be using accounting software already.

As a small business, you may not have a big budget for using accounting software and that’s where free and paid invoicing software can come in handy.

While some are standalone invoicing software solutions, most of them provide some added features that can help make accounting easier for your business.

Some of them are also complete accounting solutions that go easy on your budget so you can leverage those if you need more than just invoicing features.

So, make sure you first list down what you require from an invoicing software and compare your requirements with the given features of these invoicing software for small businesses before choosing one.

Most invoicing software for small businesses offers a free trial. So go for them only after you try them.

Disclaimer: This content contains affiliate links, which means we’ll earn a commission when you click on them (at no additional cost to you).

4 Comments

TestTestTestTestTestTestTest

Test reply comment

PIYU TEST COMMENT

Thanks for comment